.svg)

.png)

.png)

.png)

.png)

Some moments in our lives remain ingrained in our heads. One such time period was March of 2020, when it felt like the world suddenly stood still as malls, street retail, and dining establishments closed, everyone masked up, and only essential retail and health services continued. After a while, limitations relaxed, but not without a subconscious preference for open-air shopping centers that appears to linger to this day. Granted, many open-air shopping centers are also newer or redeveloped, thus likely contributing to their popularity. However, there’s no doubt that they’ve rebounded at a higher rate compared to their indoor mall and even outlet mall counterparts.

We analyzed traffic data for one of the most-visited open-air shopping centers in the nation, Victoria Gardens, to see what sets it apart and what continues to draw consumers to open-air centers.

This open-air shopping center is over 1.1 million square feet and hosts over 160 retailers within its borders. In addition to marquee brands such as Apple, lululemon, AMC Theatres, and Cheesecake Factory, it also has regional favorites such as Seven Grams dumpling house and cult-favorite Duck Donuts. Boasting a 160 acre main street community, its walkable layout beckons while classics play in the background. Quite a few of the concepts at Victoria Gardens are on trend. For instance, the Food Hall features local eatery Elephant Thai, which is perfectly in keeping with the popularity of all things Thai these days with Season 3 of White Lotus being set in Koh Samui.

Another genre that one doesn’t often see in more urban mall locations are two retailers devoted to Western wear – Buckle and Tecovas.

Tecovas has a fascinating backstory with its founder, Paul Hedrick, partnering initially with bootmakers from Leon, Mexico, the “boot-making capital of the Americas” and selling his first pairs from the backseat of his SUV. With an average dwell time of 40 minutes between April 2024 and February 2025 and holiday spikes for Thanksgiving and Christmas, it’s clear that for many shoppers, a pair of Tecova boots are on their wishlist.

One of the more unique aspects of this mall is its Cultural Center on premise. With a performing arts theater, library, and interactive children’s museum right next to retail, dining, and a movie theater, it’s truly a one-stop shop for its community.

As shopping centers continue to evolve, with many adopting a Town Square approach, the appeal of open-air shopping centers – full of public spaces, greenery, walkable paths, and fresh air – will only continue to grow.

For more data-driven consumer insights, visit placer.ai/anchor

Aldi and Lidl have firmly established themselves as discount powerhouses. The two German retailers entered the United States market at different times, with Aldi opening its first location in 1976 and Lidl making its way stateside in 2017 – and diving into the foot traffic shows that both are thriving.

In the first quarter of 2025, visits to Aldi and Lidl saw significant year-over-year (YoY) increases of 8.9% and 4.2%, respectively – well above the industry-wide average (0.9%.)

Aldi, which has been on an expansion tear for the past few years, saw a YoY increase in average visits per location – but so did Lidl, which has been slower to add new locations. And this growth – 4.7% at Aldi and 1.9% at Lidl – highlights that their stores, whether new locations or already-existing ones, are driving sustained demand.

A closer look at visitor behavior offers valuable insights into the factors driving the foot traffic success of Aldi and Lidl.

A significantly larger proportion of Aldi and Lidl's visits – 37.2% and 37.7%, respectively – took place on Saturdays and Sundays compared to visits to traditional and value grocery stores. This suggests that the attractive price points offered by Aldi and Lidl position them as prime destinations for shoppers making weekend stock-up trips.

On a chain level, both Aldi and Lidl are finding their own paths to success. Aldi is currently undergoing a significant growth phase, aiming to operate 800 stores by the end of 2028. This ambitious trajectory includes adding at least 225 new locations in 2025 alone – and examining the visit distribution across Aldi's largest markets provides valuable insights into how its strategy is unfolding. Contextualizing Aldi’s performance against the wider grocery segment provides a birds-eye view of the value grocer’s performance.

Over the past few years, Aldi has consistently increased its visit share when compared to the overall grocery segment, both nationally and across its major markets. For instance, in Florida, one of Aldi’s largest markets, its visit share grew from 4.8% in Q1 2022 to 7.0% in Q1 2025. And in Illinois, now its second-largest market, Aldi increased its visit share from 12.2% to 14.8% over the same period.

This consistent growth in visit share underscores the broad appeal of Aldi's value proposition to shoppers across the country, suggesting that its ambitious expansion plans are likely to be well-received by consumers.

Lidl also plans to grow its store count, though at a more modest pace than Aldi. And the chain is focusing on its already-existing markets in hopes of entrenching itself further in areas where it already has strong brand recognition.

Geographic segmentation data from the Esri: Tapestry Segmentation dataset within Lidl’s potential and captured markets reveals promising insights into where the retailer might find its most receptive audiences. In its potential market – calculated by weighting each Census Block Group (CBG) within Lidl’s trade area according to population size – the share of visitors from "Suburban Periphery" areas was 41.5%. However, in its captured market, determined by weighting each CBG according to its share of actual visits to Lidl – so better representing its current visitor profile – this suburban segment constitutes a significantly larger 56.4%. Conversely, the proportion of visitors originating from "Principal Urban Centers" and "Metro Cities" was higher in Lidl’s potential market compared to its captured market.

These metrics strongly suggest that Lidl has more demand in the suburbs than it may realize – and as it expands, focusing on these areas might prove to be a winning strategy for the chain.

Aldi and Lidl are thriving, growing their audiences during a challenging economic climate.

Will visits to the two chains continue to increase throughout 2025? Visit Placer.ai to keep up with the latest data-driven grocery insights.

Amid rising housing costs and shifting consumer lifestyles, self-storage has emerged as a go-to solution for many Americans. We dove into the data to take the pulse of the market in Q1 2025 – and uncover the audience segments behind the industry’s ongoing growth.

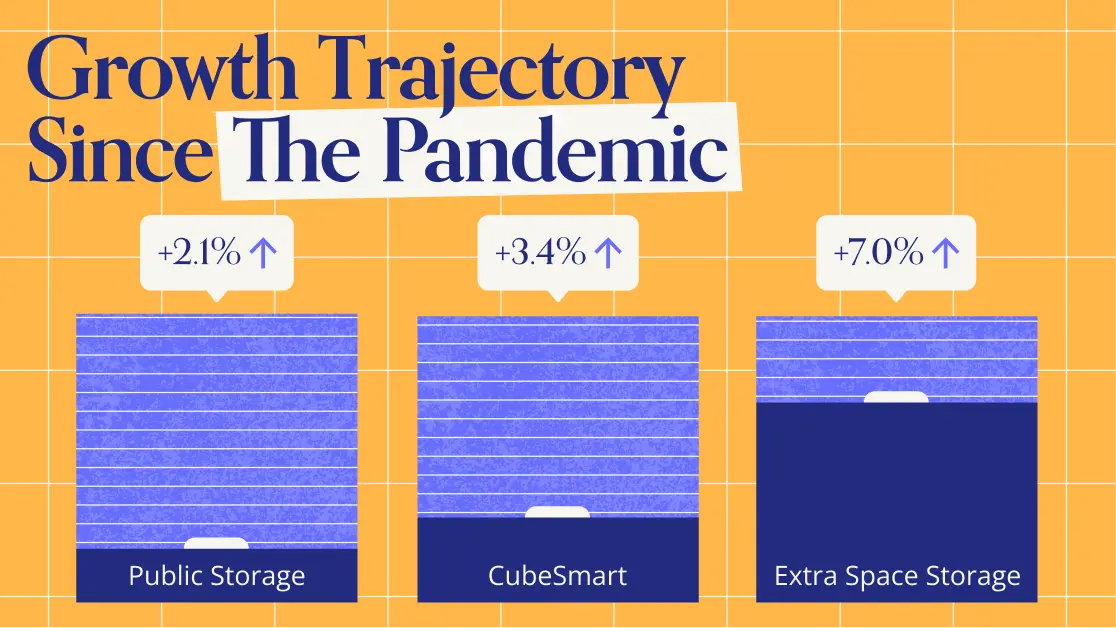

Visits to leading self-storage companies have been on a steady growth trajectory since 2019. During the pandemic, storage utilization surged as many Americans relocated or stored items to free up space for home offices or DIY projects. Since then, high prices and interest rates appear to have further fueled demand, with some households likely deferring space-adding renovations or larger home purchases.

In Q1 2025, visits to Public Storage and CubeSmart were up 24.7% and 30.7%, respectively, compared to a Q1 2019 baseline. Extra Space Storage – which substantially expanded its unit count following its 2023 acquisition of Life Storage – saw visits surge 98.3% over the same baseline. And year over year (YoY), all three chains posted foot traffic growth, partly driven by continued expansion.

The baseline visit analysis also reveals a distinct seasonal pattern in self-storage usage patterns. Each year, visits to self-storage chains peak in Q2 and Q3 (April through September), aligning with spring cleaning, home improvement prime time, and moving season. Then in Q1, visits drop as people stay indoors during winter – likely also making fewer trips to access recreational gear and vehicles in storage.

Who are the consumers driving self-storage visit growth? Looking at the demographic characteristics of Extra Space Storage, Public Storage, and CubeSmart’s visitor bases reveals a common consumer profile across chains. In Q1 2025, the captured markets of all three chains had nearly identical median household incomes (HHIs), very close to the nationwide baseline of $79.6K. Their markets were also disproportionately urban, with higher-than-average shares of renter-occupied and multi-unit housing – all groups more likely to need extra storage space.

Still, as the self-storage market has grown, industry leaders have grown their presence in more affluent suburban markets. Between Q1 2019 and Q1 2025, Extra Space Storage’s share of “Wealthy Suburban Families” rose from 9.1% to 10.1% – slightly above the nationwide baseline of 9.6%. Meanwhile, Public Storage’s share of this segment increased from 8.8% to 9.8%, and CubeSmart’s share remained steady at 10.1%. A similar pattern emerged for “Upper Suburban Diverse Families”, with all three chains at or above the nationwide segment baseline of 9.0% by Q1 2025.

This small but perceptible shift may reflect rising demand from households where adult children are increasingly staying at home or returning after college, prompting a need for additional storage. Spare rooms once used for storage may also be increasingly repurposed into home offices, studios, or workout spaces in the wake of hybrid work trends.

Known for resilience in the face of economic headwinds and uncertainty, the self-storage space appears well-positioned to continue to thrive. How will the segment evolve in the years and months ahead?

Follow Placer.ai/anchor to find out.

Romance novels have long been the unsung heroes of the publishing industry, consistently driving significant sales and topping bestseller lists year after year. And now, the category is getting its moment in the spotlight. Independent bookstores specializing in romance and fantasy are popping up across the country, connecting romance readers with the books they love in a setting exclusively dedicated to them.

We took a look at one recent addition to the romance bookstore world – The Ripped Bodice in Brooklyn, New York – to see what visitation trends reveal about the value of specialty stores in an environment increasingly dominated by general retailers.

The romance category has long been a quiet literary powerhouse – and now, the segment is getting its moment to shine. The rise of “BookTok” has helped propel the category into the spotlight, and independent, romance-centered bookstores are thriving. The Ripped Bodice is one such store: The first one opened in Culver City, CA in 2016, and the second in Brooklyn, NY in 2023. The Ripped Bodice’s Brooklyn location is located within two miles of two Barnes & Noble locations, so comparing visitation trends at the three stores highlights the value that the specialty bookstore adds to the book-centered retail landscape.

Location analytics reveal that visitors to The Ripped Bodice are much more likely to travel long distances to reach the store, with nearly half coming from over 50 miles away. In contrast, the two nearby Barnes & Noble stores saw just 4.8% and 8.6% of their visitors traveling from that distance. This suggests that the bookstore’s unique offerings make it something of a destination for romance lovers. Some vacationers visiting the area may include The Ripped Bodice as a must-see attraction, while others may make a dedicated journey just to explore its curated collection of romance novels.

The Ripped Bodice also attracts more weekend visits than nearby Barnes & Nobles. Over the past 12 months, almost half of visits to the niche bookstore – 48.8% – occurred on Saturdays and Sundays. In contrast, the two nearby Barnes & Noble locations received most of their visits on weekdays, with just 24.4% and 34.2% of their visits taking place on Saturdays and Sundays.

The contrasting weekend traffic trends highlight the unique value that specialized bookstores hold for niche hobbyists. In this case, romance enthusiasts seem to treat a trip to The Ripped Bodice as an activity in and of itself, prioritizing weekend visits to browse, connect with fellow readers, and enjoy a dedicated space for their favorite books and authors.

Further analysis of visitor behavior at The Ripped Bodice and nearby Barnes & Noble locations reveals how the specialized bookstore fosters a sense of community and encourages customers to linger.

On average, visitors to The Ripped Bodice spent 39 minutes in the store – soaking up the special ambiance or participating in the bookseller’s frequent events. In contrast, visitors to the Barnes & Noble on 7th Ave. – which unlike The Ripped Bodice, has an on-site cafe – stayed for an average of 37 minutes, while visitors to the location on Atlantic Ave. lingered for just 32 minutes.

The Ripped Bodice’s longer dwell times serve as a reminder of the value retailers can find in catering to niche interests. Specialized stores often create an environment where customers feel comfortable spending more time, allowing for greater product discovery and stronger loyalty. Retailers of all sizes can consider offering more specialized experiences within their stores to create inviting spaces that encourage exploration among diverse customer groups.

The visitation patterns at The Ripped Bodice can be read as a story of one retailer – but it can also offer insights into the value of catering to niche hobbies. When retailers provide consumers with a dedicated space to explore and deepen their interests, they open up opportunities for success.

Visit Placer.ai for more data-driven retail insights.

We dove into the visit data to see how Starbucks, Dunkin,’ and Dutch Bros are faring in Q1 2025.

Affordable luxuries like coffee tend to do well in times of rising prices and heightened budget-consciousness. So it should come as no surprise that visits to coffee chains have been on the rise recently, with overall traffic to the category up 1.8% year-over-year (YoY) in Q1 2025. Much of the increase can be attributed to the aggressive expansions of small and medium coffee chains such as Dutch Bros (13.4% YoY increase in visits in Q1 2025), Scooter’s Coffee (+15.3% YoY) and 7 Brew Coffee (+87.3%).

Meanwhile, visits to coffee leaders Starbucks and Dunkin’ remained relatively stable – falling by just 0.9% and 1.6%, respectively, in line with the wider QSR Q1 2025 YoY visit gap of 1.6%. Contrasting the growth of smaller coffee chains with Starbucks and Dunkin’s minor traffic dips may suggest that consumers prefer to spend their limited discretionary funds on unique or decadent treats instead of on classic drinks and pastries.

But despite the rapid growth of smaller coffee chains, Starbucks continues to dominate the coffee category, receiving over half of combined visits to Starbucks, Dunkin’, Dutch Bros, Scooter’s Coffee, and 7 Brew Coffee. At the same time, though, Starbucks’ stronghold on the category may be loosening slightly – the Seattle-based coffee giant’s relative visit share fell from 55.8% in Q1 2024 to 51.2% in Q1 2025 as smaller chains continued growing and expanding.

The cross-visitation data also highlights Starbucks’ dominance. In Q1 2025, the majority of visitors to most other coffee chains (51.3% of Dunkin’ visitors, 65.7% of Dutch Bros, and 58.4% of 7 Brew visitors) also visited a Starbucks in the same period. Meanwhile, only 27.4% of Starbucks consumers went to Dunkin’ and 16.4% went to Dutch Bros during the analyzed period, with even smaller shares going to Scooter’s and 7 Brew. So while the smaller chains are clearly making inroads into the coffee market, Starbucks still commands a strong central position, attracting a majority of coffee-goers and enjoying significant loyalty.

Despite the ongoing expansion of Dutch Bros and the rise of smaller coffee chains, Starbucks continues to dominate the U.S. coffee category.

For more data-driven dining insights, visit placer.ai/anchor.

Fueled by customer demand for quality, convenience, and value, CAVA and sweetgreen are cementing their place as leaders in the fast-casual space. The two chains have seen impressive growth over the past few years, adding new locations to keep up with growing demand.

We took a look at their performance over the years to see what might be driving their continued rise.

While the fast-casual dining sector as a whole experienced a slight slowdown in Q1 2025, likely driven by continued budgetary concerns among diners, CAVA and sweetgreen are thriving. The two chains are squarely in expansion mode – and their impressively elevated foot traffic numbers strongly suggest that customers are highly receptive to both chains’ offerings.

In Q1 2025, visits to CAVA were 19.8% higher than in Q1 2024, while Sweetgreen saw its visits increase by 11.1%. In contrast, the wider fast-casual space experienced a visit slowdown of 0.1% during the same period, serving as a reminder of the challenges facing the segment.

Diving into audience segmentation data for both chains provides greater insight into the expansion strategies underlying their strong performance in recent years.

CAVA, which grew from a single location in Maryland to 367 restaurants at the end of 2024, has employed a suburban-focused growth strategy that has brought the chain to a wider audience than ever. The median household income of CAVA’s trade areas has been steadily dropping over the years. And a closer look at shifts in the psychographic segments that make up its visitor base suggests that the chain is reaching new suburban audiences.

Between Q1 2022 and Q1 2025, CAVA steadily broadened its reach among the working and middle-class “Blue Collar Suburbs” and “Suburban Boomers” consumer segments. During the same period, it also gained more traction with the affluent “Upper Suburban Diverse Families” segment – while holding on to its substantial share of “Wealthy Suburban Families.” This suggests that, even as CAVA expands its reach among a wider range of suburban visitors, it has maintained its core audience. While a substantial portion of wealthy customers remains, the chain has effectively opened itself up to a larger and more diverse pool of visitors.

Similarly, sweetgreen has also been increasing its presence in suburban markets. The chain, which leans heavily into automation to improve visitor experience, has made suburban expansion a cornerstone of its strategy – and examining the geographic data clearly demonstrates this shift.

In Q1 2022, 31.3% of sweetgreen’s trade areas were made up of consumer segment groups belonging to the “Suburban Periphery” – defined by the Esri: Tapestry Segmentation dataset as commuter-oriented suburbs with access to major cities and their amenities. But by Q1 2025, this share rose sharply, to 42.2%. Over the same period, the share of “Principal Urban Centers” in sweetgreen’s trade areas dropped from 50.0% to 26.8%.

CAVA and sweetgreen are thriving, seemingly driven by their pushes into suburban markets.

Will the two chains continue to experience visit growth as Q2 gets underway?

Visit Placer.ai to find out.

1. Appetite for offline retail & dining is stronger than ever. Both retail and dining visits were higher in H1 2025 than they were pre-pandemic.

2. Consumers are willing to go the extra mile for the perfect product or brand. The era of one-stop-shops may be waning, as many consumers now prefer to visit multiple chains or stores to score the perfect product match for every item on their shopping list.

3. Value – and value perception – gives chains a clear advantage. Value-oriented retail and dining segments have seen their visits skyrocket since the pandemic.

4. Consumer behavior has bifurcated toward budget and premium options. This trend is driving strength at the ends of the spectrum while putting pressure on many middle-market players.

5. The out-of-home entertainment landscape has been fundamentally altered. Eatertainment and museums have stabilized at a different set point than pre-COVID, while movie theater traffic trends are now characterized by box-office-driven volatility.

6. Hybrid work permanently reshaped office utilization. Visits to office buildings nationwide are still 33.3% below 2019 levels, despite RTO efforts.

The first half of 2025 marked five years since the onset of the pandemic – an event that continues to impact retail, dining, entertainment, and office visitation trends today.

This report analyzes visitation patterns in the first half of 2025 compared to H1 2019 and H1 2024 to identify some of the lasting shifts in consumer behavior over the past five years. What is driving consumers to stores and dining venues? Which categories are stabilizing at a higher visit point? Where have the traffic declines stalled? And which segments are still in flux? Read the report to find out.

In the first half of 2025, visits to both the retail and dining segments were consistently higher than they were in 2019. In both the dining and the retail space, the increases compared to pre-COVID were probably driven by significant expansions from major players, including Costco, Chick-fil-A, Raising Cane's, and Dutch Bros, which offset the numerous retail and dining closures of recent years.

The overall increase in visits indicates that, despite the ubiquity of online marketplaces and delivery services, consumer appetite for offline retail and dining remains strong – whether to browse in store, eat on-premises, collect a BOPIS order, or pick up takeaway.

A closer look at the chart above also reveals that, while both retail and dining visits have exceeded pre-pandemic levels, retail visit growth has slightly outpaced the dining traffic increase.

The larger volume of retail visits could be due to a shift in consumer behavior – from favoring convenience to prioritizing the perfect product match and exhibiting a willingness to visit multiple chains to benefit from each store's signature offering. Indeed, zooming into the superstore and grocery sector shows an increase in cross-shopping since COVID, with a larger share of visitors to major grocery chains regularly visiting superstores and wholesale clubs. It seems, then, that many consumers are no longer looking for a one-stop-shop where they can buy everything at once. Instead, shoppers may be heading to the grocery stores for some things, the dollar store for other items, and the wholesale club for a third set of products.

This trend also explains the success of limited assortment grocers in recent years – shoppers are willing to visit these stores to pick up their favorite snack or a particularly cheap store-branded basic, knowing that this will be just one of several stops on their grocery run.

Diving into the traffic data by retail category reveals that much of the growth in retail visits since COVID can be attributed to the surge in visits to value-oriented categories, such as discount & dollar stores, value grocery stores, and off-price apparel. This period has been defined by an endless array of economic obstacles like inflation, recession concerns, gas price spikes, and tariffs that all trigger an orientation to value. The shift also speaks to an ability of these categories to capitalize on swings – consumers who visited value-oriented retailers to cut costs in the short term likely continued visiting those chains even after their economic situation stabilized.

Some of the visit increases are due to the aggressive expansion strategies of leaders in those categories – including Dollar General and Dollar Tree, Aldi, and all the off-price leaders. But the dramatic increase in traffic – around 30% for all three categories since H1 2019 – also highlights the strong appetite for value-oriented offerings among today's consumers. And zooming into YoY trends shows that the visit growth is still ongoing, indicating that the demand for value has not yet reached a ceiling.

While affordable pricing has clearly driven success for value retailers, offering low prices isn't a guaranteed path to growth. Although traffic to beauty and wellness chains remains significantly higher than in 2019, this growth has now plateaued – even top performers like Ulta saw slight YoY declines following their post-pandemic surge – despite the relatively affordable price points found at these chains.

Some of the beauty visit declines likely stems from consumers cutting discretionary spending – but off-price apparel's ongoing success in the same non-essential category suggests budget constraints aren't the full story. Instead, the plateauing of beauty and drugstore visits while off-price apparel visits boom may be due to the difference in value perception: Off-price retailers are inherently associated with savings, while drugstores and beauty retailers, despite carrying affordable items, lack that same value-driven brand positioning. This may suggest that in today's market, perceived value matters as much as actual affordability.

Another indicator of the importance of value perception is the decline in visits to chains selling bigger-ticket items – both home furnishing chains and electronic stores saw double-digit drops in traffic since H1 2019.

And looking at YoY trends shows that visits here have stabilized – like in the beauty and drugstore categories – suggesting that these sectors have reached a new baseline that reflects permanently shifted consumer priorities around discretionary spending.

A major post-pandemic consumer trend has been the bifurcation of consumer spending – with high-end chains and discount retailers thriving while the middle falls behind. This trend is particularly evident in the apparel space – although off-price visits have taken off since 2019 (as illustrated in the earlier graph) overall apparel traffic declined dramatically – while luxury apparel traffic is 7.6% higher than in 2019.

Dining traffic trends also illustrate this shift: Categories that typically offer lower price points such as QSR, fast casual, and coffee have expanded significantly since 2019, as has the upscale & fine dining segment. But casual dining – which includes classic full-service chains such as Red Lobster, Applebee's, and TGI Fridays – has seen its footprint shrink in recent years as consumers trade down to lower-priced options or visit higher-end venues for special occasions.

Chili's has been a major exception to the casual dining downturn, largely driven by the chain's success in cementing its value-perception among consumers – suggesting that casual dining chains can still shine in the current climate by positioning themselves as leaders in value.

Consumers' current value orientation seems to be having an impact beyond the retail and dining space: When budgets are tight, spending money in one place means having less money to spend in another – and recent data suggests that the consumer resilience in retail and dining may be coming at the expense of travel – or perhaps experiences more generally.

While airport visits from domestic travelers were up compared to pre-COVID, diving into the data reveals that the growth is mostly driven by frequent travelers visiting airports two or more times in a month. Meanwhile, the number of more casual travelers – those visiting airports no more than once a month – is lower than it was in 2019.

This may suggest that – despite consumers' self-reported preferences for "memorable, shareable moments" – at least some Americans are actually de-prioritizing experiences in the first half of 2025, and choosing instead to spend their budgets in retail and dining venues.

The out of home entertainment landscape has also undergone a significant change since COVID – and the sector seems to have settled into a new equilibrium, though for part of the sector, the equilibrium is marked by consistent volatility.

Eatertainment chains – led by significant expansions from venues like Top Golf – saw a 5.5% visit increase compared to pre-pandemic levels, though YoY growth remained modest at 1.1%. On the other hand, H1 2025 museum traffic fell 10.9% below 2019 levels with flat YoY performance (+0.2%). The minimal year-over-year changes in both categories suggest that these entertainment segments have found their new post-COVID equilibrium.

The rise of eatertainment alongside the drop in museum visits may also reflect the intense focus on value for today's consumers. Museums in 2025 offer essentially the same value proposition that they offered in 2019 – and for some, that value proposition may no longer justify the entrance fee. But eatertainment has gained popularity in recent years as a format that offers consumers more bang for their buck relative to stand-alone dining or entertainment venues – which makes it the perfect candidate for success in today's value-driven consumer landscape.

But movie theaters traffic trends are still evolving – even accounting for venue closures, visits in H1 2025 were well below H1 2019 levels. But compared to 2024, movie traffic was also up – buoyed by the release of several blockbusters that drove audiences back to cinemas in the first half of 2025. So while the segment is still far from its pre-COVID baseline, movie theaters retain the potential for significant traffic spikes when compelling content drives consumer demand.

The blockbuster-driven YoY increase can perhaps also be linked to consumers' spending caution. With budgets tight, movie-goers may want to make sure that they're spending time and money on films they are sure to enjoy – taking fewer risks than they did in 2019, when movie tickets and concession prices were lower and consumers were less budget-conscious.

H1 2025 also brought some moderate good news on the return to office (RTO) front, with YoY visits nationwide up 2.1% and most offices seeing YoY office visit increases – perhaps due to the plethora of RTO mandates from major companies. But comparing office visitation levels to pre pandemic levels highlights the way left to go – nationwide visits were 33.3% below H1 2019 levels in H1 2025, with even RTO leaders New York and Miami still seeing 11.9% and 16.1% visit gaps, respectively.

So while the data suggests that the office recovery story is still being written – with visits inching up slowly – the substantial gap from pre-pandemic levels suggests that remote and hybrid work models have fundamentally reshaped office utilization patterns.

Five years post-pandemic, consumer behavior across the retail, dining, entertainment, and office spaces has crystallized into distinct new patterns.

Traffic to retail and dining venues now surpasses pre-pandemic levels, driven primarily by value-focused segments. But retail and dining segments that cater to higher income consumers –such as luxury apparel and fine dining – have also stabilized at a higher level, highlighting the bifurcation of consumer behavior that has emerged in recent years. Entertainment formats show more variability – while eatertainment traffic has settled above and museums below 2019 levels, and movie theaters still seeking stability. Office spaces remain the laggard, with visits well below pre-pandemic levels despite corporate return-to-office initiatives showing modest impact.

It seems, then, that the new consumer landscape rewards businesses that can clearly articulate their value proposition to attract consumers' increasingly selective spending and time allocation – or offer a premium product or experience catering to higher-income audiences.

.avif)

1. Overall dining traffic is mostly flat, but growth is concentrated in specific areas.

While nationwide dining visits were nearly unchanged in early 2025, western states like Utah, Idaho, and Nevada showed moderate growth, while states in the Midwest and South, along with Washington D.C., saw declines.

2. Fine dining and coffee chains are growing through expansion, not just busier locations.

These two segments were the only ones to see an increase in total visits, but their visits-per-location actually decreased, indicating that opening new stores is the primary driver of their growth.

3. Higher-income diners are driving the growth in resilient categories.

The segments that saw visit growth—fine dining and coffee—also attracted customers with the highest median household incomes, suggesting that affluent consumers are still spending on dining despite economic headwinds.

4. Remote work continues to reshape dining habits.

The share of suburban customers at fine dining establishments has increased since 2019, while it has decreased for coffee chains. This reflects a shift towards "destination" dining closer to home and away from commute-based coffee runs.

5. Limited-service restaurants own the weekdays; full-service restaurants win the weekend.

QSR, fast casual, and coffee chains see the majority of their traffic from Monday to Friday, whereas casual and fine dining see a significant spike in visits on weekends.

6. Each dining segment dominates a specific time of day.

Consumer visits are highly predictable by the hour: coffee leads in the early morning, fast casual peaks at lunch, casual dining takes the afternoon, fine dining owns the dinner slot, and QSR captures the late-night crowd.

Overall dining visits held relatively steady in the first five months of 2025, with year-over-year (YoY) visits to the category down 0.5% for January to May 2025 compared to the same period in 2024. Most of the country saw slight declines (less than 2.0%), though some states and districts experienced larger drops: Washington, D.C, saw the largest visit gap (-3.6% YoY), followed by Kansas and North Dakota (-2.9%), Arkansas (-2.8%), Missouri and Kentucky (-2.6%), Oklahoma (-2.1%), and Louisiana (-2.0%).

Still, there were several pockets of moderate dining strength, specifically in the west of the United States. January to May 2025 dining visits in Utah, Idaho, and Nevada increased 1.8% to 2.4% YoY, while the coastal states saw traffic rise 0.6% (California) to 1.2% (Washington). Vermont also saw a slight increase in dining visits (+1.9%).

Diving into visit trends by dining segment shows that fine dining and coffee saw the strongest overall visit trends, with visits to the segments up 1.3% and 2.6% YoY, respectively, between January and May 2025. But visits per location trends were negative for both segments – a decline of 0.8% YoY for fine dining and 1.8% for coffee during the period – suggesting that much of the visit strength is due to expansions rather than more crowded restaurants and coffee shops.

In contrast, full-service casual dining saw overall visits decrease by 1.5%, while visits per location remained stable (+0.2%) YoY between January and May 2025. Several casual dining chains have rightsized in the past twelve months – including Red Lobster, TGI Fridays, and Outback Steakhouse – which impacted overall visit numbers. But the data seems to show that their rightsizing was effective, as the remaining locations successfully absorbed the traffic and maintained performance levels from the previous year. And the monthly data also provides much reason for optimism, with May traffic up both overall and on a visit per location basis – suggesting that the casual dining segment is well positioned for growth in the second half of 2025.

Meanwhile, QSR and fast casual chains saw similar minor visits per venue dips (-1.5% and -1.2%, respectively). At the same time, QSR also saw an overall visit dip (-0.8%) while traffic to fast casual chains increased slightly (+0.3%) – suggesting that the fast casual segment is expanding more aggressively than QSR. But the two segments decoupled somewhat in May, with overall traffic and visits per venue to fast casual chains up YoY while traffic remained flat and visits per venue fell slightly for QSR – perhaps due to the relatively greater affluence of fast casual's consumer base.

Analyzing the income levels of visitors to the various dining segments over time shows that each segment followed a slightly different trend – and the differences in visitor income may help explain some of the current traffic patterns.

The only three segments with YoY visit growth – casual dining, fine dining, and coffee – also had the highest captured market median household income (HHI). Although the median HHI in the captured market of upscale and fine dining chains fell after COVID, it has risen back steadily over time and now stands at $98.0K – slightly higher than the $97.1K median HHI between January to May 2019. This may explain the segment's resilience in the face of wider consumer headwinds. Meanwhile, the median HHI at fast casual and coffee chains has fallen slightly, perhaps due to aggressive expansions in the space – including Dave's Hot Chicken and Dutch Bros – which likely broadened the reach of the segments, driving visits up and trade area median HHI down.

Like fine dining, casual dining also saw its trade area median HHI increase slightly over time – but the segment has still been facing visit dips. This could mean that, even though consumers trading down to casual dining may have boosted the trade area median HHI for the segment, it still might not have been enough to make up for the customers lost to tighter budgets.

The QSR segment saw its trade area median HHI remain remarkably steady – and visits to the segment have also been quite consistent – staying between $70.6K and $70.9K between 2019 and 2025 – which may explain why the segment's visits remained relatively stable YoY.

Diving into the psychographic segmentation shows that, although the fine dining segment attracted visitors from the highest-income areas between January and May 2025, fast casual chains drew the highest share of visitors from suburban areas, followed by casual dining and coffee. QSR attracted the smallest share of suburban visitors, with just 30.5% of the category's captured market between January and May 2025 belonging to Spatial.ai: PersonaLive suburban segments.

But looking at the data since 2019 reveals small but significant changes in the shares of suburban audiences in some categories' captured markets. And although the percentage changes are slight, these represent hundreds of thousands of diners every year.

The data shows that shares of suburban segments in the captured markets of fine dining chains have increased, while their share in the captured market of coffee chains has decreased. The shares of suburban visitors to QSR, fast casual, and casual chains have remained relatively steady.

This may suggest that the COVID-19 pandemic and the subsequent rise of remote and hybrid work models are still impacting consumer dining habits, benefiting destination-worthy experiences in suburban locales such as fine dining chains while reducing the necessity of daily coffee runs that were often tied to commuting and office work. Meanwhile, the stability in QSR, fast casual, and casual dining segments could indicate that these categories continue to meet consistent suburban demand for convenience and everyday dining, largely unaffected by the redistribution seen in the fine dining and coffee sectors.

Although QSR, fast casual, casual dining, fine dining, and coffee all fall under the wider dining umbrella, the data shows distinct consumer behavior patterns regarding visits to these five categories.

Limited service segments, including QSR, fast casual, and coffee tend to see higher shares of visits on weekdays, while full service segments – casual dining and fine dining – receive higher shares of weekend visits. Diving deeper shows that QSR has the largest share of weekday visits, with 72.3% of traffic coming in between Monday and Friday, followed by fast casual (69.8% of visits on weekdays) and coffee (69.4% of visits on weekdays.) Looking at trends within the work week shows that QSR receives a slightly larger visit share between Monday and Thursday compared to the other limited service segments. Meanwhile, coffee seems to receive the smallest share of Friday visits – 16.3% compared to 17.0% for fast casual and 17.2% for QSR.

On the full-service side, casual dining and fine dining chains have relatively similar shares of weekend visits (39.0% and 38.8%, respectively), but fine dining also sees an uptick of visits on Fridays (with 19.1% of weekly visits) as consumers choose to start the weekend on a festive note.

Hourly visit patterns also show variability between the segments. Coffee is the unsurprising leader of early visits, with 14.6% of visits taking place before 8 AM and, almost two-thirds (64.9%) of visits taking place before 2 PM. Fast casual leads the lunch rush (29.4% of visits between 11 AM and 2 PM), casual dining chains receive the largest share of afternoon (2 PM to 5 PM) visits, and fine dining chains receive the largest share of dinner visits, with almost 70% of visits taking place between 5 PM and 11 PM. QSR leads the late night visit share – 4.1% of visits take place between 11 PM and 5 AM – followed by casual dining chains (3.2% late night and overnight visit share), likely due to the popularity of 24-hour diners.

This suggests that each dining segment effectively "owns" a different part of the day, from the morning coffee ritual and the quick lunch break to the leisurely evening meal and late-night cravings.

An analysis of average visit duration also reveals a small but lasting shift in post-pandemic dining behavior. Between January and May 2025, the average dwell time for nearly every dining segment was shorter than during the same period in 2019. This efficiency trend is evident across limited-service categories like QSR, fast casual, and coffee shops, suggesting a continued emphasis on speed and convenience.

The one notable exception to this trend is upscale and fine dining, where the average visit duration has actually increased compared to pre-COVID levels. This may suggest that, while visits to most segments have become more transactional, consumers are treating fine dining more as an extended, deliberate experience, reinforcing its position as a destination-worthy occasion.

1. The Midwest is the only region where Black Friday retail visits outpace Super Saturday.

But several major Midwestern markets, including Chicago and Detroit, actually see higher shopper turnout on Super Saturday.

2. Holiday season demographic shifts also vary across regions.

Nationwide, electronics stores see a slight uptick in median household income (HHI) in December – yet in certain markets, electronics retailers such as Best Buy see a drop in captured market median HHI during this period.

3. Back-to-school shopping starts earliest for clothing and office supplies retailers in the South Central region, likely tied to earlier school schedules.

But back-to-school visits surge higher for these retailers in the Northeast later in the season.

4. The share of college students among back-to-school shoppers varies by region.

In August 2024, “Collegians” made up the largest share of Target’s back-to-school shopping crowd in New England, and the smallest in the West.

5. Mother’s Day drives the biggest restaurant visit spikes in the Middle Atlantic Region, while Father’s Day sees its biggest boosts in the South Atlantic states.

Mother’s Day diners also tend to travel farther to celebrate, suggesting an extra effort to treat mom.

6. Western states proved particularly responsive to McDonald’s recent Minecraft promotion.

During the week of A Minecraft Movie’s release, the promotion drove significantly higher visit spikes in the West than in the Eastern U.S.

Retailers rely on promotional events to fuel sales – from classics like Black Friday and back-to-school sales to unique limited-time offers (LTOs) and pop-culture collaborations. Yet consumer preferences and behavior can vary significantly by region, making it critical to tailor campaigns to local markets.

This report dives into the data to reveal how consumers in 2025 are responding to major retail promotions, exploring both broad regional trends and more localized market-level nuances. Where is Black Friday most popular, and which areas see a bigger turnout on Super Saturday? Where are restaurants most packed on Mother’s Day, and where on Father’s Day? Which region kicks off back-to-school shopping – and where are August shoppers most likely to be college students? And also – which part of the country went all out on McDonald’s recent Minecraft LTO?

Read on to find out.

Promotions aimed at boosting foot traffic on key holiday season milestones like Black Friday and Super Saturday are central to retailers’ strategies across industries. The day after Thanksgiving and the Saturday before Christmas typically rank among in-store retail’s busiest days, last year generating foot traffic surges of 50.1% and 56.3%, respectively, compared to a 12-month daily average. And

But a closer look at regional data shows that these promotions land differently across the country. In the Midwest, Black Friday outperformed Super Saturday last year, fueling the nation’s biggest post-Thanksgiving retail visit spike – a testament to the milestone’s strong local appeal. Meanwhile, in the Western U.S. Black Friday trailed well behind Super Saturday, though both milestones drove smaller upticks than in other regions. And in New England and the South Central states, Super Saturday achieved its biggest impact, suggesting that last-minute holiday specials may resonate especially well in that area.

Digging deeper into major Midwestern hubs shows that even within a single region, holiday promotions can produce widely different responses.

In St. Louis, Indianapolis, and Minneapolis, for example, consumers followed the broader Midwestern pattern, flocking to stores on Black Friday exhibiting less enthusiasm for Super Saturday deals. By contrast, Chicago and Detroit saw Super Saturday edge ahead, with Chicago’s Black Friday peak falling below the nationwide average of 50.1%. examples highlight the power of local preferences to shape holiday campaign results.

Holiday promotions don’t just drive visit spikes; they also spark subtle but significant changes in the demographic profiles of brick-and-mortar shoppers, expanding many retailers’ audiences during peak periods. And these shifts, too, can vary widely across regions.

Outlet malls, department stores, and beauty & self-care chains, for instance, which typically attract higher-income consumers, tend to see slight declines in the median household incomes (HHI) of their visitor bases in December. This dip may be due to promotions drawing in more mid- and lower-income shoppers during the peak holiday season. Electronics stores and superstores, on the other hand, which generally serve a less affluent base, see modest upticks in median HHI in the lead-up to Christmas.

But once again, drilling further down into regional chain-level data reveals more nuanced regional patterns. Take Best Buy, a leading holiday season electronics destination. In some of the chain’s biggest, more affluent markets – including New York, Los Angeles, and Chicago – the big-box retailer sees small dips in median HHI during December. But in Atlanta and Houston – also relatively affluent, but slightly less so – December saw a minor HHI uptick, hinting at a stronger holiday rush from higher-income shoppers in those cities.

Back-to-school promotions also play a pivotal role in the retail calendar, with superstores, apparel chains, office supply stores and others all vying for shopper attention. And though summer markdowns drive increased foot traffic nationwide, both the timing of these shifts and the composition of the back-to-school shopping crowd differ among regions.

Analyzing weekly fluctuations in regional foot traffic to clothing and office supplies stores shows, for example, that back-to-school shopping picks up earliest in the South Central region, likely due to earlier school start dates.

But the biggest visit peaks occur in the Northeast – with clothing retailer foot traffic surging in New England in late August, and office supplies stores seeing an even bigger surge in the Middle Atlantic region in early September. Retailers and advertisers can plan their back-to-school deals around these differences, targeting promotions to local trends.

Though K-12 families drive much of the back-to-school rush, college student shoppers also play a substantial role. And here, too, their participation varies by region.

For instance, the “Collegians” segment accounted for 2.2% of Target’s shopper base nationwide over the past year – rising to 3.0% in August 2024. But regionally, the share of “Collegians” soared as high as 4.0% in New England versus just 2.2% in the West. So while retailers in New England may choose to lean into the college vibe, those in Western states may place greater emphasis on families with children.

When it comes to dining, Mother’s Day and Father’s Day are the busiest days of the year for the full-service restaurant (FSR) category, as families treat their parents to a hassle-free meal out. And eateries nationwide capitalize on this trend by offering a variety of deals and promotions that add a little extra charm (and value) to the experience.

Nationwide, Mother’s Day drives more FSR foot traffic than Father’s Day – except in parts of the Pacific Northwest, where Father’s Day traditions run especially deep. Still, the size of these holiday boosts varies substantially by region.

This year, for instance, Mother’s Day (May 11, 2025) drove the largest FSR surge in the Middle Atlantic, with the South Atlantic and Midwest not far behind. Father’s Day, by contrast, saw its biggest lift in the South Atlantic. Mother’s Day proved least resonant in the West, whereas Father’s Day had its smallest impact in New England.

Dining behavior also differs between the two occasions. Mother’s Day celebrants display a slight preference for morning FSR visits and a bigger one for afternoon visits, while Father’s Day crowds favor evenings – perhaps reflecting a preference for sports bars and later dinners with dad. Another interesting nuance: On Mother’s Day, a larger share of FSR visits originate from between 3 and 50 miles away compared to Father’s Day, suggesting that families go the extra mile – sometimes literally – to celebrate mom.

While established dates like Black Friday or Mother’s Day naturally spur promotions, brands can also craft their own moments with limited-time offers (LTOs). And much like holiday campaigns, these retailer-led events can produce varied outcomes across different regions.

Fast food restaurants, for example, have leaned heavily on limited-time offers (LTOs) and pop-culture tie-ins to fuel buzz in what remains a challenging overall market. And McDonald’s recent Minecraft promotion, launched on April 1, 2025 to coincide with the April 3 release of A Minecraft Move, shows just how impactful the practice can be.

Nationally, the Minecraft promotion (featuring offerings for both kids and adults) drove a 6.9% lift in visits during the movie’s opening week. But the impact of the promotion was far from uniform across the U.S. Many of McDonald’s Western markets – including Utah, Idaho, Nevada, California, Texas, Arizona, Colorado, and Oregon – recorded visit lifts above 10.0%. Meanwhile, Kentucky saw a 2.1% dip, and several other Eastern states registered modest gains below 3.0%. The McDonald’s example illustrates the power of regional tastes to shape the success of even the most creative pop-culture collabs.

Whether it’s properly timing holiday and back-to-school discounts, recognizing where Mother’s Day or Father’s Day will resonate more, or pinpointing markets that respond best to pop-culture tie-ins, the data reveals that effective promotions depend heavily on local nuances. And by analyzing regional and DMA-level trends, retailers and advertisers can craft compelling, relevant campaigns that heighten engagement where it matters most.