.svg)

.png)

.png)

.png)

.png)

Commercial real estate is constantly coming up with new and inventive concepts, and one of the latest ideas is the dog park bar. Chains such as Bark Social and Fetch Park are two such entrants that noted the rise in pet ownership during Covid, and are capitalizing on pet owners’ love for their dogs, as well as desire for human companionship and playdates for their canines.

These dog park bars combine the joy of seeing your furry friend run around with other dogs, while the owners can enjoy a cold frosty brew.

Fetch Park has five locations in Georgia, including Buckhead and Alpharetta. Meanwhile, Bark Social has locations in Baltimore, Bethesda, Alexandria, and Philadelphia, with upcoming plans for Los Angeles and Columbia.

Fetch Park includes events such as “Ales, Tails, and Trivia”, weekly karaoke nights, stand-up comedy, and even a singles’ mingle to meet other like-minded pooch people. Bark Social styles itself as a bar for dog lovers, and includes Bark Rangers that oversee puppy activities such as holding your pet’s first birthday party. There is even doggy daycare and summer camp available.

And in sunny LA, it’s not the San Vicente Bungalows or SoHo House that’s getting attention, it’s Dog PPL in Santa Monica, a private dog park whose $80/month membership lets your dog play in style. There are “ruffarrees” on hand to keep the calm while owners socialize and imbibe rosé or kombucha. It can even serve as a co-working location or gym substitute with its dog yoga classes.

Source: Dog PPL

If you’re in the Midwest, check out Barkside in Detroit. This 10,000 sq ft location in the West Village combines a dog park, bar, and beer garden all in one. There is a special focus on Detroit and Michigan brands when it comes to libations, which include beer, wine, spritzers, and a variety of coffee drinks.

And if you truly can’t part from your furry friend for even a minute, new BARK Air has partnered with a jet charter service and offers a Gulfstream V so you and your pet can travel in style. For the price of $6,000 one-way, amenities include dog champagne (aka chicken broth), special blankets and pillows, and delicious dog treats. This service is only available for NY, LA, and London jetsetters, but if this concept takes off and comes to more cities, that would truly be paw-some.

If there’s one sector of the retail industry that continues to innovate, evolve and perform at a high level, it’s convenience stores. Convenience chains remained in lock step with their consumers over the past few years, a difficult feat for many retailers, and benefited from suburban and rural migration patterns. 2023 was a banner year for C-Stores, with visits to large scale chains growing by 6% compared to 2022 (though some of the growth was due to chain consolidation).

C-Stores have done a fantastic job of attracting more visitors through additions like EV charging, local autonomous delivery, and expanded service offerings. However, the winning formula for many C-Store chains has been the bet on fresh, prepared and made to order foods. Chains have transformed consumer thinking around convenience driven foodservice and the concept has won over consumer’s appetites and wallets.

Chains that prioritize prepared foods have higher dwell times, more weekend visits and strong traffic growth according to our data. In a retail industry that prioritizes uniqueness in experience and product, more foodservice options clearly move the needle for visitors. Compared to the large chain C-store average dwell time of 10 minutes in Q1 2024, chains such as Buc-ee’s, Wawa, and Sheetz have higher dwell times by at least a minute, while chains associated with grab-and-go have shorter than average dwell times.

Looking a little more closely at Buc-ee’s, the darling of both the southeast and TikTok fame, the dwell time is double the average of large chain C-Stores. Buc-ee’s has the unique ability to blend entertainment, kitsch and prepared foods in a way that enchants visitors. Maybe it’s the chain’s Beaver Nuggets or the house-smoked barbeque, or its beloved mascot?

Buc-ee’s has the highest percentage of visits lasting 15 minutes or longer, and excels in visits between 15 and 45 minutes compared to other C-Store chains (below). More than half of the visits to Buc-ee’s occur between Friday-Sunday, more than any other competitor. Buc-ee’s can be seen as a destination C-Store as opposed to a daily stop due to the size and location of stores, which certainly contributes to the higher dwell time. Other C-Store chains looking to improve food offerings can use Buc-ee’s as a source of inspiration when it comes to breadth of assortment and mix of specialty packaged items and foodservice options.

The most surprising metrics come from Casey’s, a chain that has publicly committed to foodservice, but can’t seem to capture longer visits. Casey’s dwell time more closely mirrors that of grab-and-go chains like Maverik or Kwik Trip than it does Buc-ee’s or Wawa. Looking at the differences in demographic segments between Buc-ee’s, Wawa and Casey’s, Wawa and Buc-ee’s attract a visitor that is suburban, younger and more affluent than Casey’s. There may be a correlation between made to order offerings and suburban locations that’s benefitting chains focused on both.

The C-Store evolution is quickly blurring the lines between grocery, QSR and traditional convenience models, and is a bellwether of what’s to come across other sectors in retail. The bi-furcation of c-store formats is likely to accelerate throughout the remainder of 2024. Blending the right product selection, on-demand offerings and a beneficial experience for visitors is necessary in today’s retail climate.

Sprouts, the natural and organic food focused grocery chain operating in 23 states nationwide, is going through a growth spurt. We dove into the visit and audience data to see where the chain stands today and what the rest of 2024 – and beyond – may have in store.

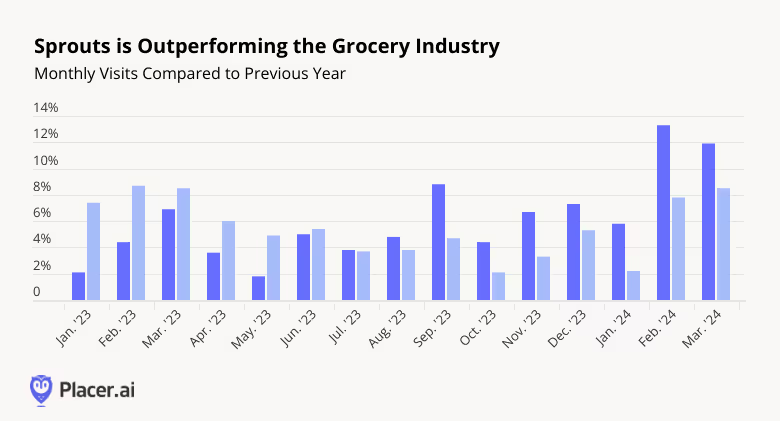

Sprouts is on the rise. Year-over-year (YoY) visits increased every month of last year and have been outperforming the nationwide Grocery average since mid-2023. And the chain continued to grow in Q1 2024, with visits up an impressive 13.3% and 11.9% in February and March 2024, respectively – an impressive feat given the comparison to an already strong Q1 2023.

Some of the growth is driven by expansion – the company opened 30 new stores in 2023 and expects to add 35 additional locations in 2024. But the increase in foot traffic is also a testament to the potential of specialty grocery stores to leverage their unique product selection to attract grocery shoppers, even in the face of growing competition in the space.

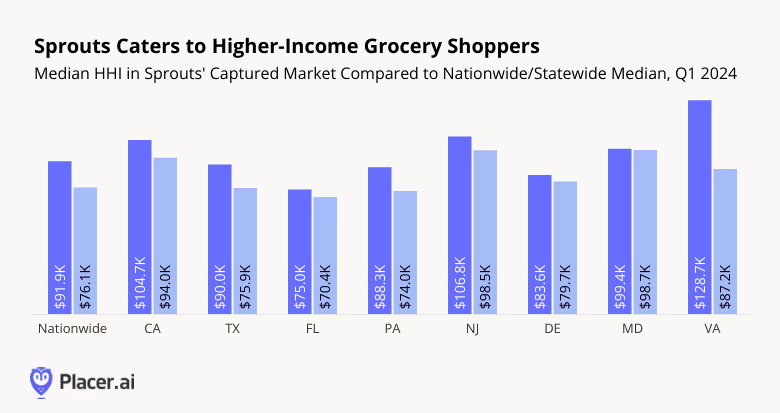

The relatively high income of Sprout’s visitor base is likely also helping the chain stay ahead of the grocery pack: Median HHI in Sprout’s trade areas nationwide is higher than the U.S. median HHI, and the data shows a similar trend in Sprout’s eight growth markets.

The relative affluence of Sprouts shoppers means that this segment may not be as impacted by high food prices as other grocery shoppers – so the retail headwinds predicted this year are not likely to slow down Sprout’s growth potential as the chain continues expanding its reach in 2024.

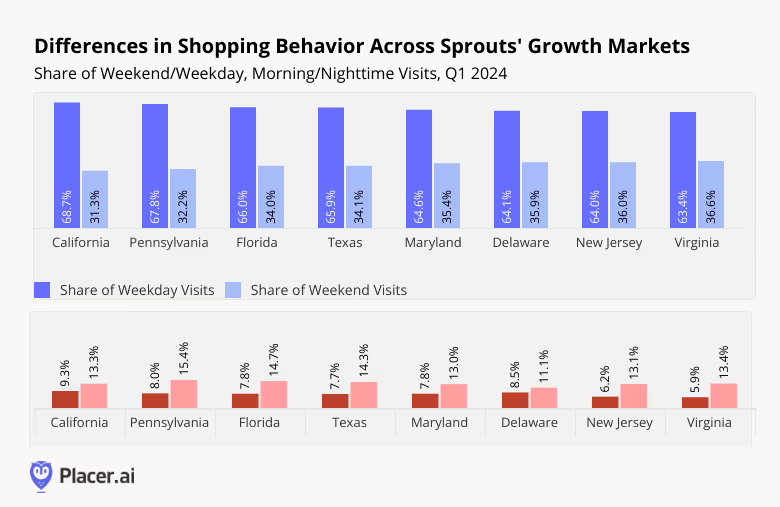

While Sprouts’ visitors across states seem to share a relatively high income level, diving deeper into the location intelligence data reveals some major differences in both in-store behavior and overall market composition.

For example, the share of weekend (as opposed to weekday) visits to Sprouts in Q1 2024 varied significantly – from 31.3% in California to 36.6% in Virginia. Shoppers in the company’s various growth markets also visited stores at different hours throughout the day: Mornings (8:00 AM to 9:59 PM) were popular with California, Delaware, and Pennsylvania residents, while evenings were favored by Pennsylvanians, Floridians, and Texans.

Understanding the in-store behavior of shoppers in each state will likely help Sprouts adapt its operations and staffing schedules as the company continues expanding in these markets.

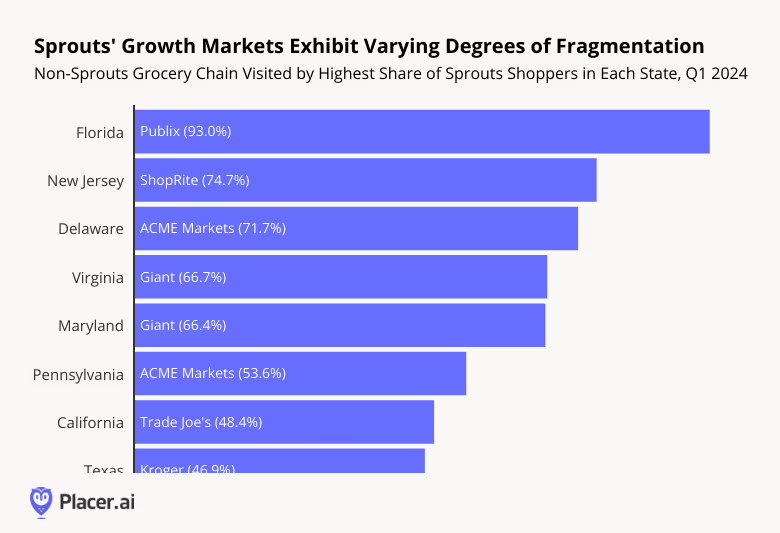

In addition to highlighting the variance between the shopping habits of Sprouts visitors across markets, diving deeper into the location intelligence data also reveals differences in the relationship between Sprouts shoppers and the wider grocery markets in each state.

The chart below shows the most popular grocery alternative for Sprouts shoppers in each state (which other grocery chain was the most visited by Sprouts visitors) and what share of Sprouts shoppers visited that grocery chain in Q1 2024.

In Florida, over 90% of Sprouts shoppers also visited a Publix location in Q1 2024 – indicating that Sprouts in the Sunshine State is operating in a relatively consolidated grocery market and operating against an established crowd favorite. Meanwhile, only 46.9% of Texan Sprouts visitors also visited a Kroger – the other grocery chain most visited by Sprouts visitors – indicating that the Texas grocery market may be more fragmented, and so may respond to a different expansion strategy, than the Florida grocery market.

Sprouts strong visitation trends indicate that the grocery chain is expanding into willing markets, and the brand’s relatively affluent shopper base means that Sprouts is unlikely to be too impacted by whatever economic headwinds may lie ahead. As the chain continues making its presence felt in newer markets, location intelligence suggests that Sprouts has plenty of room to grow in 2024 and beyond.

For more data-driven retail insights, visit our blog at placer.ai.

Crocs’ rebrand from ugly to chic is one of retail’s most fascinating Cinderella stories (glass clog, anyone?). We dive into the latest location analytics and demographic data to explore the consumer behavior that drives Crocs’ continued success.

Embarking on a journey to become a fashionable brand, in 2017 Crocs inked a partnership with Christopher Kane who became the first designer to collaborate with the brand. A stampede of designer and celebrity-inspired styles followed in 2018 and 2019 including Balenciaga's iconic ten-inch platform Croc and Post Malone's take on the classic clog.

During the pandemic, Crocs built on its success in fashion and celebrity circles, and gained a new following from comfort-first shoe shoppers stuck at home or running errands.

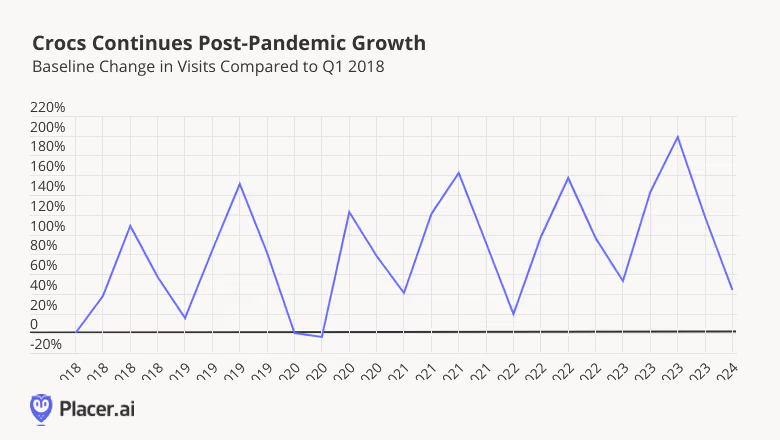

Taking a wide lens on Crocs’ foot traffic since 2018 shows how a strategy of designer partnerships as well as recognition as a functional shoe drives visits to the brand. In 2018 and 2019, as designer Crocs rolled out, visits to the brand climbed to new heights.

And since the wider retail reopening in 2021, Crocs’ foot traffic growth has accelerated as comfort reigns supreme in and out of the home.

Compared to a Q1 2018 baseline, Crocs saw its largest monthly visit peak in Q3 2023 (199.1%) – the critical summer period. And foot traffic in the most recent Q1 2024 was 43.7% above the Q1 2018 baseline. This indicates that the shoe’s acceptance within pop-culture combined with demand for comfortable footwear is elevating the brand’s traffic to new levels.

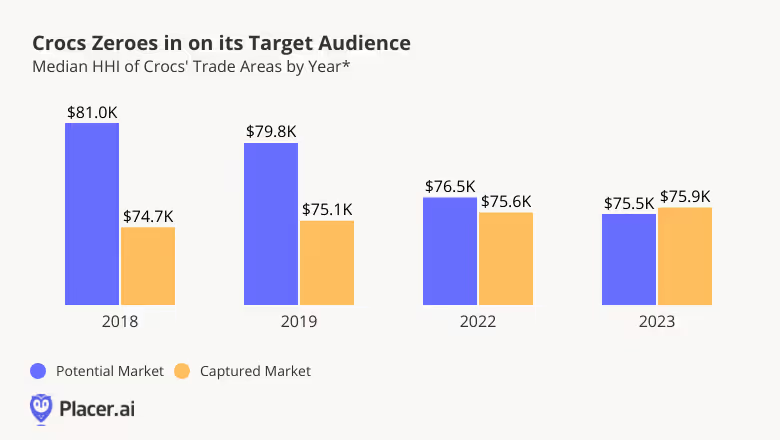

As Crocs continues to gain traction, the company appears to be pursuing a real estate strategy aimed at repositioning the brand as an affordable shoe for the whole family. Although Crocs shrank its store count in the years leading up to the pandemic, the brand has now begun opening new locations in outlet malls – five in 2023, with plans for 30 new stores in outlet malls in 2024.

Analyzing Crocs’ trade areas between 2018 and 2023 suggests that this strategy is helping the brand reach its audience. According to the STI: Popstats 2023 dataset, in 2018, there was a gap of more than $6K between the median household income (HHI) in Crocs’ potential market ($81.0K/year) and in its captured market ($74.7K/year). But by 2023, the median HHI of the brand’s potential market ($75.5K) and captured market ($75.9K) had more closely aligned. This indicates that by opening stores in outlet malls – where consumers looking for discounts are likely to shop – Crocs’ potential market more closely reflects its actual visitors and the brand can drive additional traffic from its target audience.

From humble beginnings, Crocs have become runway-famous. And yet, the clogs are more popular than ever with the everyday consumer – at home or out on the town. How will Crocs shape the next chapter of this foam fairytale?

Visit Placer.ai to find out.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Final Four weekend capped off the NCAA “March Madness” basketball tournaments with a full schedule of fan experiences on both the men’s and women’s sides of the ball.

The Women’s Final Four took place between April 4th and 7th, 2024 in Cleveland, Ohio with on-court action at Rocket Mortgage FieldHouse. “Tourney Town” – an interactive basketball exhibition – ran concurrently at the Huntington Convention Center.

The Men’s Final Four commenced on April 5th at State Farm Stadium in Glendale, Arizona, culminating with the championship game on April 8th. The multi-day exhibition “Final Four Fan Fest” took place at the Phoenix Convention Center.

We dove into the location analytics and audience segmentation for visitors to several Final Four events to better understand the fans in attendance throughout the tournament weekend.

The men and women’s Final Four weekend attracted spectators from near and far, with each event attracting a unique mix of out of town tourists and locals.

Both men and women’s championship games attracted a relatively large share of out-of-town guests, likely due to the excitement surrounding a national title game. Analysis of visitors by home location revealed that the men and women’s championship games had the smallest share of visitors from less than 100 miles away – 29.8% and 33.3% respectively. In other words, these two events had the largest share of visitors that lived more than 100 miles from the venues.

The men’s open practice appeared to be more popular with long-distance travelers than the women’s, perhaps because all four men’s teams participated – as opposed to just two at the women’s open practice. The men’s practice was also followed by an all-star game which likely increased its appeal for visitors traveling from afar in the hopes of spotting their favorite players. The data revealed that more than half of the spectators traveled over 250 miles to watch the men’s practice, as opposed to under a quarter of spectators for the women’s practice.

Meanwhile, the women’s experiential exhibition at Huntington Convention Center drew more out-of-towners than the men’s exhibition at Phoenix Convention Center – only 23.3% of visitors to the women’s exhibition came from under 30 miles away, compared to almost half (48.3%) of the men’s exhibition visitors. The larger share of out-of-town visitors to the women’s exhibition may be because the event was close to the arena, making it a more convenient stop for non-local fans. On the other hand, the distance between the men’s exhibition in downtown Phoenix and the stadium in Glendale meant that the off-court experience was more out-of-the-way for tourists who had traveled specifically for the on-court action.

Analysis of Final Four visitors by income level provides further insight into the differences between each event’s fan base. According to the STI: Popstats dataset, the women’s events generally drew visitors from areas with a lower median household income (HHI) compared to the men’s events, although the gaps between the men and women’s visitor bases varied from event to event. Some of the difference in trade area HHI may be due to regional variance and the mix of locals and tourists at each event.

The visitor bases of the men and women’s championship games exhibited the widest disparity, with the men’s championship spectator base coming from areas with a median HHI of $99.9K, compared to $74.6K for the women’s championship’s trade area. The difference may be due to the relatively higher face value of tickets to the men’s championship game – even though the star-power of Iowa’s Caitlin Clark drove up the price of women’s tickets on the secondary market. In contrast, both the men’s and women’s practices and exhibitions were free or nearly free events and drove traffic from relatively lower-income areas – even though visitors to the men’s practice still came from more affluent areas than the trade area of the women’s championship match.

Visitors to the men and women’s convention center exhibition displayed the smallest income differences, with respective trade area median HHI of $80.0K and $76.6K. The data also reveals that visitors to the women’s exhibition came from a trade area with a median HHI that was higher than the median HHI for both the championship game and the open practice, perhaps because the exhibition drew a relatively large share of tourists who could afford to be in town for a slightly longer stay.

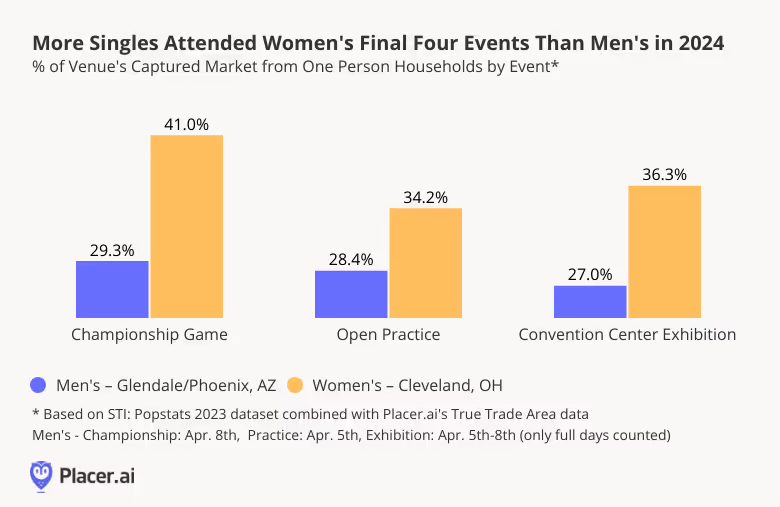

Further demographic analysis indicates that a greater share of singles – who tend to be on the younger side – attended the women’s Final Four events than the men’s. During the women’s championship, 41.0% of households in the trade area of the Rocket Mortgage FieldHouse were made up of one-person households. This segment also made up 34.2% and 36.3% of the households in the trade areas of the venues for the women’s practice and exhibition, respectively. On the men’s side, singles comprised just 29.3% of the championship’s trade area, 28.4% of the practice’s, and 27.0% of the exhibition’s.

This reflects the growing popularity of women’s college basketball players on social media which is bringing more viewership to the sport.

Want more data-driven visitor insights for sporting events? Visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

During last week’s solar eclipse, people from all over the country converged on cities within the path of totality to witness the excitement first hand. And for municipalities and local businesses, the influx of tourists was expected to generate a boon.

But just how did the celestial event impact business activity on the ground? Which sectors benefited from the hype – and which geographic areas saw the biggest visit spikes?

We dove into the data to find out.

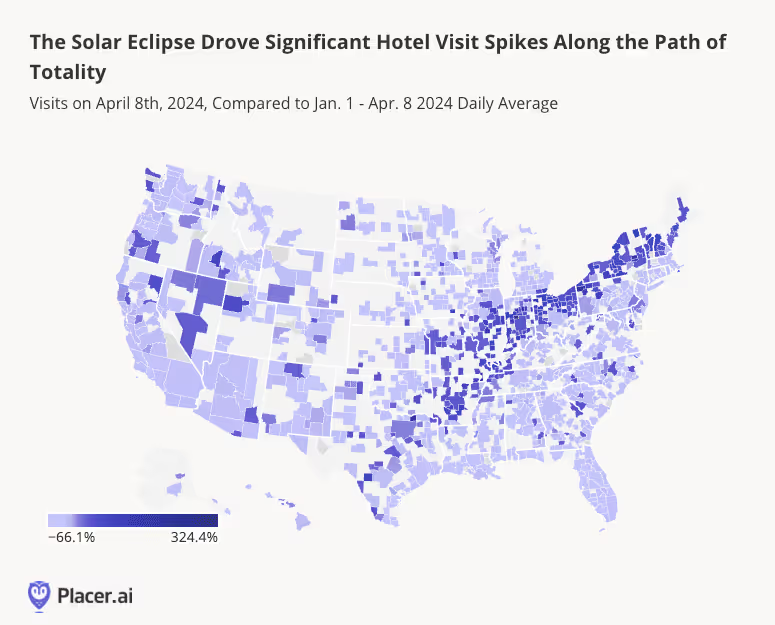

On April 8th, 2024, hotels in CBSAs where the eclipse could be viewed in all its glory (or close to it) experienced major visit boosts. And mapping hotel visits on the big day to CBSAs nationwide – compared to year-to-date daily averages – shows just how significant the cosmic alignment was for areas lucky enough to be located along or near the path of totality.

Within metropolitan CBSAs (CBSAs with at least 50,000 residents), Danville, IL – where visitors could either view a near-total eclipse or drive to a nearby location with 100% totality – experienced the biggest jump in Hotel visits, with visits to the category up 111.3%. But urban centers from north to south – including in New York, Indiana, Ohio, Arkansas, and Missouri – also experienced substantial hotel visit spikes.

.avif)

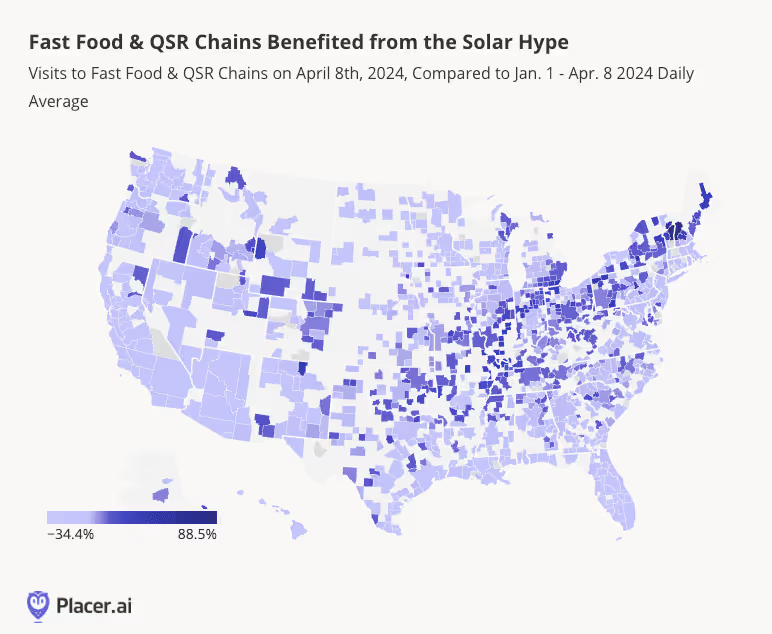

Hotels weren’t the only locations to reap the rewards of the solar eclipse. Fast Food & QSR chains in and around the path of totality enjoyed meaningful April 8th visit spikes of their own. And while the Hotel visit increases were more closely concentrated in prime viewing areas, Fast Food & QSR visits increased along a wider radius as people likely grabbed a bite to eat while making their way to a sun-gazing hotspot.

And the impact of the solar eclipse wasn’t limited to locations located in or near the path of totality. Retailers and dining chains nationwide got in on the action with special deals and limited-time offers meant to make the most of the unique interstellar opportunity.

In the week leading up to April 8th, 2024, Warby Parker drew crowds with the promise of free solar eclipse glasses. And while a burger joint may not be the first place people associate with eyewear, fast food favorite SONIC Drive In also attracted astronomy aficionados with a limited-time Blackout Slush Float that came with free eclipse viewing gear.

Krispy Kreme Doughnuts, for its part, marked the occasion with a limited-edition Total Solar Eclipse Doughnut. And though Mondays aren’t typically busy days for the chain, the special offering produced a clear visit uptick nationwide. In states along the path of totality, Krispy Kreme visits were up 55.5% on April 8th when compared to an average Monday this year, and in the rest of the country they were up 33.9%.

.avif)

For retailers across categories, landmark events from movie launches to cosmic occurrences have the potential to drive visit spikes and generate business. What other big opportunities lie in store for retailers this year?

Follow Placer.ai’s data-driven retail analyses to find out.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

1) Retail foot traffic faces lingering pressure – making promotions more critical than ever. Financial uncertainty, tariffs, and inflation continue to weigh on discretionary spending, making well-timed, targeted holiday promotions essential to reignite demand and drive in-store traffic.

2) The retail divide appears set to widen this holiday season – Luxury and off-price apparel are both outpacing overall retail, reflecting a deepening bifurcation of consumer behavior. And this December, the affluence gap between the two categories is expected to expand further, underscoring opportunities to engage both premium and value-focused shoppers across segments.

3) Despite slower overall performance, beauty and electronics have performed well during recent retail milestones. To make the most of this momentum, advertisers should align campaigns with shifting holiday audiences – electronics toward married homeowners and beauty toward affluent suburban families.

4) Early Promotions Could Lift In-Store Traffic – Last year, early holiday campaigns helped offset a shorter shopping season and sustain strong results. With another condensed window and continued shipping disruptions, retailers who start early and emphasize in-store availability will be best positioned to capture additional visits and outperform 2024’s results.

The holiday season is fast approaching, but this year’s backdrop looks especially complex. Consumers are navigating heightened financial uncertainty, with tariffs driving up prices and disrupting supply, while inflation continues to weigh on discretionary spending.

For retailers and advertisers, the stakes are high. The holiday period remains a critical window for promotional engagement, and success will depend on understanding consumer behavior and crafting promotions that are timed, targeted, and designed to meet shoppers where they are.

We turned to foot traffic data to uncover the key trends shaping this season’s retail environment, and to identify promotional strategies likely to succeed.

Consumer activity appeared strong in most of early 2025 – except in February, when extreme weather and leap-year comparisons drove sharp year-over-year (YoY) declines. But foot traffic slowed this summer, highlighting the toll of lingering financial uncertainty and strain.

For advertisers, this underscores how pivotal seasonal promotions will be in reigniting demand. With many consumers cutting back on discretionary spending, well-timed and well-targeted campaigns will be essential to encourage shoppers to spend more freely during the holidays. These promotions don’t have to rely solely on price cuts — pop-culture collaborations and other creative product launches have also proven highly effective in driving traffic this year.

> Financial uncertainty and tighter household budgets are weighing on retail foot traffic this year – making effective holiday promotions more critical than ever.

Still, not all retail categories have been equally affected by broader economic headwinds. Some segments have experienced softer demand, signaling where advertisers may need to take a more measured, efficiency-focused approach. Others, however, have shown notable resilience – offering opportunities to double down on creative promotions that deepen engagement during the holidays.

One such segment is home furnishings, which has seen YoY traffic gains over the past 12 months, driven by the strong performance of discount chains as shoppers favor accessible décor updates over large-scale renovations. Strategic campaigns highlighting affordable refreshes and quick “holiday-ready” makeovers could give the category an additional lift in Q4, as households look to update their spaces in preparation for hosting family and friends.

But the biggest gains have been in the apparel category, where a bifurcation trend has emerged, boosting visits at both luxury and off-price retailers. The success of both segments underscores promotional strategies that can amplify momentum – steep-value discounts on one end of the spectrum, and exclusivity and quality on the other. Advertisers across retail segments can adapt this dual approach to engage both budget-driven and premium audiences effectively.

And demographic data reveals just how deeply entrenched this bifurcation has become – especially during the holiday season.

The chart below examines monthly changes in the median household incomes (HHIs) of luxury and off-price retailers’ captured markets since January 2023. Even small shifts in HHI across major retail categories can signal meaningful changes in audience composition – and these patterns tell a clear story.

In luxury apparel, where the median HHI is well above the national average of $79.6K, visitor income follows a distinct seasonal rhythm. During the early holiday shopping period, HHI remains lower in October and dips slightly in November as middle-income shoppers take advantage of early promotions to snag products that may be out of reach the rest of the year. It then rises in December as affluent consumers return to purchase gifts. Notably, luxury HHI has trended upward since 2023 – with each holiday peak higher than the last – suggesting that this December’s visitor base will be even more affluent than last year.

For advertisers, this means late-season campaigns should prioritize prestige audiences while still engaging aspirational shoppers during early holiday promotions like Black Friday.

In the off-price apparel segment, on the other hand, median HHI typically declines during the holidays – especially in December – indicating an influx of more price-sensitive shoppers. And over time, this visitor base has become even more value-driven, reinforcing the importance of promotional messaging that emphasizes unbeatable deals and savings.

Together, these patterns once again highlight the growing need for tailored strategies: premium experiences for high earners and sharp value propositions for cost-conscious consumers – a lesson that may extend well beyond these categories.

>The retail divide is expected to deepen further in December 2025, with off-price retailers drawing more value-driven shoppers and luxury brands attracting increasingly affluent consumers.

In a challenging economic environment, one might expect promotions around key retail milestones to prompt consumers to deviate from their usual habits, experimenting with new brands or categories. Yet the data shows that, for the most part, shoppers instead deepened their engagement with the retailers they already patronize – utilizing holiday promotions to buy the same products at better prices.

The graph below shows that during recent shopping milestones, the off-price and luxury categories both stood out in YoY performance – reflecting the strong momentum sustained by both segments over the past twelve months.

Still, the graph above also highlights two additional segments potentially poised for holiday success: beauty & self care and electronics.

Despite slower traffic over the past year, beauty retailers saw notable spikes around key recent promotional moments – including Black Friday, Mother’s Day, and Memorial Day. And although electronics retailers continued to face headwinds as consumers delayed big-ticket purchases – including during last year’s Black Friday – more recent milestones have seen traffic stabilize or even increase YoY.

This indicates that the right promotional environment can still effectively drive engagement in these discretionary categories, and that deal-driven behavior is likely to remain a defining theme this holiday season. In addition, as the replacement cycle begins for major electronics first purchased during the pandemic, shoppers may be especially willing to upgrade to a new TV or laptop if the right offer comes along.

But to make the most of the opportunity presented by Q4, advertisers and retailers in the beauty and electronics spaces should pay close attention to the shifting demographics of their in-store audiences during the holiday season.

For electronics retailers, married couples and homeowners become increasingly important during the peak holiday shopping period. Their share in the category’s captured market rises consistently each December, indicating that campaigns emphasizing household upgrades, family entertainment, and quality-of-life improvements may resonate most effectively in late Q4.

In contrast, beauty retailers – typically buoyed by young professionals – see their audience composition shift towards suburbia during the holidays. In December, the share of wealthy suburban families in beauty retailers’ captured markets grows meaningfully, while the share of young professionals declines. Advertisers can capitalize by highlighting premium bundles, limited-edition sets, and gifting options that speak directly to these households’ desire for premium, family-oriented products.

> Off-price and luxury retailers maintained strong performance during major retail milestones, but beauty and electronics stand out as rising opportunities for the 2025 holiday season.

> As holiday demographics shift during the holiday season – with electronics drawing more married homeowners and beauty attracting wealthier suburban families – campaigns that reflect these audiences’ lifestyles and priorities will resonate most.

Timing is also a decisive factor in retailer and advertiser success during the holiday season.

Traditionally, the “core” holiday retail period begins with Black Friday and continues until Christmas Eve. But in 2024, there was one fewer week between these two milestones compared to the previous year. And to compensate, many retailers launched an “early” holiday season, rolling out promotions in October and early November to maximize consumer engagement.

As the graph below shows, the shorter “core” season of 2024 unsurprisingly drew less in-store traffic across retail categories than the longer period the year before. Yet by embracing early promotions, retailers offset much of this shortfall, leading to overall holiday season results that, in many cases, matched or even exceeded 2023’s performance.

Looking ahead, 2025 once again brings a compressed “core” shopping window. And with shipping disruptions still influenced by shifting tariff regulations, more consumers may turn to brick-and-mortar stores earlier in the season to ensure timely purchases – further supporting offline traffic.

If retailers and advertisers double down on early-season engagement while continuing to drive momentum through the “core” weeks, YoY traffic for the 2025 holiday season could deliver even bigger overall gains than those seen in 2024.

> Last year, early holiday promotions helped offset a shorter core holiday season.

> In 2025, retail and advertising professionals are again faced with a relatively short core shopping season. And aware of the condensed timeline and shipping disruptions, more shoppers may opt for early in-store purchases to avoid the risk of delayed deliveries.

This holiday season will reward advertisers and retailers who recognize the growing retail divide and tailor their messaging to the shoppers most likely to visit during the holidays – whether married homeowners on the hunt for electronics or affluent suburban families seeking beauty products. As in 2024, acting early to offset a shorter core shopping period will be essential to capturing demand. And those who combine sharp timing with audience insight will be best positioned to turn a complex season into a strong finish.

.png)

1) Value Wins in 2025: Discount & Dollar Stores and Off-Price Apparel are outperforming as consumers prioritize value and the “treasure-hunt” experience.

2) Small Splurges Over Big Projects: Clothing and Home Furnishing traffic remains strong as shoppers favor accessible wardrobe updates and decor refreshes instead of major renovations.

3) Big-Ticket Weakness: Electronics and Home Improvement visits continue to lag, reflecting a continued deferment of larger purchases.

4) Bifurcation in Apparel: Visits to off-price and luxury segments are growing, while general apparel, athleisure, and department stores face ongoing pressures from consumer trade-downs.

5) Income Dynamics Shape Apparel: Higher-income shoppers sustain luxury and athleisure, while off-price is driving traffic from more lower-income consumers.

6) Beauty Normalizes but Stays Relevant: After a pandemic-driven surge, YoY declines likely indicate that beauty visits are stabilizing; shorter trips are giving way to longer visits as retailers deploy new tech and immersive experiences.

Economic headwinds, including tariffs and higher everyday costs, are limiting discretionary budgets and prompting consumers to make more selective choices about where they spend. But despite these pressures, foot traffic to several discretionary retail categories continues to thrive year-over-year (YoY).

Of the discretionary categories analyzed, fitness and apparel had the strongest year-over-year traffic trends – likely thanks to consumers finding perceived value in these segments.

Fitness and apparel (boosted by off-price) appeal to value-driven, experience seeking consumers – fitness thanks to its membership model of unlimited visits for an often low fee, and off-price with its discount prices and treasure-hunt dynamic. Both categories may also be riding a cultural wave tied to the growing use of GLP-1s, as more consumers pursue fitness goals and refresh their wardrobes to match changing lifestyles and sizes.

Big-ticket categories, including electronics, also faced significant challenges, as tighter consumer budgets hamper growth in the space. Traffic to home improvement retailers also generally declined, as lagging home sales and consumers putting off costly renovations likely contributed to the softness in the space.

But home furnishing visits pulled ahead in July and August 2025 – benefitting from strong performances at discount chains such as HomeGoods – suggesting that consumers are directing their home-oriented spending towards more accessible decor.

The beauty sector – typically a resilient "affordable luxury" category – also experienced declines in recent months. The slowdown can be partially attributed to stabilization following several years of intense growth, but it may also mean that consumers are simplifying their beauty routines or shifting their beauty buying online.

> Traffic to fitness and apparel chains – led by off-price – continued to grow YoY in 2025, as value and experiences continue to draw consumers.

> Consumers are shopping for accessible home decor upgrades to refresh their space rather than undertaking major renovations.

> Shoppers are holding off on big-ticket purchases, leading to YoY declines in the electronics and home improvement categories.

> Beauty has experienced softening traffic trends as the sector stabilizes following its recent years of hypergrowth as shoppers simplify routines and shift some of their spending online.

After two years of visit declines, the Home Furnishings category rebounded in 2025, with visits up 4.9% YoY between January and August. By contrast, Home Improvement continued its multi-year downward trend, though the pace of decline appears to have slowed.

So what’s fueling Home Furnishings’ resurgence while Home Improvement visits remain soft? Probably a combination of factors, including a more affluent shopper base and a product mix that includes a variety of lower-ticket items.

On the audience side, this category draws a much larger share of visits from suburban and urban areas, with a median household income well above that of home improvement shoppers. The differences are especially pronounced when analyzing the audience in their captured markets – indicating that the gap stems not just from store locations, but from meaningful differences in the types of consumers each category attracts.

Home improvement's larger share of rural visits is not accidental – home improvement leaders have been intentionally expanding into smaller markets for a while. But while betting on rural markets is likely to pay off down the line, home improvement may continue to face headwinds in the near future as its rural shopper base grapples with fewer discretionary dollars.

On the merchandise side, home improvement chains cater to larger renovations and higher-cost projects – and have likely been impacted by the slowdown in larger-ticket purchases which is also impacting the electronics space. Meanwhile, home furnishing chains carry a large assortment of lower-ticket items, including home decor, accessories, and tableware.

Consumers are still spending more time at home now than they were pre-COVID, and investing in comfortable living spaces is more important than ever. And although many high-income consumers are also tightening their belts, upgrading tableware or even a piece of furniture is still much cheaper than undertaking a renovation – which could explain the differences in traffic trends.

Traditional apparel, mid-tier department stores, and activewear chains all experienced similar levels of YoY traffic declines in 2025 YTD, as shown in the graph above. But analyzing traffic data from 2021 shows that each segment's dip is part of a trajectory unique to that segment.

Traffic to mid-tier department stores has been trending downward since 2021, a shift tied not only to macroeconomic headwinds but also to structural changes in the sector. The pandemic accelerated e-commerce adoption, hitting department stores particularly hard as consumers seeking one-stop shopping and broad assortments increasingly turned to the convenience of online channels.

Traffic to traditional apparel chains has also not fully recovered from the pandemic, but the segment did consistently outperform mid-tier department stores and luxury retailers between 2021 and 2024. But in H1 2025, the dynamic with luxury shifted, so that traffic trends at luxury apparel retailers are now stronger than at traditional apparel both YoY and compared to Q1 2019. This highlights the current bifurcation of consumer spending also in the apparel space, as luxury and off-price segments outperform mid-market chains.

In contrast, the activewear & athleisure category continues to outperform its pre-pandemic baseline, despite experiencing a slight YoY softening in 2025 as consumers tighten their budgets. The category has capitalized on post-lockdown lifestyle shifts, and comfort-driven wardrobes that blur the line between work, fitness, and leisure remain entrenched consumer staples several years on.

The two segments with the highest YoY growth – off-price and luxury – are at the two ends of the spectrum in terms of household income levels, highlighting the bifurcation that has characterized much of the retail space in 2025. And luxury and off-price are also benefiting from larger consumer trends that are boosting performance at both premium and value-focused retailers.

In-store traffic behavior reveals that these two segments enjoy the longest average dwell times in the apparel category, with an average visit to a luxury or off-price retailer lasting 39.2 and 41.3 minutes, respectively. This suggests that consumers are drawn to the experiential aspect of both segments – treasure hunting at off-price chains or indulging in a sense of prestige at a luxury retailer. Together, these patterns highlight that – despite appealing to different consumer groups – both ends of the market are thriving by offering shopping experiences that foster longer engagement.

> Off-price and luxury segments are outperforming, while general apparel, athleisure, and department store visits lag YoY under tariff pressures and consumer trade-downs.

> Looking over the longer term reveals that athleisure is still far ahead of its pre-pandemic baseline – even if YoY demand has softened.

> Luxury and off-price both are thriving by offering shopping experiences that foster longer engagement.

The beauty sector has long benefitted from the “lipstick effect” — the tendency for consumers to indulge in small luxuries even when discretionary spending is constrained. And while the beauty category’s softening in today’s cautious spending environment could suggest that this effect has weakened, a longer view of the data tells a more nuanced story.

Beauty visits grew significantly between 2021 and 2024, fueled by a confluence of factors including post-pandemic “revenge shopping,” demand for bolder looks as consumers returned to social life, and new store openings and retail partnerships. Against that backdrop, recent YoY traffic dips are likely a sign of stabilization rather than true declines. Social commerce, and minimalist skincare routines may be moderating in-store traffic, but shoppers are still engaged, even as they blend online and offline shopping or seek out lower-cost alternatives to maximize value.

Analysis of average visit duration for three leading beauty chains – Ulta Beauty, Bath & Body Works, and Sally Beauty Supply – highlights the shifting role but continued relevance of physical stores in the space.

Average visit duration decreased post-pandemic – likely due to more purposeful trips and increased online product discovery. But that trend began to reverse in H1 2025, signaling the changing role of physical stores. Enhanced tech for in-store product exploration and rich experiences may be helping drive deeper engagement, underscoring beauty retail’s staying power even in a more measured spending environment.

Bottom Line:

> Beauty’s slight YoY visit declines point to a period of normalization following a post-pandemic boom, while longer-term trends show the category remains stronger than pre-pandemic levels.

> Visits grew shorter post-pandemic, driven by more purposeful trips and increased online product discovery – but dwell time is now lengthening again, signaling renewed in-store engagement driven by tech-enabled discovery and immersive experiences.

Foot traffic data highlight major differences in the recent performance of various discretionary apparel categories. Off-price, fitness, and home furnishings are pulling ahead, well-positioned to keep capitalizing on shifting priorities. Luxury also remains resilient, likely thanks to its higher-income visitor base.

At the same time, beauty’s normalization and the slowdown in mid-tier apparel, electronics, and home improvement show that caution persists across discretionary budgets. Moving forward, retailers that align with consumers’ demand for value, accessible upgrades, and immersive experiences may be best placed to thrive in this era of selective spending.

.png)

1) Broad-based growth: All four grocery formats grew year-over-year in Q2 2025, with traditional grocers posting their first rebound since early 2024.

2) Value grocers slow: After leading during the 2022–24 trade-down wave, value grocer growth has decelerated as that shift matures.

3) Fresh formats surge: Now the fastest-growing segment, fueled by affluent shoppers seeking health, wellness, and convenience.

4) Bifurcation widens: Growth concentrated at both the low-income (value) and high-income (fresh) ends, highlighting polarized spending.

5) Shopping missions diverge: Short trips are rising, supporting fresh formats, while traditional grocers retain loyal stock-up customers and value chains capture fill-in trips through private labels.

6) Traditional grocers adapt: H-E-B and Harris Teeter outperformed by tailoring strategies to their core geographies and demographics.Bifurcation of Consumer Spending Help Fresh Format Lead Grocery Growth

Grocery traffic across all four major categories – value grocers, fresh format, traditional grocery, ethnic grocers – was up year over year in Q2 2025 as shoppers continue to engage with a wide range of grocery formats. Traditional grocery posted its first YoY traffic increase since Q1 2024, while ethnic grocers maintained their steady pattern of modest but consistent gains.

Value grocers, which dominated growth through most of 2024 as shoppers prioritized affordability, continued to expand but have now ceded leadership to fresh-format grocers. Rising food costs between 2022 and 2024 drove many consumers to chains like Aldi and Lidl, but much of this “trade-down” movement has already occurred. Although price sensitivity still shapes consumer choices – keeping the value segment on an upward trajectory – its growth momentum has slowed, making it less of a driver for the overall sector.

Fresh-format grocers have now taken the lead, posting the strongest YoY traffic gains of any category in 2025. This segment, anchored by players like Sprouts, appeals to the highest-income households of the four categories, signaling a growing influence of affluent shoppers on the competitive grocery landscape. Despite accounting for just 7.0% of total grocery visits in H1 2025, the segment’s rapid gains point to a broader shift: premium brands emphasizing health and wellness are emerging as the primary engine of growth in the grocery sector.

The fact that value grocers and fresh-format grocers – segments with the lowest and highest median household incomes among their customer bases – are the two categories driving the most growth underscores how the bifurcation of consumer spending is playing out in the grocery space as well. On one end, price-sensitive shoppers continue to seek out affordable options, while on the other, affluent consumers are fueling demand for premium, health-oriented formats. This dual-track growth pattern highlights how widening economic divides are reshaping competitive dynamics in grocery retail.

1) Broad-based growth: All four grocery categories posted YoY traffic gains in Q2 2025.

2) Traditional grocery rebound: First YoY increase since Q1 2024.

3) Ethnic grocers: Continued steady but modest upward trend.

4) Value grocers: Still growing, but slowing after most trade-down activity already occurred (2022–24).

5) Fresh formats: Now the fastest-growing segment, driven by affluent shoppers and interest in health & wellness.

6) Market shift: Premium, health-oriented brands are becoming the new growth driver in grocery.

7) Bifurcation of spending: Growth at both value and fresh-format grocers highlights a polarization in consumer spending patterns that is reshaping grocery competition.

Over the past two years, short grocery trips (under 10 minutes) have grown far more quickly than longer visits. While they still make up less than one-quarter of all U.S. grocery trips, their steady expansion suggests this behavioral shift is here to stay and that its full impact on the industry has yet to be realized.

One format particularly aligned with this trend is the fresh-format grocer, where average dwell times are shorter than in other categories. Yet despite benefiting from the rise of convenience-driven shopping, fresh formats attract the smallest share of loyal visitors (4+ times per month). This indicates they are rarely used for a primary weekly shop. Instead, they capture supplemental trips from consumers looking for specific needs – unique items, high-quality produce, or a prepared meal – who also value the ability to get in and out quickly.

In contrast, leading traditional grocers like H-E-B and Kroger thrive on a classic supermarket model built around frequent, comprehensive shopping trips. With the highest share of loyal visitors (38.5% and 27.6% respectively), they command a reliable customer base coming for full grocery runs and taking time to fill their carts.

Value grocers follow a different, but equally effective playbook. Positioned as primary “fill-in” stores, they sit between traditional and fresh formats in both dwell time and visit frequency. Many rely on limited assortments and a heavy emphasis on private-label goods, encouraging shoppers to build larger baskets around basics and store brands. Still, the data suggests consumers reserve their main grocery hauls for traditional supermarkets with broader selections, while using value grocers to stretch budgets and stock up on essentials.

1) Short trips surge: Under-10-minute visits have grown fastest, signaling a lasting behavioral shift.

2) Fresh formats thrive on convenience: Small footprints, prepared foods, and specialty items align with quick missions.

3) Traditional grocers retain loyalty: Traditional grocers such as H-E-B and Kroger attract frequent, comprehensive stock-up trips.

4) Value grocers fill the middle ground: Limited assortments and private label drive larger baskets, but main hauls remain with traditional supermarkets.

5) Fresh formats as supplements: Fresh format grocers such as The Fresh Market capture quick, specialized trips rather than weekly shops.

While broad market trends favor value and fresh-format grocers, certain traditional grocers are proving that a tailored strategy is a powerful tool for success. In the first half of 2025, H-E-B and Harris Teeter significantly outperformed their category's modest 0.6% average year-over-year visit growth, posting impressive gains of 5.6% and 2.8%, respectively. Their success demonstrates that even in a polarizing environment, there is ample room for traditional formats to thrive by deeply understanding and catering to a specific target audience.

These two brands achieve their success with distinctly different, yet equally focused, demographic strategies. H-E-B, a Texas powerhouse, leans heavily into major metropolitan areas like Austin and San Antonio. This urban focus is clear, with 32.6% of its visitors coming from urban centers and their peripheries, far above the category average. Conversely, Harris Teeter has cultivated a strong following in suburban and satellite cities in the South Atlantic region, drawing a massive 78.3% of its traffic from these areas. This deliberate targeting shows that knowing your customer's geography and lifestyle remains a winning formula for growth.

1) Traditional grocers can still be competitive: H-E-B (+5.6% YoY) and Harris Teeter (+2.8% YoY) outpaced the category average of +0.6% in H1 2025.

2) H-E-B’s strategy: Strong urban focus, with 32.6% of traffic from major metro areas like Austin and San Antonio.

3) Harris Teeter’s strategy: Suburban and satellite city focus, with 78.3% of traffic from South Atlantic suburbs.