.svg)

.png)

.png)

.png)

.png)

Chipotle, Wingstop, and Shake Shack have emerged as restaurant leaders, thriving and outperforming the wider fast-casual and quick-service restaurant (QSR) categories. How did these chains perform in Q3 2024? We dove into the data to find out.

Chipotle, Wingstop, and Shake Shack have become some of the most popular dining chains in the nation, each within its own respective niche: Chipotle excels at health-focused Tex-Mex meals, Wingstop serves up chicken wings and other game-day style dishes, and Shake Shack is known for its burgers and frozen custards. All three chains are leaning into growing demand for their offerings by adding new restaurants at a brisk clip. And for all three, the investment in fleet expansion is paying off, driving double-digit YoY visit growth.

Of the three chains, Wingstop enjoyed the strongest YoY growth between June and September of this year, with visits rising 16.5% to 33.5% throughout the analyzed period. Shake Shack, for its part, saw visits increase between 12.4% and 25.9%. Meanwhile, Chipotle, continuing several years of visit growth, posted 10.0% to 12.9% YoY boosts. In contrast, the overall quick-service and fast-casual restaurant segments saw much more muted performance, with QSR visits hovering at or slightly below 2023 levels and fast-casual segments seeing modest visit upticks.

One key driver behind the significant foot traffic growth for these three chains is their aggressive expansion. Wingstop, which saw the largest year-over-year (YoY) increase in foot traffic, opened some 138 new restaurants in 2024 alone, and hopes to open around 300 by year’s end. Chipotle has also been expanding rapidly, with around 52 new stores in 2024 so far and more on the way. Shake Shack, aiming to open 80 new locations this year, is similarly focused on growth.

A closer look at shifts in the average number of visits to the chains’ individual locations shows that this expansion is being met with strong demand. Chipotle and Wingstop saw monthly YoY visit-per-location increases throughout the analyzed period, while Shake Shack saw increases between June and August and experienced just a minor dip in September.

These foot traffic trends – both across the chains and at individual locations – indicate that the new stores are successfully attracting steady customer interest.

Another key factor driving success for the three chains is their pivot towards convenient takeaway options. Chipotle has focused on expanding its Chipotlane drive-thru service, while Wingstop has invested in an in-store digital platform meant to streamline the ordering process. And despite Shake Shack’s “anti fast-food” identity, the chain has also embraced drive-thrus and ordering kiosks to speed up service.

The data suggests that consumers appreciate the increased convenience of these quicker options: In Q3 2024, short visits (10 minutes or less) to Chipotle, Wingstop, and Shake Shack surged between 17.0% and 25.5% compared to Q3 2023.

For Chipotle and Shake Shack, short visits increased significantly more than extended ones in Q3, likely due in part to the brands’ intense focus on drive-thrus: Of the 271 restaurants opened by Chipotle in 2023, 238 included Chipotlanes. And since adding its first drive-thru in 2022, Shake Shack has expanded this option to more than thirty locations. For Wingstop, longer visits increased somewhat more YoY than shorter ones – but in the wake of the chain’s rapid expansion, short and long visits both increased more than 20% YoY.

Chipotle, Wingstop, and Shake Shack are succeeding, consistently increasing foot traffic and visits per location. Through strategic expansion and the adoption of drive-through and online ordering, these brands have firmly established their presence in the fast-casual and quick-service dining landscape.

Will the three restaurants continue to drive visit growth? Visit Placer.ai to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

With Q3 2024 in the rearview mirror, we dove into the data to check in with two smoothie and bowl spots that are firmly in expansion mode – Playa Bowls and Tropical Smoothie Cafe. What lies behind their smashing success? And what awaits them in Q4?

We dove into the data to find out.

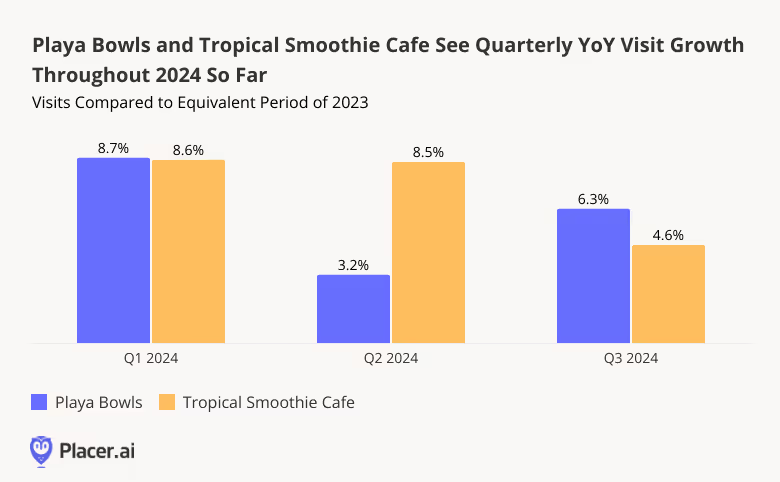

Looking first at quarterly YoY visit trends shows both Playa Bowls and Tropical Smoothie Cafe experiencing substantial year-over-year visit growth during the first three quarters of 2024 – driven in part by their rapidly growing fleets. In Q1 2024, Playa Bowls – recently acquired by Sycamore Partners – saw a YoY foot traffic jump of 8.7%. And Tropical Smoothie Cafe, acquired by Blackstone this year, saw a YoY visit boost of 8.7%. For both chains, this positive trajectory continued, though at a more moderate pace, through Q3 2024.

What's behind the fast expansion and visit growth of these smoothie leaders? With high food prices still weighing on consumers, and health still top of mind for many, brands that provide nutritious, affordable indulgences are poised to win. Those that do so while meeting the rising demand for quick and convenient dining options are especially well-positioned to thrive.

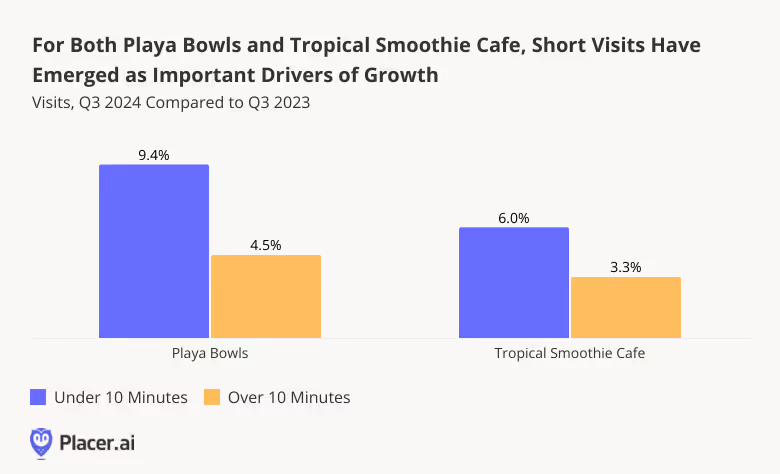

And drilling down deeper into the data for Playa Bowls and Tropical Smoothie Cafe shows that the two chains’ outsize success is being fueled, in large part, by customers dropping by for a quick pick-me-up on the go, rather than a sit-down meal.

In Q3 2024, the number of short visits to Playa Bowls (i.e. those lasting less than 10 minutes) increased 9.4% YoY, while longer visits increased just 4.5%. (In Q3 2024, short visits accounted for 31.2% of visits to Playa Bowls, compared with 30.3% in Q3 2023). This suggests that robust demand for off-premises dining has emerged as a major driver of growth for the brand.

A similar trend emerged at Tropical Smoothie Cafe, where nearly half of all Q3 2024 visits (48.4%) lasted less than 10 minutes – likely due to the chain’s ubiquitous drive-thrus. Short visits to Tropical Smoothie Cafe increased 6.0% YoY in Q3, while more extended visits increased 3.3%.

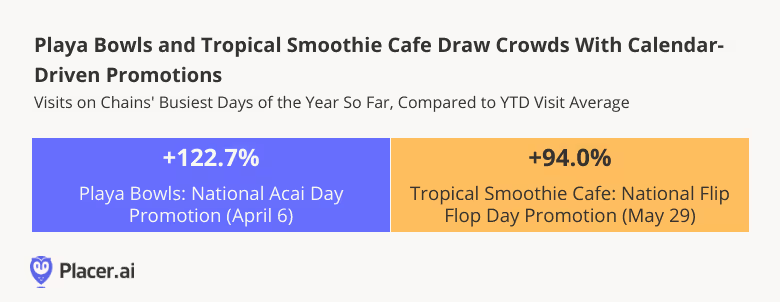

Playa Bowls and Tropical Smoothie Cafe have also fueled success by marking special calendar days with limited-time promotions.

For Playa Bowls, for example, the busiest day of 2024 so far was April 6th – National Acai Day – when the juice bar offered rewards members $5 off any acai bowl. The promotion was wildly successful, fueling a remarkable 122.7% visit surge compared to a year-to-date (January to September) daily average.

For Tropical Smoothie Cafe, it was National Flip Flop Day (yes, that’s a thing) that drew major crowds this year. On May 29th, 2024, the brand marked the occasion with free Island Punch Smoothies for guests who visited participating locations while wearing flip flops. And the promotion was a hit, generating enough excitement to drive a 94.0% visit spike for the brand.

Successful harnessing of the growing demand for convenient, healthy, and affordable off-premises dining options together with unbeatable limited-time promotions have helped propel growth for both Playa Bowls and Tropical Smoothie Cafe.

Will visits to the two chains continue to surge in the months ahead?

Follow Placer.ai’s data driven dining analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

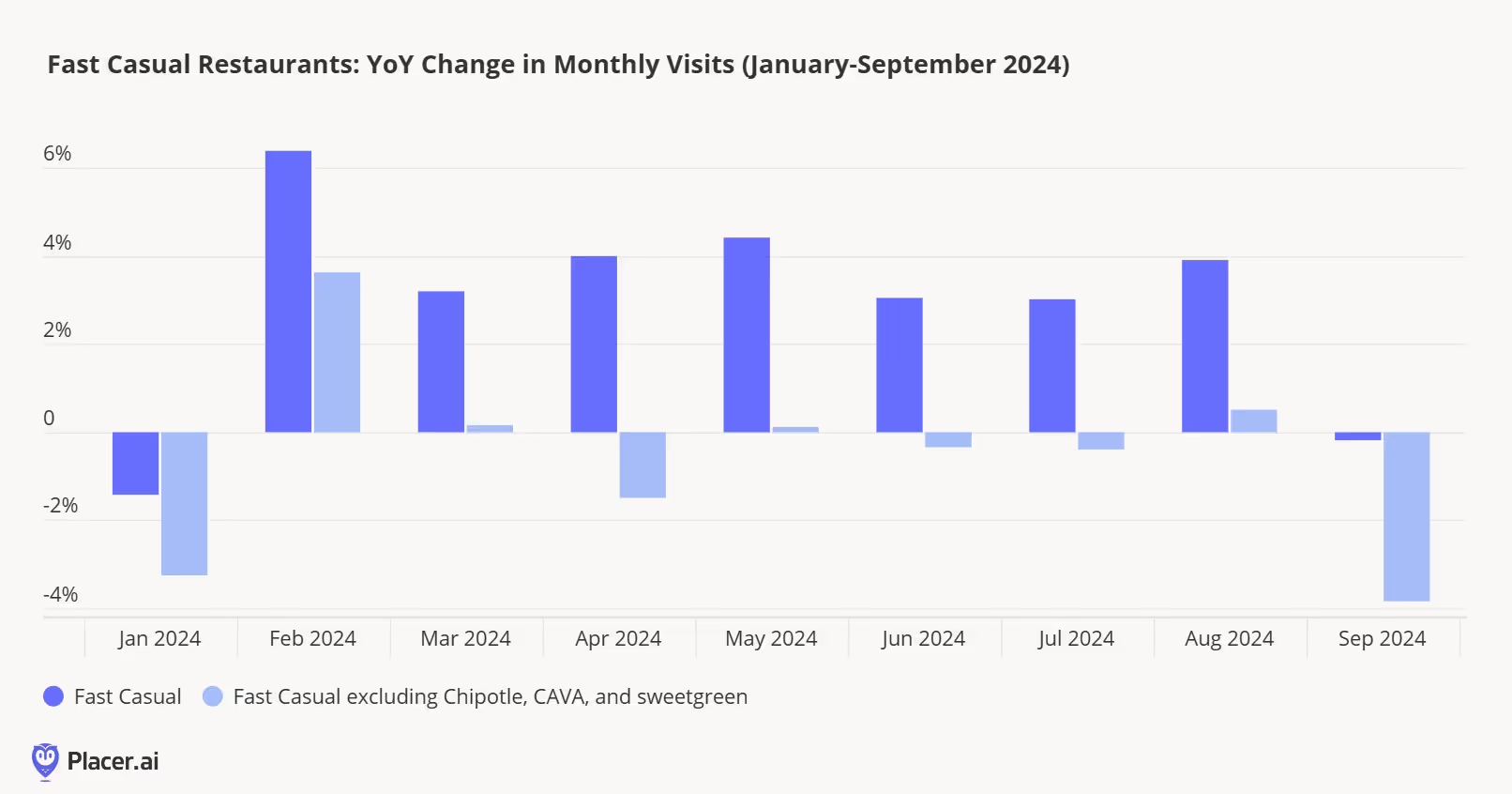

Most chains attending the 2024 Fast Casual Executive Summit in Denver acknowledged that this year has been difficult (unless you happen to be Chipotle, CAVA, or sweetgreen). We’ve highlighted a number of the challenges restaurant operators faced this past year, including inclement weather to start the year, the restaurant value wars of 2024, encroachment from other food retail channels, and the rising cost of operating a restaurant, which has resulted in increased bankruptcies. Our data validates this stance–our data shows that the fast casual category excluding the three aforementioned chains has seen year-over-year visitation declines.

Why are these three chains outperforming? As we’ve discussed in the past, we believe it comes down to (1) innovation; and (2) operational excellence. Recently, we looked at the importance of Chipotle’s Chicken al Pastor relaunch for Q2 2024 sales trends, sweetgreen’s increase in comparable visits that was helped by the launch of Caramelized Garlic Steak as a protein option, and CAVA’s exceptionally strong visitation trends due the launch of grilled steak at the beginning of June. However, innovation is only part of the outperformance, as each of these chains have also done a great job integrating their digital ordering platforms and in-store assembly line efforts, allowing for greater customization (something consumers appear to be willing to pay a premium for) and driving some of the strongest throughput numbers we’ve observed with our data.

The executives we spoke to at this week’s event had a gameplan to overcome these challenges in 2025.

Another executive told us that the currently challenging backdrop would ultimately make chains better operators. Not every chain can be Chipotle, CAVA, or sweetgreen, but there are still a lot of their strategies that restaurants can adopt to improve their own operations.

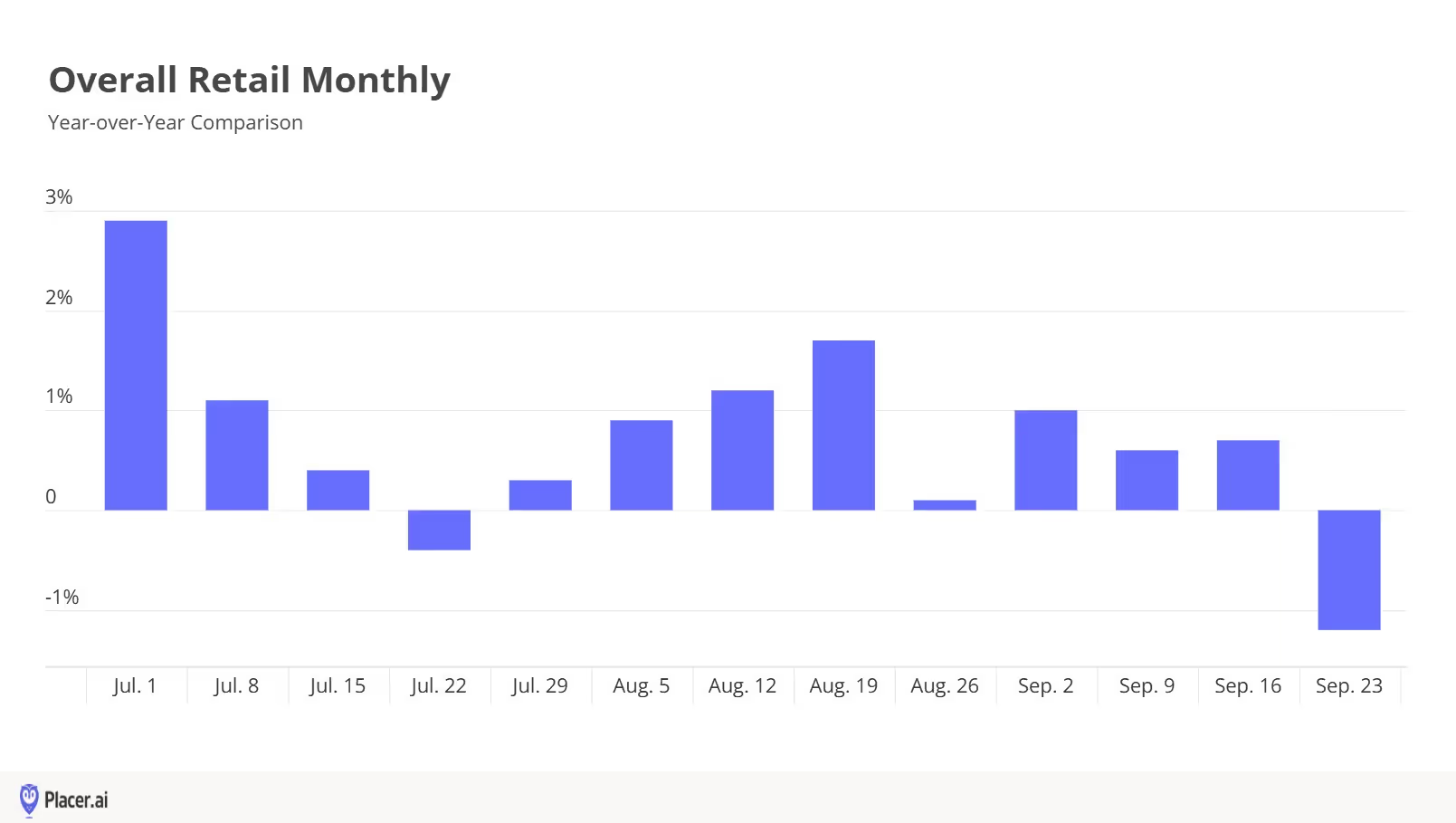

The inaugural Shoptalk Fall event brought a new energy to Chicago this week. The smaller format event allowed us to dive deeper into the trends across the retail industry and hear from key retail players about their initiatives and innovations across the industry.

One thing that is clear, retailers are bullish about physical retail. Many retailers shared plans for store openings in 2025, and there is a real focus on creating the right types of store formats and finding locations that are in line with a brand’s consumers. We may truly be at a point of inflection from a channel perspective, and physical retail is likely to become a more important part of the equation.

There’s a real energy shift in the industry in regard to the importance of stores, and it’s refreshing to see. As the industry settles from the migration shifts of consumers during and after the pandemic, the opportunity for new stores to directly cater to these new groups of shoppers is immense.

And it’s not just about the rise of physical retail, but the stories that retailers are able to tell through their offline channels. Retailers are actively focused on ways to eliminate friction for shoppers, arm store employees with more insights and tools and create experiences that forge lasting bonds with shoppers. We heard from Wayfair, Build-A-Bear Workshop, Michaels and Studs, who all referenced that differentiating experiences are driving loyalty and fostering long-term connections with consumers. Stores are an essential part of building and retaining brand equity with consumers.

The other key theme centers around none other than the consumer. The retail industry feels more customer centric than ever before, especially as we get further away from the pandemic. Retailers and brands recognize that today, the shopper is in the driver’s seat, and many initiatives and innovations center around providing the consumer with more power and knowledge. This is why we are hearing more about "micro-merchandising". Retailers need and can enhance their relevancy by understanding the unique demographics/psychographic differences and preferences of their individual locations.

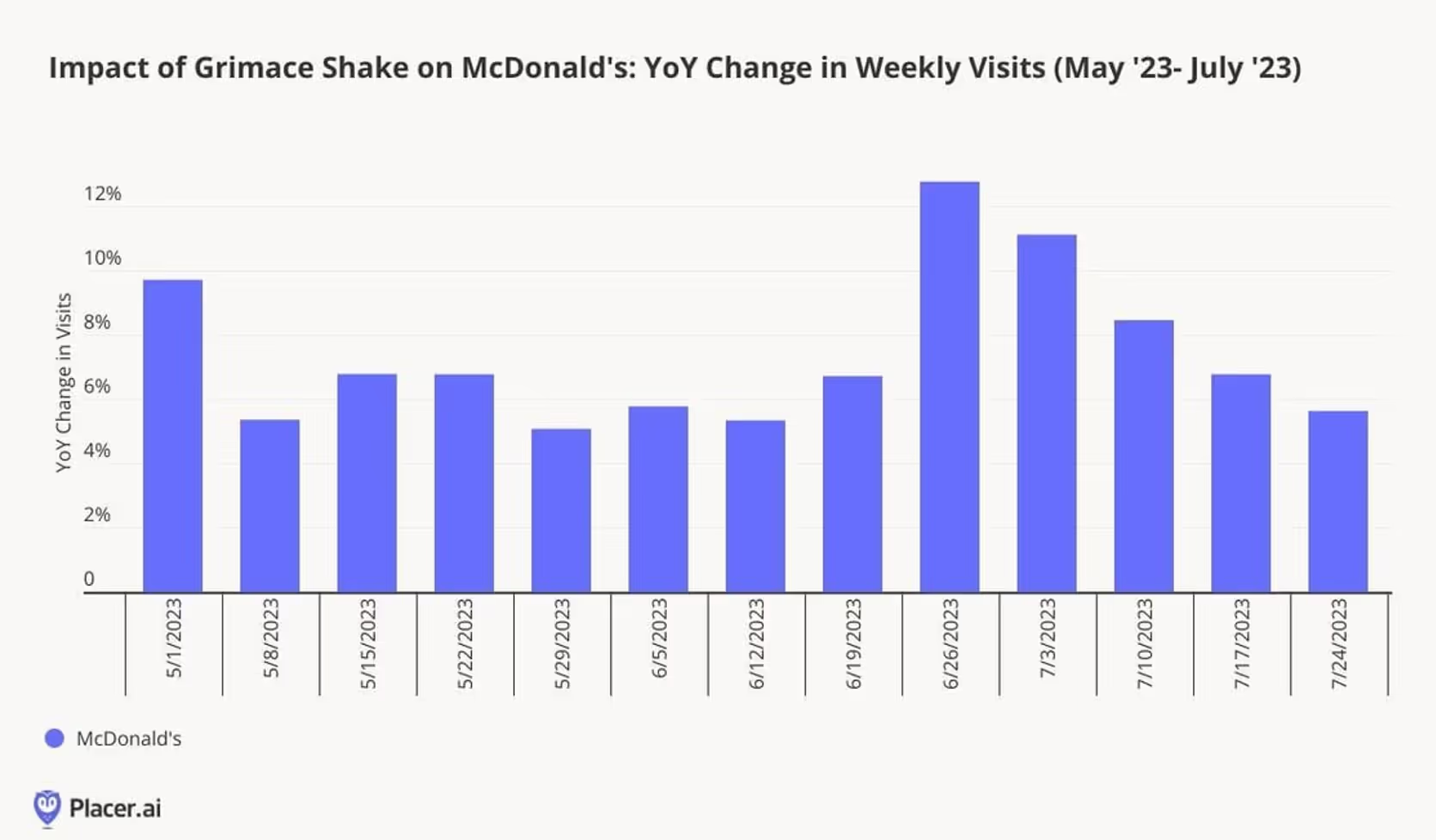

Executives at McDonald’s provided more insight into the success of June 2023's immensely popular birthday celebration for Grimace, including the Grimace Shake; they built the concept around the idea that many consumers celebrate a birthday at McDonald’s restaurants, but from there they let consumers drive the conversation around the promotion on social media.

We heard from many that word of mouth marketing is truly the key to success in retail today, and empowering consumers to share their thoughts and affinities with others in person or through social media platforms is driving engagement and adoption. Through the lens of foot traffic, we may see more consumers head to stores after hearing about them from others in their network. Marketing departments no longer consist of teams within an organization, but incorporate consumers as well.

Overall, we felt a lot of positivity from the industry about where we’re headed in the near term. As we see the slow rebound of the discretionary side of retail, new stores and innovations in the coming year and a consumer that still remains resilient despite many economic headwinds, the best might be ahead for the industry.

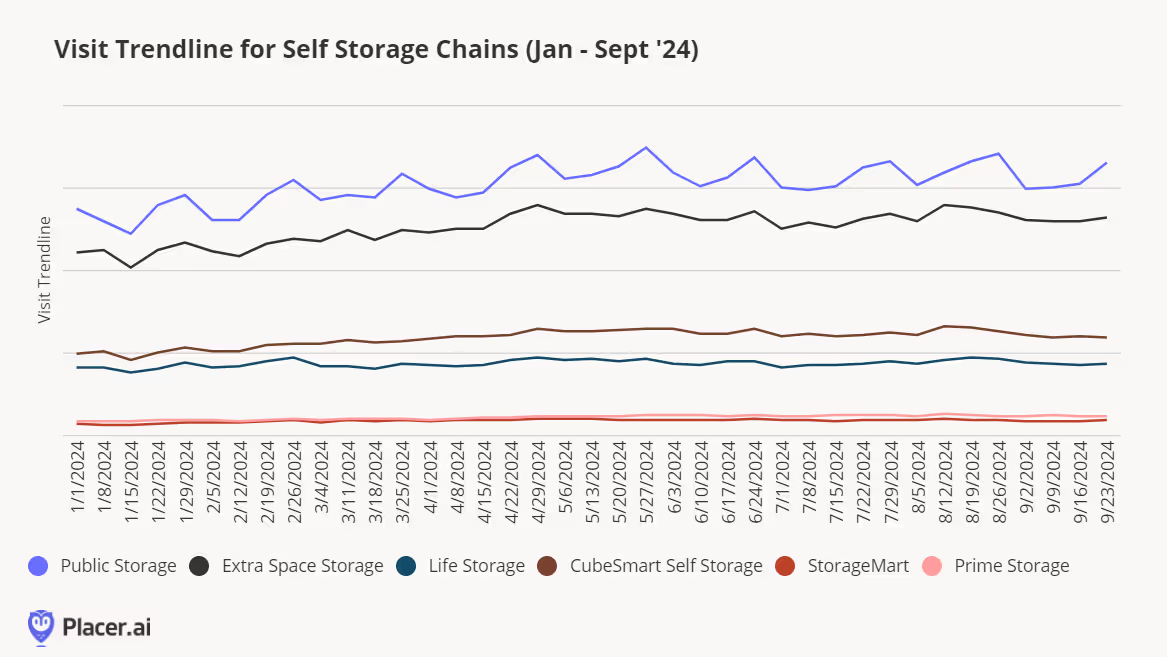

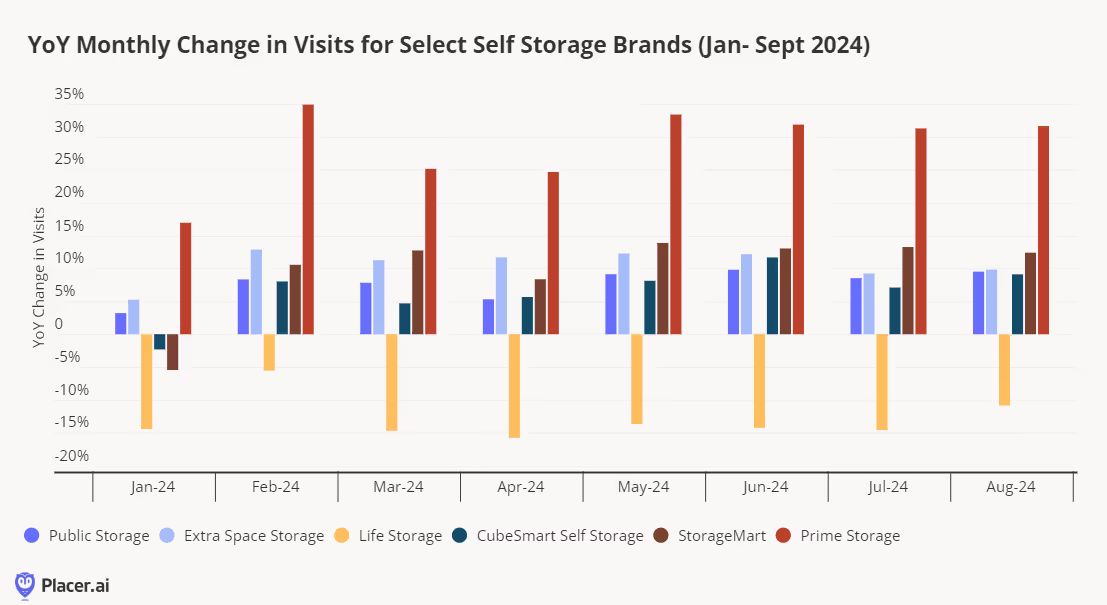

Americans have a love affair with stuff, and one of the hallmarks of this is the enduring strength of self-storage units. Public Storage takes the lead in overall visits, with Extra Space Storage not far behind. Looking at the Public Storage visits data, we see a clear spike in visits near the end of the month. This is due be due to housing transitions that also tend to occur with this pattern, as people prepare to move out at month’s end or conversely to pick up items for move-in at the beginning of a month.

Compared to last year, visits are generally up across most of these chains (which is partly the result of the industry consolidation trend we examined last year). The highest variance is seen with Prime Storage, a company largely based on the East Coast, but with a presence in the Midwest as well. StorageMart bought Manhattan Mini Storage in 2021 and has over 250 locations now.

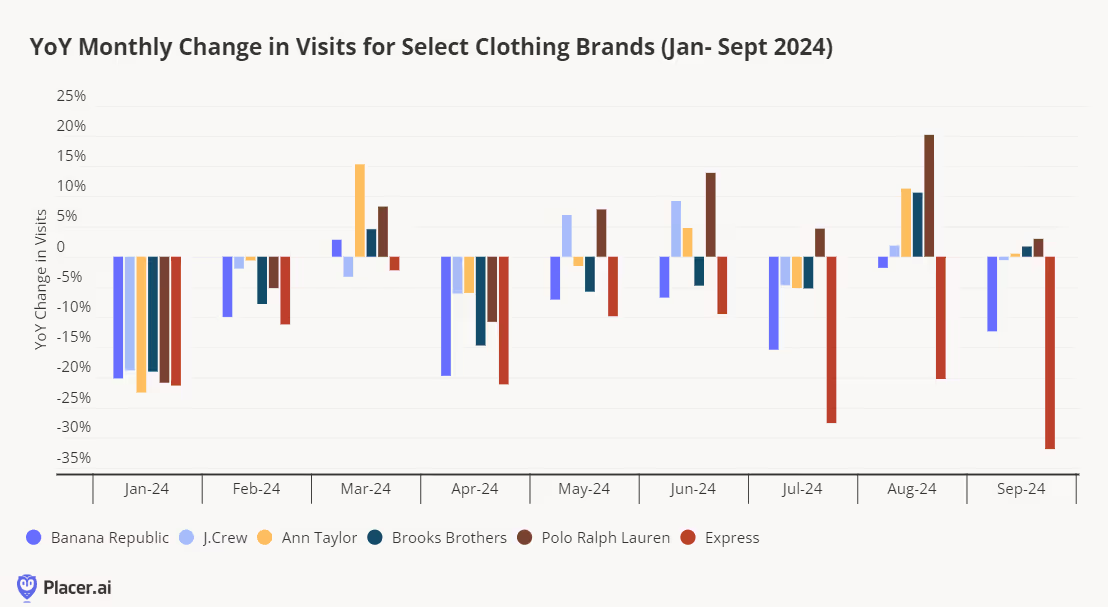

In just a few months, we will be coming on the 5-year anniversary of COVID-19. During that time, we hunkered down, bought tons of athleisure, and stared at our forlorn office clothing sitting unworn in our closets. Fast forward a few years to present day and much like bootcut jeans are back in style, the pendulum is starting to veer back towards a more tailored style. This time around, the suits may not be as constricting, but there is certainly more structure to fall’s fashion than the cozy comfy sweatpants and leggings that the whole world came to embrace upon working from home. Among locations that are not multi-story or in enclosed malls, we see that Ann Taylor increased traffic to its locations in March, June, and August compared to last year, and that Polo Ralph Lauren has also seen increases in the past few months. This particular grouping of brands all has at least 30 or more locations each tracked by Placer and tend to be ubiquitous at many malls or as standalone boutiques. A recent visit to Banana Republic indicated a merchandising assortment that appeared to be more than 50% office wear in the women’s section, with blazers and tailored pants, silky shirts, and dresses ready to be accessorized with heels and some statement jewelry.

However, we are seeing even larger increases in year-over-year traffic at some of the more specialized/high-end brands, particularly in women’s contemporary that offer sharp-looking items that look just as polished at the boardroom or the PTA meeting, like the blazers at Veronica Beard or the “Effortless Pant” from Aritzia that is a smash hit on social media. The majority of this next grouping of brands got their start at department stores or specialty retailers, but with increased success, many are launching their own brick-and-mortar boutiques. Clearly, having a holy grail item that is on the fashion editors’ favorites list gives a boost to store traffic. One of the trends we are seeing is the continuation of the love for comfort everyone adopted during Covid mixed with a slightly more structured but still understated minimalist but luxe aesthetic, like COS. Theory, a wardrobe staple with its neutral color palette and streamlined silhouettes, has been generating positive year-over-year traffic during the back-to-school and fall season. Vince, also featuring rather understated and neutral basics, also saw its traffic lift for the fall season. Eileen Fisher is another interesting brand. Once regarded as clothing adapted to your mom’s generation, Gen Z is also starting to embrace it for its softness and sustainability, and it is one of the more popular brands to buy secondhand. In April of this year, Guess and WHP Global completed the acquisition of rag & bone, which has long been hailed for their on-trend jeans and boots. Time will tell what direction they will take the brand, or if they will stick with its tried-and-true New York roots.

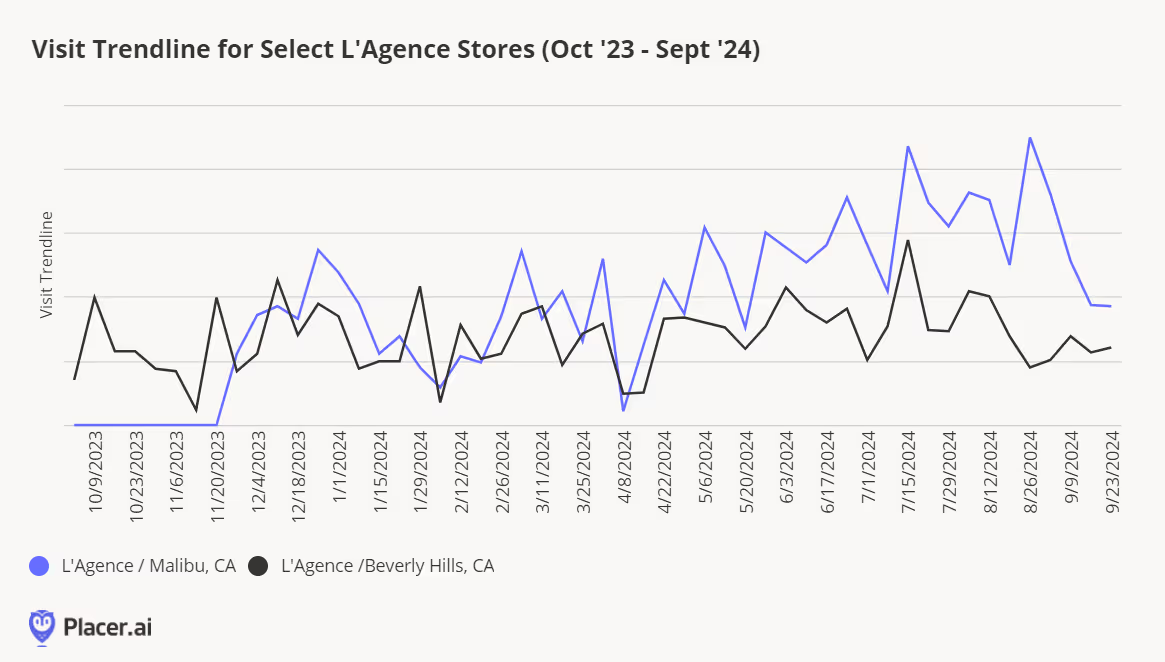

Another brand to keep an eye on that we’re already familiar with from prestige department stores like Nordstrom, Bloomingdale’s, and Saks Fifth Avenue is L’Agence. This brand goes seamlessly from day to night with classics like tweed blazers, satiny tank tops, and perfectly-fitting jeans. They’ve now expanded to more stand-alone stores, including Southern California shopping meccas like Malibu and Beverly Hills. While the Malibu one just opened in late fall 2023, its traffic has been growing steadily upwards, even overtaking that of the Beverly Hills outpost of late.

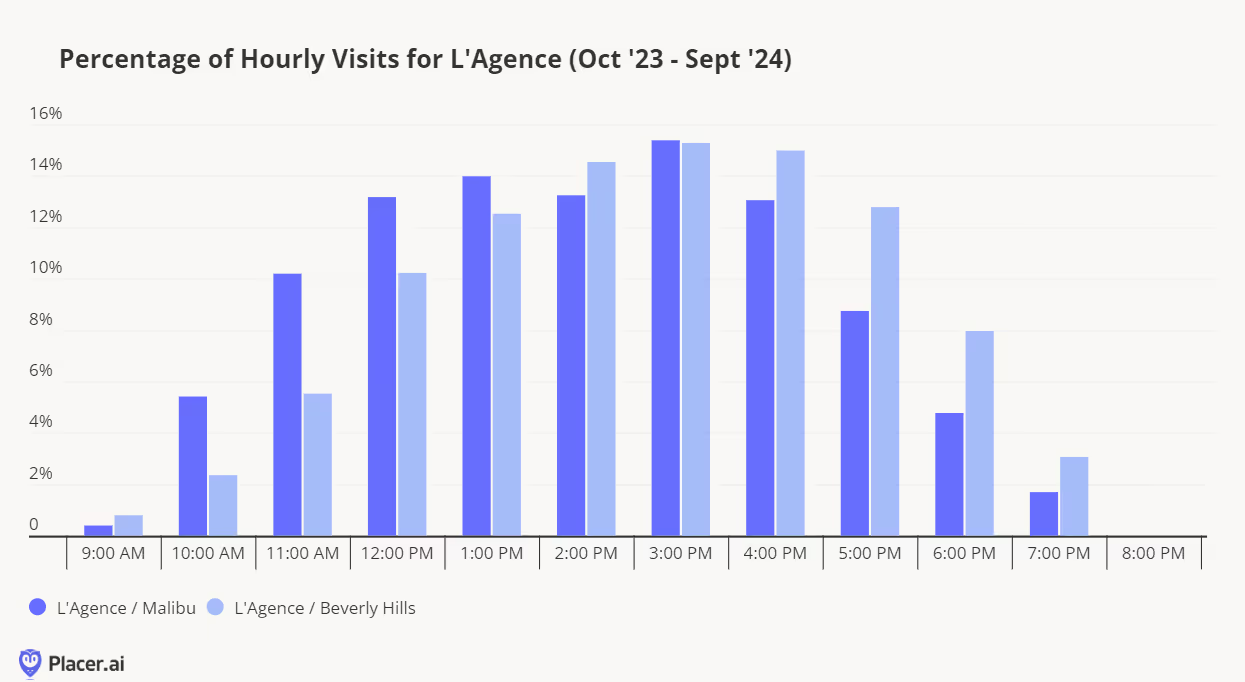

One interesting thing to note is that the Malibu location attracts a higher proportion of its audience during the morning hours, whereas the Beverly Hills location gets the evening crowd. This information would be useful for staffing purposes or for knowing when to hold events.

The full-service dining segment has experienced its fair share of challenges over the past few years, with pandemic-era closures, rising food and labor costs, and cutbacks in discretionary spending contributing to visit lags. In 2024, visits were down 0.2% year over year (YoY) and remained 8.4% below 2019 levels – a reflection of the significant number of venues that permanently closed over COVID and a testament to the industry's ongoing struggle to regain its pre-pandemic footing.

Yet, even in a difficult environment, some full-service restaurant (FSR) chains are thriving. These brands aren’t waiting for the industry to rebound – they're becoming trendsetters in their own right, proving that stand-out strategy is everything in a challenging market.

This white paper explores brands that are harnessing three key differentiators – fixed-price value offerings, elevated social experiences, and a laser focus on product – to drive full-service dining success in 2025.

One of the most defining trends over the past few years has been the unrelenting march of price increases. And as consumers continue to seek out ways to save, some chains are staying ahead of the pack with fixed-price value offerings that help diners squeeze out the very best bang for their buck.

Golden Corral, the all-you-can-eat buffet chain that lets kids under three eat for free, is one FSR that is benefiting from consumers’ current value orientation. Despite closing several locations in 2024, overall visits to the chain still tracked closely with 2023 levels, declining by just 0.5% – while the average number visits to each Golden Corral restaurant grew 3.8% YoY.

Golden Corral’s value proposition is resonating strongly with budget-conscious Americans eager to enjoy a wide variety of comfort foods at an affordable price. The chain’s visitors tend to come from trade areas with lower median household incomes (HHIs) than traditional full-service restaurant (FSR) diners. And these patrons are willing to travel to enjoy the chain’s value buffet offerings, many of which are situated in rural areas and may require a longer drive. In 2024, 25.2% of Golden Corral’s diners came from over 30 miles away – compared to just 19.2% for the wider FSR segment.

Golden Corral’s continued flourishing proves that in an era of rising costs, diners are willing to go the extra mile (literally) for a restaurant that delivers both quality and affordability.

Children’s party space and eatertainment destination Chuck E. Cheese has had a transformative few years. Following the retirement of its iconic animatronic band, the chain shifted its focus to a new membership model, announcing a revamped Summer of Fun pass in May 2024 – including unlimited visits over a two-month period, steep discounts on food, and up to 250 games per day. The pass proved incredibly popular, with YoY visits surging by 15.6% in May 2024, when the offer launched – a sharp turnaround from the YoY visit declines of the previous months. Recognizing the strong demand, Chuck E. Cheese extended the program year-round – and the strategy has paid off as YoY visits remained positive through the end of 2024.

A closer look at the data suggests that parents are making full use of their unlimited passes: The share of weekday visits was higher in H2 2024 than in H2 2023, likely due to families using their passes for weekday entertainment rather than reserving visits for weekends and special occasions.

At the same time, the share of repeat visitors – those frequenting the chain at least twice a month – also grew. Although these repeat visitors may not purchase additional gameplay beyond the flat fee, their more frequent on-site presence likely translates into increased sales of pizza and other menu items.

While value has been a major motivator for restaurant-goers in recent years, low prices aren’t the only drivers of FSR success. Brands offering unique experiences aimed at maximizing social interaction are also seeing outsized gains.

Though many of these more innovative venues tend to be on the more expensive side, they draw enthusiastic crowds willing to pony up for concepts that combine good food with fun social occasions. And some of the more successful ones bolster perceived value through offerings like fixed-price menus or club memberships.

Korean cuisine has been on the rise in recent years, with restaurants like Bonchon Chicken and GEN Korean BBQ House making significant waves in the dining space. Another chain drawing attention is KPOT Korean BBQ and Hot Pot, which began modestly in 2018 and has since expanded to over 150 locations nationwide.

Diners at KPOT can customize their meals by selecting from a variety of proteins, broths, sauces, and side dishes, known as banchan, while barbecuing or cooking in a hotpot at their table and sipping on the drinks from the menu’s extensive selection. And though pricier than Golden Corral, KPOT also offers an all-you-can-eat experience that lets customers squeeze the most value out of their indulgence.

Location intelligence shows that KPOT’s experiential dining model is resonating with customers: Since Q4 2019, the average number of visits to each KPOT location has risen steadily – even as the chain has grown its footprint – while the average dwell time has also increased. Indeed, rather than a quick dining stop, KPOT has become a destination for guests to linger, enjoying both food and drinks – and an interactive and social experience.

By positioning themselves as gathering places for fine wine aficionados, wine-club-focused concepts such as Postino WineCafe and Cooper’s Hawk Winery are also benefiting from today’s consumers’ emphasis on social experiences. The two upscale dining destinations offer club memberships that combine periodic wine releases with a variety of perks.

And the data suggests that the model is strongly resonating with diners. Both Postino and Cooper’s Hawk have grown their footprints over the past year, driving substantial YoY chain-wide visit increases while average visits per location grew as well – showing that the expansions and experiential offerings are meeting robust demand.

And analyzing the two chains’ captured markets shows that the wine club model enjoys broad appeal across a variety of audience segments.

Unsurprisingly, both wine clubs’ visitor bases include higher-than-average shares of affluent consumers with money to spend, including Experian: Mosaic’s “Power Elite”, “Booming with Confidence”, and “Flourishing Families” segments (the nation’s wealthiest families, as well as affluent suburban and middle-aged households). But the two chains also attract younger, more budget-conscious consumers – Postino, which has many downtown locations, is popular among “Singles and Starters”, while Cooper’s Hawk is popular among “Promising Families” - i.e. young couples with children.

The success of the two brands across various segments underscores the impact of a distinctive experience – especially when paired with a loyalty-boosting membership – in attracting today’s consumers.

Value offerings and unique experiences have the power to drive restaurant visits – but ultimately, a good meal in an inviting atmosphere is a draw in and of itself, as is shown by the success of First Watch and Firebirds Wood Fired Grill.

Breakfast-only restaurant First Watch excels at ambiance and menu innovation, changing up its offerings five times a year and striving to maintain a neighborhood feel at each of its locations.

First Watch has made a point of leaning into its strengths, eschewing discounts in favor of a consistently elevated dining experience and doubling down its strongest day part (weekend brunch), rather than trying to artificially drive up interest at other times.

And the strategy appears to be working: In 2024, visits to First Watch increased 6.6% YoY – with Saturdays and Sundays between 11:00 A.M. and 1:00 P.M. remaining its busiest dayparts by far. Visitors to First Watch also tend to linger over their meals more than at other breakfast chains – in 2024, the restaurant experienced an average dwell time of 54.9 minutes, significantly longer than the 48.7-minute average at other breakfast-focused restaurants.

By focusing on what matters most to its diners – innovative and exciting food and a welcoming atmosphere that allows patrons to enjoy their meals at a leisurely pace – First Watch is continuing to flourish.

Another chain that is growing its footprint and its audience on the strength of a menu and ambiance-focused approach is Firebirds Wood Fired Grill. The chain, known for its “polished casual” vibe and bold, unique flavors, added several new restaurants last year, leading to a 6.5% increase in overall visits. Over the same period, the average number of visits to each Firebirds location held steady – showing that the new restaurants aren’t cannibalizing existing business.

The chain’s success may rest, in part, on its locating its venues in areas rife with enthusiastic foodies. Data from Spatial.ai’s FollowGraph shows that in 2024, Firebird’s trade areas had significantly higher shares of “BBQ Lovers”, “Gourmet Burger Lovers,” and “Foodies” than the nationwide average. This suggests that Firebirds is attracting diners who prioritize the experience of eating – key for a chain that prides itself on putting good food first. The chain is also known for its welcoming decor and design – another aspect that may lead to its strong visit success.

Necessity often serves as the mother of invention, and challenging economic periods continue to spark new trends and innovations in the dining scene. From a heightened focus on value – drawing families and lower-HHI consumers willing to travel for a good deal – to the growing appeal of social dining and the timeless draw of good food – new trends are emerging to meet changing consumer expectations.

Stadiums and arenas – and the communities they call home – have a stake in cultivating engaged team fanbases eager to participate in live events. And venues and teams can employ a variety of strategies to strengthen their connection with fans and draw crowds to the stands.

In this report, we leverage location analytics and audience segmentation to uncover some of the ways that sports franchises and venues are driving engagement – attracting visitors from farther away and appealing to fans more likely to splurge on stadium fare. How does the signing of a star athlete impact arena visitor profiles? What happens to stadium visitation trends when a team’s performance improves dramatically? And how can teams and venues tailor their offerings to more effectively cater to visitor preferences?

We dove into the data to find out.

In sports, the signing of a star athlete can have a ripple effect across the organization, hometown, and league. In addition to driving up overall attendance at games, star power can impact everything from visit frequency to audience profile – and the buying power of stadium attendees.

Lionel Messi’s move to Inter Miami CF after decades of European play brought a foot traffic boost to Chase Stadium (formerly DRV PNK Stadium). But it also shifted the demographics of stadium visitors and increased the distance they traveled to attend a game.

At Inter Miami’s 2022 and 2023 home openers without Messi (he joined the team mid-season in 2023), only 6.4% and 5.3% of visitors to Chase Stadium came from over 250 miles away. But for the 2024 home opener with Messi on the squad, 31.3% of stadium visitors traveled more than 250 miles to attend.

The demographics of visitors at the home opener also changed with Messi on the team. Trade area data combined with the Spatial.ai: PersonaLive dataset reveals that the 2024 home opener received a smaller share of households in the “Near-Urban Diverse Families” (11.2%) and “Young Urban Singles” (7.2%) segments than the two previous years. Meanwhile, shares of “Sunset Boomers” (13.0%) and “Ultra Wealthy Families” (20.1%) increased, indicating that Messi brought an older and more affluent demographic of visitors to the stadium compared to previous years. Messi’s arrival has generated increased revenue for Inter Miami CF, Major League Soccer, and Apple TV+, which has exclusive streaming rights for MLS games. And an influx of affluent out-of-town visitors also has the potential to drive positive outcomes for tourism and employment in the Miami area.

Caitlin Clark’s WNBA debut was another star-powered game changer – this time for women’s basketball. After dazzling the sports world during her college basketball career, Caitlin Clark was drafted first overall to the Indiana Fever before the 2024 WNBA season. The superstar’s arrival has had a staggering economic impact on the city of Indianapolis and the Fever franchise, highlighting the benefit of a top athlete within the local community. However, Clark’s stardom also had a far-reaching impact on the league as a whole, adding tremendous value to the WNBA. Trade area analysis reveals that several WNBA arenas saw an uptick in visitor affluence when hosting the Fever with Clark in the lineup – likely driven in part by the elevated ticket prices associated with her appearances.

When the Minnesota Lynx hosted the Fever on July 14th, 2024, for example, the median HHI of Target Center’s captured market shot up to just over $93K/year, well above the median HHIs for the games immediately before and after that event. (A venue’s captured market refers to the census block groups (CBGs) from which it draws its visitors, weighted to reflect the share of visits from each one – and thus reflects the profile of the venue’s visitor base.) Similarly, the Fever’s away game against the Connecticut Sun on May 14th, 2024 at Mohegan Sun Arena drove a higher audience median HHI ($103.6K/year) than either of the Sun’s next two home games.

Having a superstar on the roster can drive positive outcomes locally and league-wide – but overall team success is the ultimate goal for any franchise. So it may come as no surprise that stadiums and arenas can drive engagement when their home teams perform well on the field or court. And teams that reverse their fortunes often spark even greater excitement, boosting visitor loyalty, visit duration, and other key metrics.

The Baltimore Orioles had one of the worst records in baseball just a few years ago. But since 2022, the team has flipped the script – stringing together winning seasons and postseason berths. And location intelligence shows that as the team finds success, fans are becoming more engaged with their hometown stadium.

During the 2019 regular season, one of the worst for the club in recent history, stadium attendance suffered, with only 8.3% of visitors to Oriole Park at Camden Yards visiting the stadium at least three times. But during the 2024 regular season, Oriole Park’s share of repeat visitors (those who visited at least three times) was almost double 2019 levels (16.3%) – consistent with a sharp increase in sales of multi-game ticket packages.

In addition to attending games more often, visitors to Oriole Park also appear to be spending more time at the ballpark. During the 2019 regular season, visitors spent an average of 150 minutes at the stadium, but in 2024, the average time at the park increased to 178 minutes – potentially boosting ancillary spending and in-stadium advertising exposure. The increased dwell time of visitors is particularly noteworthy when considering that MLB’s rule changes have significantly shortened average game time.

The more engaged fandom engendered by team success not only impacts stadium visitor behavior, but also has the potential to drive revenue. The Orioles added 20 new corporate sponsors before the 2024 season, likely due to the attention garnered by the well-performing club.

The NFL’s Detroit Lions provide another example of team success that has driven visitor engagement. As the franchise has improved its record in recent years, the trade area size of its stadium – Ford Field – has also increased, indicating elevated attendance from fans living further away.

The Lions finished the regular season with losing records from 2019 to 2021, but finished over .500 in 2022 (9-8), 2023 (12-5), and 2024 (15-2). And with the team’s increasing wins each consecutive season, the size of its stadium's trade area has also increased steadily – reaching 81.3% above 2019 levels in 2024.

This underscores just how much team success matters to fans, who may be more inclined to travel longer distances if they believe their team is likely to win. Ultimately, broader fan engagement across a wider trade area also increases a team’s growth potential beyond in-stadium attendance – driving merchandise sales, increasing viewership, and benefitting both the team and the league as a whole.

While stadium attendance and visitor behavior is often correlated to the performance of the sports teams that play in the arena, sporting venues can also drive fan engagement in ways that aren’t solely tied to team success or big-name athletes. By adapting their concessions and venue operations to visitor preferences, stadiums and arenas can better serve their audiences and strengthen their community presence.

Consumers have been feeling the pinch of rising food costs for quite some time, but at least one NBA team has responded to make concessions at the game more affordable for fans. In December 2024, the Phoenix Suns announced a $2 value menu for all home games at Footprint Center – delivering steep discounts on hot dogs, water, soda, and snacks.

Location analytics suggest that since the value menu launch, more fans who would have otherwise waited until after leaving the venue to grab a bite are now enjoying food and drinks inside the arena. Analysis of five Suns home games just before the value menu launch – between November 26th and December 15th, 2024 – reveals that between 7.0% and 9.3% of stadium visitors visited a dining establishment after leaving the arena. But following the value menu launch before the December 19th, 2024 home game, post-game dining decreased to under 6.0% through the end of the year.

Suns owner Mat Ishbia’s announcement of the new menu called out the need for affordable food options for families at Suns games. As the season progresses, the new menu may drive a larger share of family households to Suns games, which could provide opportunities for advertisers and other stadium partners.

Consumers in Washington – and especially Seattle – are known for their affinity for plant-based diets and environmentally-friendly lifestyles. And that goes for local football fans as well: Audience segmentation provided by the AGS: Behavior & Attitudes dataset combined with trade area data reveals that during September to December 2024, households within Lumen Field’s potential visitor base were 36% more likely to be “Environmentally Conscious Buyers” and “Environmental Contributors” and 39% more likely to be “Vegans” compared to the nationwide average. By contrast, across all NFL stadiums, potential visiting households were 2%, 1%, and 3% less likely, respectively, to belong to these segments.

And Lumen Field has been actively catering to these consumer preferences. The stadium, which has been experimenting with plant-based culinary options for quite some time, was recently recognized as one of the most vegan-friendly stadiums in the NFL. And in December 2024, Lumen became the second stadium in the league to achieve TRUE precertification for its efforts to become a zero-waste venue.

By remaining aligned with its visitor base – including both football fans and people that visit the stadium for other events – Lumen Field encourages visitors to feel at home at their local stadium. And fans may be more connected to their team knowing the club shares their values and respects their lifestyle.

Stadiums and arenas can leverage a variety of strategies to engage visitors in attendance as well as wider audiences. Signing a star athlete, putting together a winning club, or adapting to local preferences are just some of the ways that sports franchises and athletic venues can find success.

Starbucks. Amazon. Barclays. AT&T. UPS. These are just some of the major corporations that have made waves in recent months with return-to-office (RTO) mandates requiring employees to show up in person more often – some of them five days a week.

But how are crackdowns like these taking shape on the ground? Is the office recovery still underway, or has it run its course? And how are evolving in-office work patterns impacting commuting hubs and dining trends? This white paper dives into the data to assess the state of office recovery in 2024 – and to explore what lies ahead for the sector in 2025.

In 2024, office foot traffic continued its slow upward climb, with visits to the Placer.ai Office Index down just 34.3% compared to 2019. (In other words, visits to the Placer.ai Office Index were 65.7% of their pre-COVID levels). And zooming in on year-over-year (YoY) trends reveals that office visits grew by 10.0% in 2024 compared to 2023 – showing that employee (and manager) pushback notwithstanding, the RTO is still very much taking place.

Indeed, diving into quarterly office visit fluctuations since Q4 2019 shows that office visits have been on a slow, steady upward trajectory since Q2 2020, following – at least since 2022 – a fairly consistent seasonal pattern. In Q1, Q2, and Q3 of each year, office visit levels increased steadily before dipping in holiday-heavy Q4 – only to recover to an even higher start-of-year baseline in the following Q1.

Between Q1 and Q3 2022, for example, the post pandemic office visit gap (compared to a Q4 2019 baseline) narrowed from 63.1% to 47.5%. It then widened temporarily in Q4 before reaching a new low – 41.4% – in Q1 2023. The same pattern repeated itself in both 2023 and 2024. So even though Q4 2024 saw a predictable visit decline, the first quarter of Q1 2025 may well set a new RTO record – especially given the slew of strict RTO mandates set to take effect in Q1 at companies like AT&T and Amazon.

Despite the ongoing recovery, the TGIF work week – which sees remote-capable employees concentrating office visits midweek and working remotely on Fridays – remains more firmly entrenched than ever.

In 2024, just 12.3% of office visits took place on Fridays – less than in 2022 (13.3%) and on par with 2023 (12.4%). Though Fridays were always popular vacation days – after all, why not take a long weekend if you can – this shift represents a significant departure from the pre-COVID norm, which saw Fridays accounting for 17.3% of weekday office visits.

Unsurprisingly, Tuesdays and Wednesdays remained the busiest in-office days of the week, followed by Thursdays. And Mondays saw a slight resurgence in visit share – up to 17.9% from 16.9% in 2023 – suggesting that as the RTO progresses, Manic Mondays are once again on the agenda.

Indeed, a closer look at year-over-five-year (Yo5Y) visit trends throughout the work week shows that on Tuesdays and Wednesdays, 2024 office foot traffic was down just 24.3% and 26.9%, respectively, compared to 2019 levels. The Thursday visit gap registered at 30.3%, while the Monday gap came in at 40.5%.

But on Fridays, offices were less than half as busy as they were in 2019 – with foot traffic down a substantial 53.2% compared to 2019.

Before COVID, long commutes on crowded subways, trains, and buses were a mainstay of the nine-to-five grind. But the rise of remote and hybrid work put a dent in rush hour traffic – leading to a substantial slowdown in the utilization of public transportation. As the office recovery continues to pick up steam, examining foot traffic patterns at major ground transportation commuting hubs, such as Penn Station in New York or Union Station in Washington, D.C., offers additional insight into the state of RTO.

Rush hour, for one thing – especially in the mornings – isn’t quite what it used to be. In 2024, overall visits to ground transportation hubs were down 25.0% compared to 2019. But during morning rush hour – weekdays between 6:00 AM and 9:00 AM – visits were down between 44.6% and 53.0%, with Fridays (53.0%) and Mondays (49.7%) seeing the steepest drops. Even as people return to the office, it seems, many may be coming in later – leaning into their biological clocks and getting more sleep. And with today’s office-goers less likely to be suburban commuters than in the past (see below), hubs like Penn Station aren’t as bustling first thing in the morning as they were pre-pandemic.

Evening rush hour, meanwhile, has been quicker to bounce back, with 2024 visit gaps ranging from 36.4% on Fridays to 30.0% on Tuesdays and Wednesdays. Office-goers likely form a smaller part of the late afternoon and evening rush hour crowd, which may include more travelers heading to a variety of places. And commuters going to work later in the day – including “coffee badgers” – may still be apt to head home between four and seven.

The drop in early-morning public transportation traffic may also be due to a shift in the geographical distribution of would-be commuters. Data from Placer.ai’s RTO dashboard shows that visits originating from areas closer to office locations have recovered faster than visits from farther away – indicating that people living closer to work are more likely to be back at their desks.

And analyzing the captured markets of major ground transportation hubs shows that the share of households from “Principal Urban Centers” (the most densely populated neighborhoods of the largest cities) rose substantially over the past five years. At the same time, the share of households from the “Suburban Periphery” dropped from 39.1% in 2019 to 32.7% in 2024. (A location’s captured market refers to the census block groups (CBGs) from which it draws its visitors, weighted to reflect the share of visits from each one – and thus reflects the profile of the location’s visitor base.)

This shift in the profile of public transportation consumers may explain the relatively slow recovery of morning transportation visits: City dwellers , who seem to be coming into the office more frequently than suburbanites, may not need to get as early a start to make it in on time.

While the RTO debate is often framed around employer and worker interests, what happens in the office doesn’t stay in the office. Office attendance levels leave their mark on everything from local real estate markets to nationwide relocation patterns. And industries from apparel to dining have undergone significant shifts in the face of evolving work routines.

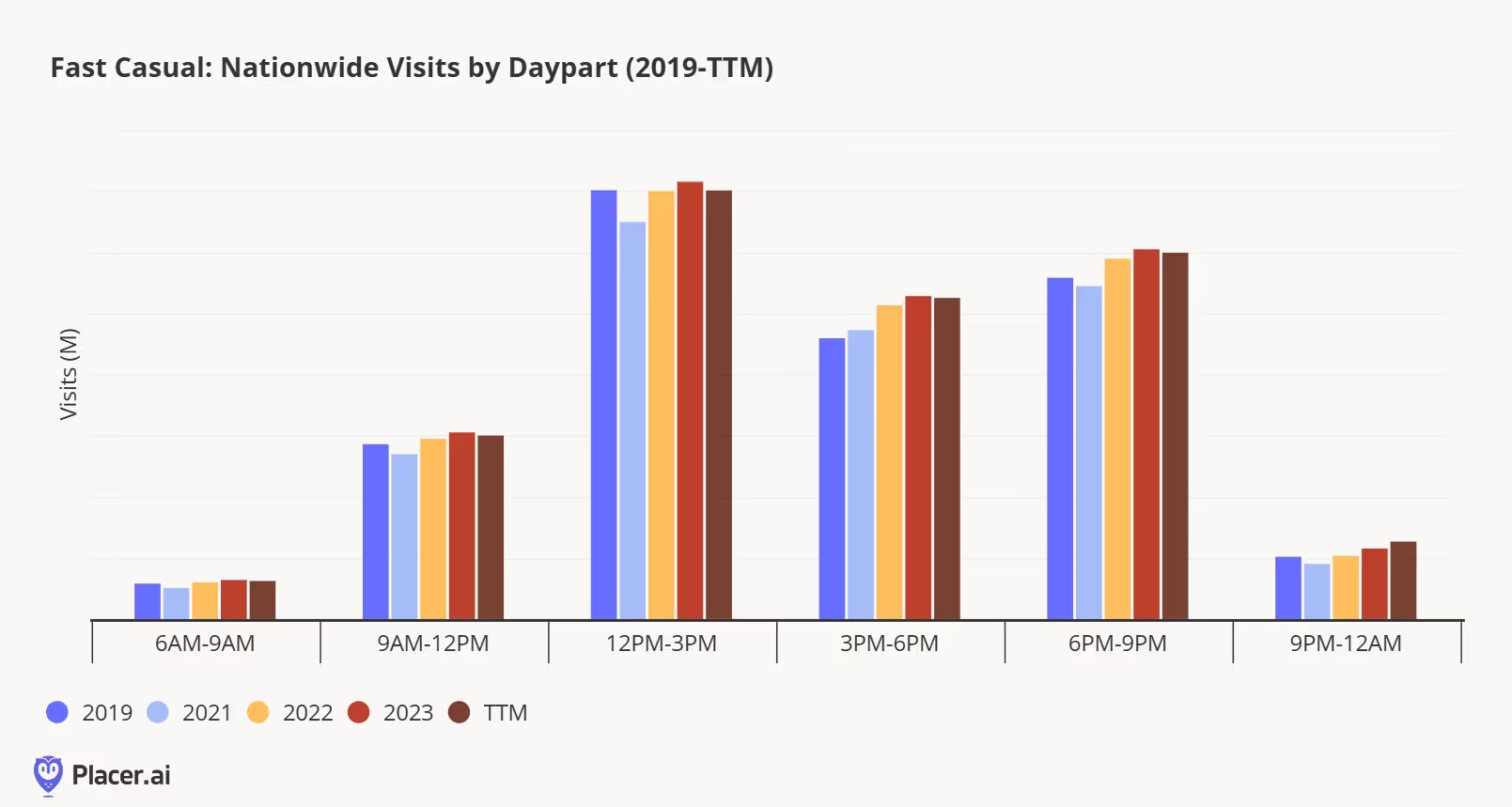

Within the dining space, for example, fast-casual chains have always been workplace favorites. Offering quick, healthy, and inexpensive lunch options, these restaurants appeal to busy office workers seeking to fuel up during a long day at their desks.

Traditionally, the category has drawn a significant share of its traffic from workplaces. And after dropping during COVID, the share of visits to leading fast-casual brands coming from workplaces is once again on the rise.

In 2019, for example, 17.3% of visits to Chipotle came directly from workplaces, a share that fell to just 11.6% in 2022. But each year since, the share has increased – reaching 16.0% in 2024. Similar patterns have emerged at other segment leaders, including Jersey Mike’s Subs, Panda Express, and Five Guys. So as people increasingly go back to the office, they are also returning to their favorite lunch spots.

For many Americans, coffee is an integral part of the working day. So it may come as no surprise that shifting work routines are also reflected in visit patterns at leading coffee chains.

In 2019, 27.5% of visits to Dunkin’ and 20.1% of visits to Starbucks were immediately followed by a workplace visit, as many employees grabbed a cup of Joe on the way to work or popped out of the office for a midday coffee break. In the wake of COVID, this share dropped for both coffee leaders. But since 2022, it has been steadily rebounding – another sign of how the RTO is shaping consumer behavior beyond the office.

Five years after the pandemic upended work routines and supercharged the soft pants revolution, the office recovery story is still being written. Workplace attendance is still on the rise, and restaurants and coffee chains are in the process of reclaiming their roles as office mainstays. Still, office visit data and foot traffic patterns at commuting hubs show that the TGIF work week is holding firm – and that people aren’t coming in as early or from as far away as they used to. As new office mandates take effect in 2025, the office recovery and its ripple effects will remain a story to watch.