.svg)

.png)

.png)

.png)

.png)

Brands like M&Ms, Hershey’s, and Jelly Belly are redefining what it means to be as happy as a “kid in a candy store.” With their life-size M&M characters on a flagship in Orlando, FL, a chocolate Statue of Liberty sculpted out of 800 pounds of Hershey’s chocolate on the Las Vegas Strip, or a working jellybean factory tour in Fairfield, CA, manufacturers are literally bringing their brands to life. M&M’s World in Orlando, FL posted particularly impressive year-over-year visits in the second half of 2023.

Recently, Hollywood darling Timothee Chalamet starred in the fantastical movie Wonka, grossing $600M+ worldwide. In other headline news, the “tried to jump on the wagon but failed miserably” fiasco of the unauthorized Willy’s Chocolate Experience in Scotland reveals that the appetite for sweets and chocolate is insatiable. Never fear, if you missed the Candytopia pop-up a few years ago, you can head over to Dylan’s Candy Bar for an experience right out of Charlie and the Chocolate Factory. It’s clear that demand peaks in the summer, probably due to locations that see summer tourists. The holidays are another popular season for buying sweets.

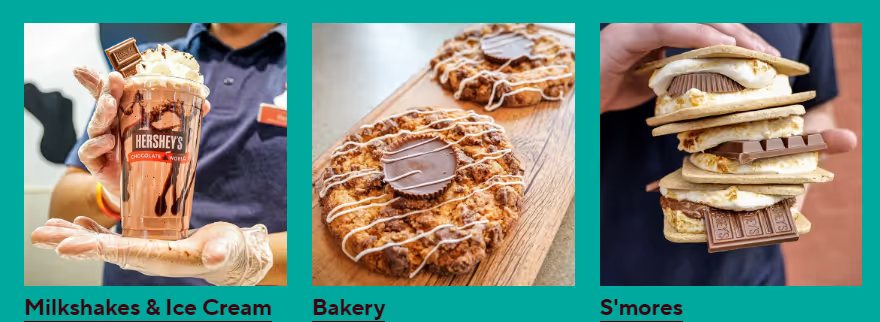

At Hershey’s Chocolate World, one can be immersed in all-things chocolate, from creating your own candy to taking a selfie with a life-size Reese’s peanut butter cup. The dessert options are limited only by your imagination. That tower of S’mores sure looks tempting!

Many visitors also opt to visit the Hershey Story Museum or stay at Hershey Lodge or the Hotel Hershey.

If you prefer your sweets in liquid form, there are three Coca-Cola Stores--in Atlanta, Las Vegas, and Orlando--to satisfy your cravings. Here, you can buy a Coke plushie, flout the famous “Enjoy Coca-Cola” slogan shirt in a variety of languages, or dress yourself head-to-toe in comfy Coke PJs. One of the coolest options is an international tasting flight that lets you try out Coca-Cola beverages from around the world, with flavors like sparberry from Zimbabwe.

At the Coca-Cola Store in Orlando, FL, visitation jumps during vacations like Spring Break, summer, and Christmas holidays.

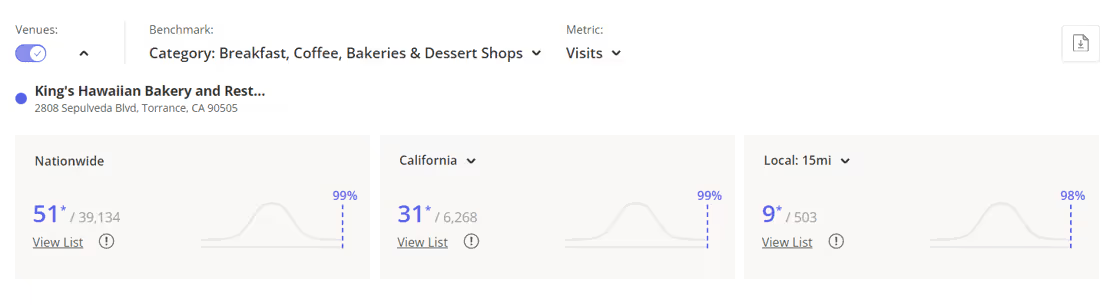

Another beloved brand that has made its way into brick-and-mortar is King’s Hawaiian. Founded in 1950, they were famous for their round loaves of sweet and fluffy Hawaiian bread. Fast forward three-quarters of a century later, and they have added new options like savory dinner rolls or pull-apart pans of bread. One can experience gastronomic delights made with Hawaiian bread at their Torrance-based King’s Hawaiian Bakery and Restaurant.

The restaurant menu includes breakfasts featuring their famous King’s Hawaiian Sweet Bread as French toast, lunch and dinner options like Macadamia Nut Onion Rings, Chicken Katsu Curry Loco Moco, and Saimin noodles, but it’s the bakery that literally takes the cake. The Paradise Delight Cake has three layers of chiffon cake in enticing flavors like guava, passionfruit, and lime. It is then topped with layers of fresh strawberries, peaches, and kiwis. One can also choose from chocolate, coconut, pineapple, raspberry cakes, and more.

With Placer's ranking of "Breakfast, Coffee, Bakeries, and Dessert Shops" indicating that King's is in the top 1% nationwide and statewide, it looks like they've found a sweet recipe for success.

The Waldorf Astoria and Ritz-Carlton hotels are two of the most recognizable names in luxury lodging. Both opened in New York City – the Waldorf Astoria in 1893 and the Ritz-Carlton in 1911 – and are owned by two major hotel corporations: the Waldorf Astoria is part the Hilton Hotels & Resorts portfolio of brands, while the Ritz-Carlton is part of Marriott International, Inc’s portfolio.

Who is most likely to visit each brand? What are the similarities – and differences – between the two hotels’ guest segmentations? We take a closer look at the demographic and psychographic data to find out.

Analyzing the demographic makeup of the Waldorf Astoria and Ritz-Carlton’s trade areas by layering the STI: Popstats dataset onto captured market trade areas revealed that the Waldorf Astoria’s trade area has a higher share of households with children compared to that of the Ritz-Carlton (25.6% compared to 23.6%). But both chains had a smaller share of households with children in their trade areas relative to the nationwide average (27.6%). It seems, then, that singles or empty nesters may be more likely to book a luxury getaway than consumers with heavier parenting responsibilities.

Unsurprisingly, the chains also attract a particularly high-income clientele: The median household income (HHI) in both brands’ trade areas is over 50% higher than the nationwide median ($108.4K and $104.5K for the trade areas of the Waldorf Astoria and Ritz Carlton, respectively, compared to a nationwide median of $69.5K). The data also showed that Waldorf Astoria’s trade area is slightly more affluent than that of the Ritz-Carlton – perhaps due in part to the Ritz-Carlton’s recent attempts to court younger guests.

.avif)

Leveraging the Spatial.ai: PersonaLive dataset to explore the psychographic composition of the hotel chains’ trade area further supports the distinctions between the brands highlighted in the demographic analysis.

The psychographic analysis showed that the Waldorf Astoria had more family segments in its trade area than the Ritz-Carlton, while the Ritz-Carlton catered to more single and empty-nester households – as expected given the demographic composition of the chains’ trade areas.

.avif)

Luxury hotels are known for their impeccable service – and to curate the ideal guest experience, these brands need to accurately predict their visitors' dining and leisure preferences. Hoteliers can leverage the Placer.ai Marketplace and combine trade area data with various datasets – including data on consumers’ social media activity with tools like the Spatial.ai: FollowGraph dataset – to pinpoint their guests’ tastes and preferences.

Analyzing the preferences for certain types of foods or entertainment within the hotel chains’ trade areas revealed – once again – similarities and differences between the brands. Both chains’ trade areas included larger shares of “Farm-to-Table Cooking Enthusiasts”, “Asian Food Enthusiasts”, and “Craft Coffee At-Home Enthusiasts,” as well as more “Opera Lovers” and “Salsa Music Fans” than the nationwide average. But the foodie segments were slightly more over-indexed within the Waldorf’s trade area, while residents of the Ritz-Carlton’s trade area seemed a little more keen on Opera and Salsa. These hotel chains can leverage this data to determine the type of dining or entertainment options that will set these brands apart from the competition and best attract their specific audience.

.avif)

The Waldorf Astoria and Ritz-Carlton continue to define luxury lodging in the country while attracting some of the nation's most discerning guests. Understanding the demographic and psychographic guest segmentation of each chain can help inform your loyalty strategy.

For more data-driven travel & leisure insights, visit placer.ai/blog.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

St. Patrick’s Day, which falls each year on March 17th, is a day for bar crawls, green makeup, and drinks with friends. Cities like New York and Chicago host major celebrations, drawing big crowds to their downtown areas. And bars and pubs fill up with revelers eager to mark the occasion with a green cocktail or a taste of corned beef and cabbage.

There’s plenty of joy to go around – and towns across the country are getting in on the St. Paddy’s Day action with parades and family-friendly events. What kind of a lift do traditional St. Patrick’s Day destinations like bars and pubs get on the big day? And what other retail categories stand to benefit from the occasion?

Unsurprisingly, bars and pubs get major boosts on the week of St. Patrick’s Day, as club hoppers and other celebrants converge on their local watering holes for drinks and fun. Chains like The Brass Tap and Bar Louie offer special deals and parties, with everything from green beer to Irish whiskey. And on the week of March 11th, 2024, visits to the two chains were up 15.7% and 21.1%, respectively, compared to an early October baseline – slightly outpacing even the busy Christmas season.

.avif)

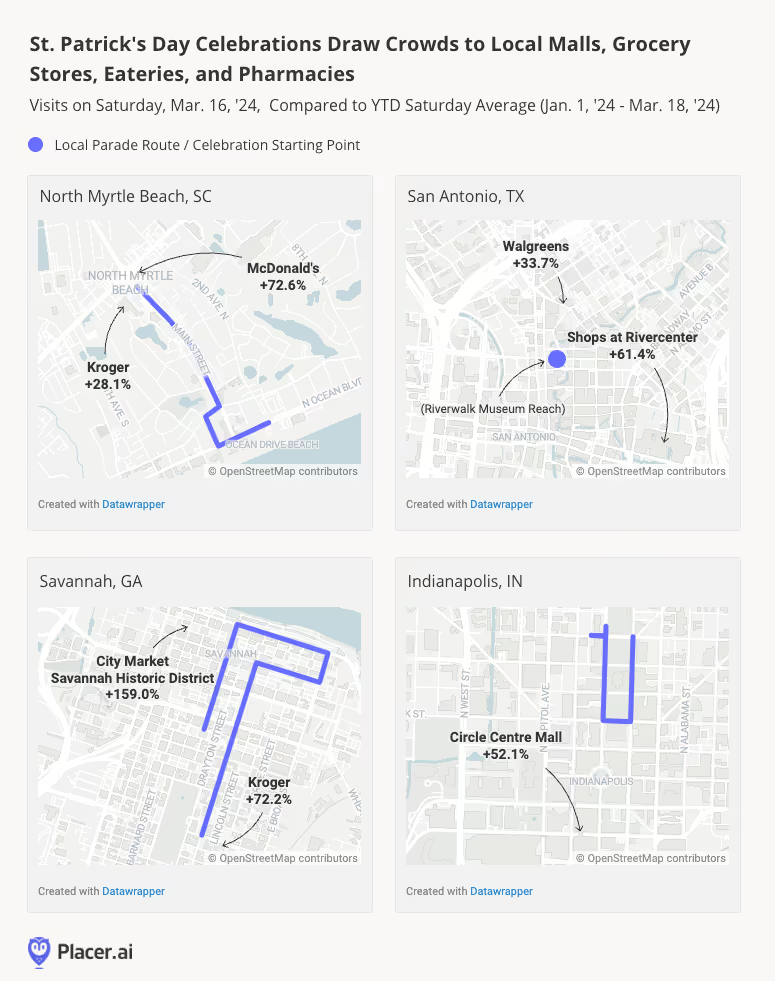

But St. Patrick’s Day isn’t just for bar crawling. And although the festivities are usually associated with major metropolises like New York City and Chicago, cities like Myrtle Beach, SC, San Antonio, TX. Indianapolis, IN, and Savannah, GA also come to life mid-March with parades and parties rivaling those of their bigger counterparts.

On Saturday, March 16th 2024 at 11:00 A.M., San Antonio, TX kicked off its annual St. Patrick’s Day festivities with the traditional dyeing of the San Antonio River. Throughout the weekend, parades and celebrations drew crowds to the city’s famed River Walk – and while bars and clubs undoubtedly benefited from the excitement, they weren’t the only ones to do so. San Antonio’s Shops at Rivercenter enjoyed its busiest day since 2019, drawing 61.4% more foot traffic on March 16th than on an average Saturday this year.

Savannah, GA, North Myrtle Beach, SC, and Indianapolis, IN also hosted big St. Patrick’s Day events, bringing foot traffic – and business – to local retailers. For Savannah, March 16th, 2024 marked the 200th anniversary of the city’s famous St. Patrick’s Day Parade, and the town was positively booming. City Market, the iconic shopping corridor located in the heart of Savannah’s Historic District, was the most crowded it’s been since at least January 2023, with March 17th 2023 (the day of last year’s parade) coming in a close second.

Malls and shopping districts weren’t the only places to get significant leprechaun-inspired visit bumps. Grocery stores, pharmacies, and eateries located in proximity to the festivities also reaped the benefits of the hubbub, as parade-goers likely dropped in to snag some essentials or fuel up for the long day.

And it isn’t just locals turning out for all these events. A look at hotel foot traffic patterns nationwide shows that the week of St. Patrick’s Day kicks off the hospitality industry’s spring season – with cities hosting special events seeing even more significant visit spikes. During the week of March 11th, 2024, hotel venues in the analyzed cities drew many more visits than usual, showcasing the power of St. Paddy’s Day to supercharge the tourism sector.

.png)

St. Patrick’s Day is about a lot more than bars and pubs. And in recent years, the popular green-themed holiday has emerged as an important driver of tourism and retail activity across the U.S.

What other local celebrations are fueling foot traffic spikes in cities nationwide? Does your city know the impact of location celebrations on local businesses? Are local businesses prepared for the increase in foot traffic and revenue opportunities during local celebrations?

Follow Placer.ai’s data-driven civic and retail analyses to find out.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

JOANN recently announced that it had filed for bankruptcy, and the company expects to go private as early as next month. Can the retailer still make a comeback? We dove into the data to find out.

JOANN went public in March 2021 – at the height of the pandemic – following a particularly strong 2020. The COVID-era crafting boom had put the company on a growth trajectory, with visits during the first year of the pandemic barely lower than in 2019 despite the lockdowns and movement restrictions. But as the country reopened and people’s schedules filled back up – leaving less time for sewing and knitting – visits began to fall. Foot traffic in 2021 was lower than in 2020, and by 2022, overall visits to the chain were 11.8% lower than they had been in 2019

But now, recent foot traffic data indicates that demand for fabric-related crafting supplies may be rebounding. In 2023, visits to the chain grew relative to 2022 and the visit gap relative to 2019 narrowed. Sewing appears to be making a comeback, with both millennials and Gen-Z exhibiting a newfound interest in the craft. And although the resurgence of interest in fiber arts was not strong enough to prevent JOANN’s recent bankruptcy filing, the YoY visit growth in 2023 indicates that the company should not be written off just yet.

.png)

According to C.F.O. Scott Sekella, 95% of JOANN’s stores are cash-flow positive. The company is also committed to maintaining usual operations during the court-supervised procedure. And this year as well – especially since the end of early 2024’s cold spell – JOANN’s year-over-year (YoY) visits have trended positive, even outperforming YoY foot traffic to other leading crafting retailers.

%20(1).png)

The unique nature of JOANN’s products give the company’s brick-and-mortar stores an advantage over digital counterparts: Crafters like to get a feel for the material before purchasing, and amateur DIY-ers who visit physical stores can consult with expert salespeople to receive guidance for ongoing projects. And although foot traffic to JOANN’s stores is not what it was at the height of the pandemic, the YoY visit growth in 2023 indicates that the brand is still serving many committed sewers and knitters who are choosing to shop in-person. So how can JOANN maintain its store fleet while optimizing in-store operations?

Analyzing the change in hourly visits between 2022 and 2023 reveals that the YoY growth is not evenly distributed across dayparts. Morning and early afternoon visits saw modest increases, but traffic growth really ramped up in the afternoon and evening – peaking between 6:00 and 6:59 PM – and visits actually decreased between 7:00 and 8:59 PM. Should the company try to streamline its logistics without sacrificing its large store fleet, JOANN may focus its staffing and operational costs on the dayparts with the most growth potential and reduce expenditure during the less popular timeslots.

.png)

Despite the crafting retailer’s current rough patch, location intelligence suggests that the company is a strong contender for a post-bankruptcy comeback. And the positive YoY trends also indicate that – despite the ongoing headwinds and contraction in discretionary spending – there is still demand for hobby-driven retail in 2024.

How will the bankruptcy proceedings impact foot traffic to JOANN? What does the rest of 2024 hold for the brand?

Check in with our blog at placer.ai to find out.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

With rumors swirling of a potential Panera Bread IPO in 2024, we dove into the data to find out how the St. Louis, Missouri-based company is performing – and what sets Panera apart from its competition.

Panera Bread has been on a growth spurt recently, with monthly visits over the past 12 months consistently exceeding 2022/2023 levels. Part of the traffic increase may be due to the brand’s larger store fleet – Panera expanded into urban and non-traditional markets with small-format locations focused on pick-up and digital ordering. And the company is not resting on its laurels, with Panera revamping its menu to compete more directly with meal-focussed fast casual concepts.

.png)

Because Panera straddles the line of coffee QSR and fast-casual lunch spot, there is no one dining chain that directly competes with Panera on all fronts. Instead, Panera plays a unique role in the QSR/fast casual landscape: The chain has a strong café feel, with the company’s “Sip Club” membership program seems specifically designed to appeal to customers looking for frequent coffee fixes. But Panera also offers more substantial fare, and the upcoming menu overhaul promises to add even more hearty salads and affordable sandwiches to its array of options.

The new menu may be aimed towards attracting more budget-conscious diners thanks to a focus on larger portions and the addition of several items priced at under $10. Some speculate that the changes are also part of the company’s broader refocusing towards the lunchtime daypart. Comparing Panera to Starbucks, which competes with Panera on the coffee shop and affordable foods front, and to Sweetgreen, a strong presence in the fast-casual lunch market, can shed light on Panera’s role within the increasingly competitive dining landscape.

Panera’s hourly visitation pattern highlights its unique place within the wider QSR-fast casual landscape. Like Sweetgreen, Panera experiences a lunchtime foot traffic rush – 30.8% of daily visits to the chain take place between 12 PM and 2 PM. But Panera also receives almost a third of its visits before noon – 30.2% of visits to the chain take between 6 AM and 11 AM, compared to just 13.2% of visits to Sweetgreen. Between 9 AM and 11 AM, Panera’s hourly visit share of 20.8% is almost on par with Starbucks’ 25.3%. (The small number of morning Sweetgreen visits is likely also driven by a difference in opening hours, with most Sweetgreen locations only opening at around 10:30 AM).

Meanwhile, Panera also seems to be a strong dinner contender. Although Panera’s evening performance may not be quite as strong as Sweetgreen’s, the St. Louis-based dining chain still sees 17.3% of its daily visits between 6 PM and 8 PM – almost double Starbucks’ 9.8.%.

These hourly visitation patterns indicate that while a significant contingent of Panera patrons treat the chain as their go-to coffee shop, many others tend to consider Panera as a lunch or early dinner destination.

.avif)

Although analyzing hourly visitation patterns highlight similarities between Panera and Sweetgreen, focusing on the three chains’ visitor bases reveals many more similarities between Starbucks and Panera.

The median HHIs in Panera and Starbucks’ trade areas stand at $79.2K/year and $76.4K/year, respectively. Around 34% of both chains’ trade areas consist of non-family and one-person households and 28% consist of households with children. Meanwhile, Sweetgreen tends to attract a much larger share of affluent singles – 42.9% of households in Sweetgreen’s trade area are non-family and one person households, and the salad and grain-bowl focused chain has a trade area median HHI stands at $102K/year.

It seems, then, that although Panera appears to compete with Sweetgreen for the lunch rush – and to a lesser extent, for dinner visits as well – the two brands’ audience bases are substantially different. On the other hand, Panera’s visitor base seems to overlap significantly with that of Starbucks – which may explain Panera’s move towards enhanced portion sizes and affordable meal options, which may set it even further apart from the Seattle-based coffee giant.

.png)

Panera Bread is one of 2024’s most anticipated IPOs – and location intelligence metrics suggest that the buzz is well substantiated.

For more data-driven dining insights, visit our blog at placer.ai.

This blog includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Nowruz took place on March 20 this year, and this celebration of the spring equinox dates back over three thousand years. Westwood Blvd, just south of UCLA, is home to a profusion of Persian restaurants, markets, bookstores, and ice-cream stores with flavors not found in your typical Baskin-Robbins. Hence, the affectionate moniker Tehrangeles for this little pocket where an Iranian diaspora has settled.

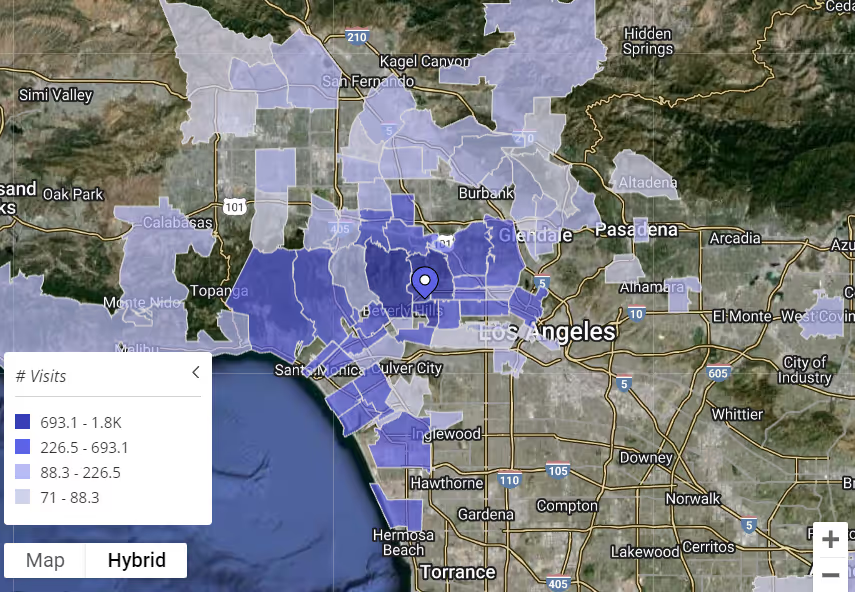

Restaurants like Shamshiri Grill, with its juicy beef koobideh kebab broiled to perfection and tomatoes that burst in your mouth, proves to be a hit with a wide cross-section of Angelenos. For dessert, be sure to stop at nearby Saffron & Rose for their namesake flavors or Mashti Malone’s for a uniquely Persian faloodeh shirazi, similar to a rosewater sorbet, topped with cherry sauce and rice starch vermicelli.

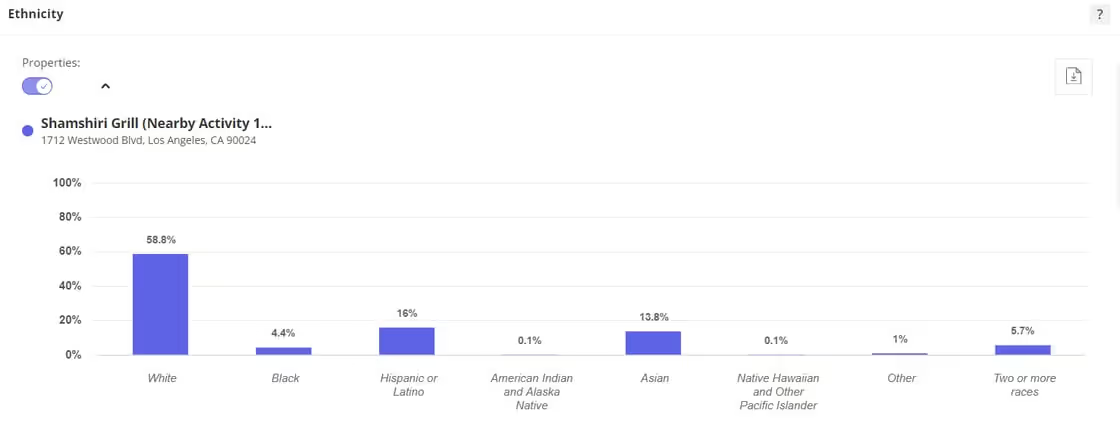

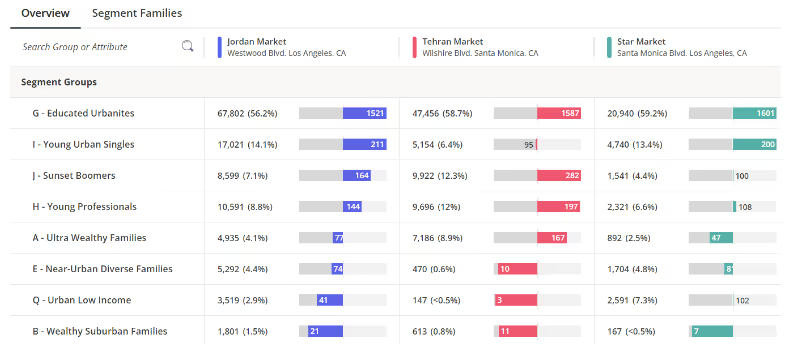

There are also numerous Persian markets in the area should you want to buy groceries and try cooking yourself. Jordan Market, Tehran Market, and Star Market all see over half their clientele come from the segment of Educated Urbanites.

If you’d like to simultaneously celebrate Women’s History Month and buy yourself a little something for the New Year, then look no further than Cult Gaia, just a short drive away in West Hollywood. Founded by Jasmin Larian Hekmat in 2012, its Ark bag reached cult status within just a few years. Oozing a vacation-ready vibe and cool-girl aesthetic, the LA-based designer has most recently opened up a new store on the ritzy island of St. Barths. While the majority of visits to the West Hollywood store come from metro LA, there are still quite a few fans coming from further afield to shop.

New year, new retail opportunities. And though 2023 is firmly in the rearview mirror, the economic headwinds that characterized much of the year have yet to fully dissipate. But every challenge also brings with it new opportunities, and many retailers are adapting to meet their customers' changing wants and needs.

This white paper analyzes location intelligence for 10 brands poised to succeed in 2024. Some, like low-cost apparel and home furnishing stores, are benefitting from consumer trade-down. Others are expanding into rural or suburban areas to meet customers where they are. Read on for some of 2024’s retail winners.

Until around four years ago, New Balance sneakers were commonly seen on the feet of suburban dads – not exactly a recipe for high fashion. But all that began to change in 2019 when the company began collaborating with Teddy Santis, who eventually became New Balance’s creative director. Since then, the brand’s popularity has surged among Gen Z and X and is now one of the fastest-growing sneaker companies in the industry, despite the increasing competition in sneaker space. In 2023, foot traffic to New Balance stores grew 3.3% year-over-year (YoY) and the brand has firmly established itself as ultimate retro cool.

Diving into the demographics of New Balance stores’ captured market trade area reveals the success of the chain’s rebranding. In 2023, New Balance’s trade area included larger shares of “Ultra Wealthy Families,” “Young Professionals,” and “Educated Urbanites” than the average shoe store’s trade area – highlighting New Balance’s successful reinvention as a brand for the young and hip.

The home improvement space is dominated by Lowe’s and Home Depot – but Harbor Freight Tools is quickly making a name for itself as a go-to destination for affordable tools and supplies.

Over the past few years, Harbor Freight Tools has expanded rapidly, with many of its new stores opening in smaller towns and cities. And the expansion appears to be paying off, with visits up YoY during every month of 2023. And although the chain is now operating with a significantly larger store fleet, the average number of visits per venue has generally increased – indicating that the company is expanding into markets where it is meeting a ready demand.

Over a decade after Mackelmore dropped his smash hit “Thrift Shop” in 2012, second-hand stores are still enjoying their time in the limelight. Shoppers, driven by a desire to reduce waste, find unique styles, and to save a few dollars at the till, continue to flock to thrift stores. And Winmark Corporation, which operates five secondhand goods chains – including apparel brands Plato’s Closet (young adult clothes), Once Upon a Child (children's clothes and toys), and Style Encore (women's clothing) – has benefited from the strong demand. Visits to the three Winmark clothing banners increased an average of 5.3% YoY in 2023.

The median household income (HHI) in the trade areas of Winmark’s apparel chains tends to be lower than the median HHI in the wider apparel category – so budget-conscious consumers are driving at least some of the company’s growth. With more consumers looking for ways to cut back on spending in 2024, the demand for second-hand clothes is expected to grow even further – and Winmark is likely to continue reaping the benefits.

HomeGoods, a treasure hunter's dream, is the discount home furnishing retailer owned by off-price retail giant TJX Companies. The chain, which operates over 900 brick-and-mortar stores, recently closed its e-commerce platform to focus on its physical locations – where foot traffic grew 6.0% between 2023 and 2022.

HomeGoods carries kitchen and home decor items along with furniture, and may be benefiting from the relative strength of the houseware segment, driven in part by an increase in at-home entertainment. And in a surprising twist, this low-cost retailer attracts more affluent visitors than visitors to the home furnishing segment overall. The median household income (HHI) in HomeGoods’ trade area stood at $84.7K/year compared to a $78.5K median HHI in the trade area of the average home furnishing chain. As economic uncertainty and the resumption of student loan payments impact consumers, wealthier shoppers seeking a budget-friendly home refresh are likely to continue choosing HomeGoods over pricier alternatives.

Florida-based Bealls, Inc., which got its start as a small town five-and-dime in 1915 in Bradenton, Florida, now operates over 600 stores across the country. The company, which saw an impressive 9.0% YoY increase in visits in 2023, recently consolidated its two largest banners – Burkes Outlet and Bealls Outlet – under the Bealls name.

One reason for Bealls’ success could be its appeal to rural consumers. Over the past five years, the share of households falling into Spatial.ai: PersonaLive’s “Rural Average Income” segment has steadily increased, growing from 12.6% in 2019 to 15.1% in 2023. With rural shoppers continuing to command ever-more attention from retailers, the increase in visits from this segment bodes well for Bealls in 2024.

Ollie’s Bargain Outlet was built for this economy. The chain saw a 13.0% YoY increase in visits in 2023, thanks in part to its popularity among a wide array of budget-conscious consumers. Ollie’s has found success with rural shoppers while maintaining its appeal among value-oriented suburban segments – and the chain’s diverse audience base seems to be setting it apart from other discount retailers.

A closer look at the chain’s captured market data, layered with the Spatial.ai: Personalive dataset, reveals that Ollie’s trade area includes larger shares of the “Blue Collar Suburbs” and “Suburban Boomer” segments when compared to the wider Discount & Dollar Stores category. As the chain plots its expansion, focusing on suburban and rural areas may help Ollie’s meet its customers where they are.

Trader Joe’s has managed to do what few stores can. The company does not invest in marketing, has no online shopping options, and loyalty programs? Forget about it. But despite this unusual approach to running a business, the California native has enjoyed consistent success over the years, with a 12.4% YoY increase in visits in 2023.

Trader Joe’s is particularly popular among younger shoppers, perhaps thanks to the company’s focus on sustainability and social responsibility – as well as its famously low prices. Analyzing the chain’s trade area using the AGS: Panorama dataset reveals that Trader Joe’s attracts more “Emerging Leaders” and “Young Coastal Technocrats” (segments that describe highly educated young professionals) than the average grocery chain. With Gen Z particularly concerned about putting their money where their mouth is, Trader Joe’s is likely to sustain its momentum in 2024 and beyond.

Convenience stores are growing up and evolving into bona-fide dining destinations. And Foxtrot, a Chicago-based chain with 29 stores across Texas, Illinois, Washington, Maryland, and Virginia, is one c-store redefining what a convenience store can be. The chain, which announced a merger with Dom’s Kitchen in November 2023, offers an upscale convenience store experience and is particularly known for including local brands in its product assortment as well as its excellent wine curation and dining options.

Visitors to the chain were significantly more likely to fall into AGS: Behavior & Attitudes dataset’s “Wine Drinker” or “Nutritionally Aware” segments than visitors to nearby convenience stores. The company plans to ramp up store openings, particularly in the suburbs, where convenience and a good bottle of wine might just find the perfect home as a welcome distraction from the daily grind.

Jersey Mike’s is one of the fastest-growing franchise dining chains in the country, operating over 2,500 locations in all 50 states. The sandwich chain has seen its popularity take off over the past few years, with 2023 visits up 14.1% YoY and plans to open 350 new stores in 2024.

The company has long prioritized affluent class suburban customers – and visitation data layered with the Experian: Mosaic dataset reveals that Jersey Mike’s has indeed succeeded in attracting this audience. The percentage of “Booming with Confidence” and “Flourishing Families” (both affluent segments) in Jersey Mike’s trade area was larger than in the trade areas of the average sub sandwich chain. As Jersey Mike’s continues its expansion, focusing on suburban areas may continue to serve the chain well.

The East Coast may not be the first region that pops to mind when thinking about tropical smoothies – but New Jersey-based Playa Bowls is making it work. The company was founded by avid surf enthusiasts determined to bring the flavors of their favorite surfing towns stateside.

Playa Bowls has enjoyed strong visit numbers in 2023, with overall visits up 23.0% and average visits per venue up 17.1% YoY – and part of the chain’s success may be driven by its ability to draw wealthier customers to its stores. The Experian: Mosaic dataset reveals that the “Power Elite” segment is overrepresented in the company’s trade areas: The share of households falling into that segment from Playa Bowl’s captured market exceeded their share in the company’s potential market. As the chain continues expanding its domestic footprint, it seems to have found its niche among a wealthy customer base.

The past year saw a wide range of challenges facing brick-and-mortar retailers as economic fears continued to shake consumer confidence. But there are plenty of bright spots as the new year gets underway. These ten brands prove that the retail world never stands still, and that the next opportunity is just around the corner.

Sports leagues like the NBA, NFL, and MLB boast billion-dollar revenues – and the venues where these games unfold hold significant commercial potential in their own rights. Many stadiums host concerts and other shows in addition to regularly held sporting matches and can accommodate tens of thousands of spectators at once – creating massive retail, dining, and advertisement opportunities.

This white paper analyzes location intelligence metrics for some of the biggest stadiums across the country to reveal the commercial potential of these venues beyond simple ticketing revenue. Where do visitors of various stadiums like to shop? Do specific sporting and cultural events impact the nearby restaurant scene differently? How can stadium operators, local businesses, and advertisers tailor their offerings to a stadium’s particular audience and make the most of the stadium and the space throughout the year?

We take a closer look below.

The three major sports leagues – the National Basketball League (NBA), Major League Baseball (MLB), and the National Football League (NFL) – play at different points of the year, and the number of games each league holds during the season also varies.

MLB leads in game frequency, with each team playing 162 games during the regular season, which runs approximately from April through September. Basketball season is also around six months – roughly from mid-October to mid-April – but each NBA team plays only 82 games a season. And the NFL has both the shortest season – 18 weeks running from early September to early January (with the pre-season starting in August) – and the fewest number of matches per team. Understanding the monthly visitation patterns for the various types of stadiums can help advertisers, stadium operators, and other stakeholders ensure that they are leveraging the full potential of the venue throughout the year.

Unsurprisingly, the sports arenas serving the different leagues see visit spikes during their leagues’ respective season. But comparing visit numbers throughout the year to the average monthly visit numbers for each category in 2023 reveals that the relative visit increases and decreases during the on- and off-season vary for each type of stadium.

MLB stadiums display the steadiest visit strength during the on-season – perhaps due to MLB’s packed game schedule. MLB tickets also tend to be relatively affordable compared to tickets to pro football or basketball matches, which may also contribute to MLB’s consistently strong visit numbers throughout the season. During the MLB off-season, baseball fields – which tend to be uncovered – are relatively empty.

The seasonal visit spike to NBA arenas is less steady. The beginning and end of the season see strong peaks, and visits slow down slightly during the mid-season months of January and February. Visits then drop during the off-season spring and summer, but the off-season visit dip is not as low as it is for MLB fields – perhaps because the NBA arenas’ indoor nature make them suitable locations for concerts and other non-basketball events.

Meanwhile, NFL stadiums see the least dramatic drop in visits during the NFL off-season, as these venues’ enormous size also make them the ideal location for concerts and other cultural events that draw large crowds. These arenas’ strong almost year-round visitation numbers mean that sponsors and advertisers looking to expand beyond sports fans to reach a diverse audience may have the most success with these venues.

Although MLB offers the most budget-friendly outing, combining STI: Popstats demographic metrics with trade area data reveals that MLB stadium visitors reside in higher-income areas when compared with visitors to NBA or NFL stadiums.

Baseball fans tend to be older than fans of the other sports, which could partially explain MLB stadium visitors’ higher household income (HHI). The combination of lower ticket prices, higher median HHI among fans, and many games per season offers baseball stadiums significant opportunities to engage effectively with their fan bases.

But while NBA and NFL stadium attendees may not come from as high-income areas as do MLB stadium visitors, fans of live basketball and football still reside in trade areas with a higher HHI compared to the nationwide median. So by leveraging stadium space, advertisers and other stakeholders can reach tens of thousands of relatively high-income consumers easily and effectively.

Sports fans are known to be passionate, engaged, and willing to spend money on their team – but stadium visitors also shop for non-sports related goods and services. Retailers and advertisers can draw on location analytics to uncover the consumer preferences of stadium visitors and tailor campaigns, sponsorships, and collaborations accordingly.

Visitation data to the top five most visited MLB stadiums during 2023 showed differences between the apparel and sporting goods shopping preferences of the various stadiums’ attendees. While 39.4% of visitors to Truist Park also visited DICK’s in 2023, only 30.8% of Yankee Stadium visitors stopped by the sporting goods retailer in the same period. Similarly, while 29.9% of visitors to Yankee Stadium frequented Kohl’s, that percentage jumped to 47.3% for Busch Stadium visitors.

Harnessing location intelligence to see the consumer preferences of a stadium’s visitor base can help retailers, stadium operators, and even team managers choose partnerships and merchandising agreements that will yield the most effective results.

Sports and snacks go hand in hand – what would a baseball game be without a hot dog or peanuts? But while every stadium likely provides a similar core of traditional game day eats, each venue also offers a unique set of dining options, both on- and off-premise. And by leveraging location analytics to gain visibility into stadium-goers dining habits, stadium operators and local food businesses can understand how to best serve each arena’s audience.

Mapping where stadium visitors dine before and after games can help stakeholders in the stadium industry reach more fans.

The chart below shows the share of visitors coming to a stadium from a dining venue (on the x-axis) or going to a dining venue after visiting the stadium (on the y-axis). The data reveals a correlation between pre-stadium dining and post-stadium dining – stadiums where many guests visit dining venues before the stadium also tend to have a large share of guests going to dining venues after the event. For example, the AT&T Stadium in Arlington, Texas, saw large shares of visitors grabbing a bite to eat on their journey to or from the stadium, while the M&T Bank Stadium in Baltimore, Maryland saw low rates of pre- and post stadium dining engagement.

These trends present opportunities for both local businesses and stadium stakeholders. For example, venues with high dining engagement can explore partnerships with local restaurants, while those with lower rates can build out their in-house dining options for hungry sports fans.

Stadiums looking to enhance their food offerings – or local entrepreneurs thinking of opening a restaurant near a stadium – can also get inspired by stadium visitors’ dining preferences. For example, psychographic data taken from the Spatial.ai: FollowGraph dataset reveals that visitors to MetLife Stadium in East Rutherford, New Jersey have a much stronger preference for Asian cuisine compared to New Jersey residents overall. With that knowledge, the stadium can enhance the visitor experience by expanding its Asian food offerings.

On the other hand, MetLife Stadium goers seem much less partial to Brewery fare than average New Jerseyans, so the stadium operators and restaurateurs may want to avoid offering too many Brewery-themed dining options. Stadium stakeholders can reserve the craft beers for Caesars Stadium, M&T Bank Stadium, and Soldier Field Stadiums, where visitors seem to enjoy artisanal brews more than the average resident in Louisiana, Maryland, and Illinois, respectively.

All of the stadiums analyzed exhibited unique visitor dining tastes, a reminder that no customer or fan base is alike. Aligning on- or off-site dining options with offerings that align with a given customer base’s preferences can improve overall visitor satisfaction and boost revenues.

Zooming in to look at consumer behavior around individual events reveals further variability in dining preferences even among visitors to the same stadium, with different types of events driving distinct dining behaviors.

State Farm Stadium in Glendale, Arizona, is home to the Arizona Cardinals. The stadium hosted the 2023 Super Bowl, but the NFL stadium also acts as a concert venue for acts ranging from Taylor Swift to Metallica. And location intelligence reveals that the dining preferences of stadium visitors vary based on the events held at the venue.

During the Super Bowl, sports bars such as Yard House and Buffalo Wild Wings saw the largest increase in visits compared to the chains’ daily average. A month later, attendees at Taylor Swift's concert gave fried-chicken leader Raising Cane’s a significant boost.

Local restaurants can leverage location analytics to see what types of events are popular with their visitor base and craft collaborations and advertising campaigns that resonate effectively with their patrons.

Sports stadiums and arenas are not just spaces for sports and music enthusiasts to gather; they also offer significant commercial opportunities for the surrounding communities. Stadium operators and local businesses can fine-tune their offerings by utilizing location analytics to better connect with their visitor bases and uncover new retail opportunities.

The dining industry showcased its agility over the past couple of years as it rapidly adapted to shifts in consumer preference brought on by COVID and rising prices. And with a new year around the corner, the pace of change shows no signs of slowing down.

This white paper harnesses location analytics, including visitation patterns, demographic data, and psychographic insights, to explore the trends that will shape the dining space in 2024. Which dining segments are likely to pull ahead of the pack? How are chains responding to changes in visitor behavior? And where are brands driving dining foot traffic by taking advantage of a new advertising possibility? Read on to find out how dining leaders can tap into emerging trends to stay ahead of the competition in 2024.

Comparing quarterly visits in 2023 and 2022 highlights the impact of the ongoing economic headwinds on the dining industry. The year started off strong, with year-over-year (YoY) dining visits up overall in Q1 2023 – perhaps aided by the comparison to an Omicron-impacted muted Q1 2022. And while overall dining growth stalled in Q2 2023, several segments – including QSR, Fast Casual, and Coffee – continued posting YoY visit increases, likely bolstered by consumers trading down from pricier full-service concepts.

Foot traffic slowed significantly in Q3 2023 as inflation and tighter consumer budgets constrained discretionary spending. Overall dining visits fell 2.4% YoY, and full-service restaurants – with their relatively high price point compared to other dining segments – seemed to be particularly impacted by the wider economic outlook. But the data also revealed some bright spots: Fast Casual still succeeded in maintaining positive YoY visit numbers and Coffee saw its Q3 visit grow an impressive 5.4% YoY. As the return to office continues, a pre-work coffee run or lunchtime foray to a fast-casual chain may continue propelling the two segments forward.

Restaurant visitation patterns have evolved over the past few years. Although an 8 PM seating was once the most coveted slot at fine-dining restaurants, recent visitation data suggests that sitting down to dinner earlier is rising in popularity.

But among the QSR segment, the opposite trend is emerging, with late-night visits rising. Analyzing hourly foot traffic to several major QSR chains reveals that the share of visits between 9 PM and 12 AM increased significantly between Q3 2019 and Q3 2023. Even Taco Bell – already known for its popularity among the late-night crowd – saw a substantial increase in late-night visits YoY – from 15.4% to 20.3%.

Who is driving the late night visit surge? One reason restaurants have been expanding their opening hours is to capture more Gen-Z diners, who tend to seek out nighttime dining options. But location intelligence reveals that younger millennials are also taking advantage of the later QSR closing times.

An analysis of the captured market for trade areas of top locations within one of Taco Bell’s major markets – the Chicago-Naperville-Elgin, IL-IN-WI Metropolitan area – reveals a year-over-four-year (Yo4Y) increase in “Singles & Starters.” The “Singles & Starters” segment is defined by Experian: Mosaic as young singles and starter families living in cities who are typically between 25 and 30 years old. As consumers continue to prioritize experiential entertainment and going out with friends, late-night dining may continue to see increased interest from young city-dwellers.

Millennials and Gen-Z consumers aren’t only heading to their favorite fast food joint for a late-night bite – these audience segments are also helping drive visits on the weekends. Smoothie King is one chain feeling the benefits of young, health-conscious consumers.

The chain, which opened in New Orleans, LA, in 1973 as a health food store, has since grown to over 1,100 locations nationwide and is currently expanding, focusing on the Dallas-Fort Worth CBSA. The area’s Smoothie King venues have seen strong visitation patterns, particularly on the weekends – weekend visits were up 3.4% YoY in Q3 2023. The smoothie brand’s trade areas in the greater Dallas region is also seeing a YoY increase in weekend visits from “Young Professionals” – defined by the Spatial.ai PersonaLive dataset as “well-educated young professionals starting their careers in white-collar or technical jobs.”

While some dining chains are appealing to the late-night or weekend crowd, others are driving visits by appealing to sports lovers. How have recent rule changes around student athletes changed the restaurant game, and how can college football teams drive business in their hometowns?

College sports have long been a major moneymaker, with top-tier teams raking in billions of dollars annually. And as of 2021, college athletes can enjoy a piece of the significant fan following of college sports thanks to the change in the NCAA’s Name, Image, and Likeness (NIL) rules, which now allows student athletes to sign endorsement deals.

Since then, multiple restaurants have jumped on the opportunity to partner with student athletes, some of whom have millions of followers on Instagram and TikTok. Chains like Chipotle, Sweetgreen, Slim Chickens, and Hooters have all signed college athletes to various brand deals.

How can brands ensure they partner with athletes their customers will want to engage with? Analyzing a chain’s audience by looking at the interests of residents in a given chain’s trade area can reveal which type of athlete will be the most attractive to each brand’s customer base. For example, data from Spatial.ai: Followgraph provides insight into the social media activity of consumers in a given trade area and can highlight desirable partnerships.

Examining the trade areas of Chipotle, Sweetgreen, Slim Chickens, and Hooters, for instance, reveals that Sweetgreen’s visitors tended to have the largest share of Women’s Soccer followers. Conversely, Sweetgreen’s trade area had lower-than-average shares of College Football Fans or College Basketball Fans, while residents of the trade areas of the other three chains showed greater-than-average interest in these sports. Leveraging location intelligence can help companies choose brand deals that their customers resonate with and find the ideal athletes to represent the chain.

Finding the right college athlete partnership is one way for dining brands to appeal to college sports enthusiasts. But dining chains and venues located near major college stadiums also benefit from the popularity of their local team by enjoying a major game day visit boost.

One of the country’s most popular college football teams, the Ohio State Buckeyes, can draw millions of TV viewers, and its stadium has a capacity of 102,780 – one of the largest stadiums in the country. And while tailgating is a popular activity for Buckeyes fans, nearby restaurants are some of the biggest beneficiaries of the college football craze. Panera experienced a 235.3% increase on game days as compared to a typical day, Domino’s Pizza visits grew by 283.3%, and Tommy’s Pizza, a local pie shop, saw its visits jump by a whopping 600.9%.

This influx in diners also causes a major shift in game day visitor demographics, as revealed by changes in visitors at dining venues located near stadiums of two of the nation’s best college football teams – the Ohio State Buckeyes and Ole Miss Rebels. Based on Spatial.ai: Personalive data for the captured market of these dining venues, game day visitors tended to come from “Ultra Wealthy Families” when compared to visitors during a typical non-game day in September or October.

The analysis indicates that popular sporting events create a unique opportunity for restaurants near college stadiums to attract high-income customers game day after game day, year after year.

While some spend game day tailgating or visiting a college restaurant, others hold a viewing party – with a six-foot submarine. And the sub’s popularity extends beyond Superbowl Sundays. Sandwich chains including Jersey Mike’s, Firehouse Subs, Jimmy John’s, and Subway (recently purchased by the same company that owns Jimmy John’s) have seen sustained YoY increases in visits and visits per venue in the first three quarters of 2023.

Some of the growth to these chains may be related to their affordability, a draw at all times but especially during a period marked by consumer uncertainty and rising food costs. And subway leaders seem to be seizing the moment and striking while the iron is hot – Jersey Mike’s opened 350 stores in 2023 and still saw its YoY visits per venue grow by 6.6%. And Subway reported ten consecutive quarters of positive sales, a promising sign for its new owner.

The love for a healthy, affordable sandwich extends across all income levels, with all four chains seeing a range in their visitors' median household income (HHI). Out of the four chains analyzed, Jersey Mike’s – which has long prioritized a suburban, middle-income customer – had the highest trade area median household income of the four chains at $77.3K/year. Subway, known for its affordability, had the lowest, with $62.9K/year. The variance in median HHI combined with the strong foot traffic growth shows that when it comes to sandwiches, there’s something for everyone.

Persistent inflation and declining consumer sentiment may pose serious challenges for the dining space, but emerging trends are helping boost some restaurants. Customers seeking out a late-night bite drive visits to QSR chains, and health-conscious diners are boosting foot traffic to smoothie bars and sandwich shops. Meanwhile, sports sponsorships and game-day restaurant visits can provide a boost to dining businesses that take advantage of these opportunities.