.svg)

.png)

.png)

.png)

.png)

Mercado Gonzalez: This Mexican Food Hall is a Magnet

Mercado Gonzalez opened less than six months ago, and boy, is it making a splash! This marketplace/food hall located in Costa Mesa, CA hosts 20 food stalls where one can stroll through, buy colorful produce, and imagine that one is at the Mercado de Coyoacan in Mexico City, one of various mercados from which this location takes inspiration. Already, we see from the Placer data below that since opening in mid-November (just in time for the holidays!), Mercado Gonzalez is proving to be one of the most-visited locations in the Northgate Gonzalez portfolio.

The weekend spikes really stand out as patrons from all over Southern California come to partake of pan dulces, aguas frescas, and oh-so-delectable hot and fresh churros at Churreria El Moro.

We wrote about food fusion last week, and indeed, in addition to traditional Mexican specialties like tortas ahogadas at Chiva Torta, one can also find Mexican-style sushi at Sushi El Sinaloense. From street food to gourmet at Maizano and Entre Nos, one has options that run the gamut from hot tortillas to cochinita pibil with fresh masa.

This food hall extravaganza bills itself as the “ultimate destination for Mexican food and culture” and it appears that customers who travel from a trade area of over 150 miles are in total agreement.

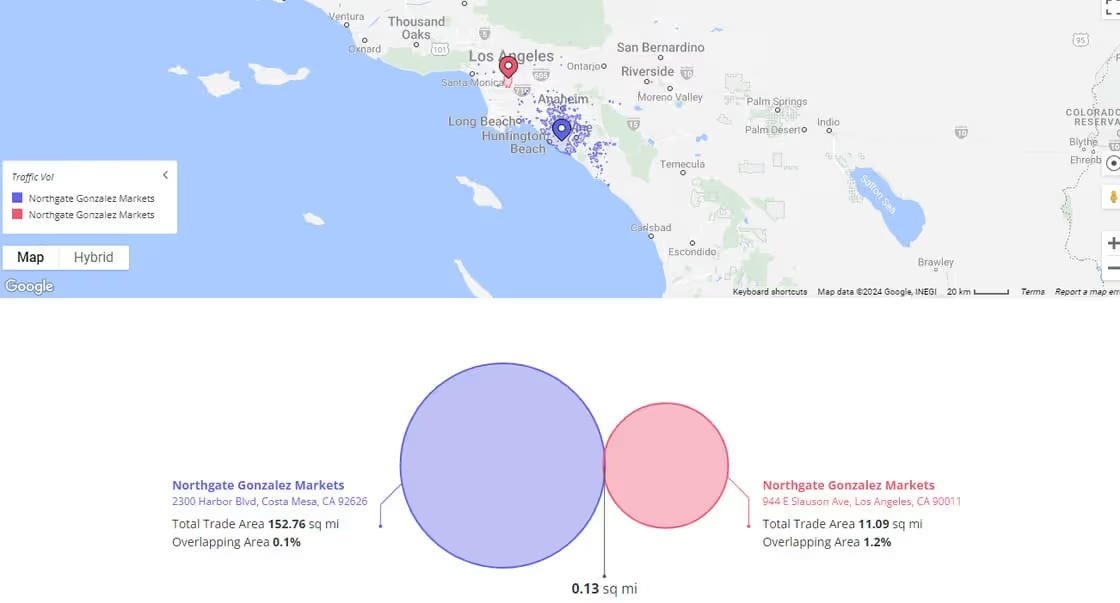

Compared to another top–trafficked Northgate Gonzalez market in Los Angeles, which draws from a much more local crowd of 11 sq miles (keep in mind, there are numerous Northgate Gonzalez markets across the Southern California landscape), this novel food hall concept attracts a much more diverse audience, across multiple dimensions like geography, ethnicity, and household income.

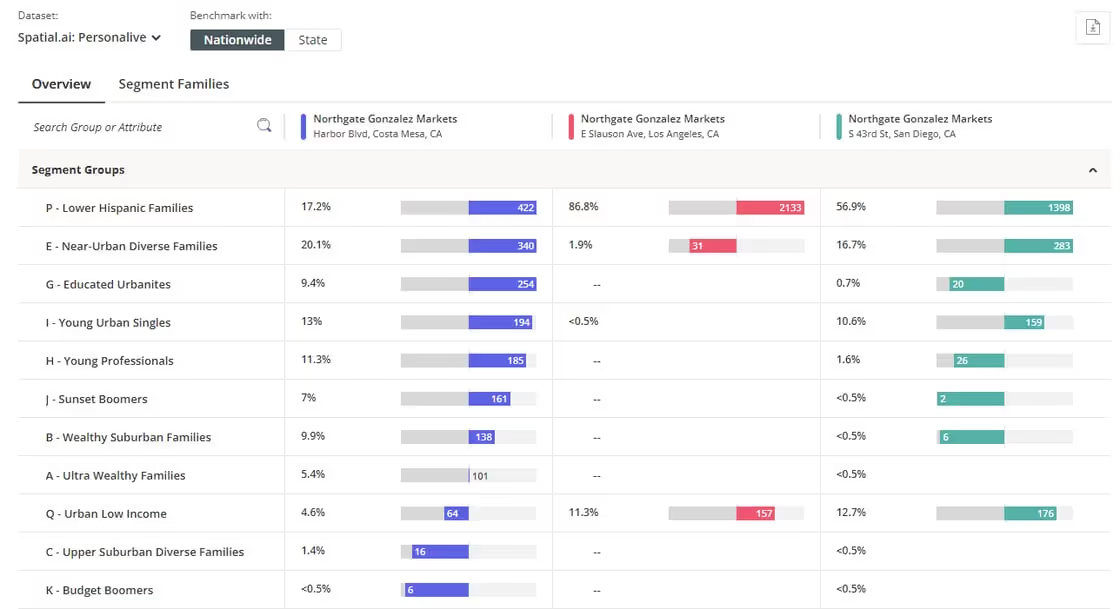

While the traditional grocery store attracts heavily from the segment of Lower Hispanic Families at the Los Angeles and San Diego locations, and also from Near-Urban Diverse Families and Young Urban Singles in San Diego, the segment data from Spatial.ai: PersonaLive reveals that Mercado Gonzalez also brings in Young Professionals, Educated Urbanites, Wealthy Suburban Families, and Ultra Wealthy Families.

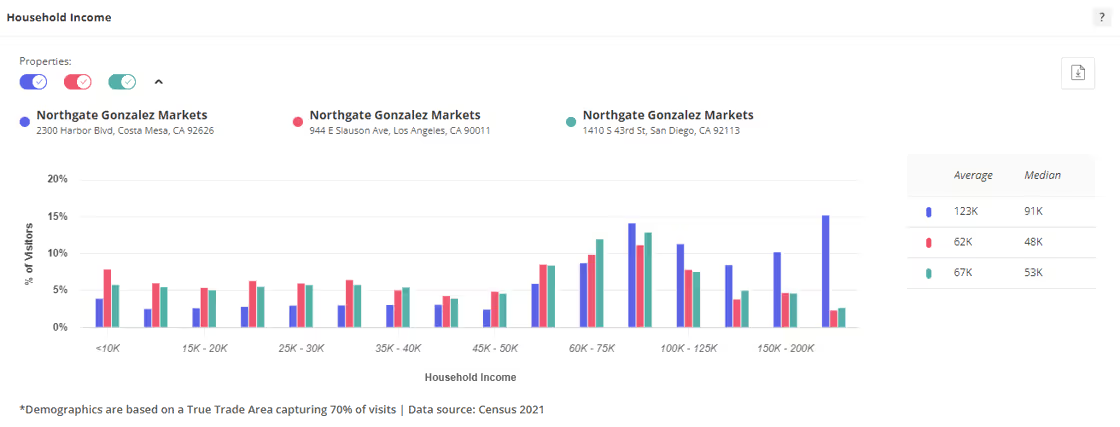

In addition, the average HHI of those visiting Mercado Gonzalez is roughly twice that of the other Northgate Gonzalez grocery stores.

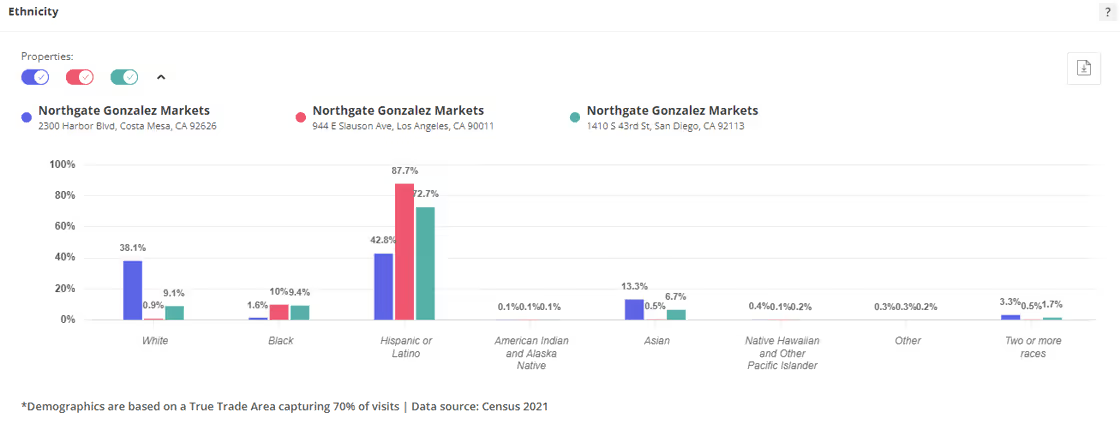

The food hall also attracts a broader swath of ethnicities.

Much like Eataly before it, Jose Andres’ Spanish Mercado Little Spain, or Asian food halls that we wrote about recently in our Lunar New Year articles, there is enthusiastic appetite for an immersive encounter reminiscent of being in another country and having access to authentic flavors and eating experiences.

Despite the inflationary headwinds that marked 2023, year-over-year (YoY) foot traffic to Indoor Malls and Open-Air Shopping Centers exceeded 2022 levels every quarter of 2023, with the two shopping center formats competing head-to-head for the top spot: Open-Air Shopping Centers outperformed Indoor Malls during the first three quarters of the year, but Indoor Malls came out ahead during the critical holiday-focused Q4. Ultimately, overall yearly visit numbers slightly favored Open-Air Shopping Centers, which finished 2023 with a 3.0% overall YoY increase in visits compared to 2.9% overall growth for Indoor Malls.

Meanwhile, Outlet Malls struggled to keep up with the other two formats. This segment saw a 1.6% YoY decline in yearly visits in 2023, perhaps due consumers looking to save on gas expenses and avoid the typically longer driving time required to get to these types of shopping centers.

.png)

Visits to all three mall formats dipped YoY in January 2024, likely due to the extreme cold temperatures that swept through much of the country and to the challenging comparisons to a strong January 2023.

But YoY foot traffic to Indoor Malls and Open-Air Shopping Centers swung positive in the second months of the year. Visits to Indoor Malls grew an impressive 6.0% relative to the same month in 2023, and foot traffic to Open-Air Shopping Centers increased 3.9% in the same period. The YoY visit gap to Outlet Malls also narrowed significantly, with foot traffic to the format just 1.6% lower than it was in February 2023, indicating that – despite predictions – 2024 consumers are still willing to spend on discretionary categories.

.png)

While visits to the mall space appear to be generally growing on a YoY basis, comparing the foot traffic performance to pre-COVID visits levels reveals a more nuanced picture. Of the three shopping centers formats, Open-Air Shopping Centers drew closest to pre-COVID levels, with 2023 visits just 1.5% lower than they were in 2019. The visit gap to Indoor Malls was slightly larger, with the format attracting 4.6% fewer visits in 2023 than in 2019. And Outlet Malls appear to be having the toughest recovery, with 2023 visits to the format 9.7% lower than in 2019.

But just because visits to the shopping center space are still catching up to 2019 levels does not mean that all is lost – a deeper dive into location intelligence data indicates that post-pandemic shopping habits are still in flux.

.png)

Analyzing shifts in shopping behavior in recent years reveals that many shoppers are still returning to pre-COVID behaviors. For example, comparing the share of shopping center visits between the hours of 12 PM and 4 PM in 2019, 2022, and 2023 indicates that the “new normal” of mid-day shopping sprees is on its way out.

The share of hourly visits between 12 PM and 4 PM jumped over the pandemic thanks to consumers’ newly flexible schedules, and mid-day foot traffic to shopping centers was still higher in 2022 compared to pre-COVID. But the relative share of mid-day visits dropped from 2022 to 2023 and moved closer to 2019 levels – indicating that shopping patterns have not yet reached a post-COVID equilibrium.

Critically, there appears to be a correlation between the return to 2019 shopping patterns and the visit recovery rate. Visits to Open-Air Shopping Centers in 2023 were almost on par with 2019 levels, and the format’s mid-day visit share was only half a percentage point higher in 2023 than in 2019. The mid-day visit share at Indoor Malls, where the year-over-four-year (Yo4Y) visit lag was slightly larger than for Open-Air Shopping Centers, was still 1.9 percentage points higher in 2023 when compared to 2019. And Outlet Malls had the largest Yo4Y visit gap along with the largest Yo4Y difference in mid-day visit share.

This data indicates that post-pandemic shopping patterns are still dynamic – and even retail sectors that appear to have permanent COVID scars may well bounce back as consumer behavior continues to normalize.

.png)

Despite predictions of slower consumer spending, foot traffic data indicates that demand for malls and shopping centers remains stable. Location intelligence showing strong monthly visit numbers and positive shifts in shopping behavior indicates that the shopping center space is off to a strong start in 2024.

For more data-driven retail insights, visit our blog at placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from some 1,000 office buildings across the country. It only includes commercial office buildings, and commercial office buildings with retail offerings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

Just when we thought the return-to-office (RTO) debate was finally settled, things are heating up once again. Leading financial institutions like Goldman Sachs are requiring employees to come into the office five days a week (gasp!). And though research shows that remote-capable employees now live twice as far from the office as they did before COVID, some are now being asked to move back closer to the office and show up in person more often.

But what impact are these renewed skirmishes having on the ground? Has the office recovery needle begun to move once again? Or is all the talk merely that – talk?

We dove into the data to find out.

Nationwide, visits to office buildings were down just 31.3% in February 2024 compared to February 2020 – the nation’s last “normal” in-office month before COVID changed everything. This relatively narrow year-over-four-year (Yo4Y) visit gap may be partially due to this year’s February leap day: Last month had 20 working days, compared to just 19 in February 2020 and 2023. (2020 was also a leap year, but the extra day fell on the weekend.)

Still, office visits in February 2024 were also higher than in January 2024, when unusually cold and stormy weather stranded many Americans at home. And year over year (YoY), February 2024 visits were up 18.6% – which, even accounting for the month’s extra day, points towards significant growth.

.avif)

Taking a look at city-wide trends shows the persistence of significant regional variation – with Miami and New York continuing to lead the post-COVID office recovery pack, and San Francisco bringing up the rear. Dallas, Atlanta, and Washington, D.C. also outperformed the nationwide Yo4Y baseline of -31.3%. And of the cities that continued to lag behind, Chicago, Boston, and San Francisco all outpaced the national average for YoY visit growth.

Here, too, February 2024’s additional business day did some of the work. Nevertheless, urban centers like Miami and New York – where office visits were down just 9.4% and 14.5%, respectively, compared to February 2020 – are clearly experiencing accelerated recovery. In Miami, an influx of tech companies may be contributing to the narrowing foot traffic gap – while in New York, the finance sector is likely a major driver of visit growth. And though San Francisco continues to lag behind other cities, the tech hub’s impressive YoY foot traffic increases indicate real change on the ground.

.avif)

Hybrid work may be here to stay – but February’s office foot traffic data appears to indicate that companies and employees are still feeling out the ideal balance between RTO and WFH. And whether due to growing demands by employers or workers’ own concerns about the possible deleterious effects of fully remote work on their careers, further office recovery may yet be on the table.

How will RTO progress as 2024 gets into full swing? Will New York and Miami close the gap? And what will happen in San Francisco?

Follow Placer.ai’s data-driven office recovery analyses to find out.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

The multi-billion dollar beauty industry has proved to be one of the most resilient retail categories over the past few years – and Ulta Beauty has been one of the biggest beneficiaries of this trend, reporting record growth and experiencing strong foot traffic to its stores.

We dove into the location intelligence data for Ulta to analyze recent foot traffic performance, explore seasonal trends, and better understand the chain’s visitor base.

The past few years have seen Ulta’s monthly foot traffic growing on a near-constant basis – and 2023 was no exception. Year-over-year (YoY) visits to the chain were up by double digits most months and Ulta consistently outperformed the wider Beauty & Spa segment. The company’s success appears poised to continue in 2024, with January 2024 visits up 4.9% relative to the already impressive January 2023, even as foot traffic to the wider Beauty & Spa category dipped.

The consistent foot traffic growth Ulta experienced in 2023 and early 2024 is particularly impressive given that 2022 was also a banner year for the brand – meaning that foot traffic has exceeded the previous years’ growth for two years straight. And the company seems to be capitalizing on its success by further enhancing its shopping experience, expanding its presence with new stores, and emphasizing wellness offerings at existing locations to keep its customers coming back.

.png)

Charting the change in monthly foot traffic to Ulta helps visualize the chain’s seasonal visit patterns and highlight the company’s consistent upward climb since the 2021 retail reopening. The COVID-19 pandemic and ensuing lockdowns led to a steep drop in foot traffic, but visits picked up – and stayed up – as soon as social-distancing restrictions eased. And though inflation replaced the pandemic as an economic concern, Ulta visits continued on their upward climb, highlighting the broad appeal the chain offers to shoppers of all economic levels.

Ulta also enjoys significantly elevated visits during the holiday season, with foot traffic surging every December. And visits to the chain, even without a holiday spike, continue to exhibit growth – January 2024’s visits were 43.3% higher than they were in January 2019.

.avif)

While December may be the month that Ulta sees the most visits, there are plenty of other minor holidays and retail opportunities that contribute to foot traffic spikes to the retailer. And although Valentine’s Day isn’t a holiday in the official sense of the word, Ulta still enjoyed a mid-week boost in visits on Wednesday, February 14th 2024.

Visits to Ulta grew 17.2% on Valentine’s Day compared to traffic of the previous six Wednesdays. February 14th 2024 also saw 10.5% more visitors to Ulta than the day did in 2023, signaling a continued, growing interest in the beauty retailer.

.png)

Ulta has taken pains to carry products for consumers of all ages, genders, and backgrounds –and recently, one age group in particular has been making headlines for its interest in beauty and skincare. Teens and tweens have been flocking to their local malls to try out products from brands like Drunk Elephant, driven, in part, by the rise of #BeautyTok, where influencers on TikTok post their makeup and skincare routines.

And indeed, trade area data indicates that families of all types are overrepresented among Ulta’s visitor base: Analyzing the psychographic makeup of Ulta’s trade areas using the Spatial.ai: PersonaLive dataset revealed that the chain’s captured market* includes more family segments when compared to the chain’s potential market*. Specifically, the chain’s captured markets had higher rates of “Near-Urban Diverse Families”, “Upper Suburban Diverse Families”, and “Wealthy Suburban Families” relative to the chain’s potential market. On the flip side, “Young Urban Singles” saw a smaller share of visitors in Ulta’s captured market than in its potential market.

Ulta’s popularity with family segments may be due to the increased demand for skincare and makeup among the families’ younger generations. And by continuing to cater to these younger consumers – alongside the numerous other segment that shop at Ulta – the company can hope to foster long-term brand loyalty and continue driving sales and foot traffic to its stores.

.png)

*A chain’s potential market refers to the population residing in a given trade area, where the Census Block Groups (CBGs) making up the trade area are weighted to reflect the number of households in each CBG.. A chain’s captured market weighs each CBG according to the actual number of visits originating to the chain from that CBG.

Ulta continues to impress, growing its sales and foot traffic even during a uniquely challenging period for the average consumer. By creating a shopping experience that is accessible to people across all ages and income levels, the company ensures that its visits can continue to grow.

For more data-driven retail insights, follow placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

First Watch has been around for over 40 years and is famous for being open from morning to early afternoon and a revolving menu that leans into seasonal ingredients. In recent years, the casual cafe – which derives its name from the nautical term for the first shift of the day – has made significant waves. The chain went public in 2021 and continues to drive consistent revenue and foot traffic – despite a stormy economic climate. We dove into the data to take a closer look at the consumer behavior behind First Watch’s success and understand where the chain could be heading in 2024 and beyond.

The Early Advantage

At First Watch, brunch and lunch join breakfast as the most important meals of the day. And while some of the chain’s competitors are open all day – or even all night – sticking to limited business hours has not steered the brand off course. Analysis of First Watch’s H2 2023 foot traffic compared to the wider breakfast-first category shows that First Watch’s monthly year-over-year (YoY) visits consistently outperformed the Breakfast, Coffee, Bakeries, and Dessert Shops space as a whole.

Some of the chain’s success is due to its expanding store fleet, with visits during the last five months of 2023 up by double digits compared to the equivalent months in 2022. And the chain is likely to rise even further in 2024 and beyond, with CEO Christopher Tomasso seeing continued expansion on the horizon.

.avif)

Indeed, looking at more recent data shows that First Watch’s growth is continuing even relative to the already strong 2023, with foot traffic to the chain up YoY and outperforming the wider Breakfast, Bakeries & Dessert Shops space every week of 2024 so far.

.avif)

The Next Voyage

C.E.O. Tomasso is determined to stay “true to who we are and what we’ve done regardless of how big we get.” And one way First Watch has stayed true to its identity is by being attentive to the preferences of its target audience. When customers wanted cocktails as a way to unwind with friends over brunch – First Watch delivered. And location intelligence can help identify the next consumer trend to drive the brand’s continued success.

Trade Area Analysis of First Watch in Q4 2023 using the AGS: Behavior & Attitudes dataset revealed that “Food Label Readers”, “Organic Foodies”, and “Vegans” were overrepresented in the restaurant’s trade areas compared to the nationwide benchmark. This indicates that First Watch’s commitment to fresh ingredients resonates with clientele that prioritize a healthy diet. Meanwhile, the data also showed that these consumers were likely to be involved in various forms of exercise; “Fitness Fans”, “Joggers”, “Pilates People”, and “Weight Lifters” were also prevalent psychographic segments in First Watch’s trade area.

This suggests that First Watch might consider exploring uncharted waters by adding smoothies or post-workout shakes to its menu, or by opening smaller-format locations in fitness centers to better serve its health-conscious audience.

.avif)

Land Ho!

First Watch has enjoyed smooth sailing through a commitment to bringing diners a fresh take on breakfast, brunch, and lunch. As long as this ship stays anchored in its identity, First Watch should find that the wind is at its back for the foreseeable future.

For updates and more data-driven dining insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Whether it’s an at-home yoga practice, a workout at the gym, or a sports league at the park, the biggest players in the sporting goods space – Hibbett Sports and DICK’s Sporting Goods – have the gear to keep a variety of consumers outfitted. Armed with the latest location intelligence data, we took a closer look at these retailers’ recent offline performance and analyzed some of the psychographic characteristics of visitors to DICK’s and Hibbett’s.

Last year started off strong for DICK’s Sporting Goods and Hibbett Sports, with visits to both retailers up in Q1 2023 relative to the equivalent quarter in 2022. But ongoing inflation and tighter consumer budgets weighed on visits as the year progressed, and foot traffic to DICK’s and Hibbett dipped slightly year-over-year (YoY) in the second half of the year. Still, in spite of the challenges, both brands succeeded in keeping their visits close to 2022 levels and maintaining minimal visit gaps.

.png)

The strong Q1 2023 combined with unusually cold weather were likely partially to blame for DICK’s and Hibbett’s sluggish early 2024 performance. But by the end of January, YoY visit gaps had narrowed for both brands – a promising sign for the year ahead.

Who is likely to visit these brands in 2024? We looked at the retailers’ trade area composition to find out.

.png)

Analyzing DICK’s and Hibbett’s trade area using the Spatial.ai: Proximity dataset revealed that both brands were positioned to drive traffic from two significant fitness-related psychographic segments at the end of 2023.

In Q4 2023, “Yoga Advocates” as well as fans of “Functional Fitness” were overrepresented in DICK’s and Hibbett’s trade area relative to the nationwide average. And DICK’s and Hibbett are investing heavily in getting these consumers in the door. DICK’s debut of a new functional fabric and ad campaign for its CALIA clothing line and Hibbett’s new joint loyalty program with Nike could provide an extra foot traffic boost from fitness-forward consumers as 2024 progresses. As temperatures thaw and demand rebounds, these consumers are likely to play a part in a foot traffic resurgence for both brands.

.png)

But while certain sporty audience segments seem to visit both brands, diving deeper into DICK’s and Hibbett’s trade areas using the Spatial.ai: Followgraph dataset also revealed differences between the two retailers’ offline consumer base.

For example, the share of “Hunting Enthusiasts” in DICK’s trade area was 8% smaller compared to the nationwide average, while Hibbett’s trade area included 20% more “Hunting Enthusiasts” than the prevalence of the segment nationwide. Meanwhile, the “Triathlon Participants'’ segment was overrepresented in DICK’s potential market – 4.0% above the national average – and underrepresented in Hibbet’s potential market (8.0% below). These differences suggest that the sporting goods space is big enough to accommodate multiple players at the top, with leading retailers each carving out their own slice of the market.

.avif)

So Much Potential

After a relatively rocky end to 2023, foot traffic appears to be on the upswing for both DICK’s and Hibbett early on in 2024. The prevalence of fitness-minded and sporting consumers in the trade areas of both brands could provide a continued foot traffic lift in the weeks and months ahead.

For updates and more data-driven foot traffic insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Malls have come a long way since their introduction to the world in the 1950s. These gleaming retail hubs promised shoppers a taste of the American dream, offering a third place for teens, families, and everyone in between to shop, socialize, and hang out.

And though malls have faced challenges in recent years, as e-commerce and pandemic-induced store closures led to shifts in consumer habits, the outlook is brightening. Malls have embraced innovation, incorporating enhanced entertainment, dining, and experiential offerings that attract a diverse range of visitors and redefine their purpose.

This white paper takes a look at the recent location intelligence metrics to gain an understanding of the changes taking place at malls across the country – including both indoor malls and open-air shopping centers. The report explores questions like: Why do malls experience foot traffic bumps during the summer months? How much of an impact do movie theaters have on mall visits, and what can mall operators learn from the Mall of America and American Dream malls’ focus on experiential entertainment?

Mall visitation is highly seasonal, with strikingly consistent monthly visitation patterns. Each year, visits decline somewhat in February, pick up in March, and begin to trend upward again in May – before peaking again in August. Then, after a slower September and October, foot traffic skyrockets during the holiday season, spiking dramatically in December.

And while these trends follow similar patterns every year, comparing monthly visits throughout 2019, 2023, and 2024 (YTD) to each year’s own January baseline shows that this seasonality is growing more pronounced - especially for indoor malls.

Following a lackluster 2023, visits to both indoor malls and open-air shopping centers peaked higher in March 2024 than in 2019. And this summer, indoor malls in particular saw a much larger visit boost than in previous years. In August 2024, for example, visits to indoor malls were 27.3% higher than in January 2024 – a substantially higher baseline jump than that seen either in August 2019 (17.0%) or in August 2023 (12.0%). And though open-air shopping centers experienced a smaller summer visit boost, they too saw a bigger bump this year than in 2019 or in 2023.

But malls aren’t just seeing larger visit spikes this year relative to their January baselines – they are also drawing bigger crowds than they did in 2023.

Between June and August 2024, indoor malls and open-air shopping centers both experienced year-over-year (YoY) visit growth. Indoor malls saw the largest YoY foot traffic boost (3.7%) – perhaps owing in part to 2024’s record-breaking heat, which led many patrons to seek refuge in air conditioned spaces. Still, open-air shopping centers, which feature plenty of air conditioned stores and restaurants, also enjoyed a YoY visit boost of 2.8% during the analyzed period.

Malls’ strong summer baseline and YoY foot traffic growth built upon the strong performance seen during most of 2024 so far, leading to the question: What is driving malls’ positive momentum? We delve into some of the factors propelling these changes below.

One offering that continues to play a significant role in driving foot traffic to malls is on-site movie theaters. Summer blockbuster releases, in particular, help attract crowds to theaters, in turn boosting overall visits to malls.

Much like malls, movie theaters have also proven their resilience over the past few years. While pundits fretted about the theater’s impending death, production houses were busy releasing blockbuster after blockbuster and shattering box-office records at an impressive clip. And while 2023 was certainly a banner year for blockbuster summer releases, 2024 has had its fair share of stunning box-office successes, leading to major visit boosts at theaters across the country.

Analyzing visits to malls with and without movie theaters highlights the impact of these summer Hollywood hits. Between June and August 2024, malls with theaters saw bigger visit boosts compared to a monthly year-to-date (YTD) average than malls without – an effect observed both for indoor malls and for open-air shopping centers.

For both mall types, the gap between centers with and without movie theaters was most pronounced in July 2024, likely owing to the release of Inside Out 2 in mid-June as well as the July releases of Deadpool & Wolverine and Twister. But in June and August 2024, too, centers with movie theaters sustained particularly impressive visit boosts – a solid sign that movie theaters and malls remain a winning combination.

Malls with movie theaters also drew higher shares of evening visits (7:00 PM - 10:00 PM) this summer than those without. Between June and August 2024, for example, evening outings accounted for 22.9% of visits to open-air shopping centers with movie theaters – compared to 18.2% of visits to centers without theaters. Indoor malls with theaters also saw a larger share of evening visits than those without – 18.1% compared to 15.0%.

This increase in evening traffic is likely driven by major summer movie releases and the flexibility of summer schedules, with many visitors – including families – taking advantage of late-night outings without the concern of early wakeup calls. These summer visitation trends benefit both theaters and malls, opening up opportunities for increased sales through concessions, promotions, and evening deals that attract a more relaxed and engaged crowd.

Analyzing the demographics of malls’ captured markets also reveals that centers with movie theaters are more likely to attract certain family-oriented segments than those without. (A mall’s captured market consists of the mall’s trade areas – the census block groups (CBGs) feeding visitors to the mall – weighted according to each CBG’s actual share of visits to the mall.)

Between June and August 2024, for example, 14.2% of the captured markets of open-air shopping centers with movie theaters were made up of “Wealthy Suburban Families” – compared to 9.7% for open-air shopping centers without theaters.

Indoor malls saw a similar pattern with regard to “Near-Urban Diverse Families”: Middle class families living in and around cities made up 9.0% of the captured markets of indoor malls with movie theaters, compared to 7.1% of the captured markets of those without.

This increase in foot traffic from middle-class and wealthy family segments can be a boon for malls and retail tenants – driving up food court profits and bolstering sales at stores with kid-friendly offerings.

Malls have long positioned themselves as destinations for summer entertainment as well as retail therapy, holding – in addition to back to school sales – events like Fourth of July celebrations and even indoor basketball and arena football games. And during the summer months, malls attract visitors from further away.

Between June and August 2024, indoor malls drew 18.2% of visitors from 30+ miles away – compared to just 16.7% during the first five months of the year. Similarly, open-air shopping centers drew 19.6% of visits from 30+ miles away during the summer, compared to 17.1% between January and May.

Extended daylight hours, summer trips away from home, and more free time are likely among the contributors to the summer draw for long-distance mall visitors. But in addition to their classic offerings – from movie theaters to stores and food courts – malls have also invested in other kinds of unique experiences to attract visitors. This next section takes a look at two mega-malls winning at the visitation game, to see what sets them apart.

The Minneapolis-based Mall of America opened in 1992, redefining the limits of what a mall could offer. The mall boasts hundreds of stores, games, rides, and more – and is constantly expanding its attractions, cementing its status as a top destination for retail and entertainment.

Between June and August 2024, Mall of America experienced a 13.8% YoY visit increase, far outperforming the 3.7% visit boost seen by the wider indoor mall space. And as a major tourist attraction – the mall hosted a series of Olympic-themed events throughout the summer – it also drew 41.6% of visits from 30+ miles away. This share of distant visitors was significantly higher than that seen at the mall during the first five months of 2024, and more than double the segment-wide summer average of 18.2%.

The Mall of America also seems to be attracting more upper-middle-class families during the summer than other indoor malls: Between June and August 2024, some 18.0% of Mall of America’s captured market consisted of “Upper Suburban Diverse Family Households” – a segment including upper-middle-class suburbanites – compared to just 11.1% for the wider indoor mall segment. The increased presence of these families at the Mall of America may be driven by the variety of events offered during the summer.

In 2019, the American Dream Mall in New Jersey opened and became the second-largest mall in the country. Since the mall opened its doors, it has also focused on blending retail and entertainment to draw in as wide a range of visitors as possible – and summer 2024 was no exception.

The mall hosted the Arena Football League Championship, ArenaBowl XXXIII, on Friday, July 19th. The event successfully attracted a higher share of visitors traveling from 30+ miles away compared to the average summer Friday – 35.4% compared to 25.7%.

Visits to the mall on the day of the championship were also 13.6% higher than the Friday visit average for the period between June and August 2024, showcasing the mall’s ability to draw in crowds by hosting major events.

Malls – both indoor and open-air – continue to evolve while playing a central role in the American retail landscape. Increasingly, malls are emerging as destinations for more than just shopping – especially during the summer – driving up foot traffic and attracting visitors from near and far. And while much is often said about the impact of holiday seasons on mall foot traffic, summer months offer another opportunity to boost mall visits. Malls that can curate experiences that resonate with their clientele can hope to see foot traffic growth – in the summer months and beyond.

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.