.svg)

.png)

.png)

.png)

.png)

Earlier this week, we attended the National Restaurant Association show in Chicago and had the chance to speak with a wide range of restaurant owner/operators (large chains, small chains, independents, and franchisees) as well as their vendors, distributors, and other technology solutions. We’ve already seen some great recaps of the event (including one from Nation’s Restaurant News), but we thought we’d offer some of our own observations from the event.

Fierce Fight for Visits Amid New Sources of Competition

We discussed this during our trade show preview last week, but concerns about slowing foot traffic trends and increased competition with alternative food retail channels like grocery, dollar stores, and convenience stores was easily the number one topic of discussion at the event. Most operators we spoke with acknowledged flat or year-over-year declines in comparable visits, which is consistent with the year-to-date on most of the restaurant subcategories we monitor (below)

Most of the restaurant executives we spoke to at the event also noted the improvements of prepared food offerings in the grocery and c-store channels as a competitive headwind. One executive even told us that “C-stores have gone from copying QSR category innovations to setting the bar higher in many ways.” We’ve seen this in the channel shift taking place across the food retail category, which we touched upon last week.

As it pertains to competition in the months ahead, operators across all categories admitted that they were curious about the ripple effect of McDonald’s plans to launch a $5 value menu on June 25 (which will run for a month). We’re already starting to see competitors try to front-run McDonald’s $5 value menu, and there will likely be others who introduce similar promotions in the coming weeks. While these offers are likely to help QSR chains recapture some of the visits lost to other channels, these chains will likely need to continue with their value messaging in the back half of the year (especially with the rollbacks taking place at Walmart, Target, and other superstore chains) while also committing to more menu innovation than we’ve seen year-to-date.

Coffee’s Momentum Continues–With A Notable Outlier

One of the two subcategories that is seeing year-over-year increases is coffee. Some of this growth has been fueled by expansion plans of Dutch Bros, 7 Brew Coffee, 151 Coffee, Scooter’s Coffee, Philz Coffee, particularly in the South and Southeast U.S. (something we touched on late last year). Below, we’ve put together a custom chain of drive-thru focused chains versus the category average to put some context behind where the growth in the category is coming from (although the category itself as a whole continues to see healthy growth).

Starbucks–which reported a 7% decline in comparable transactions during its January-March 2024 quarter–is one of the key outliers from this category. Starbucks CEO Laxman Narasimhan called the company’s performance “disappointing” on its most recent update call. There have been no shortage of opinions on why the chain has underperformed, but our data continues to indicate that occasional visitors are the root of the softer visitation trends, much like they were last quarter. To reverse these trends, the company has already launched flavored pearls for a series of summer seasonal drinks and an improved blueberry muffin. Additionally, the company plans to launch more sugar-free customization options (including syrups) as well as a zero-to-low-calorie energy beverage.

Casual Dining’s Quiet Comeback

The other restaurant category posting seeing year-over-year growth may come as a surprise: casual-dining chains. After a slow start to the year due to weather, the category has generally seen low-single-digit growth on a year-over-year basis (something Placer’s blog team pointed out a few weeks ago). Several executives in the casual dining space we spoke with noted that they had started to see improving trends, with a few citing a narrowing price gap with QSR/fast casual chains (in other words, if consumers are going to pay the same price per entree, they’ll gravitate toward casual dining) as well as a continued propensity to spend for events/holidays (a theme we touched on repeatedly in the past).

Where is the growth coming from? There are a couple of expected categories, including steakhouses, breakfast-first concepts, and eatertainment. Asian concepts have also performed well this year, helped by growth from experiential concepts like Kura Sushi and GEN Korean BBQ.

On the other end of the spectrum, we see weakness in Mexican and Seafood concepts. Seafood should not come as a surprise given that one of other notable development in the restaurant industry this week was Red Lobster’s bankruptcy announcement. The company's Endless Shrimp promotion has been widely blamed for the company's bankruptcy filing--and our visitation data does show a spike in visits coinciding with the promotion--but there were certainly other factors such as unfavorable lease terms that played a part.

It’s been nicknamed the “Superbowl for Dealmakers” and this year’s packed ICSC Las Vegas conference paved the way for tons of pipelines. All had comfy shoes on, phones ready to scan badges, and everyone was eager to learn and network.

Based on the buzz in the booths, it’s clear that dealmakers were happy to be able to meet face-to-face. High-demand retail locations are staying strong and able to command higher rents. However, there are also landlords in areas with less demand willing to negotiate and toss in reduced rent or concessions. With higher costs for construction and borrowing and limited supply in hot areas, both landlord and tenants are getting creative with solutions. Some are carving up vacant anchors for non-traditional tenants or experimenting with smaller footprints and more curated merchandise. Kroger is launching new concepts within the ethnic grocery space. Meanwhile others are taking advantage of large spaces to create experiential flagships, as we noted in the panel on “Shifting Store Formats” that Placer participated in, along with Kohl’s, CBRE, and Colliers. Other fascinating panels included understanding the impact of influencer marketing and innovations that are revolutionizing the shopping experience.

In a panel on “The Office - The Effect of Flexible Work Models on Foot Traffic,” a panel including Avison Young, CBRE, and Placer discussed how shoppers are shifting their times and locations for shopping, dining, fitness, and entertainment as a result of migration and varying remote and hybrid work schedules.

Over the course of the conference, one city kept popping up in conversation and that city was Miami. Whether it was cocktail party conversation, pub crawl chit chat, or booth banter, people kept lauding how this city barely missed a beat during COVID, new residents kept flocking in, its vibrant and cosmopolitan feel, and the opportunity for new concepts and store openings here. Let’s unpack some of the things happening in Miami.

Migration

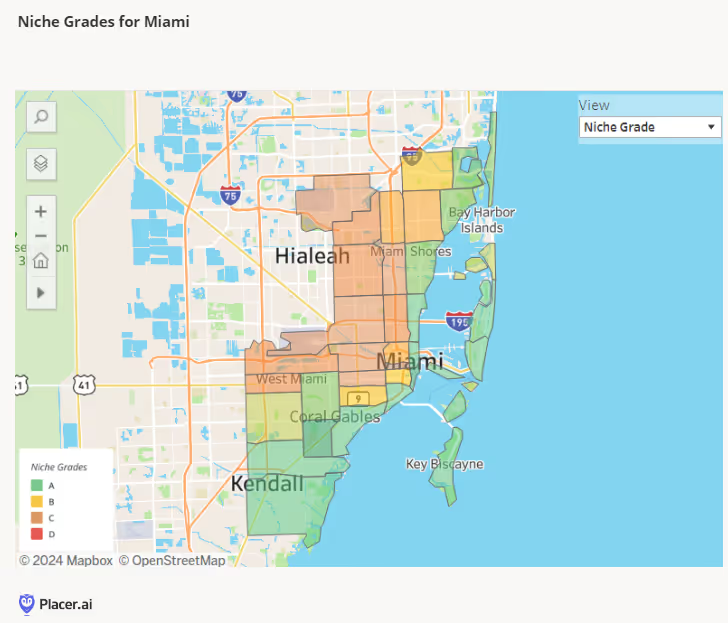

Using Placer’s Migration Dashboard and honing on our Migration Draw tool, we see that Miami’s coastal areas are extremely attractive to residents.

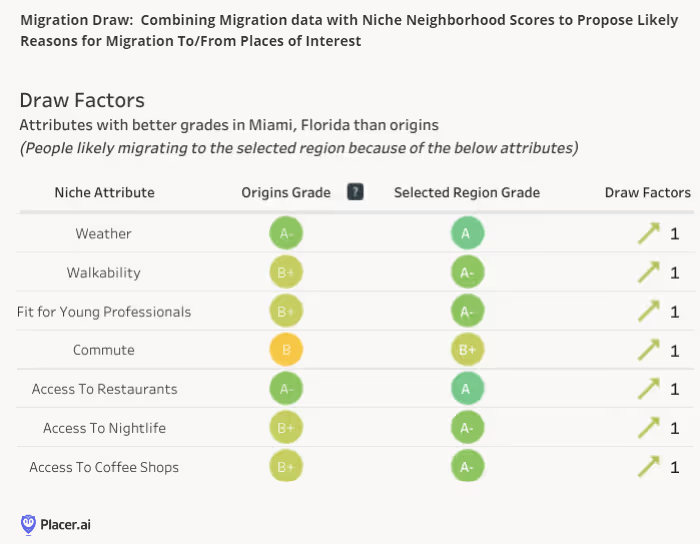

Some of the factors that most affect Miami’s desirability include weather, being pedestrian-friendly, and superior access to restaurants and nightlife.

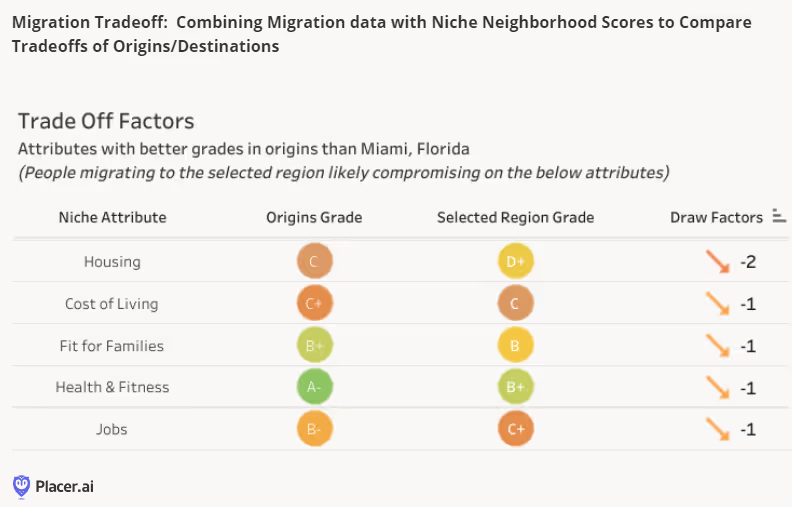

There are of course some trade-offs as well, such as higher housing costs and overall cost of living than many transplants’ original locales.

Nightlife

If you want to party in the city where the heat is on, Miami's the place for you. Taking a look at the time period of 6pm- midnight, nightlife visits in Miami outnumber those in East Williamsburg, Capitol Hill, or Deep Ellum.

Return to Office

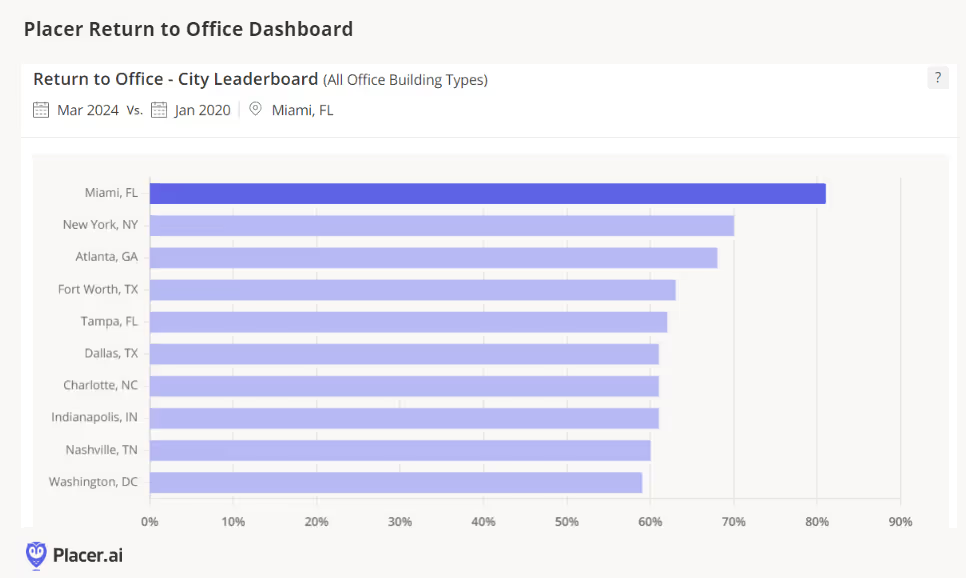

In an interesting twist, Miami also leads in having the highest rate of return-to-office. How do they manage to do that if they’ve been out partying? It’s likely a work hard/play harder mentality. Or, like many at ICSC mentioned, Miami never really closed down as much as other cities during Covid, hence there is less to recover from. Placer's Office Dashboard notes that Miami is in the lead with the highest recovery rate.

Shopping and Entertainment

For those who love all things retail, there are plenty of shopping centers and shopping areas to choose from. Brickell City Centre has seen some of the largest year-over-year increases. Meanwhile, Aventura’s April visits are up considerably compared to last year. The Miami Design District, which the Anchor has written about previously, has also been showing consistent year-over-year growth this year.

DICK’S Sporting Goods is one of the best-known names in the sportswear and sporting goods retail segment, with more than 700 stores across the country. The company, which also operates several smaller banners including its interactive House of Sport, has thrived in recent years, buoyed by a continued interest in health and wellness.

How is the chain faring into 2024? We took a look at the latest location intelligence to find out.

DICK'S was a major pandemic-era winner, sustaining visit gains through 2021 and 2022 and into early 2023. And though YoY visits slowed as 2023 wore on, DICK’s ended last year in a strong position, reporting the largest sales quarter of its history in Q4 2023.

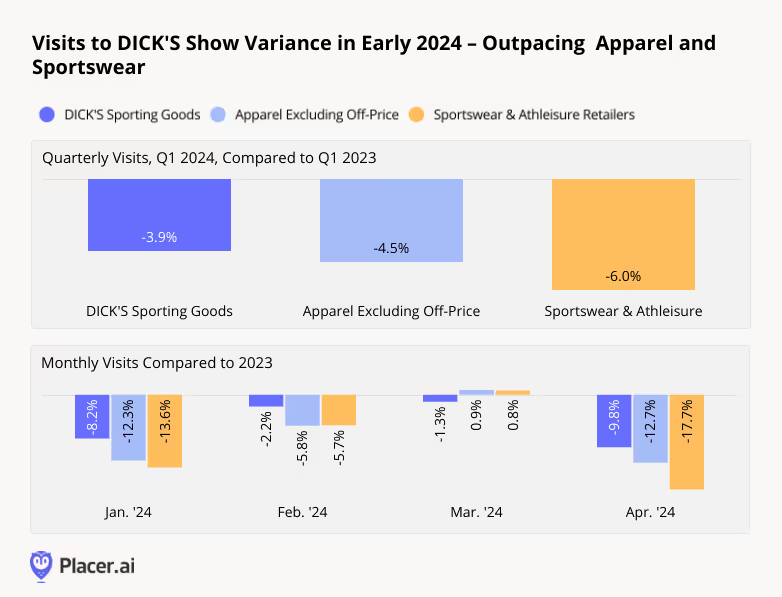

And in early 2024, DICK’s largely held on to its gains. Like many retailers, DICK’S saw YoY foot traffic fall in January, as unusually cold and stormy weather kept many shoppers at home. But in February and March, the chain’s YoY visit gap narrowed considerably, with foot traffic hovering just under 2023 levels – no small feat for a discretionary chain in an environment marked by stubbornly elevated prices and flagging consumer confidence.

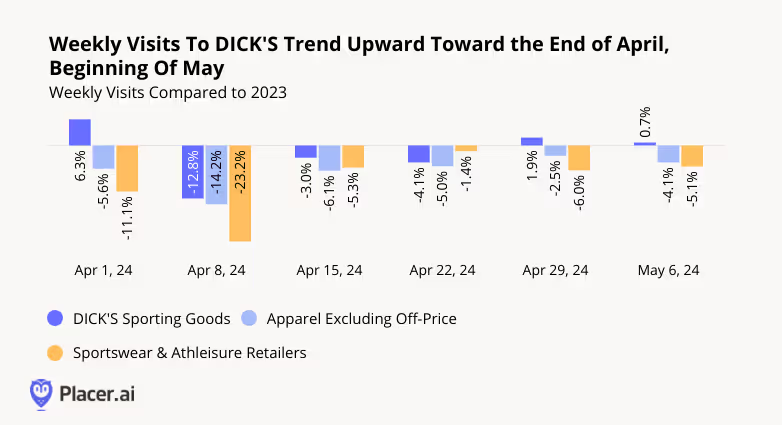

During most analyzed months, DICK’S outperformed both traditional Apparel and Sportswear & Athleisure retailers. And though the chain saw monthly YoY foot traffic drop once again in April, an analysis of weekly data shows that it entered May on an upswing.

Indeed, zooming into weekly visits to DICK’S shows that only during the week of April 8th, 2024 did the chain experience a large visit gap. And visits to the sportswear company began to trend upward towards the end of April and beginning of May – with YoY visits growing by 1.9% during the week of April 29th, and by 0.7% in the week of May 6th. The company also outperformed the Apparel and Sportswear segments in all but one of the analyzed weeks – Sportswear retailers had a slightly stronger showing than DICK’S did for the week of April 22.

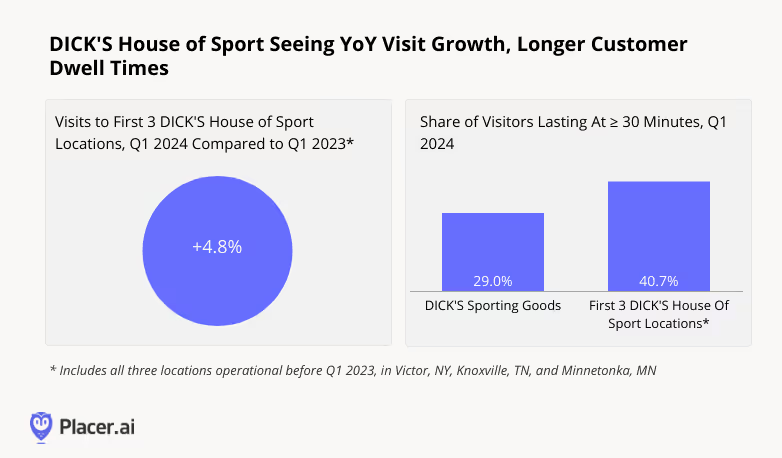

Experiential retail has emerged as a significant success story in recent years, and DICK’S has enthusiastically embraced the trend. In 2021, the company introduced its House Of Sport concept, offering visitors the opportunity to browse athletic gear or try their hand at a climbing wall or a batting cage.

The concept quickly gained traction, expanding to fourteen locations, with several more slated to open in 2024 alone. And an analysis of visitation patterns at DICK’S House Of Sport locations shows why the model is such a powerful one.

In Q1 2024, YoY visits to the three original House of Sport locations in Victor, NY, Minnetonka, MN, and Knoxville TN – the only ones operational at the start of 2023 – increased by 4.8%. So as DICK’S continues to expand its portfolio of House of Sport locations, existing ones are also drawing bigger crowds.

The original House of Sport locations also drew more extended visits in Q1 2024 than other DICK’s locations – with a remarkable 40.7% of visits lasting more than 30 minutes. With the success of House of Sport under its belt, DICK’S has begun further diversifying its fleet with a new store format that brings an interactive retail experience to the chain’s traditional store type.

DICK’S continues to outperform the wider Apparel and Sportswear retail segments, and its expanding House of Sport concept is meeting healthy and growing demand. As the company continues to lean into its experiential offerings, will the chain’s positive momentum accelerate further?

Visit placer.ai for the latest data-driven retail insights.

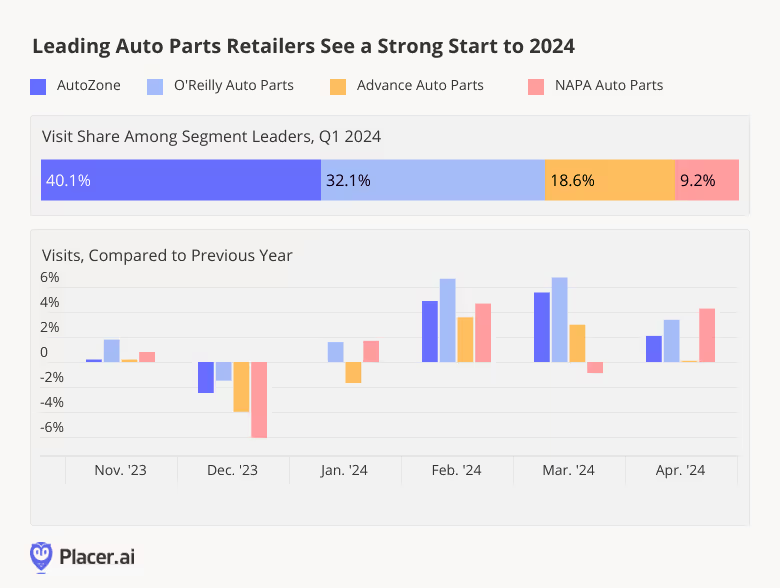

As cars get more expensive, demand for repairs rises – and auto part chains are reaping the benefits. We analyzed the visit data for four leading auto part chains – AutoZone, O'Reilly Auto Parts, NAPA Auto Parts and Advance Auto Parts – and dove into O’Reilly Auto Parts’ recent growth to understand what may be driving success in this flourishing segment.

Auto parts chains are having a moment. With vehicle prices significantly higher than before COVID, many consumers would rather fix their cars than purchase new ones. At the same time, inflation has begun to subside, leaving people with more room in their budgets for non-essential maintenance and repairs.

Following a drop in December 2023, YoY visits to AutoZone, O’Reilly Auto Parts, Advance Auto Parts, and NAPA Auto Parts began to pick up in January 2024 – despite unusually cold and stormy weather that left many consumers hunkered down at home. And between February and April, YoY visits to the four chains remained nearly uniformly elevated.

On a quarterly basis, O’Reilly Auto Parts saw the biggest YoY visit increase, despite lapping a strong 2023. The chain, which drew 32.1% of total visits to the four brands in Q1, saw quarterly YoY foot traffic increase by 5.1%. AutoZone, which received 40.1% of quarterly visits to the four chains, saw quarterly YoY visits increase by 3.5%. And Advance Auto Parts and NAPA Auto Parts both saw quarterly YoY visits increase by 1.7%.

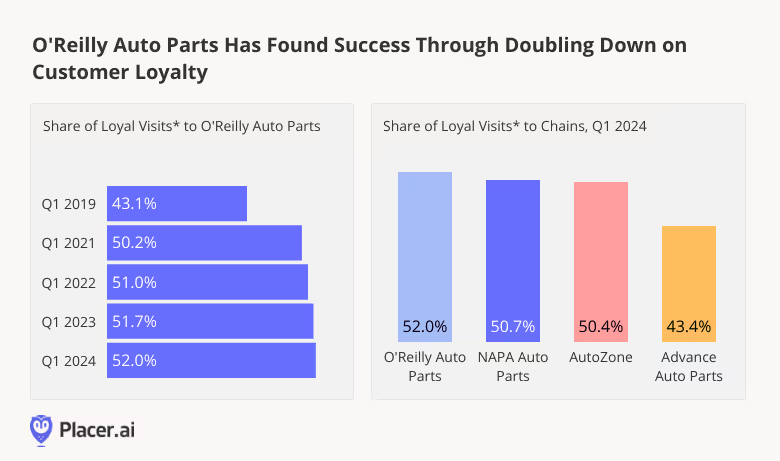

One strategy that has likely helped O’Reilly Auto Parts stay ahead of the pack is its much-touted loyalty program, recently ranked by Newsweek as one of the best in the nation.

Location intelligence shows that since COVID, O’Reilly Auto Parts has seen a steady increase in the loyalty of its customer base. And in April 2024, O’Reilly Auto Parts boasted the most loyal customer base of the four analyzed chains – with 52.0% of visits made by individuals that frequented the chain at least twice during the month. But other auto chains, including AutoZone, also enjoyed significant shares of visits by repeat customers – showing that there’s plenty of room at the top in the auto parts space.

The auto parts industry is poised for success in 2024, with leading chains like O'Reilly Auto Parts, AutoZone, Advance Auto Parts, and NAPA Auto Parts demonstrating resilience and growth. How will these chains continue to perform as the year wears on?

Visit placer.ai to find out.

We looked at nationwide and regional visitation patterns for CAVA to understand how the fast-growing fast-casual chain is performing across its major markets.

CAVA – which operated a little over 300 locations by the end of 2023 – is growing rapidly, with plans to reach 1,000 locations by 2032. The chain has seen consistent year-over-year (YoY) visit growth in most of its major markets, with a 23.6% YoY overall increase in nationwide visits in Q1 2024 – in large part due to its ongoing expansion.

CAVA is headquartered in Washington, D.C., and currently, most of its venues are located in the mid-Atlantic and southeastern United States. But the chain also has a strong presence in Texas and California and operates restaurants in a handful of additional states. Recently, CAVA entered the Midwest with its first Chicago location – and has plans to extend its reach even further. So what do CAVA’s various markets have in common – and what sets them apart?

Nationwide, the median household income (HHI) in CAVA’s captured market trade area is higher than the US median HHI – and diving into the regional markets indicates that this trend persists across regional markets.

In most states with a major CAVA presence – including Texas, Virginia, California, North Carolina, Georgia, and Maryland – the median HHI in CAVA’s trade area is 11% to 24% higher than the statewide median. Even in Florida, where the chain’s trade area HHI is closest to the statewide median, households in CAVA’s captured market are still slightly more affluent than in Florida as a whole.

But while the chain seems to attract a similar demographic across states, diving into the hourly visitation patterns in CAVA’s various markets indicates that dining habits differ between regions.

In Texas, Georgia, Florida, and North Carolina, the share of 11:00 AM - 10:00 PM CAVA visits taking place during the lunchtime daypart (11:00 AM - 2:00 PM) ranges from 35.5% to 36.9% – at or above the nationwide average of 35.4%. But in Virginia and Maryland, and especially California, the lunchtime rush is more subdued. In these states, the afternoon and evening dayparts tend to be busier than in the other analyzed states – with California in particular seeing 35.7% of visits taking place between 6:00 PM and 10:00 PM.

Identifying similarities and differences between the visitor bases in CAVA’s various markets can help the company identify ideal locations, optimize staffing needs, and tailor promotional efforts as it continues to enter new markets and open additional restaurants in existing ones.

For more data-driven dining insights, visit placer.ai/blog.

How did Mother’s Day (May 12th, 2024) impact retail and dining foot traffic this year? We dove into the data to find out.

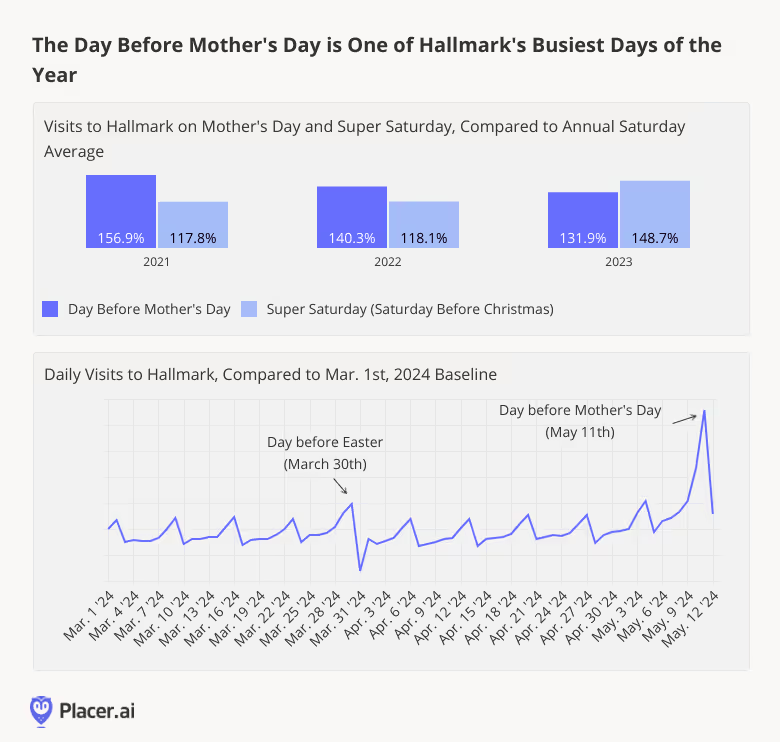

Urban legends notwithstanding, Mother’s Day wasn’t actually created by the greeting card industry. But the occasion hasn’t become known as the “Hallmark holiday” for nothing. Every year in the run-up to Mother’s Day, shoppers descend on the chain to purchase everything from cards to candy.

Most years, the day before Mother’s Day is Hallmark’s busiest day of the year, with Super Saturday (the Saturday before Christmas) a not-so-close second. In 2023, Mother’s Day was edged out by Super Saturday, which converged with Christmas Eve Eve to create a pre-holiday shopping bonanza for the ages.

And this year is shaping up to be no different: On May 11th, 2024 (the day before Mother’s Day), Hallmark experienced a major visit spike – leaving all other Saturdays, including the Saturday before Easter, in the dust.

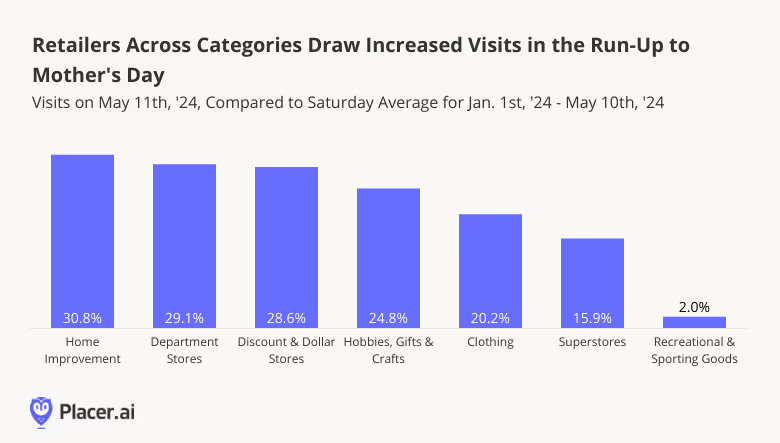

But greeting card retailers like Hallmark aren’t the only ones to benefit from Mother’s Day. A look at foot traffic to major industries on May 11th, 2024 shows that retailers across segments – from Home Improvement chains to Superstores – enjoy substantial visit boosts on the day before Mother’s Day. (Recreational & Sporting Goods, not so much).

For Home Improvement, Department Stores, Hobbies, Gifts & Crafts, and Clothing, May 11th, 2024 was the busiest day of the year so far, while for Discount & Dollar Stores and Superstores it was superseded only by March 30th – the day before Easter.

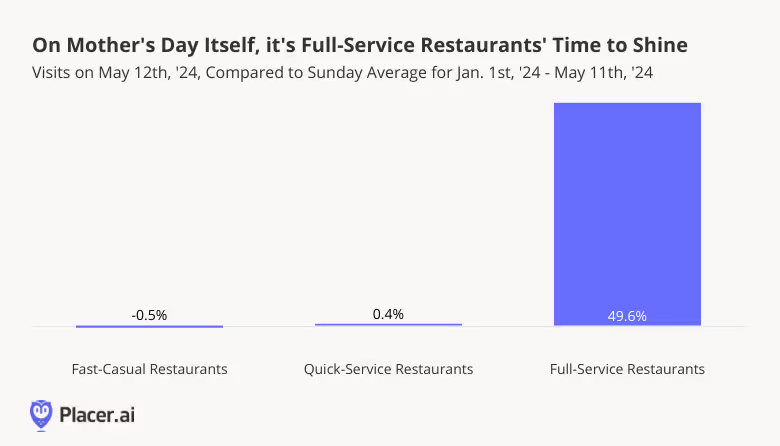

While the day before Mother’s Day is an important retail milestone, Mother’s Day itself is an occasion for treating mom to a nice meal out. And though grabbing a bite at a fast food joint or fast-casual fave is lots of fun – it decidedly isn’t the Mother’s Day vibe. A special occasion calls for a splurge, and Mother’s Day is Full-Service Restaurants’ time to shine.

On May 12th, 2024, Quick-Service and Fast-Casual Restaurants received about the same number of visits as on an average Sunday this year. But Full-Service Restaurants saw visits skyrocket – outperforming an average Sunday by 49.6%.

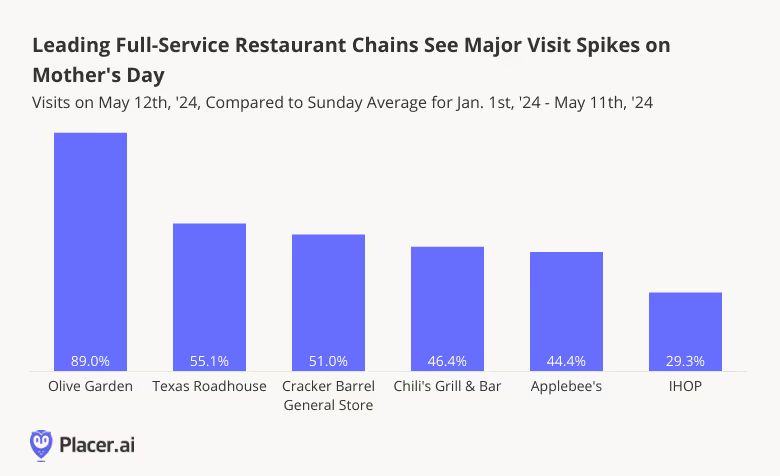

And drilling down into the data for six of Mother’s Day’s busiest Full-Service Restaurant chains shows Olive Garden emerging as a major holiday winner – with 89.0% more visits on May 12th, 2024 than on an average Sunday this year. Olive Garden drew more visits this Mother’s Day than on any other day since the beginning of the year – with Valentine’s Day (February 14th, 2024) coming in a close second.

But the Italian-American cuisine giant certainly isn’t the only FSR to enjoy a substantial visit boost on the big day: Texas Roadhouse, Cracker Barrel General Store, Chili’s Grill & Bar, Applebee’s, and IHOP saw respective May 12th visit increases of 55.1%, 51.0%, 46.4%, 44.4%, and 29.3%, compared to an average Sunday.

Mother’s Day comes but once a year – and grateful offspring nationwide show their appreciation with gifts and celebratory meals, generating boons for businesses across categories.

With Father’s Day right around the corner, what kind of impact will Dad’s big day have on retail and restaurant visits? Will Recreational & Sporting Goods brands have their day in the sun?

For more data-driven retail and dining insights, follow placer.ai.

Placer.ai observes a panel of mobile devices in order to extrapolate and generate visitation insights for a variety of locations across the U.S. This panel covers only visitors from within the United States and does not represent or take into account international visitors.

Downtown districts in the nation’s major cities attract domestic travelers all year long with their iconic sights, lively entertainment, and diverse dining offerings. But each hub follows its own rhythm, shaped by distinct seasonal peaks and dips in visitor flow.

This white paper examines downtown hotel visitation patterns in four of the nation’s most popular destinations for domestic tourists: Miami, Chicago, New York, and Los Angeles. Focusing on 20 downtown hotels in each city, the analysis explores seasonal variations in domestic travel, city-specific dynamics, and differentiating factors.

Domestic tourism has rebounded strongly in recent years, and hotels in Miami and Chicago have been the biggest beneficiaries. In 2024, visits to analyzed hotels in each of these cities’ downtown areas grew by 8.9% and 7.4%, respectively, compared to 2023. Meanwhile, hotels in downtown and midtown Manhattan saw a more modest 2.0% increase, while Los Angeles experienced a slight year-over-year (YoY) decline in downtown hotel visits.

One factor that may be driving Miami and Chicago’s stronger performance is their higher proportion of long-distance visitors, defined as those visiting from over 250 miles away. Miami remains a top destination for snowbirds and spring breakers, while Chicago serves as a cultural and entertainment hub for the sprawling Midwest. These long-distance leisure travelers may be more likely to splurge on downtown hotel stays during their trips, helping drive hotel visit growth in the two cities.

By contrast, hotels in the Los Angeles and Manhattan city centers drew lower shares of domestic travelers coming from less than 250 miles away. These shorter-haul domestic tourists may be less likely to splurge on downtown hotels than those taking longer vacations. Both cities are also surrounded by numerous regional getaway options that can draw long-haul leisure travelers away from their downtown cores.

Each of the four analyzed cities has its own unique ebbs and flows – and city center hotel visits reflect these patterns. Miami, with its warm, sunny climate, experiences influxes of tourists during the winter and spring, with March seeing the biggest jump in downtown hotel visits last year (13.0% above the monthly visit average). Chicago, which thrives in the summer with its many festivals and events, saw its biggest downtown hotel visit bump in August. Meanwhile, Manhattan experienced a major uptick in December, likely fueled by holiday tourism and New Year celebrations, and Los Angeles visits were highest in the summertime.

What drives these seasonal visit peaks? Miami has long been a top tourism destination, especially in early spring, when snowbirds and spring breakers flock to the city for sun and relaxation. In recent years, the city has seen a rise in short-term domestic tourism, suggesting that the city is becoming increasingly popular for weekend getaways. According to the Placer.ai Tourism Dashboard, the share of domestic tourists staying just one or two nights grew from 71.7% in March 2022 to 78.3% in March 2024.

This shift aligns with an impressive increase in the magnitude of downtown Miami’s springtime hotel visit peak: In March 2022, visits to downtown hotels were 5.0% above the monthly average for the year, a share that more than doubled by 2024 to 12.9%.

These numbers may mean that more people are choosing to head to Miami for a quick break from the cold – and staying in downtown hotels to make the most of their short getaway.

Chicago’s major August visit spike was likely driven by the Windy City’s impressive lineup of major summer festivals, from Lollapalooza to the Chicago Air and Water Show, which draw thousands of attendees from across the country.

Lollapalooza fueled the largest visit spike to the city – between Thursday, August 1st and Sunday, August 4th, visits to downtown Chicago hotels surged between 51.1% and 63.8% above 2024 daily averages for those days of the week. The Air and Water Show and the Chicago Jazz Festival also generated significant hotel visit increases – highlighting the boost these events bring to the city’s tourism and hospitality sector.

The Big Apple draws a diverse mix of visitors throughout the year. But in December – the city’s peak tourist season – visitors pour in from all over the country to skate in Rockefeller Center, browse Fifth Avenue’s festive window displays and experience the city’s unique holiday magic.

And analyzing data from hotels in midtown and downtown Manhattan reveals a striking shift in the types of visitors who stay in the heart of NYC during the holiday season. While visitors from other urban centers dominated downtown hotel stays throughout most of the year – accounting for 47.9% of visits from January to November 2024 – their share dropped to 42.0% in December 2024. Meanwhile, the share of guests from suburban areas and small towns rose from 37.3% to 41.0%, and the share of guests from rural and semi-rural areas nearly doubled, from 3.5% to 6.1%.

These patterns suggest that, though Manhattan typically attracts a wide range of visitors, the holiday season is uniquely appealing to tourists from smaller towns and suburban areas. Understanding these trends can provide crucial context for hotels and civic stakeholders alike as they work to maximize the opportunities presented by the city’s December visit surge.

Los Angeles hotels also experience significant demographic shifts during peak season. In July, visits to downtown LA hotels surged by 15.3% relative to the 2024 monthly visit average. And a closer look at audience segmentation data suggests a corresponding surge in the share of "Flourishing Families" – an Experian: Mosaic segment consisting of affluent, middle-aged households with children. Throughout the year, "Flourishing Families" comprised between 7.7% and 8.7% of the census block groups (CBGs) driving visits to downtown LA hotels. But in July, this share jumped to 9.9%.

These families may be taking advantage of summer vacations to enjoy Los Angeles’ cultural attractions and entertainment. Hotels and city stakeholders who understand the appeal the city holds for this demographic can better cater to them through family-friendly promotions and strategic marketing efforts to target these households.

Downtowns are making a comeback – and hotels in the heart of the nation’s major tourist hubs are reaping the benefits. By understanding who frequents these downtown hotels and when, local businesses and civic leaders can optimize their resource management and strategic planning to make the most of these opportunities.

The New York office scene is buzzing once again, as companies from JPMorgan to Meta double down on return-to-office (RTO) mandates. But just how did New York office foot traffic fare in 2024? How did Big Apple office foot traffic compare to that of other major business hubs nationwide? And how is New York’s office recovery impacting post-COVID trends like the TGIF work week? Are office visits still concentrated mid-week, or are people coming in more on Fridays and Mondays? And how has Manhattan’s RTO affected local commuting patterns?

We dove into the data to find out.

In 2024, New York City cemented its position as the nationwide leader in office recovery. Thanks in part to remote work crackdowns by banking behemoths like Goldman Sachs, Morgan Stanley, and JPMorgan, visits to NYC office buildings in 2024 were just 13.1% below pre-pandemic (2019) levels.

For comparison, Miami’s office foot traffic remained 16.2% below pre-pandemic levels, while Atlanta, Washington D.C., and Boston saw significantly larger gaps at 28.6%, 37.8%, and 43.9%, respectively.

Perhaps unsurprisingly given the Big Apple’s robust year-over-five-year (Yo5Y) recovery, the pace of year-over-year (YoY) visit growth to NYC office buildings was somewhat slower in 2024 than in other major East Coast business centers. Still, New York’s YoY office recovery rate of 12.4% outpaced the nationwide baseline, and came in just slightly below Washington, D.C.’s 15.2% and Atlanta’s 14.6%.

Interestingly, New York’s return to office has not led to a significant retreat from the TGIF work week that emerged during COVID. In 2024, just 11.9% of weekday (Monday to Friday) visits to NYC offices took place on Fridays – only slightly more than the 11.5% recorded in 2023 and significantly below the pre-pandemic baseline of 17.2%.

Meanwhile, Monday has quietly regained its footing as the dreaded start of the New York work week. After dropping significantly in 2022 and 2023, the share of weekday office visits taking place on Mondays rebounded to 18.2% in 2024 – just slightly below 2019’s 19.5%. Still, Tuesday remained the Big Apple’s busiest in-office day of the week last year, accounting for nearly a quarter (24.6%) of weekday NYC office foot traffic.

And diving into Yo5Y data for each day of the work week shows just how much New York’s overall recovery is driven by mid-week visits – and especially Tuesday ones. In 2024, Friday visits to NYC office buildings were down 40.2% compared to 2019. But on Tuesdays, visits were essentially on par with pre-pandemic levels (-0.3%), even as nationwide office visits remained 24.6% below 2019.

Another post-COVID trend that has shown staying power in New York is the growing share of office visits coming from employees who live nearby. As hybrid schedules become the norm, it seems that those commuting more frequently are often just a short subway ride -or even a stroll- away.

The share of NYC office workers coming from less than five miles away, for example, has risen steadily since COVID, reaching 46.0% in 2024. Over the same period, the share of workers coming from 5-10 miles, 10-15 miles, or 25+ miles away has declined.

Looking at commuting trends across the East Coast helps put New York City’s shift into perspective. In 2019, NYC’s share of nearby commuters was on par with Washington, D.C. and slightly below Boston. But while both cities experienced moderate increases in local commuters between 2019 and 2024, New York pulled ahead, outpacing all other analyzed cities in its share of nearby office workers last year.

Miami and Atlanta – two other standout cities in office recovery – also saw significant growth in the percentage of short-distance commuters over the past five years. This trend underscores a broader shift: As hybrid work reshapes commuting habits, employees across multiple markets are more likely to go into the office if they live nearby, reducing reliance on long-haul commutes.

As the nation’s office recovery leader, New York offers a glimpse into what other cities can expect as office visitation rates continue to improve. Even at just 13.1% below pre-pandemic levels, NYC office visit levels continue to rise. And as recovery nears completion, trends that took hold during COVID remain firmly entrenched.

The full-service dining segment has experienced its fair share of challenges over the past few years, with pandemic-era closures, rising food and labor costs, and cutbacks in discretionary spending contributing to visit lags. In 2024, visits were down 0.2% year over year (YoY) and remained 8.4% below 2019 levels – a reflection of the significant number of venues that permanently closed over COVID and a testament to the industry's ongoing struggle to regain its pre-pandemic footing.

Yet, even in a difficult environment, some full-service restaurant (FSR) chains are thriving. These brands aren’t waiting for the industry to rebound – they're becoming trendsetters in their own right, proving that stand-out strategy is everything in a challenging market.

This white paper explores brands that are harnessing three key differentiators – fixed-price value offerings, elevated social experiences, and a laser focus on product – to drive full-service dining success in 2025.

One of the most defining trends over the past few years has been the unrelenting march of price increases. And as consumers continue to seek out ways to save, some chains are staying ahead of the pack with fixed-price value offerings that help diners squeeze out the very best bang for their buck.

Golden Corral, the all-you-can-eat buffet chain that lets kids under three eat for free, is one FSR that is benefiting from consumers’ current value orientation. Despite closing several locations in 2024, overall visits to the chain still tracked closely with 2023 levels, declining by just 0.5% – while the average number visits to each Golden Corral restaurant grew 3.8% YoY.

Golden Corral’s value proposition is resonating strongly with budget-conscious Americans eager to enjoy a wide variety of comfort foods at an affordable price. The chain’s visitors tend to come from trade areas with lower median household incomes (HHIs) than traditional full-service restaurant (FSR) diners. And these patrons are willing to travel to enjoy the chain’s value buffet offerings, many of which are situated in rural areas and may require a longer drive. In 2024, 25.2% of Golden Corral’s diners came from over 30 miles away – compared to just 19.2% for the wider FSR segment.

Golden Corral’s continued flourishing proves that in an era of rising costs, diners are willing to go the extra mile (literally) for a restaurant that delivers both quality and affordability.

Children’s party space and eatertainment destination Chuck E. Cheese has had a transformative few years. Following the retirement of its iconic animatronic band, the chain shifted its focus to a new membership model, announcing a revamped Summer of Fun pass in May 2024 – including unlimited visits over a two-month period, steep discounts on food, and up to 250 games per day. The pass proved incredibly popular, with YoY visits surging by 15.6% in May 2024, when the offer launched – a sharp turnaround from the YoY visit declines of the previous months. Recognizing the strong demand, Chuck E. Cheese extended the program year-round – and the strategy has paid off as YoY visits remained positive through the end of 2024.

A closer look at the data suggests that parents are making full use of their unlimited passes: The share of weekday visits was higher in H2 2024 than in H2 2023, likely due to families using their passes for weekday entertainment rather than reserving visits for weekends and special occasions.

At the same time, the share of repeat visitors – those frequenting the chain at least twice a month – also grew. Although these repeat visitors may not purchase additional gameplay beyond the flat fee, their more frequent on-site presence likely translates into increased sales of pizza and other menu items.

While value has been a major motivator for restaurant-goers in recent years, low prices aren’t the only drivers of FSR success. Brands offering unique experiences aimed at maximizing social interaction are also seeing outsized gains.

Though many of these more innovative venues tend to be on the more expensive side, they draw enthusiastic crowds willing to pony up for concepts that combine good food with fun social occasions. And some of the more successful ones bolster perceived value through offerings like fixed-price menus or club memberships.

Korean cuisine has been on the rise in recent years, with restaurants like Bonchon Chicken and GEN Korean BBQ House making significant waves in the dining space. Another chain drawing attention is KPOT Korean BBQ and Hot Pot, which began modestly in 2018 and has since expanded to over 150 locations nationwide.

Diners at KPOT can customize their meals by selecting from a variety of proteins, broths, sauces, and side dishes, known as banchan, while barbecuing or cooking in a hotpot at their table and sipping on the drinks from the menu’s extensive selection. And though pricier than Golden Corral, KPOT also offers an all-you-can-eat experience that lets customers squeeze the most value out of their indulgence.

Location intelligence shows that KPOT’s experiential dining model is resonating with customers: Since Q4 2019, the average number of visits to each KPOT location has risen steadily – even as the chain has grown its footprint – while the average dwell time has also increased. Indeed, rather than a quick dining stop, KPOT has become a destination for guests to linger, enjoying both food and drinks – and an interactive and social experience.

By positioning themselves as gathering places for fine wine aficionados, wine-club-focused concepts such as Postino WineCafe and Cooper’s Hawk Winery are also benefiting from today’s consumers’ emphasis on social experiences. The two upscale dining destinations offer club memberships that combine periodic wine releases with a variety of perks.

And the data suggests that the model is strongly resonating with diners. Both Postino and Cooper’s Hawk have grown their footprints over the past year, driving substantial YoY chain-wide visit increases while average visits per location grew as well – showing that the expansions and experiential offerings are meeting robust demand.

And analyzing the two chains’ captured markets shows that the wine club model enjoys broad appeal across a variety of audience segments.

Unsurprisingly, both wine clubs’ visitor bases include higher-than-average shares of affluent consumers with money to spend, including Experian: Mosaic’s “Power Elite”, “Booming with Confidence”, and “Flourishing Families” segments (the nation’s wealthiest families, as well as affluent suburban and middle-aged households). But the two chains also attract younger, more budget-conscious consumers – Postino, which has many downtown locations, is popular among “Singles and Starters”, while Cooper’s Hawk is popular among “Promising Families” - i.e. young couples with children.

The success of the two brands across various segments underscores the impact of a distinctive experience – especially when paired with a loyalty-boosting membership – in attracting today’s consumers.

Value offerings and unique experiences have the power to drive restaurant visits – but ultimately, a good meal in an inviting atmosphere is a draw in and of itself, as is shown by the success of First Watch and Firebirds Wood Fired Grill.

Breakfast-only restaurant First Watch excels at ambiance and menu innovation, changing up its offerings five times a year and striving to maintain a neighborhood feel at each of its locations.

First Watch has made a point of leaning into its strengths, eschewing discounts in favor of a consistently elevated dining experience and doubling down its strongest day part (weekend brunch), rather than trying to artificially drive up interest at other times.

And the strategy appears to be working: In 2024, visits to First Watch increased 6.6% YoY – with Saturdays and Sundays between 11:00 A.M. and 1:00 P.M. remaining its busiest dayparts by far. Visitors to First Watch also tend to linger over their meals more than at other breakfast chains – in 2024, the restaurant experienced an average dwell time of 54.9 minutes, significantly longer than the 48.7-minute average at other breakfast-focused restaurants.

By focusing on what matters most to its diners – innovative and exciting food and a welcoming atmosphere that allows patrons to enjoy their meals at a leisurely pace – First Watch is continuing to flourish.

Another chain that is growing its footprint and its audience on the strength of a menu and ambiance-focused approach is Firebirds Wood Fired Grill. The chain, known for its “polished casual” vibe and bold, unique flavors, added several new restaurants last year, leading to a 6.5% increase in overall visits. Over the same period, the average number of visits to each Firebirds location held steady – showing that the new restaurants aren’t cannibalizing existing business.

The chain’s success may rest, in part, on its locating its venues in areas rife with enthusiastic foodies. Data from Spatial.ai’s FollowGraph shows that in 2024, Firebird’s trade areas had significantly higher shares of “BBQ Lovers”, “Gourmet Burger Lovers,” and “Foodies” than the nationwide average. This suggests that Firebirds is attracting diners who prioritize the experience of eating – key for a chain that prides itself on putting good food first. The chain is also known for its welcoming decor and design – another aspect that may lead to its strong visit success.

Necessity often serves as the mother of invention, and challenging economic periods continue to spark new trends and innovations in the dining scene. From a heightened focus on value – drawing families and lower-HHI consumers willing to travel for a good deal – to the growing appeal of social dining and the timeless draw of good food – new trends are emerging to meet changing consumer expectations.