.svg)

.png)

.png)

.png)

.png)

Sprouts Farmers Market, the Phoenix, Arizona-based natural foods chain with some 419 locations across 23 states – up from 391 in July 2023 – is firmly in expansion mode. The chain reported a strong Q2 2024, including a 6.7% increase in comparable store sales.

But how did Sprouts perform in Q3? We dove into the data to find out.

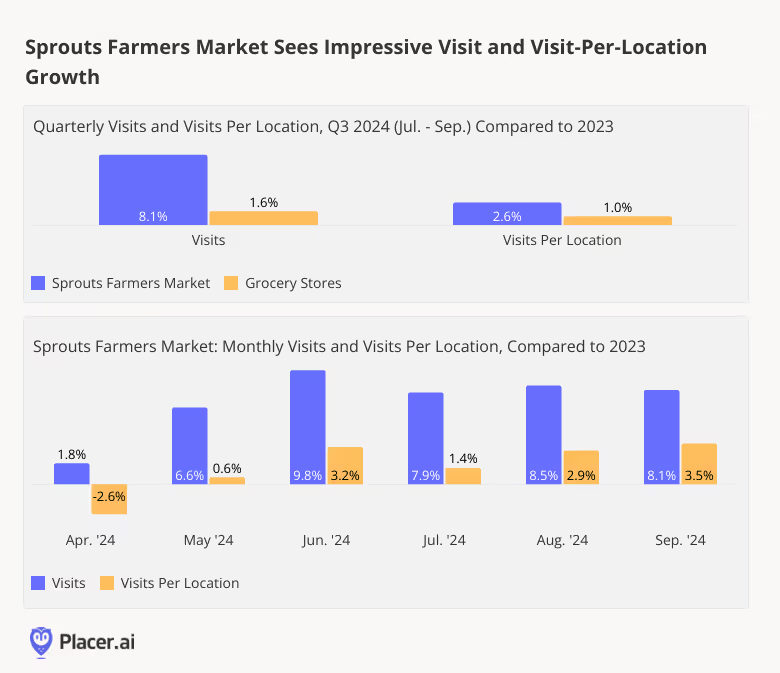

Given its rapidly-growing footprint, Sprouts’ strong year-over-year (YoY) foot traffic growth – 8.1% in Q3 2024, far above the industry average of 1.6% – may seem unremarkable. After all, a bigger fleet means more locations to contribute to the chain’s overall visit count. But for Sprouts, expansion is just part of the story. Throughout Q3 and most of Q2, the average number of visits to each of Sprouts Farmers Market’s locations also increased YoY, showing that the chain’s growing store count is meeting robust demand. And though the wider grocery space also saw a YoY uptick in visits per location, the increase was significantly lower (1.0% in Q3 for the segment as a whole, compared to 2.6% for Sprouts).

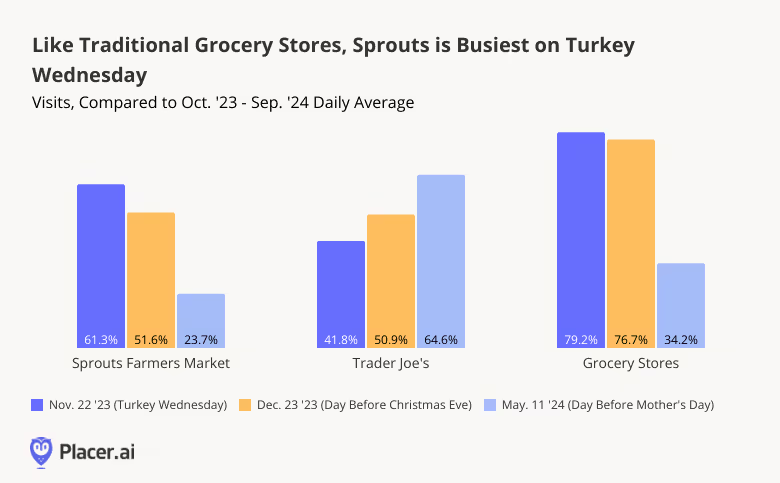

What can Sprouts expect this holiday season? In the past, location analytics have shown that while Turkey Wednesday – the day before Thanksgiving – is a major milestone for traditional grocery stores, specialty grocers like Trader Joe’s see smaller visit peaks on the big day.

But though Sprouts Farmers Market is certainly positioned as a specialty grocer, it is somewhat more akin to a traditional supermarket than key competitors like Trader Joe’s. For one thing, Sprouts boasts a wider array of merchandise than Trader Joe’s – including a huge selection of fresh, organic fruits and vegetables. And while Sprouts has been leaning heavily into its growing portfolio of private-label products, they still account for a minority of the chain’s revenue (In Q2 2024, just about 20% of Sprouts’ revenue came from private-label items – while at Trader Joe’s, some 80% of products sold are own-label.)

Perhaps as a result of these differences, consumers interact with Sprouts in some ways as they would with a traditional supermarket – including during the holidays. On November 22nd, 2023, for example (last year’s Turkey Wednesday), visits to Sprouts were up 61.3% compared to the chain’s daily average for the 12-month period ending September 30th, 2024 – making it Sprouts’ busiest day of the year by far. Though this jump was smaller than the 79.2% visit spike seen by the wider grocery store category, it was significantly larger than the 41.8% boost experienced by Trader Joe’s – which draws more traffic on the day before Mother’s Day. (December 23rd was the second-busiest day of the year for all three.)

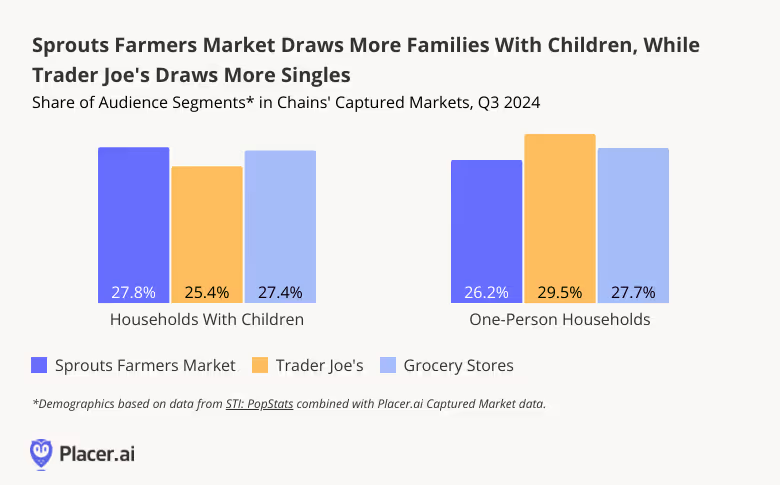

Additionally, like traditional grocery stores, Sprouts Farmers Market attracts more parental households, and fewer singles, than Trader Joe’s – another reason, perhaps, why it’s so busy on Turkey Wednesday.

Over the past twelve months, the share of families with children in Sprouts’ captured market stood at 27.8% – higher than Trader Joe’s 25.4% and in line with the industry-wide average of 27.4%. On the flip side, the share of one-person households in Sprouts’ captured market was 26.2%, lower than Trader Joe’s 29.5%, and once again more closely aligned with the somewhat-higher 27.7% observed for the grocery category as a whole. As a family-friendly chain that caters to parents on the hunt for healthy food items, Sprouts will likely be a key destination this year for households seeking to load up on ingredients for the holidays.

*Captured market analysis weights each census block group (CBG) feeding visits to the chain according to its share in the chain’s overall foot traffic – thus reflecting the profile of the chain’s actual visitor base.

Sprouts Farmers Market is a specialty grocer– but one that is often treated like a traditional supermarket. With stellar YoY visit and visit-per-location performance under its belt, Sprouts appears poised to be a stand-out beneficiary of both Turkey Wednesday and the day before Christmas Eve (December 23rd) this year. What else lies in store for Sprouts this year?

Follow Placer.ai’s data driven retail analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Fast-casual dining chain CAVA has had a great few years. The restaurant chain, which serves up health and flavor-forward Mediterranean fare, has increased its footprint massively over the past few years, and shows no signs of slowing down.

We took a closer look at the location intelligence data to understand what is driving success for the fast-casual dining chain.

CAVA, which has been opening restaurants at a rapid clip, is firmly in expansion mode. The restaurant chain featured 341 restaurants at the end of Q2 2024 – up from roughly 300 at the end of 2023 – and has set its sights on operating 1,000 locations by 2032.

Partly as a result of its growing footprint, CAVA’s foot traffic – already elevated in 2023 – has continued to surge throughout 2024. The chain achieved double-digit year-over-year (YoY) visit growth during every month of the year so far, with September visits up 24.9% YoY. By comparison, the broader fast-casual dining sector – which is also thriving – saw more modest YoY visit growth over the same period, as well as some minor YoY declines in January and September.

Still, though much of CAVA’s YoY foot traffic growth may be attributed to its rapid expansion – after all, more restaurants mean more opportunities for diners to try a lemon chicken or harissa avocado bowl – CAVA’s individual locations are also drawing more traffic. In all but one month of 2024 – January, when inclement weather led to a retail slowdown nationwide – the average number of visits to each CAVA restaurant also rose significantly. And in August and September 2024, visits per location grew by 15.0% and 9.9% YoY, respectively.

These trends suggest that CAVA’s expansion strategy is leaning into robust demand – and has succeeded in generating excitement and visit growth in both new and existing markets.

One factor that may be helping CAVA drive traffic is the growing diversity of its customer base. Analyzing changes in CAVA’s captured market over time with demographics from STI: PopStats shows that the median household income (HHI) of the brand’s visitor base has dropped over the past few years. (A chain’s captured market is obtained by weighting each census block group (CBG) in its trade area according to its share of visits to the chain in question – and thus represents the profile of the business’ actual visitor base.) In Q3 2021, the median HHI of CAVA’s captured market was $107.5k – much higher than the nationwide median of $76.1K. But as the chain has expanded, the median HHI of its visitor base has steadily declined, reaching $92.3K by Q3 2024.

Similarly, using the Spatial.ai: PersonaLive dataset to look at the psychographic makeup of CAVA’s trade areas reveals that the share of “Ultra-Wealthy Families” in the chain’s captured market has also declined – from 22.9% 2021 to 17.1% in 2024. At the same time, the share of “Young Urban Singles” grew from 5.4% to 7.3%.

This shift suggests that as CAVA expands, it is welcoming a broader and more diverse customer base – positioning it for continued growth as it opens new locations.

CAVA continues to exceed expectations, opening stores at a rapid clip while maintaining visit numbers and appealing to an ever-growing range of customers.

What might the final quarter of the year hold in store for the fast-casual chain?

Visit Placer.ai to keep up to date with the latest data-driven dining insights.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

If you’ve been to your local recreation center or even shopping center lately, pickleball is definitely still going on strong. Invented in 1965 on Bainbridge Island, for many decades it was considered more of a seniors’ recreational activity. But with the recent explosion of interest and proliferation of courts, we may be about to see the same snowboarding vs skiing battle that occurred in the 1980s and 1990s, except instead of the young punks carving down the slopes, it’s people of all ages carving out Pickleball courts with tape to the dismay of their tennis-loving brethren and sound-sensitive neighbors.

According to the Sports and Fitness Industry Association (SFIA), “pickleball continues to be the fastest growing sport in America, having grown 51.8% from 2022 to 2023 and an incredible 223.5% in 4 years since 2020.” The sport has some similarities to tennis, table tennis, and badminton, but one reason it has become so popular is the social nature of it - often played as doubles - and the fact that since the court is smaller, there’s less running to engage in, but there is still the excitement of rapid volleying. The ability to serve underhand also makes it more accessible to new players.

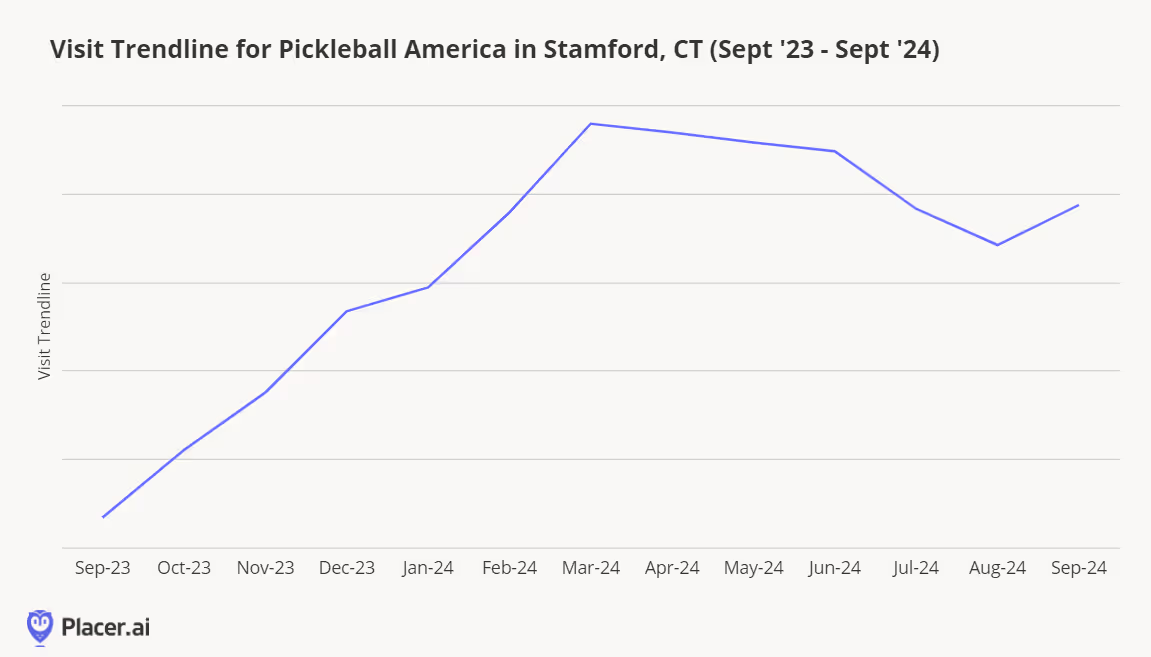

Pickleball America bills itself as “one of the largest indoor pickleball venues in America” and with 80,000 sq ft at the Stamford Town Center, it clearly can live up to that claim. With clever events like “Dinko de Mayo” or resident events to bring a nearby living community together, pickleball could just be the glue that starts to bring people together for socialization and cure the loneliness epidemic. Indoor pickleball venues can also be a source of family fun, with lounges and fresh popcorn available, as well as foosball, table tennis, and essential board games.

Another sport that may be giving tennis and pickleball a run for its money is padel. This sport has the unique benefit of one being able to hit shots off the fence or wall, often made of glass or mesh, that is at the perimeter. So now we’re talking 3D thinking as one figures out what angles to hit.

One can fit about 2 padel courts on a tennis court, and up to 4 pickleball courts on a tennis court. So from an economics perspective, you can definitely charge for more people when playing padel or pickleball. Padel is described more as a mix of tennis, squash, and badminton and is the fastest-growing sport globally with over 25 million players in 90+ countries, per PadAthletes. At P1 Padel in Las Vegas, NV, the most popular times to frequent are in the evening from 6-8 PM. There is also a morning contingent between 9-11 AM.

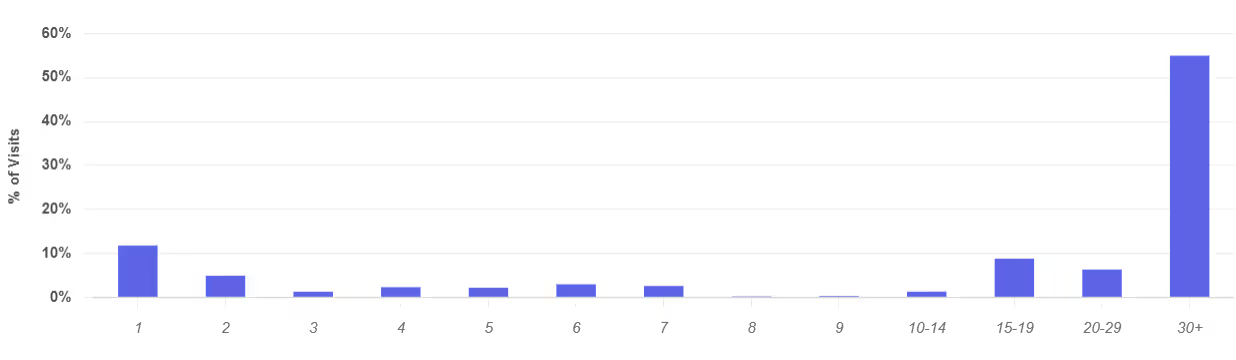

Padel players at this location are quite loyal, with a majority coming 30+ times in the past 12 months.

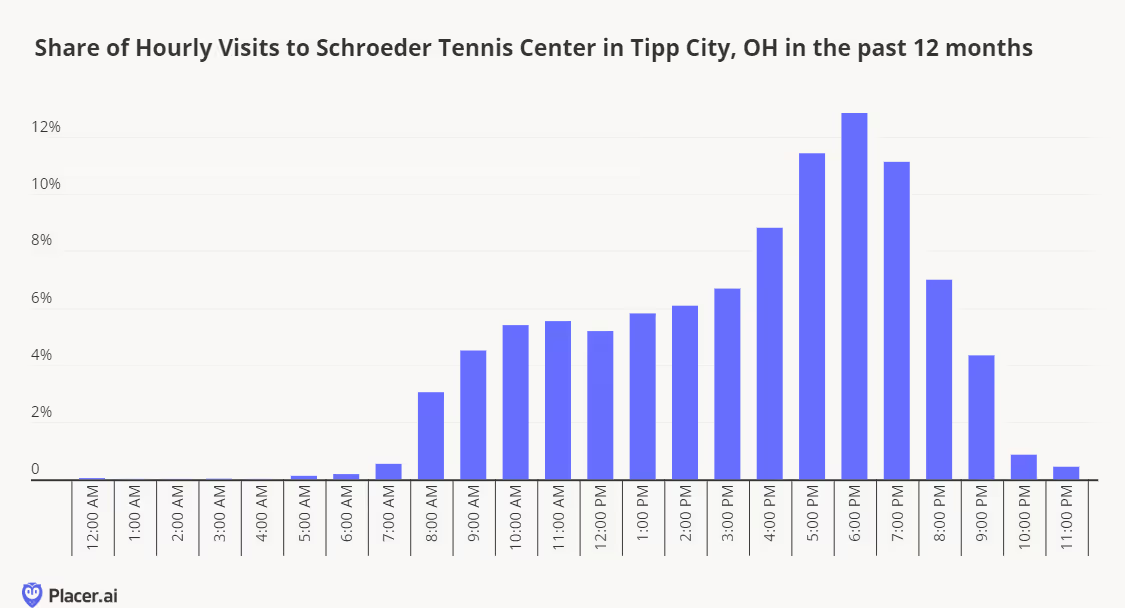

With pickleball and padel nipping at its heels, the USTA (US Tennis Association) is fighting back with its own version of more accessible tennis, namely “red ball.” With a smaller court, a smaller racket, and balls that are up to 75% slower, this version helps newbies obtain control over the ball more quickly and has less ground to cover for those lateral runs and quick pivots. Schroeder Tennis Center in Tipp City, OH is one such location that is participating in this USTA pilot program. The bulk of visits are between 4-8 pm, which are prime post-school or post-work hours. According to the Tennis Industry Association, 23.8 million Americans ages 6 and older played tennis at least once in 2023 and 25.1 million Americans who didn’t play tennis in 2023 are “very interested” in doing so now.

Tennis has a long and storied history and iconic locations like Wimbledon and Roland Garros. What young tennis player doesn’t dream of their moment on Center Court? Tennis also has associations with country clubs and networking. It will likely remain the king of racquet sports. But these two new princes of pickleball and padel prove that tennis cannot just rest on its laurels but will need to evolve in order to stay competitive.

We’re in the midst of not only the beginning of the holiday season in retail, but also at the peak of wedding season. September and October are now the most popular months to get married, and fall weddings have become extremely popular with younger generations. Wedding planning encompasses so many different occasions, events and appointments, but none more important than wedding dress shopping.

The bridal retail space across the U.S. is incredibly fragmented, with much of the business being done by local boutiques and small chains with a handful of stores. However, there are still major retailers in the market and more entering each year. Brands in apparel have especially taken note with Abercrombie & Fitch, Reformation and e-commerce brands like Lulus all making a play at capturing a bride’s attention.

Two larger, more established forces in bridal retail include David’s Bridal and Anthropologie Weddings (formerly known as BHLDN). Both concepts have distinct value propositions for their consumers, but both aim at providing an elevated assortment and experience that is also value oriented. As value continues to be a motivating factor across all consumer decision making, both of these retailers have seen positive momentum in 2024.

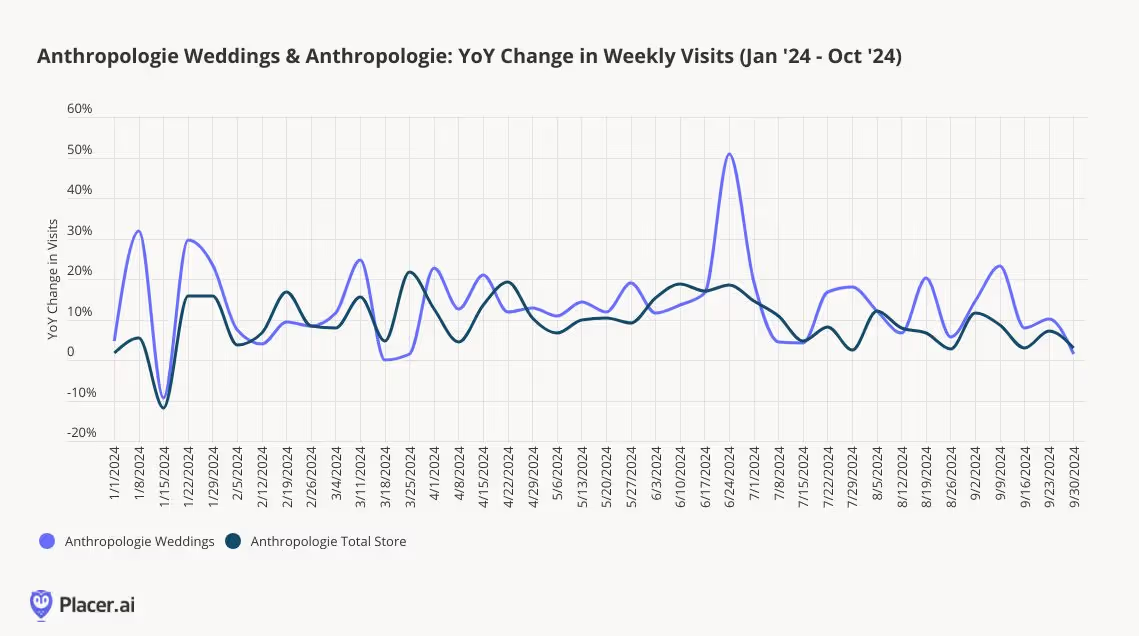

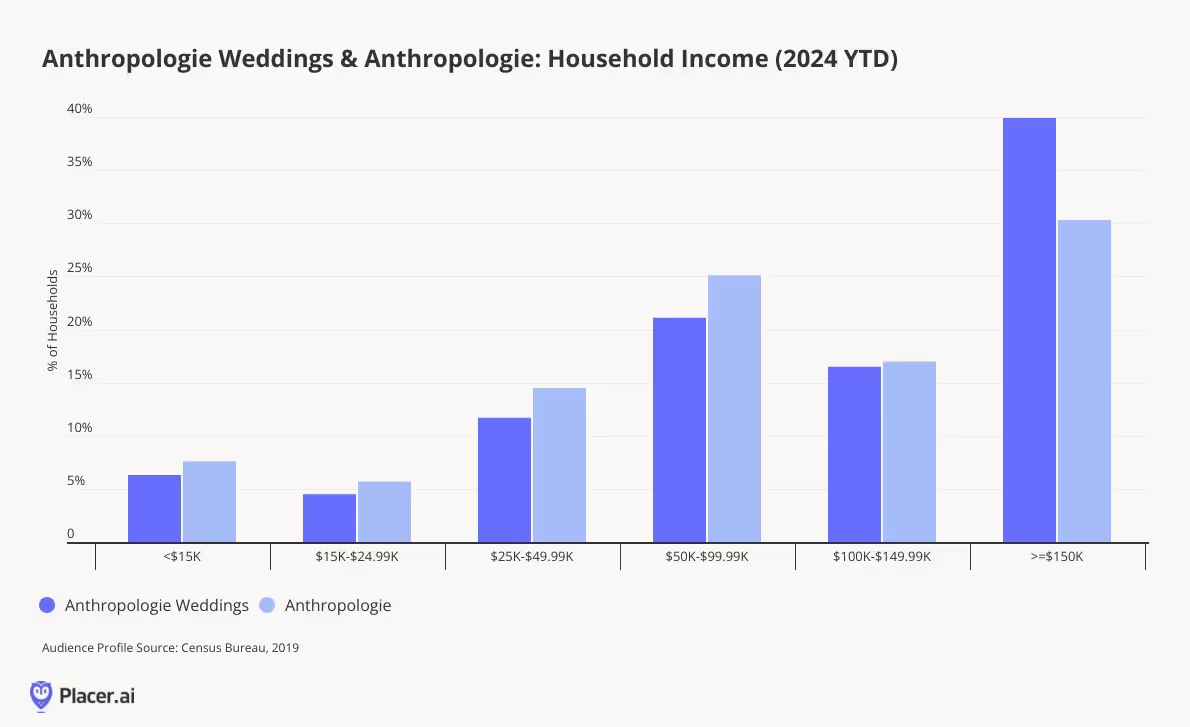

Looking at year-over-year change in visitation, Anthropologie Weddings locations have consistently seen traffic growth in 2024 and have outperformed the total chain from a visitation perspective. The wedding shop is not located in all Anthropologie stores, but the stores that do have the concept cater to a higher income and trendy consumer; the location selection of towns such as Newport Beach, Westport, CT, and Newton, MA has certainly benefited the stores.

The median household income of visits to Anthropologie weddings is $117K compared to $94K chainwide. Despite the higher income profile of visitors to the wedding focused stores, Anthropologie Weddings still does appeal to value-conscious brides, despite socioeconomic status; most bridal gowns are under $2,500, which is still relatively affordable based on the industry standard.

Looking at the audience segmentation of visitors to Anthropologie Weddings compared to the total chain using PersonaLive, the wedding shops saw almost double the share of visits from Educated Urbanites, a key segment for a bridal business to not only capture, but convert. All of this highlights the success of the brand’s wedding strategy, from its location selection, to assortment and experience, which are distinctly Anthropologie, but also fitting of a special trip. Other retailers looking to make a splash in the bridal market should certainly look to Anthropologie as a case study in brand extension.

David’s Bridal had a challenging start to 2024, mirroring a few years of challenging foot traffic to its stores. However, around the midpoint of the year, there’s been an acceleration in visitation across the chain. Looking at visitation trends for 2023 and 2024, the brand started to close the gap in August. As a true value centered bridal retailer, the brand may have found its moment in the current economic climate.

Looking at the change in visitation throughout 2024, from January to July, on average, visits were down 32% YoY; from August through the most recent week, visits were down only 2% year-over-year. That’s a great improvement in trend against the backdrop of a challenging year, and even more interesting when thinking about the lead time brides have for ordering wedding gowns; most dresses for fall weddings would have been ordered in the winter or spring months, where David’s Bridal sees higher levels of visitation.

.avif)

The audience segmentation of the brand has also shifted over that time. Compared to 2023 as a benchmark, the period of August 2024 through present has seen a higher share of visits from Suburban Boomers and Melting Pot Families, and a slight increase in Young Professionals. The brand also stocks special occasion and homecoming dresses, which both could appeal to these groups.

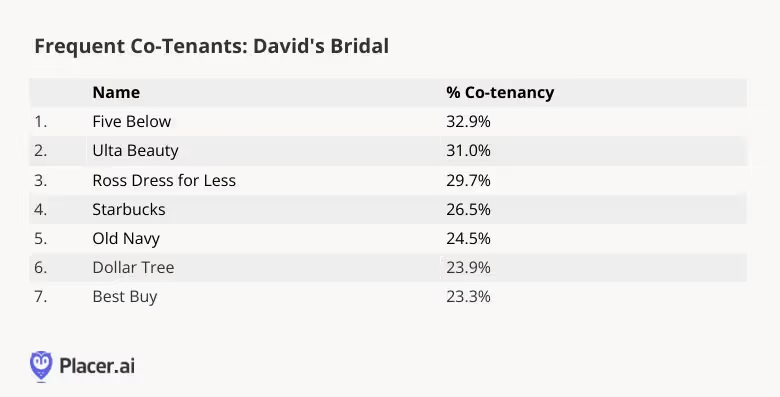

Using Placer’s Frequent Co-Tenants report, David’s Bridal locations tend to be co-located with other specialty retailers, including Five Below, Ulta Beauty, and Ross Dress for Less, who are also value oriented and the latter two retailers have been doing well in securing more traffic. The stores may have benefits from their co-location with retailers that meet current consumer desires.

Weddings continue to be a big business across the U.S., and retailers that support the wedding industry have a lot of opportunities for growth, if they can find and appeal to the right consumer cohorts. Brides of all levels are looking for an elevated experience and selection, no matter her budget.

We’ve spent a lot of time this past year analyzing how consumer behavior has evolved across the broader food and essentials category, noting that consumers continue to shop a wide number of stores across multiple channels for food purchases. With the release of Placer Data Version 2.1, we thought we’d revisit the topic.

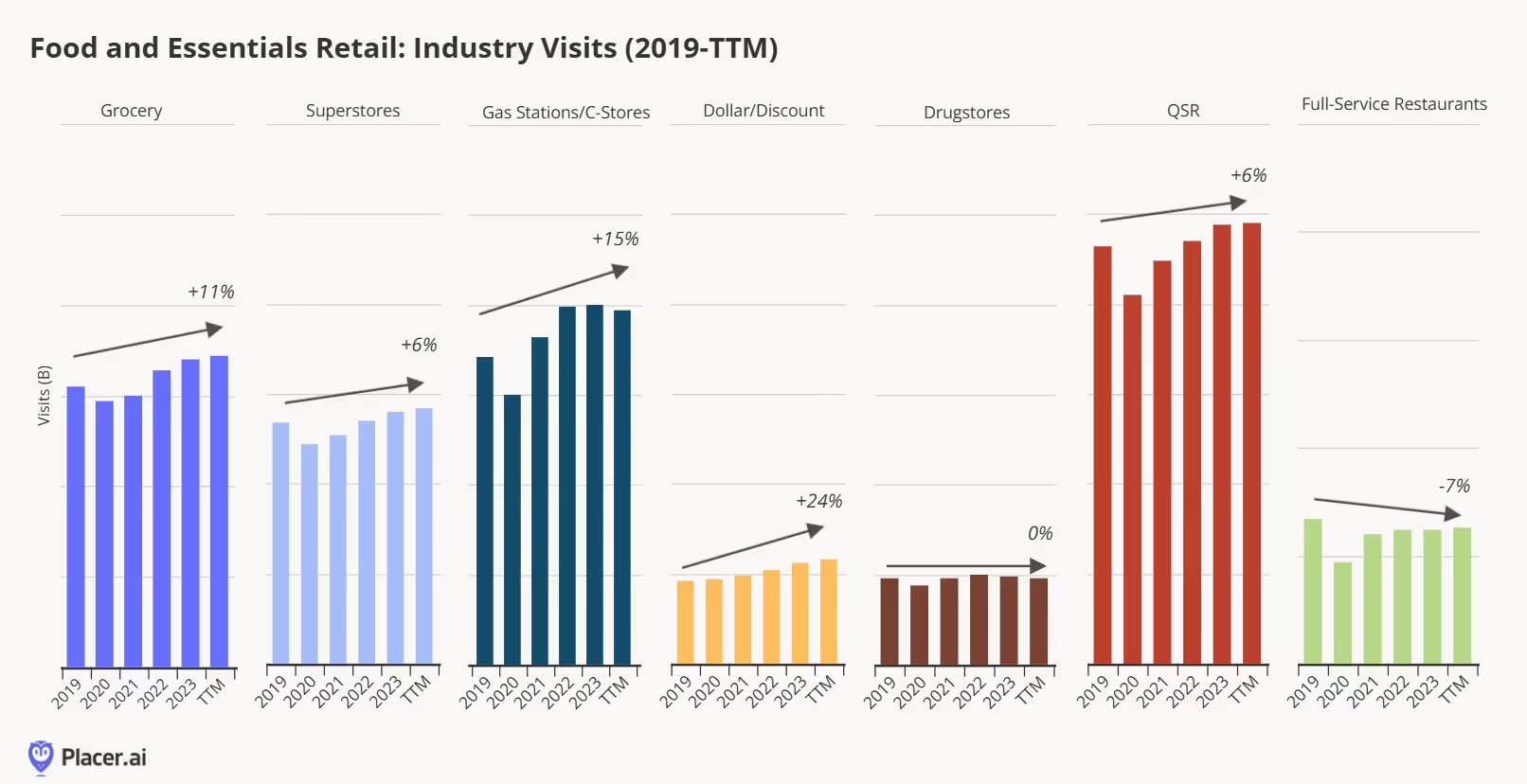

Below, we’ve presented total category visits for grocery stores (including both conventional and value grocery chains), superstores (including mass merchants and warehouse clubs), gas stations and convenience stores, dollar and discount stories (including liquidators), drugstores, quick-service restaurants (QSR), and full-service restaurants from 2019 to the trailing-twelve-month period (TTM0. A few takeaways: (1) Dollar stores saw the largest increase in total visits versus the other categories as they vastly expanded their food and consumables offering since 2019 to drive frequency and traffic. However, the pace of growth has decelerated materially over the past twelve months amid increased competitive pressure from superstore and value-oriented retailers like Aldi and 99 Cents Only Stores exiting the market; (2) drugstore visits have remained flat versus 2019 despite most of the major chains in the category undergoing store closure programs. We believe healthcare service and weight-loss drug prescriptions visits have helped to offset some of the store closures, although we continue to see some transfer of visits to other retail categories in this channel; and (3) the decline in full-service restaurants is partly due to permanent closures compared to 2019.

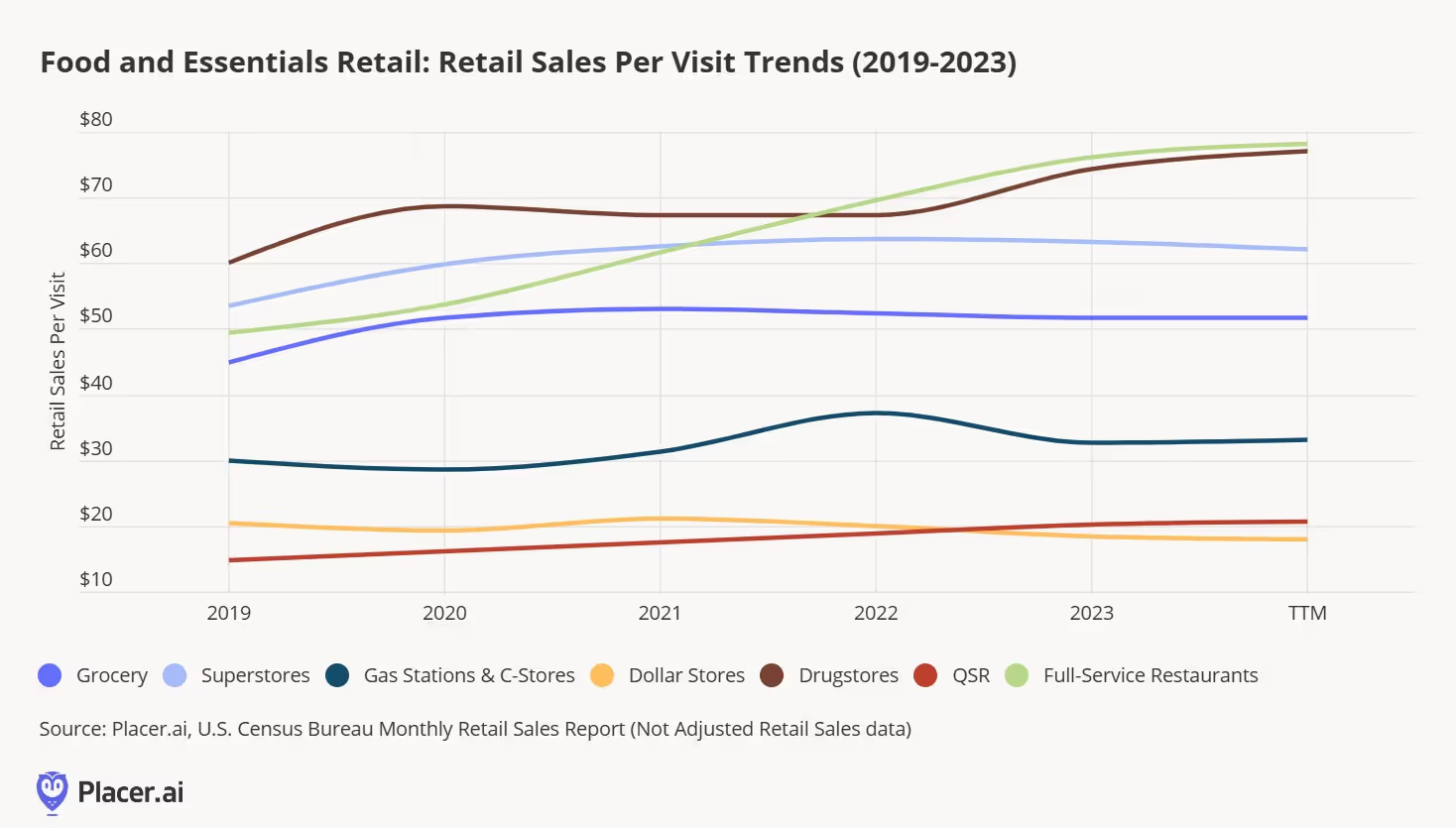

It gets interesting when we compare category-level retail sales data from the U.S. Census Bureau to our visitation data. Below, we’ve taken retail sales (on an unadjusted basis) for the same timeframe that we looked at above to analyze retail spend per visit. A few things stand out here: (1) Three categories saw the average retail sales per visit increase period of the analysis: QSR, full-service restaurants, and drugstores. The increase in drugstores is likely partly to due with the shift in sales mix to more healthcare related services, while the increase in QSR and full-service restaurant retail sales per visit likely explain this summer’s promotional activity to win back customers who traded to other channels; (2) The impact of increased promotional activity and fewer units purchased per transaction can be seen across the other categories, where we saw an inflection in retail sales per visit in 2023 and continuing into 2024 for most.

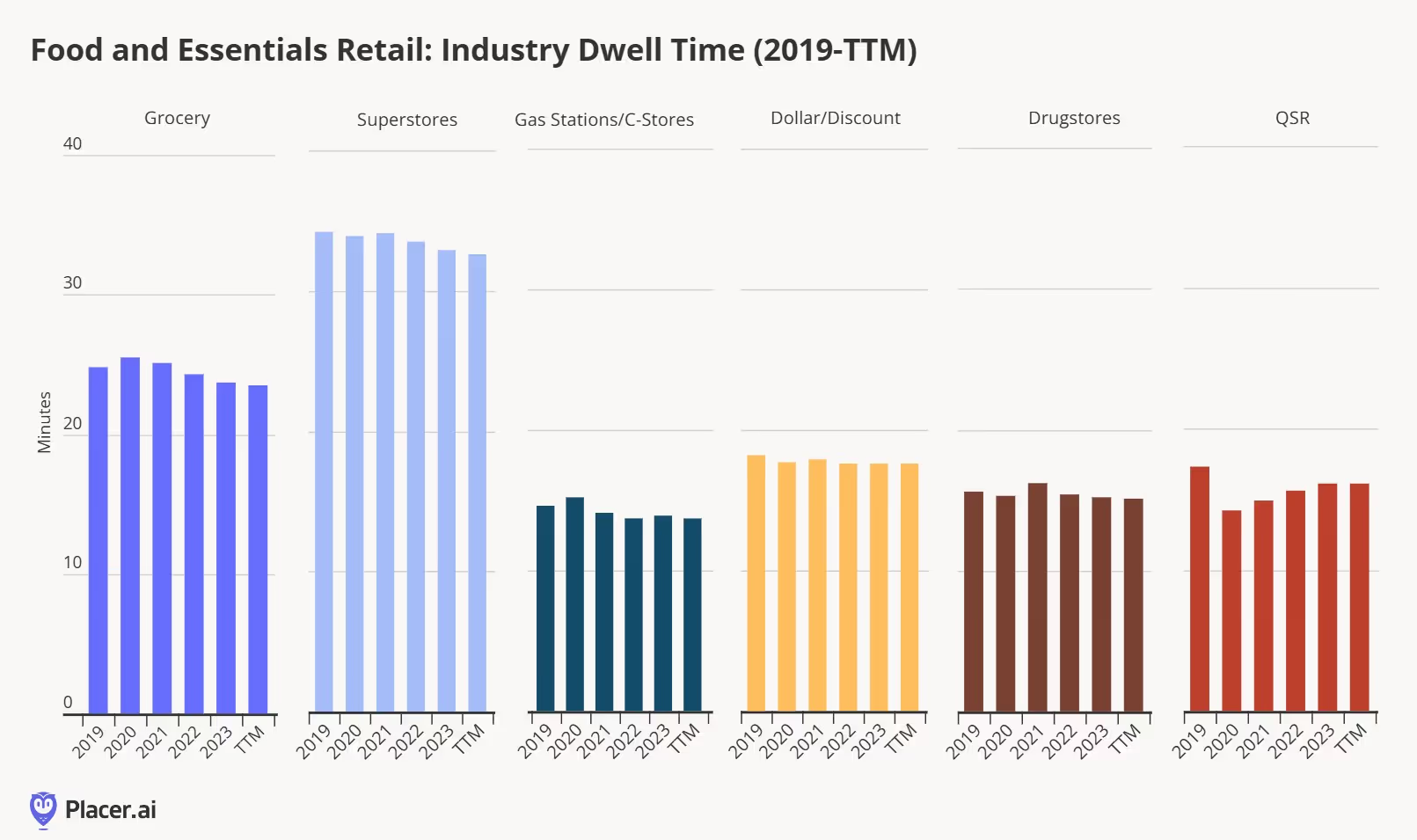

We also thought we’d assess dwell times across the different food and essentials retail categories (for purposes of this analysis, we’ve removed full-service restaurants, which have gone from an average dwell time of 52 minutes in 2019 to 49 minutes over the past twelve months, although we continue to see fine-dining chain dwell times exceed pre-pandemic levels as consumers look to maximize their experience when dining out). Here, we also see two callouts: (1) As consumers make food purchases across a wider number of channels, dwell time has decreased for most, matching the decrease in units per transaction that we've called out in the past. We did see dwell times increase for a few categories during the back half of 2023 which we believe was due to consumers engaging in price comparisons, but this has reversed in 2024 as consumers have now solidified new shopping routines (i.e., knowing what stores to get what deals); and (2) QSR dwell time remains below pre-pandemic levels, which isn’t surprising given that a higher percentage of transactions are now taking place via drive-thru and takeout orders. However, the increase in dwell time the past few years also suggests the potential for improved drive-thru optimization, a topic we recently analyzed.

Carter’s Inc., owner of the OshKosh B’gosh and Carter’s baby and children’s clothing brands, is a major player in the nation’s $28 billion children's clothing industry. As of the end of 2023, the company boasted nearly 800 physical stores throughout the U.S. And after closing hundreds of stores in 2020, the brand is back to betting big on brick-and-mortar – with plans to open some 250 new U.S. locations by 2027.

How is Carter's faring in 2024? We took a closer look to find out.

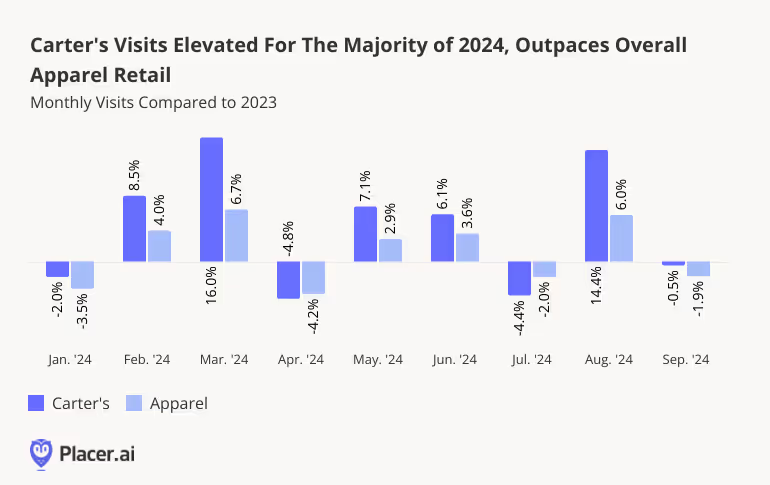

Discretionary spending cutbacks and the rise of online shopping have weighed on apparel retailers in recent years. But some clothing chains – including Carter’s – are bucking the trend. Between January and September 2024, monthly visits to Carter’s stores generally outpaced the wider apparel industry, with some months posting double-digit growth.

March and August 2024 saw respective YoY visit increases of 16.0% and 14.4%, likely driven by pre-Easter and back-to-school shopping. (March and August 2024 each also had one more Saturday than March or August 2023 – a busy day for clothing stores.) And Carter’s finished out Q3 2024 with a 4.3% YoY visit increase, even as the broader apparel category saw just a minor 0.8% uptick.

Indeed, examining weekly foot traffic to Carter's highlights the seasonality of the company’s visitation patterns. Visits are typically lower during the colder winter months but pick up in anticipation of Easter and spring break – likely encouraged by spring sales held by the brand.

Carter’s real spike, however, comes during the back-to-school season, when parents head to the store to pick up new clothing for the school year – and when Carter's holds major back-to-school sales. During the week of August 5th, foot traffic surged to 29.5% above the year-to-date (YTD) weekly visit average. And with the holiday season fast approaching – including major retail milestones like Black Friday and Super Saturday – the children's retailer appears poised to enjoy continued success.

Unsurprisingly, Carter's attracts family segments to its stores, and over-indexes for wealthy and suburban family markets.

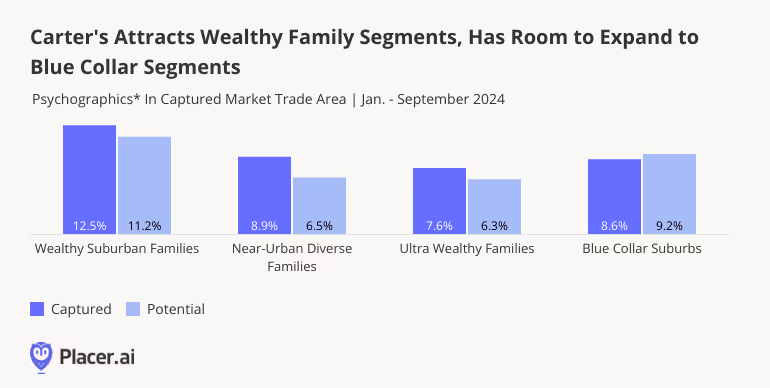

Using the Spatial.ai: PersonaLive dataset to analyze Carter's trade areas reveals that, on a nationwide level, the company’s captured market has higher shares of wealthy and suburban consumer segments than its potential one. (A chain’s potential market is obtained by weighting each Census Block Group (CBG) in its trade area according to population size, thus reflecting the overall makeup of the chain’s trade area. A business’ captured market, on the other hand, is obtained by weighting each CBG according to its share of visits to the chain in question – and thus represents the profile of its actual visitor base).

Between January and September 2024, the shares of “Wealthy Suburban Families” and “Ultra Wealthy Families” in Carter's captured market stood at 12.5% and 8.9%, respectively – outpacing the company’s potential market shares. This highlights Carter's’ success in attracting these high-income family segments. Meanwhile, households hailing from “Blue Collar Suburbs” were underrepresented in Carter's captured market compared to its potential one. This suggests that, as Carter’s continues to open stores, targeting blue collar suburban areas may pay off for the brand.

Carter's is managing not just to survive, but to thrive. After closing stores during the pandemic, the company is back with full force, driving visits and maximizing high-traffic periods.

Will Carter's continue to outpace the wider apparel category during the upcoming holiday season?

Visit Placer.ai to keep up with the latest data-driven retail insights.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

The dining industry showcased its agility over the past couple of years as it rapidly adapted to shifts in consumer preference brought on by COVID and rising prices. And with a new year around the corner, the pace of change shows no signs of slowing down.

This white paper harnesses location analytics, including visitation patterns, demographic data, and psychographic insights, to explore the trends that will shape the dining space in 2024. Which dining segments are likely to pull ahead of the pack? How are chains responding to changes in visitor behavior? And where are brands driving dining foot traffic by taking advantage of a new advertising possibility? Read on to find out how dining leaders can tap into emerging trends to stay ahead of the competition in 2024.

Comparing quarterly visits in 2023 and 2022 highlights the impact of the ongoing economic headwinds on the dining industry. The year started off strong, with year-over-year (YoY) dining visits up overall in Q1 2023 – perhaps aided by the comparison to an Omicron-impacted muted Q1 2022. And while overall dining growth stalled in Q2 2023, several segments – including QSR, Fast Casual, and Coffee – continued posting YoY visit increases, likely bolstered by consumers trading down from pricier full-service concepts.

Foot traffic slowed significantly in Q3 2023 as inflation and tighter consumer budgets constrained discretionary spending. Overall dining visits fell 2.4% YoY, and full-service restaurants – with their relatively high price point compared to other dining segments – seemed to be particularly impacted by the wider economic outlook. But the data also revealed some bright spots: Fast Casual still succeeded in maintaining positive YoY visit numbers and Coffee saw its Q3 visit grow an impressive 5.4% YoY. As the return to office continues, a pre-work coffee run or lunchtime foray to a fast-casual chain may continue propelling the two segments forward.

Restaurant visitation patterns have evolved over the past few years. Although an 8 PM seating was once the most coveted slot at fine-dining restaurants, recent visitation data suggests that sitting down to dinner earlier is rising in popularity.

But among the QSR segment, the opposite trend is emerging, with late-night visits rising. Analyzing hourly foot traffic to several major QSR chains reveals that the share of visits between 9 PM and 12 AM increased significantly between Q3 2019 and Q3 2023. Even Taco Bell – already known for its popularity among the late-night crowd – saw a substantial increase in late-night visits YoY – from 15.4% to 20.3%.

Who is driving the late night visit surge? One reason restaurants have been expanding their opening hours is to capture more Gen-Z diners, who tend to seek out nighttime dining options. But location intelligence reveals that younger millennials are also taking advantage of the later QSR closing times.

An analysis of the captured market for trade areas of top locations within one of Taco Bell’s major markets – the Chicago-Naperville-Elgin, IL-IN-WI Metropolitan area – reveals a year-over-four-year (Yo4Y) increase in “Singles & Starters.” The “Singles & Starters” segment is defined by Experian: Mosaic as young singles and starter families living in cities who are typically between 25 and 30 years old. As consumers continue to prioritize experiential entertainment and going out with friends, late-night dining may continue to see increased interest from young city-dwellers.

Millennials and Gen-Z consumers aren’t only heading to their favorite fast food joint for a late-night bite – these audience segments are also helping drive visits on the weekends. Smoothie King is one chain feeling the benefits of young, health-conscious consumers.

The chain, which opened in New Orleans, LA, in 1973 as a health food store, has since grown to over 1,100 locations nationwide and is currently expanding, focusing on the Dallas-Fort Worth CBSA. The area’s Smoothie King venues have seen strong visitation patterns, particularly on the weekends – weekend visits were up 3.4% YoY in Q3 2023. The smoothie brand’s trade areas in the greater Dallas region is also seeing a YoY increase in weekend visits from “Young Professionals” – defined by the Spatial.ai PersonaLive dataset as “well-educated young professionals starting their careers in white-collar or technical jobs.”

While some dining chains are appealing to the late-night or weekend crowd, others are driving visits by appealing to sports lovers. How have recent rule changes around student athletes changed the restaurant game, and how can college football teams drive business in their hometowns?

College sports have long been a major moneymaker, with top-tier teams raking in billions of dollars annually. And as of 2021, college athletes can enjoy a piece of the significant fan following of college sports thanks to the change in the NCAA’s Name, Image, and Likeness (NIL) rules, which now allows student athletes to sign endorsement deals.

Since then, multiple restaurants have jumped on the opportunity to partner with student athletes, some of whom have millions of followers on Instagram and TikTok. Chains like Chipotle, Sweetgreen, Slim Chickens, and Hooters have all signed college athletes to various brand deals.

How can brands ensure they partner with athletes their customers will want to engage with? Analyzing a chain’s audience by looking at the interests of residents in a given chain’s trade area can reveal which type of athlete will be the most attractive to each brand’s customer base. For example, data from Spatial.ai: Followgraph provides insight into the social media activity of consumers in a given trade area and can highlight desirable partnerships.

Examining the trade areas of Chipotle, Sweetgreen, Slim Chickens, and Hooters, for instance, reveals that Sweetgreen’s visitors tended to have the largest share of Women’s Soccer followers. Conversely, Sweetgreen’s trade area had lower-than-average shares of College Football Fans or College Basketball Fans, while residents of the trade areas of the other three chains showed greater-than-average interest in these sports. Leveraging location intelligence can help companies choose brand deals that their customers resonate with and find the ideal athletes to represent the chain.

Finding the right college athlete partnership is one way for dining brands to appeal to college sports enthusiasts. But dining chains and venues located near major college stadiums also benefit from the popularity of their local team by enjoying a major game day visit boost.

One of the country’s most popular college football teams, the Ohio State Buckeyes, can draw millions of TV viewers, and its stadium has a capacity of 102,780 – one of the largest stadiums in the country. And while tailgating is a popular activity for Buckeyes fans, nearby restaurants are some of the biggest beneficiaries of the college football craze. Panera experienced a 235.3% increase on game days as compared to a typical day, Domino’s Pizza visits grew by 283.3%, and Tommy’s Pizza, a local pie shop, saw its visits jump by a whopping 600.9%.

This influx in diners also causes a major shift in game day visitor demographics, as revealed by changes in visitors at dining venues located near stadiums of two of the nation’s best college football teams – the Ohio State Buckeyes and Ole Miss Rebels. Based on Spatial.ai: Personalive data for the captured market of these dining venues, game day visitors tended to come from “Ultra Wealthy Families” when compared to visitors during a typical non-game day in September or October.

The analysis indicates that popular sporting events create a unique opportunity for restaurants near college stadiums to attract high-income customers game day after game day, year after year.

While some spend game day tailgating or visiting a college restaurant, others hold a viewing party – with a six-foot submarine. And the sub’s popularity extends beyond Superbowl Sundays. Sandwich chains including Jersey Mike’s, Firehouse Subs, Jimmy John’s, and Subway (recently purchased by the same company that owns Jimmy John’s) have seen sustained YoY increases in visits and visits per venue in the first three quarters of 2023.

Some of the growth to these chains may be related to their affordability, a draw at all times but especially during a period marked by consumer uncertainty and rising food costs. And subway leaders seem to be seizing the moment and striking while the iron is hot – Jersey Mike’s opened 350 stores in 2023 and still saw its YoY visits per venue grow by 6.6%. And Subway reported ten consecutive quarters of positive sales, a promising sign for its new owner.

The love for a healthy, affordable sandwich extends across all income levels, with all four chains seeing a range in their visitors' median household income (HHI). Out of the four chains analyzed, Jersey Mike’s – which has long prioritized a suburban, middle-income customer – had the highest trade area median household income of the four chains at $77.3K/year. Subway, known for its affordability, had the lowest, with $62.9K/year. The variance in median HHI combined with the strong foot traffic growth shows that when it comes to sandwiches, there’s something for everyone.

Persistent inflation and declining consumer sentiment may pose serious challenges for the dining space, but emerging trends are helping boost some restaurants. Customers seeking out a late-night bite drive visits to QSR chains, and health-conscious diners are boosting foot traffic to smoothie bars and sandwich shops. Meanwhile, sports sponsorships and game-day restaurant visits can provide a boost to dining businesses that take advantage of these opportunities.

“Retail media networks have turned retailers into ad moguls. That’s a huge change and nobody yet understands all the implications of it.”

Constantine von Hoffman, MARTECH

Companies operating consumer-facing brick-and-mortar venues traditionally relied on selling goods and services as their primary revenue stream. But recently, leading retailers such as Walmart and Target have begun to leverage their immense store fleet into a powerful advertising platform.

Online retailers have been tapping into the advertising power of their digital sites for years by relying on various automated tools to show third-party advertisements to relevant consumer segments. But now, retailers with a strong offline presence can also leverage physical marketing impressions and focus their campaigns while reaching consumers at the point of purchase. Retailers have long recognized the intent that drives a store visit, and understanding the full value of leveraging that visit to its full extent is an important new frontier.

Major retailers are continuing to see their physical visits outnumber their online ones.

And in spite of the gloomy predictions regarding the future of brick and mortar retail, major retailers are continuing to see their physical visits outnumber their online ones. Monthly numbers of visitors to Walmart and Target significantly outpace the brands’ online reach, according to web data from Similarweb. So although, up until recently, these brands have focused their media placements on their digital channels, it is becoming increasingly clear that these chains’ physical stores hold powerful – and currently untapped – advertising potential.

Online visitor data source: similarweb.com

And with the recent rise in digital advertising costs, retail media networks are becoming more attractive for companies looking to make the most of their ad budget. Retail media networks can also help brands reach rural communities, elderly Americans, and other consumer segments that are currently underserved by digital advertisers.

This white paper explores several retailers on the cutting edge of the retail media network revolution. Keep reading to find out how advertisers can use retail media networks to promote to hard-to-reach consumers, segment their ad spending, and optimize their campaigns.

Residents of rural areas use the internet less frequently, and have lower levels of technology ownership than their urban and suburban counterparts. As a result, companies that stick to digital advertising may have a harder time reaching rural consumers. Brick and mortar retailers popular in smaller markets can fill in the gaps and help brands promote their products and services to this hard-to-reach audience.

Brick and mortar retailers popular in smaller markets can help brands advertise to hard-to-reach audiences.

Dollar General saw significant success over the pandemic, with the current economic climate continuing to benefit the brand. Between January and August 2022, nationwide visits to Dollar General venues were 35.6% higher than they were between January and August 2019, while the number of visitors increased 25.4% in the same period.Visit numbers aggregate the visits to the chain’s various locations in a given period, while visitor numbers track the number of people who enter the brand’s stores.

The company has also been operating a media network since 2018. The Dollar General Media Network (DGMN) enables advertisers to reach Dollar General consumers across the company’s channels to build awareness both digitally and in physical spaces. Advertisers with DGMN can display in-store bollard, blade, and wipe stand signs, security pedestals, basket bottomers, and shelfAdz to deliver in-store messaging from parking lot to purchase. Recently, Dollar General announced that its ad platform was now working with 21 new advertising partners, including Unilever, General Mills, Hershey’s, and Colgate-Palmolive.

Embracing the Power of the Small Market

Advertising partners can leverage the DGMN to promote their goods and services to harder-to-reach consumers.

Dollar General has been serving rural residents for years, with the majority of the company’s stores located in communities with fewer than 20,00 residents. And while the brand is growing nationwide, Dollar General’s strength is particularly evident in small markets – which means that advertising partners can leverage the DGMN to promote their goods and services to harder-to-reach consumers.

Comparing year-over-three-year (Yo3Y) visit change to Dollar General stores in metropolitan and micropolitan core based statistical areas (CBSAs) highlights the company’s success in smaller markets. According to the United States Office of Management and Budget, metropolitan and micropolitan CBSAs have over and under 50,000 residents, respectively. Since January 2022, monthly Yo3Y visit growth to Dollar General venues in select Texas micropolitans has consistently outpaced foot traffic to nearby metropolitan areas. While the Sherman-Denison metro area saw August 2022 foot traffic hit a solid 24.5% increase over August 2019, the Gainesville, Texas micro area – around 35 miles east of Sherman – saw its foot traffic increase 54.5% in the same period.

Dollar General’s presence across a significant number of smaller markets means that advertising partners can use the growing DGMN to increase awareness and drive purchase consideration among these harder-to-reach consumers.

In the digital space, three tech giants – Alphabet (previously Google), Meta (previously Facebook), and Amazon – enjoy over 60% of the digital ad revenue in the United States. This means that companies are competing for impressions on a small number of platforms – and smaller brands geared at specific consumer segments may need to spend significant advertising budgets to outbid the larger players. Retail media networks create additional advertising platforms, and enable advertisers to diversify their ad spend, increase their (physical) impressions, focus on more specialized channels to better reach their audience, and potentially reach customers at their highest point of intent.

Retail media networks create additional advertising platforms and potentially reach customers at their highest point of intent.

Albertsons launched its retail media network, Albertsons Media Collective, in November 2021 with the goal of delivering “digitally native, shopper-centric and engaging branded content to the company’s ever-growing network of shoppers.” Currently, the grocer’s media network is primarily digital, but Albertsons’ head of retail media products Evan Hovorka recognizes the importance of leveraging in-store assets to deliver a unique advertising experience. The company is testing out smart carts that link with “Albertsons for U” loyalty program to display ads to shoppers – and Albertsons is likely to find more ways to reach in-store consumers as it continues to develop its retail media network.

The chain is also one of the most popular grocers nationwide. With the exception of March and April 2022, when inflation and high gas prices temporarily halted growth, the brand’s monthly visits and visitor numbers have consistently exceeded pre-pandemic levels. Monthly visits for Albertsons in August 2022 were up 5.7% and monthly visitors were up 5.4% on a Yo3Y basis. This means that advertisers with Albertsons can increase their reach and grow their physical ad impressions just by displaying their ads in Albertsons locations and tapping into the chain’s growing visitor base.

Looking beyond Albertsons' nationwide average foot traffic trends reveals some important regional differences. Between January and July 2022, visits to the brands increased 4.6% in Wyoming on a Yo3Y basis, while foot traffic to the brand’s locations in Oregon jumped 18.5% compared to January through July 2019. This means that a brand looking to reach consumers in Oregon can contract with Albertsons’ media network to show its ads to a fast-growing pool of visitors.

A larger visitor count translates to an increase in unique ad impressions, while more visits from fewer visitors can drive repeated exposures.

Diving deeper into the data reveals an additional layer of insight. Some states with only moderate visit growth are seeing a surge in visitor numbers, while other states are seeing a drop in visitor numbers but a rise in visits. A larger visitor count translates to an increase in unique ad impressions and more people exposed to the ads, while more visits from fewer visitors translates to more overall impressions that can drive repeated exposure among a smaller group of visitors. So advertisers can use segmented foot traffic data to decide where to focus their marketing depending on the goal of the campaign.

For example, Wyoming's moderate increase in visits hides a significant spike in visitors, which means that advertisers to Albertsons venues in Wyoming can get their impressions before a large number of different potential consumers. Meanwhile, Oregon's 18.5% increase in visits is the result of just a 9.4% increase in visitors – so Albertsons is cultivating an increasingly loyal following in the Beaver State, and the grocer’s advertising partners can expect that the same visitors will be exposed to their brand repeatedly.

So companies that want to increase unique ad impressions and build awareness can advertise to Albertsons customers in Wyoming, where their ads will be seen by a large number of new people. But in Oregon, companies may want to promote a campaign that focuses on moving Albertsons visitors through their funnel.

In order to accurately assess the ad distribution patterns in each location, brands operating retail media networks need to understand both visits and visitors trends in each region and for the chain as a whole.

Advertisers with retail media networks can use foot traffic data to refine their geographic audience by identifying the consumer preferences of a given brick-and-mortar brand on a store or city level.

In August 2020, CVS Pharmacy launched its media network, the CVS Media Exchange (cMx). The company estimates that 76% of U.S. consumers live within five miles of at least one store, and the cMx allows partners to tap into the chain’s reach by giving advertisers access to CVS’ online and offline channels, including in-store ads.

Although CVS has been closing locations recently, the brand is still one of the strongest players in the brick-and-mortar retail space. Its 2022 visit numbers have consistently exceeded pre-pandemic levels nationwide, and data from CVS locations in leading cities shows that its Yo3Y visits per venue and visitor numbers are even higher.

CVS’s nationally distributed fleet means that the brand’s locations in different regions attract distinct consumer bases.

CVS carries a varied product mix of daily essentials in addition to its healthcare offerings, so the brand attracts a wide range of consumer segments. And the chain’s nationally distributed store fleet means that CVS has locations in different regions that attract distinct consumer bases who do not all have the same lifestyle preferences. By using foot traffic data to understand the regional consumer preferences of CVS consumers beyond the store, advertising partners can refine their market and make the most of the cMx.

Different regions have different fitness cultures. Chains catering to health-conscious consumers can use retail media networks and foot traffic data to focus their efforts on areas where inhabitants exhibit a high demand for regular workouts.

Analyzing cross-visit data from CVS locations across five major urban centers in the U.S. shows that the percentage of those who also visited gyms or fitness studios varied significantly across each DMA. In the New York area, 62.7% of those who visited CVS in Q2 2022 also visited a fitness venue during that period, in contrast with only 38.0% of CVS visitors around Dallas-Ft. Worth, TX in the same period. This information can help advertising partners in the health and wellness space decide where to place their campaigns.

Looking at cross-visit data on a city-wide level can provide a sense of the consumer culture in each area, but advertisers that dive into foot traffic data for individual stores can refine their messaging even further.

On average, 43.8% of CVS visitors in the Chicago DMA also visited a gym in Q2 2022. But drilling down to the top CVS locations in the city reveals that the rate of cross-visits varies significantly from location to location. Both the E 53rd Street and W 103rd Street locations have a relatively high share of visitors who visit fitness locations – 52.5% and 49.2%, respectively. Meanwhile fitness cross-visits were at just 36.6% for the South Stony Island Avenue location. Advertisers promoting health and wellness related products and services may want to focus on the 103rd St. and 53rd St. CVS locations.

Diving into a customer’s behavior and preferences outside the store can help retail media network operators and advertising partners find the areas and locations best suited for each type of ad.

Cross-visit data is one way to identify consumer preferences beyond the physical store. Advertisers can also analyze digital preferences of offline visitors to focus their marketing on the most appropriate locations.

Advertisers can also analyze digital preferences of offline visitors to focus on the most appropriate locations.

Over the past couple of years, Macy’s has been finding ways to reinvent itself and optimize its store fleet – and foot traffic data indicates that the retailer's efforts are paying off. In the first half of 2022, Macy’s exceeded its H1 2021 overall visit and average visits per venue numbers and posted a positive year-over-year (YoY) visitor count. In Q2 2022, despite the wider economic challenges, Macy’s visitors, visits, and average visits per venue saw YoY increases of 3.4%, 4.0% and 9.9% increases.

Like CVS, Macy’s launched its media network in August 2020, and by February 2021 the Macy’s Media Network was already generating $35 million annually. In addition to advertising on the company’s digital channels, Macy’s also offers partners the use of in-store screen displays, package inserts, and the brand’s iconic billboard in New York City’s Herald Square.

Advertisers can optimize their advertising by analyzing the differences in consumer profiles between a chain’s various stores.

Advertisers that understand the differences in consumer profiles between a chain’s various stores can optimize their advertising efforts. While looking at variations in cross-visit trends is one way to identify interested brick-and-mortar consumers, diving into visitor’s digital behavior and online preferences can also provide valuable insights.

Tools such as Spatial.ai’s GeoWeb, which tracks online engagement with various trends and topics by neighborhood, can reveal how offline consumers behave online. An index score of 100 indicates that consumers in an area have an average interest in a given topic, while scores over (or under) 100 indicate that consumers are more (or less) interested in the topic when compared to the national average interest.

We used Spatial.ai’s GeoWeb tool to analyze the online behavior of consumers in the True Trade Areas (TTA) of five Macy’s locations in the Philadelphia, PA DMA – and found that residents of the different TTAs stores showed differing indexes. For example, the Macy’s in the King of Prussia Mall location showed a high index of 161 in “Men’s Business Clothes Shoppers,” while the Cottman Ave. location had an only slightly above average index of 102. This means that advertisers of men’s business apparel may see more results by focussing their advertising on visitors to the King of Prussia location.

Advertisers that use retail media networks do a lot more than just reach in-store shoppers. Stores exist in the physical world, so advertisers can also reach passers-by through physical venues’ windows, blade signs – or in the case of Macy’s, through its Herald Square Billboard. Here too, foot traffic data can reveal the consumer preferences of people walking by the sign.

We looked at the online behavior in the TTA around the traffic pin on the corner where the billboard is located (Broadway/6th Ave and 34th Street in New York) to understand which advertisers might benefit most from a billboard at that location. While the “Men’s Business Clothes Shoppers” category was over-indexed compared to the national average, as would be expected in midtown Manhattan, “Women’s Fashion Brand Shoppers” had an even higher index. “Gen Z Apparel Shoppers” were over-represented, but “Leather Good Shoppers” and ”Athleisure Shoppers” were under-represented. So a brand that carries both elegant wear and athleisure may want to display its less casual clothing lines on the billboard.

Understanding how consumers behave both on and offline can help retail media networks and advertising partners promote their campaigns most effectively.

To transform their physical store fleet into a media network, brands and companies need to analyze the reach of each venue. The same chain operating in multiple regions may be reaching different types of consumers in each area, or even in various neighborhoods of the same city. These distinct audiences may have contrasting products, brands, and shopping preferences.

Retailers that leverage their brick and mortar presence can transform the advertisement space as it exists today.

Retailers can also partner with advertising partners who wish to promote goods and services not carried by the retailer. For this to succeed, the retailer will need to analyze how consumers behave outside of its stores. Understanding what characterizes the overall behavior of consumers in each locations’ trade area will allow the retailer to reach a larger audience and truly compete with the digital giants. And by leveraging their brick and mortar presence, brick and mortar retail can transform the advertisement space as it exists today.

Malls have long acted as a gleaming symbol of American retail. Following the opening of the first indoor mall in 1956, and as the American middle class increasingly moved from the city to the suburbs, malls continued to open at a rapid rate. By 1960, some 4,500 shopping centers had opened nationwide, filling the growing demand for “third places” – spaces that allowed the newly suburban populations to gather, socialize, and create community. And while that role evolved over the years, it’s safe to say that malls have played a major part in shaping the American shopping culture.

But malls’ rapid expansion led to an oversaturated market – some estimates suggest that there are approximately 24 square feet of retail space per U.S. citizen, as compared to 4.6 for the U.K. and 2.8 for China. Many began to predict the demise and downfall of malls, and that narrative intensified as online shopping grew in popularity. The rise of big-box stores, a focus on “services, not things,” and COVID-19 only accelerated these trends.

A lot of the doom and gloom predictions tend to de-emphasize the mall's role as a modern incarnation of a bustling downtown shopping area.

But a lot of these doom and gloom predictions focus on malls only as a place to shop, and tend to de-emphasize their other role as the third place – a modern incarnation of a bustling downtown shopping area, replete with shops, services, and places to meet. And after two years of isolation and a new, pandemic-induced wave of suburban relocation, malls’ potential to bring people together is more prized than ever.

So although malls were hit hard during COVID-19, many of them are finding ways to reinvent themselves and stay relevant. Today, more than halfway through 2022, the challenges that malls face continue to evolve and change – but malls are evolving too. This white paper covers a few specific ways that some malls have found to thrive in the new normal. Some shopping centers are turning to entertainment to draw crowds into their doors. Others are focusing on offering a full visitor experience that extends beyond simply grabbing a new shirt or a burger at the food court. Still, more are embracing omnichannel options, offering an integrated on and offline experience to their shoppers. In the face of significant retail challenges, top-tier malls are turning to innovative solutions to stay ahead of the game.

The pandemic posed significant challenges to malls. Although foot traffic to the category rose back up in the summer of 2021, the Delta and subsequent Omicron waves brought visits down once more. And as visit gaps post-Omicron began to narrow, inflation and gas prices put the brakes on any return to normalcy. April and May 2022 saw visits beginning to trend up, though the unrelenting rise of inflation, the highest it’s been in the past 40 years, has slowed that recovery slightly.

Foot traffic data shows that malls are continuing to attract visitors, despite the challenges that seem to crop up weekly.

Still, foot traffic data shows that malls are continuing to attract visitors, despite the challenges that seem to crop up weekly. And while they may no longer play the central role they once did in Americans’ shopping routines, malls still serve as indoor community hubs where friends and family can come together for diverse food, shops, and entertainment options. This could explain why top-tier malls keep on coming back despite the seemingly constant obstacles.

Comparing monthly visits from January 2022 through July 2022 to the same period in 2019 highlights the significant difficulties facing the sector. Indoor malls, open-air lifestyle centers, and outlet malls alike saw marked lags in foot traffic as compared to three years ago.

Monthly year-over-three-year (Yo3Y) foot traffic comparisons also highlight mall resilience.

The monthly year-over-three-year (Yo3Y) foot traffic comparisons also highlight mall resilience. Following an Omicron-plagued January, the visit gaps narrowed in February 2022 to less than 5% for all the segments. And although the increase in gas prices and inflation brought visits down in March, malls quickly bounced back in April 2022, with indoor malls seeing only 1.8% fewer visits than in 2019 and open-air shopping centers down only 4.8% Yo3Y. Foot traffic fell again in May and June as consumers tightened their budgets in the face of rising prices, but consumers appear to have quickly made peace with the new economic reality. By July 2022, visits to indoor malls and open-air lifestyle centers were only 3.5% and 2.7% lower than they had been in July 2019.

COVID didn’t just impact visit numbers – since 2020, mall visits have also gotten shorter, likely a result of pandemic restrictions and a general desire not to congregate any longer than necessary. And although 2021 and 2022 saw a slight uptick in time spent at malls and shopping centers – from 60 minutes in 2020 to 62 minutes in 2021 and 2022 – the median dwell time is still significantly lower than the 70 minutes median dwell time of pre-COVID 2018 and 2019.

Shorter visits are not necessarily a bad thing – intent-driven shoppers may simply be doing more research ahead of time and less in-mall browsing.

Shorter visits are not necessarily a bad thing in and of themselves – consumers today are highly informed, so many intent-driven shoppers may simply be doing more research ahead of time and less in-mall browsing. But shorter (and fewer) visits do mean that malls must focus on giving shoppers a reason to visit. We explore some successful strategies below.

Malls have long integrated entertainment into their overall experience in the form of arcades, movie theaters, and even coin-operated animal rides. Some malls, however, are taking their entertainment offerings to the next level.

In August 2021, CBL Properties, a Tennessee-based property developer, announced the opening of the Hollywood Casino by Penn National Gaming in the York Galleria Mall in York, Pennsylvania. The 80,000 square foot casino, which boasts 500 slots and 24 live-action table games, opened in the mall’s lower level. The space was occupied by a now-closed Sears department store, and the entertainment venue now functions as a new anchor to draw customers in.

The casino’s opening has had a dramatic impact on the mall’s foot traffic. In a year-over-three-year (Yo3Y) comparison, July 2021 saw 2.4% fewer visitors than July 2018. But when the casino opened in August 2021, visits to the location jumped to 31.4% Yo3Y. This increase is all the more impressive considering that the casino opened on August 19th, with only 12 days left in the month.

The mall, which had seen negative Yo3Y visit numbers until the casino’s opening, has sustained the positive visit trend through July 2022 – a testament to the appeal of in-mall entertainment.

Another mall betting on indoor entertainment is the Pierre Bossier Mall in Bossier City, Louisiana. In April 2022, Surge Entertainment opened a child-friendly space, which includes zip-lining, bowling, laser tag and arcade games. The Surge Entertainment chain is co-owned by Drew Brees, the former New Orleans Saints quarterback, and has 15 locations around the country. The Pierre Bossier Mall branch is filling the space vacated by Virginia College, which closed its doors in 2018.

Since Surge Entertainment opened its Bossier City location, the mall has seen a dramatic increase in average dwell time.

Since Surge Entertainment opened its Bossier City location, the mall has seen a dramatic increase in average dwell time. Between July 2021 and March 2022, median dwell time hovered between 51 and 58 minutes. But following the center’s opening, median dwell time jumped to 78 minutes. Since then, the median dwell time has remained consistently elevated: In the four months since the Surge Entertainment opening, median dwell times did not drop below 75 minutes.

Brick-and-mortar retailers once viewed online shopping as a threat – but now, mall owners and operators are increasingly turning to digital channels to complement existing approaches. COVID-19 and the surge of online shopping further fueled malls’ digital progress. Over the past two years, large malls and suburban shopping centers across the country have been rolling out various online and social shopping options and adopting omnichannel strategies.

In September 2020, Centennial, a real estate investment firm with many malls and mixed-use entertainment centers in its portfolio, launched a chain-wide omnichannel platform called Shop Now!. The app allows consumers to shop across all Centennial malls the way someone would shop on Amazon.

The first phase of the program, which launched in October 2020, allowed users to browse an AI-powered search engine connected to the inventory of all of the stores operating in their mall of interest. In February 2022, Centennial debuted phase two of the program at its Santa Ana, CA based MainPlace Mall. It allows customers to consolidate orders from several stores into a single cart, get the order fulfilled by personal shoppers, and have the orders ready for same-day delivery or on-site pickup.

The e-commerce app could have detracted shoppers from physically going to the mall – but instead, the program increased both monthly and loyal visitors.

The app allows consumers to browse and shop from the comfort of their phones. It could have detracted shoppers from physically going to the mall – but instead, the program has increased both monthly and loyal visitors. In the months following the launch of the second phase, MainPlace Mall saw its loyal visits increase by 5% (from 46.2% in February ‘22 to 51.3% in June ‘22), while overall monthly visits in April ‘22 increased by 5.5% when compared to 2019. The digital investment also helped the mall make sales that could have been lost to other e-commerce platforms. The mall’s brick-and-mortar success following the addition of a digital channel highlights how malls can rise to the top by embracing an omnichannel strategy.

Continuing its innovative streak, the MainPlace Mall recently added an experiential component with the opening the American Ninja Warrior Adventure Park in July 2022 in the place of four former retail stores. During its first month of operation, the park drove the mall’s share of loyal visits up by 13.4% compared to the previous month while boosting Yo3Y monthly visits by 18.0%.

The difference in impact between the online platform launch and the opening of the American Ninja Warrior Adventure Park indicates that malls can enjoy both gradual gains over time as well as jumps in foot traffic and loyalty, depending on the strategy they adopt.

Omnichannel strategies can also revitalize food courts hit hard by the pandemic. Arundel Mills Mall, part of the Simon Property Group, began offering online orders in February 2022 via a platform called Snackpass, allowing users to use the app at various eateries around the mall. Snackpass, launched in 2017 as a food ordering app on the Yale campus, facilitates group ordering and includes various social features. Its current iteration allows customers to pre-order food, skip lines, collect rewards, and engage with friends. It also offers discounts on group orders, in an effort to promote social dining.

Since the beginning of the Snackpass partnership, the shopping center itself is seeing more visitors – many of whom are coming from farther away.

Since the beginning of the Snackpass partnership, the shopping center itself is seeing more visitors – many of whom are coming from farther away. In the five months following the app’s launch, Arundel Mills saw an overall increase of 15 square miles to its True Trade Area (TTA), and an increase of 29.5% in visits per sq. ft. – The consistent increase in TTA and visits per sq. ft. are a testament to the power of innovative dining partnerships to draw traffic to top-tier malls.

With many retailers reducing their on-mall presence, empty brick-and-mortar stores have attracted plenty of negative attention. But now, malls are increasingly repurposing vacated spaces in new, innovative ways that resonate with local communities and can fill their evolving needs.

At the Ocean County Mall in Toms River, NJ, Simon Property Group repurposed the huge space left by a former Sears store and turned it into a lifestyle center, with stores opening throughout 2020. The space is now being used by a number of highly popular chains such as LA Fitness, Ulta Beauty, HomeSense, and P.F. Chang’s and also includes a children's play area.

This pivot seems to be working. Median dwell time to the mall has increased from 53 minutes to 56 minutes, a significant change when considering that a majority of malls have recently seen their dwell times drop.

The center has also seen the median age for its trade area decrease from 40.5 years old in the first half of 2021 to 37.2 in the first half of 2022, a dramatic shift in visitor demographics. Yo3Y visits are strong as well – July 2022 were up by 17.1%.

In a similar tale of a closed Sears turning into a lifestyle center, the Northshore Mall in Peabody, MA turned the space vacated by the department store into a mixed-use center. The most significant anchor is now the high-end Life Time Fitness Center that offers cardio, weights, and functional training rooms, and includes yoga, pilates, and cycling studios, indoor and outdoor pools, basketball and pickleball courts, saunas, and a bistro.

As soon as the health club opened its doors in July 2021, visits to the mall increased – significantly outpacing the levels seen when Sears was still open.

As soon as the health club opened its doors in July 2021, visits to the mall increased – significantly outpacing the levels seen when Sears was still open. Both Yo3Y and year-over-four-year (Yo4Y) foot traffic numbers were impressive, with July 2022 seeing 17.2% more visitors than three years prior.

As visits to malls become more focussed, selecting the right tenant has never been more important – and that may mean looking at unconventional occupants to draw in customers.

In one example of tapping into local needs, the Westfield Oakridge shopping center in San Jose, CA, opened a specialty grocery store on its premises. 99 Ranch Market, one of the largest Asian supermarket chains in the U.S., began operating its first mall location in March 2022. The location includes classic grocery store items such as produce, meat, and seafood sections, and also boasts a dining hall, tea bar, and bakery.

Its opening day saw lines snaking out the door, as excited locals queued to sample the store’s delicacies. And the crowd-drawing hype seems to be more than a flash in the pan – the months following the opening were the mall’s strongest in the past year and a half. Yo3Y visits were up by 10.1% in July 2022 , with some shoppers reporting that the addition of the grocery store had turned Westfield Oakridge into their all-in-one stop shop.

Although the area was not lacking in grocery options, retail foot traffic data indicates that the new 99 Ranch Market at Westfield Oakridge Mall still filled a void.

Although the area was not lacking in grocery options, retail foot traffic data indicates that the new 99 Ranch Market at Westfield Oakridge Mall still filled a void – the new grocery store’s trade area has only minimal overlaps with the other trade areas of the nearby 99 Ranch Markets locations. This means that most of the new 99 Ranch Market’s customers were not being well-served by the existing locations of the chain.

Westfield Oakridge is not the only San Jose mall turning to food to attract the crowds. On June 16th 2022, following much hype and a pandemic-related delay, Eataly, the all-in-one Italian market, restaurant, and cooking school opened its first Northern California location at the Westfield Valley Fair in Santa Clara, CA.

Prior to the launch, the Westfield Valley Fair mall was already one of the more successful malls in the country – but the opening of Eataly seems to be driving even more foot traffic. Yo3Y visits to malls during Eataly’s opening week exceeded 20% for the first time in months and have since remained consistently elevated, with visits for the week of July 25th up 27.7% relative to the equivalent week in 2019.

In March 2022, regional department store Von Maur opened its doors at The Village of Rochester Hills, an open-air lifestyle center in Michigan. The retailer, which has 36 locations throughout the Midwest, took over the space left vacant by Carson’s, another Midwest-based department store.

What may be the first new department store in the Detroit metropolitan area in over a decade is driving visits to the shopping center.

What may be the first new department store in the Detroit metropolitan area in over a decade is driving visits to the shopping center. Von Maur’s March 2022 opening pushed Yo3Y visits up by 16.9% compared to the mere 4.3% Yo3Y increase the month before.

Part of the secret to Von Maur’s success lies in the psychographic characteristics of residents within the mall’s trade area. Using Spatial.ai’s GeoWeb data, a tool which tracks online engagement with various trends and topics by neighborhood, we found that the TTA surrounding The Village had an index of 131 for department store shoppers. In other words, people in the mall’s trade area exhibited heightened interest in department stores – they engaged with department-store-related content at a rate that was 1.3 times higher than the national average – which helps explain why Von Maur is thriving in this specific location. And in another testament to the strength of immersive retail experiences, Von Maur, which focuses on curating a unique shopper journey and features a pianist at all of its locations, has been ranked the top department store in America.

The addition of Von Maur is not the only change that The Village is implementing – the mall has continued adding new stores and will be opening more throughout the year. These, too, will likely boost foot traffic to the lifestyle center.

The mall’s ability to select tenants that cater to, and reflect the needs and behaviors of its consumers is likely to continue driving success. By drilling down into the nitty-gritty details of who comes to shop, where they come from, and what shops they enjoy frequenting, mall management can tailor the shopping center to meet the needs of its base.

The “death of the American mall” has been predicted for years. The reality, however, is much more nuanced than that – like many other sectors, malls are undergoing a shift to help them better serve evolving customer needs and survive and thrive in an ever-shifting retail landscape.

The malls featured in this white paper have found ways to consistently attract visitors despite the various obstacles faced by the category over the past two years. By understanding that the American mall must evolve along with the consumers, mall owners can successfully revitalize their retail spaces.