.svg)

.png)

.png)

.png)

.png)

Columbus, Ohio is among the Midwest’s fastest-growing metro areas. Like downtown business districts across the country, its urban core is seeing a return to the office. What do inbound commuter traffic patterns reveal about this shift – and how can local stakeholders, from retailers to commercial real estate investors, capitalize on the opportunities created by this growing influx?

Growing metro areas depend on vibrant downtown anchors for employment and economic activity. In Columbus, OH, the downtown area has long served as a key destination for commuters as the city’s population and labor force have grown. Favorable business incentives, and the presence of major employers such as Nationwide Insurance, Huntington Bancshares, and American Electric Power contribute to Downtown Columbus’s rising commuter population.

Analysis of the regions with the highest shares of commuters to Downtown Columbus shows that both nearby urban neighborhoods and surrounding suburbs contribute significantly to the city’s downtown workforce.

The map below reveals that over the past 12 months, the densely-populated 43201 zip code drove one of the highest shares of downtown commuters. This urban corridor includes the rejuvenated Weinland Park neighborhood and parts of the University District and trendy Short North. Many of these commuters are likely students or recent graduates entering the workforce – drawn downtown by internships, early-career roles, and professional opportunities.

At the same time, the suburbs also play a defining role in Downtown Columbus’s workforce composition. The 43123 zip code – centered around Grove City – and 43026 – anchored by Hilliard – also had relatively large shares of Downtown Columbus commuters. This reflects a broader trend of workers balancing suburban lifestyles with city-based employment opportunities.

While Downtown Columbus’s workforce reflects a mix of suburban and urban commuters, the composition within its commercial corridors is even more nuanced – shaped by distinct demographic and psychographic characteristics.

Among the analyzed corridors, the Arena District stood out for having the highest median household income (HHI) and the largest share of the “Young Professionals” segment among commuters in 2025, suggesting a workforce anchored in early- to mid-career white-collar roles. This profile aligns with the district’s mix of corporate offices, and sports and entertainment–adjacent employers that may attract younger, upwardly mobile workers.

The Discovery District followed closely in terms of median income, but its psychographic mix skewed differently. The area had one of the highest shares of the “Ultra Wealthy Families” segment, alongside the largest concentration of the “City Hopefuls” segment, among the downtown corridors analyzed. Anchored by institutions such as Columbus State Community College, major healthcare employers, research organizations, and cultural assets like the Columbus Metropolitan Library and the Columbus Museum of Art, the district appears to draw a diverse, but upper-income mix of commuters tied to public service, education, and nonprofit work.

The Uptown District stood apart with a median commuter HHI below that of the Columbus, OH DMA, and elevated shares of “City Hopefuls” and “Young Professionals” compared to the region. This profile likely reflects the district’s concentration of government offices and white-collar employers in law and finance, alongside the service-sector workforce that supports the area’s high daily activity – together pulling a wide spectrum of income levels into the corridor each day.

With the right strategy, the diversity among commuters – who are also consumers of restaurants, retailers, and other service-oriented industries – creates opportunities for businesses to engage their target audiences where they spend meaningful daytime hours.

A downtown reflects not only a metro’s economic strength but also the fabric of its cultures and communities. In Columbus, the downtown serves as both a hub of commercial activity and a crossroads for commuters from diverse backgrounds. This diversity presents businesses with opportunities to carve out a target audience and civic leaders with a responsibility to ensure that Downtown Columbus continues to serve the needs of all who power it.

For more regional analyses, visit Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

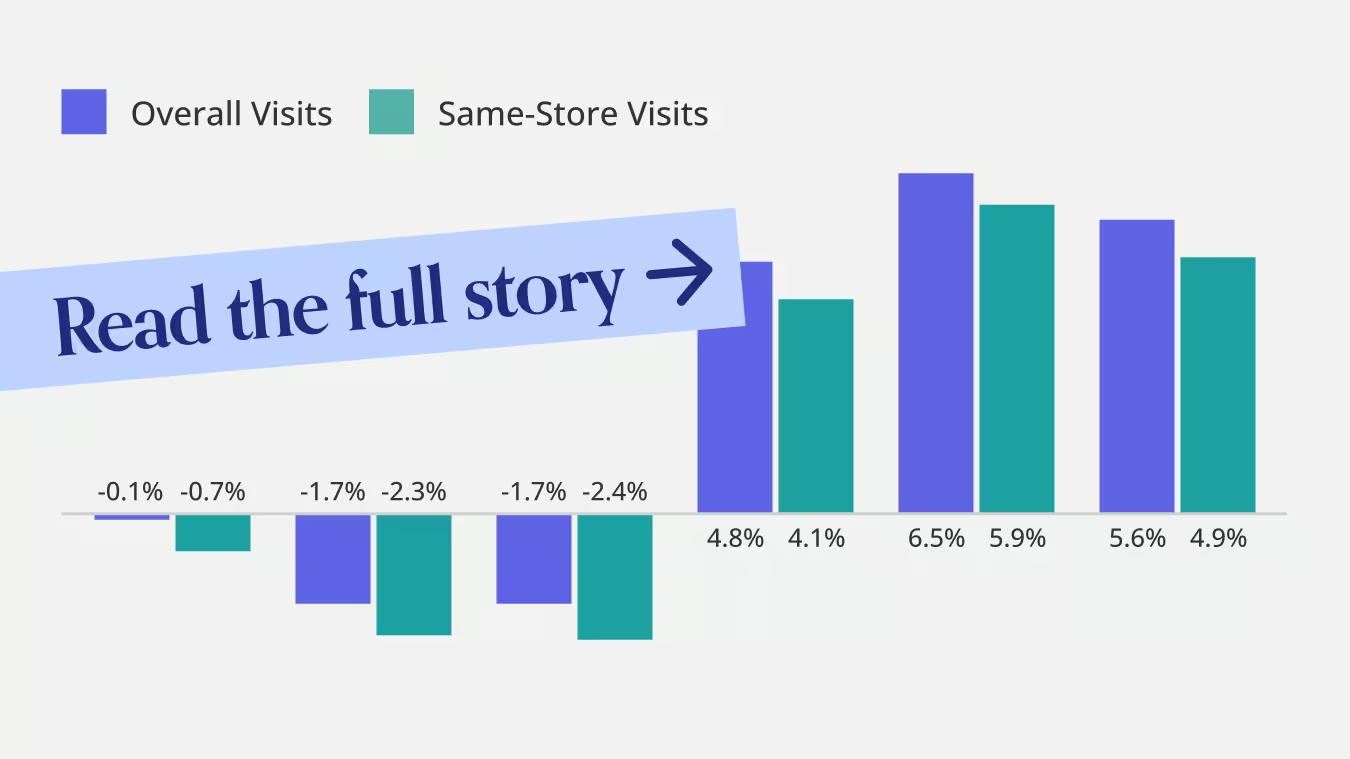

Between July and October 2025, Chipotle’s year-over-year (YoY) visit growth was driven almost entirely by expansion. Overall chain-wide visits rose each month, while same-store visits remained negative, generally hovering between -1% and -2%.

This pattern aligns closely with Chipotle’s recent earnings results. In Q2 2025, the company reported a 4% decline in comparable restaurant sales driven by a nearly 5% drop in transactions, even as average check size increased modestly. Q3 showed a slight improvement in same-store sales, but that gain was driven by higher checks rather than traffic, prompting Chipotle to trim its same-store sales outlook to a low single-digit decline. Throughout this period, digital sales remained a significant share of revenue, and new restaurant openings continued to support overall growth.

More recent visit data, however, suggests the dynamic may be shifting. In November, same-store visits turned slightly positive, contributing to a stronger increase in total chain-wide traffic, and December data shows that improvement continued to build. While expansion remains a key driver, this emerging pattern suggests existing locations may be starting to regain momentum.

Some of Chipotle’s late-year momentum appears to be driven by a growing share of short visits (defined as those lasting under ten minutes), which accounted for 42.2% of total chain traffic in 2025 – up from 41.2% in 2024. These quicker trips have consistently outperformed longer visits on a YoY basis, making their increasing share an important contributor to overall visit growth.

Importantly, the rise in short visits does not appear to be coming at the expense of longer ones. From July through October 2025, average per-location visits lasting under ten minutes remained essentially flat even as longer visits continued to lag; by December, however, both short and longer visits were growing on a per-location basis. This pattern indicates that the shift toward convenience is not cannibalizing traditional visit occasions, but may instead be lifting overall engagement with the brand.

Chipotle still benefits from expansion, but the more important story may be what’s happening inside existing restaurants: Same-store visits are stabilizing while quick trips gain share. And with the December launch of an all-new high-protein menu, Chipotle is signaling that it isn’t standing still – it’s continuing to refine its offerings to stay relevant as customer expectations and visit behaviors change.

For more data-driven dining insights, visit Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

McDonald’s ended 2025 with clear visit momentum, reversing earlier softness and posting steady gains in the back half of the year. Same-store visits followed a similar trajectory, indicating that growth was driven by stronger underlying demand rather than unit expansion. This late-year rebound positions McDonald’s with solid visit momentum heading into 2026, suggesting improving consumer engagement as the year closed.

Some of the visit growth is likely due to the chain's popular Q4 LTOs – but diving deeper into the visit frequency data suggests that McDonald’s long-term investment in its loyalty program is also playing a part. The company's launch of MyMcDonald’s Rewards in 2021 seems to have succeeded in shifting traffic toward higher-frequency, incremental visits rather than relying on new customer acquisition.

Compared to pre-loyalty levels in H2 2019, a growing share of McDonald’s visits now comes from diners visiting an average of 4+ times per month, with the share of visits from consumers visiting the chain an average of 8+ times per month showing the most dramatic growth. Grouping YoY visit trends by visit frequency also shows that visits from high-frequency diners grew the most compared to H2 2024 and H2 2019. This dynamic points to a core benefit of loyalty-led growth: driving incremental visits from existing customers is typically far more efficient than acquiring new ones, especially in a mature, highly penetrated category like quick service restaurants.

McDonald’s executives have been explicit that loyalty is designed to increase frequency, not just enrollment. The continued growth of the program through 2025 – including deeper integration with value offers and digital ordering – suggests McDonald’s is still finding room to extract incremental visits from an already loyal base.

For other restaurant chains, McDonald’s experience points to the value of using loyalty as a lever for incremental growth, particularly once a customer has already been acquired. While many QSR brands continue to drive expansion by entering new markets or opening additional locations, McDonald’s data illustrates how meaningful gains can also come from increasing visit frequency among existing customers. Even without McDonald’s scale, the underlying strategy is broadly applicable: converting first-time or occasional visitors into higher-frequency customers can serve as a complementary – and often more efficient – path to growth alongside physical expansion.

Will these lessons shape the QSR space in 2026? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

In 2024, Dollar Tree capitalized on the liquidation of the 99 Cents Only chain to execute a strategic "land grab" in the notoriously tight US retail market. By acquiring designation rights for 170 leases across priority markets like California, Arizona, Nevada, and Texas, the retailer aimed to bypass zoning hurdles and accelerate growth.

AI-powered location analytics indicates the selection process was highly disciplined: Looking at over 85 California stores that were converted from 99 Cents Only to Dollar Tree reveals that Dollar Tree cherry-picked high-performing sites that were generating 6.0% more foot traffic than the 99 Cents Only chain average in 2023. This suggests the acquisition was a calculated move to secure proven, high-quality real estate.

However, 2025 performance data reveals that capitalizing on this opportunity comes with distinct operational costs. Total visits to the converted stores have dropped 38.8% compared to their 2023 baselines. While some of this decline is structural – Dollar Tree operates a lower-frequency "treasure hunt" model compared to the high-frequency grocery model of the previous tenant – a significant portion is self-inflicted through network overlap.

A staggering 36% of the new sites are located less than a mile from an existing Dollar Tree, which inevitably dilutes local traffic through cannibalization. This serves as a critical lesson for retailers considering bulk acquisitions: purchasing a portfolio "en masse" often prevents perfect network optimization, forcing the acquirer to manage the friction where new footprints compete with the old.

Still, despite this cannibalization and the drop in raw volume, the transition offers a potential "healthy correction" for the business. The previous tenant collapsed under the weight of "rising levels of shrink" and low-margin grocery sales. By shifting the model, Dollar Tree is effectively filtering out non-paying visitors and low-value transactions, trading chaotic volume for a more controlled, margin-focused operation. The discrepancy between the sharp drop in total visits (-38.8%) and the more moderate dip in visits per square foot (-25.0%) suggests Dollar Tree is already rightsizing these operations, leaving some "ghost space" inactive rather than over-investing in labor to manage the entire cavernous floor.

And this excess square footage is only a liability if it remains empty; turning it into an asset requires leveraging the fundamental change in who is now shopping these aisles. The shift in shopper demographics – where "Wealthy Suburban Families" have replaced the "Young Urban Singles" and "Melting Pot Families" of the previous tenant – is crucial for Dollar Tree's future. This new audience, which is less price-sensitive, provides the ideal environment for Dollar Tree to deploy its "Multi-Price" strategy.

While CFO Jeff Davis has cited "start-up costs" regarding these conversions, the long-term opportunity is clear: if Dollar Tree can utilize the extra square footage to showcase this higher-margin assortment, these locations could evolve from overlapping burdens into profitable flagships that capture a share of wallet the traditional small-box fleet never could.

For more data-driven CRE insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.avif)

It’s mid-January, and you promised yourself this would be the year you finally join a gym and get in shape.

But let’s be honest – choosing a gym is about more than fitness goals alone. You’ll still need to judge the equipment, locker rooms, and showers for yourself (we’re not here to do your dirty work) but there are other, less obvious factors that can determine which gym feels like the right fit – and that’s where we come in.

Trying to dodge the morning rush? Hoping to make new friends? Curious where other singles work out? Letting AI-powered location analytics do some of the heavy lifting, we analyzed major fitness chains to uncover the patterns that could help you find your ideal gym in 2026.

Few things derail motivation faster than showing up ready to work out – only to find every treadmill and weight machine taken. To understand which gyms are most likely to offer breathing room during the busiest parts of the day, we analyzed hourly visit patterns across the nation’s largest fitness chains.

The analysis shows clear differences in how morning traffic is distributed. For early risers, LA Fitness recorded the lowest share of daily visits between 5:00 AM and 8:00 AM in 2025, at just 8.9%. 24 Hour Fitness and EōS Fitness also kept morning traffic below the 10% mark, suggesting these chains may be better options for members looking to avoid crowded early workouts.

If after-work workouts are more your style – and minimizing crowds is the priority – the data points to a few clear standouts.

Among the analyzed gyms, Club Pilates recorded the smallest share of visits between 5:00 PM and 8:00 PM at 16.5%, followed by Orangetheory (17.3%) and Burn Boot Camp (18.7%). That lighter early-evening traffic likely reflects the structured nature of class-based formats, which can help limit overcrowding even during peak hours.

Looking specifically at traditional gyms, EōS Fitness, Life Time, and Vasa Fitness saw the lowest share of early-evening visits – making them potential options for those hoping to squeeze in a workout while avoiding the after-work rush.

If getting in shape and finding love are both on the agenda this year, there may be a way to double up. Using AI-powered captured market data, we analyzed major gym chains to understand where members are most likely to be single – which may mean a higher chance of meeting someone special.

The analysis shows that Genesis Health Clubs had the highest combined share of one-person households and non-family households – i.e. people living alone or with roommates – in its captured market, at 36.6%. Crunch Fitness followed closely at 35.8%, with Planet Fitness just behind at 35.2%. These household segmentation patterns suggest that these gyms may offer more opportunities to meet other singles while getting in a workout.

If you’re looking for love, or simply to make new friends, age demographics may be something to consider when choosing a gym.

Our analysis of major fitness chains shows that the potential markets of Fitness Connection, Vasa Fitness, and In-Shape Family Fitness – i.e. the areas from which each chain draws its visitors – skewed younger in 2025, with large shares of visitors under 30.

By contrast, gyms such as The Edge Fitness Club, Retro Fitness, and Life Time tended to attract older audiences, with large shares of visitors 45 and older. For members looking to work out alongside peers closer to their own age, these demographic patterns could help narrow the field.

Age is just a number, right? So if you’re looking to make a real connection at the gym this year, you might look for some common areas of interest with other members. Our analysis highlights which gyms are most likely to attract visitors with your shared passions.

For dog lovers hoping to meet a fellow fitness enthusiast who’s just as excited about the dog park as leg day, Burn Boot Camp stands out. The chain over-indexed most strongly for the “Dog Lovers” segment, based on Spatial.ai: Proximity and AI-powered captured market data.

Prefer bonding over a good book? Genesis Health Clubs led the pack for the “Bookish” segment, suggesting a higher likelihood of members who enjoy reading as much as a solid workout. Coffee aficionados may find their people at 24 Hour Fitness, which showed the strongest over-indexing for the “Coffee Connoisseur” segment.

For those with travel on the brain, Workout Anytime over-indexed for the “Wanderlust” segment – pointing to a member base more likely to dream about their next destination. And if your ideal post-workout plan includes a movie or live show, 24 Hour Fitness and Gold’s Gym emerged as standouts, over-indexing for the “Film Lovers” and “Live & Local Music” segments, respectively.

Ultimately, choosing the right gym goes beyond equipment, pricing, or proximity. Visit patterns, demographics, and shared interests all shape the experience – influencing when you’ll work out, who you’ll see, and how the gym fits into your broader lifestyle. While no dataset can guarantee a perfect match, these patterns offer a data-backed starting point for finding a gym that aligns with how you want to train, socialize, and show up in 2026.

Want more data-driven insights for the real world? Visit Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

*This article excludes data from Washington State due to local regulations

Brick-and-mortar retail ended 2025 on a high note, with offline retailers posting a 2.4% increase in traffic in Q4 2025 relative to Q4 2024. This growth underscores the sector’s continued relevance even amid ongoing e-commerce growth and reinforces that retail growth is not a zero-sum dynamic, but one in which physical and digital channels increasingly coexist and complement one another.

The traffic gains during the holiday season also highlights the particular appeal of physical retail during the holiday season, when demand for in-person shopping experiences is particularly high. And as retailers refine store formats, right-size footprints, and better integrate physical locations into omnichannel strategies, brick-and-mortar retail is well positioned to remain a critical growth and engagement channel heading into 2026.

Foot traffic to e-commerce distribution centers remained consistently positive YoY throughout 2025, underscoring the strength of the logistics segment and signaling durable demand for logistics space rather than short-term fluctuations. This pattern aligns with the broader trajectory of e-commerce in the U.S., where online retail sales are projected to continue expanding, and reflects a broader structural shift in how goods move through the economy, with fulfillment infrastructure playing an increasingly central role.

This consistency is driven by long-term forces shaping retail and supply chains, including omnichannel fulfillment, faster delivery expectations, and inventory decentralization. As retailers rely more heavily on regional distribution nodes to support ship-from-store, curbside pickup, and next-day delivery, logistics facilities have become essential infrastructure rather than optional back-end operations. Even as growth moderated slightly later in the year, the persistence of positive YoY traffic points to sustained operational intensity and long-term relevance.

Year-over-year (YoY) foot traffic to U.S. manufacturing facilities points to volatility rather than sustained growth, reflecting a sector that is actively managing uncertainty. Visits declined during much of the year, suggesting restrained hiring as manufacturers appear to be operating lean – adjusting labor and on-site activity quickly in response to demand changes. Productivity gains and automation are likely also playing a role, allowing facilities to maintain output with less consistent physical presence. As a result, the foot traffic volatility may be reflecting operational flexibility rather than simple expansion or contraction.

Against this backdrop, December stands out with a clear uptick in manufacturing visits, signaling increased end-of-year activity. This rise likely reflects a mix of year-end production runs, inventory adjustments, maintenance work, and preparation for early-year demand. The December traffic increase reinforces that U.S. manufacturing – still one of the largest and most economically significant sectors globally – is adapting, not retreating, maintaining operational relevance even as it recalibrates for efficiency, automation, and selective growth.

For more data-driven retail & CRE insights, visit placer.ai/anchor.

The first Lollapalooza – a four-day music festival – took place in 1991. Chicago’s Grant Park became the event’s permanent home (at least in the United States) in 2005, drawing thousands of revelers and music fans to the park each year.

This year, the festival once again demonstrated its powerful impact on the city. On August 1st, 2024, visits to Grant Park surged by 1,313.2% relative to the YTD daily average, as crowds converged on the park to see Chappell Roan’s much-anticipated performance. And during the first three days of the event, the event drew significantly more foot traffic than in 2023 – with visits up 18.9% to 35.9% compared to the first three days of last year’s festival (August 3rd to 5th, 2023).

Lollapalooza led to a dramatic spike in visits to Grant Park – and it also attracted a different type of visitor compared to the rest of the year.

Analyzing Grant Park’s captured market with Spatial.ai’s PersonaLive dataset reveals that Lollapalooza attendees are more likely to belong to the “Young Professionals” and “Ultra Wealthy Families” segment groups than the typical Grant Park visitor.

By contrast, the “Near-Urban Diverse Families” segment group, comprising middle-class diverse families living in or near cities, made up only 6.5% of visitors during the festival, compared to 12.0% during the rest of the year.

Additionally, visitors during Lollapalooza came from areas with higher HHIs than both the nationwide baseline of $76.1K and the average for park visitors throughout the year. Understanding the demographic profile of visitors to the park during Lollapalooza can help planners and city officials tailor future events to these segment groups – or look for ways to make the festival accessible to a wider range of music lovers.

Lollapalooza’s impact on Chicago extended beyond the boundaries of Grant Park, with nearby hotels seeing remarkable surges in foot traffic. The Congress Plaza Hotel on South Michigan Avenue witnessed a staggering 249.1% rise in visits during the week of July 29, 2024, compared to the YTD visit average. And Travelodge on East Harrison Street saw an impressive 181.8% increase. These spikes reflect the festival’s draw not just for locals but for out-of-town visitors who fill hotels across the city.

The North Michigan Avenue retail corridor also enjoyed a significant increase in foot traffic during the festival, with visits on Thursday, August 1st 56.0% higher than the YTD Thursday visit average. On Friday, August 2nd, visits to the corridor were 55.7% higher than the Friday visit average. These numbers highlight Lollapalooza’s role in driving economic activity across Chicago, as festival-goers venture beyond the park to explore the city’s vibrant retail and hospitality offerings.

City parks often serve as community hubs, and Flushing Meadows Corona Park in Queens, NY, has been a major gathering point for New Yorkers. The park hosted one of New York’s most beloved summer concerts – Governors Ball – which moved from Governors Island to Flushing Meadows in 2023.

During the festival (June 9th -11th, 2024), musicians like Post Malone and The Killers drew massive crowds to the park, with visits soaring to the highest levels seen all year. On June 9th, the opening day of the festival, foot traffic in the park was up 214.8% compared to the YTD daily average, and at its height, on June 8th, the festival drew 392.7% more visits than the YTD average.

The park also hosted other big events this summer – a July 21st set by DMC helped boost visits to 185.1% above the YTD average. And the Hong Kong Dragon Boat Festival on August 3rd and 4th led to major visit boosts of 221.4% and 51.6%, respectively.

These events not only draw large crowds, but also highlight the park’s role as a space where cultural and civic life can find expression, flourish, and contribute to the health of local communities.

Analyzing changes in Flushing Meadows Corona Park’s trade area size offers insight into how far people are willing to travel for these events. During Governors Ball, for example, the park’s trade area ballooned to 254.5 square miles, showing the festival's wide appeal. On July 20th, by contrast, when the park hosted several local bands and DJs, the trade area was a much more modest 57.0 square miles.

Summer events drive community engagement, economic activity, and civic pride. Cities that invest in their parks and event hubs, fostering lively and inclusive spaces, can create lasting value for both residents and visitors, enriching the cultural and social life of urban areas.

For more data-driven civic stories, visit Placer.ai.

The pandemic and economic headwinds that marked the past few years presented the multi-billion dollar hotel industry with significant challenges. But five years later, the industry is rallying – and some hotel segments are showing significant growth.

This white paper delves into location analytics across six major hotel categories – Luxury Hotels, Upper Upscale Hotels, Upscale Hotels, Upper Midscale Hotels, Midscale Hotels, and Economy Hotels – to explore the current state of the American hospitality market. The report examines changes in guest behavior, personas, and characteristics and looks at factors driving current visitation trends.

Overall, visits to hotels were 4.3% lower in Q2 2024 than in Q2 2019 (pre-pandemic). But this metric only tells part of the story. A deeper dive into the data shows that each hotel tier has been on a more nuanced recovery trajectory.

Economy chains – those offering the most basic accommodations at the lowest prices – saw visits down 24.6% in Q2 2024 compared to pre-pandemic – likely due in part to hotel closures that have plagued the tier in recent years. Though these chains were initially less impacted by the pandemic, they were dealt a significant blow by inflation – and have seen visits decline over the past three years. As hotels that cater to the most price-sensitive guests, these chains are particularly vulnerable to rising costs, and the first to suffer when consumer confidence takes a hit.

Luxury Hotels, on the other hand, have seen accelerated visit growth over the past year – and have succeeded in closing their pre-pandemic visit gap. Upscale chains, too, saw Q2 2024 visits on par with Q2 2019 levels. As tiers that serve wealthier guests with more disposable income, Luxury and Upscale Hotels are continuing to thrive in the face of headwinds.

But it is the Upper Midscale level – a tier that includes brands like Trademark Collection by Wyndham, Fairfield by Marriott, Holiday Inn Express by IHG Hotels & Resorts, and Hampton by Hilton – that has experienced the most robust visit growth compared to pre-pandemic. In Q2 2024, Upper Midscale Hotels drew 3.5% more visits than in Q2 2019. And during last year’s peak season (Q3 2023), Upper Midscale hotels saw the biggest visit boost of any analyzed tier.

As mid-range hotels that still offer a broad range of amenities, Upper Midscale chains strike a balance between indulgence and affordability. And perhaps unsurprisingly, hotel operators have been investing in this tier: In Q4 2023, Upper Midscale Hotels had the highest project count of any tier in the U.S. hotel construction and renovation pipeline.

The shift in favor of Upper Midscale Hotels and away from Economy chains is also evident when analyzing changes in relative visit share among the six hotel categories.

Upper Midscale hotels have always been major players: In H1 2019 they drew 28.7% of overall hotel visits – the most of any tier. But by H1 2024, their share of visits increased to 31.2%. Upscale Hotels – the second-largest tier – also saw their visit share increase, from 24.8% to 26.1%.

Meanwhile, Economy, Midscale, and Upper Upscale Hotels saw drops in visit share – with Economy chains, unsurprisingly, seeing the biggest decline. Luxury Hotels, for their parts, held firmly onto their piece of the pie, drawing 2.8% of visits in H1 2024.

Who are the visitors fueling the Upper Midscale visit revival? This next section explores shifts in visitor demographics to four Upper Midscale chains that are outperforming pre-pandemic visit levels: Trademark Collection by Wyndham, Holiday Inn Express by IHG Hotels & Resorts, Fairfield by Marriott, and Hampton by Hilton.

Analyzing the captured markets* of the four chains with demographics from STI: Popstats (2023) shows variance in the relative affluence of their visitor bases.

Fairfield by Marriott drew visitors from areas with a median household income (HHI) of $84.0K in H1 2024, well above the nationwide average of $76.1K. Hampton by Hilton and Trademark Collection by Wyndham, for their parts, drew guests from areas with respective HHIs of $79.6K and $78.5K – just above the nationwide average. Meanwhile, Holiday Inn Express by IHG Hotels & Resorts drew visitors from areas below the nationwide average.

But all four brands saw increases in the median HHIs of their captured markets over the past five years. This provides a further indication that it is wealthier consumers – those who have had to cut back less in the face of inflation – who are driving hotel recovery in 2024.

(*A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice.)

Much of the Upper Midscale visit growth is being driven by chain expansion. But in some areas of the country, the average number of visits to individual hotel locations is also on the rise – highlighting especially robust growth potential.

Analyzing visits to existing Upper Midscale chains in four metropolitan areas with booming tourism industries – Salt Lake City, UT, Palm Bay, FL, San Diego, CA, and Richmond, VA – shows that these markets feature robust untapped demand.

Utah, for example, has emerged as a tourist hotspot in recent years – with millions of visitors flocking each year to local destinations like Salt Lake City to see the sights and take in the great outdoors. And Upper Midscale hotels in the region are reaping the benefits. In H1 2024, the overall number of visits to Upper Midscale chains in Salt Lake City was 69.4% higher than in H1 2019. Though some of this increase can be attributed to local chain expansion, the average number of visits to each individual Upper Midscale location in the area also rose by 12.5% over the same period.

Palm Bay, FL (the Space Coast) – another tourist favorite – is experiencing a similar trend. Between H1 2019 and H1 2024, overall visits to local Upper Midscale hotel chains grew by 36.4% – while the average number of visits per location increased a substantial 16.9%. Given this strong demand, it may come as no surprise that the area is undergoing a hotel construction boom. Upper Midscale hotels in other areas with flourishing tourism sectors, like San Diego, CA and Richmond, VA, are seeing similar trends, with increases in both overall visits and and in the average number of visits per location.

Though Economy chains have underperformed versus other categories in recent years, the tier does feature some bright spots. Some extended-stay brands in the Economy tier – hotels with perks and amenities that cater to the needs of longer-stay travelers – are succeeding despite category headwinds.

Choice Hotels’ portfolio, for example, includes WoodSpring Suites, an Economy chain offering affordable extended-stay accommodations in 35 states. In H1 2024, the chain drew 7.7% more visits than in the first half of 2019 – even as the wider Economy sector continued to languish. InTown Suites, another Economy extended stay chain, saw visits increase by 8.9% over the same period.

And location intelligence shows that the success of these two chains is likely being driven, in part, by their growing appeal to young, well-educated professionals. In H1 2019, households belonging to Spatial.ai: PersonaLive’s “Young Professionals” segment made up 9.6% of WoodSpring Suites’ captured market. But by H1 2024, the share of this group jumped dramatically to 13.3%. At the same time, InTown Suites saw its share of Young Professionals increase from 12.0% to 13.4%.

Whether due to an affinity for prolonged “workcations” (so-called “bleisure” excursions) or an embrace of super-commuting, younger guests have emerged as key drivers of growth for the extended stay segment. And by offering low–cost accommodations that meet the needs of these travelers, Economy chains can continue to grow their share of the pie.

The hospitality industry recovery continues – led by Upper Midscale Hotels, which offer elevated experiences that don’t break the bank. But today’s market has room for other tiers as well. By keeping abreast of local visitation patterns and changing consumer profiles, hotels across chain scales can personalize the visitor experience and drive customer satisfaction.

The past few years have provided the tourism sector with a multitude of headwinds, from pandemic-induced lockdowns to persistent inflation and a rise in extreme weather events. But despite these challenges, people are more excited than ever to travel – more than half of respondents to a recent survey are planning on increasing their travel budgets in the coming months.

And while revenge travel to overseas destinations is still very much alive and well, the often high costs associated with traveling abroad are shaping the way people choose to travel. Domestic travel and tourism are seeing significant growth as more affordable alternatives.

This white paper takes a closer look at two of the most popular domestic tourism destinations in the country – New York City and Los Angeles. Over the past year, both cities have continued to be leading tourism hotspots, offering a wealth of attractions for visitors. What does tourism to these two cities look like in 2024, and what has changed since before the pandemic? How have inflation and rising airfare prices affected the demographics and psychographics of visitors to these major hubs?

Analyzing the distribution of domestic tourists across CBSAs nationwide from May 2023 to April 2024 reveals New York and Los Angeles to be two of the nation’s most popular destinations. (Tourists include overnight visitors staying in a given CBSA for up to 31 days).

The New York-Newark-Jersey City, NY-NJ-PA metro area drew the largest share of domestic tourists of any CBSA during the analyzed period (2.7%), followed closely by the Los Angeles-Long Beach-Anaheim, CA CBSA (2.5%). Other domestic tourism hotspots included Orlando-Kissimmee-Sanford, FL (tied for second place with 2.5% of visitors), Dallas-Fort Worth-Arlington, TX (1.9%), Las Vegas-Henderson-Paradise, NV (1.8%), Miami-Fort Lauderdale-Pompano Beach, FL (1.8%), and Chicago-Naperville, Elgin, IL-IN-WI (1.6%).

The Big Apple. The City That Never Sleeps. Empire City. Whatever it’s called, New York City remains one of the most well-known tourist destinations in the world. And for many Americans, New York is the perfect place for an extended weekend getaway – or for a multi-day excursion to see the sights.

But where do these NYC-bound vacationers come from? Diving into the data on the origin of visitors making medium-length trips to New York City (three to seven nights) reveals that increasingly, these domestic tourists are coming from nearby metro areas.

Between 2018-2019 and 2023-2024, for example, the number of tourists visiting New York City from the Philadelphia metro area increased by 19.2%.

The number of tourists coming from the Boston and Washington, D.C metro areas, and from the New York CBSA itself (New York-Newark-Jersey City, NY-NJ-PA) also increased over the same period.

Meanwhile, further-away CBSAs like San Francisco-Oakland-Berkeley, CA, Atlanta-Sandy Springs-Alpharetta, GA, and Miami-Fort Lauderdale-Pompano Beach, FL fed fewer tourists to NYC in 2023-2024 than they did pre-pandemic. It seems that residents of these more distant metro areas are opting for vacation destinations closer to home to avoid the high costs of air travel.

Diving even deeper into the characteristics of visitors taking medium-length trips to New York City reveals another demographic shift: Tourists staying between three and seven nights in the Big Apple are skewing younger.

Between 2018-2019 and 2023-2024, the share of visitors to New York City from areas with median ages under 30 grew from 2.1% to 4.5%. Meanwhile, the share of visitors from areas with median ages between 31 and 40 increased from 34.3% to 37.7%.

The impact of this trend is already being felt in the Big Apple, with The Broadway League reporting that the average age of audiences to its shows during the 2022- 2023 season was the youngest it had been in 20 seasons.

The shift towards younger tourists can also be seen when examining the psychographic makeup of visitors to popular attractions in New York City. Analyzing the captured markets of major NYC landmarks with data from Spatial.ai’s PersonaLive dataset reveals an increase in households belonging to the “Educated Urbanites” segment between 2018-2019 and 2023-2024.

These well-educated, young singles are increasingly visiting iconic NYC venues such as the Whitney Museum of American Art, The Metropolitan Museum of Art, The American Museum of Natural History, and the Statue of Liberty. This shift highlights the growing popularity of these attractions among young, educated singles, reflecting a broader trend of increased domestic tourism among this demographic.

New York City’s tourism sector is adapting to meet the changing needs of travelers, fueled increasingly by younger visitors who may be unable to take a costly international vacation. How have travel patterns to Los Angeles changed in response to increasing travel costs?

While New York City is the East Coast’s tourism hotspot, Los Angeles takes center stage on the West Coast. And as overseas travel has become increasingly out of reach for Americans with less discretionary income, the share of domestic tourists originating from areas with lower HHIs has risen.

Before the pandemic, 57.6% of visitors to LA came from affluent areas with median household incomes (HHIs) of over $90K/year. But by 2023-2024, this share decreased to 50.7%. Over the same period, the share of visitors from areas with median HHIs between $41K and $60K increased from 9.7% to 12.5%, while the share of visitors from areas with HHIs between $61K and $90K rose from 32.1% to 35.8%.

Diving into the psychographic makeup of visitors to popular Los Angeles attractions – Universal Studios Hollywood, Disneyland California, the Santa Monica Pier, and Griffith Observatory – also reflects the above-mentioned shift in HHI. The captured markets of these attractions had higher shares of middle-income households belonging to the “Family Union” psychographic segment in 2023-2024 than in 2018-2019.

Experian: Mosaic defines this segment as “middle income, middle-aged families living in homes supported by solid blue-collar occupations.” Pre-pandemic, 16.0% of visitors to Universal Studios Hollywood came from trade areas with high shares of “Family Union” households. This number jumped to 18.8% over the past year. A similar trend occurred at Disneyland, Santa Monica Pier, and Griffith Observatory.

And like in New York City, growing numbers of visitors to Los Angeles appear to be coming from nearby areas. Between 2018-2019 and 2023-2024, the share of in-state visitors to major Los Angeles attractions increased substantially – as people likely sought to cut costs by keeping things local.

Pre-pandemic, for example, 68.9% of visitors to Universal Studios Hollywood came from within California – a share that increased to 72.0% over the past year. Similarly, 59.7% of Griffith Observatory visitors in 2018-2019 came from within the state – and by 2023-2024, that number grew to 64.7%.

Even when times are tight, people love to travel – and New York and Los Angeles are two of their favorite destinations. With prices for airfare, hotels, and dining out increasing across the board, younger and more price-conscious households are adapting, choosing to visit nearby cities and enjoy attractions closer to home. And as the tourism industry continues its recovery, understanding emerging visitation trends can help stakeholders meet travelers where they are.