Saks Global’s Bankruptcy Was About More Than Debt

Saks Global’s Chapter 11 filing reflects a convergence of balance-sheet pressure and evolving consumer behavior rather than a sudden collapse of its brands or customer relevance. Following the acquisition of Neiman Marcus in late 2024, the company carried a significantly higher debt load, which reduced financial flexibility at a time when the broader luxury department store sector was facing uneven demand.

But while a missed interest payment was the immediate catalyst for the bankruptcy filing, traffic data suggests that the challenges facing Saks Global extended beyond balance-sheet constraints. AI-powered traffic data shows that Saks Fifth Avenue and Neiman Marcus were underperforming most major department stores both on average visits per venue and on rates of repeat visitors already in H1 – before supplier relationships became more visibly strained. So even if inventory constraints and vendor caution likely amplified these trends in H2, the data suggests that softer consumer engagement with these chains was also due to earlier challenges in delivering an experience that consistently brought shoppers through the door.

(Kohl’s is a notable exception – while it underperformed Neiman Marcus on year-over-year visits per venue in H1, the banner still maintained the highest rate of repeat visitation by far, pointing to a more resilient customer base that can help cushion short-term traffic volatility).

Saks and Neiman Traffic Patterns Suggest Fewer Destination Visits

Analyzing in-store behavior at Saks Fifth Avenue and Neiman Marcus relative to other premium department stores is also revealing. Both banners skew more heavily toward midday and weekday visits than Nordstrom or Bloomingdale’s, a pattern that suggests a greater reliance on proximity- and convenience-driven traffic rather than by planned destination trips.

In contrast, Nordstrom and Bloomingdale's capture more visits during evenings, and weekends – times typically associated with browsing, social shopping, and occasions when shoppers are more willing to spend time in-store. These visit patterns reinforce the idea that Saks and Neiman Marcus are currently attracting more “pop-in” visits than experience-led ones.

Rebuilding Destination Retail While Right-Sizing the Footprint

Looking ahead, Saks Global’s path out of bankruptcy depends on repairing its balance sheet while rebuilding in-store experiences that support destination-driven shopping. To remain competitive, the company will need to restore consistent inventory, sharpen merchandising curation, and reinvest in service and experiences that encourage planned visits rather than incidental stop-ins.

At the same time, the data suggests a clear framework for rationalizing the footprint. Underperforming locations are likely those that skew heavily toward weekday, midday, and low-frequency visits, signaling reliance on proximity rather than loyalty or experience. These stores may struggle to justify continued investment, particularly if they sit in markets with limited repeat demand or weak engagement relative to peers. By using traffic trends, visit timing, and repeat behavior to guide closure or consolidation decisions, Saks Global can emerge from bankruptcy with a smaller but healthier store base – one aligned around markets where the brand can reclaim its role as a destination. In that sense, bankruptcy offers not just a financial reset, but a chance to refocus the business around the stores and experiences most likely to drive sustainable, long-term demand.

For more data-driven insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.avif)

How Did Winter Storm Fern Shape Consumer Behavior?

As Winter Storm Fern advanced across the U.S. in late January, consumer behavior followed a predictable pattern: early preparation gave way to a sharp pre-storm rush, followed by widening geographic divergence as conditions worsened. Retail visit data from January 22nd and 23rd highlights how quickly storm-driven demand intensified – and which categories and regions were best positioned to capture it.

Retail Visits Accelerated as the Storm Drew Closer

Retailers saw a clear escalation in traffic from January 22nd to January 23rd, underscoring how storm proximity compressed shopping activity into a narrow window.

Home Improvement & Furnishings retailers saw the largest visit spikes on both January 22nd and 23rd as consumers focused on preparing their homes ahead of the storm. Visits were already 20.2% above the YTD (January 1st to 23rd) daily average on January 22nd and rose to 41.7% above average the following day – making the category the clear pre-storm leader. The pattern suggests shoppers were prioritizing purchases such as heating supplies, generators, weatherproofing materials, and snow-removal equipment as conditions grew more imminent.

Grocery Stores recorded the second-largest increases, reflecting consumers’ efforts to stock up on food and beverages in anticipation of staying home, with visits up 14.2% on January 22nd and climbing to 28.4% on January 23rd compared to the YTD daily average.

Value-oriented and necessity-driven categories also saw demand intensify. Discount & Dollar Stores experienced a modest 6.2% lift on January 22nd, which surged to 25.5% the following day. Drugstores & Pharmacies saw visits climb from 9.8% to 21.0%, while Superstores rose from 7.5% to 19.9% over the same period.

Pet Stores & Services stood out for their late-breaking surge: after seeing virtually flat traffic on January 22nd (+0.2%), visits jumped to 18.5% above average on January 23rd, suggesting that many consumers delayed pet-related preparedness until just before conditions worsened.

Across all categories, the doubling of visit lifts from one day to the next indicates that while some consumers planned ahead, a significant share delayed their storm preparations until the threat felt immediate.

Storm Conditions Drove Growing Regional Divergence

The storm’s west-to-east progression was also reflected in shifting regional visitation patterns. On January 22nd, the largest visit surges were concentrated in parts of the Midwest, consistent with Winter Storm Fern’s earlier impacts across inland regions. By January 23rd, as the storm intensified and expanded across the South and Eastern Seaboard, retail visits spiked sharply in those areas as consumers rushed to complete last-minute errands ahead of worsening conditions. At the same time, parts of the Midwest saw more muted growth or visit slowdowns, suggesting that storm-related shopping activity there may have peaked earlier.

This data suggests that storm-related shopping remains a fundamentally local behavior, with consumers responding most strongly when severe conditions feel imminent in their immediate area. At the same time, the Midwest slowdown suggests that storm-related demand is finite and front-loaded, with visit activity tapering once households complete their initial preparation trips.

Winter Storm Fern Reveals How Quickly – and Locally – Storm-Driven Retail Demand Peaks

AI-driven location analytics reveals that storm-driven retail demand is not only intense but highly compressed, with visits surging in the brief window just before conditions deteriorate locally and fading quickly once preparation trips are complete. For retailers, capturing weather-driven demand seems to depend less on the size of the storm and more on aligning operations to where – and when – urgency is about to peak.

For more data-driven consumer insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

_texasroadhouse_dine.png)

Q4 2025 Reveals Uneven Traffic Gains Across Major FSR Chains

Recent traffic trends to major dining chains show the divergence within the full-service dining space going into 2026. While Brinker International's flagship brand Chili's Grill continued reaping the benefits of its popular food bundles and drinks specials, Maggiano's Little Italy – the company's more upscale concept – struggled to reach 2024 visitation levels in Q4 2025.

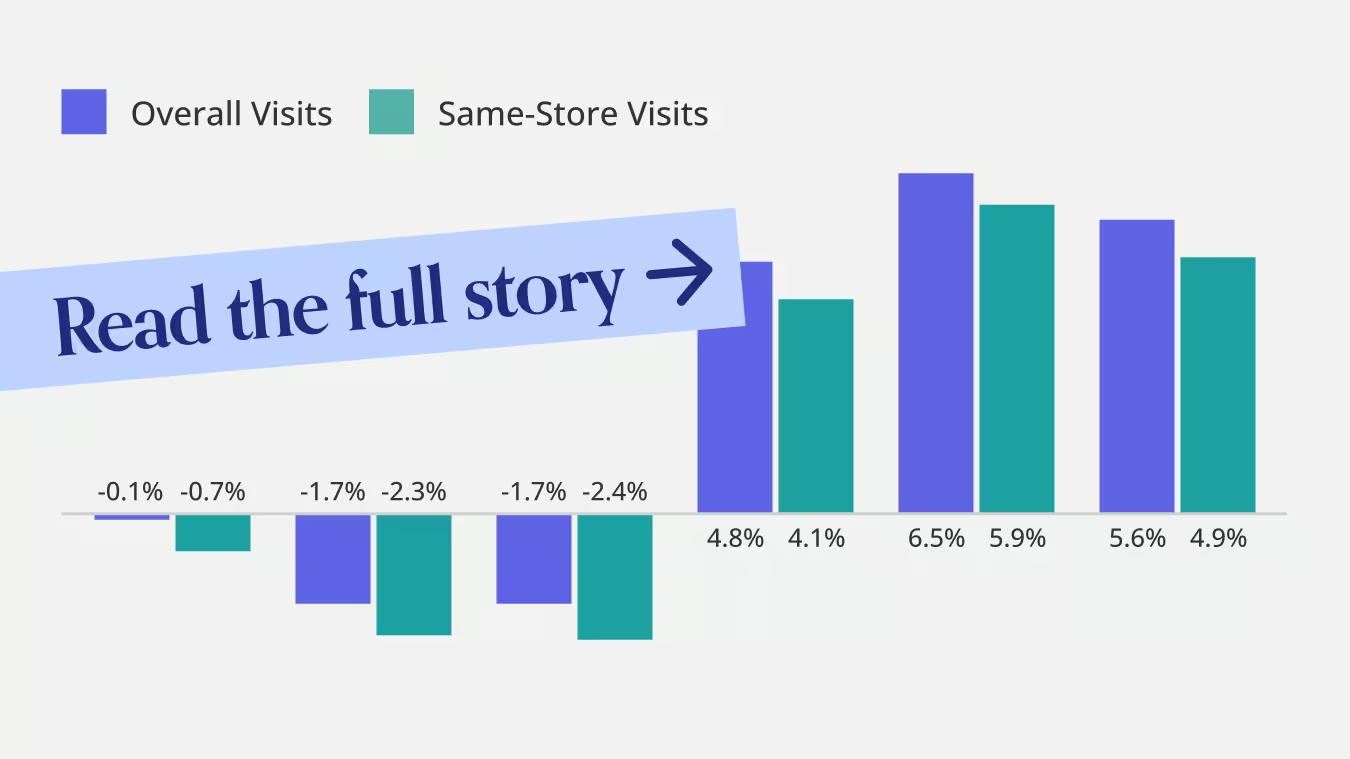

For both Dine Brands Global, Inc. and Texas Roadhouse, Inc., traffic changes were mostly due to storefleet reconfigurations. Dine Brands' three banners contracted in 2025, leading to overall visit declines at Applebee's and Fuzzy's (IHOP maintained stable traffic patterns) – but all three concepts outperformed in terms of average visits per venue as the company's rightsizing efforts appeared to be bearing fruit. Meanwhile, Texas Roadhouse, Inc. showed the opposite pattern as its three banners expanded, leading to overall visit growth – but average visits per venue decreased, suggesting that traffic gains were mostly driven by unit expansion.

These patterns reflect a more selective consumer environment heading into 2026, where growth is increasingly shaped by brand positioning, value perception, and disciplined fleet strategies rather than broad-based demand recovery. A closer look at monthly visit trends across major banners further illustrates these dynamics.

Chili’s Value Strategy Drove Success in 2025 – But Momentum Will be Harder to Sustain in 2026

After leading the full-service restaurant category in 2024, Chili’s once again emerged as a standout performer in 2025, delivering consistent monthly visit gains despite a softer consumer environment. The brand has successfully established and maintained a clear value proposition, helping keep Chili’s top of mind for consumers seeking an affordable sit-down dining option

At the same time, recent monthly traffic trends suggest that sustaining this momentum into 2026 may require continued innovation, whether through refreshed bundled offerings, targeted promotions, or menu updates that reinforce value without eroding margins. But even if traffic growth moderates in the year ahead, maintaining the elevated visitation levels achieved over the past two years would still leave Chili’s in a notably strong competitive position within the full-service dining landscape.

Rightsizing Helped Stabilize Traffic at Dine Brands

Applebee’s and IHOP saw YoY declines in overall visits, but same-store traffic generally held up better – indicating that fleet rationalization helped stabilize per-restaurant demand. These trends point to the importance of right-sizing footprints and prioritizing unit-level productivity in a constrained consumer environment.

Overall Traffic Growth for Texas Roadhouse

Visits to Texas Roadhouse in 2025 were up 2.1% compared to 2024, in part thanks to the chain's ongoing expansion. Same-store performance also remained positive for much of the year, suggesting that the larger store fleet can be supported by existing demand.

And even as traffic trends moderated toward the end of the year, the chain’s overall 2025 visit growth suggests an underlying demand that is strong enough to support Texas Roadhouse’s expanding footprint despite the most recent slowdown.

Positioning and Execution Will Shape 2026 Traffic Outcomes

Overall, traffic patterns at these three major FSR players point to a more selective and competitive full-service dining environment heading into 2026, where broad-based demand recovery remains elusive. Brands that clearly communicate value or actively optimize their store fleets appear better positioned to defend store-level demand, while expansion-led growth models face increasing pressure to deliver stronger unit-level productivity. As consumer discretion remains constrained, execution and positioning – not scale alone – will likely define traffic winners in the year ahead.

Fore more data-driven consumer insights, visit placer.ai/anchor

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

McDonald’s Builds Visit Momentum Heading Into 2026

McDonald’s ended 2025 with clear visit momentum, reversing earlier softness and posting steady gains in the back half of the year. Same-store visits followed a similar trajectory, indicating that growth was driven by stronger underlying demand rather than unit expansion. This late-year rebound positions McDonald’s with solid visit momentum heading into 2026, suggesting improving consumer engagement as the year closed.

Higher-Frequency Diners Drive McDonald’s Visit Growth

Some of the visit growth is likely due to the chain's popular Q4 LTOs – but diving deeper into the visit frequency data suggests that McDonald’s long-term investment in its loyalty program is also playing a part. The company's launch of MyMcDonald’s Rewards in 2021 seems to have succeeded in shifting traffic toward higher-frequency, incremental visits rather than relying on new customer acquisition.

Compared to pre-loyalty levels in H2 2019, a growing share of McDonald’s visits now comes from diners visiting an average of 4+ times per month, with the share of visits from consumers visiting the chain an average of 8+ times per month showing the most dramatic growth. Grouping YoY visit trends by visit frequency also shows that visits from high-frequency diners grew the most compared to H2 2024 and H2 2019. This dynamic points to a core benefit of loyalty-led growth: driving incremental visits from existing customers is typically far more efficient than acquiring new ones, especially in a mature, highly penetrated category like quick service restaurants.

McDonald’s executives have been explicit that loyalty is designed to increase frequency, not just enrollment. The continued growth of the program through 2025 – including deeper integration with value offers and digital ordering – suggests McDonald’s is still finding room to extract incremental visits from an already loyal base.

What McDonald’s Loyalty Strategy Signals for Other Restaurant Chains

For other restaurant chains, McDonald’s experience points to the value of using loyalty as a lever for incremental growth, particularly once a customer has already been acquired. While many QSR brands continue to drive expansion by entering new markets or opening additional locations, McDonald’s data illustrates how meaningful gains can also come from increasing visit frequency among existing customers. Even without McDonald’s scale, the underlying strategy is broadly applicable: converting first-time or occasional visitors into higher-frequency customers can serve as a complementary – and often more efficient – path to growth alongside physical expansion.

Will these lessons shape the QSR space in 2026? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

Lessons From Dollar Tree's 99 Cents Only Acquisition

In 2024, Dollar Tree capitalized on the liquidation of the 99 Cents Only chain to execute a strategic "land grab" in the notoriously tight US retail market. By acquiring designation rights for 170 leases across priority markets like California, Arizona, Nevada, and Texas, the retailer aimed to bypass zoning hurdles and accelerate growth.

AI-powered location analytics indicates the selection process was highly disciplined: Looking at over 85 California stores that were converted from 99 Cents Only to Dollar Tree reveals that Dollar Tree cherry-picked high-performing sites that were generating 6.0% more foot traffic than the 99 Cents Only chain average in 2023. This suggests the acquisition was a calculated move to secure proven, high-quality real estate.

Beware of Cannibalization

However, 2025 performance data reveals that capitalizing on this opportunity comes with distinct operational costs. Total visits to the converted stores have dropped 38.8% compared to their 2023 baselines. While some of this decline is structural – Dollar Tree operates a lower-frequency "treasure hunt" model compared to the high-frequency grocery model of the previous tenant – a significant portion is self-inflicted through network overlap.

A staggering 36% of the new sites are located less than a mile from an existing Dollar Tree, which inevitably dilutes local traffic through cannibalization. This serves as a critical lesson for retailers considering bulk acquisitions: purchasing a portfolio "en masse" often prevents perfect network optimization, forcing the acquirer to manage the friction where new footprints compete with the old.

A "Healthy Correction"

Still, despite this cannibalization and the drop in raw volume, the transition offers a potential "healthy correction" for the business. The previous tenant collapsed under the weight of "rising levels of shrink" and low-margin grocery sales. By shifting the model, Dollar Tree is effectively filtering out non-paying visitors and low-value transactions, trading chaotic volume for a more controlled, margin-focused operation. The discrepancy between the sharp drop in total visits (-38.8%) and the more moderate dip in visits per square foot (-25.0%) suggests Dollar Tree is already rightsizing these operations, leaving some "ghost space" inactive rather than over-investing in labor to manage the entire cavernous floor.

Increasingly Affluent Dollar Tree Audience Key to New Stores' Success

And this excess square footage is only a liability if it remains empty; turning it into an asset requires leveraging the fundamental change in who is now shopping these aisles. The shift in shopper demographics – where "Wealthy Suburban Families" have replaced the "Young Urban Singles" and "Melting Pot Families" of the previous tenant – is crucial for Dollar Tree's future. This new audience, which is less price-sensitive, provides the ideal environment for Dollar Tree to deploy its "Multi-Price" strategy.

While CFO Jeff Davis has cited "start-up costs" regarding these conversions, the long-term opportunity is clear: if Dollar Tree can utilize the extra square footage to showcase this higher-margin assortment, these locations could evolve from overlapping burdens into profitable flagships that capture a share of wallet the traditional small-box fleet never could.

For more data-driven CRE insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.avif)

Indoor Malls Led On a Full-Year Basis, Open-Air Outperformed Over the Holidays

Indoor malls outperformed both open-air centers and outlet malls on a full-year basis as the only format to post visit gains during all four quarters – signaling a shift from recovery into growth.

Open-air shopping centers came in second – and though the format trailed indoor malls on a full-year basis, open-air shopping centers came out on top over the holidays, with Q4 visits up 2.0% year over year (YoY) and December traffic up 1.5%. This seasonal strength can be attributed to the format's sit-down and alcohol-forward dining options, which attract social holiday visits, as well as layouts that support quick trips and easy access to both essential and discretionary retail.

Meanwhile, outlet malls remained the weakest-performing format throughout 2025, with an annual traffic decline driven in part by a 1.1% drop in visits during the critical holiday season. This softness could reflect a broader shift in value perception. Price-conscious consumers may be increasingly weighing time cost alongside monetary savings, and long drives can offset the appeal of discounted pricing – particularly when promotions and loyalty incentives are widely available online and in traditional retail formats. To win consumers back, outlet malls may need to reduce the perceived time tradeoff by strengthening food and entertainment offerings and positioning themselves as curated, experience-driven value destinations rather than purely price-led ones.

Families Lead Mall Visitation

Malls continue to resonate with a wide range of family segments, though different formats appeal to different household profiles. Across formats, higher-income and suburban family segments over-index among mall visitors. Indoor malls and open-air centers attract a disproportionate share of ultra-wealthy and affluent suburban households, underscoring malls’ ongoing relevance for consumers seeking family-friendly activities and experiences. Outlet malls, meanwhile, skew more heavily toward near-urban diverse families, reflecting their positioning as value-oriented destinations rather than lifestyle hubs.

At the same time, young professionals also play a meaningful role in mall traffic, over-indexing across all formats relative to their 5.8% share of the national population.

Malls Compete Within Broader Shopping Ecosystems

Across all formats, mall visitors also frequented mass merchants, big-box retailers, and off-price chains at high rates in 2025, underscoring that mall trips are often embedded within broader, multi-stop shopping routines rather than standing alone.

More than 70% of visitors across all mall formats also visited Walmart and Target at some point in 2025, and over half of mall visitors also visited Dollar Tree – underscoring how deeply mass merchants and discount chains are embedded in consumers’ retail lives. This indicates that malls face stiff competition as an everyday shopping destination. Malls that want to pull ahead in 2026 may focus on differentiating themselves from superstores by leaning into experiences and services that mass merchants cannot efficiently deliver – using tenant mix and programming to capture discretionary spend beyond routine retail needs.

Of the three formats, outlet malls showed the highest overlap with value-oriented and off-price chains, highlighting both their competitive pressure and their opportunity to redefine value. As discounted retail becomes increasingly ubiquitous, outlets can differentiate by extending value beyond merchandise—pairing sharp pricing with affordable dining, family-friendly entertainment, and experience-led programming that reinforces the outlet trip as a high-value day out, not just a bargain hunt.

Maximizing Visit Quality Across Mall Formats in 2026

Mall success in 2026 will likely hinge on maximizing the quality and purpose of each visit. Indoor malls are best positioned to double down on experiential retail, entertainment, and family-friendly programming that supports longer dwell times and higher discretionary spend. Open-air centers can continue to capitalize on convenience and dining-led visitation by optimizing for short, high-intent trips – particularly during peak seasonal periods.

For outlet malls, the opportunity lies in expanding the definition of value. As discounts become easier to access everywhere, outlets can differentiate by applying value thinking to food, entertainment, and experiences – turning the outlet trip into an affordable day out rather than a pure bargain hunt. Across all formats, operators and retailers that align tenant mix, layout, and programming with how consumers actually shop – across channels and formats – will be best positioned to capture wallet share in an increasingly fragmented retail landscape.

For more data-driven retail insights, visit placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.svg)

.png)

.png)

.png)

.png)