.svg)

.png)

.png)

.png)

.png)

Our latest white paper, Who’s in the Stands? An In-Depth Look at Arena and Stadium Visits, uses location intelligence tools to uncover the demographic and psychographic characteristics of sporting events attendees – including Super Bowl fans. Below is a taste of our findings. For the full report, click here.

As the biggest game of the year, the Super Bowl usually brings a tourism boom to the host city. The heat map below depicts the origins of travelers to the past three Super Bowls (excluding Super Bowl LV in 2021 which was held under COVID restrictions). Year after year, the distribution of Super Bowl attendees is relatively similar to the country’s population distribution – which means, perhaps unsurprisingly, that the most densely populated regions are well-represented at the game.

But the data also reveals that many Super Bowl attendees travel from the regions where the competing teams are based, which indicates that die-hard fans are willing to make the trip to see their local team potentially win a championship. The map also shows that visitors from the Super Bowl’s host city and surrounding areas are heavily represented at the game, regardless of whether or not a local team is playing. It’s likely that a significant number of football fans who live nearby take advantage of the rare opportunity to see a Super Bowl close to home.

Super Bowl LVI in 2022, for example, was played at SoFi Stadium in Los Angeles, CA between the Cincinnati Bengals and the Los Angeles Rams. The event was heavily visited by fans from Southern California as the game was not only being played by the LA Rams, but also at their home stadium in Inglewood, CA. A greater contingent than previous years was also in attendance from Cincinnati, OH and its surrounding areas.

Many fans travel to the Super Bowl from the same regions every year, with the host city and the contending teams’ hometowns also providing significant factions of attendees. But analyzing Super Bowl crowds throughout the years also reveals an important demographic shift taking place among those traveling to the Super Bowl – the growing number of family-oriented visitors.

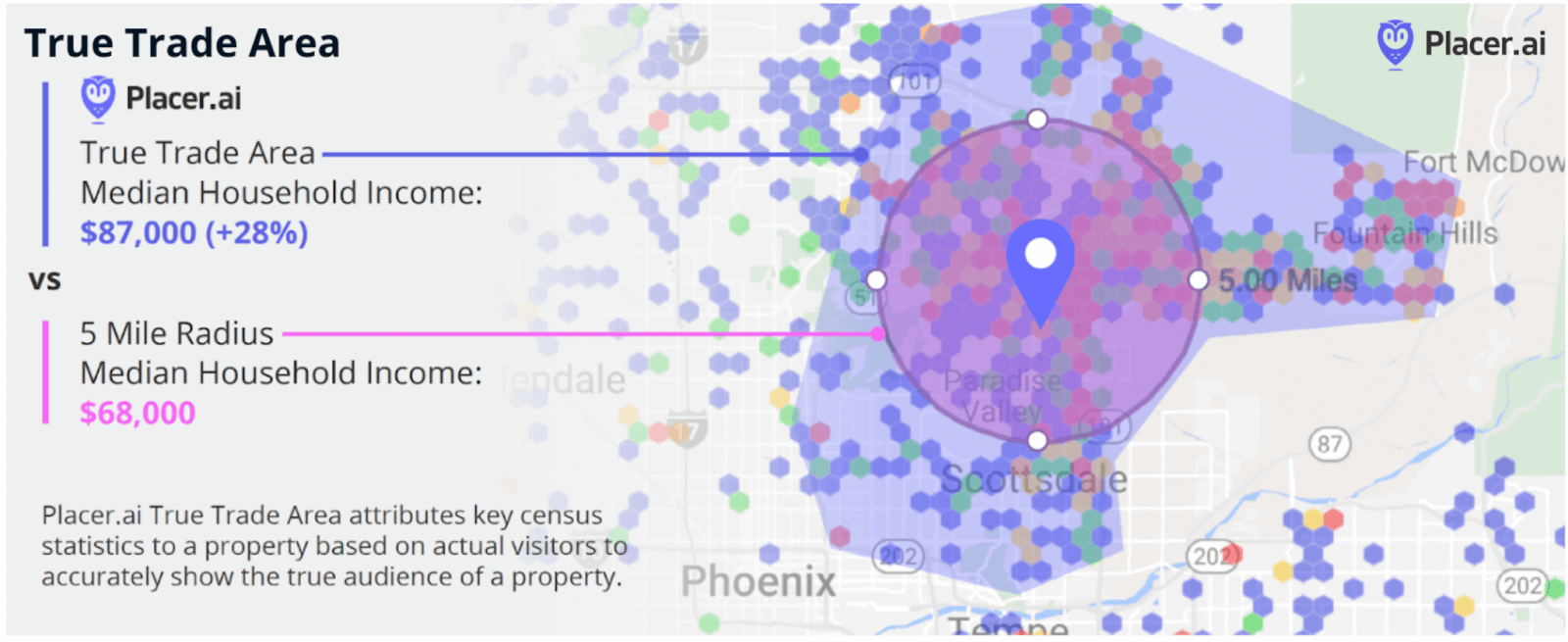

Since 2019, the True Trade Areas of the Super Bowl stadiums include increasingly greater shares of larger families. Last year’s Super Bowl LVI had an in-person audience that reflected a trade area in which 17.9% of residents came from families of five or more, up from 11.9% at the Super Bowl three years prior. Conversely, Super Bowl attendees in 2022 reflected a trade area in which 37.7% of residents were part of two-person households, a decrease from 47.8% in 2019.

The increase in attendees from areas with larger families could reflect the NFL’s initiatives to make football a more family-friendly sport, including rule and equipment changes aimed at increasing player safety and supporting youth football clubs. The trend towards an increase in attendees from larger families may also inform decisions about products to promote as well as amenities that will contribute to a family-friendly experience on game day.

Brands invest heavily in ads that air during the Super Bowl. But with the right insights, stadium advertising platforms have tremendous potential to reach target audiences in-person at the big game. While a large audience is part of the equation, in order to achieve maximum impact, an in-depth understanding of visitors is critical.

For more insights into sports events attendees, read the full report here.

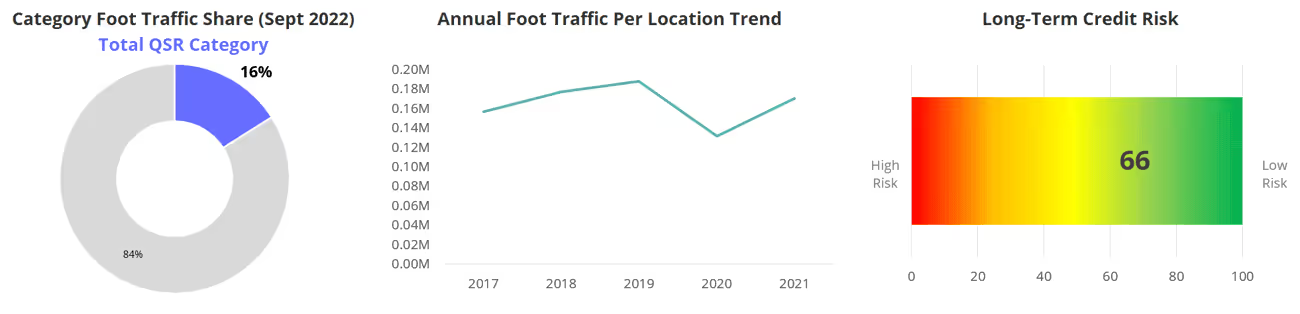

Key McDonald's Metrics

While focus and streamlined operations are key to restaurant growth strategies, we also continue to see evidence of the impact of innovation and nostalgia in driving visits. McDonald’s has had success with its past celebrity meal collaborations with Travis Scott and J Balvin, with our data indicating a mid-to-high teens lift in visits compared to the weeks prior to the promotion. However, McDonald’s "Adult Happy Meal" collaboration with streetwear brand Cactus Plant Flea Market might be its most successful collaboration today, with data suggesting more than a 30% increase in in-store visitation trends compared to the weeks leading up to the promotion (below). We’ve discussed the impact of limited-time offers (LTO) in the QSR space earlier this year, but McDonald’s has set a new bar for the industry (beating out Taco Bell’s Mexican Pizza launch in May).

Although QSR chains saw more resilient visitation trends than other restaurant categories for much of 2022, the gap between the QSR, fast casual, and full-service restaurant chains had narrowed in September as lower-income consumers continue to face inflationary headwinds from menu price hikes across the QSR space while higher-end consumers continue to dine out. Nevertheless, the impact of McDonald’s adult happy meal promotion is evident in not only the massive spike in visitation trends for the full QSR sector last week (below). While not everyone may love these promotions, they can be an extremely effective way to drive visitation growth.

We, the founding team, always loved data - ideating around it, engineering with it, understanding the world better with it.

But what captivated us most was imagining data products that can be used by tens of thousands of businesses across the world.

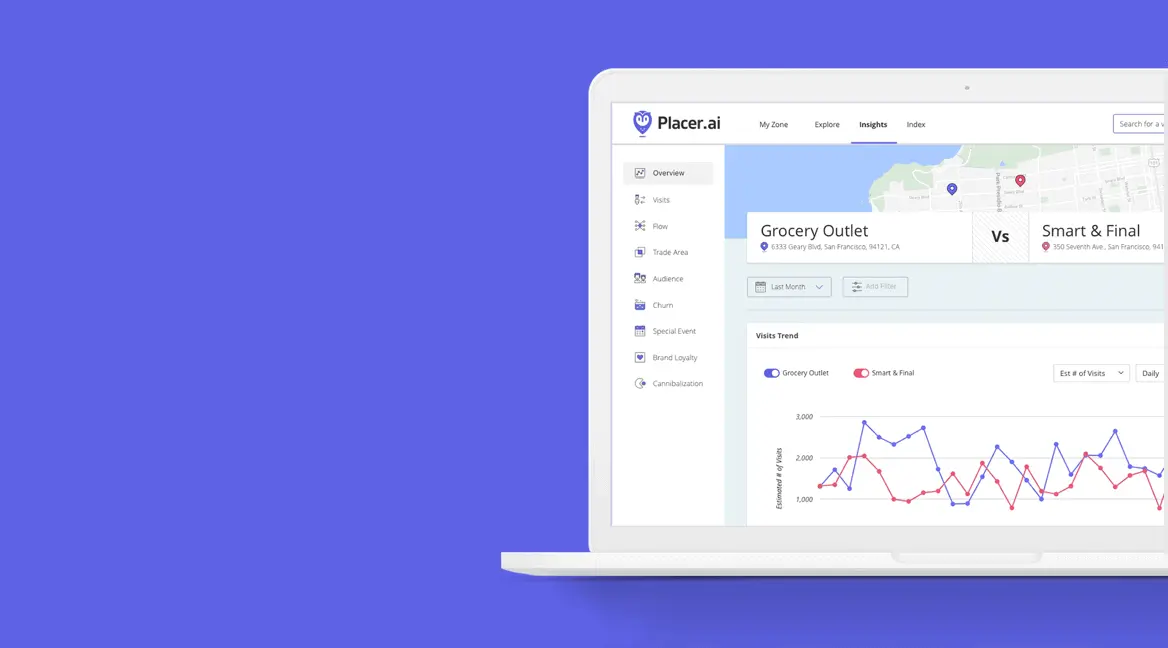

Among all the ideas and visions we bounced around before starting the company, one stood out for its simplicity and potential impact - building a ‘Physical Market Intelligence Platform’ to provide everyone in the offline world (a.k.a the ‘real world’) with aggregate insights for decision-making. Or in layman’s terms, “a dashboard to get instant insights for any place to understand its audience, surroundings, and competition”.

In 2016, the Placer founding team gathered in a basement and spent a weekend sketching out a plan to turn this idea into a massive world-class data company.

Whiteboarding without customers or tech debt is fun!!!

The more paper we stuck to that basement wall, the bigger the vision became! Everything is possible with the stroke of a pen…

But very quickly, we hit some glaring challenges:

The best way to approach a big challenge is breaking it down into smaller ones. So we worked hard to define Phase 1 - focusing on building a product that (1) was centered around the mobile location analytics dataset and (2) generated reports tailored for CRE and retail.

5 years and 5 funding rounds later, we’re FINALLY feeling “pretty good” about Phase 1: we launched a world-class mobile analytics product that’s used by over 1,000 customers, and thousands more are using our free products.

But it’s also been “frustrating” - we were always strapped for cash and resources. We’re yet to integrate most of the datasets we need; key reports for certain verticals remain in the product pipeline; and in terms of usability and workflow features, we still have a lot to do in order to create a truly comprehensive platform (vs “read only” status insights tool).

That’s why the $100M Series C funding we just announced is so momentous for me and the rest of the Placer team. It finally removes the shackles and equips us with the tools and materials we need for Phase 2 - rapidly building the full Placer.ai Market Intelligence Platform.

So let’s dive into what that means…

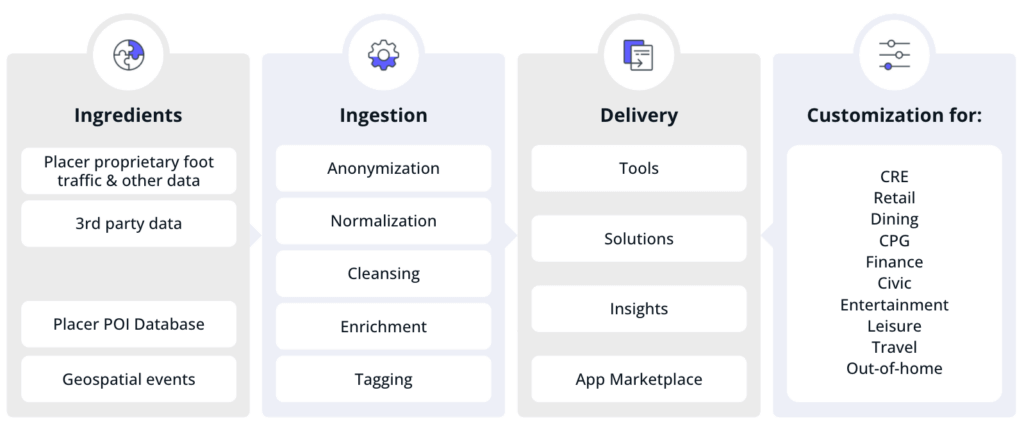

A Physical Market Intelligence Platform is a big data puzzle. Piecing it together - in a nutshell - consists of four phases:

A vast amount of interconnected data is required to create a truly accurate and complete picture of what’s going on at a location. This data falls into two broad categories:

Now consider all things you see going on in the world and imagine how POI and geospatial data can capture and quantify them…

Here’s a snippet:

We track dozens of data categories and thousands of datasets and vendors in order to identify new data that can help answer our customers’ questions.

This is 50% of our work and is a huge data challenge - but also great fun!

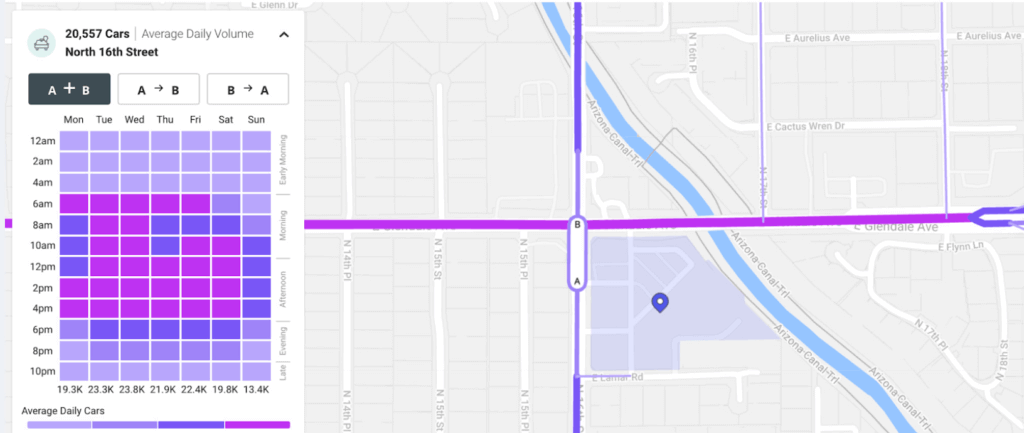

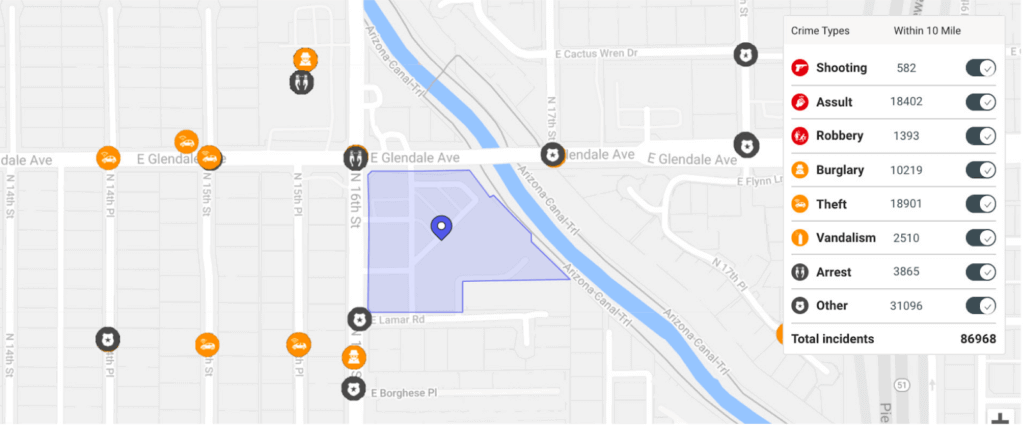

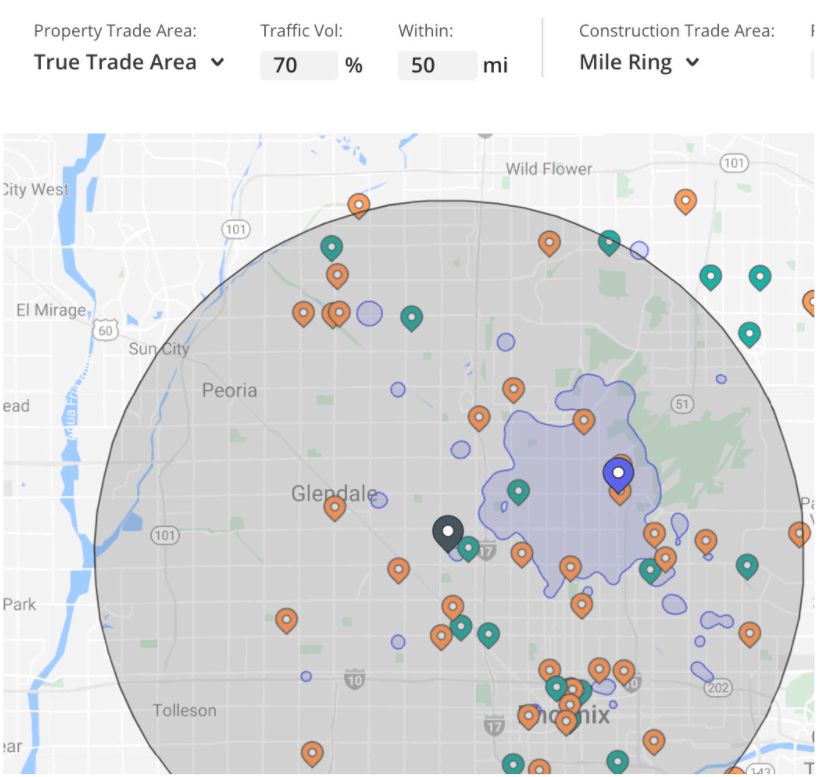

Through partnerships and our App Marketplace, we’ve recently integrated online reviews, credit card data, demographics, vehicle traffic volume, crime figures and planned construction into our platform. And we have lots more datasets in our pipeline: retail sales, property sales, financial data, leasing comparisons and climate data to name just a few.

If the data are the ingredients, then ingestion is the cooking. This includes complex data science processes:

Tagging data to POIs is a massive task. Placer’s POI database contains millions of entities: a commercial real estate asset in a customer’s portfolio; stores of a retailer’s chain or that hold a CPG brand’s products; a billboard used for out-of-home advertising; a downtown area being regenerated by a municipality or business improvement district. We geofence each one so data can be tagged to it.

But a much greater complexity than the volume of data-POI matching is the fact that our data structure is mutable - it changes. Stores, restaurants, strip malls and other POIs open, close, merge and move. Our physical environment is constantly changing. One of our platform’s standout attributes is that it always reflects historical change.

In practice, this means that, for each POI change, we not only adjust our data tagging but also re-tag 5 years of historical data to ensure any historical comparisons are “like with like”. This is a huge investment of resources on the part of our data science, devops and engineering teams - exponentially increasing our data management burden.

To complete the cooking metaphor, after selecting ingredients (datasets) and cooking them (data ingestion), we then lay out a buffet-style feast of solutions for our users:

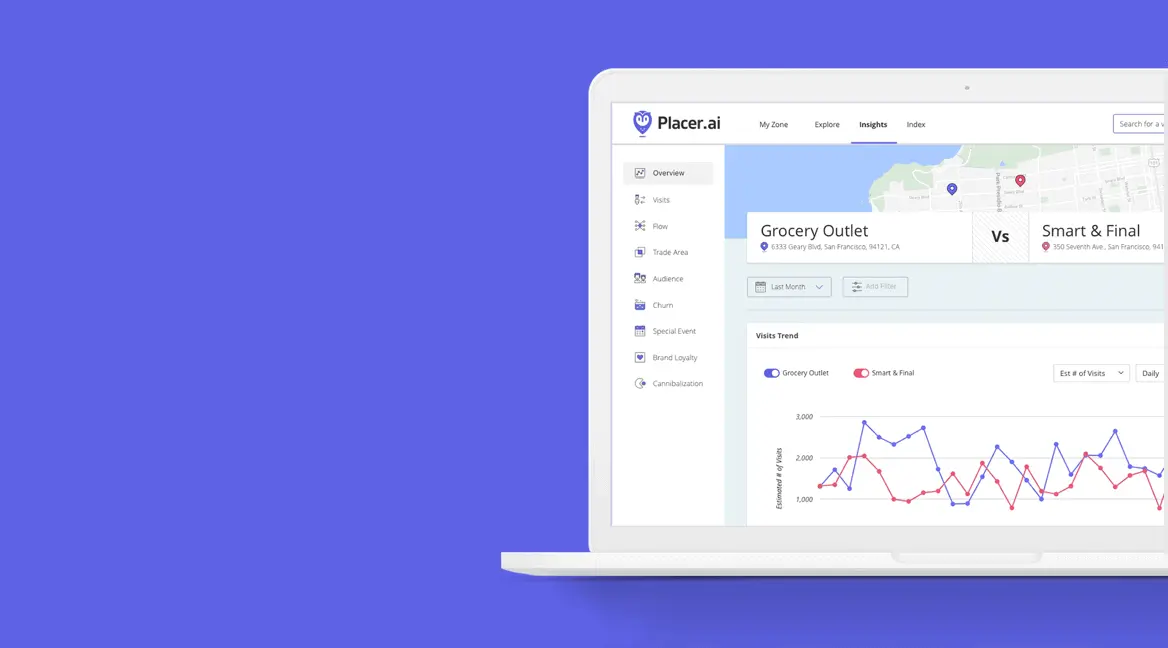

The most basic level of the platform is converting the data into real-world constructs that can be understood by industry professionals: tables, charts, maps and other graphics displaying cross shopping, trade areas (below), cannibalization, risk analysis, visit frequency and so on.

A key tenet of the Market Intelligence Platform is the approach that insights like those are often not the answer to the questions that our customers are looking for. Rather, they are just part of the explanation behind the answer. That means providing a comprehensive suite of Solutions SUPPORTED by insights, not just a library of uncontextualized insights.

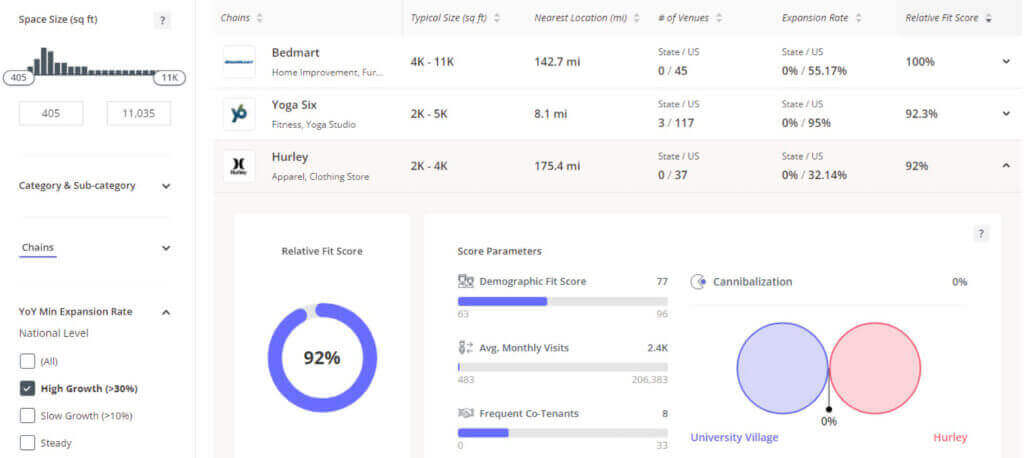

An excellent example of this is Void Analysis. A key question for retail real estate is “who is my ideal tenant?” While our platform offered important insights (such as retailers’ average monthly foot traffic and cannibalization) for reaching an answer, landlords were doing a lot of legwork. The Void Analysis tool we released late last year enables CRE professionals to instantly analyze thousands of potential tenants through automatically generated reports that include ranking according to our unique Relative Fit Score. This significantly improves the speed and scope of a search for new tenants.

We are now working on the many additional solutions like Void Analysis in our development pipeline - sales forecasting, site selection for retail chains, market selection, market change reports, product optimization for CPG to name a few.

To be truly useful, solutions must also be delivered in a way that fits various users’ workflows. A dashboard is a good start, but a full platform must offer a range of access points. This means data feeds, REST APIs, and other methods of programmatic access.

We’ll also add to that a rich layer of data exploration tools such as GIS, templates, graph builders, pivot table functionality and advanced entity search. This will provide users with maximum flexibility in how they explore and visualize our data.

The lion’s share of the work is still ahead of us here - more widgets, third party integrations, report generators, scheduled intelligence reports and alerts, and much more.

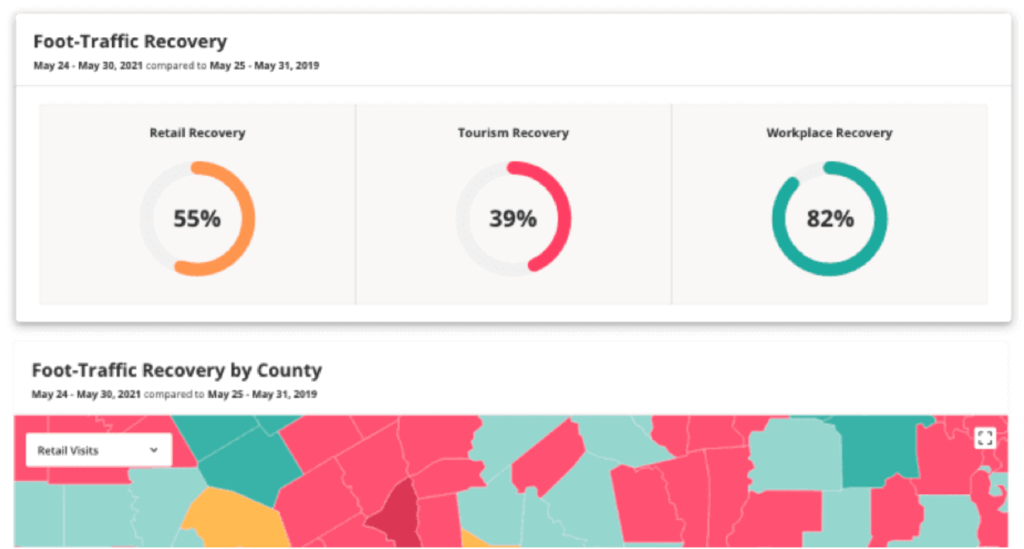

The platform’s user interface must be fully customized to fit the needs of its different user types across verticals AND within companies (business users, data scientists, data analysts, third party users). An example of how we’ve begun to do this is a portfolio overview section for CRE analysts to rapidly scan properties’ performance metrics. Another is our COVID-19 Recovery Dashboard, particularly used by civic organizations to assess the impact of the pandemic on local economic areas.

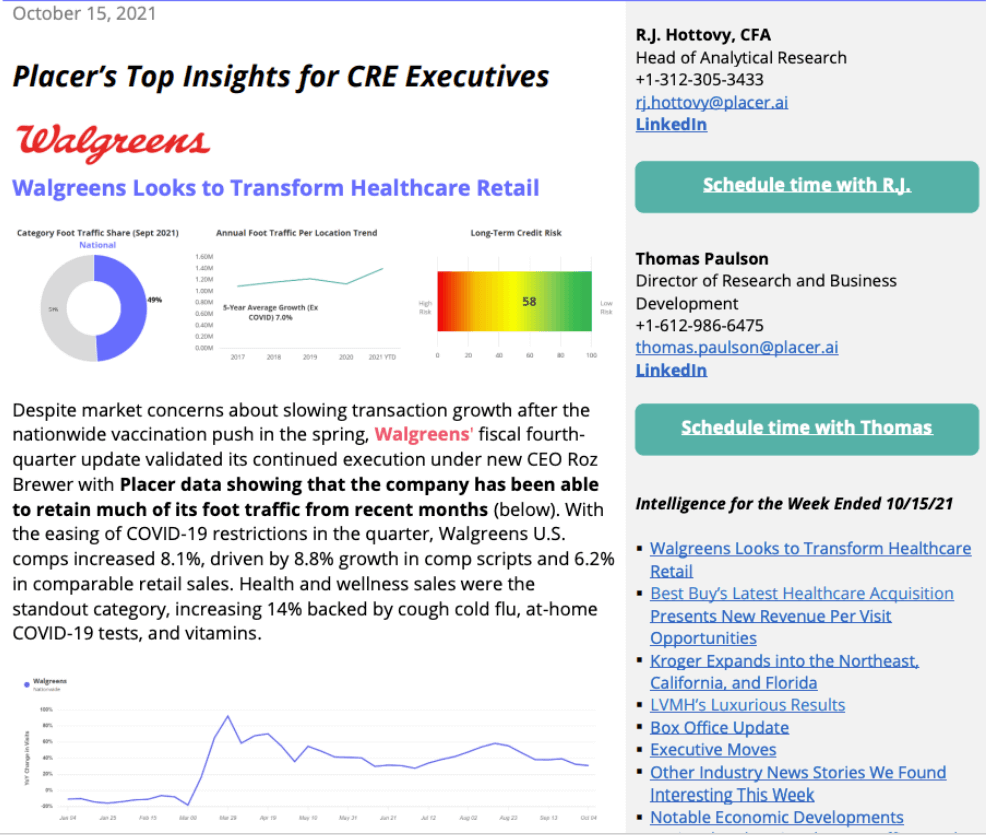

As we presented “just data”, we quickly realized some customers were looking for humans to add a “research layer” and context around the data. So an analytical research team has become part of the product. They capture and present key market intelligence, respond to the latest industry trends and customer interests. “The Anchor”, a weekly CRE executive intelligence report launched last September, has now become an inbox staple for many of our customers.

To our current understanding, we’re just “5%” of the way to our Market Intelligence Platform vision. The remaining 95% will be built by scaling POI coverage, datasets, answering more questions and developing the other core components of the platform.

So our focus now is on ramping up the velocity of this development. And to do that, we need even more of the world’s best talent across the company.

So, during 2022, we will use our new capital to double the size of our engineering team and significantly expand the data at our disposal. In parallel, we will also channel more resources to supporting our customers and contributing to industry understanding through our analytical research department and educational content.

Placer.ai is committed to transforming the way real-world businesses make decisions. And we don’t want to waste any time going about it.

LOS ALTOS, CA (January 12, 2021)--Placer.ai, the leader in location analytics and foot traffic data, announced today the closing of a $100M Series C funding round at a $1B valuation. The round was led by Josh Buckley with participation from WndrCo, Lachy Groom, MMC Technology Ventures LLC, Fifth Wall Ventures, JBV Capital, and Array Ventures. The round also included the participation of leading commercial real estate investors and operators, including J.M. Schapiro (Continental Realty Corp), Eliot Bencuya and Jeff Karsh (Tryperion Partners), Daniel Klein (Klein Enterprises/Sundeck Capital), Majestic Realty, and others. The funding will be used to expand the company’s R&D capabilities to further increase the pace of innovation.

“Placer experienced significant growth during 2021 as a consensus formed across the market that accurate, reliable consumer behavior analytics is indispensable to brick and mortar decision-making,” said Noam Ben-Zvi, CEO and Co-Founder of Placer.ai. “Yet, location analytics is just the foundation for a much broader and more comprehensive vision. With this funding, we will accelerate the development of the Placer.ai platform, adding an unprecedented range of new data sets - such as vehicle traffic, planned construction, web traffic, purchase data, and much more - as well as more advanced solutions to empower any professional with a stake in the physical world to make better decisions, faster than ever before. ”

Since launching in November 2018, Placer.ai has been adopted by over 1,000 customers including industry leaders in commercial real estate and retail like JLL, Regency Centers, Taubman, Planet Fitness, BJ’s Wholesale Club, and Grocery Outlet. In the wake of COVID-driven upheaval, the company saw widespread adoption among a series of new categories, among them hedge funds and CPG leaders including Tyson Foods and Reckitt Benckiser.

"Placer provides instant, simple and actionable insights to questions we've been asking as operators for over 30 years. The pace of innovation, the unique trust that the company has developed, and the massive market demand all point to the magnitude and scale of what this team can achieve,” said Jeffrey Katzenberg, Founding Partner of WndrCo.

"We have long felt like the disruption Placer can bring is massive, but the market demand has far exceeded our initial expectations," said Josh Buckley. “We see a powerful opportunity to continue partnering with Placer to improve the way decisions are made in the physical world, fundamentally improving the way these businesses and organizations operate."

Try Placer.ai for free here.

About Placer.ai:

Placer.ai is the most advanced foot traffic analytics platform allowing anyone with a stake in the physical world to instantly generate insights into any property for a deeper understanding of the factors that drive success. Placer.ai is the first platform that fully empowers professionals in retail, commercial real estate, hospitality, economic development, and more to truly understand and maximize their offline activities. Find more information here: https://placer.ai/

LOS ALTOS, CA (April 27, 2021) --Placer.ai, the leader in location analytics and foot traffic data, announced today the close of a $50M Series B funding round. The round was led by Josh Buckley, Todd Goldberg and Rahul Vohra, with participation from Fifth Wall, JBV Capital and Aleph VC. The funding will be used to grow the company’s R&D, expand sales and marketing teams, introduce additional reports and data sets, and grow the recently announced marketplace.

Since launching in November 2019, Placer.ai has been adopted by over 500 customers including industry leaders in Commercial Real Estate and Retail like JLL, Brixmor, Taubman, Planet Fitness, and Dollar General. Yet, the recent upheaval caused by COVID led to widespread adoption among a series of new categories including Hedge Funds and CPG leaders.

“As a business deeply rooted in offline retail, we expected COVID to present a unique challenge. Yet, adoption actually increased as a result of our ability to introduce certainty into such an uncertain environment. The result has been a clearer and deeper understanding by the market of the absolute imperative of location data to improve the decision-making process,” said Placer.ai CEO and Co-Founder Noam Ben-Zvi.

“But our current offering is just the beginning, and we are fully focused on expanding the capabilities both through the development of a range of new features and tools, and the integration of a wide range of data sets through our marketplace. Placer.ai is rapidly becoming the market intelligence platform for anyone with a stake in the physical world.”

In the last year, Placer.ai continued to expand its presence in core markets like Commercial Real Estate, Retail, Municipal governments, and Hospitality while advancing into new segments like CPG and Hedge Funds. The result has been growing market adoption and an increasingly large and diverse reach.

"Fifth Wall has some of the largest owners and operators of real estate as our limited partners and several were customers of Placer.ai, giving us a unique perspective on the company’s growth and potential. We saw firsthand the impact that the data is already having in reimagining the way business is done in retail and real estate broadly,” said Kevin Campos, Partner on the Retail & Consumer Investment team at Fifth Wall. “Yet, what’s even more exciting is that we’re still only seeing a piece of the puzzle and know that there are so many other sectors where the data can be applied. We’re thrilled to help grow and execute this vision alongside this exceptional team.”

"Placer allows businesses that operate offline to make data-driven decisions, fundamentally improving the way they operate. This is the same type of tooling that online businesses have used to grow, moving from hunches to definitive answers," said Josh Buckley. “I'm excited to be partnering with the company's next phase of growth and product development."

“Our journey with Placer.ai started at the very beginning as one of the company's first beta customers. Seeing the disruptive power of the product up close, the speed at which the company developed new features, and the tremendous traction they achieved in the marketplace led us to invest less than a year later and in every round since," said Sandy Sigal, CEO of NewMark Merrill Companies, an owner and developer of over 80 shopping centers and Chairman of BrightStreet Ventures, their venture capital arm. "Several years later, the customer growth, their ongoing product development, and the continuing value they have brought to our organization has only deepened our conviction and makes continued support a no-brainer for us."

Learn more about Placer.ai.

The Fitness industry was a major post-pandemic winner. Visits to gyms across the country surged as stay-at-home orders ended and people returned to their in-person workout routines. And even as consumers reduced discretionary spending in the face of inflation, they kept going to the gym – finding room in their budgets for the chance to embrace wellness and get in shape while interacting with other people.

But no category can sustain such unabated growth forever – and as the segment inevitably stabilizes, gyms will need to stay nimble on their feet to maintain their competitive edge.

This white paper takes a closer look at the state of Fitness as the category transitions into a more stable growth phase following two years of outsize post-pandemic demand. The report digs into the location analytics to reveal how the Fitness space has changed – and what strategies gyms can adopt to stay ahead of the pack.

*This report excludes locations within Washington state due to local legislation.

Monthly visits to the Fitness category have grown consistently year over year (YoY) since early 2022, when COVID subsided and gyms returned to full capacity. And the segment is still doing remarkably well. Even in January and March 2024 – when visits were curtailed by an Arctic blast and by the Easter holiday weekend – YoY Fitness visits remained positive, despite the comparison to an already strong 2023.

Still, recent months have seen smaller YoY increases than last year, indicating that the Fitness category is entering a more normalized growth phase.

By keeping a close watch on evolving consumer preferences, fitness chains can uncover new opportunities for growth and adaptation within a stabilizing market – including leaning into increasingly popular dayparts.

Examining the evolving distribution of gym visits by daypart over the past six years shows that major shifts were brought on by the COVID-19 pandemic.

Between Q1 2019 and Q1 2021, as remote work took hold, gyms saw their share of 2:00 PM - 5:00 PM visits increase from 15.8% to 18.6%. Though this trend partially reversed as the pandemic receded, afternoon visits remained elevated in Q1 2024 compared to pre-COVID – likely a reflection of hybrid work patterns that leave people free to take an exercise break during their workdays.

At the same time, the share of morning visits to fitness chains (between 8:00 AM and 11:00 AM) dropped from 20.5% in Q1 2019 to 17.2% in Q1 2024, while evening visits (between 8:00 PM and 11:00 PM) increased from 11.3% to 13.2%.

Gyms that recognize this changing behavior can adapt to new workout preferences – whether by incentivizing morning visits, scheduling popular classes mid-afternoon, or offering extended evening hours.

In fact, the data indicates that gyms that are leaning into the evening workout trend are already finding success: Of the top 12 most-visited gym chains in the country, those that saw bigger increases in their shares of evening visits also tended to see greater YoY visit growth.

EōS Fitness and Crunch Fitness, for example, have seen their shares of evening visits grow by 5.5% and 3.4%, respectively, since COVID – and in Q1 2024, their YoY visits grew by 29.0% and 21.8%, respectively. Other chains, including 24 Hour Fitness and Chuze Fitness, experienced similar shifts in visit patterns. At the same time, LA Fitness saw just a minor increase in its share of evening visits between Q1 2019 and Q1 2024, and a correspondingly small increase in YoY visits.

As the evening workout slot gains popularity, gym operators that can adapt to these new trends and encourage evening visits may see significant benefits in the years to come.

Diving into demographic data for the analyzed gym chains sheds light on some factors that may be driving this heightened preference for evening workouts at top-performing gyms.

The four fitness chains that experienced the greatest YoY visit boosts in Q1 – Crunch Fitness, EōS Fitness, 24 Hour Fitness, and Chuze Fitness – all featured trade areas with significantly higher-than-average shares of Young Professionals and Non-Family Households. (STI: PopStat’s Non-Family Household segment includes households with more than one person not defined as family members. Spatial.ai: PersonaLive’s Young Professional consumer segment includes young professionals starting their careers in white collar or technical jobs.)

In plainer terms, these consumer segments – typically young, well-educated, and without children – and therefore more likely to be flexible in their workout times – are driving visits to some of the best-performing gyms across the country. And these audiences seem to be displaying a preference for nighttime sweat sessions – a factor that gyms can take into account when planning programming and marketing efforts.

Leaning into emerging gym visitation patterns is one way for fitness chains to thrive in 2024 – but it isn’t the only marker of success for the segment. Even after years of visit growth, the market remains open to new opportunities and innovations that meet health-conscious consumers where they are.

STRIDE Fitness, a gym that offers treadmill-based interval training, has sparked a trend among running enthusiasts. This niche player is finding success, particularly among a specific demographic: runners and endurance training enthusiasts.

Between January and April 2024, monthly YoY visits to STRIDE Fitness consistently outperformed the wider Fitness space. A standout month was January, when STRIDE Fitness’s visits soared by an impressive 33.6% YoY, surpassing the industry average of 5.7% for the same period.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – suggests that STRIDE Fitness’ trade areas are well-positioned to attract those visitors most open to its offerings. Residents of STRIDE Fitness’s potential market are 24% more likely to be, or to be interested in, Endurance Athletes than the nationwide average – compared to just 3% for the Fitness industry as a whole. Similar patterns emerge for Marathon Runners and Triathlon Participants. This indicates that the chain is well-situated near consumers with a passion for endurance sports and long distance running, helping it maintain a competitive edge in the crowded gym market.

Pickleball, a game that blends elements of tennis, ping pong, and badminton, is the fastest-growing sport in the country. And recognizing its broad appeal, some fitness chains have begun incorporating pickleball courts into their facilities.

Arizona-based EōS Fitness added a pickleball court at a Phoenix, AZ location – and early 2024 data highlights the impact of this addition. Between January and April 2024, the location drew between 9.1% and 33.3% more monthly visits than the chain’s Arizona visit-per-location average.

And analyzing the demographic profile of the chain’s location with a pickleball court reinforces the game’s increasingly wide appeal. Young consumer segments have been embracing the game in large numbers – and the Phoenix EōS Fitness location’s potential market includes a significantly higher share of 18 to 34-year-olds than the chain’s overall Arizona potential market. Residents of the pickleball location’s trade area are also less affluent than the chain’s Arizona average.

Pickleball has typically been associated with more affluent consumer segments, and it seems like this may be shifting. With more people than ever embracing the game, gyms that choose to add courts to their facilities may reap the foot traffic benefits.

The Fitness industry has undergone a significant transformation since COVID-19. The category’s outsize post-pandemic visit growth has begun to stabilize, and gyms are staying ahead by adapting to changing consumer preferences. Evenings are emerging as crucial dayparts for gym operators, likely driven by younger consumer segments. And niche fitness chains are seeing visit success, proving that there are plenty of ways for the Fitness segment to succeed.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Grabbing a coffee or snack at a convenience store is a time-honored road trip tradition – but increasingly, Convenience Stores (C-Stores) have also emerged as places people go out of their way to visit.

Convenience stores have thrived in recent years, making inroads into the discretionary dining space and growing both their audiences and their sales. Between April 2023 and March 2024, C-Stores experienced consistent year-over-year (YoY) visit growth, generally outperforming Overall Retail. Unsurprisingly, C-Stores fell behind Overall Retail in November and December 2023, when holiday shoppers flocked to malls and superstores to buy gifts for loved ones. But in January 2024, the segment regained its lead, growing YoY visits even as Overall Retail languished in the face of an Arctic blast that had many consumers hunkering down at home.

C-Stores’ current strength is partially due to the significant innovation by leading players in the space: Chains like Casey’s, Maverik, Buc-ee’s, and Rutter’s are investing in both in their product offerings and in their physical venues to transform the humble C-Store from a stop along the way into a bona fide destination. Dive into the data to explore some of the key strategies helping C-Stores drive consumer engagement and stay ahead of the pack.

While chain expansion may explain some of the C-Store segment growth, a look at visit-per-location trends shows that demand is growing at the store level as well. Over the past year (April 2023 to March 2024), average visits per location on an industry-wide basis grew by 1.8%, compared to the year prior (April 2022 to 2023).

And within this growing segment, some brands are distinguishing themselves and outperforming category averages. Casey’s, for example, saw the average number of visits to each of its locations increase by 2.3% over the same time frame – while Maverik, Buc-ee’s and Rutter’s saw visits per location increase by 3.2%, 3.4% and 3.9%, respectively.

Each in its own way, Casey’s, Maverik, Buc-ee’s, and Rutter’s, are helping to transform C-Stores from pit stops where people can stretch their legs and grab a cup of coffee to destinations in and of themselves.

Midwestern gas and c-store chain Casey’s – famous for its breakfast pizza and other grab-and-go breakfast items – has emerged as a prime spot for fast food pizza lovers to grab a slice first thing in the morning. And Salt Lake City, Utah-based Maverik – which recently acquired Kum & Go and its 400-plus stores – is also establishing itself as a breakfast destination thanks to its specialty burritos and other chef-inspired creations.

Casey’s and Maverik’s popular breakfast options are likely helping the chains receive its larger-than-average share of morning visits: In Q1 2024, 16.3% of visits to Maverik and 17.5% of visits to Casey’s took place during the 7:00 AM - 10:00 AM daypart, compared to just 14.9% of visits to the wider C-Store category.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – also suggests that Casey’s and Maverik’s have opened stores in locations that allow them to reach their target audience. Compared to the average consumer, residents of Casey’s potential market are 7% more likely to be “Fast Food Pizza Lovers” than both the average consumer and the average C-Store trade area resident. Residents of Maverik’s potential market are 16% more likely than the average consumer to be “Mexican Food Enthusiasts,” compared to residents of the average C-Store’s trade area who are only 1% more likely to fall into that category.

With both chains expanding, Casey’s and Maverik can hope to introduce new audiences to their unique breakfast options and solidify their hold over the morning daypart within the C-Store space over the next few years.

Everything is said to be bigger in the Lone Star State, and Texas-based convenience store chain Buc-ee’s – holder of the record for the worlds’ largest C-Store – is no exception. With a unique array of specialty food items and award-winning bathrooms, Buc-ee’s has emerged as a well-known tourist attraction. And the popular chain’s status as a visitor hotspot is reflected in two key metrics.

First, Buc-ee’s attracts a much greater share of weekend visits than other convenience store chains. In Q1 2024, 39.6% of visits to Buc-ee’s took place on the weekends, compared to just 28.3% for the wider C-Store industry. And second, Buc-ee’s captured markets feature higher-than-average shares of family-centric households – including those belonging to Experian: Mosaic’s Suburban Style, Flourishing Families, and Promising Families segments.

Rather than merely a place to stop on the way to work, Buc-ee’s has emerged as a favored destination for families and for people looking for something fun to do on their days off.

Buc-ee’s isn’t the only C-Store chain that believes bigger is better. Pennsylvania-based Rutter’s is increasing visits and customer dwell time by expanding its footprint – both in terms of store count and venue size. New stores will be 10,000 to 12,000 square feet – significantly larger than the industry average of around 3,100 square feet. And in more urban areas, where space is at a premium, the company is building upwards.

Rutter’s added a second floor to one of its existing locations in York, PA in December 2023. The remodel, which was met with enthusiasm by customers, provided additional seating for up to 30 diners, a beer cave, and an expanded wine selection. And in Q1 2024, the location experienced 15.6% YoY visit growth – compared to a chainwide average of 7.6%. Visitors to the newly remodeled Rutter’s also stayed significantly longer than they did pre-renovation. The share of extended visits to the store (longer than ten minutes) grew from 20.8% in Q1 2023 to 27.0% in Q1 2024 – likely from people browsing the chain’s selection of beers or grabbing a bite to eat.

Convenience stores are flourishing, transforming into some of the most exciting dining and tourist destinations in the country. Today, C-Store customers can expect to find brisket sandwiches, gourmet coffees, or craft beers, rather than the stale cups of coffee of old. And the data shows that customers are receptive to these innovations, helping drive the segment’s success.

The first quarter of 2024 was generally a good one for retailers. Though unusually cold and stormy weather left its mark on the sector’s January performance, February and March saw steady year-over-year (YoY) weekly visit growth that grew more robust as the quarter wore on.

March ended on a high note, with the week of March 25th – including Easter Sunday – seeing a 6.1% YoY visit boost, driven in part by increased retail activity in the run-up to the holiday. (Last year, Easter fell on April 9th, 2023, so the week of March 25th is being compared to a regular week.)

Though prices remain high and consumer confidence has yet to fully regain its footing, retail’s healthy Q1 showing may be a sign of good things to come in 2024.

Drilling down into the data for leading retail segments demonstrates the continued success of value-priced, essential, and wellness-related categories.

Discount & Dollar Stores led the pack with 11.2% YoY quarterly visit growth, followed by Grocery Stores, Fitness, and Superstores – all of which outperformed Overall Retail. Dining also enjoyed a YoY quarterly visit bump, despite the segment’s largely discretionary nature. And despite the high interest rates continuing to weigh on the housing and home renovation markets, Home Improvement & Furnishings maintained just a minor YoY visit gap.

Discount & Dollar Stores experienced strong YoY visit growth throughout most of Q1 – and as go-to destinations for groceries and other other essential goods, they held their own even during mid-January’s Arctic blast. In the last week of March, shoppers flocked to leading discount chains for everything from chocolate Easter bunnies to basket-making supplies – driving a remarkable 21.5% YoY visit spike.

Dollar General continued to dominate the Discount & Dollar Store space in Q1, with visits to its locations accounting for nearly half of the segment’s quarterly foot traffic (44.7%). Next in line was Dollar Tree, followed by Family Dollar and Five Below. Together, the four chains – all of which experienced positive YoY quarterly visit growth – drew a whopping 91.6% of quarterly visits to the category.

Rain or shine, people have to eat. And like Discount & Dollar Stores, traditional Grocery Stores were relatively busy through January as shoppers braved the storms to stock up on needed items. Momentum continued to build throughout the quarter, culminating in a 10.5% foot traffic increase in the week ending with Easter Sunday.

Like in other categories, it was budget-friendly Grocery banners that took the lead. No-frills Aldi drove a chain-wide 24.4% foot traffic increase in Q1, by expanding its fleet – while also growing the average number of visits per location. Other value-oriented chains, including Trader Joe’s and Food Lion, experienced significant foot traffic increases of their own. And though conventional grocery leaders like H-E-B, Kroger, and Albertsons saw smaller visit bumps, they too outperformed Q1 2023 by meaningful margins.

January is New Year’s resolution season – when people famously pick themselves up off the couch, dust off their trainers, and vow to go to the gym more often. And with wellness still top of mind for many consumers, the Fitness category enjoyed robust YoY visit growth throughout most of Q1 – despite lapping a strong Q1 2023.

Predictably, Fitness’s visit growth slowed during the last week of March, when many Americans likely indulged in Easter treats rather than work out. But given the category’s strength over the past several years, there is every reason to believe it will continue to flourish.

For Fitness chains, too, cost was key to success in Q1 – with value gyms experiencing the biggest visit jumps. EōS Fitness and Crunch Fitness, both of which offer low-cost membership options, saw their Q1 visits skyrocket 28.9% and 22.0% YoY, respectively – helped in part by aggressive expansions. At the same time, premium and mid-range gyms like Life Time and LA Fitness are also finding success – showing that when it comes to Fitness, there’s plenty of room for a variety of models to thrive.

Superstores – including wholesale clubs – are prime destinations for big, planned shopping expeditions – during which customers can load up on a month’s supply of food items or stock up on home goods. And perhaps for this reason, the category felt the impact of January’s inclement weather more than either dollar chains or supermarkets – which are more likely to see shoppers pop in as needed for daily essentials.

But like Grocery Stores and Discount & Dollar Stores, Superstores ended the quarter with an impressive YoY visit spike, likely fueled by Easter holiday shoppers.

As in Q4 2023, membership warehouse chains – Costco Wholesale, BJ’s Wholesale Club, and Sam’s Club – drove much of the Superstore category’s positive visit growth, as shoppers likely engaged in mission-driven shopping in an effort to stretch their budgets. Still, segment mainstays Walmart and Target also enjoyed positive foot traffic growth, with YoY visits up 3.9% and 3.5%, respectively.

Moving into more discretionary territory, Dining experienced a marked January slump, as hunkered-down consumers likely opted for delivery. But the segment rallied in February and March, even though foot traffic dipped slightly during the last week of March, when many families gathered to enjoy home-cooked holiday meals.

Coffee Chains and Fast-Casual Restaurants saw the largest YoY visit increases, followed by QSR – highlighting the enduring power of lower-cost, quick-serve dining options. But Full-Service Restaurants (FSR) also saw a slight segment-wide YoY visit uptick in Q1 – good news for a sector that has yet to bounce back from the one-two punch of COVID and inflation. Within each Dining category, however, some chains experienced outsize visit growth – including favorites like Dutch Bros. Coffee, Slim Chickens, In-N-Out Burger, and Texas Roadhouse.

Since the shelter-in-place days of COVID – when everybody had their sourdough starter and DIY was all the rage – Home Improvement & Furnishings chains have faced a tough environment. Many deferred or abandoned home improvement projects in the wake of inflation, and elevated interest rates coupled with a sluggish housing market put a further damper on the category.

Against this backdrop, Home Improvement & Furnishings’ relatively lackluster Q1 visit performance should come as no surprise. But the narrowing of the visit gap in March – which also saw one week of positive visit growth – may serve as a promising sign for the segment. (The abrupt foot traffic drop during the week of March 25th, 2024 is likely a just reflection of Easter holiday shopping pattern.)

Within the Home Improvement & Furnishings space, some bright spots stood out in Q1 – including Harbor Freight Tools, which saw visits increase by 10.0%, partly due to the brand’s growing store count. Tractor Supply Co., Menards, and Ace Hardware also registered visit increases.

January 2024’s stormy weather left its mark on the Q1 retail environment, especially for discretionary categories. But as the quarter progressed, retailers rallied, with healthy YoY foot traffic growth that peaked during the last week of March – the week of Easter Sunday. All in all, retail’s positive Q1 performance leaves plenty of room for optimism about what’s in store for the rest of 2024.