.svg)

.png)

.png)

.png)

.png)

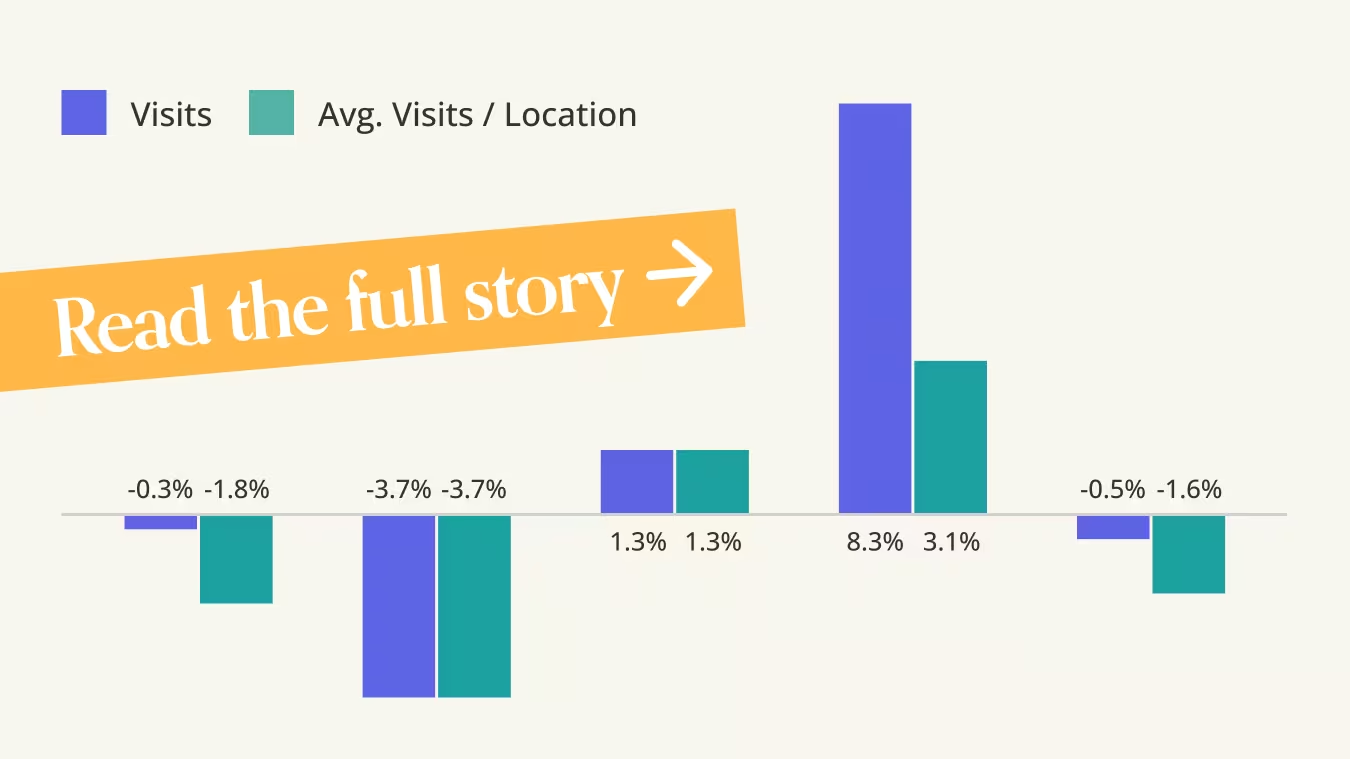

Year-over-year (YoY) visit performance for RBI chains was mixed in Q4 2025. Burger King (0.7%) and Popeyes (-0.5%) had nearly flat foot traffic, while Firehouse Subs (3.9%) had more significant growth. Meanwhile, Tim Hortons (-4.5%) experienced a significant visit gap.

Foot traffic trends across RBI brands in Q4 2025 reveal a divide in chain performance. Burger King and Firehouse Subs were the primary drivers of domestic visit growth, while Popeyes and Tim Hortons experienced softer traffic patterns.

As the monthly visit graph below shows, Burger King’s Q4 2025 momentum came mostly in December 2025, coinciding with the brand’s limited-time SpongeBob Movie Menu and its 13 Days of Deals promotion. Meanwhile, Firehouse Subs sustained visit growth throughout Q4 2025, supported by continued expansion of its store footprint.

Popeyes visits and same-store visits tracked closely and remained largely flat in Q4 2025, pointing to continued challenges for the brand. RBI has emphasized long-term operational improvements and a renewed focus on core menu items as key levers for improving Popeyes’ performance, and while the impact of these initiatives has yet to materialize in the visit data, they could begin to support meaningful growth in 2026.

Domestic traffic to Tim Hortons – a relatively small chain in the U.S. coffee space – lagged significantly in Q4 2025. However, RBI has signaled ambitions to replicate the brand’s international success domestically, leveraging a robust promotional calendar and an accelerated expansion strategy that could help lift brand awareness and strengthen consumer loyalty over time.

What’s next for these brands in 2026? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

I grew up playing soccer and have great World Cup memories growing up near the Rose Bowl.

In 1994, the US hosted the men’s World Cup, marking the first time the country had ever hosted a World Cup – men's or women's. We tied our first game against Switzerland, and the second game was against Columbia at the Rose Bowl. I went to that game! Valderama was at his peak, and it seemed one in five fans wore a big yellow wig. The US went on to win that game – our first win ever on home soil. The party that ensued was madness. Seemingly, the whole stadium paraded to Old Town Pasadena after the game, basking in the upset. Old Town had not expected tens of thousands of soccer fans to descend upon them.

But something even greater happened in 1999. The Rose Bowl hosted another epic game, this time between the US and China in the Women’s World Cup finals. The game went into overtime, and then penalties, where we finally won. The image of Brandi Chastain after her game-winning penalty is one of my favorite images of all time.

This year’s World Cup will be played across stadiums nationwide – and although none of these venues include the Rose Bowl, new memories will still be made for fans new and old.

Eight tournament matches, including the final, will be held at MetLife Stadium in New Jersey, which already hosted a World Cup-like audience during the 2025 FIFA Club World Cup. Analyzing the demographics and consumer preferences of fans at that event can provide a strong preview of who will fill the stands in 2026 – and how marketers can capitalize on the opportunity.

So if you are a brand that wants to tap into this experience, here are a few things you can do to help get as close to the action as possible.

Comparing the FIFA Club World Cup Final (July 13, 2025) to other high-profile sporting events held at MetLife Stadium reveals that the soccer match attracted a higher share of Millennials and Gen X attendees than high-profile NFL and NHL events at the same venue. Meanwhile, the NFL and NHL events skewed more heavily toward both older generations and Gen Z.

Takeaway: Global soccer events such as the FIFA World Cup may be especially effective for brands targeting Millennial and Gen X consumers at major U.S. venues.

Diving deeper into the differences between FIFA Club World Cup attendees compared to NHL and NFL fans at MetLife Stadium shows that FIFA Club World Cup Final Attendees tended to travel to the match from further away. The data also shows that MetLife visitors during the FIFA Club World Cup were more likely to take advantage of their trip to MetLife to visit the nearby American Dream Mall compared to NHL or NFL fans.

Takeaway: Global soccer events drive stronger destination-style behavior, creating meaningful spillover for nearby retail and entertainment destinations – and expanded opportunity for brands beyond game day itself.

Compared to NFL and NHL audiences, FIFA Club World Cup Final attendees showed distinct food and beverage preferences. In terms of food choices, soccer fans tended to have a strong preference for Asian cuisine and a slightly higher-than-average affinity for Italian food. On the beverage front, FIFA Club World Cup guests showed lower relative interest in craft beer and higher interest in at-home craft coffee compared to the NFL or NHL game-day crowds.

Takeaway: Soccer fans’ psychographic profiles point to opportunities for non-traditional, globally inspired food and beverage concepts around major soccer events.

One of my favorite learnings from being around brands my entire professional life is that fans are diehard. Fans go to extraordinary lengths to get access to experiences and content that they love. If you are a brand that is somehow lucky enough to be part of the experience, you are etched positively in memory. But if you try to force yourself into the experience and aren’t authentic, consumers will punish you for it.

The World Cup is a global event, but it’s not for everyone. By leveraging AI-powered location analytics, you can see who attends these types of events, how far they travel, where they stay, where they eat – and maybe most importantly, what they do when they are not at the game.

Our recent analysis highlighted Dutch Bros’ push to capture a greater share of morning-daypart visits alongside its aggressive expansion strategy. Now, we’ll dive deeper into the connection between these two aspects of Dutch Bros’ strategy. Using an AI-powered analysis of visitor behavior we’ll explore how Dutch Bros’ play for the morning commuter could help foster brand recognition and loyalty in new markets, driving success as the chain grows its footprint.

Dutch Bros saw consistently positive visit growth in 2025, largely driven by rapid unit expansion, while the chain’s elevated same-store visits indicate strong demand as it entered new markets. The brand’s particularly robust end-of-year momentum may also be linked to its holiday season promotions.

As Dutch Bros grows its footprint, its visitor’s journeys appear consistent with a brand yet to cement itself as part of morning coffee and breakfast routines in new geographies.

In 2025, fewer Dutch Bros visitors came from home immediately before visiting the chain or continued to work immediately after visiting, compared to 2024. This shift may reflect consumers who are encountering the chain more organically as it opens in their area – with curiosity and novelty fueling irregular visits rather than visitation being part of an established routine or commute.

Perhaps morning commuters, the kind Dutch Bros hopes to attract with its aforementioned breakfast strategy, could be the key to turning discovery into loyalty among consumers in new markets.

Viewed together, two facets of Dutch Bros’ growth plan – expansion and morning commuter visits – appear highly complementary; expanded breakfast offerings could potentially facilitate the transition from unfamiliar brand to habitual pit stop as the chain grows its footprint.

What will Dutch Bros’ visit patterns reveal about its growth in the months ahead? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

Fleming’s Prime Steakhouse & Wine Bar – Bloomin’s most upscale concept – posted year-over-year visit growth in Q4 2025, while elevated-casual chain Bonefish Grill also sustained traffic gains. Both brands draw disproportionately from higher-income trade areas: Bonefish and Fleming’s captured market median household incomes are $88.0K and $102.6K, respectively, compared with a nationwide median of $79.6K, according to STI: Popstats 2024.

By contrast, Outback Steakhouse saw largely flat traffic in Q4 2025, while Carrabba’s Italian Grill recorded a 3.7% year-over-year decline in visits. These brands attract diners from trade areas with median household incomes closer to the national average – $79.7K for Outback and $82.9K for Carrabba’s.

The traffic trends combined with the trade-area income patterns suggest Bloomin’s brand performance mirrors broader industry dynamics. As consumers remain selective with discretionary spending – particularly on dining out – traffic is increasingly concentrated among higher-end destinations offering a clear “value-plus-experience” proposition or casual chains with a well-defined value proposition. Meanwhile, undifferentiated casual dining brands continue to lag.

Against this backdrop, Outback Steakhouse’s flat to slightly negative same-store traffic through much of H2 2025 reflects its positioning within the more challenged segment of casual dining rather than a lack of strategic focus. Management has outlined plans to sharpen the Outback's value proposition through improvements in food quality, guest experience, and operational consistency – steps designed to better position Outback with diners seeking greater value and differentiation in 2026.

Taken month by month, the data suggest that Bloomin’ Brands’ higher-end concepts benefited from both stronger underlying demand and greater flexibility in capturing discretionary spend. Meanwhile core casual brands remained more exposed to year-end pressure.

Bonefish Grill’s same-store traffic showed episodic strength – most notably in October – indicating periods of solid unit-level demand even as momentum softened into the holidays. Fleming’s Prime Steakhouse & Wine Bar, by contrast, delivered its strongest gains on an overall traffic basis, pointing to system-level growth and traffic concentration that helped offset more uneven same-store performance.

Meanwhile, Outback Steakhouse and Carrabba’s Italian Grill saw declines deepen into December across both metrics. This dip underscores the heightened vulnerability of traditional casual dining concepts during the holiday season, when increased competition for discretionary spending tends to pressure lower-differentiated dining occasions.

Looking ahead to 2026, Bloomin’ Brands appears positioned to benefit as stabilizing consumer conditions intersect with ongoing brand-level investments. With higher-end concepts demonstrating resilience and Outback’s repositioning efforts underway, the portfolio is better aligned to capture both experience-driven and value-oriented dining demand.

For more data-driven consumer insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

What should restaurant operators expect in 2026? Like much of the consumer sector, 2025 was an up-and-down year for the industry. The year started out on a strong note, but visitation trends quickly turned volatile amid uncertainty over tariff news and broader macroeconomic uncertainty. With the threat of higher prices, it’s no surprise that consumers became hyper price sensitive as the year progressed, resulting in a clear bifurcation in trends among diners.

On one hand, affluent consumers – who generally take their spending cues from the health of the stock and housing market – continued to visit more upscale and fine dining chains. Meanwhile, lower and middle income consumers pulled back from QSR and fast casual restaurant chains that they perceived as expensive. This set up a challenging development for many restaurant operators, as consumers traded out of traditionally lower-priced restaurant channels for substitutes across other food retailers. This trend continued for much of the year until McDonald’s and others introduced more value-oriented promotions with pop-culture tie-ins (which we discussed here).

Heading into 2026, where does the restaurant category stand? We’ve highlighted three key trends that restaurant operators, executives, and investors should consider.

As mentioned above, traditionally lower-priced restaurant channels generally had a challenging 2025 headlined by increased competition with other food retailers like value grocers like Trader Joe’s and Aldi, food-forward convenience stores like Wawa, Sheetz, Buc-ee’s, and Casey’s, and warehouse clubs like Costco and Sam’s Club (which have increasingly attracted younger visitors in recent years). In fact, our data suggests a substantial increase in the percentage of QSR visitors also visiting Aldi – and while some of the increase may be attributed to Aldi's expansion, the rise in cross-visitation trends also underscores this competitive encroachment.

While certain players like Taco Bell were able to hold their ground against other food retail competitors, others – like McDonald’s – needed the boost from special promotions like the launch of its Extra Value Meal in September 2025 to win back value-focused consumers.

We’ve already covered some of the key ways that QSR chains plan to wield promotional strategies in 2026, including a focus on freebies, pop-culture tie-ins, sequencing, and storytelling. We’re already seeing some evidence of this with Taco Bell’s Luxe Value Menu featuring 10 menu items priced at $3 or less. However, with several key events taking place in 2026, including the Winter Olympics and World Cup, there will be more opportunities for QSR chains to amplify their value messaging. We may not quite see the return of the Value Wars of 2024 given ongoing input cost inflation pressures, but given the success that McDonald’s and Taco Bell have seen, it’s apparent that value messaging will be critical in 2026.

As macroeconomic and inflationary uncertainty increased throughout 2025, restaurants’ primary competition shifted from other chains to alternative food retail channels, including value grocers, convenience stores, warehouse clubs, and dollar stores. Chipotle CEO Scott Boatwright noted this trend on the company’s Q3 2025 earnings conference call as well. While Chipotle noted pressure among customers under $100K in household income from July-September, our data also indicated a major shift in the behavior of fast casual restaurant consumers in trade areas between $100-$125K for much of the second half of 2025.

Where did these consumers go? Like for QSR chains, we believe visits were impacted by a combination of factors – including a shift to differentiated food retailers like Trader Joe’s. Below, we see the percentage of fast casual visitors that also visited Trader Joe’s has increased significantly over the past five years. Like for Aldi, some of this can be attributed to Trader Joe’s expansion plans, but we believe that some visitors have chosen to substitute some fast casual lunch visits for value grocers.

After years of outperforming the industry, these high-growth brands face a "convenience plateau." The price gap between fast-casual and casual dining narrowed to the point where consumers began questioning the value of a $16 bowl eaten at a counter versus a $20 sit-down meal. To win back these consumers in 2026, fast-casual brands must reinvest in the physical experience. This means moving away from "ghost kitchen" vibes and back toward inviting dining rooms, while simultaneously fixing the "mobile order friction" that has made many store lobbies feel chaotic and impersonal.

Both QSR and fast casual chains looking to win back middle-income visitors who have traded down to at-home dining will need to move beyond the $5 value meal. The winners in 2025 realized that value is a calculation of price combined with innovation. McDonald’s "Grinch Meal" and various "limited-time" spicy chicken iterations proved that consumers are willing to spend if the product feels like a unique event. In 2026, restaurants must continue this trend, using "innovation-led value" to justify the discretionary spend of a household that is increasingly selective.

One of the standout stories of 2025 was the continued strength of casual dining giants like Chili’s. Building on the momentum gained in 2024 with the "Big Smasher" burger and clear value messaging (like the "3 for Me" deal), Chili’s didn't just win new customers – it kept them. Data shows that same-store visits to Chili's were up every month of 2025 despite the tough comparison to an already strong 2024.

Observing Chili's successful resurrection through its aggressive "3 for Me" platform and direct antagonism toward fast-food pricing, rivals like Applebee's and Red Robin are frantically adopting the same playbook to win back budget-conscious diners. These chains have largely abandoned complex culinary innovations in favor of simplifying operations and launching hard-hitting tiered meal deals – often priced between $10 and $12 – designed to explicitly undercut the rising cost of a "Big Mac" combo.

By pivoting their marketing to highlight that a sit-down meal with unlimited sides now costs less than a drive-thru visit, competitors are validating Chili's core thesis: the new battleground for casual dining isn't service or ambiance, but proving they are the superior economic alternative to the quick-service sector.

Ultimately, 2026 will be defined by precision rather than broad-stroke expansion. The 'rising tide' era of post-pandemic growth is over; simply opening doors in high-growth Sunbelt markets or offering a generic discount is no longer enough to guarantee traffic. To succeed in this increasingly saturated and price-sensitive environment, operators must execute a delicate balancing act: aggressively defending their value proposition to fight off grocery competitors, while simultaneously reinvesting in the in-store experience to justify the visit. Whether it is through the tactical 'sequencing' of limited-time offers, the aggressive tiered pricing of casual dining, or the revitalization of physical dining rooms, the winners of 2026 will be the brands that give consumers a distinct, irrefutable reason to choose dining out over staying in.

For more data-driven dining insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

The U.S. grocery sector is increasingly polarized. Traffic and growth are concentrating at the far ends of the quality-savings spectrum, where retailers with clear, disciplined value propositions are pulling ahead. Meanwhile, grocers that sit in the middle – or only weakly signal what they stand for – are struggling to keep pace.

This analysis builds on the insights from dunnhumby's U.S. Retailer Preference Index (RPI) for Grocery.

As the chart below illustrates, visit growth is diverging significantly across grocery formats, with success concentrated at both ends of the quality-price spectrum.

Savings-first retailers such as Aldi have been thriving consistently since 2023, with year-over-year (YoY) traffic growth generally outpacing that of the wider grocery category. Quality-first non-conventional chains like Sprouts Farmers Market have also done well, particularly in 2025 – though their performance lagged behind savings-first chains for much of 2023 and 2024.

But arguably the most consistently impressive performers – with slightly lower YoY growth most months but less volatility over time – have been the so-called “Unicorns”, including chains such as Trader Joe’s and H-E-B that defy grocery’s traditional quality-price tradeoff through extreme focus. By limiting assortments or going all-in on specific geographic areas, these retailers funnel profits back into innovation within their core missions, inspiring deep customer loyalty and creating a virtuous cycle that steadily improves the quality-savings equation.

Middle-of-the-road chains, by contrast, have consistently trailed the pack, struggling to gain traction in a market that increasingly rewards clear, decisive positioning.

But not every chain can be a Unicorn – hence the moniker. And between savings-first and quality-first chains, several indicators (beyond their more consistent YoY growth) suggest that savings-first grocers may be better positioned for long-term growth.

One such signal comes from cross-shopping behavior. In 2025, the share of visitors to Grocery Outlet Bargain Market who visited another grocery store either immediately before or after their trip declined YoY – indicating that more shoppers are treating the savings-first retailer as a primary grocery destination rather than a secondary or fill-in stop. A similar pattern emerged at Unicorn Trader Joe’s.

Quality-first chain Natural Grocers, by contrast, saw a higher and growing share of visitors arriving from another grocery store or heading to one directly afterward, suggesting it is more often part of a multi-stop shopping pattern rather than the first or only trip. As value-oriented chains become more complete grocery solutions, they are capturing a growing share of intentional, first-stop visits, reinforcing their role as everyday essentials rather than complementary alternatives.

Another indication of savings-first retailers’ special growth potential is the rising affluence of their customer base.

While savings-first grocery stores have not yet reached Unicorn status, their assortments have moved well beyond bare-bones essentials, and they are no longer fully trading quality for value. Expanded private-label offerings, improved fresh selections, and tighter SKU curation increasingly emphasize quality alongside cost. And as perceived quality gaps have narrowed, median household income in these retailers’ trade areas has increased – rising from $72.5K in 2022 to $73.1K in 2025. This shift suggests savings-first grocery chains are gaining access to higher-income shoppers who once defaulted to premium formats, expanding both their addressable market and runway for growth.

By contrast, quality-first grocery chains, which serve the most affluent consumers, have seen median household income in their trade areas fluctuate in recent years – rising between 2022 and 2023 before declining thereafter. While this softening could indicate some broadening of their customer base, these formats are built around narrowly defined, premium missions, which may limit the extent to which such broadening can translate into scalable growth. As a result, their path to expansion may be more constrained than savings-first retailers’ upward reach.

As price sensitivity rises and perceived quality differences narrow, the retailers winning today are those with the clearest answers to a simple question: Why shop here instead of anywhere else? And in today’s market, being essential beats being special – unless you can convincingly be both.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

The Fitness industry was a major post-pandemic winner. Visits to gyms across the country surged as stay-at-home orders ended and people returned to their in-person workout routines. And even as consumers reduced discretionary spending in the face of inflation, they kept going to the gym – finding room in their budgets for the chance to embrace wellness and get in shape while interacting with other people.

But no category can sustain such unabated growth forever – and as the segment inevitably stabilizes, gyms will need to stay nimble on their feet to maintain their competitive edge.

This white paper takes a closer look at the state of Fitness as the category transitions into a more stable growth phase following two years of outsize post-pandemic demand. The report digs into the location analytics to reveal how the Fitness space has changed – and what strategies gyms can adopt to stay ahead of the pack.

*This report excludes locations within Washington state due to local legislation.

Monthly visits to the Fitness category have grown consistently year over year (YoY) since early 2022, when COVID subsided and gyms returned to full capacity. And the segment is still doing remarkably well. Even in January and March 2024 – when visits were curtailed by an Arctic blast and by the Easter holiday weekend – YoY Fitness visits remained positive, despite the comparison to an already strong 2023.

Still, recent months have seen smaller YoY increases than last year, indicating that the Fitness category is entering a more normalized growth phase.

By keeping a close watch on evolving consumer preferences, fitness chains can uncover new opportunities for growth and adaptation within a stabilizing market – including leaning into increasingly popular dayparts.

Examining the evolving distribution of gym visits by daypart over the past six years shows that major shifts were brought on by the COVID-19 pandemic.

Between Q1 2019 and Q1 2021, as remote work took hold, gyms saw their share of 2:00 PM - 5:00 PM visits increase from 15.8% to 18.6%. Though this trend partially reversed as the pandemic receded, afternoon visits remained elevated in Q1 2024 compared to pre-COVID – likely a reflection of hybrid work patterns that leave people free to take an exercise break during their workdays.

At the same time, the share of morning visits to fitness chains (between 8:00 AM and 11:00 AM) dropped from 20.5% in Q1 2019 to 17.2% in Q1 2024, while evening visits (between 8:00 PM and 11:00 PM) increased from 11.3% to 13.2%.

Gyms that recognize this changing behavior can adapt to new workout preferences – whether by incentivizing morning visits, scheduling popular classes mid-afternoon, or offering extended evening hours.

In fact, the data indicates that gyms that are leaning into the evening workout trend are already finding success: Of the top 12 most-visited gym chains in the country, those that saw bigger increases in their shares of evening visits also tended to see greater YoY visit growth.

EōS Fitness and Crunch Fitness, for example, have seen their shares of evening visits grow by 5.5% and 3.4%, respectively, since COVID – and in Q1 2024, their YoY visits grew by 29.0% and 21.8%, respectively. Other chains, including 24 Hour Fitness and Chuze Fitness, experienced similar shifts in visit patterns. At the same time, LA Fitness saw just a minor increase in its share of evening visits between Q1 2019 and Q1 2024, and a correspondingly small increase in YoY visits.

As the evening workout slot gains popularity, gym operators that can adapt to these new trends and encourage evening visits may see significant benefits in the years to come.

Diving into demographic data for the analyzed gym chains sheds light on some factors that may be driving this heightened preference for evening workouts at top-performing gyms.

The four fitness chains that experienced the greatest YoY visit boosts in Q1 – Crunch Fitness, EōS Fitness, 24 Hour Fitness, and Chuze Fitness – all featured trade areas with significantly higher-than-average shares of Young Professionals and Non-Family Households. (STI: PopStat’s Non-Family Household segment includes households with more than one person not defined as family members. Spatial.ai: PersonaLive’s Young Professional consumer segment includes young professionals starting their careers in white collar or technical jobs.)

In plainer terms, these consumer segments – typically young, well-educated, and without children – and therefore more likely to be flexible in their workout times – are driving visits to some of the best-performing gyms across the country. And these audiences seem to be displaying a preference for nighttime sweat sessions – a factor that gyms can take into account when planning programming and marketing efforts.

Leaning into emerging gym visitation patterns is one way for fitness chains to thrive in 2024 – but it isn’t the only marker of success for the segment. Even after years of visit growth, the market remains open to new opportunities and innovations that meet health-conscious consumers where they are.

STRIDE Fitness, a gym that offers treadmill-based interval training, has sparked a trend among running enthusiasts. This niche player is finding success, particularly among a specific demographic: runners and endurance training enthusiasts.

Between January and April 2024, monthly YoY visits to STRIDE Fitness consistently outperformed the wider Fitness space. A standout month was January, when STRIDE Fitness’s visits soared by an impressive 33.6% YoY, surpassing the industry average of 5.7% for the same period.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – suggests that STRIDE Fitness’ trade areas are well-positioned to attract those visitors most open to its offerings. Residents of STRIDE Fitness’s potential market are 24% more likely to be, or to be interested in, Endurance Athletes than the nationwide average – compared to just 3% for the Fitness industry as a whole. Similar patterns emerge for Marathon Runners and Triathlon Participants. This indicates that the chain is well-situated near consumers with a passion for endurance sports and long distance running, helping it maintain a competitive edge in the crowded gym market.

Pickleball, a game that blends elements of tennis, ping pong, and badminton, is the fastest-growing sport in the country. And recognizing its broad appeal, some fitness chains have begun incorporating pickleball courts into their facilities.

Arizona-based EōS Fitness added a pickleball court at a Phoenix, AZ location – and early 2024 data highlights the impact of this addition. Between January and April 2024, the location drew between 9.1% and 33.3% more monthly visits than the chain’s Arizona visit-per-location average.

And analyzing the demographic profile of the chain’s location with a pickleball court reinforces the game’s increasingly wide appeal. Young consumer segments have been embracing the game in large numbers – and the Phoenix EōS Fitness location’s potential market includes a significantly higher share of 18 to 34-year-olds than the chain’s overall Arizona potential market. Residents of the pickleball location’s trade area are also less affluent than the chain’s Arizona average.

Pickleball has typically been associated with more affluent consumer segments, and it seems like this may be shifting. With more people than ever embracing the game, gyms that choose to add courts to their facilities may reap the foot traffic benefits.

The Fitness industry has undergone a significant transformation since COVID-19. The category’s outsize post-pandemic visit growth has begun to stabilize, and gyms are staying ahead by adapting to changing consumer preferences. Evenings are emerging as crucial dayparts for gym operators, likely driven by younger consumer segments. And niche fitness chains are seeing visit success, proving that there are plenty of ways for the Fitness segment to succeed.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Grabbing a coffee or snack at a convenience store is a time-honored road trip tradition – but increasingly, Convenience Stores (C-Stores) have also emerged as places people go out of their way to visit.

Convenience stores have thrived in recent years, making inroads into the discretionary dining space and growing both their audiences and their sales. Between April 2023 and March 2024, C-Stores experienced consistent year-over-year (YoY) visit growth, generally outperforming Overall Retail. Unsurprisingly, C-Stores fell behind Overall Retail in November and December 2023, when holiday shoppers flocked to malls and superstores to buy gifts for loved ones. But in January 2024, the segment regained its lead, growing YoY visits even as Overall Retail languished in the face of an Arctic blast that had many consumers hunkering down at home.

C-Stores’ current strength is partially due to the significant innovation by leading players in the space: Chains like Casey’s, Maverik, Buc-ee’s, and Rutter’s are investing in both in their product offerings and in their physical venues to transform the humble C-Store from a stop along the way into a bona fide destination. Dive into the data to explore some of the key strategies helping C-Stores drive consumer engagement and stay ahead of the pack.

While chain expansion may explain some of the C-Store segment growth, a look at visit-per-location trends shows that demand is growing at the store level as well. Over the past year (April 2023 to March 2024), average visits per location on an industry-wide basis grew by 1.8%, compared to the year prior (April 2022 to 2023).

And within this growing segment, some brands are distinguishing themselves and outperforming category averages. Casey’s, for example, saw the average number of visits to each of its locations increase by 2.3% over the same time frame – while Maverik, Buc-ee’s and Rutter’s saw visits per location increase by 3.2%, 3.4% and 3.9%, respectively.

Each in its own way, Casey’s, Maverik, Buc-ee’s, and Rutter’s, are helping to transform C-Stores from pit stops where people can stretch their legs and grab a cup of coffee to destinations in and of themselves.

Midwestern gas and c-store chain Casey’s – famous for its breakfast pizza and other grab-and-go breakfast items – has emerged as a prime spot for fast food pizza lovers to grab a slice first thing in the morning. And Salt Lake City, Utah-based Maverik – which recently acquired Kum & Go and its 400-plus stores – is also establishing itself as a breakfast destination thanks to its specialty burritos and other chef-inspired creations.

Casey’s and Maverik’s popular breakfast options are likely helping the chains receive its larger-than-average share of morning visits: In Q1 2024, 16.3% of visits to Maverik and 17.5% of visits to Casey’s took place during the 7:00 AM - 10:00 AM daypart, compared to just 14.9% of visits to the wider C-Store category.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – also suggests that Casey’s and Maverik’s have opened stores in locations that allow them to reach their target audience. Compared to the average consumer, residents of Casey’s potential market are 7% more likely to be “Fast Food Pizza Lovers” than both the average consumer and the average C-Store trade area resident. Residents of Maverik’s potential market are 16% more likely than the average consumer to be “Mexican Food Enthusiasts,” compared to residents of the average C-Store’s trade area who are only 1% more likely to fall into that category.

With both chains expanding, Casey’s and Maverik can hope to introduce new audiences to their unique breakfast options and solidify their hold over the morning daypart within the C-Store space over the next few years.

Everything is said to be bigger in the Lone Star State, and Texas-based convenience store chain Buc-ee’s – holder of the record for the worlds’ largest C-Store – is no exception. With a unique array of specialty food items and award-winning bathrooms, Buc-ee’s has emerged as a well-known tourist attraction. And the popular chain’s status as a visitor hotspot is reflected in two key metrics.

First, Buc-ee’s attracts a much greater share of weekend visits than other convenience store chains. In Q1 2024, 39.6% of visits to Buc-ee’s took place on the weekends, compared to just 28.3% for the wider C-Store industry. And second, Buc-ee’s captured markets feature higher-than-average shares of family-centric households – including those belonging to Experian: Mosaic’s Suburban Style, Flourishing Families, and Promising Families segments.

Rather than merely a place to stop on the way to work, Buc-ee’s has emerged as a favored destination for families and for people looking for something fun to do on their days off.

Buc-ee’s isn’t the only C-Store chain that believes bigger is better. Pennsylvania-based Rutter’s is increasing visits and customer dwell time by expanding its footprint – both in terms of store count and venue size. New stores will be 10,000 to 12,000 square feet – significantly larger than the industry average of around 3,100 square feet. And in more urban areas, where space is at a premium, the company is building upwards.

Rutter’s added a second floor to one of its existing locations in York, PA in December 2023. The remodel, which was met with enthusiasm by customers, provided additional seating for up to 30 diners, a beer cave, and an expanded wine selection. And in Q1 2024, the location experienced 15.6% YoY visit growth – compared to a chainwide average of 7.6%. Visitors to the newly remodeled Rutter’s also stayed significantly longer than they did pre-renovation. The share of extended visits to the store (longer than ten minutes) grew from 20.8% in Q1 2023 to 27.0% in Q1 2024 – likely from people browsing the chain’s selection of beers or grabbing a bite to eat.

Convenience stores are flourishing, transforming into some of the most exciting dining and tourist destinations in the country. Today, C-Store customers can expect to find brisket sandwiches, gourmet coffees, or craft beers, rather than the stale cups of coffee of old. And the data shows that customers are receptive to these innovations, helping drive the segment’s success.

The first quarter of 2024 was generally a good one for retailers. Though unusually cold and stormy weather left its mark on the sector’s January performance, February and March saw steady year-over-year (YoY) weekly visit growth that grew more robust as the quarter wore on.

March ended on a high note, with the week of March 25th – including Easter Sunday – seeing a 6.1% YoY visit boost, driven in part by increased retail activity in the run-up to the holiday. (Last year, Easter fell on April 9th, 2023, so the week of March 25th is being compared to a regular week.)

Though prices remain high and consumer confidence has yet to fully regain its footing, retail’s healthy Q1 showing may be a sign of good things to come in 2024.

Drilling down into the data for leading retail segments demonstrates the continued success of value-priced, essential, and wellness-related categories.

Discount & Dollar Stores led the pack with 11.2% YoY quarterly visit growth, followed by Grocery Stores, Fitness, and Superstores – all of which outperformed Overall Retail. Dining also enjoyed a YoY quarterly visit bump, despite the segment’s largely discretionary nature. And despite the high interest rates continuing to weigh on the housing and home renovation markets, Home Improvement & Furnishings maintained just a minor YoY visit gap.

Discount & Dollar Stores experienced strong YoY visit growth throughout most of Q1 – and as go-to destinations for groceries and other other essential goods, they held their own even during mid-January’s Arctic blast. In the last week of March, shoppers flocked to leading discount chains for everything from chocolate Easter bunnies to basket-making supplies – driving a remarkable 21.5% YoY visit spike.

Dollar General continued to dominate the Discount & Dollar Store space in Q1, with visits to its locations accounting for nearly half of the segment’s quarterly foot traffic (44.7%). Next in line was Dollar Tree, followed by Family Dollar and Five Below. Together, the four chains – all of which experienced positive YoY quarterly visit growth – drew a whopping 91.6% of quarterly visits to the category.

Rain or shine, people have to eat. And like Discount & Dollar Stores, traditional Grocery Stores were relatively busy through January as shoppers braved the storms to stock up on needed items. Momentum continued to build throughout the quarter, culminating in a 10.5% foot traffic increase in the week ending with Easter Sunday.

Like in other categories, it was budget-friendly Grocery banners that took the lead. No-frills Aldi drove a chain-wide 24.4% foot traffic increase in Q1, by expanding its fleet – while also growing the average number of visits per location. Other value-oriented chains, including Trader Joe’s and Food Lion, experienced significant foot traffic increases of their own. And though conventional grocery leaders like H-E-B, Kroger, and Albertsons saw smaller visit bumps, they too outperformed Q1 2023 by meaningful margins.

January is New Year’s resolution season – when people famously pick themselves up off the couch, dust off their trainers, and vow to go to the gym more often. And with wellness still top of mind for many consumers, the Fitness category enjoyed robust YoY visit growth throughout most of Q1 – despite lapping a strong Q1 2023.

Predictably, Fitness’s visit growth slowed during the last week of March, when many Americans likely indulged in Easter treats rather than work out. But given the category’s strength over the past several years, there is every reason to believe it will continue to flourish.

For Fitness chains, too, cost was key to success in Q1 – with value gyms experiencing the biggest visit jumps. EōS Fitness and Crunch Fitness, both of which offer low-cost membership options, saw their Q1 visits skyrocket 28.9% and 22.0% YoY, respectively – helped in part by aggressive expansions. At the same time, premium and mid-range gyms like Life Time and LA Fitness are also finding success – showing that when it comes to Fitness, there’s plenty of room for a variety of models to thrive.

Superstores – including wholesale clubs – are prime destinations for big, planned shopping expeditions – during which customers can load up on a month’s supply of food items or stock up on home goods. And perhaps for this reason, the category felt the impact of January’s inclement weather more than either dollar chains or supermarkets – which are more likely to see shoppers pop in as needed for daily essentials.

But like Grocery Stores and Discount & Dollar Stores, Superstores ended the quarter with an impressive YoY visit spike, likely fueled by Easter holiday shoppers.

As in Q4 2023, membership warehouse chains – Costco Wholesale, BJ’s Wholesale Club, and Sam’s Club – drove much of the Superstore category’s positive visit growth, as shoppers likely engaged in mission-driven shopping in an effort to stretch their budgets. Still, segment mainstays Walmart and Target also enjoyed positive foot traffic growth, with YoY visits up 3.9% and 3.5%, respectively.

Moving into more discretionary territory, Dining experienced a marked January slump, as hunkered-down consumers likely opted for delivery. But the segment rallied in February and March, even though foot traffic dipped slightly during the last week of March, when many families gathered to enjoy home-cooked holiday meals.

Coffee Chains and Fast-Casual Restaurants saw the largest YoY visit increases, followed by QSR – highlighting the enduring power of lower-cost, quick-serve dining options. But Full-Service Restaurants (FSR) also saw a slight segment-wide YoY visit uptick in Q1 – good news for a sector that has yet to bounce back from the one-two punch of COVID and inflation. Within each Dining category, however, some chains experienced outsize visit growth – including favorites like Dutch Bros. Coffee, Slim Chickens, In-N-Out Burger, and Texas Roadhouse.

Since the shelter-in-place days of COVID – when everybody had their sourdough starter and DIY was all the rage – Home Improvement & Furnishings chains have faced a tough environment. Many deferred or abandoned home improvement projects in the wake of inflation, and elevated interest rates coupled with a sluggish housing market put a further damper on the category.

Against this backdrop, Home Improvement & Furnishings’ relatively lackluster Q1 visit performance should come as no surprise. But the narrowing of the visit gap in March – which also saw one week of positive visit growth – may serve as a promising sign for the segment. (The abrupt foot traffic drop during the week of March 25th, 2024 is likely a just reflection of Easter holiday shopping pattern.)

Within the Home Improvement & Furnishings space, some bright spots stood out in Q1 – including Harbor Freight Tools, which saw visits increase by 10.0%, partly due to the brand’s growing store count. Tractor Supply Co., Menards, and Ace Hardware also registered visit increases.

January 2024’s stormy weather left its mark on the Q1 retail environment, especially for discretionary categories. But as the quarter progressed, retailers rallied, with healthy YoY foot traffic growth that peaked during the last week of March – the week of Easter Sunday. All in all, retail’s positive Q1 performance leaves plenty of room for optimism about what’s in store for the rest of 2024.