.svg)

.png)

.png)

.png)

.png)

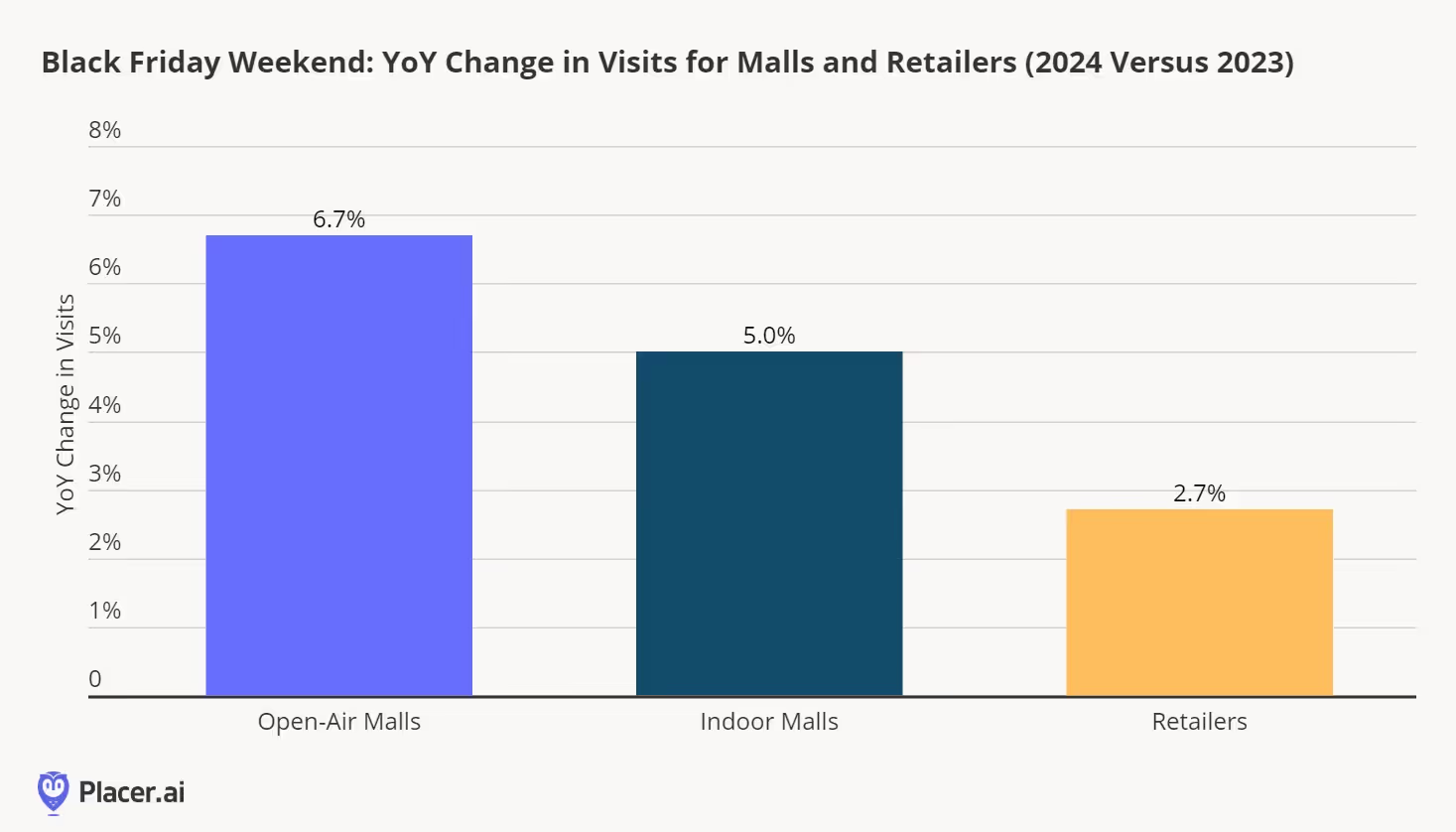

Black Friday 2024 provided valuable insights into consumer behavior as we look ahead to 2025. Placer’s blog highlighted a +2.7% increase in Black Friday weekend visits compared to last year, with shoppers focusing on value while also seeking unique and differentiated products, evidenced by strong year-over-year trends at off-price retailers like HomeGoods, Marshalls, and T.J. Maxx. Pandemic-era categories like home furnishings and sporting goods may also be seeing signs of a resurgence.

The standout takeaway, however, was the evolving role of malls. Mixed-use developments and placemaking, a key trend for malls heading into 2024, proved pivotal this Black Friday weekend. Open-air and indoor malls saw larger year-over-year visit increases (6.7% and 5.0%, respectively) than retailers across all property types (up 2.7%). This was a trend echoed by operators like Simon, further underscoring the mall’s continued relevance in modern retail.

Retailers remain integral to malls, but seasonal attractions, entertainment options, and a more diverse tenant mix have transformed malls into community hubs and prime destinations for both residents and tourists. These attractions have a symbiotic effect, driving greater foot traffic to mall tenants compared to standalone stores of the same brands.

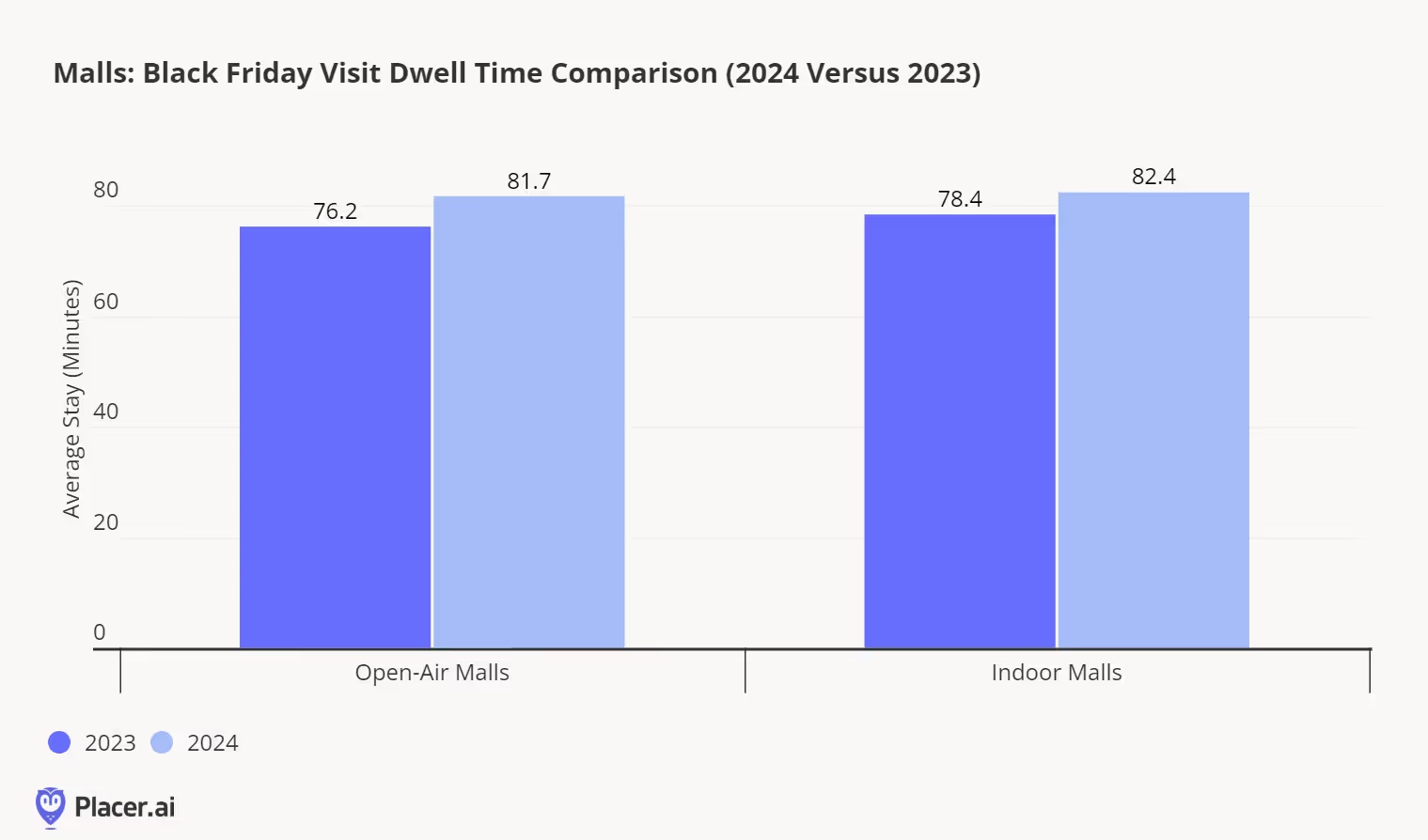

Need evidence that this strategy works? Consumers are staying longer. Our data shows that open-air malls experienced a 7.2% increase in dwell time over Black Friday weekend, while indoor malls saw a 5.1% rise. As we've highlighted before, the longer consumers spend at a mall, the more likely they are to make a purchase.

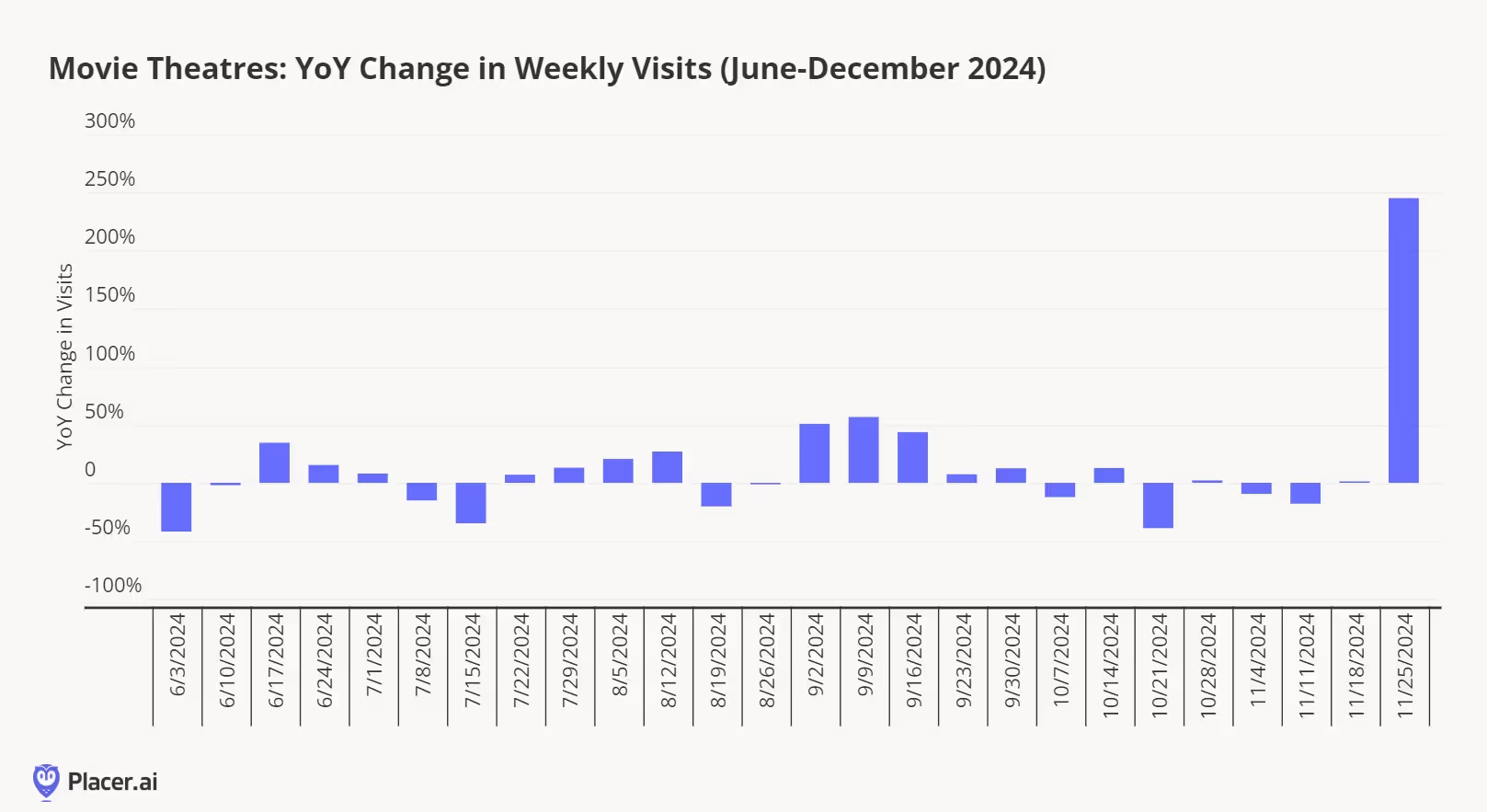

A strong box office undeniably played a role in Black Friday visit trends and dwell time. Our data shows a nearly 250% increase in visits to movie theaters this Black Friday compared to last year (below). However, the data also reveals that many malls with unique holiday attractions and effective marketing strategies experienced increased visits, indicating that mall traffic was driven by more than just blockbuster movies.

Taken together, our data reinforces that malls have become more vital than ever to modern retail, evolving from traditional shopping hubs into multifaceted destinations that blend commerce, entertainment, and community experiences. Changes in tenant mix have introduced a diverse array of retailers, including digitally native brands, experiential stores, and unique local offerings, catering to broader consumer tastes. Increased visitor attractions, such as dine-in theaters, fitness studios, and immersive art installations, create compelling reasons that drive repeat visits for more than just shopping. Mall-focused events, from seasonal pop-ups to live performances, further enhance the draw by fostering engagement and creating a sense of occasion. This strategic evolution has positioned malls as essential anchors in the retail ecosystem, blending convenience and experience to meet the demands of today’s shoppers.

The holiday shopping season is in full swing, and with Black Friday weekend behind us, it's time to assess how this season is shaping up for retailers. As we noted before Thanksgiving, the shortened window between Thanksgiving and Christmas this year places added pressure on retailers to drive store traffic during key holiday events and weekends.

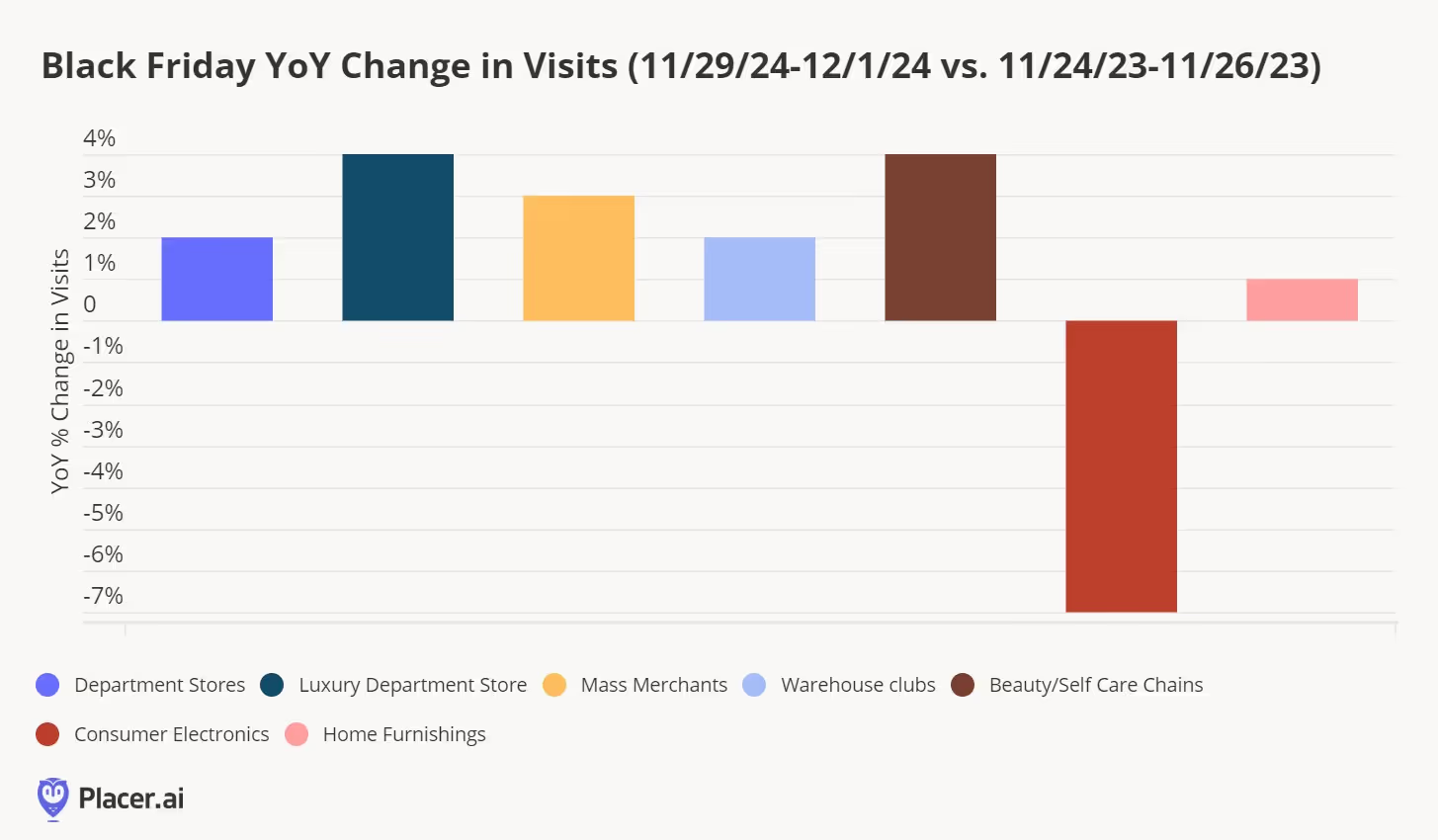

In 2023, Black Friday accounted for approximately 7% of holiday season retail visits, making it crucial for retailers this year to attract consumers early to mitigate potential slowdowns later in the season. Without burying the lede, Black Friday weekend (Friday through Sunday) delivered on this goal, with six of the seven analyzed retail sectors experiencing visitation growth. While the fervor around Black Friday may not match the excitement of the 1990s and 2000s, this year reaffirmed its enduring importance as a cornerstone of holiday shopping.

From a category perspective, luxury department stores had a strong performance this year, with traffic up 4% compared to Black Friday weekend last year. Nordstrom, in particular, stood out with a successful event. Throughout 2024, luxury department stores have worked hard to align more closely with consumer expectations in terms of assortment, in-store experience, and value, which clearly paid off during this key retail event. According to PersonaLive segmentation, Ultra Wealthy Families made up a quarter of visitors to luxury department stores during Black Friday weekend, bolstering traffic as these consumers tend to be less price-sensitive.

Full-line department stores, mass merchants, beauty, and home furnishing retailers also saw a 2-3% increase in traffic year-over-year. Overall, while discretionary retail still faces challenges, the weekend showed more positive momentum than we've seen in recent years.

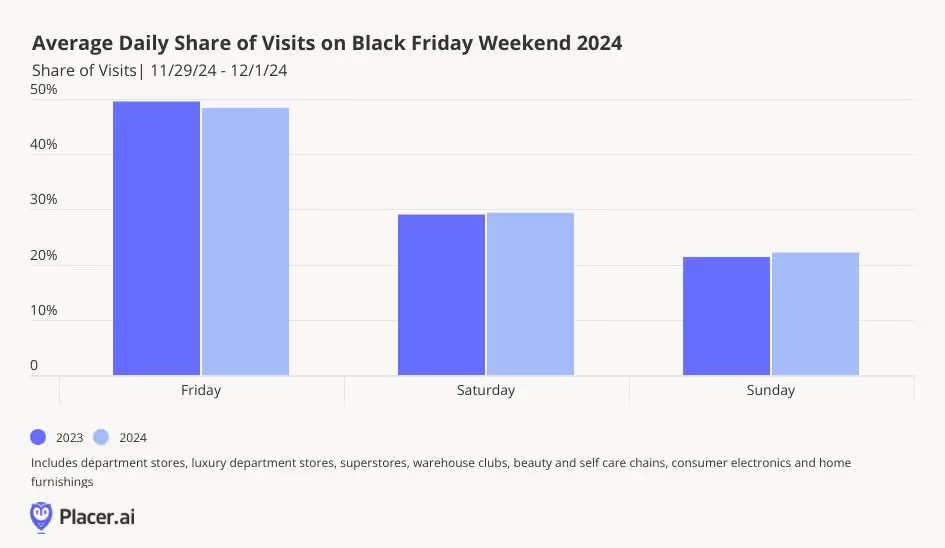

Placer’s traffic estimates revealed that while most categories experienced an increase in weekend traffic, there was a noticeable shift in the distribution of visits across the days compared to last year. This year, Friday accounted for a smaller share of event visits than in 2023, while Sunday saw a higher percentage of traffic. Despite this shift, Friday still represented nearly 50% of event visits on average across retail sectors. It’s possible that consumers delayed their shopping trips until later in the weekend, potentially after conducting online research on Friday and Saturday.

What about the iconic lines outside retailers—did they make a comeback? Our data indicates that a few specific items drove consumers to camp out and arrive early for store openings on Black Friday. Notably, Target's exclusive release of the Taylor Swift Eras Tour book and a vinyl edition of her latest album, The Tortured Poets Department, attracted early crowds. Hourly visit data shows a higher share of visits between 4 AM and 6 AM compared to 2023. While last year saw a greater share of visits during regular store hours, this year shoppers arrived earlier, likely drawn by these exclusive products.

What does Black Friday weekend reveal about the rest of the holiday season? The industry successfully overcame its first hurdle—boosting overall holiday visitation despite fewer shopping days—thanks to the growth seen last weekend. However, challenges remain with more lull weeks ahead and an earlier Super Saturday this year. As we noted previously, a shorter season also means tighter shipping windows, which could drive increased in-store visits in the final days before Christmas. On the positive side, discretionary retail saw strong visitation, with key items and promotions effectively capturing the holiday spirit and engaging consumers during this critical period.

Black Friday is the biggest retail milestone of the year – drawing millions of shoppers to stores nationwide. And even as e-commerce claims a growing piece of the holiday shopping pie, consumers flock to brick-and-mortar retailers to browse the aisles, check out new products, and enjoy the festive holiday atmosphere.

But how did brick-and-mortar retailers fare during this year’s Black Friday? Did the high-stakes shopping period deliver?

Black Friday has evolved into a multi-day shopping bonanza. Early holiday sales draw crowds well before Thanksgiving, and major markdowns continue into the weekend and through Cyber Monday. Still, foot traffic data shows that the traditional milestone hasn’t lost its touch. On November 29th, 2024 visits to retailers nationwide surged by 40.4% compared to an average Friday this year – up slightly from 39.8% in 2023.

Year over year (YoY), retail foot traffic increased 0.9% on Black Friday this year – a modest uptick, but one which highlights the resilience of physical retail in an increasingly digital world. Most of the days during the week leading up to Black Friday also saw modest YoY visit increases, as shoppers got a head start on their bargain hunting. And the Saturday and Sunday following the milestone saw more significant YoY visit increases of 2.0% and 6.2%, respectively – perhaps driven in part by customers picking up orders placed online during Black Friday.

Digging deeper into the data for different areas of the country shows that the resonance of the milestone varies significantly by region. In Delaware and New Hampshire, visits to retailers on November 29th were up a whopping 75.9% and 72.8%, respectively, compared to an average Friday this year. And in much of the Midwest – including North and South Dakota, Nebraska, Indiana, Minnesota, Wisconsin, Iowa, Kentucky, Tennessee, and Kansas – retail foot traffic surged by more than 50.0%. By contrast, Western states such as California (26.0%), Wyoming (24.1%), New Mexico (24.5%), Montana (31.3%), Colorado (32.6%), Nevada (33.1%), and Utah (33.6%) experienced much more modest visit boosts.

The differences in statewide Black Friday performance may reflect more general regional Black Friday patterns. Though the Mountain states saw smaller Black Friday visit spikes than other areas of the country, retail visits in the region on November 29th, 2024 were up 4.1% YoY – perhaps a sign that the milestone is growing in local importance. The Eastern and Western South Central regions saw YoY visit increases of 3.7% and 2.8%, respectively – while the South Atlantic region saw a 1.5% increase. Meanwhile, some of the areas where Black Friday is most resonant – including the Midwest – saw visits remain flat or fall slightly below 2023 levels.

Holiday shopping is about more than just making transactions – consumers eagerly leave the comfort of their homes to embrace the thrill of the treasure hunt, explore new products firsthand, and enjoy the experience of shopping with friends. And foot traffic data shows that Black Friday retains plenty of in-person appeal.

For more data-driven insights, visit placer.ai.

Many Americans choose to take the entire week of Thanksgiving off, heading home early and maximizing family time during the holiday. How does the extra vacation time impact travel and leisure foot traffic? We dove into the data to find out.

The Tuesday and Wednesday before Thanksgiving are among the busiest travel days of the year as Americans head back home or travel to friends to celebrate the holiday with loved ones. But with many employees taking the entire week of Thanksgiving off – or choosing to work remotely – the Saturday before Thanksgiving is also a popular travel day.

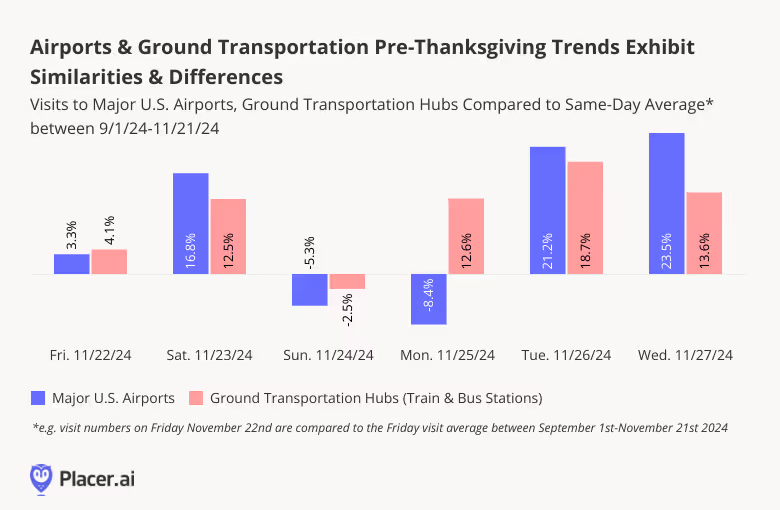

On Saturday November 23rd, 2024, major U.S. airports and ground transportation hubs saw a 16.8% and 12.5% increase in visits, respectively, compared to the recent Saturday average. The Saturday spike suggests that many travelers started their holiday journey early to avoid the pre-Thanksgiving rush while enjoying a little more time with family and friends.

Visits to both airports and ground transportation hubs then fell on Sunday – although the airport drop was more pronounced than the bus and train station dip – before diverging for the rest of the week: Bus and train stations rose on Monday and peaked on Tuesday before leveling off, while airport visits stayed low on Monday, spiked on Tuesday, and peaked on Wednesday.

The dip in Monday visits along with the relatively larger drop in Sunday visits for airports is likely due to athe decrease in business travel during the week of Thanksgiving. Meanwhile, ground transportation may pick up on Monday because those trips tend to be longer – so travelers could be choosing to head out earlier.

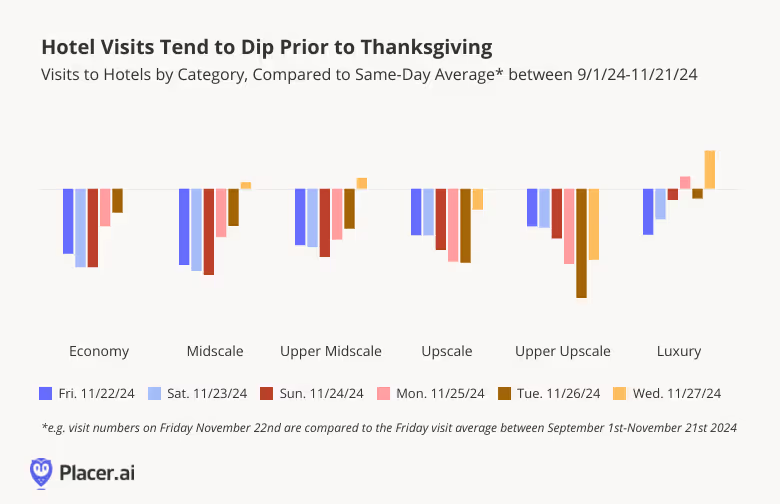

But even as travel traffic increased, hospitality visits dipped. Most hotel categories – with the exception of luxury hotels – received significantly fewer visits on the days before Thanksgiving relative to their recent daily visit averages, with visits only rising slightly for some categories just before the holiday.

This substantial drop in hotel visits pre-Thanksgiving is likely due to a decrease in business travel ahead of the holiday. But all that Saturday travel (see above) still means more people away from home – so where are these travelers staying? The dip in hotel visits before Thanksgiving suggests that many people traveling earlier in the week may be choosing to forego the hotel and instead stay with friends or family.

How do these early Thanksgiving travelers spend their time ahead of the holiday?

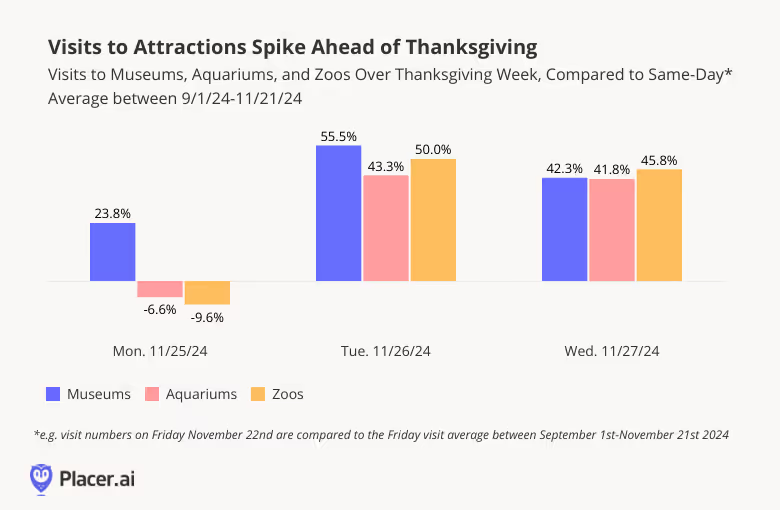

Many of those traveling early may be taking extra PTO ahead of the holiday to maximize quality time with their geographically distant family – so, unsurprisingly, foot traffic data indicates that visits to family-friendly destinations spike ahead of the holiday.

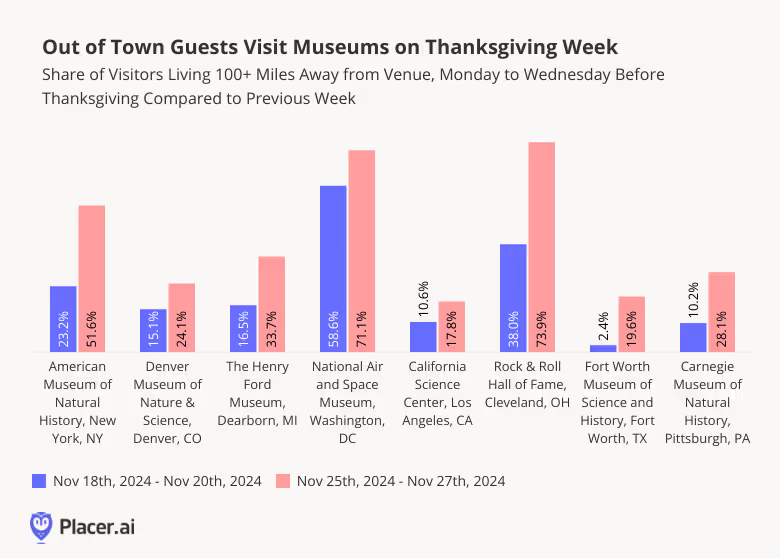

This year, visits to museums, aquariums, and zoos peaked on the Tuesday before Thanksgiving relative to the recent Tuesday average, and remained significantly elevated on Wednesday. Museums – which may appeal to a wider age range than the other two types of attractions – also received a substantial visit boost on Monday.

This trend highlights the opportunity for family-friendly venues to strategically plan events, promotions, and extended hours during the early Thanksgiving week to attract traveling families seeking meaningful experiences together.

Indeed, zooming in on family-friendly museums across the country reveals that these venues tend to welcome a much larger share of out-of-town guests on the Monday to Wednesday before Thanksgiving compared to the same period the week before. This suggests that many of those who traveled early for Thanksgiving use the days ahead of the holiday to spend quality time with their relatives and engage in family-friendly activities in their hosts’ cities. Museums and similar venues can capitalize on this trend by tailoring their offerings or promotions to appeal to these out-of-town visitors during this peak period.

Analyzing pre-Thanksgiving foot traffic to travel hubs and leisure venues reveals that many Americans likely leverage the extra time off to extend their stay with their loved ones and explore local attractions together. By understanding these trends, businesses and cultural institutions can better cater to holiday travelers, creating meaningful experiences during this uniquely busy and family-focused season.

For more data-driven insights, visit Placer.ai.

Many of Thanksgiving’s consumer behavior impacts are broadly recognized, from the pre-Thanksgiving Turkey Wednesday peak at grocery stores to the post-Thanksgiving Black Friday shopping bonanza. But diving into consumer foot traffic trends for the week before the holiday reveals some lesser-known ripple effects from many Americans’ favorite national event. So how did Thanksgiving impact retail, dining, and airport visits this year? We analyzed the data to find out.

Many Americans host friends and family for Thanksgiving dinner, leading to the well-recognized spike in pre-Thanksgiving grocery traffic that culminates on Turkey Wednesday. But hosting a proper Thanksgiving dinner requires more than just good food – the space needs to be prepped as well.

Foot traffic data indicates that many consumers do in fact spend the week before Thanksgiving shopping for decor and other entertainment supplies, driving visit increases at home furnishing stores such as Homesense and at party supply stores such as Party City. And the prospect of guests also seems to motivate consumers to tackle whatever home repair projects they’ve been putting off – visits to home improvement stores, including Home Depot and Lowe’s, also received a significant boost the week before Turkey Day.

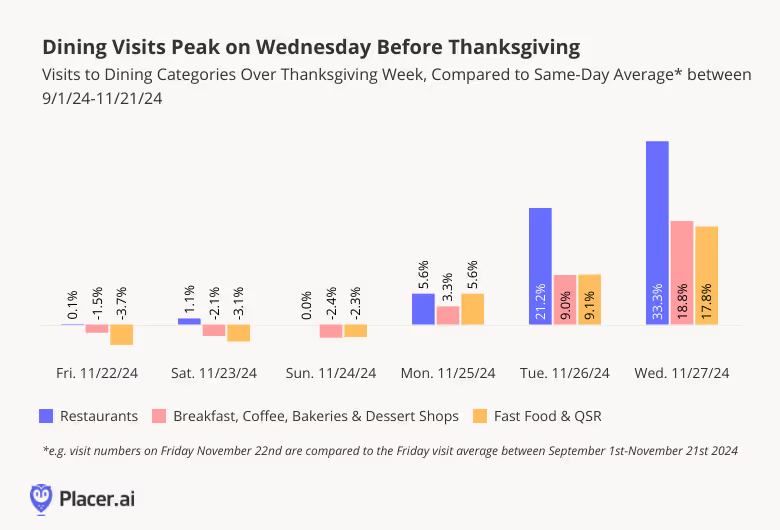

All the time spent in the kitchen cooking for Thanksgiving may also be contributing to a rise in dining visits on the days leading up to the holiday. Although visits to restaurants, breakfast joints, and fast food places dipped slightly during the weekend before Thanksgiving, foot traffic to major dining segments began climbing on Monday, November 25th before peaking on Turkey Wednesday.

This increase in dining visits could be due in part to home cooks – and their families – looking to fuel up outside the home as the kitchen gets taken over by Thanksgiving prep. And some Americans who started the Thanksgiving vacation early may choose to spend some quality time going out to eat with their friends and families prior to the big day. Others who are already traveling may also be driving up dining visits by looking for more meals on the go.

But even as some Americans begin their Thanksgiving travels earlier in the week, most Americans traveling by car seem to wait until Wednesday to head out – and the traffic boost to car-related categories seems to occur much closer to the day itself. Car shops & services and gas stations & convenience stores received a minor bump on the Tuesday before Thanksgiving as some Americans hit the road early or got their car serviced ahead of the long drive back home. But most of the traffic boost to car shops, car washes, and gas stations occurred on Wednesday November 27th – just before Thanksgiving travel.

Thanksgiving’s economic impact is not limited to grocery stores and post-Thanksgiving Black Friday shopping. Analyzing consumer foot traffic data for the week before the holiday reveals the widespread impact that Thanksgiving has on a range of consumer sectors, from car washes to dining segments to home improvement.

For more data-driven consumer insights, visit placer.ai.

Turkey Wednesday – the day before Thanksgiving – is the grocery industry’s Black Friday. As shoppers flock to stores for turkeys, cranberry sauce, and other holiday essentials, the day delivers impressive visit spikes for grocery, superstore, and dollar stores alike. But how did this year’s Turkey Wednesday measure up – and which brands capitalized most successfully on this critical shopping event?

We dove into the data to find out.

People love to shop – but they also love to procrastinate, descending on stores just before major holidays to grab last-minute supplies. So far in 2024, March 30th (Easter Eve), May 11th (the day before Mother's Day), and November 27th (Turkey Wednesday) have been the busiest days of the year for grocery stores, superstores, and discount & dollar stores. But while the first two milestones drew bigger crowds to superstores and discount & dollar stores – both natural destinations for gift buyers and food shoppers alike – Turkey Wednesday was the grocery sector’s time to shine.

On November 27th, 2024, grocery stores saw visits surge by 81.0% compared to a year-to-date (YTD) daily average, capturing over half (51.2%) of visits across grocery, superstore, and discount chains. (During the rest of the year, grocery stores account for just 46.6% of the three industries’ overall visit pie.) Still, superstores and discount & dollar stores also attracted plenty of pre-Thanksgiving shoppers with enticing holiday promotions of their own. And despite reports of consumer cut-backs ahead of the holiday, this year’s Turkey Wednesday performance was on par with last year’s, with grocery visits on November 27th 2024 up 0.7% relative to November 22nd 2023 (last year’s Turkey Wednesday).

Diving into statewide grocery store data shows that like Black Friday, Turkey Wednesday’s appeal isn’t evenly distributed across the United States. Though grocery visits spiked nationwide on November 27th, 2024, some regions saw bigger foot traffic peaks than others.

In the Pacific Northwest, parts of New England, and some Mountain states, for example, grocery visits increased by less than 70.0% compared to a YTD daily average. But in parts of the Midwest and South, visits spiked by over 90.0%. Mississippi and Minnesota in particular stood out as major Turkey Wednesday winners, with visits up 96.8% and 96.5%, respectively. These regional differences highlight Turkey Wednesday’s special resonance in areas where holiday shopping traditions like Black Friday also dominate.

Which grocery chains benefit the most from Turkey Wednesday? A look at individual brands shows that traditional grocery stores – think Kroger, Albertsons, and Safeway – generally see bigger pre-Thanksgiving visit boosts than limited-assortment value chains like Aldi and Trader Joe’s. And in keeping with the regional trends noted above, some of the best-performing chains are midwestern favorites like Schnucks and Albertsons’ Jewel-Osco, which saw Turkey Wednesday foot traffic surges this year of 103.9% and 92.6%, respectively.

But numerous other chains also saw major Turkey-fueled visit increases on November 27th – including Food 4 Less, the Kroger-owned regional value chain with locations in both the Midwest and California, and East Coast brands ShopRite and Wegmans. When it comes to last-minute holiday shopping, it seems, there is plenty of room for multiple brands to thrive.

Though value-oriented grocery chains typically see smaller visit spikes on Turkey Wednesday, many budget brands are steadily growing their pre-holiday audiences.

Grocery Outlet Bargain Market and Aldi saw foot traffic rise by 13.5% and 11.2%, respectively, on November 27th, 2024 compared to last year’s Turkey Wednesday. (Both chains also saw substantial increases in the average number of visits to each of their individual locations – 9.7% and 8.4%, respectively – proving that the increase isn’t solely a result of fleet expansion.) Meanwhile, traditional grocery leaders like H-E-B, Kroger’s Ralphs, Ahold Delhaize’s Hannaford, and Albertsons’ Jewel Osco, also recorded year-over-year (YoY) foot traffic gains, highlighting robust performance across much of the sector.

Groceries are a crucial part of the Thanksgiving holiday – but liquor, it seems, may be even more indispensable. On November 27th, 2024, visits to liquor stores surged even higher than visits to grocery stores – generating a remarkable 186.4% visit spike, as consumers stocked up on spirits to ease the mood at stressful family gatherings or to show gratitude to hard-working hosts. Like for grocery stores, Turkey Wednesday was liquor stores’ busiest day of the year so far – though if last year is any indication, the run-up to Christmas will likely generate even more impressive traffic bumps.

Turkey Wednesday 2024 reaffirmed the key role played by traditional grocery stores in the run-up to Thanksgiving. And though supermarkets and liquor stores stole the spotlight, superstores and discount & dollar stores also experienced significant visit upticks – and value chains are steadily growing their pre-holiday audiences. How will these categories continue to fare throughout the rest of the holiday season?

Follow Placer.ai’s data-driven retail analysis to find out.

The Fitness industry was a major post-pandemic winner. Visits to gyms across the country surged as stay-at-home orders ended and people returned to their in-person workout routines. And even as consumers reduced discretionary spending in the face of inflation, they kept going to the gym – finding room in their budgets for the chance to embrace wellness and get in shape while interacting with other people.

But no category can sustain such unabated growth forever – and as the segment inevitably stabilizes, gyms will need to stay nimble on their feet to maintain their competitive edge.

This white paper takes a closer look at the state of Fitness as the category transitions into a more stable growth phase following two years of outsize post-pandemic demand. The report digs into the location analytics to reveal how the Fitness space has changed – and what strategies gyms can adopt to stay ahead of the pack.

*This report excludes locations within Washington state due to local legislation.

Monthly visits to the Fitness category have grown consistently year over year (YoY) since early 2022, when COVID subsided and gyms returned to full capacity. And the segment is still doing remarkably well. Even in January and March 2024 – when visits were curtailed by an Arctic blast and by the Easter holiday weekend – YoY Fitness visits remained positive, despite the comparison to an already strong 2023.

Still, recent months have seen smaller YoY increases than last year, indicating that the Fitness category is entering a more normalized growth phase.

By keeping a close watch on evolving consumer preferences, fitness chains can uncover new opportunities for growth and adaptation within a stabilizing market – including leaning into increasingly popular dayparts.

Examining the evolving distribution of gym visits by daypart over the past six years shows that major shifts were brought on by the COVID-19 pandemic.

Between Q1 2019 and Q1 2021, as remote work took hold, gyms saw their share of 2:00 PM - 5:00 PM visits increase from 15.8% to 18.6%. Though this trend partially reversed as the pandemic receded, afternoon visits remained elevated in Q1 2024 compared to pre-COVID – likely a reflection of hybrid work patterns that leave people free to take an exercise break during their workdays.

At the same time, the share of morning visits to fitness chains (between 8:00 AM and 11:00 AM) dropped from 20.5% in Q1 2019 to 17.2% in Q1 2024, while evening visits (between 8:00 PM and 11:00 PM) increased from 11.3% to 13.2%.

Gyms that recognize this changing behavior can adapt to new workout preferences – whether by incentivizing morning visits, scheduling popular classes mid-afternoon, or offering extended evening hours.

In fact, the data indicates that gyms that are leaning into the evening workout trend are already finding success: Of the top 12 most-visited gym chains in the country, those that saw bigger increases in their shares of evening visits also tended to see greater YoY visit growth.

EōS Fitness and Crunch Fitness, for example, have seen their shares of evening visits grow by 5.5% and 3.4%, respectively, since COVID – and in Q1 2024, their YoY visits grew by 29.0% and 21.8%, respectively. Other chains, including 24 Hour Fitness and Chuze Fitness, experienced similar shifts in visit patterns. At the same time, LA Fitness saw just a minor increase in its share of evening visits between Q1 2019 and Q1 2024, and a correspondingly small increase in YoY visits.

As the evening workout slot gains popularity, gym operators that can adapt to these new trends and encourage evening visits may see significant benefits in the years to come.

Diving into demographic data for the analyzed gym chains sheds light on some factors that may be driving this heightened preference for evening workouts at top-performing gyms.

The four fitness chains that experienced the greatest YoY visit boosts in Q1 – Crunch Fitness, EōS Fitness, 24 Hour Fitness, and Chuze Fitness – all featured trade areas with significantly higher-than-average shares of Young Professionals and Non-Family Households. (STI: PopStat’s Non-Family Household segment includes households with more than one person not defined as family members. Spatial.ai: PersonaLive’s Young Professional consumer segment includes young professionals starting their careers in white collar or technical jobs.)

In plainer terms, these consumer segments – typically young, well-educated, and without children – and therefore more likely to be flexible in their workout times – are driving visits to some of the best-performing gyms across the country. And these audiences seem to be displaying a preference for nighttime sweat sessions – a factor that gyms can take into account when planning programming and marketing efforts.

Leaning into emerging gym visitation patterns is one way for fitness chains to thrive in 2024 – but it isn’t the only marker of success for the segment. Even after years of visit growth, the market remains open to new opportunities and innovations that meet health-conscious consumers where they are.

STRIDE Fitness, a gym that offers treadmill-based interval training, has sparked a trend among running enthusiasts. This niche player is finding success, particularly among a specific demographic: runners and endurance training enthusiasts.

Between January and April 2024, monthly YoY visits to STRIDE Fitness consistently outperformed the wider Fitness space. A standout month was January, when STRIDE Fitness’s visits soared by an impressive 33.6% YoY, surpassing the industry average of 5.7% for the same period.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – suggests that STRIDE Fitness’ trade areas are well-positioned to attract those visitors most open to its offerings. Residents of STRIDE Fitness’s potential market are 24% more likely to be, or to be interested in, Endurance Athletes than the nationwide average – compared to just 3% for the Fitness industry as a whole. Similar patterns emerge for Marathon Runners and Triathlon Participants. This indicates that the chain is well-situated near consumers with a passion for endurance sports and long distance running, helping it maintain a competitive edge in the crowded gym market.

Pickleball, a game that blends elements of tennis, ping pong, and badminton, is the fastest-growing sport in the country. And recognizing its broad appeal, some fitness chains have begun incorporating pickleball courts into their facilities.

Arizona-based EōS Fitness added a pickleball court at a Phoenix, AZ location – and early 2024 data highlights the impact of this addition. Between January and April 2024, the location drew between 9.1% and 33.3% more monthly visits than the chain’s Arizona visit-per-location average.

And analyzing the demographic profile of the chain’s location with a pickleball court reinforces the game’s increasingly wide appeal. Young consumer segments have been embracing the game in large numbers – and the Phoenix EōS Fitness location’s potential market includes a significantly higher share of 18 to 34-year-olds than the chain’s overall Arizona potential market. Residents of the pickleball location’s trade area are also less affluent than the chain’s Arizona average.

Pickleball has typically been associated with more affluent consumer segments, and it seems like this may be shifting. With more people than ever embracing the game, gyms that choose to add courts to their facilities may reap the foot traffic benefits.

The Fitness industry has undergone a significant transformation since COVID-19. The category’s outsize post-pandemic visit growth has begun to stabilize, and gyms are staying ahead by adapting to changing consumer preferences. Evenings are emerging as crucial dayparts for gym operators, likely driven by younger consumer segments. And niche fitness chains are seeing visit success, proving that there are plenty of ways for the Fitness segment to succeed.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Grabbing a coffee or snack at a convenience store is a time-honored road trip tradition – but increasingly, Convenience Stores (C-Stores) have also emerged as places people go out of their way to visit.

Convenience stores have thrived in recent years, making inroads into the discretionary dining space and growing both their audiences and their sales. Between April 2023 and March 2024, C-Stores experienced consistent year-over-year (YoY) visit growth, generally outperforming Overall Retail. Unsurprisingly, C-Stores fell behind Overall Retail in November and December 2023, when holiday shoppers flocked to malls and superstores to buy gifts for loved ones. But in January 2024, the segment regained its lead, growing YoY visits even as Overall Retail languished in the face of an Arctic blast that had many consumers hunkering down at home.

C-Stores’ current strength is partially due to the significant innovation by leading players in the space: Chains like Casey’s, Maverik, Buc-ee’s, and Rutter’s are investing in both in their product offerings and in their physical venues to transform the humble C-Store from a stop along the way into a bona fide destination. Dive into the data to explore some of the key strategies helping C-Stores drive consumer engagement and stay ahead of the pack.

While chain expansion may explain some of the C-Store segment growth, a look at visit-per-location trends shows that demand is growing at the store level as well. Over the past year (April 2023 to March 2024), average visits per location on an industry-wide basis grew by 1.8%, compared to the year prior (April 2022 to 2023).

And within this growing segment, some brands are distinguishing themselves and outperforming category averages. Casey’s, for example, saw the average number of visits to each of its locations increase by 2.3% over the same time frame – while Maverik, Buc-ee’s and Rutter’s saw visits per location increase by 3.2%, 3.4% and 3.9%, respectively.

Each in its own way, Casey’s, Maverik, Buc-ee’s, and Rutter’s, are helping to transform C-Stores from pit stops where people can stretch their legs and grab a cup of coffee to destinations in and of themselves.

Midwestern gas and c-store chain Casey’s – famous for its breakfast pizza and other grab-and-go breakfast items – has emerged as a prime spot for fast food pizza lovers to grab a slice first thing in the morning. And Salt Lake City, Utah-based Maverik – which recently acquired Kum & Go and its 400-plus stores – is also establishing itself as a breakfast destination thanks to its specialty burritos and other chef-inspired creations.

Casey’s and Maverik’s popular breakfast options are likely helping the chains receive its larger-than-average share of morning visits: In Q1 2024, 16.3% of visits to Maverik and 17.5% of visits to Casey’s took place during the 7:00 AM - 10:00 AM daypart, compared to just 14.9% of visits to the wider C-Store category.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – also suggests that Casey’s and Maverik’s have opened stores in locations that allow them to reach their target audience. Compared to the average consumer, residents of Casey’s potential market are 7% more likely to be “Fast Food Pizza Lovers” than both the average consumer and the average C-Store trade area resident. Residents of Maverik’s potential market are 16% more likely than the average consumer to be “Mexican Food Enthusiasts,” compared to residents of the average C-Store’s trade area who are only 1% more likely to fall into that category.

With both chains expanding, Casey’s and Maverik can hope to introduce new audiences to their unique breakfast options and solidify their hold over the morning daypart within the C-Store space over the next few years.

Everything is said to be bigger in the Lone Star State, and Texas-based convenience store chain Buc-ee’s – holder of the record for the worlds’ largest C-Store – is no exception. With a unique array of specialty food items and award-winning bathrooms, Buc-ee’s has emerged as a well-known tourist attraction. And the popular chain’s status as a visitor hotspot is reflected in two key metrics.

First, Buc-ee’s attracts a much greater share of weekend visits than other convenience store chains. In Q1 2024, 39.6% of visits to Buc-ee’s took place on the weekends, compared to just 28.3% for the wider C-Store industry. And second, Buc-ee’s captured markets feature higher-than-average shares of family-centric households – including those belonging to Experian: Mosaic’s Suburban Style, Flourishing Families, and Promising Families segments.

Rather than merely a place to stop on the way to work, Buc-ee’s has emerged as a favored destination for families and for people looking for something fun to do on their days off.

Buc-ee’s isn’t the only C-Store chain that believes bigger is better. Pennsylvania-based Rutter’s is increasing visits and customer dwell time by expanding its footprint – both in terms of store count and venue size. New stores will be 10,000 to 12,000 square feet – significantly larger than the industry average of around 3,100 square feet. And in more urban areas, where space is at a premium, the company is building upwards.

Rutter’s added a second floor to one of its existing locations in York, PA in December 2023. The remodel, which was met with enthusiasm by customers, provided additional seating for up to 30 diners, a beer cave, and an expanded wine selection. And in Q1 2024, the location experienced 15.6% YoY visit growth – compared to a chainwide average of 7.6%. Visitors to the newly remodeled Rutter’s also stayed significantly longer than they did pre-renovation. The share of extended visits to the store (longer than ten minutes) grew from 20.8% in Q1 2023 to 27.0% in Q1 2024 – likely from people browsing the chain’s selection of beers or grabbing a bite to eat.

Convenience stores are flourishing, transforming into some of the most exciting dining and tourist destinations in the country. Today, C-Store customers can expect to find brisket sandwiches, gourmet coffees, or craft beers, rather than the stale cups of coffee of old. And the data shows that customers are receptive to these innovations, helping drive the segment’s success.

The first quarter of 2024 was generally a good one for retailers. Though unusually cold and stormy weather left its mark on the sector’s January performance, February and March saw steady year-over-year (YoY) weekly visit growth that grew more robust as the quarter wore on.

March ended on a high note, with the week of March 25th – including Easter Sunday – seeing a 6.1% YoY visit boost, driven in part by increased retail activity in the run-up to the holiday. (Last year, Easter fell on April 9th, 2023, so the week of March 25th is being compared to a regular week.)

Though prices remain high and consumer confidence has yet to fully regain its footing, retail’s healthy Q1 showing may be a sign of good things to come in 2024.

Drilling down into the data for leading retail segments demonstrates the continued success of value-priced, essential, and wellness-related categories.

Discount & Dollar Stores led the pack with 11.2% YoY quarterly visit growth, followed by Grocery Stores, Fitness, and Superstores – all of which outperformed Overall Retail. Dining also enjoyed a YoY quarterly visit bump, despite the segment’s largely discretionary nature. And despite the high interest rates continuing to weigh on the housing and home renovation markets, Home Improvement & Furnishings maintained just a minor YoY visit gap.

Discount & Dollar Stores experienced strong YoY visit growth throughout most of Q1 – and as go-to destinations for groceries and other other essential goods, they held their own even during mid-January’s Arctic blast. In the last week of March, shoppers flocked to leading discount chains for everything from chocolate Easter bunnies to basket-making supplies – driving a remarkable 21.5% YoY visit spike.

Dollar General continued to dominate the Discount & Dollar Store space in Q1, with visits to its locations accounting for nearly half of the segment’s quarterly foot traffic (44.7%). Next in line was Dollar Tree, followed by Family Dollar and Five Below. Together, the four chains – all of which experienced positive YoY quarterly visit growth – drew a whopping 91.6% of quarterly visits to the category.

Rain or shine, people have to eat. And like Discount & Dollar Stores, traditional Grocery Stores were relatively busy through January as shoppers braved the storms to stock up on needed items. Momentum continued to build throughout the quarter, culminating in a 10.5% foot traffic increase in the week ending with Easter Sunday.

Like in other categories, it was budget-friendly Grocery banners that took the lead. No-frills Aldi drove a chain-wide 24.4% foot traffic increase in Q1, by expanding its fleet – while also growing the average number of visits per location. Other value-oriented chains, including Trader Joe’s and Food Lion, experienced significant foot traffic increases of their own. And though conventional grocery leaders like H-E-B, Kroger, and Albertsons saw smaller visit bumps, they too outperformed Q1 2023 by meaningful margins.

January is New Year’s resolution season – when people famously pick themselves up off the couch, dust off their trainers, and vow to go to the gym more often. And with wellness still top of mind for many consumers, the Fitness category enjoyed robust YoY visit growth throughout most of Q1 – despite lapping a strong Q1 2023.

Predictably, Fitness’s visit growth slowed during the last week of March, when many Americans likely indulged in Easter treats rather than work out. But given the category’s strength over the past several years, there is every reason to believe it will continue to flourish.

For Fitness chains, too, cost was key to success in Q1 – with value gyms experiencing the biggest visit jumps. EōS Fitness and Crunch Fitness, both of which offer low-cost membership options, saw their Q1 visits skyrocket 28.9% and 22.0% YoY, respectively – helped in part by aggressive expansions. At the same time, premium and mid-range gyms like Life Time and LA Fitness are also finding success – showing that when it comes to Fitness, there’s plenty of room for a variety of models to thrive.

Superstores – including wholesale clubs – are prime destinations for big, planned shopping expeditions – during which customers can load up on a month’s supply of food items or stock up on home goods. And perhaps for this reason, the category felt the impact of January’s inclement weather more than either dollar chains or supermarkets – which are more likely to see shoppers pop in as needed for daily essentials.

But like Grocery Stores and Discount & Dollar Stores, Superstores ended the quarter with an impressive YoY visit spike, likely fueled by Easter holiday shoppers.

As in Q4 2023, membership warehouse chains – Costco Wholesale, BJ’s Wholesale Club, and Sam’s Club – drove much of the Superstore category’s positive visit growth, as shoppers likely engaged in mission-driven shopping in an effort to stretch their budgets. Still, segment mainstays Walmart and Target also enjoyed positive foot traffic growth, with YoY visits up 3.9% and 3.5%, respectively.

Moving into more discretionary territory, Dining experienced a marked January slump, as hunkered-down consumers likely opted for delivery. But the segment rallied in February and March, even though foot traffic dipped slightly during the last week of March, when many families gathered to enjoy home-cooked holiday meals.

Coffee Chains and Fast-Casual Restaurants saw the largest YoY visit increases, followed by QSR – highlighting the enduring power of lower-cost, quick-serve dining options. But Full-Service Restaurants (FSR) also saw a slight segment-wide YoY visit uptick in Q1 – good news for a sector that has yet to bounce back from the one-two punch of COVID and inflation. Within each Dining category, however, some chains experienced outsize visit growth – including favorites like Dutch Bros. Coffee, Slim Chickens, In-N-Out Burger, and Texas Roadhouse.

Since the shelter-in-place days of COVID – when everybody had their sourdough starter and DIY was all the rage – Home Improvement & Furnishings chains have faced a tough environment. Many deferred or abandoned home improvement projects in the wake of inflation, and elevated interest rates coupled with a sluggish housing market put a further damper on the category.

Against this backdrop, Home Improvement & Furnishings’ relatively lackluster Q1 visit performance should come as no surprise. But the narrowing of the visit gap in March – which also saw one week of positive visit growth – may serve as a promising sign for the segment. (The abrupt foot traffic drop during the week of March 25th, 2024 is likely a just reflection of Easter holiday shopping pattern.)

Within the Home Improvement & Furnishings space, some bright spots stood out in Q1 – including Harbor Freight Tools, which saw visits increase by 10.0%, partly due to the brand’s growing store count. Tractor Supply Co., Menards, and Ace Hardware also registered visit increases.

January 2024’s stormy weather left its mark on the Q1 retail environment, especially for discretionary categories. But as the quarter progressed, retailers rallied, with healthy YoY foot traffic growth that peaked during the last week of March – the week of Easter Sunday. All in all, retail’s positive Q1 performance leaves plenty of room for optimism about what’s in store for the rest of 2024.