.svg)

.png)

.png)

.png)

.png)

How did the home improvement and decor segments fare in the first months of 2024? We checked in with some of the categories’ biggest names – including Home Depot, Lowe’s, Tractor Supply Co., Harbor Freight Tools, Homesense, HomeGoods, and At Home – to see what Q1 portends for their performance the rest of the year.

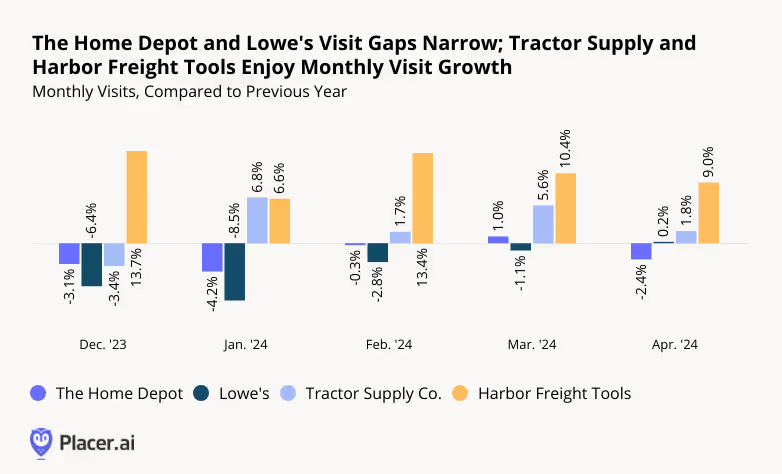

Last year was a challenging one for the home improvement space – as consumers cut back on discretionary spending and put pricey renovations on hold. But Q1 2024 visit data suggests that the category may be ready for a comeback. Throughout Q1 2024, Lowe’s saw its monthly visit gap narrow steadily – and in April 2024 saw the first YoY visit uptick the chain has experienced since 2021. And YoY visits to Home Depot were down just 0.3% in February 2024 and up 1.0% in March. Though Home Depot saw a minor visit gap emerge once again in April, the home improvement powerhouse appears to be on solid footing heading into the spring season.

While Home Depot and Lowe’s are rebounding, other home improvement chains are thriving. Discount chain Harbor Freight Tools continued to grow its footprint – and its visits – by expanding into new markets and cementing its role as a go-to destination for inexpensive home maintenance supplies. And farming essentials retailer Tractor Supply Co. also increased its store count together with its traffic. By occupying somewhat less discretionary niches, these two retailers have managed to avoid some of the headwinds plaguing the category.

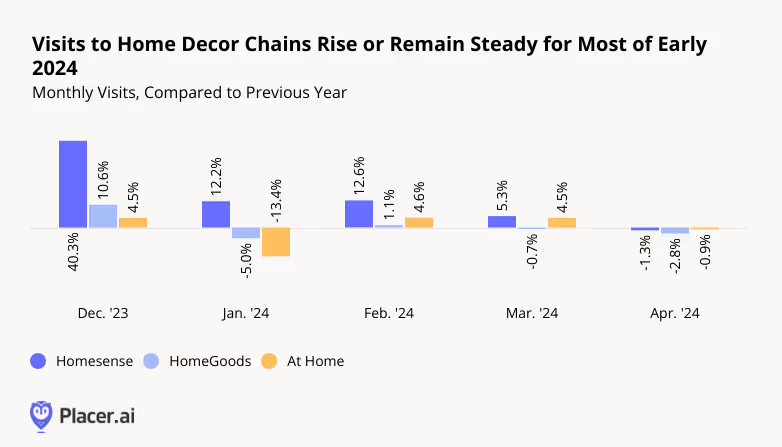

The home decor segment, including brands like Homesense, HomeGoods (both owned by parent company TJX Companies), and At Home, offers consumers a way to enhance their living spaces while avoiding the high costs associated with renovations or moving. And in Q1 2024, shoppers leaned into the category’s offerings.

Despite lapping a strong 2023, Homesense – which recently decided to close its ecommerce channel and focus on offline expansion – saw YoY visit growth throughout Q1. And though inclement weather weighed on HomeGoods’ and At Home’s January performance, YoY visits to the two brands increased or remained stable in February and March. In April 2024, all three chains held steady with slight YoY visit gaps – no small feat given the category’s largely discretionary nature.

Indeed, diving into the demographics of visitors to Homesense, HomeGoods, and At Home reveals that it is more affluent consumers that are driving visits to the three chains. Each chain's potential market* boasts a median household income (HHI) close to or above the nationwide median of $76.1K/year. But the median HHI of each chain’s captured market is notably higher – suggesting it is the wealthiest consumer segments in each chain’s trade area that are visiting the brands.

*A chain’s potential market refers to the population residing in a given trade area, where the Census Block Groups (CBGs) making up the trade area are weighted to reflect the number of households in each CBG. A chain’s captured market weighs each CBG according to the actual number of visits originating to the chain from that CBG.

.avif)

Home improvement and decor chains have seen their shares of ups and downs over the past few years, from pandemic highs to inflationary lows. And while some players thrived in Q1 2024, others weathered headwinds while maintaining their equilibrium. How will the space continue to fare as 2024 progresses?

Follow Placer.ai to find out.

The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from some 1,000 office buildings across the country. It only includes commercial office buildings, and commercial office buildings with retail offerings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

Recent survey data shows that while most people don’t want to go back to the office five days a week, they also don’t want to be fully remote. Many employees – and companies – prefer a middle-of-the-road approach that balances flexibility with opportunities for in-person engagement, learning, and collaboration.

But what’s happening on the ground? We checked in with our Nationwide and regional Office Indexes to find out.

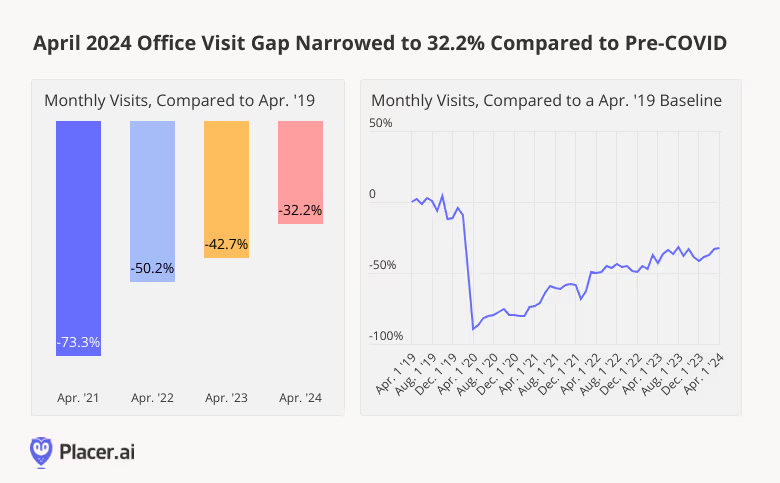

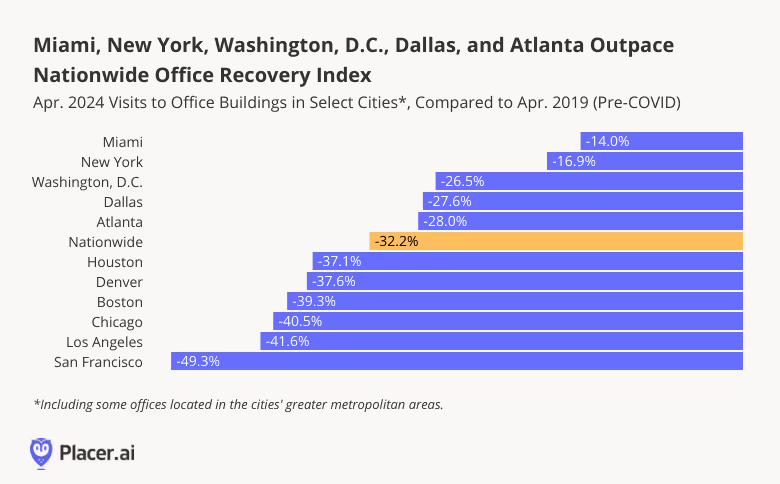

Last month saw a continuation of the positive office recovery momentum observed in February and March 2024. April 2024 office visits were just 32.2% below what they were in the equivalent period of 2019 (pre-pandemic), and nearly the highest they’ve been since COVID. Comparing monthly visits to an April 2019 baseline also shows that April 2024 was outperformed only by August 2023 – a rare month featuring 23 business days. (April 2024 had 22 business days – as did April 2019).

Drilling down into the data for major regional hubs shows Miami and New York solidifying their office recovery leads with respective pre-COVID visit gaps of just 14.0% and 16.9%. But these weren’t the only cities to shine: Washington, D.C., Dallas, and Atlanta also outperformed the nationwide baseline – and like Miami, experienced their single busiest in-office months since COVID.

All the analyzed regional hubs saw significant YoY office visit growth – with the prize once again going to San Francisco, where visits were up 26.0%. Though San Francisco still lags significantly behind other regional hubs compared to pre-COVID, the city’s persistent YoY office visit growth may signal a light at the end of the Golden Gate City’s commercial real estate tunnel.

To be fair, April 2023 had two less business days than April 2024 – a fact that may have served to amplify YoY growth trends across the board. But even accounting for this discrepancy, last month’s strong office recovery was a particularly strong one – showing that RTO remains very much a work in progress.

The benefits and drawbacks of remote work are still being debated. But no matter how you slice it, spending some time in the office each week seems to have its benefits. As companies and employees continue to negotiate the new hybrid status quo, office visit patterns will continue to shift nationwide.

Follow Placer.ai for more data-driven office insights.

We dove into the latest foot traffic analytics for leading movie theater chains – AMC Theatres, Regal Cinemas, and Cinemark – to uncover how recent consumer behavior and visitor demographics are setting the stage for the cinema category’s next chapter.

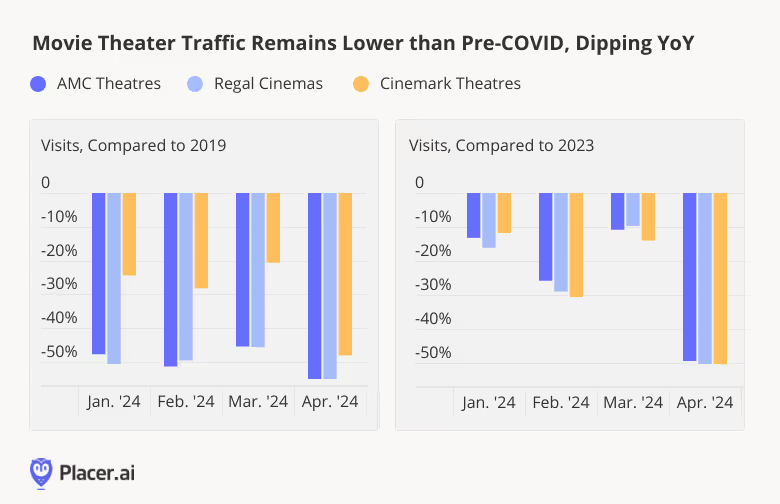

Cinemas have yet to reclaim their pre-COVID glory – and during the first few months of 2024, visits to AMC and Regal, and to a lesser extent Cinemark, remained substantially below 2019 levels. While some of these visit gaps can be attributed to exhibitors downsizing their real estate portfolios, the rise in at-home entertainment continues to impact pre-pandemic foot traffic comparisons.

In addition, since the pandemic, blockbuster releases have taken on even greater importance as drivers of movie theater visit spikes. And in early 2024, a relative absence of new blockbusters took its toll on theater operators’ performance. Between January and April 2024, cinema leaders saw YoY visit dips – likely attributable in part to delayed releases. And smash-hit titles that drove box-office success in early 2023 – including Avatar: The Way of Water, Ant Man, and The Super Mario Bros. Movie – helped set the stage for challenging YoY comparisons.

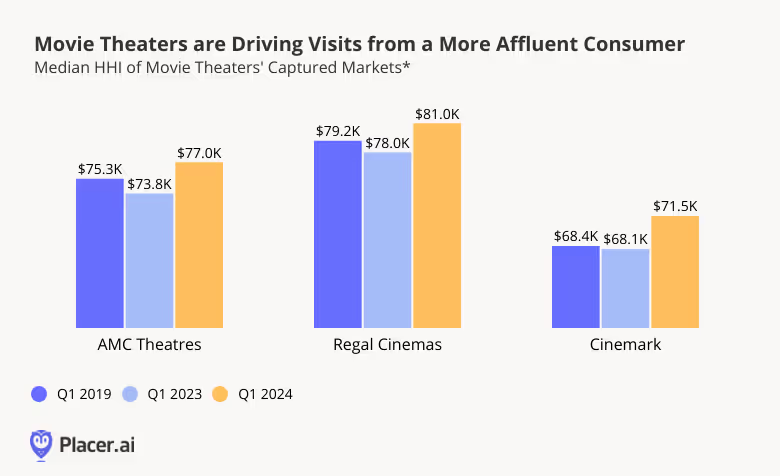

Despite these visit gaps, analysis of changing visitor demographics suggests that there remain a variety of ways for theater operators to succeed.

Analyzing cinema leaders’ captured markets with demographics from STI: PopStats shows that today’s movie-goers are more affluent than they were before COVID. After dipping in Q1 2023, the median household incomes (HHIs) of AMC, Regal Cinema, and Cinemark’s captured markets spiked in Q1 2024, surpassing the chains’ own pre-pandemic benchmarks. This shift may be due in part to discretionary spending cutbacks by less affluent consumers – who may be particularly inclined to hold off on going to the movies when there are no big releases on offer.

For exhibitors, the increase in visitors’ spending power presents an important opportunity: Affluent movie-goers are likely to spend more on revenue-boosting concessions and premium formats, a boon for theater chains at a time when visit gaps linger.

Five years after COVID sent movie theaters into a tailspin, the category is holding its own. Though routine visits remain lower than they were before the pandemic, a shifting customer base continues to provide operators with new avenues for success.

For more data-driven entertainment insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

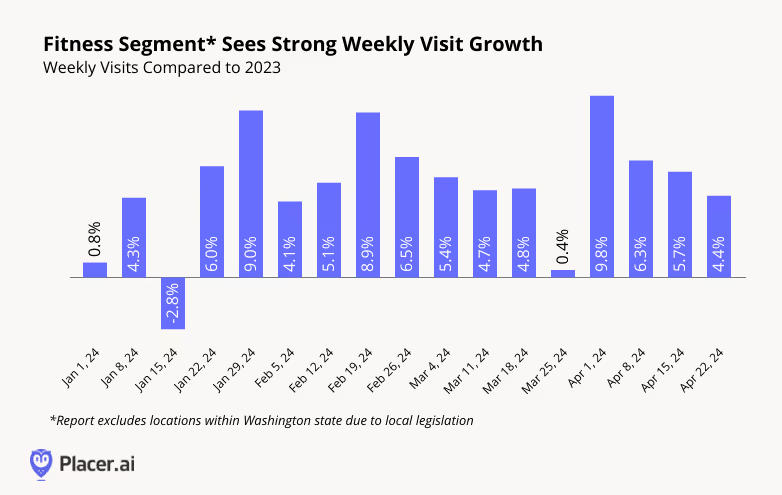

The fitness industry has experienced steady growth in recent years, propelled by consumers’ prioritization of health and wellness – and gyms across the country are benefiting.

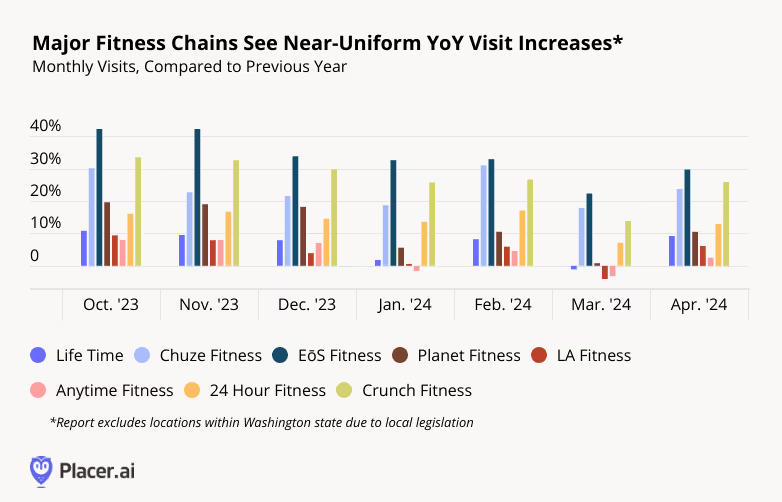

So with 2024 underway, we dove into the data to examine the segment’s performance during the first months of the year. Did Fitness’ strong January showing persist beyond the season of new year’s resolutions? And how did major gym chains – including Planet Fitness, Life Time, Crunch Fitness, and EōS – perform in Q1 2024 relative to last year?

Fitness has been a consistent success story over the past few years, and the category is showing no signs of slowing down. Year-over-year (YoY) visits to the industry were up nearly every week between January and April 2024, with the sole exception of the week of January 15th, when an Arctic blast saw many people hunkering down indoors. And visits remained slightly elevated even during the week of March 25th, when Easter celebrations likely distracted many people from their gym goals – an impressive feat given the comparison to a non-holiday week in 2023.

Drilling down into visit trends for eight major fitness chains shows that in today’s robust fitness environment, there’s enough demand to sustain a variety of chains: Both premium and mid-range options like Life Time and LA Fitness as well as more affordable choices like Planet Fitness and Crunch Fitness saw visits increase or remain steady for most of Q1 – and all saw YoY visit bumps in April.

Some gym-goers hit the gym several times a week and spend hours working out, while others have a more relaxed get-in-shape schedule. And analyzing leading chains’ visitation patterns shows that gyms are finding success by catering to fitness buffs’ varying preferences.

Perhaps unsurprisingly, the data reveals a strong correlation between a chain’s share of frequent visitors (i.e. those visiting the gym eight or more times in a month), and a chain’s share of visitors staying longer than 90 minutes. While some clubs, including Life Time and EōS appear to attract highly dedicated gym-goers, others, including Planet Fitness and Anytime Fitness, seem to draw more casual visitors.

The fact that both fitness chains attracting frequent visitors for longer workouts and gyms that cater to more casual exercisers who spend less time in the gym during each session are seeing positive visitation trends indicates that there are plenty of models for fitness success in 2024.

One thing seems clear – interest in gyms is not going away anytime soon. Visits continue to show YoY growth, and the industry is full of options for every kind of fitness enthusiast. Whether opting for occasional visits or adhering to a structured workout regimen – there’s something for everyone.

To stay ahead of the latest retail and fitness developments, visit placer.ai/blog.

Following a busy week of Q1 2024 updates several restaurant chains, the key question facing operators is whether menu price increases the past several years have forced consumers into alternative food retail channels. Several restaurant chains--most notably McDonald’s–highlighted a more “discriminating” consumer during their quarterly updates. According McDonald’s CEO Chris Kempczinski on the company’s Q1 2024 update this week: “U.S. consumers continued to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending which is putting pressure on the QSR industry.” In turn, this has resulted in flat-to-declining industry traffic in the U.S. during the quarter. Looking at year-to-date visitation trends across the different restaurant categories, we see a weak start to the year due to inclement weather, followed by a rebound to low-single-digit growth for the limited-service categories (QSR and fast casual) and low-single-digit declines for the full-service restaurant chains.

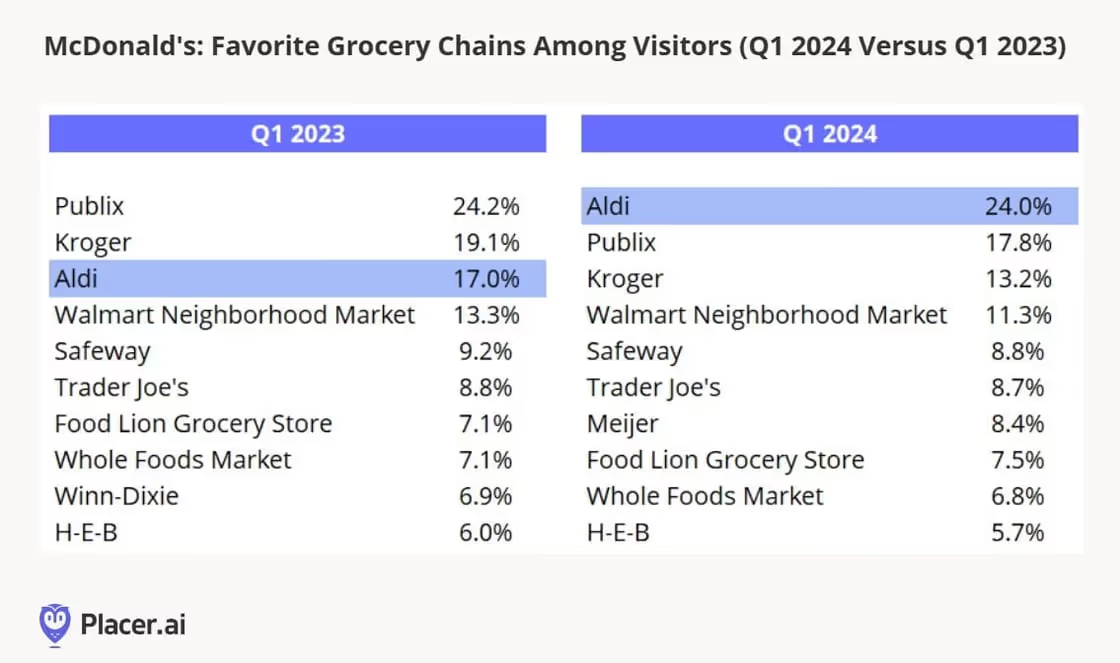

As we discuss throughout this week’s Anchor report, consumers will likely remain discriminating over the next several quarters. As such, we expect a continuation of the channel shifts we’ve been witnessing across the broader food retail sector. According to our data, the QSR category saw a +5% increase in visits from 2019-2023, while the full-service restaurant category saw a -8% decrease in visits (partly explained by the permanent closure of many smaller, regional full-service dining chains). Conversely, the grocery, superstore, convenience store, and dollar/discount stores have all seen meaningfully higher visit growth over the same period (as our friends at Restaurant Business have also called out), indicating these channels are taking share from the restaurant industry.

Looking at McDonald’s cross-visitation trends during the quarter, we see further evidence of this shift. We’ve compared the favorite grocery chains of McDonald’s visitors in Q1 2024 to Q1 2023 below. We see a material increase in the percentage of McDonald’s visitors that visited an Aldi location year-over-year–24% versus 17% in the year ago period. We also see a decrease in percentage of visits to most conventional grocery chains.

Not surprisingly, McDonald’s plans to accentuate its value offerings in the coming quarters. On its update call, management noted that 90% of its U.S. locations offer meal bundles for $4 or less and that it has been running several promotions through its digital app. The company also noted the need to align around a strong national value proposition so that the company can use its tremendous media scale to drive high consumer awareness. It will likely take time for McDonald’s to organize around its value platform, but once it does start to promote its value offerings on a nationwide basis, we would expect much of the rest of the QSR category to follow suit.

This weekend, Formula 1 is once again ready to take the track in the United States, this time at the Miami Grand Prix on Sunday. The Miami Grand Prix is the first U.S. race in the 2024 calendar, followed by the U.S. Grand Prix in Austin, Texas and the Las Vegas Grand Prix in the fall.

America has grown into the new epicenter of the sport and is the only country besides Italy to host multiple races in a singular season. Not only does the U.S. host races, but countless American retail, tech, CPG and hospitality brands serve as team sponsors, including Marriott, Rokt, Tommy Hilfiger, Google, eBay, Coca Cola and more. For brands looking at the consumption habits of younger, more affluent consumers, the rise of Formula 1 in the U.S. can help unlock insights on this group. Credit for Formula 1’s exponential growth in popularity is largely due to the Netflix docuseries, Drive to Survive, which just released its sixth season in the first quarter of 2024. According to Netflix, over 90 million hours of the program were watched throughout the first half of last year. The immense popularity of the show and its behind the scenes access to the luxurious world of F1 generated a large demand for the sport by Americans, and the appetite for home grown F1 races where U.S. based fans can participate is palpable.

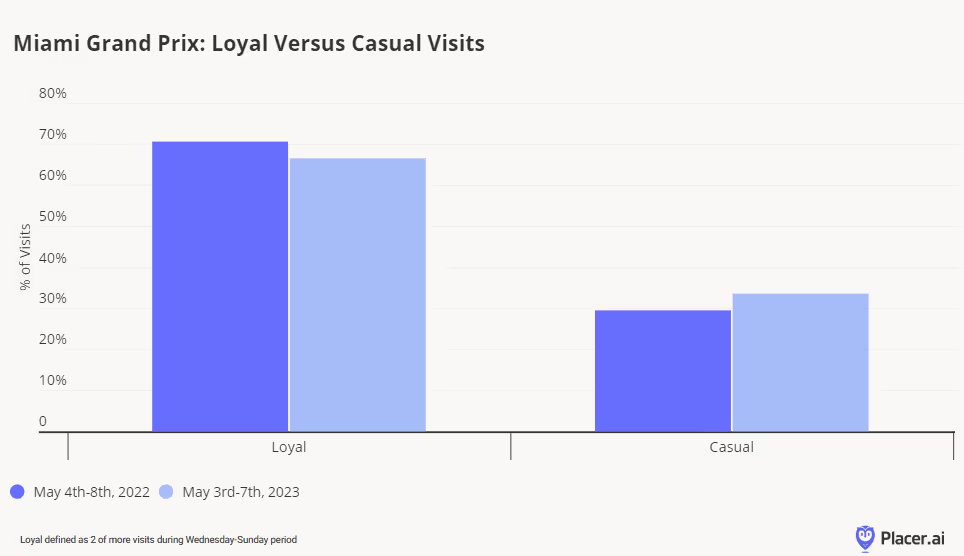

2024 is the third running of the Miami Grand Prix, held around Hard Rock Stadium, with the event debuting in 2022. According to Placer.ai data, traffic at the event, which usually runs Thursday-Sunday, in 2023 increased 3% compared to 2022. Usually during grand prix weekends, visitors have the option to purchase single or multi-day passes, and our data (as shown below) indicates that there were fewer repeat visits in 2023 compared to 2022; consumers may have chosen single day passes more often or made the event a part of a larger weekend in Miami. The highest number of visits occurred on Sunday each year, which aligns with the fact that the actual race takes place that day, with practice sessions and qualifying taking place on Friday and Saturday respectively.

Despite slightly fewer loyal visits during the weekend, the time spent at the event increased, with an average of 179 minutes, up 4% year-over-year. With consumers spending around three hours at the venue, there is a huge opportunity for American CPG and retail companies to engage with this captive audience.

The U.S. Grand Prix, held annually in Austin, has seen similar success from the influx of American F1 fans. Traffic at the 2023 event weekend grew by 38% compared to 2019. 2022 saw peak event attendance, most likely due to a competitive and exhilarating end to the 2021 season that bled into the next year. 2023 also saw the highest percentage of three-day visits during the weekend, highlighting that most U.S. Grand Prix attendees visit the track multiple days for the various race weekend events.

While the growth of the event itself is impressive, the change in visitor demographics provides an even more striking opportunity for American retailers and brands. 2023 brought the highest percentage of visits from young professionals and young urban singles compared to all other segments in 2023. Young professionals also grew to 36% of visits in 2023 from less than 30% in 2019, showcasing the rise in younger and more affluent visitors. Both the popularity of Netflix coupled with the increase in influencer marketing brand trips to races may both have contributed to this shift over time.

It’s clear that Formula 1’s growing popularity has no doubt fueled race expansion stateside and that has been able to capture the attention of the elusive younger consumer, especially those with disposable income. Brands, licensees and retailers have all jumped on the opportunity to collaborate with drivers, teams and race weekends to tap into this growth market. Sporting events are a highly competitive landscape, excuse the pun, but the intersection of sports and content have paved the way for Formula 1’s success in the U.S.

.png)

1) Broad-based growth: All four grocery formats grew year-over-year in Q2 2025, with traditional grocers posting their first rebound since early 2024.

2) Value grocers slow: After leading during the 2022–24 trade-down wave, value grocer growth has decelerated as that shift matures.

3) Fresh formats surge: Now the fastest-growing segment, fueled by affluent shoppers seeking health, wellness, and convenience.

4) Bifurcation widens: Growth concentrated at both the low-income (value) and high-income (fresh) ends, highlighting polarized spending.

5) Shopping missions diverge: Short trips are rising, supporting fresh formats, while traditional grocers retain loyal stock-up customers and value chains capture fill-in trips through private labels.

6) Traditional grocers adapt: H-E-B and Harris Teeter outperformed by tailoring strategies to their core geographies and demographics.Bifurcation of Consumer Spending Help Fresh Format Lead Grocery Growth

Grocery traffic across all four major categories – value grocers, fresh format, traditional grocery, ethnic grocers – was up year over year in Q2 2025 as shoppers continue to engage with a wide range of grocery formats. Traditional grocery posted its first YoY traffic increase since Q1 2024, while ethnic grocers maintained their steady pattern of modest but consistent gains.

Value grocers, which dominated growth through most of 2024 as shoppers prioritized affordability, continued to expand but have now ceded leadership to fresh-format grocers. Rising food costs between 2022 and 2024 drove many consumers to chains like Aldi and Lidl, but much of this “trade-down” movement has already occurred. Although price sensitivity still shapes consumer choices – keeping the value segment on an upward trajectory – its growth momentum has slowed, making it less of a driver for the overall sector.

Fresh-format grocers have now taken the lead, posting the strongest YoY traffic gains of any category in 2025. This segment, anchored by players like Sprouts, appeals to the highest-income households of the four categories, signaling a growing influence of affluent shoppers on the competitive grocery landscape. Despite accounting for just 7.0% of total grocery visits in H1 2025, the segment’s rapid gains point to a broader shift: premium brands emphasizing health and wellness are emerging as the primary engine of growth in the grocery sector.

The fact that value grocers and fresh-format grocers – segments with the lowest and highest median household incomes among their customer bases – are the two categories driving the most growth underscores how the bifurcation of consumer spending is playing out in the grocery space as well. On one end, price-sensitive shoppers continue to seek out affordable options, while on the other, affluent consumers are fueling demand for premium, health-oriented formats. This dual-track growth pattern highlights how widening economic divides are reshaping competitive dynamics in grocery retail.

1) Broad-based growth: All four grocery categories posted YoY traffic gains in Q2 2025.

2) Traditional grocery rebound: First YoY increase since Q1 2024.

3) Ethnic grocers: Continued steady but modest upward trend.

4) Value grocers: Still growing, but slowing after most trade-down activity already occurred (2022–24).

5) Fresh formats: Now the fastest-growing segment, driven by affluent shoppers and interest in health & wellness.

6) Market shift: Premium, health-oriented brands are becoming the new growth driver in grocery.

7) Bifurcation of spending: Growth at both value and fresh-format grocers highlights a polarization in consumer spending patterns that is reshaping grocery competition.

Over the past two years, short grocery trips (under 10 minutes) have grown far more quickly than longer visits. While they still make up less than one-quarter of all U.S. grocery trips, their steady expansion suggests this behavioral shift is here to stay and that its full impact on the industry has yet to be realized.

One format particularly aligned with this trend is the fresh-format grocer, where average dwell times are shorter than in other categories. Yet despite benefiting from the rise of convenience-driven shopping, fresh formats attract the smallest share of loyal visitors (4+ times per month). This indicates they are rarely used for a primary weekly shop. Instead, they capture supplemental trips from consumers looking for specific needs – unique items, high-quality produce, or a prepared meal – who also value the ability to get in and out quickly.

In contrast, leading traditional grocers like H-E-B and Kroger thrive on a classic supermarket model built around frequent, comprehensive shopping trips. With the highest share of loyal visitors (38.5% and 27.6% respectively), they command a reliable customer base coming for full grocery runs and taking time to fill their carts.

Value grocers follow a different, but equally effective playbook. Positioned as primary “fill-in” stores, they sit between traditional and fresh formats in both dwell time and visit frequency. Many rely on limited assortments and a heavy emphasis on private-label goods, encouraging shoppers to build larger baskets around basics and store brands. Still, the data suggests consumers reserve their main grocery hauls for traditional supermarkets with broader selections, while using value grocers to stretch budgets and stock up on essentials.

1) Short trips surge: Under-10-minute visits have grown fastest, signaling a lasting behavioral shift.

2) Fresh formats thrive on convenience: Small footprints, prepared foods, and specialty items align with quick missions.

3) Traditional grocers retain loyalty: Traditional grocers such as H-E-B and Kroger attract frequent, comprehensive stock-up trips.

4) Value grocers fill the middle ground: Limited assortments and private label drive larger baskets, but main hauls remain with traditional supermarkets.

5) Fresh formats as supplements: Fresh format grocers such as The Fresh Market capture quick, specialized trips rather than weekly shops.

While broad market trends favor value and fresh-format grocers, certain traditional grocers are proving that a tailored strategy is a powerful tool for success. In the first half of 2025, H-E-B and Harris Teeter significantly outperformed their category's modest 0.6% average year-over-year visit growth, posting impressive gains of 5.6% and 2.8%, respectively. Their success demonstrates that even in a polarizing environment, there is ample room for traditional formats to thrive by deeply understanding and catering to a specific target audience.

These two brands achieve their success with distinctly different, yet equally focused, demographic strategies. H-E-B, a Texas powerhouse, leans heavily into major metropolitan areas like Austin and San Antonio. This urban focus is clear, with 32.6% of its visitors coming from urban centers and their peripheries, far above the category average. Conversely, Harris Teeter has cultivated a strong following in suburban and satellite cities in the South Atlantic region, drawing a massive 78.3% of its traffic from these areas. This deliberate targeting shows that knowing your customer's geography and lifestyle remains a winning formula for growth.

1) Traditional grocers can still be competitive: H-E-B (+5.6% YoY) and Harris Teeter (+2.8% YoY) outpaced the category average of +0.6% in H1 2025.

2) H-E-B’s strategy: Strong urban focus, with 32.6% of traffic from major metro areas like Austin and San Antonio.

3) Harris Teeter’s strategy: Suburban and satellite city focus, with 78.3% of traffic from South Atlantic suburbs.

1. The hypergrowth of Costco, Dollar Tree, and Dollar General between 2019 and 2025 has fundamentally changed the brick-and-mortar retail landscape.

2. Overall visits to Target and Walmart have remained essentially stable even as traffic to the new retail giants skyrocketed – so the increased competition is not necessarily coming at legacy giants' expense. Instead, each retail giant is filling a different need, and success now requires excelling at specific shopping missions rather than broad market dominance.

3. Cross-shopping has become the new normal, with Walmart and Target maintaining their popularity even as their relative visit shares decline, creating opportunities for complementary rather than purely competitive strategies.

4. Dollar stores are rapidly graduating from "fill-in" destinations to primary shopping locations, signaling a fundamental shift in how Americans approach everyday retail.

5. Walmart still enjoys the highest visit frequency, but the other four chains – and especially Dollar General – are gaining ground in this realm.

6. Geographic and demographic specialization is becoming the key differentiator, as each chain carves out distinct niches rather than competing head-to-head across all markets and customer segments.

Evolving shopper priorities, economic pressures, and new competitors are reshaping how and where Americans buy everyday goods. And as value-focused players gain ground, legacy retail powerhouses are adapting their strategies in a bid to maintain their visit share. In this new consumer reality, shoppers no longer stick to one lane, creating a complex ecosystem where loyalty, geography, and cross-visitation patterns – not just market share – define who is truly winning.

This report explores the latest retail traffic data for Walmart, Target, Costco, Dollar Tree, and Dollar General to decode what consumers want from retail giants in 2025. By analyzing visit patterns, loyalty trends, and cross-shopping shifts, we reveal how fast-growing chains are winning over consumers and uncover the strategies helping legacy players stay competitive in today's value-driven retail landscape.

In 2019, Walmart and Target were the two major behemoths in the brick-and-mortar retail space. And while traffic to these chains remains close to 2019 levels, overall visits to Dollar General, Dollar Tree, and Costco have increased 36.6% to 45.9% in the past six years. Much of the growth was driven by aggressive store expansions, but average visits per location stayed constant (in the case of Dollar Tree) or grew as well (in the case of Dollar General and Costco). This means that these chains are successfully filling new stores with visitors – consumers who in the past may have gone to Walmart or Target for at least some of the items now purchased at wholesale clubs and dollar stores.

This substantial increase in visits to Costco, Dollar General, and Dollar Tree has altered the competitive landscape in which Walmart and Target operate. In 2019, 55.9% of combined visits to the five retailers went to Walmart. Now, Walmart’s relative visit share is less than 50%. Target received the second-highest share of visits to the five retailers in 2019, with 15.9% of combined traffic to the chains. But Between January and July 2025, Dollar General received more visits than Target – even though the discount store had received just 12.1% of combined visits in 2019.

Some of the growth of the new retail giants could be attributed to well-timed expansion. But the success of these chains is also due to the extreme value orientation of U.S. consumers in recent years. Dollar General, Dollar Tree, and Costco each offer a unique value proposition, giving today's increasingly budget-conscious shoppers more options.

Walmart’s strategy of "everyday low prices" and its strongholds in rural and semi-rural areas reflect its emphasis on serving broad, value-focused households – often catering to essential, non-discretionary shopping.

Dollar General serves an even larger share of rural and semi-rural shoppers than Walmart, following its strategy of bringing a curated selection of everyday basics to underserved communities. The retailer's packaging is typically smaller than Walmart's, which allows Dollar General to price each item very affordably – and its geographic concentration in rural and semi-rural areas also highlights its direct competition to Walmart.

By contrast, Target and Costco both compete for consumer attention in suburban and small city settings, where shopper profiles tilt more toward families seeking one-stop-shopping and broader discretionary offerings. But Costco's audience skews slightly more affluent – the retailer attracts consumers who can afford the membership fees and bulk purchasing requirements – and its visit growth may be partially driven by higher income Target shoppers now shopping at Costco.

Dollar Tree, meanwhile, showcases a uniquely balanced real estate strategy. The chain's primary strength lies in suburban and small cities but it maintains a solid footing in both rural and urban areas. The chain also offers a unique value proposition, with a smaller store format and a fixed $1.25 price point on most items. So while the retailer isn't consistently cheaper than Walmart or Dollar General across all products, its convenience and predictability are helping it cement its role as a go-to chain for quick shopping trips or small quantities of discretionary items. And its versatile, three-pronged geographic footprint allows it to compete across diverse markets: Dollar Tree can serve as a convenient, quick-trip alternative to big-box retailers in the suburbs while also providing essential value in both rural and dense urban communities.

As each chain carves out distinct geographic and demographic niches, success increasingly depends on being the best option for particular shopping missions (bulk buying, quick trips, essential needs) rather than trying to be everything to everyone.

Still, despite – or perhaps due to – the increased competition, shoppers are increasingly spreading their visits across multiple retailers: Cross-shopping between major chains rose significantly between 2019 and 2025. And Walmart remains the most popular brick-and-mortar retailer, consistently ranking as the most popular cross-shopping destination for visitors of every other chain, followed by Target.

This creates an interesting paradox when viewed alongside the overall visit share shift. Even as Walmart and Target's total share of visits has declined, their importance as a secondary stop has actually grown. This suggests that the legacy retail giants' dip in market share isn't due to shoppers abandoning them. Instead, consumers are expanding their shopping routines by visiting other growing chains in addition to their regular trips to Walmart and Target, effectively diluting the giants' share of a larger, more fragmented retail landscape.

Cross-visitation to Costco from Walmart, Target, and Dollar Tree also grew between 2019 and 2025, suggesting that Costco is attracting a more varied audience to its stores.

But the most significant jumps in cross-visitation went to Dollar Tree and Dollar General, with cross-visitation to these chains from Target, Walmart, and Costco doubling or tripling over the past six years. This suggests that these brands are rapidly graduating from “fill-in” fare to primary shopping destinations for millions of households.

The dramatic rise in cross-visitation to dollar stores signals an opportunity for all retailers to identify and capitalize on specific shopping missions while building complementary partnerships rather than viewing every chain as direct competition.

Walmart’s status as the go-to destination for essential, non-discretionary spending is clearly reflected in its exceptional loyalty rates – nearly half its visitors return at least three times per month on average -between January to July 2025, a figure virtually unchanged since 2019. This steady high-frequency visitation underscores how necessity-driven shopping anchors customer routines and keeps Walmart atop the retail loyalty ranks.

But the data also reveals that other retail giants – and Dollar General in particular – are steadily gaining ground. Dollar General's increased visit frequency is largely fueled by its strategic emphasis on adding fresh produce and other grocery items, making it a viable everyday stop for more households and positioning it to compete more directly with Walmart.

Target also demonstrates a notable uptick in loyal visitors, with its share of frequent shoppers visiting at least three times a month rising from 20.1% to 23.6% between 2019 and 2025. This growth may suggest that its strategic initiatives – like the popular Drive Up service, same-day delivery options, and an appealing mix of essentials and exclusive brands – are successfully converting some casual shoppers into repeat customers.

Costco stands out for a different reason: while overall visits increased, loyalty rates remained essentially unchanged. This speaks to Costco’s unique position as a membership-based outlet for targeted bulk and premium-value purchases, where the shopping behavior of new visitors tends to follow the same patterns as those of its already-loyal core. As a result, trip frequency – rooted largely in planned stock-ups – remains remarkably consistent even as the warehouse giant grows foot traffic overall.

Dollar Tree currently has the smallest share of repeat visitors but is improving this metric. As it successfully encourages more frequent trips and narrows the loyalty gap with its larger rivals, it's poised to become an increasing source of competition for both Target and Costco.

The increase in repeat visits and cross-shopping across the five retail giants showcases consumers' current appetite for value-oriented mass merchants and discount chains. And although the retail giants landscape may be more fragmented, the data also reveals that the pie itself has grown significantly – so the increased competition does not necessarily need to come at the expense of legacy retail giants.

The retail landscape of 2025 demands a fundamental shift from zero-sum competition to strategic complementarity, where success lies in owning specific shopping missions rather than fighting for total market dominance. Retailers that forego attempting to compete on every front and instead clearly communicate their mission-specific value propositions – whether that's emergency runs, bulk essentials, or family shopping experiences – may come out on top.