.svg)

.png)

.png)

.png)

.png)

Darden Restaurants Inc. is the largest full-service restaurant group in the country, operating ten dining chains that range from fine dining to casual bars.

How has the company fared in recent months? We examined the location analytics to evaluate Darden’s recent performance and took a closer look at what the holiday season might bring for its wide array of brands.

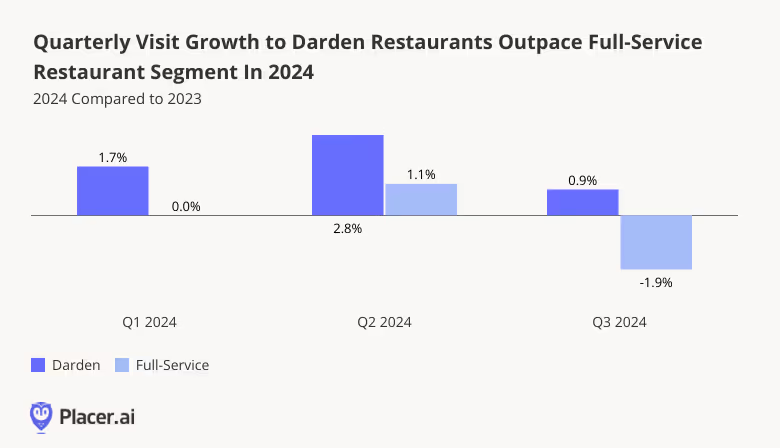

The full-service restaurant category has faced significant challenges in recent years as rising food prices, labor shortages, and inflation pushed costs up and some customers away. But since the beginning of 2024, Darden has managed to stay ahead and outpace the wider full-service restaurant segment in terms of year-over-year (YoY) quarterly visits. Q3 2024 visits were 0.9% higher than in Q3 2023. In contrast, the broader full-service segment experienced a 1.9% decline in the same period.

As restaurant inflation finally begins to cool and the dining segment tiptoes cautiously toward recovery, Darden’s ability to stay ahead of the competition suggests that its brands are resonating with customers even during periods of economic uncertainty.

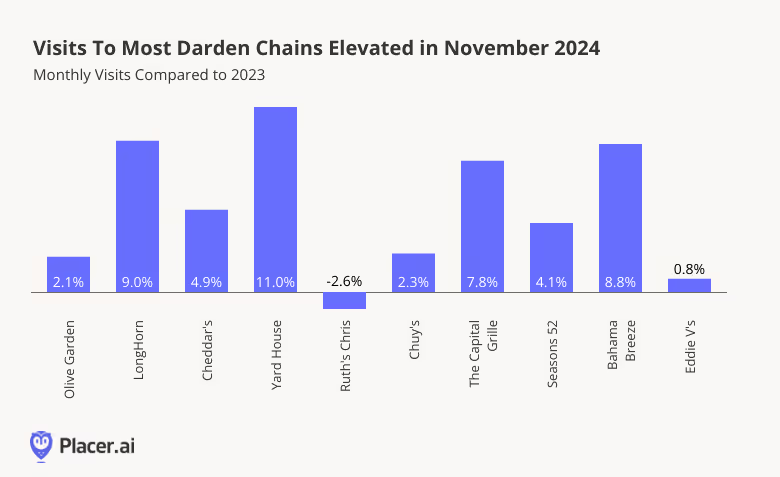

Darden’s portfolio runs the gamut from household names like Olive Garden (with over 900 locations) and LongHorn Steakhouse (over 500 locations) to smaller chains like Yard House and Bahama Breeze. And zooming in on the recent November data reveals that most chains are still enjoying year-over-year (YoY) visit growth. Yard House led the pack with 11.0% more visits than in November 2023, followed by LongHorn Steakhouse (9.0% YoY growth), and Bahama Breeze (8.8% YoY growth).

This steady November momentum bodes well for Darden as the typically busy holiday season approaches.

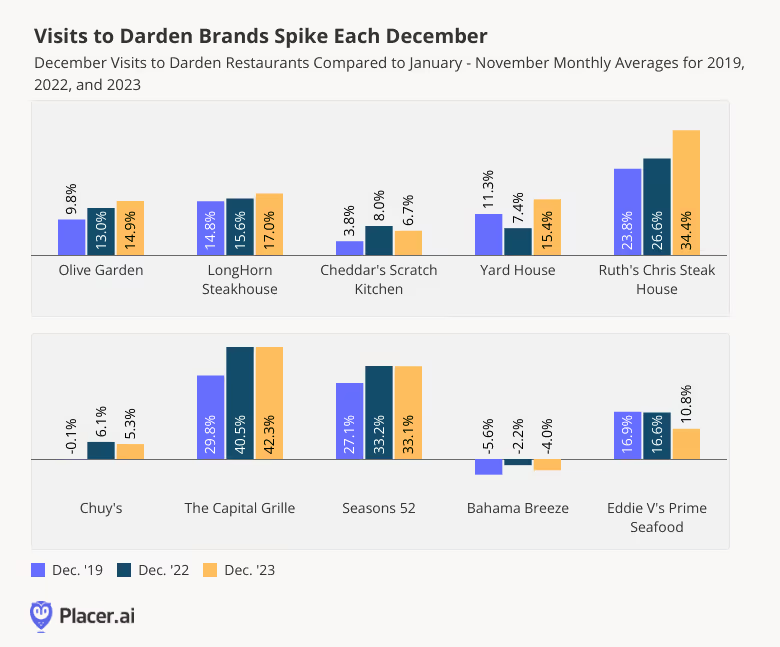

Indeed, diving into previous years’ visitation patterns reveals that Darden’s brands generally receive sizable visit bumps over the holiday season.

Analyzing December visits in 2019, 2022, and 2023 relative to each year’s January to November monthly visit average highlighted significant visit boosts across almost all Darden brands. The Capital Grille led the charge in December 2023, with visits 42.3% higher than the January to November average, followed closely by Ruth’s Chris Steak House (34.4%) and Season’s 52 (31.1%).

These consistent December traffic spikes coupled with November’s strong showing suggests that the company is well-positioned to sustain its current momentum into the holiday season and beyond.

Darden Restaurants continues to be a leader in the full-service segment, enjoying visit growth and capturing holiday foot traffic.

Will this year’s holiday season bring increased foot traffic to the company’s brands?

Visit Placer.ai to keep up with the latest data-driven dining insights.

About the Placer 100 Index for Retail & Dining: The Placer 100 Index for Retail and Dining is a curated, dynamic list of leading chains that often serve as prime tenants for shopping centers and malls. The index includes chains from various industries, such as superstores, grocery, dollar stores, dining, apparel, and more. Among the notable chains featured are Walmart, Target, Costco, Kroger, Ulta Beauty, The Home Depot, McDonald’s, Chipotle, Crunch Fitness, and Trader Joe's. The goal of the list is to provide insight into the wider trends impacting the retail, dining and shopping center segments.

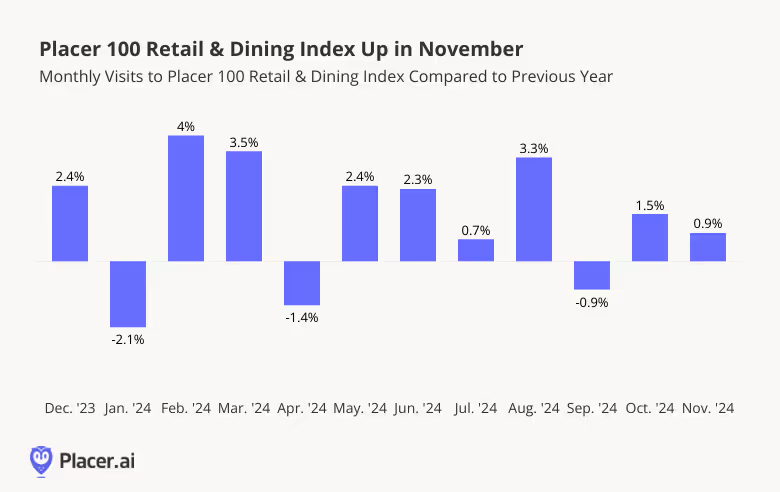

October’s positive visitation trends continued in November, with overall visits to the Placer 100 Retail & Dining Index up 0.9% year-over-year (YoY) – a strong start to the holiday season.

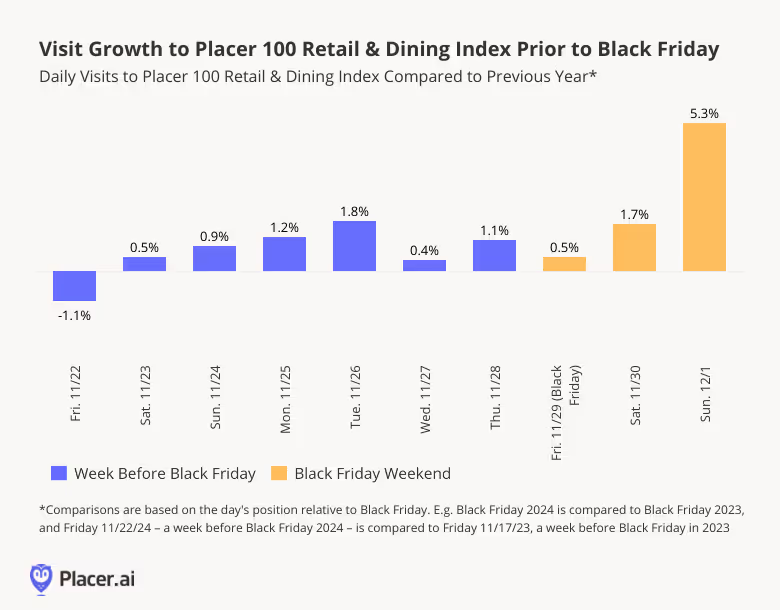

Some of the November uptick was likely driven by Black Friday – visits to the Placer 100 Index were up 2.2% YoY overall for Black Friday Weekend 2024, with Sunday seeing a particularly pronounced visit spike of 5.3%.

And zooming out to the week before Black Friday reveals that the visit boost started even earlier – YoY visits increased as early as the Saturday before Thanksgiving, with traffic remaining positive throughout the week leading up to the retail milestone. The early growth in visits highlights the success of early promotions in driving visits this year.

Once again, Chili’s Grill & Bar topped the Placer 100 Index, likely thanks to the ongoing popularity of the chain’s Big Smash Burger, 3 For Me value meal, and Triple Dipper offering. The chain’s even more remarkable visit growth in November was likely also due to Chili’s free Veteran’s Day meals to veterans and active duty personnel, which generated a 135.4% increase in visits on Monday, November 11th relative to the previous three Mondays’ average.

November’s Placer 100 Index winners also included several value-driven chains – such as Aldi’s, HomeGoods, and Crunch Fitness – as well luxury brands such as Nordstrom and Jared Jewelers – perhaps a testament to the still bifurcated consumer market.

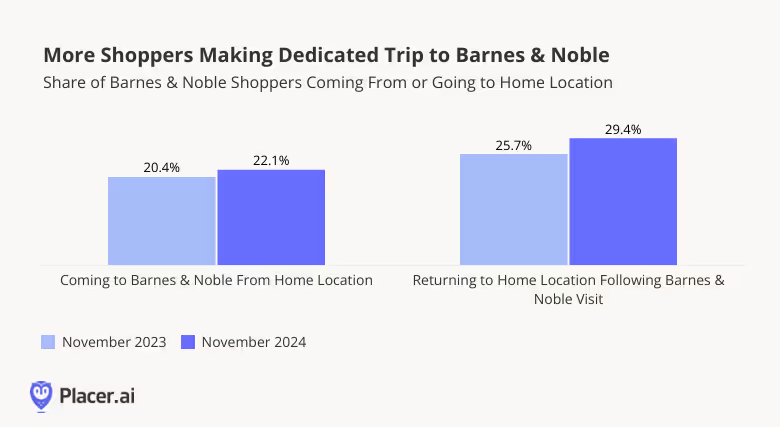

Barnes & Noble also made the November 2024 top 10 list, with 13.0% overall visit growth and 9.8% more visits per location, on average, than in November 2023. The legacy book retailer, on an upward trajectory since 2021, has gained significant momentum this year – and the strong November numbers indicate that the company is headed into a promising holiday season.

The chain is seeing more than just impressive visit growth – since November 2023, the share of visitors coming to Barnes & Noble from their home location or headed straight home after a trip to the book retailer has also grown. This visitation pattern suggests that Barnes & Noble is becoming a primary destination for consumers rather than an incidental stop on the way to or from another errand – underscoring the chain’s restored relevance in the wider retail landscape.

Who will dominate the holiday season and top the Placer.ai 100 Retail & Dining Index in December 2024?

Visit placer.ai to find out.

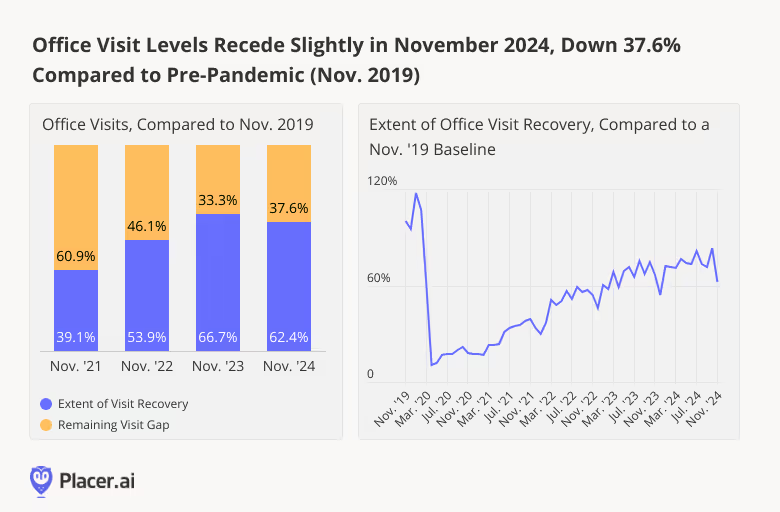

After reaching new heights in October 2024, how did the office recovery fare in November? We dove into the data to find out.

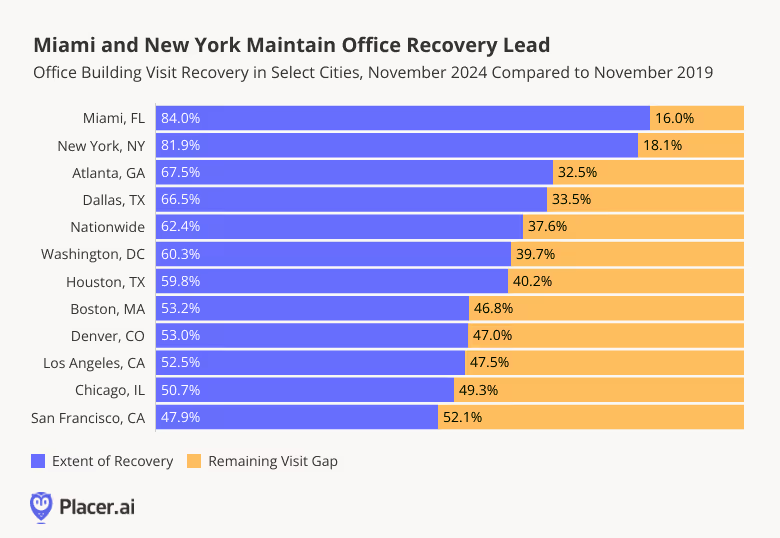

In November 2024, visits to office buildings nationwide were 62.4% of what they were in November 2019, down from 66.7% in November 2023. This marks the most substantial drop in office foot traffic since January 2024 – and a sharp decline from October 2024.

But though significant, November’s downturn is likely a reflection of this year’s record-breaking Thanksgiving travel rather than of any real office recovery slowdown. Millions of Americans took to the skies and roads to spend the holiday with loved ones. And with remote work making it easier than ever before for professionals to plug in from virtually anywhere, many likely extended their trips without taking extra days off – leading to fewer office visits in the days leading up to the holiday.

Taking a look at regional trends, Miami continued to outshine other cities in November 2024, with visits at 84.0% of pre-pandemic levels – perhaps due in part to strict return-to-office (RTO) policies implemented by major players within the city’s growing tech and finance sector. New York came in second with recovery at 81.9%, while San Francisco continued to lag behind other major cities. But with major projects like the September 2024 grand opening of the revamped Transamerica Pyramid set to revitalize the city’s Financial District, more accelerated recovery may be ahead for this West Coast hub.

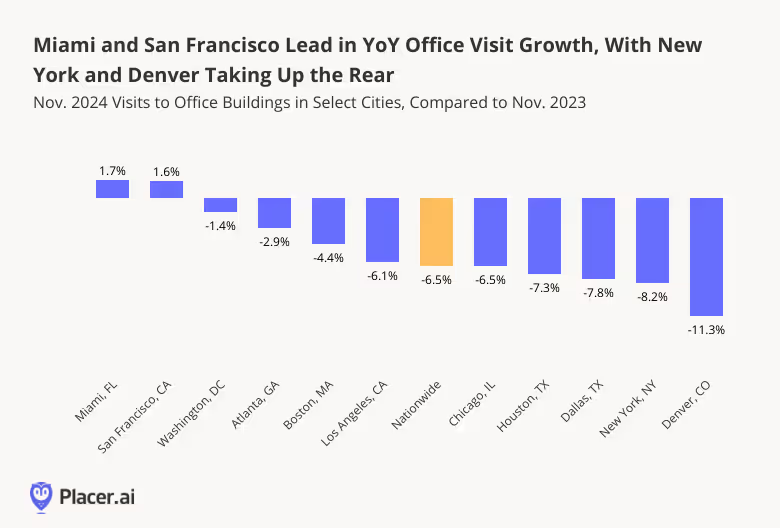

Indeed, San Francisco was among November 2024’s regional leaders for year over year (YoY) office visit growth. Nationwide, office building foot traffic was down 6.5% YoY. But in San Francisco, visits increased 1.6% – likely bolstered by recent RTO mandates from major local employers like Salesforce. The city’s temperate climate may also have played a role in encouraging residents to stay local for the holidays. Miami, too – a popular holiday destination in its own right – saw visits increase 1.7% YoY.

Denver, meanwhile, experienced its fourth snowiest November on record, which may have contributed to a larger portion of its workforce embracing remote work during the month – and an 11.3% YoY visit decline. And in New York, extended “workcations” by remote-capable finance employees, as well as potential disruptions in public transit and increased congestion during the holiday season, may have fueled a larger-than-average drop. Given the Big Apple’s strong overall recovery trajectory, we will likely see a rebound to more robust YoY growth by January, when the holiday season winds down.

While Thanksgiving travel created a temporary headwind for office recovery, cities like Miami and San Francisco demonstrate that the story is far from uniform. And looking ahead to the coming months, the office recovery still appears poised to continue apace.

For more data-driven office recovery analyses, follow Placer.ai.

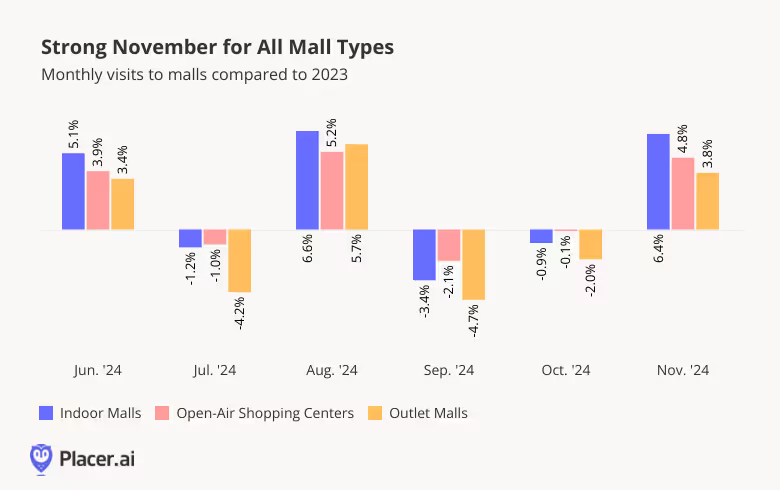

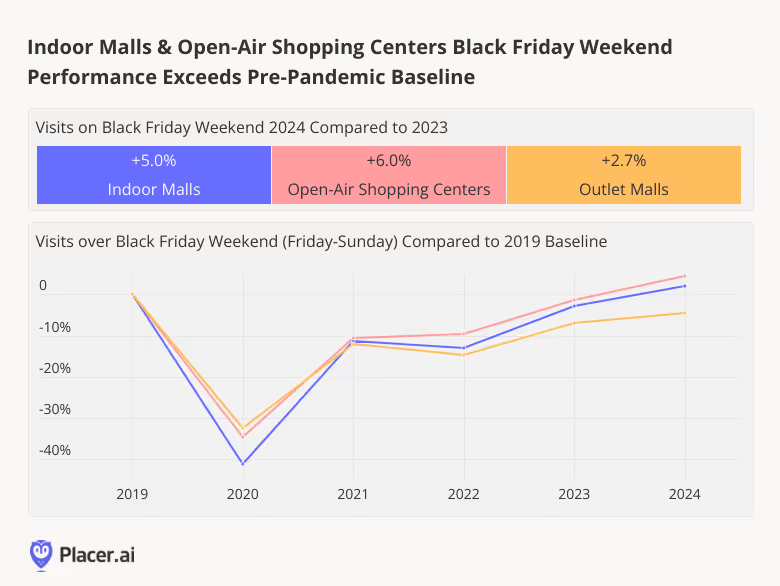

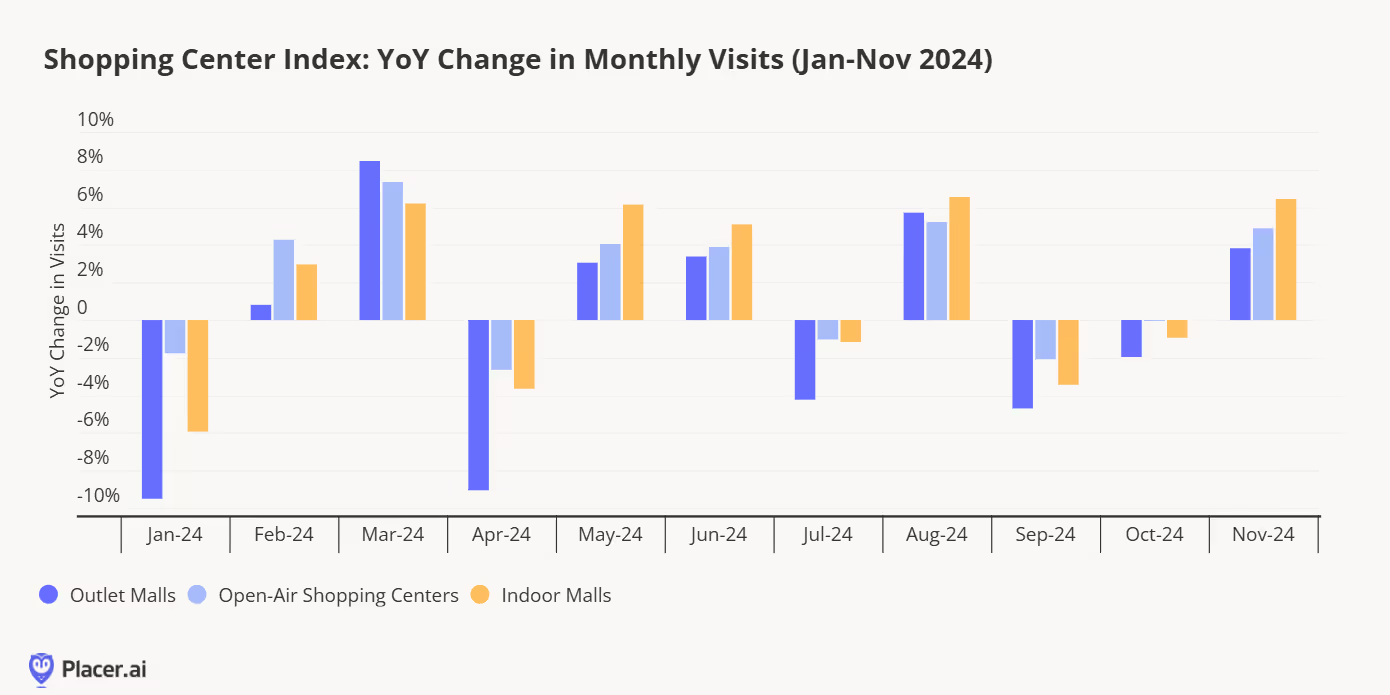

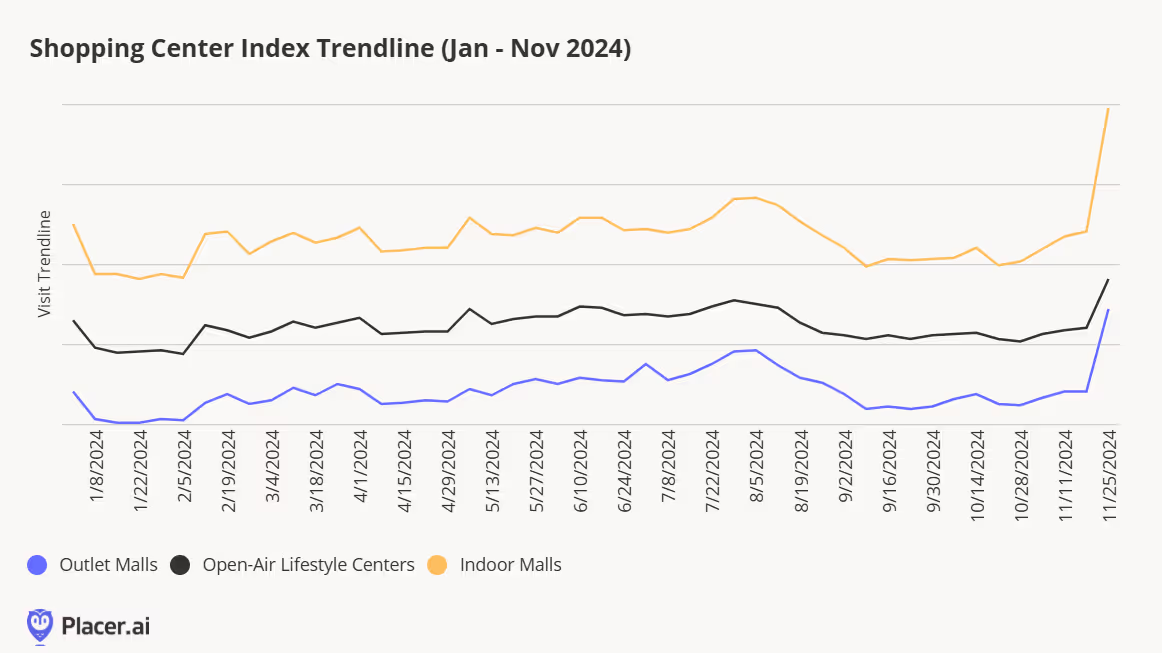

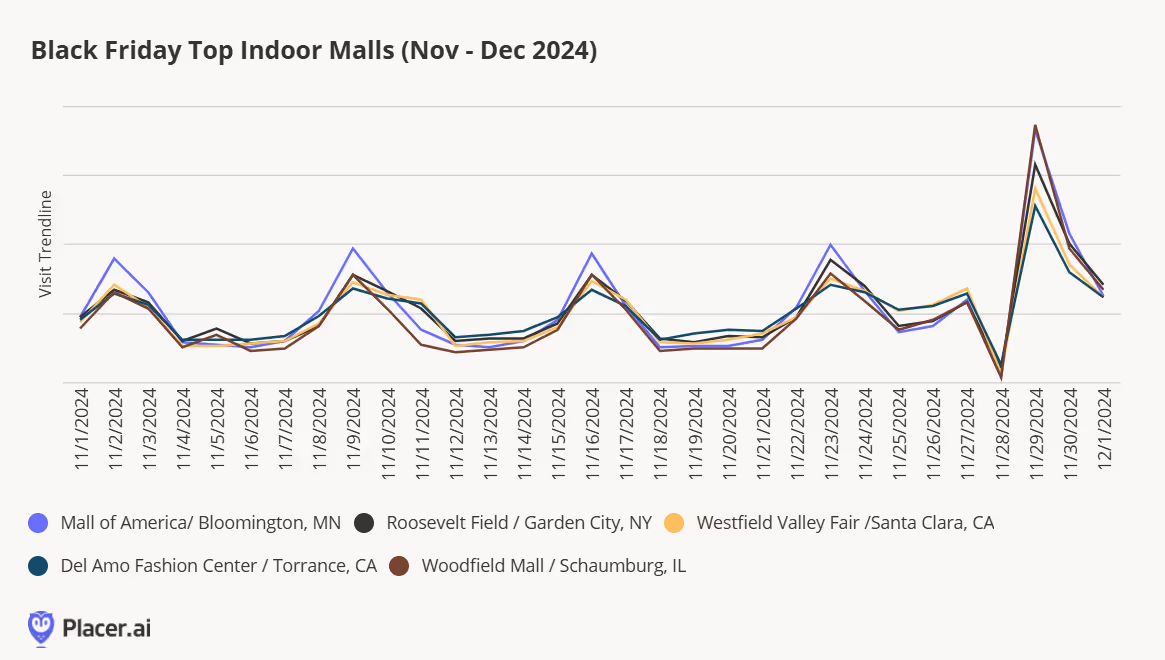

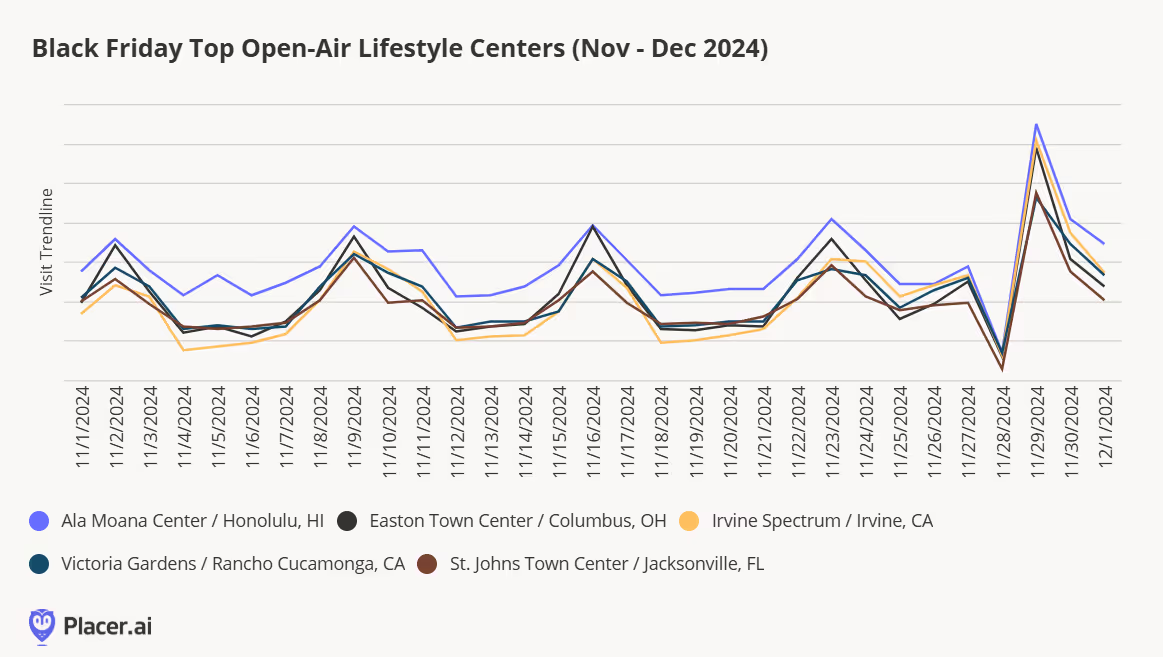

Following weaker foot traffic performances in September and October, mall visits swung positive in November: Indoor malls, open-air shopping centers, and outlet malls received year-over-year (YoY) visit boosts of 6.4%, 4.8%, and 3.8%, respectively. The strong YoY growth across all mall types underscores the continued attraction of brick-and-mortar retail – particularly during the holiday season.

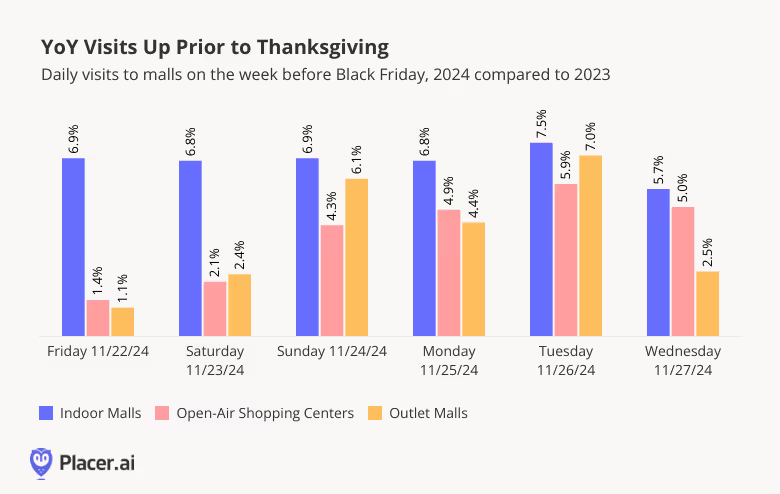

While much of the November boost is likely due to the malls’ strong Black Friday performance, foot traffic data indicates that early deals also drove visits before the big day: Comparing daily visits during the week before Black Friday (from Friday November 22nd to Wednesday November 27th) to visits during the equivalent days in 2023 (November 17th to 22nd 2023) reveals that malls received more pre-Black Friday mall visits this year than in 2023.

This willingness to shop ahead of Black Friday instead of waiting for the best deals on the day itself may highlight the effectiveness of retailers’ early promotions– or it could signal the readiness of some consumers to spend more freely this holiday season.

Still, despite the positive pre-Black Friday showing, the majority of the November visit boost can likely be attributed to malls’ impressive Black Friday Performance. All three formats saw YoY visit growth over Black Friday weekend, with open-air shopping centers seeing the largest visit increases – foot traffic for this sub-category was up 6.0% compared to Black Friday weekend 2023. In fact, this year’s Black Friday numbers were so strong that visits to indoor malls and open-air shopping centers even exceeded pre-pandemic Black Friday weekend.

These numbers reveal that, despite the rise in early Black Friday deals and online shopping, many consumers still want to experience the excitement of Black Friday bargain hunting in person. And this powerful kickoff to the 2024 holiday season indicates that the unique experiential offering of malls – combining shopping, dining, and entertainment all under one roof – continue to play a central role in the wider retail landscape.

For more data-driven retail insights, visit placer.ai.

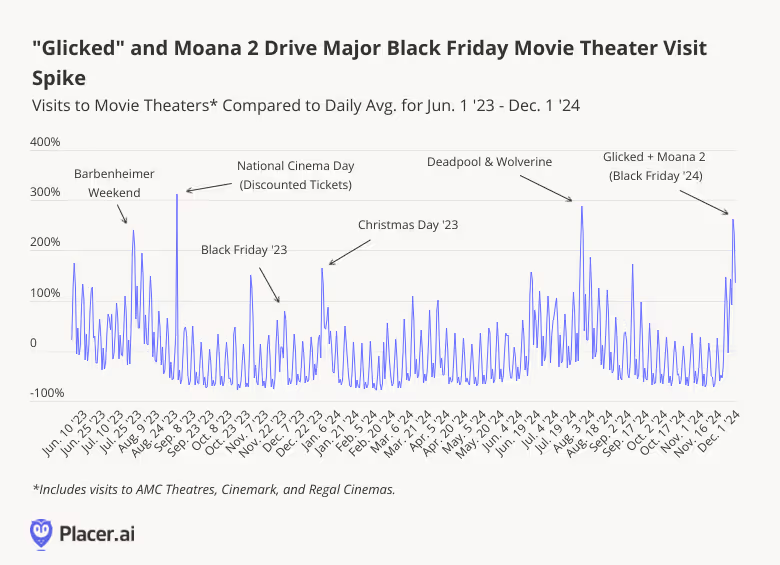

Hot on the heels of last year’s Barbenheimer phenomenon, 2024 brought us “Glicked”— the powerhouse pairing of Gladiator II and Wicked that lit up movie theaters across the country. How did these box office juggernauts – followed just a few days later by Disney’s much-anticipated release of Moana 2 – impact movie theater foot traffic during the Thanksgiving holiday weekend?

We dove into the data to find out.

On its premiere day (Friday, November 22nd, 2024) “Glicked” drew a 69.2% increase in movie theater visits compared to the daily average between June 1, 2023 and December 1, 2024. By Saturday, November 23rd, foot traffic surged by a dramatic 147.3%, solidifying the weekend as one of the most memorable of the year. And on Wednesday, November 27th, the release of Moana 2 drove an impressive 142.6% foot traffic increase.

But the real box office magic came on Black Friday (November 29th), when the combined power of Glicked, Moana 2, and the holiday shopping frenzy fueled an epic 263.2% surge in theater visits – making November 29th the third busiest for theaters since June 1st 2023. Foot traffic to movie theaters on this year’s Black Friday even outpaced the unforgettable levels seen on Barbenheimer Saturday (July 22nd, 2023), when visits soared to 241.0% above the daily average.

Black Friday is always a busy time for movie theaters. In 2019, movie theater visits on Black Friday (November 29th, 2019) were up 80.2% compared to an average 2019 Friday – while in 2022 and 2023 (November 25th, 2022 and November 24th, 2023), they were up 40.8% and 39.4% compared to an average Friday for each of those years.

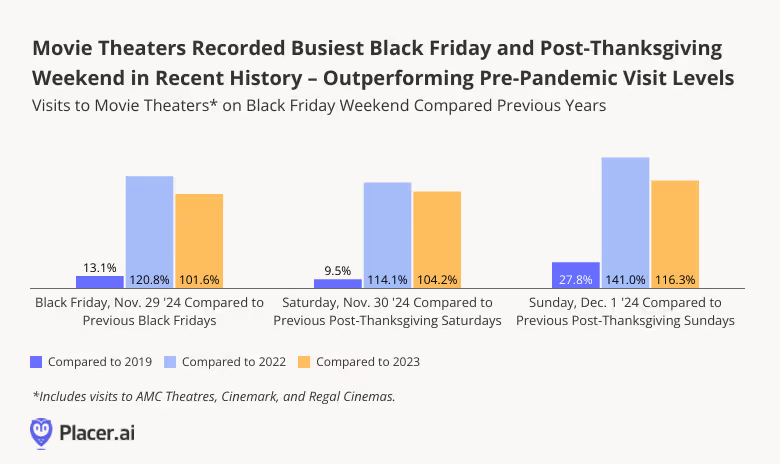

And in 2024, Black Friday cinematic foot traffic surged past previous years’ benchmarks – surpassing even pre-pandemic levels. On November 29th, 2024, visits to movie theaters were 13.1% higher than on Black Friday in 2019 – and the effect lasted through the weekend, pushing visits up 9.5% and 27.8% on the Saturday and Sunday after Thanksgiving compared to the equivalent period of 2019.

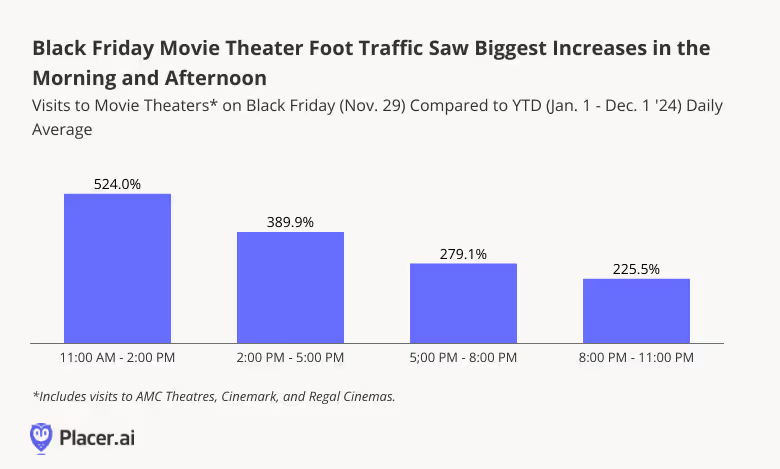

But the Black Friday foot traffic surge wasn’t distributed equally throughout the day. Unsurprisingly given the holiday weekend, morning and early afternoon screenings saw the most impressive visit increases – with foot traffic up an incredible 524.0% between 11:00 AM and 2:00 PM compared to an average year-to-date (YTD) Friday. Afternoons (2:00 PM–5:00 PM) weren’t far behind, with visits climbing 389.9%. But impressively, even though Friday evenings are typically busy times for movie theaters year round, visits on the evening of Black Friday surged by more than 200% between 5:00 PM and 11:00 PM.

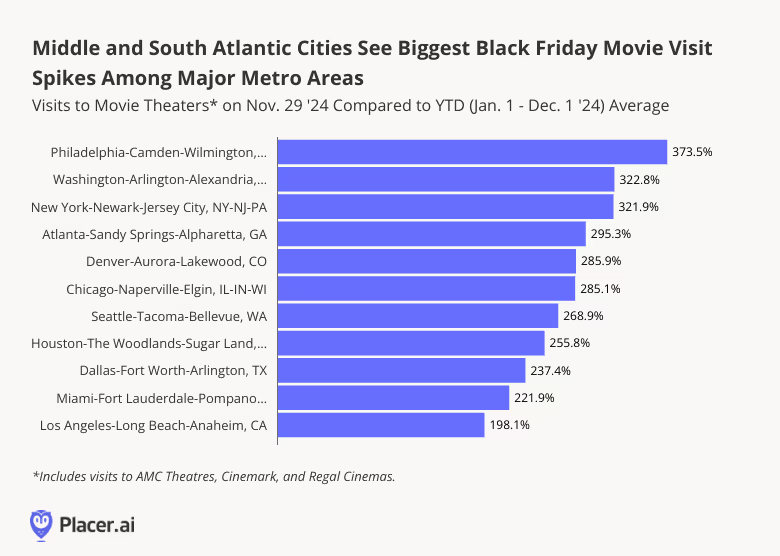

Black Friday’s box office boost also wasn’t evenly spread across the map. Leading the charge was the Philadelphia-Camden-Wilmington area, where theater visits soared by an astonishing 373.5% compared to its 2024 year-to-date average. Close on its heels were Washington, D.C. (322.8%) and New York (321.9%), proving that East Coast audiences were all in for some big-screen magic.

Interestingly, Black Friday was less resonant on the West Coast, particularly in California, where the cultural pull of the big shopping day seems to be less strong. Los Angeles, for example, saw a more modest boost in visits, reflecting the region’s typically lighter Black Friday enthusiasm.

Black Friday, it turns out, isn’t just about shopping – it also has the power to supercharge movie theater foot traffic. And while Gladiator II, Wicked, and Moana 2 all drew crowds on their opening days, the strategic timing of their pre-holiday releases drove a Black Friday visit surge for the ages. Whether driven by the thrill of a new hit or the magic of the holiday season, people are returning to theaters – and in record numbers.

For more data-driven consumer behavior insights, visit placer.ai.

Holiday shoppers in November 2024 turned out in greater numbers than last year, particularly at malls. Following a strong spring and summer year-over-year performance (despite April having one fewer weekend and Easter falling in March, as well as July having one less weekend than 2023), and a weaker early fall, it seems many consumers held off on their mall visits until November.

Indoor malls saw the highest total visits, followed by open-air lifestyle centers and outlet malls.

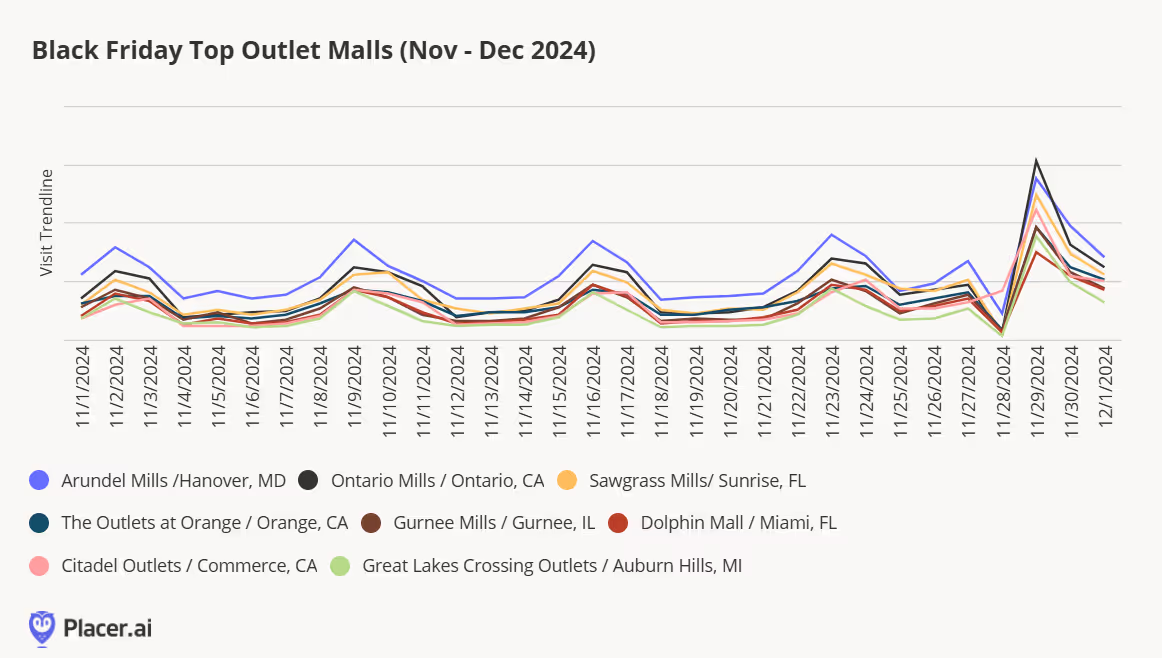

Deal-hunting was a major theme this year, drawing shoppers in large numbers to outlet malls. For most of November, Arundel Mills in Hanover, MD, led in total visits. However, when it came to post-Thanksgiving steps and walking off turkey-induced calories, Ontario Mills in Southern California claimed the top spot. Sawgrass Mills in Florida secured third place, while the Assyrian fortress-themed Citadel Outlets in Los Angeles landed fourth—complete with a massive Black Friday traffic jam on the 5 Freeway. Gurnee Mills in Illinois rounded out the top five for national outlet mall traffic.

We watched Moana 2 on Black Friday at the Outlets of Orange, the sixth most-visited outlet mall in America. Judging by the unbelievably crowded parking lot, it might be worth checking the Placer app for historical traffic comparisons. The silver lining to the 25-minute parking hunt? With half an hour of previews now the norm, no one missed a moment of the movie! The mall was bustling, with lines stretching around the corners of some stores. Crowds filled the main thoroughfare, and eager shoppers formed long queues at popular spots like Victoria’s Secret and Pink.

Shoppers at juniors' retailers like American Eagle needed a bit of patience, as did those heading to Skechers.

Great Lakes Crossing Outlets in Michigan secured seventh place, while Dolphin Mall in Miami, FL rounded out the top eight.

From November 1 to December 1, the top five most-visited indoor malls were Mall of America in Minnesota, Roosevelt Field in New York, Westfield Valley Fair in California, Del Amo Fashion Center in California, and Woodfield Mall in Illinois. However, Black Friday brought a shift in rankings. Woodfield Mall claimed the top spot for Black Friday visits, with the other malls each moving down one position compared to their overall November visitation rankings.

From November 1 to December 1, Ala Moana Center in Hawaii consistently held its #1 spot among open-air shopping centers, including on Black Friday. If you're enjoying the aloha spirit this holiday season, don’t miss unique Hawaiian stores like Honolulu Cookie Co., Island Slipper, and Malie Organics. The rankings saw some shifts on Black Friday, with Irvine Spectrum climbing from third place throughout November to the #2 spot. Easton Town Center secured third place, while St. Johns Town Center and Victoria Gardens rounded out the fourth and fifth spots, respectively, on the busiest shopping day of the year.

The first Lollapalooza – a four-day music festival – took place in 1991. Chicago’s Grant Park became the event’s permanent home (at least in the United States) in 2005, drawing thousands of revelers and music fans to the park each year.

This year, the festival once again demonstrated its powerful impact on the city. On August 1st, 2024, visits to Grant Park surged by 1,313.2% relative to the YTD daily average, as crowds converged on the park to see Chappell Roan’s much-anticipated performance. And during the first three days of the event, the event drew significantly more foot traffic than in 2023 – with visits up 18.9% to 35.9% compared to the first three days of last year’s festival (August 3rd to 5th, 2023).

Lollapalooza led to a dramatic spike in visits to Grant Park – and it also attracted a different type of visitor compared to the rest of the year.

Analyzing Grant Park’s captured market with Spatial.ai’s PersonaLive dataset reveals that Lollapalooza attendees are more likely to belong to the “Young Professionals” and “Ultra Wealthy Families” segment groups than the typical Grant Park visitor.

By contrast, the “Near-Urban Diverse Families” segment group, comprising middle-class diverse families living in or near cities, made up only 6.5% of visitors during the festival, compared to 12.0% during the rest of the year.

Additionally, visitors during Lollapalooza came from areas with higher HHIs than both the nationwide baseline of $76.1K and the average for park visitors throughout the year. Understanding the demographic profile of visitors to the park during Lollapalooza can help planners and city officials tailor future events to these segment groups – or look for ways to make the festival accessible to a wider range of music lovers.

Lollapalooza’s impact on Chicago extended beyond the boundaries of Grant Park, with nearby hotels seeing remarkable surges in foot traffic. The Congress Plaza Hotel on South Michigan Avenue witnessed a staggering 249.1% rise in visits during the week of July 29, 2024, compared to the YTD visit average. And Travelodge on East Harrison Street saw an impressive 181.8% increase. These spikes reflect the festival’s draw not just for locals but for out-of-town visitors who fill hotels across the city.

The North Michigan Avenue retail corridor also enjoyed a significant increase in foot traffic during the festival, with visits on Thursday, August 1st 56.0% higher than the YTD Thursday visit average. On Friday, August 2nd, visits to the corridor were 55.7% higher than the Friday visit average. These numbers highlight Lollapalooza’s role in driving economic activity across Chicago, as festival-goers venture beyond the park to explore the city’s vibrant retail and hospitality offerings.

City parks often serve as community hubs, and Flushing Meadows Corona Park in Queens, NY, has been a major gathering point for New Yorkers. The park hosted one of New York’s most beloved summer concerts – Governors Ball – which moved from Governors Island to Flushing Meadows in 2023.

During the festival (June 9th -11th, 2024), musicians like Post Malone and The Killers drew massive crowds to the park, with visits soaring to the highest levels seen all year. On June 9th, the opening day of the festival, foot traffic in the park was up 214.8% compared to the YTD daily average, and at its height, on June 8th, the festival drew 392.7% more visits than the YTD average.

The park also hosted other big events this summer – a July 21st set by DMC helped boost visits to 185.1% above the YTD average. And the Hong Kong Dragon Boat Festival on August 3rd and 4th led to major visit boosts of 221.4% and 51.6%, respectively.

These events not only draw large crowds, but also highlight the park’s role as a space where cultural and civic life can find expression, flourish, and contribute to the health of local communities.

Analyzing changes in Flushing Meadows Corona Park’s trade area size offers insight into how far people are willing to travel for these events. During Governors Ball, for example, the park’s trade area ballooned to 254.5 square miles, showing the festival's wide appeal. On July 20th, by contrast, when the park hosted several local bands and DJs, the trade area was a much more modest 57.0 square miles.

Summer events drive community engagement, economic activity, and civic pride. Cities that invest in their parks and event hubs, fostering lively and inclusive spaces, can create lasting value for both residents and visitors, enriching the cultural and social life of urban areas.

For more data-driven civic stories, visit Placer.ai.

The pandemic and economic headwinds that marked the past few years presented the multi-billion dollar hotel industry with significant challenges. But five years later, the industry is rallying – and some hotel segments are showing significant growth.

This white paper delves into location analytics across six major hotel categories – Luxury Hotels, Upper Upscale Hotels, Upscale Hotels, Upper Midscale Hotels, Midscale Hotels, and Economy Hotels – to explore the current state of the American hospitality market. The report examines changes in guest behavior, personas, and characteristics and looks at factors driving current visitation trends.

Overall, visits to hotels were 4.3% lower in Q2 2024 than in Q2 2019 (pre-pandemic). But this metric only tells part of the story. A deeper dive into the data shows that each hotel tier has been on a more nuanced recovery trajectory.

Economy chains – those offering the most basic accommodations at the lowest prices – saw visits down 24.6% in Q2 2024 compared to pre-pandemic – likely due in part to hotel closures that have plagued the tier in recent years. Though these chains were initially less impacted by the pandemic, they were dealt a significant blow by inflation – and have seen visits decline over the past three years. As hotels that cater to the most price-sensitive guests, these chains are particularly vulnerable to rising costs, and the first to suffer when consumer confidence takes a hit.

Luxury Hotels, on the other hand, have seen accelerated visit growth over the past year – and have succeeded in closing their pre-pandemic visit gap. Upscale chains, too, saw Q2 2024 visits on par with Q2 2019 levels. As tiers that serve wealthier guests with more disposable income, Luxury and Upscale Hotels are continuing to thrive in the face of headwinds.

But it is the Upper Midscale level – a tier that includes brands like Trademark Collection by Wyndham, Fairfield by Marriott, Holiday Inn Express by IHG Hotels & Resorts, and Hampton by Hilton – that has experienced the most robust visit growth compared to pre-pandemic. In Q2 2024, Upper Midscale Hotels drew 3.5% more visits than in Q2 2019. And during last year’s peak season (Q3 2023), Upper Midscale hotels saw the biggest visit boost of any analyzed tier.

As mid-range hotels that still offer a broad range of amenities, Upper Midscale chains strike a balance between indulgence and affordability. And perhaps unsurprisingly, hotel operators have been investing in this tier: In Q4 2023, Upper Midscale Hotels had the highest project count of any tier in the U.S. hotel construction and renovation pipeline.

The shift in favor of Upper Midscale Hotels and away from Economy chains is also evident when analyzing changes in relative visit share among the six hotel categories.

Upper Midscale hotels have always been major players: In H1 2019 they drew 28.7% of overall hotel visits – the most of any tier. But by H1 2024, their share of visits increased to 31.2%. Upscale Hotels – the second-largest tier – also saw their visit share increase, from 24.8% to 26.1%.

Meanwhile, Economy, Midscale, and Upper Upscale Hotels saw drops in visit share – with Economy chains, unsurprisingly, seeing the biggest decline. Luxury Hotels, for their parts, held firmly onto their piece of the pie, drawing 2.8% of visits in H1 2024.

Who are the visitors fueling the Upper Midscale visit revival? This next section explores shifts in visitor demographics to four Upper Midscale chains that are outperforming pre-pandemic visit levels: Trademark Collection by Wyndham, Holiday Inn Express by IHG Hotels & Resorts, Fairfield by Marriott, and Hampton by Hilton.

Analyzing the captured markets* of the four chains with demographics from STI: Popstats (2023) shows variance in the relative affluence of their visitor bases.

Fairfield by Marriott drew visitors from areas with a median household income (HHI) of $84.0K in H1 2024, well above the nationwide average of $76.1K. Hampton by Hilton and Trademark Collection by Wyndham, for their parts, drew guests from areas with respective HHIs of $79.6K and $78.5K – just above the nationwide average. Meanwhile, Holiday Inn Express by IHG Hotels & Resorts drew visitors from areas below the nationwide average.

But all four brands saw increases in the median HHIs of their captured markets over the past five years. This provides a further indication that it is wealthier consumers – those who have had to cut back less in the face of inflation – who are driving hotel recovery in 2024.

(*A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice.)

Much of the Upper Midscale visit growth is being driven by chain expansion. But in some areas of the country, the average number of visits to individual hotel locations is also on the rise – highlighting especially robust growth potential.

Analyzing visits to existing Upper Midscale chains in four metropolitan areas with booming tourism industries – Salt Lake City, UT, Palm Bay, FL, San Diego, CA, and Richmond, VA – shows that these markets feature robust untapped demand.

Utah, for example, has emerged as a tourist hotspot in recent years – with millions of visitors flocking each year to local destinations like Salt Lake City to see the sights and take in the great outdoors. And Upper Midscale hotels in the region are reaping the benefits. In H1 2024, the overall number of visits to Upper Midscale chains in Salt Lake City was 69.4% higher than in H1 2019. Though some of this increase can be attributed to local chain expansion, the average number of visits to each individual Upper Midscale location in the area also rose by 12.5% over the same period.

Palm Bay, FL (the Space Coast) – another tourist favorite – is experiencing a similar trend. Between H1 2019 and H1 2024, overall visits to local Upper Midscale hotel chains grew by 36.4% – while the average number of visits per location increased a substantial 16.9%. Given this strong demand, it may come as no surprise that the area is undergoing a hotel construction boom. Upper Midscale hotels in other areas with flourishing tourism sectors, like San Diego, CA and Richmond, VA, are seeing similar trends, with increases in both overall visits and and in the average number of visits per location.

Though Economy chains have underperformed versus other categories in recent years, the tier does feature some bright spots. Some extended-stay brands in the Economy tier – hotels with perks and amenities that cater to the needs of longer-stay travelers – are succeeding despite category headwinds.

Choice Hotels’ portfolio, for example, includes WoodSpring Suites, an Economy chain offering affordable extended-stay accommodations in 35 states. In H1 2024, the chain drew 7.7% more visits than in the first half of 2019 – even as the wider Economy sector continued to languish. InTown Suites, another Economy extended stay chain, saw visits increase by 8.9% over the same period.

And location intelligence shows that the success of these two chains is likely being driven, in part, by their growing appeal to young, well-educated professionals. In H1 2019, households belonging to Spatial.ai: PersonaLive’s “Young Professionals” segment made up 9.6% of WoodSpring Suites’ captured market. But by H1 2024, the share of this group jumped dramatically to 13.3%. At the same time, InTown Suites saw its share of Young Professionals increase from 12.0% to 13.4%.

Whether due to an affinity for prolonged “workcations” (so-called “bleisure” excursions) or an embrace of super-commuting, younger guests have emerged as key drivers of growth for the extended stay segment. And by offering low–cost accommodations that meet the needs of these travelers, Economy chains can continue to grow their share of the pie.

The hospitality industry recovery continues – led by Upper Midscale Hotels, which offer elevated experiences that don’t break the bank. But today’s market has room for other tiers as well. By keeping abreast of local visitation patterns and changing consumer profiles, hotels across chain scales can personalize the visitor experience and drive customer satisfaction.

The past few years have provided the tourism sector with a multitude of headwinds, from pandemic-induced lockdowns to persistent inflation and a rise in extreme weather events. But despite these challenges, people are more excited than ever to travel – more than half of respondents to a recent survey are planning on increasing their travel budgets in the coming months.

And while revenge travel to overseas destinations is still very much alive and well, the often high costs associated with traveling abroad are shaping the way people choose to travel. Domestic travel and tourism are seeing significant growth as more affordable alternatives.

This white paper takes a closer look at two of the most popular domestic tourism destinations in the country – New York City and Los Angeles. Over the past year, both cities have continued to be leading tourism hotspots, offering a wealth of attractions for visitors. What does tourism to these two cities look like in 2024, and what has changed since before the pandemic? How have inflation and rising airfare prices affected the demographics and psychographics of visitors to these major hubs?

Analyzing the distribution of domestic tourists across CBSAs nationwide from May 2023 to April 2024 reveals New York and Los Angeles to be two of the nation’s most popular destinations. (Tourists include overnight visitors staying in a given CBSA for up to 31 days).

The New York-Newark-Jersey City, NY-NJ-PA metro area drew the largest share of domestic tourists of any CBSA during the analyzed period (2.7%), followed closely by the Los Angeles-Long Beach-Anaheim, CA CBSA (2.5%). Other domestic tourism hotspots included Orlando-Kissimmee-Sanford, FL (tied for second place with 2.5% of visitors), Dallas-Fort Worth-Arlington, TX (1.9%), Las Vegas-Henderson-Paradise, NV (1.8%), Miami-Fort Lauderdale-Pompano Beach, FL (1.8%), and Chicago-Naperville, Elgin, IL-IN-WI (1.6%).

The Big Apple. The City That Never Sleeps. Empire City. Whatever it’s called, New York City remains one of the most well-known tourist destinations in the world. And for many Americans, New York is the perfect place for an extended weekend getaway – or for a multi-day excursion to see the sights.

But where do these NYC-bound vacationers come from? Diving into the data on the origin of visitors making medium-length trips to New York City (three to seven nights) reveals that increasingly, these domestic tourists are coming from nearby metro areas.

Between 2018-2019 and 2023-2024, for example, the number of tourists visiting New York City from the Philadelphia metro area increased by 19.2%.

The number of tourists coming from the Boston and Washington, D.C metro areas, and from the New York CBSA itself (New York-Newark-Jersey City, NY-NJ-PA) also increased over the same period.

Meanwhile, further-away CBSAs like San Francisco-Oakland-Berkeley, CA, Atlanta-Sandy Springs-Alpharetta, GA, and Miami-Fort Lauderdale-Pompano Beach, FL fed fewer tourists to NYC in 2023-2024 than they did pre-pandemic. It seems that residents of these more distant metro areas are opting for vacation destinations closer to home to avoid the high costs of air travel.

Diving even deeper into the characteristics of visitors taking medium-length trips to New York City reveals another demographic shift: Tourists staying between three and seven nights in the Big Apple are skewing younger.

Between 2018-2019 and 2023-2024, the share of visitors to New York City from areas with median ages under 30 grew from 2.1% to 4.5%. Meanwhile, the share of visitors from areas with median ages between 31 and 40 increased from 34.3% to 37.7%.

The impact of this trend is already being felt in the Big Apple, with The Broadway League reporting that the average age of audiences to its shows during the 2022- 2023 season was the youngest it had been in 20 seasons.

The shift towards younger tourists can also be seen when examining the psychographic makeup of visitors to popular attractions in New York City. Analyzing the captured markets of major NYC landmarks with data from Spatial.ai’s PersonaLive dataset reveals an increase in households belonging to the “Educated Urbanites” segment between 2018-2019 and 2023-2024.

These well-educated, young singles are increasingly visiting iconic NYC venues such as the Whitney Museum of American Art, The Metropolitan Museum of Art, The American Museum of Natural History, and the Statue of Liberty. This shift highlights the growing popularity of these attractions among young, educated singles, reflecting a broader trend of increased domestic tourism among this demographic.

New York City’s tourism sector is adapting to meet the changing needs of travelers, fueled increasingly by younger visitors who may be unable to take a costly international vacation. How have travel patterns to Los Angeles changed in response to increasing travel costs?

While New York City is the East Coast’s tourism hotspot, Los Angeles takes center stage on the West Coast. And as overseas travel has become increasingly out of reach for Americans with less discretionary income, the share of domestic tourists originating from areas with lower HHIs has risen.

Before the pandemic, 57.6% of visitors to LA came from affluent areas with median household incomes (HHIs) of over $90K/year. But by 2023-2024, this share decreased to 50.7%. Over the same period, the share of visitors from areas with median HHIs between $41K and $60K increased from 9.7% to 12.5%, while the share of visitors from areas with HHIs between $61K and $90K rose from 32.1% to 35.8%.

Diving into the psychographic makeup of visitors to popular Los Angeles attractions – Universal Studios Hollywood, Disneyland California, the Santa Monica Pier, and Griffith Observatory – also reflects the above-mentioned shift in HHI. The captured markets of these attractions had higher shares of middle-income households belonging to the “Family Union” psychographic segment in 2023-2024 than in 2018-2019.

Experian: Mosaic defines this segment as “middle income, middle-aged families living in homes supported by solid blue-collar occupations.” Pre-pandemic, 16.0% of visitors to Universal Studios Hollywood came from trade areas with high shares of “Family Union” households. This number jumped to 18.8% over the past year. A similar trend occurred at Disneyland, Santa Monica Pier, and Griffith Observatory.

And like in New York City, growing numbers of visitors to Los Angeles appear to be coming from nearby areas. Between 2018-2019 and 2023-2024, the share of in-state visitors to major Los Angeles attractions increased substantially – as people likely sought to cut costs by keeping things local.

Pre-pandemic, for example, 68.9% of visitors to Universal Studios Hollywood came from within California – a share that increased to 72.0% over the past year. Similarly, 59.7% of Griffith Observatory visitors in 2018-2019 came from within the state – and by 2023-2024, that number grew to 64.7%.

Even when times are tight, people love to travel – and New York and Los Angeles are two of their favorite destinations. With prices for airfare, hotels, and dining out increasing across the board, younger and more price-conscious households are adapting, choosing to visit nearby cities and enjoy attractions closer to home. And as the tourism industry continues its recovery, understanding emerging visitation trends can help stakeholders meet travelers where they are.