.svg)

.png)

.png)

.png)

.png)

For fashion-focused consumers, there’s never been more choices available to shop. While luxury brands and retailers are still viewed as the trend setters, there are many brands in the mid-tier luxury market gaining traction. At a time when perceived value is paramount to shopper decision-making, brands that provide a great experience and on-trend styles that won’t break a budget are winning visits.

Product knowledge, recommendations and styling tips can all be accessed in the digital and social world, which gives smaller brands a fighting chance at connecting with shoppers who may not have stores located near them. Those brands whose social presence also coincides with a physical shopping experience, they’re able to build a cult-like following.

Accessories is a market that’s even further fragmented when it comes to the number of consumer choices, specifically in areas like handbags. Brands that have found their niche in the mid-tier market, like Clare V. and Stoney Clover Lane, have been able to hedge against the headwinds facing most discretionary brands. Although each brand has a handful of locations in comparison to accessory behemoths, their unique selection, brand storytelling and ability to assimilate to local environments have helped them to garner quite the following.

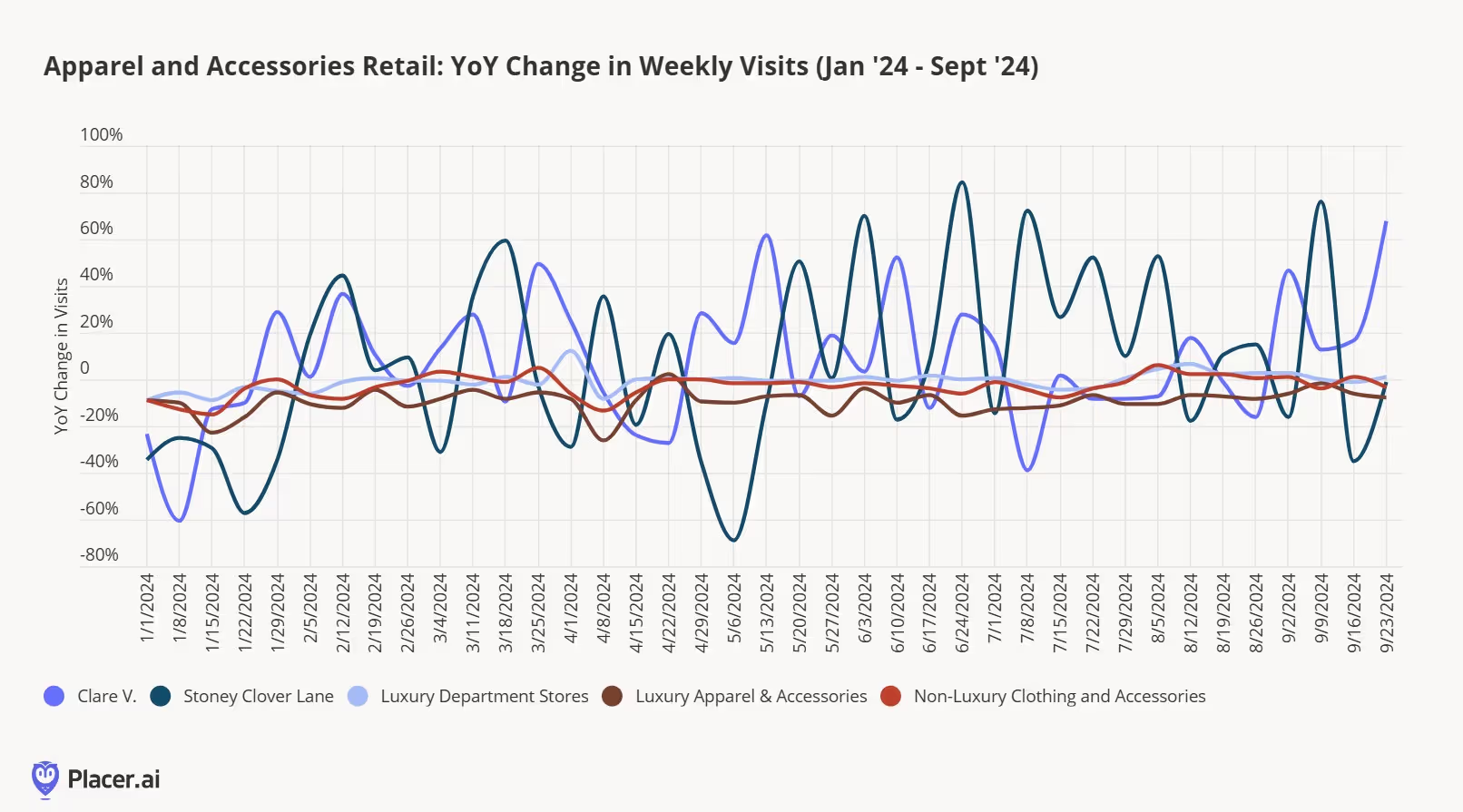

In comparing both brands to other apparel and accessories sectors, they have outperformed the other areas handily throughout 2024. Certainly fashion is very cyclical; one day, a brand is hot, and within a few weeks the craze might be over. However, both of these brands have been around since before the pandemic and continued to climb.

Looking further into Stoney Clover Lane, the brand is known for its colorful nylon pouches, purses and luggage that consumers can customize with a broad assortment of patches. The brand has also had licensing partnerships with brands such as American Girl and Disney.

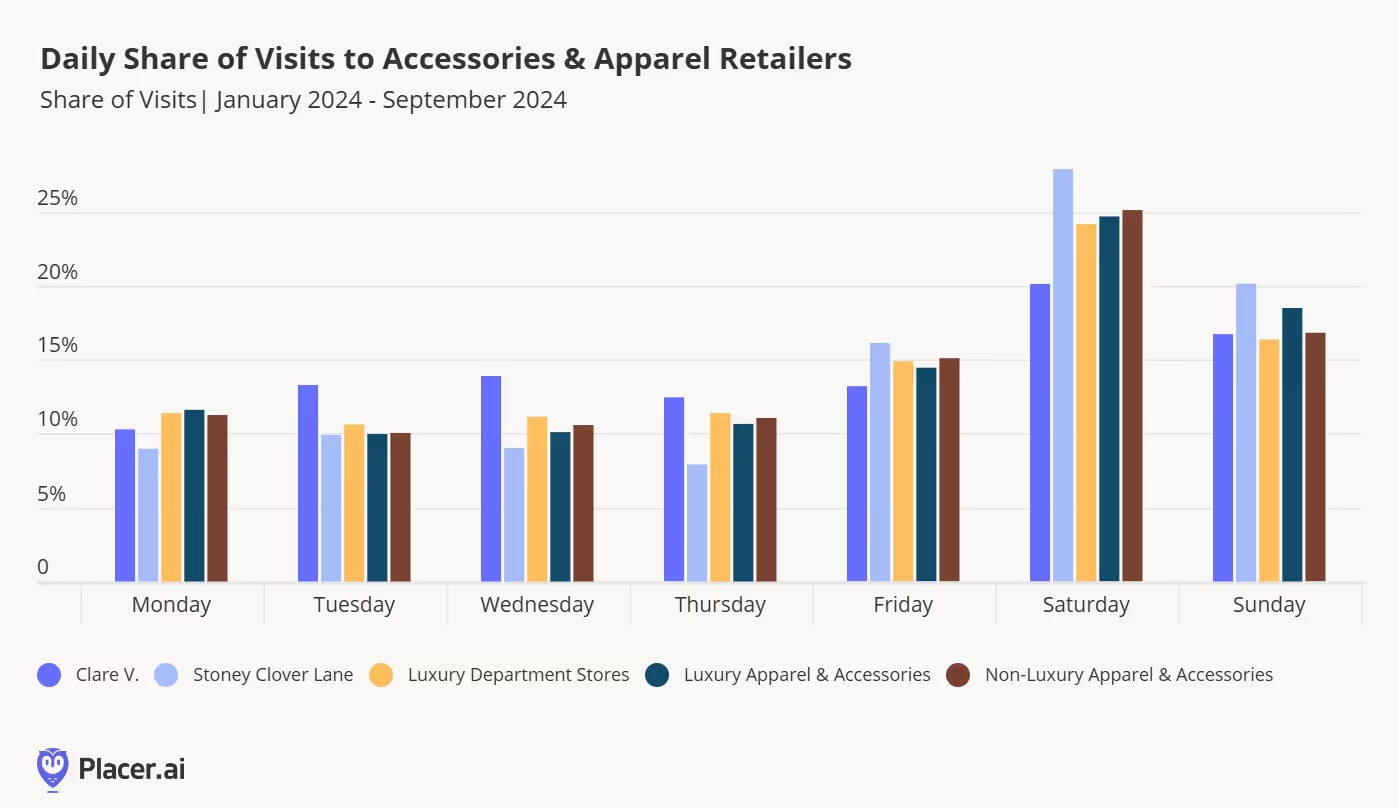

Its physical retail presence combines experiences and an expansive assortment where consumers can customize their bags in store with patches and also attend local events. The brand has the highest percentage of weekend visits compared to the competitive set, and it’s clear that it’s a destination retailer for visitors.

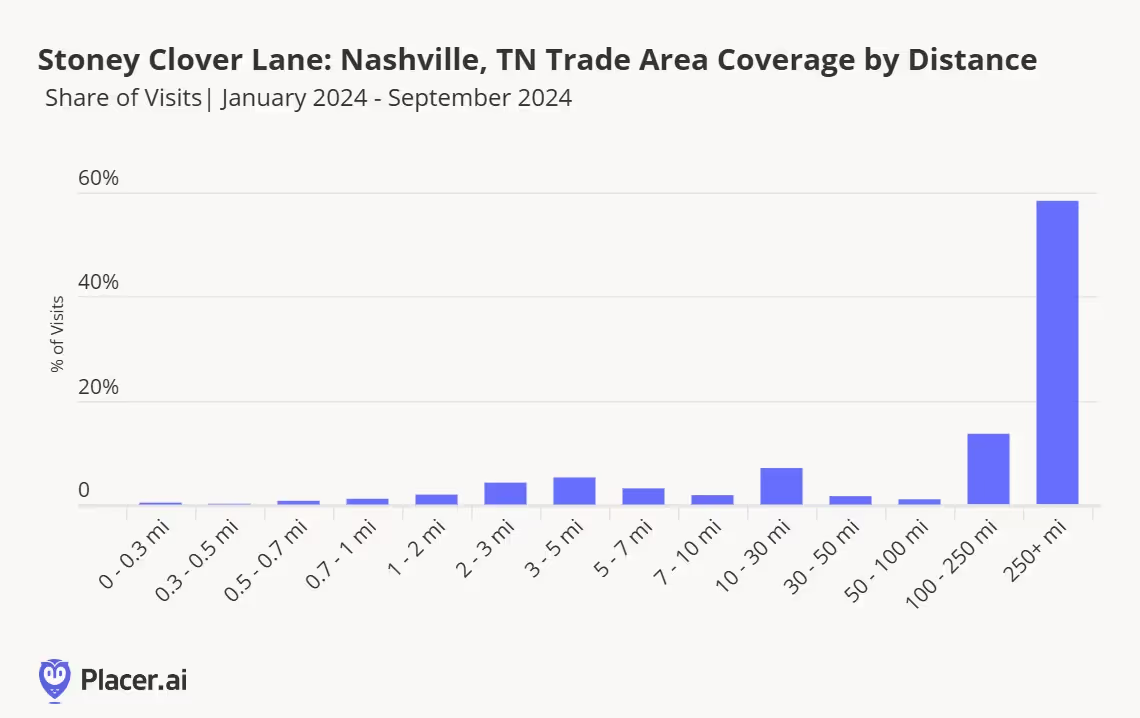

Stoney Clover Lane’s Nashville outpost, located in the popular 12 South neighborhood, offers the product customization as well as a performance stage to infuse some of the local culture into the store. Looking at the visitor journey for this location, there is a high level of cross visitation to hotels and restaurants, indicating that this store may serve as a destination for out-of-town travelers who want to shop the location. Placer’s Trade Area feature corroborates this, as there is a high concentration of visits from other Southern cities including Atlanta, Birmingham, Dallas and Miami.

Clare V. blends the iconic styles of Los Angeles and Paris into an accessories brand that feels inherently cool. Its retail locations feel like an art museum blended with your best friend’s closet and each store location incorporates the local feel of the neighborhood it inhabits, including iconic locations like the Brentwood Country Mart in Los Angeles.

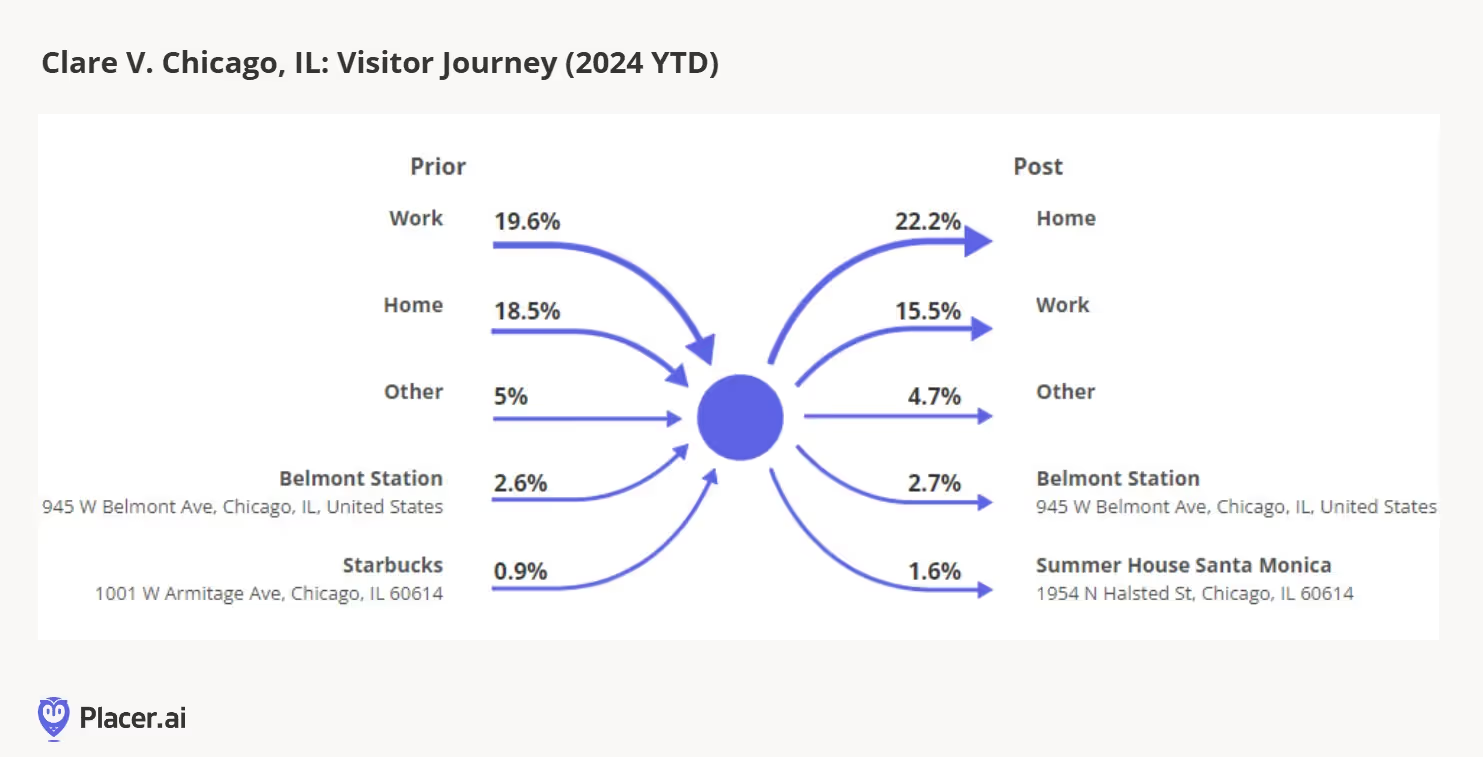

Clare V.’s Chicago shop draws a more local crowd, with a high level of cross-vistation to and from home as well as transportation services. Other neighborhood shops, restaurants and venues like Wrigley Field also have high levels of cross-visitation for visitors to Clare V.. By entrenching itself into the local look and feel of the neighborhoods it occupies, this national brand still feels like a well kept secret for those passing by. In comparing the trade area of the Chicago location in 2024 and 2023, the brand has been able to expand its reach further in Western Chicago Suburbs this year.

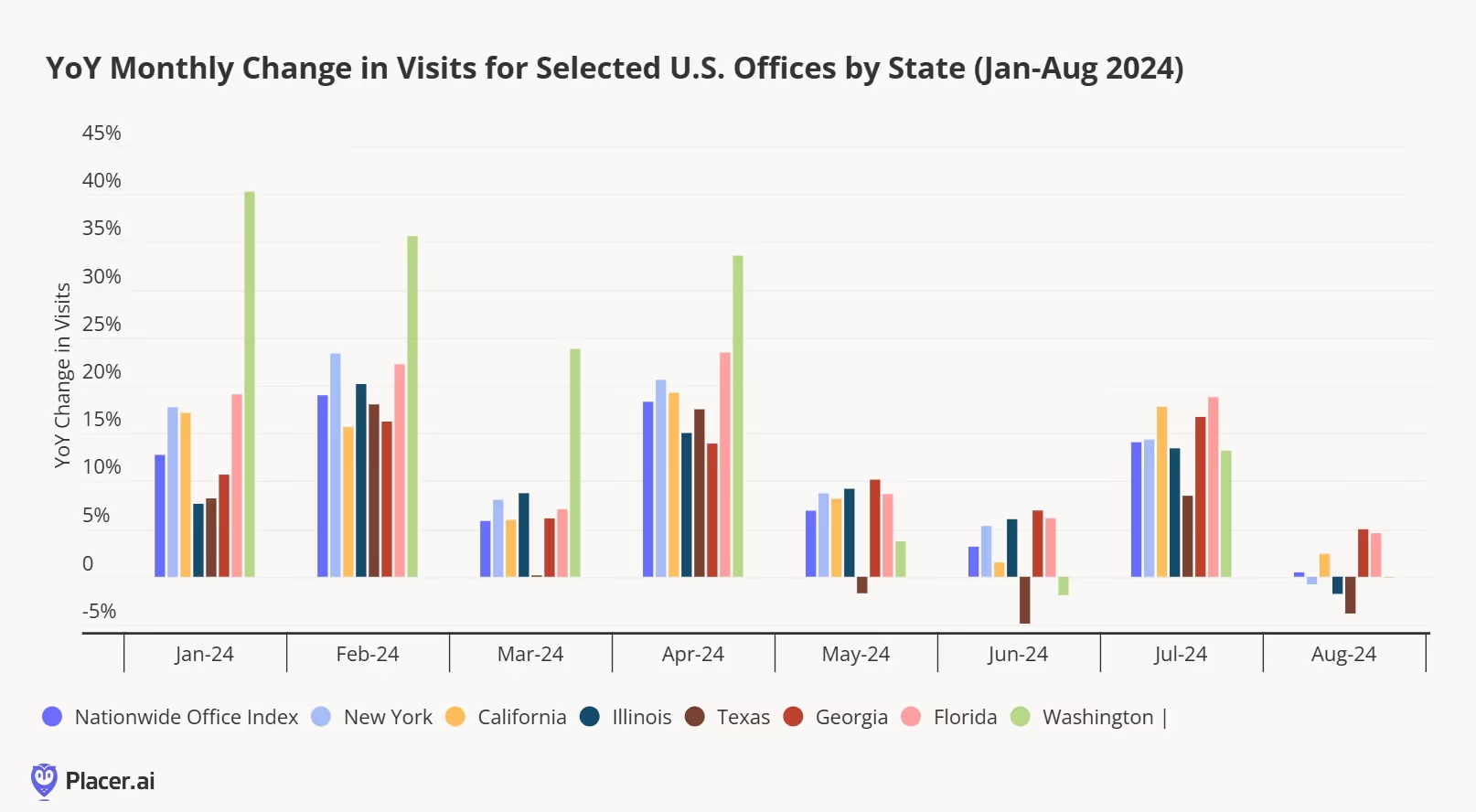

It’s been about a month since Labor Day, so let’s take a look and see how return-to-office (RTO) has been faring year-to-date. A majority of states saw fairly sizable bumps in year-over-year office traffic at the beginning of the year. The return in the state of Washington was particularly pronounced in the first four months of the year, with a 40% increase in January 2024 compared to January 2023.

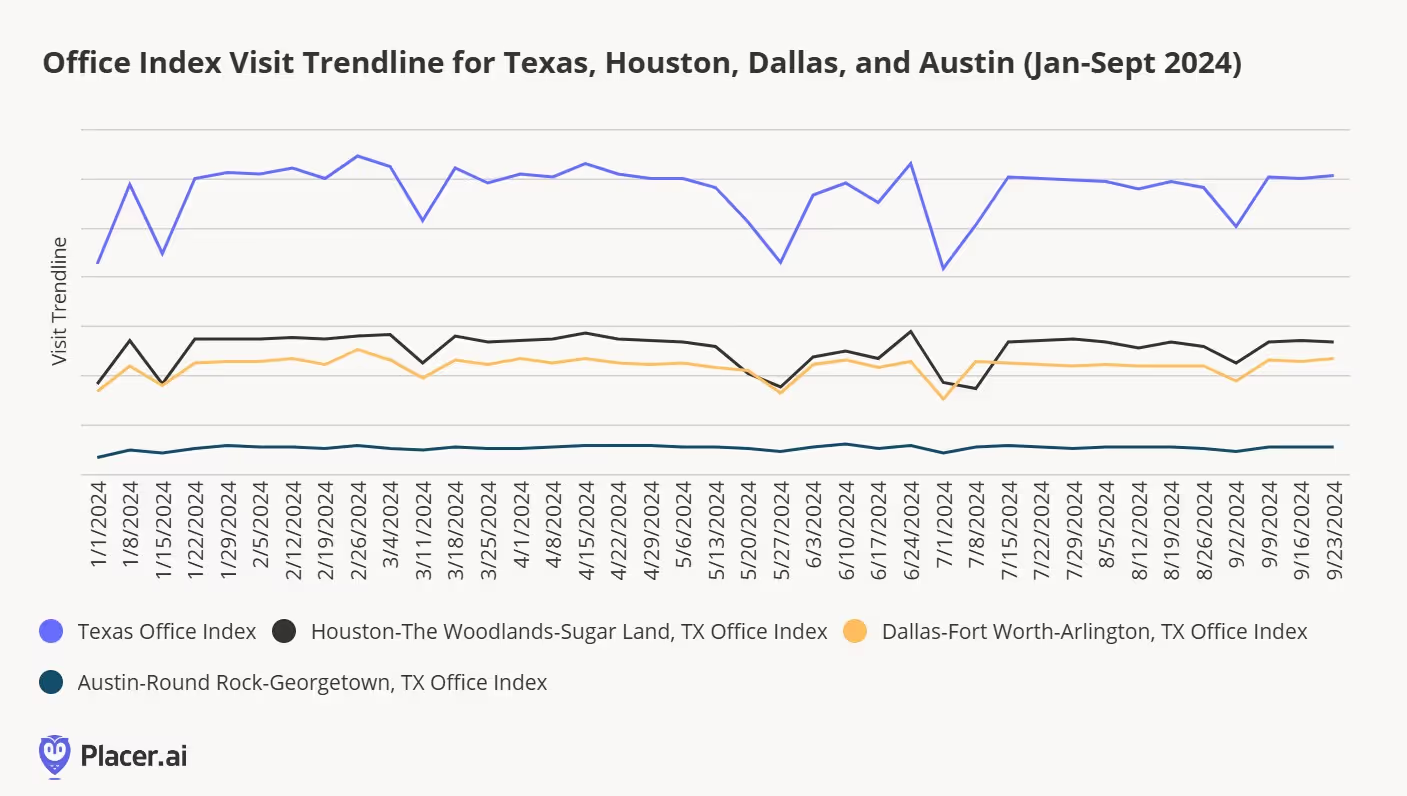

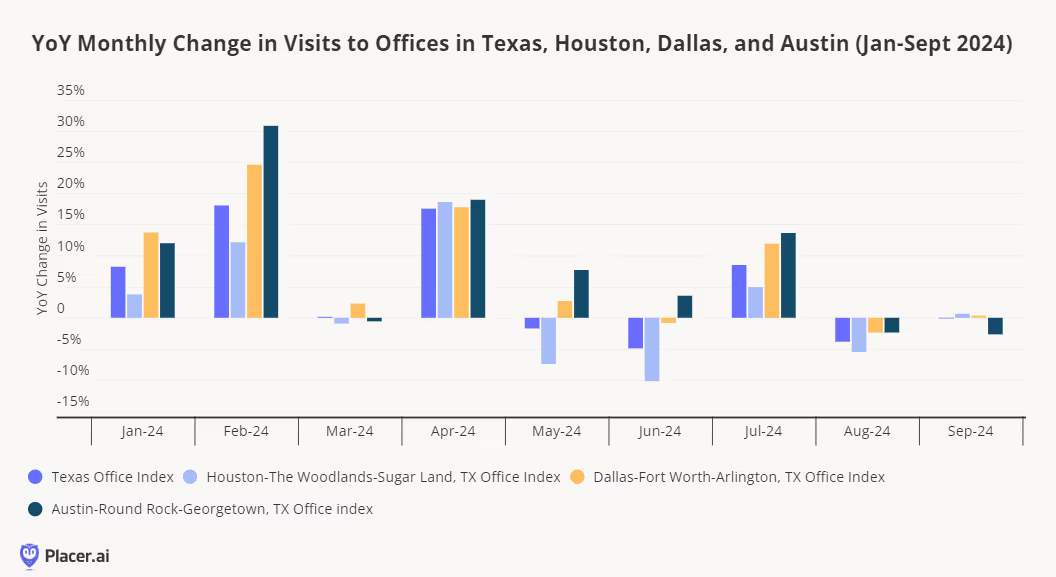

Texas saw a bit of a decrease in May, June, and August. Overall, Houston and Dallas account for more of the office visits, followed by Austin.

Houston drove a decrease in office visits in the months of May, June, and August, while office visits were largely flat in September, with the exception of Austin, which showed a decline compared to the prior year.

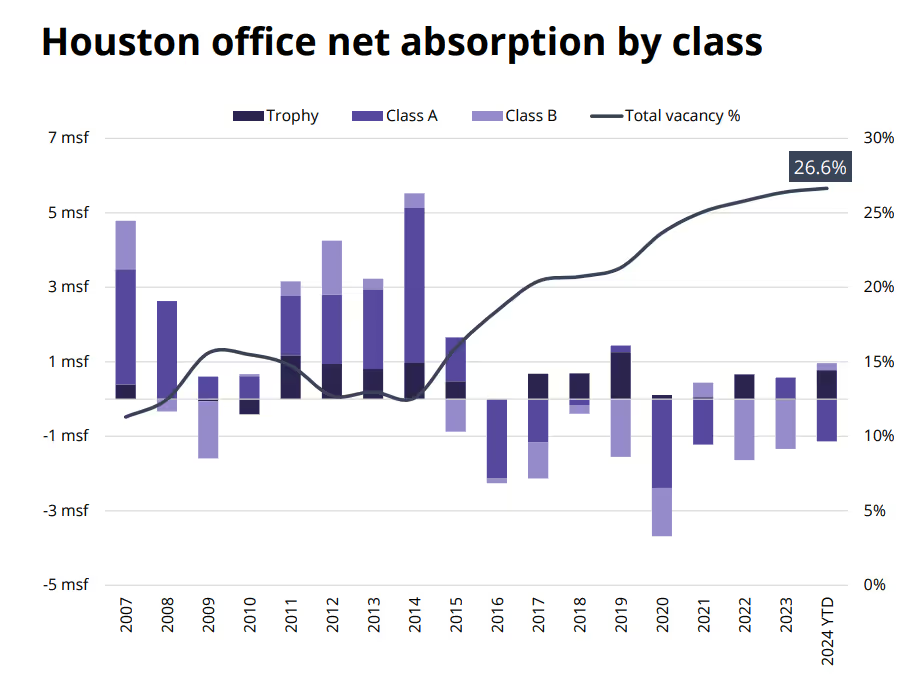

There are multiple reasons potentially driving some of the decreases in Houston. The devastation of Hurricane Harvey in 2017 resulted in a long recovery. Many large companies along the I-10 chose to reduce their office footprint. However, per Avison Young, vacancy rates are lower at trophy assets.

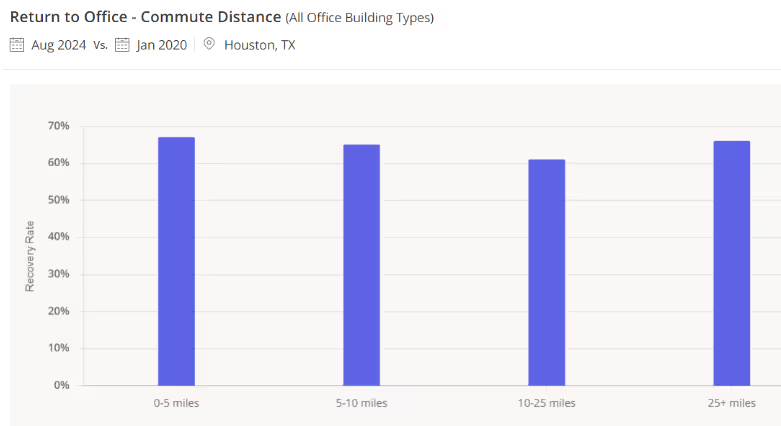

Interestingly, those commuting 10-25 miles away have a lower RTO rate than those living 0-5 miles away, 5-10 miles away, or 25+ miles away. The first two make sense as we generally see higher RTO rates among those living within a closer commuting distance.

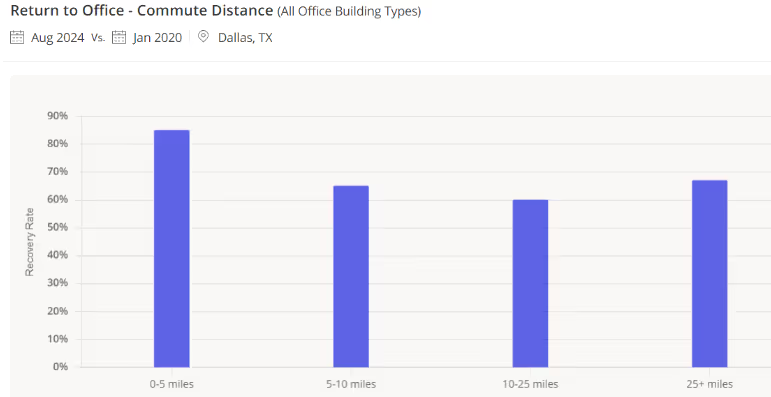

Dallas sees a similar pattern, though those who live within 5 miles have returned to office at a considerably higher rate at 85% than those farther afield.

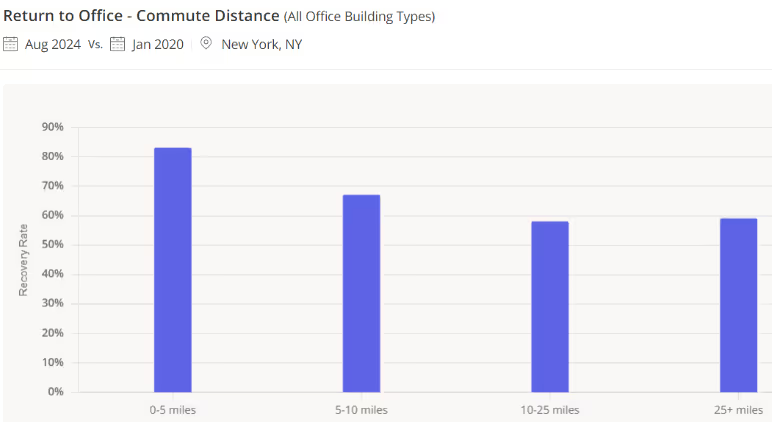

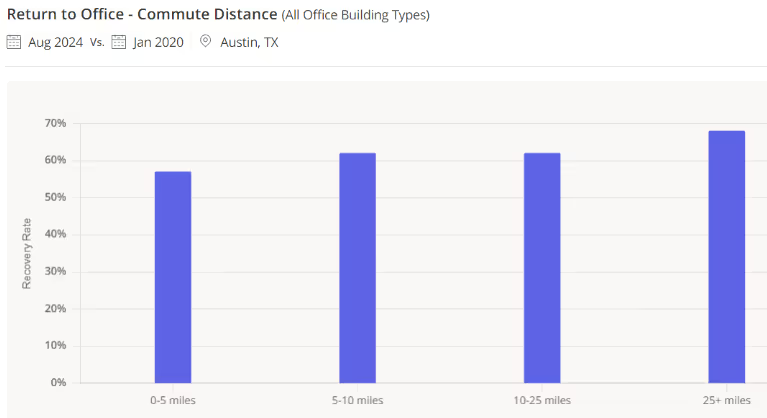

One of the more intriguing patterns we are seeing is in Austin, Texas. Here, the RTO rate is actually higher the longer the commute. This seems rather counterintuitive, as in most locations, highest RTO rates are found the closer one lives to the office. New York is more typical, as we see that people are more likely to come into the office the closer they live.

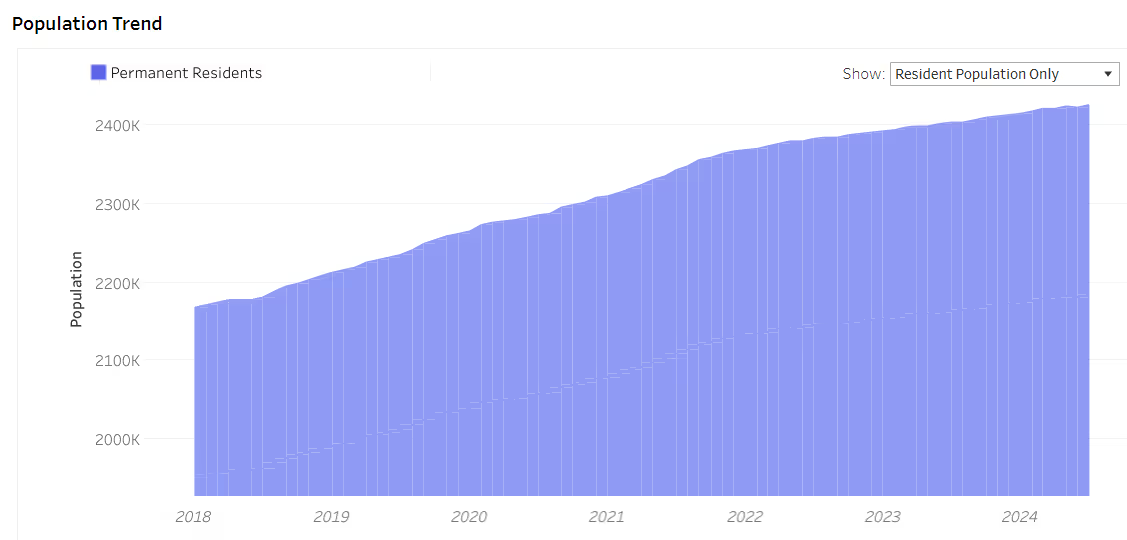

Austin may, in fact, be a victim of its own success. Per Placer’s Migration Dashboard, its population has skyrocketed in the past few years. With more demand comes higher prices, and as a result, people are forced to move farther out in their quest for homes or more land. On the other hand, Austin traffic is not nearly as bad as some major cities like Los Angeles or New York, so living 25+ miles may not be as daunting a prospect when it comes to commuting.

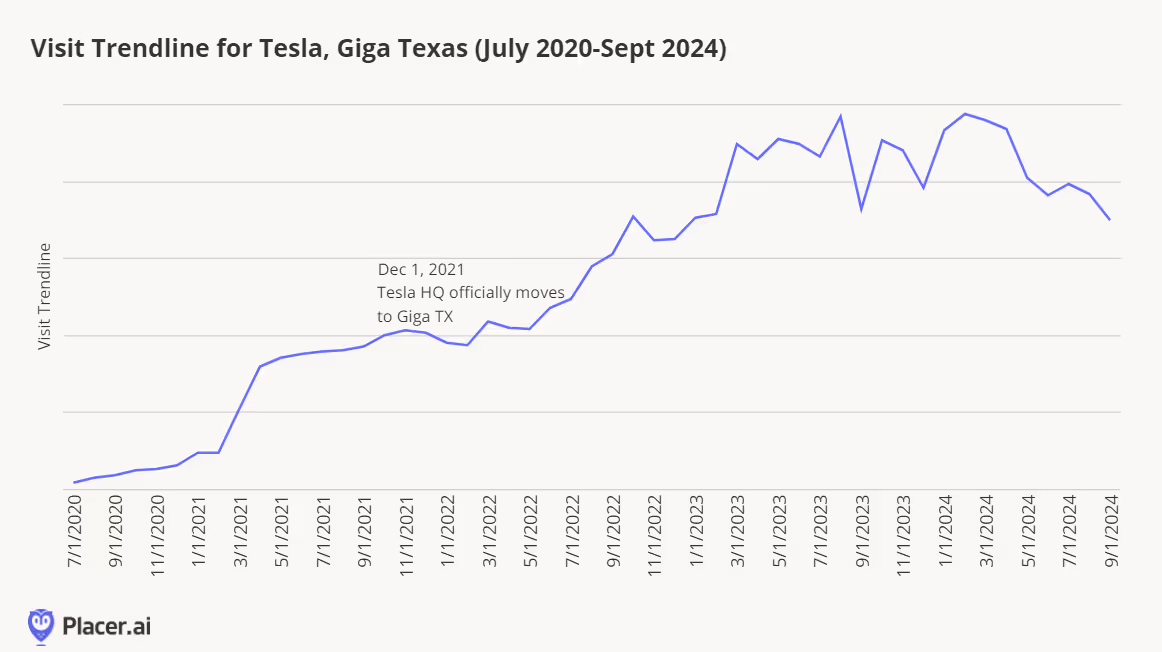

Another huge factor? The move from California to Austin, Texas for Tesla's HQ means that it is now Austin’s largest employer, surpassing H-E-B, and Tesla CEO Elon Musk has made it clear that he expects his employees to fully return to office. Both visits and visitors to Giga, Texas have exploded.

With Q4 2024 just underway, retailers are already gearing up for the all-important holiday season. A condensed shopping window – just 27 days between Thanksgiving and Christmas this year – is prompting many to launch early deals and promotions. And though consumers remain cautious, shoppers are expected to spend more this year than they did in 2023.

But what can recent visitation trends tell us about how this year’s holiday season will really play out? We dove into visit data for various retail categories and chains to try and predict what’s in store for the all-important fourth quarter of 2024.

A look at the overall state of brick-and-mortar retail this year offers a glimpse into what we can expect this holiday season.

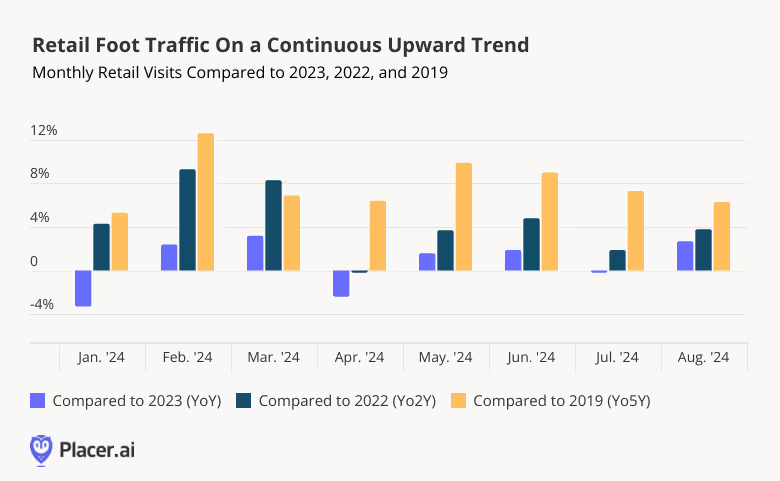

Since January 2024, monthly retail foot traffic has generally been on an upswing, with YoY visits up most months since January 2024 – and foot traffic higher than in 2022 or 2019 (pre-pandemic). This steady rise in retail visits signals strong consumer engagement in 2024, setting the stage for what may turn out to be a robust Q4.

Holiday promotions are kicking off early this year, offering customers more time to take advantage of deals and helping retailers navigate supply chain and logistics challenges. And though early sales are nothing new, 2024’s shorter holiday shopping season may suffuse them with more significance than ever.

In 2023, Thanksgiving fell on November 23rd, leaving consumers with 32 days in which to do their holiday shopping. But this year, the holiday will be on November 28th, shortening the period between Thanksgiving and Christmas by five days. To make up for lost time, retailers and consumers alike may embrace an early shopping frenzy, potentially detracting from the power of milestones like Black Friday, Super Saturday, and Christmas Eve Eve.

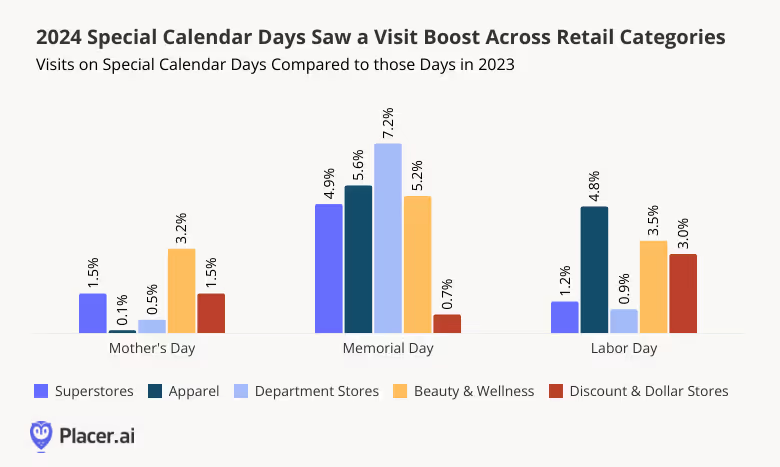

But a look at consumer behavior during special calendar days this year suggests that traditional retail milestones still very much resonate with customers. On Mother’s Day, Memorial Day, and Labor Day, key industries saw YoY visit boosts, though the magnitude of the increases varied across categories.

On Mother’s Day, for example, the beauty and wellness sector saw a 3.2% YoY increase in visits – highlighting the category’s enduring popularity for grateful offspring seeking to give mom a special gift. But on Memorial Day, department stores had their time in the sun, overshadowing other segments with a 7.2% YoY visit boost.

Overall, these occasions proved particularly effective at driving consumer engagement this year. So whether by targeting big days like Black Friday or planning extended holiday campaigns, the 2024 holiday season gives retailers a great chance to benefit from consumer excitement.

While all retail categories participate in the holiday season's flurry of sales, promotions, and limited-time offers, a select few shine especially bright during this period. These segments’ strong performance can often make up for quieter stretches earlier in the year.

Department stores are prime examples of holiday season winners. An analysis of weekly visits throughout 2023 shows that department stores experience one of the most impressive visits spikes of the holiday season. In the week leading up to Christmas, visits to department stores surged 113.4% compared to a 2023 weekly average – highlighting the segment’s success at positioning itself as a go-to destination for holiday shopping.

Another standout during the holiday season is the hobbies, gifts, and crafts category. Unlike department stores, this category sees a more evenly-distributed rise in foot traffic across Q4, with peaks leading up to Halloween, Thanksgiving, and Christmas. This pattern reflects the popularity of holiday-related decorations and gifts, which drive increased visits during these festive periods.

These two powerhouse categories – department stores and hobbies, gifts, and crafts – are poised to dominate the 2024 holiday season, just as they did last year. And with consumer spending expected to rise and foot traffic showing no signs of slowing, both categories have significant potential for even greater success this year.

The upcoming holiday season looks on track to be a big one. Despite the shorter shopping window, retailers are taking steps to maximize shopping opportunities with early promotions. And against the backdrop of this year’s robust consumer engagement – especially around milestones – Q4 is shaping up to be a festive season indeed.

Will retailers rise to the challenge? Follow Placer.ai to see how this holiday season unfolds.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Grocery stores have been on an upward foot traffic trajectory as of late, and Trader Joe’s – with its cult-like following – is often near the top of the pack.

We dove into the location analytics for the chain, exploring its nationwide performance and visitor trends in its home state of California, to uncover what’s behind the grocer’s ongoing success.

Despite positive signs that food-at-home inflation is stabilizing, many consumers are still feeling the pinch of high grocery costs. And with the help of its wide range of premium-quality, private-label products, Trader Joe’s offers an upscale experience at prices that are attractive to value-conscious grocery shoppers.

Perhaps bolstered in part by several new locations, Trader Joe’s year-over-year (YoY) visit growth has outperformed the wider grocery category every month of 2024 so far. And the chain appears to be doubling down on its expansion strategy, with two dozen new stores planned through the end of 2024.

By continuing to meet consumer demand for value and quality, and through the ongoing expansion of its fleet, Trader Joe’s is likely to sustain foot traffic growth in the near future.

In addition to competitive pricing and a growing real estate footprint, examining visitor dynamics in California – Trader Joe’s largest market by far – suggests that the chain may be driving success by becoming more shoppers’ principal grocery destination.

Between January and August 2024, California Trader Joe’s experienced YoY visit growth ranging from 3.2% to 11.1% – while YoY foot traffic to the wider grocery segment ranged from -2.7% to 4.6%. And over the same period, the share of Trader Joe’s visitors that also frequented other leading California grocery chains decreased significantly – indicating that TJ’s is making inroads with some of its toughest competition in the state.

Between January and August 2023, for example, 50.1% of visitors to a California Trader Joe’s also visited Ralphs – a share that dropped to 47.1% during the equivalent period of 2024. Similar patterns could be observed for VONS, Sprouts Farmers Market, and even California’s grocery visit leader, Safeway.

This suggests that a growing percentage of Trader Joe’s shoppers may be relying on the chain for more of their essentials – rather than visiting TJ’s in addition to a traditional grocery store.

Diving deeper into the demographic characteristics of visitors to California Trader Joe’s provides further insight into the consumers driving the chain’s statewide YoY visit gains. Analyzing California TJ’s trade areas with data from STI: PopStats reveals that Trader Joe’s drives an outsized share of visits from singles – living on their own or with roommates.

Between January and August 2024, 26.5% of residents in Trader Joe’s California captured market lived in one-person households – compared to a statewide average of 22.9%. Meanwhile, 10.0% of the trade area residents were from non-family households – well above the state average of 8.0%.

This could be partially due to Trader Joe’s ongoing investment in college town locations, as well as its fail-safe frozen food selection – a winner with novice cooks pressed for time or space for meal-prep. Plus, Trader Joe’s boasts cheerfully-themed, seasonal products that change every few months, which may be particularly likely to resonate with college students that follow seasonal rhythms of their own.

Trader Joe’s continues to shine in the grocery space in part due to ongoing consumer demand for value and the chain’s expansion. And in California, a loyal and disproportionately single audience is a significant driver of foot traffic.

For updates and more grocery foot traffic insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Bowlero Corporation operates more than 350 bowling alleys nationwide, under a portfolio of brands that includes Bowlero and AMF – the company’s two largest chains. How have the bowling alleys performed this year?

We dove into the data to find out.

A look at year-over-year (YoY) visitation trends shows that after a January weather-induced slump and a lackluster three months between February and April 2024, YoY visits to both Bowlero and AMF Bowling Centers picked up major steam. Beginning in May, the two chains saw consistent monthly YoY visit growth ranging from 8.4% to 21.9%.

Fleet expansions undoubtedly contributed to the chains’ summer traffic jumps – but the visit increases were likely also driven by the reintroduction of Bowlero’s popular summer season pass – redeemable across the company’s portfolio of brands – which entitles customers to two free games daily at a center of their choosing. (A premium version can be used at any of the company’s locations.) The pass, which was valid from May 24th to September 2nd, proved to be such a runaway success this year that the company decided to launch a similar promotion for fall. This year’s record-breaking heat may have also contributed to the bowling alleys’ visit boosts – as consumers sought to cool down with indoor activities.

Bowlero and AMF are owned by the same company, but customers seem to interact with each brand slightly differently. Between January and August 2024, AMF attracted a higher share of frequent visitors than Bowlero – perhaps indicating the brand’s positioning as a destination for more serious bowlers and league participants.

On average, 21.4% of AMF’s visitors frequented the chain at least twice a month during the analyzed period – and 8.4% visited at least four times a month. Meanwhile, Bowlero, which touts itself as a “bowling/dining/nightlife experience,” drew smaller shares of frequent visitors – though 16.5% of Bowlero visitors turned out 2+ times a month on average during the analyzed period, and 5.7% visited at least four times a month.

Bowlero, which attracts more casual bowlers than AMF, is also a destination for families. Between January and August 2024, Bowlero’s captured market featured a higher-than-average share of households with children – 28.5%, compared to 26.5% for AMF and a nationwide baseline of 26.9%.

AMF, for its part, was more popular among singles: During the analyzed period, 28.6% of its captured market was made up of one-person households – more than both the nationwide baseline and that of Bowlero (26.7%).

Still, though Bowlero and AMF attract somewhat different audiences, drilling down further into the psychographic segmentation of their captured markets shows that bowling really is an all-American favorite pastime.

During the analyzed period, Bowlero’s was more likely to attract “Young Professionals” and “Near-Urban Diverse Families” – middle-class families living in and around cities – while AMF was more likely to attract upper-middle class, suburban families (“Upper-Suburban Diverse Families”) and households from “Blue Collar Suburbs”. But despite these differences, both chains attracted consumers from a variety of communities, highlighting their broad appeal.

Will consumers continue frequenting bowling alleys as the weather cools down – and will Bowlero’s autumn season pass be as successful as its summer one?

Follow Placer.ai’s data-driven analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Recreational retailers – from hobby shops to arts and crafts retailers and bookstores – can play a role in fostering creativity and community.

We took a closer look at several players in the space – including Barnes & Noble, Half Price Books, Hobby Lobby, and Michaes – to see how they are faring as 2024 draws to a close.

One of the biggest challenges traditional brick-and-mortar retailers have faced in recent decades is the rise of online shopping, especially from Amazon – ironically, a company that started as a book retailer. Yet, in 2024, brick-and-mortar bookstores are defying expectations and thriving. Nearly every month this year, chains like Barnes & Noble and Half Price Books have seen more foot traffic at their stores than in 2023.

Despite closing several locations over the past year, Half Price Books experienced significant YoY visit increases between May and August 2024 – with only July seeing a YoY lag likely reflective of the chain’s substantial July 2023 seasonal uptick. Meanwhile, Barnes & Noble – which has been expanding its fleet – saw YoY foot traffic increases ranging from 8.0% to 17.2% throughout the analyzed period. Both chains finished off the summer with impressive 14.3% (Barnes & Noble) and 10.3% (Half Price Books) YoY boosts.

Analyzing monthly fluctuations in visits to the two chains relative to a January 1, 2021 baseline shows just how important both the summer and holiday seasons are for the two bookstores. As brands that cater to both families and college students (see below), Barnes & Noble and Half Price Books see significant annual summer visit upticks in July and August – likely boosted by back-to-school shopping. But particularly for Barnes & Noble, the real magic happens during the holiday season, when people flock to the chain in search of gifts for loved ones.

Bookstores’ strong performance shows that consumers are voting with their feet – embracing the special – and irreplaceable –reading and browsing experience provided by brick-and-mortar stores. And with a strong summer under their belts, Barnes & Noble and Half Price books have every reason to expect a highly successful Q4 2024.

Diving into trade area demographics shows that both Barnes & Noble and Half Price Books appeal to diverse audiences – outperforming nationwide baselines for everything from “Wealthy Suburban Families” to “Young Professionals” (a segment group that includes college students) and “Blue Collar Suburbs”. Still, there are differences between the two chains – offering opportunities for the retailers to tailor their marketing strategies to align with their respective visitors.

Barnes & Noble’s captured market trade area, for example, features a higher share of the middle-class “Near Urban Diverse Families” segment group – while that of Half Price Books features higher shares of the other analyzed segments. The chains’ different audiences can help them strategically curate their book assortments and offer a more tailored experience for their customers – a strategy that Barnes & Noble has placed at the center of its blueprint for growth.

While bookstores have thrived in 2024, craft stores have faced a more mixed performance. Hobby Lobby and Michaels both experienced varying YoY foot traffic trends, with monthly visits tracking closely with 2023’s. Still, August 2024 visits were elevated by 7.9% and 6.0% at Hobby Lobby and Michaels, proving the significance of the back-to-school season.

Weekly visit data further highlights the significant impact of the back-to-school season on craft retailers – which offer both classroom decor and school supplies. As the shopping season kicked in, Hobby Lobby and Michaels both experienced notable increases in foot traffic compared to their year-to-date (YTD) averages.

The week of September 2, 2024 in particular was a strong one across both chains, with visits surging to their highest levels relative to the YTD average. Hobby Lobby experienced an 18.3% surge in visits and Michaels grew by 15.9%. This data emphasizes the critical role seasonality plays in driving traffic to craft retailers, particularly during key periods like back-to-school, when customers are stocking up on supplies. And since the category usually sees its biggest monthly spike during the holiday season (December 2023 visits to Hobby Lobby were 57.7% higher than the 2023 monthly visit average and 52.1% higher at Michaels), the chains seem poised to see more visitors in the coming months. October visits will also likely rise for the two chains, as customers go on the hunt for fall decor.

Hobby and recreational stores have shown resilience and adaptability in 2024, with strong seasonal peaks and diverse customer bases fueling their visits. With the holiday season fast approaching, these companies seem set to continue experiencing foot traffic boosts for the rest of the year.

Visit Placer.ai to keep up with the latest data-driven retail news.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

1. Shoppers are taking more, shorter trips to grocery stores. Over the past 12 months, grocery stores have experienced nearly uniform YoY visit growth. And since COVID, the segment has steadily increased both overall visits and average visits per location – even as average dwell times have consistently declined.

2. Grocery stores are holding ground against fierce competition. Despite growing inroads by discount and dollar stores, wholesale clubs, and general mass retailers like Walmart and Target, grocery stores have maintained their share of the overall food-at-home visit pie over the past several years.

3. Grocery visit share is most pronounced on the coasts. In Q1 2025, grocery stores claimed the majority of food-at-home visits on the West Coast, in parts of the Northeast, Mid-Atlantic, and Mountain Regions, and in Florida and Michigan.

4. Fresh-format, value, and ethnic grocery visit shares are growing at the expense of traditional chains. And in Q1 2025, fresh-format and value grocers outperformed the other sub-segments with positive YoY visit and average visit-per-location growth.

5. Hispanic markets are on the rise. Though the broader ethnic grocery sub-segment was essentially flat YoY in Q1 2025, Hispanic-focused stores recorded increases in both visits and visits per location – and have been steadily growing visits since 2021.

6. Smaller formats for the win. In Q1 2025, smaller-format grocery store locations outpaced mid-sized and larger-format ones, underscoring the power of compact spaces to deliver significant foot traffic gains.

Brick-and-mortar grocery stores face an uncertain market in 2025. Rising food-at-home prices (eggs, anyone?), declining consumer confidence, and increased competition from discounters, superstores, and online shopping channels all present the segment with significant headwinds. Yet even in the face of these challenges, the sector has demonstrated remarkable resilience – growing its foot traffic and holding onto visit share.

What strategies have helped the segment navigate today’s tough market? And how can industry stakeholders make the most of the opportunities in the current market? This report draws on the latest location intelligence to uncover the trends shaping grocery retail in early 2025 – highlighting insights to help key players make informed, data-driven decisions on store formats, product offerings, and more.

The grocery segment has experienced nearly uniform positive year-over-year (YoY) growth over the last 12 months. This sustained performance in the face of inflation and other headwinds highlights the underlying strength of the category.

What is driving this growth? Since 2022, the grocery segment has seen consistent overall visit growth that has outpaced increases in visits per location – a sign that chain expansion has played a key role in the category’s success. But the average number of visits to each grocery store has also been on the rise, indicating that the segment continues to expand without cannibalizing existing store traffic.

At the same time, visitor dwell times have been steadily dropping since 2021. This shift appears to reflect a trend towards multiple, shorter trips by inflation-wary consumers eager to avoid large, costly carts or cherry pick deals across various retailers. Many shoppers may also be placing more bulk orders online and supplementing those deliveries with brief in-store stops for additional items as needed.

The bottom line: Shoppers are taking more grocery trips overall each year, but spending less time in-store during each visit. Operators can respond to this trend by optimizing layouts and promoting “grab-and-go” areas for an even more efficient quick-trip experience.

Visit share data also shows that despite fierce competition from discount and dollar stores, wholesalers, and general mass retailers, the grocery segment has steadfastly preserved its share of the overall food-at-home visit pie.

Between Q1 2019 and Q1 2025, wholesale clubs and discount and dollar stores increased their share of total food-at-home visits, gains that have come primarily at the expense of Walmart and Target. Meanwhile, grocery outlets have held firm – despite some fluctuations over the years, their Q1 2019 visit share remained essentially unchanged in Q1 2025.

So even as consumers flock to alternative food purveyors in search of lower prices, grocery stores aren’t losing ground – and on a nationwide level, they remain the biggest player by far in the food-at-home shopping space.

Still, grocery store visit share varies significantly by region. On the West Coast, in parts of the Northeast, Mid-Atlantic, and Mountain regions, and in Florida and Michigan, grocery stores accounted for the majority of food-at-home visits in Q1 2025. Oregon (61.6%) and Washington (59.6%) led the pack, followed by Massachusetts (59.2%), Vermont (58.5%), and California (57.9%). Meanwhile, in West Virginia, Arkansas, South Dakota, Oklahoma, North Dakota, and Mississippi, less than 30% of food-at-home traffic went to grocery stores, with more shoppers in these regions turning to general mass retailers or discounters.

Grocery store operators in lower-grocery-share regions may choose to focus on price competitiveness and convenient store locations to capture more foot traffic from competitors in the space.

Which types of grocery stores are thriving the most? The grocery segment is diverse, encompassing traditional grocery chains like Kroger, Safeway, and H-E-B; budget-oriented value chains such as Aldi, WinCo Foods, Grocery Outlet Bargain Market, and Market Basket; fresh-format specialty brands like Trader Joe’s, Whole Foods, and Sprouts Farmers Market; and numerous ethnic grocers.

Examining shifts in visit share among these various grocery store segments shows that traditional grocery still dominates, commanding over 70.0% of total grocery store foot traffic.

Still, over the past several years, traditional grocers have gradually ceded ground to other segments – especially value chains. Budget grocers saw a temporary surge in visits during the panic-buying days of early 2020 – and have been more gradually gaining visit share since Q1 2023. . Fresh-format banners, which lost ground in 2021 after a Q1 2020 bump, in the wake of COVID, have also been on the upswing and appear poised to capture additional visit share in the coming months and years. And though ethnic grocers still account for a relatively small portion of the overall market, they have slightly increased their visit share, reflecting heightened consumer interest in these specialized offerings.

Recent performance metrics point to a bifurcation in the grocery market similar to that observed in other retail categories. In Q1 2025, fresh-format and value retailers – which appeal, respectively, to the most and least affluent visitor bases – saw the greatest growth in both overall visits and average visits per location.

This trend highlights the power of both value and health-focused quality to motivate consumers in 2025. And grocery players that can meet these needs will be well-positioned for success in the months ahead.

One factor fueling fresh-format’s success may be its role as a convenient, relatively affordable midday lunch destination for the remote work crowd.

In Q1 2025, consumers working from home accounted for 20.2% of fresh-format grocery stores’ captured market – a significantly higher share than any other analyzed grocery segment. These stores also tended to be busier midday than the other segments. Remote workers may be stopping by to grab a quick bite – and some may be choosing to do their grocery shopping during their lunch break when stores are less crowded.

This finding suggests an opportunity for grocery operators across all segments to develop or enhance in-store salad bars and quick-serve sections to tap into the lunch rush. Likewise, CPG companies may benefit from developing more ready-made, nutritious meal options that align with these midday dining habits.

Though the broader ethnic grocery category remained essentially flat in Q1 2025, Hispanic-focused grocers emerged as a sub-segment to watch. Both overall visits and average visits per location to these stores have been on the rise since 2021.

This robust demand presents an opportunity for CPG brands and grocers across segments to expand Hispanic-focused offerings, capturing a slice of this growing market.

Finally, store size matters more than ever in 2025. During the first quarter of the year, smaller format grocery store locations (locations under 30K square feet, across different chains) outpaced larger stores with a 3.2% YoY jump in visits, showing that bigger isn’t always better in the grocery store space.

This pattern aligns with the decrease in dwell times noted above – shoppers may be making shorter trips to smaller, more convenient grocery store locations. These quick errands are ideal for picking up a few items to supplement online orders, shopping multiple deals, or sourcing specialty products unavailable at larger grocery destinations. And to lean into this trend, grocery operators might consider testing neighborhood “micro-store” concepts, focusing on curated selections, and offering convenient parking or pickup to match consumer preferences for targeted purchases and quicker trips.

Location intelligence reveals a growing, dynamic grocery landscape which is holding its ground in the face of increased competition. Shorter trips, busier lifestyles, and changing work routines are reshaping in-store experiences. And grocery players that refine their store formats, target both lunch and on-the-go shoppers, and adapt to shifting demographics can position themselves to thrive in this competitive sector. As the market continues to evolve, continuous attention to these changing patterns will be key to maintaining and expanding market share.

1. Elevated visitor frequency could mean that gym-goers are getting more value out of their memberships and are therefore more likely to stay signed up. Between January and March 2025, all of the gym chains analyzed had a higher share of frequent visitors (those who visited about once a week) than in the equivalent month of 2024.

2. Fitness chains at all price tiers need to be strategic about the value they offer and the amenities that can engage budget-conscious consumers. Between Q1 2022 and Q1 2025, the captured trade area median HHI increased for all fitness subsegments – value-priced, mid-range, and high-end – suggesting that consumers swapped pricier gym memberships for more affordable options.

3. Close attention should be paid to how long visitors spend at fitness chains in order to reduce crowding and bottlenecks. Between Q1 2022 and Q1 2025, the average visit length increased at value-priced, mid-range, and high-end gyms. Floorplan and equipment improvements could be considered, as well as having trainers available to help gym-goers streamline workouts.

4. Gyms can use hourly visit data to better serve their members or use promotions to stabilize facility usage throughout the day. In Q1 2025, high-end chains received a larger share of morning visits while value-priced and mid-range fitness chains received larger shares of evening visits.

Like many industries in recent years, the fitness sector has experienced significant shifts in consumer behavior. From the rise in home workouts during the pandemic to the strain of hyper-inflation, foot traffic trends to gyms and health clubs have been as dynamic as the consumers they serve.

This report leverages location analytics to explore the consumer trends driving visitation in the fitness space and provides actionable insights for industry stakeholders.

The pandemic drove several shifts in the fitness space. Widespread gym closures led consumers to embrace home-based workouts, while demand for all things fitness increased due to an emphasis on overall health and wellness. This subsequently drove a renewed interest in gym-based workouts as restrictions lifted – even as some consumers remained committed to their home workout routines.

In Q1 2023, visits to fitness chains surpassed Q1 2019 levels for the first time since the onset of the pandemic, a sign that consumers had recommitted to out-of-home fitness. And in Q1 2024 and Q1 2025, fitness chains saw further growth, climbing to 12.8% and 15.5% above the Q1 2019 baseline, respectively.

Several factors have likely driven consumers’ return to gyms and health clubs, including the desire for both social connection and professional-grade facilities difficult to replicate at home. The steep increase in cost of living has likely also played a role, since consumers cutting back on discretionary spending can enjoy multiple outings and a range of recreational activities at the gym for one monthly fee.

Zooming in on weekly visits to the fitness space in Q1 2025 reveals the industry’s exceptional strength and resilience in the early part of the year.

The fitness industry experienced YoY visit growth nearly every week of Q1 2025 (and 2.4% YoY visit growth overall) with only minor visit gaps the weeks of January 20th, 2025 and February 17th, 2025 – likely due to extreme weather that prevented many Americans from hitting the gym.

And the fitness industry’s weekly visit growth appeared to strengthen throughout the quarter, defying the typical waning of New Year's resolutions. This could indicate that gym visits haven't plateaued and that consumers are demonstrating greater commitment to their fitness routines compared to last year.

Diving into visitation patterns for leading fitness chains highlights how increased visitor frequency drove foot traffic growth in Q1 2025.

Fitness chains tend to receive the most visits during the first months of the year as consumers recommit to health and wellness in their post-holidays New Year’s resolutions. And not only do more people hit the gym – analyzing the data reveals that gym-goers also typically work out more frequently during this period. Zooming in on 2025 so far suggests that consumers are especially committed to their fitness routines this year: Leading gyms saw an increase in the proportion of frequent visitors (4+ times a month) in Q1 2025 compared to the already significant percentage of frequent visitors in the first quarter of 2024.

Elevated visitor frequency could mean that gym-goers are getting more value out of their memberships than last year, and are therefore more likely to stay signed up throughout the year.

At the same time, the data also reveals that – contrary to what may be expected – a fitness chain’s share of frequent visitors appears to be independent of the cost of membership associated with the club: Life Time, a high-end club, and EōS Fitness, a value-priced gym, had the highest shares of frequent visitors between January 2024 and March 2025. This suggests that factors other than cost, such as location convenience, class offerings, community, or individual motivation, might be more influential in driving frequent gym attendance.

Segmenting the fitness industry by membership price tiers – value-priced, mid-range, and high-end – can reveal further insights on current consumer behavior around out-of-home fitness.

In Q1 2025, the captured market* median household income (HHI) was higher than the nationwide median HHI ($79.6K/year) across all price tiers – suggesting that even value-priced fitness chains are attracting a relatively affluent audience. This could indicate that gym memberships are somewhat of a luxury and that consumers from lower-income households gave up their gym memberships altogether as they tightened their purse strings.

Analyzing the historical data since Q1 2022 also reveals that the captured market median HHI has risen consistently over the past couple of years with the largest median HHI increase observed in the captured trade areas of high-end fitness chains. This suggests that middle-income households – that are more sensitive to the rising cost of living – likely swapped pricier gym memberships for more affordable options in recent years.

These metrics indicate that fitness chains at all price tiers need to think strategically about the value they offer and the amenities that can engage budget-conscious consumers who are carefully weighing every expenditure.

*Captured trade area is obtained by weighting the census block groups (CBGs) from which the chain draws its visitors according to their share of visits to the chain and thus reflects the population that visits the chain in practice.

Fitness clubs of all types need to manage their capacity to ensure health and safety standards and a positive experience for members. And understanding the average amount of time visitors spend at the gym can help fitness chains at every price point keep their finger on the pulse of their facilities.

Between Q1 2022 and Q1 2025, the average visit length increased at value-priced, mid-range, and high-end gyms. Value-priced gyms experienced the largest increase in average visit length – from 72.4 minutes in Q1 2022 to 74.0 minutes in Q1 2025 – perhaps due to their relatively lower-income visitors spending more time enjoying club amenities after cutting back on other forms of recreation. Meanwhile, mid-range and high-end gyms experienced relatively modest increases in average visit length, which were higher to begin with – likely due to their ample class and spa offerings and overall inviting, upscale spaces.

Elevated average visit length could mean that visitors are well-engaged and less likely to cancel their memberships. But as overall gym visits are on the rise, fitness chains may want to pay close attention to how long visitors spend at the facility. Floorplan and equipment improvements could be considered in order to reduce bottlenecks, and having trainers available to instruct on equipment usage and workout technique could help gym-goers streamline workouts.

Along with average visit length, understanding the daypart in which they receive the most visits is another way that fitness chains can improve efficiency and prevent overcrowding. And analysis of the hourly visits to fitness sub-segments revealed that some fitness segments receive more morning visits while others are more popular in the evenings.

In Q1 2025, high-end chains received a larger share of visits between 6 a.m. and 9 a.m. (19.7%) than value-priced and mid-range fitness chains (11.6% and 11.8%, respectively). Meanwhile, value-priced and mid-range fitness chains received larger shares of visits between 6 p.m. and 9 p.m. (21.9% and 22.2%) than high-end chains (16.5%).

Gyms can leverage this data to better serve members, for instance by scheduling more classes during peak hours. Value-priced and mid-range gyms, which saw a larger disparity between shares of morning and evening visits in Q1 2025, might also consider incentivizing off-peak usage through discounted morning memberships or early-bird snack bar deals.

The fitness space appears to be in good shape in 2025. Visits have made a full recovery from the pandemic era and still continue to grow, indicating strong consumer demand for out-of-home workouts. And using location intelligence to analyze the behavior and demographics of visitors to gyms at different price points can help identify opportunities for driving even greater success.

1. Idaho and South Carolina have emerged as significant domestic migration magnets over the past four years. Between January 2021 and 2025, both states gained over 3.0% of their populations through domestic migration. Other Mountain and Sun Belt states – including Nevada, Montana, and Florida – also drew significant inflow, while California, New York, and Illinois experienced the greatest outmigration.

2. Interstate migration cooled noticeably in 2024. During the 12-month period ending January 2025, California, New York and Illinois saw their outflows slow dramatically, while domestic migration hotspots like Georgia, Texas, and Florida saw inflows flatten to zero. A similar cooling trend emerged on a CBSA level.

3. Still, some states continued to see notable relocation activity over the past year. In 2024, Idaho, South Carolina, and North Dakota drew the most relocators relative to their populations. And among the nation’s ten largest states, North Carolina led with an inflow of 0.4%.

4. Phoenix remained a rare bright spot among the nation’s ten largest metro areas. The CBSA was the only major analyzed hub to maintain positive net domestic migration through 2024.

Over the past several years, the United States has experienced significant domestic migration shifts, driven by factors like remote work, housing affordability, and regional economic opportunities. As some areas reap the benefits of population inflows, others grapple with outflows tied to higher living costs and evolving workplace dynamics.

This report dives into the location analytics to explore where Americans have moved since 2021 – and how these patterns began to change in 2024.

Since 2021, Americans have flocked toward warmer climates, expansive natural scenery, and more affordable housing options – particularly in the Mountain and Sun Belt states.

Between January 2021 and January 2025, South Carolina led the nation in positive net domestic migration – drawing an influx of newcomers equivalent to 3.6% of its January 2025 population. (This metric is referred to as a state’s “net migrated percent of population.”) Next in line was Idaho with a 3.4% net migrated percent of population, followed by Nevada, (2.8%), Montana (2.8%), Florida (2.1%), South Dakota (2.1%), Wyoming (2.0%), North Carolina (2.0%), and Tennessee (1.9%). Texas saw positive net migration of just 0.9% during the same period. However, the Lone Star State’s large overall population means a substantial number of newcomers in absolute terms.

Meanwhile, California (-2.2%), New York (-2.1%), and Illinois (-1.9%) experienced the greatest outflows relative to their populations. This exodus was driven largely by soaring housing costs and the rise of remote work, which lowered barriers to moving out of high-priced areas.

Between January 2024 and January 2025, many of the same broad patterns persisted, but at a more moderate clip – suggesting a stabilization of domestic migration nationwide. This leveling off could reflect factors such as rising mortgage interest rates, which dampened home buying and selling, as well as the increased push for employees to return to the office.

Still, South Carolina (+0.6%) and Idaho (+0.6%) remained among the top inflow states. The two hotspots were joined – and slightly surpassed – by North Dakota (+0.8%), where even modest waves of newcomers make a big impact due to the state’s lower population base. A wealth of affordable housing and a strong job market have positioned North Dakota as a particularly attractive destination for U.S. relocators in recent years. And Microsoft and Amazon’s establishment of major presences around Fargo has strengthened the region’s economy.

Meanwhile, California (-0.3%), New York (-0.2%), and Illinois (-0.1%) continued to post negative net migration, but at a markedly slower rate than in prior years. And notably, several states that had been struggling with outflow, such as Michigan, Minnesota, Virginia, Ohio, and Oregon, began showing minor positive inflow during the same 12-month window. As home affordability erodes in pandemic-era hot spots like the Mountain states and Sun Belt, these areas may emerge as new destinations for Americans seeking lower costs of living.

Zooming in on the ten most populous U.S. states offers an even clearer picture of how domestic migration patterns have stabilized over the past year. The graph below shows a side-by-side comparison of domestic migration patterns during the 36-month period ending January 2024 and the 12-month period ending January 2025.

California, New York, and Illinois saw population outflows slow dramatically during the 12 months ending January 2025 – while domestic migration magnets such as Georgia, Texas, and Florida saw inflow flatten to zero. Meanwhile, Ohio, Michigan, and Pennsylvania flipped from slightly negative to slightly positive net migration – incremental upticks that could signal a possible turnaround.

The only “Big Ten” pandemic-era migration magnet to maintain strong inflow in 2024 was North Carolina – which saw a 0.4% influx in 2024 as a result of interstate moves.

A closer look at the top four states receiving outmigration from California and New York (October 2020 to October 2024) reveals that residents leaving both states tended to settle in nearby areas or in Florida.

Among those leaving New York, 37.4% ended up in neighboring states – 21.1% moved to New Jersey, 9.2% to Pennsylvania, and 7.1% to Connecticut. But an astonishing 28.8% decamped all the way to the Sunshine State, trading the Northeast’s colder climate for Florida sunshine.

Similarly, 20.1% of California leavers chose to stay nearby, moving to Nevada (11.5%) or Arizona (8.6%). Another 19.1% moved to Texas, and 8.0% moved to Florida, making it the fourth-largest destination for Californians.

Zooming in on CBSA-level data – focusing on the nation’s ten largest metropolitan areas, all with over five million people – reveals a similar picture of slowing domestic migration over the last year.

Los Angeles, New York, Chicago, and Washington, D.C. – four cities that experienced notable population outflows between January 2021 and January 2024 – saw those outflows flatten considerably. For these metros, this leveling-off may serve as a promising sign that the waves of departures seen in recent years may have begun to subside. Conversely, Houston and Dallas, which both welcomed positive net migration between January 2021 and January 2024, registered zero-net domestic migration in 2024. Atlanta, for its part, remained flat in both of the analyzed periods.

In Miami, however, outmigration persisted at a substantial rate. Despite Florida’s overall status as a domestic migration magnet, Miami lost 2.6% of its population to domestic net migration between January 2020 and January 2024 – and another 1.0% between January 2024 and January 2025. As one of Florida’s most expensive housing markets, Miami may be losing some residents to other parts of the state or elsewhere in the region. Meanwhile, Philadelphia, which lost 0.3% of its population to net domestic migration between January 2021 and January 2024, continued losing residents at a slightly faster pace in 2024 – another 0.3% just last year.

Of the ten biggest CBSAs nationwide, only Phoenix continued to see a net domestic migration gain through 2024 (+0.2%). This highlights the CBSA’s continued draw as a (relative) relocation hotspot even in 2024’s cooling market.

Who are the domestic relocators heading to Phoenix?

From October 2020 to October 2024, the top five metro areas sending residents to the Phoenix CBSA each registered median household incomes (HHIs) of $73K to $98K – surpassing Phoenix’s own median of $72K. This suggests that many of those moving in are arriving from wealthier, often more expensive metro areas – for whom even Phoenix’s high-priced market may offer more affordable living.

Overall, domestic migration patterns appear to have cooled in 2024, reflecting economic and societal trends that have slowed the rush from pricey coastal hubs to more affordable regions. Yet states like South Carolina, Idaho, and North Dakota – as well as metro areas like Phoenix – continue to attract new arrivals, paving the way for evolving regional demographics in the years to come.