.svg)

.png)

.png)

.png)

.png)

Black Friday is the biggest retail milestone of the year – drawing millions of shoppers to stores nationwide. And even as e-commerce claims a growing piece of the holiday shopping pie, consumers flock to brick-and-mortar retailers to browse the aisles, check out new products, and enjoy the festive holiday atmosphere.

But how did brick-and-mortar retailers fare during this year’s Black Friday? Did the high-stakes shopping period deliver?

Black Friday has evolved into a multi-day shopping bonanza. Early holiday sales draw crowds well before Thanksgiving, and major markdowns continue into the weekend and through Cyber Monday. Still, foot traffic data shows that the traditional milestone hasn’t lost its touch. On November 29th, 2024 visits to retailers nationwide surged by 40.4% compared to an average Friday this year – up slightly from 39.8% in 2023.

Year over year (YoY), retail foot traffic increased 0.9% on Black Friday this year – a modest uptick, but one which highlights the resilience of physical retail in an increasingly digital world. Most of the days during the week leading up to Black Friday also saw modest YoY visit increases, as shoppers got a head start on their bargain hunting. And the Saturday and Sunday following the milestone saw more significant YoY visit increases of 2.0% and 6.2%, respectively – perhaps driven in part by customers picking up orders placed online during Black Friday.

Digging deeper into the data for different areas of the country shows that the resonance of the milestone varies significantly by region. In Delaware and New Hampshire, visits to retailers on November 29th were up a whopping 75.9% and 72.8%, respectively, compared to an average Friday this year. And in much of the Midwest – including North and South Dakota, Nebraska, Indiana, Minnesota, Wisconsin, Iowa, Kentucky, Tennessee, and Kansas – retail foot traffic surged by more than 50.0%. By contrast, Western states such as California (26.0%), Wyoming (24.1%), New Mexico (24.5%), Montana (31.3%), Colorado (32.6%), Nevada (33.1%), and Utah (33.6%) experienced much more modest visit boosts.

The differences in statewide Black Friday performance may reflect more general regional Black Friday patterns. Though the Mountain states saw smaller Black Friday visit spikes than other areas of the country, retail visits in the region on November 29th, 2024 were up 4.1% YoY – perhaps a sign that the milestone is growing in local importance. The Eastern and Western South Central regions saw YoY visit increases of 3.7% and 2.8%, respectively – while the South Atlantic region saw a 1.5% increase. Meanwhile, some of the areas where Black Friday is most resonant – including the Midwest – saw visits remain flat or fall slightly below 2023 levels.

Holiday shopping is about more than just making transactions – consumers eagerly leave the comfort of their homes to embrace the thrill of the treasure hunt, explore new products firsthand, and enjoy the experience of shopping with friends. And foot traffic data shows that Black Friday retains plenty of in-person appeal.

For more data-driven insights, visit placer.ai.

Many Americans choose to take the entire week of Thanksgiving off, heading home early and maximizing family time during the holiday. How does the extra vacation time impact travel and leisure foot traffic? We dove into the data to find out.

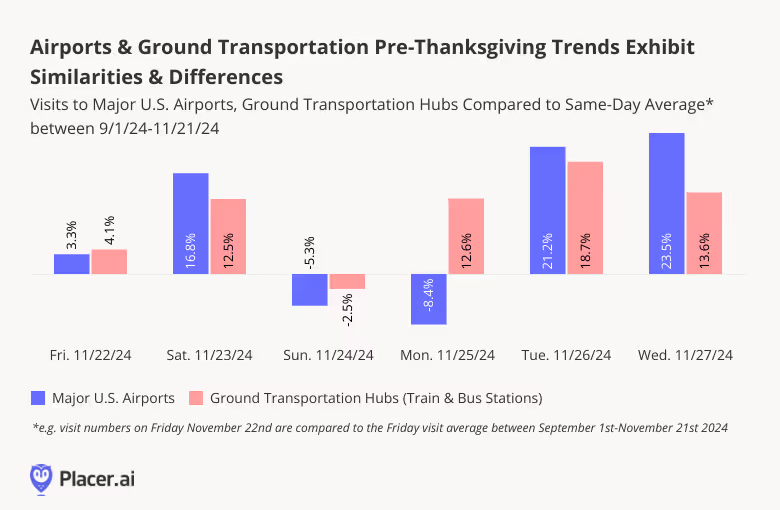

The Tuesday and Wednesday before Thanksgiving are among the busiest travel days of the year as Americans head back home or travel to friends to celebrate the holiday with loved ones. But with many employees taking the entire week of Thanksgiving off – or choosing to work remotely – the Saturday before Thanksgiving is also a popular travel day.

On Saturday November 23rd, 2024, major U.S. airports and ground transportation hubs saw a 16.8% and 12.5% increase in visits, respectively, compared to the recent Saturday average. The Saturday spike suggests that many travelers started their holiday journey early to avoid the pre-Thanksgiving rush while enjoying a little more time with family and friends.

Visits to both airports and ground transportation hubs then fell on Sunday – although the airport drop was more pronounced than the bus and train station dip – before diverging for the rest of the week: Bus and train stations rose on Monday and peaked on Tuesday before leveling off, while airport visits stayed low on Monday, spiked on Tuesday, and peaked on Wednesday.

The dip in Monday visits along with the relatively larger drop in Sunday visits for airports is likely due to athe decrease in business travel during the week of Thanksgiving. Meanwhile, ground transportation may pick up on Monday because those trips tend to be longer – so travelers could be choosing to head out earlier.

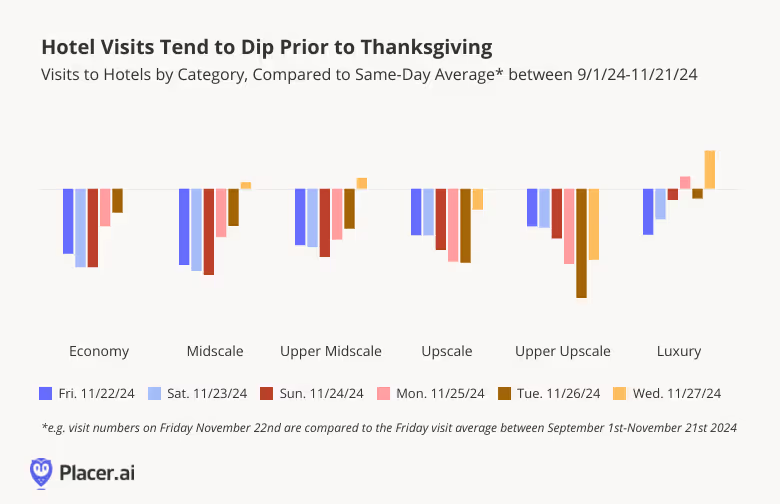

But even as travel traffic increased, hospitality visits dipped. Most hotel categories – with the exception of luxury hotels – received significantly fewer visits on the days before Thanksgiving relative to their recent daily visit averages, with visits only rising slightly for some categories just before the holiday.

This substantial drop in hotel visits pre-Thanksgiving is likely due to a decrease in business travel ahead of the holiday. But all that Saturday travel (see above) still means more people away from home – so where are these travelers staying? The dip in hotel visits before Thanksgiving suggests that many people traveling earlier in the week may be choosing to forego the hotel and instead stay with friends or family.

How do these early Thanksgiving travelers spend their time ahead of the holiday?

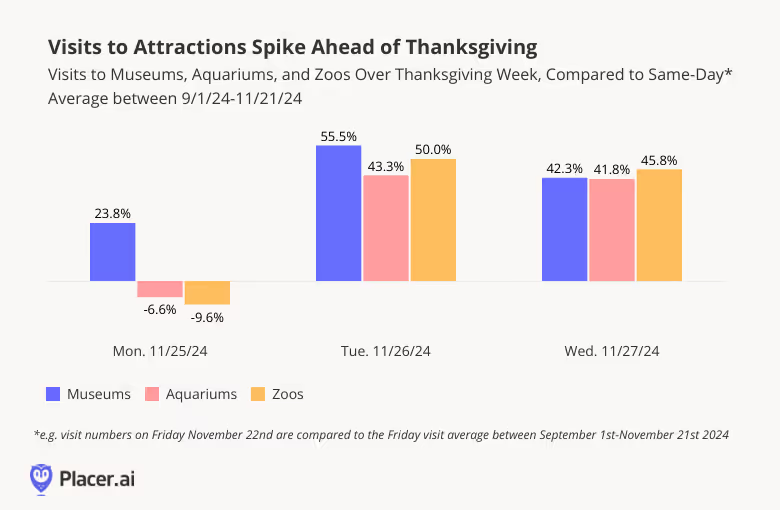

Many of those traveling early may be taking extra PTO ahead of the holiday to maximize quality time with their geographically distant family – so, unsurprisingly, foot traffic data indicates that visits to family-friendly destinations spike ahead of the holiday.

This year, visits to museums, aquariums, and zoos peaked on the Tuesday before Thanksgiving relative to the recent Tuesday average, and remained significantly elevated on Wednesday. Museums – which may appeal to a wider age range than the other two types of attractions – also received a substantial visit boost on Monday.

This trend highlights the opportunity for family-friendly venues to strategically plan events, promotions, and extended hours during the early Thanksgiving week to attract traveling families seeking meaningful experiences together.

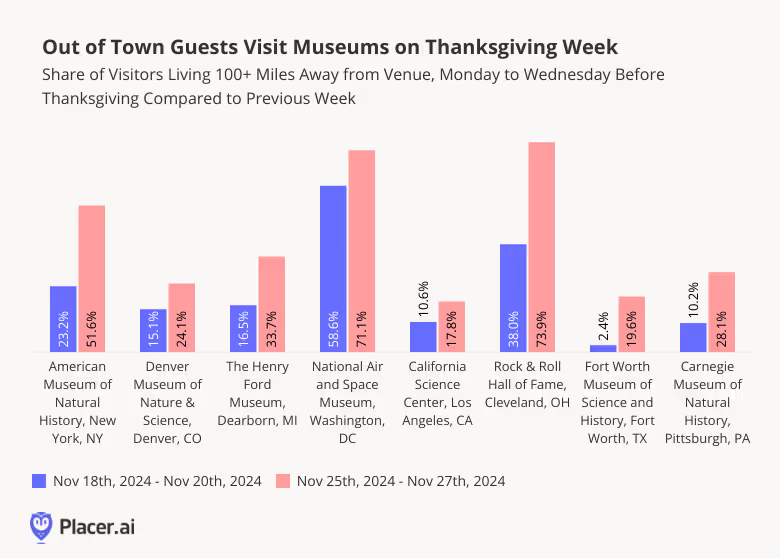

Indeed, zooming in on family-friendly museums across the country reveals that these venues tend to welcome a much larger share of out-of-town guests on the Monday to Wednesday before Thanksgiving compared to the same period the week before. This suggests that many of those who traveled early for Thanksgiving use the days ahead of the holiday to spend quality time with their relatives and engage in family-friendly activities in their hosts’ cities. Museums and similar venues can capitalize on this trend by tailoring their offerings or promotions to appeal to these out-of-town visitors during this peak period.

Analyzing pre-Thanksgiving foot traffic to travel hubs and leisure venues reveals that many Americans likely leverage the extra time off to extend their stay with their loved ones and explore local attractions together. By understanding these trends, businesses and cultural institutions can better cater to holiday travelers, creating meaningful experiences during this uniquely busy and family-focused season.

For more data-driven insights, visit Placer.ai.

Many of Thanksgiving’s consumer behavior impacts are broadly recognized, from the pre-Thanksgiving Turkey Wednesday peak at grocery stores to the post-Thanksgiving Black Friday shopping bonanza. But diving into consumer foot traffic trends for the week before the holiday reveals some lesser-known ripple effects from many Americans’ favorite national event. So how did Thanksgiving impact retail, dining, and airport visits this year? We analyzed the data to find out.

Many Americans host friends and family for Thanksgiving dinner, leading to the well-recognized spike in pre-Thanksgiving grocery traffic that culminates on Turkey Wednesday. But hosting a proper Thanksgiving dinner requires more than just good food – the space needs to be prepped as well.

Foot traffic data indicates that many consumers do in fact spend the week before Thanksgiving shopping for decor and other entertainment supplies, driving visit increases at home furnishing stores such as Homesense and at party supply stores such as Party City. And the prospect of guests also seems to motivate consumers to tackle whatever home repair projects they’ve been putting off – visits to home improvement stores, including Home Depot and Lowe’s, also received a significant boost the week before Turkey Day.

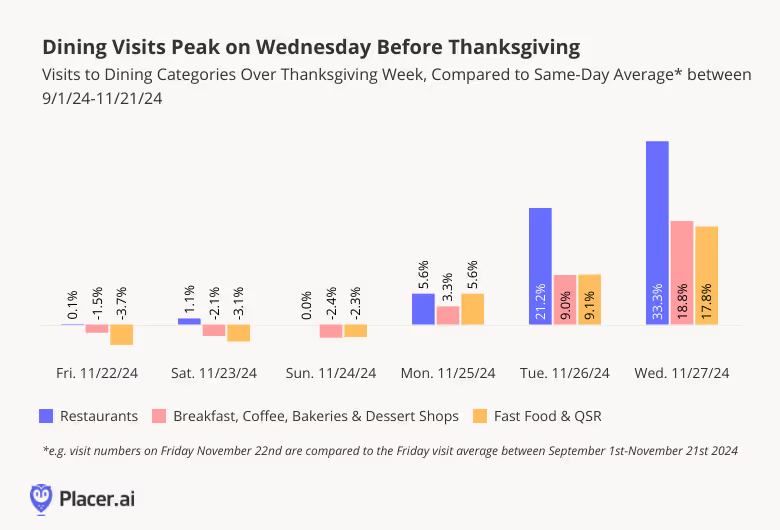

All the time spent in the kitchen cooking for Thanksgiving may also be contributing to a rise in dining visits on the days leading up to the holiday. Although visits to restaurants, breakfast joints, and fast food places dipped slightly during the weekend before Thanksgiving, foot traffic to major dining segments began climbing on Monday, November 25th before peaking on Turkey Wednesday.

This increase in dining visits could be due in part to home cooks – and their families – looking to fuel up outside the home as the kitchen gets taken over by Thanksgiving prep. And some Americans who started the Thanksgiving vacation early may choose to spend some quality time going out to eat with their friends and families prior to the big day. Others who are already traveling may also be driving up dining visits by looking for more meals on the go.

But even as some Americans begin their Thanksgiving travels earlier in the week, most Americans traveling by car seem to wait until Wednesday to head out – and the traffic boost to car-related categories seems to occur much closer to the day itself. Car shops & services and gas stations & convenience stores received a minor bump on the Tuesday before Thanksgiving as some Americans hit the road early or got their car serviced ahead of the long drive back home. But most of the traffic boost to car shops, car washes, and gas stations occurred on Wednesday November 27th – just before Thanksgiving travel.

Thanksgiving’s economic impact is not limited to grocery stores and post-Thanksgiving Black Friday shopping. Analyzing consumer foot traffic data for the week before the holiday reveals the widespread impact that Thanksgiving has on a range of consumer sectors, from car washes to dining segments to home improvement.

For more data-driven consumer insights, visit placer.ai.

Turkey Wednesday – the day before Thanksgiving – is the grocery industry’s Black Friday. As shoppers flock to stores for turkeys, cranberry sauce, and other holiday essentials, the day delivers impressive visit spikes for grocery, superstore, and dollar stores alike. But how did this year’s Turkey Wednesday measure up – and which brands capitalized most successfully on this critical shopping event?

We dove into the data to find out.

People love to shop – but they also love to procrastinate, descending on stores just before major holidays to grab last-minute supplies. So far in 2024, March 30th (Easter Eve), May 11th (the day before Mother's Day), and November 27th (Turkey Wednesday) have been the busiest days of the year for grocery stores, superstores, and discount & dollar stores. But while the first two milestones drew bigger crowds to superstores and discount & dollar stores – both natural destinations for gift buyers and food shoppers alike – Turkey Wednesday was the grocery sector’s time to shine.

On November 27th, 2024, grocery stores saw visits surge by 81.0% compared to a year-to-date (YTD) daily average, capturing over half (51.2%) of visits across grocery, superstore, and discount chains. (During the rest of the year, grocery stores account for just 46.6% of the three industries’ overall visit pie.) Still, superstores and discount & dollar stores also attracted plenty of pre-Thanksgiving shoppers with enticing holiday promotions of their own. And despite reports of consumer cut-backs ahead of the holiday, this year’s Turkey Wednesday performance was on par with last year’s, with grocery visits on November 27th 2024 up 0.7% relative to November 22nd 2023 (last year’s Turkey Wednesday).

Diving into statewide grocery store data shows that like Black Friday, Turkey Wednesday’s appeal isn’t evenly distributed across the United States. Though grocery visits spiked nationwide on November 27th, 2024, some regions saw bigger foot traffic peaks than others.

In the Pacific Northwest, parts of New England, and some Mountain states, for example, grocery visits increased by less than 70.0% compared to a YTD daily average. But in parts of the Midwest and South, visits spiked by over 90.0%. Mississippi and Minnesota in particular stood out as major Turkey Wednesday winners, with visits up 96.8% and 96.5%, respectively. These regional differences highlight Turkey Wednesday’s special resonance in areas where holiday shopping traditions like Black Friday also dominate.

Which grocery chains benefit the most from Turkey Wednesday? A look at individual brands shows that traditional grocery stores – think Kroger, Albertsons, and Safeway – generally see bigger pre-Thanksgiving visit boosts than limited-assortment value chains like Aldi and Trader Joe’s. And in keeping with the regional trends noted above, some of the best-performing chains are midwestern favorites like Schnucks and Albertsons’ Jewel-Osco, which saw Turkey Wednesday foot traffic surges this year of 103.9% and 92.6%, respectively.

But numerous other chains also saw major Turkey-fueled visit increases on November 27th – including Food 4 Less, the Kroger-owned regional value chain with locations in both the Midwest and California, and East Coast brands ShopRite and Wegmans. When it comes to last-minute holiday shopping, it seems, there is plenty of room for multiple brands to thrive.

Though value-oriented grocery chains typically see smaller visit spikes on Turkey Wednesday, many budget brands are steadily growing their pre-holiday audiences.

Grocery Outlet Bargain Market and Aldi saw foot traffic rise by 13.5% and 11.2%, respectively, on November 27th, 2024 compared to last year’s Turkey Wednesday. (Both chains also saw substantial increases in the average number of visits to each of their individual locations – 9.7% and 8.4%, respectively – proving that the increase isn’t solely a result of fleet expansion.) Meanwhile, traditional grocery leaders like H-E-B, Kroger’s Ralphs, Ahold Delhaize’s Hannaford, and Albertsons’ Jewel Osco, also recorded year-over-year (YoY) foot traffic gains, highlighting robust performance across much of the sector.

Groceries are a crucial part of the Thanksgiving holiday – but liquor, it seems, may be even more indispensable. On November 27th, 2024, visits to liquor stores surged even higher than visits to grocery stores – generating a remarkable 186.4% visit spike, as consumers stocked up on spirits to ease the mood at stressful family gatherings or to show gratitude to hard-working hosts. Like for grocery stores, Turkey Wednesday was liquor stores’ busiest day of the year so far – though if last year is any indication, the run-up to Christmas will likely generate even more impressive traffic bumps.

Turkey Wednesday 2024 reaffirmed the key role played by traditional grocery stores in the run-up to Thanksgiving. And though supermarkets and liquor stores stole the spotlight, superstores and discount & dollar stores also experienced significant visit upticks – and value chains are steadily growing their pre-holiday audiences. How will these categories continue to fare throughout the rest of the holiday season?

Follow Placer.ai’s data-driven retail analysis to find out.

Visits to Starbucks usually spike on its annual Red Cup Day, as patrons flock to the chain to order a specialty holiday beverage and receive a complimentary reusable red cup. But last year, the chain’s Red Cup Day performance was relatively muted – although foot traffic still got a boost, the jump was not quite as significant as in previous years. Was the promotion more effective in 2024? We dove into the data to find out.

Starbucks’ Red Cup Day came roaring back in 2024, with Thursday, November 14th – the day of the promotion – receiving 42.4% more visits than the recent Thursday daily visit average. And Red Cup Day didn’t just drive visits relative to a regular weekday – the promotion brought a 9.4% lift in overall weekly visits to Starbucks during the week of the event.

The relative visit bump was significantly higher than on Red Cup Day 2023 – when visits on Thursday, November 16th 2023 were only 25.0% higher than the previous five Thursday averages – and even outshined the already strong performance of Red Cup Day 2022.

As usual, Red Cup Day at Starbucks drove a larger visit spike than the launch of the chain’s popular Pumpkin Spice Latte (PSL): During the week of the PSL launch, visits rose 9.7% compared to the first week of H2 (July 1st-7th 2024), while Red Cup Day drove a 12.9% foot traffic bump relative to that same baseline.

Nevertheless, the recent data also indicates that the PSL remains a seasonal fan favorite – Starbucks received more weekly visits on the PSL’s arrival week than it did when it launched the holiday menu, when visits increased 6.7% relative to the beginning of H2.

This year’s Red Cup Day followed several weeks of year-over-year (YoY) visit dips at Starbucks, with weekly foot traffic between September 2nd and November 10th 2024 down an average of 4.4% YoY. But the success of the promotion – which drove YoY visit growth for the first time since August – showcases Starbucks’ expertise at driving visits by owning the calendar.

The chain has succeeded in establishing a yearly buzz around its branded cups that drive visits during what would otherwise be an off-season for the chain. And even this year, when consumers seem to be tightening their purse strings and cutting down on discretionary spending ahead of the holidays, Red Cup Day still managed to drive patrons to Starbucks stores in search of holiday beverages and free swag.

How will Starbucks perform throughout the end of 2024?

Visit placer.ai to find out.

How did leading eatertainment chains Dave & Buster’s and Chuck E. Cheese perform in Q3 2024? We dove into the data to find out.

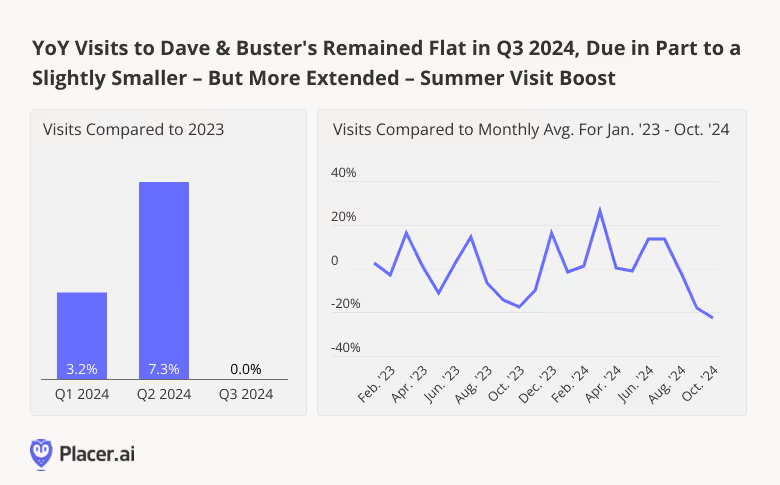

Since January 2024, Dave & Buster’s has enjoyed mainly positive YoY visit growth, fueled in part by the eatertainment leader’s continued expansion. In Q2 and Q3 2024, visits to the chain were up 3.2% and 7.3%, respectively. And though YoY foot traffic to the chain slowed down in Q3 2024, a look at Dave & Buster’s monthly visit patterns shows that this may have been due in part to a summer visit peak that was slightly lower – but more extended – than that seen last year.

In 2023, Dave & Buster’s experienced three distinct visit spikes – in March, July, and December – with the restaurant’s 14.6% July visit boost (compared to a monthly average for Jan. ‘23 - Oct. ‘24) preceded by a relatively quiet June (+2.0%). But this year, summer foot traffic began to trend upwards earlier, with both June and July seeing substantial upticks – 13.6% and 13.4%, respectively. (June is in Q2 and so this part of the uptick would not have been included in Q3 foot traffic numbers). And though September, usually a down period for Dave & Buster’s, saw a modest drop in visitors compared to 2023, the chain’s March peak was higher than last year’s.

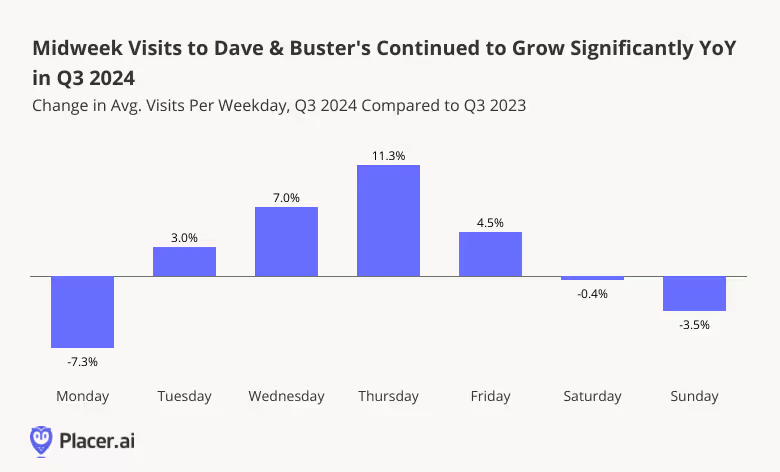

Digging even deeper into the data shows that even as YoY quarterly visits to Dave & Buster’s remained flat in Q3 2024, mid-week visits to the chain continued to climb. Dave & Buster’s has been investing heavily in mid-week promotions meant to drive traffic during quieter periods, and its efforts are clearly paying off. On Wednesdays, Dave & Buster’s offers a 50% discount on games – and the average number of Wednesday visits to the chain were up 7.0% YoY. Thursdays, too, saw an 11.3% YoY foot traffic increase, likely fueled by diners drawn to Thursday specials as the most intensive part of the work week wound down. (In Q3 2024, July 4th fell on a Thursday, which also generated a significant visit bump – but even when discounting the week of the holiday, Thursday visits were up 6.4% on average.)

Against the backdrop of solid seasonal peaks and impressive mid-week visitation trends, Dave & Buster’s appears poised to enjoy a robust December – another important seasonal milestone for the restaurant. And keep an eye out for the week after Christmas, traditionally Dave & Buster’s busiest week of the year: Last year, the week starting December 25th drove a 65.0% visit spike to the chain compared to a 2023 weekly average.

Speaking of promotions – Chuck E. Cheese is another eatertainment leader that has been finding success by leaning into special deals, making it easier for price-conscious consumers to treat their kids to pizza and fun.

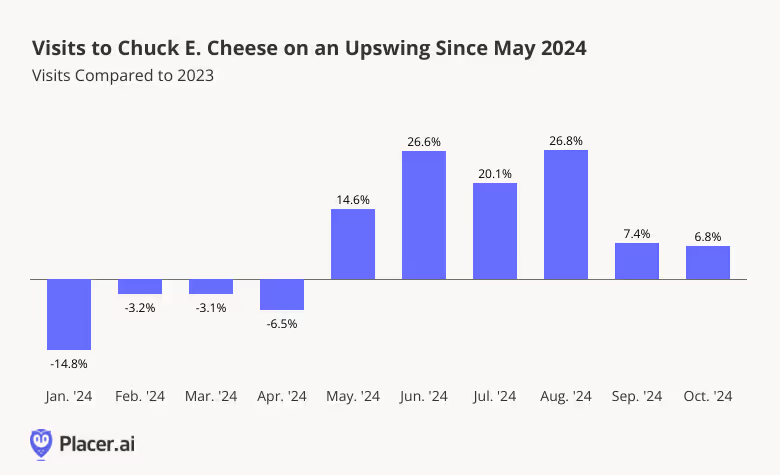

Following a lackluster start to the year, YoY visits to Chuck E. Cheese began trending upwards in May 2024 and have remained elevated ever since. Between June and August 2024, foot traffic to Chuck E. Cheese was up between 20.1% and 26.8% compared to the equivalent period of 2023. And though the pace of visit growth began to taper in September as kids went back to school, visits remained substantially higher than last year.

What’s behind Chuck E. Cheese’s summer flourishing? A look at shifts in loyalty trends at the chain suggests that the success of this year’s Summer Fun Pass may be a big part of the story.

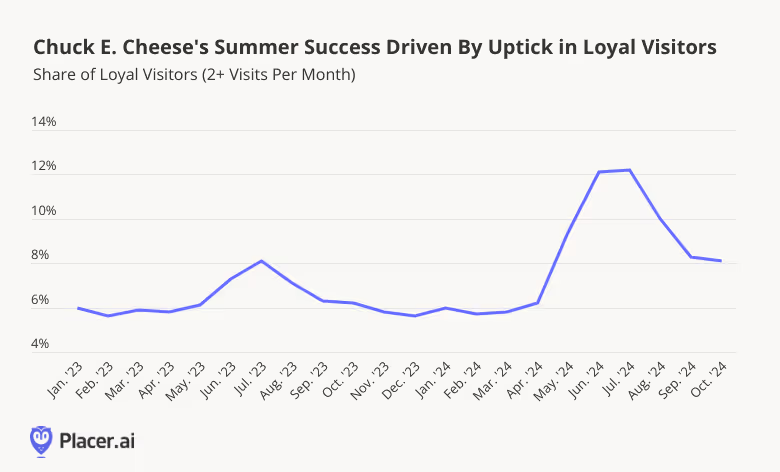

On average, the share of loyal visitors to Chuck E. Cheese – i.e. those frequenting the restaurant at least twice in a month – tends to range between five and seven percent. Last summer, this percentage increased to 8.1%, as parents sought out indoor activities to keep kids occupied when school was out. But this year’s summer loyalty spike – just over 12.0% in both June and July – was significantly higher.

Though Chuck E. Cheese also offered a Summer Fun Pass last year, this year’s deal provided even greater value – including unlimited visits over a two-month period, steep discounts on food, and up to 250 games per day. And the promotion was such a smashing success that Chuck E. Cheese has launched a new unlimited-visit pass meant to make frequent trips to the chain more affordable for families all year round. As the kids’ eatertainment leader continues to revamp its offerings – remodeling locations and adding new activities like indoor trampolines – Chuck E. Cheese appears poised to keep drawing the crowds.

Today’s cautious consumers are always on the lookout for ways to save – and eatertainment chains are paying attention. Will Dave & Buster’s post-Christmas visit spike outperform last year’s? And will Chuck E. Cheese’s new unlimited play model continue to drive traffic throughout Q4?

Follow Placer.ai’s data driven analyses to find out.

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.