.svg)

.png)

.png)

.png)

.png)

After theaters were dominated by Barbenheimer in 2023, 2024 is shaping up to be another record-breaking year, with several big-name releases. We took a closer look at visitation patterns at major movie theater chains – AMC Theatres, Regal Cinemas, and Cinemark – to analyze how foot traffic has been impacted by the highly anticipated summer releases of Deadpool & Wolverine and Twisters.

Last year was one of the most exciting ones in recent memory for cinema, with multiple films breaking box-office records and driving foot traffic at movie theaters across the country. But 2024 has had plenty of tricks up its cinematic sleeve, and several summer releases have been meeting the high bar set by Barbenheimer. Inside Out 2, released nationwide on June 14th 2024, kickstarted the summer with a major movie-goer visit boost– and Deadpool & Wolverine, released on July 26, 2024 brought out even bigger crowds.

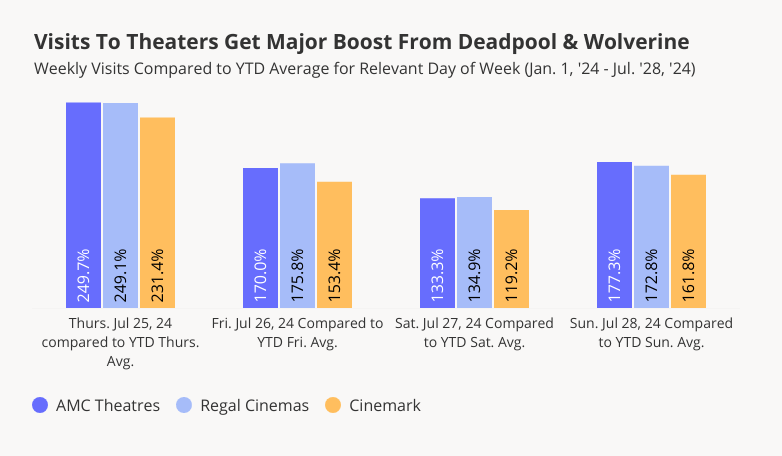

Indeed, the superhero crossover movie Deadpool & Wolverine is set to be one of the best-performing films of 2024. During the week of July 22nd, 2024 – when Deadpool & Wolverine was released – visits to movie leaders AMC Theatres, Regal Cinemas, and Cinemark jumped by 132.7% to 140.5% compared to a YTD weekly average. Twisters, released on July 19th, also drove impressive visit boosts ranging from 39.8% to 48.3% during the week of July 15th.

Early screenings have always been a big driver of visits for those lucky enough to grab tickets. And on the day before Deadpool & Wolverine’s big July 26th release, movie theaters already started filling up. On Thursday, July 25th, 2024, visits to AMC, Regal, and Cinemark were up a whopping 231.4% to 249.7% compared to a YTD Thursday average. And Friday, Saturday, and Sunday continued to see visit numbers significantly higher than the YTD visit averages for those days of the week, confirming the movie’s ability to drive visits to theaters. (In absolute terms, Saturday, July 27th was the cinema leaders’ busiest day of the year so far – but since Saturdays tend to be busier than Thursdays, the relative visit spike was somewhat smaller).

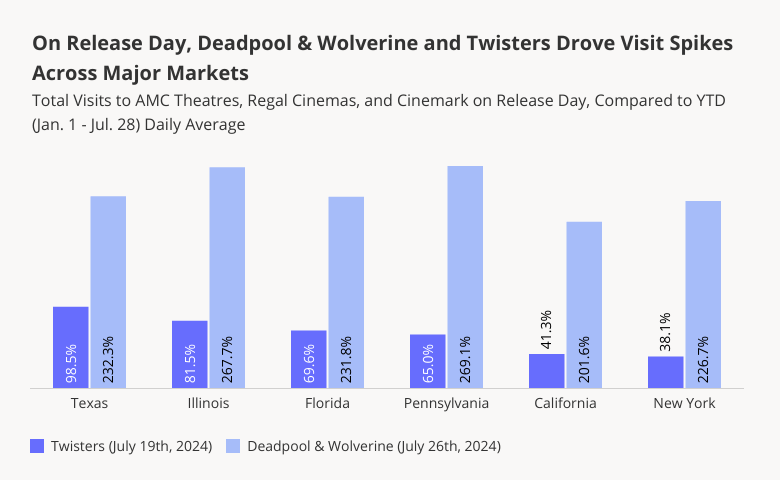

Drilling down into the data for major markets shows that though Deadpool & Wolverine was the runaway hit of the summer, Twisters also drove significant visit spikes throughout the country. And of the major markets, some of Twisters’ biggest visit boosts took place in states with plenty of hands-on tornado experience – like Texas, where July 19th visits to AMC, Regal, and Cinemark (combined) were up 98.5% compared to a YTD daily average.

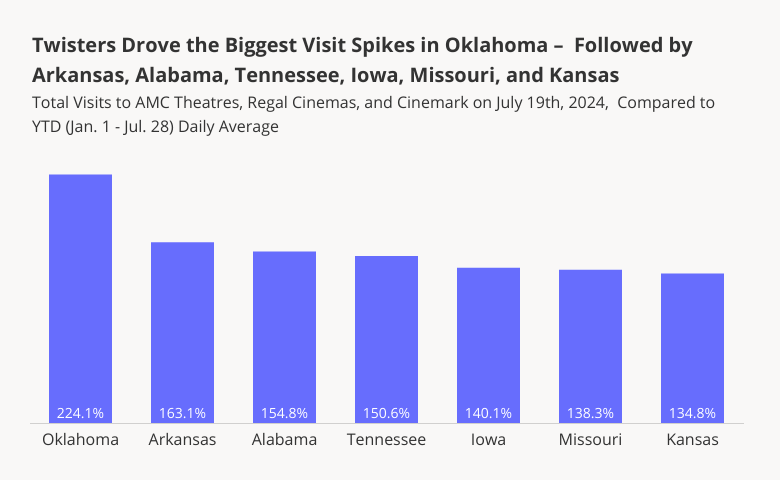

Indeed, looking at the states where Twisters drove the biggest visit spikes shows that many of the top performers were in tornado-prone areas. Oklahoma – where much of the movie was filmed – saw the most impressive Twisters foot traffic bump, with visits to leading cinemas up 224.1% on July 19th, 2024 compared to a YTD daily average. And the tornado-focused thriller also drew outsize crowds in other states where the theme of the movie was more likely than average to resonate with local audiences’ personal experiences – including Arkansas, Alabama, Tennessee, Iowa, Missouri, and Kansas.

Blockbuster releases like Deadpool & Wolverine, Twisters, and Inside Out 2 highlight the enduring appeal of out-of-home entertainment, and proves that movie theaters are as relevant as ever.

With more highly-anticipated releases still yet to come in 2024, can movie theaters across the country continue to break visit records?

Visit Placer.ai to stay on top of the latest data-driven leisure and entertainment stories.

Ahead of Toyota’s August 1st earnings call, we dove into the data to explore Q2 2024 visitation patterns at Toyota dealerships nationwide. How did year-over-year (YoY) foot traffic to Toyota showrooms perform in Q2 2024 – and what happened in June 2024, when the CDK Global outage caused paralysis across the industry? Who are the customers driving growth for Toyota – and what lies in store for the brand in the months ahead?

We dove into the data to find out.

During the second quarter of 2024, Toyota subsidiary TMNA (Toyota Motor North America, Inc.) reported a remarkable 9.2% year-over-year (YoY) increase in U.S. Toyota vehicle sales, buoyed by rising demand for hybrid cars. (The company also owns the luxury Lexus line).

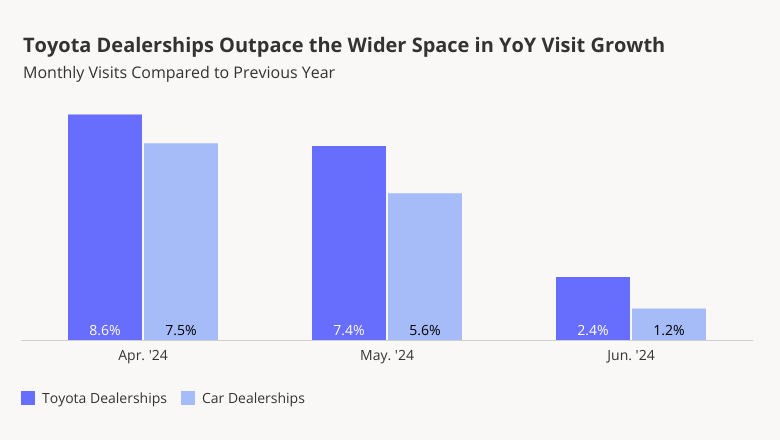

And foot traffic data shows that U.S. Toyota dealerships have indeed been significantly busier in Q2 2024 than in Q2 2023, outperforming the wider space. Apart from the regular portion of repair and maintenance visits, the auto brand’s YoY visit growth also reflects an increase in interested buyers. In April and May 2024, Toyota dealerships saw respective YoY visit boosts of 8.6% and 7.4%. And though the pace of YoY foot traffic growth to dealerships dropped in June 2024 – likely due in part to the CDK outage – the brand appears poised for continued visit success throughout the rest of the year.

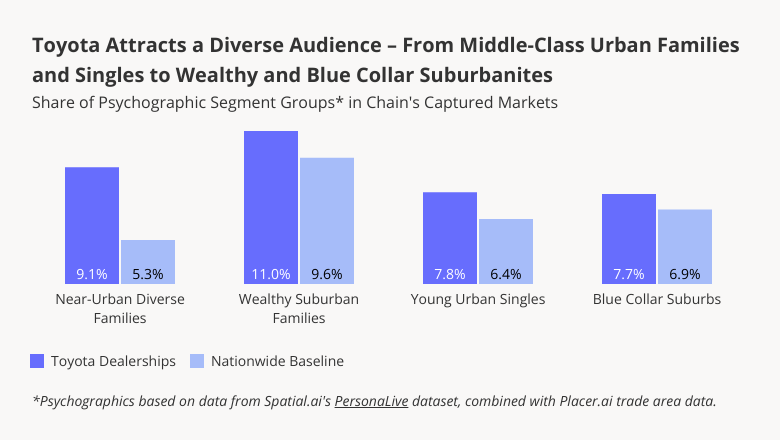

Toyota’s outsize success is likely due, in part, to its broad appeal – amongst everyone from price-conscious families seeking to maximize reliability and fuel efficiency to more affluent consumers that place a high premium on style. Toyota’s Certified Used Vehicles offering also draws in customers looking for trustworthy, pre-owned cars.

Analyzing Toyota dealerships’ captured markets with psychographics from Spatial.ai’s PersonaLive shows that their trade areas are economically diverse. Toyota attracts customers from areas with higher-than-average shares of both middle and working-class families, as well as more affluent ones. And Young Urban Singles are also more likely than average to visit Toyota dealerships.

Still, in Q2 2024, Toyota dealerships attracted a slightly more affluent consumer than average. The median household income (HHI) of the dealerships’ captured markets was $77.0K, just above the nationwide baseline of $76.1K. And looking at changes in Toyota’s audience over time also shows that the median HHI of its customer base has increased steadily over the past few years – rebounding to, and even exceeding, pre-pandemic levels. In the face of high interest rates, consumers with less room in their budgets may be cutting back on visits to car dealerships. And Toyota’s hybrid first strategy may also be increasing its appeal among more affluent car owners, who are more likely to purchase hybrid vehicles.

Will Toyota continue to thrive in the months ahead? And how will its customer base continue to evolve as inflation stabilizes and interest rates eventually come down?

Follow Placer.ai’s data-driven retail analyses to find out.

All-day breakfast mainstays Denny’s and IHOP (owned by Dine Brands) are two of the most popular full-service restaurants (FSRs) in the United States. But though the chains occupy similar niches, there are some differences between them. We dove into the data to check in with the two breakfast leaders – and see how they stack up against one another on key visitation metrics.

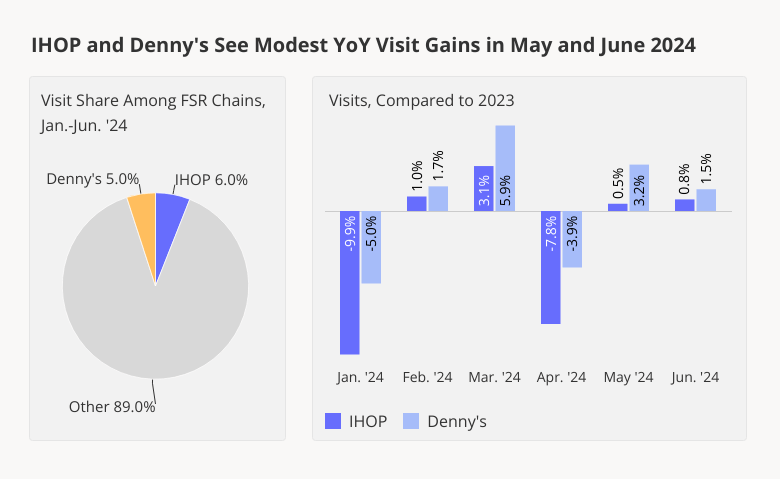

Both Denny’s and IHOP are major players in the FSR space. With its somewhat larger footprint, IHOP captured 6.0% of visits to full-service restaurant chains in the U.S in H1 2024, while Denny’s captured 5.0%. And despite the headwinds that continued to weigh on the sector this year, both chains saw modest YoY foot traffic gains in May and June 2024.

(The relatively big YoY fluctuations that both chains experienced in March and April 2024 are likely due in part to calendar shifts: March 2024 had one more weekend than March 2023, while April 2024 had one fewer weekend than April 2023. The two chains’ YoY June performance was also likely buoyed by an extra weekend in June 2024.)

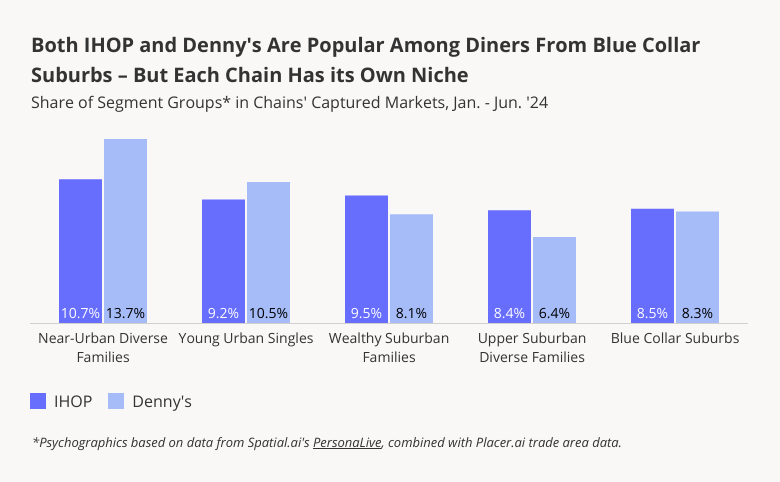

Who are IHOP’s and Denny’s typical customers? Given the two diners’ affordable offerings, it may come as no surprise that both restaurants draw visitors from captured markets with median household incomes below the nationwide baseline of $76.1K – $67.5K for Denny’s and $69.2K for IHOP.* Both chains also draw substantial shares of customers from Blue Collar Suburbs.

But each breakfast leader also draws a unique mix of visitors from a range of segments – with Denny’s attracting higher shares of middle-class urbanites and IHOP attracting higher shares of wealthy and upper-middle-class suburbanites.

Wealthy Suburban Families, for example, made up 9.5% of IHOP’s captured market and 8.1% of Denny’s in H1 2024 – while Young Urban Singles made up 10.5% of Denny’s captured market and 9.2% of IHOP’s. And while Denny’s visitors were more likely to hail from middle-class Near-Urban Diverse Families, IHOP visitors were more likely to be from upper-middle-class Upper Suburban Diverse Families.

The ability of both chains to attract a wide variety of audiences across economic strata is an important factor in their success and staying power.

*Based on STI: PopStats, combined with Placer.ai trade area data for January-June 2024.

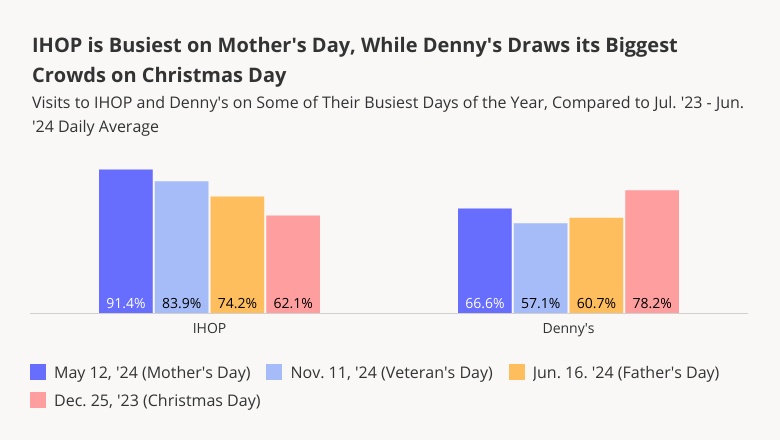

Plenty of people eat at all-day breakfast chains on a regular basis: In June 2024, for example, 16.9% and 14.1% of visitors to Denny’s and IHOP, respectively, frequented the chains at least twice during the month. But for both restaurants, holidays and other special milestones – including Christmas, Mother’s Day, Father’s Day, and Veteran’s Day – drive major visit spikes.

Here too, however, the data reveals important differences between the two chains. Generally speaking, IHOP’s special-occasion visit boosts (compared to annual daily averages) are more substantial than those of Denny’s. And while for Denny’s, Christmas Day is the busiest day of the year, for IHOP, Mother’s Day reigns supreme. And Veteran’s Day – which both IHOP and Denny’s mark with free meals for current and former servicemen and women – is more important for IHOP than for Denny’s.

A look at the daily and hourly breakdown of visits to IHOP and Denny’s shows that the two chains also follow similar visitation patterns – but with a twist. For both restaurants, Sunday morning between 10:00 AM and 1:00 PM is the single most busiest daypart of the week – when many customers likely visit the chains to enjoy leisurely weekend brunches. Predictably, the 10:00 AM to 1:00 PM daypart is also bustling for both breakfast brands throughout the rest of the week.

But though IHOP and Denny’s both have many restaurants that are open 24/7, Denny’s sees a greater share of evening and late night visits than IHOP – perhaps reflecting the chain’s recent push to increase the number of locations open in the wee hours. Between January and June 2024, Friday and Saturday evenings between 10:00 PM and 1:00 AM drew 2.3% and 2.5%, respectively, of weekly visits to Denny’s – compared to just 1.6% and 1.7%, respectively, for IHOP.

IHOP and Denny’s are two of the most important FSR chains on the category landscape. And location analytics shows that there’s plenty of room at the top for both chains, which despite similar offerings serve audiences with somewhat different profiles and behaviors.

For more data-driven restaurant insights, follow Placer.ai.

Warby Parker continues to impress. The company got its start as an online eyewear retailer before opening its first brick-and-mortar location in 2013, and has since expanded rapidly to operate over 200 stores nationwide.

What is driving its success? We dove into the data to find out.

Warby Parker debuted its innovative retail model in 2010, disrupting an eyewear industry dominated by legacy brands. The company’s direct-to-consumer model and online try-on options proved highly popular, and as the brand moved offline, its physical stores flourished.

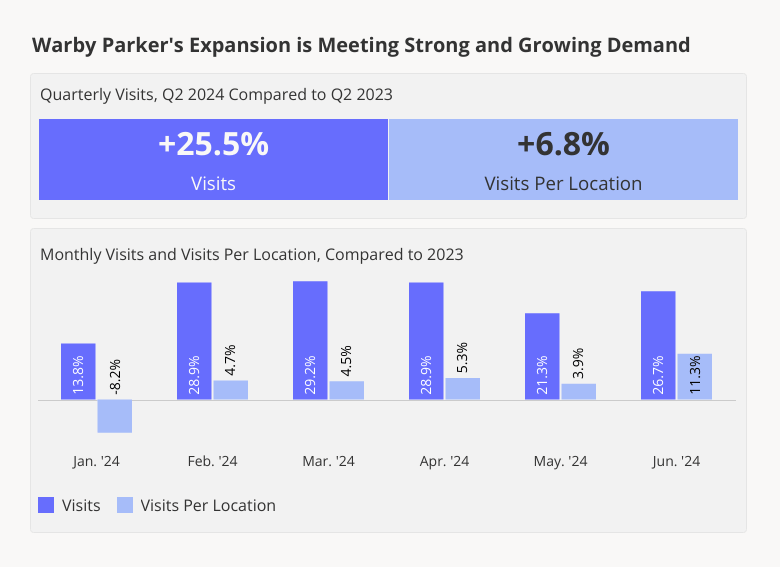

And more than decade after Warby Parker opened its first brick-and-mortar store, the chain’s offline locations continue to thrive. Between January and June 2024, YoY visits to Warby Parker increased significantly as the chain continued to expand – growing from 204 U.S. locations at the end of Q1 2023 to over 250 today. Over the same period, the average number of visits to each Warby Parker store also rose (except in January, when retail was hard hit by inclement weather) – showing that the brand’s growing footprint is meeting robust demand.

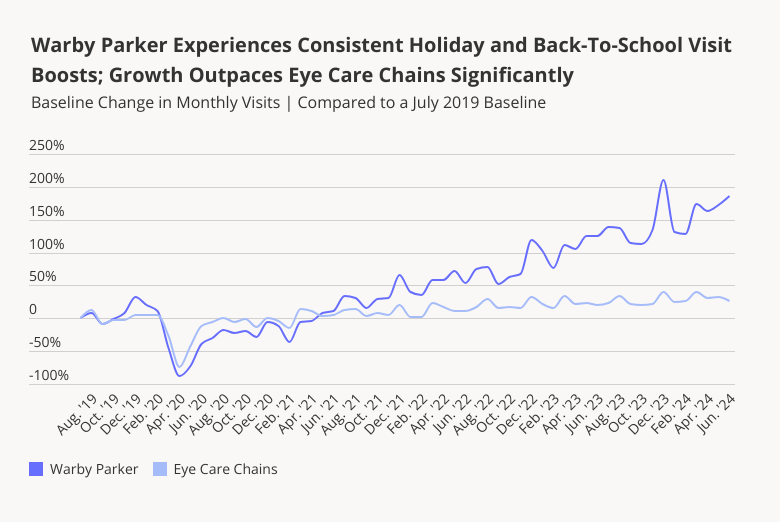

Zooming out on Warby Parker’s monthly visit trajectory – compared to a July 2019 baseline – reveals just how well-positioned the company is heading into the summer. Aside from a brief dip during the early days of the pandemic, the company’s visits have been on a remarkable upward trend, outpacing visits to eye care retailers by a wide margin.

The baseline trend analysis also shows that Warby Parker is particularly prone to seasonal visit fluctuations – with notable foot traffic boosts during the December holiday season. And like other eye care chains, Warby Parker also experiences smaller visit increases during the summer months, as back-to-school shopping gets underway. Given Warby Parker’s strong June 2024 performance, the chain appears poised to enjoy a strong July and August this year.

Warby Parker’s robust positioning heading into the summer may be driven, in part, by its special appeal to college students. Analyzing Warby Parker’s captured market with demographics and psychographics from STI’s PopStats and Landscape datasets shows that the eyewear brand draws customers from trade areas with significantly higher shares of this coveted demographic than the wider eyewear segment: Between January and June 2024 STI: Landscape’s Collegian segment made up 4.2% of Warby Parker’s captured market, compared to just 1.2% for the wider eyewear category. As back-to-college shopping picks up steam, college students may flock to the chain to upgrade their wardrobes with trendy eyeglasses.

And though Warby Parker’s captured market features a lower share of families with children than the category average, parents – who may also get their kids fitted for new glasses before the start of the school year – make up a significant portion of the brand’s visitor base.

Warby Parker has successfully transitioned from an online retailer to a brick-and-mortar powerhouse. Will the chain continue to meet with success as it expands even further?

Visit Placer.ai to keep up with the latest data-driven retail insights.

Gym visits flourished at the start of 2024, as consumers made their yearly New Years resolutions and flocked to fitness clubs nationwide. But how did category leaders fare in Q2 2024? We dove into the data to find out – zooming in on Planet Fitness, a major player in the fitness space.

Throughout H1 2024, Planet Fitness experienced consistent YoY visit growth, finishing out Q2 2024 with a quarterly increase of 6.3% compared to the equivalent period of 2023. And though some of this visit growth is due to Planet Fitness’ ongoing expansion, the average number of visits to each of the chain’s gyms also increased YoY during most of the analyzed period.

Indeed, only in March and May 2024 did the average number of visits to each Planet Fitness location decline YoY. And a look at the weekly breakdown of visits to Planet Fitness shows that these declines may be due, in part, to calendar shifts.

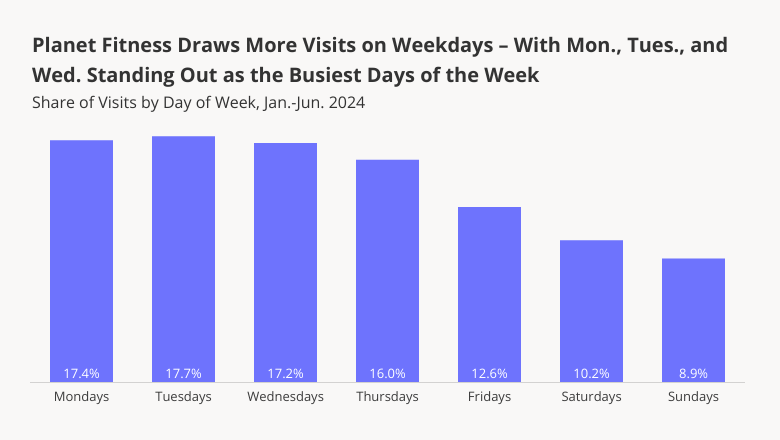

Location analytics reveal that though some people like to hit the gym on weekends, many customers prefer to get their exercise in on regular work days, especially at the start of the week: Throughout H1 2024, Planet Fitness drew the most visits on Mondays (17.4% of weekly visits), Tuesdays (17.7%), and Wednesdays (17.2%), with attendance dropping steadily as the week wore on. And both March and May 2024 – the two months that saw visits per location decline YoY – contained fewer non-holiday Mondays, Tuesdays, or Wednesdays than the equivalent periods of 2023.

Planet Fitness’ continued visit success appears to be driven, in part, by its growing share of frequent visitors. Gym visitation is highly seasonal – with visits slumping during the holidays and then spiking in January, as people vow to double down on exercise routines.

A look at changes in the share of Planet Fitness visitors hitting the gym at least four times per month (roughly, once a week) reveals a similar pattern. The share of frequent visitors is at its highest in January, remains elevated through April or May, and declines as the year draws to a close. (January 2022 deviated from this pattern, likely due to the Omicron resurgence.)

Despite these seasonal fluctuations, the share of visitors making weekly stops at Planet Fitness has been on an overall upward trajectory – going higher each year between 2021 and 2023. And though this rise leveled off in 2024 amidst a stabilizing fitness market, frequent visitor rates remained high in 2024, with some months seeing continued YoY increases. This elevated loyalty is good news for Planet Fitness – since more engaged customers are more likely to renew or even upgrade their memberships.

With value still top of mind for many consumers, Planet Fitness’ famously low prices have positioned the chain for success. Will this positive momentum continue as consumers adjust to the chain’s first basic membership price increase in 26 years?

Follow Placer.ai’s data-driven analyses to find out.

*This report excludes locations within Washington state due to local legislation.

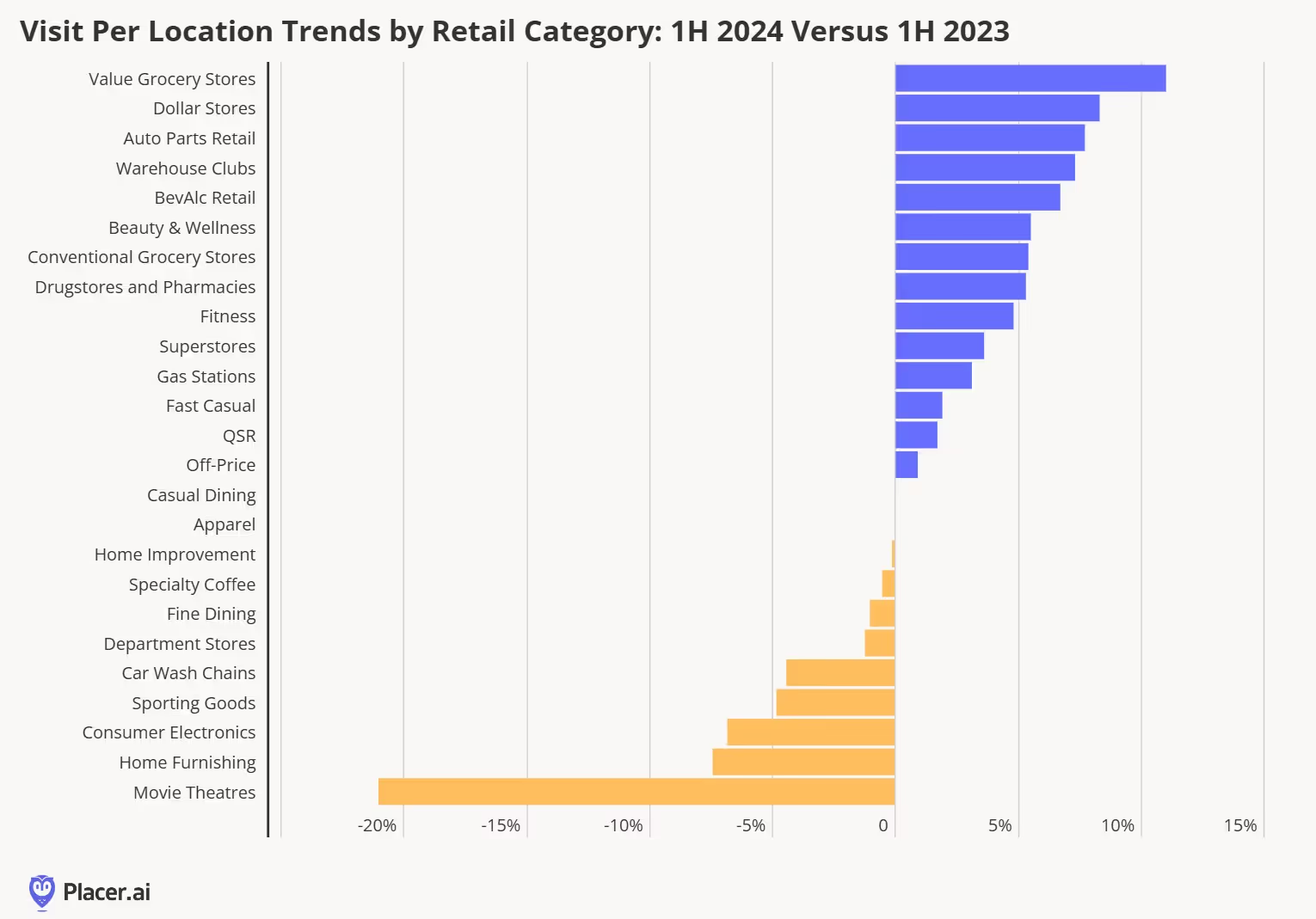

Now that we’ve cleared the halfway point for 2024 with retailers preparing for back-to-school shopping (and Q2 2024 reporting season), we thought we’d take stock of where we stand from a retail category perspective. Last year, we looked at visit per location data by retail category at the halfway point for the year, which proved to be a useful indicator for what to expect for the rest of the year. We thought we’d revisit the analysis to give some perspective of what to expect in the months to come.

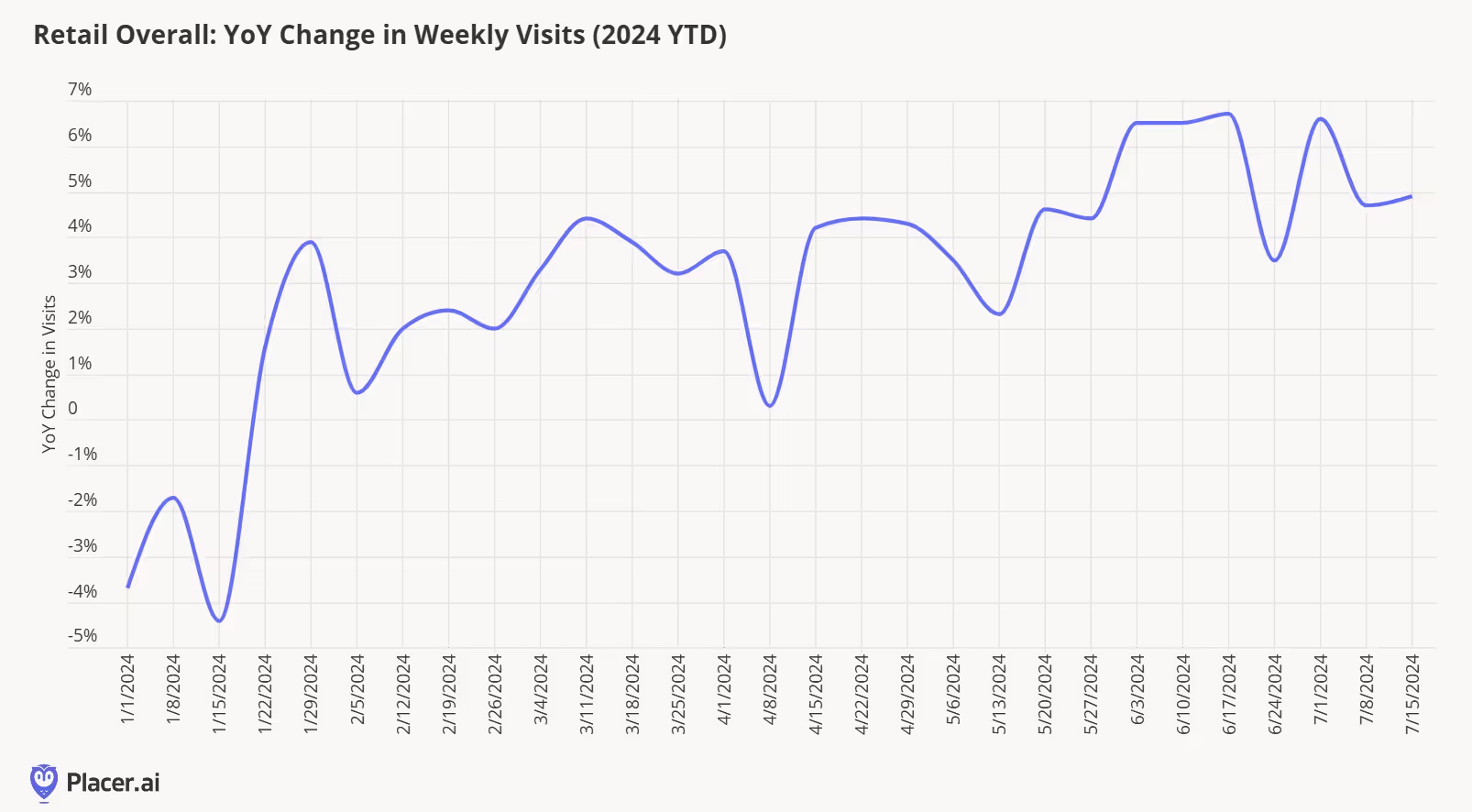

Needless to say, it’s been another volatile year for most retailers, with a tepid start to the year due to weather, followed by solid event/holiday spending in February/March, and a lackluster April (though partly the result of the Easter holiday calendar shift). May, June, and July visitation data offered some encouraging signs, with year-over-year visits increasing to a mid-single-digit level (according to Placer's Industry Trends report). Importantly, increased visits won’t necessarily translate into the same level of sales increases, as visits are continuously being driven by deals/lower price points for many categories.

Based on the positive trendline for retail in general, it shouldn’t be a surprise that the majority of the 25 retail categories we’ve presented show positive growth from a visit per location year-over-year perspective (below).

A few notable takeaways from the visit per location analysis:

Last year, our midpoint visit per location trends gave us some ideas as to how the second half of the year might shake out. Based on our first half 2024 visitation data, we expect (1) consumers to continue prioritize value in the second half of the year, especially those chains that have been able to create excitement/newness for their value assortment; (2) consumers will continue to prioritize holidays/events, which bodes well for back-to-school, Halloween, Thanksgiving, and Christmas; (3) we will continue to see better balance between experiences and goods this year (as we've discussed in the past).

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.