.svg)

.png)

.png)

.png)

.png)

Some moments in our lives remain ingrained in our heads. One such time period was March of 2020, when it felt like the world suddenly stood still as malls, street retail, and dining establishments closed, everyone masked up, and only essential retail and health services continued. After a while, limitations relaxed, but not without a subconscious preference for open-air shopping centers that appears to linger to this day. Granted, many open-air shopping centers are also newer or redeveloped, thus likely contributing to their popularity. However, there’s no doubt that they’ve rebounded at a higher rate compared to their indoor mall and even outlet mall counterparts.

We analyzed traffic data for one of the most-visited open-air shopping centers in the nation, Victoria Gardens, to see what sets it apart and what continues to draw consumers to open-air centers.

This open-air shopping center is over 1.1 million square feet and hosts over 160 retailers within its borders. In addition to marquee brands such as Apple, lululemon, AMC Theatres, and Cheesecake Factory, it also has regional favorites such as Seven Grams dumpling house and cult-favorite Duck Donuts. Boasting a 160 acre main street community, its walkable layout beckons while classics play in the background. Quite a few of the concepts at Victoria Gardens are on trend. For instance, the Food Hall features local eatery Elephant Thai, which is perfectly in keeping with the popularity of all things Thai these days with Season 3 of White Lotus being set in Koh Samui.

Another genre that one doesn’t often see in more urban mall locations are two retailers devoted to Western wear – Buckle and Tecovas.

Tecovas has a fascinating backstory with its founder, Paul Hedrick, partnering initially with bootmakers from Leon, Mexico, the “boot-making capital of the Americas” and selling his first pairs from the backseat of his SUV. With an average dwell time of 40 minutes between April 2024 and February 2025 and holiday spikes for Thanksgiving and Christmas, it’s clear that for many shoppers, a pair of Tecova boots are on their wishlist.

One of the more unique aspects of this mall is its Cultural Center on premise. With a performing arts theater, library, and interactive children’s museum right next to retail, dining, and a movie theater, it’s truly a one-stop shop for its community.

As shopping centers continue to evolve, with many adopting a Town Square approach, the appeal of open-air shopping centers – full of public spaces, greenery, walkable paths, and fresh air – will only continue to grow.

For more data-driven consumer insights, visit placer.ai/anchor

Aldi and Lidl have firmly established themselves as discount powerhouses. The two German retailers entered the United States market at different times, with Aldi opening its first location in 1976 and Lidl making its way stateside in 2017 – and diving into the foot traffic shows that both are thriving.

In the first quarter of 2025, visits to Aldi and Lidl saw significant year-over-year (YoY) increases of 8.9% and 4.2%, respectively – well above the industry-wide average (0.9%.)

Aldi, which has been on an expansion tear for the past few years, saw a YoY increase in average visits per location – but so did Lidl, which has been slower to add new locations. And this growth – 4.7% at Aldi and 1.9% at Lidl – highlights that their stores, whether new locations or already-existing ones, are driving sustained demand.

A closer look at visitor behavior offers valuable insights into the factors driving the foot traffic success of Aldi and Lidl.

A significantly larger proportion of Aldi and Lidl's visits – 37.2% and 37.7%, respectively – took place on Saturdays and Sundays compared to visits to traditional and value grocery stores. This suggests that the attractive price points offered by Aldi and Lidl position them as prime destinations for shoppers making weekend stock-up trips.

On a chain level, both Aldi and Lidl are finding their own paths to success. Aldi is currently undergoing a significant growth phase, aiming to operate 800 stores by the end of 2028. This ambitious trajectory includes adding at least 225 new locations in 2025 alone – and examining the visit distribution across Aldi's largest markets provides valuable insights into how its strategy is unfolding. Contextualizing Aldi’s performance against the wider grocery segment provides a birds-eye view of the value grocer’s performance.

Over the past few years, Aldi has consistently increased its visit share when compared to the overall grocery segment, both nationally and across its major markets. For instance, in Florida, one of Aldi’s largest markets, its visit share grew from 4.8% in Q1 2022 to 7.0% in Q1 2025. And in Illinois, now its second-largest market, Aldi increased its visit share from 12.2% to 14.8% over the same period.

This consistent growth in visit share underscores the broad appeal of Aldi's value proposition to shoppers across the country, suggesting that its ambitious expansion plans are likely to be well-received by consumers.

Lidl also plans to grow its store count, though at a more modest pace than Aldi. And the chain is focusing on its already-existing markets in hopes of entrenching itself further in areas where it already has strong brand recognition.

Geographic segmentation data from the Esri: Tapestry Segmentation dataset within Lidl’s potential and captured markets reveals promising insights into where the retailer might find its most receptive audiences. In its potential market – calculated by weighting each Census Block Group (CBG) within Lidl’s trade area according to population size – the share of visitors from "Suburban Periphery" areas was 41.5%. However, in its captured market, determined by weighting each CBG according to its share of actual visits to Lidl – so better representing its current visitor profile – this suburban segment constitutes a significantly larger 56.4%. Conversely, the proportion of visitors originating from "Principal Urban Centers" and "Metro Cities" was higher in Lidl’s potential market compared to its captured market.

These metrics strongly suggest that Lidl has more demand in the suburbs than it may realize – and as it expands, focusing on these areas might prove to be a winning strategy for the chain.

Aldi and Lidl are thriving, growing their audiences during a challenging economic climate.

Will visits to the two chains continue to increase throughout 2025? Visit Placer.ai to keep up with the latest data-driven grocery insights.

Amid rising housing costs and shifting consumer lifestyles, self-storage has emerged as a go-to solution for many Americans. We dove into the data to take the pulse of the market in Q1 2025 – and uncover the audience segments behind the industry’s ongoing growth.

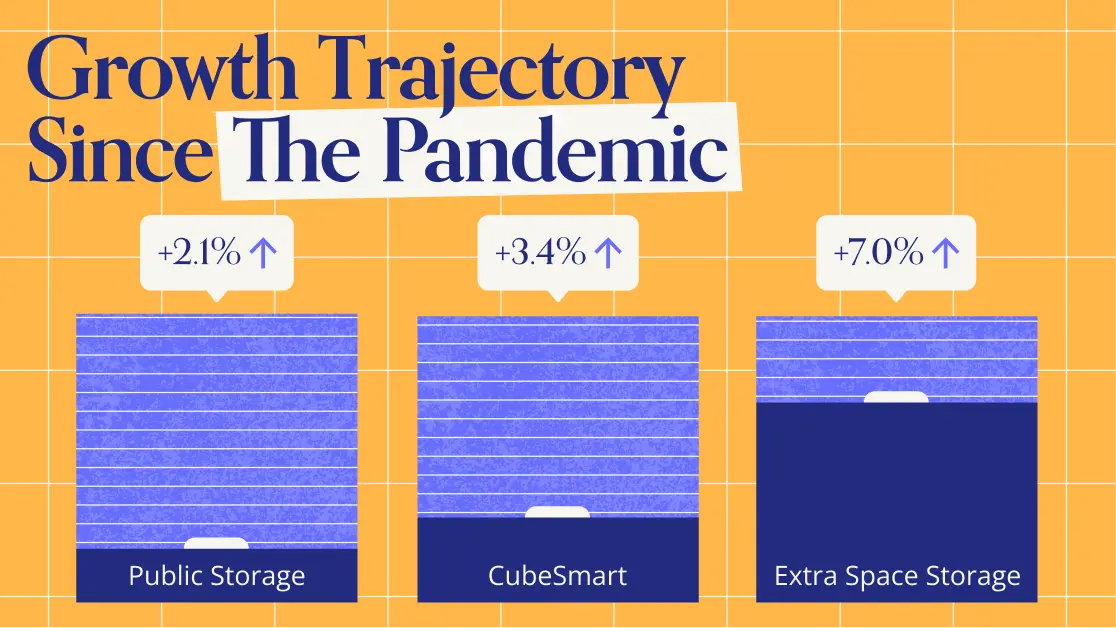

Visits to leading self-storage companies have been on a steady growth trajectory since 2019. During the pandemic, storage utilization surged as many Americans relocated or stored items to free up space for home offices or DIY projects. Since then, high prices and interest rates appear to have further fueled demand, with some households likely deferring space-adding renovations or larger home purchases.

In Q1 2025, visits to Public Storage and CubeSmart were up 24.7% and 30.7%, respectively, compared to a Q1 2019 baseline. Extra Space Storage – which substantially expanded its unit count following its 2023 acquisition of Life Storage – saw visits surge 98.3% over the same baseline. And year over year (YoY), all three chains posted foot traffic growth, partly driven by continued expansion.

The baseline visit analysis also reveals a distinct seasonal pattern in self-storage usage patterns. Each year, visits to self-storage chains peak in Q2 and Q3 (April through September), aligning with spring cleaning, home improvement prime time, and moving season. Then in Q1, visits drop as people stay indoors during winter – likely also making fewer trips to access recreational gear and vehicles in storage.

Who are the consumers driving self-storage visit growth? Looking at the demographic characteristics of Extra Space Storage, Public Storage, and CubeSmart’s visitor bases reveals a common consumer profile across chains. In Q1 2025, the captured markets of all three chains had nearly identical median household incomes (HHIs), very close to the nationwide baseline of $79.6K. Their markets were also disproportionately urban, with higher-than-average shares of renter-occupied and multi-unit housing – all groups more likely to need extra storage space.

Still, as the self-storage market has grown, industry leaders have grown their presence in more affluent suburban markets. Between Q1 2019 and Q1 2025, Extra Space Storage’s share of “Wealthy Suburban Families” rose from 9.1% to 10.1% – slightly above the nationwide baseline of 9.6%. Meanwhile, Public Storage’s share of this segment increased from 8.8% to 9.8%, and CubeSmart’s share remained steady at 10.1%. A similar pattern emerged for “Upper Suburban Diverse Families”, with all three chains at or above the nationwide segment baseline of 9.0% by Q1 2025.

This small but perceptible shift may reflect rising demand from households where adult children are increasingly staying at home or returning after college, prompting a need for additional storage. Spare rooms once used for storage may also be increasingly repurposed into home offices, studios, or workout spaces in the wake of hybrid work trends.

Known for resilience in the face of economic headwinds and uncertainty, the self-storage space appears well-positioned to continue to thrive. How will the segment evolve in the years and months ahead?

Follow Placer.ai/anchor to find out.

Romance novels have long been the unsung heroes of the publishing industry, consistently driving significant sales and topping bestseller lists year after year. And now, the category is getting its moment in the spotlight. Independent bookstores specializing in romance and fantasy are popping up across the country, connecting romance readers with the books they love in a setting exclusively dedicated to them.

We took a look at one recent addition to the romance bookstore world – The Ripped Bodice in Brooklyn, New York – to see what visitation trends reveal about the value of specialty stores in an environment increasingly dominated by general retailers.

The romance category has long been a quiet literary powerhouse – and now, the segment is getting its moment to shine. The rise of “BookTok” has helped propel the category into the spotlight, and independent, romance-centered bookstores are thriving. The Ripped Bodice is one such store: The first one opened in Culver City, CA in 2016, and the second in Brooklyn, NY in 2023. The Ripped Bodice’s Brooklyn location is located within two miles of two Barnes & Noble locations, so comparing visitation trends at the three stores highlights the value that the specialty bookstore adds to the book-centered retail landscape.

Location analytics reveal that visitors to The Ripped Bodice are much more likely to travel long distances to reach the store, with nearly half coming from over 50 miles away. In contrast, the two nearby Barnes & Noble stores saw just 4.8% and 8.6% of their visitors traveling from that distance. This suggests that the bookstore’s unique offerings make it something of a destination for romance lovers. Some vacationers visiting the area may include The Ripped Bodice as a must-see attraction, while others may make a dedicated journey just to explore its curated collection of romance novels.

The Ripped Bodice also attracts more weekend visits than nearby Barnes & Nobles. Over the past 12 months, almost half of visits to the niche bookstore – 48.8% – occurred on Saturdays and Sundays. In contrast, the two nearby Barnes & Noble locations received most of their visits on weekdays, with just 24.4% and 34.2% of their visits taking place on Saturdays and Sundays.

The contrasting weekend traffic trends highlight the unique value that specialized bookstores hold for niche hobbyists. In this case, romance enthusiasts seem to treat a trip to The Ripped Bodice as an activity in and of itself, prioritizing weekend visits to browse, connect with fellow readers, and enjoy a dedicated space for their favorite books and authors.

Further analysis of visitor behavior at The Ripped Bodice and nearby Barnes & Noble locations reveals how the specialized bookstore fosters a sense of community and encourages customers to linger.

On average, visitors to The Ripped Bodice spent 39 minutes in the store – soaking up the special ambiance or participating in the bookseller’s frequent events. In contrast, visitors to the Barnes & Noble on 7th Ave. – which unlike The Ripped Bodice, has an on-site cafe – stayed for an average of 37 minutes, while visitors to the location on Atlantic Ave. lingered for just 32 minutes.

The Ripped Bodice’s longer dwell times serve as a reminder of the value retailers can find in catering to niche interests. Specialized stores often create an environment where customers feel comfortable spending more time, allowing for greater product discovery and stronger loyalty. Retailers of all sizes can consider offering more specialized experiences within their stores to create inviting spaces that encourage exploration among diverse customer groups.

The visitation patterns at The Ripped Bodice can be read as a story of one retailer – but it can also offer insights into the value of catering to niche hobbies. When retailers provide consumers with a dedicated space to explore and deepen their interests, they open up opportunities for success.

Visit Placer.ai for more data-driven retail insights.

We dove into the visit data to see how Starbucks, Dunkin,’ and Dutch Bros are faring in Q1 2025.

Affordable luxuries like coffee tend to do well in times of rising prices and heightened budget-consciousness. So it should come as no surprise that visits to coffee chains have been on the rise recently, with overall traffic to the category up 1.8% year-over-year (YoY) in Q1 2025. Much of the increase can be attributed to the aggressive expansions of small and medium coffee chains such as Dutch Bros (13.4% YoY increase in visits in Q1 2025), Scooter’s Coffee (+15.3% YoY) and 7 Brew Coffee (+87.3%).

Meanwhile, visits to coffee leaders Starbucks and Dunkin’ remained relatively stable – falling by just 0.9% and 1.6%, respectively, in line with the wider QSR Q1 2025 YoY visit gap of 1.6%. Contrasting the growth of smaller coffee chains with Starbucks and Dunkin’s minor traffic dips may suggest that consumers prefer to spend their limited discretionary funds on unique or decadent treats instead of on classic drinks and pastries.

But despite the rapid growth of smaller coffee chains, Starbucks continues to dominate the coffee category, receiving over half of combined visits to Starbucks, Dunkin’, Dutch Bros, Scooter’s Coffee, and 7 Brew Coffee. At the same time, though, Starbucks’ stronghold on the category may be loosening slightly – the Seattle-based coffee giant’s relative visit share fell from 55.8% in Q1 2024 to 51.2% in Q1 2025 as smaller chains continued growing and expanding.

The cross-visitation data also highlights Starbucks’ dominance. In Q1 2025, the majority of visitors to most other coffee chains (51.3% of Dunkin’ visitors, 65.7% of Dutch Bros, and 58.4% of 7 Brew visitors) also visited a Starbucks in the same period. Meanwhile, only 27.4% of Starbucks consumers went to Dunkin’ and 16.4% went to Dutch Bros during the analyzed period, with even smaller shares going to Scooter’s and 7 Brew. So while the smaller chains are clearly making inroads into the coffee market, Starbucks still commands a strong central position, attracting a majority of coffee-goers and enjoying significant loyalty.

Despite the ongoing expansion of Dutch Bros and the rise of smaller coffee chains, Starbucks continues to dominate the U.S. coffee category.

For more data-driven dining insights, visit placer.ai/anchor.

Fueled by customer demand for quality, convenience, and value, CAVA and sweetgreen are cementing their place as leaders in the fast-casual space. The two chains have seen impressive growth over the past few years, adding new locations to keep up with growing demand.

We took a look at their performance over the years to see what might be driving their continued rise.

While the fast-casual dining sector as a whole experienced a slight slowdown in Q1 2025, likely driven by continued budgetary concerns among diners, CAVA and sweetgreen are thriving. The two chains are squarely in expansion mode – and their impressively elevated foot traffic numbers strongly suggest that customers are highly receptive to both chains’ offerings.

In Q1 2025, visits to CAVA were 19.8% higher than in Q1 2024, while Sweetgreen saw its visits increase by 11.1%. In contrast, the wider fast-casual space experienced a visit slowdown of 0.1% during the same period, serving as a reminder of the challenges facing the segment.

Diving into audience segmentation data for both chains provides greater insight into the expansion strategies underlying their strong performance in recent years.

CAVA, which grew from a single location in Maryland to 367 restaurants at the end of 2024, has employed a suburban-focused growth strategy that has brought the chain to a wider audience than ever. The median household income of CAVA’s trade areas has been steadily dropping over the years. And a closer look at shifts in the psychographic segments that make up its visitor base suggests that the chain is reaching new suburban audiences.

Between Q1 2022 and Q1 2025, CAVA steadily broadened its reach among the working and middle-class “Blue Collar Suburbs” and “Suburban Boomers” consumer segments. During the same period, it also gained more traction with the affluent “Upper Suburban Diverse Families” segment – while holding on to its substantial share of “Wealthy Suburban Families.” This suggests that, even as CAVA expands its reach among a wider range of suburban visitors, it has maintained its core audience. While a substantial portion of wealthy customers remains, the chain has effectively opened itself up to a larger and more diverse pool of visitors.

Similarly, sweetgreen has also been increasing its presence in suburban markets. The chain, which leans heavily into automation to improve visitor experience, has made suburban expansion a cornerstone of its strategy – and examining the geographic data clearly demonstrates this shift.

In Q1 2022, 31.3% of sweetgreen’s trade areas were made up of consumer segment groups belonging to the “Suburban Periphery” – defined by the Esri: Tapestry Segmentation dataset as commuter-oriented suburbs with access to major cities and their amenities. But by Q1 2025, this share rose sharply, to 42.2%. Over the same period, the share of “Principal Urban Centers” in sweetgreen’s trade areas dropped from 50.0% to 26.8%.

CAVA and sweetgreen are thriving, seemingly driven by their pushes into suburban markets.

Will the two chains continue to experience visit growth as Q2 gets underway?

Visit Placer.ai to find out.

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.