.svg)

.png)

.png)

.png)

.png)

Turkey Wednesday – the day before Thanksgiving – is the grocery industry’s Black Friday. As shoppers flock to stores for turkeys, cranberry sauce, and other holiday essentials, the day delivers impressive visit spikes for grocery, superstore, and dollar stores alike. But how did this year’s Turkey Wednesday measure up – and which brands capitalized most successfully on this critical shopping event?

We dove into the data to find out.

People love to shop – but they also love to procrastinate, descending on stores just before major holidays to grab last-minute supplies. So far in 2024, March 30th (Easter Eve), May 11th (the day before Mother's Day), and November 27th (Turkey Wednesday) have been the busiest days of the year for grocery stores, superstores, and discount & dollar stores. But while the first two milestones drew bigger crowds to superstores and discount & dollar stores – both natural destinations for gift buyers and food shoppers alike – Turkey Wednesday was the grocery sector’s time to shine.

On November 27th, 2024, grocery stores saw visits surge by 81.0% compared to a year-to-date (YTD) daily average, capturing over half (51.2%) of visits across grocery, superstore, and discount chains. (During the rest of the year, grocery stores account for just 46.6% of the three industries’ overall visit pie.) Still, superstores and discount & dollar stores also attracted plenty of pre-Thanksgiving shoppers with enticing holiday promotions of their own. And despite reports of consumer cut-backs ahead of the holiday, this year’s Turkey Wednesday performance was on par with last year’s, with grocery visits on November 27th 2024 up 0.7% relative to November 22nd 2023 (last year’s Turkey Wednesday).

Diving into statewide grocery store data shows that like Black Friday, Turkey Wednesday’s appeal isn’t evenly distributed across the United States. Though grocery visits spiked nationwide on November 27th, 2024, some regions saw bigger foot traffic peaks than others.

In the Pacific Northwest, parts of New England, and some Mountain states, for example, grocery visits increased by less than 70.0% compared to a YTD daily average. But in parts of the Midwest and South, visits spiked by over 90.0%. Mississippi and Minnesota in particular stood out as major Turkey Wednesday winners, with visits up 96.8% and 96.5%, respectively. These regional differences highlight Turkey Wednesday’s special resonance in areas where holiday shopping traditions like Black Friday also dominate.

Which grocery chains benefit the most from Turkey Wednesday? A look at individual brands shows that traditional grocery stores – think Kroger, Albertsons, and Safeway – generally see bigger pre-Thanksgiving visit boosts than limited-assortment value chains like Aldi and Trader Joe’s. And in keeping with the regional trends noted above, some of the best-performing chains are midwestern favorites like Schnucks and Albertsons’ Jewel-Osco, which saw Turkey Wednesday foot traffic surges this year of 103.9% and 92.6%, respectively.

But numerous other chains also saw major Turkey-fueled visit increases on November 27th – including Food 4 Less, the Kroger-owned regional value chain with locations in both the Midwest and California, and East Coast brands ShopRite and Wegmans. When it comes to last-minute holiday shopping, it seems, there is plenty of room for multiple brands to thrive.

Though value-oriented grocery chains typically see smaller visit spikes on Turkey Wednesday, many budget brands are steadily growing their pre-holiday audiences.

Grocery Outlet Bargain Market and Aldi saw foot traffic rise by 13.5% and 11.2%, respectively, on November 27th, 2024 compared to last year’s Turkey Wednesday. (Both chains also saw substantial increases in the average number of visits to each of their individual locations – 9.7% and 8.4%, respectively – proving that the increase isn’t solely a result of fleet expansion.) Meanwhile, traditional grocery leaders like H-E-B, Kroger’s Ralphs, Ahold Delhaize’s Hannaford, and Albertsons’ Jewel Osco, also recorded year-over-year (YoY) foot traffic gains, highlighting robust performance across much of the sector.

Groceries are a crucial part of the Thanksgiving holiday – but liquor, it seems, may be even more indispensable. On November 27th, 2024, visits to liquor stores surged even higher than visits to grocery stores – generating a remarkable 186.4% visit spike, as consumers stocked up on spirits to ease the mood at stressful family gatherings or to show gratitude to hard-working hosts. Like for grocery stores, Turkey Wednesday was liquor stores’ busiest day of the year so far – though if last year is any indication, the run-up to Christmas will likely generate even more impressive traffic bumps.

Turkey Wednesday 2024 reaffirmed the key role played by traditional grocery stores in the run-up to Thanksgiving. And though supermarkets and liquor stores stole the spotlight, superstores and discount & dollar stores also experienced significant visit upticks – and value chains are steadily growing their pre-holiday audiences. How will these categories continue to fare throughout the rest of the holiday season?

Follow Placer.ai’s data-driven retail analysis to find out.

Visits to Starbucks usually spike on its annual Red Cup Day, as patrons flock to the chain to order a specialty holiday beverage and receive a complimentary reusable red cup. But last year, the chain’s Red Cup Day performance was relatively muted – although foot traffic still got a boost, the jump was not quite as significant as in previous years. Was the promotion more effective in 2024? We dove into the data to find out.

Starbucks’ Red Cup Day came roaring back in 2024, with Thursday, November 14th – the day of the promotion – receiving 42.4% more visits than the recent Thursday daily visit average. And Red Cup Day didn’t just drive visits relative to a regular weekday – the promotion brought a 9.4% lift in overall weekly visits to Starbucks during the week of the event.

The relative visit bump was significantly higher than on Red Cup Day 2023 – when visits on Thursday, November 16th 2023 were only 25.0% higher than the previous five Thursday averages – and even outshined the already strong performance of Red Cup Day 2022.

As usual, Red Cup Day at Starbucks drove a larger visit spike than the launch of the chain’s popular Pumpkin Spice Latte (PSL): During the week of the PSL launch, visits rose 9.7% compared to the first week of H2 (July 1st-7th 2024), while Red Cup Day drove a 12.9% foot traffic bump relative to that same baseline.

Nevertheless, the recent data also indicates that the PSL remains a seasonal fan favorite – Starbucks received more weekly visits on the PSL’s arrival week than it did when it launched the holiday menu, when visits increased 6.7% relative to the beginning of H2.

This year’s Red Cup Day followed several weeks of year-over-year (YoY) visit dips at Starbucks, with weekly foot traffic between September 2nd and November 10th 2024 down an average of 4.4% YoY. But the success of the promotion – which drove YoY visit growth for the first time since August – showcases Starbucks’ expertise at driving visits by owning the calendar.

The chain has succeeded in establishing a yearly buzz around its branded cups that drive visits during what would otherwise be an off-season for the chain. And even this year, when consumers seem to be tightening their purse strings and cutting down on discretionary spending ahead of the holidays, Red Cup Day still managed to drive patrons to Starbucks stores in search of holiday beverages and free swag.

How will Starbucks perform throughout the end of 2024?

Visit placer.ai to find out.

How did leading eatertainment chains Dave & Buster’s and Chuck E. Cheese perform in Q3 2024? We dove into the data to find out.

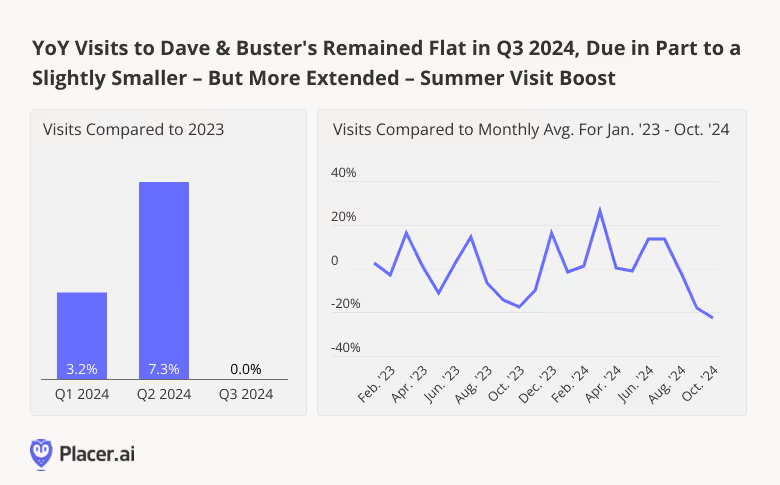

Since January 2024, Dave & Buster’s has enjoyed mainly positive YoY visit growth, fueled in part by the eatertainment leader’s continued expansion. In Q2 and Q3 2024, visits to the chain were up 3.2% and 7.3%, respectively. And though YoY foot traffic to the chain slowed down in Q3 2024, a look at Dave & Buster’s monthly visit patterns shows that this may have been due in part to a summer visit peak that was slightly lower – but more extended – than that seen last year.

In 2023, Dave & Buster’s experienced three distinct visit spikes – in March, July, and December – with the restaurant’s 14.6% July visit boost (compared to a monthly average for Jan. ‘23 - Oct. ‘24) preceded by a relatively quiet June (+2.0%). But this year, summer foot traffic began to trend upwards earlier, with both June and July seeing substantial upticks – 13.6% and 13.4%, respectively. (June is in Q2 and so this part of the uptick would not have been included in Q3 foot traffic numbers). And though September, usually a down period for Dave & Buster’s, saw a modest drop in visitors compared to 2023, the chain’s March peak was higher than last year’s.

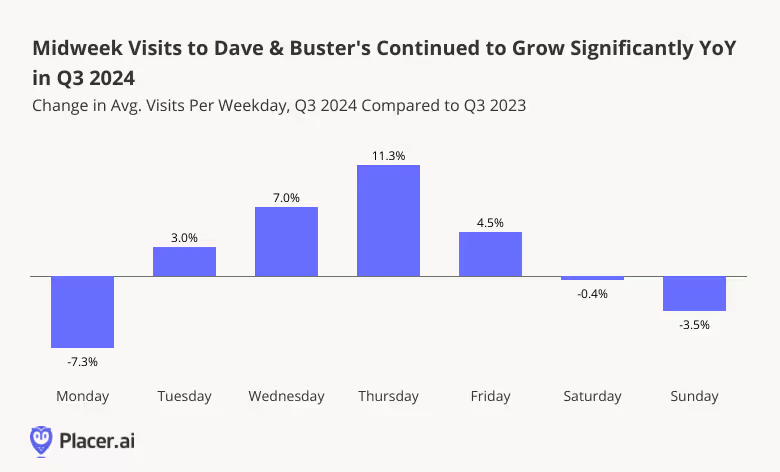

Digging even deeper into the data shows that even as YoY quarterly visits to Dave & Buster’s remained flat in Q3 2024, mid-week visits to the chain continued to climb. Dave & Buster’s has been investing heavily in mid-week promotions meant to drive traffic during quieter periods, and its efforts are clearly paying off. On Wednesdays, Dave & Buster’s offers a 50% discount on games – and the average number of Wednesday visits to the chain were up 7.0% YoY. Thursdays, too, saw an 11.3% YoY foot traffic increase, likely fueled by diners drawn to Thursday specials as the most intensive part of the work week wound down. (In Q3 2024, July 4th fell on a Thursday, which also generated a significant visit bump – but even when discounting the week of the holiday, Thursday visits were up 6.4% on average.)

Against the backdrop of solid seasonal peaks and impressive mid-week visitation trends, Dave & Buster’s appears poised to enjoy a robust December – another important seasonal milestone for the restaurant. And keep an eye out for the week after Christmas, traditionally Dave & Buster’s busiest week of the year: Last year, the week starting December 25th drove a 65.0% visit spike to the chain compared to a 2023 weekly average.

Speaking of promotions – Chuck E. Cheese is another eatertainment leader that has been finding success by leaning into special deals, making it easier for price-conscious consumers to treat their kids to pizza and fun.

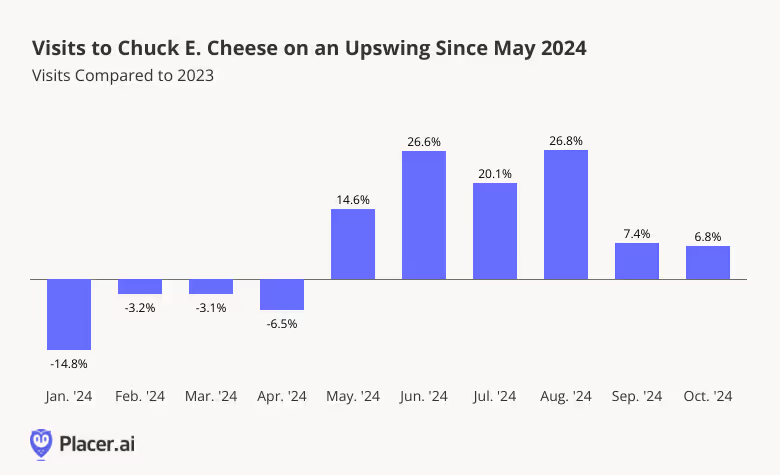

Following a lackluster start to the year, YoY visits to Chuck E. Cheese began trending upwards in May 2024 and have remained elevated ever since. Between June and August 2024, foot traffic to Chuck E. Cheese was up between 20.1% and 26.8% compared to the equivalent period of 2023. And though the pace of visit growth began to taper in September as kids went back to school, visits remained substantially higher than last year.

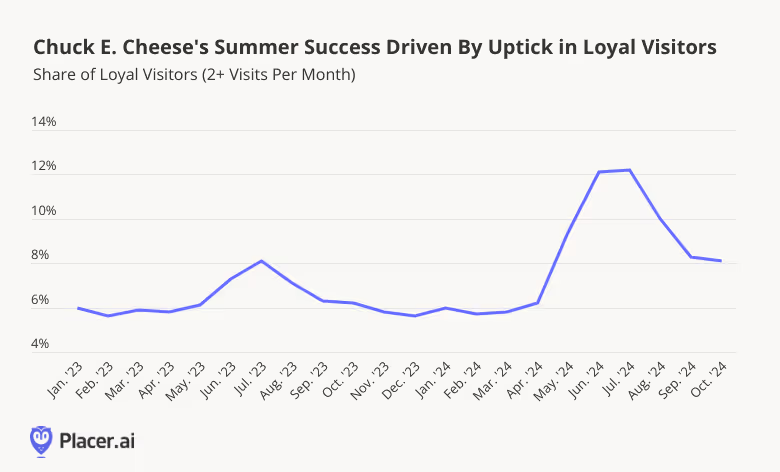

What’s behind Chuck E. Cheese’s summer flourishing? A look at shifts in loyalty trends at the chain suggests that the success of this year’s Summer Fun Pass may be a big part of the story.

On average, the share of loyal visitors to Chuck E. Cheese – i.e. those frequenting the restaurant at least twice in a month – tends to range between five and seven percent. Last summer, this percentage increased to 8.1%, as parents sought out indoor activities to keep kids occupied when school was out. But this year’s summer loyalty spike – just over 12.0% in both June and July – was significantly higher.

Though Chuck E. Cheese also offered a Summer Fun Pass last year, this year’s deal provided even greater value – including unlimited visits over a two-month period, steep discounts on food, and up to 250 games per day. And the promotion was such a smashing success that Chuck E. Cheese has launched a new unlimited-visit pass meant to make frequent trips to the chain more affordable for families all year round. As the kids’ eatertainment leader continues to revamp its offerings – remodeling locations and adding new activities like indoor trampolines – Chuck E. Cheese appears poised to keep drawing the crowds.

Today’s cautious consumers are always on the lookout for ways to save – and eatertainment chains are paying attention. Will Dave & Buster’s post-Christmas visit spike outperform last year’s? And will Chuck E. Cheese’s new unlimited play model continue to drive traffic throughout Q4?

Follow Placer.ai’s data driven analyses to find out.

Shoppers continue to prioritize value in 2024, offering opportunities for discount and dollar stores to thrive during the upcoming holiday season.

With that in mind, we took a look at visitation metrics – both from 2024 and from previous years – to see how the segment is performing and what the crucial holiday season might hold for discount retailers Dollar Tree and Dollar General.

Discount and dollar stores continue to benefit from an inflation-impacted economy, with category leaders like Dollar Tree and Dollar General continuing to expand their footprints to serve the increasing number of budget-conscious shoppers.

And in large part thanks to the increased store count, visits to Dollar Tree and Dollar General have continued to increase – Q3 2024 visits to the chains were up by 5.3% and 4.8% YoY, respectively. Monthly visits also showed impressive growth, with October 2024 visits up by 7.6% at Dollar Tree and 7.8% at Dollar General. These growth numbers may be slightly lower than the visit increases posted by the category in the past – but the ongoing positive performance by discount & dollar store leaders indicates that the category remains one of the most consistently strong players in the wider retail space.

November and December are typically the most important months for retailers as multiple shopping events – Turkey Wednesday, Black Friday, Christmas Eve Eve, and Boxing Day – drive consumers to the tills. And while many retailers open the holiday season with visit spikes driven by big Black Friday discounts, the visitation patterns look slightly different at discount chains, where prices are already low and discounts are – as their name implies – already applied. So when do these retailers get their holiday visit boosts?

Comparing weekly visit numbers in 2021, 2022, and 2023 to each year’s weekly average reveals differences between the two discount & dollar store leaders. Visits to Dollar Tree gradually increase from early November onward and peak on the last full week before Christmas, likely driven by shoppers flocking to its stores to pick up snacks, gift wrap, and stocking stuffers. Meanwhile, Dollar General’s visits exhibited more stability – although visits were higher than average between Black Friday and Christmas Eve Eve, the increase was much more muted relative to Dollar Tree’s holiday spike. Dollar General’s softer holiday traffic may be due to the expansion of its Dollar General Market concept, which turned many of its stores into destinations for fresh foods – so consumers may be treating Dollar General more like a grocery store and less like a holiday shopping spot.

Previous years’ visitation patterns indicate that the busiest time of the year is still ahead for Dollar General and Dollar Tree. How will these retailers perform during the critical pre-Christmas rush? Visit Placer.ai to find out.

Heading into the Q3 2024 retailer reporting period, most expected Walmart to continue gaining market share from essentials-focused retailers. In our coverage of Walmart’s Q2 2024 update, we highlighted the chain’s significant disruption in the grocery category, driven by everyday low pricing, Walmart+ store delivery orders, store remodeling efforts, an improved selection of premium merchandise, and a broadened marketplace offering. These strategies notably boosted visits among higher-income households earning $100,000 or more annually.

While Walmart did indeed disrupt essentials retailers this quarter, what stood out even more was its impact across discretionary categories. Management reported low-single-digit comparable sales growth in general merchandise, with mid-single-digit unit growth offsetting low-to-mid single-digit price deflation. Categories like home, toys, and hardlines led this growth, complemented by strength in beauty, fashion, and apparel. Walmart’s marketplace played a key role in this success, offering consumers a broader selection of brands and items than in-store. Marketplace sales in beauty, toys, hardlines, and home each grew by 20% year-over-year.

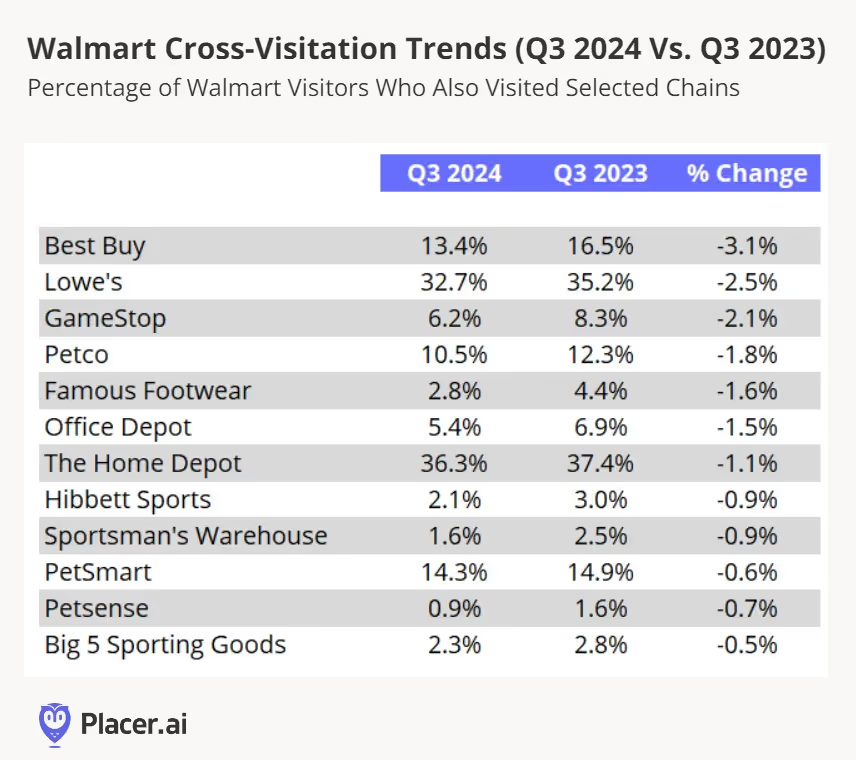

To assess Walmart’s impact on other general merchandise retailers, we analyzed cross-visitation trends. Our data indicates that year-over-year cross-visitation between Walmart and other hardgoods retailers like Best Buy, GameStop, Lowe’s, Home Depot, Hibbett Sports, Sportsman Warehouse, and Big 5—as well as pet retailers like Petco and PetSmart—declined. This suggests a potential shift in consumer behavior, with shoppers consolidating more of their general merchandise purchases at Walmart.

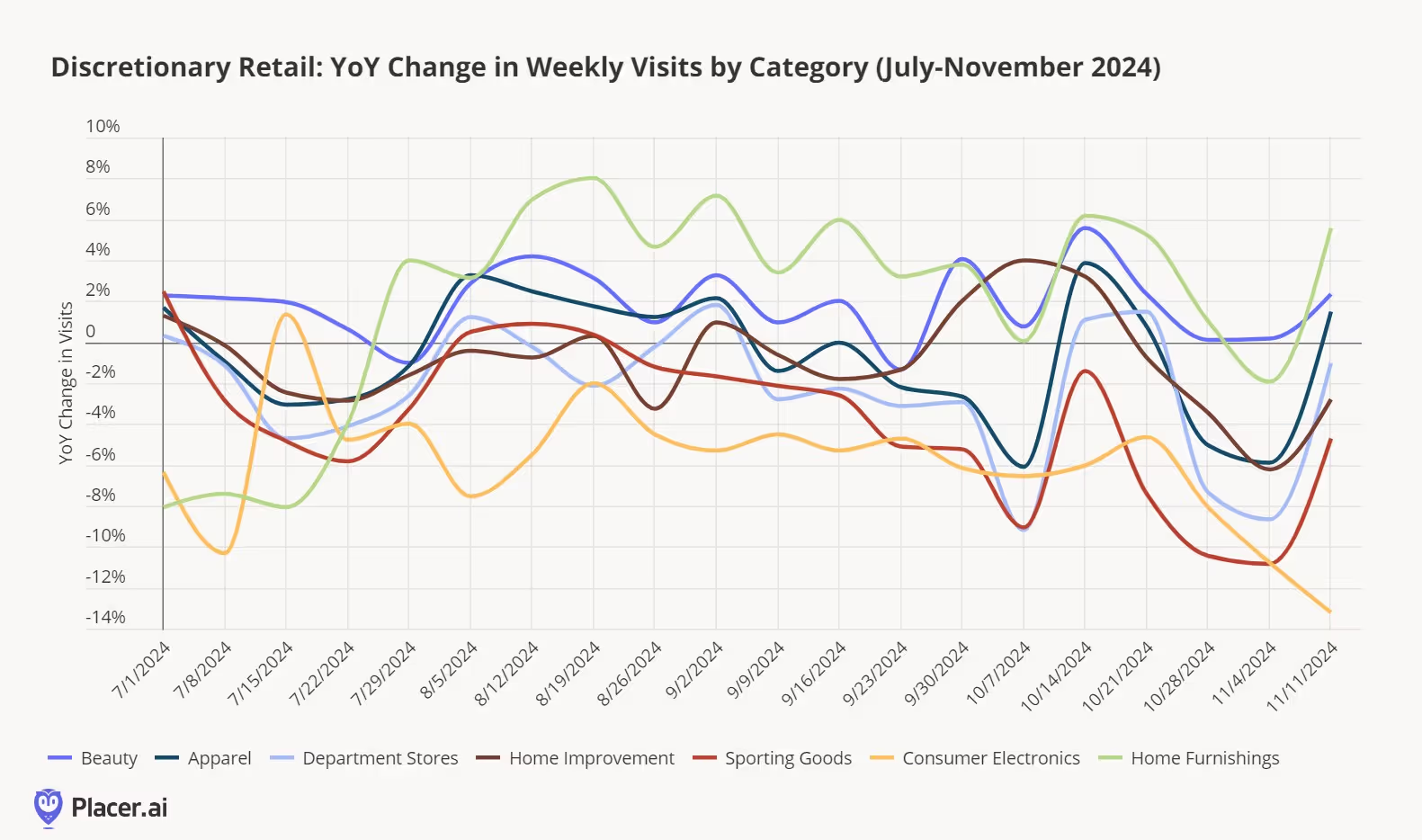

To confirm Walmart's impact on general merchandise, we analyzed visitation trends across several discretionary categories from July to November 2024 (below). With the exceptions of beauty and home furnishings—more on that category in a minute—most categories experienced year-over-year declines throughout much of the August to October quarter. Notably, mid-October brought a temporary improvement in visit trends, coinciding with major promotional events such as Amazon’s Big Deal Days, Walmart’s Holiday Deals Event, and Target’s Circle Week, underscoring how deal-driven consumers are in today’s environment. Following these promotions, shopping activity largely paused until last week, when Black Friday deal announcements began to drive renewed interest.

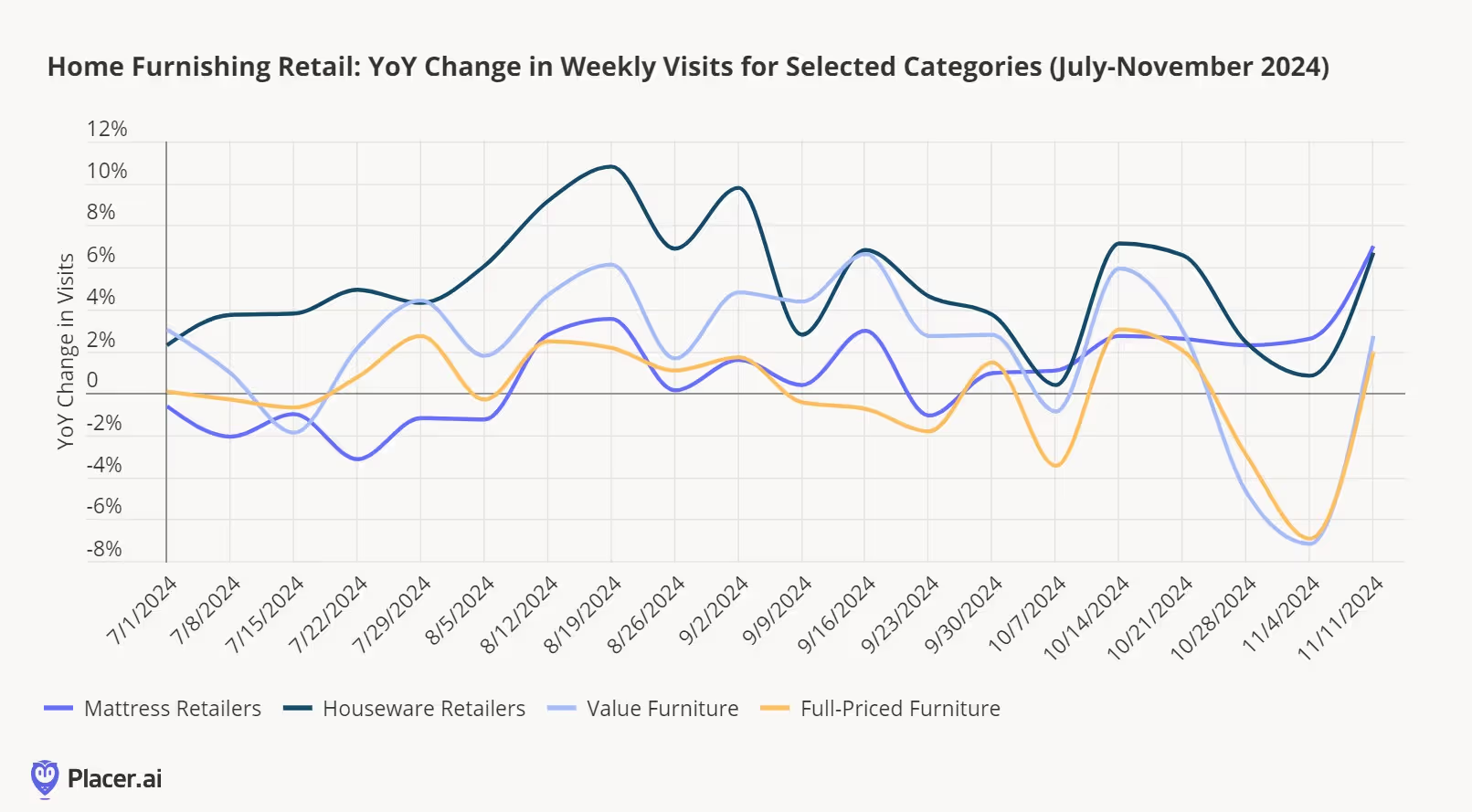

Home furnishings deserve a closer look. Earlier this year, we noted strong visit trends in housewares retail, and that momentum has largely continued. Mattress retailers, which began the year on a high note, have also maintained positive year-over-year visitation growth in the second half of 2024. Notably, furniture retailers—both value-focused and full-priced—saw year-over-year visitation gains during the quarter, though there was a slight pause in November as consumers waited for Black Friday deals.

These trends align with the third-quarter 2024 update from Williams-Sonoma, where management highlighted improvements in furniture sales at its West Elm and Pottery Barn brands. Additionally, the company cited strength in seasonal items and housewares, suggesting that Walmart’s strong performance in the home category reflects both broader industry trends and its own merchandising improvements. These patterns may also mark the early stages of a new home furnishings cycle as we near the five-year anniversary of the COVID-19 pandemic.

Walmart’s strong performance in discretionary categories serves as a warning to other discretionary retailers to elevate their strategies ahead of the holiday shopping season. With in-store merchandise enhancements and a robust third-party marketplace offering access to over 700 million stock-keeping units (SKUs), Walmart is positioned to be even more competitive this holiday season.

With the rise of hybrid and remote work, we’ve observed a notable shift in everyday consumer behaviors, particularly around fitness, shopping, running errands, and grabbing takeout. Without the need to commute on certain days, it’s easier for consumers to squeeze in a workout or make a quick trip to a store. Local outdoor shopping centers have become prime beneficiaries of this new “pop-in, pop-out” behavior. Here, we explore some of the brands poised to thrive in this evolving landscape.

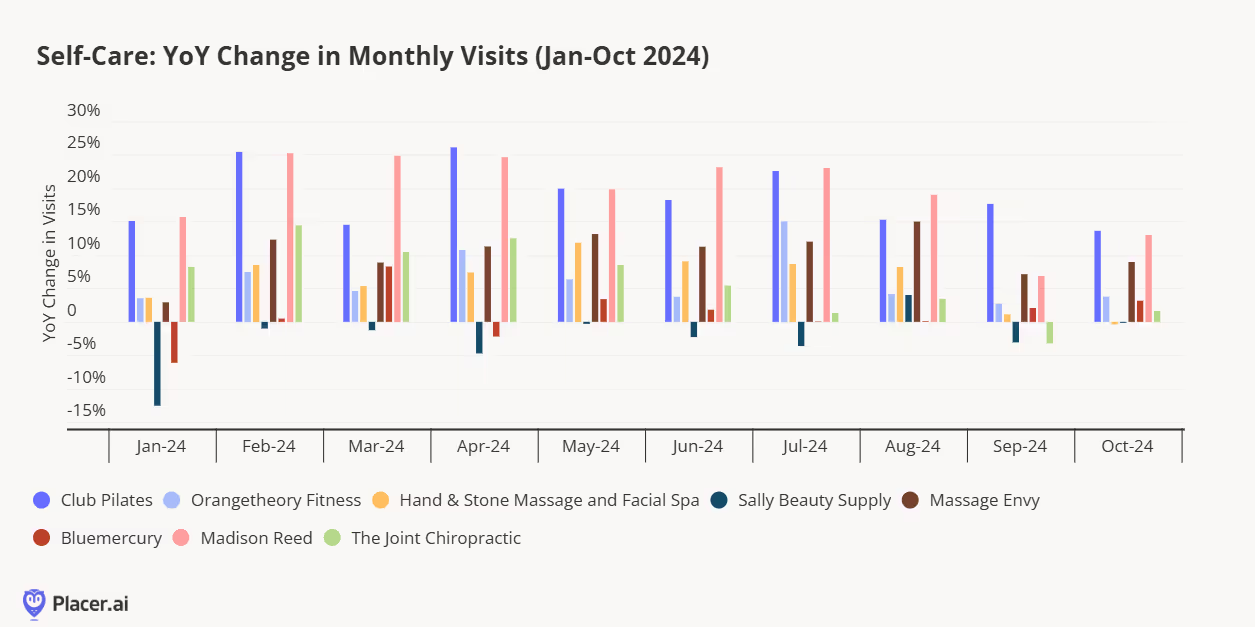

At the start of this year, we predicted that the beauty category boom we witnessed last year would persist, with wellness and self-care becoming integral parts of that definition. For many, self-care includes a good workout, whether low-impact or high-intensity. We've previously highlighted fitness trends, with brands like Club Pilates and Orangetheory Fitness continuing to demonstrate year-over-year growth. A perfect post-workout activity might include a massage or chiropractic session to ease sore muscles or restore alignment—services that have driven increased traffic for brands like Massage Envy and Joint Chiropractic. Another standout is Madison Reed, which offers "salon results without salon cost or time" and continues to expand its footprint.

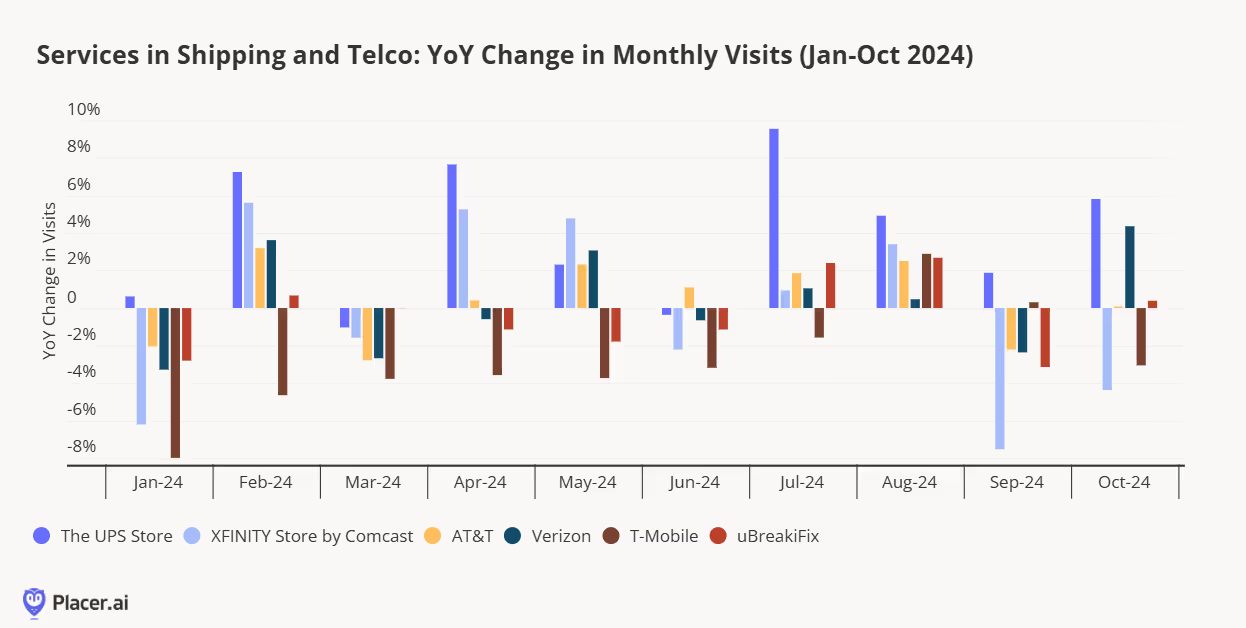

The next group of brands stands out for their ubiquity—you’re likely to find one or more of these stores in any local outdoor shopping center. UPS is indispensable for shipping and returning items, serving as a go-to for everyday logistics. Meanwhile, telecommunications and internet service providers like AT&T, Verizon, T-Mobile, and Xfinity maintain a steady customer base, driven by the regular upgrade cycle for cell phones and service plans.

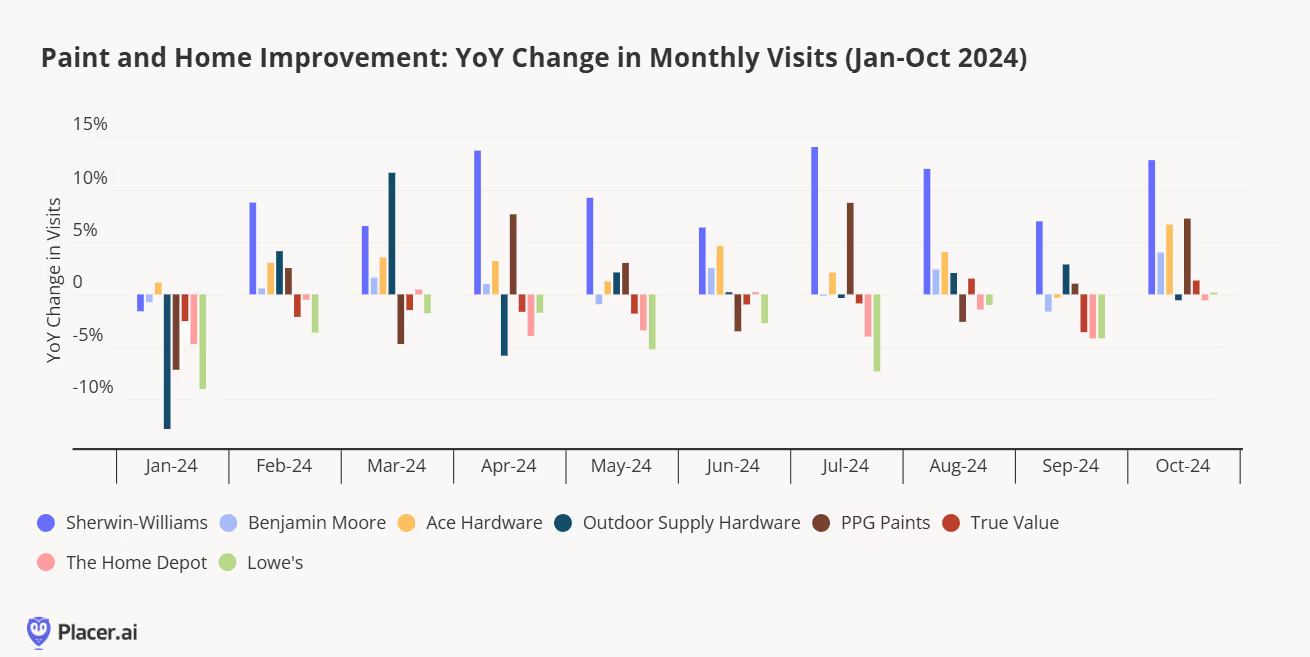

Another home improvement and furnishings replacement cycle may be upon us. Pandemic-driven nesting behaviors accelerated demand in previous years, but now, many consumers are cautiously approaching this phase. Instead of investing in big-ticket items like dining or living room furniture, there’s growing enthusiasm for budget-friendly updates, such as applying a fresh coat of paint. Sherwin-Williams stands out as a key player, experiencing increased foot traffic. This rise in paint store visits could signal a positive trend for future investments in home improvement, redecorating, and refurnishing.

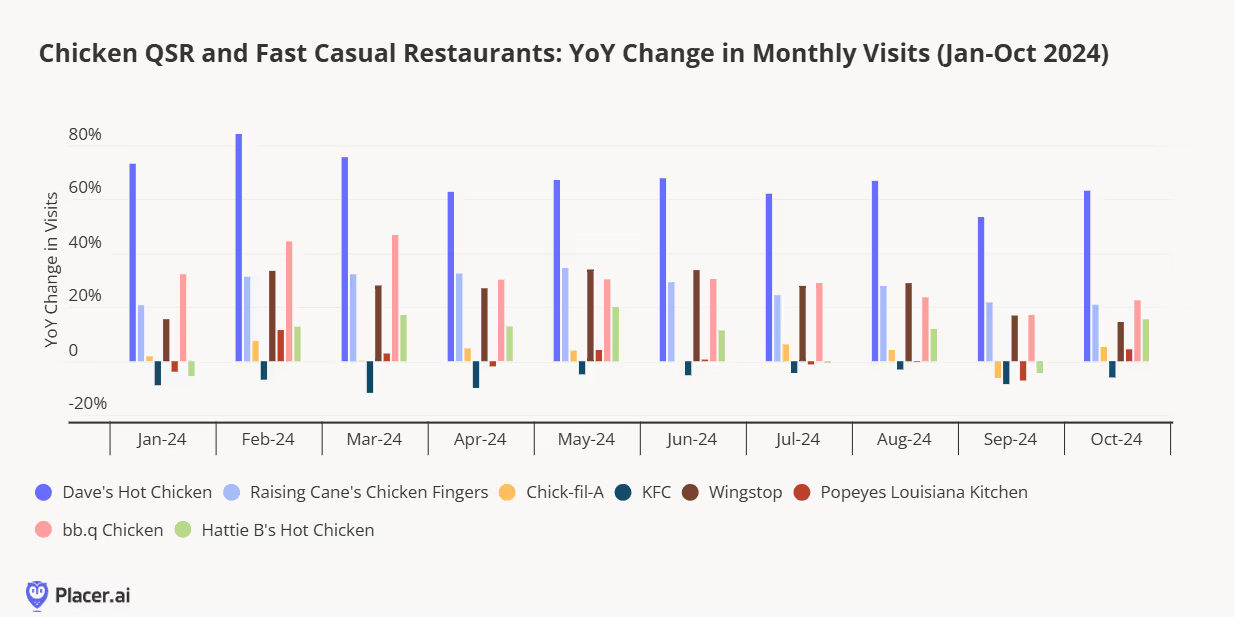

Next, we have some tasty additions perfect for local outdoor shopping centers. Americans’ love affair with chicken shows no signs of slowing down. Dave’s Hot Chicken has developed a cult following for its juicy, flavorful chicken, while Raising Cane’s draws loyal fans for its irresistible tenders and signature sauce. Bb.q Chicken offers a unique twist, boasting over a dozen wing flavors, including Caribbean Spice, Hot Mala, and Cheesling cheese dust.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.

Convenience stores, or c-stores, have been one of the more exciting retail categories to watch over the past few years. The segment has undergone significant shifts, embracing more diverse offerings like fresh food and expanded dining options, while also exploring new markets and adapting to changing consumer needs. We looked at the recent foot traffic data to see what this category's successes reveal about the current state of brick-and-mortar retail.

Convenience stores are increasingly viewed not only as places to fuel up, but as affordable destinations for quick meals, snacks, and other necessities. And analyzing monthly visits to the category shows that it is continuing to benefit from its positioning as a stop for food, fuel, and in some cases, tourism.

Despite lapping a strong H1 2023, visits to the category either exceeded last year’s levels or held steady during all but one of the first eight months of 2024 – highlighting the segment’s ongoing strength. Only in January 2024 did C-stores see a slight YoY dip, likely reflecting a weather-induced exaggeration of the segment’s normal seasonality.

Indeed, examining monthly fluctuations in visits to c-stores (compared to a January 2021 baseline) shows that foot traffic to the category tends to peak in summer months – perhaps driven by summer road trips and vacations – and slow down significantly in winter. Given summer’s importance for convenience stores, the category’s August YoY visit bump is a particularly promising indication of c-stores’ robust positioning this year.

While some C-store chains, like 7-Eleven, have a nationwide presence, others are concentrated in specific areas of the country. But as the popularity of C-stores continues to grow, regional chains like Wawa, Buc-ee’s, and Sheetz are expanding into new territories, broadening their reach.

Wawa, a beloved brand with roots in Pennsylvania, has become synonymous with its fresh sandwiches, coffee, and a highly loyal customer base. Wawa has been a major player in the c-store space in recent years, with a revamped menu driving ever-stronger foot traffic to its Mid-Atlantic region stores. Between January and August 2024, YoY visits to the chain were mostly elevated. And the chain is now venturing into states like Florida – where its store count has grown significantly over the past few years – as well as Georgia and Alabama.

Meanwhile, Texas favorite Buc-ee’s, though known for its enormous stores and mind boggling array of dining options, has a relatively small footprint – but that might be changing. The chain, which also outpaced its already-strong 2023 performance this year, is opening locations in Arkansas and North Carolina, further building on its reputation as a destination for travelers. And Sheetz, another regional chain with a strong presence in Pennsylvania, is also expanding, with plans to open locations in Southern states like North Carolina and Tennessee.

This trend toward regional expansion offers significant opportunities for growth, not only by increasing store count, but also by reaching new consumer bases and target audiences. Customer behavior differs between markets – and by expanding into new areas, c-stores can tap into unique local visitation patterns.

One metric that highlights local differences in consumer behavior is dwell time, or the amount of time a customer spends inside a convenience store per visit. In some regions, visitors tend to move in and out quickly, while in others, customers linger for longer periods of time.

Analyzing convenience store dwell times by state highlights substantial differences in visitor behavior. During the first eight months of 2024, coastal states (with the exception of Oregon) tended to see shorter average dwell times (between 7.5 and 11.8 minutes). On the other hand, in states like Wyoming, Montana, and North Dakota, average dwell times ranged between 21.2 and 28.2 minutes.

Interestingly, the states with the longest dwell times also have some of the highest percentages of truck traffic on interstate highways – suggesting that these longer stops are perhaps made by long-haul truckers looking for a place to shower, relax, and grab a bite to eat.

Even as regional favorites expand their reach, nationwide classic 7-Eleven is taking steps to further cement its growing role as a prime grab-and-go food and beverage destination. And like other dining destinations, the chain relies on limited-time offers (LTOs) to fuel excitement – and visits.

One of the most iconic, and beloved c-store LTOs is 7-Eleven’s Slurpee Day, which falls each year on July 11th. The event, during which all 7-Eleven locations hand out free slurpees, tends to drive significant upticks in foot traffic – and this year was no exception. Visits to the convenience store jumped by a whopping 127.3% on July 11th, 2024 relative to the YTD daily visit average – proving that good deals will bring customers in the door.

The convenience store sector continues building on the impressive growth seen in 2023. As many chains double down on expanding both their regional presence and their offerings, will they continue to drive growth in the coming years?

Visit Placer.ai to keep up with the latest data-driven convenience store updates.