.svg)

.png)

.png)

.png)

.png)

The festive season is upon us, making it the perfect time to focus on a retail category that truly shines in Q4 2024: gifting, books, and paper. Despite the digital age, consumers continue to show a strong preference for shopping for these items in-store and still value tangible versions of these products. However, as discretionary retail faces challenges in meeting consumer expectations, has this category managed to capture consumer excitement and deliver delight amidst competing distractions and purchase priorities?

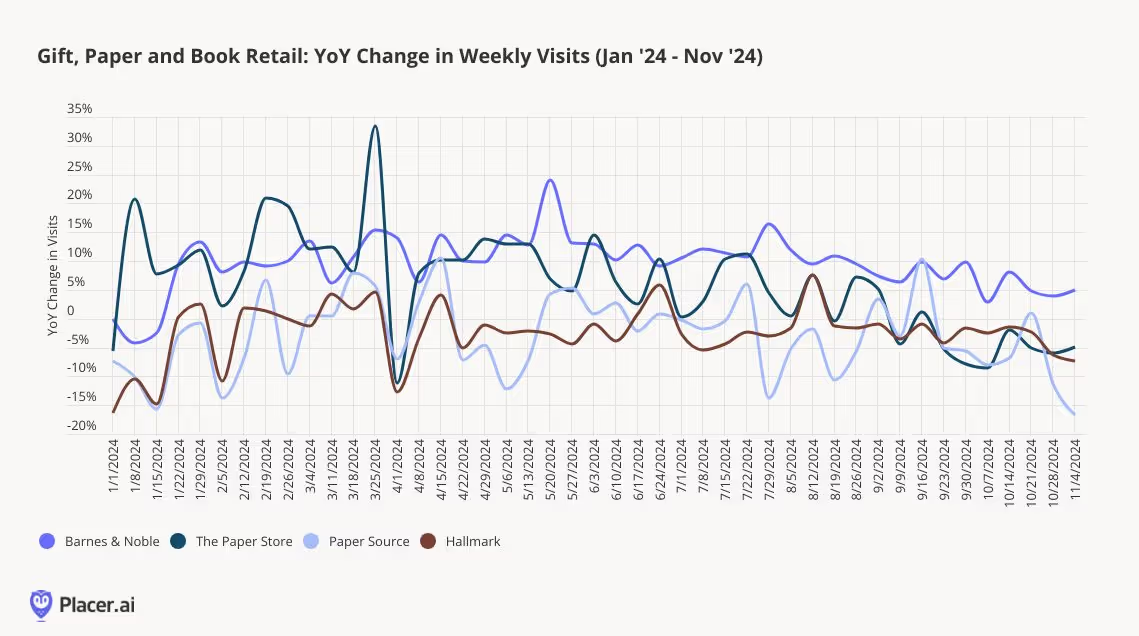

The book, paper, and gift market has experienced mixed performance among retailers this year, but even those facing year-over-year traffic declines have opportunities to improve. Barnes & Noble continues to set the standard, particularly in a category that was among the first to face e-commerce disruption; compared to 2019, visits are up 7% in 2024 despite a smaller store footprint. Paper Source is down 2% year-over-year in visits but is maintaining trends consistent with 2023. Similarly, Hallmark stores have seen a 2% decline in traffic year-to-date, though this aligns with a 5% reduction in store count. Notably, The Paper Store, a Northeastern chain of Hallmark Gold Crown stores, has outperformed the broader Hallmark brand by positioning itself more as a gift-first retailer, with cards and stationery playing a secondary role.

The book, paper, and gift market has experienced mixed performance among retailers this year, but even those facing year-over-year traffic declines have opportunities to improve. Barnes & Noble continues to set the standard, particularly in a category that was among the first to face e-commerce disruption; compared to 2019, visits are up 7% in 2024 despite a smaller store footprint. Paper Source is down 2% year-over-year in visits but is maintaining trends consistent with 2023. Similarly, Hallmark stores have seen a 2% decline in traffic year-to-date, though this aligns with a 5% reduction in store count. Notably, The Paper Store, a Northeastern chain of Hallmark Gold Crown stores, has outperformed the broader Hallmark brand by positioning itself more as a gift-first retailer, with cards and stationery playing a secondary role.

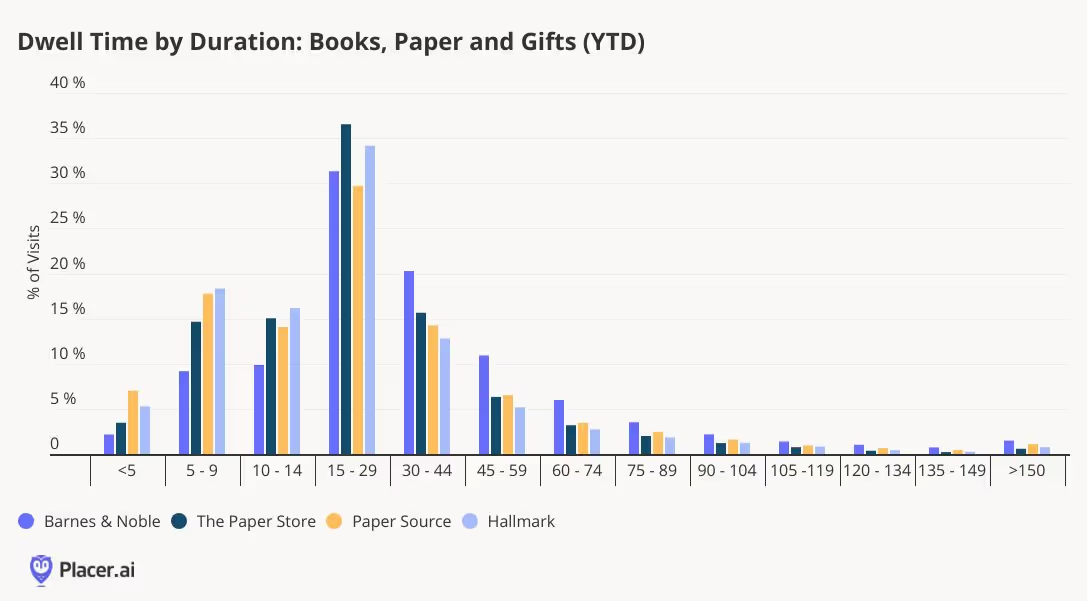

Barnes & Noble's consistent and sustainable traffic growth can be attributed to several successful initiatives. The retailer has expanded its product categories, doubled down on gifting, strengthened its position as a third space, and tapped into consumers' enduring love for books—all of which have set it apart in a challenging discretionary retail landscape. The effectiveness of these efforts is reflected in the chain's dwell time, which averages 37 minutes—nearly 10 minutes longer than any of the other chains reviewed—and excels at keeping visitors in-store for over 30 minutes.

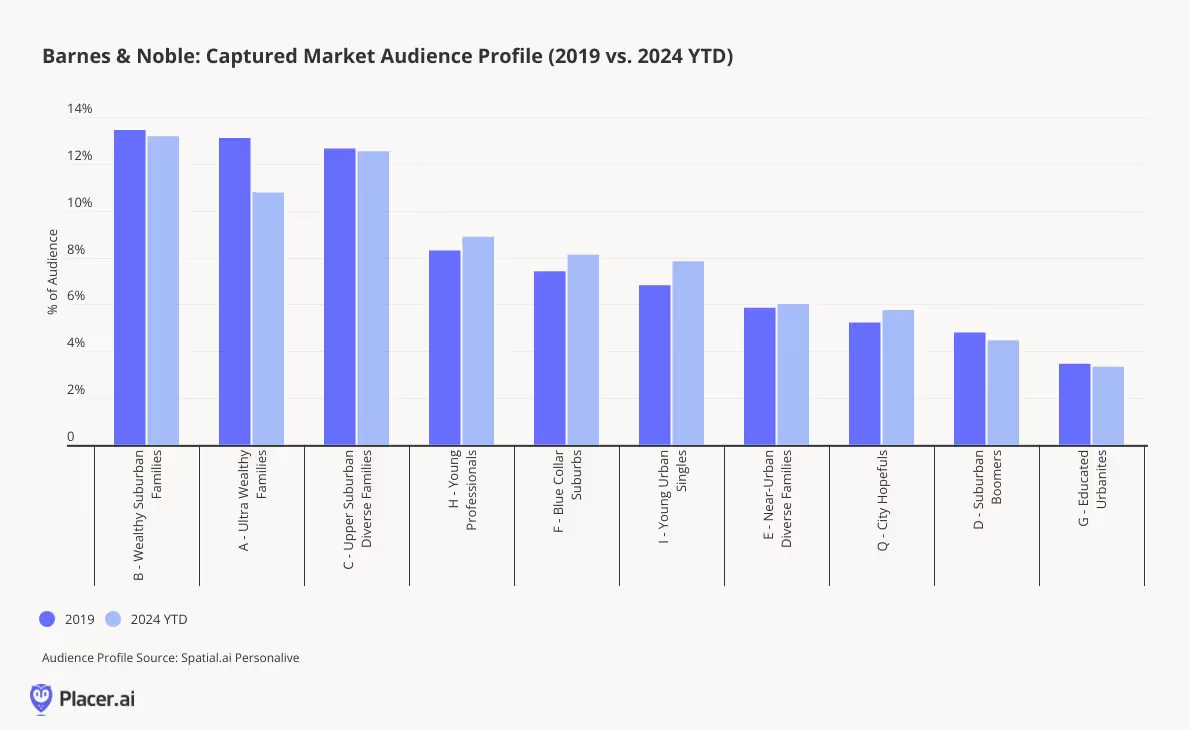

Barnes & Noble has done an impressive job of evolving its visitor demographics over time, particularly in the face of the digital revolution and the disruption of the book category. The success of specialty retailers often reflects broader cultural movements and shifts in consumer preferences, and Barnes & Noble is no exception. According to PersonaLive customer segments, the chain has significantly increased its penetration of younger consumer segments, such as Young Professionals and Young Urban Singles, when comparing 2024 year-to-date with 2019. Factors contributing to this trend could include the rise of book club culture among younger cohorts, the appeal of working from the in-store café, and an expanded assortment of gifts and paper products for special occasions.

This focus on younger consumers seems to be paying off. In 2024, 6% of Barnes & Noble visitors also shopped at a Hallmark location, although only 1% visited Paper Source, its sister brand. The integration of Paper Source shop-in-shops within Barnes & Noble locations may be cannibalizing cross-visitation between the two standalone chains.

As for Paper Source, it shares many of the elements driving Barnes & Noble's success but faces challenges in fully unlocking its potential. One key differentiator is its invitation business, but as consumers increasingly turn to digital platforms like Facebook or Paperless Post for invitations, even the booming wedding market hasn’t been enough to significantly drive growth.

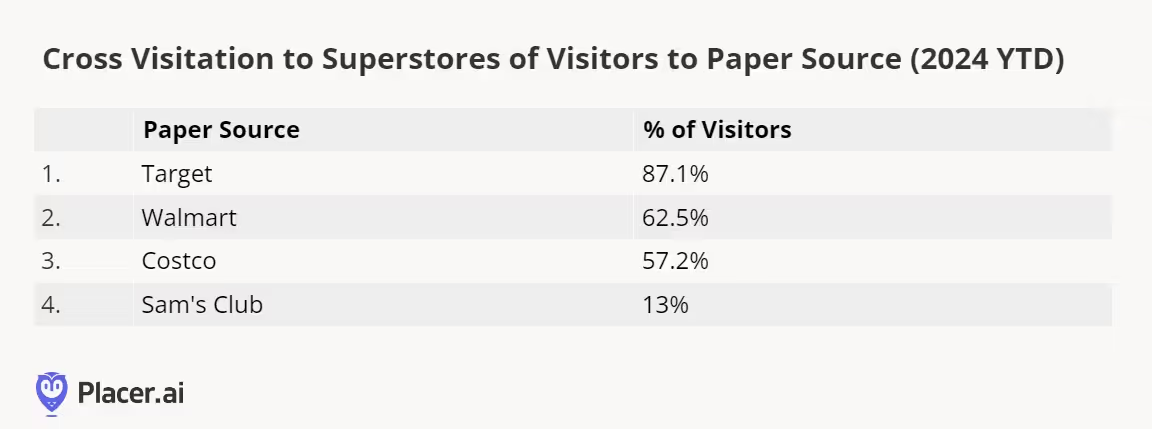

A significant challenge for Paper Source comes from competition within the superstore category. This year, 87% of Paper Source visitors also shopped at Target, and 63% visited Walmart. Both retailers have invested heavily in expanding their party supplies, cards, and gifting assortments, making it more convenient for shoppers to purchase these items during a single trip, rather than visiting a separate specialty store.

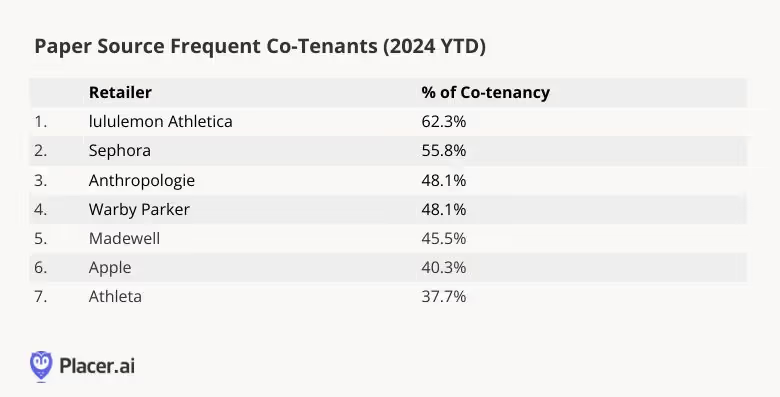

Paper Source has a strong demographic foundation to build upon as it works toward stabilization. According to PersonaLive, the chain significantly outperforms Barnes & Noble in visitation percentages among Ultra Wealthy Families, Young Professionals, and Educated Urbanites, with Ultra Wealthy Families accounting for nearly a quarter of its visitors. Its frequent co-tenants reflect similar socio-economic patterns, aligning with successful specialty chains that appeal to wealthier shoppers, such as lululemon, Sephora, Anthropologie, Warby Parker, Madewell, and Apple. With these favorable dynamics in place, Paper Source has an opportunity to thrive—success may depend on effective messaging and marketing to this affluent customer base.

The differences between Hallmark stores and The Paper Store highlight contrasting strategies: one chain has successfully expanded its product offerings to capture a more engaged audience, while the other remains closely tied to the traditional paper category and has struggled to do the same. There is little overlap in visitation between the two chains, suggesting that consumers may perceive The Paper Store as entirely separate from Hallmark, despite its status as a Gold Crown retailer.

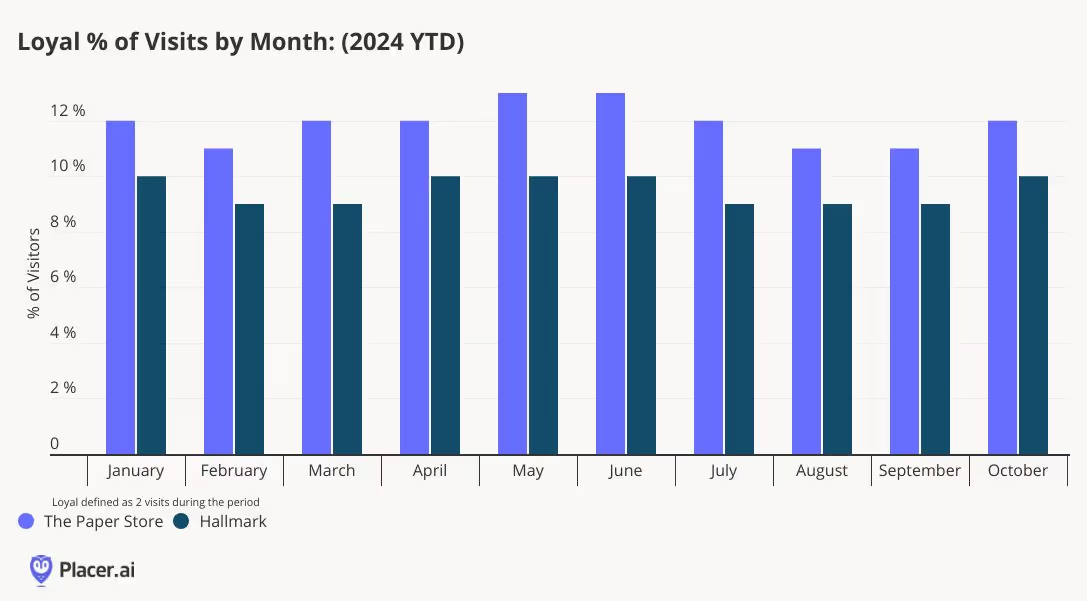

The Paper Store’s elevated and expanded assortment has fostered stronger loyalty among its visitors compared to the Hallmark chain. In 2024, loyal visitors—defined as those visiting twice per month—accounted for 12% of The Paper Store’s visitors, 2 percentage points higher than Hallmark. Additionally, The Paper Store serves more as a destination, with 37% of visitors heading home afterward, also 2 points higher than Hallmark. By expanding its product categories and curating localized selections, The Paper Store has successfully differentiated itself from the traditional Hallmark model, a strategy that could benefit the national chain as well.

The gifting, book, and paper retail category demonstrates varied consumer behavior across chains. The success of Barnes & Noble and The Paper Store underscores the importance of expanding product assortments to attract visits, as consumers increasingly seek convenience by consolidating their purchases in fewer trips. While consumers may tolerate more frequent visits for essential retail, in specialty retail, convenience and variety are critical. The category’s overall resilience suggests that consumers still have discretionary spending power for the right products at the right time, offering hope for retailers still refining their approach.

The sporting goods and sportswear category has had a rough couple of months. Two mainstays in the space – Bob’s Stores and Eastern Mountain Sports – filed for bankruptcy in June, and several sportswear and athleisure leaders posted disappointing results. So is the consumer demand for leggings and sneakers waning? Or is the category merely facing a temporary slowdown? We dove into the data to find out.

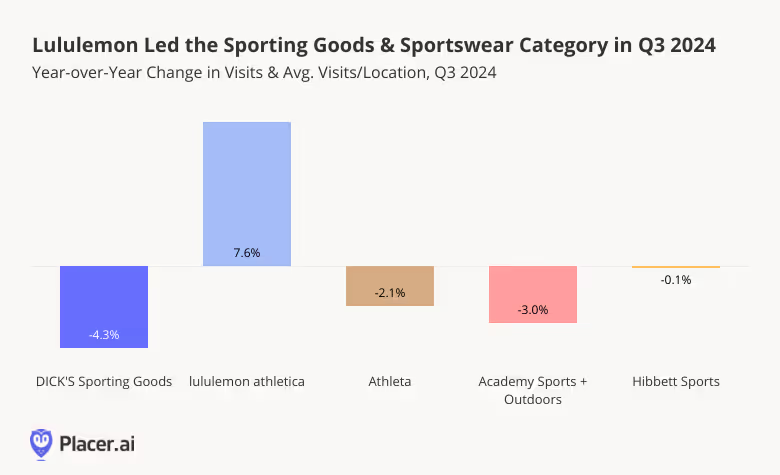

With budgets still tight, many shoppers are turning to value apparel and value athletic wear – and this trading down may be impacting the sporting goods and sportswear space: Q3 2024 visits to most sporting goods and athletic wear chains analyzed, including DICK’s Sporting Goods, Athleta, Academy Sports + Outdoor, and Hibbett Sports, remained at or moderately below 2023 levels. Still, the relatively minimal visit gaps indicate that demand for the category remains stable and may rise again with increased consumer confidence.

Meanwhile, lululemon athletica saw a 7.6% increase in YoY visits in Q3 2024 thanks to the company’s ongoing expansion.

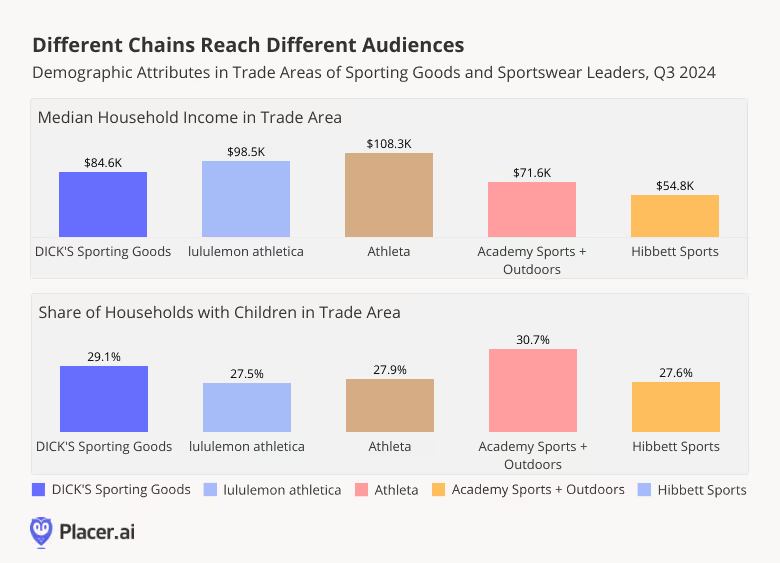

But even as the sporting goods and sportswear category may be facing a temporary lull, diving into the demographics of the trade areas for the various retailers reveals the variety of sporting goods and sportswear consumers – showing the varied demand for the category.

The median household income within the trade areas of the five chains analyzed ranged from $54.8K for Hibbett Sports to $108.3K for Athleta. The share of households with children within the trade areas also varied among the chains: DICK’s Sporting Goods, and Academy Sports + Outdoors included significantly more households with children in their captured markets when compared with Athleta, lululemon, or Hibbett Sports.

It seems, then, that each chain appeals to a specific consumer segment – DICK’s and Academy Sports both serve families, although DICK’s attracts the higher-income households and Academy Sports draws more middle-income shoppers. Lululemon and Athleta both operate at the higher-end of the athletic wear spectrum, but Athleta shoppers tend to come from slightly more affluent areas with larger household sizes. And Hibbett has carved out a niche among lower-income consumers.

Demand for sportswear and gym gear may not be as strong as it was at the height of the pandemic when gyms were closed and consumers were doubling down on comfort. But the variety of audiences within the category leaders’ trade areas indicates that appetite for athletic wear and sporting goods is still widespread. And with Black Friday around the corner, these chains – and especially the higher-priced retailers among them – may well get a boost from price-conscious consumers looking to snag discounts at their favorite premium chains.

For more data-driven retail insights, visit placer.ai.

About the Placer 100 Index for Retail & Dining: The Placer 100 Index for Retail and Dining is a curated, dynamic list of leading chains that often serve as prime tenants for shopping centers and malls. The index includes chains from various industries, such as superstores, grocery, dollar stores, dining, apparel, and more. Among the notable chains featured are Walmart, Target, Costco, Kroger, Ulta Beauty, The Home Depot, McDonald’s, Chipotle, Crunch Fitness, and Trader Joe's. The goal of the list is to provide insight into the wider trends impacting the retail, dining and shopping center segments.

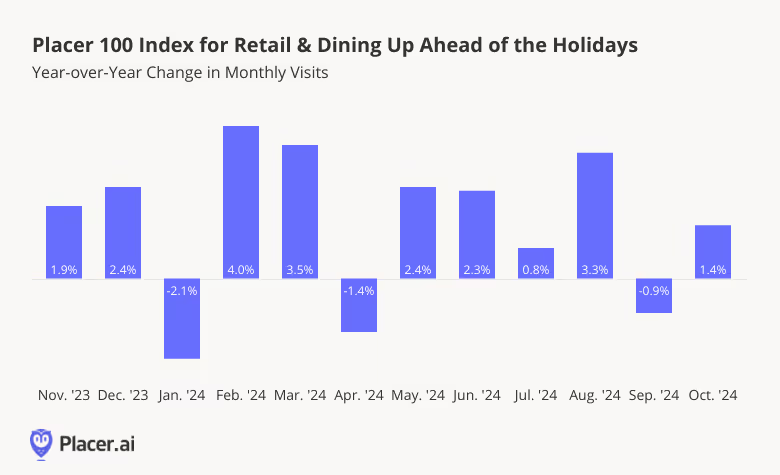

Visits to the Placer 100 Index chains grew over the summer, as the back to school season drove a 3.3% year-over-year (YoY) jump in August 2024 visits. And visits in September 2024 were essentially on par with September 2023 levels – indicating that shoppers did not stay home to make up for retail’s summer surge, which could signal an increased willingness to spend ahead of the critical Q4.

And indeed, the fourth quarter of the year started strong, with the Placer 100 Index up 1.4% YoY in October 2024 – and with consumer confidence recently hitting a 9-months-high, the upcoming holiday season looks particularly promising.

Chili’s Grill & Bar topped the Placer 100 October chart in terms of both overall and per-location visit growth. The chain is still riding the wave of its Big Smasher Burger success, which sent visits skyrocketing following the product’s launch in late April. Warby Parker also saw impressive increases in overall visits and in visits per location as the chain continued opening new stores and adding eye exam offerings to existing locations.

Aldi and Crunch Fitness also saw growth in both metrics, with the increase in overall visits outpacing the strong increase in visits per location – pointing to a successful expansion strategy.

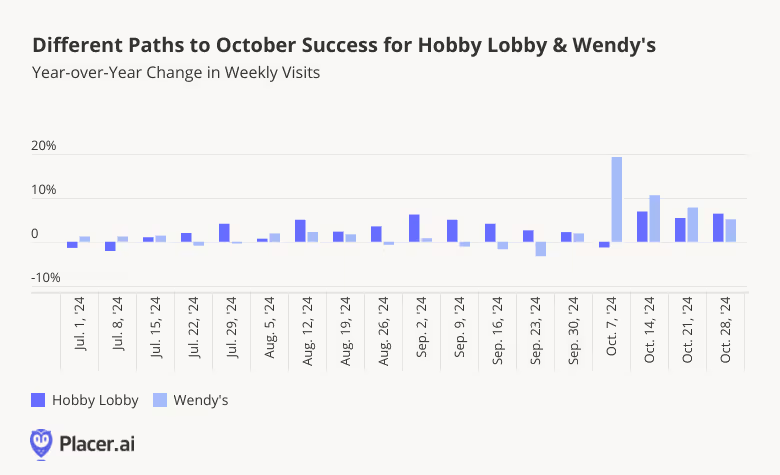

Hobby Lobby and Wendy’s also experienced increases in both overall visits and visits per location in October, with different paths leading to the two chains’ October successes.

Hobby Lobby’s visits follow clear seasonal patterns. The chain’s traffic usually peaks in December, but traffic already begins to rise in August as parents and teachers stock up on supplies and classroom decorations. Visit growth then ramps up throughout September and October as consumers purchase Halloween-themed costumes and decorations. So far, Hobby Lobby appears to be having a particularly successful year, with visits outpacing last year’s numbers since the summer – and with the chain’s busiest season of the year coming up, Hobby Lobby is positioned to close out the year with a bang.

Wendy’s, meanwhile, demonstrated how chains can create their own growth opportunities without aligning with existing calendar-driven spending occasions. The chain introduced the Krabby Patty Kollab menu items on October 2nd to celebrate the 25th anniversary of "SpongeBob SquarePants,” which sent visits surging. And YoY traffic was still up four weeks later, revealing the potential of LTOs to drive up dining traffic even in the absence of a specific seasonal boost.

Which chains will top the Placer 100 Index in November?

Visit placer.ai to find out!

Note: This post utilizes data from Placer.ai Data Version 2.1. and thus reflects minor adjustments in data from previous reports.

Amazon, Dell, Goldman Sachs, Walmart, UPS – these are just a few of the major employers that have been cracking down on remote work in recent months, some requiring their teams to be on-site full time.

So with summer behind us, we dove into the data to assess the impact these accumulating RTO mandates are having on the ground. Are offices continuing to fill up, or has the office recovery run its course?

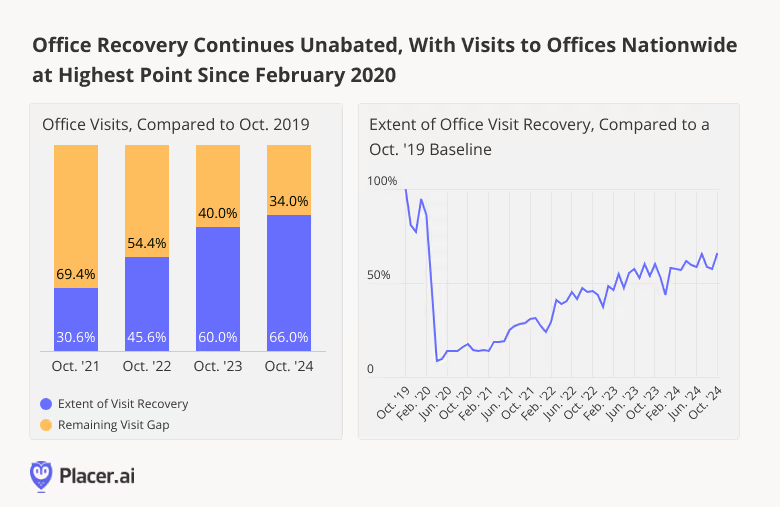

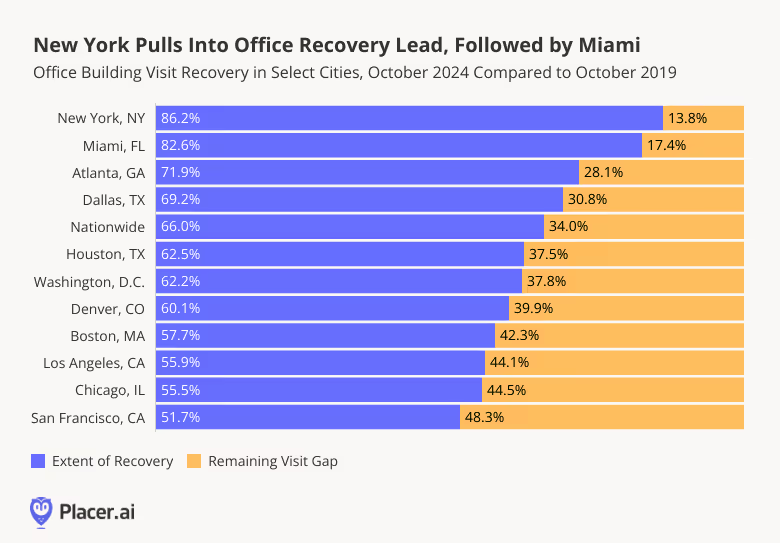

In October 2024, office visits nationwide were 34.0% below October 2019 levels. And looking at monthly fluctuations in office foot traffic over the past five years shows that the RTO remains in full swing – with last month’s visits reaching the highest point seen since February 2020.

Digging down into regional data shows that in several major hubs – including Atlanta, Dallas, Houston, Denver, Washington, D.C., Chicago, and San Francisco – October 2024 was the single busiest in-office month since COVID. And in Boston, Los Angeles, Miami, and New York, October was the second-busiest month, outpaced only by July.

Still, New York and Miami continued to lead the regional office recovery pack, with October 2024 visits in the two cities up to 86.2% and 82.6%, respectively, of 2019 levels. The two hubs, joined by Atlanta and Dallas, continued to outperform the nationwide average. And Houston, which lagged behind other major business hubs during the summer in the wake of major storms, reclaimed its position just under the nationwide baseline.

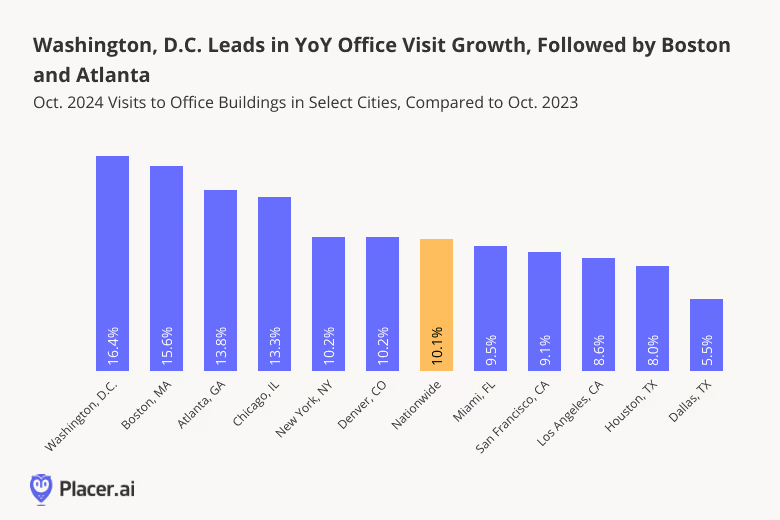

In October 2024, visits to office buildings in Washington D.C. increased 16.4% year over year (YoY), likely boosted by an RTO push meant to increase meaningful in-person work in federal agencies – though many government employees continue to telework. Boston, where office building occupancy is outperforming national levels, visits saw a 15.6% YoY uptick. And Atlanta, where major employers from UPS to NCR Voyix are requiring workers to show their faces five days a week, saw visits grow 13.8% YoY.

Nationwide, office foot traffic increased 10.1% YoY – showing that the return-to-office is still very much a work in progress.

Office attendance fosters creativity, mutual learning, and a sense of community – and can be critical for early-career success. But working from home at least some of the time offers greater flexibility that can improve employees’ work-life balance and in some cases, even enhance productivity. How will companies and employees continue to navigate the ongoing RTO?

Follow Placer.ai’s data-driven office recovery analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

With the holiday season just around the corner, we dove into the Placer.ai Mall Index to see how these shopping mainstays performed during the fall retail lull.

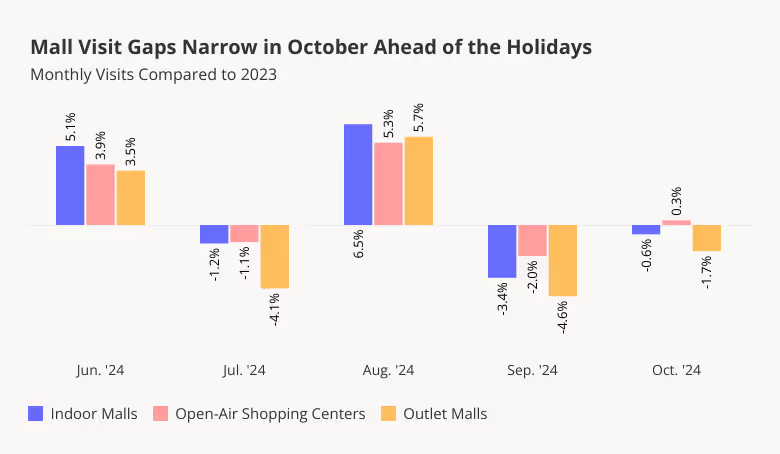

Following several months of roller-coaster visit trends – as August visits surged compared to last year and September visits dipped year-over-year (YoY) – mall traffic stabilized in October: Last month’s visits to indoor malls, open-air shopping centers, and outlet malls generally matched 2023 visitation trends. The closing of the YoY visit gaps may indicate that consumers are once again ready to spend following the brief September slow-down – boding well for the upcoming holiday season.

Diving into the weekly trends offers even further reasons for optimism: YoY visits over the last two full weeks of October were positive for all three mall categories, with outlet malls in particular seeing the largest YoY increases. Outlet malls’ positive performance during the second half of the month may signal a comeback for the format, which has generally lagged behind indoor malls and open-air shopping centers in recent months.

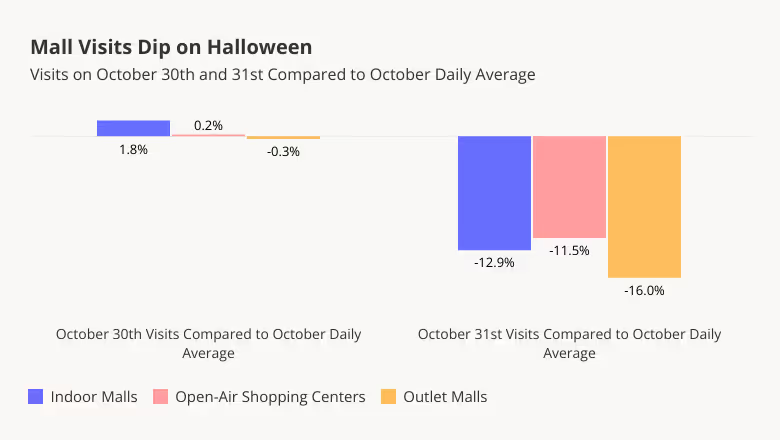

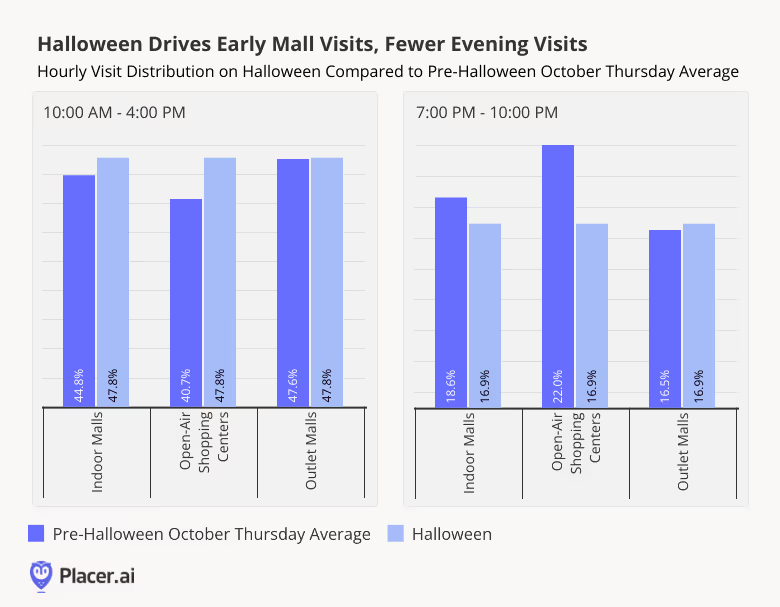

Unlike certain retail categories that enjoy Halloween-driven visit surges either on the day itself or on October 30th, malls do not appear to benefit from the spooky holiday. Analyzing daily visits reveals that October 30th visits were on par with the daily October average, while October 31st traffic actually took a hit across the three mall formats in the Placer.ai Mall Index.

The dip is likely due to shoppers putting off their mall trips and instead choosing superstores and specialty retailers such as party supply stores and liquor shops for their holiday prep. Stores hoping to avoid the Halloween dip may want to offer special promotions around the day – and managers can also use this information to optimize their staffing schedules on October 31st.

Diving into hourly visit distributions provides even more data for those looking to optimize store performance. On Halloween, indoor malls and open-air shopping centers received a larger share of their visits before 4:00 PM and relatively fewer visits in the evening when compared to an average Thursday in October. So while some consumers did come out to malls in the morning, by evening, many shoppers may have been too busy scrambling to complete their Halloween costume or stock up on candy for the evening. Meanwhile, the Halloween dip in visits to outlet malls appears to have been evenly spaced throughout the day, with hourly visit shares on October 31st closely matching the average Thursday visit distribution patterns.

Store managers operating in indoor malls or open-air shopping centers may use this data to optimize staffing for the afternoon and evening Halloween shifts, while those working at outlet malls may want to reconsider their manpower needs for the day as a whole. At the same time, those looking to draw in more foot traffic may try offering promotions that appeal to early birds or trick-or-treaters.

With October in the rearview mirror, the holiday season is kicking off. How will malls perform?

Visit placer.ai to find out.

As essential sectors of retail face a slowdown in traffic momentum, the need for unique offerings and competitive advantages is more pressing than ever. Grocery retailers have benefited from increased visits, which has kept consumers engaged with chains and their offerings, even if it hasn’t always translated into larger basket sizes. In an increasingly competitive grocery market, retailers will need to consistently prove to consumers that they’re worth the extra visit.

Specialty grocers are better positioned to meet this challenge as value-focused grocery options become more constrained. Many local and regional chains have the added benefit of nimble operating models, enabling them to quickly adapt to consumer preferences. Beyond that, these specialty chains have deeply embedded themselves in the communities they serve. Looking ahead to 2025 and the growing recognition of physical stores’ importance, the strong relationships between specialty grocery retailers and consumers could help them thrive in this evolving environment.

One specialty chain that stands out in this context is Stew Leonard’s. Beloved in the Tri-State area—an area known for outstanding grocery chains—Stew Leonard’s combines product expertise with a unique in-store experience, famously described by The New York Times as “the Disneyland of Dairy Stores.” Imagine a grocery store with animatronics and birthday parties! In an era when we need more joy in retail, Stew Leonard’s sets the gold standard. With just eight locations, each with a large footprint and a strong connection to its local community, Stew Leonard’s offers a compelling package. A robust private label program, specialty departments, and high service levels make this chain stand out without relying on promotions or low prices.

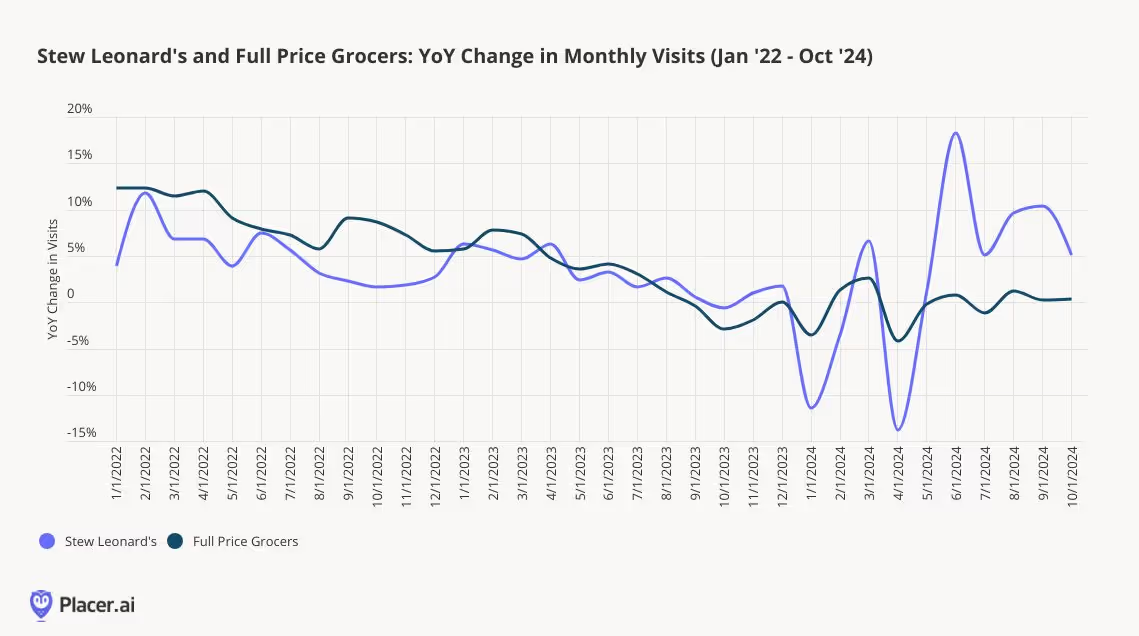

According to Placer’s foot traffic estimates, Stew Leonard’s has effectively hedged against the slowdown in growth seen by other full-price grocery chains this year. Year-to-date, the chain has experienced a 3% year-over-year increase, compared to flat growth for full-price chains. Examining trends over time, Stew Leonard’s has shown consistent, sustainable growth throughout 2022 and 2023, with an acceleration in visits in the latter half of this year, driven by the opening of its new store in Clifton, NJ.

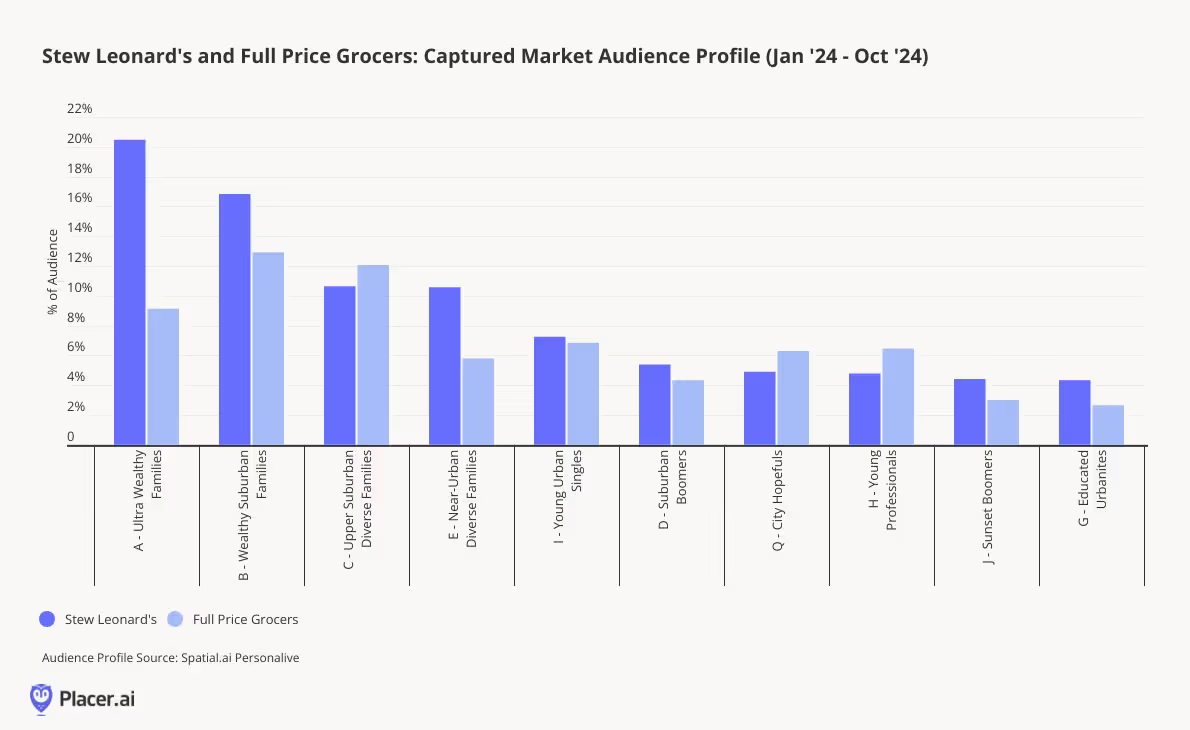

One reason for Stew Leonard’s success is the elasticity of its consumer base. Operating in the Tri-State area allows the chain to tap into wealthier consumer segments compared to national chains. According to PersonaLive audience segmentation, Stew Leonard’s has more than double the concentration of Ultra Wealthy Families compared to full-price grocery chains, along with a high percentage of Wealthy Suburban Families. The chain also attracts a notable share of Young Urban Singles, likely drawn by its strong offerings in prepared and specialty foods.

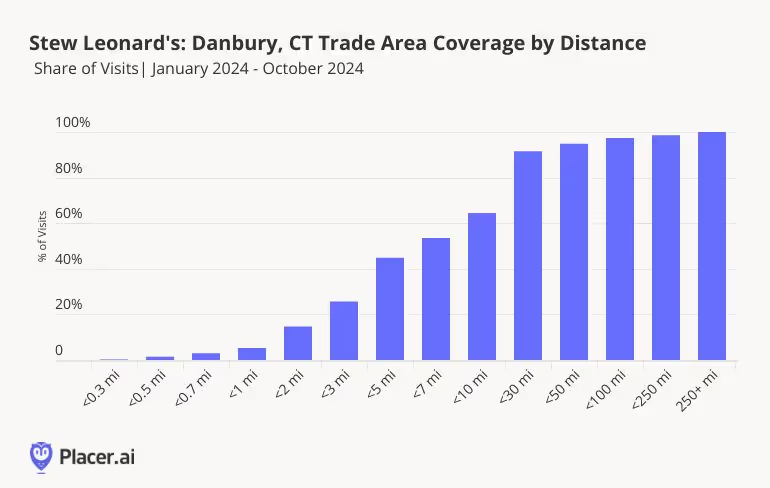

Stew Leonard’s Danbury, CT location offers insight into the brand’s appeal to shoppers. According to Placer’s trade area metrics, 35% of visitors to this store travel from more than 10 miles away, and nearly 10% come from over 30 miles, with clusters of visits from across the Northeastern corridor.

Store-level metrics also reveal strong loyalty among Stew Leonard’s visitors. Year-to-date in 2024, over a quarter of visitors to the Danbury location visited at least four times, and 35% visited three or more times. At the same time, there is a substantial share of visitors who appear to make special, less frequent trips to the store. These visitors show high cross-visitation rates with other grocers, such as Costco and ShopRite, as well as with Stew Leonard’s own operated Wine and Spirits locations.

Stew Leonard’s exemplifies a retailer that resonates with local consumers while offering an experience that attracts visitors from further away. Its combination of unique experiences, services, and products creates a shopping experience that goes well beyond traditional retail. Even as visits slow down across the sector, specialty grocers that remain hyper-focused on their unique offerings are likely to continue drawing in customers.

Everybody loves coffee. And with some 75% of American adults indulging in a cup of joe at least once a week, it’s no wonder the industry is constantly on an upswing.

In early 2024, year-over-year (YoY) visits to coffee chains increased nationwide – with every state in the continental U.S. experiencing year-over-year (YoY) coffee visit growth.

The most substantial foot traffic boosts were seen in smaller markets like Oklahoma (19.4%), Wyoming (19.3%), and Arkansas (16.9%), where expansions may have a more substantial impact on statewide industry growth. But the nation’s largest coffee markets, including Texas (10.9%), California (4.2%), Florida (4.2%), and New York (3.5%), also experienced significant YoY upticks.

The nation’s coffee visit growth is being fueled, in large part, by chain expansions: Major coffee players are leaning into growing demand by steadily increasing their footprints. And a look at per-location foot traffic trends shows that by and large, they are doing so without significantly diluting visitation to existing stores.

On an industry-wide level, visits to coffee chains increased 5.1% YoY during the first five months of 2024. And over the same period, the average number of visits to each individual coffee location declined just slightly by 0.6% – meaning that individual stores drew just about the same amount of foot traffic as they did in 2023.

Drilling down into chain-level data shows some variation between brands. Dutch Bros., BIGGBY COFFEE and Dunkin’ all saw significant chain-wide visit boosts, accompanied by minor increases in their average number of visits per location.

Starbucks, for its part, which reported a YoY decline in U.S. sales for Q2 2024, maintained a small lag in visits per location. But given the coffee leader’s massive footprint – some 16,600 stores nationwide – its ability to expand while avoiding more significant dilution of individual store performance shows that Starbucks’ growth is meeting robust demand.

What is driving the coffee industry’s remarkable category-wide growth? And who are the customers behind it? This white paper dives into the data to explore key factors driving foot traffic to leading coffee chains in early 2024. The report explores the demographic and psychographic characteristics of visitors to major players in the coffee space and examines strategies brands can use to make the most of the opportunity presented by a thriving industry.

One factor shaping the surge in coffee visit growth is the slow-but-sure return-to-office (RTO). Hybrid work may be the post-COVID new normal – but RTO mandates and WFH fatigue have led to steady increases in office foot traffic over the past year. And in some major hubs – including New York and Miami – office visits are back to more than 80.0% of what they were pre-pandemic.

A look at shifting Starbucks visitation patterns shows that customer journeys and behavior increasingly reflect those of office-goers. In April and May 2022, for example, 18.6% of Starbucks visitors proceeded to their workplace immediately following their coffee stop – but by 2024, this share shot up to 21.0%.

Over the same period, the percentage of early morning (7:00 to 10:00 AM) Starbucks visits lasting less than 10 minutes also increased significantly – from 64.3% in 2022 to 68.7% in 2024. More customers are picking up their coffee on the go – many of them on the way to work – rather than settling down to enjoy it on-site.

Dunkin’ is another chain that is benefiting from consumers on the go. Examining the coffee giant’s performance across major regional markets – those where the chain maintains a significant presence – reveals a strong correlation between the share of Dunkin’ visits in each state lasting less than five minutes and the chain’s local YoY trajectory.

In Wisconsin, for example, 50.9% of visits to Dunkin’ between January and May 2024 lasted less than five minutes. And Wisconsin also saw the most impressive YoY visit growth (5.9%). Illinois, Ohio, Maine, and Connecticut followed similar patterns, with high shares of very short visits and strong YoY showings.

On the other end of the spectrum lay Tennessee, Alabama, and Florida, where very short visits accounted for a low share of the chain’s statewide total – under 40.% – and where visits declined YoY.

Dunkin’s success with very short visits may be driven in part by its popular app, which makes it easy for harried customers to place their order online and save time in-store. And this is good news indeed for the coffee leader – since customers using the app also tend to generate bigger tickets.

Dutch Bros.’ meteoric rise has been fueled, in part, by its appeal to younger audiences. Recently ranked as Gen Z’s favorite quick-service restaurant, the rapidly-expanding coffee chain sets itself apart with a strong brand identity built on cultivating a positive, friendly customer experience.

And Dutch Bros.’ people-centered approach is resonating especially well with singles – including young adults living alone – who may particularly appreciate the chain’s community atmosphere.

Analyzing the relative performance of Dutch Bros.’ locations across metro areas – focusing on regions where the chain has a strong local presence – shows that it performs best in areas with plenty of singles. Indeed, the share of one-person households in Dutch Bros.’ local captured markets is very strongly correlated with the coffee brand’s CBSA-level YoY per-location visit performance. Areas with higher concentrations of one-person households saw significantly more YoY visit growth in the first part of 2024. (A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice).

The share of one-person households in Dutch Bros.’ Tucson, AZ captured market, for example, stands at 33.4% – well above the nationwide baseline of 27.5%. And between January and May 2024, Tucson-area Dutch Bros. saw a 6.0% increase in the average number of visits per location. Tulsa, OK, Medford, OR, and Oklahoma City, OK – which also feature high shares of one-person households (over 30.0%) – similarly saw per-location visit increases ranging from 3.6% - 7.0%. On the flip side, Fresno, CA, Las Vegas-Henderson-Paradise, NV, and San Antonio-New Braunfels, TX, which feature lower-than-average shares of single-person households, saw YoY per-location visit declines ranging from 1.5%-9.5%.

As Dutch Bros. forges ahead with its planned expansions, it may benefit from doubling down on this trends and focusing its development efforts on markets with higher-than-average shares of one-person households – such as university towns or urban areas with lots of young professionals.

Michigan-based BIGGBY COFFEE is another java winner in expansion mode. With a growth strategy focused on emerging markets with less brand saturation, BIGGBY has been setting its sights on small towns and rural areas throughout the Midwest and South. Though the chain does have locations in bigger cities like Detroit and Cincinnati, some of its most significant markets are in smaller population centers.

And a look at the captured markets of BIGGBY’s 20 top-performing locations in early 2024 shows that they are significantly over-indexed for suburban consumers – both compared to BIGGBY as a whole and compared to nationwide baselines. (Top-performing locations are defined as those that experienced the greatest YoY visit growth between January and May 2024).

“Suburban Boomers”, for example – a Spatial.ai: PersonaLive segment encompassing middle-class empty-nesters living in suburbs – comprised 10.6% of BIGGBY’s top captured markets in early 2024, compared to just 6.6% for BIGGBY’s overall. (The nationwide baseline for Suburban Boomers is even lower – 4.4%.) And Upper Diverse Suburban Families – a segment made up of upper-middle-class suburbanites – accounted for 9.6% of the captured markets of BIGGBY’s 20 top locations, compared to just 7.2% for BIGGBY’s as a whole, and 8.3% nationwide.

Coffee has long been one of America’s favorite beverages. And java chains that offer consumers an enjoyable, affordable way to splurge are expanding both their footprints and their audiences. By leaning into shifting work routines and catering to customers’ varying habits and preferences, major coffee players like Starbucks, Dunkin’, Dutch Bros., and BIGGBY COFFEE are continuing to thrive.

Note: This report is based on an analysis of visitation patterns for regional and nationwide grocery chains and does not include single-location stores.

Grocery stores, superstores, and dollar stores all carry food products – and American consumers buy groceries at all three. But even in today’s crowded food retail environment, traditional grocery chains have a special role to play. With their primary focus on stocking a wide variety of fresh foods, these chains serve a critical function in offering consumers access to healthy options.

But visualizing the footprints of major grocery chains across the continental U.S. – alongside those of discount & dollar stores – shows that the geographical distribution of grocery chains remains uneven.

In some areas, including parts of the Northeast, Midwest, South Atlantic, and Pacific regions, grocery chains are plentiful. But in others – some with population centers large enough to feature a robust dollar store presence – they remain in short supply.

And though many superstore locations also provide a full array of grocery offerings, they, too, are often sparsely represented in areas with low concentrations of grocery chains.

For grocery chain operators seeking to expand, these underserved grocery markets can present a significant opportunity. And for civic stakeholders looking to broaden access to healthy food across communities, these areas highlight a policy challenge. For both groups, identifying underserved markets with significant untapped demand can be a critical first step in deciding where to focus grocery development initiatives.

This white paper dives into the location analytics to examine grocery store availability across the United States – and harnesses these insights to explore potential demand in some underserved markets. The report focuses on locations belonging to regional or nationwide grocery chains, rather than single-location stores.

Last year, grocery chains accounted for 43.4% of nationwide visits to food retailers – including grocery chains, superstores, and discount & dollar stores. But drilling down into the data for different areas of the country reveals striking regional variation – offering a glimpse into the variability of grocery store access throughout the U.S. In some states, grocery stores attract the majority of visit share to food retailers, while in others, dollar stores or superstores dominate the scene.

The ten states where residents were most likely to visit grocery chains in early 2024 – Oregon, Vermont, Washington, Massachusetts, California, Maryland, New Hampshire, Connecticut, New Jersey, and Rhode Island – were all on the East or West Coasts. In these states, as well as in Nevada and New York, grocery chain visits accounted for 50.0% or more of food retail visits between January and April 2024.

Meanwhile, residents of many West North Central and South Central states were much less likely to do their food shopping at grocery chains. In North Dakota, for example, grocery chain visits accounted for just 11.7% of visits to food retailers over the analyzed period. And in Mississippi, Oklahoma, and Arkansas, too, grocery stores drew less than 20.0% of the overall food retail foot traffic.

But low grocery store visit share does not necessarily indicate a lack of consumer interest or ability to support such stores. And in some of these underserved regions, existing grocery chains are seeing outsize visit growth – indicating growing demand for their offerings.

North Dakota, the state with the smallest share of visits going to grocery chains in early 2024, experienced a 9.1% year-over-year (YoY) increase in grocery visits during the same period – nearly double the nationwide baseline of 5.7%. Other states with low grocery visit share, including Nebraska, Arkansas, Alabama, Mississippi, and New Mexico, also experienced higher-than-average YoY grocery chain visit growth. This suggests significant untapped potential for grocery stores and a market that is hungry for more.

Alabama is one state where grocery chains accounted for a relatively small share of overall food retail foot traffic in early 2024 (just 28.9%) – but where YoY visit growth outperformed the nationwide average. And digging down even further into local grocery store visitation trends provides further evidence that at least in some places, low grocery visit share may be due to inadequate supply, rather than insufficient demand.

In Central Alabama, for example, many residents drive at least 10 miles to reach a local grocery chain. And several parts of the state, both rural and urban, feature clusters of grocery stores that draw customers from relatively far away.

But zooming in on YoY visitation data for local grocery chain locations shows that at least some of these areas likely harbor untapped demand. Take for example the Camden, Butler, Thomasville, and Gilbertown areas (circled in the map above). The Piggly Wiggly location in Butler, AL, drew 40.1% of visits from 10 or more miles away. The same store experienced a 23.3% YoY increase in visits in early 2024 – far above the statewide baseline of 6.6%. Meanwhile, the Super Foods location in Thomasville, AL, which drew 52.8% of visits from at least 10 miles away – experienced YoY visit growth of 12.3%. The Piggly Wiggly locations in Camden, AL and Gilbertown, AL saw similar trends.

At the same time, trade area analysis of the four locations reveals that the grocery stores had little to no trade area overlap during the analyzed period. Each store served specific areas, with minimal cannibalization among customer bases.

These metrics appear to highlight robust demand for grocery stores in the region – grocery visits are growing at a stronger rate than those in the overall state, people are willing to make the drive to these stores, and each one has little to no competition from the others.

While significant opportunity exists across the country, many communities still face considerable challenges in supporting large grocery stores. Though South Carolina has a significant number of grocery chain locations, for example, certain areas within the state have low access to food shopping opportunities. And one local government – Greenville County – is considering offering tax breaks to grocery stores that set up shop in the area, to improve local fresh food accessibility.

Placer.ai migration and visitation data shows that Greenville County is ripe for such initiatives: the county’s population grew by 4.8% over the past four years – with much of that increase a result of positive net migration. And YoY visits to Greenville County Grocery Stores have consistently outperformed state averages: In April 2024, grocery visits in the county grew by 6.1% YoY, while overall visits to grocery stores in South Carolina grew by 4.2%. This growth – both in terms of grocery visits and population – points to rising demand for grocery stores in Greenville County.

Analyzing the Greenville County grocery store trade areas with Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – offers further insight into local grocery shoppers’ particular demand and preferences.

Consumers in Greenville-area grocery store trade areas, for example, are more likely to be interested in “Mid-Range Grocery Stores” (including brands like Aldi, Kroger, and Lidl) than residents of grocery store trade areas in the state as a whole. This metric provides further evidence of local demand for grocery chains – and offers a glimpse into the kinds of specific grocery offerings likely to succeed in the area.

Grocery stores remain essential services for many consumers, providing a place to pick up fresh produce, meat, and other healthy food options. And many areas in the country are ripe for expansion, with eager customer bases and growing demand. Identifying such areas with location analytics can help both grocery store operators and municipal stakeholders provide their communities and customer bases with an enhanced grocery shopping experience that caters to local preferences.

Following COVID-era highs, domestic migration levels have begun to taper off – with the number of Americans moving within the U.S. hitting an all-time low, according to some sources, in 2023.

To be sure, some popular COVID-era destinations – including Idaho, the Carolinas, and Utah – saw their net domestic migration continue to rise, albeit at a slower pace. But other states which had been relocation hotspots between February 2020 and February 2023, such as Wyoming and Texas, experienced negative net migration between February 2023 and February 2024.

Analyzing CBSA-level migration data reveals differences and similarities between last year’s migration patterns and COVID-era trends.

Between February 2020 and February 2023, seven out of the ten CBSAs posting the largest population increases due to inbound domestic migration were located in Florida. But between February 2023 and February 2024, the top 10 CBSAs with the largest net migrated percent of the population were significantly more diverse. Only four out of the ten CBSAs were located in Florida, and several new metro areas – including Provo-Orem, UT, Kingsport-Bristol, TN-VA, and Boulder, CO – joined the list.

This white paper leverages a variety of location intelligence tools – including Placer.ai’s Migration Report, Niche Neighborhood Grades, and ACS Census Data location intelligence – to analyze two migration hotspots. Specifically, the report focuses on Daytona Beach, FL, which already appeared on the February 2020 to February 2023 list and has continued to see steady growth, and Boulder, CO, which has emerged as a new top destination. The data highlights the potential of CBSAs with unique value propositions to continue to attract newcomers despite ongoing housing headwinds.

The Boulder, CO CBSA has emerged as a domestic migration hotspot: The net influx of population between February 2023 and February 2024 (i.e. the total number of people that moved to Boulder from elsewhere in the U.S., minus those that left) constituted 3.1% of the CBSA’s February 2024 population.

The strong migration is partially due to the University of Colorado, Boulder’s growing popularity. But the metro area has also emerged as a flourishing tech hub, with Google, Apple, and Amazon all setting up shop in town, along with a wealth of smaller start ups.

Most domestic relocators tend to remain within state lines – so unsurprisingly, many of the recent newcomers to Boulder moved from other CBSAs in Colorado. But perhaps due to Boulder’s robust tech ecosystem, many of the new residents also came from Los Angeles, CA (6.6%) and San Francisco, CA (3.4%) – other CBSAs known for their thriving tech scenes.

At the same time, looking at the other CBSAs feeding migration to the area indicates that tech is likely not the only draw attracting people to Boulder: A significant share of relocators came from the CBSAs of Chicago, IL (6.1%), Dallas , TX (4.9%), and New York, NY (3.9%). The move from these relatively urbanized CBSAs to scenic Boulder indicates that some of the domestic migration to the area is likely driven by people looking for better access to nature or a general lifestyle change.

According to the U.S. News & World Report, Boulder ranked in second place in terms of U.S. cities with the best quality of life. Using Niche Neighborhood Grades to compare quality of life attributes in the Boulder CBSA and in the areas of origin dataset highlights some of the draw factors attracting newcomers to Boulder beyond the thriving tech scene.

The Boulder CBSA ranked higher than the metro areas of origin for “Public Schools,” “Health & Fitness,” “Fit for Families,” and “Access to Outdoor Activities.” These migration draw factors are likely helping Boulder attract more senior executives alongside younger tech workers – and can also explain why relocators from more urban metro areas may be choosing to make Boulder their home.

Boulder’s strong inbound migration numbers over the past year – likely driven by its flourishing tech scene and beautiful natural surroundings – reveal the growth potential of certain CBSAs regardless of wider housing market headwinds.

Florida experienced a population boom during the pandemic, and several CBSAs in the state – including the Deltona-Daytona Beach-Ormond Beach, FL CBSA – have continued to welcome domestic relocators in high numbers. The CBSA’s anchor city, Daytona Beach – known for its Bike Week and NASCAR’s Daytona 500 – has also seen positive net migration between February 2023 and February 2024.

Americans planning for retirement or retirees operating on a fixed income are likely particularly interested in optimizing their living expenses. And given Daytona’s relative affordability, it’s no surprise that the median age in the areas of origin feeding migration to Daytona Beach tends to be on the older side.

According to the 2021 Census ACS 5-Year Projection data, the median age in Daytona Beach was 39.0. Meanwhile, the weighted median age in the areas of migration origin was 42.6, indicating that those moving to Daytona Beach may be older than the current residents of the city.

Zooming into the migration data on a zip code level also highlights Daytona Beach’s appeal to older Americans: The zip code welcoming the highest rates of domestic migration was 32124, home to both Jimmy Buffet’s Latitude Margaritaville’s 55+ community and the LPGA International Golf Club, host of the LPGA Tour. The median age in this zip code is also older than in Daytona Beach as a whole, and the weighted age in the zip codes of origin was even higher – suggesting that older Americans and retirees may be driving much of the migration to the area.

Looking at the migration draw factors for Daytona Beach also suggests that the city is particularly appealing to retirees, with the city scoring an A grade for its “Fit for Retirees.” But the city of Daytona Beach is also an attractive destination for anyone looking to elevate their leisure time, with the city scoring higher than Daytona Beach’s cities of migration origin for “Weather,” “Access to Restaurants,” or “Access to Nightlife.”

Like Boulder, Daytona’s scenery – including its famous beaches – is likely attracting newcomers looking to spend more time outdoors and improve their work-life balance. And like Boulder and its tech scene, Daytona Beach also has an extra pull factor – its affordability and fit for older Americans – that is likely helping the area continue to attract new residents, even as domestic migration slows down nationwide.

Although the overall pace of domestic migration has slowed, analyzing location intelligence data reveals several migration hotspots amidst the overall cooldown. Boulder and Daytona Beach each have a set of unique draw factors that seem to attract different populations – and the success of these regions highlights the many paths to migration growth in 2024.