.svg)

.png)

.png)

.png)

.png)

Arrowhead Towne Centre in Glendale, AZ recently opened the newest family fun entertainment center with both a ROUND1 Bowling & Arcade as well as a Spo-Cha. Taking over an erstwhile Mervyn’s, the former includes eight bowling lanes, a variety of favorite games like a claw machine, and two party/karaoke rooms. Upstairs is Spo-Cha, short for Sports Challenge, which is an indoor sports complex where one pays a flat fee for 90 minutes to access activities like riding a mechanical bull, batting cages, a trampoline park, basketball, different sport courts, and billiards.

Spo-Cha is currently in five mall locations in the United States, with plans for more. Overall foot traffic at the malls where it’s currently operational has been positive year-over-year for the month of March.

In addition to the mechanical bull, there is also a Kids Spo-Cha climbing gym and obstacle course.

Source: Spo-Cha

Source: Spo-Cha

At an overall chain level, Round1 Entertainment tends to attract Near Urban Diverse Families and Wealthy Suburban Families the most.

Pandemic restrictions ushered in a new age of remote work that slashed commuting and office-wide coffee orders. But the coffee space has adapted to changing consumer behavior, and category leaders – Starbucks, Dunkin’, and Dutch Bros. Coffee – have found success in the new normal.

With Q1 2024 in the rearview mirror, we took a closer look at how visitation to the coffee space has changed since the pandemic.

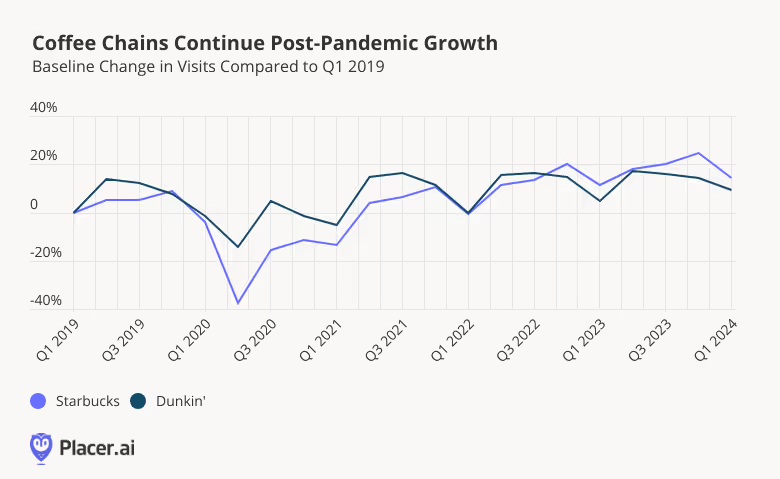

Over the last few years, Starbucks, Dunkin’, and Dutch Bros have expanded their footprints, helping drive visits in a turbulent retail environment. Notably, visits to all three chains have remained above pre-pandemic levels nearly every quarter since Q2 2021, signifying a rapid and robust foot traffic recovery for the space.

Starbucks and Dunkin’ have both implemented expansion plans recently, with Starbucks focusing on smaller-format stores and Dunkin’ going after non-traditional sites such as airports, universities, and travel plazas. The store fleet growth likely contributed to both chains’ visit increases – in Q1 2024, foot traffic to Starbucks and Dunkin’s was up 14.5% and 9.5%, respectively, compared to Q1 2019.

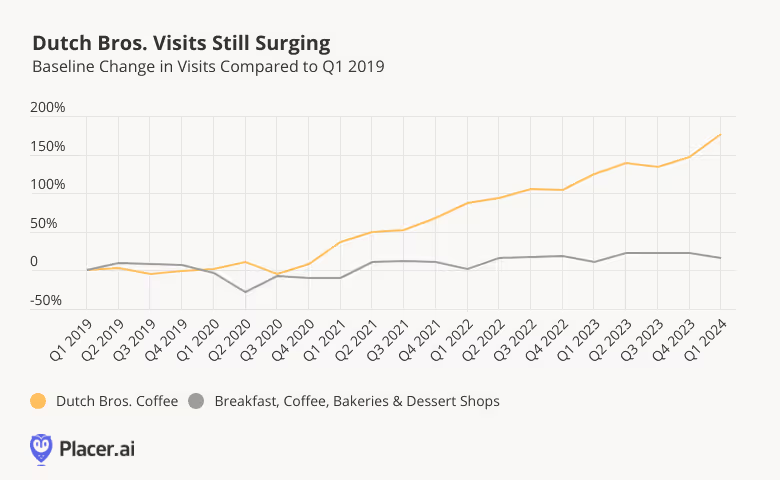

Meanwhile Dutch Bros.’ physical footprint has grown exponentially since 2019, and the chain is now working on developing its digital footprint, including the rollout of mobile ordering.The company’s aggressive expansion contributed to Dutch Bros.’ significantly elevated visits in Q1 2024 – 177.6% above the Q1 2019 baseline. (The chain’s considerably larger year-over-five-year visit increases compared to Starbucks and Dunkin’ can be attributed to Dutch Bros.’ substantially smaller starting footprint, so that every opening brings a larger visit boost to the chain as a whole.)

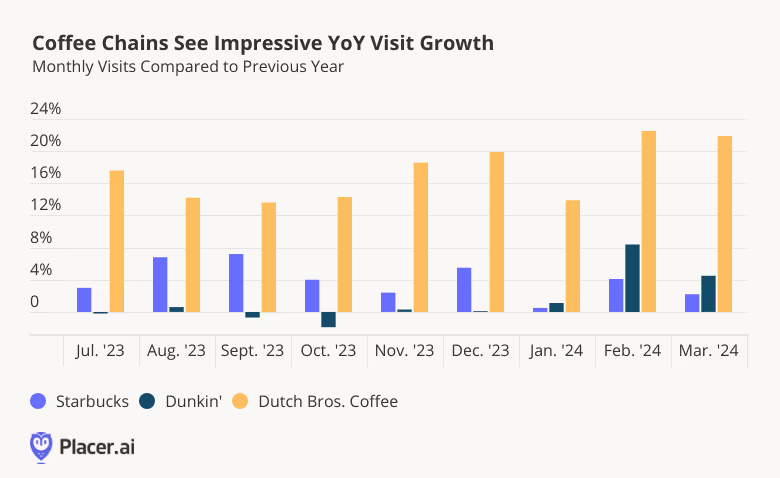

Zooming in on visits since the halfway point of 2023 shows that the coffee space’s post-pandemic momentum continued in recent months, with year-over-year (YoY) monthly visits to all three chains positive since the beginning of 2024.

Dutch Bros.’ ongoing aggressive expansion once again gave the Oregon-based chain the largest year-over-year boost, and Starbucks and Dunkin’ also sustained YoY visit growth nearly every month.

Each Coffee Brand Fills a Different Need

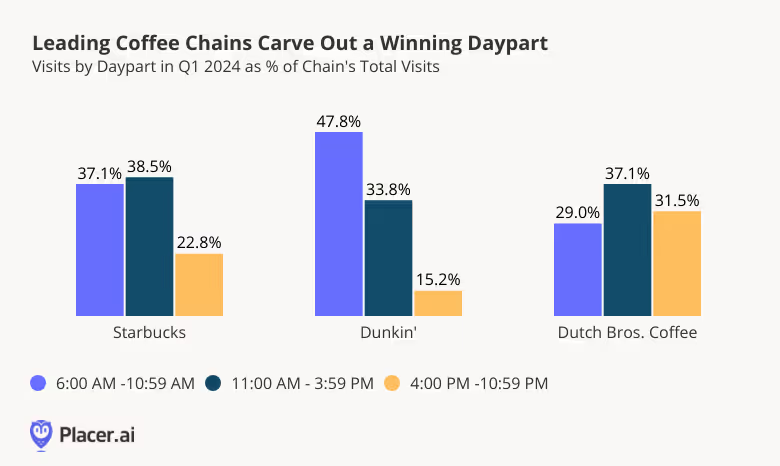

The visit growth for the three coffee leaders analyzed shows that there is enough consumer demand to support across-the-board growth in the space. And analyzing the Q1 2024 hourly visit distribution for Starbucks, Dunkin’, and Dutch Bros. reveals that visits to each chain follow a unique pattern – suggesting that every brand plays a unique role in the wider coffee landscape.

Dunkin’ received almost half (47.8%) of its visits before 11:00 AM, indicating that many guests visit Dunkin’ primarily for coffee or other breakfast fare. Starbucks’s guests tended to visit a little later in the day – with 38.5% of Starbucks visits taking place between 11:00 AM and 3:59 PM – so many consumers may be visiting the Seattle-based chain for a midday pick-me-up. Meanwhile, Dutch Bros. saw the largest share of late afternoon and evening visits (between 4:00 and 10:59 PM) relative to the other two chains – perhaps thanks to the chain’s wide variety of non-caffeinated beverages.

The variance in the hourly visit distribution between the three chains shows that the coffee space is big enough for multiple players and bodes well for the three chains’ performance in 2024.

For more data-driven pick-me-ups, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Amid the economic headwinds that plagued the wider dining industry in 2022 and 2023, the QSR and Fast Casual segments offered price-conscious consumers places to treat themselves to affordable indulgences and grab quick meals on the go.

Many of the major chains in this space – including Burger King, Popeyes, Pizza Hut, Taco Bell, and KFC – are brands owned by Restaurant Brands International (RBI) or Yum! Brands. How are these players faring in 2024?

We dove into the data to find out.

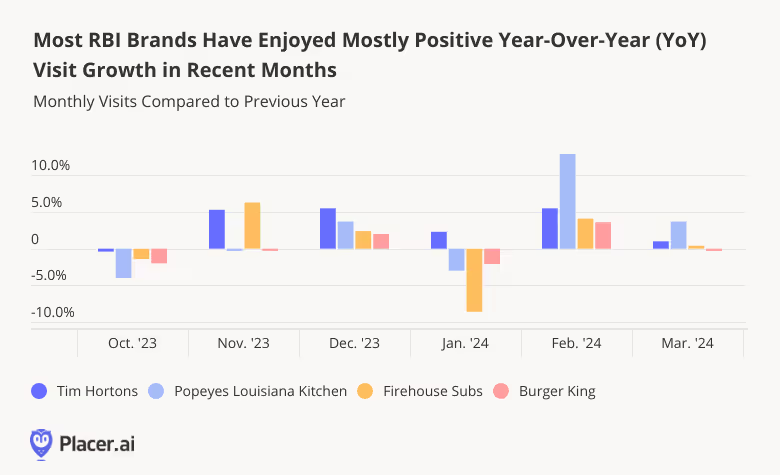

Restaurant Brands International, Inc. owns three leading QSR banners – Burger King, Popeyes Louisiana Kitchen, and Tim Hortons – as well as Fast Casual chain Firehouse Subs. And since December 2023, all four chains have experienced mainly-positive year-over-year monthly (YoY) foot traffic growth – with the stark exception of January 2024, when unusually cold weather caused overall dining visits to dip.

The January Arctic Blast did not impact all RBI brands equally: Coffee favorite Tim Horton managed to maintain positive visit growth throughout the first month of the year, perhaps thanks to the chain’s emphasis on hot drinks. On the other hand, YoY visits to Firehouse Subs dropped 8.8% in January 2024 – so although the traffic picked back up in February and March, the brand still finished out Q1 2024 with a minor YoY quarterly visit gap.

Popeyes, for its part, enjoyed a 4.4% quarterly visit bump in Q1 2024, fueled in part by the chain’s fleet expansion. And though Burger King ended the quarter with just a slight overall quarterly visit increase (0.3%), this is likely a reflection of the chain’s rightsizing efforts: In Q1 2024, the average number of visits to each of the chain’s venues increased by 4.3%.

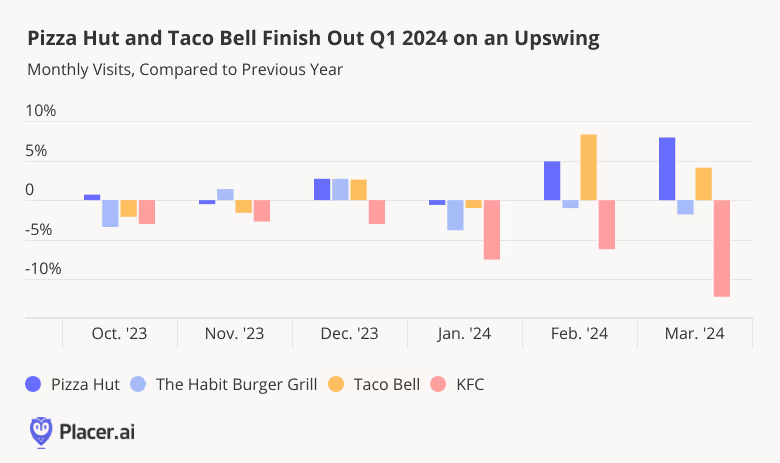

Yum! Brands also owns three major fast food chains – Pizza Hut, Taco Bell, and KFC – in addition to Fast Casual The Habit Burger Grill. And though KFC – which has been focusing on international expansion – maintained a Q1 2024 YoY visit gap, quarterly visits to YUM!’s two biggest QSR banners, Pizza Hut and Taco Bell, were up 4.3% and 3.8%, respectively.

Neither RBI nor YUM! banners are resting on their laurels. Banners at both companies are finding creative ways to drive business, leaning into limited time offers (LTOs) to help customers mark special occasions.

RBI’s Firehouse Subs celebrated leap day – Thursday, February 29th, 2024 – with a special 2-for-1 LTO for customers whose names start with the letters L, E, A, or P. The day of the promotion was the restaurant’s single busiest Thursday between March 2023 and March 2024: Visits were up 21.5% compared to an average Thursday, and about 6.0% compared to an average Friday or Saturday (Firehouse Sub’s two busiest days of the week).

Super Bowl Sunday came this year just two days after National Pizza Day – and YUM!’s Pizza Hut enticed hungry viewers with crowd-pleasing limited time menu offerings. Although many football fans likely ordered their grub online, February 11th, 2024 was still the chain’s busiest day of the past year – with visits up 47.5% compared to a daily average. In the Las Vegas-Henderson-Paradise, NV CBSA, which hosted Super Bowl LVIII, Pizza Hut’s big-day visit spike was an even more impressive 74.1%.

Inflation may have cooled, but food-away-from-home prices remain high – and are likely to continue to increase this year. Against this backdrop, companies like RBI and YUM! that offer hungry consumers affordable ways to fill up and have fun appear poised for success.

Follow Placer.ai for more data-driven dining insights.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

McDonald’s and Chipotle are two of the biggest names in the QSR and fast-casual space, with thousands of restaurants to their names and millions of visitors monthly. With Q1 2024 behind us, how are the two chains performing? And what can visitation patterns to McDonald’s new beverage concept, CosMc, tell us about the new chain?

We dove into the foot traffic data to find out.

Foot traffic to McDonald’s has remained consistently strong over the past year, with the chain generally outperforming the wider Quick-Service Restaurant (QSR) and posting positive visit growth almost every month.

As the chain continues to roll out new concepts, like its Krispy Kreme partnership or revamped menu, visits may keep trending in their positive direction.

McDonald’s isn’t limiting its innovation to in-store partnerships and menu tweaks. The company recently launched its first spin-off restaurant, CosMc's, in December 2023 in the Chicago suburb of Bolingbrook, Illinois, and plans to open at least ten stores by the end of the year. CosMc is named after a lesser-known McDonald's character and aims to compete with beverage and coffee-focused chains while meeting the growing demand for an afternoon pick-me-up.

Comparing the Q1 2024 hourly visit distribution for the first CosMc location with that of nearby (within one mile) McDonald’s, Dunkin', and Starbucks locations reveals significant differences in visitation patterns between the concepts. CosMc received the smallest share of 7:00 to 10:59 AM visits – even less than the nearby McDonald’s – while the nearby Dunkin’ and Starbucks received the largest share of morning visits. But CosMc’s saw the largest share of late afternoon and evening visits – 40.2% of CosMc’s visits were between 4:00 and 7:59 PM, compared to 36.4%, 24.7%, and 18.3% for McDonald’s, Dunkin’, Starbucks, respectively. It seems, then, that CosMc’s is creating its own niche: Instead of competing to provide guests with their morning caffeine fix in the already crowded coffee space, the new brand is using its beverage-forward menu and playful snacks to attract guests with the promise of an afternoon pick-me-up.

Since its launch, CosMc has opened three new locations in Texas and plans to continue rolling out the concept across the country. With a strong reception at its first few locations, CosMc is well-positioned to continue capturing afternoon beverage visits.

Tex-Mex powerhouse Chipotle has also experienced strong foot traffic growth throughout the past twelve months, with the chain outperforming the wider Fast-Casual segment in every month analyzed. Some of the visit increase is likely due to Chipotle’s expansion, and the growth is not likely to slow down any time soon – the company plans to add around 300 new locations in 2024.

With the Fast-Casual segment expected to continue growing in the coming year – and with Chipotle’s record of staying ahead of the curve – the fast casual leader is well-positioned to continue driving visits to its restaurants.

Despite industry challenges, McDonald's and Chipotle continue to drive visits and innovate in the QSR and fast-casual dining spaces, and CosMc's is making progress in the competitive QSR beverage space.

Will these dining destinations continue on their upward streaks?

To keep up with these and other data-driven dining insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

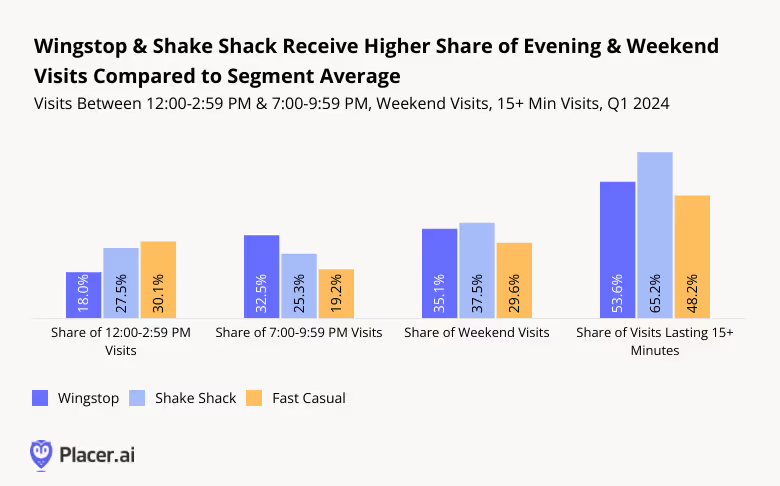

Wingstop and Shake Shack are on a roll. We dove into recent location intelligence data to understand what is driving success at these two dining leaders.

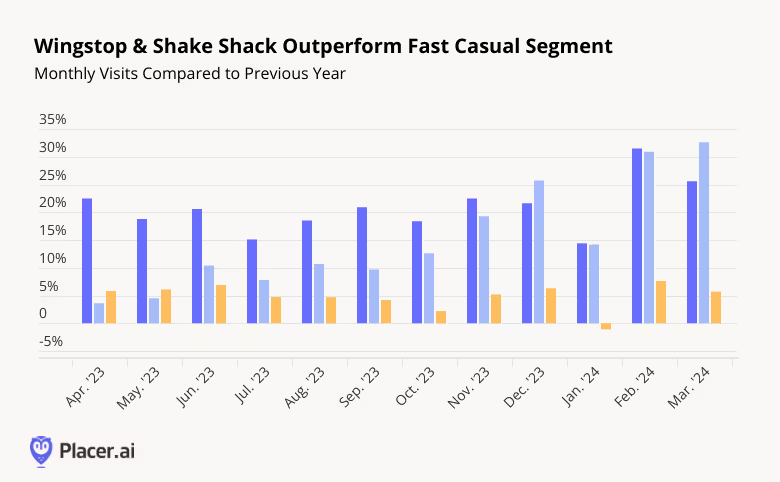

Texas-based Wingstop and New York-based Shake Shack are growing fast. Over the past twelve months, both chains outperformed the fast casual segment and posted impressive traffic increases – in March 2024, visits to Wingstop and Shake Shack were up 25.6% and 32.6%, respectively, compared to March 2023.

Some of the visit strength is likely driven by the chains’ recent expansion. Last year, Wingstop opened around 200 of its almost 2000 U.S. locations, while Shake Shack opened around 40 new restaurants domestically for a total of more than 300 locations in December 2023.

A rapidly expanding footprint is not the only factor driving success for these fast casual leaders. Location intelligence suggests that both chains attract visitors looking for a more leisurely dining experience, which could be helping Wingstop and Shake Shack stay ahead of the competition.

Compared to the average fast-casual dining venue, Wingstop and Shake Shack receive fewer visits during the lunch rush (12:00 to 2:59 PM) when diners are looking for a quick bite to eat before returning to work. Instead, the two chains attract a larger share of visits in the evening hours (between 7:00 and 9:59 PM) – when guests tend to have more time to savor their meals. Both chains also receive a relatively sizable portion of their visits on weekends, when patrons have more time to linger on premises.

And the data indicates that Shake Shack and Wingstop visitors do indeed linger longer than the average fast casual patron: Over half of visits to Wingstop and almost two-thirds of Shake Shack visits last longer than 15 minutes, compared to just 48.2% of visits lasting 15+ minutes for the wider fast casual segment.

It seems, then, that consumers are not just visiting Shake Shack or Wingstop for a burger and shake combo or a platter of steaming wings. The data suggests that many guests are also visiting these chains during more leisurely times when they can focus on the dining experience and take in the chains’ atmosphere.

As the companies continue to expand into new markets and deepen their reach in existing ones, the willingness of consumers to dedicate evenings and weekends to eating at Shake Shack and Wingstop bodes well for these chains in 2024 – and beyond.

For more data-driven dining insights, visit placer.ai/blog.

We recently looked at where the home improvement retail category stood after 1Q 2024, noting that industry had seen improved visit trends and that we could see continued momentum in the second half of 2024 as housing turnover picks up. As a follow up to that analysis, we thought we’d examine a wider range of retailers in the home improvement retail category. Below, we’ve presented year-over-year visitation trends for the top retailers in the home improvement category in terms of visits. While Home Depot and Lowe’s are down on a year-over-year basis, we see that a number of smaller box chains like Harbor Freight and Ace Hardware are seeing year-over-year visits (Large-box Menards has also been relatively strong).

The trend of smaller box home improvement retailers outperforming has actually been going on for a while. Below, we show share visit data from 2017-2023 for the largest home improvement retailers. Here we also see big gains from Ace Hardware and Harbor Freight

What explains these trends? We believe a lot of it boils down to store expansion and migration trends. Both chains have been growing. We discussed Ace Hardware’s unit growth plans back in November 2022, with the chain reaching 5,800 stores globally (and more than 4,700 in the U.S.) after opening 160 locations in 2022 and 170 in 2023. We’ve also called out Harbor Freight’s recent growth–it was one of the reasons we named it to our Top 10 Brands to watch list this year–and the chain now operates almost 1,500 locations across the U.S. Below, using Placer’s new Map Studio feature to plot Harbor Freight and Ace Hardware locations nationwide. We see a heavy concentration of stores in the Eastern U.S. for both chains.

We’ve also presented a map from Placer’s Migration Report below showing population percentage growth from January 2020 to January 2024 at the market level. Green dots represent markers that have seen permanent population growth, while red represents markets that have seen population declines.

Examining the two maps together sheds some light on the success of Harbor Freight and Ace Hardware–they have a high degree of overlap with some of the highest growth markets in the U.S. We’ve covered the migration of consumers to these markets in the past, including markets have populations smaller than 500,000 people and often under 200,000 individuals. Here, having a smaller format box is an advantage for chains like Harbor Freight and Ace Hardware. Home Depot and Lowe’s both average more than 100,000 square feet per store, which can be difficult to justify in a smaller population market. However, the average Harbor Freight store is 15,000-16,500 square feet and the average Ace Hardware is 10,000 square feet (although ranging between 3,000 and 30,000 square feet). This has allowed both chains to tap smaller markets where much of the population (and household income) has transferred to.

Not surprising, we’ve seen a flood of announcements about retail chains planning to adopt smaller store formats over the past few months. We’ve previously discussed examples across a number of retail categories, including home furnishing (Arhaus and Ethan Allen) and department stores (Bloomie’s), but there has been a notable uptick in announcements from retailers unveiling smaller format stores, including Best Buy, Macy’s, and Whole Foods. Lowe’s has recognized this trend, announcing plans to more aggressively open stores in rural markets.

At a time when it’s more expensive for retailers to operate physical stores due to higher interest rates, higher rent costs (especially among A malls properties), minimum wage increases and labor scarcity, retailers are looking for any way they can to maximize the returns on their store properties, including retail media networks, store-in-store partnerships, and co-branded stores. However, in addition to generating more revenue from ancillary services like advertising or store-in-store partnerships, it’s clear that utilizing a smaller box to address population migration trends has become an increasingly attractive option

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.