.svg)

.png)

.png)

.png)

.png)

The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from some 1,000 office buildings across the country. It only includes commercial office buildings, and commercial office buildings with retail offerings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

Recent survey data shows that while most people don’t want to go back to the office five days a week, they also don’t want to be fully remote. Many employees – and companies – prefer a middle-of-the-road approach that balances flexibility with opportunities for in-person engagement, learning, and collaboration.

But what’s happening on the ground? We checked in with our Nationwide and regional Office Indexes to find out.

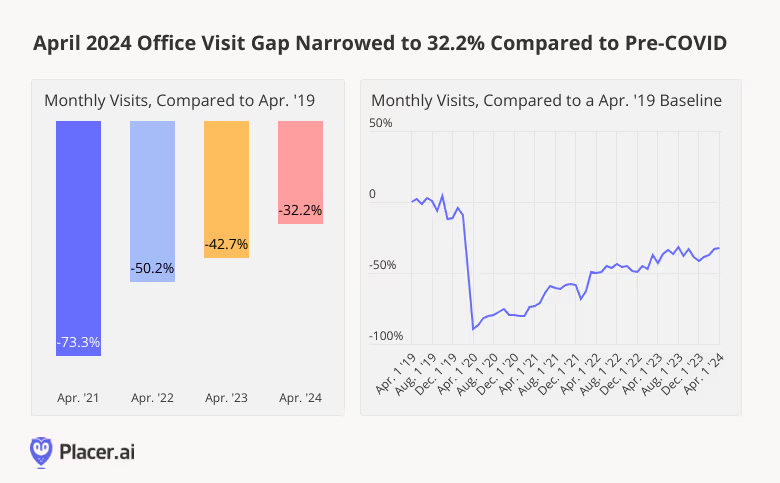

Last month saw a continuation of the positive office recovery momentum observed in February and March 2024. April 2024 office visits were just 32.2% below what they were in the equivalent period of 2019 (pre-pandemic), and nearly the highest they’ve been since COVID. Comparing monthly visits to an April 2019 baseline also shows that April 2024 was outperformed only by August 2023 – a rare month featuring 23 business days. (April 2024 had 22 business days – as did April 2019).

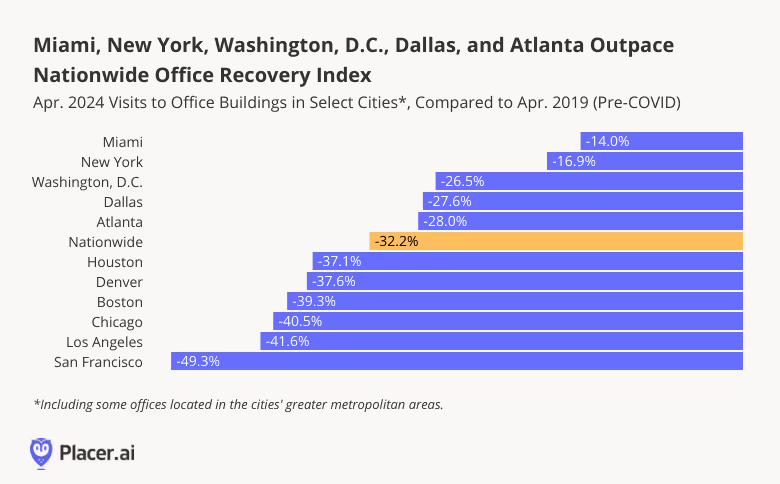

Drilling down into the data for major regional hubs shows Miami and New York solidifying their office recovery leads with respective pre-COVID visit gaps of just 14.0% and 16.9%. But these weren’t the only cities to shine: Washington, D.C., Dallas, and Atlanta also outperformed the nationwide baseline – and like Miami, experienced their single busiest in-office months since COVID.

All the analyzed regional hubs saw significant YoY office visit growth – with the prize once again going to San Francisco, where visits were up 26.0%. Though San Francisco still lags significantly behind other regional hubs compared to pre-COVID, the city’s persistent YoY office visit growth may signal a light at the end of the Golden Gate City’s commercial real estate tunnel.

To be fair, April 2023 had two less business days than April 2024 – a fact that may have served to amplify YoY growth trends across the board. But even accounting for this discrepancy, last month’s strong office recovery was a particularly strong one – showing that RTO remains very much a work in progress.

The benefits and drawbacks of remote work are still being debated. But no matter how you slice it, spending some time in the office each week seems to have its benefits. As companies and employees continue to negotiate the new hybrid status quo, office visit patterns will continue to shift nationwide.

Follow Placer.ai for more data-driven office insights.

We dove into the latest foot traffic analytics for leading movie theater chains – AMC Theatres, Regal Cinemas, and Cinemark – to uncover how recent consumer behavior and visitor demographics are setting the stage for the cinema category’s next chapter.

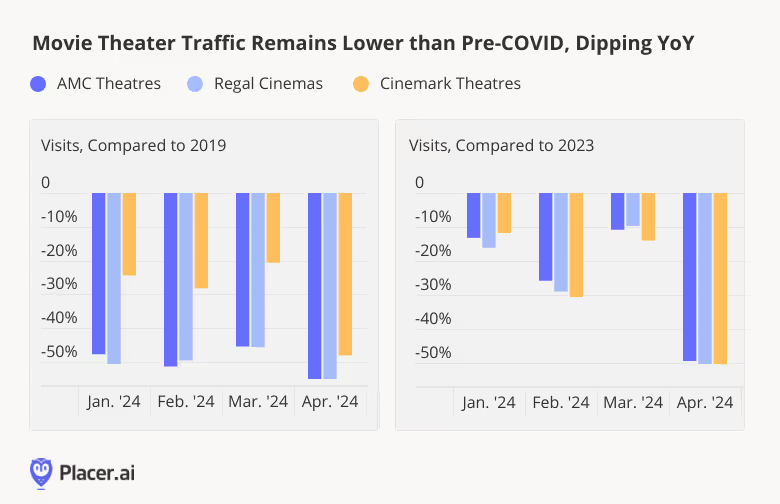

Cinemas have yet to reclaim their pre-COVID glory – and during the first few months of 2024, visits to AMC and Regal, and to a lesser extent Cinemark, remained substantially below 2019 levels. While some of these visit gaps can be attributed to exhibitors downsizing their real estate portfolios, the rise in at-home entertainment continues to impact pre-pandemic foot traffic comparisons.

In addition, since the pandemic, blockbuster releases have taken on even greater importance as drivers of movie theater visit spikes. And in early 2024, a relative absence of new blockbusters took its toll on theater operators’ performance. Between January and April 2024, cinema leaders saw YoY visit dips – likely attributable in part to delayed releases. And smash-hit titles that drove box-office success in early 2023 – including Avatar: The Way of Water, Ant Man, and The Super Mario Bros. Movie – helped set the stage for challenging YoY comparisons.

Despite these visit gaps, analysis of changing visitor demographics suggests that there remain a variety of ways for theater operators to succeed.

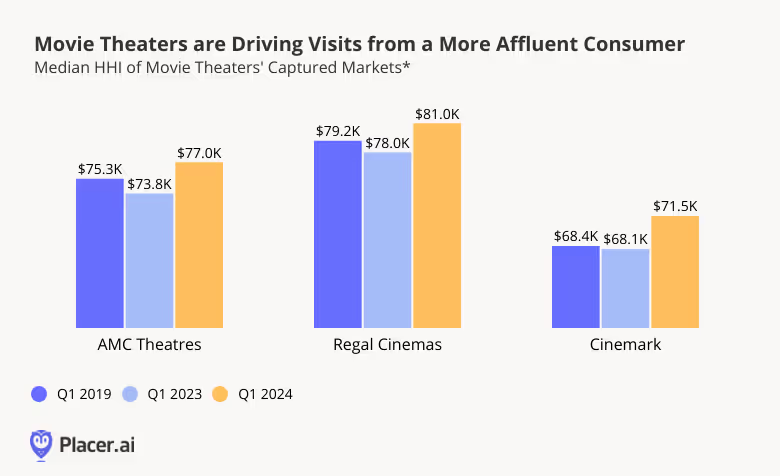

Analyzing cinema leaders’ captured markets with demographics from STI: PopStats shows that today’s movie-goers are more affluent than they were before COVID. After dipping in Q1 2023, the median household incomes (HHIs) of AMC, Regal Cinema, and Cinemark’s captured markets spiked in Q1 2024, surpassing the chains’ own pre-pandemic benchmarks. This shift may be due in part to discretionary spending cutbacks by less affluent consumers – who may be particularly inclined to hold off on going to the movies when there are no big releases on offer.

For exhibitors, the increase in visitors’ spending power presents an important opportunity: Affluent movie-goers are likely to spend more on revenue-boosting concessions and premium formats, a boon for theater chains at a time when visit gaps linger.

Five years after COVID sent movie theaters into a tailspin, the category is holding its own. Though routine visits remain lower than they were before the pandemic, a shifting customer base continues to provide operators with new avenues for success.

For more data-driven entertainment insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

The fitness industry has experienced steady growth in recent years, propelled by consumers’ prioritization of health and wellness – and gyms across the country are benefiting.

So with 2024 underway, we dove into the data to examine the segment’s performance during the first months of the year. Did Fitness’ strong January showing persist beyond the season of new year’s resolutions? And how did major gym chains – including Planet Fitness, Life Time, Crunch Fitness, and EōS – perform in Q1 2024 relative to last year?

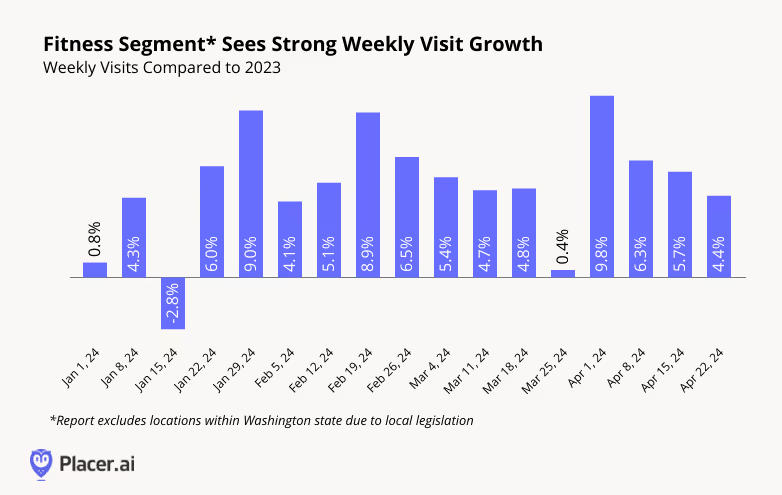

Fitness has been a consistent success story over the past few years, and the category is showing no signs of slowing down. Year-over-year (YoY) visits to the industry were up nearly every week between January and April 2024, with the sole exception of the week of January 15th, when an Arctic blast saw many people hunkering down indoors. And visits remained slightly elevated even during the week of March 25th, when Easter celebrations likely distracted many people from their gym goals – an impressive feat given the comparison to a non-holiday week in 2023.

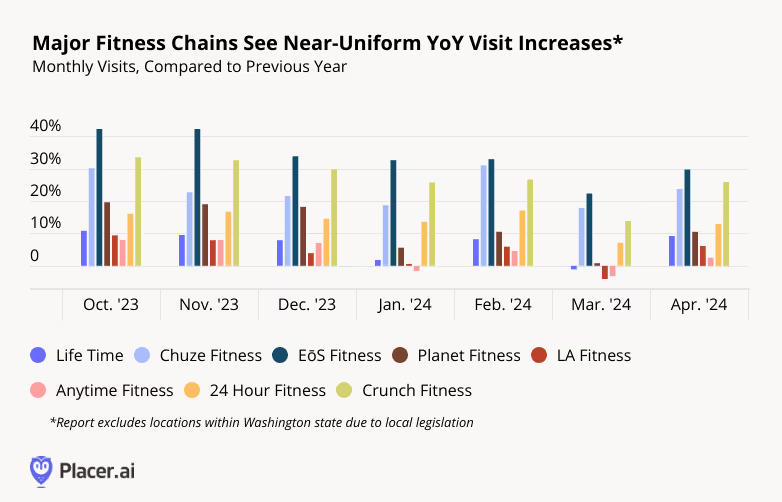

Drilling down into visit trends for eight major fitness chains shows that in today’s robust fitness environment, there’s enough demand to sustain a variety of chains: Both premium and mid-range options like Life Time and LA Fitness as well as more affordable choices like Planet Fitness and Crunch Fitness saw visits increase or remain steady for most of Q1 – and all saw YoY visit bumps in April.

Some gym-goers hit the gym several times a week and spend hours working out, while others have a more relaxed get-in-shape schedule. And analyzing leading chains’ visitation patterns shows that gyms are finding success by catering to fitness buffs’ varying preferences.

Perhaps unsurprisingly, the data reveals a strong correlation between a chain’s share of frequent visitors (i.e. those visiting the gym eight or more times in a month), and a chain’s share of visitors staying longer than 90 minutes. While some clubs, including Life Time and EōS appear to attract highly dedicated gym-goers, others, including Planet Fitness and Anytime Fitness, seem to draw more casual visitors.

The fact that both fitness chains attracting frequent visitors for longer workouts and gyms that cater to more casual exercisers who spend less time in the gym during each session are seeing positive visitation trends indicates that there are plenty of models for fitness success in 2024.

One thing seems clear – interest in gyms is not going away anytime soon. Visits continue to show YoY growth, and the industry is full of options for every kind of fitness enthusiast. Whether opting for occasional visits or adhering to a structured workout regimen – there’s something for everyone.

To stay ahead of the latest retail and fitness developments, visit placer.ai/blog.

Following a busy week of Q1 2024 updates several restaurant chains, the key question facing operators is whether menu price increases the past several years have forced consumers into alternative food retail channels. Several restaurant chains--most notably McDonald’s–highlighted a more “discriminating” consumer during their quarterly updates. According McDonald’s CEO Chris Kempczinski on the company’s Q1 2024 update this week: “U.S. consumers continued to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending which is putting pressure on the QSR industry.” In turn, this has resulted in flat-to-declining industry traffic in the U.S. during the quarter. Looking at year-to-date visitation trends across the different restaurant categories, we see a weak start to the year due to inclement weather, followed by a rebound to low-single-digit growth for the limited-service categories (QSR and fast casual) and low-single-digit declines for the full-service restaurant chains.

As we discuss throughout this week’s Anchor report, consumers will likely remain discriminating over the next several quarters. As such, we expect a continuation of the channel shifts we’ve been witnessing across the broader food retail sector. According to our data, the QSR category saw a +5% increase in visits from 2019-2023, while the full-service restaurant category saw a -8% decrease in visits (partly explained by the permanent closure of many smaller, regional full-service dining chains). Conversely, the grocery, superstore, convenience store, and dollar/discount stores have all seen meaningfully higher visit growth over the same period (as our friends at Restaurant Business have also called out), indicating these channels are taking share from the restaurant industry.

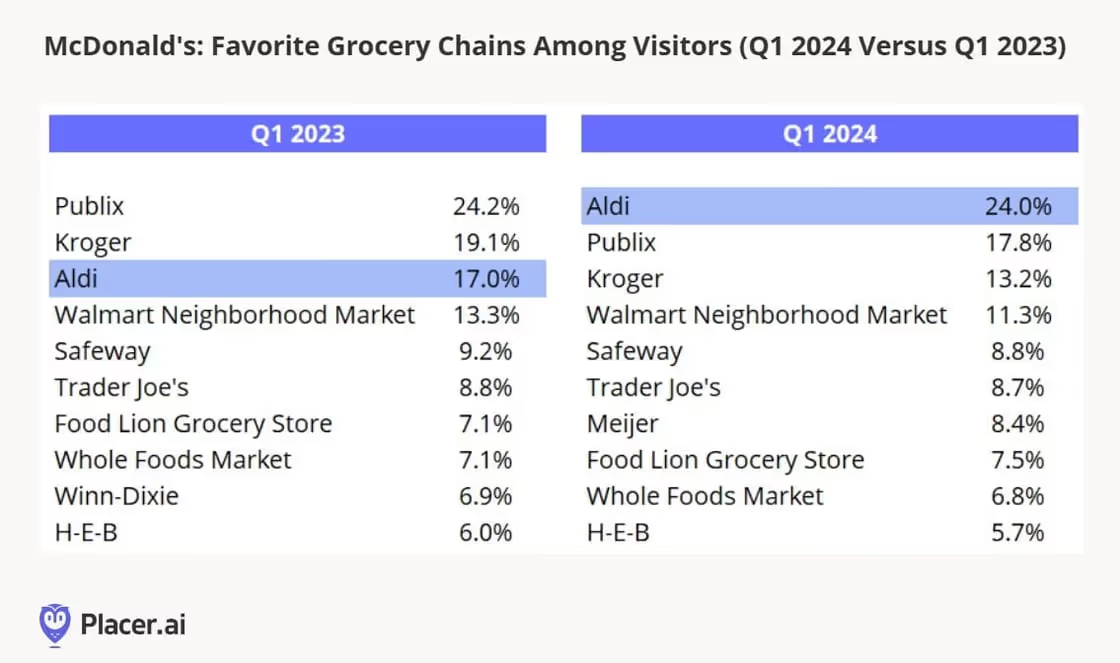

Looking at McDonald’s cross-visitation trends during the quarter, we see further evidence of this shift. We’ve compared the favorite grocery chains of McDonald’s visitors in Q1 2024 to Q1 2023 below. We see a material increase in the percentage of McDonald’s visitors that visited an Aldi location year-over-year–24% versus 17% in the year ago period. We also see a decrease in percentage of visits to most conventional grocery chains.

Not surprisingly, McDonald’s plans to accentuate its value offerings in the coming quarters. On its update call, management noted that 90% of its U.S. locations offer meal bundles for $4 or less and that it has been running several promotions through its digital app. The company also noted the need to align around a strong national value proposition so that the company can use its tremendous media scale to drive high consumer awareness. It will likely take time for McDonald’s to organize around its value platform, but once it does start to promote its value offerings on a nationwide basis, we would expect much of the rest of the QSR category to follow suit.

This weekend, Formula 1 is once again ready to take the track in the United States, this time at the Miami Grand Prix on Sunday. The Miami Grand Prix is the first U.S. race in the 2024 calendar, followed by the U.S. Grand Prix in Austin, Texas and the Las Vegas Grand Prix in the fall.

America has grown into the new epicenter of the sport and is the only country besides Italy to host multiple races in a singular season. Not only does the U.S. host races, but countless American retail, tech, CPG and hospitality brands serve as team sponsors, including Marriott, Rokt, Tommy Hilfiger, Google, eBay, Coca Cola and more. For brands looking at the consumption habits of younger, more affluent consumers, the rise of Formula 1 in the U.S. can help unlock insights on this group. Credit for Formula 1’s exponential growth in popularity is largely due to the Netflix docuseries, Drive to Survive, which just released its sixth season in the first quarter of 2024. According to Netflix, over 90 million hours of the program were watched throughout the first half of last year. The immense popularity of the show and its behind the scenes access to the luxurious world of F1 generated a large demand for the sport by Americans, and the appetite for home grown F1 races where U.S. based fans can participate is palpable.

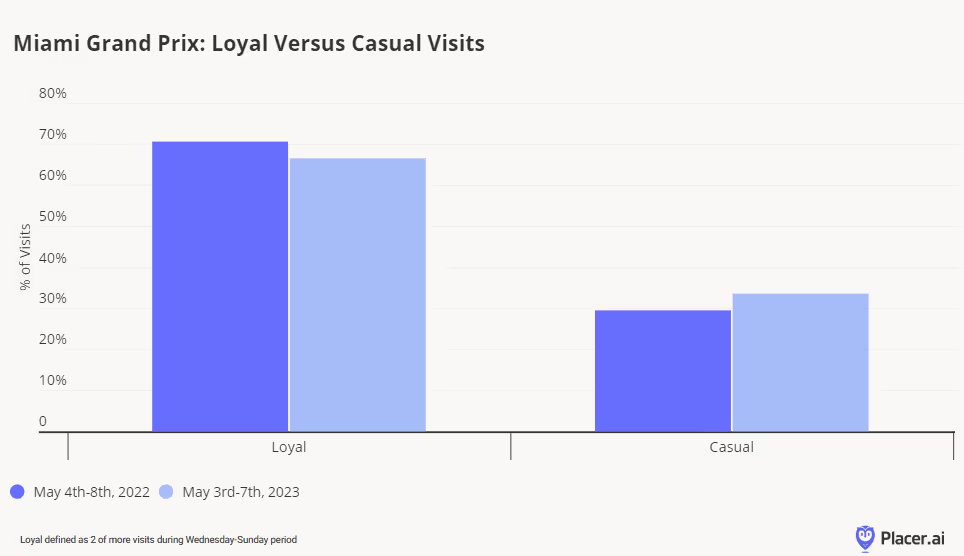

2024 is the third running of the Miami Grand Prix, held around Hard Rock Stadium, with the event debuting in 2022. According to Placer.ai data, traffic at the event, which usually runs Thursday-Sunday, in 2023 increased 3% compared to 2022. Usually during grand prix weekends, visitors have the option to purchase single or multi-day passes, and our data (as shown below) indicates that there were fewer repeat visits in 2023 compared to 2022; consumers may have chosen single day passes more often or made the event a part of a larger weekend in Miami. The highest number of visits occurred on Sunday each year, which aligns with the fact that the actual race takes place that day, with practice sessions and qualifying taking place on Friday and Saturday respectively.

Despite slightly fewer loyal visits during the weekend, the time spent at the event increased, with an average of 179 minutes, up 4% year-over-year. With consumers spending around three hours at the venue, there is a huge opportunity for American CPG and retail companies to engage with this captive audience.

The U.S. Grand Prix, held annually in Austin, has seen similar success from the influx of American F1 fans. Traffic at the 2023 event weekend grew by 38% compared to 2019. 2022 saw peak event attendance, most likely due to a competitive and exhilarating end to the 2021 season that bled into the next year. 2023 also saw the highest percentage of three-day visits during the weekend, highlighting that most U.S. Grand Prix attendees visit the track multiple days for the various race weekend events.

While the growth of the event itself is impressive, the change in visitor demographics provides an even more striking opportunity for American retailers and brands. 2023 brought the highest percentage of visits from young professionals and young urban singles compared to all other segments in 2023. Young professionals also grew to 36% of visits in 2023 from less than 30% in 2019, showcasing the rise in younger and more affluent visitors. Both the popularity of Netflix coupled with the increase in influencer marketing brand trips to races may both have contributed to this shift over time.

It’s clear that Formula 1’s growing popularity has no doubt fueled race expansion stateside and that has been able to capture the attention of the elusive younger consumer, especially those with disposable income. Brands, licensees and retailers have all jumped on the opportunity to collaborate with drivers, teams and race weekends to tap into this growth market. Sporting events are a highly competitive landscape, excuse the pun, but the intersection of sports and content have paved the way for Formula 1’s success in the U.S.

Last week, Chipotle’s Q1 2024 update featured a number of positives, including visitation trends that outperformed the broader restaurant category and strong contribution from new store openings. More than 5% of the company’s 7% comparable sales growth during the quarter was driven by transaction growth, and year-over-year visitation trends have accelerated thus far in April. (Recall that our year-over-year visitation data includes contribution from stores opened during the past year as well as improvements in visits per location).

Impressively, there were multiple sources driving Chipotle’s transaction growth during the quarter. The company’s strong track record for menu innovation under CEO Brian Niccol continued during the most recent quarter, with the company spotlighting Barbacoa and the return of Chicken Al Pastor as a limited time offer. Management will continue to explore new menu additions, and is currently developing a new product pipeline for the next 18-24 months.

While menu innovation is important, it’s clear that throughput (the amount of customers that can be served with Chipotle’s assembly line process) is becoming a major factor in visitation traffic outperformance. We believe this has been driven by lower employee turnover rates—the company noted that it is experiencing the lowest turnover rates since Niccol joined the company in March 2018. According to management, throughput reached the highest levels in four years because of more consistent staffing, which aligns with our visit per location data for the past five years (below).

Chipotle noted that its throughput improved by nearly 2 entrees in its peak 15 minutes compared to last year with each month showing an acceleration. According to the company, “the restaurants run more smoothly as our teams are properly trained and deployed, which allows them to keep up with demand without stress. This leads to more stability and therefore more experienced teams that execute better every day, and this can be seen in our latest turnover data which is at historically low levels.” Our data also shows that visitation trends are improving during its peak hours, but that its peak hours are also changing. Historically, the hours between 12:00 PM-2:00 PM have represented Chipotle’s most frequently visited hours, but post-pandemic, we’ve seen visits shift to the 6:00 PM-8:00 PM timeframe (below). Return-to-office trends partly explain these trends, as do Chipotle’s push into smaller, more suburban/rural markets.

When we look at visit per location trends by hour, we see that most of the improvement during the Q1 2024 compared to Q1 2023 took place during the later afternoon and evening dayparts.

Looking ahead, Chipotle sees an opportunity to improve peak hour throughput, including adjusting the cadence of digital orders to better balance the deployment of labor (thus eliminating the need to pull a crew member from the front makeline to help the digital makeline during peak periods). The company also plans to bring back a coaching tool for its associates that it had in place prior to the pandemic. With more and more retailers embracing generative AI to help educate and train their employees-–a trend we heard consistently at this week’s Analytics Unite conference–we would expect Chipotle to also adopt generative AI with its updated coaching tool, potentially unlocking greater throughput improvements in the process.

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.