.svg)

.png)

.png)

.png)

.png)

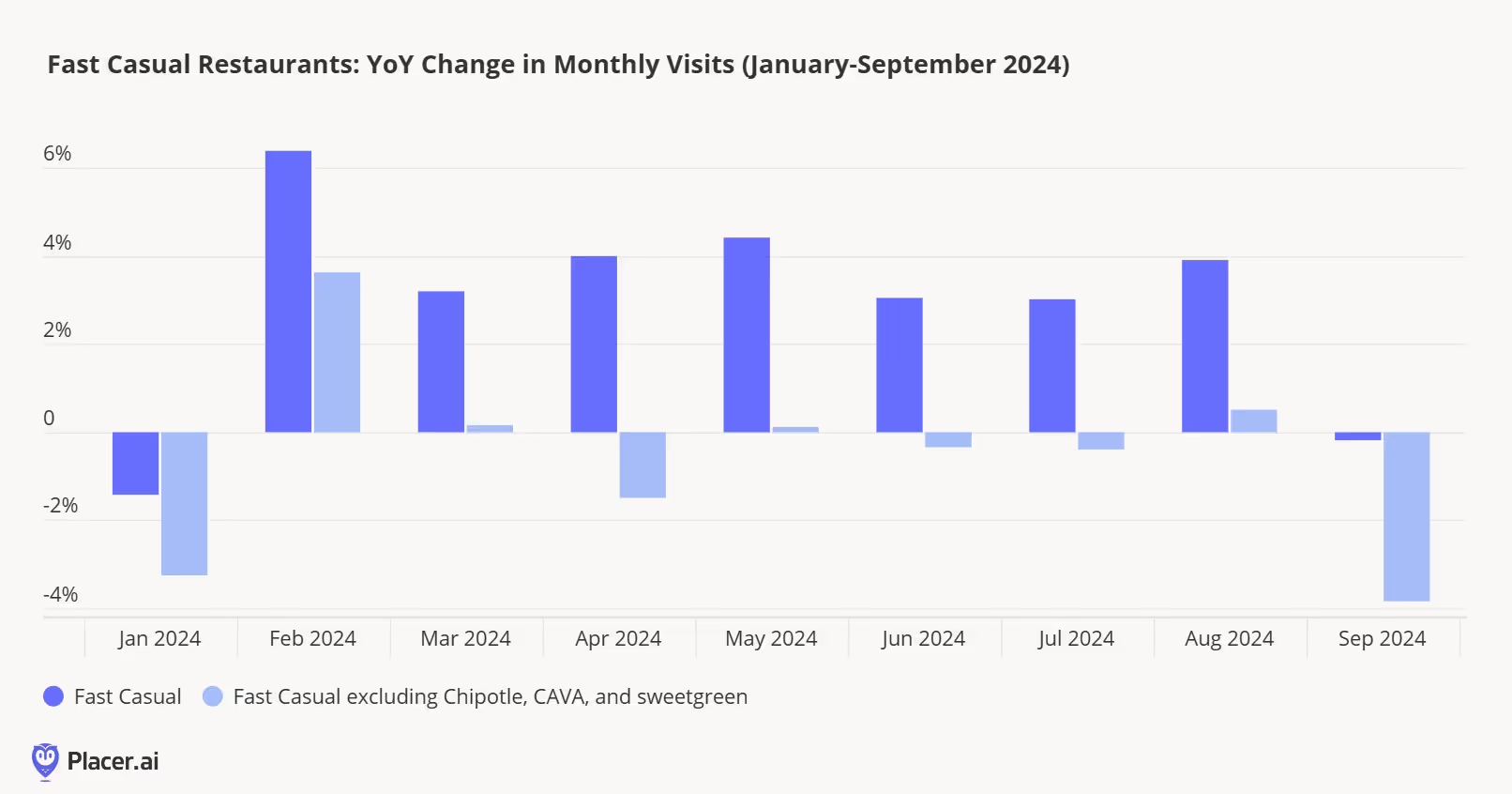

Most chains attending the 2024 Fast Casual Executive Summit in Denver acknowledged that this year has been difficult (unless you happen to be Chipotle, CAVA, or sweetgreen). We’ve highlighted a number of the challenges restaurant operators faced this past year, including inclement weather to start the year, the restaurant value wars of 2024, encroachment from other food retail channels, and the rising cost of operating a restaurant, which has resulted in increased bankruptcies. Our data validates this stance–our data shows that the fast casual category excluding the three aforementioned chains has seen year-over-year visitation declines.

Why are these three chains outperforming? As we’ve discussed in the past, we believe it comes down to (1) innovation; and (2) operational excellence. Recently, we looked at the importance of Chipotle’s Chicken al Pastor relaunch for Q2 2024 sales trends, sweetgreen’s increase in comparable visits that was helped by the launch of Caramelized Garlic Steak as a protein option, and CAVA’s exceptionally strong visitation trends due the launch of grilled steak at the beginning of June. However, innovation is only part of the outperformance, as each of these chains have also done a great job integrating their digital ordering platforms and in-store assembly line efforts, allowing for greater customization (something consumers appear to be willing to pay a premium for) and driving some of the strongest throughput numbers we’ve observed with our data.

The executives we spoke to at this week’s event had a gameplan to overcome these challenges in 2025.

Another executive told us that the currently challenging backdrop would ultimately make chains better operators. Not every chain can be Chipotle, CAVA, or sweetgreen, but there are still a lot of their strategies that restaurants can adopt to improve their own operations.

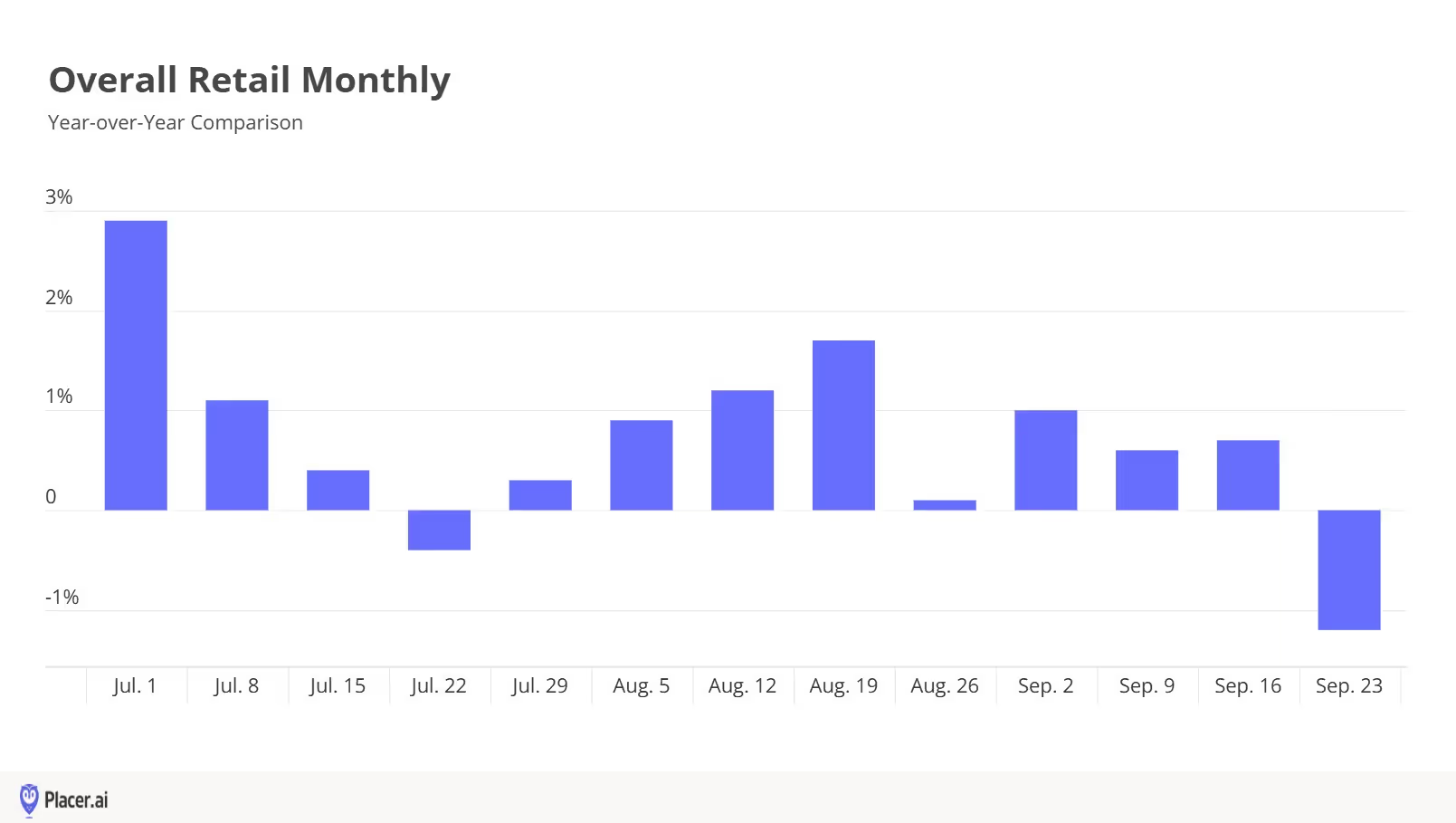

The inaugural Shoptalk Fall event brought a new energy to Chicago this week. The smaller format event allowed us to dive deeper into the trends across the retail industry and hear from key retail players about their initiatives and innovations across the industry.

One thing that is clear, retailers are bullish about physical retail. Many retailers shared plans for store openings in 2025, and there is a real focus on creating the right types of store formats and finding locations that are in line with a brand’s consumers. We may truly be at a point of inflection from a channel perspective, and physical retail is likely to become a more important part of the equation.

There’s a real energy shift in the industry in regard to the importance of stores, and it’s refreshing to see. As the industry settles from the migration shifts of consumers during and after the pandemic, the opportunity for new stores to directly cater to these new groups of shoppers is immense.

And it’s not just about the rise of physical retail, but the stories that retailers are able to tell through their offline channels. Retailers are actively focused on ways to eliminate friction for shoppers, arm store employees with more insights and tools and create experiences that forge lasting bonds with shoppers. We heard from Wayfair, Build-A-Bear Workshop, Michaels and Studs, who all referenced that differentiating experiences are driving loyalty and fostering long-term connections with consumers. Stores are an essential part of building and retaining brand equity with consumers.

The other key theme centers around none other than the consumer. The retail industry feels more customer centric than ever before, especially as we get further away from the pandemic. Retailers and brands recognize that today, the shopper is in the driver’s seat, and many initiatives and innovations center around providing the consumer with more power and knowledge. This is why we are hearing more about "micro-merchandising". Retailers need and can enhance their relevancy by understanding the unique demographics/psychographic differences and preferences of their individual locations.

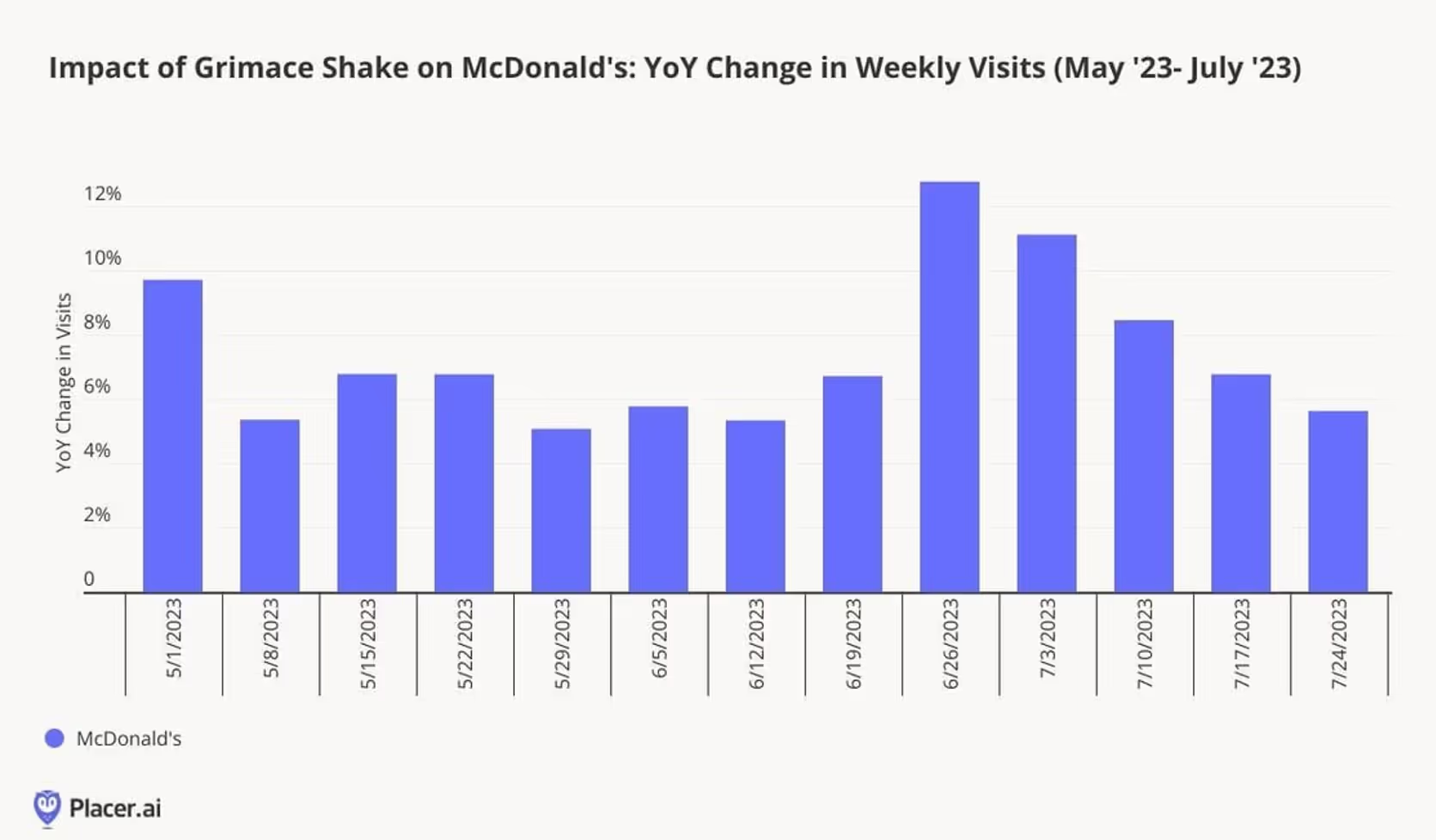

Executives at McDonald’s provided more insight into the success of June 2023's immensely popular birthday celebration for Grimace, including the Grimace Shake; they built the concept around the idea that many consumers celebrate a birthday at McDonald’s restaurants, but from there they let consumers drive the conversation around the promotion on social media.

We heard from many that word of mouth marketing is truly the key to success in retail today, and empowering consumers to share their thoughts and affinities with others in person or through social media platforms is driving engagement and adoption. Through the lens of foot traffic, we may see more consumers head to stores after hearing about them from others in their network. Marketing departments no longer consist of teams within an organization, but incorporate consumers as well.

Overall, we felt a lot of positivity from the industry about where we’re headed in the near term. As we see the slow rebound of the discretionary side of retail, new stores and innovations in the coming year and a consumer that still remains resilient despite many economic headwinds, the best might be ahead for the industry.

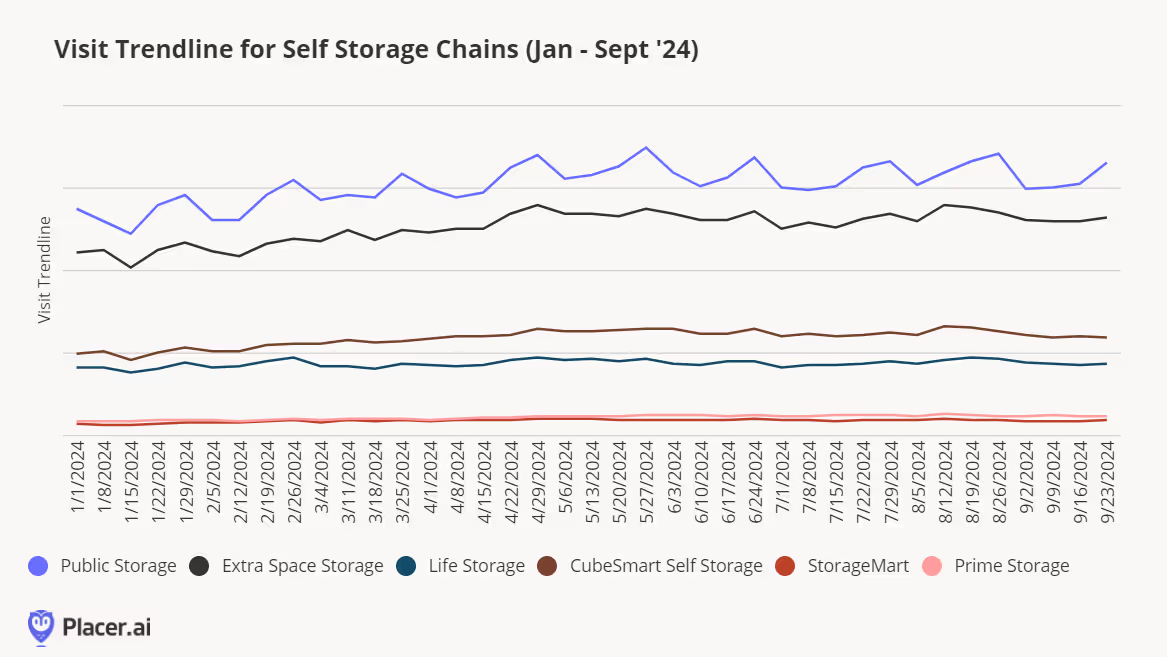

Americans have a love affair with stuff, and one of the hallmarks of this is the enduring strength of self-storage units. Public Storage takes the lead in overall visits, with Extra Space Storage not far behind. Looking at the Public Storage visits data, we see a clear spike in visits near the end of the month. This is due be due to housing transitions that also tend to occur with this pattern, as people prepare to move out at month’s end or conversely to pick up items for move-in at the beginning of a month.

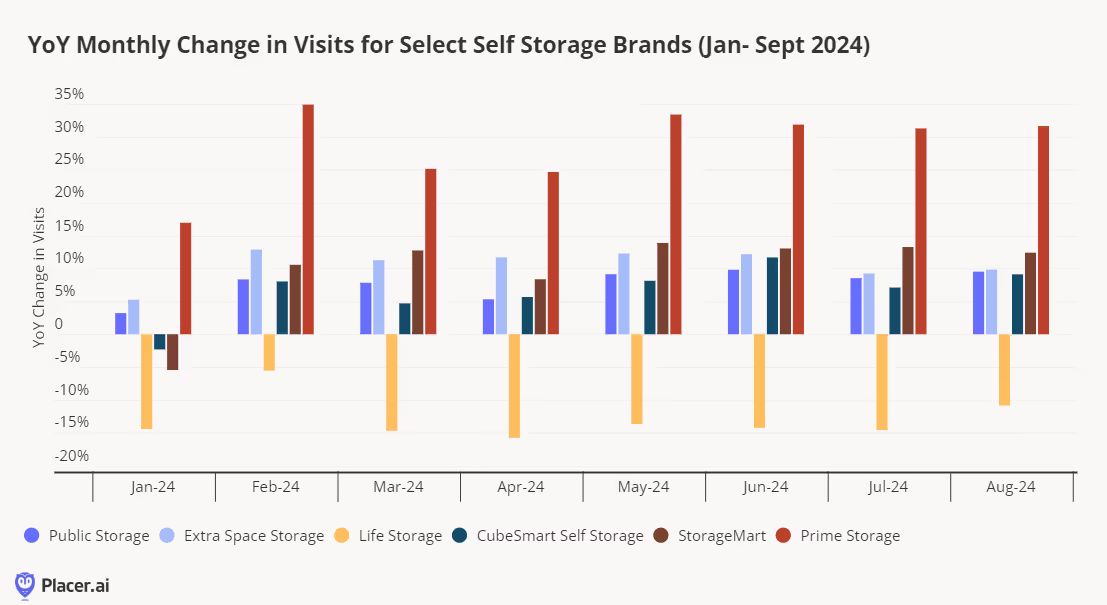

Compared to last year, visits are generally up across most of these chains (which is partly the result of the industry consolidation trend we examined last year). The highest variance is seen with Prime Storage, a company largely based on the East Coast, but with a presence in the Midwest as well. StorageMart bought Manhattan Mini Storage in 2021 and has over 250 locations now.

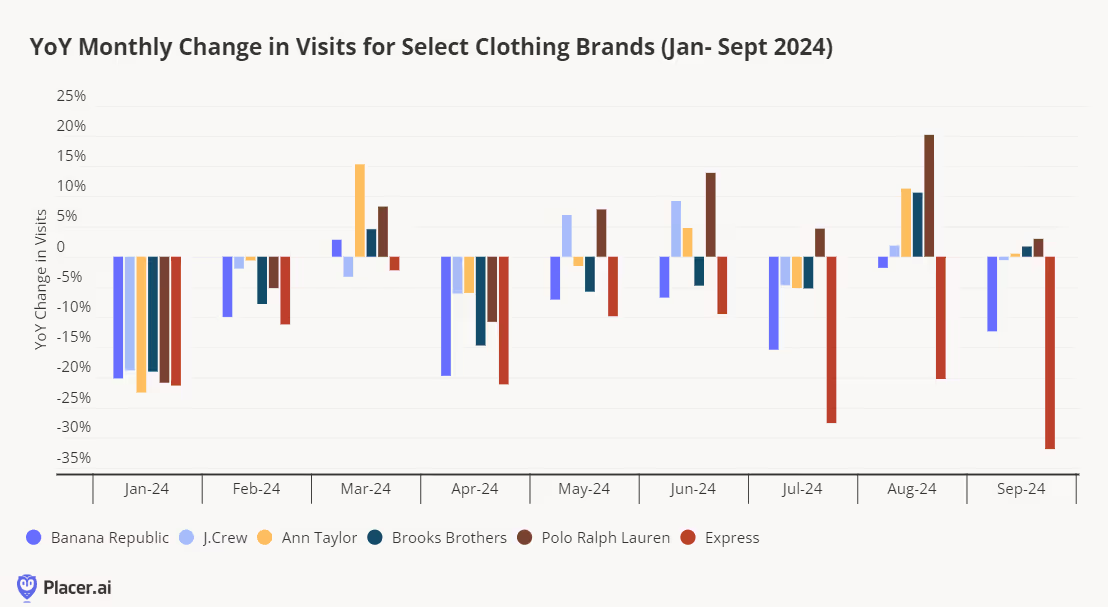

In just a few months, we will be coming on the 5-year anniversary of COVID-19. During that time, we hunkered down, bought tons of athleisure, and stared at our forlorn office clothing sitting unworn in our closets. Fast forward a few years to present day and much like bootcut jeans are back in style, the pendulum is starting to veer back towards a more tailored style. This time around, the suits may not be as constricting, but there is certainly more structure to fall’s fashion than the cozy comfy sweatpants and leggings that the whole world came to embrace upon working from home. Among locations that are not multi-story or in enclosed malls, we see that Ann Taylor increased traffic to its locations in March, June, and August compared to last year, and that Polo Ralph Lauren has also seen increases in the past few months. This particular grouping of brands all has at least 30 or more locations each tracked by Placer and tend to be ubiquitous at many malls or as standalone boutiques. A recent visit to Banana Republic indicated a merchandising assortment that appeared to be more than 50% office wear in the women’s section, with blazers and tailored pants, silky shirts, and dresses ready to be accessorized with heels and some statement jewelry.

However, we are seeing even larger increases in year-over-year traffic at some of the more specialized/high-end brands, particularly in women’s contemporary that offer sharp-looking items that look just as polished at the boardroom or the PTA meeting, like the blazers at Veronica Beard or the “Effortless Pant” from Aritzia that is a smash hit on social media. The majority of this next grouping of brands got their start at department stores or specialty retailers, but with increased success, many are launching their own brick-and-mortar boutiques. Clearly, having a holy grail item that is on the fashion editors’ favorites list gives a boost to store traffic. One of the trends we are seeing is the continuation of the love for comfort everyone adopted during Covid mixed with a slightly more structured but still understated minimalist but luxe aesthetic, like COS. Theory, a wardrobe staple with its neutral color palette and streamlined silhouettes, has been generating positive year-over-year traffic during the back-to-school and fall season. Vince, also featuring rather understated and neutral basics, also saw its traffic lift for the fall season. Eileen Fisher is another interesting brand. Once regarded as clothing adapted to your mom’s generation, Gen Z is also starting to embrace it for its softness and sustainability, and it is one of the more popular brands to buy secondhand. In April of this year, Guess and WHP Global completed the acquisition of rag & bone, which has long been hailed for their on-trend jeans and boots. Time will tell what direction they will take the brand, or if they will stick with its tried-and-true New York roots.

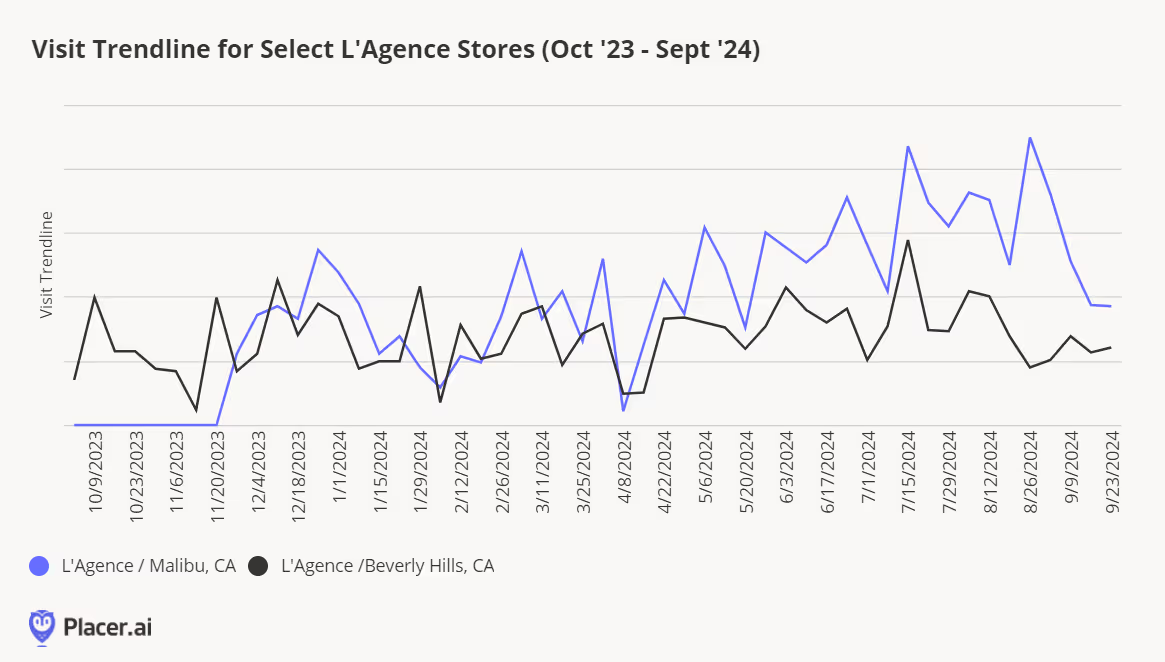

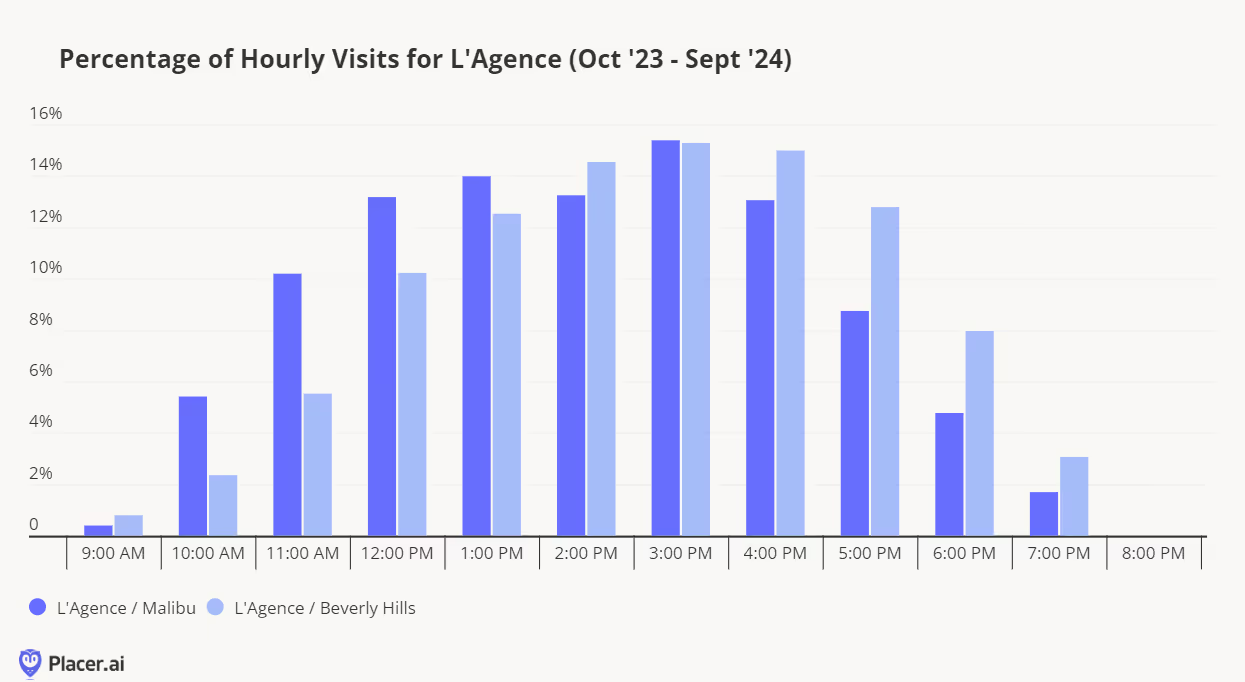

Another brand to keep an eye on that we’re already familiar with from prestige department stores like Nordstrom, Bloomingdale’s, and Saks Fifth Avenue is L’Agence. This brand goes seamlessly from day to night with classics like tweed blazers, satiny tank tops, and perfectly-fitting jeans. They’ve now expanded to more stand-alone stores, including Southern California shopping meccas like Malibu and Beverly Hills. While the Malibu one just opened in late fall 2023, its traffic has been growing steadily upwards, even overtaking that of the Beverly Hills outpost of late.

One interesting thing to note is that the Malibu location attracts a higher proportion of its audience during the morning hours, whereas the Beverly Hills location gets the evening crowd. This information would be useful for staffing purposes or for knowing when to hold events.

In a dining segment that has faced more than its fair share of headwinds, The Cheesecake Factory and BJ's Restaurant & Brewhouse have emerged as bright spots. We took a closer look at how the two chains have performed over the past year, and dove into some of the factors driving their success.

The full-service dining segment has seen turbulence since the pandemic, with many consumers embracing lower-cost meal options and redirecting their discretionary dollars. But the Cheesecake Factory – marked as a chain to watch this year – is one FSR that’s been particularly adept at weathering the storm. During the third quarter of 2024, visits to the chain were up 2.0% YoY, even as the wider FSR segment experienced a minor visit decline. And by continuing to offer a consistent, high-quality dining experience – while investing in staff retention to keep customer satisfaction higher than ever – the brand appears poised to continue growing its customer base.

BJ’s Restaurant & Brewhouse is another FSR chain that has been outperforming the wider segment. Like its cheesecake counterpart, BJ’s offers an especially varied menu – including its famous Pizookie dessert and a massive selection of craft beers. And after seeing a minor 1.7% YoY visit decline in Q2 2024, the chain finished out Q3 with an impressive 4.2% YoY uptick.

What’s driving the resilience of these two chains while others in the category struggle? We explored two factors driving this foot traffic success.

One factor that may be helping The Cheesecake Factory and BJ’s Restaurant drive traffic is their ability to harness the power of annual dining milestones. Special calendar days can be powerful drivers of foot traffic at restaurants, offering chains a prime opportunity to grow visits – and sales.

But the two chains experience these milestones somewhat differently. For BJ’s Restaurant, the weeks of Mother’s Day (week of May 6th) and Father’s Day (week of June 10th) drew the most traffic during the last twelve months, with visits during these holidays rising 18.2% and 14.1%, respectively, compared to an October ‘23 - September ‘24 weekly visit average.

But for The Cheesecake Factory, it was the period right after Christmas that drew the biggest crowds. During the week of December 25th, 2023, visits were up 24.5% compared to the chain’s weekly average – likely driven in part by customers eager to redeem holiday gift cards. (Last year, the chain offered a special holiday gift card promotion, which went into effect in late November). Other calendar days, like Mother’s Day, Valentine’s Day, and National Cheesecake Day (week of July 29th), also provided the restaurant with substantial visit boosts.

Another factor that may be contributing to both brands’ better-than-average performance is their appeal among higher-income consumers. Using the Experian: Mosaic dataset to analyze The Cheesecake Factory and BJ’s trade areas reveals that both chains see higher shares of wealthy families in their captured markets than in their potential markets. (A chain’s potential market is obtained by weighting each Census Block Group (CBG) in its trade area according to population size, thus reflecting the overall makeup of the chain’s trade area. A business’ captured market, on the other hand, is obtained by weighting each CBG according to its share of visits to the chain in question – and thus represents the profile of its actual visitor base.)

Between January and September 2024, the shares of “Flourishing Families” in the Cheesecake Factory and BJ’s captured markets stood at 9.5% and 10.9%, respectively – outpacing their potential market shares. Similarly, the “Booming with Confidence” segment – wealthy, established couples living in suburban areas – was overrepresented in both restaurants’ captured markets.

These metrics highlight the two chains' success in attracting high-income family segments – groups who may be more resilient to the impacts of rising prices. For this consumer group, these restaurants strike a balance between quality and cost-effectiveness, making them a compelling choice for dining out in an uncertain economic landscape.

The Cheesecake Factory and BJ’s have found ways to thrive in a challenging dining environment, keeping foot traffic up and tapping into a receptive customer base.

With the holiday season around the corner, can these two chains maintain their foot traffic growth? Will The Cheesecake Factory see another major holiday season visit spike?

Visit Placer.ai to keep up to date with the latest data-driven dining news.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

2024 has been a tough year for quick-service restaurants (QSRs), with rising costs, inflation, and changing consumer preferences putting pressure on the industry. And as if these challenges weren’t enough, incursions into the convenient meal space by c-stores, fast-casual restaurants, and even grocery chains have forced QSRs to contend with increased competition.

But visit data shows that despite these headwinds, fast food leaders like McDonald’s and Wendy’s are holding their ground. During the first three quarters of 2024, both McDonald’s and Wendy’s experienced visit levels generally on par with those seen last year, with minimal year-over-year (YoY) variation. Despite a minor dip for McDonald's in Q2, when visits dropped by 2.2% compared to 2023, the overall difference in visit levels for both chains was less than 1% across the remaining quarters.

This stability highlights the ability of both brands to retain a steady flow of traffic despite competitive pressures and economic challenges.

One strategy QSRs have successfully deployed to entice hungry customers has been the introduction of discounted limited-time offers (LTOs). And following summer LTOs that garnered plenty of excitement, McDonald’s and Wendy’s are back in the limited-time game. On October 8th, 2024, Wendy's launched its Krabby Patty Kollab, celebrating the 25th anniversary of SpongeBob SquarePants with two limited-time items. Meanwhile, McDonald’s introduced the Chicken Big Mac on October 10th, expanding its menu with an item that had already gained global recognition.

While both launches positively impacted visitation, Wendy's limited-time menu had a more pronounced effect. Wendy’s saw a dramatic surge in visits in the wake of the Kollab, with an increase of 26.4% on the Tuesday of the Krabby Patty launch, compared to a year-to-date (YTD) Tuesday average. The following Wednesday and Thursday also saw increases of 20.7% and 23.9%, respectively, compared to the YTD daily average for those days of the week.

And though the response to McDonald’s menu addition was somewhat more restrained, the limited-time chicken offering also generated a visit increase: On the Thursday of the launch, McDonald’s saw visits jump by 7.9% compared to the chain’s YTD Thursday visit average – showing the power of limited-time items to generate excitement and urgency among consumers.

In addition to new menu items, McDonald’s has placed a strong emphasis on its breakfast offerings – a strategic focus that has grown more pronounced throughout 2024. By expanding its breakfast menu, offering healthier alternatives, and promoting limited-time deals, McDonald’s has successfully driven morning traffic. The introduction of CosMc's, a new McCafé spinoff, further boosts the company’s breakfast and coffee offerings, appealing to a broader audience seeking affordable beverages and quick meals.

And McDonald’s breakfast strategy appears to be paying off. In 2024, 24.8% of McDonald’s daily visits occurred between 5:00 AM and 11:00 AM – compared to just 8.5% for Wendy’s. Wendy’s, for its part, had a stronger foothold in the lunchtime segment, with the 11:00 AM - 2:00 PM time slot accounting for 27.5% of visits, compared to 21.2% for McDonald’s.

Both McDonald’s and Wendy’s have displayed resilience in maintaining steady customer visits, with menu innovations and breakfast strategies playing a significant role in shaping their traffic patterns in 2024.

How will the two quick-service giants sign off this year?

Follow our blog at Placer.ai to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.