.svg)

.png)

.png)

.png)

.png)

Kohl’s emergence as a hot new meme stock wasn’t on anyone’s bingo card for 2025. The retailer has grappled with declining sales and ongoing leadership challenges, driving a steep drop in its share price over the past several years. But beyond the internet buzz, is there any real reason for optimism about Kohl’s outlook?

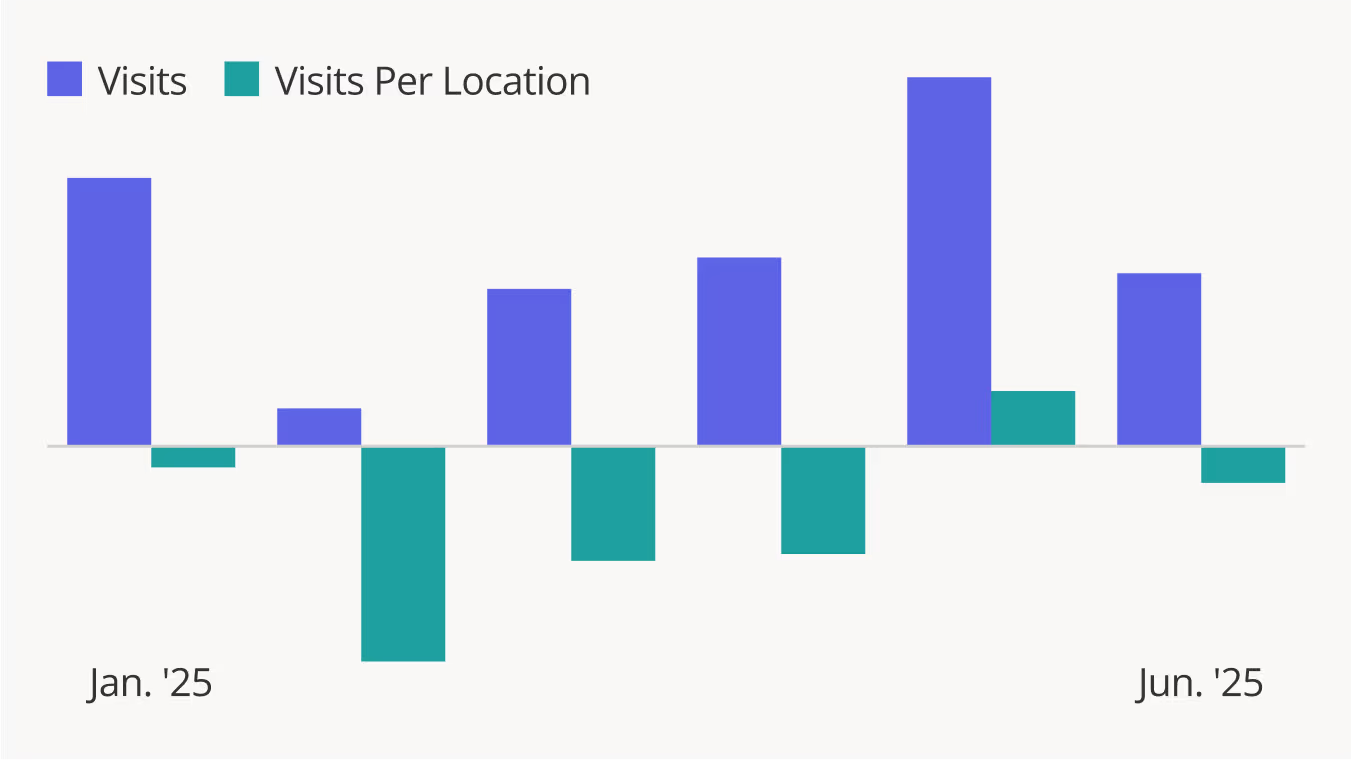

Despite recent setbacks, Kohl’s surprised investors in Q1 2025 with a smaller-than-expected 3.9% year-over-year (YoY) drop in comparable sales – fueling speculation that a turnaround might be in the works. The company’s foot traffic gap also narrowed to just 2.7% YoY in Q1, a notable improvement from the 6.0% gap in Q4 2024. In Q2 2025, too, Kohl’s visit-per-location gap remained relatively modest at 3.1%. But monthly YoY data showed substantial volatility, with June experiencing a sharp decline while March through May visits per location held close to last year’s levels.

All in all, Kohl’s clearly has a long way to go to reclaim its former glory – and it’s too soon to tell whether a comeback is indeed in the cards. But with the right strategy, the data does point to some underlying strength that may help the company regain its footing – meme stock or not.

For more data-driven retail analyses, follow Placer.ai/anchor.

Pharmacies have weathered a challenging landscape in recent years, marked by shrinking drug margins, rising costs, and heightened competition from online retailers. Major industry leaders have had to rethink their strategies in response.

So with CVS Health set to report earnings later this month, we dove into the data to see how visits to the company’s eponymous pharmacy chain fared in Q2 2025. How have CVS’s rightsizing and optimization efforts impacted visitation? And what can location analytics reveal about some of the strategies that may drive further growth for the chain?

We dove into the data to find out.

CVS Pharmacy began 2025 on a high note. Despite hundreds of recent store closures, the chain posted steady year-over-year (YoY) visit growth throughout the first half of 2025, with only February seeing a slight dip due to the leap-year comparison.

In the first quarter of the year, CVS Health’s Pharmacy and Consumer Wellness segment reported an 11.1% jump in revenue – driven in part by a 6.7% rise in same-store prescription volume. This growth was reflected in the chain’s solid Q1 visit numbers – a momentum sustained into Q2 2025, when overall foot traffic rose 2.2% YoY and average visits per location saw an even more impressive 5.0% increase.

CVS's strong visit numbers appear to underscore the success of its rightsizing efforts, which have largely focused on optimizing the pharmacy and healthcare side of the business. In addition to closing hundreds of stores, CVS plans to open several smaller-format, pharmacy-first locations – as well as featuring limited over-the-counter offerings. The drugstore leader is also set to absorb prescription files from 625 closing Rite Aid locations, in addition to acquiring 64 of its physical stores.

CVS's pharmacy-focused strategy comes amid softening demand for its front store business – including items like cosmetics, candy, greeting cards, and other over-the-counter products – which saw a 2.4% revenue decline in Q1 2025. Yet location analytics show that these non-medical offerings remain an important traffic driver for CVS – especially during key retail milestones.

In the first half of 2025, for example, Valentine’s Day (February 14th) was CVS's busiest day of the year to date, registering a 39.2% surge in visits compared to the chain’s year-to-date (YTD) daily average and a 26.3% boost compared to an average Friday. Other holidays, including Mother’s Day and Father’s Day, sparked smaller but still significant upticks, as shoppers stopped by for gifts and cards.

CVS’s 2025 visit numbers suggest the chain is adeptly navigating pharmacy’s choppy waters – staying nimble and capitalizing on opportunities as they arise. Will the pharmacy leader continue to thrive in the months ahead?

Follow Placer.ai/anchor to find out.

.avif)

In my last column for The Anchor, I debuted a new quarterly series, entitled “All The Things I Think I Think About Retail Over The Last Quarter.”

Well, another quarter has come and gone, so that means it is time to dust off the shelves and scorecard past predictions as well as to signal what is most top of mind at present.

So, first, the scorecard. Loyal readers of my first column will remember these predictions:

It has only been three months since I put a stake in the ground on all of them, but on the “Nailed It/Too Early To Tell/Dead Wrong” scale, I am feeling pretty darn good about most of the above.

It is way too early to tell on Macy’s, Bloomie’s, and Wayfair. Same goes for Sam’s Club and Sprouts. And, as much as I would like to take a victory lap on these last two especially, the proof will be in the pudding much more down the road. Though I still am feeling like all six will break my way soon.

Finally, I would be remiss if I didn’t mention Kohl’s. Kohl’s is such a dumpster fire (meme stock, anyone?) that the very same above prediction is also likely in play for whomever gets chosen as Ashley Buchanan’s ultimate successor.

All of which leads me to…

Over the last quarter, Costco and Target have been a tale of two retailers. One stood strong on DEI, while the other kowtowed to public pressure. Both companies stated their contrasting positions publicly this past January, and the traffic results speak for themselves..

Costco has emerged unscathed, as predicted, while Target now faces concerns that it could become the next Kmart or Sears (and for a whole host of reasons beyond DEI).

The biggest takeaway for me, however?

No matter your personal opinions on DEI, the most important thing retail executives have to ask themselves is, “What matters most to our brand?”

Target and Brian Cornell forgot this one important question. They didn’t do their homework, and thereby took their fingers off the pulse of the Target customer, and clearly the customer has been voting with his or her feet.

It will likely take a regime change with a clear stated purpose to get them back.

I missed on Starbucks, and, frankly, I am kind of pissed about it. I was thrilled when Starbucks’ new CEO Brian Niccol announced his intentions to enliven the in-store Starbucks experience. His promise of “4 Minutes or Less” wait times and his introduction of ceramic mugs had me at Frappuccino.

But then something interesting happened on the way to the coffee roaster.

First, few, if any, baristas have ever offered me a ceramic mug at checkout. Plus, the experience of drinking my coffee in said ceramic mug actually adds more friction to the overall Starbucks’ experience because you still have to go back and wait in line to take your coffee to go.

Second, the wait time promise has also fallen flat. When Niccol first made the announcement, I would go into Starbucks, order at the counter, track the wait time on my phone, and, without fail, get served my coffee in under four minutes. I even proudly shared my improved wait time experiences on social media.

I bought into Brian Niccol’s java-flavored Kool-Aid hook, line, and sinker, but, as much it pains me to admit it, I also forgot one important axiom of retailing – never judge anything out-of-the-gate (which, side note, is also why, in contrast, I have not jumped on the Richard Dickson at Gap Inc. bandwagon yet, too).

Any initial promise for Starbucks in Q1 was quickly overshadowed by Starbucks’ Q2 results. Starbucks same-store sales fell for the fifth straight quarter, with U.S. same-store sales down 2%.

Shame on me. I should have known better.

When running stores, it is easy to get store teams behind anything for a short period of time. I simply made the call too early and now worry the pendulum may be swinging back entirely. Part and parcel, people appear to be spending less time, not more time, in Starbucks since the regime change, which doesn’t bode well.

Any Kool-Aid drinking, whether it be for Niccol, for Dickson, or, as Target CEO Brian Cornell has received during his tenure, should always be reserved until one is sure that results are sustainable.

For more data-driven retail insights, visit placer.ai/anchor

The coffee space has become increasingly competitive in recent years. And while traffic to the segment is up, the growth of small and medium sized chains may be coming at the expense of Starbucks. Visits to the reigning coffee giant were down slightly (0.1%) YoY in Q2 2025 while average visits per location declined 4.2% in the same period.

Still, these trends mark an improvement compared to last quarter, when YoY visits and average visits per venue were down 0.9% and 5.4%, respectively – suggesting that the company's "Back to Starbucks" strategy and recent menu innovations are beginning to drive a turnaround.

Meanwhile, Dunkin' – the second-largest coffee chain in the country – is seeing modest growth, with overall visits and average visits per venue up 1.7% and 0.3% YoY, respectively, in Q2 2025. Like Starbucks, Dunkin' showed improvement in Q2 2025 compared to Q1 2025 – perhaps an early sign of strengthening consumer confidence.

But while broader market forces may have helped, Dunkin's Q2 2025 turnaround may also be attributed to the chain's promotional efforts – including a new ad campaign to promote the chain's $6 Meal Deals. As value continues to drive consumer decision-making, Dunkin's emphasis on affordable bundles positions it well to maintain its visit share despite the growing competition in the space.

Dutch Bros, one of the fastest growing coffee brands in recent years, maintained its momentum in Q2 2025, as coffee chains betting on small-format, largely drive-thru locations – including 7Brew, PJ's Coffee, Biggby, and Foxtail – continue to resonate with consumers.

Overall visits to the Oregon-based chain grew 13.8% YoY alongside a 0.8% increase in average visits per venue – indicating that the chain's ongoing expansion is not cannibalizing traffic from existing venues. This bodes well for the brand as it continues its aggressive expansion – 2,029 stores by 2029.

As we look to the second half of 2025, the coffee sector will be characterized by the distinct strategies of its key players. Dutch Bros' aggressive expansion will continue to challenge the incumbents on a local level, while Dunkin's focus on value will likely remain a key advantage with budget-conscious consumers. The ultimate test will be for Starbucks, as the industry leader's ability to translate its strategic innovations into sustained visit growth will determine its capacity to defend its market share.

For more data-driven dining insights, visit placer.ai/anchor.

Shake Shack traffic increased an impressive 13.7% year-over-year (YoY) in Q2 2025 while average visits per venue held relatively steady at -1.7% – indicating that the chain's aggressive expansion strategy is capturing new market share without cannibalizing existing locations.

Meanwhile, although Q2 2025 visits to Wingstop were up 3.6%, the chain's average visits per venue declined 6.3% – which may suggest that discretionary dining brands serving lower-income consumers may be experiencing pressure from tightening household budgets.

Analyzing trade area demographic data reveals that Wingstop's captured market has a median household income of $69.5K – significantly lower than Shake Shack's $97.0K. Wingstop's trade area also includes a much higher proportion of households with children.

Wingstop attracts families with tighter budgets who must stretch their dining dollars further, which likely contributed to the decline in average visits per venue during this period of economic uncertainty. Meanwhile, Shake Shack's appeals to higher-income consumers with more discretionary spending power could explain the chain's impressive visit strength despite the ongoing headwinds.

Looking at the change in visit frequency compared to 2024 also suggests that Wingstop is feeling the impact of its visitors' tighter budgets.

Wingstop still maintains a significant advantage in customer loyalty, with 16.8% to 18.1% repeat monthly visitors in H1 2025 compared to Shake Shack's 10.5% to 11.4%. But comparing these numbers to 2024 reveals that Wingstop's share of repeat visitors has declined slightly since 2024, while Shake Shack has posted modest monthly gains throughout H1 2025.

This shift suggests that budget-conscious families may be reducing their regular Wingstop visits to save money, while Shake Shack's strategic expansion is bringing locations closer to customers which could be driving increased repeat visitation.

Despite facing economic headwinds, Wingstop's continued positive visit growth and superior customer loyalty metrics demonstrate the brand's strong fundamentals and deep connection with its core family demographic.

As economic conditions stabilize, Wingstop's established customer base and proven appeal to budget-conscious families positions the chain for a strong rebound, particularly given that families with children represent a large and resilient market segment that will likely return to regular dining patterns when household budgets recover.

Visit Placer.ai/anchor for the latest data-driven dining insights.

Eyewear chain Warby Parker continues to be a disruptor. The glasses chain got its start online and made the pivot to brick-and-mortar in 2013. And while many retailers who made that move have since shifted to other retail formats, Warby Parker is pressing on – the brand has plans to open 45 new locations in 2025 alone and is partnering with Target to open store-in-stores in H2 2025.

The chain's ongoing expansion drove year-over-year (YoY) visit increases for all months of 2025 so far. Average visits per location showed more variance – average visits per venue declined 2.7% YoY in Q2 2025 – perhaps reflecting the brand's deliberate focus on market penetration and its use of stores as strategic omnichannel touchpoints rather than purely traffic-dependent locations.

Like Warby Parker, footwear brand Allbirds began online before pivoting to physical retail. But Allbirds is now going in a different direction and shrinking rather than expanding its footprint. In March 2024, the company made the strategic decision to shutter about one-third of its store fleet – and the result has been impressive. While overall visits declined YoY by -12.5% in Q2 2025, visits per location surged, increasing by 18.2% in the same period.

Monthly visits followed a similar pattern, with overall visits generally lower than they were in 2024 while visits per location were largely positive – and looking at visits since the beginning of 2025 shows that the YoY overall visit gap has also been narrowing. Visits in January 2025 were 37.1% lower than they were in January 2024, but by June 2025 that visit gap had narrowed to just 15.1%. Meanwhile, average visits per location were elevated by 13.2% YoY in June 2025. This impressive shift highlights that demand for in-store shopping at Allbirds is strong, and the decision to focus on its highest-performing stores has had the intended effect.

Warby Parker and Allbirds have taken divergent approaches to their brick-and-mortar strategy, and both chains are managing to keep things moving forward.

What will H2 look like for these brands? Visit Placer.ai/anchor for the latest data-driven retail insights.

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.