.svg)

.png)

.png)

.png)

.png)

How did the Placer 100 Index for Retail & Dining fare in June 2024? We dove into the data to find out.

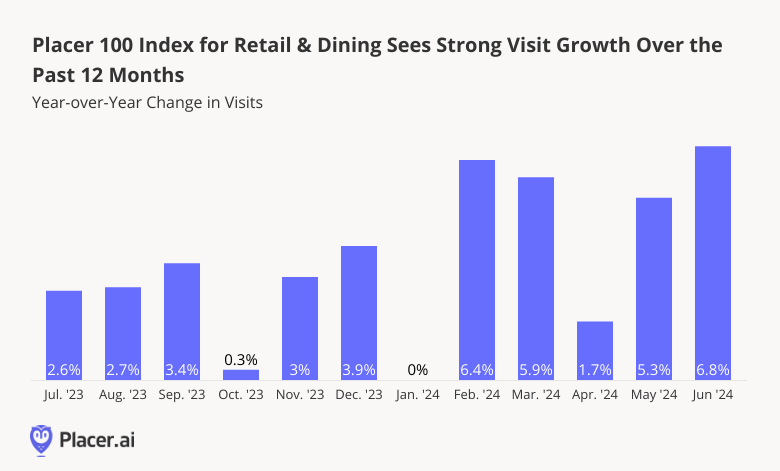

As the first half of the year comes to a close, retail and dining visits continue to demonstrate resilience. Analyzing the YoY foot traffic performance of the Placer 100 Index for Retail and Dining highlights this positive trend, with June visits increasing 6.8% relative to June 2023. This growth follows May 2024's YoY visit growth of 5.3%.

This upward visitation pattern shows that despite continued concerns, consumers are feeling cautiously optimistic about the current economic climate. With back-to-school shopping set to ramp up over the next two months, retail visits may well continue on their upward trajectory.

Drilling down deeper into the data highlights the priority shoppers continue to place on value – with bargain retailers claiming many of the top spots for YoY visit growth. Grocery stores were also major winners in June 2024, likely buoyed by consumers seeking to cut costs by making more of their food at home.

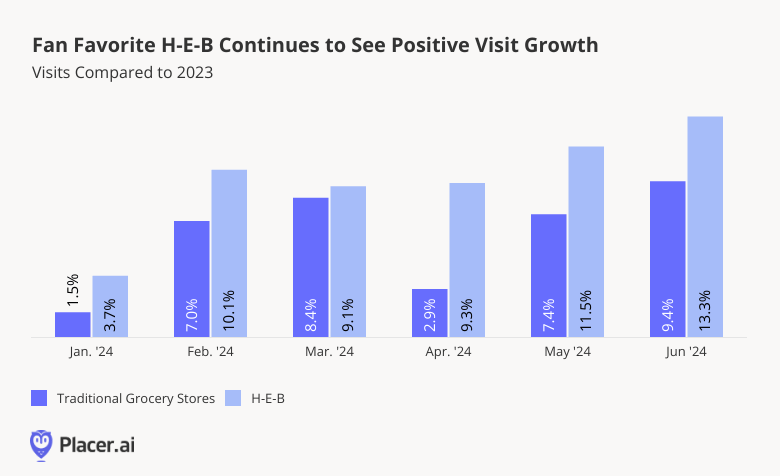

Three grocery chains ranked among June 2024’s top YoY visit performers: Aldi (28.4%), Trader Joe’s (17.4%) and H-E-B (13.3%). These chains, as well as three others – Food Lion Grocery Store, ShopRite, and Walmart Neighborhood Market – were also among the top performing chains for YoY visits per location.

Within the already-strong grocery segment, one chain – H-E-B – continues to prove its staying power. Despite being concentrated in Texas, the chain consistently ranks as one of the most popular grocery chains in the country, as evidenced by its consistently elevated foot traffic.

Since January 2024, YoY visits to H-E-B have increased substantially – outperforming the wider traditional grocery sector. Though very much a full-service supermarket, H-E-B’s foot traffic growth has been more akin to that seen by budget-oriented, limited assortment chains like Aldi and Trader Joe's.

One factor that may be contributing to H-E-B’s ongoing success is its growing role as a purveyor of takeout and inexpensive prepared food options. Many of H-E-B’s grocery stores have in-store restaurants – and the chain also offers a variety of other ready meals and snacks.

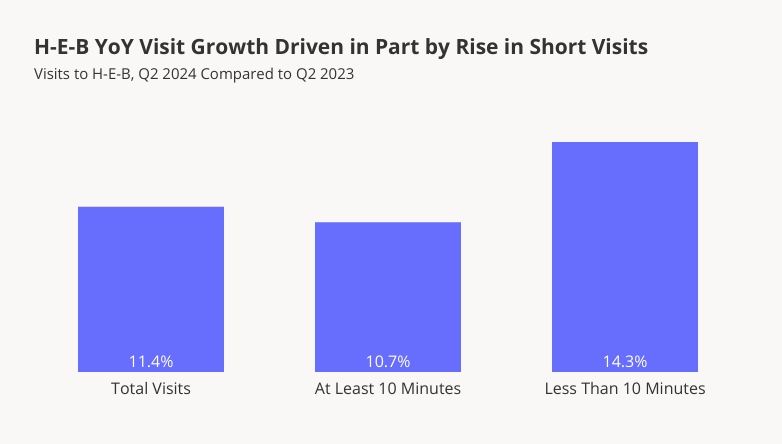

The focus on takeout and convenience food seems to be a solid move for H-E-B, as evidenced by the chain’s YoY increase in short visits – i.e., those lasting under ten minutes. In Q2 2024, short visits to H-E-B increased by 14.3% compared to Q2 2023, while over the same period, longer visits increased by a more modest 10.7%. Some of these quick-stop visitors may be dropping by to grab a snack or to-go meal.

In recognition of the growing demand for quick-stop grocery and prepared food options, H-E-B has also been making inroads into the c-store space, with a chain of twelve convenience stores recently rebranded as H-E-B Fresh Bites. And as a grocer with its finger on the pulse of what shoppers want, H-E-B appears poised for further success.

As the summer gets underway, retail and dining visitation patterns remain strong – with value chains and grocery retailers leading the way. How will these trends continue to play out throughout the summer?

Visit Placer.ai to find out.

How did indoor malls, open-air shopping centers, and outlet malls fare in June 2024? We dove into the data to find out.

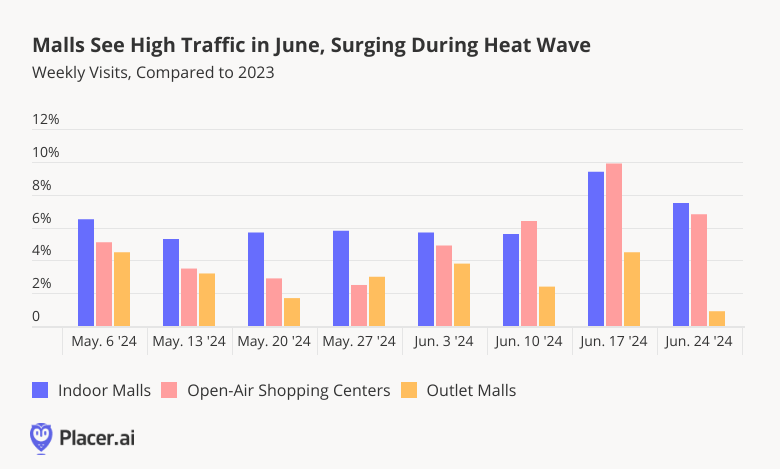

Fresh on the heels of May’s strong showing, malls continued to impress in June 2024. Weekly year-over-year (YoY) visits to all three mall types (indoor malls, open-air shopping centers, and outlet malls) remained robust throughout the month, as shoppers took advantage of the warm weather to go shopping.

YoY foot traffic to malls was especially high during the week of June 17th – when a record-breaking heat wave likely drove shoppers to seek refuge in air-conditioned spaces – including both malls and individual stores. During that week, indoor malls, open-air shopping centers, and outlet malls saw YoY visit increases of 9.4%, 9.9%, and 4.5%, respectively.

Malls’ positive June performance appears to herald a strong summer shopping season for the sector – which tends to draw larger crowds in summer months.

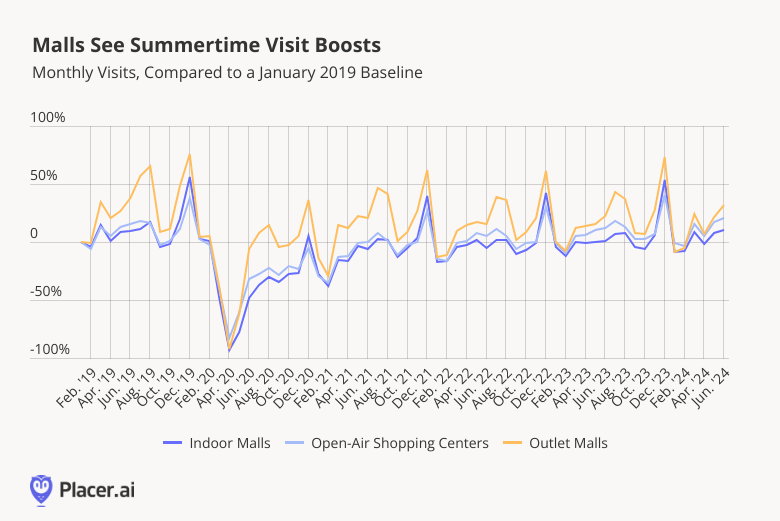

Comparing monthly mall visits to a January 2019 baseline shows that all three mall types experience substantial summer foot traffic boosts. For indoor malls and open-air shopping centers, the summer foot traffic increases – though significant – pale in comparison to those of the holiday season. But for outlet malls, the July and August foot traffic spikes rival those seen in December.

Outlet malls’ special summertime opportunity may be driven by a variety of factors. People may have more time to travel to outlet malls during summer vacations and may be more inclined to embrace the experience of a leisurely shopping day trip when the weather is warm. College students and parents eager to find back-to-school deals may also flock to outlet malls in July and August as they gear up for the academic year.

And with such a strong June under their belts, outlet malls – as well as indoor malls and open-air shopping centers – appear poised for a successful summer indeed.

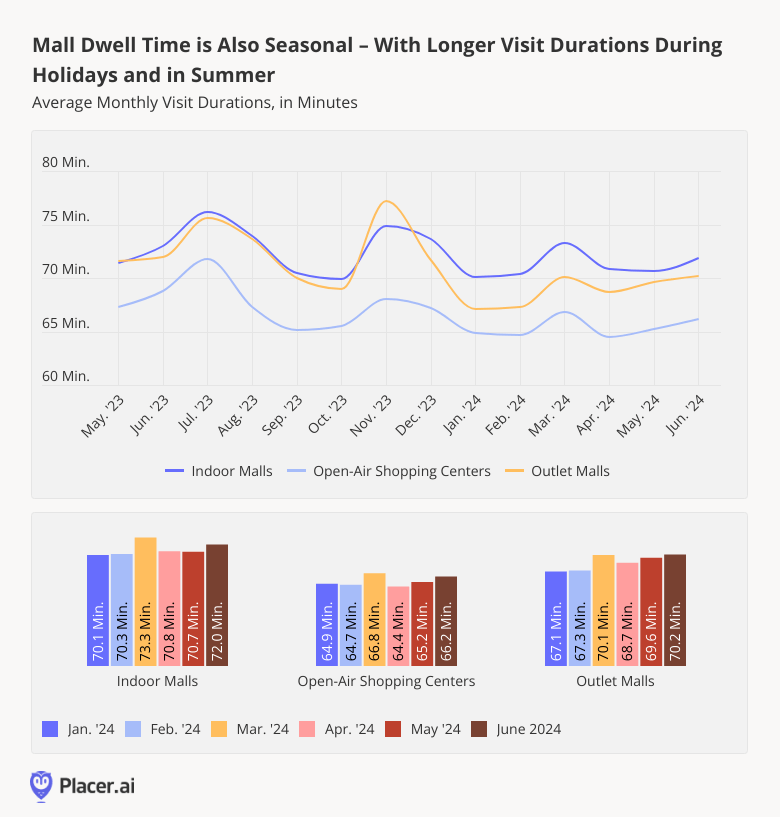

The warm summer months not only bring more shoppers to malls, but also lead to longer visits. Analyzing monthly shifts in malls’ average visit durations since May 2023 shows that like foot traffic, mall dwell time also has a seasonal element – with people staying longer during holiday shopping seasons, as well as in the summer. Visit durations peak in July, and then again in November and December – with smaller jumps seen in March, likely a result of Easter and Spring Break.

And looking more closely at dwell time trends over the past six months shows that since the beginning of 2024, mall visit length increased slightly each month for all three mall types. June 2024 average visit durations to indoor malls, open-air shopping centers, and outlet malls were 1.9, 1.3, and 3.1 minutes longer, respectively, than in January 2024. While these differences are subtle, the consistency of the shift is striking – and considering that the averages are derived from millions of visits to hundreds of malls, it reflects a significant trend.

As the temperatures warm up, shoppers are happy to hit the mall. All three mall types saw a strong June, indicating a promising summer ahead.

Will July and August meet these high expectations for shopping malls across the country?

Visit our blog at placer.ai to find out.

Return-to-office (RTO) mandates are once again the talk of the town, with growing numbers of employers requiring workers to move back closer to the office and come into the office more frequently. Despite employee pushback, the trend is leaving its mark on everything from downtown retailers to local housing markets.

But how is the RTO push impacting office attendance? We dove into the data to find out.

In June 2024, visits to offices nationwide were just 29.4% below June 2019 levels – and the highest they’ve been since before the pandemic. June’s strong year-over-year (YoY) showing is particularly impressive given the fact that June 2024 had one fewer workday than June 2019 (Juneteenth was declared a federal holiday in 2021).

Digging down into regional data shows Miami continuing to lead the office recovery pack, with June 2024 visits down just 9.8% compared to the equivalent period of 2019. New York was once again close on Miami’s heels – driven in part by strict RTO policies on Wall Street. Atlanta, Dallas, and Washington, D.C. also outperformed the nationwide baseline, while Boston, Chicago, Denver, Los Angeles, Houston, and San Francisco took up the rear.

A look at regional YoY visitation patterns offers additional insight into each city’s unique office recovery trajectory. Houston, which was hit hard by inclement weather in May 2024, suffered an additional setback in June – with tropical storm warnings and extreme heat waves likely inducing many locals to stay home.

Atlanta and Boston, on the other hand, experienced their busiest in-office month since the pandemic – with respective June 2024 YoY visit increases of 10.0% and 10.3%. Atlanta, which has been outperforming nationwide averages for some months now, has seen an accelerated recovery fueled by accumulating RTO mandates. And in Boston, too, growing numbers of companies are calling on employees to put in more face time.

San Francisco, meanwhile, surrendered its YoY visit growth lead, even as the San Francisco Federal Reserve president urged tech companies to tighten their in-office policies.

The new hybrid normal may be firmly entrenched – but foot traffic data shows that the RTO story is still very much ongoing. How will office visits continue to shape up as the year wears on?

Follow Placer.ai’s data-driven analyses to find out.

Movie theaters, among the hardest-hit industries during the pandemic, have faced challenges in foot traffic recovering to pre-COVID levels. However, the release of major blockbusters including Barbie, Oppenheimer, Spiderman: No Way Home, Top Gun: Maverick, and others, led to dramatic surges in movie theater visits, proving that the silver screen can still draw crowds.

While some of these films shattered box-office records upon release, the recently premiered "Inside Out 2" – an animated coming-of-age film – is poised to exceed even those impressive metrics, setting a new benchmark for success.

Expectations for the new Disney-Pixar powerhouse sequel “Inside Out 2” were high long before its theatrical premiere on June 14th, 2024. Fans and critics alike were eagerly anticipating the return of Riley and her emotions. But even among these high expectations, the film’s effect was astonishing, becoming the fastest-ever animated feature to surpass the billion-dollar mark.

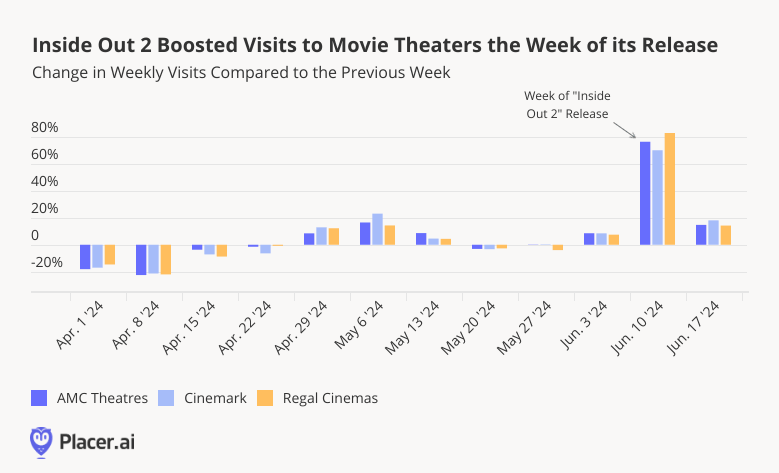

And the film's huge success is only further emphasized by foot traffic data of major movie theater chains across the country. On the week of June 10th, when the film was released, AMC theaters, Cinemark, and Regal Cinemas saw remarkable respective visit peaks of 76.7%, 70.5%, and 83.2% compared to the previous week.

But the momentum didn’t stop there. Theater visits continued to surge into the second week following the film’s release, driven by the ongoing hype surrounding "Inside Out 2." Week over week, AMC theaters, Cinemark and Regal Cinemas experienced respective visits increases of 14.8%, 18.2%, and 14.3%.

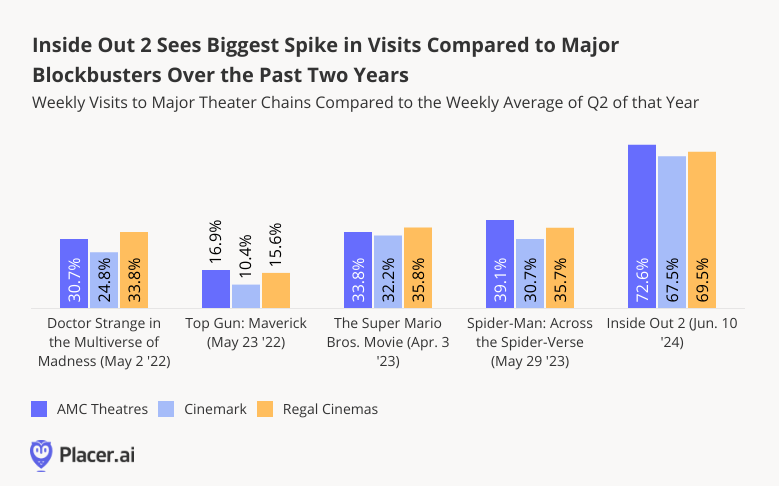

The "Inside Out 2" visit effect was not only impressive on its own but also remarkable when compared to other major blockbuster films released in the past two years. Visits to the three biggest theater chains nationwide saw extraordinary upticks ranging from 67.5% to 72.6% compared to the weekly average of the second quarter of 2024. The closest comparable accomplishment in the past two years was the release of the “Super Mario Bros. Movie” in April 2023, which generated theater visits between 32.2% and 35.8% higher than the weekly average visits for that quarter.

The visit surge brought on by "Inside Out 2" highlights the movie’s massive draw and sets a new industry benchmark, solidifying its place as a monumental success in recent cinema history.

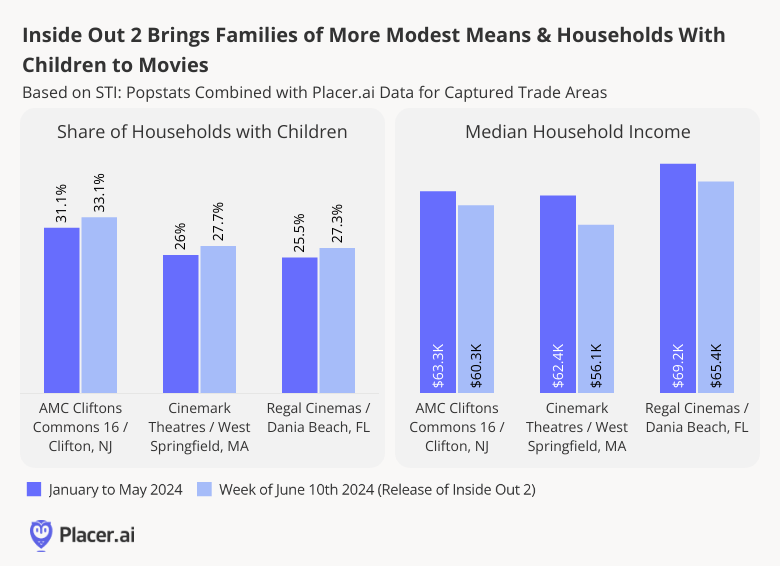

Theater chains know in advance that a highly anticipated Disney-Pixar film will fill their theaters with the joyful squeals of little ones. However, family films don’t just attract families; they also draw visitors from a wider range of socioeconomic backgrounds, all eager to enjoy a much-talked-about film and an affordable outing for the entire family. This was especially true for "Inside Out 2," which premiered just as a record-breaking heat wave hit the country, driving millions to seek refuge in an air-conditioned movie theater.

Indeed, analyzing the captured markets of the most-visited AMC, Cinemark, and Regal Cinemas during the week of the film’s release showed that not only did they attract a higher percentage of visitors from households with children, as anticipated, but they also drew more visitors with lower household incomes. This influx significantly lowered the median household income of the theater’s captured markets, highlighting the film’s broad appeal and its ability to provide accessible entertainment to all.

The impressive visit surge from the release of "Inside Out 2" highlights the still-strong demand for out-of-home entertainment and the staying power of the movie theater industry. And with a lineup of highly anticipated releases this summer, theaters are poised to continue satisfying the demand for in-cinema entertainment well into 2024 and beyond.

Will major blockbuster films continue to be the main factor driving the movie theater industry forward? Can the industry maintain strong visit volumes between top releases?

Visit our blog at Placer.ai to find out.

How did Petco and PetSmart, the two big-box leaders of the pet sector, fare in early 2024? We dove into the data to find out.

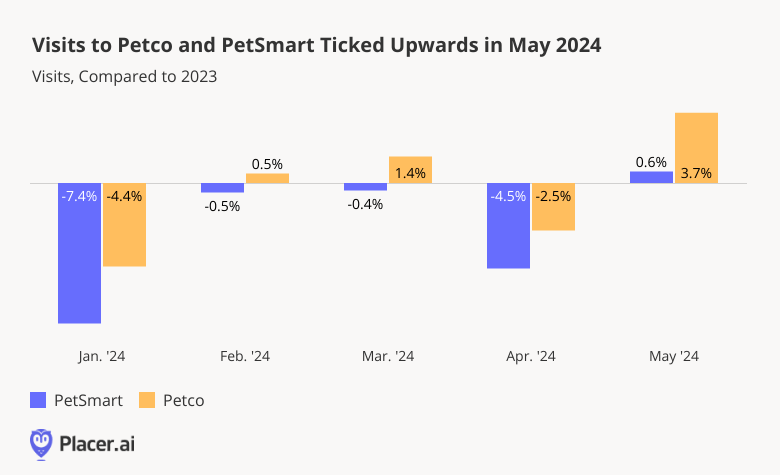

In recent months, Inflation and sagging consumer confidence have taken their toll on the pet supplies industry, which relies at least partially on discretionary spending, and in its Q1 2024 earnings report, Petco reported a minor YoY drop in revenue. But while Petco saw YoY visit dips in January and April – softened by minor upticks in February and March – visits increased 3.7% YoY in May.

PetSmart, for its part, experienced even more consistent YoY visit lags in early 2024. But like its competitor, the pet supplies giant also saw signs of a potential softening or even reversal of this trend in May. And for both chains, May’s positive showing may be a sign of even better things to come heading into summer.

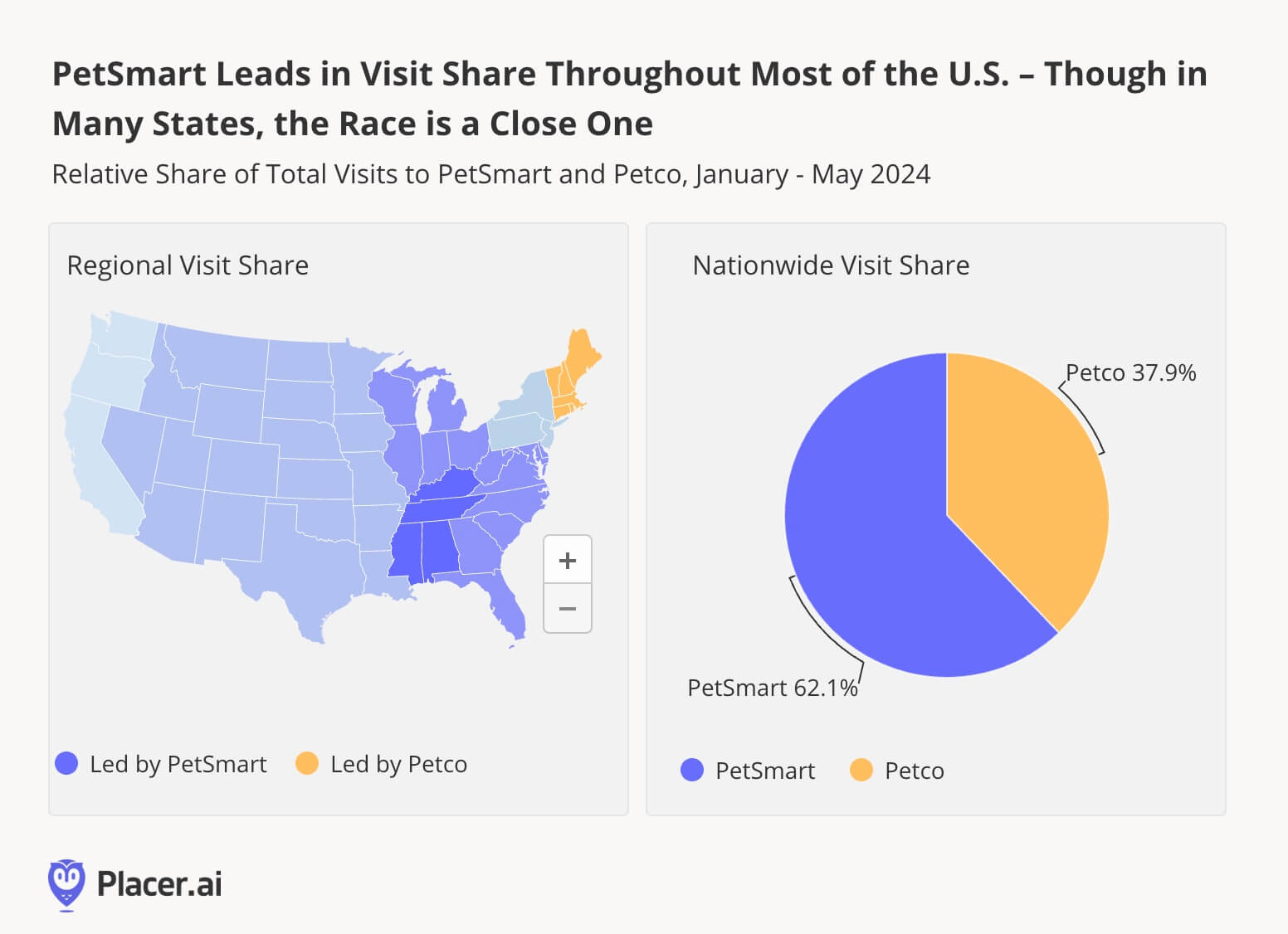

But while Petco led PetSmart in YoY visit performance in early 2024, PetSmart hasn’t relinquished its position as the most-visited pet store chain in the country. Between January and May 2024, 62.1% of total foot traffic to the two chains went to PetSmart, compared to just 37.9% for Petco, and PetSmart was the top-visited chain in most regions nationwide.

Still, drilling down into statewide-level data reveals a more complex picture. In New England, Petco was the dominant player in early 2024. And in the Pacific region, the two chains were neck in neck.

PetSmart’s visit share lead is partially driven by its larger fleet. But foot traffic data shows that other factors are likely at play as well.

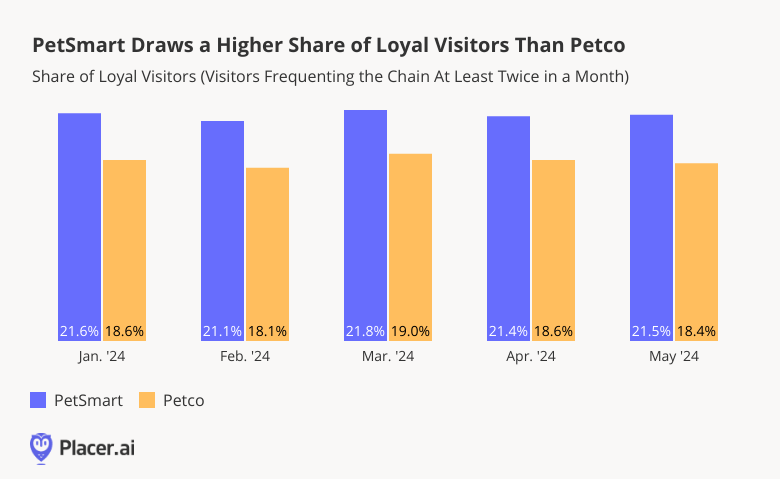

Indeed, though both chains boast loyal visitor bases, PetSmart customers generate more repeat visits than Petco ones – a factor likely further contributing to PetSmart’s increased visit share.

During the first part of 2024, some 21.1% to 21.8% of PetSmart visitors visited the chain at least twice each month – compared to 18.1% to 19.0% for Petco. PetSmart’s enhanced loyalty may be driven in part by the greater selection in-house pet services offered by the chain.

Pet store visits tend to be seasonal – December is generally the industry’s busiest month of the year, followed by March and July. Do Petco’s and PetSmart’s May upticks herald strong July peaks this year?

Follow Placer.ai’s data driven retail analyses to find out.

Everybody loves ice cream – so with summer underway, we dove into the data to explore the performance of ice cream shops nationwide.

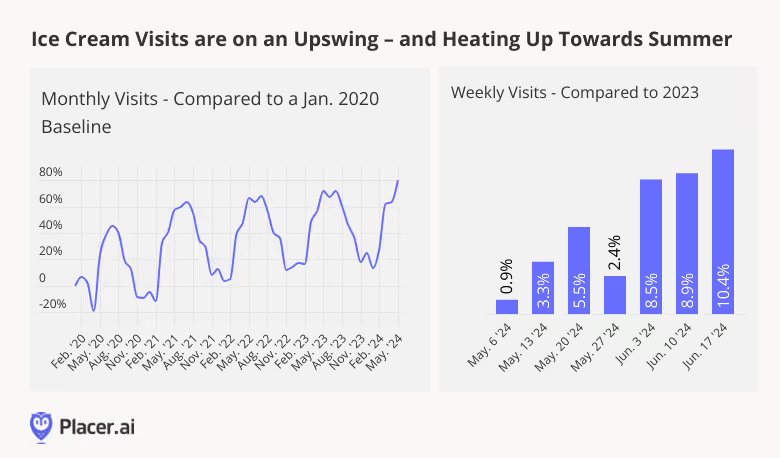

The past couple of years have been all about affordable indulgences – and ice cream chains have been riding the wave. Comparing monthly category-wide visits to a January 2020 baseline shows the industry reaching new peaks each summer, with May 2024 seeing the most monthly foot traffic in 4.5 years.

In June 2024, weekly YoY visits trended upwards even more sharply – as a record-breaking heat wave during the week of June 17th sent Americans nationwide seeking ways to cool down. The scorching temperatures left no doubt that summer had officially arrived, and as consumers fired up their ACs and got their summer wardrobes ready, they also flocked to ice-cream chains to chill out with a sweet treat.

With such strong performance under their belts, ice cream chains appear poised to continue to flourish as the peak summer season wears on.

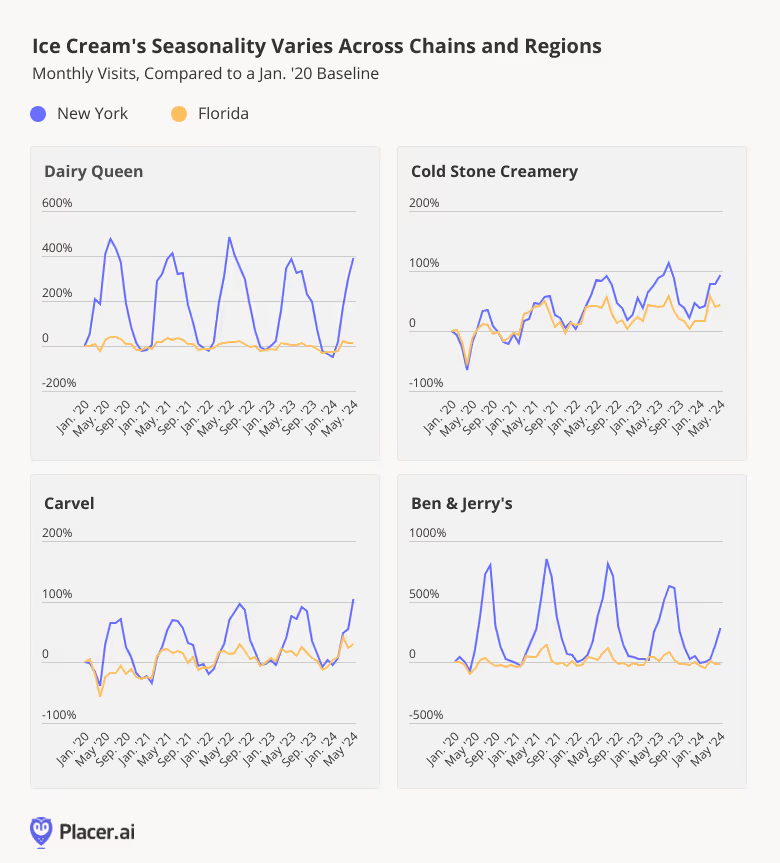

It’s no secret that ice cream is one of the most seasonal food sectors – and the success of many ice cream chains hinges on their ability to make the most of the summer months, when foot traffic is generally at its highest. But a look at seasonal visitation trends for four major chains – Dairy Queen (focusing on “treat only” locations that do not include a full-service restaurant), Cold Stone Creamery, Carvel, and Ben & Jerry’s – shows that the extent of this seasonality varies among chains – and among different regions of the country.

Visits to Dairy Queen locations in New York, for example, are highly driven by seasonality – with May foot traffic more than 300% higher than that seen in January. Dairy Queen locations in Florida, on the other hand, experience much more subdued summer visit peaks. Similar trends can be observed for the other analyzed chains.

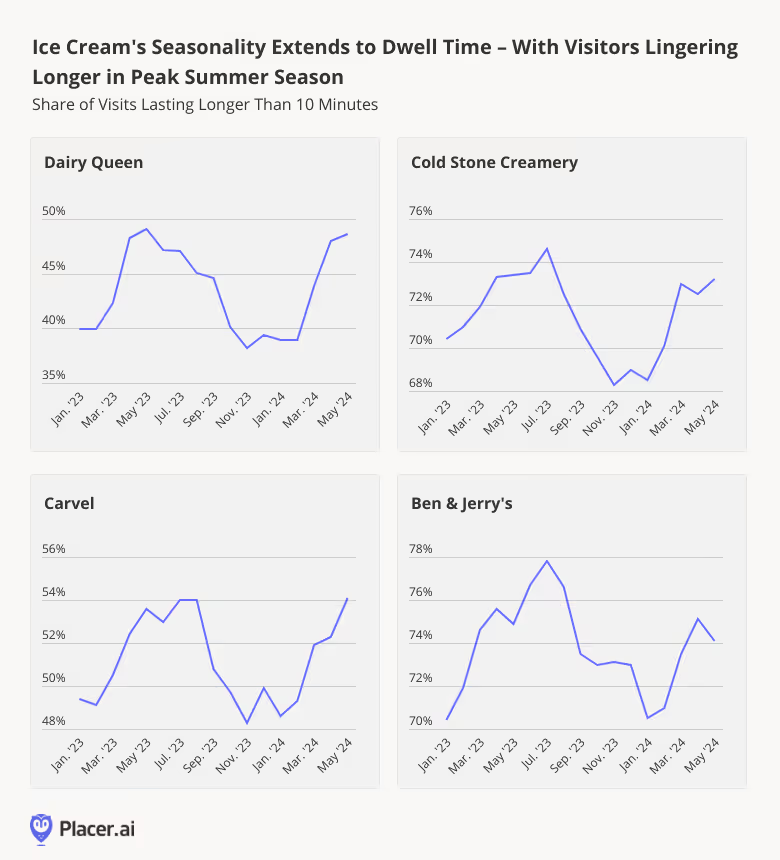

Ice cream’s seasonality impacts consumer behavior in other ways as well. Though there are once again important differences between ice cream chains, all analyzed brands saw visitor dwell time jump during the summer and decline in winter.

In May 2023 and 2024, for example, a respective 49.1% and 48.6% of visits to Dairy Queen lasted more than ten minutes. But between November 2023 and February 2024, less than 40.0% of visits lasted more than ten minutes – as customers likely ordered their ice-cream to go. Visitors to Ben and Jerry’s, on the other hand, are more likely to linger in-store, with over 70.0% of visits lasting more than ten minutes year-round. But like Dairy Queen, the chain also sees a significant jump in longer visits during the summer.

The ice cream industry continues to show strong performance across the board, with indications of an even stronger summer ahead. Are there more visit peaks in store for the category this year?

Follow our blog at Placer.ai to find out.

Retail media networks (RMNs) have cemented their roles as the future – and present – of advertising. These networks enable advertisers to promote products and services through a retailer’s online properties and physical stores, when consumers are close to the point-of-purchase and primed to buy.

Today, we take a closer look at two newcomers to the retail media space: Costco Wholesale and Wawa. Both chains have an online presence – but both also excel at in-store experiences, offering unique opportunities for consumer engagement and exposure to new products.

This white paper dives into the data to explore some of the key advantages Costco and Wawa bring to the retail media table – and examine how the retailers’ physical reach can best be leveraged to help advertising partners find new audiences.

Wawa and Costco, the latest additions to the growing number of companies with retail media networks, exhibit significant advertising potential. Both brands boast a wide reach and diverse customer base, and both have access to troves of customer data through membership and loyalty programs.

Foot traffic data confirms the robust offline positioning of the two retailers. In Q1 2024, year-over-year (YoY) visits to Costco and Wawa increased 9.5% and 7.5% respectively – showing that their in-store engagement is on a growth trajectory.

And since consumers tend to spend a lot more time in-store than they do on retailers’ websites, Costco’s and Wawa’s strong brick-and-mortar growth positions them especially well to help advertisers reach new customers. In Q1 2024, the average visits to Costco’s and Wawa’s physical stores lasted 37.4 and 11.4 minutes respectively – compared to just 6.7 and 4.6 minutes for the chains’ websites. These longer in-store dwell times can be harnessed to maximize ad exposure and offer partners more extended opportunities for meaningful interactions with customers. Partners can also analyze the behavior and preferences of the two chains’ growing visitor bases to craft targeted online campaigns.

Costco’s retail media network will tap into the on- and offline shopping habits of its staggering 74.5 million members to inform targeted advertising by partners. And the retailer’s tremendous reach offers a significant opportunity to engage customers in-store.

But while Costco is dominant in some areas of the country, other markets are led by competitors like Sam’s Club and BJ’s Wholesale Club. And advertisers looking to choose between competing RMNs or hone in on the areas where Costco is strongest can analyze Costco's performance and visit share – on a local or national level – to determine where to focus their efforts.

An analysis of the share of visits to wholesalers across the country reveals that Costco is the dominant wholesale membership club in much of the Western United States. But Costco also captures the largest share of wholesale club visits in many other major population centers, including important markets like New York, Chicago, Phoenix, and San Antonio. Costco’s widespread brick-and-mortar dominance offers prospective advertising partners a significant opportunity to connect with regional audiences in a wide array of key markets.

Another one of Costco’s key advantages as a retail media provider lies in its highly loyal and engaged audience. In May 2024, a whopping 41.4% of Costco’s visitors frequented the club at least twice during the month – compared to 36.6% for Sam’s Club and 36.0% for BJ’s Wholesale.

Moreover, Costco led in average visit duration compared to its competitors. In May 2024, customers spent an average of 37.1 minutes at Costco – surpassing even the impressive dwell times at Sam’s Club and BJ’s Wholesale Club.

YoY visits per location to Costco, too, were the highest of the analyzed wholesalers, all three of which saw YoY increases. These metrics further establish the wholesaler’s position as an effective retail media provider.

Even when foot traffic doesn't show a brand’s clear regional dominance, location analytics can reveal other metrics that signal its unique potential. Take the Richmond-Petersburg, VA, designated market area (DMA), for example. In May 2024, BJ’s Wholesale Club led the DMA with 41.2% of wholesale club visits, while Costco was a close second with 37.3% of visits.

But despite BJ’s lead in visit share, Costco's Richmond audience was more affluent. Costco's visitors came from trade areas with a median household income (HHI) of $93.2K/year, compared to $73.1K/year for Sam’s Club and $89.5K/year for BJ’s. Additionally, Costco drew a higher share of weekday visits than its counterparts.

Analyzing shopper habits and preferences across chains on a local level can provide crucial context for strategists working on media campaigns. Advertisers can partner with the brands most likely to attract consumers interested in their offerings, and identify where – and when – to focus their advertising efforts.

Convenience stores, or c-stores, are emerging as destinations in and of themselves – and their rising popularity among a wider-than-ever swath of consumers opens up significant opportunities in the retail advertising space.

Wawa is a relative newcomer to the world of retail media, after other c-stores like 7-Eleven and Casey’s launched their networks in 2022 and 2023. But despite coming a bit late to the party, the potential for Wawa’s Goose Media Network is significant – thanks to a cadre of highly loyal visitors who enjoy the physical shopping experience the c-store chain offers.

In May 2024, Wawa’s share of loyal visitors (defined as those who visited the chain at least twice in a month) was 60.1%. In contrast, other leading c-store chains operating in Wawa’s market area – QuickTrip and 7-Eleven, for example – saw loyalty rates of 56.0% and 47.9%, respectively, for the same period.

Additionally, Wawa visitors browsed the aisles longer than those at other convenience retailers. In May 2024, 39.9% of Wawa visitors stayed in-store for 10 minutes or longer, compared to 29.6% at QuickTrip and 25.7% at 7-Eleven.

Wawa's loyal customer base and longer visit durations make it a strong contender in the retail media space. By harnessing this high level of customer engagement, Wawa can draw in advertisers and develop targeted marketing strategies that resonate with its dedicated shoppers.

Wawa has been on an expansion roll over the past few years, with plans to open at least 280 stores over the next decade in North Carolina, Tennessee, Georgia, Alabama, Ohio, Indiana, and Kentucky. The chain has also been steadily increasing its footprint in Florida – between January 2019 and April 2024, Wawa grew from 167 Sunshine State locations to 280, with more to come.

And analyzing changes in Wawa’s visit share in one of Florida’s biggest markets – the Miami-Ft. Lauderdale DMA – shows how successful the chain’s local expansion has been. Between January 2019 and April 2024, Wawa more than doubled its category-wide visit share in the Miami area (i.e. the portion of total c-store visits in the DMA going to Wawa) – from 19.0% to nearly 40.0%.

A look at changes in Wawa’s Miami-Ft. Lauderdale trade area shows that the chain’s growing visit share has been driven by an expanding market and an increasingly diverse audience.

In April 2019, there were some 55 zip code tabulation areas (ZCTAs) in the Miami-Ft. Lauderdale DMA from which Wawa drew at least 3,000 visits per month. By April 2021, this figure grew to 96 – and by April 2024, it reached 129.

Over the same period, the share of “Family Union” households in Wawa’s local captured market – defined by the Experian: Mosaic dataset as families comprised of middle-income, blue collar workers – nearly doubled, growing from 7.4% in April 2019 to 14.4% in April 2024.

Retail media networks that make it easier to introduce shoppers to products and brands that are closely aligned with their preferences and habits offer a win-win-win for retailers, advertisers, and consumers alike. And Costco and Wawa are extremely well-positioned to make the most of this opportunity.

Everybody loves coffee. And with some 75% of American adults indulging in a cup of joe at least once a week, it’s no wonder the industry is constantly on an upswing.

In early 2024, year-over-year (YoY) visits to coffee chains increased nationwide – with every state in the continental U.S. experiencing year-over-year (YoY) coffee visit growth.

The most substantial foot traffic boosts were seen in smaller markets like Oklahoma (19.4%), Wyoming (19.3%), and Arkansas (16.9%), where expansions may have a more substantial impact on statewide industry growth. But the nation’s largest coffee markets, including Texas (10.9%), California (4.2%), Florida (4.2%), and New York (3.5%), also experienced significant YoY upticks.

The nation’s coffee visit growth is being fueled, in large part, by chain expansions: Major coffee players are leaning into growing demand by steadily increasing their footprints. And a look at per-location foot traffic trends shows that by and large, they are doing so without significantly diluting visitation to existing stores.

On an industry-wide level, visits to coffee chains increased 5.1% YoY during the first five months of 2024. And over the same period, the average number of visits to each individual coffee location declined just slightly by 0.6% – meaning that individual stores drew just about the same amount of foot traffic as they did in 2023.

Drilling down into chain-level data shows some variation between brands. Dutch Bros., BIGGBY COFFEE and Dunkin’ all saw significant chain-wide visit boosts, accompanied by minor increases in their average number of visits per location.

Starbucks, for its part, which reported a YoY decline in U.S. sales for Q2 2024, maintained a small lag in visits per location. But given the coffee leader’s massive footprint – some 16,600 stores nationwide – its ability to expand while avoiding more significant dilution of individual store performance shows that Starbucks’ growth is meeting robust demand.

What is driving the coffee industry’s remarkable category-wide growth? And who are the customers behind it? This white paper dives into the data to explore key factors driving foot traffic to leading coffee chains in early 2024. The report explores the demographic and psychographic characteristics of visitors to major players in the coffee space and examines strategies brands can use to make the most of the opportunity presented by a thriving industry.

One factor shaping the surge in coffee visit growth is the slow-but-sure return-to-office (RTO). Hybrid work may be the post-COVID new normal – but RTO mandates and WFH fatigue have led to steady increases in office foot traffic over the past year. And in some major hubs – including New York and Miami – office visits are back to more than 80.0% of what they were pre-pandemic.

A look at shifting Starbucks visitation patterns shows that customer journeys and behavior increasingly reflect those of office-goers. In April and May 2022, for example, 18.6% of Starbucks visitors proceeded to their workplace immediately following their coffee stop – but by 2024, this share shot up to 21.0%.

Over the same period, the percentage of early morning (7:00 to 10:00 AM) Starbucks visits lasting less than 10 minutes also increased significantly – from 64.3% in 2022 to 68.7% in 2024. More customers are picking up their coffee on the go – many of them on the way to work – rather than settling down to enjoy it on-site.

Dunkin’ is another chain that is benefiting from consumers on the go. Examining the coffee giant’s performance across major regional markets – those where the chain maintains a significant presence – reveals a strong correlation between the share of Dunkin’ visits in each state lasting less than five minutes and the chain’s local YoY trajectory.

In Wisconsin, for example, 50.9% of visits to Dunkin’ between January and May 2024 lasted less than five minutes. And Wisconsin also saw the most impressive YoY visit growth (5.9%). Illinois, Ohio, Maine, and Connecticut followed similar patterns, with high shares of very short visits and strong YoY showings.

On the other end of the spectrum lay Tennessee, Alabama, and Florida, where very short visits accounted for a low share of the chain’s statewide total – under 40.% – and where visits declined YoY.

Dunkin’s success with very short visits may be driven in part by its popular app, which makes it easy for harried customers to place their order online and save time in-store. And this is good news indeed for the coffee leader – since customers using the app also tend to generate bigger tickets.

Dutch Bros.’ meteoric rise has been fueled, in part, by its appeal to younger audiences. Recently ranked as Gen Z’s favorite quick-service restaurant, the rapidly-expanding coffee chain sets itself apart with a strong brand identity built on cultivating a positive, friendly customer experience.

And Dutch Bros.’ people-centered approach is resonating especially well with singles – including young adults living alone – who may particularly appreciate the chain’s community atmosphere.

Analyzing the relative performance of Dutch Bros.’ locations across metro areas – focusing on regions where the chain has a strong local presence – shows that it performs best in areas with plenty of singles. Indeed, the share of one-person households in Dutch Bros.’ local captured markets is very strongly correlated with the coffee brand’s CBSA-level YoY per-location visit performance. Areas with higher concentrations of one-person households saw significantly more YoY visit growth in the first part of 2024. (A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice).

The share of one-person households in Dutch Bros.’ Tucson, AZ captured market, for example, stands at 33.4% – well above the nationwide baseline of 27.5%. And between January and May 2024, Tucson-area Dutch Bros. saw a 6.0% increase in the average number of visits per location. Tulsa, OK, Medford, OR, and Oklahoma City, OK – which also feature high shares of one-person households (over 30.0%) – similarly saw per-location visit increases ranging from 3.6% - 7.0%. On the flip side, Fresno, CA, Las Vegas-Henderson-Paradise, NV, and San Antonio-New Braunfels, TX, which feature lower-than-average shares of single-person households, saw YoY per-location visit declines ranging from 1.5%-9.5%.

As Dutch Bros. forges ahead with its planned expansions, it may benefit from doubling down on this trends and focusing its development efforts on markets with higher-than-average shares of one-person households – such as university towns or urban areas with lots of young professionals.

Michigan-based BIGGBY COFFEE is another java winner in expansion mode. With a growth strategy focused on emerging markets with less brand saturation, BIGGBY has been setting its sights on small towns and rural areas throughout the Midwest and South. Though the chain does have locations in bigger cities like Detroit and Cincinnati, some of its most significant markets are in smaller population centers.

And a look at the captured markets of BIGGBY’s 20 top-performing locations in early 2024 shows that they are significantly over-indexed for suburban consumers – both compared to BIGGBY as a whole and compared to nationwide baselines. (Top-performing locations are defined as those that experienced the greatest YoY visit growth between January and May 2024).

“Suburban Boomers”, for example – a Spatial.ai: PersonaLive segment encompassing middle-class empty-nesters living in suburbs – comprised 10.6% of BIGGBY’s top captured markets in early 2024, compared to just 6.6% for BIGGBY’s overall. (The nationwide baseline for Suburban Boomers is even lower – 4.4%.) And Upper Diverse Suburban Families – a segment made up of upper-middle-class suburbanites – accounted for 9.6% of the captured markets of BIGGBY’s 20 top locations, compared to just 7.2% for BIGGBY’s as a whole, and 8.3% nationwide.

Coffee has long been one of America’s favorite beverages. And java chains that offer consumers an enjoyable, affordable way to splurge are expanding both their footprints and their audiences. By leaning into shifting work routines and catering to customers’ varying habits and preferences, major coffee players like Starbucks, Dunkin’, Dutch Bros., and BIGGBY COFFEE are continuing to thrive.

Note: This report is based on an analysis of visitation patterns for regional and nationwide grocery chains and does not include single-location stores.

Grocery stores, superstores, and dollar stores all carry food products – and American consumers buy groceries at all three. But even in today’s crowded food retail environment, traditional grocery chains have a special role to play. With their primary focus on stocking a wide variety of fresh foods, these chains serve a critical function in offering consumers access to healthy options.

But visualizing the footprints of major grocery chains across the continental U.S. – alongside those of discount & dollar stores – shows that the geographical distribution of grocery chains remains uneven.

In some areas, including parts of the Northeast, Midwest, South Atlantic, and Pacific regions, grocery chains are plentiful. But in others – some with population centers large enough to feature a robust dollar store presence – they remain in short supply.

And though many superstore locations also provide a full array of grocery offerings, they, too, are often sparsely represented in areas with low concentrations of grocery chains.

For grocery chain operators seeking to expand, these underserved grocery markets can present a significant opportunity. And for civic stakeholders looking to broaden access to healthy food across communities, these areas highlight a policy challenge. For both groups, identifying underserved markets with significant untapped demand can be a critical first step in deciding where to focus grocery development initiatives.

This white paper dives into the location analytics to examine grocery store availability across the United States – and harnesses these insights to explore potential demand in some underserved markets. The report focuses on locations belonging to regional or nationwide grocery chains, rather than single-location stores.

Last year, grocery chains accounted for 43.4% of nationwide visits to food retailers – including grocery chains, superstores, and discount & dollar stores. But drilling down into the data for different areas of the country reveals striking regional variation – offering a glimpse into the variability of grocery store access throughout the U.S. In some states, grocery stores attract the majority of visit share to food retailers, while in others, dollar stores or superstores dominate the scene.

The ten states where residents were most likely to visit grocery chains in early 2024 – Oregon, Vermont, Washington, Massachusetts, California, Maryland, New Hampshire, Connecticut, New Jersey, and Rhode Island – were all on the East or West Coasts. In these states, as well as in Nevada and New York, grocery chain visits accounted for 50.0% or more of food retail visits between January and April 2024.

Meanwhile, residents of many West North Central and South Central states were much less likely to do their food shopping at grocery chains. In North Dakota, for example, grocery chain visits accounted for just 11.7% of visits to food retailers over the analyzed period. And in Mississippi, Oklahoma, and Arkansas, too, grocery stores drew less than 20.0% of the overall food retail foot traffic.

But low grocery store visit share does not necessarily indicate a lack of consumer interest or ability to support such stores. And in some of these underserved regions, existing grocery chains are seeing outsize visit growth – indicating growing demand for their offerings.

North Dakota, the state with the smallest share of visits going to grocery chains in early 2024, experienced a 9.1% year-over-year (YoY) increase in grocery visits during the same period – nearly double the nationwide baseline of 5.7%. Other states with low grocery visit share, including Nebraska, Arkansas, Alabama, Mississippi, and New Mexico, also experienced higher-than-average YoY grocery chain visit growth. This suggests significant untapped potential for grocery stores and a market that is hungry for more.

Alabama is one state where grocery chains accounted for a relatively small share of overall food retail foot traffic in early 2024 (just 28.9%) – but where YoY visit growth outperformed the nationwide average. And digging down even further into local grocery store visitation trends provides further evidence that at least in some places, low grocery visit share may be due to inadequate supply, rather than insufficient demand.

In Central Alabama, for example, many residents drive at least 10 miles to reach a local grocery chain. And several parts of the state, both rural and urban, feature clusters of grocery stores that draw customers from relatively far away.

But zooming in on YoY visitation data for local grocery chain locations shows that at least some of these areas likely harbor untapped demand. Take for example the Camden, Butler, Thomasville, and Gilbertown areas (circled in the map above). The Piggly Wiggly location in Butler, AL, drew 40.1% of visits from 10 or more miles away. The same store experienced a 23.3% YoY increase in visits in early 2024 – far above the statewide baseline of 6.6%. Meanwhile, the Super Foods location in Thomasville, AL, which drew 52.8% of visits from at least 10 miles away – experienced YoY visit growth of 12.3%. The Piggly Wiggly locations in Camden, AL and Gilbertown, AL saw similar trends.

At the same time, trade area analysis of the four locations reveals that the grocery stores had little to no trade area overlap during the analyzed period. Each store served specific areas, with minimal cannibalization among customer bases.

These metrics appear to highlight robust demand for grocery stores in the region – grocery visits are growing at a stronger rate than those in the overall state, people are willing to make the drive to these stores, and each one has little to no competition from the others.

While significant opportunity exists across the country, many communities still face considerable challenges in supporting large grocery stores. Though South Carolina has a significant number of grocery chain locations, for example, certain areas within the state have low access to food shopping opportunities. And one local government – Greenville County – is considering offering tax breaks to grocery stores that set up shop in the area, to improve local fresh food accessibility.

Placer.ai migration and visitation data shows that Greenville County is ripe for such initiatives: the county’s population grew by 4.8% over the past four years – with much of that increase a result of positive net migration. And YoY visits to Greenville County Grocery Stores have consistently outperformed state averages: In April 2024, grocery visits in the county grew by 6.1% YoY, while overall visits to grocery stores in South Carolina grew by 4.2%. This growth – both in terms of grocery visits and population – points to rising demand for grocery stores in Greenville County.

Analyzing the Greenville County grocery store trade areas with Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – offers further insight into local grocery shoppers’ particular demand and preferences.

Consumers in Greenville-area grocery store trade areas, for example, are more likely to be interested in “Mid-Range Grocery Stores” (including brands like Aldi, Kroger, and Lidl) than residents of grocery store trade areas in the state as a whole. This metric provides further evidence of local demand for grocery chains – and offers a glimpse into the kinds of specific grocery offerings likely to succeed in the area.

Grocery stores remain essential services for many consumers, providing a place to pick up fresh produce, meat, and other healthy food options. And many areas in the country are ripe for expansion, with eager customer bases and growing demand. Identifying such areas with location analytics can help both grocery store operators and municipal stakeholders provide their communities and customer bases with an enhanced grocery shopping experience that caters to local preferences.