.svg)

.png)

.png)

.png)

.png)

With sales of mountain passes up and eager skiers and snowboarders ready to hit the slopes, let’s take a look at how Backcountry has been performing of late. This brand may be familiar to many, as it has been an online retailer for the past 27 years. Lately, though, the retailer has made a foray into brick-and-mortar stores in areas where they have a strong concentration of online customers, with the store count currently up to 9 nationwide.

The Palo Alto store opened in Spring 2023. Visitation trendlines show that this store at the Stanford Shopping Center has jumped to be neck-and-neck with the Seattle store in Dec 2023.

The majority of Backcountry shoppers come from very high-income households, such as Ultra Wealthy Families, Educated Urbanites, and Sunset Boomers (using PersonaLive data for select store trade areas).

Backcountry opened its first physical store downstairs from its corporate headquarters in Park City, UT in 2021. The impetus for opening a brick-and-mortar store was to “deepen connections with its customers.” In addition to the Palo Alto store, Backcountry also opened its first east coast outpost on 14th St in Washington DC during spring 2023, one of the hot retail corridors we wrote about. The newest entrant is a 23,000 square-foot flagship location open at the Grove in Los Angeles in July, which will provide gear for all sorts of popular outdoor activities, such as hiking, camping, water sports, running and climbing.

The holidays conjure up warm, cozy images of families sitting around artfully-set tables and enjoying delicious home-cooked meals. But for many people, Christmas Day is also a time to eat out. And while many restaurants are closed on December 25th, several national and regional chains keep their doors open for patrons eager to enjoy a nice, stress-free meal with loved ones – without the clean-up.

So with the holiday season in the rearview mirror, we dove into the data to explore nationwide December 25th dining trends – focusing our analysis on more than 100 chains, mostly full-service, with significant national or regional presence. Which brands are most popular on Christmas Day? And what differences can be observed in different regions of the country?

Nationwide, visits to dining chains nationwide were down 59.7% on December 25th, 2023, compared to a Q4 2023 daily average. But digging down deeper into the different areas of the country reveals significant regional differences.

The Pacific states – including California, Washington, Oregon, Alaska, and Hawaii – saw a drop of just 33.8% in dining visits on Christmas Day compared to the region’s Q4 2023 daily average. Next in line were the various regions of the South, where December 25th foot traffic dropped between 51.2% and 56.9%, followed by the Mountain states. And on the other end of the spectrum lay New England, where visits were down 83.3% compared to a Q4 baseline. Other areas of the Northeast and Midwest also experienced foot traffic dips in excess of 70.0% – indicating that residents of these areas are less likely to dine out on the holiday.

%20(1).avif)

But which chains are most popular on December 25th? Analyzing the distribution of holiday visits among 25 leading Christmas Day restaurant destinations shows that three all-day breakfast chains – Waffle House, IHOP, and Denny’s – dominated the Christmas Day dining market this year.

Together, these 24/7 eateries, which tend to experience significant holiday visit bumps, accounted for an impressive 70.4% of holiday dining foot traffic. After a leisurely morning of presents and hot cocoa, it seems, nothing quite hits the spot like waffles, pancakes, and other breakfast favorites. And with affordable prices, seasonal menus, and special holiday vibes (complete with pajama-clad customers), these restaurants offer plenty of holiday cheer.

But breakfast chains aren’t the only dining venues that draw Christmas Day crowds. Red Lobster, the popular seafood chain, cornered 4.9% of this year’s December 25th dining foot traffic. And Applebee’s, Black Bear Diner, Golden Corral, and TGI Fridays each received between 2.0% and 3.0% of Christmas Day visits.

.avif)

Drilling down deeper into the data for holiday visit trends shows that each state has its own favorite Christmas Day destination. In no fewer than 21 states nationwide – including New York, Texas, Michigan, and Florida – IHOP topped the chart. Denny’s and Waffle House, for their parts, each led the charge in 11 states, with Waffle House dominating the Christmas Day scene in much of the South.

But in some places, other chains topped the Christmas Day rankings. In Iowa, Minnesota, and North Dakota, people flocked to Perkins Restaurant & Bakery – the casual-dining chain known for its iconic pies and pancakes. In Wyoming and South Dakota, Red Lobster drew the biggest crowds. And in Oregon, Shari’s – a chain with some 80 locations in the western region of the country – attracted the most holiday visits.

.avif)

Foot traffic data also reveals, unsurprisingly, that visitors to the three Christmas Day leaders – Waffle House, IHOP, and Denny’s – spent more time in the restaurants on Christmas Day than they usually do. Some 17.3% of Christmas Day Waffle House visits lasted more than one hour – compared to 14.7% on an average day in 2023. IHOP and Denny’s also saw significant holiday increases in dwell time.

.avif)

Though many restaurants are closed on December 25th, chains that do stay open – especially all-day breakfast eateries – draw significant crowds. How will holiday winners like Waffle House, IHOP, and Denny’s continue to fare as people settle back into their post-holiday routines? And how will Christmas Day dining trends evolve nationwide in the years to come?

Follow placer.ai/blog to find out.

The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from some 1,000 office buildings across the country. It only includes commercial office buildings, and commercial office buildings with retail offerings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

Has the remote work war run its course? For a while last year, it seemed like not a day went by without another headline proclaiming the demise of WFH. And as return-to-office mandates continued to pile up (et tu, Zoom?), the debate over offsite work productivity grew ever more rancorous.

But amidst all the noise, a new hybrid reality appears to have taken hold, offering both companies and employees the benefits of a mixed model. Yes, productivity can thrive outside the office – but there is something about the intangible spark that ignites when people interact with one another in person that has proven crucial to business success. So while recent survey data shows a precipitous drop in fully remote work over the past three years, most companies aren’t requiring people to go back to the office full time.

With these trends in mind, we dove into the data to explore the state of office foot traffic as the year drew to a close. How did December 2023 office visits compare to pre-COVID? And what impact did the holiday season have on the demographic profile of the typical office-goer?

Last month, buildings in our Nationwide Office Index received 36.5% fewer visits than they did in December 2019 – reflecting a continuation of the same general holding pattern that has seen foot traffic hovering around 40.0% of pre-COVID levels, with some minor fluctuations.

But delving further into the data for key commercial hubs nationwide highlights the persistence of important regional differences – with New York City emerging as last month’s clear office recovery winner. In December 2023, the Big Apple experienced a year-over-four-year (Yo4Y) visit gap of just 19.2% – the smallest seen by the city in some time. At the other end of the spectrum lay San Francisco, with a Yo4Y visit gap of 53.1%.

.avif)

But December is a bit of an outlier, work-wise. It’s the heart of the holiday season – kicked off by Thanksgiving at the end of November, and bookended by New Year’s Eve on the other side. And foot traffic data shows a small but distinct shift in the demographic profiles of office buildings’ captured markets – i.e. the areas their visitors come from – during the last month of the year.

Nationwide, and in major cities like New York and San Francisco, office-goers tend to come from relatively affluent areas with greater-than-average shares of one-person households. But over the final three months of 2023, both of these metrics in office buildings’ captured markets gradually declined. November office visitors were more likely to come from larger and lower-HHI households than October visitors – and December visitors were more likely to come from such households than November ones. This may reflect the greater flexibility of higher-HHI employees to work from home more often during the holiday season. It may also reflect a greater tendency on the part of singles to take extended trips to visit family during the holidays, and plug in from afar.

.avif)

Hybrid work may be here to stay, but employees and companies will likely continue to negotiate the exact terms of the new model in the months and years ahead. Are the remote work wars really over? And what will office recovery look like in the new year?

Follow placer.ai/blog to find out.

With their experiential vibes and treasured blends of well-known brands and local gems, high-street retail corridors are experiencing something of a renaissance. Iconic shopping districts like Fifth Avenue and SoHo in New York City, Rodeo Drive in Beverly Hills, and Newbury Street in Boston are seeing steady influxes of luxury and high-end apparel brands. And economic headwinds notwithstanding, consumers continue to flock to these important retail destinations to shop, grab a bite to eat, and take in all the sights and sounds they have to offer.

So with the new year upon us, we dove into the data to see how major urban shopping districts nationwide fared this holiday season. How did visits to these corridors in the final months of 2023 compare to last year? And who are the consumers driving the high-street revival?

Over the past six months, visits to major urban shopping districts have been consistently higher than they were last year. And as the holiday season kicked into gear, the year-over-year (YoY) growth trajectory trended upwards – indicating a robust turnout during this holiday period.

%20(1).avif)

To examine some of the factors behind this growth, we analyzed the demographic profiles of the captured markets of POIs (points of interest) corresponding to major high-street corridors throughout the country.

The analysis shows that throughout the U.S., high-street shopping districts hold special appeal for affluent audiences – and for consumers belonging to Spatial.ai’s PersonaLive’s “Educated Urbanite” psychographic segment. This segment encompasses well-educated young singles that live in dense urban areas and make relatively high salaries. Given the demographic profile of their visitors, it’s no wonder that high-street corridors are finding success while expanding their luxury and high-end apparel portfolios.

In Q4 2023, the captured markets of Fifth Avenue, SoHo, and Times Square all featured higher median household incomes (HHIs), and greater shares of the “Educated Urbanite” segment than New York’s statewide baselines. Each of these quintessential New York City landmarks, however, drew a somewhat different visitor base.

Fifth Avenue, with its array of museums, luxury high-rises, and expensive department stores, drew the most affluent crowd, with a captured market median HHI of $105.6K – some 35.7% above the statewide median. SoHo, for its part, known for designer apparel stores, trendy cafes, and whimsical tourist attractions (Museum of Ice Cream, anyone?), attracted the largest share of “Educated Urbanites.” And Times Square, a top Big Apple attraction with broad popular appeal, boasted a visitor profile closest to statewide baselines.

.avif)

A look at the visitor profiles of major California shopping districts reveals a similar trend. The captured markets of Beverly Hills’ Rodeo Drive, Santa Monica’s 3rd Street Promenade, Hayes Valley in San Francisco, and Abbot Kinney in Los Angeles all had higher median HHIs in Q4 2023 than the statewide median of $85.7K. Of these, the captured market with the highest median HHI was that of Hayes Valley in San Francisco – an unsurprising finding given the relative affluence of the Bay Area. Not far behind was Rodeo Drive, with a median HHI of $113.9K.

Hayes Valley also led the charge for “Educated Urbanites,” with no less than 61.4% of the population of its captured market – nearly two-thirds – belonging to this segment. But all four of the analyzed high-street corridors were significantly over-indexed for this demographic compared to the California baseline of 13.1%.

.avif)

Looking at urban shopping districts in other major cities nationwide – including Newbury Street in Boston, Fulton Market in Chicago, and Walnut Street in Philadelphia – shows that the unique draw of these corridors for young, affluent singles isn’t confined to New York and Chicago. In all three corridors, the median HHIs and shares of “Educated Urbanites” in the captured markets

also exceeded statewide baselines – oftentimes by a wide margin.

.avif)

Evolving work routines and post-COVID population shifts continue to present municipalities and other civic stakeholders with significant challenges. But the revival of high-street retail corridors shows that cities are up to the task. How will major urban shopping districts fare in the new year? And how will their audiences continue to evolve?

Follow Placer.ai’s data-driven retail foot traffic analyses to find out.

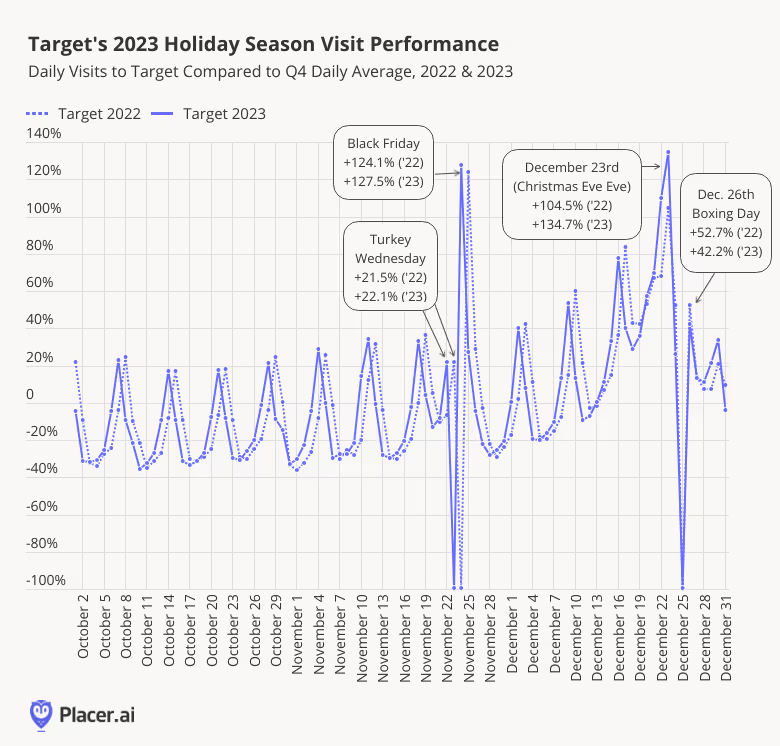

How did the brick-and-mortar divisions of Walmart, Target, and other leading retailers perform this holiday season? Which days drove the most visits, and how did foot traffic performance this year compare to 2022? We dove into the data to find out.

Looking at daily visits to Target, Walmart, mid-tier department stores (including Macy’s, JCPenney, Kohl’s Belk, and Dillard’s), luxury department stores (including Saks Fifth Avenue, Neiman Marcus, Bloomingdale’s, and Nordstrom) and Best Buy reveals several common trends.

In all cases, retail visits began to creep up over the days leading up to Thanksgiving (Monday through Wednesday) as consumers took advantage of early Black Friday discounts. And the visit increase on Black Friday 2023 relative to the Q4 daily average was larger than in 2022 – perhaps thanks to budget-conscious consumers holding out for the steep discounts offered the day after Thanksgiving. The Christmas Eve Eve (December 23rd) and Super Saturday spikes were also particularly pronounced in 2023, likely thanks to the combination of both retail events falling on the same day this year.

All retailers and retail segments analyzed also saw smaller surges on Boxing Day (December 26th) 2023 when compared to 2022, likely due to calendar differences. Christmas fell on a Sunday in 2022, so December 26th was declared a federal holiday in lieu of December 25th, and many private-sector employers likely gave time off as well – giving consumers the opportunity to hit the stores and enjoy after-Christmas sales. But Boxing Day still drove visit peaks across the board in 2023 (albeit not smaller peaks than in 2022) – indicating that Boxing Day is now a U.S. phenomenon as well.

December 27th, 28th, and 29th saw a greater increase relative to the daily Q4 average in 2023 compared to 2022, culminating in a larger New Years Eve Eve (December 30th) spike. The December 30th surge may be because this year’s December 30th fell on a Saturday, which is a major shopping day in its own right. But the increase in the days prior to New Years Eve Eve, when after-Christmas sales were in full force, could indicate that consumers are still particularly attune to sales events.

Still, despite the similarities across retail categories, foot traffic data also reveals some important differences between the segments.

Visits to Target began to increase in November 2023 relative to October as the retailer offered “Four Weeks of Early Black Friday Deals,” starting October 29th. And like the other categories analyzed, Target saw its first small visit peak of the season on the Wednesday before Thanksgiving (also known as Turkey Wednesday thanks to the massive Grocery visit spikes on the day). Visits on the day before Thanksgiving were up by 21.5% and 22.1%, in 2022 and 2023, respectively, despite foot traffic on an average Wednesday tends to be lower than the Q4 daily average – indicating that “Turkey Wednesday” also holds retail significance for grocery-adjacent categories.

Visits then spiked on Black Friday and returned to seasonally normal levels on Saturday. Throughout December, foot traffic continued to swell, with every week exceeding the previous week’s visit performance. The intensity of the visit growth picked up the week before Christmas, with Christmas Eve Eve/Super Saturday seeing a significant jump. Finally, Target visits on Boxing Day and the week following Christmas also exceeded the Q4 daily average as consumers took advantage of end-of-season sales and looked for festive attire for their New Year’s Eve celebrations.

The holiday season visit pattern at Walmart differs from those at Target in several instances. The superstore’s Turkey Visit spike was significantly more pronounced than Target’s, likely thanks to Walmart’s more extensive grocery offerings. Walmart also saw smaller spikes on Black Friday – perhaps due to the retailer’s famous “everyday low prices,” which may reduce the appeal of specific sales events. The Christmas Eve Eve/Super Saturday surge were also lower than for Target, but the Super Saturday increase relative to Black Friday spike was more pronounced, with some consumers probably visiting Walmart for last-minute groceries ahead of their Christmas dinners.

.avif)

Visits to luxury department stores (Saks Fifth Avenue, Neiman Marcus, Nordstrom, and Bloomingdale’s) followed the general retail foot traffic trends, with larger peaks on Black Friday and on Christmas Eve Eve/Super Saturday in 2023 compared to 2022. Boxing Day 2023 drove a smaller visit spike relative to last year, but foot traffic was still 98.2% higher than the Q4 2023 daily average – indicating that the day is still emerging as an important retail milestone, especially for pricier segments.

.avif)

Mid-tier department stores (Macy’s, Kohl’s, JCPenney, Belk, and Dillard’s) saw more significant spikes on Black Friday and Christmas Eve Eve/Super Saturday, and smaller spikes on Boxing Day. Luxury’s department stores’ biggest post-Christmas visit peak was on Boxing Day, but mid-tier department stores experienced their largest end-of-year increase on New Year’s Eve Eve (December 30th).

.avif)

Best Buy saw the strongest Q4 visit spike on Black Friday out of all the retailers and retail segments analyzed, with foot traffic up a whopping 510.9% compared to its Q4 2023 daily average. The electronics leader also had the largest Christmas Eve Eve/Super Saturday bump – with visits up 188.1% – and Boxing Day boost, with traffic up 112.9% compared to the Q4 daily average. The visit surges over the holiday season’s retail milestones indicate that demand for electronics remains strong – even as some consumers may be putting off large purchases due to economic headwinds.

.avif)

The holiday season drove significant retail foot traffic across categories, with every segment displaying its own unique Q4 visitation pattern. How will these sectors perform in the year ahead?

Visit placer.ai/blog to find out.

2023 was a year that forced restaurant operators to stay agile. Inflation was top-of-mind for most consumers throughout the year, resulting in a trade-down to value-oriented restaurants (or trading out to value grocery chains, dollar stores, and convenience stores). That said, value wasn’t the only factor driving visits, as new menu innovations (Taco Bell was a standout) or marketing partnerships (McDonald’s Famous Orders and “adult” happy meals helping the chain to outperform from a visitation perspective). While we’ve seen visitation trends for the morning daypart improve due to a steady recovery in return to office trends, we continue to see visits during late morning and early afternoon for coffee and QSR chains due to changes in consumer routines (not to mention a resurgence in late night dining). This has also prompted several chains to refine their approach to drive-thrus and pick-up windows (Shake Shack, Chipotle, Taco Bell, among several others). On top of these trends, we’ve seen massive changes in restaurant trade areas, driving many chains to rethink their expansion plans (including an emphasis on South and Southeast, which have seen population growth due to migration).

McDonald’s new exploratory restaurant concept CosMc’s sits at the intersection of several of these trends. The smaller-format (approximately 2,800 square feet, compared to 4,000-4,500 square feet for the average McDonald’s), drive-thru only concept opened its doors last month in Bolingbrook, IL, and is part of a “limited test run”. Its menu heavily focuses on beverages, including four “Signature Galactic Boosts” (featuring Sour Cherry Energy Boost and Island Pick-Me-Up Punch drinks), iced teas and lemonades (such as a Tropical Spiceade and Blackberry Mist Green Tea), slushes and frappes (including a Chai Frappe Burst and Popping Pear Slush), and coffee-based products (highlighted by the S’Mores Cold Brew and Turmeric Spiced Latte). While beverages are the focal point, there are also a variety of breakfast and snack food options, including a Spicy Queso and Creamy Avocado Tomatillo breakfast sandwiches, McPops (filled doughnuts), Savory Hash Brown Bites, and Pretzel Bites. In addition to the experimental fare, the menu also features a host of traditional breakfast sandwiches and beverage offerings.

Given the early buzz, we decided to check out the concept for ourselves this week. It was immediately apparent how much interest CosMc’s was drawing, as the drive-thru lane spanned roughly 80 vehicles upon arrival (which required use of a separate parking lot at the Maple Park Place shopping center, which also features Burlington, Ross Dress for Less, Dollar Tree, Aldi, and Best Buy stores).

.avif)

While its unique menu has rightfully generated a significant amount of attention, it’s also clear that McDonald’s is also using CosMc’s as a test for other potential drive-thru only locations in the future. Customers order from dynamic menu boards and cashless payment devices are used to expedite the payment process. Visitors wait at the menu board until their order is ready, and then pickup windows are assigned when the order is ready.

.avif)

.avif)

Admittedly, it’s tough to make definitive conclusions about CosMc’s with the location being open for only a few weeks. Placer’s data suggests that CosMc’s saw more than double the number of visits that a typical McDonald’s saw chainwide during December 2023 (despite being open only since Dec. 7) and more than triple the number of visits per square foot (given CosMc’s smaller, roughly 2,500 square feet footprint). However, it’s also worth noting that CosMc’s visitation numbers would likely have been much higher if the location had additional capacity to satisfy the overwhelming demand.

Still, Placer offers some other ways to evaluate CosMc’s early trends. Based on 2019 Census Block Group data, CosMc’s trade area size (using a 70% of visit threshold) was just over 155 square miles during December 2023 (below). This is roughly 2.5 times the size of the trade area for the average McDonald’s location during December 2023 (62 miles) and significantly larger than the average trade area for most coffee brands (25-35 miles for more urban focused brands to 50-60 miles for more suburban/secondary market brands). In fact, the closest recent comparison we could find for CosMc’s was Raising Cane’s Post Malone and Dallas Cowboys restaurant collaboration, which had an impressive 264-mile trade area during its initial month of opening (though also helped by cross-traffic from Dallas Cowboys home game visitors from across the state of Texas). In some ways, there were also similarities between CosMc's and the Hello Kitty Cafe Trucks, which the Placer.ai Blog team wrote about last September.

Given that McDonald’s also appears to be targeting a younger demographic with CosMc’s, we thought we’d also look at the age breakdown for the potential market trade area (the population living within the trade area for the CosMc’s store). McDonald’s collective potential market trade area largely mirrors U.S. trends given its reach (the company has previously stated that 85% of the population in its top five markets–the U.S., France, the U.K., Germany and Canada–are within three miles of a McDonald’s location), it’s interesting that the potential market trade area for CosMc’s does skew to a younger audience, particularly the 22–29-year-old cohort.

By the end of 2024, McDonald’s plans to open an additional 10 CosMc’s test units, including locations in the Dallas-Fort Worth and San Antonio markets (notably some of the fastest growing markets in the U.S.). Does CosMc’s have the potential to be something more than a 10-unit test over a longer horizon? McDonald's has attempted to differentiate its coffee business in the past with its McCafe menu and standalone McCafe locations in international markets, but competition with Starbucks and others made it difficult for the company to distinguish McCafe as a standalone retail brand in the U.S. CosMc's is interesting from this perspective, as it may allow the company to build a brand more naturally and stand out with a younger audience (which appears to be working). It’s unlikely that future CosMc’s will look or operate like the pilot location in Bolingbrook. Nevertheless, the excitement around new products, an expansive trade area, and potential to connect with younger audience make it a worthwhile test (especially with 2024 shaping up to be a strong year for unit growth within the coffee category).

Starbucks. Amazon. Barclays. AT&T. UPS. These are just some of the major corporations that have made waves in recent months with return-to-office (RTO) mandates requiring employees to show up in person more often – some of them five days a week.

But how are crackdowns like these taking shape on the ground? Is the office recovery still underway, or has it run its course? And how are evolving in-office work patterns impacting commuting hubs and dining trends? This white paper dives into the data to assess the state of office recovery in 2024 – and to explore what lies ahead for the sector in 2025.

In 2024, office foot traffic continued its slow upward climb, with visits to the Placer.ai Office Index down just 34.3% compared to 2019. (In other words, visits to the Placer.ai Office Index were 65.7% of their pre-COVID levels). And zooming in on year-over-year (YoY) trends reveals that office visits grew by 10.0% in 2024 compared to 2023 – showing that employee (and manager) pushback notwithstanding, the RTO is still very much taking place.

Indeed, diving into quarterly office visit fluctuations since Q4 2019 shows that office visits have been on a slow, steady upward trajectory since Q2 2020, following – at least since 2022 – a fairly consistent seasonal pattern. In Q1, Q2, and Q3 of each year, office visit levels increased steadily before dipping in holiday-heavy Q4 – only to recover to an even higher start-of-year baseline in the following Q1.

Between Q1 and Q3 2022, for example, the post pandemic office visit gap (compared to a Q4 2019 baseline) narrowed from 63.1% to 47.5%. It then widened temporarily in Q4 before reaching a new low – 41.4% – in Q1 2023. The same pattern repeated itself in both 2023 and 2024. So even though Q4 2024 saw a predictable visit decline, the first quarter of Q1 2025 may well set a new RTO record – especially given the slew of strict RTO mandates set to take effect in Q1 at companies like AT&T and Amazon.

Despite the ongoing recovery, the TGIF work week – which sees remote-capable employees concentrating office visits midweek and working remotely on Fridays – remains more firmly entrenched than ever.

In 2024, just 12.3% of office visits took place on Fridays – less than in 2022 (13.3%) and on par with 2023 (12.4%). Though Fridays were always popular vacation days – after all, why not take a long weekend if you can – this shift represents a significant departure from the pre-COVID norm, which saw Fridays accounting for 17.3% of weekday office visits.

Unsurprisingly, Tuesdays and Wednesdays remained the busiest in-office days of the week, followed by Thursdays. And Mondays saw a slight resurgence in visit share – up to 17.9% from 16.9% in 2023 – suggesting that as the RTO progresses, Manic Mondays are once again on the agenda.

Indeed, a closer look at year-over-five-year (Yo5Y) visit trends throughout the work week shows that on Tuesdays and Wednesdays, 2024 office foot traffic was down just 24.3% and 26.9%, respectively, compared to 2019 levels. The Thursday visit gap registered at 30.3%, while the Monday gap came in at 40.5%.

But on Fridays, offices were less than half as busy as they were in 2019 – with foot traffic down a substantial 53.2% compared to 2019.

Before COVID, long commutes on crowded subways, trains, and buses were a mainstay of the nine-to-five grind. But the rise of remote and hybrid work put a dent in rush hour traffic – leading to a substantial slowdown in the utilization of public transportation. As the office recovery continues to pick up steam, examining foot traffic patterns at major ground transportation commuting hubs, such as Penn Station in New York or Union Station in Washington, D.C., offers additional insight into the state of RTO.

Rush hour, for one thing – especially in the mornings – isn’t quite what it used to be. In 2024, overall visits to ground transportation hubs were down 25.0% compared to 2019. But during morning rush hour – weekdays between 6:00 AM and 9:00 AM – visits were down between 44.6% and 53.0%, with Fridays (53.0%) and Mondays (49.7%) seeing the steepest drops. Even as people return to the office, it seems, many may be coming in later – leaning into their biological clocks and getting more sleep. And with today’s office-goers less likely to be suburban commuters than in the past (see below), hubs like Penn Station aren’t as bustling first thing in the morning as they were pre-pandemic.

Evening rush hour, meanwhile, has been quicker to bounce back, with 2024 visit gaps ranging from 36.4% on Fridays to 30.0% on Tuesdays and Wednesdays. Office-goers likely form a smaller part of the late afternoon and evening rush hour crowd, which may include more travelers heading to a variety of places. And commuters going to work later in the day – including “coffee badgers” – may still be apt to head home between four and seven.

The drop in early-morning public transportation traffic may also be due to a shift in the geographical distribution of would-be commuters. Data from Placer.ai’s RTO dashboard shows that visits originating from areas closer to office locations have recovered faster than visits from farther away – indicating that people living closer to work are more likely to be back at their desks.

And analyzing the captured markets of major ground transportation hubs shows that the share of households from “Principal Urban Centers” (the most densely populated neighborhoods of the largest cities) rose substantially over the past five years. At the same time, the share of households from the “Suburban Periphery” dropped from 39.1% in 2019 to 32.7% in 2024. (A location’s captured market refers to the census block groups (CBGs) from which it draws its visitors, weighted to reflect the share of visits from each one – and thus reflects the profile of the location’s visitor base.)

This shift in the profile of public transportation consumers may explain the relatively slow recovery of morning transportation visits: City dwellers , who seem to be coming into the office more frequently than suburbanites, may not need to get as early a start to make it in on time.

While the RTO debate is often framed around employer and worker interests, what happens in the office doesn’t stay in the office. Office attendance levels leave their mark on everything from local real estate markets to nationwide relocation patterns. And industries from apparel to dining have undergone significant shifts in the face of evolving work routines.

Within the dining space, for example, fast-casual chains have always been workplace favorites. Offering quick, healthy, and inexpensive lunch options, these restaurants appeal to busy office workers seeking to fuel up during a long day at their desks.

Traditionally, the category has drawn a significant share of its traffic from workplaces. And after dropping during COVID, the share of visits to leading fast-casual brands coming from workplaces is once again on the rise.

In 2019, for example, 17.3% of visits to Chipotle came directly from workplaces, a share that fell to just 11.6% in 2022. But each year since, the share has increased – reaching 16.0% in 2024. Similar patterns have emerged at other segment leaders, including Jersey Mike’s Subs, Panda Express, and Five Guys. So as people increasingly go back to the office, they are also returning to their favorite lunch spots.

For many Americans, coffee is an integral part of the working day. So it may come as no surprise that shifting work routines are also reflected in visit patterns at leading coffee chains.

In 2019, 27.5% of visits to Dunkin’ and 20.1% of visits to Starbucks were immediately followed by a workplace visit, as many employees grabbed a cup of Joe on the way to work or popped out of the office for a midday coffee break. In the wake of COVID, this share dropped for both coffee leaders. But since 2022, it has been steadily rebounding – another sign of how the RTO is shaping consumer behavior beyond the office.

Five years after the pandemic upended work routines and supercharged the soft pants revolution, the office recovery story is still being written. Workplace attendance is still on the rise, and restaurants and coffee chains are in the process of reclaiming their roles as office mainstays. Still, office visit data and foot traffic patterns at commuting hubs show that the TGIF work week is holding firm – and that people aren’t coming in as early or from as far away as they used to. As new office mandates take effect in 2025, the office recovery and its ripple effects will remain a story to watch.

Many retail and dining chains performed well in 2024 despite the ongoing economic uncertainty. But with the consumer headwinds continuing into 2025, which brands can continue pulling ahead of the pack?

This report highlights 10 brands (in no particular order) that exhibit significant potential to grow in 2025 – as well as three chains that have faced some challenges in 2024 but appear poised to make a comeback in the year ahead. Which chains made the cut? Dive into the report to find out.

Through 2024, visits to Sprouts Farmers Market locations increased an average of 7.2% year-over-year (YoY) each month, outpacing the wider grocery segment standard by an average of six percentage points. And not only were visits up – monthly visits per location also grew YoY.

The promising coupling of overall and visits per location growth seems driven by the brands’ powerful understanding of who they are and what they bring to the market. The focus on high quality, fresh products is resonating, and the utilization of small- format locations is empowering the chain to bring locations to the doorstep of their ideal audiences.

This combination of forces positions the brand to better identify and reach key markets efficiently, offering an ideal path to continued growth. The result is a recipe for ongoing grocery success.

CAVA has emerged as a standout success story in the restaurant industry over the past several years. Traditionally, Mediterranean concepts have not commanded the same level of demand as burger, sandwich, Mexican, or Asian fast-casual concepts, which is why the category lacked a true national player until CAVA's rise. However, evolving consumer tastes have created a fertile landscape for Mediterranean cuisine to thrive, driven by factors such as social media influence, expanded food options via third-party delivery, growing demand for healthier choices, the rise of food-focused television programming, and the globalization of restaurant concepts .

CAVA’s success can be attributed to several key factors. Roughly 80% of CAVA locations were in suburban areas before the pandemic, aligning well with consumer migration and work-from-home trends. Additionally, CAVA was an early adopter of digital drive-thru lanes, similar to Chipotle’s "Chipotlanes," and began developing these store formats well before the pandemic. The brand has also utilized innovative tools like motion sensors in its restaurants to optimize throughput and staffing during peak lunchtime hours, enabling it to refine restaurant design and equipment placement as it expanded. CAVA’s higher employee retention rates have also contributed to its ability to maintain speed-of-service levels above category averages.

These strengths allowed CAVA to successfully enter new markets like Chicago in 2024. While many emerging brands have struggled to gain traction in new areas, CAVA’s visit-per-location metrics in recently entered markets have matched its national averages, positioning the brand for continued growth in 2025.

Ashley’s recent strategy shift to differentiate itself through experiential events, such as live music, workshops, and giveaways, is a compelling approach in the challenging consumer discretionary category. Post-pandemic, commercial property owners have successfully used community events to boost visit frequency, dwell time, and trade area size for mall properties. It’s no surprise that retailers like Ashley are adopting similar strategies to engage customers and enhance their in-store experience.

The decision to incorporate live events into its marketing strategy reflects the growing demand for experiential and immersive retail experiences. While home furnishings saw a surge in demand during the pandemic, the category has struggled over the past two years, underperforming other discretionary retail sectors compared to pre-pandemic levels. Recognizing this challenge, Ashley’s rebrand focuses on creating interactive and memorable experiences that allow customers to engage directly with its products and explore various design possibilities. In turn, this has helped to drive visits from trade areas with younger consumers with lower household incomes.

Ashley has leaned into collaborations with interior designers and industry experts to offer informative sessions and workshops during these events. These initiatives not only attract traffic but also provide valuable insights into customers’ preferences, which can be used to refine product offerings, enhance customer service, and shape future marketing efforts. This approach is particularly relevant as millennials and Gen Z drive new household formation. While still early, Ashley’s pivot to live events is showing promising results in attracting visits and increasing customer engagement.

Department stores have had many challenges in navigating changing consumer behavior and finding their place in an evolving retail landscape. Nordstrom, an example of department store success in 2024, has been able to maintain a strong brand relationship with its shoppers and regain its footing with its store fleet. While the chain has certainly benefited from catering to a more affluent, and less price sensitive, consumer base, it still shines in fostering a shopping experience that stands out.

Value might be a driver of retail visitation across the industry, but for Nordstrom, service and experience is paramount. The retailer has downplayed promotional activity in favor of driving loyalty among key visitors. Nordstrom also has captured higher shares of high-value, younger consumer segments, which defies commonly held thoughts about department stores. The chain was a top visited chain during Black Friday in 2024, showcasing that it’s top of mind for shoppers for both gift giving and self-gifting.

What’s next? Nordstrom announced at the end of December that it plans to go private with the help of Mexican retail chain Liverpool. We expect to see even more innovation in store experience, assortments and services with this newfound flexibility and investment. And, we cannot forget about Nordstrom Rack, which allows the retailer to still engage price-conscious shoppers of all income levels, which is certainly still a bright spot as we head into 2025.

Visits are up, and the audience visiting Sam’s Club locations seems to be getting younger which – when taken together – tells us a few critical things. First, Sam’s Club has parlayed its pandemic resurgence into something longer term, leveraging the value and experience it provides to create loyal customers. Second, the power of its offering is attracting a newer audience that had previously been less apt to take advantage of the unique Sam’s Club benefits.

The result is a retailer that is proving particularly adept at understanding the value of a visit. The membership club model incentives loyalty which means that once a visitor takes the plunge, the likelihood of more visits is heightened significantly. And the orientation to value, a longer visit duration, and a wide array of items on sale leads to a larger than normal basket size.

In a retail segment where the value of loyalty and owning ‘share of shopping list’ is at a premium, Sam’s Club is positioned for the type of success that builds a foundation for strength for years to come.

Raising Cane’s exemplifies the power of focus by excelling at a simple menu done exceptionally well. Over the past several years, the chain has been one of the fastest-growing in the QSR segment, driven by a streamlined menu that enhances speed and efficiency, innovative marketing campaigns, and strategic site selection in both new and existing markets. Notably, Raising Cane’s ranked among the top QSR chains for visit-per-location growth last year. Unlike many competitors that leaned on deep discounts or nostalgic product launches to boost traffic in 2024, Raising Cane’s relied on operational excellence to build brand awareness and drive visits. This approach has translated into some of the highest average unit sales in the segment, with restaurants averaging around $6 million in sales last year.

Raising Cane’s operational efficiency has also been a key driver of its rapid expansion, growing from 460 locations at the end of 2019 to more than 830 heading into 2025. This includes over 100 new store openings in 2024 alone, placing it among the top QSR chains for year-over-year visit growth. The chain’s ability to maintain exceptional performance while scaling rapidly highlights its strong foundation and operational strategy.

While Life Time has fitness at its core, it has also expanded to become a lifestyle. Healthy living is its mantra and this extends to both the gym aspect, but also the social health of its members with offerings like yoga, childcare, personalized fitness programs, coworking, and even an option for luxury living just steps away.

With all these choices, it’s no wonder that its members are more loyal than others in its peer group.

To the delight of book lovers everywhere, Barnes & Noble is back in force. With a presence in every single state and approximately 600 stores, location options are growing to browse bestsellers, chat with in-store bibliophiles, or grab a latte. Stores are feeling cozier and more local, with handwritten recommendations across the store. The chain’s extensive selection of gifts and toys mean that one can stop in for more than just books. The membership program is also relaunching, rewarding members for their purchases. Even though some locations have downsized, efficiency is up with average visits per square foot increasing over the last 3 years. Customers are also lingering, with nearly 3 in 10 visitors staying 45 minutes or longer.

With options for a “third place” that’s not home or work dwindling, Barnes & Noble is poised to fill that hole.

From its origins as a corner grocery store in Queens, NY 42 years ago, H Mart now boasts over 80 stores throughout the US. Shoppers are enticed by the aroma of hot roasted sweet potatoes wafting through the store, the opportunities to try new brands like Little Jasmine fruit teas, and the array of prepared foods such as gimbap and japchae. In addition to traditional Korean, Chinese, and Japanese groceries, H Mart’s assortment has expanded to staple items and American brands as well like Chobani yogurt or Doritos.

As the Hallyu wave sweeps across the nation and K-pop stars like Rose top the charts for the eight straight week with the catchy “APT”, so too is the appetite for Asian food. At the second-most visited H Mart in the nation in Carrollton, TX, the ethnic makeup of customers is 39% White, 14% Black, 23% Hispanic or Latino, and 20% Asian – reflecting the truly universal appeal of this supermarket chain.

Beauty retail had a transformative 2024, with a general cooling off in demand for the category. Competition between chains has increased and delivering quality products, expertise and services is critical to maintain visits. Against this backdrop, Bluemercury stands out as a shining star in parent company Macy’s portfolio of brands, with the brand well positioned to take on this next chapter of beauty retail.

Bluemercury’s success lies in its ability to be a retailer, an expert, and a spa service provider to its consumers. Placer data has shown that beauty chains with a service and retail component tend to attract more visitors than those who just specialize in retail offerings, and Bluemercury is no exception. The chain also focuses solely on the prestige market within the beauty industry and caters to higher income households compared to the broader beauty category; both of those factors have contributed to more elastic demand than with other retailers.

Bluemercury’s bet on product expertise and knowledge combined with a smaller format store help to foster a strong connection between the beauty retailer and its consumers. The brand overindexes with visitors “seeking youthful appearance” and has cemented itself as a destination for niche and emerging beauty brands. As the larger Macy’s brand grapples with its transformation, Bluemercury’s relevance and deep connection to its consumer base can serve as an inspiration, especially as the beauty industry faces mounting uncertainty.

Competitors like Dutch Bros and 7Brew are on the rise, critical office visitation patterns remain far behind pre-pandemic levels, and the chain did not end the year in the most amazing way in terms of visit performance. But there is still so much to love about Starbucks – and the addition of new CEO Brian Niccol positions the coffee giant to rebound powerfully.

The focused attention on leaning into its legendary ‘third place’ concept is in excellent alignment with the shift to the suburbs and hybrid work and with audiences that continue to show they value experience over convenience. But the convenience-oriented customer will likely also benefit from the brand’s recent initiatives, including pushes to improve staffing, mobile ordering alignment and menu simplification. In addition, the brand is still the gold standard when it comes to owning the calendar, as seen with their annual visit surges for the release of the Pumpkin Spice Latte or Red Cup Day and their ability to capitalize on wider retail holidays like Black Friday and Super Saturday.

The combination of the tremendous reach, brand equity, remaining opportunities in growing markets and the combined ability to address both convenience and experience oriented customers speaks to a unique capacity to regain lost ground and drive a significant resurgence against the expectations of many.

Retail has had its challenges this year, with many consumers opting for off-price to snag deals – but the strength of the Adidas brand should not be underestimated. Gazelles and Sambas are still highly coveted, and a partnership with Messi x Bad Bunny racked up over a million likes. Consumers are favoring classic silhouettes across both shoes and clothing, and nothing says classic like those three stripes.

Gap, and its family of brands including Old Navy and Banana Republic, are synonymous with American apparel retail. The namesake brand has always been at the center of comfort, value and style, but over time lost its way with consumers. However, over the past year and a half, the reinvigoration of the Gap family of brands has started to take shape under the direction of CEO Richard Dickson.

New designs, collaborations, splashy marketing campaigns and store layouts have taken shape across the portfolio. While we haven’t seen a lot of change in visitation to stores over the past year, trends are certainly moving in the right direction and outpacing many other brands in the apparel space. Gap has also reinserted itself into the fabric of American fashion this past year with designs for the Met Gala.

The benefit of Gap Inc.’s portfolio is that each brand has a distinct and unique audience of consumers that it draws from. This allows each brand to focus on meeting the needs of its visitors directly instead of trying to be all things for a broader group of consumers. Old Navy in particular has a strong opportunity with consumers as value continues to be a key motivator.

Gap has done all of the right things to not only catch up to consumers’ expectations but to rise beyond them. Even as legacy store-based retail brands have seen more disruption over the past few years, Gap is ready to step back into the spotlight.

The diversity of brands featured in this report highlight the variety of categories and strategic initiatives that can drive retail and dining success in 2025.

Sprouts’ focus on quality products and small-format stores, CAVA’s rise as a suburban dining powerhouse, and Nordstrom’s commitment to customer experience all highlight how understanding and responding to consumer needs can drive success. Brands like Ashley Furniture, Sam’s Club, H Mart, and Life Time have shown how offering a unique value proposition within a crowded segment, leveraging loyalty, and creating memorable experiences can fuel growth. And Raising Cane’s demonstrates the power of simplicity and operational efficiency in building momentum.

At the same time, niche players like Bluemercury are excelling by catering to specific audiences with authenticity and expertise. And while Starbucks, Adidas, and Gap Inc. face challenges, the three companies’ brand equity and revitalization efforts suggest potential for a significant comeback.