Table of Contents

What is Retail Business Intelligence (Retail BI)?

Retail business intelligence (retail BI) is the process of collecting and analyzing data from a wide variety of sources to assess retailer performance and make data-driven business decisions. Store owners, chain managers, consumer-goods suppliers, and commercial real estate (CRE) professionals can use retail BI solutions to derive actionable insights that help them run and market their products and ventures. Investors and other stakeholders in the retail space can also use retail BI to assess the health and performance of any enterprise that sells products directly to consumers as part of its core operations, whether online or in-store.

When done right, retail business intelligence offers professionals a comprehensive picture of broader market trends and of specific retail businesses. The insights derived from retail BI empower managers to optimize every aspect of their enterprise – from merchandising decisions to store fleet configuration.

In this article, we’ll review some key retail BI intelligence metrics and explore how one often overlooked aspect of retail BI – location intelligence – can take the analysis to the next level. Utilizing location analytics enables executives to answer questions like: How many customers visit a store or chain without making a purchase? Are upticks in window shopping reflected later in online sales? Which retailers control a dominant share of the local, regional, or national market in a given category? How do the demographic and psychographic characteristics of a store's trade area compare to those of the competition?

Key Metrics in Retail BI

Some of the most important metrics used in retail business intelligence – often referred to as KPIs, or Key Performance Indicators – include:

- Comparable store sales (comps) and sales per square foot;

- Average basket size and transaction value;

- Brick-and-mortar visitation trends;

- Conversion rate – i.e. the percentage of visitors who actually make a purchase;

- Year-over-year (YoY) and year-over-three-year (Yo3Y) sales and visit growth;

- Cost of goods sold (COGS);

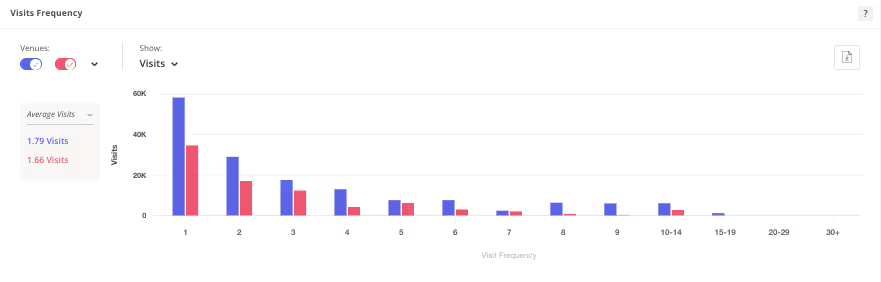

- Customer retention rates;

- Retail competitive intelligence about the relevant markets;

- Customer habits and profiles;

- On- and offline website traffic and customer engagement;

- Inventory turnover (how quickly inventory is sold);

- Gross margins return on investment.

Harnessing Location Intelligence for Retail BI

Robust business intelligence must account for a broad range of factors – from changing shopping patterns to emerging consumer preferences in the relevant retail space. And since the vast majority of retail sales still take place offline, a comprehensive retail business intelligence solution will include data on foot traffic trends, visit shares, and other brick-and-mortar retail metrics.

Until recently, however, executives lacked the tools to reliably quantify and analyze offline consumer behavior. So although retailers could examine sales and inventory data for their own venues or chain, they were unable to obtain granular insights into their competitors’ performance. The lack of large-scale, accurate, and up-to-date offline shopping metrics also made it difficult to spot broader patterns like those taken for granted in online commerce. Other retail stakeholders, such as investors and retail real estate professionals, had even less visibility into offline shopping trends and behaviors – so many had to take major decisions on the basis of incomplete data.

Today, location analytics solutions like Placer.ai allow retailers and other stakeholders to easily apply the data-driven approach typically reserved for e-commerce channels to analyze the performance of offline retail platforms.

6 Use Cases for Location Analytics in Retail BI

Indeed, many of the insights needed to successfully run and evaluate the performance of an offline retail business rely on location analytics derived from foot traffic data. Information on physical visitation patterns, neighborhood consumer profiles, local market players, and other location-based metrics is crucial for everything from site selection to evaluating and improving the performance of existing venues. Location-rooted retail intelligence also allows other retail players – from commercial real estate brokers to investors in publicly-traded retail companies – to make fact-based investment decisions, manage properties, attract tenants, and more.

In this section we’ll explore in depth six key ways location analytics can be leveraged to derive crucial retail business intelligence insights.

1. Analyzing Venue Performance

A retail BI analysis that includes metrics like visitation, dwell time, and customer loyalty lets store owners and other retail stakeholders keep their fingers on the pulse of what’s working – and what’s not. Foot traffic data reveals how many people visit a store each day, how long they stay, the share of repeat visitors, as well as daily and hourly visit share breakdowns. These metrics can inform decisions ranging from opening hours and staffing scheduling at specific venues to larger, chain-level questions relating to site selection and product-market fit.

Up-to-date location-based business intelligence can also be useful for conducting rent negotiations. One shopping center operator used Placer.ai’s visitation data to demonstrate increased foot traffic to its retail center and justify a rent increase.

2. Understanding Consumer Behavior Patterns

A comprehensive retail BI solution should provide visibility into consumer behavior patterns for a variety of retail venues. Data on shopping habits help executives answer questions such as – do shoppers tend to visit the analyzed venue after grabbing coffee or on their way to the gym? Where else do customers of a given brand like to shop? Where do visitors to a given retailer like to eat?

Cross-shopping and customer journey data can help commercial real estate brokers find the ideal tenants to fill vacancies and navigate potential pitfalls. One CRE broker used Placer’s cross-shopping data to successfully convince an existing dining tenant to waive a restriction preventing the addition of any new restaurants to a shopping center. The broker was able to use location analytics from a different shopping center which housed both dining concepts to show that the new eatery’s presence would augment, rather than undermine, the business of the existing one.

3. Identifying Broader Market Trends

Foot traffic data can also be harnessed to gain insight into wider industry trends, assess local demand for their products, and analyze the trajectories of regional markets. For example, an asset manager used Placer’s location intelligence to analyze the relative performance of apparel and electronics chains in the region in order to choose the right anchor tenant for a shopping center.

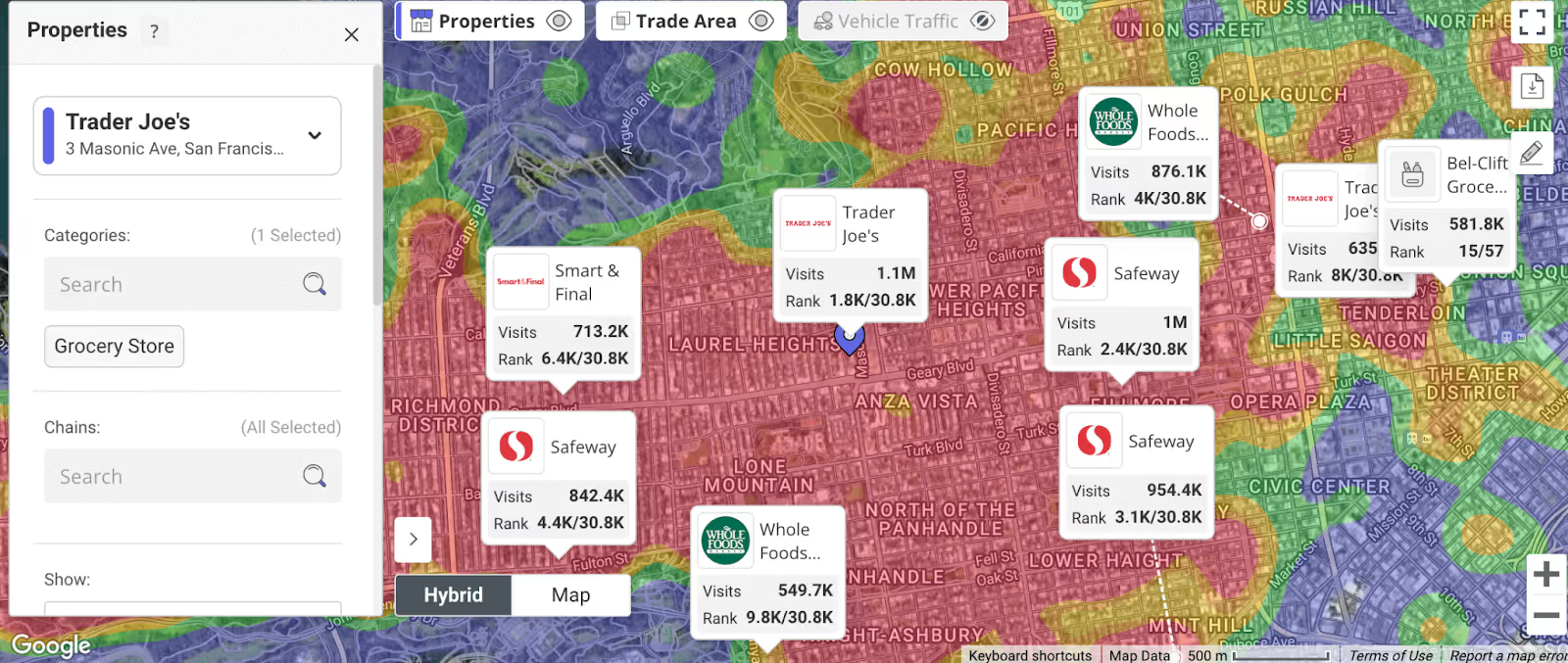

4. Keeping Tabs on the Competition

Location-based retail business intelligence helps business owners stay on top of their competition. Foot traffic analytics can be used to keep track of competitors’ performance, examine their customer bases’ preferences and habits, and discover gaps in existing supply.

An electronics retailer used Placer’s analytics platform to analyze the competition before entering a new market. Using foot traffic data, the retailer studied changes in competitors’ local market share over time, and learned how it could best optimize its merchandising strategy to compete with the leading electronics vendors in the area.

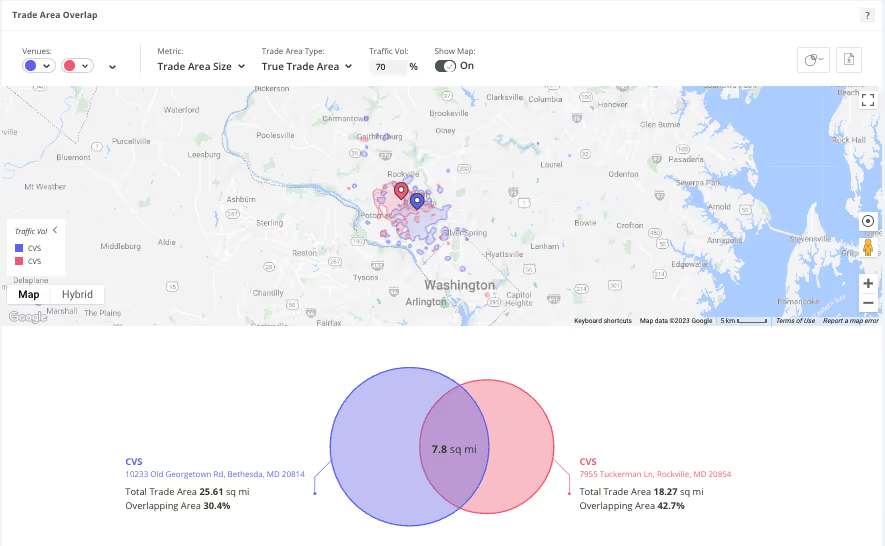

5. Quantifying Cannibalization Risks

Retail BI that considers location intelligence metrics helps retailers mitigate cannibalization risks by revealing the physical reach of each venue in their store fleet. This helps retailers decide where to position new stores, where to reduce fleet size, and how to optimize their physical footprint.

One retail chain used Placer’s location intelligence platform to improve the performance of a store by moving it to a new location. Data analysis showed that nearby locations of the same chain were significantly cannibalizing the store’s business – and that a different neighborhood would also present a better demographic fit. The relocation significantly improved sales and boosted the performance of the chain’s other locations as well.

Quantifying cannibalization risk can also help CRE professionals market their properties to prospective tenants. A shopping center owner used Placer data to attract a restaurant tenant that already had another venue nearby and was concerned about cannibalization. Using location intelligence, the shopping center owner was able to demonstrate that the risk of cannibalization would be outweighed by the traffic generated by the new location.

6. Creating Targeted Advertising Campaigns and Measuring the Impact of Promotions

Footfall analytics coupled with demographic and psychographic datasets can also provide brick-and-mortar retailers with the business intelligence they need to advertise effectively. Businesses can harness foot traffic data to make sure their offline campaigns and promotions are just as targeted and cost-effective as their online ones.

For example, a food truck used Placer to analyze the specific areas its visitors were coming from and lowered costs by targeting ads at the relevant zip codes. A lifestyle center used Placer’s retail BI to determine that a promotional event led to increased visitation.

Placer.ai: Your Brick-and-Mortar Retail BI Solution

Business intelligence has always been key to running a retail enterprise. But to stay competitive, retailers and other retail analysts and stakeholders need more sophisticated data solutions than ever before. And while there are a plethora of retail BI platforms for tracking e-commerce performance along with conventional metrics like sales and inventory – reliable and accurate location intelligence data providers remain few and far between.

That’s why an increasing number of executives nationwide have come to rely on Placer.ai – the industry leader for brick-and-mortar location intelligence – to fill the void. Placer is for brick-and-mortar retail what Google Analytics is for the online world: the intuitive, user-friendly, and accurate platform makes it easy for retail professionals to gain unprecedented visibility into physical visitation patterns in the real world.

Key Takeaways

In an increasingly omnichannel environment, retail BI tools that harness the potential of location intelligence offer visibility into actual customer behavior in the physical world. And while sales and online shopping data can help inform many retail decisions, reliable foot traffic data – integrated with other datasets – is critical for analyzing the performance of brick-and-mortar venues and for keeping tabs on offline industry trends.

For more information and examples of how professionals across industries can use Placer.ai to grow their businesses, improve return-on-investment, and save money, check out some more of the guides and case studies on our website.