.svg)

.png)

.png)

.png)

.png)

In recent years, Americans have gotten serious about fitness. Even as consumers tightened their purse strings, they found room in their budgets for the ultimate affordable indulgence: A (relatively) low-cost gym membership that, once paid, offers customers unlimited access to club facilities.

How did Planet Fitness, the nation’s largest value gym perform in Q3 2024? We dove into the data to find out.

Planet Fitness has been on a roll. In Q2 2024, the chain reported a 4.2% system-wide increase in same store sales and the addition of 18 new gyms to its fleet. (Though Planet Fitness operates clubs outside the U.S., the vast majority of its some 2600 locations are domestic).

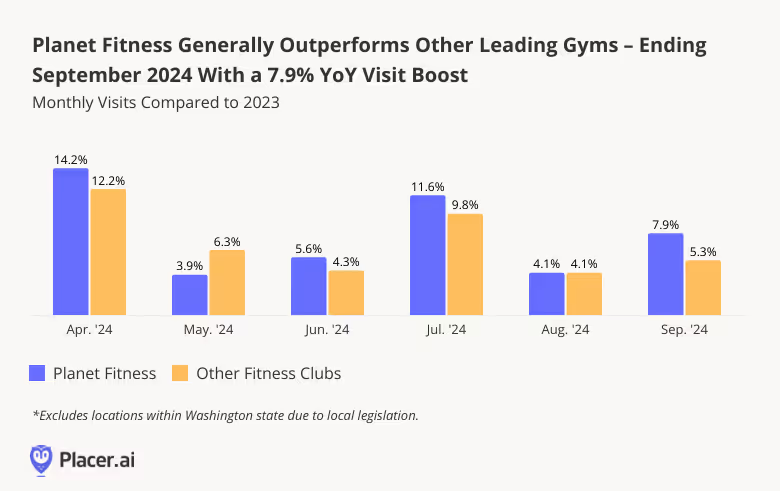

Foot traffic data shows that the chain continued to thrive through Q3, with year-over-year (YoY) monthly visit upticks ranging from 4.1% to 11.6% – outperforming the wider industry. And while the value gym giant finally raised the price of its basic membership this summer for the first time in more than thirty years, the move does not seem to have dented Planet Fitness’ growth trajectory – though it’s still early days.

Planet Fitness takes pains to emphasize its commitment to being a “Judgement Free Zone” – and casual gym-goers make up a significant portion of its visitor base. In Q3 2024, 44.3% of visitors hit the club, on average, less than twice a month.

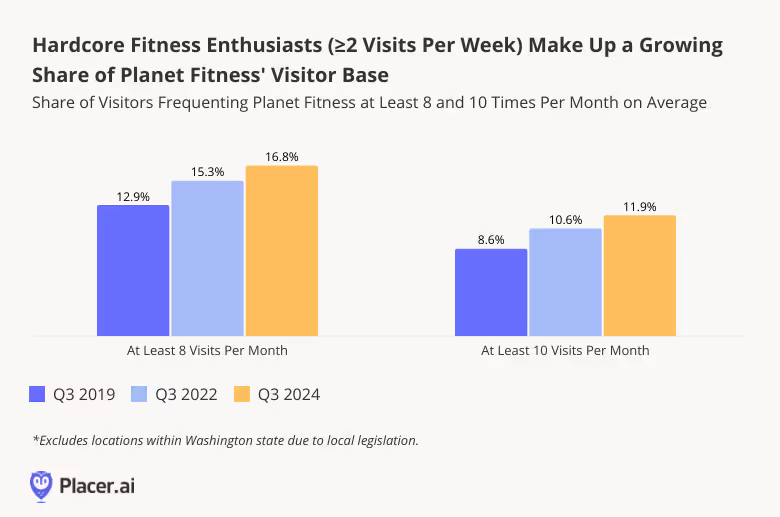

But Planet Fitness also has a significant – and growing – share of die-hard gym buffs who visit the club at least eight or ten times a month - i.e. at least twice a week. In Q3 2024, a full 16.8% of visitors to Planet Fitness came to the gym at least eight times a month on average – up from just 12.9% in 2019 and 15.3% in 2022. And 11.9% visited the chain ten or more times a month – up from 8.6% in 2019 and 10.6% in 2022.

Though casual visitors are also important for any fitness club’s bottom line, a strong and thriving community of highly committed members is an important foundation for future growth.

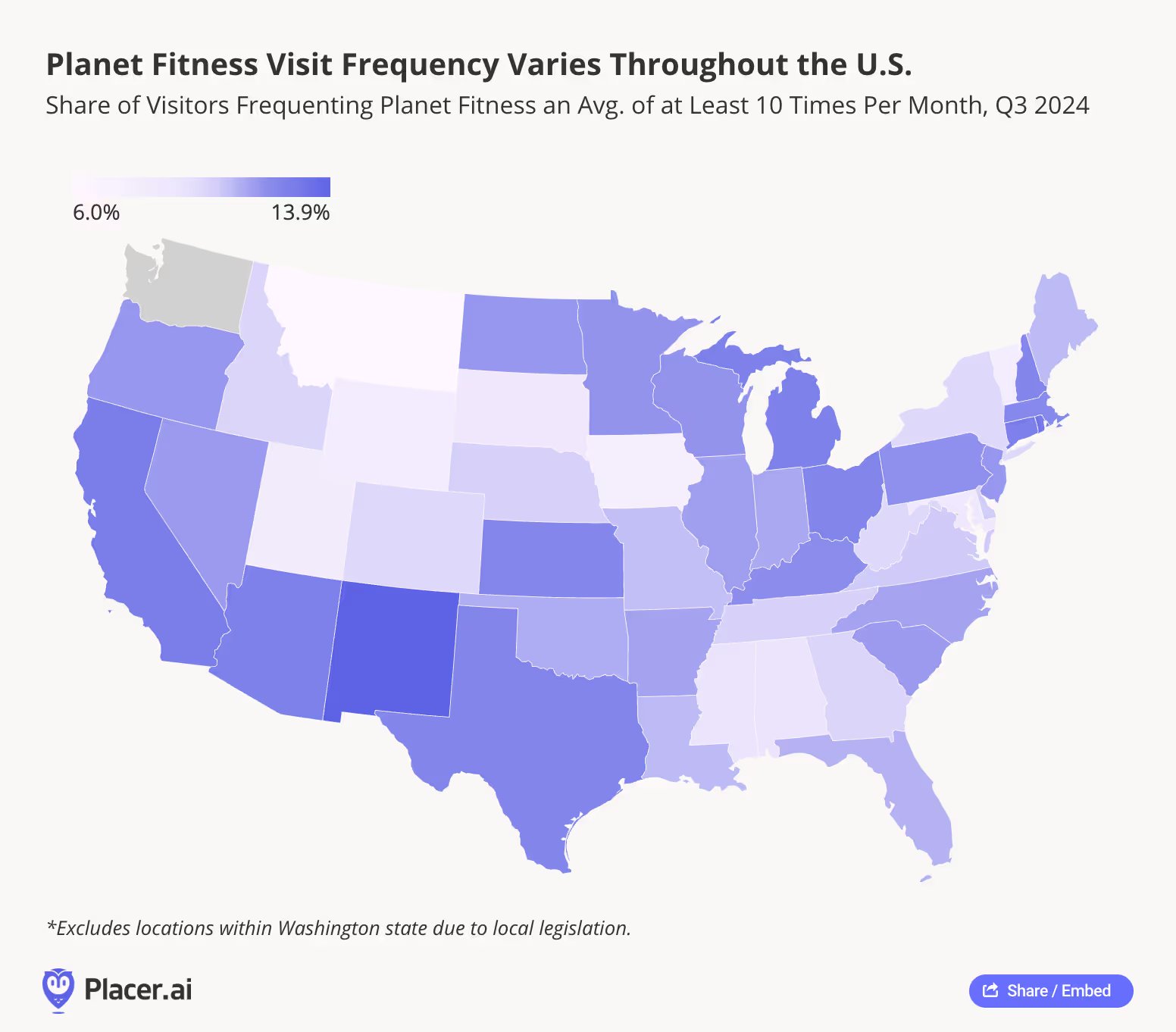

Gym visit frequency, however, varies throughout the United States. Analyzing the share of highly committed visitors to Planet Fitness reveals significant differences between states.

New Mexico led the pack in Q3 with 13.9% of visitors frequenting the gym, on average, at least ten times a month – followed by Rhode Island (13.1%) and California (12.7%). On the other end of the spectrum lay Montana, where just 6.0% of club goers were highly committed visitors in Q3, followed by Iowa (7.7%) and Vermont (8.0%).

This data highlights how gym engagement can be influenced by regional factors such as lifestyle, climate, and access to alternative fitness options – suggesting that Planet Fitness and similar chains may benefit from tailoring their marketing and membership strategies to local trends and preferences.

The holiday season isn’t a particularly busy one for gyms – which usually see traffic begin to slow down in September before picking up again in the new year. But if Planet Fitness’ solid September 2024 performance is any indication, the chain may be in for a busier fourth quarter this year than last. Will Planet Fitness continue to deliver as the year draws to a close?

Follow Placer.ai’s data-driven analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

In a market ruled by value and convenience, traditional full-service restaurants (FSRs) have faced an uphill slog. But even in 2024, some FSRs are flourishing. We dove into the data to explore factors driving success at three very different full-service chains: First Watch, Chili’s Grill & Bar, and Outback Steakhouse.

First Watch first burst onto the scene in 1983 with a single restaurant in California – and now boasts some 544 locations across 29 states. With offerings ranging from Superfood Kale Salads to more traditional pancakes and bacon and eggs, First Watch has emerged as a prime destination for diners seeking to enjoy a leisurely breakfast with family and friends.

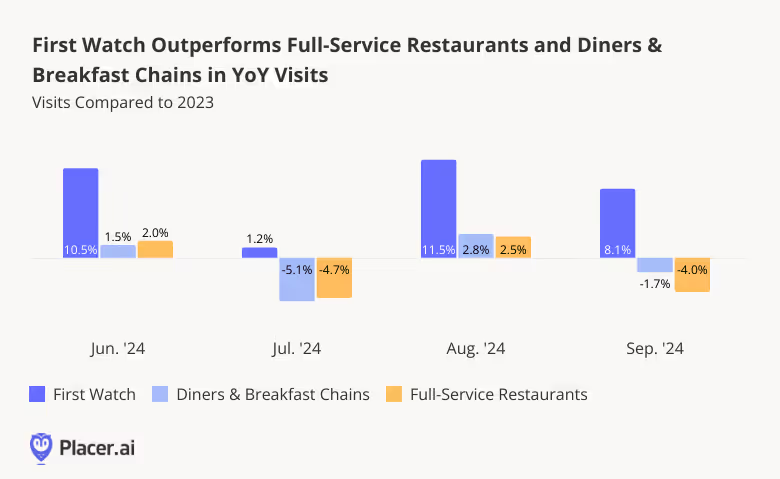

And foot traffic data shows that First Watch, still firmly in expansion mode, is continuing to grow its audience. Between June and September 2024, First Watch saw consistent year-over-year (YoY) visit growth, outperforming both the full-service restaurant category and other diners & breakfast spots.

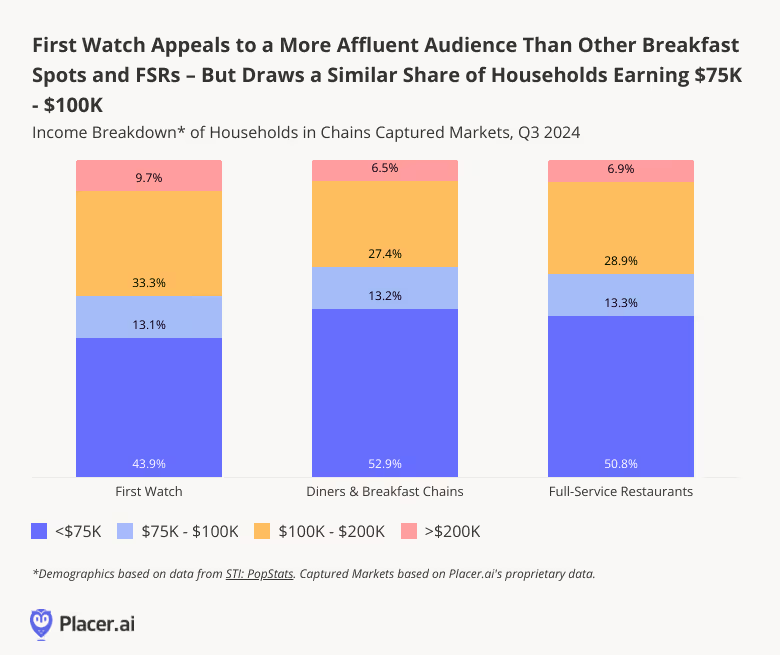

One factor that may be helping to propel First Watch’s success is the relative affluence of its customer base. Analyzing the income breakdown of First Watch’s trade area shows that in Q3 2024, nearly ten percent (9.7%) of households in the chain’s captured market earned $200K+ per year, compared with 6.5% for diners & breakfast chains and 6.9% for the wider FSR space. On the flip side, only 43.9% of households in First Watch’s captured market had annual incomes below $75K, compared to just over 50.0% for both analyzed segments.

Amidst concerns surrounding food inflation, rising labor costs, and discretionary spending cutbacks, First Watch’s wealthier customer base may be helping to shield it from some of the value pressures that have weighed on other restaurants – contributing to its resilience.

Another FSR that has been experiencing outsized visit growth this year – at least since April – is Chili’s Grill & Bar. Following a tepid start to the year, Chili’s launched its much-vaunted Big Smasher Burger on April 29th, 2024, and hasn’t looked back since.

The new offering, added to Chili’s 3 For Me value menu, presented a full-service value challenge to QSR favorites like the Big Mac. And in Q2 2023, the item helped drive a 14.8% increase in same-store sales.

Since the big launch, weekly YoY visits to Chili’s have been consistently elevated – kept aloft with the help of viral hype around Chili’s long standing Triple Dipper offering, as well as the new secret Nashville Hot Mozz offering that became so popular it spawned a halloween costume.

Unlike First Watch, Chili’s has found success by embracing its role as a value chain. The median household income (HHI) of Chili’s captured market in Q3 2024 was $73.1K – below the nationwide median of $76.1K, and on par with that of the wider FSR space ($73.7K – By way of comparison, the median HHI of First Watch’s captured market was $85.6K in Q3).

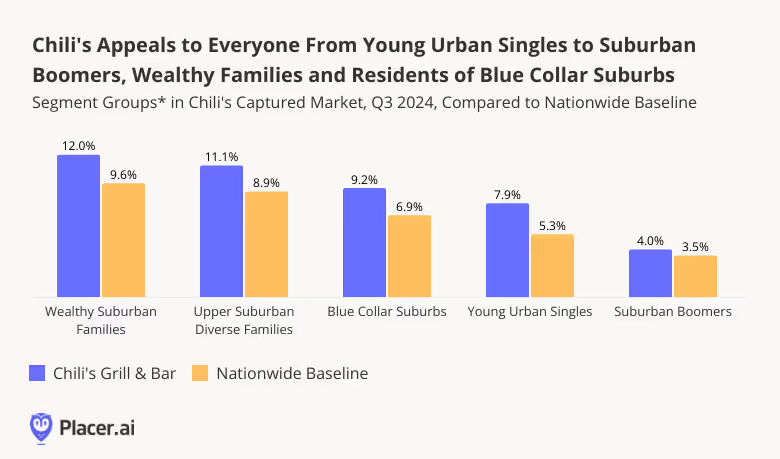

And a closer look at the demographic make-up of Chili’s captured market shows just how broad the appeal of the chain is. In Q3 2024, Chili’s visitor base was over-represented for a wide range of segments across age and income groups – from “Wealthy Suburban Families” to “Young Urban Singles”, “Suburban Boomers’, and residents of “Blue Collar Suburbs”. By delivering high-quality meals at affordable prices, Chili’s has solidified its place as an everyman’s chain, offering value comparable to that of quick-service restaurants.

Aussie-themed Outback Steakhouse – Bloomin’ Brands’ biggest chain – is another full-service restaurant that is successfully weathering the storm. Like other FSRs, Outback has faced its fair share of challenges over the past few years, with rising costs and spending cutbacks taking a toll on the chain’s performance. But in Q3 2024, the average number of visits to each Outback Steakhouse location increased 0.5% YoY, even as overall traffic to the chain fell 1.7% in the wake of strategic rightsizing moves that included the shuttering of a number of underperforming locations. By contrast, the average number of visits per location in the wider FSR space dropped 1.2%, while overall foot traffic to the segment fell 2.1%. Outback Steakhouse’s ability to sustain a YoY visit-per-location uptick in Q3, even if a minor one, shows that its rightsizing efforts are paying off.

And drilling down deeper into regional data for the chain shows that in some areas of the country, Outback Steakhouse is positively thriving. In California, Outback’s third-largest market in terms of store count, the chain saw a YoY visit increase of 5.3% – significantly higher than the statewide FSR average of 1.1%. In Washington and Oregon, Outback Steakhouse experienced even more substantial visit increases – 9.0% and 9.6%, respectively – even as full-service restaurants generally languished. And in all three states, the number of Outback Steakhouse locations has remained basically unchanged over the past year, meaning that these increases reflect the growing draw of the chain’s existing venues.

First Watch, Chili’s Grill & Bar, and Outback Steakhouse are very different full-service chains – but each of them is thriving in its own way. How will the three brands fare as the holiday season picks up steam?

Follow Placer.ai’s data-driven dining analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Quick-service restaurants (QSRs) have faced headwinds in 2024, from higher costs to increased competition. But some brands are weathering the storm particularly well. We dove into the data to check in with two of the nation’s most prominent restaurant companies – Restaurant Brands International (RBI) and Yum! Brands – to see how their biggest chains, Burger King (RBI) and Taco Bell (Yum!), performed in Q3 2024.

Burger King, RBI’s largest restaurant chain, has been the focus of a major modernization effort, dubbed the “Royal Reset”, that includes a series of restaurant remodels and equipment and technology upgrades. Burger King has also been rightsizing – closing underperforming restaurants to shore up the chain’s overall strategic positioning.

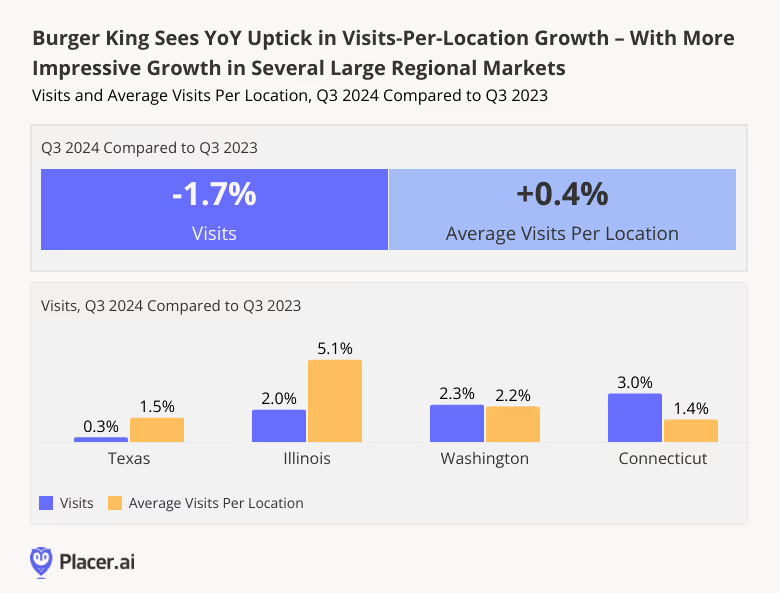

And foot traffic data shows that these initiatives are paying off. In Q3 2024, overall visits to Burger King dipped 1.7% YoY – but the average number of visits to each Burger King location increased slightly (0.4%). This per-location uptick may have been fueled, in part, by the chain’s summer “$5 Your Way” value meal special, which kept YoY visits elevated through July. And some major markets – including Texas, Illinois, Washington, and Connecticut – performed even better, with average visit-per-location growth ranging from 1.5% - 5.1% YoY.

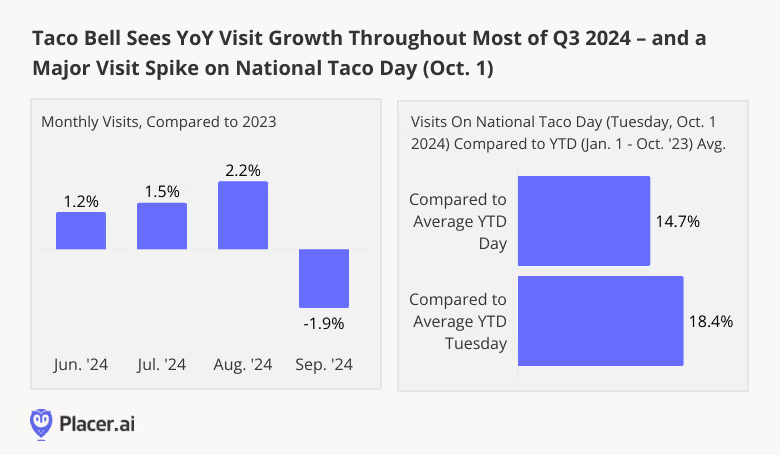

Taco Bell is Yum! Brands’ largest chain – accounting for over 70.0% of visits to the company’s U.S. restaurants in Q3 2024. And the Tex-Mex leader is another QSR that is standing strong in 2024. Throughout the summer, Taco Bell experienced YoY visit growth ranging from 1.2% to 2.2% – and though the chain saw a minor 1.9% YoY dip in September, this may be due to the month having one fewer Friday than the equivalent period of 2023. (Friday is Taco Bell’s busiest day of the week). Even accounting for this dip, visits to Taco Bell were up 0.6% YoY overall in Q3 2024.

One factor that has likely helped Taco Bell weather recent QSR storms has been its strength in executing special promotions. In July, the Tex-Mex leader attracted big crowds with a limited-time offer commemorating the 20th anniversary of the chain’s popular Baja Blast beverage. And in October 2024, the restaurant marked National Taco Day (Tuesday, October 1st) with ten hours of $1 tacos – fueling a substantial traffic spike: On the big day, visits rose 14.7% above the chain’s daily year-to-date (YTD) average, and 18.4% above the chain’s Tuesday YTD average.

Burger King and Taco Bell found success in Q3 2024 through limited-time promotions – and in the case of the former, a strategic focus on rightsizing while updating existing stores. How will RBI and Yum!’s biggest brands perform in Q4?

Follow Placer.ai’s data-driven restaurant analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

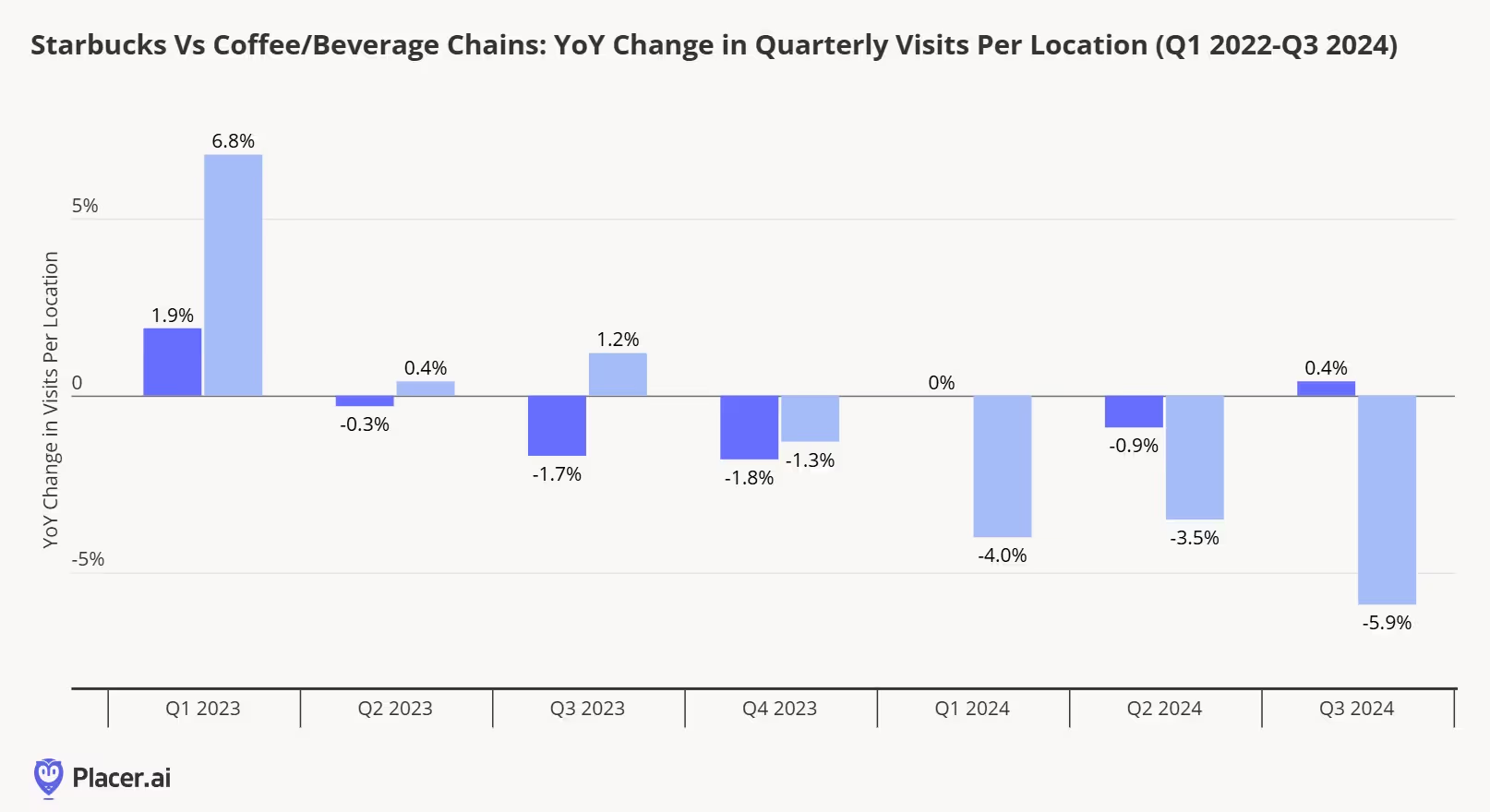

Starbucks’ preliminary fiscal Q4 2024 (July-September 2024) results--including a 10% decline in comparable transactions in its North America segment--reinforce that the company has "drifted from its core", as new Starbucks CEO Brian Niccol discussed following the release. The results also come at a time when other coffee and beverage chains are seeing year-over-year visit increases, reinforcing that new product innovations aren't connecting with consumers–management explained that “accelerated investments in an expanded range of product offerings coupled with more frequent in-app promotions and integrated marketing to entice frequency across the customer base did not improve customer behaviors.” (The difference between our visit per location figure and Starbucks’ reported number is likely due to lower coverage of urban stores in our platform).

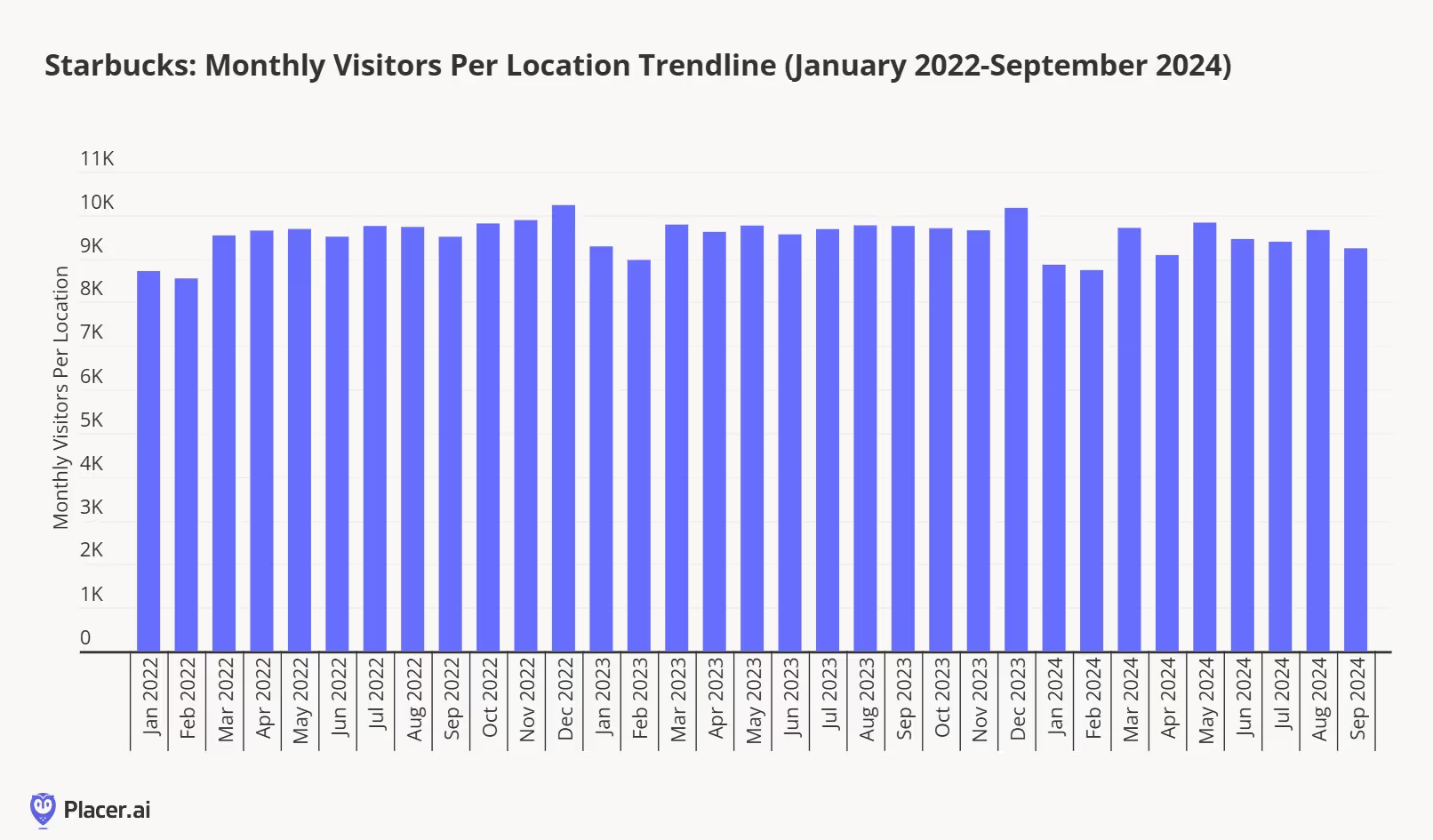

As we wrote when Niccol assumed the CEO role in August, Starbucks’ transformation won’t happen overnight, but the data behind Niccol’s early strategies at Chipotle still hints at a successful turnaround. Niccol's plan to improve the Starbucks customer experience, remove bottlenecks and operational complexities (including a more streamlined menu), and refine Mobile Order and Pay is a sound strategy, but it will take time to implement. Positively, we believe that Starbucks has a strong foundation to work from. Below, we show the monthly visitor per location trend line since the beginning of 2022. While declines in visit frequency is something the company will work to address with its current initiatives, the number of visitors coming into each location generally remains strong (down only 2%-3% per month on average thus far in 2024). Assuming the company can execute Niccol’s plan to reduce bottlenecks and operation complexities, Starbucks’ wide visitor reach should drive improved engagement and visit frequency.

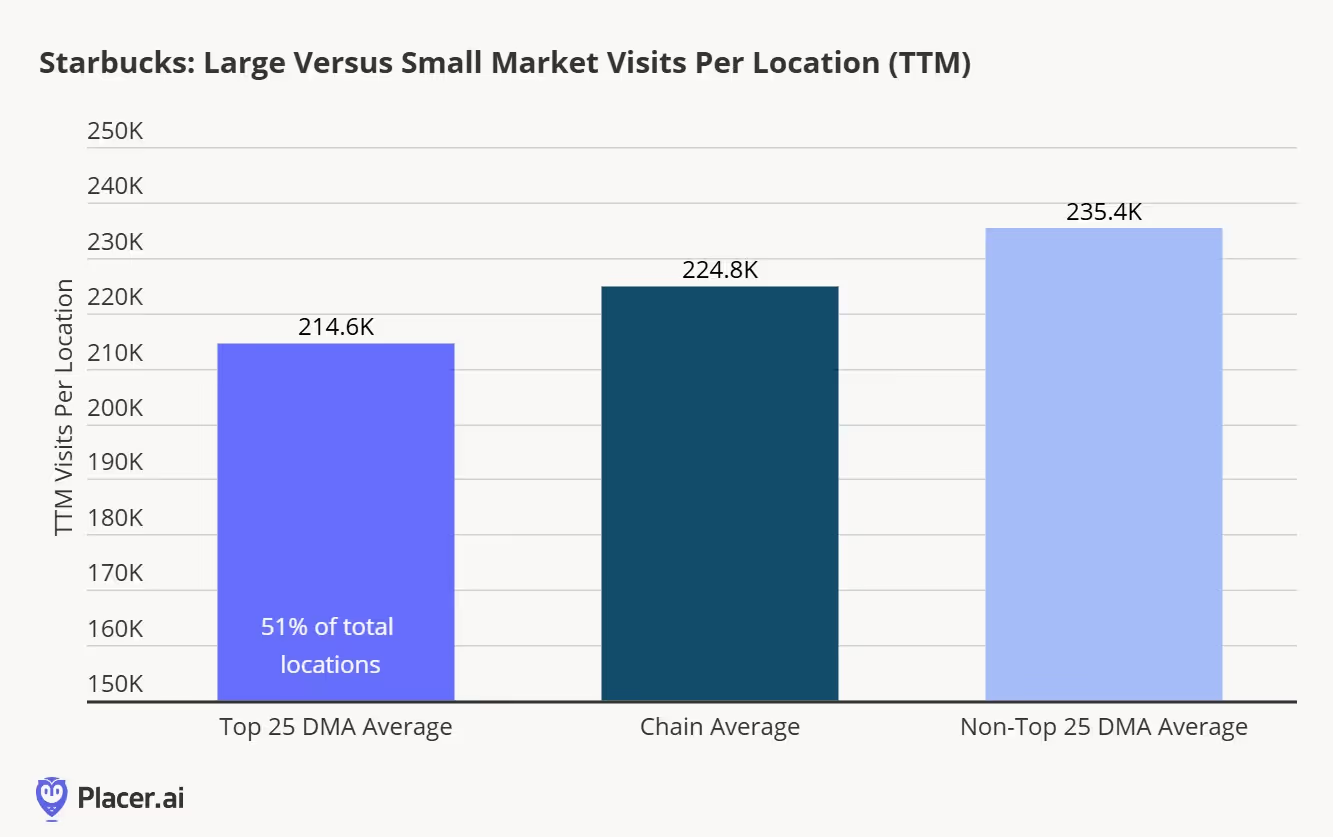

As we also pointed out a few months ago, we believe that Starbucks’ success in smaller underpenetrated markets have been somewhat overlooked. We analyzed Starbucks’ unit expansion opportunities in detail in September 2022, and we’ve seen progress on this initiative since then. Starbucks’ recent store development effects have been focused on “Tier 2 and Tier 3 cities where we see population growth and forecast both underserved demand and high incrementality.” We’ve revisited our visit per location data for Starbucks’ Top 25 designated market areas (DMAs) versus non-Top 25 DMAs over the last 12 full months below, and similar to our last update, Starbucks is seeing higher visits per location in its non-Top 25 markets. Many of these non-Top 25 DMA stores have been opened in the past 12-18 months, which suggests improved metrics as operational complexities are reduced and these locations enter the same-store sales base.

Photo Image Credit: Orange County Register

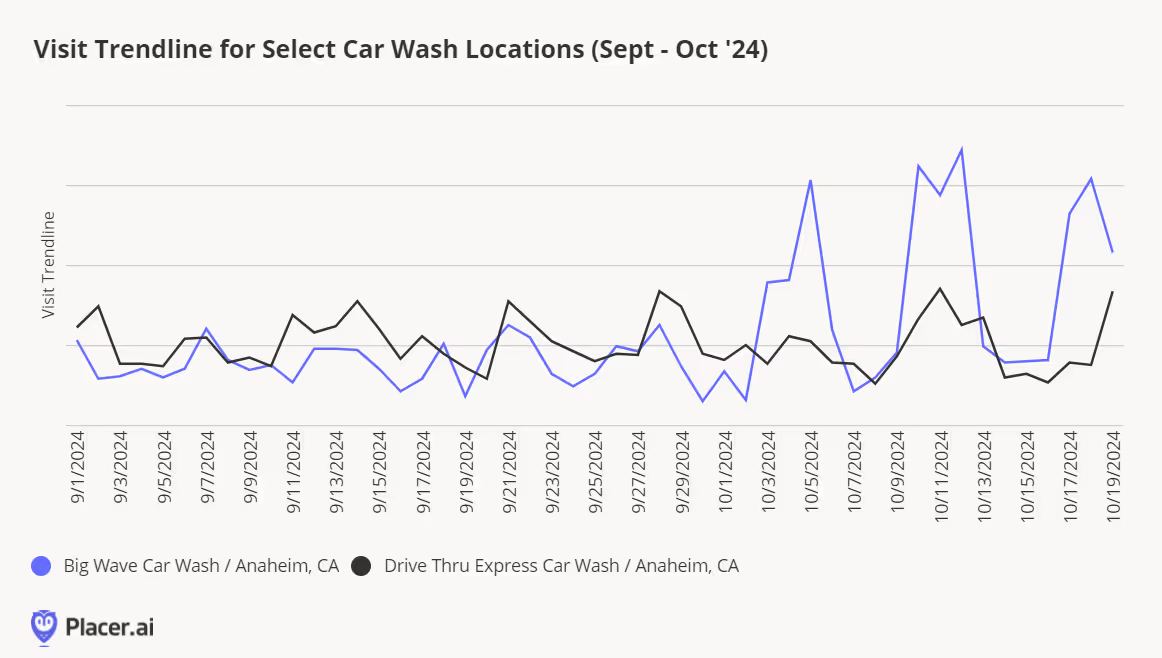

We know there’s appetite for Six Flags Fright Fest, Universal Studios Halloween Horror Nights, Knotts’ Scary Farm, and Halloween Screams at Walt Disney World, but one innovative car wash takes you to another level, inviting you to go on a “nightmarish journey that turns an ordinary car wash into a realm of terror.” Big Wave Car Wash in Anaheim is one of the locations, and it’s immediately clear that this spooky spectacular is a hit. Compared to another local car wash competitor, we see that the addition of the scary performers nearly triples Big Wave’s traffic, especially Thursday-Sunday with the October kickoff.

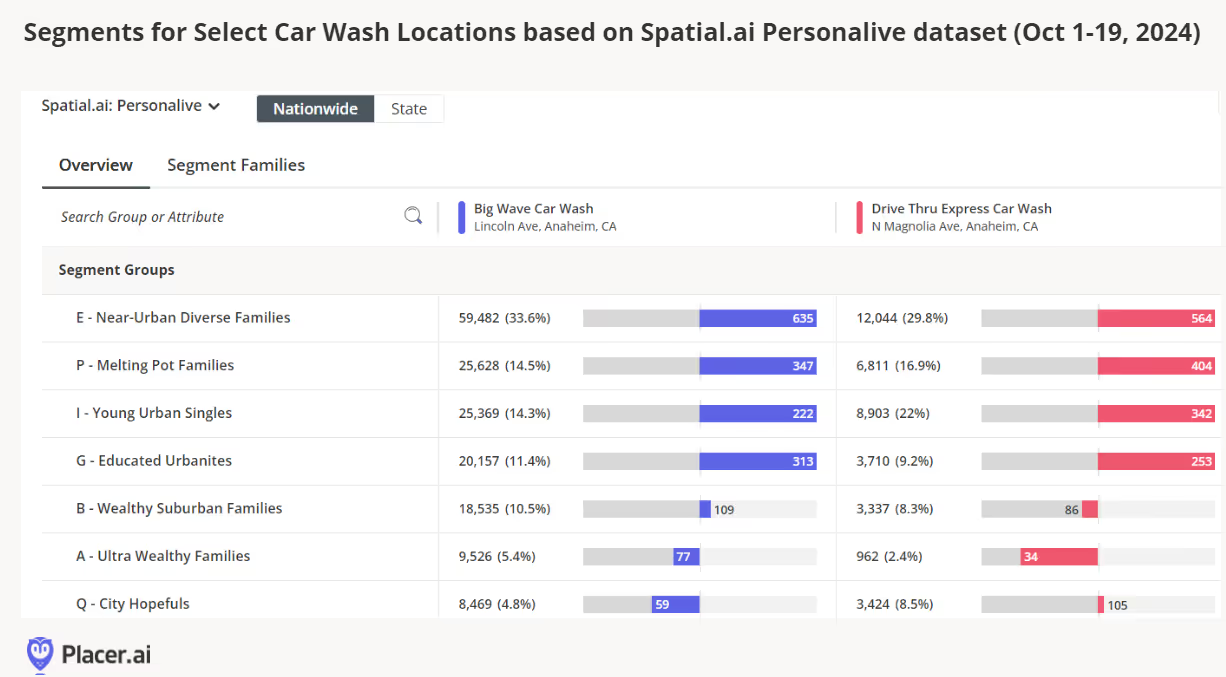

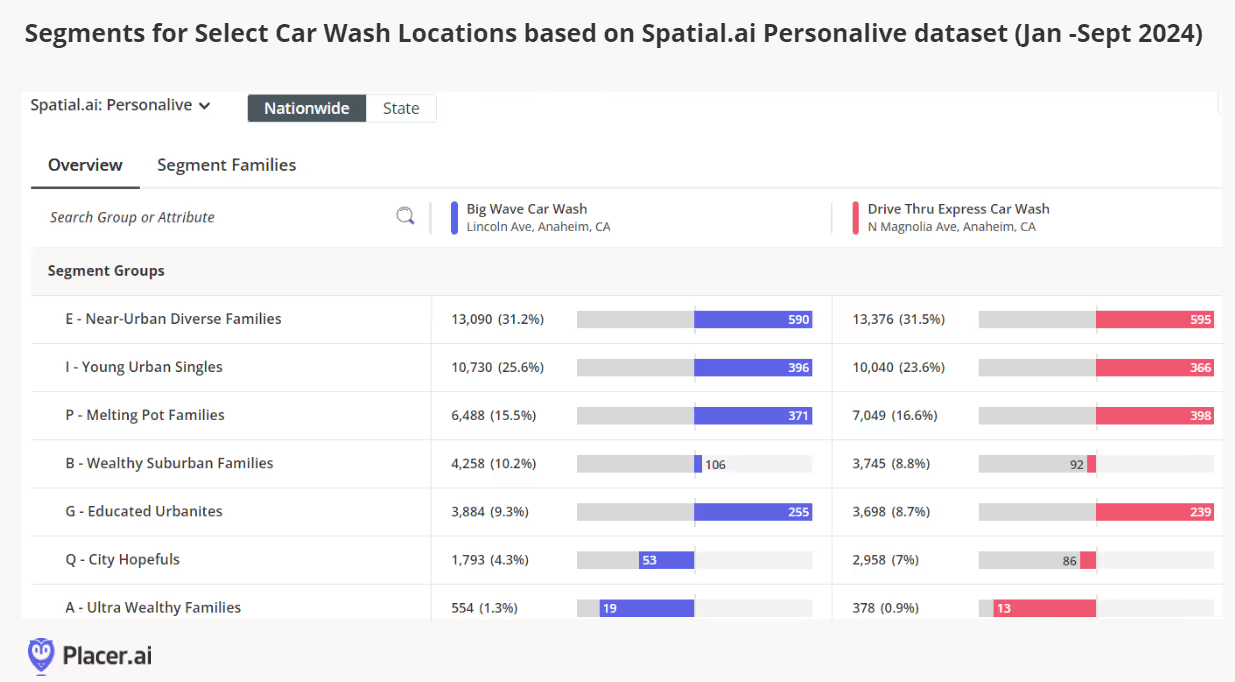

We compared the Spatial.ai PersonaLive segments for Big Wave and Drive Thru Express Car Wash from January-September 2024 vs from October 1-19, 2024. In the month of October alone, we saw over 4x more visits from Near-Urban Diverse families and from Melting Pot Families to the haunted carwash compared to the entire rest of the year. Among Young Urban Singles, there was a 2.5x multiplier for just the three weeks in October compared to January-September. And while Ultra Wealthy Families normally only make up 1% of the visits, during this spooky spectacular, they accounted for 5%. Now you know where to go when junior is bored–head for the haunted car wash!

No surprise, the trade area drawn during the month of October is significantly larger as people come from a total trade area of 53 sq miles during this event (October 1-19, 2024 in red), compared to 12 sq miles the rest of the year (January-September 2024 in blue).

Over the past two weeks, the home industry has been abuzz with news from the remnants of Bed Bath & Beyond. A retailer that stood as the leader among specialty players continues to try and find new life in physical retail despite the closure of the original chain and its subsidiaries. After a year back in business, buybuy BABY, under new management, announced that it would be closing its 10 reopened locations.

Over at Beyond Inc., the new holding company for Overstock.com and the newly reformed Bed Bath & Beyond brand, they announced new partnerships with both Kirkland’s and The Container Store. The former partnership is going to help bring the brand back to physical retail with the creation of five Bed Bath & Beyond “neighborhood” small format stores, with locations to be announced; stores will be scouted, developed and operated by Kirkland’s. In the partnership with The Container Store, Beyond Inc. made a financial investment in the retailer and will allow The Container Store to leverage the brand’s assets, name, assortment and data; shop-in-shops also appear to be a part of this new partnership.

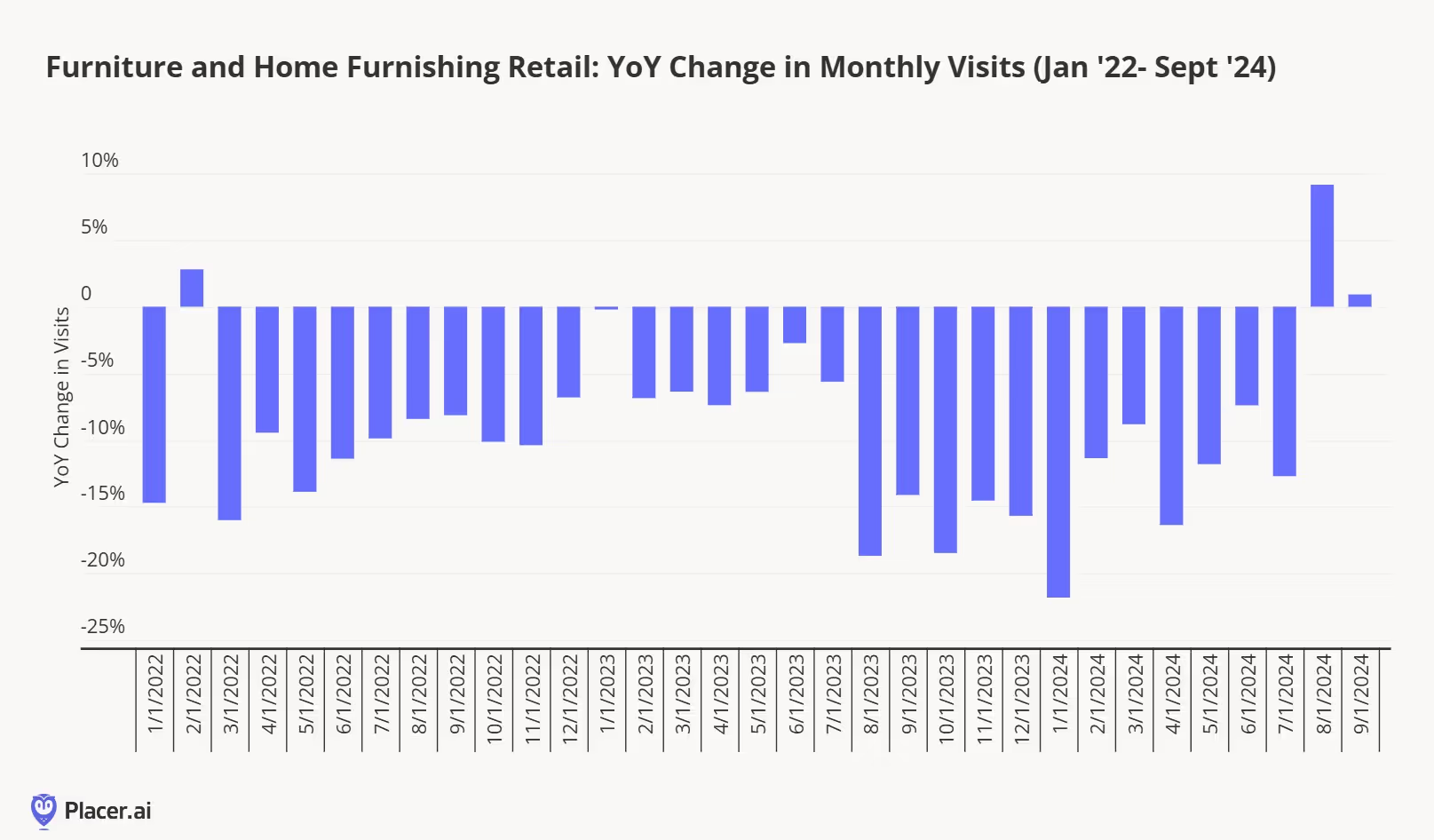

The home industry has been incredibly challenged in the post-pandemic period (below). However, as the category became further consolidated over the past few years, these new partnerships could help to revitalize all three brands, all of which have a strong brand identity with consumers. These partnerships also allow the brands to harness their strengths to benefit multiple banners.

How closely aligned are these brands? Kirkland’s tends to focus on furniture and furnishings, The Container Store handles all things organization, and the Bed Bath & Beyond brand name still carries weight as the undisputed leader in all things home.

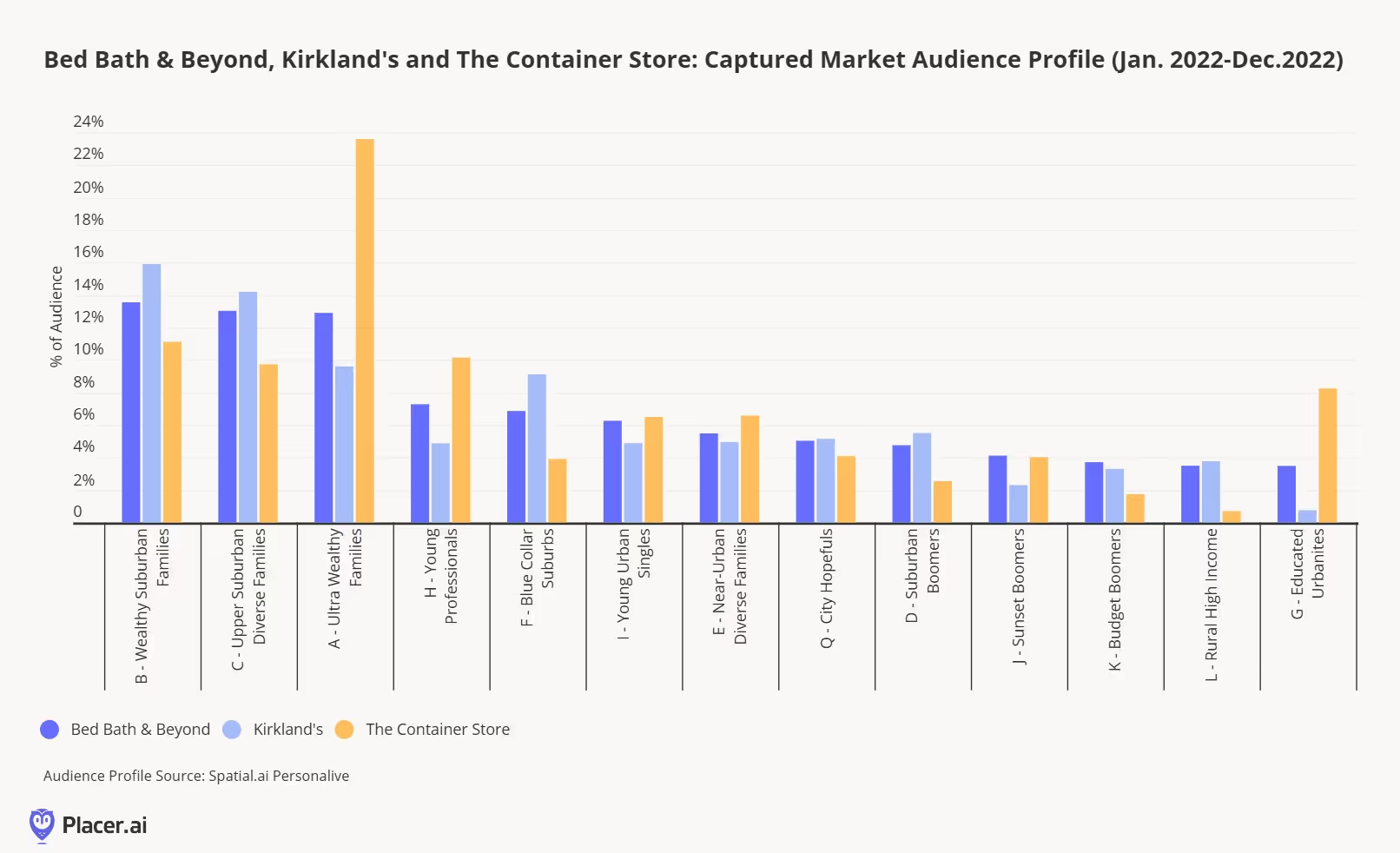

Looking at PersonaLive’s demographic and psychographic segmentation of visitors to all three brands in 2022, before Bed Bath & Beyond’s closure the next year, there are some clear alignments and also opportunities to reach new visitors through the partnerships. Kirkland outperformed Bed Bath & Beyond with suburban cohorts such as Wealthy Suburban Families, Upper Suburban Diverse Families and Blue Collar Suburbs.

Through the lens of The Container Store, it provides a lot more opportunity for Beyond Inc. to reach higher concentrations of visitors from segments such as Ultra Wealthy Families, Educated Urbanites and Young Professionals. Looking at the partnerships with both Kirkland’s and the Container Store as a collective strategy, Beyond Inc. can capitalize on the migration to suburban communities by consumers and higher income households with the new brand.

Another positive sign for the partnerships is the high levels of cross visitation between the retailers before the closing of Bed Bath & Beyond. In 2022, Bed Bath & Beyond’s final full year of operation, 20% of visitors to Kirkland’s and almost a quarter of visitors to The Container Store cross visited Bed Bath & Beyond.

In theory, both partnerships will allow Bed Bath & Beyond to return to physical retail in alignment with both consumers and the current retail landscape. Industry specific retailers and incredibly important to the health and long term success of the industry, and the idea of welcoming back a beloved brand is exciting. It should be interesting to see the new small format stores and installations as the debut and look at the impacts of the partnership on the broader home category.

The first Lollapalooza – a four-day music festival – took place in 1991. Chicago’s Grant Park became the event’s permanent home (at least in the United States) in 2005, drawing thousands of revelers and music fans to the park each year.

This year, the festival once again demonstrated its powerful impact on the city. On August 1st, 2024, visits to Grant Park surged by 1,313.2% relative to the YTD daily average, as crowds converged on the park to see Chappell Roan’s much-anticipated performance. And during the first three days of the event, the event drew significantly more foot traffic than in 2023 – with visits up 18.9% to 35.9% compared to the first three days of last year’s festival (August 3rd to 5th, 2023).

Lollapalooza led to a dramatic spike in visits to Grant Park – and it also attracted a different type of visitor compared to the rest of the year.

Analyzing Grant Park’s captured market with Spatial.ai’s PersonaLive dataset reveals that Lollapalooza attendees are more likely to belong to the “Young Professionals” and “Ultra Wealthy Families” segment groups than the typical Grant Park visitor.

By contrast, the “Near-Urban Diverse Families” segment group, comprising middle-class diverse families living in or near cities, made up only 6.5% of visitors during the festival, compared to 12.0% during the rest of the year.

Additionally, visitors during Lollapalooza came from areas with higher HHIs than both the nationwide baseline of $76.1K and the average for park visitors throughout the year. Understanding the demographic profile of visitors to the park during Lollapalooza can help planners and city officials tailor future events to these segment groups – or look for ways to make the festival accessible to a wider range of music lovers.

Lollapalooza’s impact on Chicago extended beyond the boundaries of Grant Park, with nearby hotels seeing remarkable surges in foot traffic. The Congress Plaza Hotel on South Michigan Avenue witnessed a staggering 249.1% rise in visits during the week of July 29, 2024, compared to the YTD visit average. And Travelodge on East Harrison Street saw an impressive 181.8% increase. These spikes reflect the festival’s draw not just for locals but for out-of-town visitors who fill hotels across the city.

The North Michigan Avenue retail corridor also enjoyed a significant increase in foot traffic during the festival, with visits on Thursday, August 1st 56.0% higher than the YTD Thursday visit average. On Friday, August 2nd, visits to the corridor were 55.7% higher than the Friday visit average. These numbers highlight Lollapalooza’s role in driving economic activity across Chicago, as festival-goers venture beyond the park to explore the city’s vibrant retail and hospitality offerings.

City parks often serve as community hubs, and Flushing Meadows Corona Park in Queens, NY, has been a major gathering point for New Yorkers. The park hosted one of New York’s most beloved summer concerts – Governors Ball – which moved from Governors Island to Flushing Meadows in 2023.

During the festival (June 9th -11th, 2024), musicians like Post Malone and The Killers drew massive crowds to the park, with visits soaring to the highest levels seen all year. On June 9th, the opening day of the festival, foot traffic in the park was up 214.8% compared to the YTD daily average, and at its height, on June 8th, the festival drew 392.7% more visits than the YTD average.

The park also hosted other big events this summer – a July 21st set by DMC helped boost visits to 185.1% above the YTD average. And the Hong Kong Dragon Boat Festival on August 3rd and 4th led to major visit boosts of 221.4% and 51.6%, respectively.

These events not only draw large crowds, but also highlight the park’s role as a space where cultural and civic life can find expression, flourish, and contribute to the health of local communities.

Analyzing changes in Flushing Meadows Corona Park’s trade area size offers insight into how far people are willing to travel for these events. During Governors Ball, for example, the park’s trade area ballooned to 254.5 square miles, showing the festival's wide appeal. On July 20th, by contrast, when the park hosted several local bands and DJs, the trade area was a much more modest 57.0 square miles.

Summer events drive community engagement, economic activity, and civic pride. Cities that invest in their parks and event hubs, fostering lively and inclusive spaces, can create lasting value for both residents and visitors, enriching the cultural and social life of urban areas.

For more data-driven civic stories, visit Placer.ai.

The pandemic and economic headwinds that marked the past few years presented the multi-billion dollar hotel industry with significant challenges. But five years later, the industry is rallying – and some hotel segments are showing significant growth.

This white paper delves into location analytics across six major hotel categories – Luxury Hotels, Upper Upscale Hotels, Upscale Hotels, Upper Midscale Hotels, Midscale Hotels, and Economy Hotels – to explore the current state of the American hospitality market. The report examines changes in guest behavior, personas, and characteristics and looks at factors driving current visitation trends.

Overall, visits to hotels were 4.3% lower in Q2 2024 than in Q2 2019 (pre-pandemic). But this metric only tells part of the story. A deeper dive into the data shows that each hotel tier has been on a more nuanced recovery trajectory.

Economy chains – those offering the most basic accommodations at the lowest prices – saw visits down 24.6% in Q2 2024 compared to pre-pandemic – likely due in part to hotel closures that have plagued the tier in recent years. Though these chains were initially less impacted by the pandemic, they were dealt a significant blow by inflation – and have seen visits decline over the past three years. As hotels that cater to the most price-sensitive guests, these chains are particularly vulnerable to rising costs, and the first to suffer when consumer confidence takes a hit.

Luxury Hotels, on the other hand, have seen accelerated visit growth over the past year – and have succeeded in closing their pre-pandemic visit gap. Upscale chains, too, saw Q2 2024 visits on par with Q2 2019 levels. As tiers that serve wealthier guests with more disposable income, Luxury and Upscale Hotels are continuing to thrive in the face of headwinds.

But it is the Upper Midscale level – a tier that includes brands like Trademark Collection by Wyndham, Fairfield by Marriott, Holiday Inn Express by IHG Hotels & Resorts, and Hampton by Hilton – that has experienced the most robust visit growth compared to pre-pandemic. In Q2 2024, Upper Midscale Hotels drew 3.5% more visits than in Q2 2019. And during last year’s peak season (Q3 2023), Upper Midscale hotels saw the biggest visit boost of any analyzed tier.

As mid-range hotels that still offer a broad range of amenities, Upper Midscale chains strike a balance between indulgence and affordability. And perhaps unsurprisingly, hotel operators have been investing in this tier: In Q4 2023, Upper Midscale Hotels had the highest project count of any tier in the U.S. hotel construction and renovation pipeline.

The shift in favor of Upper Midscale Hotels and away from Economy chains is also evident when analyzing changes in relative visit share among the six hotel categories.

Upper Midscale hotels have always been major players: In H1 2019 they drew 28.7% of overall hotel visits – the most of any tier. But by H1 2024, their share of visits increased to 31.2%. Upscale Hotels – the second-largest tier – also saw their visit share increase, from 24.8% to 26.1%.

Meanwhile, Economy, Midscale, and Upper Upscale Hotels saw drops in visit share – with Economy chains, unsurprisingly, seeing the biggest decline. Luxury Hotels, for their parts, held firmly onto their piece of the pie, drawing 2.8% of visits in H1 2024.

Who are the visitors fueling the Upper Midscale visit revival? This next section explores shifts in visitor demographics to four Upper Midscale chains that are outperforming pre-pandemic visit levels: Trademark Collection by Wyndham, Holiday Inn Express by IHG Hotels & Resorts, Fairfield by Marriott, and Hampton by Hilton.

Analyzing the captured markets* of the four chains with demographics from STI: Popstats (2023) shows variance in the relative affluence of their visitor bases.

Fairfield by Marriott drew visitors from areas with a median household income (HHI) of $84.0K in H1 2024, well above the nationwide average of $76.1K. Hampton by Hilton and Trademark Collection by Wyndham, for their parts, drew guests from areas with respective HHIs of $79.6K and $78.5K – just above the nationwide average. Meanwhile, Holiday Inn Express by IHG Hotels & Resorts drew visitors from areas below the nationwide average.

But all four brands saw increases in the median HHIs of their captured markets over the past five years. This provides a further indication that it is wealthier consumers – those who have had to cut back less in the face of inflation – who are driving hotel recovery in 2024.

(*A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice.)

Much of the Upper Midscale visit growth is being driven by chain expansion. But in some areas of the country, the average number of visits to individual hotel locations is also on the rise – highlighting especially robust growth potential.

Analyzing visits to existing Upper Midscale chains in four metropolitan areas with booming tourism industries – Salt Lake City, UT, Palm Bay, FL, San Diego, CA, and Richmond, VA – shows that these markets feature robust untapped demand.

Utah, for example, has emerged as a tourist hotspot in recent years – with millions of visitors flocking each year to local destinations like Salt Lake City to see the sights and take in the great outdoors. And Upper Midscale hotels in the region are reaping the benefits. In H1 2024, the overall number of visits to Upper Midscale chains in Salt Lake City was 69.4% higher than in H1 2019. Though some of this increase can be attributed to local chain expansion, the average number of visits to each individual Upper Midscale location in the area also rose by 12.5% over the same period.

Palm Bay, FL (the Space Coast) – another tourist favorite – is experiencing a similar trend. Between H1 2019 and H1 2024, overall visits to local Upper Midscale hotel chains grew by 36.4% – while the average number of visits per location increased a substantial 16.9%. Given this strong demand, it may come as no surprise that the area is undergoing a hotel construction boom. Upper Midscale hotels in other areas with flourishing tourism sectors, like San Diego, CA and Richmond, VA, are seeing similar trends, with increases in both overall visits and and in the average number of visits per location.

Though Economy chains have underperformed versus other categories in recent years, the tier does feature some bright spots. Some extended-stay brands in the Economy tier – hotels with perks and amenities that cater to the needs of longer-stay travelers – are succeeding despite category headwinds.

Choice Hotels’ portfolio, for example, includes WoodSpring Suites, an Economy chain offering affordable extended-stay accommodations in 35 states. In H1 2024, the chain drew 7.7% more visits than in the first half of 2019 – even as the wider Economy sector continued to languish. InTown Suites, another Economy extended stay chain, saw visits increase by 8.9% over the same period.

And location intelligence shows that the success of these two chains is likely being driven, in part, by their growing appeal to young, well-educated professionals. In H1 2019, households belonging to Spatial.ai: PersonaLive’s “Young Professionals” segment made up 9.6% of WoodSpring Suites’ captured market. But by H1 2024, the share of this group jumped dramatically to 13.3%. At the same time, InTown Suites saw its share of Young Professionals increase from 12.0% to 13.4%.

Whether due to an affinity for prolonged “workcations” (so-called “bleisure” excursions) or an embrace of super-commuting, younger guests have emerged as key drivers of growth for the extended stay segment. And by offering low–cost accommodations that meet the needs of these travelers, Economy chains can continue to grow their share of the pie.

The hospitality industry recovery continues – led by Upper Midscale Hotels, which offer elevated experiences that don’t break the bank. But today’s market has room for other tiers as well. By keeping abreast of local visitation patterns and changing consumer profiles, hotels across chain scales can personalize the visitor experience and drive customer satisfaction.

The past few years have provided the tourism sector with a multitude of headwinds, from pandemic-induced lockdowns to persistent inflation and a rise in extreme weather events. But despite these challenges, people are more excited than ever to travel – more than half of respondents to a recent survey are planning on increasing their travel budgets in the coming months.

And while revenge travel to overseas destinations is still very much alive and well, the often high costs associated with traveling abroad are shaping the way people choose to travel. Domestic travel and tourism are seeing significant growth as more affordable alternatives.

This white paper takes a closer look at two of the most popular domestic tourism destinations in the country – New York City and Los Angeles. Over the past year, both cities have continued to be leading tourism hotspots, offering a wealth of attractions for visitors. What does tourism to these two cities look like in 2024, and what has changed since before the pandemic? How have inflation and rising airfare prices affected the demographics and psychographics of visitors to these major hubs?

Analyzing the distribution of domestic tourists across CBSAs nationwide from May 2023 to April 2024 reveals New York and Los Angeles to be two of the nation’s most popular destinations. (Tourists include overnight visitors staying in a given CBSA for up to 31 days).

The New York-Newark-Jersey City, NY-NJ-PA metro area drew the largest share of domestic tourists of any CBSA during the analyzed period (2.7%), followed closely by the Los Angeles-Long Beach-Anaheim, CA CBSA (2.5%). Other domestic tourism hotspots included Orlando-Kissimmee-Sanford, FL (tied for second place with 2.5% of visitors), Dallas-Fort Worth-Arlington, TX (1.9%), Las Vegas-Henderson-Paradise, NV (1.8%), Miami-Fort Lauderdale-Pompano Beach, FL (1.8%), and Chicago-Naperville, Elgin, IL-IN-WI (1.6%).

The Big Apple. The City That Never Sleeps. Empire City. Whatever it’s called, New York City remains one of the most well-known tourist destinations in the world. And for many Americans, New York is the perfect place for an extended weekend getaway – or for a multi-day excursion to see the sights.

But where do these NYC-bound vacationers come from? Diving into the data on the origin of visitors making medium-length trips to New York City (three to seven nights) reveals that increasingly, these domestic tourists are coming from nearby metro areas.

Between 2018-2019 and 2023-2024, for example, the number of tourists visiting New York City from the Philadelphia metro area increased by 19.2%.

The number of tourists coming from the Boston and Washington, D.C metro areas, and from the New York CBSA itself (New York-Newark-Jersey City, NY-NJ-PA) also increased over the same period.

Meanwhile, further-away CBSAs like San Francisco-Oakland-Berkeley, CA, Atlanta-Sandy Springs-Alpharetta, GA, and Miami-Fort Lauderdale-Pompano Beach, FL fed fewer tourists to NYC in 2023-2024 than they did pre-pandemic. It seems that residents of these more distant metro areas are opting for vacation destinations closer to home to avoid the high costs of air travel.

Diving even deeper into the characteristics of visitors taking medium-length trips to New York City reveals another demographic shift: Tourists staying between three and seven nights in the Big Apple are skewing younger.

Between 2018-2019 and 2023-2024, the share of visitors to New York City from areas with median ages under 30 grew from 2.1% to 4.5%. Meanwhile, the share of visitors from areas with median ages between 31 and 40 increased from 34.3% to 37.7%.

The impact of this trend is already being felt in the Big Apple, with The Broadway League reporting that the average age of audiences to its shows during the 2022- 2023 season was the youngest it had been in 20 seasons.

The shift towards younger tourists can also be seen when examining the psychographic makeup of visitors to popular attractions in New York City. Analyzing the captured markets of major NYC landmarks with data from Spatial.ai’s PersonaLive dataset reveals an increase in households belonging to the “Educated Urbanites” segment between 2018-2019 and 2023-2024.

These well-educated, young singles are increasingly visiting iconic NYC venues such as the Whitney Museum of American Art, The Metropolitan Museum of Art, The American Museum of Natural History, and the Statue of Liberty. This shift highlights the growing popularity of these attractions among young, educated singles, reflecting a broader trend of increased domestic tourism among this demographic.

New York City’s tourism sector is adapting to meet the changing needs of travelers, fueled increasingly by younger visitors who may be unable to take a costly international vacation. How have travel patterns to Los Angeles changed in response to increasing travel costs?

While New York City is the East Coast’s tourism hotspot, Los Angeles takes center stage on the West Coast. And as overseas travel has become increasingly out of reach for Americans with less discretionary income, the share of domestic tourists originating from areas with lower HHIs has risen.

Before the pandemic, 57.6% of visitors to LA came from affluent areas with median household incomes (HHIs) of over $90K/year. But by 2023-2024, this share decreased to 50.7%. Over the same period, the share of visitors from areas with median HHIs between $41K and $60K increased from 9.7% to 12.5%, while the share of visitors from areas with HHIs between $61K and $90K rose from 32.1% to 35.8%.

Diving into the psychographic makeup of visitors to popular Los Angeles attractions – Universal Studios Hollywood, Disneyland California, the Santa Monica Pier, and Griffith Observatory – also reflects the above-mentioned shift in HHI. The captured markets of these attractions had higher shares of middle-income households belonging to the “Family Union” psychographic segment in 2023-2024 than in 2018-2019.

Experian: Mosaic defines this segment as “middle income, middle-aged families living in homes supported by solid blue-collar occupations.” Pre-pandemic, 16.0% of visitors to Universal Studios Hollywood came from trade areas with high shares of “Family Union” households. This number jumped to 18.8% over the past year. A similar trend occurred at Disneyland, Santa Monica Pier, and Griffith Observatory.

And like in New York City, growing numbers of visitors to Los Angeles appear to be coming from nearby areas. Between 2018-2019 and 2023-2024, the share of in-state visitors to major Los Angeles attractions increased substantially – as people likely sought to cut costs by keeping things local.

Pre-pandemic, for example, 68.9% of visitors to Universal Studios Hollywood came from within California – a share that increased to 72.0% over the past year. Similarly, 59.7% of Griffith Observatory visitors in 2018-2019 came from within the state – and by 2023-2024, that number grew to 64.7%.

Even when times are tight, people love to travel – and New York and Los Angeles are two of their favorite destinations. With prices for airfare, hotels, and dining out increasing across the board, younger and more price-conscious households are adapting, choosing to visit nearby cities and enjoy attractions closer to home. And as the tourism industry continues its recovery, understanding emerging visitation trends can help stakeholders meet travelers where they are.