.svg)

.png)

.png)

.png)

.png)

Our latest white paper, Who’s in the Stands? An In-Depth Look at Arena and Stadium Visits, uses location intelligence tools to uncover the demographic and psychographic characteristics of sporting events attendees – including Super Bowl fans. Below is a taste of our findings. For the full report, click here.

As the biggest game of the year, the Super Bowl usually brings a tourism boom to the host city. The heat map below depicts the origins of travelers to the past three Super Bowls (excluding Super Bowl LV in 2021 which was held under COVID restrictions). Year after year, the distribution of Super Bowl attendees is relatively similar to the country’s population distribution – which means, perhaps unsurprisingly, that the most densely populated regions are well-represented at the game.

But the data also reveals that many Super Bowl attendees travel from the regions where the competing teams are based, which indicates that die-hard fans are willing to make the trip to see their local team potentially win a championship. The map also shows that visitors from the Super Bowl’s host city and surrounding areas are heavily represented at the game, regardless of whether or not a local team is playing. It’s likely that a significant number of football fans who live nearby take advantage of the rare opportunity to see a Super Bowl close to home.

Super Bowl LVI in 2022, for example, was played at SoFi Stadium in Los Angeles, CA between the Cincinnati Bengals and the Los Angeles Rams. The event was heavily visited by fans from Southern California as the game was not only being played by the LA Rams, but also at their home stadium in Inglewood, CA. A greater contingent than previous years was also in attendance from Cincinnati, OH and its surrounding areas.

Many fans travel to the Super Bowl from the same regions every year, with the host city and the contending teams’ hometowns also providing significant factions of attendees. But analyzing Super Bowl crowds throughout the years also reveals an important demographic shift taking place among those traveling to the Super Bowl – the growing number of family-oriented visitors.

Since 2019, the True Trade Areas of the Super Bowl stadiums include increasingly greater shares of larger families. Last year’s Super Bowl LVI had an in-person audience that reflected a trade area in which 17.9% of residents came from families of five or more, up from 11.9% at the Super Bowl three years prior. Conversely, Super Bowl attendees in 2022 reflected a trade area in which 37.7% of residents were part of two-person households, a decrease from 47.8% in 2019.

The increase in attendees from areas with larger families could reflect the NFL’s initiatives to make football a more family-friendly sport, including rule and equipment changes aimed at increasing player safety and supporting youth football clubs. The trend towards an increase in attendees from larger families may also inform decisions about products to promote as well as amenities that will contribute to a family-friendly experience on game day.

Brands invest heavily in ads that air during the Super Bowl. But with the right insights, stadium advertising platforms have tremendous potential to reach target audiences in-person at the big game. While a large audience is part of the equation, in order to achieve maximum impact, an in-depth understanding of visitors is critical.

For more insights into sports events attendees, read the full report here.

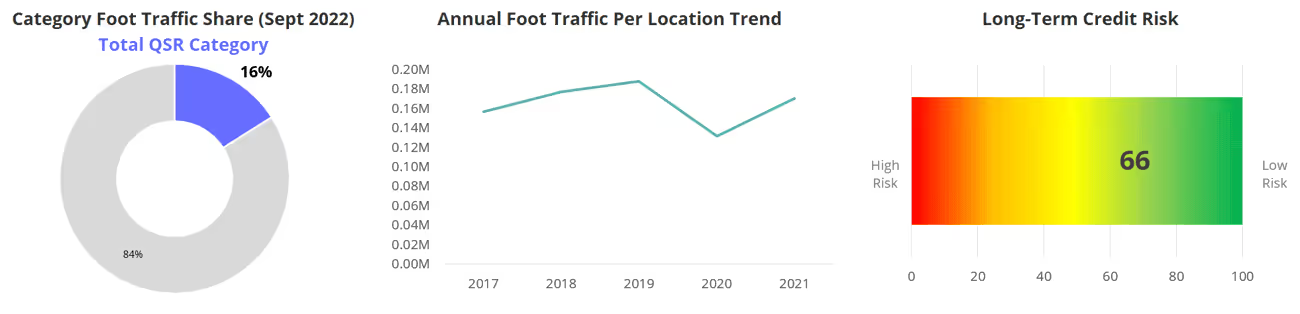

Key McDonald's Metrics

While focus and streamlined operations are key to restaurant growth strategies, we also continue to see evidence of the impact of innovation and nostalgia in driving visits. McDonald’s has had success with its past celebrity meal collaborations with Travis Scott and J Balvin, with our data indicating a mid-to-high teens lift in visits compared to the weeks prior to the promotion. However, McDonald’s "Adult Happy Meal" collaboration with streetwear brand Cactus Plant Flea Market might be its most successful collaboration today, with data suggesting more than a 30% increase in in-store visitation trends compared to the weeks leading up to the promotion (below). We’ve discussed the impact of limited-time offers (LTO) in the QSR space earlier this year, but McDonald’s has set a new bar for the industry (beating out Taco Bell’s Mexican Pizza launch in May).

Although QSR chains saw more resilient visitation trends than other restaurant categories for much of 2022, the gap between the QSR, fast casual, and full-service restaurant chains had narrowed in September as lower-income consumers continue to face inflationary headwinds from menu price hikes across the QSR space while higher-end consumers continue to dine out. Nevertheless, the impact of McDonald’s adult happy meal promotion is evident in not only the massive spike in visitation trends for the full QSR sector last week (below). While not everyone may love these promotions, they can be an extremely effective way to drive visitation growth.

We, the founding team, always loved data - ideating around it, engineering with it, understanding the world better with it.

But what captivated us most was imagining data products that can be used by tens of thousands of businesses across the world.

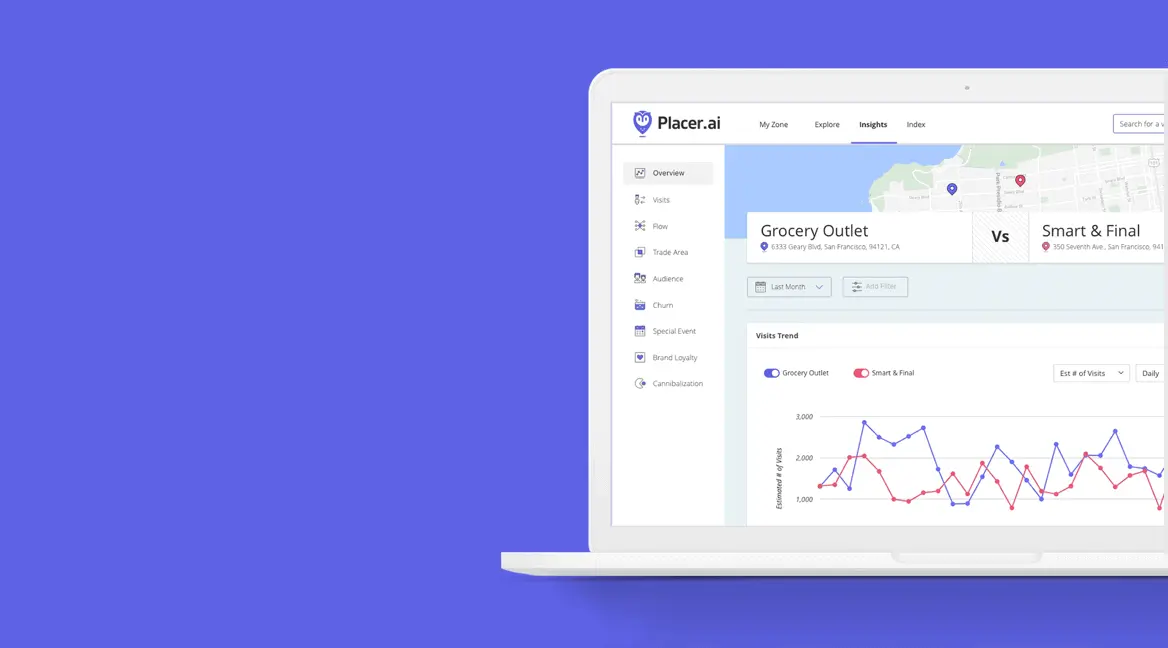

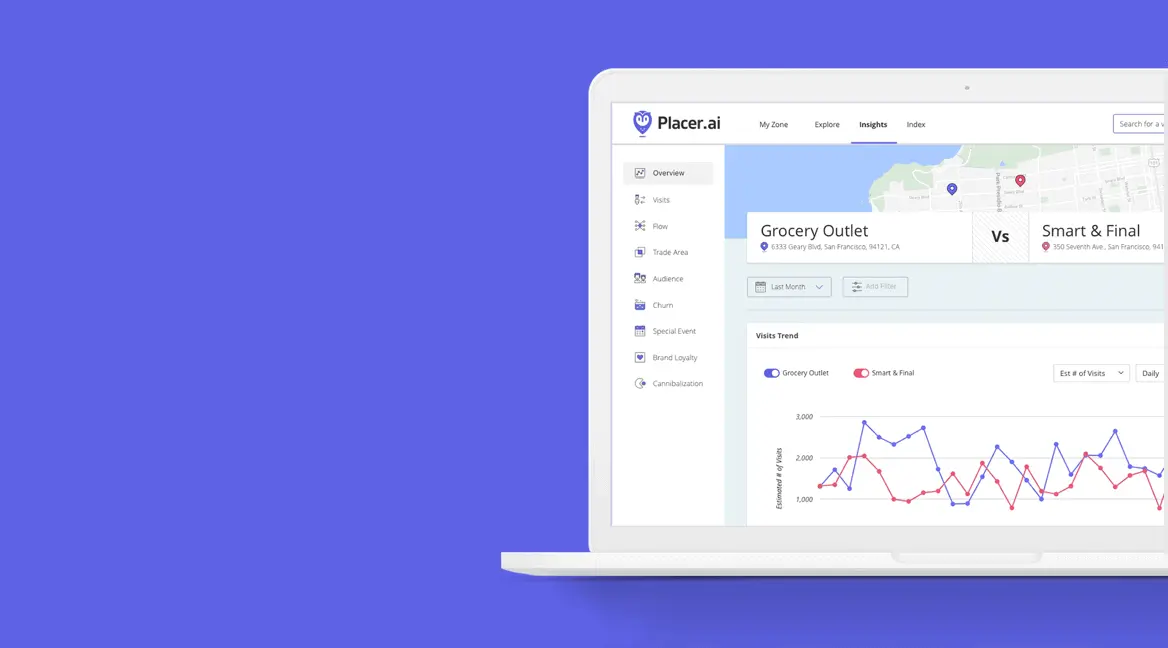

Among all the ideas and visions we bounced around before starting the company, one stood out for its simplicity and potential impact - building a ‘Physical Market Intelligence Platform’ to provide everyone in the offline world (a.k.a the ‘real world’) with aggregate insights for decision-making. Or in layman’s terms, “a dashboard to get instant insights for any place to understand its audience, surroundings, and competition”.

In 2016, the Placer founding team gathered in a basement and spent a weekend sketching out a plan to turn this idea into a massive world-class data company.

Whiteboarding without customers or tech debt is fun!!!

The more paper we stuck to that basement wall, the bigger the vision became! Everything is possible with the stroke of a pen…

But very quickly, we hit some glaring challenges:

The best way to approach a big challenge is breaking it down into smaller ones. So we worked hard to define Phase 1 - focusing on building a product that (1) was centered around the mobile location analytics dataset and (2) generated reports tailored for CRE and retail.

5 years and 5 funding rounds later, we’re FINALLY feeling “pretty good” about Phase 1: we launched a world-class mobile analytics product that’s used by over 1,000 customers, and thousands more are using our free products.

But it’s also been “frustrating” - we were always strapped for cash and resources. We’re yet to integrate most of the datasets we need; key reports for certain verticals remain in the product pipeline; and in terms of usability and workflow features, we still have a lot to do in order to create a truly comprehensive platform (vs “read only” status insights tool).

That’s why the $100M Series C funding we just announced is so momentous for me and the rest of the Placer team. It finally removes the shackles and equips us with the tools and materials we need for Phase 2 - rapidly building the full Placer.ai Market Intelligence Platform.

So let’s dive into what that means…

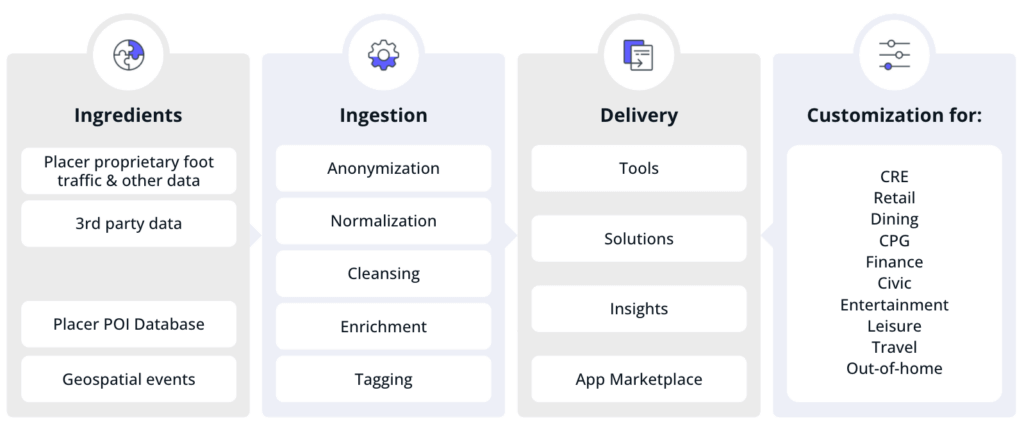

A Physical Market Intelligence Platform is a big data puzzle. Piecing it together - in a nutshell - consists of four phases:

A vast amount of interconnected data is required to create a truly accurate and complete picture of what’s going on at a location. This data falls into two broad categories:

Now consider all things you see going on in the world and imagine how POI and geospatial data can capture and quantify them…

Here’s a snippet:

We track dozens of data categories and thousands of datasets and vendors in order to identify new data that can help answer our customers’ questions.

This is 50% of our work and is a huge data challenge - but also great fun!

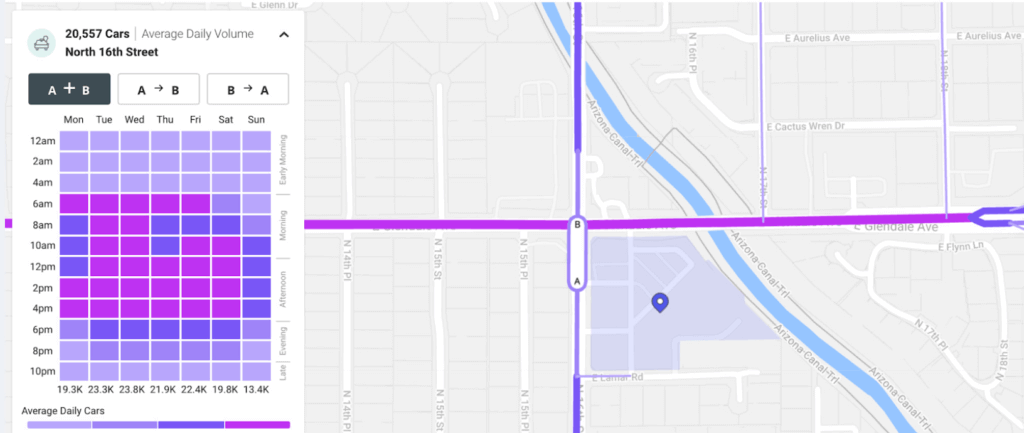

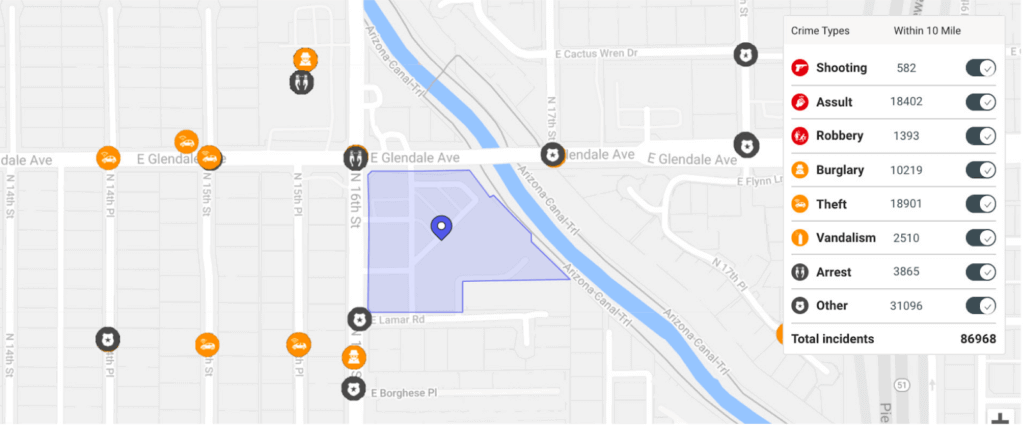

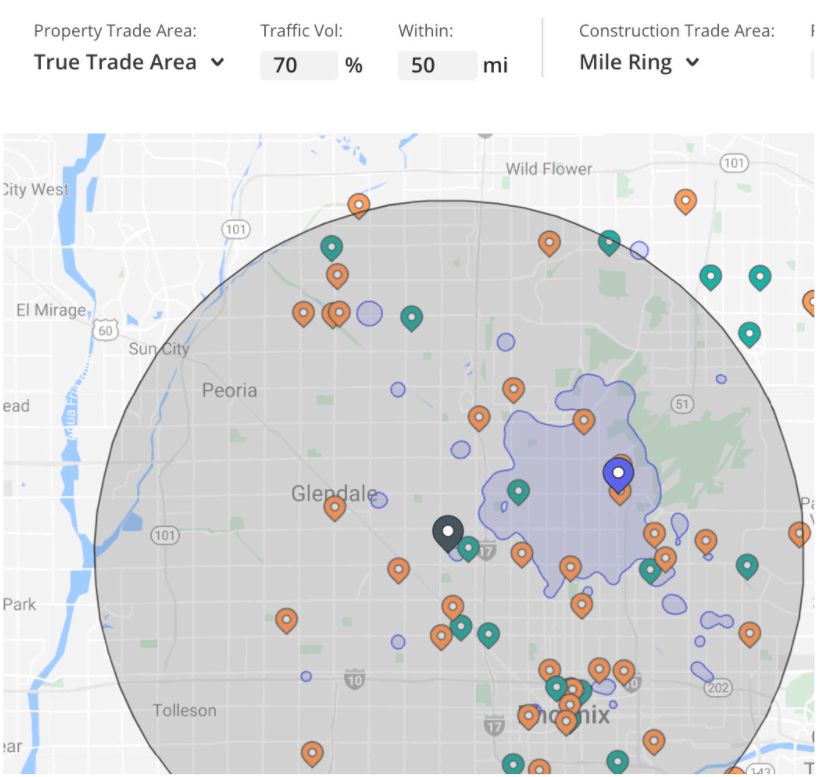

Through partnerships and our App Marketplace, we’ve recently integrated online reviews, credit card data, demographics, vehicle traffic volume, crime figures and planned construction into our platform. And we have lots more datasets in our pipeline: retail sales, property sales, financial data, leasing comparisons and climate data to name just a few.

If the data are the ingredients, then ingestion is the cooking. This includes complex data science processes:

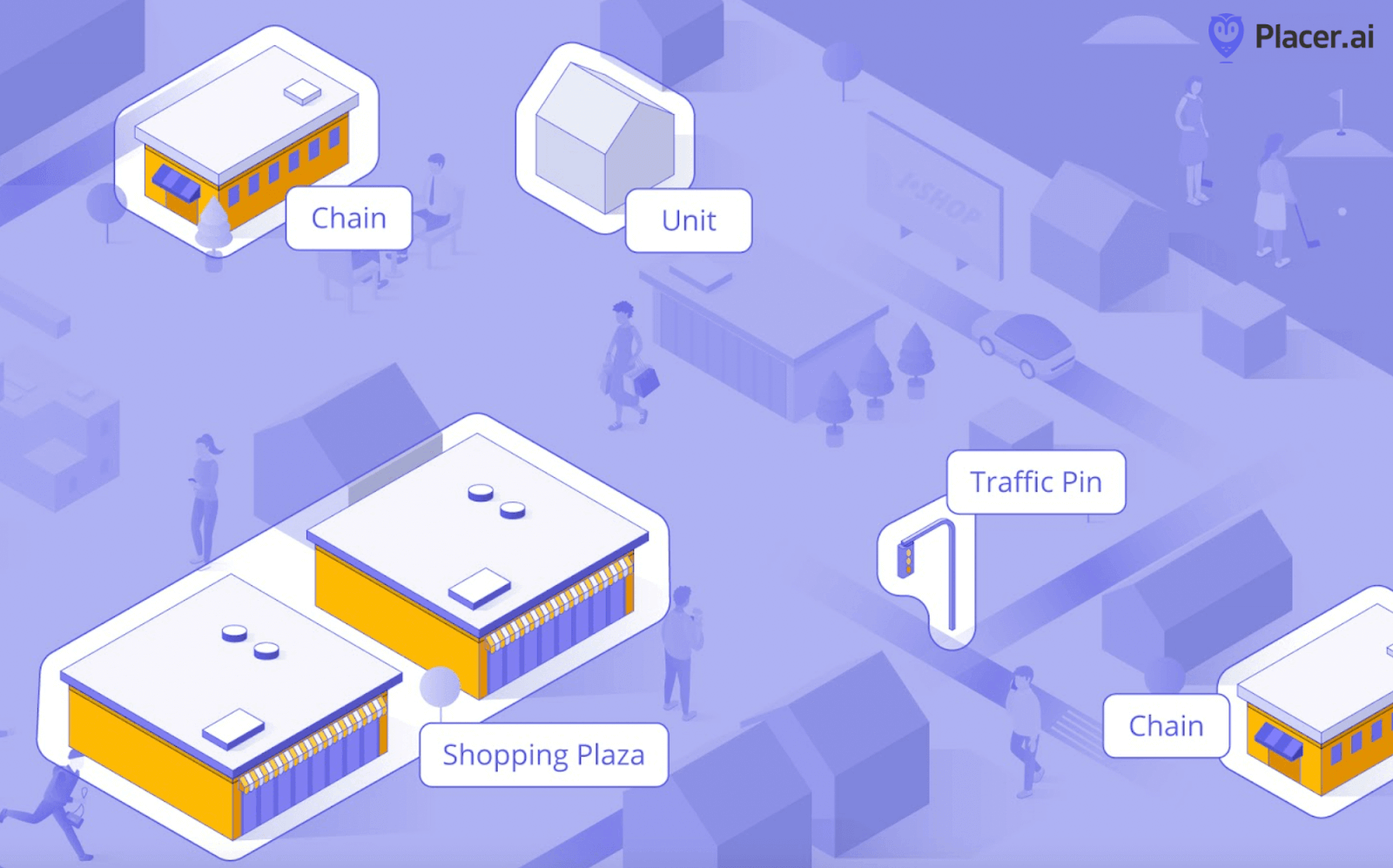

Tagging data to POIs is a massive task. Placer’s POI database contains millions of entities: a commercial real estate asset in a customer’s portfolio; stores of a retailer’s chain or that hold a CPG brand’s products; a billboard used for out-of-home advertising; a downtown area being regenerated by a municipality or business improvement district. We geofence each one so data can be tagged to it.

But a much greater complexity than the volume of data-POI matching is the fact that our data structure is mutable - it changes. Stores, restaurants, strip malls and other POIs open, close, merge and move. Our physical environment is constantly changing. One of our platform’s standout attributes is that it always reflects historical change.

In practice, this means that, for each POI change, we not only adjust our data tagging but also re-tag 5 years of historical data to ensure any historical comparisons are “like with like”. This is a huge investment of resources on the part of our data science, devops and engineering teams - exponentially increasing our data management burden.

To complete the cooking metaphor, after selecting ingredients (datasets) and cooking them (data ingestion), we then lay out a buffet-style feast of solutions for our users:

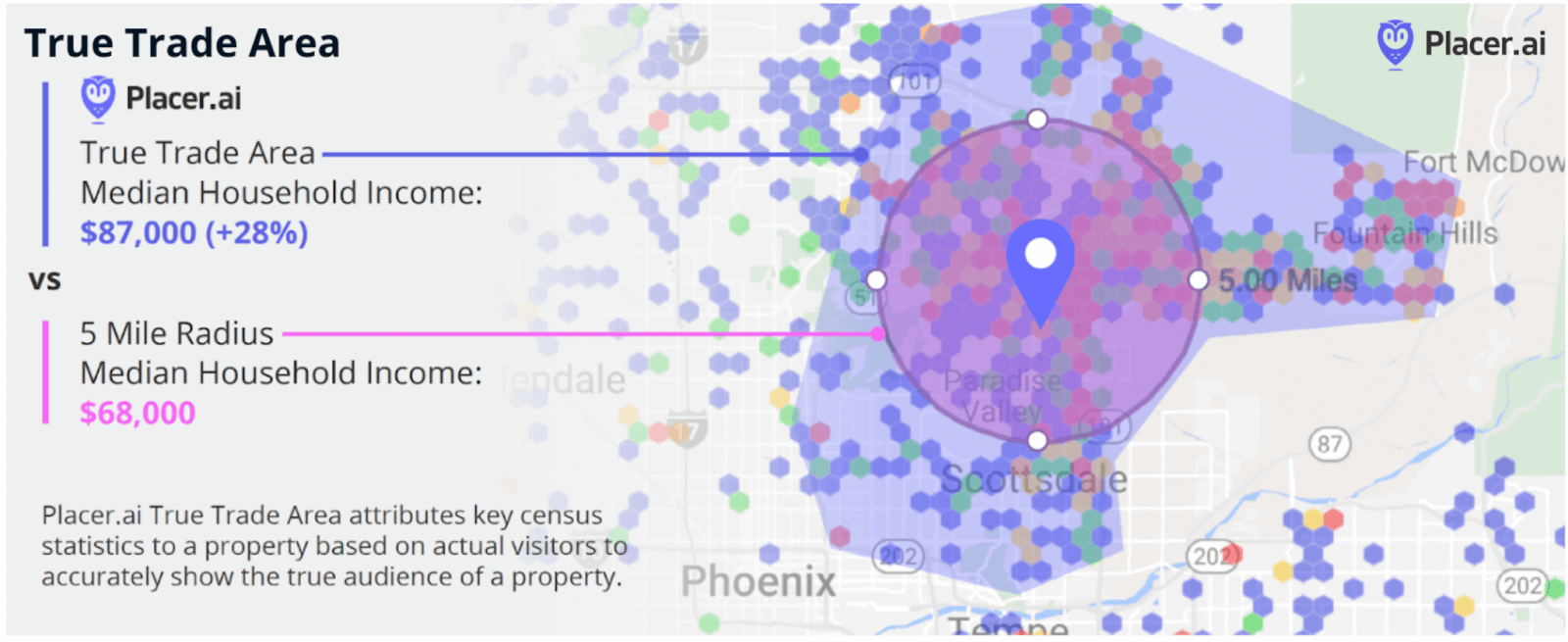

The most basic level of the platform is converting the data into real-world constructs that can be understood by industry professionals: tables, charts, maps and other graphics displaying cross shopping, trade areas (below), cannibalization, risk analysis, visit frequency and so on.

A key tenet of the Market Intelligence Platform is the approach that insights like those are often not the answer to the questions that our customers are looking for. Rather, they are just part of the explanation behind the answer. That means providing a comprehensive suite of Solutions SUPPORTED by insights, not just a library of uncontextualized insights.

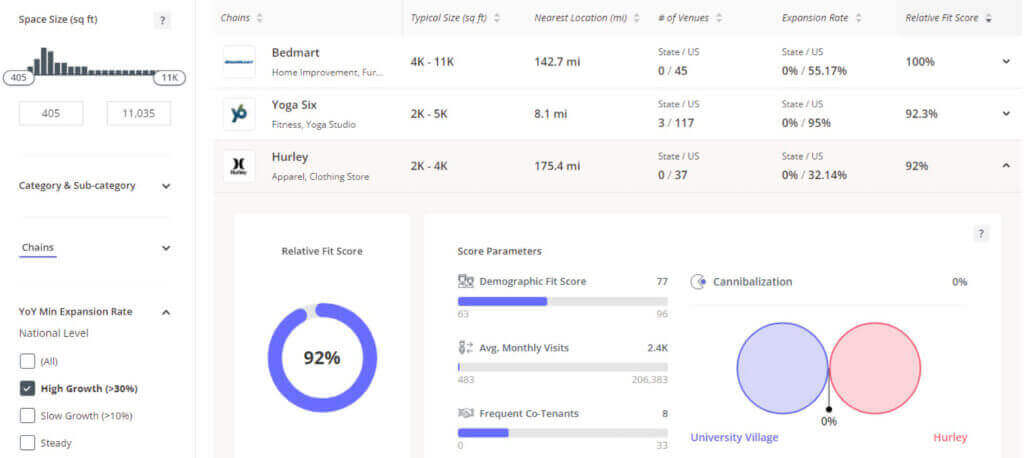

An excellent example of this is Void Analysis. A key question for retail real estate is “who is my ideal tenant?” While our platform offered important insights (such as retailers’ average monthly foot traffic and cannibalization) for reaching an answer, landlords were doing a lot of legwork. The Void Analysis tool we released late last year enables CRE professionals to instantly analyze thousands of potential tenants through automatically generated reports that include ranking according to our unique Relative Fit Score. This significantly improves the speed and scope of a search for new tenants.

We are now working on the many additional solutions like Void Analysis in our development pipeline - sales forecasting, site selection for retail chains, market selection, market change reports, product optimization for CPG to name a few.

To be truly useful, solutions must also be delivered in a way that fits various users’ workflows. A dashboard is a good start, but a full platform must offer a range of access points. This means data feeds, REST APIs, and other methods of programmatic access.

We’ll also add to that a rich layer of data exploration tools such as GIS, templates, graph builders, pivot table functionality and advanced entity search. This will provide users with maximum flexibility in how they explore and visualize our data.

The lion’s share of the work is still ahead of us here - more widgets, third party integrations, report generators, scheduled intelligence reports and alerts, and much more.

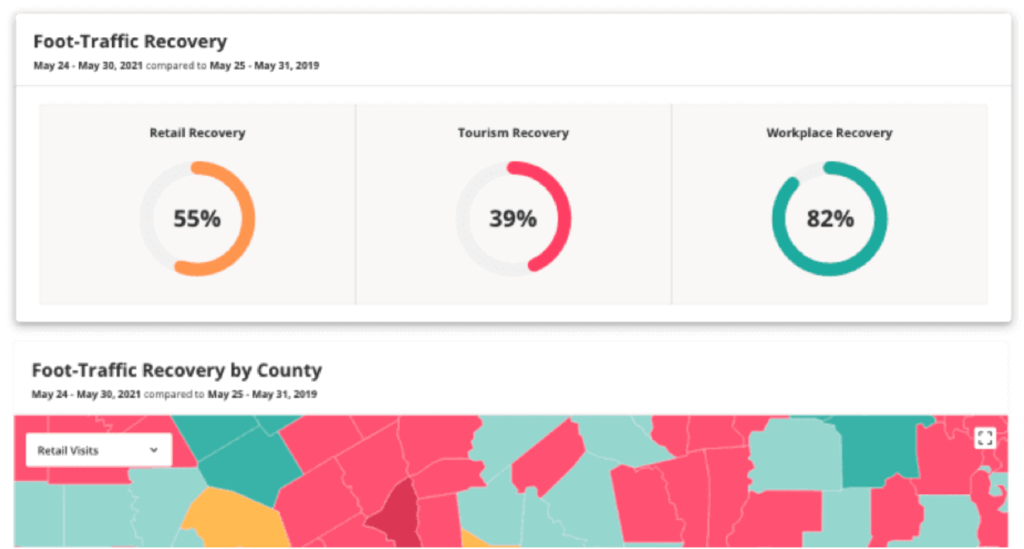

The platform’s user interface must be fully customized to fit the needs of its different user types across verticals AND within companies (business users, data scientists, data analysts, third party users). An example of how we’ve begun to do this is a portfolio overview section for CRE analysts to rapidly scan properties’ performance metrics. Another is our COVID-19 Recovery Dashboard, particularly used by civic organizations to assess the impact of the pandemic on local economic areas.

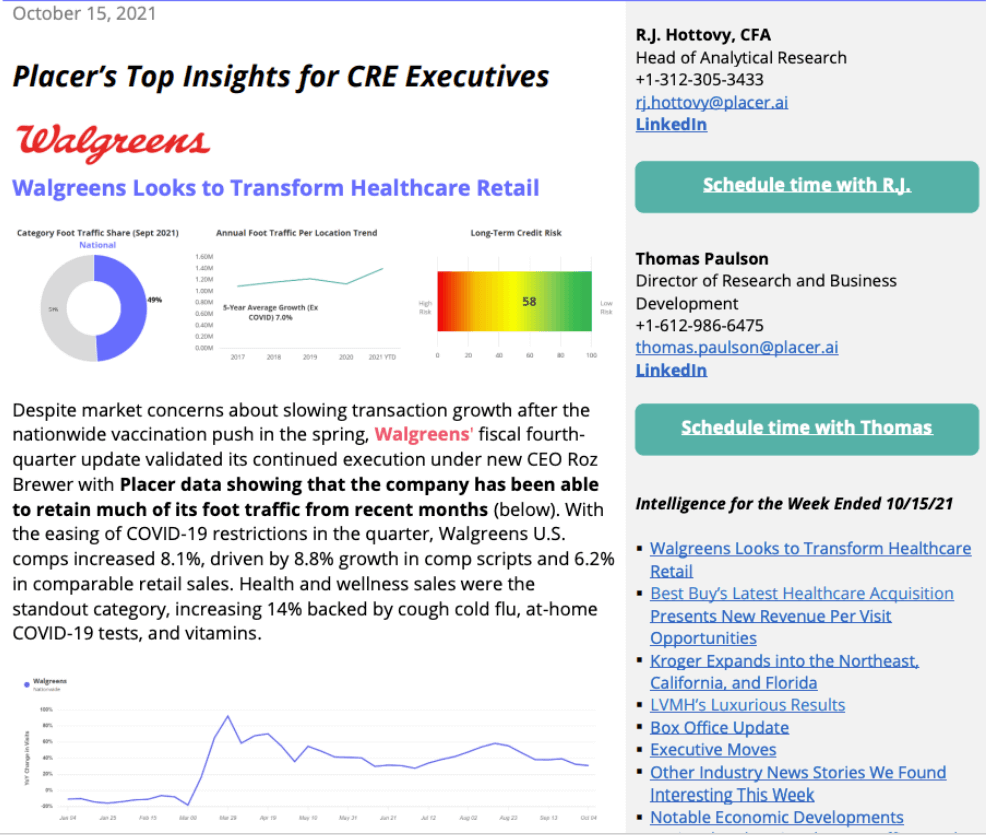

As we presented “just data”, we quickly realized some customers were looking for humans to add a “research layer” and context around the data. So an analytical research team has become part of the product. They capture and present key market intelligence, respond to the latest industry trends and customer interests. “The Anchor”, a weekly CRE executive intelligence report launched last September, has now become an inbox staple for many of our customers.

To our current understanding, we’re just “5%” of the way to our Market Intelligence Platform vision. The remaining 95% will be built by scaling POI coverage, datasets, answering more questions and developing the other core components of the platform.

So our focus now is on ramping up the velocity of this development. And to do that, we need even more of the world’s best talent across the company.

So, during 2022, we will use our new capital to double the size of our engineering team and significantly expand the data at our disposal. In parallel, we will also channel more resources to supporting our customers and contributing to industry understanding through our analytical research department and educational content.

Placer.ai is committed to transforming the way real-world businesses make decisions. And we don’t want to waste any time going about it.

LOS ALTOS, CA (January 12, 2021)--Placer.ai, the leader in location analytics and foot traffic data, announced today the closing of a $100M Series C funding round at a $1B valuation. The round was led by Josh Buckley with participation from WndrCo, Lachy Groom, MMC Technology Ventures LLC, Fifth Wall Ventures, JBV Capital, and Array Ventures. The round also included the participation of leading commercial real estate investors and operators, including J.M. Schapiro (Continental Realty Corp), Eliot Bencuya and Jeff Karsh (Tryperion Partners), Daniel Klein (Klein Enterprises/Sundeck Capital), Majestic Realty, and others. The funding will be used to expand the company’s R&D capabilities to further increase the pace of innovation.

“Placer experienced significant growth during 2021 as a consensus formed across the market that accurate, reliable consumer behavior analytics is indispensable to brick and mortar decision-making,” said Noam Ben-Zvi, CEO and Co-Founder of Placer.ai. “Yet, location analytics is just the foundation for a much broader and more comprehensive vision. With this funding, we will accelerate the development of the Placer.ai platform, adding an unprecedented range of new data sets - such as vehicle traffic, planned construction, web traffic, purchase data, and much more - as well as more advanced solutions to empower any professional with a stake in the physical world to make better decisions, faster than ever before. ”

Since launching in November 2018, Placer.ai has been adopted by over 1,000 customers including industry leaders in commercial real estate and retail like JLL, Regency Centers, Taubman, Planet Fitness, BJ’s Wholesale Club, and Grocery Outlet. In the wake of COVID-driven upheaval, the company saw widespread adoption among a series of new categories, among them hedge funds and CPG leaders including Tyson Foods and Reckitt Benckiser.

"Placer provides instant, simple and actionable insights to questions we've been asking as operators for over 30 years. The pace of innovation, the unique trust that the company has developed, and the massive market demand all point to the magnitude and scale of what this team can achieve,” said Jeffrey Katzenberg, Founding Partner of WndrCo.

"We have long felt like the disruption Placer can bring is massive, but the market demand has far exceeded our initial expectations," said Josh Buckley. “We see a powerful opportunity to continue partnering with Placer to improve the way decisions are made in the physical world, fundamentally improving the way these businesses and organizations operate."

Try Placer.ai for free here.

About Placer.ai:

Placer.ai is the most advanced foot traffic analytics platform allowing anyone with a stake in the physical world to instantly generate insights into any property for a deeper understanding of the factors that drive success. Placer.ai is the first platform that fully empowers professionals in retail, commercial real estate, hospitality, economic development, and more to truly understand and maximize their offline activities. Find more information here: https://placer.ai/

LOS ALTOS, CA (April 27, 2021) --Placer.ai, the leader in location analytics and foot traffic data, announced today the close of a $50M Series B funding round. The round was led by Josh Buckley, Todd Goldberg and Rahul Vohra, with participation from Fifth Wall, JBV Capital and Aleph VC. The funding will be used to grow the company’s R&D, expand sales and marketing teams, introduce additional reports and data sets, and grow the recently announced marketplace.

Since launching in November 2019, Placer.ai has been adopted by over 500 customers including industry leaders in Commercial Real Estate and Retail like JLL, Brixmor, Taubman, Planet Fitness, and Dollar General. Yet, the recent upheaval caused by COVID led to widespread adoption among a series of new categories including Hedge Funds and CPG leaders.

“As a business deeply rooted in offline retail, we expected COVID to present a unique challenge. Yet, adoption actually increased as a result of our ability to introduce certainty into such an uncertain environment. The result has been a clearer and deeper understanding by the market of the absolute imperative of location data to improve the decision-making process,” said Placer.ai CEO and Co-Founder Noam Ben-Zvi.

“But our current offering is just the beginning, and we are fully focused on expanding the capabilities both through the development of a range of new features and tools, and the integration of a wide range of data sets through our marketplace. Placer.ai is rapidly becoming the market intelligence platform for anyone with a stake in the physical world.”

In the last year, Placer.ai continued to expand its presence in core markets like Commercial Real Estate, Retail, Municipal governments, and Hospitality while advancing into new segments like CPG and Hedge Funds. The result has been growing market adoption and an increasingly large and diverse reach.

"Fifth Wall has some of the largest owners and operators of real estate as our limited partners and several were customers of Placer.ai, giving us a unique perspective on the company’s growth and potential. We saw firsthand the impact that the data is already having in reimagining the way business is done in retail and real estate broadly,” said Kevin Campos, Partner on the Retail & Consumer Investment team at Fifth Wall. “Yet, what’s even more exciting is that we’re still only seeing a piece of the puzzle and know that there are so many other sectors where the data can be applied. We’re thrilled to help grow and execute this vision alongside this exceptional team.”

"Placer allows businesses that operate offline to make data-driven decisions, fundamentally improving the way they operate. This is the same type of tooling that online businesses have used to grow, moving from hunches to definitive answers," said Josh Buckley. “I'm excited to be partnering with the company's next phase of growth and product development."

“Our journey with Placer.ai started at the very beginning as one of the company's first beta customers. Seeing the disruptive power of the product up close, the speed at which the company developed new features, and the tremendous traction they achieved in the marketplace led us to invest less than a year later and in every round since," said Sandy Sigal, CEO of NewMark Merrill Companies, an owner and developer of over 80 shopping centers and Chairman of BrightStreet Ventures, their venture capital arm. "Several years later, the customer growth, their ongoing product development, and the continuing value they have brought to our organization has only deepened our conviction and makes continued support a no-brainer for us."

Learn more about Placer.ai.

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.