.svg)

.png)

.png)

.png)

.png)

About the Mall Index: The Index analyzes data from 100 top-tier indoor malls, 100 open-air shopping centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the country.

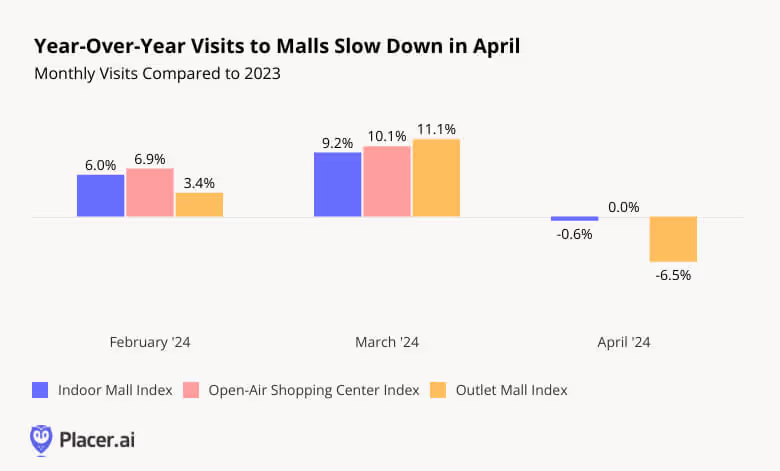

In April 2024, YoY mall visits slowed following two months of positive visit growth. For Indoor Malls, the decline was marginal – and Open-Air Shopping Centers saw visits remain on par with last year’s levels. But Outlet Malls saw a significant drop of 6.5% in visits.

Although at first glance this slowdown may suggest a resurgence of the retail challenges that plagued much of 2022 and 2023, a deeper dive into weekly visit trends paints a much rosier picture.

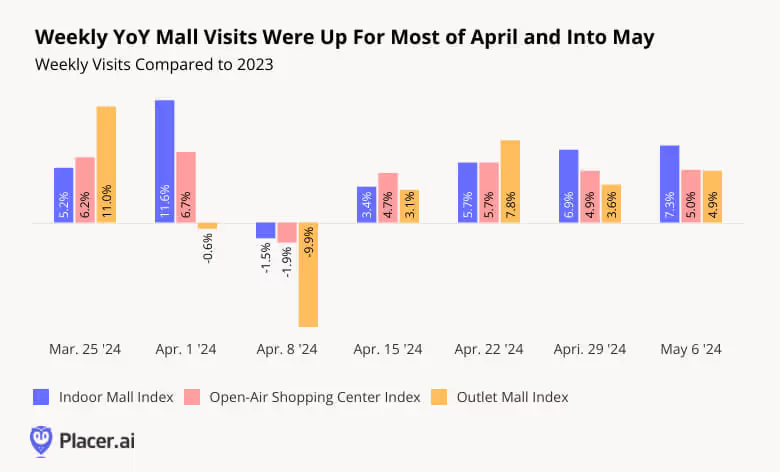

Indoor Malls and Open-Air Shopping Centers experienced robust YoY visit increases every week of April 2024 and into May, with the sole exception of the week of April 8th. This isolated drop appears to be due to a calendar discrepancy: In 2023, Easter fell on April 9th, while in 2024, the holiday fell on March 31st. So the week of April 8th, 2024 is being compared to the week immediately after the holiday (including Easter Monday) when malls likely experienced heightened activity due to gift returns and pent-up demand following holiday store closures. Though Easter Monday isn’t an official holiday in the U.S., many people likely take the day off – giving them more time to hit the stores.

Outlet Malls, which saw a steeper decline during the week of April 8th, appear to have been particularly impacted by the Easter calendar difference – shoppers may be especially likely to make the trek to an outlet mall on a holiday weekend, or on Easter Monday. But Outlet Malls also saw their positive momentum quickly recover.

The continued rise in weekly YoY mall visits signals continued retail strength into the spring of 2024.

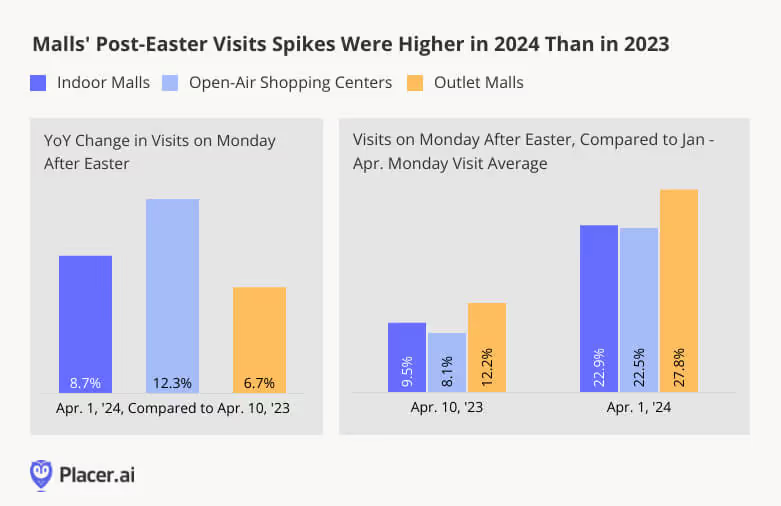

Holiday retail foot traffic is typically characterized by two main spikes: a pre-holiday visit spike evident in the days preceding the holiday, and a post-holiday uptick driven largely by gift returns and pent-up demand after stores reopen. The Monday after Easter follows this pattern – and comparing this year’s post-Easter visit spike to the one observed in 2023 provides further evidence of the category’s resilience.

On Monday, April 1st, 2024 – the day after Easter – Indoor Malls, Open-Air Shopping Centers, and Outlet Malls all drew significantly more visits than on an average Monday. And this year’s post-Easter visit spikes – ranging from 22.5% to 27.8% – were even more impressive than last year’s. Outlet Malls, which may be more likely to draw visitors on the day after Easter, saw the biggest post-Easter visit spikes.

All three mall types also saw more absolute visits this year on the day after Easter than they did in 2023 – with April 1st, 2024 foot traffic to Indoor Malls, Open-Air Shopping Centers, and Outlet Malls up 8.7%, 12.3%, and 6.7%, respectively, compared to April 10th, 2023.

Weekly YoY visit data and post-Easter foot traffic trends show that malls remain on an upward trajectory. As inflation continues to ease, malls may regain some leverage and can potentially attract crowds more readily than they did in 2023.

For more data-driven retail insights, visit our blog at placer.ai.

.avif)

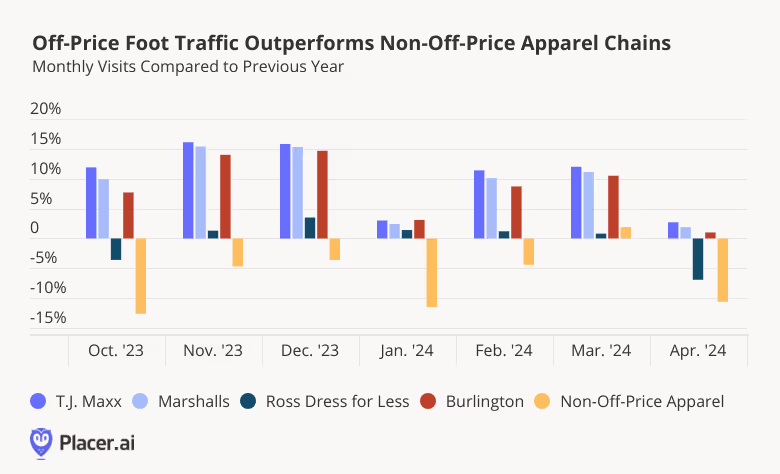

Off-price apparel chains continue to drive traffic in 2024. We dove into the latest location analytics for four of the largest brands – T.J. Maxx, Marshalls, Ross Dress for Less, and Burlington – to take a closer look at these retailers’ foot traffic growth and evolving visitor bases.

The off-price sector started off 2024 strong, with the four off-price leaders – T.J. Maxx, Marshalls (both owned by TJX Companies), Ross Dress for Less, and Burlington – consistently outperforming the wider non-off-price apparel segment. YoY visits to the four brands were also mostly positive for the period analyzed, in part thanks to the companies’ ongoing expansions.

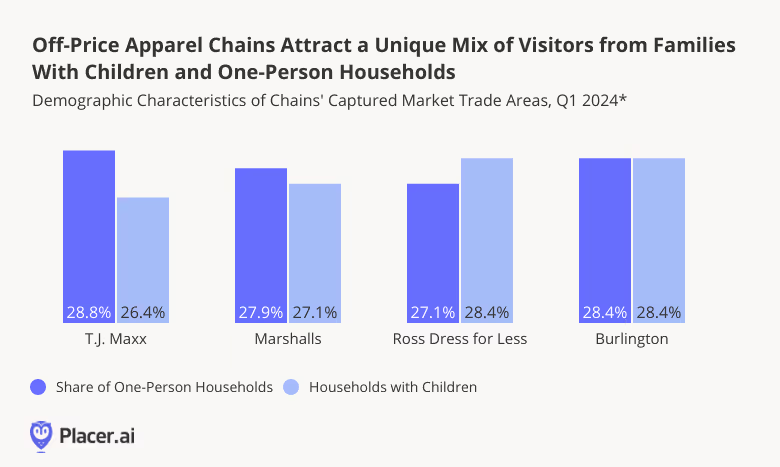

Diving into the demographic composition of the four chains’ trade areas reveals that there are many formulas for success in the off-price space. And while some companies have found success by attracting families looking to stretch their budgets, others are growing their visits by drawing singles looking to stock up on the latest styles without breaking the bank.

T.J. Maxx and Marshalls – where YoY Q1 2024 visits grew 8.9% and 7.9%, respectively – both have relatively large shares of one-person households in their trade areas. Members of these one-person households are typically younger – often belonging to the coveted Gen-Z demographic – and TJX C.E.O. Ernie Herrman has emphasized the company’s success among this audience segment as an important growth driver.

Meanwhile, the 1.1% YoY increase in overall visits for Ross Dress for Less in Q1 2024 seems driven by the chain’s popularity among families – 28.4% of the chain’s captured market consists of households with children. And Burlington achieved its Q1 7.6% YoY visit growth by appealing to both demographics.

It seems, then, that each off-price leader has found a different formula for success by catering to a unique demographic mix.

Over the last several months, off-price apparel chains have outperformed traditional apparel retailers in YoY visits as they expand their real estate footprints. Taking on new territory, off-price retailers drive visits from a unique mix of households with children and singles.

For more data-driven retail insights, visit Placer.ai.

As visits to Superstores continue to rise, we analyzed recent foot traffic data for Walmart, Target, Costco Wholesale, Sam’s Club, and BJ’s Wholesale Club and dove into Walmart’s Q1 2024 regional performance.

Wholesale chains – which receive about 20% of all visits to Walmart, Target, Costco Wholesale, Sam’s Club (owned by Walmart), and BJ’s Wholesale Club – generally outperformed classic superstore banners Target and Walmart during the first four months of the year. Visits to all three wholesale clubs analyzed were up every month on a year-over-year (YoY) basis, with Costco maintaining its lead in the space. Some of the success of wholesale clubs may be due to the makeup of their visitor base – Costco, Sam’s Club, and BJ’s tend to serve a large share of consumers from family households, and these may be opting for more buying in bulk in an effort to stretch budgets.

But visits to more classic superstores are also heating up – following a muted performance in January, when an arctic blast kept many at home, foot traffic to Target grew YoY in February, March, and April.

Walmart also experienced visit growth for most of the period, despite the slight dip in April due to calendar shifts: Visits for the superstore giant dropped 8.5% in YoY for the week of April 1st - 8th 2024 compared to the traffic surges of Easter week 2023 (April 3rd - 9th 2023), impacting the overall monthly numbers, but visits returned to growth during the last two weeks of April (4.3% and 4.0% YoY, respectively, for the weeks of April 15th - 21st and 22nd -28th).

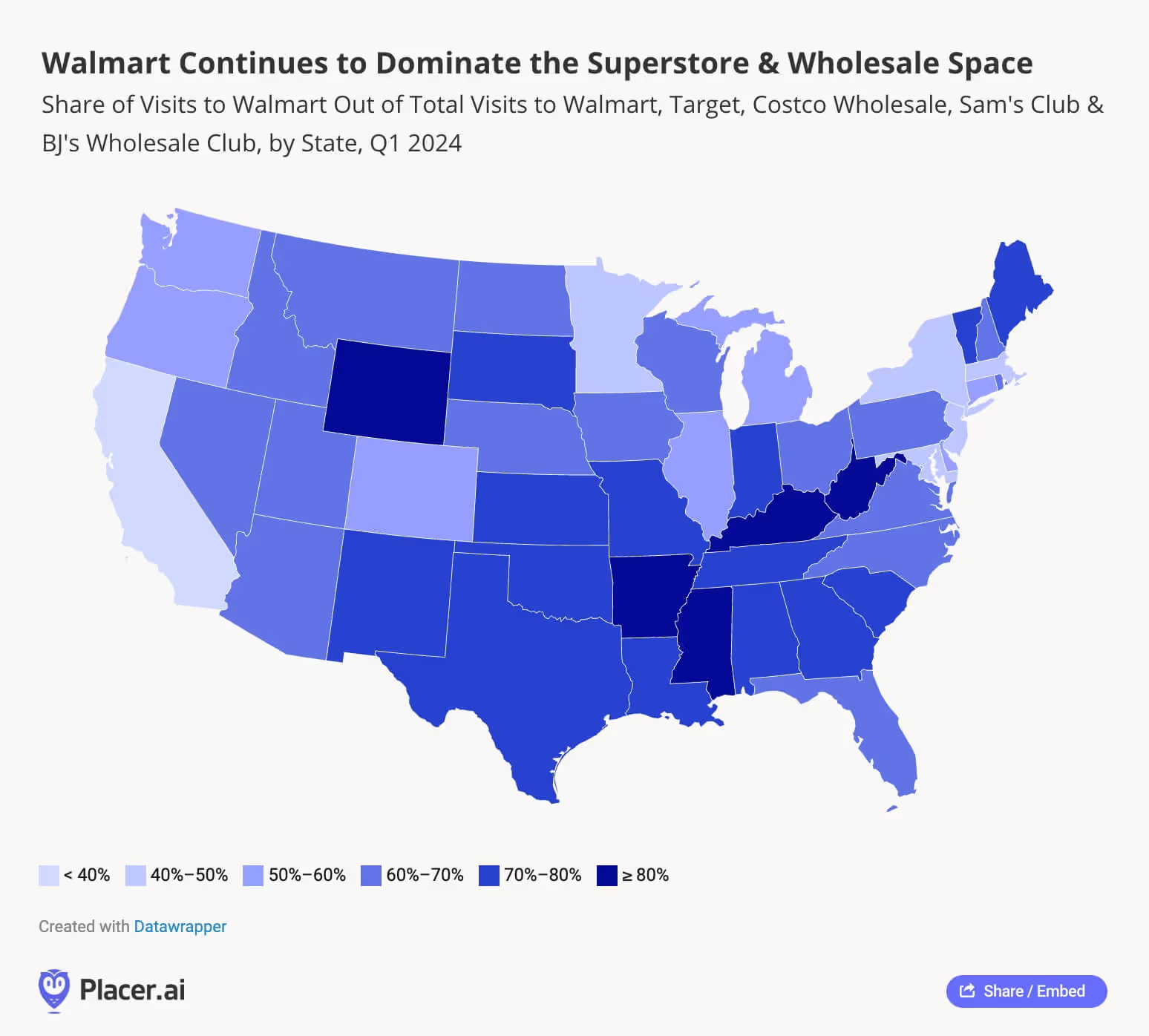

And while Walmart’s growth may not be quite as impressive as that of smaller superstores, the company has retained its position as the largest retailer in the U.S. Nationwide, the Walmart banner receives over 60% of all visits to Target, Walmart, Costco, Sam’s Club, and BJ’s, and in most of the south, the superstore’s relative visit share exceeds 70%. In a handful of states – including the retailer’s home state of Arkansas along with Mississippi, Kentucky, West Virginia, and Wyoming – 4 out of every 5 visits to the five superstore chains analyzed go to Walmart.

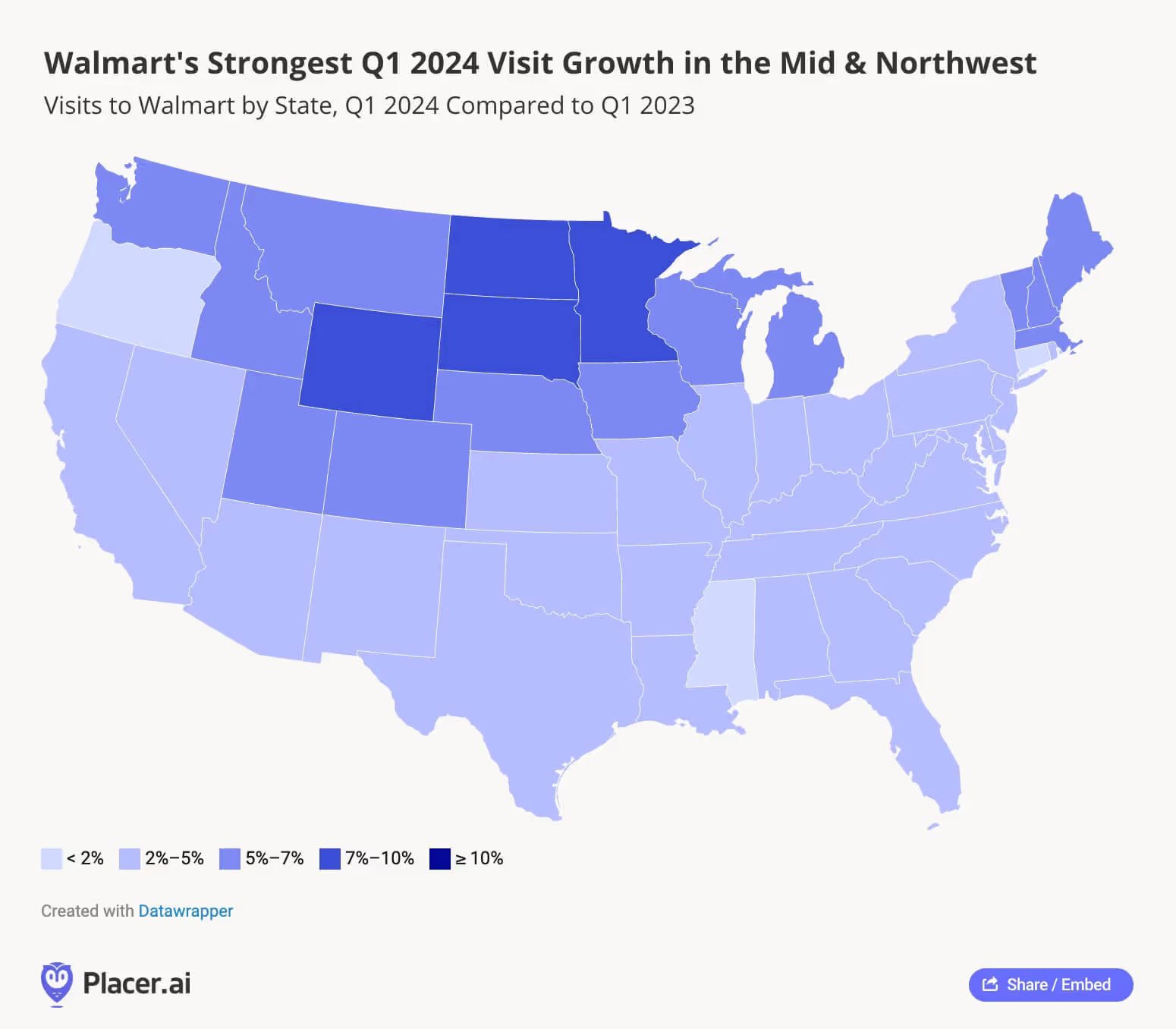

And even as Walmart optimizes its fleet, analyzing the retailer’s Q1 2024 YoY visit increases by region reveals pockets of major growth throughout the country. In addition to the 2-5% traffic increases across most of the South – where the retailer already dominates the superstore space – Walmart is also posting impressive visit increases in the Northeast, Midwest, and Northwest, with the strongest growth in Minnesota, Wyoming, and the Dakotas.

As budget-strapped consumers continue looking for bargains, the legacy retail giant may still have room to grow even larger in 2024.

Superstore and wholesale club visits are on the rise as U.S. shoppers continue to defy predictions of a consumer spending slowdown while still looking for ways to stretch their budgets.

Will these trends continue as the year progresses?

Visit placer.ai to find out.

.avif)

Discount & Dollar Stores have become an important part of the wider retail landscape over the past couple of years, and location intelligence indicates that the category is continuing to gain momentum in 2024. We dove into the data for Dollar General, Dollar Tree, and Family Dollar to understand how these banners are performing and analyze the regional reach of each chain.

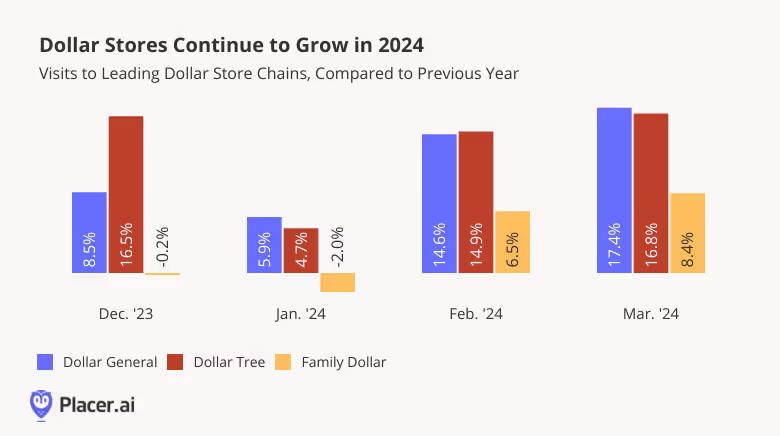

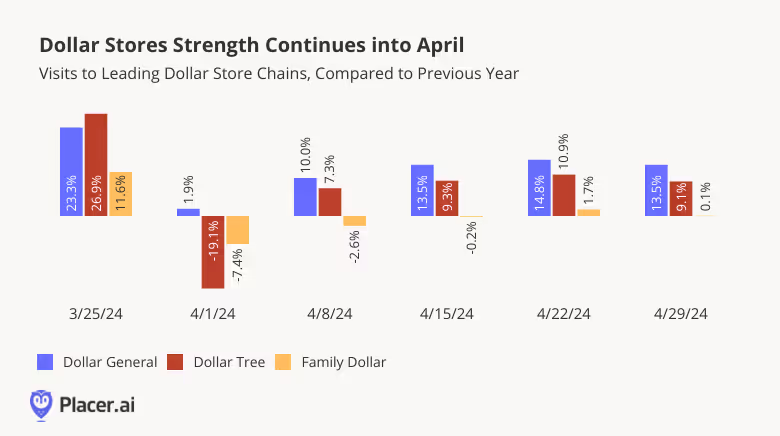

Recent visitation data for the major Discount & Dollar Store banners indicates that the category is still on the rise: Monthly visits to both Dollar General and Dollar Tree grew year-over-year (YoY) between December 2023 and March 2024. Dollar Tree-owned Family Dollar – which recently announced the closure of 1000 stores over the next couple of years – also saw its YoY traffic grow in February and March.

With the exception of the week of April 1st 2024 – when the Easter calendar shift caused a regular week in 2024 to be compared to the week of Easter in 2023 – visitation trends remained positive in April, highlighting the ongoing strength of the Discount & Dollar Store category. Even Family Dollar – which has already begun to close stores – saw its numbers remain on par with last year’s visit levels, indicating the ongoing demand for value-priced goods in 2024.

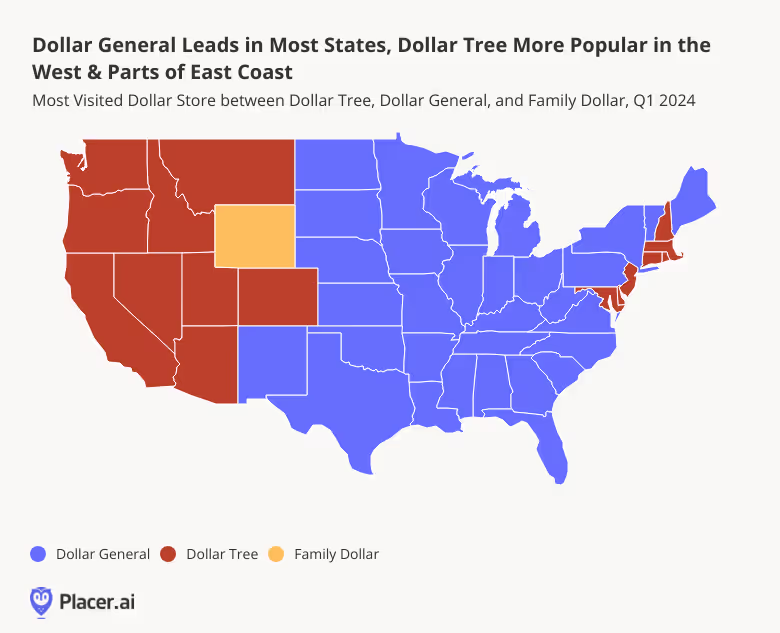

Looking at the Q1 2024 state-by-state relative visit share of the three chains – Dollar General, Dollar Tree, or Family Dollar – reveals some clear regional differences in consumer preferences across states.

Dollar Tree was more popular in the West, with the Dollar Tree brand leading in most western states and the company’s Family Dollar banner receiving the plurality of visits in Wyoming. Dollar Tree was also the most-visited chain in several states on the East Coast, including Maryland, New Jersey, Connecticut, and Massachusetts.

Dollar General, meanwhile, received the majority or plurality of the visit share in the rest of the country.

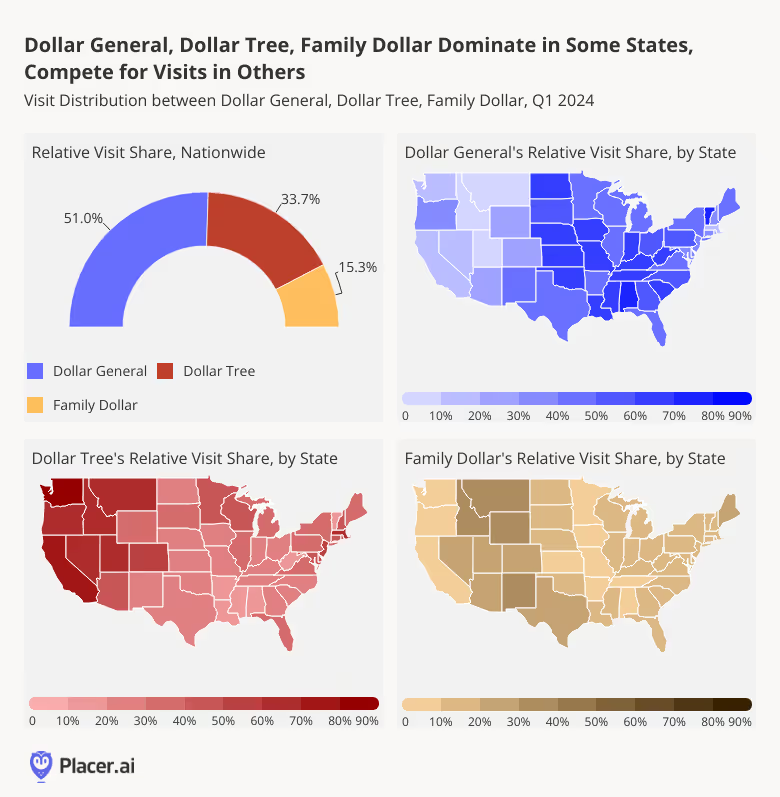

But although Dollar General does receive a majority of the combined Dollar General, Dollar Tree, and Family Dollar visit share nationwide, the Discount & Dollar Store category does not conform to a “winner-take-all” model. In many states, Dollar Tree’s visit share is just slightly lower than that of Dollar General.

In New York, for example, where Dollar General received 44.6% of the combined visit share in Q1 2024, 38.1% of visits in the same period went to Dollar Tree. And in Florida, where 44.2% of the combined visits to the three banners went to Dollar General, 38.2% of visits went to Dollar Tree. It seems, then, that even in states where Dollar General takes the lead, there is plenty of Discount & Dollar Store demand to sustain multiple players in the space.

Early 2024 data suggests that the Discount & Dollar Store sector is not slowing down any time soon. What will the rest of the year have in store for the space?

Visit placer.ai to find out.

Equinox hit the news this week as they rolled out a new $40,000 per year longevity membership called “Optimize by Equinox.” This program promises to provide a personalized health plan of action that includes personal training, nutrition, sleep coaching, and massage therapy. There will also be biomarker testing in partnership with Function Health and fitness testing. New York City and Highland Park, Texas are the pioneering locations for this program, with more to come. Placer took a look at the Highland Park location as well as one on Greenwich Ave in New York City. The Highland Park location has shown extraordinary year-over-year growth, with each month of the year showing increases compared to the prior year. The New York City location is a bit more mixed but had a strong showing year-over-year last fall and at the beginning of 2024.

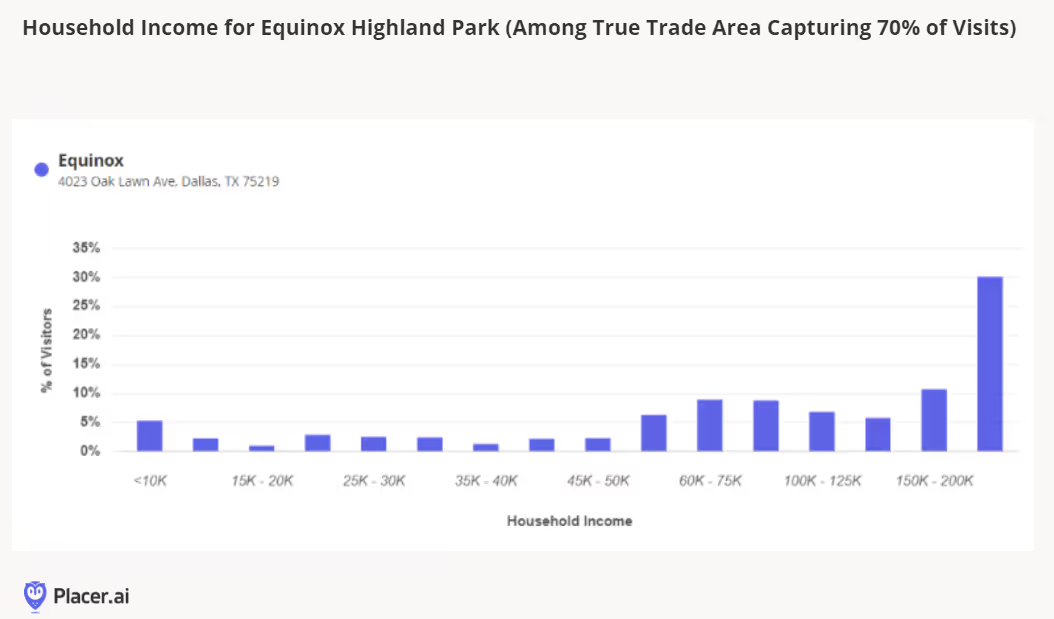

A 2023 survey by A/B Consulting and Maveron VC suggested that almost half (46%) of people earning over $250,000 would spend the majority of their discretionary income on trying to improve health and longevity, compared to only 34% of people earning under $50,000. Bryan Johnson is a tech millionaire who is often in the press with his latest experiments at reversing aging. From routine MRIs to frequent sampling of bodily fluids, he is a rare example of what one might do to try to live forever if one had nearly unlimited means to do so. While not all of us have millions to spend on unlocking the secrets to the fountain of youth, there’s no doubt that wellness and longevity are top of mind for many people, be it endeavoring to walk 10,000 steps a day or aiming for a rainbow diet. Looking at Equinox in Highland Park in Dallas, TX we see that indeed, this wealthy enclave is an apt location to pioneer this longevity offering. In the true trade area capturing 70% of visits, more than 3 in 10 have a household income exceeding $200K.

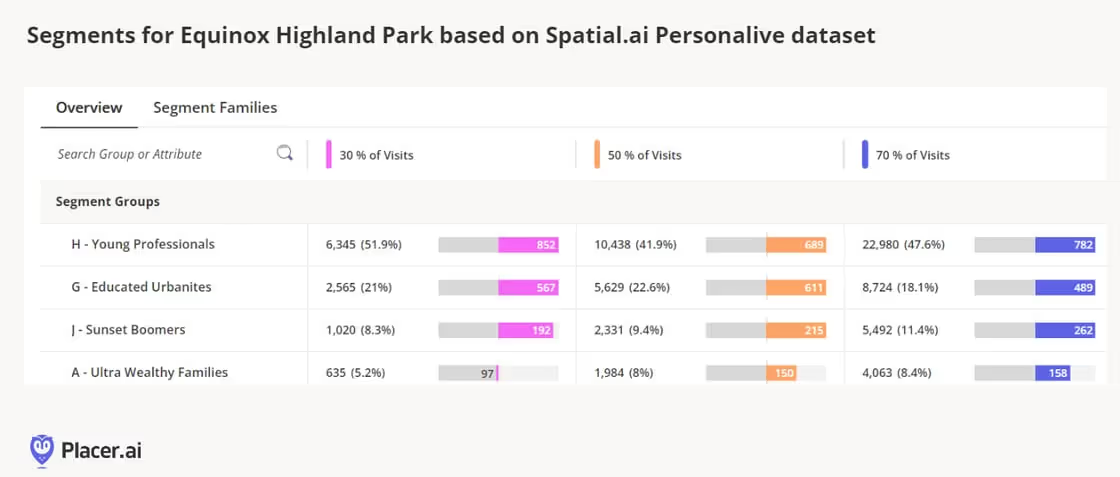

The Spatial.ai PersonaLive dataset further cements the fact that the top visitor segments are a group with higher-than-average discretionary incomes, such as Young Professionals, Educated Urbanites, Sunset Boomers, and Ultra Wealthy Families.

Additional data from the AGS Behavior & Attitudes dataset indicates that among those living in trade areas comprising 70% of visits to the Highland Park Equinox, many are indeed health-oriented, over-indexing on behaviors such as exercising (index 122), being yoga enthusiasts (index 168), and utilizing mobile app fitness trackers (index 160). However, they tend to under-index on getting regular medical checkups (index 86) - which is exactly where Optimize could fit in with its frequent testing and personalized approach. In addition, this particular location might want to take advantage of the clamor for pedicures (index 137) and manicures (index 147) and consider increased retail media network exposure due to enthusiasm for health info from TV (index 159).

Of all the specialty retail sectors, baby has been one of the most interesting to watch over the past few years for a few reasons. The industry is closely tied to a specific consumer life stage, and the CDC recently reported that the birth rate in the United States declined 2% in 2023, reaching the lowest rate recorded. If fewer consumers enter the family formation life stage, or have fewer children, the pool of potential visitors for retailers to draw from slowly dries up. The industry also faced massive disruption over the past year with the bankruptcy of Bed Bath & Beyond and the shuttering of its buybuy Baby chain last summer. The buybuy Baby closure marked the end of the large specialty baby chain sector in the retail industry, with the category facing the bifurcation of sales and traffic between big box retailers + Amazon and small independent specialty retailers.

Still, there have been some signs of life for baby-based retail despite the headwinds. Babylist, a popular online registry tool, launched its first brick-and-mortar outpost in Los Angeles last year. Buybuy Baby’s new owners reopened 11 locations in late 2023, concentrated in New England and the Mid-Atlantic. Then, in March, Kohl’s announced its partnership with WHP Global to bring Babies“R”Us to its stores. The Babies“R”Us shop-in-shop format receives a lot of positive momentum from both the Sephora at Kohl's partnership as well as the Toys“R”Us & Macy’s partnership; both predecessor collaborations have been rolled out to a majority, if not all, doors.

This week, we learned of the 200 initial locations receiving the Babies“R”Us (BRU) concept this summer, which will receive a wide assortment of hardgoods and softgoods, and be positioned next to the children’s apparel department. This new partnership is no doubt a continuation of Kohl’s strategy to attract and retain younger visitors, and the Babies“R”Us model can hopefully help the retailer hold onto Sephora shoppers as they enter the family formation period. Another likely goal is to steal some market share away from the mass merchants dominating in baby and lure some former buybuy Baby shoppers.

According to Placer.ai data, The Babies“R”Us + Kohl’s locations performed similarly to the total Kohl’s chain in 2024, with both chains showing visits down 23% year-over-year. The Babies“R”Us + Kohl’s locations do have a slightly higher visitor median household income of $84k compared to the total chain at $81K, which supports the notion that the Sephora & Babies“R”Us partnerships are meant to bring premium offerings to the typical store.

The partnership launch, as mentioned above, is a clear offensive move to capture some of the former buybuy Baby business in the areas where the locations did not reopen. Using Placer’s location analytics, we compared a national subset of 16 former buybuy Baby locations to the newly announced Babies”R”Us + Kohl’s locations. Looking at the visit demographics between the Kohl’s locations in the first four months of 2024 and the former buybuy Baby locations in 2023, it’s clear that Kohl’s attracts a suburban family and more mature consumer base, as where buybuy Baby locations were a stronghold with young urban singles and young professionals. Kohl’s may have an opportunity to attract new or existing grandparents to the partner stores, but will need to use the Sephora angle to attract younger consumers who may also be looking to start a family in the next few years.

Kohl’s is also betting big on the East Coast, with a number of partnership stores located in New York, New Jersey, Pennsylvania and Massachusetts. A few of these locations are in direct competition with the newly reopened buybuy Baby locations and will create some fascinating local competition. In the Boston metro area, there are both a Kohl’s and buybuy Baby location within 9 miles of each other but have local differences that may benefit Kohl’s entry into the market. Kohl’s has a median household income of about $30k more than visits to buybuy Baby and also captures more loyalty, with more loyal visits than buybuy Baby throughout the first four months of 2024.

This particular Kohl’s location has a smaller disparity to buybuy Baby in attracting young professionals, but it also attracts wealthier and more mature visitors that once again may translate into attracting parents and grandparents. 22% of buybuy Baby’s trade area overlaps with Kohl’s and the two share 11 square miles of overlapping trade area, so it will be interesting to see how Kohl’s can pull visits away from the competition.

As 2024 progresses, Kohl’s opens its partnership locations, baby retail will hopefully find its footing and provide retail solutions for potential and new parents. E-commerce has filled the void for baby registry services, but brick-and-mortar retail still holds a lot of importance for parents. Baby specialty retail is essential to the success of baby products and brands, and there is a lot of white space opportunity in the category for retailers to emerge to take share. Consumers, even if there are fewer of them, need experiences and solutions provided by retailers, and baby retail is a cautionary, but optimistic tale for other specialty sectors for the remainder of the year.

1. The Midwest is the only region where Black Friday retail visits outpace Super Saturday.

But several major Midwestern markets, including Chicago and Detroit, actually see higher shopper turnout on Super Saturday.

2. Holiday season demographic shifts also vary across regions.

Nationwide, electronics stores see a slight uptick in median household income (HHI) in December – yet in certain markets, electronics retailers such as Best Buy see a drop in captured market median HHI during this period.

3. Back-to-school shopping starts earliest for clothing and office supplies retailers in the South Central region, likely tied to earlier school schedules.

But back-to-school visits surge higher for these retailers in the Northeast later in the season.

4. The share of college students among back-to-school shoppers varies by region.

In August 2024, “Collegians” made up the largest share of Target’s back-to-school shopping crowd in New England, and the smallest in the West.

5. Mother’s Day drives the biggest restaurant visit spikes in the Middle Atlantic Region, while Father’s Day sees its biggest boosts in the South Atlantic states.

Mother’s Day diners also tend to travel farther to celebrate, suggesting an extra effort to treat mom.

6. Western states proved particularly responsive to McDonald’s recent Minecraft promotion.

During the week of A Minecraft Movie’s release, the promotion drove significantly higher visit spikes in the West than in the Eastern U.S.

Retailers rely on promotional events to fuel sales – from classics like Black Friday and back-to-school sales to unique limited-time offers (LTOs) and pop-culture collaborations. Yet consumer preferences and behavior can vary significantly by region, making it critical to tailor campaigns to local markets.

This report dives into the data to reveal how consumers in 2025 are responding to major retail promotions, exploring both broad regional trends and more localized market-level nuances. Where is Black Friday most popular, and which areas see a bigger turnout on Super Saturday? Where are restaurants most packed on Mother’s Day, and where on Father’s Day? Which region kicks off back-to-school shopping – and where are August shoppers most likely to be college students? And also – which part of the country went all out on McDonald’s recent Minecraft LTO?

Read on to find out.

Promotions aimed at boosting foot traffic on key holiday season milestones like Black Friday and Super Saturday are central to retailers’ strategies across industries. The day after Thanksgiving and the Saturday before Christmas typically rank among in-store retail’s busiest days, last year generating foot traffic surges of 50.1% and 56.3%, respectively, compared to a 12-month daily average. And

But a closer look at regional data shows that these promotions land differently across the country. In the Midwest, Black Friday outperformed Super Saturday last year, fueling the nation’s biggest post-Thanksgiving retail visit spike – a testament to the milestone’s strong local appeal. Meanwhile, in the Western U.S. Black Friday trailed well behind Super Saturday, though both milestones drove smaller upticks than in other regions. And in New England and the South Central states, Super Saturday achieved its biggest impact, suggesting that last-minute holiday specials may resonate especially well in that area.

Digging deeper into major Midwestern hubs shows that even within a single region, holiday promotions can produce widely different responses.

In St. Louis, Indianapolis, and Minneapolis, for example, consumers followed the broader Midwestern pattern, flocking to stores on Black Friday exhibiting less enthusiasm for Super Saturday deals. By contrast, Chicago and Detroit saw Super Saturday edge ahead, with Chicago’s Black Friday peak falling below the nationwide average of 50.1%. examples highlight the power of local preferences to shape holiday campaign results.

Holiday promotions don’t just drive visit spikes; they also spark subtle but significant changes in the demographic profiles of brick-and-mortar shoppers, expanding many retailers’ audiences during peak periods. And these shifts, too, can vary widely across regions.

Outlet malls, department stores, and beauty & self-care chains, for instance, which typically attract higher-income consumers, tend to see slight declines in the median household incomes (HHI) of their visitor bases in December. This dip may be due to promotions drawing in more mid- and lower-income shoppers during the peak holiday season. Electronics stores and superstores, on the other hand, which generally serve a less affluent base, see modest upticks in median HHI in the lead-up to Christmas.

But once again, drilling further down into regional chain-level data reveals more nuanced regional patterns. Take Best Buy, a leading holiday season electronics destination. In some of the chain’s biggest, more affluent markets – including New York, Los Angeles, and Chicago – the big-box retailer sees small dips in median HHI during December. But in Atlanta and Houston – also relatively affluent, but slightly less so – December saw a minor HHI uptick, hinting at a stronger holiday rush from higher-income shoppers in those cities.

Back-to-school promotions also play a pivotal role in the retail calendar, with superstores, apparel chains, office supply stores and others all vying for shopper attention. And though summer markdowns drive increased foot traffic nationwide, both the timing of these shifts and the composition of the back-to-school shopping crowd differ among regions.

Analyzing weekly fluctuations in regional foot traffic to clothing and office supplies stores shows, for example, that back-to-school shopping picks up earliest in the South Central region, likely due to earlier school start dates.

But the biggest visit peaks occur in the Northeast – with clothing retailer foot traffic surging in New England in late August, and office supplies stores seeing an even bigger surge in the Middle Atlantic region in early September. Retailers and advertisers can plan their back-to-school deals around these differences, targeting promotions to local trends.

Though K-12 families drive much of the back-to-school rush, college student shoppers also play a substantial role. And here, too, their participation varies by region.

For instance, the “Collegians” segment accounted for 2.2% of Target’s shopper base nationwide over the past year – rising to 3.0% in August 2024. But regionally, the share of “Collegians” soared as high as 4.0% in New England versus just 2.2% in the West. So while retailers in New England may choose to lean into the college vibe, those in Western states may place greater emphasis on families with children.

When it comes to dining, Mother’s Day and Father’s Day are the busiest days of the year for the full-service restaurant (FSR) category, as families treat their parents to a hassle-free meal out. And eateries nationwide capitalize on this trend by offering a variety of deals and promotions that add a little extra charm (and value) to the experience.

Nationwide, Mother’s Day drives more FSR foot traffic than Father’s Day – except in parts of the Pacific Northwest, where Father’s Day traditions run especially deep. Still, the size of these holiday boosts varies substantially by region.

This year, for instance, Mother’s Day (May 11, 2025) drove the largest FSR surge in the Middle Atlantic, with the South Atlantic and Midwest not far behind. Father’s Day, by contrast, saw its biggest lift in the South Atlantic. Mother’s Day proved least resonant in the West, whereas Father’s Day had its smallest impact in New England.

Dining behavior also differs between the two occasions. Mother’s Day celebrants display a slight preference for morning FSR visits and a bigger one for afternoon visits, while Father’s Day crowds favor evenings – perhaps reflecting a preference for sports bars and later dinners with dad. Another interesting nuance: On Mother’s Day, a larger share of FSR visits originate from between 3 and 50 miles away compared to Father’s Day, suggesting that families go the extra mile – sometimes literally – to celebrate mom.

While established dates like Black Friday or Mother’s Day naturally spur promotions, brands can also craft their own moments with limited-time offers (LTOs). And much like holiday campaigns, these retailer-led events can produce varied outcomes across different regions.

Fast food restaurants, for example, have leaned heavily on limited-time offers (LTOs) and pop-culture tie-ins to fuel buzz in what remains a challenging overall market. And McDonald’s recent Minecraft promotion, launched on April 1, 2025 to coincide with the April 3 release of A Minecraft Move, shows just how impactful the practice can be.

Nationally, the Minecraft promotion (featuring offerings for both kids and adults) drove a 6.9% lift in visits during the movie’s opening week. But the impact of the promotion was far from uniform across the U.S. Many of McDonald’s Western markets – including Utah, Idaho, Nevada, California, Texas, Arizona, Colorado, and Oregon – recorded visit lifts above 10.0%. Meanwhile, Kentucky saw a 2.1% dip, and several other Eastern states registered modest gains below 3.0%. The McDonald’s example illustrates the power of regional tastes to shape the success of even the most creative pop-culture collabs.

Whether it’s properly timing holiday and back-to-school discounts, recognizing where Mother’s Day or Father’s Day will resonate more, or pinpointing markets that respond best to pop-culture tie-ins, the data reveals that effective promotions depend heavily on local nuances. And by analyzing regional and DMA-level trends, retailers and advertisers can craft compelling, relevant campaigns that heighten engagement where it matters most.

1. Experiential and niche retailers can deliver anchor-level traffic. At Towne East Square Mall, the addition of a Scheels in 2023 significantly increased foot traffic and long-distance travelers, while Barnes & Noble at Coronado Center in Albuquerque has become a key driver of both foot traffic and higher-spend demographics.

2. Size isn’t everything – especially for dining venues. At Glendale Galleria and Northridge Fashion Center, smaller restaurants attracted more foot traffic than some traditional anchors.

3. Refocusing on tenants’ actual traffic contributions enables a flexible anchor approach. Balancing weekend draws like Scheels with weekday favorites such as Costco or Chick-fil-A can help maintain steady visitor flow throughout the week. Similarly, onsite fitness clubs can shift traffic to earlier in the day – an opportunity to adjust store hours and capture additional morning shoppers.

4. Temporary pop-ups can form an integral part of a visit-focused anchor strategy. The Barbie Dreamhouse Living Truck Tour generates mall visit spikes well above typical Saturday levels. Operators can integrate these events into their overall anchor strategies, offering preferential terms to high-performing pop-ups.

5. New tenants can boost traffic for existing stores in similar categories. After Aldi joined Green Acres Commons in February 2020, visits to an existing BJ’s Wholesale Club trended upwards. This synergy highlights how overlapping audiences can become a strength, creating a larger overall customer base.

Malls, it seems, are cool once again. After languishing in the wake of the pandemic, shopping centers across the country are thriving – reinventing themselves as prime “third places” where people can hang out, shop, and grab a bite to eat.

One key driver behind this resurgence is a shift in how malls view their anchor tenants. While traditional mainstays like Macy’s and JCPenney still play an important role, specialized offerings – from popular eateries to fitness centers and immersive retailtainment destinations – are increasingly taking center stage. These attractions maximize the experiential value that brick-and-mortar venues can deliver, driving visits and sales for the center as a whole.

Against this backdrop, this report leverages the latest location intelligence data to explore the types of tenants that can function as mall anchors in 2025. Should mall operators still focus on general merchandisers to draw crowds, or can dining chains and more niche retailers also do the job? How important is square footage in identifying the anchor-like tenants in a shopping center? And how can a visit-focused approach help mall operators select effective anchor or anchor-like tenants – whether to fill big-box spaces or to leverage the leasing perks traditionally reserved for major large-format chains?

One of the most important functions of a mall anchor is to ensure steady visitation – providing its smaller tenants with a constant flow of potential customers. And as the role of the mall continues to evolve, analyzing the actual foot traffic impacts of different types of businesses can help identify the kinds of non-traditional anchors best suited to fulfill that purpose.

Experiential venues, for example, are particularly well-poised to serve as powerful anchors in today’s retail environment – as illustrated by the visit surge experienced by Towne East Square Mall in Wichita, KS following the addition of a Scheels in July 2023.

By blending traditional retail with immersive experiences, Scheels has emerged as a true experiential destination. And this pull has also helped the mall draw more long-distance visitors willing to travel to enjoy Scheels’ offerings. In 2024, 41.9% of the mall’s customers traveled more than 50 miles to visit, compared to 35.8% back in 2018 when Sears occupied the same lot.

Traditionally, anchors aimed to please the widest possible audiences – with department stores, big-box chains, and grocery stores leading the way. But visitation data shows that niche concepts can also deliver anchor-level traffic if they’re compelling enough to attract dedicated fans.

The experience of the Barnes & Noble at Coronado Center in Albuquerque, NM is a case in point. After being written off as all but obsolete, Barnes & Noble has staged an impressive comeback in recent years, finding success through a more curated, localized approach to book selling. And despite not being a formal anchor, the Coronado Center Barnes & Noble accounted for 7.9% of visits to the mall in 2024 – outperforming both Macy’s and JCPenney.

Year-over-year data also shows foot traffic surging at the Coronado Center Barnes & Noble, lifting overall visitation to the mall. And demographic data reveals that the bookstore draws a more affluent audience than either the center as a whole or the two department stores – attracting a crowd with more spending power.

This example also illustrates how smaller tenants can sometimes draw larger crowds. Even though Barnes & Noble occupies a smaller onsite space than either Macy’s or JCPenney, it is proving a powerful visit driver out of proportion to its physical size.

Dining chains are also adept at punching above their square footage – often attracting crowds disproportionate to their size.

Despite its relatively small footprint, for example, the In-N-Out Burger at Glendale Galleria drew an impressive 8.6% of visits to the mall complex in 2024, outpacing some of the mall’s official anchors like DICK’s Sporting Goods, Macy’s, and JCPenney. Still, the onsite Target drew even larger crowds at 14.4% of visits.

A similar pattern emerged at Northridge Fashion Center, where Porto’s Bakery and Cafe captured a notable 15.6% of visits to the complex in 2024 – more than some of the center’s traditional department stores.

These examples underscore the potential for dining chains, which typically require less space, to serve as micro-anchors by consistently attracting outsized crowds – a key consideration for mall operators looking to sustain visitor traffic.

Refocusing on tenants’ actual foot traffic contributions also opens the door to a more flexible and dynamic approach to anchor selection and management – one that considers each venue’s unique visitation patterns.

Seasonal factors, for example, can make certain anchors more powerful at specific times of the year, while different venues shine on particular days of the week.

At Jordan Creek Town Center in West Des Moines, Iowa, for instance, Scheels and Costco each delivered just under 20.0% of the complex’s overall visits in 2024. But the two retailers’ daily patterns differed significantly: Scheels saw bigger crowds on weekends, while Costco was the primary weekday destination.

Understanding differences like these can help operators optimize their tenant mix to maintain a balanced flow of shoppers throughout the week.

Another example of the impact of differing weekday traffic patterns is offered by the impact of mall-based Chick-fil-A locations on the distribution of mall visits throughout the week.

Despite its relatively small size, Chick-fil-A draws substantial traffic to malls. And after adding Chick-fil-A locations, both Northridge and Miller Hill Malls saw meaningful drops in the share of visits to the centers taking place on Sundays – even as the wider indoor mall segment saw slight upticks.

Recognizing this trend could prompt mall operators to compensate by adding more weekend-friendly traffic drivers – or to lean into this distinction by taking additional steps to bolster the mall’s role as a go-to weekday destination.

The power of different mall traffic magnets also varies throughout the day. Increasingly, shopping centers are turning to fitness centers as experiential anchors. And since many people work out early in the morning, these gyms are having a significant impact on the distribution of mall visits across dayparts.

The addition of gyms to Northshore Mall in Peabody, MA and Jackson Crossing in Jackson, MI, for instance, led to a significant rise in visits between 7:00 AM and noon. And though the rest of the stores in these malls typically open at 10:00 or 11:00 AM, this shift presents the centers with a significant opportunity.

By adjusting opening hours to accommodate these early-morning patrons, malls can capitalize on this added traffic, driving up visits and sales for relevant tenants – especially health-focused retailers such as juice bars and sporting goods stores.

Adopting a broader, visit-focused view of anchoring also allows mall operators to apply some of the strategies typically reserved for anchors to non-conventional traffic-generating businesses, to ensure a consistent flow of traffic year-round.

Pop-up stores and events, for example, generally don’t follow the same seasonal trends as other retailers – instead, they generate short-term visit boosts during their runs, whenever in the year that may be. And a visit-focused anchor strategy can leverage some of the perks traditionally reserved for anchor tenants – such as preferential leasing terms – to complement traditional full-time anchors during slower retail periods.

The Barbie Dreamhouse Living Truck Tour is a prime example of a traffic-driving pop-up. By bringing exclusive merchandise to malls across the U.S., the truck generates plenty of buzz, drawing crowds eager to snatch up limited-edition items and immerse themselves in all things Barbie. As a result, malls hosting the tour often see significant visit spikes, with foot traffic surging well above typical Saturday levels. Well-timed pop-ups like these can help balance out traffic throughout the year, offsetting traditional slow periods.

A visit-focused approach to anchor management can also help mall operators assess the potential impact of new tenants on existing stores operating in similar categories. For example, mall owners often worry that new tenants operating in similar categories might cannibalize existing businesses. But a visit-focused anchor approach reveals that a well-chosen addition can sometimes benefit current tenants – especially if they cater to similar audiences.

In February 2020, for instance, value supermarket Aldi opened at Green Acres Commons in Valley Stream, NY – a center that already hosted budget-friendly BJ’s Wholesale Club. While BJ’s visits were relatively flat in 2018 and 2019, they began to rise after Aldi’s opening (and following a pandemic-induced dip). Cross-shopping data also shows that Aldi customers were more likely to visit BJ’s than the average Green Acres patron last year.

This synergy may be due in part to the two retailers’ similar visitor bases: In 2024, the Aldi and BJ’s stores in Green Acres Common drew shoppers with comparable economic profiles. This suggests that overlapping audiences can become a strength if aligned brands attract new shoppers, who then explore multiple stores in the same center.

Looking ahead, effective mall anchors will be defined less by physical footprint and more by their capacity to maintain consistent, valuable foot traffic. While traditional department stores remain pivotal, smaller or niche brands can often rival – or surpass – large-format retailers. And by thinking out of the anchor box and choosing tenants that cultivate a balanced visitor flow and align with local preferences, operators can position their centers as true go-to destinations.

1. Shoppers are taking more, shorter trips to grocery stores. Over the past 12 months, grocery stores have experienced nearly uniform YoY visit growth. And since COVID, the segment has steadily increased both overall visits and average visits per location – even as average dwell times have consistently declined.

2. Grocery stores are holding ground against fierce competition. Despite growing inroads by discount and dollar stores, wholesale clubs, and general mass retailers like Walmart and Target, grocery stores have maintained their share of the overall food-at-home visit pie over the past several years.

3. Grocery visit share is most pronounced on the coasts. In Q1 2025, grocery stores claimed the majority of food-at-home visits on the West Coast, in parts of the Northeast, Mid-Atlantic, and Mountain Regions, and in Florida and Michigan.

4. Fresh-format, value, and ethnic grocery visit shares are growing at the expense of traditional chains. And in Q1 2025, fresh-format and value grocers outperformed the other sub-segments with positive YoY visit and average visit-per-location growth.

5. Hispanic markets are on the rise. Though the broader ethnic grocery sub-segment was essentially flat YoY in Q1 2025, Hispanic-focused stores recorded increases in both visits and visits per location – and have been steadily growing visits since 2021.

6. Smaller formats for the win. In Q1 2025, smaller-format grocery store locations outpaced mid-sized and larger-format ones, underscoring the power of compact spaces to deliver significant foot traffic gains.

Brick-and-mortar grocery stores face an uncertain market in 2025. Rising food-at-home prices (eggs, anyone?), declining consumer confidence, and increased competition from discounters, superstores, and online shopping channels all present the segment with significant headwinds. Yet even in the face of these challenges, the sector has demonstrated remarkable resilience – growing its foot traffic and holding onto visit share.

What strategies have helped the segment navigate today’s tough market? And how can industry stakeholders make the most of the opportunities in the current market? This report draws on the latest location intelligence to uncover the trends shaping grocery retail in early 2025 – highlighting insights to help key players make informed, data-driven decisions on store formats, product offerings, and more.

The grocery segment has experienced nearly uniform positive year-over-year (YoY) growth over the last 12 months. This sustained performance in the face of inflation and other headwinds highlights the underlying strength of the category.

What is driving this growth? Since 2022, the grocery segment has seen consistent overall visit growth that has outpaced increases in visits per location – a sign that chain expansion has played a key role in the category’s success. But the average number of visits to each grocery store has also been on the rise, indicating that the segment continues to expand without cannibalizing existing store traffic.

At the same time, visitor dwell times have been steadily dropping since 2021. This shift appears to reflect a trend towards multiple, shorter trips by inflation-wary consumers eager to avoid large, costly carts or cherry pick deals across various retailers. Many shoppers may also be placing more bulk orders online and supplementing those deliveries with brief in-store stops for additional items as needed.

The bottom line: Shoppers are taking more grocery trips overall each year, but spending less time in-store during each visit. Operators can respond to this trend by optimizing layouts and promoting “grab-and-go” areas for an even more efficient quick-trip experience.

Visit share data also shows that despite fierce competition from discount and dollar stores, wholesalers, and general mass retailers, the grocery segment has steadfastly preserved its share of the overall food-at-home visit pie.

Between Q1 2019 and Q1 2025, wholesale clubs and discount and dollar stores increased their share of total food-at-home visits, gains that have come primarily at the expense of Walmart and Target. Meanwhile, grocery outlets have held firm – despite some fluctuations over the years, their Q1 2019 visit share remained essentially unchanged in Q1 2025.

So even as consumers flock to alternative food purveyors in search of lower prices, grocery stores aren’t losing ground – and on a nationwide level, they remain the biggest player by far in the food-at-home shopping space.

Still, grocery store visit share varies significantly by region. On the West Coast, in parts of the Northeast, Mid-Atlantic, and Mountain regions, and in Florida and Michigan, grocery stores accounted for the majority of food-at-home visits in Q1 2025. Oregon (61.6%) and Washington (59.6%) led the pack, followed by Massachusetts (59.2%), Vermont (58.5%), and California (57.9%). Meanwhile, in West Virginia, Arkansas, South Dakota, Oklahoma, North Dakota, and Mississippi, less than 30% of food-at-home traffic went to grocery stores, with more shoppers in these regions turning to general mass retailers or discounters.

Grocery store operators in lower-grocery-share regions may choose to focus on price competitiveness and convenient store locations to capture more foot traffic from competitors in the space.

Which types of grocery stores are thriving the most? The grocery segment is diverse, encompassing traditional grocery chains like Kroger, Safeway, and H-E-B; budget-oriented value chains such as Aldi, WinCo Foods, Grocery Outlet Bargain Market, and Market Basket; fresh-format specialty brands like Trader Joe’s, Whole Foods, and Sprouts Farmers Market; and numerous ethnic grocers.

Examining shifts in visit share among these various grocery store segments shows that traditional grocery still dominates, commanding over 70.0% of total grocery store foot traffic.

Still, over the past several years, traditional grocers have gradually ceded ground to other segments – especially value chains. Budget grocers saw a temporary surge in visits during the panic-buying days of early 2020 – and have been more gradually gaining visit share since Q1 2023. . Fresh-format banners, which lost ground in 2021 after a Q1 2020 bump, in the wake of COVID, have also been on the upswing and appear poised to capture additional visit share in the coming months and years. And though ethnic grocers still account for a relatively small portion of the overall market, they have slightly increased their visit share, reflecting heightened consumer interest in these specialized offerings.

Recent performance metrics point to a bifurcation in the grocery market similar to that observed in other retail categories. In Q1 2025, fresh-format and value retailers – which appeal, respectively, to the most and least affluent visitor bases – saw the greatest growth in both overall visits and average visits per location.

This trend highlights the power of both value and health-focused quality to motivate consumers in 2025. And grocery players that can meet these needs will be well-positioned for success in the months ahead.

One factor fueling fresh-format’s success may be its role as a convenient, relatively affordable midday lunch destination for the remote work crowd.

In Q1 2025, consumers working from home accounted for 20.2% of fresh-format grocery stores’ captured market – a significantly higher share than any other analyzed grocery segment. These stores also tended to be busier midday than the other segments. Remote workers may be stopping by to grab a quick bite – and some may be choosing to do their grocery shopping during their lunch break when stores are less crowded.

This finding suggests an opportunity for grocery operators across all segments to develop or enhance in-store salad bars and quick-serve sections to tap into the lunch rush. Likewise, CPG companies may benefit from developing more ready-made, nutritious meal options that align with these midday dining habits.

Though the broader ethnic grocery category remained essentially flat in Q1 2025, Hispanic-focused grocers emerged as a sub-segment to watch. Both overall visits and average visits per location to these stores have been on the rise since 2021.

This robust demand presents an opportunity for CPG brands and grocers across segments to expand Hispanic-focused offerings, capturing a slice of this growing market.

Finally, store size matters more than ever in 2025. During the first quarter of the year, smaller format grocery store locations (locations under 30K square feet, across different chains) outpaced larger stores with a 3.2% YoY jump in visits, showing that bigger isn’t always better in the grocery store space.

This pattern aligns with the decrease in dwell times noted above – shoppers may be making shorter trips to smaller, more convenient grocery store locations. These quick errands are ideal for picking up a few items to supplement online orders, shopping multiple deals, or sourcing specialty products unavailable at larger grocery destinations. And to lean into this trend, grocery operators might consider testing neighborhood “micro-store” concepts, focusing on curated selections, and offering convenient parking or pickup to match consumer preferences for targeted purchases and quicker trips.

Location intelligence reveals a growing, dynamic grocery landscape which is holding its ground in the face of increased competition. Shorter trips, busier lifestyles, and changing work routines are reshaping in-store experiences. And grocery players that refine their store formats, target both lunch and on-the-go shoppers, and adapt to shifting demographics can position themselves to thrive in this competitive sector. As the market continues to evolve, continuous attention to these changing patterns will be key to maintaining and expanding market share.