.svg)

.png)

.png)

.png)

.png)

Columbus, Ohio is among the Midwest’s fastest-growing metro areas. Like downtown business districts across the country, its urban core is seeing a return to the office. What do inbound commuter traffic patterns reveal about this shift – and how can local stakeholders, from retailers to commercial real estate investors, capitalize on the opportunities created by this growing influx?

Growing metro areas depend on vibrant downtown anchors for employment and economic activity. In Columbus, OH, the downtown area has long served as a key destination for commuters as the city’s population and labor force have grown. Favorable business incentives, and the presence of major employers such as Nationwide Insurance, Huntington Bancshares, and American Electric Power contribute to Downtown Columbus’s rising commuter population.

Analysis of the regions with the highest shares of commuters to Downtown Columbus shows that both nearby urban neighborhoods and surrounding suburbs contribute significantly to the city’s downtown workforce.

The map below reveals that over the past 12 months, the densely-populated 43201 zip code drove one of the highest shares of downtown commuters. This urban corridor includes the rejuvenated Weinland Park neighborhood and parts of the University District and trendy Short North. Many of these commuters are likely students or recent graduates entering the workforce – drawn downtown by internships, early-career roles, and professional opportunities.

At the same time, the suburbs also play a defining role in Downtown Columbus’s workforce composition. The 43123 zip code – centered around Grove City – and 43026 – anchored by Hilliard – also had relatively large shares of Downtown Columbus commuters. This reflects a broader trend of workers balancing suburban lifestyles with city-based employment opportunities.

While Downtown Columbus’s workforce reflects a mix of suburban and urban commuters, the composition within its commercial corridors is even more nuanced – shaped by distinct demographic and psychographic characteristics.

Among the analyzed corridors, the Arena District stood out for having the highest median household income (HHI) and the largest share of the “Young Professionals” segment among commuters in 2025, suggesting a workforce anchored in early- to mid-career white-collar roles. This profile aligns with the district’s mix of corporate offices, and sports and entertainment–adjacent employers that may attract younger, upwardly mobile workers.

The Discovery District followed closely in terms of median income, but its psychographic mix skewed differently. The area had one of the highest shares of the “Ultra Wealthy Families” segment, alongside the largest concentration of the “City Hopefuls” segment, among the downtown corridors analyzed. Anchored by institutions such as Columbus State Community College, major healthcare employers, research organizations, and cultural assets like the Columbus Metropolitan Library and the Columbus Museum of Art, the district appears to draw a diverse, but upper-income mix of commuters tied to public service, education, and nonprofit work.

The Uptown District stood apart with a median commuter HHI below that of the Columbus, OH DMA, and elevated shares of “City Hopefuls” and “Young Professionals” compared to the region. This profile likely reflects the district’s concentration of government offices and white-collar employers in law and finance, alongside the service-sector workforce that supports the area’s high daily activity – together pulling a wide spectrum of income levels into the corridor each day.

With the right strategy, the diversity among commuters – who are also consumers of restaurants, retailers, and other service-oriented industries – creates opportunities for businesses to engage their target audiences where they spend meaningful daytime hours.

A downtown reflects not only a metro’s economic strength but also the fabric of its cultures and communities. In Columbus, the downtown serves as both a hub of commercial activity and a crossroads for commuters from diverse backgrounds. This diversity presents businesses with opportunities to carve out a target audience and civic leaders with a responsibility to ensure that Downtown Columbus continues to serve the needs of all who power it.

For more regional analyses, visit Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

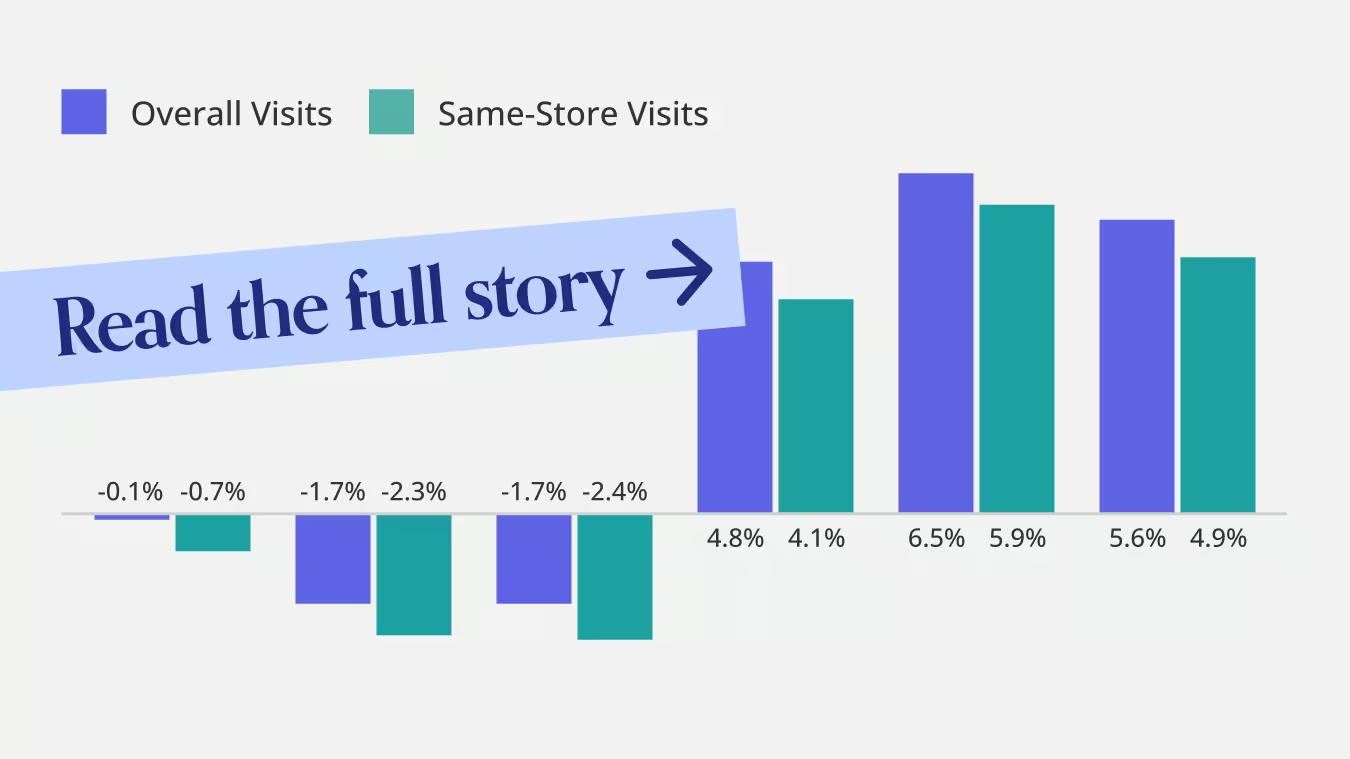

Between July and October 2025, Chipotle’s year-over-year (YoY) visit growth was driven almost entirely by expansion. Overall chain-wide visits rose each month, while same-store visits remained negative, generally hovering between -1% and -2%.

This pattern aligns closely with Chipotle’s recent earnings results. In Q2 2025, the company reported a 4% decline in comparable restaurant sales driven by a nearly 5% drop in transactions, even as average check size increased modestly. Q3 showed a slight improvement in same-store sales, but that gain was driven by higher checks rather than traffic, prompting Chipotle to trim its same-store sales outlook to a low single-digit decline. Throughout this period, digital sales remained a significant share of revenue, and new restaurant openings continued to support overall growth.

More recent visit data, however, suggests the dynamic may be shifting. In November, same-store visits turned slightly positive, contributing to a stronger increase in total chain-wide traffic, and December data shows that improvement continued to build. While expansion remains a key driver, this emerging pattern suggests existing locations may be starting to regain momentum.

Some of Chipotle’s late-year momentum appears to be driven by a growing share of short visits (defined as those lasting under ten minutes), which accounted for 42.2% of total chain traffic in 2025 – up from 41.2% in 2024. These quicker trips have consistently outperformed longer visits on a YoY basis, making their increasing share an important contributor to overall visit growth.

Importantly, the rise in short visits does not appear to be coming at the expense of longer ones. From July through October 2025, average per-location visits lasting under ten minutes remained essentially flat even as longer visits continued to lag; by December, however, both short and longer visits were growing on a per-location basis. This pattern indicates that the shift toward convenience is not cannibalizing traditional visit occasions, but may instead be lifting overall engagement with the brand.

Chipotle still benefits from expansion, but the more important story may be what’s happening inside existing restaurants: Same-store visits are stabilizing while quick trips gain share. And with the December launch of an all-new high-protein menu, Chipotle is signaling that it isn’t standing still – it’s continuing to refine its offerings to stay relevant as customer expectations and visit behaviors change.

For more data-driven dining insights, visit Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

McDonald’s ended 2025 with clear visit momentum, reversing earlier softness and posting steady gains in the back half of the year. Same-store visits followed a similar trajectory, indicating that growth was driven by stronger underlying demand rather than unit expansion. This late-year rebound positions McDonald’s with solid visit momentum heading into 2026, suggesting improving consumer engagement as the year closed.

Some of the visit growth is likely due to the chain's popular Q4 LTOs – but diving deeper into the visit frequency data suggests that McDonald’s long-term investment in its loyalty program is also playing a part. The company's launch of MyMcDonald’s Rewards in 2021 seems to have succeeded in shifting traffic toward higher-frequency, incremental visits rather than relying on new customer acquisition.

Compared to pre-loyalty levels in H2 2019, a growing share of McDonald’s visits now comes from diners visiting an average of 4+ times per month, with the share of visits from consumers visiting the chain an average of 8+ times per month showing the most dramatic growth. Grouping YoY visit trends by visit frequency also shows that visits from high-frequency diners grew the most compared to H2 2024 and H2 2019. This dynamic points to a core benefit of loyalty-led growth: driving incremental visits from existing customers is typically far more efficient than acquiring new ones, especially in a mature, highly penetrated category like quick service restaurants.

McDonald’s executives have been explicit that loyalty is designed to increase frequency, not just enrollment. The continued growth of the program through 2025 – including deeper integration with value offers and digital ordering – suggests McDonald’s is still finding room to extract incremental visits from an already loyal base.

For other restaurant chains, McDonald’s experience points to the value of using loyalty as a lever for incremental growth, particularly once a customer has already been acquired. While many QSR brands continue to drive expansion by entering new markets or opening additional locations, McDonald’s data illustrates how meaningful gains can also come from increasing visit frequency among existing customers. Even without McDonald’s scale, the underlying strategy is broadly applicable: converting first-time or occasional visitors into higher-frequency customers can serve as a complementary – and often more efficient – path to growth alongside physical expansion.

Will these lessons shape the QSR space in 2026? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

In 2024, Dollar Tree capitalized on the liquidation of the 99 Cents Only chain to execute a strategic "land grab" in the notoriously tight US retail market. By acquiring designation rights for 170 leases across priority markets like California, Arizona, Nevada, and Texas, the retailer aimed to bypass zoning hurdles and accelerate growth.

AI-powered location analytics indicates the selection process was highly disciplined: Looking at over 85 California stores that were converted from 99 Cents Only to Dollar Tree reveals that Dollar Tree cherry-picked high-performing sites that were generating 6.0% more foot traffic than the 99 Cents Only chain average in 2023. This suggests the acquisition was a calculated move to secure proven, high-quality real estate.

However, 2025 performance data reveals that capitalizing on this opportunity comes with distinct operational costs. Total visits to the converted stores have dropped 38.8% compared to their 2023 baselines. While some of this decline is structural – Dollar Tree operates a lower-frequency "treasure hunt" model compared to the high-frequency grocery model of the previous tenant – a significant portion is self-inflicted through network overlap.

A staggering 36% of the new sites are located less than a mile from an existing Dollar Tree, which inevitably dilutes local traffic through cannibalization. This serves as a critical lesson for retailers considering bulk acquisitions: purchasing a portfolio "en masse" often prevents perfect network optimization, forcing the acquirer to manage the friction where new footprints compete with the old.

Still, despite this cannibalization and the drop in raw volume, the transition offers a potential "healthy correction" for the business. The previous tenant collapsed under the weight of "rising levels of shrink" and low-margin grocery sales. By shifting the model, Dollar Tree is effectively filtering out non-paying visitors and low-value transactions, trading chaotic volume for a more controlled, margin-focused operation. The discrepancy between the sharp drop in total visits (-38.8%) and the more moderate dip in visits per square foot (-25.0%) suggests Dollar Tree is already rightsizing these operations, leaving some "ghost space" inactive rather than over-investing in labor to manage the entire cavernous floor.

And this excess square footage is only a liability if it remains empty; turning it into an asset requires leveraging the fundamental change in who is now shopping these aisles. The shift in shopper demographics – where "Wealthy Suburban Families" have replaced the "Young Urban Singles" and "Melting Pot Families" of the previous tenant – is crucial for Dollar Tree's future. This new audience, which is less price-sensitive, provides the ideal environment for Dollar Tree to deploy its "Multi-Price" strategy.

While CFO Jeff Davis has cited "start-up costs" regarding these conversions, the long-term opportunity is clear: if Dollar Tree can utilize the extra square footage to showcase this higher-margin assortment, these locations could evolve from overlapping burdens into profitable flagships that capture a share of wallet the traditional small-box fleet never could.

For more data-driven CRE insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.avif)

It’s mid-January, and you promised yourself this would be the year you finally join a gym and get in shape.

But let’s be honest – choosing a gym is about more than fitness goals alone. You’ll still need to judge the equipment, locker rooms, and showers for yourself (we’re not here to do your dirty work) but there are other, less obvious factors that can determine which gym feels like the right fit – and that’s where we come in.

Trying to dodge the morning rush? Hoping to make new friends? Curious where other singles work out? Letting AI-powered location analytics do some of the heavy lifting, we analyzed major fitness chains to uncover the patterns that could help you find your ideal gym in 2026.

Few things derail motivation faster than showing up ready to work out – only to find every treadmill and weight machine taken. To understand which gyms are most likely to offer breathing room during the busiest parts of the day, we analyzed hourly visit patterns across the nation’s largest fitness chains.

The analysis shows clear differences in how morning traffic is distributed. For early risers, LA Fitness recorded the lowest share of daily visits between 5:00 AM and 8:00 AM in 2025, at just 8.9%. 24 Hour Fitness and EōS Fitness also kept morning traffic below the 10% mark, suggesting these chains may be better options for members looking to avoid crowded early workouts.

If after-work workouts are more your style – and minimizing crowds is the priority – the data points to a few clear standouts.

Among the analyzed gyms, Club Pilates recorded the smallest share of visits between 5:00 PM and 8:00 PM at 16.5%, followed by Orangetheory (17.3%) and Burn Boot Camp (18.7%). That lighter early-evening traffic likely reflects the structured nature of class-based formats, which can help limit overcrowding even during peak hours.

Looking specifically at traditional gyms, EōS Fitness, Life Time, and Vasa Fitness saw the lowest share of early-evening visits – making them potential options for those hoping to squeeze in a workout while avoiding the after-work rush.

If getting in shape and finding love are both on the agenda this year, there may be a way to double up. Using AI-powered captured market data, we analyzed major gym chains to understand where members are most likely to be single – which may mean a higher chance of meeting someone special.

The analysis shows that Genesis Health Clubs had the highest combined share of one-person households and non-family households – i.e. people living alone or with roommates – in its captured market, at 36.6%. Crunch Fitness followed closely at 35.8%, with Planet Fitness just behind at 35.2%. These household segmentation patterns suggest that these gyms may offer more opportunities to meet other singles while getting in a workout.

If you’re looking for love, or simply to make new friends, age demographics may be something to consider when choosing a gym.

Our analysis of major fitness chains shows that the potential markets of Fitness Connection, Vasa Fitness, and In-Shape Family Fitness – i.e. the areas from which each chain draws its visitors – skewed younger in 2025, with large shares of visitors under 30.

By contrast, gyms such as The Edge Fitness Club, Retro Fitness, and Life Time tended to attract older audiences, with large shares of visitors 45 and older. For members looking to work out alongside peers closer to their own age, these demographic patterns could help narrow the field.

Age is just a number, right? So if you’re looking to make a real connection at the gym this year, you might look for some common areas of interest with other members. Our analysis highlights which gyms are most likely to attract visitors with your shared passions.

For dog lovers hoping to meet a fellow fitness enthusiast who’s just as excited about the dog park as leg day, Burn Boot Camp stands out. The chain over-indexed most strongly for the “Dog Lovers” segment, based on Spatial.ai: Proximity and AI-powered captured market data.

Prefer bonding over a good book? Genesis Health Clubs led the pack for the “Bookish” segment, suggesting a higher likelihood of members who enjoy reading as much as a solid workout. Coffee aficionados may find their people at 24 Hour Fitness, which showed the strongest over-indexing for the “Coffee Connoisseur” segment.

For those with travel on the brain, Workout Anytime over-indexed for the “Wanderlust” segment – pointing to a member base more likely to dream about their next destination. And if your ideal post-workout plan includes a movie or live show, 24 Hour Fitness and Gold’s Gym emerged as standouts, over-indexing for the “Film Lovers” and “Live & Local Music” segments, respectively.

Ultimately, choosing the right gym goes beyond equipment, pricing, or proximity. Visit patterns, demographics, and shared interests all shape the experience – influencing when you’ll work out, who you’ll see, and how the gym fits into your broader lifestyle. While no dataset can guarantee a perfect match, these patterns offer a data-backed starting point for finding a gym that aligns with how you want to train, socialize, and show up in 2026.

Want more data-driven insights for the real world? Visit Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

*This article excludes data from Washington State due to local regulations

Brick-and-mortar retail ended 2025 on a high note, with offline retailers posting a 2.4% increase in traffic in Q4 2025 relative to Q4 2024. This growth underscores the sector’s continued relevance even amid ongoing e-commerce growth and reinforces that retail growth is not a zero-sum dynamic, but one in which physical and digital channels increasingly coexist and complement one another.

The traffic gains during the holiday season also highlights the particular appeal of physical retail during the holiday season, when demand for in-person shopping experiences is particularly high. And as retailers refine store formats, right-size footprints, and better integrate physical locations into omnichannel strategies, brick-and-mortar retail is well positioned to remain a critical growth and engagement channel heading into 2026.

Foot traffic to e-commerce distribution centers remained consistently positive YoY throughout 2025, underscoring the strength of the logistics segment and signaling durable demand for logistics space rather than short-term fluctuations. This pattern aligns with the broader trajectory of e-commerce in the U.S., where online retail sales are projected to continue expanding, and reflects a broader structural shift in how goods move through the economy, with fulfillment infrastructure playing an increasingly central role.

This consistency is driven by long-term forces shaping retail and supply chains, including omnichannel fulfillment, faster delivery expectations, and inventory decentralization. As retailers rely more heavily on regional distribution nodes to support ship-from-store, curbside pickup, and next-day delivery, logistics facilities have become essential infrastructure rather than optional back-end operations. Even as growth moderated slightly later in the year, the persistence of positive YoY traffic points to sustained operational intensity and long-term relevance.

Year-over-year (YoY) foot traffic to U.S. manufacturing facilities points to volatility rather than sustained growth, reflecting a sector that is actively managing uncertainty. Visits declined during much of the year, suggesting restrained hiring as manufacturers appear to be operating lean – adjusting labor and on-site activity quickly in response to demand changes. Productivity gains and automation are likely also playing a role, allowing facilities to maintain output with less consistent physical presence. As a result, the foot traffic volatility may be reflecting operational flexibility rather than simple expansion or contraction.

Against this backdrop, December stands out with a clear uptick in manufacturing visits, signaling increased end-of-year activity. This rise likely reflects a mix of year-end production runs, inventory adjustments, maintenance work, and preparation for early-year demand. The December traffic increase reinforces that U.S. manufacturing – still one of the largest and most economically significant sectors globally – is adapting, not retreating, maintaining operational relevance even as it recalibrates for efficiency, automation, and selective growth.

For more data-driven retail & CRE insights, visit placer.ai/anchor.

“Retail media networks have turned retailers into ad moguls. That’s a huge change and nobody yet understands all the implications of it.”

Constantine von Hoffman, MARTECH

Companies operating consumer-facing brick-and-mortar venues traditionally relied on selling goods and services as their primary revenue stream. But recently, leading retailers such as Walmart and Target have begun to leverage their immense store fleet into a powerful advertising platform.

Online retailers have been tapping into the advertising power of their digital sites for years by relying on various automated tools to show third-party advertisements to relevant consumer segments. But now, retailers with a strong offline presence can also leverage physical marketing impressions and focus their campaigns while reaching consumers at the point of purchase. Retailers have long recognized the intent that drives a store visit, and understanding the full value of leveraging that visit to its full extent is an important new frontier.

Major retailers are continuing to see their physical visits outnumber their online ones.

And in spite of the gloomy predictions regarding the future of brick and mortar retail, major retailers are continuing to see their physical visits outnumber their online ones. Monthly numbers of visitors to Walmart and Target significantly outpace the brands’ online reach, according to web data from Similarweb. So although, up until recently, these brands have focused their media placements on their digital channels, it is becoming increasingly clear that these chains’ physical stores hold powerful – and currently untapped – advertising potential.

Online visitor data source: similarweb.com

And with the recent rise in digital advertising costs, retail media networks are becoming more attractive for companies looking to make the most of their ad budget. Retail media networks can also help brands reach rural communities, elderly Americans, and other consumer segments that are currently underserved by digital advertisers.

This white paper explores several retailers on the cutting edge of the retail media network revolution. Keep reading to find out how advertisers can use retail media networks to promote to hard-to-reach consumers, segment their ad spending, and optimize their campaigns.

Residents of rural areas use the internet less frequently, and have lower levels of technology ownership than their urban and suburban counterparts. As a result, companies that stick to digital advertising may have a harder time reaching rural consumers. Brick and mortar retailers popular in smaller markets can fill in the gaps and help brands promote their products and services to this hard-to-reach audience.

Brick and mortar retailers popular in smaller markets can help brands advertise to hard-to-reach audiences.

Dollar General saw significant success over the pandemic, with the current economic climate continuing to benefit the brand. Between January and August 2022, nationwide visits to Dollar General venues were 35.6% higher than they were between January and August 2019, while the number of visitors increased 25.4% in the same period.Visit numbers aggregate the visits to the chain’s various locations in a given period, while visitor numbers track the number of people who enter the brand’s stores.

The company has also been operating a media network since 2018. The Dollar General Media Network (DGMN) enables advertisers to reach Dollar General consumers across the company’s channels to build awareness both digitally and in physical spaces. Advertisers with DGMN can display in-store bollard, blade, and wipe stand signs, security pedestals, basket bottomers, and shelfAdz to deliver in-store messaging from parking lot to purchase. Recently, Dollar General announced that its ad platform was now working with 21 new advertising partners, including Unilever, General Mills, Hershey’s, and Colgate-Palmolive.

Embracing the Power of the Small Market

Advertising partners can leverage the DGMN to promote their goods and services to harder-to-reach consumers.

Dollar General has been serving rural residents for years, with the majority of the company’s stores located in communities with fewer than 20,00 residents. And while the brand is growing nationwide, Dollar General’s strength is particularly evident in small markets – which means that advertising partners can leverage the DGMN to promote their goods and services to harder-to-reach consumers.

Comparing year-over-three-year (Yo3Y) visit change to Dollar General stores in metropolitan and micropolitan core based statistical areas (CBSAs) highlights the company’s success in smaller markets. According to the United States Office of Management and Budget, metropolitan and micropolitan CBSAs have over and under 50,000 residents, respectively. Since January 2022, monthly Yo3Y visit growth to Dollar General venues in select Texas micropolitans has consistently outpaced foot traffic to nearby metropolitan areas. While the Sherman-Denison metro area saw August 2022 foot traffic hit a solid 24.5% increase over August 2019, the Gainesville, Texas micro area – around 35 miles east of Sherman – saw its foot traffic increase 54.5% in the same period.

Dollar General’s presence across a significant number of smaller markets means that advertising partners can use the growing DGMN to increase awareness and drive purchase consideration among these harder-to-reach consumers.

In the digital space, three tech giants – Alphabet (previously Google), Meta (previously Facebook), and Amazon – enjoy over 60% of the digital ad revenue in the United States. This means that companies are competing for impressions on a small number of platforms – and smaller brands geared at specific consumer segments may need to spend significant advertising budgets to outbid the larger players. Retail media networks create additional advertising platforms, and enable advertisers to diversify their ad spend, increase their (physical) impressions, focus on more specialized channels to better reach their audience, and potentially reach customers at their highest point of intent.

Retail media networks create additional advertising platforms and potentially reach customers at their highest point of intent.

Albertsons launched its retail media network, Albertsons Media Collective, in November 2021 with the goal of delivering “digitally native, shopper-centric and engaging branded content to the company’s ever-growing network of shoppers.” Currently, the grocer’s media network is primarily digital, but Albertsons’ head of retail media products Evan Hovorka recognizes the importance of leveraging in-store assets to deliver a unique advertising experience. The company is testing out smart carts that link with “Albertsons for U” loyalty program to display ads to shoppers – and Albertsons is likely to find more ways to reach in-store consumers as it continues to develop its retail media network.

The chain is also one of the most popular grocers nationwide. With the exception of March and April 2022, when inflation and high gas prices temporarily halted growth, the brand’s monthly visits and visitor numbers have consistently exceeded pre-pandemic levels. Monthly visits for Albertsons in August 2022 were up 5.7% and monthly visitors were up 5.4% on a Yo3Y basis. This means that advertisers with Albertsons can increase their reach and grow their physical ad impressions just by displaying their ads in Albertsons locations and tapping into the chain’s growing visitor base.

Looking beyond Albertsons' nationwide average foot traffic trends reveals some important regional differences. Between January and July 2022, visits to the brands increased 4.6% in Wyoming on a Yo3Y basis, while foot traffic to the brand’s locations in Oregon jumped 18.5% compared to January through July 2019. This means that a brand looking to reach consumers in Oregon can contract with Albertsons’ media network to show its ads to a fast-growing pool of visitors.

A larger visitor count translates to an increase in unique ad impressions, while more visits from fewer visitors can drive repeated exposures.

Diving deeper into the data reveals an additional layer of insight. Some states with only moderate visit growth are seeing a surge in visitor numbers, while other states are seeing a drop in visitor numbers but a rise in visits. A larger visitor count translates to an increase in unique ad impressions and more people exposed to the ads, while more visits from fewer visitors translates to more overall impressions that can drive repeated exposure among a smaller group of visitors. So advertisers can use segmented foot traffic data to decide where to focus their marketing depending on the goal of the campaign.

For example, Wyoming's moderate increase in visits hides a significant spike in visitors, which means that advertisers to Albertsons venues in Wyoming can get their impressions before a large number of different potential consumers. Meanwhile, Oregon's 18.5% increase in visits is the result of just a 9.4% increase in visitors – so Albertsons is cultivating an increasingly loyal following in the Beaver State, and the grocer’s advertising partners can expect that the same visitors will be exposed to their brand repeatedly.

So companies that want to increase unique ad impressions and build awareness can advertise to Albertsons customers in Wyoming, where their ads will be seen by a large number of new people. But in Oregon, companies may want to promote a campaign that focuses on moving Albertsons visitors through their funnel.

In order to accurately assess the ad distribution patterns in each location, brands operating retail media networks need to understand both visits and visitors trends in each region and for the chain as a whole.

Advertisers with retail media networks can use foot traffic data to refine their geographic audience by identifying the consumer preferences of a given brick-and-mortar brand on a store or city level.

In August 2020, CVS Pharmacy launched its media network, the CVS Media Exchange (cMx). The company estimates that 76% of U.S. consumers live within five miles of at least one store, and the cMx allows partners to tap into the chain’s reach by giving advertisers access to CVS’ online and offline channels, including in-store ads.

Although CVS has been closing locations recently, the brand is still one of the strongest players in the brick-and-mortar retail space. Its 2022 visit numbers have consistently exceeded pre-pandemic levels nationwide, and data from CVS locations in leading cities shows that its Yo3Y visits per venue and visitor numbers are even higher.

CVS’s nationally distributed fleet means that the brand’s locations in different regions attract distinct consumer bases.

CVS carries a varied product mix of daily essentials in addition to its healthcare offerings, so the brand attracts a wide range of consumer segments. And the chain’s nationally distributed store fleet means that CVS has locations in different regions that attract distinct consumer bases who do not all have the same lifestyle preferences. By using foot traffic data to understand the regional consumer preferences of CVS consumers beyond the store, advertising partners can refine their market and make the most of the cMx.

Different regions have different fitness cultures. Chains catering to health-conscious consumers can use retail media networks and foot traffic data to focus their efforts on areas where inhabitants exhibit a high demand for regular workouts.

Analyzing cross-visit data from CVS locations across five major urban centers in the U.S. shows that the percentage of those who also visited gyms or fitness studios varied significantly across each DMA. In the New York area, 62.7% of those who visited CVS in Q2 2022 also visited a fitness venue during that period, in contrast with only 38.0% of CVS visitors around Dallas-Ft. Worth, TX in the same period. This information can help advertising partners in the health and wellness space decide where to place their campaigns.

Looking at cross-visit data on a city-wide level can provide a sense of the consumer culture in each area, but advertisers that dive into foot traffic data for individual stores can refine their messaging even further.

On average, 43.8% of CVS visitors in the Chicago DMA also visited a gym in Q2 2022. But drilling down to the top CVS locations in the city reveals that the rate of cross-visits varies significantly from location to location. Both the E 53rd Street and W 103rd Street locations have a relatively high share of visitors who visit fitness locations – 52.5% and 49.2%, respectively. Meanwhile fitness cross-visits were at just 36.6% for the South Stony Island Avenue location. Advertisers promoting health and wellness related products and services may want to focus on the 103rd St. and 53rd St. CVS locations.

Diving into a customer’s behavior and preferences outside the store can help retail media network operators and advertising partners find the areas and locations best suited for each type of ad.

Cross-visit data is one way to identify consumer preferences beyond the physical store. Advertisers can also analyze digital preferences of offline visitors to focus their marketing on the most appropriate locations.

Advertisers can also analyze digital preferences of offline visitors to focus on the most appropriate locations.

Over the past couple of years, Macy’s has been finding ways to reinvent itself and optimize its store fleet – and foot traffic data indicates that the retailer's efforts are paying off. In the first half of 2022, Macy’s exceeded its H1 2021 overall visit and average visits per venue numbers and posted a positive year-over-year (YoY) visitor count. In Q2 2022, despite the wider economic challenges, Macy’s visitors, visits, and average visits per venue saw YoY increases of 3.4%, 4.0% and 9.9% increases.

Like CVS, Macy’s launched its media network in August 2020, and by February 2021 the Macy’s Media Network was already generating $35 million annually. In addition to advertising on the company’s digital channels, Macy’s also offers partners the use of in-store screen displays, package inserts, and the brand’s iconic billboard in New York City’s Herald Square.

Advertisers can optimize their advertising by analyzing the differences in consumer profiles between a chain’s various stores.

Advertisers that understand the differences in consumer profiles between a chain’s various stores can optimize their advertising efforts. While looking at variations in cross-visit trends is one way to identify interested brick-and-mortar consumers, diving into visitor’s digital behavior and online preferences can also provide valuable insights.

Tools such as Spatial.ai’s GeoWeb, which tracks online engagement with various trends and topics by neighborhood, can reveal how offline consumers behave online. An index score of 100 indicates that consumers in an area have an average interest in a given topic, while scores over (or under) 100 indicate that consumers are more (or less) interested in the topic when compared to the national average interest.

We used Spatial.ai’s GeoWeb tool to analyze the online behavior of consumers in the True Trade Areas (TTA) of five Macy’s locations in the Philadelphia, PA DMA – and found that residents of the different TTAs stores showed differing indexes. For example, the Macy’s in the King of Prussia Mall location showed a high index of 161 in “Men’s Business Clothes Shoppers,” while the Cottman Ave. location had an only slightly above average index of 102. This means that advertisers of men’s business apparel may see more results by focussing their advertising on visitors to the King of Prussia location.

Advertisers that use retail media networks do a lot more than just reach in-store shoppers. Stores exist in the physical world, so advertisers can also reach passers-by through physical venues’ windows, blade signs – or in the case of Macy’s, through its Herald Square Billboard. Here too, foot traffic data can reveal the consumer preferences of people walking by the sign.

We looked at the online behavior in the TTA around the traffic pin on the corner where the billboard is located (Broadway/6th Ave and 34th Street in New York) to understand which advertisers might benefit most from a billboard at that location. While the “Men’s Business Clothes Shoppers” category was over-indexed compared to the national average, as would be expected in midtown Manhattan, “Women’s Fashion Brand Shoppers” had an even higher index. “Gen Z Apparel Shoppers” were over-represented, but “Leather Good Shoppers” and ”Athleisure Shoppers” were under-represented. So a brand that carries both elegant wear and athleisure may want to display its less casual clothing lines on the billboard.

Understanding how consumers behave both on and offline can help retail media networks and advertising partners promote their campaigns most effectively.

To transform their physical store fleet into a media network, brands and companies need to analyze the reach of each venue. The same chain operating in multiple regions may be reaching different types of consumers in each area, or even in various neighborhoods of the same city. These distinct audiences may have contrasting products, brands, and shopping preferences.

Retailers that leverage their brick and mortar presence can transform the advertisement space as it exists today.

Retailers can also partner with advertising partners who wish to promote goods and services not carried by the retailer. For this to succeed, the retailer will need to analyze how consumers behave outside of its stores. Understanding what characterizes the overall behavior of consumers in each locations’ trade area will allow the retailer to reach a larger audience and truly compete with the digital giants. And by leveraging their brick and mortar presence, brick and mortar retail can transform the advertisement space as it exists today.

Malls have long acted as a gleaming symbol of American retail. Following the opening of the first indoor mall in 1956, and as the American middle class increasingly moved from the city to the suburbs, malls continued to open at a rapid rate. By 1960, some 4,500 shopping centers had opened nationwide, filling the growing demand for “third places” – spaces that allowed the newly suburban populations to gather, socialize, and create community. And while that role evolved over the years, it’s safe to say that malls have played a major part in shaping the American shopping culture.

But malls’ rapid expansion led to an oversaturated market – some estimates suggest that there are approximately 24 square feet of retail space per U.S. citizen, as compared to 4.6 for the U.K. and 2.8 for China. Many began to predict the demise and downfall of malls, and that narrative intensified as online shopping grew in popularity. The rise of big-box stores, a focus on “services, not things,” and COVID-19 only accelerated these trends.

A lot of the doom and gloom predictions tend to de-emphasize the mall's role as a modern incarnation of a bustling downtown shopping area.

But a lot of these doom and gloom predictions focus on malls only as a place to shop, and tend to de-emphasize their other role as the third place – a modern incarnation of a bustling downtown shopping area, replete with shops, services, and places to meet. And after two years of isolation and a new, pandemic-induced wave of suburban relocation, malls’ potential to bring people together is more prized than ever.

So although malls were hit hard during COVID-19, many of them are finding ways to reinvent themselves and stay relevant. Today, more than halfway through 2022, the challenges that malls face continue to evolve and change – but malls are evolving too. This white paper covers a few specific ways that some malls have found to thrive in the new normal. Some shopping centers are turning to entertainment to draw crowds into their doors. Others are focusing on offering a full visitor experience that extends beyond simply grabbing a new shirt or a burger at the food court. Still, more are embracing omnichannel options, offering an integrated on and offline experience to their shoppers. In the face of significant retail challenges, top-tier malls are turning to innovative solutions to stay ahead of the game.

The pandemic posed significant challenges to malls. Although foot traffic to the category rose back up in the summer of 2021, the Delta and subsequent Omicron waves brought visits down once more. And as visit gaps post-Omicron began to narrow, inflation and gas prices put the brakes on any return to normalcy. April and May 2022 saw visits beginning to trend up, though the unrelenting rise of inflation, the highest it’s been in the past 40 years, has slowed that recovery slightly.

Foot traffic data shows that malls are continuing to attract visitors, despite the challenges that seem to crop up weekly.

Still, foot traffic data shows that malls are continuing to attract visitors, despite the challenges that seem to crop up weekly. And while they may no longer play the central role they once did in Americans’ shopping routines, malls still serve as indoor community hubs where friends and family can come together for diverse food, shops, and entertainment options. This could explain why top-tier malls keep on coming back despite the seemingly constant obstacles.

Comparing monthly visits from January 2022 through July 2022 to the same period in 2019 highlights the significant difficulties facing the sector. Indoor malls, open-air lifestyle centers, and outlet malls alike saw marked lags in foot traffic as compared to three years ago.

Monthly year-over-three-year (Yo3Y) foot traffic comparisons also highlight mall resilience.

The monthly year-over-three-year (Yo3Y) foot traffic comparisons also highlight mall resilience. Following an Omicron-plagued January, the visit gaps narrowed in February 2022 to less than 5% for all the segments. And although the increase in gas prices and inflation brought visits down in March, malls quickly bounced back in April 2022, with indoor malls seeing only 1.8% fewer visits than in 2019 and open-air shopping centers down only 4.8% Yo3Y. Foot traffic fell again in May and June as consumers tightened their budgets in the face of rising prices, but consumers appear to have quickly made peace with the new economic reality. By July 2022, visits to indoor malls and open-air lifestyle centers were only 3.5% and 2.7% lower than they had been in July 2019.

COVID didn’t just impact visit numbers – since 2020, mall visits have also gotten shorter, likely a result of pandemic restrictions and a general desire not to congregate any longer than necessary. And although 2021 and 2022 saw a slight uptick in time spent at malls and shopping centers – from 60 minutes in 2020 to 62 minutes in 2021 and 2022 – the median dwell time is still significantly lower than the 70 minutes median dwell time of pre-COVID 2018 and 2019.

Shorter visits are not necessarily a bad thing – intent-driven shoppers may simply be doing more research ahead of time and less in-mall browsing.

Shorter visits are not necessarily a bad thing in and of themselves – consumers today are highly informed, so many intent-driven shoppers may simply be doing more research ahead of time and less in-mall browsing. But shorter (and fewer) visits do mean that malls must focus on giving shoppers a reason to visit. We explore some successful strategies below.

Malls have long integrated entertainment into their overall experience in the form of arcades, movie theaters, and even coin-operated animal rides. Some malls, however, are taking their entertainment offerings to the next level.

In August 2021, CBL Properties, a Tennessee-based property developer, announced the opening of the Hollywood Casino by Penn National Gaming in the York Galleria Mall in York, Pennsylvania. The 80,000 square foot casino, which boasts 500 slots and 24 live-action table games, opened in the mall’s lower level. The space was occupied by a now-closed Sears department store, and the entertainment venue now functions as a new anchor to draw customers in.

The casino’s opening has had a dramatic impact on the mall’s foot traffic. In a year-over-three-year (Yo3Y) comparison, July 2021 saw 2.4% fewer visitors than July 2018. But when the casino opened in August 2021, visits to the location jumped to 31.4% Yo3Y. This increase is all the more impressive considering that the casino opened on August 19th, with only 12 days left in the month.

The mall, which had seen negative Yo3Y visit numbers until the casino’s opening, has sustained the positive visit trend through July 2022 – a testament to the appeal of in-mall entertainment.

Another mall betting on indoor entertainment is the Pierre Bossier Mall in Bossier City, Louisiana. In April 2022, Surge Entertainment opened a child-friendly space, which includes zip-lining, bowling, laser tag and arcade games. The Surge Entertainment chain is co-owned by Drew Brees, the former New Orleans Saints quarterback, and has 15 locations around the country. The Pierre Bossier Mall branch is filling the space vacated by Virginia College, which closed its doors in 2018.

Since Surge Entertainment opened its Bossier City location, the mall has seen a dramatic increase in average dwell time.

Since Surge Entertainment opened its Bossier City location, the mall has seen a dramatic increase in average dwell time. Between July 2021 and March 2022, median dwell time hovered between 51 and 58 minutes. But following the center’s opening, median dwell time jumped to 78 minutes. Since then, the median dwell time has remained consistently elevated: In the four months since the Surge Entertainment opening, median dwell times did not drop below 75 minutes.

Brick-and-mortar retailers once viewed online shopping as a threat – but now, mall owners and operators are increasingly turning to digital channels to complement existing approaches. COVID-19 and the surge of online shopping further fueled malls’ digital progress. Over the past two years, large malls and suburban shopping centers across the country have been rolling out various online and social shopping options and adopting omnichannel strategies.

In September 2020, Centennial, a real estate investment firm with many malls and mixed-use entertainment centers in its portfolio, launched a chain-wide omnichannel platform called Shop Now!. The app allows consumers to shop across all Centennial malls the way someone would shop on Amazon.

The first phase of the program, which launched in October 2020, allowed users to browse an AI-powered search engine connected to the inventory of all of the stores operating in their mall of interest. In February 2022, Centennial debuted phase two of the program at its Santa Ana, CA based MainPlace Mall. It allows customers to consolidate orders from several stores into a single cart, get the order fulfilled by personal shoppers, and have the orders ready for same-day delivery or on-site pickup.

The e-commerce app could have detracted shoppers from physically going to the mall – but instead, the program increased both monthly and loyal visitors.

The app allows consumers to browse and shop from the comfort of their phones. It could have detracted shoppers from physically going to the mall – but instead, the program has increased both monthly and loyal visitors. In the months following the launch of the second phase, MainPlace Mall saw its loyal visits increase by 5% (from 46.2% in February ‘22 to 51.3% in June ‘22), while overall monthly visits in April ‘22 increased by 5.5% when compared to 2019. The digital investment also helped the mall make sales that could have been lost to other e-commerce platforms. The mall’s brick-and-mortar success following the addition of a digital channel highlights how malls can rise to the top by embracing an omnichannel strategy.

Continuing its innovative streak, the MainPlace Mall recently added an experiential component with the opening the American Ninja Warrior Adventure Park in July 2022 in the place of four former retail stores. During its first month of operation, the park drove the mall’s share of loyal visits up by 13.4% compared to the previous month while boosting Yo3Y monthly visits by 18.0%.

The difference in impact between the online platform launch and the opening of the American Ninja Warrior Adventure Park indicates that malls can enjoy both gradual gains over time as well as jumps in foot traffic and loyalty, depending on the strategy they adopt.

Omnichannel strategies can also revitalize food courts hit hard by the pandemic. Arundel Mills Mall, part of the Simon Property Group, began offering online orders in February 2022 via a platform called Snackpass, allowing users to use the app at various eateries around the mall. Snackpass, launched in 2017 as a food ordering app on the Yale campus, facilitates group ordering and includes various social features. Its current iteration allows customers to pre-order food, skip lines, collect rewards, and engage with friends. It also offers discounts on group orders, in an effort to promote social dining.

Since the beginning of the Snackpass partnership, the shopping center itself is seeing more visitors – many of whom are coming from farther away.

Since the beginning of the Snackpass partnership, the shopping center itself is seeing more visitors – many of whom are coming from farther away. In the five months following the app’s launch, Arundel Mills saw an overall increase of 15 square miles to its True Trade Area (TTA), and an increase of 29.5% in visits per sq. ft. – The consistent increase in TTA and visits per sq. ft. are a testament to the power of innovative dining partnerships to draw traffic to top-tier malls.

With many retailers reducing their on-mall presence, empty brick-and-mortar stores have attracted plenty of negative attention. But now, malls are increasingly repurposing vacated spaces in new, innovative ways that resonate with local communities and can fill their evolving needs.

At the Ocean County Mall in Toms River, NJ, Simon Property Group repurposed the huge space left by a former Sears store and turned it into a lifestyle center, with stores opening throughout 2020. The space is now being used by a number of highly popular chains such as LA Fitness, Ulta Beauty, HomeSense, and P.F. Chang’s and also includes a children's play area.

This pivot seems to be working. Median dwell time to the mall has increased from 53 minutes to 56 minutes, a significant change when considering that a majority of malls have recently seen their dwell times drop.

The center has also seen the median age for its trade area decrease from 40.5 years old in the first half of 2021 to 37.2 in the first half of 2022, a dramatic shift in visitor demographics. Yo3Y visits are strong as well – July 2022 were up by 17.1%.

In a similar tale of a closed Sears turning into a lifestyle center, the Northshore Mall in Peabody, MA turned the space vacated by the department store into a mixed-use center. The most significant anchor is now the high-end Life Time Fitness Center that offers cardio, weights, and functional training rooms, and includes yoga, pilates, and cycling studios, indoor and outdoor pools, basketball and pickleball courts, saunas, and a bistro.

As soon as the health club opened its doors in July 2021, visits to the mall increased – significantly outpacing the levels seen when Sears was still open.

As soon as the health club opened its doors in July 2021, visits to the mall increased – significantly outpacing the levels seen when Sears was still open. Both Yo3Y and year-over-four-year (Yo4Y) foot traffic numbers were impressive, with July 2022 seeing 17.2% more visitors than three years prior.

As visits to malls become more focussed, selecting the right tenant has never been more important – and that may mean looking at unconventional occupants to draw in customers.

In one example of tapping into local needs, the Westfield Oakridge shopping center in San Jose, CA, opened a specialty grocery store on its premises. 99 Ranch Market, one of the largest Asian supermarket chains in the U.S., began operating its first mall location in March 2022. The location includes classic grocery store items such as produce, meat, and seafood sections, and also boasts a dining hall, tea bar, and bakery.

Its opening day saw lines snaking out the door, as excited locals queued to sample the store’s delicacies. And the crowd-drawing hype seems to be more than a flash in the pan – the months following the opening were the mall’s strongest in the past year and a half. Yo3Y visits were up by 10.1% in July 2022 , with some shoppers reporting that the addition of the grocery store had turned Westfield Oakridge into their all-in-one stop shop.

Although the area was not lacking in grocery options, retail foot traffic data indicates that the new 99 Ranch Market at Westfield Oakridge Mall still filled a void.

Although the area was not lacking in grocery options, retail foot traffic data indicates that the new 99 Ranch Market at Westfield Oakridge Mall still filled a void – the new grocery store’s trade area has only minimal overlaps with the other trade areas of the nearby 99 Ranch Markets locations. This means that most of the new 99 Ranch Market’s customers were not being well-served by the existing locations of the chain.

Westfield Oakridge is not the only San Jose mall turning to food to attract the crowds. On June 16th 2022, following much hype and a pandemic-related delay, Eataly, the all-in-one Italian market, restaurant, and cooking school opened its first Northern California location at the Westfield Valley Fair in Santa Clara, CA.

Prior to the launch, the Westfield Valley Fair mall was already one of the more successful malls in the country – but the opening of Eataly seems to be driving even more foot traffic. Yo3Y visits to malls during Eataly’s opening week exceeded 20% for the first time in months and have since remained consistently elevated, with visits for the week of July 25th up 27.7% relative to the equivalent week in 2019.

In March 2022, regional department store Von Maur opened its doors at The Village of Rochester Hills, an open-air lifestyle center in Michigan. The retailer, which has 36 locations throughout the Midwest, took over the space left vacant by Carson’s, another Midwest-based department store.

What may be the first new department store in the Detroit metropolitan area in over a decade is driving visits to the shopping center.

What may be the first new department store in the Detroit metropolitan area in over a decade is driving visits to the shopping center. Von Maur’s March 2022 opening pushed Yo3Y visits up by 16.9% compared to the mere 4.3% Yo3Y increase the month before.

Part of the secret to Von Maur’s success lies in the psychographic characteristics of residents within the mall’s trade area. Using Spatial.ai’s GeoWeb data, a tool which tracks online engagement with various trends and topics by neighborhood, we found that the TTA surrounding The Village had an index of 131 for department store shoppers. In other words, people in the mall’s trade area exhibited heightened interest in department stores – they engaged with department-store-related content at a rate that was 1.3 times higher than the national average – which helps explain why Von Maur is thriving in this specific location. And in another testament to the strength of immersive retail experiences, Von Maur, which focuses on curating a unique shopper journey and features a pianist at all of its locations, has been ranked the top department store in America.

The addition of Von Maur is not the only change that The Village is implementing – the mall has continued adding new stores and will be opening more throughout the year. These, too, will likely boost foot traffic to the lifestyle center.

The mall’s ability to select tenants that cater to, and reflect the needs and behaviors of its consumers is likely to continue driving success. By drilling down into the nitty-gritty details of who comes to shop, where they come from, and what shops they enjoy frequenting, mall management can tailor the shopping center to meet the needs of its base.

The “death of the American mall” has been predicted for years. The reality, however, is much more nuanced than that – like many other sectors, malls are undergoing a shift to help them better serve evolving customer needs and survive and thrive in an ever-shifting retail landscape.

The malls featured in this white paper have found ways to consistently attract visitors despite the various obstacles faced by the category over the past two years. By understanding that the American mall must evolve along with the consumers, mall owners can successfully revitalize their retail spaces.

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.