.svg)

.png)

.png)

.png)

.png)

About the Mall Index: The Index analyzes data from 100 top-tier indoor malls, 100 open-air shopping centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the country.

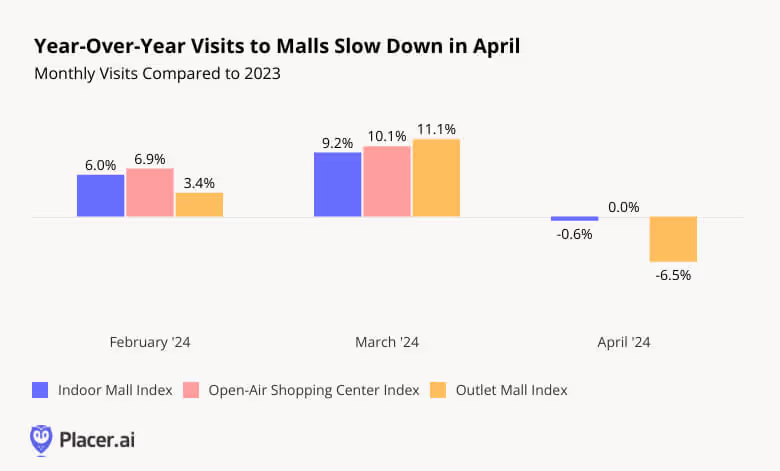

In April 2024, YoY mall visits slowed following two months of positive visit growth. For Indoor Malls, the decline was marginal – and Open-Air Shopping Centers saw visits remain on par with last year’s levels. But Outlet Malls saw a significant drop of 6.5% in visits.

Although at first glance this slowdown may suggest a resurgence of the retail challenges that plagued much of 2022 and 2023, a deeper dive into weekly visit trends paints a much rosier picture.

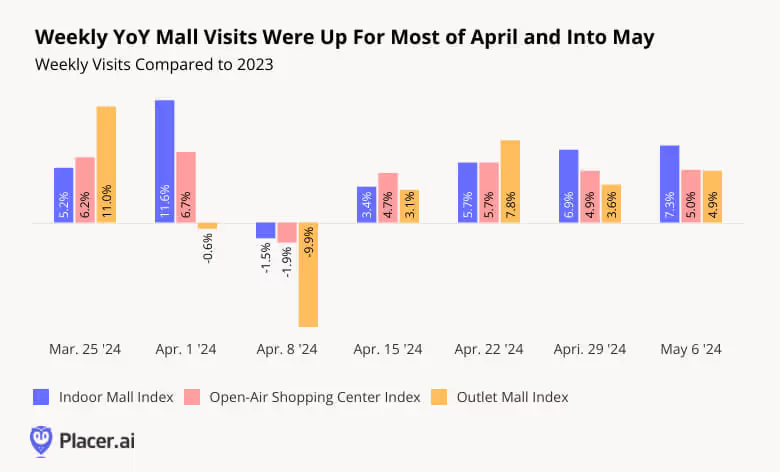

Indoor Malls and Open-Air Shopping Centers experienced robust YoY visit increases every week of April 2024 and into May, with the sole exception of the week of April 8th. This isolated drop appears to be due to a calendar discrepancy: In 2023, Easter fell on April 9th, while in 2024, the holiday fell on March 31st. So the week of April 8th, 2024 is being compared to the week immediately after the holiday (including Easter Monday) when malls likely experienced heightened activity due to gift returns and pent-up demand following holiday store closures. Though Easter Monday isn’t an official holiday in the U.S., many people likely take the day off – giving them more time to hit the stores.

Outlet Malls, which saw a steeper decline during the week of April 8th, appear to have been particularly impacted by the Easter calendar difference – shoppers may be especially likely to make the trek to an outlet mall on a holiday weekend, or on Easter Monday. But Outlet Malls also saw their positive momentum quickly recover.

The continued rise in weekly YoY mall visits signals continued retail strength into the spring of 2024.

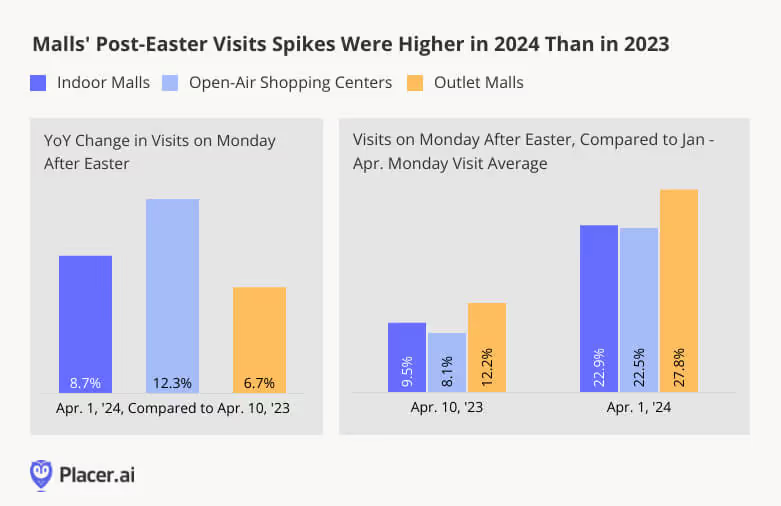

Holiday retail foot traffic is typically characterized by two main spikes: a pre-holiday visit spike evident in the days preceding the holiday, and a post-holiday uptick driven largely by gift returns and pent-up demand after stores reopen. The Monday after Easter follows this pattern – and comparing this year’s post-Easter visit spike to the one observed in 2023 provides further evidence of the category’s resilience.

On Monday, April 1st, 2024 – the day after Easter – Indoor Malls, Open-Air Shopping Centers, and Outlet Malls all drew significantly more visits than on an average Monday. And this year’s post-Easter visit spikes – ranging from 22.5% to 27.8% – were even more impressive than last year’s. Outlet Malls, which may be more likely to draw visitors on the day after Easter, saw the biggest post-Easter visit spikes.

All three mall types also saw more absolute visits this year on the day after Easter than they did in 2023 – with April 1st, 2024 foot traffic to Indoor Malls, Open-Air Shopping Centers, and Outlet Malls up 8.7%, 12.3%, and 6.7%, respectively, compared to April 10th, 2023.

Weekly YoY visit data and post-Easter foot traffic trends show that malls remain on an upward trajectory. As inflation continues to ease, malls may regain some leverage and can potentially attract crowds more readily than they did in 2023.

For more data-driven retail insights, visit our blog at placer.ai.

.avif)

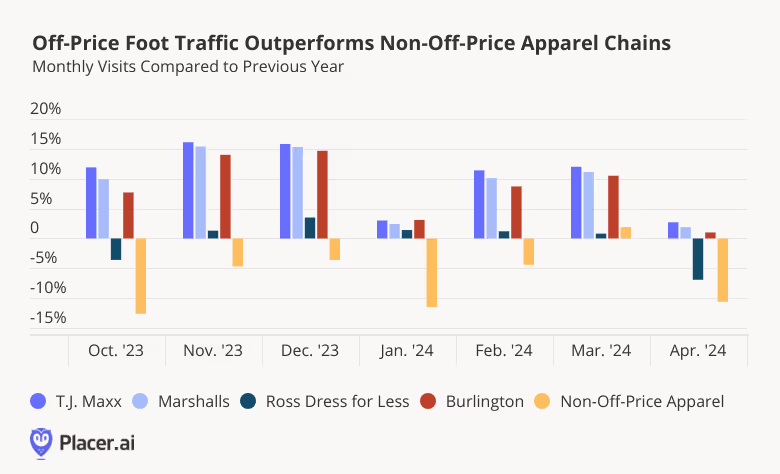

Off-price apparel chains continue to drive traffic in 2024. We dove into the latest location analytics for four of the largest brands – T.J. Maxx, Marshalls, Ross Dress for Less, and Burlington – to take a closer look at these retailers’ foot traffic growth and evolving visitor bases.

The off-price sector started off 2024 strong, with the four off-price leaders – T.J. Maxx, Marshalls (both owned by TJX Companies), Ross Dress for Less, and Burlington – consistently outperforming the wider non-off-price apparel segment. YoY visits to the four brands were also mostly positive for the period analyzed, in part thanks to the companies’ ongoing expansions.

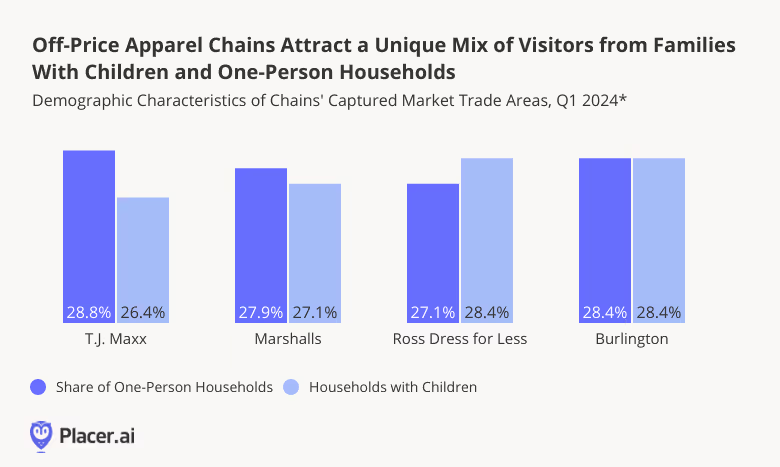

Diving into the demographic composition of the four chains’ trade areas reveals that there are many formulas for success in the off-price space. And while some companies have found success by attracting families looking to stretch their budgets, others are growing their visits by drawing singles looking to stock up on the latest styles without breaking the bank.

T.J. Maxx and Marshalls – where YoY Q1 2024 visits grew 8.9% and 7.9%, respectively – both have relatively large shares of one-person households in their trade areas. Members of these one-person households are typically younger – often belonging to the coveted Gen-Z demographic – and TJX C.E.O. Ernie Herrman has emphasized the company’s success among this audience segment as an important growth driver.

Meanwhile, the 1.1% YoY increase in overall visits for Ross Dress for Less in Q1 2024 seems driven by the chain’s popularity among families – 28.4% of the chain’s captured market consists of households with children. And Burlington achieved its Q1 7.6% YoY visit growth by appealing to both demographics.

It seems, then, that each off-price leader has found a different formula for success by catering to a unique demographic mix.

Over the last several months, off-price apparel chains have outperformed traditional apparel retailers in YoY visits as they expand their real estate footprints. Taking on new territory, off-price retailers drive visits from a unique mix of households with children and singles.

For more data-driven retail insights, visit Placer.ai.

As visits to Superstores continue to rise, we analyzed recent foot traffic data for Walmart, Target, Costco Wholesale, Sam’s Club, and BJ’s Wholesale Club and dove into Walmart’s Q1 2024 regional performance.

Wholesale chains – which receive about 20% of all visits to Walmart, Target, Costco Wholesale, Sam’s Club (owned by Walmart), and BJ’s Wholesale Club – generally outperformed classic superstore banners Target and Walmart during the first four months of the year. Visits to all three wholesale clubs analyzed were up every month on a year-over-year (YoY) basis, with Costco maintaining its lead in the space. Some of the success of wholesale clubs may be due to the makeup of their visitor base – Costco, Sam’s Club, and BJ’s tend to serve a large share of consumers from family households, and these may be opting for more buying in bulk in an effort to stretch budgets.

But visits to more classic superstores are also heating up – following a muted performance in January, when an arctic blast kept many at home, foot traffic to Target grew YoY in February, March, and April.

Walmart also experienced visit growth for most of the period, despite the slight dip in April due to calendar shifts: Visits for the superstore giant dropped 8.5% in YoY for the week of April 1st - 8th 2024 compared to the traffic surges of Easter week 2023 (April 3rd - 9th 2023), impacting the overall monthly numbers, but visits returned to growth during the last two weeks of April (4.3% and 4.0% YoY, respectively, for the weeks of April 15th - 21st and 22nd -28th).

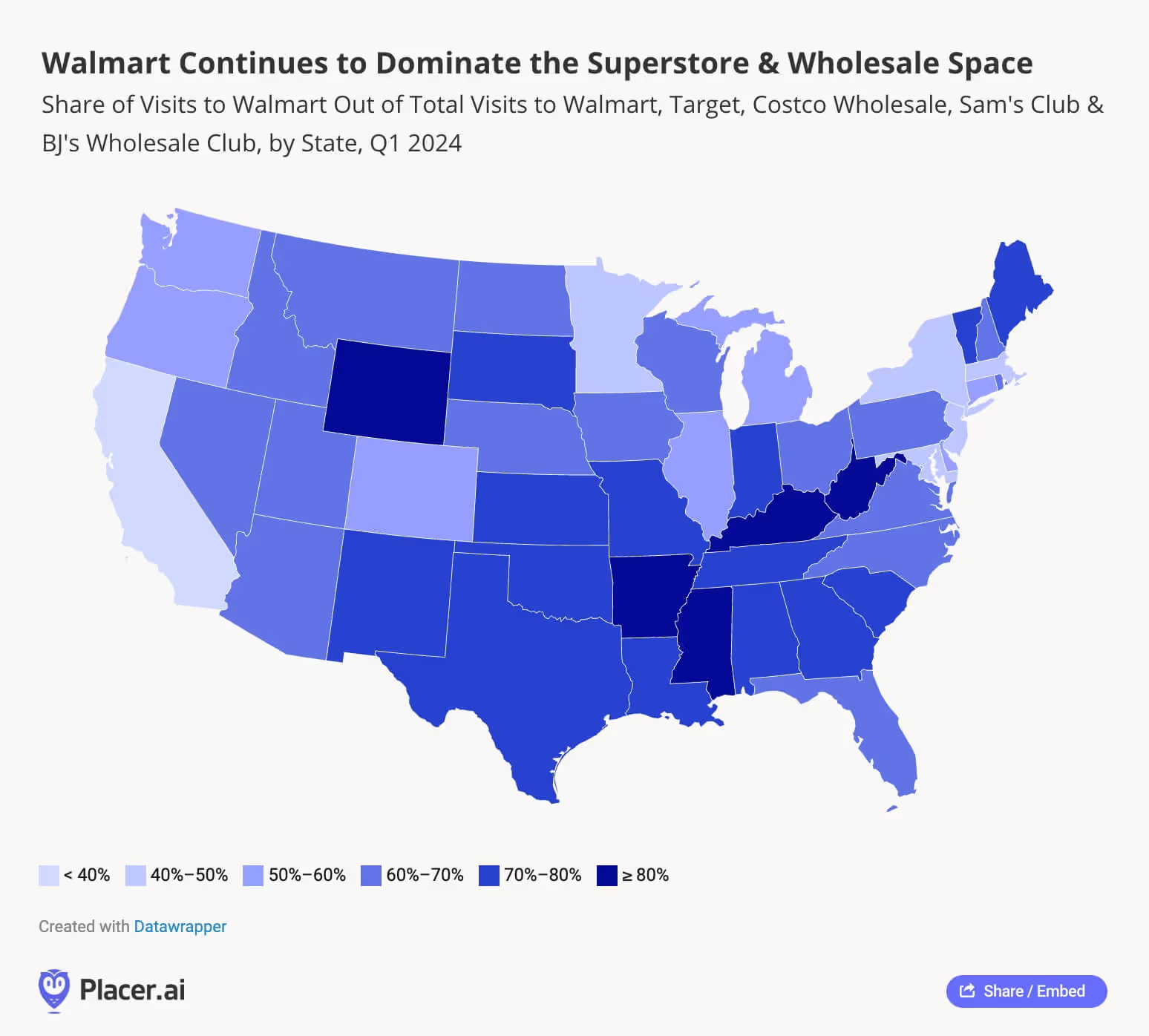

And while Walmart’s growth may not be quite as impressive as that of smaller superstores, the company has retained its position as the largest retailer in the U.S. Nationwide, the Walmart banner receives over 60% of all visits to Target, Walmart, Costco, Sam’s Club, and BJ’s, and in most of the south, the superstore’s relative visit share exceeds 70%. In a handful of states – including the retailer’s home state of Arkansas along with Mississippi, Kentucky, West Virginia, and Wyoming – 4 out of every 5 visits to the five superstore chains analyzed go to Walmart.

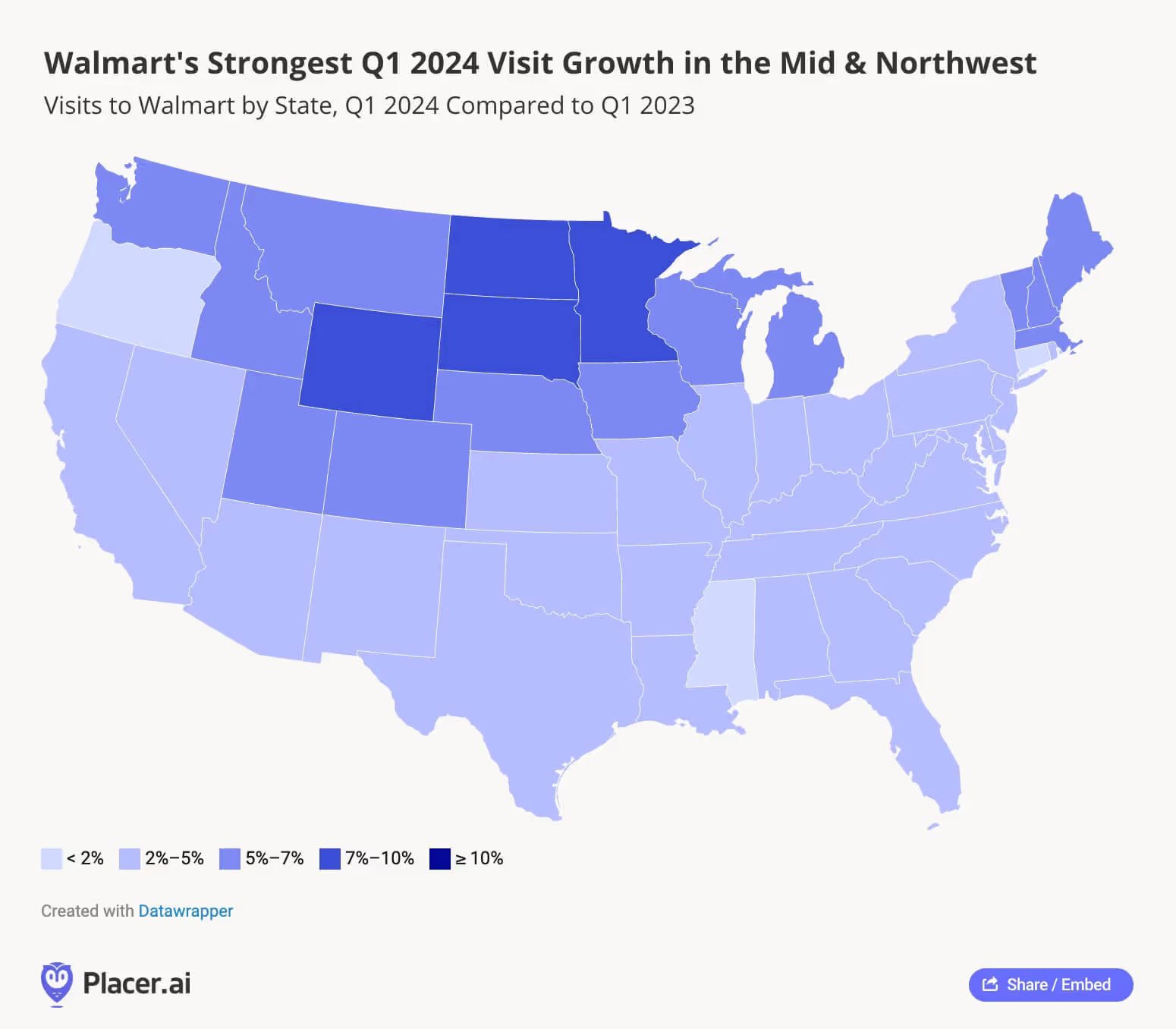

And even as Walmart optimizes its fleet, analyzing the retailer’s Q1 2024 YoY visit increases by region reveals pockets of major growth throughout the country. In addition to the 2-5% traffic increases across most of the South – where the retailer already dominates the superstore space – Walmart is also posting impressive visit increases in the Northeast, Midwest, and Northwest, with the strongest growth in Minnesota, Wyoming, and the Dakotas.

As budget-strapped consumers continue looking for bargains, the legacy retail giant may still have room to grow even larger in 2024.

Superstore and wholesale club visits are on the rise as U.S. shoppers continue to defy predictions of a consumer spending slowdown while still looking for ways to stretch their budgets.

Will these trends continue as the year progresses?

Visit placer.ai to find out.

.avif)

Discount & Dollar Stores have become an important part of the wider retail landscape over the past couple of years, and location intelligence indicates that the category is continuing to gain momentum in 2024. We dove into the data for Dollar General, Dollar Tree, and Family Dollar to understand how these banners are performing and analyze the regional reach of each chain.

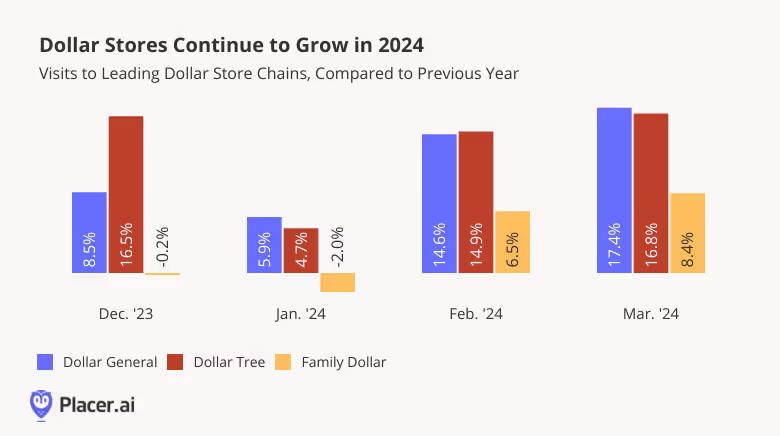

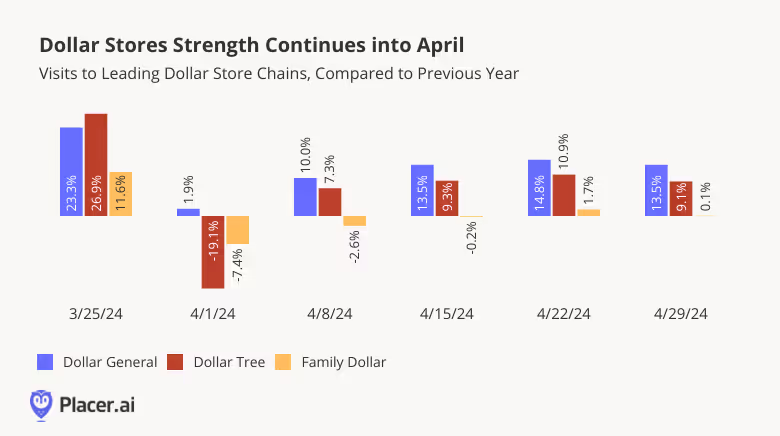

Recent visitation data for the major Discount & Dollar Store banners indicates that the category is still on the rise: Monthly visits to both Dollar General and Dollar Tree grew year-over-year (YoY) between December 2023 and March 2024. Dollar Tree-owned Family Dollar – which recently announced the closure of 1000 stores over the next couple of years – also saw its YoY traffic grow in February and March.

With the exception of the week of April 1st 2024 – when the Easter calendar shift caused a regular week in 2024 to be compared to the week of Easter in 2023 – visitation trends remained positive in April, highlighting the ongoing strength of the Discount & Dollar Store category. Even Family Dollar – which has already begun to close stores – saw its numbers remain on par with last year’s visit levels, indicating the ongoing demand for value-priced goods in 2024.

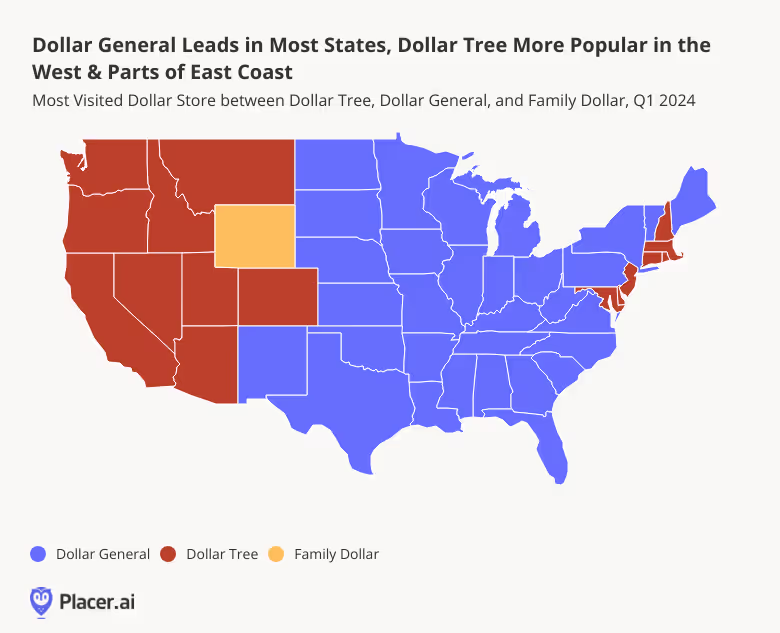

Looking at the Q1 2024 state-by-state relative visit share of the three chains – Dollar General, Dollar Tree, or Family Dollar – reveals some clear regional differences in consumer preferences across states.

Dollar Tree was more popular in the West, with the Dollar Tree brand leading in most western states and the company’s Family Dollar banner receiving the plurality of visits in Wyoming. Dollar Tree was also the most-visited chain in several states on the East Coast, including Maryland, New Jersey, Connecticut, and Massachusetts.

Dollar General, meanwhile, received the majority or plurality of the visit share in the rest of the country.

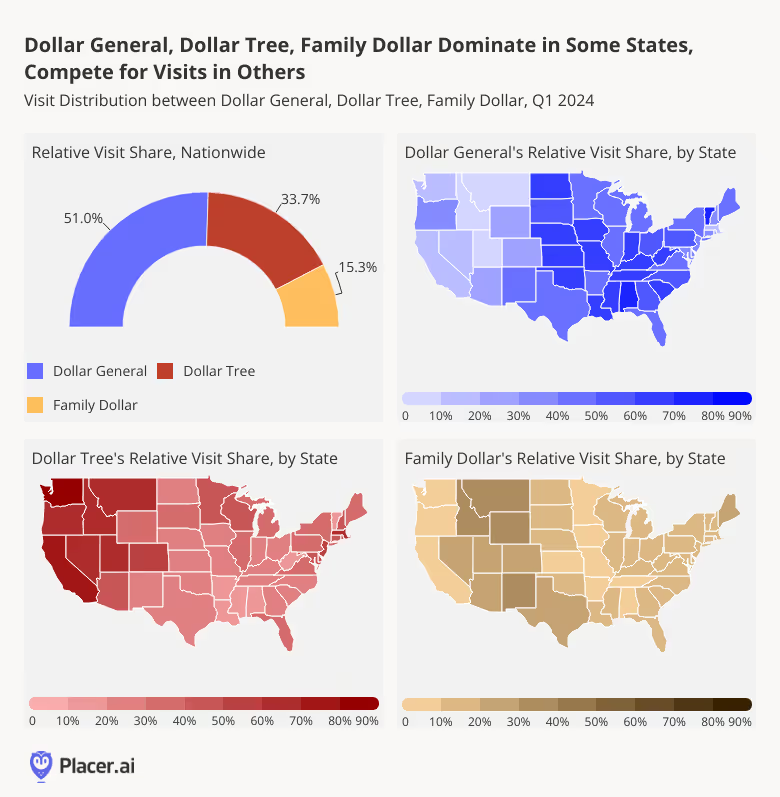

But although Dollar General does receive a majority of the combined Dollar General, Dollar Tree, and Family Dollar visit share nationwide, the Discount & Dollar Store category does not conform to a “winner-take-all” model. In many states, Dollar Tree’s visit share is just slightly lower than that of Dollar General.

In New York, for example, where Dollar General received 44.6% of the combined visit share in Q1 2024, 38.1% of visits in the same period went to Dollar Tree. And in Florida, where 44.2% of the combined visits to the three banners went to Dollar General, 38.2% of visits went to Dollar Tree. It seems, then, that even in states where Dollar General takes the lead, there is plenty of Discount & Dollar Store demand to sustain multiple players in the space.

Early 2024 data suggests that the Discount & Dollar Store sector is not slowing down any time soon. What will the rest of the year have in store for the space?

Visit placer.ai to find out.

Equinox hit the news this week as they rolled out a new $40,000 per year longevity membership called “Optimize by Equinox.” This program promises to provide a personalized health plan of action that includes personal training, nutrition, sleep coaching, and massage therapy. There will also be biomarker testing in partnership with Function Health and fitness testing. New York City and Highland Park, Texas are the pioneering locations for this program, with more to come. Placer took a look at the Highland Park location as well as one on Greenwich Ave in New York City. The Highland Park location has shown extraordinary year-over-year growth, with each month of the year showing increases compared to the prior year. The New York City location is a bit more mixed but had a strong showing year-over-year last fall and at the beginning of 2024.

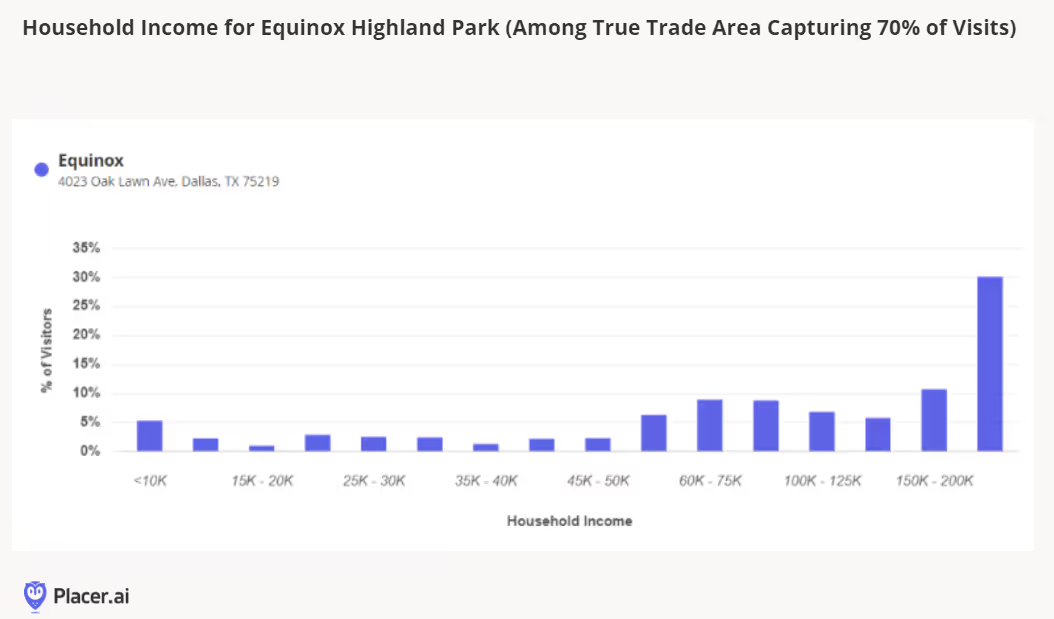

A 2023 survey by A/B Consulting and Maveron VC suggested that almost half (46%) of people earning over $250,000 would spend the majority of their discretionary income on trying to improve health and longevity, compared to only 34% of people earning under $50,000. Bryan Johnson is a tech millionaire who is often in the press with his latest experiments at reversing aging. From routine MRIs to frequent sampling of bodily fluids, he is a rare example of what one might do to try to live forever if one had nearly unlimited means to do so. While not all of us have millions to spend on unlocking the secrets to the fountain of youth, there’s no doubt that wellness and longevity are top of mind for many people, be it endeavoring to walk 10,000 steps a day or aiming for a rainbow diet. Looking at Equinox in Highland Park in Dallas, TX we see that indeed, this wealthy enclave is an apt location to pioneer this longevity offering. In the true trade area capturing 70% of visits, more than 3 in 10 have a household income exceeding $200K.

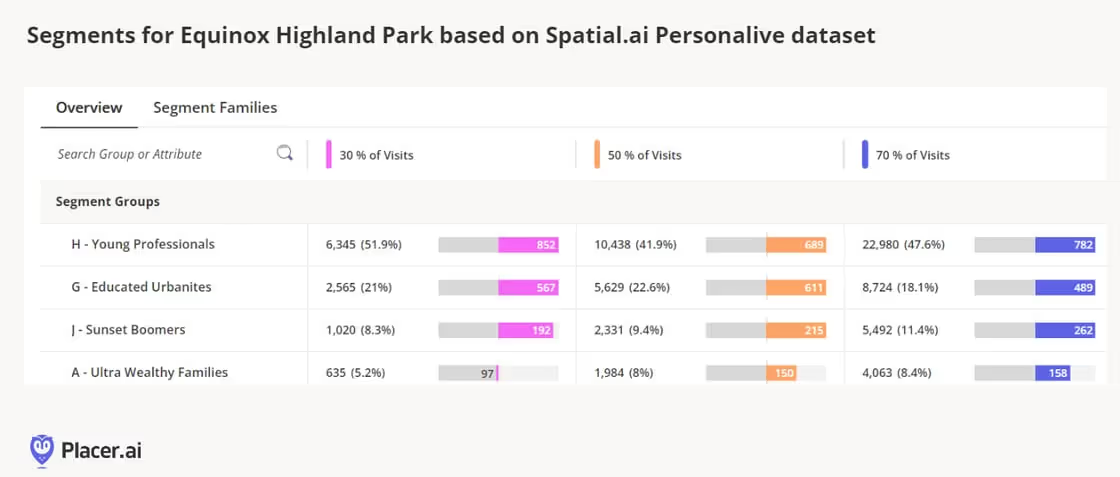

The Spatial.ai PersonaLive dataset further cements the fact that the top visitor segments are a group with higher-than-average discretionary incomes, such as Young Professionals, Educated Urbanites, Sunset Boomers, and Ultra Wealthy Families.

Additional data from the AGS Behavior & Attitudes dataset indicates that among those living in trade areas comprising 70% of visits to the Highland Park Equinox, many are indeed health-oriented, over-indexing on behaviors such as exercising (index 122), being yoga enthusiasts (index 168), and utilizing mobile app fitness trackers (index 160). However, they tend to under-index on getting regular medical checkups (index 86) - which is exactly where Optimize could fit in with its frequent testing and personalized approach. In addition, this particular location might want to take advantage of the clamor for pedicures (index 137) and manicures (index 147) and consider increased retail media network exposure due to enthusiasm for health info from TV (index 159).

Of all the specialty retail sectors, baby has been one of the most interesting to watch over the past few years for a few reasons. The industry is closely tied to a specific consumer life stage, and the CDC recently reported that the birth rate in the United States declined 2% in 2023, reaching the lowest rate recorded. If fewer consumers enter the family formation life stage, or have fewer children, the pool of potential visitors for retailers to draw from slowly dries up. The industry also faced massive disruption over the past year with the bankruptcy of Bed Bath & Beyond and the shuttering of its buybuy Baby chain last summer. The buybuy Baby closure marked the end of the large specialty baby chain sector in the retail industry, with the category facing the bifurcation of sales and traffic between big box retailers + Amazon and small independent specialty retailers.

Still, there have been some signs of life for baby-based retail despite the headwinds. Babylist, a popular online registry tool, launched its first brick-and-mortar outpost in Los Angeles last year. Buybuy Baby’s new owners reopened 11 locations in late 2023, concentrated in New England and the Mid-Atlantic. Then, in March, Kohl’s announced its partnership with WHP Global to bring Babies“R”Us to its stores. The Babies“R”Us shop-in-shop format receives a lot of positive momentum from both the Sephora at Kohl's partnership as well as the Toys“R”Us & Macy’s partnership; both predecessor collaborations have been rolled out to a majority, if not all, doors.

This week, we learned of the 200 initial locations receiving the Babies“R”Us (BRU) concept this summer, which will receive a wide assortment of hardgoods and softgoods, and be positioned next to the children’s apparel department. This new partnership is no doubt a continuation of Kohl’s strategy to attract and retain younger visitors, and the Babies“R”Us model can hopefully help the retailer hold onto Sephora shoppers as they enter the family formation period. Another likely goal is to steal some market share away from the mass merchants dominating in baby and lure some former buybuy Baby shoppers.

According to Placer.ai data, The Babies“R”Us + Kohl’s locations performed similarly to the total Kohl’s chain in 2024, with both chains showing visits down 23% year-over-year. The Babies“R”Us + Kohl’s locations do have a slightly higher visitor median household income of $84k compared to the total chain at $81K, which supports the notion that the Sephora & Babies“R”Us partnerships are meant to bring premium offerings to the typical store.

The partnership launch, as mentioned above, is a clear offensive move to capture some of the former buybuy Baby business in the areas where the locations did not reopen. Using Placer’s location analytics, we compared a national subset of 16 former buybuy Baby locations to the newly announced Babies”R”Us + Kohl’s locations. Looking at the visit demographics between the Kohl’s locations in the first four months of 2024 and the former buybuy Baby locations in 2023, it’s clear that Kohl’s attracts a suburban family and more mature consumer base, as where buybuy Baby locations were a stronghold with young urban singles and young professionals. Kohl’s may have an opportunity to attract new or existing grandparents to the partner stores, but will need to use the Sephora angle to attract younger consumers who may also be looking to start a family in the next few years.

Kohl’s is also betting big on the East Coast, with a number of partnership stores located in New York, New Jersey, Pennsylvania and Massachusetts. A few of these locations are in direct competition with the newly reopened buybuy Baby locations and will create some fascinating local competition. In the Boston metro area, there are both a Kohl’s and buybuy Baby location within 9 miles of each other but have local differences that may benefit Kohl’s entry into the market. Kohl’s has a median household income of about $30k more than visits to buybuy Baby and also captures more loyalty, with more loyal visits than buybuy Baby throughout the first four months of 2024.

This particular Kohl’s location has a smaller disparity to buybuy Baby in attracting young professionals, but it also attracts wealthier and more mature visitors that once again may translate into attracting parents and grandparents. 22% of buybuy Baby’s trade area overlaps with Kohl’s and the two share 11 square miles of overlapping trade area, so it will be interesting to see how Kohl’s can pull visits away from the competition.

As 2024 progresses, Kohl’s opens its partnership locations, baby retail will hopefully find its footing and provide retail solutions for potential and new parents. E-commerce has filled the void for baby registry services, but brick-and-mortar retail still holds a lot of importance for parents. Baby specialty retail is essential to the success of baby products and brands, and there is a lot of white space opportunity in the category for retailers to emerge to take share. Consumers, even if there are fewer of them, need experiences and solutions provided by retailers, and baby retail is a cautionary, but optimistic tale for other specialty sectors for the remainder of the year.

The holiday shopping season traditionally stretches from Black Friday to New Years Eve: Shoppers looking to snag deals, purchase gifts, or enhance their celebrations drive visit spikes at retailers across the country. And although many consumers expressed concern over high prices impacting their holiday budget, spending in 2024 actually increased compared to 2023, with brick-and-mortar stores playing a key role in last year’s holiday season.

So where were the largest holiday spikes? How did last year’s calendar configuration impact retail traffic? Which segment came out ahead – and how did dining fit into the mix? Most importantly – what can we learn from the 2024 holiday season to prepare for 2025?

The holiday shopping season is the busiest time of the year for many retail categories. Between Black Friday and December 31st 2024, daily visits to brick-and-mortar stores increased 12.7%, on average, compared to the rest of the year.

Department stores led the pack, with visits to the segment 102.1% higher than the pre-holiday season average – likely aided by strong Black Friday performances. Other favorite gifting categories, including beauty & self care (72.7%), hobbies, gifts & crafts (60.9%), recreational & sporting goods (55.5%), clothing (41.8%), and electronics stores (32.7%) also received significant traffic boosts. Shopping centers benefited as well with a 24.8% increase in daily visits over the holiday season. Retailers in these segments can capitalize on their holiday popularity and stand out amidst the crowd by promoting their brand early and ensuring their staffing and inventory can accommodate the season’s traffic increases.

The holidays are also a time for entertainment – and purchasing gifts for hosts – which likely helped drive the 48.4% and 41.7% traffic increases at liquor stores and at furniture & home furnishings retailers, respectively. Superstores and discount & dollar stores – with their selection of affordable giftable products and entertainment essentials – also saw holiday-driven visit bumps of 21.2% and 20.2%, respectively. Retailers may choose to highlight seasonal items and hosting-friendly products to increase these traffic bumps in 2025.

Pet stores & services received a smaller (10.0%) bump than the wider retail average – indicating that, although some shoppers buy gifts for their fur babies, pets may not be at the top of most Americans’ gift lists. And visits to the home improvement segment were essentially on par with the pre-holiday period – indicating that the holidays are not the time for extensive home renovation projects. But home improvement chains looking to get in on the holiday action might consider promoting decorations and smaller giftable items in December.

And despite the grocery frenzy of Turkey Wednesday and Christmas Eve Eve, the Grocery segment received a relatively minor holiday boost of 5.0% – perhaps due to holiday travelers skipping their weekly grocery haul. Grocers who lean into prepared foods or pre-packaged meal kits might get an additional bump.

Although the holidays drive retail visit surges across the country, some regions see a bigger traffic bump than others.

In December 2024, almost all 50 states (with the exception of Wyoming ) received a holiday-driven retail traffic boost ranging from a 3.3% (Montana) to a 16.8% (New Hampshire). On a regional basis, the South received the largest increase: The West South Central, East South Central, and South Atlantic divisions received a collective 12.2% increase in daily visits between Black Friday and New Years Eve compared to the pre-Black Friday daily average. (Washington, D.C. saw a slight visit decline of 0.4%, likely due to the many residents leaving the capital for the holiday break.) Retailers in this region may choose to increase staffing and inventory ahead of the 2025 holiday season to handle the increased demand.

Meanwhile, the Midwest region had the smallest holiday-driven traffic spike (9.2%) – despite starting the season ahead of the pack, with the highest Black Friday weekend visit boost. This suggests that Midwestern retailers may have more success with early promotions than with last-minute discounts.

While the holiday season drove an overall retail visit boost nationwide, diving deeper into the data reveals that different retail segments peak at different points of the holiday season.

Most categories – especially the ones that tend to offer steep post-Thanksgiving discounts, such as recreational & sporting goods, department stores, electronics stores, and beauty retailers – received the biggest visit spikes on Black Friday. Retailers in these categories may benefit from promotional campaigns ahead of Thanksgiving to cater to early shoppers and maximize their performance on their busiest day.

Other segments that carry more affordable gifts, stocking stuffers, and food items gained momentum as Christmas approached – with superstores visits spiking on December 23rd and discount & dollar stores peaking on December 24th. These retailers may get even larger end-of-year visit bumps by offering discounts and bundles to last-minute shoppers.

The grocery segment received its largest boost ahead of Thanksgiving, with visits also surging on the days before Christmas as home cooks picked up supplies for the holiday dinner. Grocers who can save their shoppers time during this busy period by offering curbside pickup, pre-prepped ingredients or meal kits, and other conveniences may see particularly strong performances in 2025.

Calendar shifts also play an important role in shaping holiday shopping patterns. Last year, Super Saturday and “Christmas Eve Eve” – each a significant milestone in its own right – coincided on December 23rd, 2023 to create a supercharged shopping event that generated massive visit spikes at retailers across categories.

But in 2024, when the milestones occurred separately, important differences emerged between retailers. Gift-shopping destinations like Macy’s, Nordstrom, and Best Buy saw bigger visit spikes on Super Saturday, while retailers like Target, Walmart, and Costco – carrying both gifts and food items – saw visits surge higher on December 23rd. Dollar Tree, a prime destination for affordable stocking stuffers, also experienced a more pronounced visit spike on Super Saturday.

Predictably, this year’s pre-Christmas milestones generally drove smaller individual visit spikes, as shoppers spread their errands across a longer period. But the stand-alone Super Saturday on December 21st 2024 also allowed consumers to prioritize gift-shopping on Saturday and shop for groceries and last minute stocking stuffers on December 23rd – benefiting certain retailers.

Nordstrom, for instance, saw visits soar to 215.9% above the chain’s 2024 daily average on December 21, 2024 – surpassing the 196.2% increase recorded on December 23, 2023. Macy’s also experienced a slightly higher Super Saturday visit boost this year. Next year, retailers can expect another spread-out pre-Christmas shopping period, with Super Saturday falling on December 20th, 2025 – five days before the holiday. Gift-focused retailers can leverage this timing by ramping up promotions in the run-up to Super Saturday – or by enhancing offerings on December 23rd to capture more late-season shoppers.

Big box retailers like Target, Walmart, and Costco, conversely, can double down on December 23rd or amplify earlier deals to capture a larger share of Super Saturday traffic. And retailers across categories can benefit from the more extended last-minute shopping period by implementing multi-day sales and promotions that encourage repeat visits and drive traffic throughout the week.

Turkey Wednesday – the day before Thanksgiving – is traditionally the grocery sector’s time to shine. And this year didn’t disappoint: On November 27th, 2024, visits to traditional grocery mainstays like Kroger, Safeway, and H-E-B shot up by a remarkable 66.9% to 79.2% compared to the 2024 daily average. And on December 23rd, foot traffic to the chains rose once again, though somewhat more moderately, as shoppers geared up for Christmas celebrations.

But the holiday season stock-up, it turns out, is about more than just food. Whether to help smooth out the rough edges of family interactions or to take celebrations to the next level, consumers also make pre-holiday runs to liquor stores. On Turkey Wednesday, leading spirit purveyors outperformed traditional grocery stores with epic 140.1% to 236.5% visit spikes. And the day before Christmas Eve was an even bigger milestone for the segment, with foot traffic skyrocketing by a staggering 153.6% to 283.8% above daily averages.

Ethnic supermarkets – chains like El Super and Vallarta Supermarket – also thrived on these traditional pre-holiday grocery store milestones. But like liquor stores, they saw bigger visit spikes on December 23rd, as customers likely sought out ingredients for their festive holiday dinners.

Grocery stores seeking to maximize the power of these pre-holiday milestones in 2025 could enhance their liquor selections and launch targeted promotions in the lead-up to both Thanksgiving and Christmas.

Dining venues are also impacted by the rhythms of the holiday season – but each segment within the dining industry follows its own unique seasonal trajectory.

Visits to the fast-casual, coffee, and fine-dining segments increased the week before Thanksgiving, with fast-casual and coffee visits peaking on Wednesday and fine-dining peaking on Thanksgiving day. Both coffee and fine-dining chains also received a small traffic bump on Black Friday, with coffee traffic likely aided by consumers looking to refuel during their shopping.

But beginning in mid-December, the fine-dining category pulled ahead of the other dining segments, picking up steam as the month wore on before peaking on December 23rd and 24th. And while traffic predictably declined on Christmas Day, the drop was less pronounced than for the other analyzed segments. Fine dining then resumed its strong showing on December 26th, maintaining elevated visits through the following days, potentially reflecting its appeal as a festive holiday dining destination for families.

Coffee chains and fast-casual restaurants also enjoyed moderately elevated December traffic, with smaller visit spikes on December 23rd. Traffic to both segments then slowed during the holiday – though coffee chains continued to see higher-than-average foot traffic on Christmas Eve – before tapering off as the month drew to a close.

Looking ahead to 2025, each dining segment can take steps to maximize its holiday impact. Fine dining chains can attract more special-occasion celebrants with unique holiday-themed menu items – paired with targeted promotions that make its premium offerings more accessible to families. Meanwhile, fast-casual and coffee chains can capitalize on high-traffic days like December 23rd by catering to the needs of busy holiday shoppers – extending operating hours and offering streamlined ordering and pickup options.

The 2024 holiday season proved strong for most retail categories, with each retail category displaying a different holiday visit pattern. This year’s calendar layout also presented a unique advantage, with a longer stretch between Super Saturday and Christmas compared to last year.

By analyzing 2024 holiday regional visit trends, understanding the role that each year’s specific calendar configuration plays in shaping consumer behavior, and identifying the unique retail milestones for each chain and category, retail and dining stakeholders can refine their strategies and make the most of the 2025 holiday season.

Placer.ai observes a panel of mobile devices in order to extrapolate and generate visitation insights for a variety of locations across the U.S. This panel covers only visitors from within the United States and does not represent or take into account international visitors.

Professional sports are big business – the industry is valued at nearly $1 billion in the United States alone. And beyond the economic impact of actual ticket sales and stadium and sponsorship gains, major sporting events can have significant impacts on local industries such as tourism, dining, and hospitality. Cities hosting sports events tend to see influxes of visitors who boost tourism, spend money at restaurants and hotels, and create ripple effects that benefit entire local economies.

The 2024 Copa América, typically held in South America but hosted in the United States this year, provides a prime example of the effect sports tourism can have on local economies. The games kicked off in Atlanta, Georgia on June 20th, 2024, before moving on to other host cities and boosting hospitality traffic along the way.

This white paper dives into the data to see how the games impacted hotel visits in cities across America – and especially in Atlanta. The report uncovers the hotel tiers and brands that saw the largest visit boosts and explores visitor demographics to better understand the audiences drawn to the event.

The Copa América took place in June and July 2024, with fourteen cities – mainly across the Sunbelt – hosting games. Thousands of fans attended each event, driving up demand in local hotel markets.

Arlington, TX, saw the largest hotel visit bump during the week it hosted the games, with hospitality traffic up 23.0% compared to the metro area's weekly January to September 2024 visit average. Orlando, FL, too, enjoyed a significant visit spike (22.1%), followed by Kansas City, KS-MO (17.4%).

The Atlanta metropolitan area, for its part, also saw a significant 11.0% increase in hotel visits during its hosting week compared to the city’s weekly visit average.

The Copa América games attracted fans from across the country – from as far away as Washington State and New Hampshire, as well as from neighboring states like Florida. On the day the tournament began, 26.1% of the domestic visitors to Atlanta’s Mercedes-Benz Stadium came from over 250 miles away, up from an average of 19.7% during the rest of the year (January to September 2024). These out-of-towners likely had a significant impact on Atlanta’s local economy – through spending on accommodations, dining, and entertainment.

During the week of the Copa América game, all of the analyzed hotel types in Atlanta received a visit bump. And while some of these visits were likely unrelated to the game, the massive scale of the event means that a significant share of the visit growth was likely driven by out-of-town soccer fans. Analyzing these patterns Atlanta can provide valuable insights for hospitality stakeholders looking to attract attendees of major sporting events.

Upper Midscale hotels saw the biggest boost during the week of the event, with visits 20.8% higher than the weekly visit average between January and September 2024. Midscale and Upscale hotels also experienced significant visit increases of 15.8% and 14.0%, respectively. During the same period, visits to Luxury hotels grew by 9.0% and Economy Hotel visits rose by 7.0% compared to the January to September 2024 weekly average. Meanwhile Upper Upscale Hotels received the smallest boost, with visits up by 2.9%.

Judging by these travel patterns, it appears that most Copa América spectators prefer to stay at Midscale, Upper Midscale, or Upscale hotels during the trip.

While Upper Midscale Hotels in the Atlanta-Sandy Springs-Alpharetta metro area generally experienced the biggest visit boost during the Copa América, visit performance varied somewhat from chain to chain. TownePlace Suites and Fairfield Inn, both Upper Midscale Marriott properties, saw increases of 27.5% and 25.3%, respectively, compared to their January to September 2024 weekly averages. Other chains in the tier also enjoyed visit boosts – visits to Home2 Suites by Hilton and Hampton Inn – both Hilton chains – jumped by 17.3% and 17.4%, respectively, during the same period.

The popularity of these Upper Midscale hotels may be driven by a multitude of factors. Some, like TownePlace Suites and Home2 Suites offer kitchenettes, something that may appeal to visitors looking to save by preparing their own meals. Others, such as Fairfield Inn and Hampton Inn which offer more locations closer to the stadium may attract visitors that prioritize convenience.

Layering the STI: PopStats dataset onto Placer.ai’s captured market can provide insights into Copa América attendees by revealing the demographic attributes of census block groups (CBGs) contributing visitors to the Mercedes-Benz Stadium. (The CBGs feeding visitors to a chain or venue, weighted to reflect the share of visitors from each one, are collectively referred to as the business’ captured market.)

During the Copa América opener,Mercedes-Benz Stadium drew visitors from CBGs with a median household income (HHI) of $90.0K – well above the national median of $76.1K and similar to the median HHI during the Taylor Swift concert ($90.6K). The stadium’s trade area median HHI was even higher during the Super Bowl ($117.9K).

This visitor profile suggests that Copa América attendees – along with guests of other major cultural and sporting events – often have the means to splurge on comfortable, mid-range hotels for their stays. As Atlanta gears up to host the College Football National Championship in January 2025, the 62nd Super Bowl in February 2028, and the MLB All Star Game in July 2025, along with a host of smaller-scale events – the city can draw on historical data from past events, including the Copa América, to better understand the needs and preferences of stadium visitors and plan accordingly.

And although Upper Upscale hotels generally experienced relatively subdued growth during the Atlanta Copa América opener, some Upper Upscale properties – including Marriott’s Autograph Collection Twelve Downtown, saw visits jump. Visits to the hotel were up 19.7% during the week of the Copa América compared to the January to September 2024 weekly average.

The Twelve Downtown has become a popular lodging choice for major events in the city, likely due to its proximity to Mercedes-Benz Stadium. (The hotel is located just over a mile away from the stadium). During the Super Bowl LIII five years ago, the Twelve Downtown drew 27.9% more visits than its weekly average for January to September 2019. And during the 2023 Taylor Swift concert, the hotel saw a 25.5% visit bump.

A closer look at the median HHI of the hotel’s captured market during the three periods reveals that, despite each event attracting visitors from varying income brackets, the median HHI of visitors to the Twelve Downtown remained stable. Visitors to the hotel between January and September 2024 came from trade areas where the median HHI was $76.2K, not far off from the median HHI during the 2019 Super Bowl ($75.4K), Taylor Swift’s 2023 concert ($80.6K) and the Copa América ($76.7K).

This stability suggests that, regardless of the event, hotels attract a specific visitor base. And understanding the similarities within the demographic profiles of likely hotel visitors during different events will be key for hotels at all levels seeking to capitalize on the economic opportunities created by major local events.

The Mountain region offers employment opportunities, affordable housing, outdoors recreation, and a relatively low cost of living – which could explain why these states are emerging as major domestic migration hubs. Idaho, Nevada and Wyoming in particular have consistently attracted inbound domestic migration in recent years, as Americans continue leaving higher density regions in search of greener – and calmer – pastures.

This report uses various datasets from the Placer.ai Migration Trends Report to analyze domestic migration to Idaho, Nevada, and Wyoming. Where are people coming from? And how is recent migration impacting local population centers in these states? Keep reading to find out.

Idaho emerged as a domestic migration hotspot over the pandemic, as many Americans freed from the obligation of in-person work relocated to the Gem State. Between June 2020 and June 2024, Idaho saw positive net migration of 4.7%, more than any other state in the U.S. (This metric measures the number of people moving to a state minus the number of people leaving – expressed as a percentage of the state’s total population.) And between 2023 and 2024, Idaho remained the nation’s top domestic migration performer (see map above).

Diving into the data reveals that though people moved to Idaho from across the U.S., most of Idaho’s influx over the past four years came from neighboring West Coast and Mountain States – especially California. Former residents of the Golden State accounted for a whopping 58.1% of inbound migrants to Idaho over the analyzed period.

California’s position as the top feeder of relocators to Idaho during the analyzed period may come as no surprise, given the state’s recent population outflow and the many former California residents who have settled in the Mountain region. But Washington, Oregon, and Nevada – where inbound and outbound migration remained relatively even in recent years – have also been seeing shifts to Idaho.

Idaho has a lower tax burden, robust employment opportunities, and greater overall affordability than its top four feeder states. So some of the recent relocators likely moved to the Gem State to enjoy better economic opportunities while staying relatively close to their states of origin. And these recent Idahoans may be reshaping Idaho’s demographic and economic landscape in the process.

Most inbound migration to Idaho is concentrated in the state’s metro areas, with Boise – the capital of Idaho and the major city closest to California – consistently absorbing the highest share of net inbound migration.

But recently, other CBSAs have emerged as key destinations for new Idahoans. The location of two emerging domestic relocation hubs in particular suggests that many new Idaho residents may be looking to stay close to their areas of origin: Coeur d’Alene, located near the border with Washington, attracts its largest contingent of new residents from the Spokane, WA metro area, while Twin Falls’ top feeder area is the Elko CBSA in northern Nevada.

Twin Falls in southern Idaho has a strong job market – and has received a substantial share of inbound domestic migration over the past three years. Coeur d’Alene is also flush with economic opportunities, and after declining steadily for several years, the share of relocators heading to the metro area increased to 20.7% between June 2023 and 2024.

The chart above also reveals that the share of inbound migration heading to Boise declined slightly between June 2023 and June 2024 – following a period of consistent growth between June 2020 and June 2023 – even as the share of migration to Coeur d’Alene ballooned. This may mean that, although the state’s largest metro area may have reached its saturation point, other areas in the state are still primed to receive inbound migration.

While Nevada is losing some of its population to nearby Idaho, the Silver State is also gaining new residents of its own: Between September 2020 and September 2024, the Silver State experienced positive net migration of 3.3%. And the data indicates that many new Nevadans are choosing to settle in the state's rapidly growing suburban centers.

Zooming into the Las Vegas-Henderson CBSA reveals that much of the growth is concentrated outside the main city of Las Vegas. Instead, the more suburban cities of Enterprise, Henderson, and North Las Vegas received the largest migration bump – with Henderson and North Las Vegas’ population now surpassing that of Reno. And while year-over-year migration trends suggest that the growth is beginning to stabilize, Enterprise and Henderson are still growing significantly faster than the CBSA as a whole – indicating that the suburbs continue to draw Nevada newcomers.

Analyzing the inbound domestic migration to Enterprise – one of the fastest growing areas in the country – may shed light on the aspects of suburban Las Vegas that are driving population growth.

Many new Enterprise residents moved to the city from elsewhere in Nevada, while most out-of-state newcomers came from California or Hawaii – mirroring the migration patterns for Nevada as a whole. And according to the Niche Neighborhood Grades dataset, Enterprise is a good fit for retirees and young professionals alike, with the city ranking higher than its feeder areas with regard to a range of factors – from jobs and commute to weather.

Like with migration to the rest of the Mountain region, domestic migration to Nevada – particularly to suburban areas like Enterprise and Henderson – is likely driven by newcomers looking for more economic opportunities along with higher quality of life.

Wyoming – currently the least populous state in the country – is another Mountain region state where inbound migration is driving up the population numbers. But in the Cowboy State, urban areas – as opposed to suburban ones – seem to be the main magnets for population growth.

The Cheyenne, Wyoming CBSA – home to Wyoming’s capital – is the largest metro area in the state. And analyzing the CBSA’s population trends over the past six years reveals a recent shift in Wyoming’s inbound migration patterns.

Cheyenne’s population is mostly suburban, and the CBSA’s suburban areas remain popular with newcomers – suburban Cheyenne has also seen steady population growth since January 2018. But when the CBSA became a popular relocation destination over the pandemic, many newcomers to the Cheyenne region chose to move to metro area’s more rural areas: By April 2022, Cheyenne’s rural population had jumped by 10.8% compared to a January 2018 baseline, compared to a 5.9% and 3.9% increase in the CBSA’s suburban and urban populations, respectively.

As the country opened back up, however, the number of rural Cheyenne residents dropped back down – and by September 2024, Cheyenne’s rural population was only 0.1% bigger than it had been in January 2018. The population growth in suburban Cheyenne also slowed down, with the September 2024 suburban population numbers more or less on par with the April 2022 figures.

Now, Cheyenne’s urban areas have overtaken both rural and suburban areas in terms of population growth: In September 2024, Cheyenne’s urban population was 9.4% bigger than in January 2018, compared to 5.2% and 0.1% growth for the suburban and urban areas, respectively.

Despite the growth in Cheyenne’s urban population, the suburbs still remain the most populous – as of September 2024, 71.2% of the CBSA’s population resided in suburban areas. But the continued growth of Cheyenne’s urban population may reflect a rising demand among Wyomingites for amenities and economic opportunities unavailable elsewhere in the state, mirroring the trend in Idaho’s urban CBSAs such as Boise and Coeur d'Alene.

Cheyenne’s urban growth could be partially due to shifts in migration patterns. At the height of the pandemic, most newcomers to Cheyenne were coming from out of state, perhaps drawn by the quiet and spaciousness of rural Wyoming. But since 2022, the share of migration to Cheyenne from within Wyoming has grown – coinciding with the population increase in its urban areas and suggesting that Cheyenne's amenities are attracting more residents statewide.

This growing intra-state migration to Cheyenne’s urban areas underscores the city’s evolving role as a hub within Wyoming, appealing not just to newcomers from outside the state but increasingly to Wyoming residents seeking the benefits of a more urban lifestyle relative to the rest of the state.

The Mountain States are solidifying their status as key migration hubs in the U.S., driven by economic opportunities, affordable living, and lifestyle appeal. Between September 2023 and September 2024, Idaho, Nevada, and Wyoming all experienced significant population growth due to inbound domestic migration. In Idaho, newcomers from neighboring states are boosting the population of the Gem State’s major metro areas. Meanwhile the Cheyenne, Wyoming, CBSA is emerging as a focal point for intra-state migration, with urban Cheyenne seeing particularly pronounced growth. And in Nevada, suburban hubs like Henderson and Enterprise are welcoming new arrivals seeking a balance of suburban comfort and economic potential. With the cost of living continuing to increase – and the Mountain region offering something for everyone through its various states – Idaho, Nevada, and Wyoming are likely to remain top migration destinations in 2025 and beyond.