.svg)

.png)

.png)

.png)

.png)

As new retail construction slows, the trend of repurposing underperforming malls is accelerating, offering exciting opportunities to transform these properties into vibrant mixed-use developments. By blending retail, lifestyle, entertainment, and essential services, these redevelopments can better serve the evolving needs of today’s consumers. Class B malls offer significant potential for investors and retailers to unlock value while meeting the needs of local communities.

According to Green Street, there are 250 Class-B malls in the U.S., making up 28% of all U.S. malls. These properties are typically located in suburban or secondary markets and often feature a mid-tier tenant mix of national and regional retailers within a traditional enclosed mall format. According to Green Street data, A-rated malls boast an impressive 95% occupancy rate, while B malls sit at 89%. Meanwhile, occupancy drops significantly to 72% for C-rated malls and below.

B Malls face a number of challenges in addition to their higher vacancy rates, including lower sales per square foot, less desirable locations, outdated designs, and competition from newer lifestyle centers that offer a more dynamic mix of retail, dining, and entertainment.

Class-B malls, despite their challenges, offer a compelling opportunity for adaptive reuse. Often priced below their original value, these properties are ideal for redevelopment into community-centric hubs, featuring a mix of residential, retail, and public spaces. Reimagining these spaces not only allows investors and developers to achieve significant returns, but also fosters positive economic growth in local communities. For retailers, these revitalized spaces offer the chance to thrive in environments with increasing foot traffic and elevated customer engagement.

Hawthorn Mall, a premier two-story super-regional shopping center in Vernon Hills, Illinois, is one B Mall currently undergoing a significant transformation – and early data suggests that the revitalization efforts are already bearing fruit.

Owned by Centennial Real Estate, Hawthorn is strategically positioned at the intersection of Lake County’s key thoroughfares, offering exceptional convenience and accessibility. The center is anchored by major brands like AMC, Dave & Buster’s, JCPenney, and Macy’s, with a diverse mix of more than 60 retailers and restaurants, including Anthropologie, FP Movement, H&M, Lovesac, PGA Tour Superstore, Perry’s Steakhouse & Grille, and Pure Barre. Now, in the midst of redevelopment, Hawthorn is evolving into a vibrant mixed-use community, integrating luxury residential, expanded retail and dining, and pedestrian-friendly spaces.

Although the Hawthorn Mall redevelopment is still under way, visit quality to the mall has already improved – with the median visit duration rising from 54 minutes between April 2022 and March 2023 to 61 minutes between April 2024 and March 2025. The median household income in Hawthorn’s captured market has increased as well, perhaps thanks to the addition of a luxury apartment complex on the mall’s property. Lastly, the share of evenings visits also grew, suggesting that Hawthorn's revamped dining and entertainment are making it an increasingly popular evening destination for locals.

Class-B malls represent a unique opportunity to meet both market demands and community needs through thoughtful redevelopment. While challenges such as securing financing, navigating zoning and regulatory hurdles, and managing costs exist, the potential rewards are significant. Successful redevelopment requires targeted tenant curation, strategic location, and a bold, forward-thinking vision. With expansive footprints, prime access, and adaptability, Class-B malls are perfectly positioned to evolve into dynamic, mixed-use centers – redefining retail experiences and meeting the needs of modern consumers and communities.

Traffic to First Watch continues to climb as the company forges on with its expansion. Visits to the chain were 7.3% higher year-over-year (YoY) in Q1 2025 as visits per location held essentially steady (-0.8% YoY) – revealing that demand for the breakfast, brunch, and lunch dining concept remains robust despite the consumer headwinds.

And according to the latest monthly data, First Watch may be in even better shape than its already strong Q1 2024 visit numbers suggest. In April 2025, overall visits to the chain grew 10.5% YoY while visits per location increased by 3.0% – indicating that the morning and afternoon-focused dining brand likely still has more room to grow.

For more data-driven consumer analysis, visit placer.ai/anchor.

While Warby Parker and Allbirds both originated as direct-to-consumer brands, they have since firmly established themselves as brick-and-mortar retailers. Warby Parker, known for its quirky and affordable approach to eyecare, has around 270 stores in the United States, while Allbirds, which recently underwent a significant rightsizing process, currently operates 24 stores across the country.

We took a look at the visit data for the two retailers to explore how they are faring thus far in 2025.

Warby Parker continues to impress. The eyewear chain, which transitioned from an online-only model to physical stores in 2013, spent 2024 adding stores to its current fleet – and visit data highlights the positive impact of this expansion.

Q4 2024 and Q1 2025 visits to Warby Parker were 13.4% and 6.6% higher, respectively, than in Q4 2023 and Q1 2024. Average visits per location, too, showed growth in Q4 2024 (+4.9%), though they slowed slightly in Q1 2025. Still, Warby Parker’s ability to drive visit growth while keeping average visits per location stable suggests that its expansions are meeting with consistent demand.

Weekly visits from 2025 onward highlight the brands’ strong positioning, with YoY visit growth in most analyzed weeks. (The significant YoY visit decline during the weeks of March 31st and April 7th is likely due to the comparison with last year’s major eclipse-related promotion, during which the chain offered free solar eclipse glasses.)

Shoewear company Allbirds has been charting a new performance course over the last year. The chain, known for its sustainable approach to footwear, recently closed nearly a third of its U.S. fleet in an attempt to optimize its stateside operations. And this consolidation, which allows Allbirds to prioritize top-performing locations, has yielded promising results for the chain.

While YoY visits were down across all analyzed months – an anticipated outcome given the significant reduction in store count – average visits per location, a more relevant indicator of Allbirds’ performance, were up on a near-constant basis. In Q1 2025, visits declined by 35.8% YoY, but visits per location grew by 14.1%.

Monthly visits followed a similar pattern: while overall visits declined by 25.9% YoY in March 2025, visits per location were up by 23.8%. This positive trend continued into April 2025, with overall visits down by just 9.2% YoY and visits per location remaining elevated at 21.0%, suggesting a strengthened performance at the remaining Allbirds stores.

This focus on a more efficient store footprint seems to be paying off for Allbirds, allowing the chain to accurately target its most receptive audience while cutting out underperforming locations.

Warby Parker and Allbirds are performing well, highlighting the importance of remaining agile and pivoting to meet evolving consumer challenges.

Will the two retailers continue to thrive?

Visit Placer.ai to keep up with the latest data-driven retail news.

Some moments in our lives remain ingrained in our heads. One such time period was March of 2020, when it felt like the world suddenly stood still as malls, street retail, and dining establishments closed, everyone masked up, and only essential retail and health services continued. After a while, limitations relaxed, but not without a subconscious preference for open-air shopping centers that appears to linger to this day. Granted, many open-air shopping centers are also newer or redeveloped, thus likely contributing to their popularity. However, there’s no doubt that they’ve rebounded at a higher rate compared to their indoor mall and even outlet mall counterparts.

We analyzed traffic data for one of the most-visited open-air shopping centers in the nation, Victoria Gardens, to see what sets it apart and what continues to draw consumers to open-air centers.

This open-air shopping center is over 1.1 million square feet and hosts over 160 retailers within its borders. In addition to marquee brands such as Apple, lululemon, AMC Theatres, and Cheesecake Factory, it also has regional favorites such as Seven Grams dumpling house and cult-favorite Duck Donuts. Boasting a 160 acre main street community, its walkable layout beckons while classics play in the background. Quite a few of the concepts at Victoria Gardens are on trend. For instance, the Food Hall features local eatery Elephant Thai, which is perfectly in keeping with the popularity of all things Thai these days with Season 3 of White Lotus being set in Koh Samui.

Another genre that one doesn’t often see in more urban mall locations are two retailers devoted to Western wear – Buckle and Tecovas.

Tecovas has a fascinating backstory with its founder, Paul Hedrick, partnering initially with bootmakers from Leon, Mexico, the “boot-making capital of the Americas” and selling his first pairs from the backseat of his SUV. With an average dwell time of 40 minutes between April 2024 and February 2025 and holiday spikes for Thanksgiving and Christmas, it’s clear that for many shoppers, a pair of Tecova boots are on their wishlist.

One of the more unique aspects of this mall is its Cultural Center on premise. With a performing arts theater, library, and interactive children’s museum right next to retail, dining, and a movie theater, it’s truly a one-stop shop for its community.

As shopping centers continue to evolve, with many adopting a Town Square approach, the appeal of open-air shopping centers – full of public spaces, greenery, walkable paths, and fresh air – will only continue to grow.

For more data-driven consumer insights, visit placer.ai/anchor

Aldi and Lidl have firmly established themselves as discount powerhouses. The two German retailers entered the United States market at different times, with Aldi opening its first location in 1976 and Lidl making its way stateside in 2017 – and diving into the foot traffic shows that both are thriving.

In the first quarter of 2025, visits to Aldi and Lidl saw significant year-over-year (YoY) increases of 8.9% and 4.2%, respectively – well above the industry-wide average (0.9%.)

Aldi, which has been on an expansion tear for the past few years, saw a YoY increase in average visits per location – but so did Lidl, which has been slower to add new locations. And this growth – 4.7% at Aldi and 1.9% at Lidl – highlights that their stores, whether new locations or already-existing ones, are driving sustained demand.

A closer look at visitor behavior offers valuable insights into the factors driving the foot traffic success of Aldi and Lidl.

A significantly larger proportion of Aldi and Lidl's visits – 37.2% and 37.7%, respectively – took place on Saturdays and Sundays compared to visits to traditional and value grocery stores. This suggests that the attractive price points offered by Aldi and Lidl position them as prime destinations for shoppers making weekend stock-up trips.

On a chain level, both Aldi and Lidl are finding their own paths to success. Aldi is currently undergoing a significant growth phase, aiming to operate 800 stores by the end of 2028. This ambitious trajectory includes adding at least 225 new locations in 2025 alone – and examining the visit distribution across Aldi's largest markets provides valuable insights into how its strategy is unfolding. Contextualizing Aldi’s performance against the wider grocery segment provides a birds-eye view of the value grocer’s performance.

Over the past few years, Aldi has consistently increased its visit share when compared to the overall grocery segment, both nationally and across its major markets. For instance, in Florida, one of Aldi’s largest markets, its visit share grew from 4.8% in Q1 2022 to 7.0% in Q1 2025. And in Illinois, now its second-largest market, Aldi increased its visit share from 12.2% to 14.8% over the same period.

This consistent growth in visit share underscores the broad appeal of Aldi's value proposition to shoppers across the country, suggesting that its ambitious expansion plans are likely to be well-received by consumers.

Lidl also plans to grow its store count, though at a more modest pace than Aldi. And the chain is focusing on its already-existing markets in hopes of entrenching itself further in areas where it already has strong brand recognition.

Geographic segmentation data from the Esri: Tapestry Segmentation dataset within Lidl’s potential and captured markets reveals promising insights into where the retailer might find its most receptive audiences. In its potential market – calculated by weighting each Census Block Group (CBG) within Lidl’s trade area according to population size – the share of visitors from "Suburban Periphery" areas was 41.5%. However, in its captured market, determined by weighting each CBG according to its share of actual visits to Lidl – so better representing its current visitor profile – this suburban segment constitutes a significantly larger 56.4%. Conversely, the proportion of visitors originating from "Principal Urban Centers" and "Metro Cities" was higher in Lidl’s potential market compared to its captured market.

These metrics strongly suggest that Lidl has more demand in the suburbs than it may realize – and as it expands, focusing on these areas might prove to be a winning strategy for the chain.

Aldi and Lidl are thriving, growing their audiences during a challenging economic climate.

Will visits to the two chains continue to increase throughout 2025? Visit Placer.ai to keep up with the latest data-driven grocery insights.

Amid rising housing costs and shifting consumer lifestyles, self-storage has emerged as a go-to solution for many Americans. We dove into the data to take the pulse of the market in Q1 2025 – and uncover the audience segments behind the industry’s ongoing growth.

Visits to leading self-storage companies have been on a steady growth trajectory since 2019. During the pandemic, storage utilization surged as many Americans relocated or stored items to free up space for home offices or DIY projects. Since then, high prices and interest rates appear to have further fueled demand, with some households likely deferring space-adding renovations or larger home purchases.

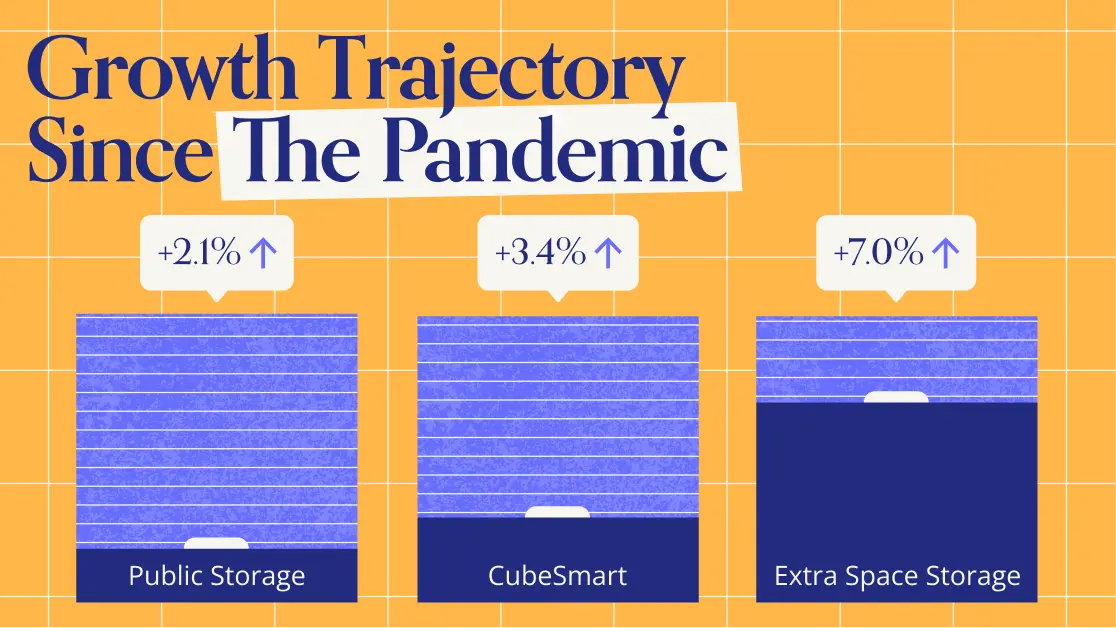

In Q1 2025, visits to Public Storage and CubeSmart were up 24.7% and 30.7%, respectively, compared to a Q1 2019 baseline. Extra Space Storage – which substantially expanded its unit count following its 2023 acquisition of Life Storage – saw visits surge 98.3% over the same baseline. And year over year (YoY), all three chains posted foot traffic growth, partly driven by continued expansion.

The baseline visit analysis also reveals a distinct seasonal pattern in self-storage usage patterns. Each year, visits to self-storage chains peak in Q2 and Q3 (April through September), aligning with spring cleaning, home improvement prime time, and moving season. Then in Q1, visits drop as people stay indoors during winter – likely also making fewer trips to access recreational gear and vehicles in storage.

Who are the consumers driving self-storage visit growth? Looking at the demographic characteristics of Extra Space Storage, Public Storage, and CubeSmart’s visitor bases reveals a common consumer profile across chains. In Q1 2025, the captured markets of all three chains had nearly identical median household incomes (HHIs), very close to the nationwide baseline of $79.6K. Their markets were also disproportionately urban, with higher-than-average shares of renter-occupied and multi-unit housing – all groups more likely to need extra storage space.

Still, as the self-storage market has grown, industry leaders have grown their presence in more affluent suburban markets. Between Q1 2019 and Q1 2025, Extra Space Storage’s share of “Wealthy Suburban Families” rose from 9.1% to 10.1% – slightly above the nationwide baseline of 9.6%. Meanwhile, Public Storage’s share of this segment increased from 8.8% to 9.8%, and CubeSmart’s share remained steady at 10.1%. A similar pattern emerged for “Upper Suburban Diverse Families”, with all three chains at or above the nationwide segment baseline of 9.0% by Q1 2025.

This small but perceptible shift may reflect rising demand from households where adult children are increasingly staying at home or returning after college, prompting a need for additional storage. Spare rooms once used for storage may also be increasingly repurposed into home offices, studios, or workout spaces in the wake of hybrid work trends.

Known for resilience in the face of economic headwinds and uncertainty, the self-storage space appears well-positioned to continue to thrive. How will the segment evolve in the years and months ahead?

Follow Placer.ai/anchor to find out.

Walmart, Target, and Costco are three of the most popular retailers in the country, drawing millions of shoppers through their doors each day. Each of these retail giants boasts distinct strengths and strategies that cater to their unique customer bases, allowing them to thrive in a highly competitive market.

This white paper takes a closer look at some of the factors that are helping the three chains flourish. How does Walmart’s positioning as a family-friendly retailer help it drive visits in its more competitive markets? How can Target leverage its reach to drive more loyal visits? And what does the increase in young shoppers frequenting membership warehouse clubs mean for Costco?

We dove into the location analytics to explore these questions further.

Examining monthly visitation patterns for the three retail giants shows Costco’s wholesale club model leading the way with consistent year-over-year (YoY) visit growth – ranging from 6.1% in stormy January 2024 to 13.3% in June. Family favorite Walmart followed closely behind, seeing YoY foot traffic growth during all but two months, when visits briefly trailed slightly behind 2023 levels before rebounding.

Target, meanwhile, had a slower start to the year, with visits trending below 2023 levels for most of January to April. Over this same period (the three months ending May 2024), Target reported a 3.7% decline in YoY comparable sales. But since then, things have begun to turn around for the chain, with YoY visits rising in May (2.5%), June (8.9%), and July (4.7%). This renewed visit growth into the second half of the year bodes well for the superstore – and the ongoing back-to-school season may well push visits up further as the summer winds down.

For all three chains, Q2 2024’s visit success has likely been bolstered in part by summer deals and intensifying price wars – as the retailers slash prices to woo inflation-weary consumers back to the store.

Over the past few years, consumer behaviors have been changing rapidly in response to shifting economic conditions. This next section explores some of these changes at Walmart, Target, and Costco, to better understand what may be driving these shifts.

One way that consumers have traditionally responded to inflation and other headwinds has been through the adoption of mission-driven shopping – making fewer, but longer, trips to retailers, so that every visit counts. Superstores and wholesale clubs, which offer one-stop shopping experiences, have long been prime destinations for these extended shopping trips. And even during periods when visits have lagged, these retailers have often benefited from extended dwell times – leading to bigger basket sizes.

A look at changes in average dwell times at Walmart and Target suggests that as YoY visits have picked up, dwell times have come down – perhaps reflecting a normalization of consumers’ shopping patterns. With inflation stabilizing and gas prices lower than they were in 2022 and 2023, customers may feel less pressure to consolidate shopping trips than they have in recent years.

In contrast, Costco’s comparatively long dwell times have remained stable over the past several years. The warehouse club’s bulk offerings, plentiful free samples, and inexpensive food court encourage shoppers to spend more time browsing the aisles than they would at other retailers. And even if mission-driven shopping continues to subside, Costco customers will likely keep on making extra-long shopping trips.

While inflation is cooling faster than expected, prices remain high, and new players are stepping into the retail space occupied by Walmart, Target, and Costco – especially dollar stores. Though higher-income customers increasingly rely on the three retail giants for many of their purchases, customers of more modest means are often drawn to the rock-bottom prices offered at dollar stores.

And analyzing the cross-shopping patterns of visitors to Walmart, Target, and Costco shows that growing shares of visitors to the three behemoths also visit Dollar Tree on a regular basis. In Q2 2019, the share of visitors to Walmart, Target, and Costco who frequented Dollar Tree at least three times ranged between 9.8% and 13.7%. But by Q2 2024, that share rose to 16.7%-21.6%.

Dollar Tree is leaning into this increased interest among superstore shoppers. Over the past year, Dollar Tree added some 350 Dollar Tree locations, even as it shuttered nearly 400 Family Dollar stores. And the chain recently acquired the leases of some 170 99 Cents Only Stores – offering Dollar Tree access to a customer base accustomed to buying everything from groceries to household goods. As Dollar Tree continues to grow its footprint and expand its food offerings, the chain will be better positioned than ever to provide a real challenge to Walmart, Target, and Costco.

Still, the three retail giants each have unique offerings that distinguish them from dollar stores. This next section examines what sets Walmart, Target, and Costco apart – and how they can continue to strengthen their competitive edge.

With competition on the rise, Walmart, Target, and Costco must display agility in navigating an ever-evolving market landscape. This section dives into the data for each chain’s more successful metro areas to see what factors are helping them outperform nationwide averages – and what metrics the retailers can harness to try to replicate these results nationwide.

Target recently expanded its Target Circle Rewards program, rolling out three new tiers for its 100 million members. And this focus on loyalty has proven successful for the chain. Demographic and visitation data reveal a strong correlation between the median household incomes (HHIs) of Target locations’ captured markets across CBSAs (core-based statistical areas), and their share of loyal visitors in Q2 2024: CBSAs where Target locations’ captured markets had higher median HHIs also tended to draw more repeat monthly visitors.

Target’s captured markets in the Los Angeles-Long Beach-Anaheim, LA CBSA, for example, featured a median HHI of $89.8K in Q2 2024 – and 48.0% of the chain’s LA visitors frequented a Target at least twice a month during the quarter. Target stores in the Chicago-Naperville-Elgin, IL-IN-WI CBSA, where the chain’s captured markets had a median HHI of $88.7K in Q2 2024, also had a loyalty rate of 48.0%.

Target generally attracts a more affluent audience than Walmart. And even as the superstore slashes prices to attract more price-conscious consumers, the retailer is also taking steps likely to enhance its popularity among higher-income households. In April 2024, Target debuted a paid membership tier within its loyalty program offering perks like same-day delivery for a fee. Maintaining and expanding these premium offerings will be key for Target as it seeks to attract more affluent customers and replicate its high-performing results in CBSAs nationwide.

The persistent inflation of the past few years, while challenging for some retailers, has also created new opportunities – particularly for wholesalers. Membership warehouse clubs, including Costco, are gaining popularity among younger shoppers, a cohort often looking for new ways to stretch their more limited budgets. An October 2023 survey revealed that nearly 15% of respondents aged 18 to 24 and 17% of those aged 25 to 30 shop at Costco.

A closer look at some of Costco’s best-performing CBSAs for YoY visit-per-location growth highlights the significance of these younger shoppers: In H1 2024, the company’s YoY visit-per-location growth was strongest in areas with higher-than-average shares of young urban singles.

For example, the San Diego-Chula Vista-Carlsbad, CA CBSA experienced visit-per-location growth of 10.4% YoY in H1 2024, while the nationwide average stood at 7.9%. And the CBSA’s share of Young Urban Singles, defined by the Spatial.ai: PersonaLive dataset as “singles starting their careers in trade and service jobs,” was 12.1%, well above Costco’s nationwide average of 7.3%.

Walmart is a one-stop shop for everything from affordable groceries to clothing to home furnishings, making it especially popular among families. The retailer actively courts this segment with baby offerings designed to meet the needs of both kids and parents, virtual offerings in the metaverse, and collectible toys.

And visitation data reveals a connection between the extent of different Walmart locations’ YoY visit growth and the share of households with children in their captured markets.

In H1 2024, nationwide visits to Walmart increased by 4.1% YoY, while the share of households with children in the chain’s overall captured market hovered just under the nationwide baseline. But in some CBSAs where Walmart outpaced this nationwide growth, the retail giant also proved especially adept at attracting parental households – outpacing relevant statewide baselines.

In Boston-Cambridge-Newton, MA, for example, Walmart experienced 5.0% YoY visit growth in H1 2024 – while the share of households with children in the chain’s local captured market stood 7% above the Massachusetts state average. And in Grand Rapids-Kentwood, MI, where Walmart’s share of parental households outpaced the Minnesota state average by an even wider 15% margin, the retailer saw impressive 7.3% YoY visit growth. This pattern repeated itself in other metro areas, suggesting that there may be a correlation between local Walmart locations’ visit growth and their relative ability to draw households with children.

Walmart can continue solidifying its market position by leaning into its family-oriented offerings and expanding its footprint in regions with growing populations of young families.

Walmart, Target, and Costco all experienced YoY visit growth in the final months of H1 2024, with Costco leading the way. And though the three chains still face considerable challenges, each one brings unique strengths to the table. By continuously innovating and responding to changing market conditions, Walmart, Target, and Costco can not only overcome obstacles but also leverage them to reinforce their market positions and drive continued growth.

The first Lollapalooza – a four-day music festival – took place in 1991. Chicago’s Grant Park became the event’s permanent home (at least in the United States) in 2005, drawing thousands of revelers and music fans to the park each year.

This year, the festival once again demonstrated its powerful impact on the city. On August 1st, 2024, visits to Grant Park surged by 1,313.2% relative to the YTD daily average, as crowds converged on the park to see Chappell Roan’s much-anticipated performance. And during the first three days of the event, the event drew significantly more foot traffic than in 2023 – with visits up 18.9% to 35.9% compared to the first three days of last year’s festival (August 3rd to 5th, 2023).

Lollapalooza led to a dramatic spike in visits to Grant Park – and it also attracted a different type of visitor compared to the rest of the year.

Analyzing Grant Park’s captured market with Spatial.ai’s PersonaLive dataset reveals that Lollapalooza attendees are more likely to belong to the “Young Professionals” and “Ultra Wealthy Families” segment groups than the typical Grant Park visitor.

By contrast, the “Near-Urban Diverse Families” segment group, comprising middle-class diverse families living in or near cities, made up only 6.5% of visitors during the festival, compared to 12.0% during the rest of the year.

Additionally, visitors during Lollapalooza came from areas with higher HHIs than both the nationwide baseline of $76.1K and the average for park visitors throughout the year. Understanding the demographic profile of visitors to the park during Lollapalooza can help planners and city officials tailor future events to these segment groups – or look for ways to make the festival accessible to a wider range of music lovers.

Lollapalooza’s impact on Chicago extended beyond the boundaries of Grant Park, with nearby hotels seeing remarkable surges in foot traffic. The Congress Plaza Hotel on South Michigan Avenue witnessed a staggering 249.1% rise in visits during the week of July 29, 2024, compared to the YTD visit average. And Travelodge on East Harrison Street saw an impressive 181.8% increase. These spikes reflect the festival’s draw not just for locals but for out-of-town visitors who fill hotels across the city.

The North Michigan Avenue retail corridor also enjoyed a significant increase in foot traffic during the festival, with visits on Thursday, August 1st 56.0% higher than the YTD Thursday visit average. On Friday, August 2nd, visits to the corridor were 55.7% higher than the Friday visit average. These numbers highlight Lollapalooza’s role in driving economic activity across Chicago, as festival-goers venture beyond the park to explore the city’s vibrant retail and hospitality offerings.

City parks often serve as community hubs, and Flushing Meadows Corona Park in Queens, NY, has been a major gathering point for New Yorkers. The park hosted one of New York’s most beloved summer concerts – Governors Ball – which moved from Governors Island to Flushing Meadows in 2023.

During the festival (June 9th -11th, 2024), musicians like Post Malone and The Killers drew massive crowds to the park, with visits soaring to the highest levels seen all year. On June 9th, the opening day of the festival, foot traffic in the park was up 214.8% compared to the YTD daily average, and at its height, on June 8th, the festival drew 392.7% more visits than the YTD average.

The park also hosted other big events this summer – a July 21st set by DMC helped boost visits to 185.1% above the YTD average. And the Hong Kong Dragon Boat Festival on August 3rd and 4th led to major visit boosts of 221.4% and 51.6%, respectively.

These events not only draw large crowds, but also highlight the park’s role as a space where cultural and civic life can find expression, flourish, and contribute to the health of local communities.

Analyzing changes in Flushing Meadows Corona Park’s trade area size offers insight into how far people are willing to travel for these events. During Governors Ball, for example, the park’s trade area ballooned to 254.5 square miles, showing the festival's wide appeal. On July 20th, by contrast, when the park hosted several local bands and DJs, the trade area was a much more modest 57.0 square miles.

Summer events drive community engagement, economic activity, and civic pride. Cities that invest in their parks and event hubs, fostering lively and inclusive spaces, can create lasting value for both residents and visitors, enriching the cultural and social life of urban areas.

For more data-driven civic stories, visit Placer.ai.

The pandemic and economic headwinds that marked the past few years presented the multi-billion dollar hotel industry with significant challenges. But five years later, the industry is rallying – and some hotel segments are showing significant growth.

This white paper delves into location analytics across six major hotel categories – Luxury Hotels, Upper Upscale Hotels, Upscale Hotels, Upper Midscale Hotels, Midscale Hotels, and Economy Hotels – to explore the current state of the American hospitality market. The report examines changes in guest behavior, personas, and characteristics and looks at factors driving current visitation trends.

Overall, visits to hotels were 4.3% lower in Q2 2024 than in Q2 2019 (pre-pandemic). But this metric only tells part of the story. A deeper dive into the data shows that each hotel tier has been on a more nuanced recovery trajectory.

Economy chains – those offering the most basic accommodations at the lowest prices – saw visits down 24.6% in Q2 2024 compared to pre-pandemic – likely due in part to hotel closures that have plagued the tier in recent years. Though these chains were initially less impacted by the pandemic, they were dealt a significant blow by inflation – and have seen visits decline over the past three years. As hotels that cater to the most price-sensitive guests, these chains are particularly vulnerable to rising costs, and the first to suffer when consumer confidence takes a hit.

Luxury Hotels, on the other hand, have seen accelerated visit growth over the past year – and have succeeded in closing their pre-pandemic visit gap. Upscale chains, too, saw Q2 2024 visits on par with Q2 2019 levels. As tiers that serve wealthier guests with more disposable income, Luxury and Upscale Hotels are continuing to thrive in the face of headwinds.

But it is the Upper Midscale level – a tier that includes brands like Trademark Collection by Wyndham, Fairfield by Marriott, Holiday Inn Express by IHG Hotels & Resorts, and Hampton by Hilton – that has experienced the most robust visit growth compared to pre-pandemic. In Q2 2024, Upper Midscale Hotels drew 3.5% more visits than in Q2 2019. And during last year’s peak season (Q3 2023), Upper Midscale hotels saw the biggest visit boost of any analyzed tier.

As mid-range hotels that still offer a broad range of amenities, Upper Midscale chains strike a balance between indulgence and affordability. And perhaps unsurprisingly, hotel operators have been investing in this tier: In Q4 2023, Upper Midscale Hotels had the highest project count of any tier in the U.S. hotel construction and renovation pipeline.

The shift in favor of Upper Midscale Hotels and away from Economy chains is also evident when analyzing changes in relative visit share among the six hotel categories.

Upper Midscale hotels have always been major players: In H1 2019 they drew 28.7% of overall hotel visits – the most of any tier. But by H1 2024, their share of visits increased to 31.2%. Upscale Hotels – the second-largest tier – also saw their visit share increase, from 24.8% to 26.1%.

Meanwhile, Economy, Midscale, and Upper Upscale Hotels saw drops in visit share – with Economy chains, unsurprisingly, seeing the biggest decline. Luxury Hotels, for their parts, held firmly onto their piece of the pie, drawing 2.8% of visits in H1 2024.

Who are the visitors fueling the Upper Midscale visit revival? This next section explores shifts in visitor demographics to four Upper Midscale chains that are outperforming pre-pandemic visit levels: Trademark Collection by Wyndham, Holiday Inn Express by IHG Hotels & Resorts, Fairfield by Marriott, and Hampton by Hilton.

Analyzing the captured markets* of the four chains with demographics from STI: Popstats (2023) shows variance in the relative affluence of their visitor bases.

Fairfield by Marriott drew visitors from areas with a median household income (HHI) of $84.0K in H1 2024, well above the nationwide average of $76.1K. Hampton by Hilton and Trademark Collection by Wyndham, for their parts, drew guests from areas with respective HHIs of $79.6K and $78.5K – just above the nationwide average. Meanwhile, Holiday Inn Express by IHG Hotels & Resorts drew visitors from areas below the nationwide average.

But all four brands saw increases in the median HHIs of their captured markets over the past five years. This provides a further indication that it is wealthier consumers – those who have had to cut back less in the face of inflation – who are driving hotel recovery in 2024.

(*A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice.)

Much of the Upper Midscale visit growth is being driven by chain expansion. But in some areas of the country, the average number of visits to individual hotel locations is also on the rise – highlighting especially robust growth potential.

Analyzing visits to existing Upper Midscale chains in four metropolitan areas with booming tourism industries – Salt Lake City, UT, Palm Bay, FL, San Diego, CA, and Richmond, VA – shows that these markets feature robust untapped demand.

Utah, for example, has emerged as a tourist hotspot in recent years – with millions of visitors flocking each year to local destinations like Salt Lake City to see the sights and take in the great outdoors. And Upper Midscale hotels in the region are reaping the benefits. In H1 2024, the overall number of visits to Upper Midscale chains in Salt Lake City was 69.4% higher than in H1 2019. Though some of this increase can be attributed to local chain expansion, the average number of visits to each individual Upper Midscale location in the area also rose by 12.5% over the same period.

Palm Bay, FL (the Space Coast) – another tourist favorite – is experiencing a similar trend. Between H1 2019 and H1 2024, overall visits to local Upper Midscale hotel chains grew by 36.4% – while the average number of visits per location increased a substantial 16.9%. Given this strong demand, it may come as no surprise that the area is undergoing a hotel construction boom. Upper Midscale hotels in other areas with flourishing tourism sectors, like San Diego, CA and Richmond, VA, are seeing similar trends, with increases in both overall visits and and in the average number of visits per location.

Though Economy chains have underperformed versus other categories in recent years, the tier does feature some bright spots. Some extended-stay brands in the Economy tier – hotels with perks and amenities that cater to the needs of longer-stay travelers – are succeeding despite category headwinds.

Choice Hotels’ portfolio, for example, includes WoodSpring Suites, an Economy chain offering affordable extended-stay accommodations in 35 states. In H1 2024, the chain drew 7.7% more visits than in the first half of 2019 – even as the wider Economy sector continued to languish. InTown Suites, another Economy extended stay chain, saw visits increase by 8.9% over the same period.

And location intelligence shows that the success of these two chains is likely being driven, in part, by their growing appeal to young, well-educated professionals. In H1 2019, households belonging to Spatial.ai: PersonaLive’s “Young Professionals” segment made up 9.6% of WoodSpring Suites’ captured market. But by H1 2024, the share of this group jumped dramatically to 13.3%. At the same time, InTown Suites saw its share of Young Professionals increase from 12.0% to 13.4%.

Whether due to an affinity for prolonged “workcations” (so-called “bleisure” excursions) or an embrace of super-commuting, younger guests have emerged as key drivers of growth for the extended stay segment. And by offering low–cost accommodations that meet the needs of these travelers, Economy chains can continue to grow their share of the pie.

The hospitality industry recovery continues – led by Upper Midscale Hotels, which offer elevated experiences that don’t break the bank. But today’s market has room for other tiers as well. By keeping abreast of local visitation patterns and changing consumer profiles, hotels across chain scales can personalize the visitor experience and drive customer satisfaction.