.svg)

.png)

.png)

.png)

.png)

Affecting everything from merchandise sales to local bars to entire neighborhoods, the economic effect of the Los Angeles Dodgers’ road to the World Series cannot be disputed.

After a comeback from 5-0 to win 7-6 against the New York Yankees, the Dodgers kept everyone on the edge of their seats. With history made by Freddie Freeman’s walk-off grand slam to win Game 1, fans will have moments seared in their memories for decades to come. Dodgers fans are willing to shell out big to celebrate their champions. Fanatics reported that after winning Wednesday night, “the Dodgers set a Fanatics sales record for first-hour sales of a team's merchandise, across any sport, after claiming a championship.” The top five players for merchandise sales were Ohtani, Freeman, Betts, Yamamoto, and Kershaw.

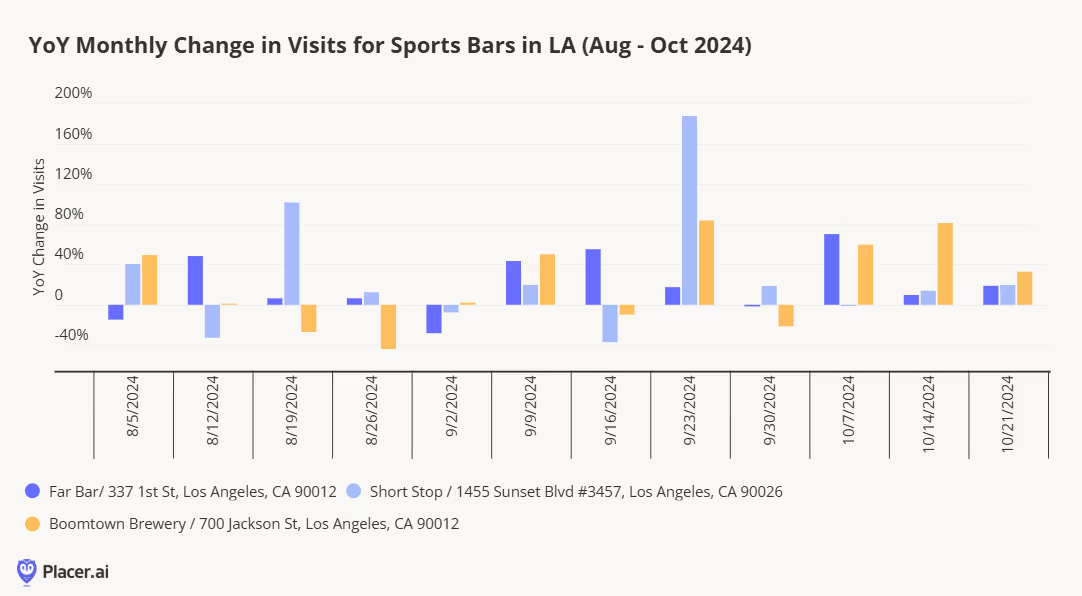

Local bars in various parts of L.A. that featured Dodgers games saw an uptick in year-over-year traffic most weeks, particularly in recent weeks leading up to the National League Championship and the World Series. Spontaneous parades erupted in locations such as Whittier Blvd in East L.A., in Downtown L.A., and near Dodger Stadium in Elysian Park.

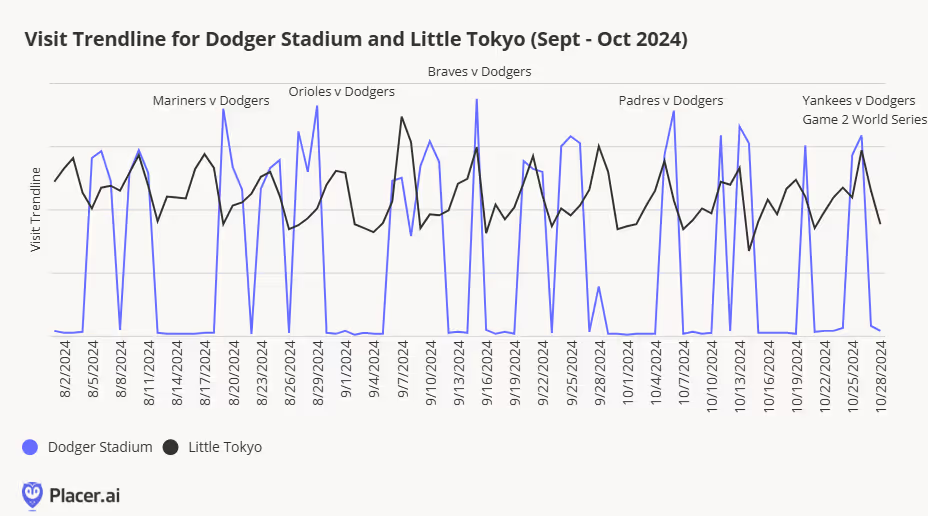

We’ve previously written about the Shohei Effect on hotels like the Miyako that features the mural “LA Rising” by Robert Vargas, but now after a World Series championship, the Boys in Blue are set to go even higher into the stratosphere of fandom. We looked at the foot traffic to Dodger Stadium and to Little Tokyo, and no surprise there’s definitely an uptick to the latter on game days, especially on Saturdays. Vargas is currently working on a mural of the late Fernando Valenzuela in Boyle Heights, and Angelenos will likely be flocking in droves to come see “Fernandomania Forever” when it is unveiled.

One interesting finding is that visitation was actually higher during some of the regular season games than for the World Series Games 1 and 2 that took place in LA. One reason may be the sky high prices. Per reseller Ticket IQ, “the average price for a World Series ticket on the secondary market was $3,887, the second most expensive average since it started tracking data in 2010.” For some fans, it was a dream of a lifetime, one that some were willing to “sell a kidney” to attend.

As we enter November, the holiday season is already in full swing across the country. We’re likely to see the consumer’s embrace of seasonal decorations soon, just as we saw in the fall season. The retail industry has already lived through one major promotional event in October, and it’s time to take the temperature on physical retail foot traffic as we head into the busiest part of the season.

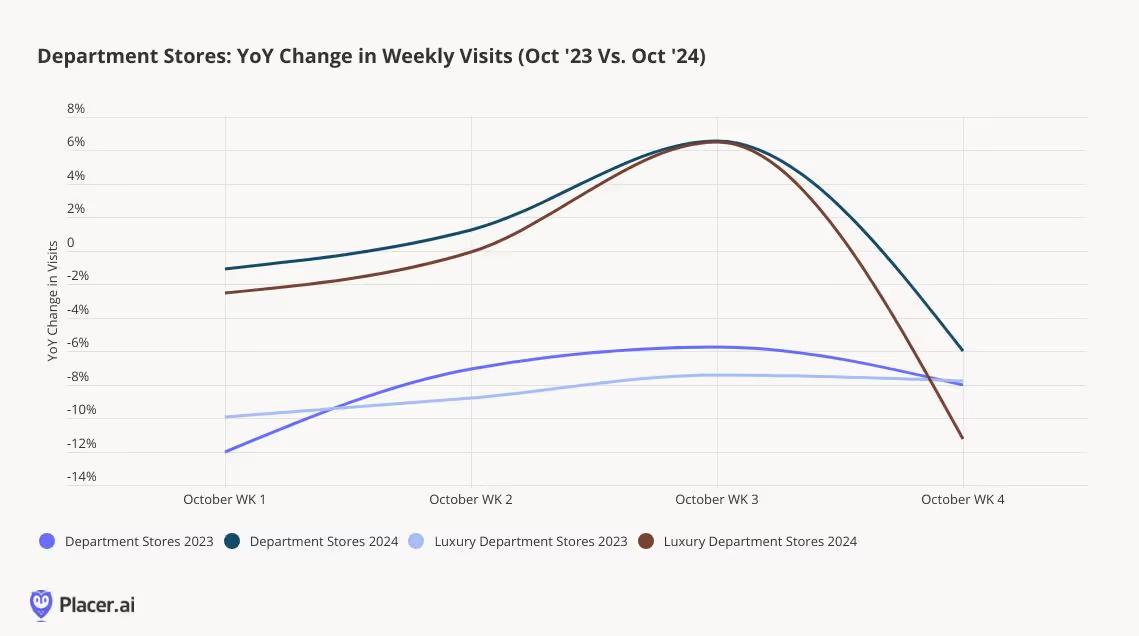

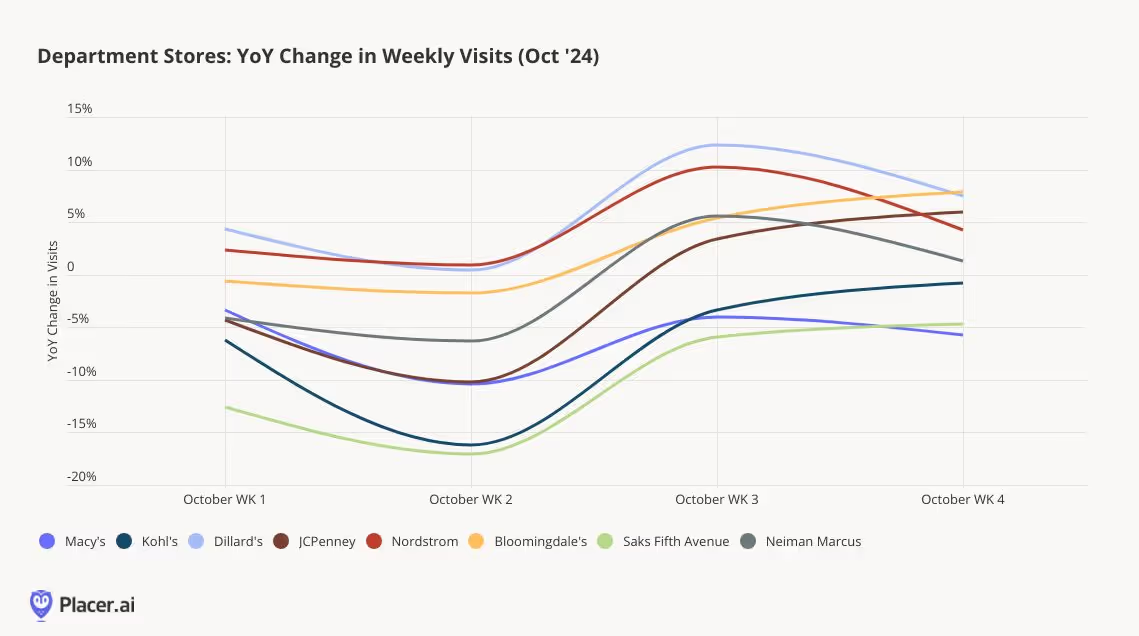

One thing that jumped out upon initial review was the foot traffic from department stores, excluding off-price retail. Looking at the four full weeks of October 2024, traffic to full line department stores was flat to last year, compared to the same period last year when traffic was down 8% to 2022 in October (store counts are about even to last year). Visits to luxury department stores show a similar story; traffic in 2023 was down 9% in October and trended down 2% this year. Coming from a sector of retail that has been challenged for years, this slight improvement is worthy of celebration.

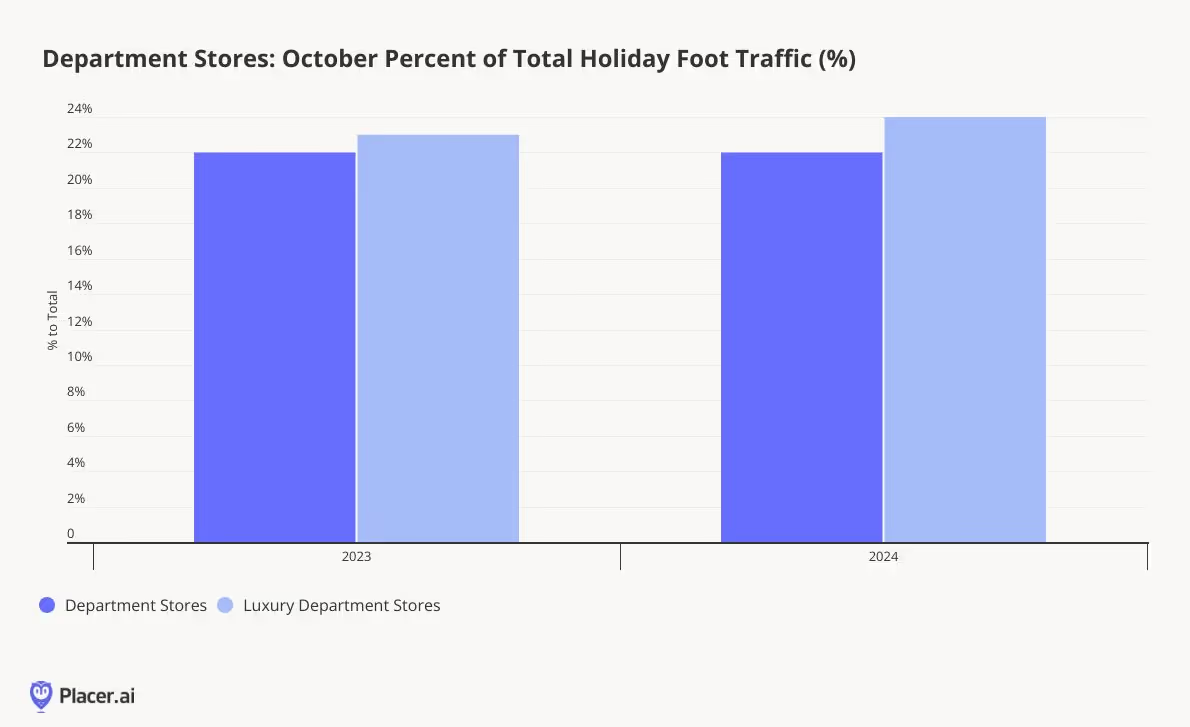

Just how important is October’s contribution to holiday shopping visits? For full line department stores, October accounted for 22% of total holiday season visits in both 2022 and 2023; October traffic for luxury department stores was 24% of total holiday traffic in 2022 and 23% in 2023. That means that there’s still almost ¾ of total visitation still left for retailers to capture over the next two months. However, with traffic trending better in 2024 than in 2023 for department stores overall, this year might actually be a proof point for pull forward holiday demand.

Looking at visitation by retailers within the two sectors, Dillard’s, unsurprisingly led the charge for full line department stores in visitation growth. JCPenney also saw a lot of trend improvement compared to last year, as did Macy’s in the back half of the month. The only major retailer that has underperformed 2023 in October was Kohl’s. Through the lens of luxury department stores, Bloomingdale’s and Nordstrom grew traffic in the low to mid-single digits in October, with Neiman Marcus only down slightly to 2023 levels.

Another interesting insight Placer’s data uncovered; department stores are more of a destination for consumers this year. Looking at Macy’s cross-visitation specifically in October, the percent of visitors to Macy’s that traveled home after visiting was almost 50 basis points higher than in 2023. Our data also showed a lower percentage of cross visitation between Macy’s and other department stores this year compared to last October. Department stores may be doing a better job of capturing consumers' attention and better aligning themselves with the needs of their shoppers. This is in contrast of what we're seeing in essential retail categories such as grocery stores and superstores, where consumers are willing to cross shop multiple retailers; this underscores just how different consumer behavior is by category.

What does this signal about the remainder of the “true” holiday season? It’s hard to tell as we stand today, but the trend improvement across department stores this year gives us some optimism about consumers flocking to physical stores this year. But, it’s important to give consumers a reason to visit as many times as possible, especially as retail fatigue sets in from shopping earlier in the season. Value is still going to be the top driver of visitation this year, but unique products, services and experiences are still important to capturing the joy of the season.

If you’ve ever wished you could root for your alma mater from afar, attend a World Series, or blast into space, Cosm may have the solution. This immersive technology company combines state-of-the art stadium experiences with dining and bar service. Think a smaller version of the Sphere, a larger version of an IMAX theater, with the simulation of being at an actual stadium all while enjoying the comforts of a booth with food brought to you.

For fans of large screen immersive experiences, this venue allows you to be enveloped by the aquatic performers of Cirque du Soleil's “O”, feel like you’re on the 50-yard line for the Ohio State versus Penn State football game, or be a pioneering astronaut seeing the earth from space in “Orbital.”

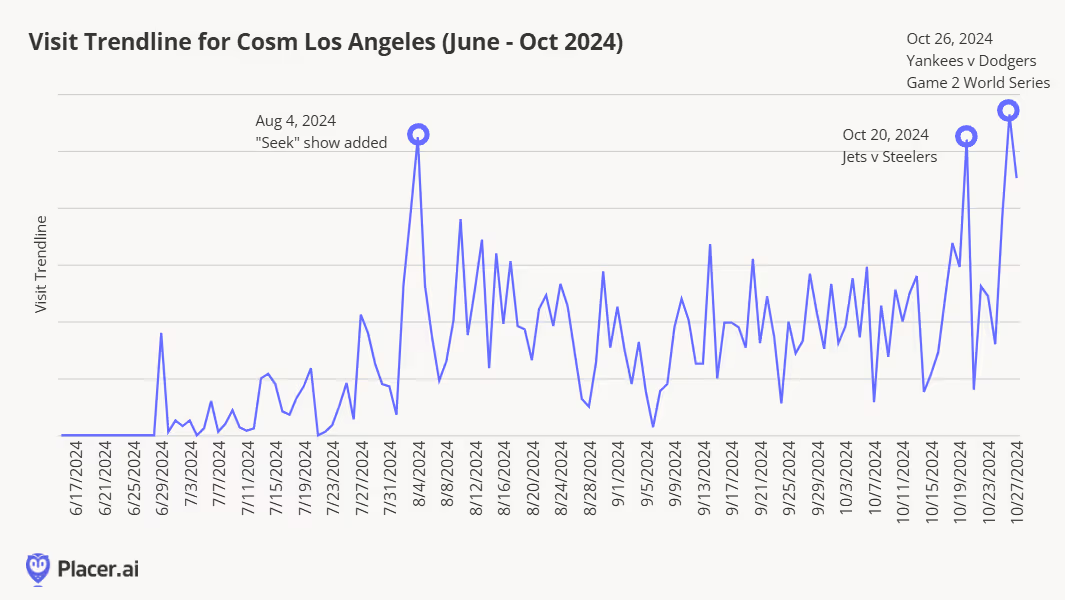

Since it opened at the end of June this year, popular showings have included “Seek,” which takes you on a journey through the cosmos, as well as sports favorites like the New York Jets versus Pittsburgh Steelers game. Game 2 of the World Series had a sell-out crowd as those who chose not to buy tickets for thousands of dollars still had the joy of celebrating in an arena venue with hundreds of other fans, with the feeling of being behind the dugout.

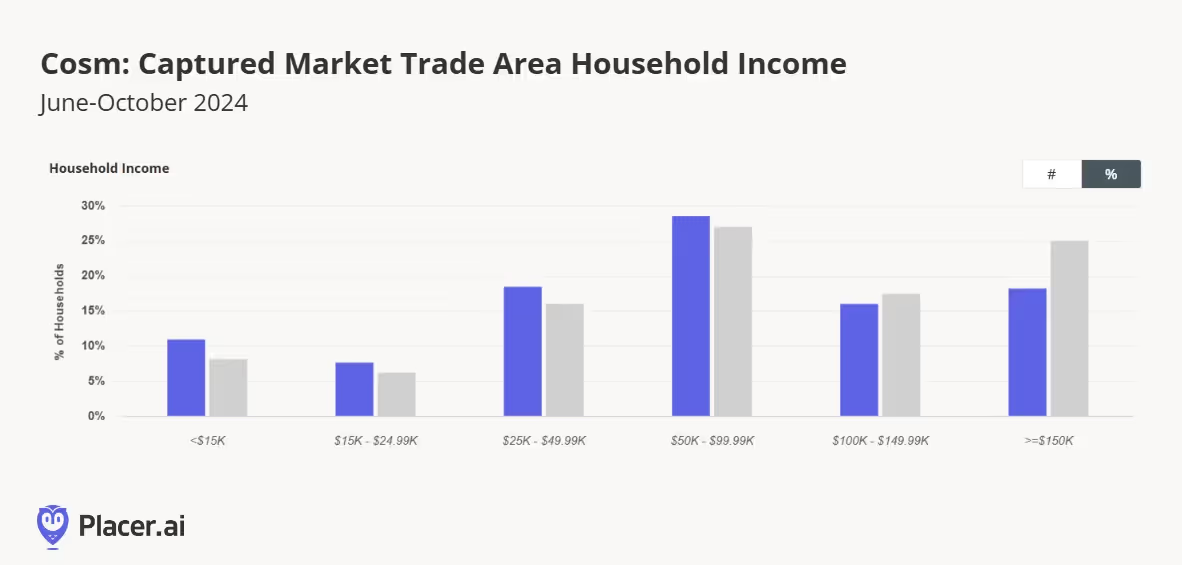

The Los Angeles Times describes Cosm as “part planetarium, part mini-Sphere,” so instead of needing to travel to Griffith Observatory or Las Vegas, one can just jet down the 405 to Inglewood to have a similar experience. So, who’s visiting Cosm? Roughly 3 in 10 (29%) have a hold income (HHI) of $50K-$99.9K. Nearly 1 in 5 (19%) have a HHI of $25K-$49.9K. These two household income segments over index compared to the CA household incomes (shown in gray).

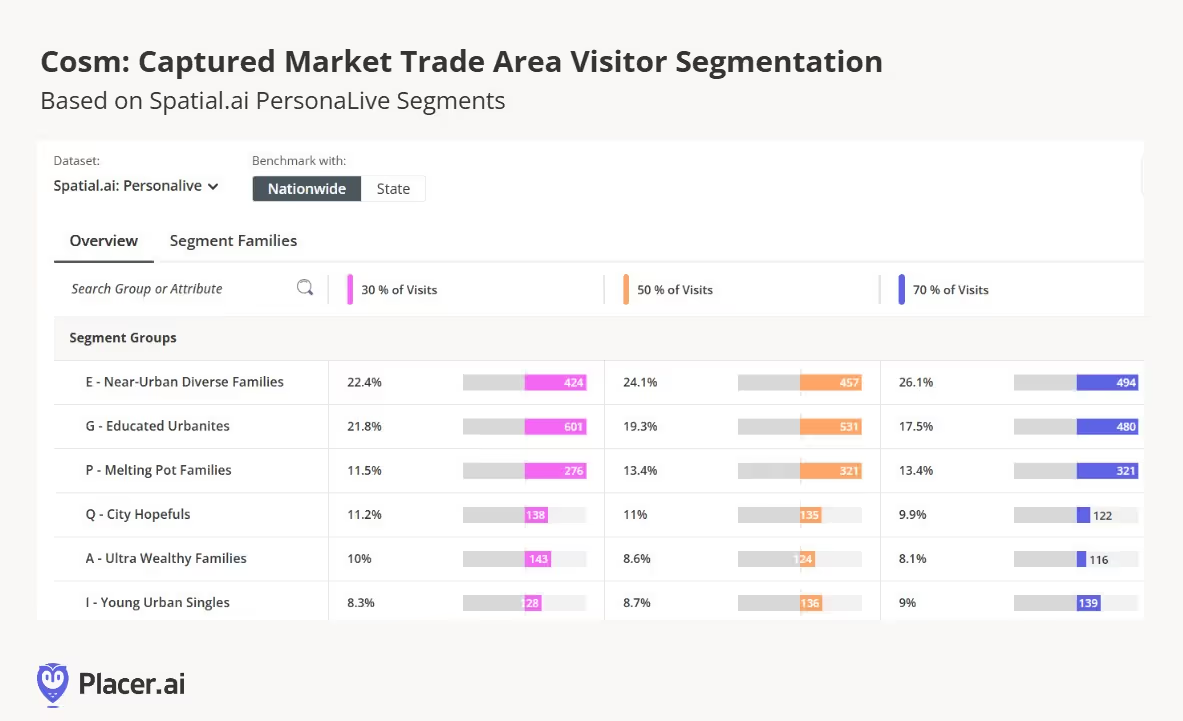

In terms of demographics, per Spatial.ai PersonaLive, Near-Urban Diverse Families, Educated Urbanites, and Melting Pot Families make up the top 3 segments.

Starbucks, the largest coffee chain in the world, and Dutch Bros, one of the fastest growing in the country, are major players in the hot and cold beverage space. With Q3 2024 in the rearview mirror, we took a closer look at the visitation patterns to both chains to see how they are faring – and what might lie ahead for both brands.

Starbucks is one of the most dominant names in coffee across the world, with thousands of stores in the United States alone. Between July 2023 and July 2024, the chain added more than 500 stores to its domestic fleet, bringing its U.S. store count to 16,730. And though Starbucks has faced its share of challenges, these store additions helped keep overall traffic to the coffee leader on par with 2023 levels throughout the summer – though visits dipped somewhat in September as consumers went back to their routines.

But digging deeper into the visit data shows that even as Starbucks saw overall foot traffic growth stall in Q3, the number of short visits to the chain – i.e. those lasting less than 10 minutes – increased. In August and September 2024, the chain drew 8.5% and 4.7% more short visits, respectively, than in the same periods of 2023 – revealing how important these quick stops are for the chain.

In-app ordering, which together with drive-thru orders made up about 70% of sales at the chain as of January 2024, may be contributing to the short visit trend. Still, new CEO Brian Niccol is looking for ways to return the chain to its roots as the third place, and the chain may yet implement shifts to encourage longer visits in the coming months.

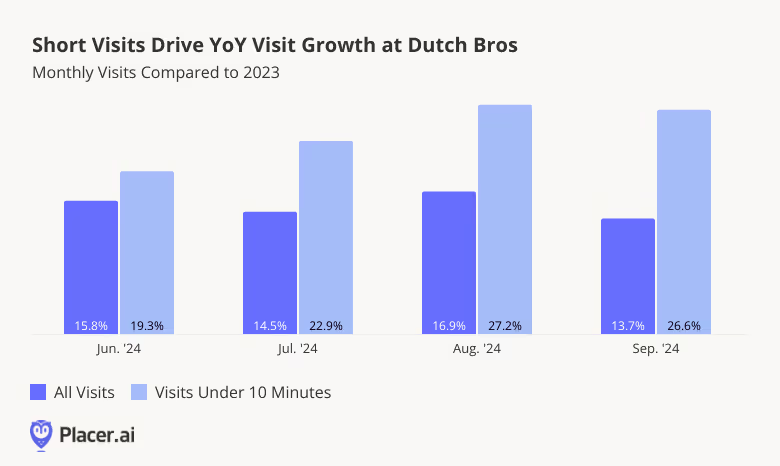

Dutch Bros has been one of the most impressive coffee chains to watch over the past few years. The Oregon-based chain has been on an expansion tear – opening more than 150 stores between Q2 2023 and Q2 2024 – and has seen the elevated monthly visits to match. Between June and September 2024, visits to Dutch Bros increased between 13.7% and 16.9%, highlighting the chain’s success at growing its audience.

But like at Starbucks, short visits outperformed longer ones at Dutch Bros – and by a lot. In September 2024, for example, overall visits to the chain grew by 13.7% – but visits lasting less than 10 minutes shot up by 26.6%.

The strength of these short visits, for both Starbucks and Dutch Bros, suggests a shift towards convenience, with both chains utilizing drive-thru services and in-app ordering to accommodate busy consumers.

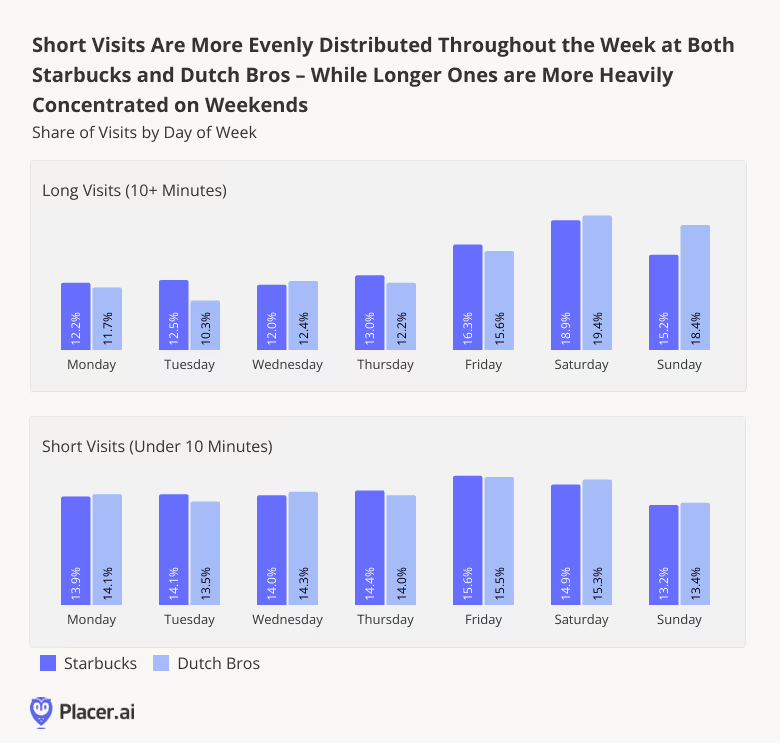

Digging down deeper into the data shows that for both Starbucks and Dutch Bros, these all-important short visits follow a distinct weekly pattern.

While longer visits (≥10 minutes) to both chains peaked in Q3 2024 on Saturdays, shorter visits were more evenly distributed throughout the week, peaking on Fridays. Overall, 34.1% of long visits to Starbucks, and 37.8% of long visits to Dutch Bros, took place on the weekends in Q3 2024 – compared to 28.1% and and 28.7%, respectively, for shorter visits.

Unsurprisingly, customers may be more likely to grab a quick coffee to go during the work week. And with the return to office still underway, quick visits may be enjoying a boost fueled by commuters in need of a quick cubicle pick-me-up.

As Starbucks works to adapt to shifting consumer preferences, understanding when customers spend more time in-store can help the brand reconnect with its roots as a community hub. And Dutch Bros can continue to enhance the quick-service experience that has fueled its growth. How will the two chains continue to perform in what remains a competitive coffee environment?

Follow Placer.ai for the latest data-driven dining insights.

In recent years, Americans have gotten serious about fitness. Even as consumers tightened their purse strings, they found room in their budgets for the ultimate affordable indulgence: A (relatively) low-cost gym membership that, once paid, offers customers unlimited access to club facilities.

How did Planet Fitness, the nation’s largest value gym perform in Q3 2024? We dove into the data to find out.

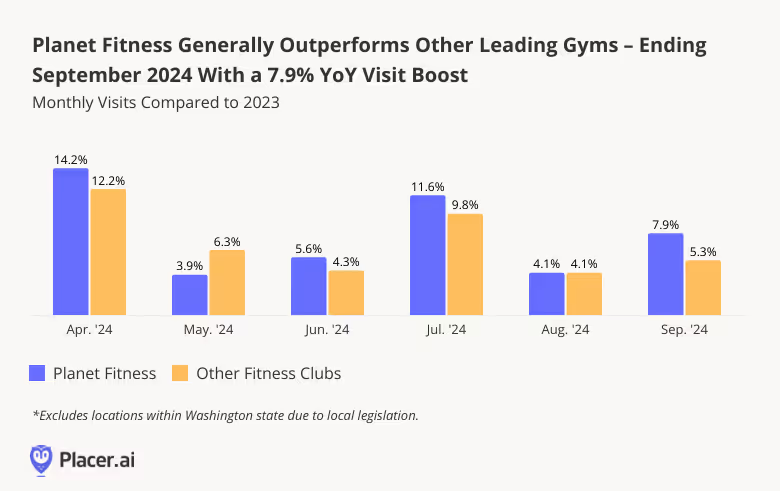

Planet Fitness has been on a roll. In Q2 2024, the chain reported a 4.2% system-wide increase in same store sales and the addition of 18 new gyms to its fleet. (Though Planet Fitness operates clubs outside the U.S., the vast majority of its some 2600 locations are domestic).

Foot traffic data shows that the chain continued to thrive through Q3, with year-over-year (YoY) monthly visit upticks ranging from 4.1% to 11.6% – outperforming the wider industry. And while the value gym giant finally raised the price of its basic membership this summer for the first time in more than thirty years, the move does not seem to have dented Planet Fitness’ growth trajectory – though it’s still early days.

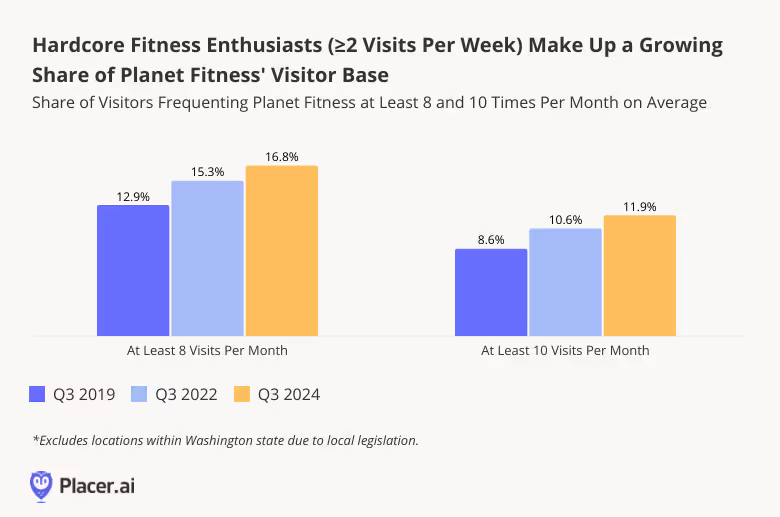

Planet Fitness takes pains to emphasize its commitment to being a “Judgement Free Zone” – and casual gym-goers make up a significant portion of its visitor base. In Q3 2024, 44.3% of visitors hit the club, on average, less than twice a month.

But Planet Fitness also has a significant – and growing – share of die-hard gym buffs who visit the club at least eight or ten times a month - i.e. at least twice a week. In Q3 2024, a full 16.8% of visitors to Planet Fitness came to the gym at least eight times a month on average – up from just 12.9% in 2019 and 15.3% in 2022. And 11.9% visited the chain ten or more times a month – up from 8.6% in 2019 and 10.6% in 2022.

Though casual visitors are also important for any fitness club’s bottom line, a strong and thriving community of highly committed members is an important foundation for future growth.

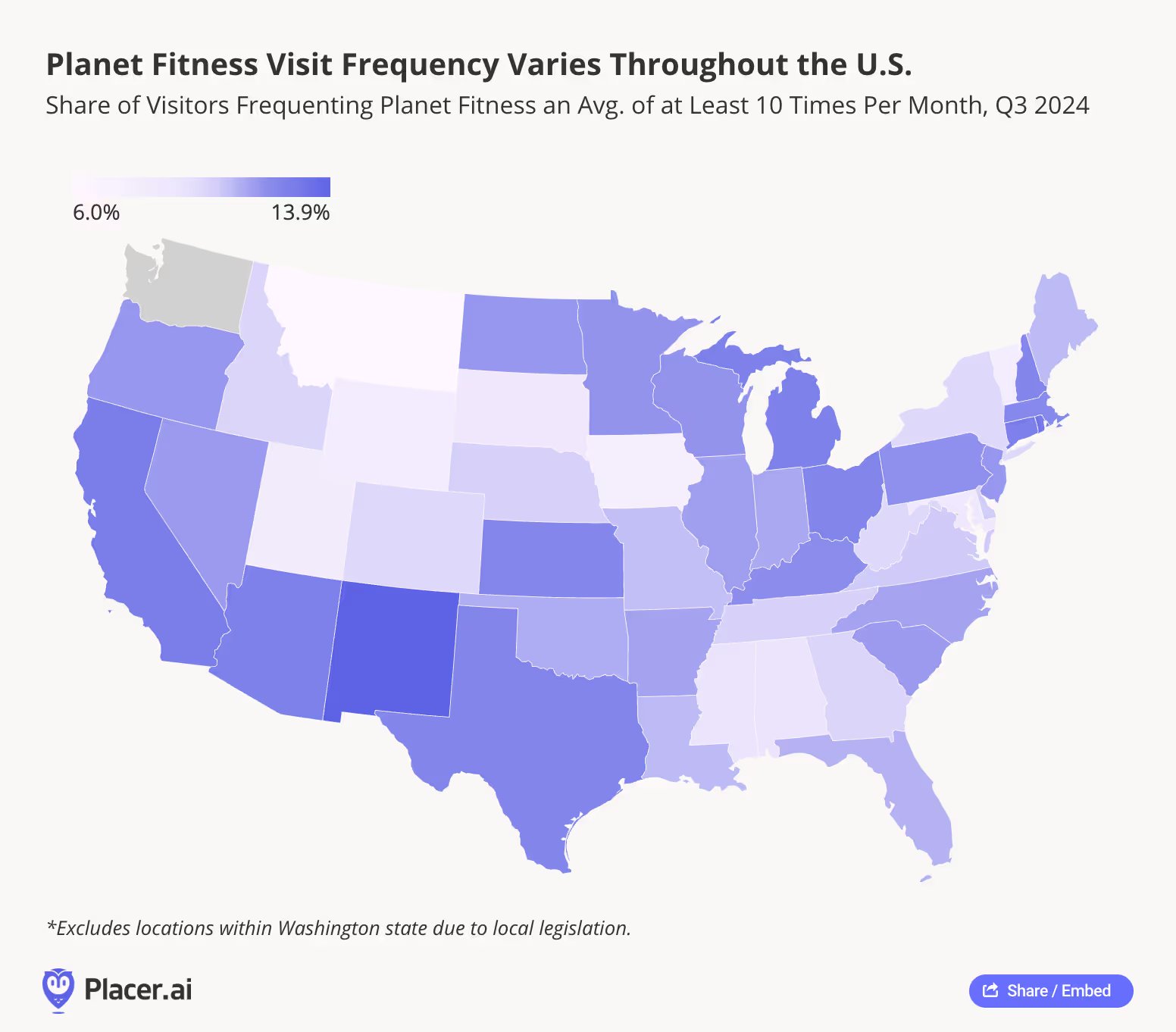

Gym visit frequency, however, varies throughout the United States. Analyzing the share of highly committed visitors to Planet Fitness reveals significant differences between states.

New Mexico led the pack in Q3 with 13.9% of visitors frequenting the gym, on average, at least ten times a month – followed by Rhode Island (13.1%) and California (12.7%). On the other end of the spectrum lay Montana, where just 6.0% of club goers were highly committed visitors in Q3, followed by Iowa (7.7%) and Vermont (8.0%).

This data highlights how gym engagement can be influenced by regional factors such as lifestyle, climate, and access to alternative fitness options – suggesting that Planet Fitness and similar chains may benefit from tailoring their marketing and membership strategies to local trends and preferences.

The holiday season isn’t a particularly busy one for gyms – which usually see traffic begin to slow down in September before picking up again in the new year. But if Planet Fitness’ solid September 2024 performance is any indication, the chain may be in for a busier fourth quarter this year than last. Will Planet Fitness continue to deliver as the year draws to a close?

Follow Placer.ai’s data-driven analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

In a market ruled by value and convenience, traditional full-service restaurants (FSRs) have faced an uphill slog. But even in 2024, some FSRs are flourishing. We dove into the data to explore factors driving success at three very different full-service chains: First Watch, Chili’s Grill & Bar, and Outback Steakhouse.

First Watch first burst onto the scene in 1983 with a single restaurant in California – and now boasts some 544 locations across 29 states. With offerings ranging from Superfood Kale Salads to more traditional pancakes and bacon and eggs, First Watch has emerged as a prime destination for diners seeking to enjoy a leisurely breakfast with family and friends.

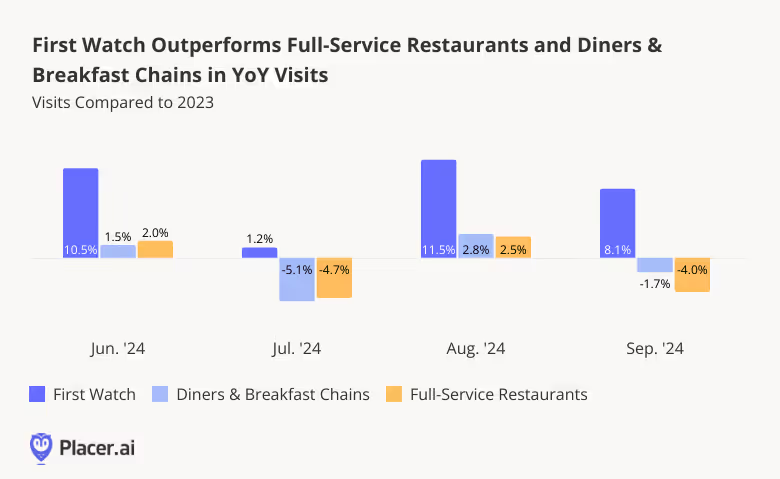

And foot traffic data shows that First Watch, still firmly in expansion mode, is continuing to grow its audience. Between June and September 2024, First Watch saw consistent year-over-year (YoY) visit growth, outperforming both the full-service restaurant category and other diners & breakfast spots.

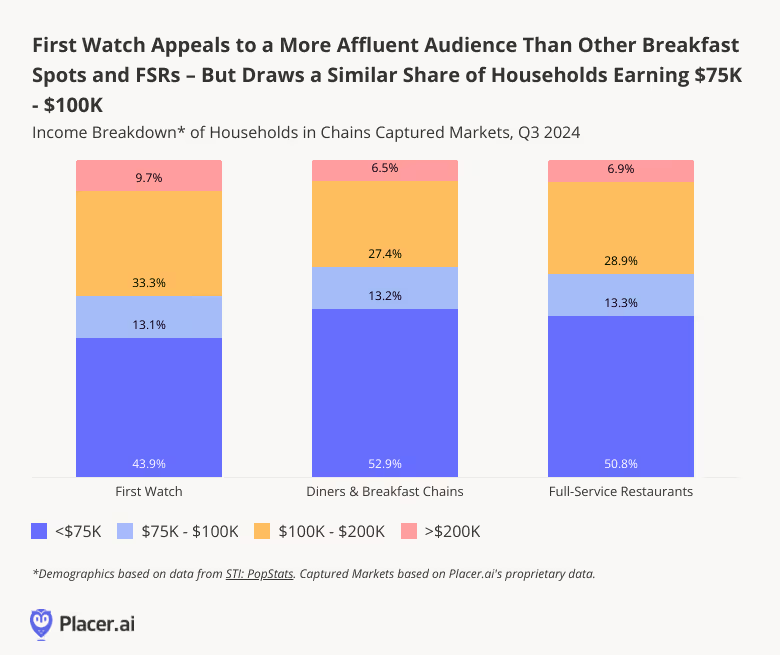

One factor that may be helping to propel First Watch’s success is the relative affluence of its customer base. Analyzing the income breakdown of First Watch’s trade area shows that in Q3 2024, nearly ten percent (9.7%) of households in the chain’s captured market earned $200K+ per year, compared with 6.5% for diners & breakfast chains and 6.9% for the wider FSR space. On the flip side, only 43.9% of households in First Watch’s captured market had annual incomes below $75K, compared to just over 50.0% for both analyzed segments.

Amidst concerns surrounding food inflation, rising labor costs, and discretionary spending cutbacks, First Watch’s wealthier customer base may be helping to shield it from some of the value pressures that have weighed on other restaurants – contributing to its resilience.

Another FSR that has been experiencing outsized visit growth this year – at least since April – is Chili’s Grill & Bar. Following a tepid start to the year, Chili’s launched its much-vaunted Big Smasher Burger on April 29th, 2024, and hasn’t looked back since.

The new offering, added to Chili’s 3 For Me value menu, presented a full-service value challenge to QSR favorites like the Big Mac. And in Q2 2023, the item helped drive a 14.8% increase in same-store sales.

Since the big launch, weekly YoY visits to Chili’s have been consistently elevated – kept aloft with the help of viral hype around Chili’s long standing Triple Dipper offering, as well as the new secret Nashville Hot Mozz offering that became so popular it spawned a halloween costume.

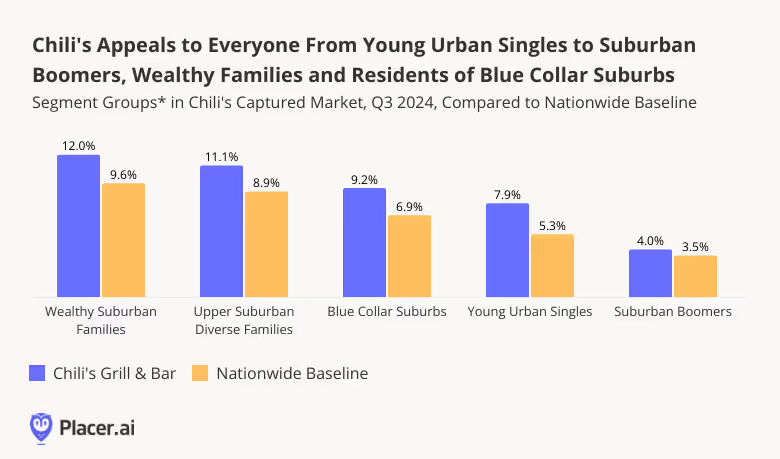

Unlike First Watch, Chili’s has found success by embracing its role as a value chain. The median household income (HHI) of Chili’s captured market in Q3 2024 was $73.1K – below the nationwide median of $76.1K, and on par with that of the wider FSR space ($73.7K – By way of comparison, the median HHI of First Watch’s captured market was $85.6K in Q3).

And a closer look at the demographic make-up of Chili’s captured market shows just how broad the appeal of the chain is. In Q3 2024, Chili’s visitor base was over-represented for a wide range of segments across age and income groups – from “Wealthy Suburban Families” to “Young Urban Singles”, “Suburban Boomers’, and residents of “Blue Collar Suburbs”. By delivering high-quality meals at affordable prices, Chili’s has solidified its place as an everyman’s chain, offering value comparable to that of quick-service restaurants.

Aussie-themed Outback Steakhouse – Bloomin’ Brands’ biggest chain – is another full-service restaurant that is successfully weathering the storm. Like other FSRs, Outback has faced its fair share of challenges over the past few years, with rising costs and spending cutbacks taking a toll on the chain’s performance. But in Q3 2024, the average number of visits to each Outback Steakhouse location increased 0.5% YoY, even as overall traffic to the chain fell 1.7% in the wake of strategic rightsizing moves that included the shuttering of a number of underperforming locations. By contrast, the average number of visits per location in the wider FSR space dropped 1.2%, while overall foot traffic to the segment fell 2.1%. Outback Steakhouse’s ability to sustain a YoY visit-per-location uptick in Q3, even if a minor one, shows that its rightsizing efforts are paying off.

And drilling down deeper into regional data for the chain shows that in some areas of the country, Outback Steakhouse is positively thriving. In California, Outback’s third-largest market in terms of store count, the chain saw a YoY visit increase of 5.3% – significantly higher than the statewide FSR average of 1.1%. In Washington and Oregon, Outback Steakhouse experienced even more substantial visit increases – 9.0% and 9.6%, respectively – even as full-service restaurants generally languished. And in all three states, the number of Outback Steakhouse locations has remained basically unchanged over the past year, meaning that these increases reflect the growing draw of the chain’s existing venues.

First Watch, Chili’s Grill & Bar, and Outback Steakhouse are very different full-service chains – but each of them is thriving in its own way. How will the three brands fare as the holiday season picks up steam?

Follow Placer.ai’s data-driven dining analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

The first American mall opened in 1956 and reinvented retail – within a decade there were over 4,500 malls across the country. But a rise in e-commerce coupled with the oversaturation of mall options across the country paved the way for mall visits to slow, and many predicted that malls would go the way of the dinosaur.

But although malls were hit hard over the past few years as lockdowns and rising costs contributed to a significant drop in foot traffic, shopping centers have proven resilient. Leading players in the space have consistently reinvented themselves and explored alternate ways to draw in crowds – and as inflation cools, malls are bouncing back as well.

This white paper analyzes the Placer.ai Shopping Center Industry – a collection of over 3000 shopping centers across the United States – as well as the Placer.ai’s Mall Indexes, which focus on top-tier Indoor Malls, Open-Air Shopping Centers, Outlet Malls. The report examines how visits are shifting and where behaviors are changing – and where they’re staying the same – and takes a closer look at the strategies malls are using to attract shoppers in 2024.

Malls experienced a rocky few years as pandemic-related restrictions and economic headwinds kept many shoppers at home, and visits to all mall types in 2021 were between 10.7% to 15.3% lower than in 2019. But foot traffic trends improved significantly in 2022 – likely due to the fading out of COVID restrictions.

By 2023, visits to the wider Shopping Center Industry were just 2.3% lower than they had been in 2019, and the visit gaps for Indoor Malls and Open-Air Shopping Centers had narrowed to 5.8% and 1.0% lower, respectively. Outlet Malls also saw visits ticking up once again, with the visit gap compared to 2019 narrowing to 8.5% in 2023 after having dropped to 11.3% in 2022. This more sustained foot traffic dip may stem from consumers’ desire to save on gas costs or the impacts of inclement weather. However, the narrowing visit gaps suggest that shoppers are increasingly returning to the segment, and foot traffic may yet pick up again in 2024.

COVID-19 impacted more than just visit numbers – it also changed in-store consumer behavior. And now, with the Coronavirus a distant memory for many, some of these pandemic-acquired habits are fading away, while other shifts appear to be holding steady.

One visit metric that appears to have reverted to pre-COVID norms is the share of weekday vs. weekend visits. Weekday visits had increased in 2021 – at the height of COVID – as consumers found themselves with more free time midweek, but the balance of weekday vs. weekend visits has now returned to 2019 levels.

In 2023, the Shopping Center Industry, which includes a number of grocery-anchored centers along with open-air shopping centers and their relatively large variety of dining options, saw the largest share of weekday visits, followed by Indoor Malls. Outlet Malls received the lowest share of weekday visits – around 55% – likely due to the longer distances usually required to drive to these malls, making them ideal destinations for weekend day trips.

While the day of the week that people frequent malls hasn't changed significantly since 2019, there is one notable difference in mall foot traffic pre- and post-pandemic. Almost all mall categories are seeing fewer during the late morning-midday and late evening dayparts, while the amount of people heading to a mall in the afternoon and early evening has increased.

In 2019, Indoor Malls saw 20.1% of visits occurring between 10:00am and 1:00pm, but that share decreased to 18.6% in 2023. Meanwhile, the share of visits between 4:00-7:00 pm rose from 29.1% in 2019 to 32.4% in 2023. Similar patterns repeated across all shopping center categories, with the 1:00-4:00pm daypart seeing a slight increase, the 4:00-7:00 pm daypart receiving the largest boost and the 7:00-10:00 pm daypart seeing the largest drop. So although changes in work habits have not altered the weekly visit distribution, it seems like hybrid workers are taking advantage of their new, and likely more flexible schedules to frequent malls in the afternoon instead of reserving their mall trips for after work. The significant numbers of Americans moving to the suburbs in recent years may also be contributing to the decline of late night visits, with these suburban newcomers perhaps less likely to spend time outside the house during the evening hours.

Although malls have enjoyed consistent growth in foot traffic over the past two years, visits still remain below 2019 levels. How can shopping centers attract more shoppers and recover their pre-COVID foot traffic?

Some malls are attracting visitors by looking beyond traditional retail with offerings such as gyms, amusement parks, and even entertainment complexes. And with more traditional mall anchors shutting their doors than ever, even smaller shopping centers are adding lifestyle experiences options in newly vacant spaces – and incorporating unique elements into traditional retail spaces.

In September 2023, the Chandler Fashion Center in Arizona opened a giant SCHEELS store in its mall. The 250,000-square-foot sporting goods store boasts more than just sneakers – visitors can ride on a 45-foot Ferris Wheel or marvel at a 16,000-gallon saltwater aquarium. And monthly visitation data to the mall reveals the power of this new retail destination, with foot traffic to the mall experiencing a major jump from October 2023 onward. The excitement of the new SCHEELS seems to be sustaining itself, with February 2024 visits 23.3% higher than the same period of 2023.

Restaurants, too, can help bring people into malls. The Southgate Mall in Missoula, Montana, experienced a jump in monthly visits following the opening of a Texas Roadhouse steakhouse in November 2023. Customers seem to be receptive to this new addition – the mall saw a sustained increase in foot traffic from November 2023 onward, with year-over-year (YoY) visit growth of 17.0% in February 2024.

The addition of Texas Roadhouse provides Missoula residents with a family-friendly dining experience while tapping into the evergreen popularity of steakhouses.

Malls that don’t want to choose between adding a dining option and incorporating a novel entertainment venue can blend the two and go the “eatertainment” route. One shopping center – North Carolina’s Cross Creek Mall – is proving just how effective these concepts can be for a mall looking to grow its foot traffic.

Eatertainment destination Main Event opened at the mall in August 2023, bringing laser tag, video games, virtual reality, and 18 bowling lanes with it. Main Event’s opening also provided a boost in foot traffic to the mall – monthly visits to Cross Creek Mall surged following the opening. And this foot traffic boost sustained itself, particularly into the colder winter months – January and February 2024 saw YoY growth of 12.3% and 25.1%, respectively.

Integrating entertainment options at malls is one strategy for driving visits, but there are plenty of other ways to bring people through the doors. Pop-ups have been a particularly popular option of late, especially as more online brands venture into the world of physical retail. And malls, which typically tend to leave a small portion of their storefronts vacant, can be the perfect place to host a retailer for a limited time.

One brand – Shein – has been a leader in the pop-up space, bringing its affordable fashion to malls in Las Vegas, Seattle, and Indianapolis. These short-term residencies – typically no longer than three to four days – allow shoppers to try the popular online retailer’s products before they buy.

Shein has enjoyed success with its mall residencies, evidenced by the foot traffic at the Woodfield Mall in Illinois, which hosted a three-day pop-up from December 15-17, 2023. The retail event was hugely popular, with visits reaching Super Saturday (the last weekend before Christmas) proportions – even though this year’s Super Saturday coincided with Christmas Eve Eve (December 23rd) and drove unusually high traffic spikes.

Shein pop-ups are typically very short – no more than three to four days. This format, known for creating a sense of urgency among shoppers, has proven powerful in driving store visits. But can longer-lasting pop-ups find success as well?

Foot traffic data from pop-ups hosted by Swedish home furnisher IKEA suggests that yes – longer-term residencies can be successful. The chain is working on growing its presence across the country, particularly in malls. To that end, IKEA has been experimenting with mall pop-ups, beginning with a six-month residency at the Rosedale Center in Roseville, Minnesota.

IKEA opened its store on February 16, 2024, and visits to the mall increased significantly immediately after. The first week of the pop-up saw a 12.9% growth in visits compared to a January 1-7, 2024 baseline. And by the third week of the pop-up, there were still noticeably more people frequenting the mall than before the launch.

The luxury retail segment has had a great few years, and malls are tapping into this popularity. Nearly 40% of new high-end store openings in 2023 were in mall settings, many in Sunbelt states like Texas, Florida, and Arizona, perhaps driven in part by demand from an influx of wealthy newcomers to those states.

A comparison of upscale shopping malls to standard shopping centers across Sunbelt States reveals just how popular high-end retail is in the region. Malls with a high percentage of luxury and designer stores like the Lenox Square Mall in Georgia or the NorthPark Center in Texas saw considerably more YoY visit growth than the average visit growth for shopping centers in their respective states.

Lenox Square Mall saw foot traffic increase 31.2% YoY in 2023, while shopping centers in Georgia saw their visits grow by just 2.7% YoY in the same period. Similar trends repeated in Louisiana, Arizona, California, and Florida. And while some of this growth may be due to the resilience of these wealthier shoppers in the face of inflation, one thing is clear – luxury is here to stay.

Malls are thriving, carving out spaces for themselves in a competitive retail environment. By prioritizing experiential retail, entertainment, pop-up shops, and luxury offerings, shopping centers across the country are remaining relevant in a rapidly changing retail world. And mall operators that recognize the power of innovation and evolve along with their customers can hope to meet with continued success.

Consumer preferences have shifted over the past five years. COVID-19 and inflation impacted shopping habits and behaviors across the retail space – and while some of the changes were short-lived, others appear to have more staying power. Now, with memories of the lockdowns fading, and as the inflation that plagued much of 2022 and 2023 wanes (hopefully), we analyzed location intelligence data to understand what the retail and dining landscape looks like today.

This report leverages historical and current foot traffic data and trade area analysis to better understand the current retail and dining landscape and reveal consumer trends likely to shape 2024 and beyond. Which segments have benefited most from the shifts of the past five years? How are legacy brands staying on top of current shopping and dining trends? Where are people shopping and dining in 2024? And what characterizes the modern consumer?

One of the major retail stories of the past five years has been the rise of Discount & Dollar Stores. Category leaders such as Dollar General and Dollar Tree expanded significantly prior to the pandemic, which helped these essential retailers attract large numbers of customers during the initial months of lockdowns.

During this period, many Discount & Dollar Stores invested in more than just their store count – several leading chains also expanded their grocery selection, allowing these companies to compete more directly for Grocery and Superstore shoppers. As Discount & Dollar Stores continued growing their store fleets – and as the pandemic gave way to inflation concerns – shoppers looking for more affordable consumables options gravitated to this segment.

Location intelligence shows that the rapidly opening stores and stocking them with fresh groceries is working – since 2019, Discount & Dollar Stores have slowly but steadily grown their visit share relative to the Grocery and Superstore sectors.

In 2019, Discount & Dollar retailers captured 15.1% of the visit share between the three categories analyzed. This number grew by a full percentage point between 2019 and 2020 and the trend has continued, with the category enjoying 16.6% of the relative visit share in 2023. Meanwhile, Superstores’ relative visit share decreased during the same period, dropping from 41.7% in 2019 to 40.0% in 2023, while the relative visit share of Grocery Stores remained mostly stable.

Still, consumers are not giving up their regular Grocery or Superstore run quite yet – over 80% of combined visits to Grocery Stores, Superstore, and Discount & Dollar Store sectors still go to Grocery Stores and Superstores. But the data does indicate that some shoppers are likely choosing to shop for groceries and other consumables at Discount & Dollar Stores. And CPG companies and category managers looking to reach customers where they shop may want to consider adding Discount & Dollar Stores to their distribution channels.

The key question that remains is how much of the gained visit share can the Discount & Dollar leaders maintain as the economic environment improves. This metric will be the strongest sign of whether the short term gains made within a favorable context drove long term value.

Superstores’ visit share may be shrinking somewhat in the face of Discount & Dollar Stores’ growth. But diving into the Superstore leaders reveals that these macro-shifts are having a different impact on the various sub-categories within the wider Superstore segment.

Walmart remains the undisputed Superstore leader thanks to its 61.8% share of overall visits to Walmart, Target, Costco, Sam’s Club, and BJ’s in 2023. But 61.8% is still lower than the 66.3% relative visits share that the Superstore behemoth enjoyed in 2019. Meanwhile, Target grew its relative visit share from 17.3% in 2019 to 19.3% in 2023, while the combined visit share of the three membership club brands increased from 16.5% in 2019 to 18.9% in the same period.

Some of the shift in visit share can be attributed to Walmart closing several locations while Target, Costco Sam's Club, and BJ's expanded their fleet – but other factors are likely at play.

Costco and Target attract the most affluent clientele of the five chains analyzed, which could explain why these chains have seen significant growth at a time when many consumers are operating with tighter budgets. The success of these companies also suggests that there are enough consumers willing to spend beyond the basics – as shown with Target’s Stanley Cup success (more on that below) – to support a varied product selection that includes higher-priced options. It also speaks to a high upside on a per customer basis for chains that have proven effective at providing higher-end products alongside those with a value orientation. This speaks to a unique capacity to effectively address “the middle” – an audience that is defined neither solely by value-seeking nor by high-end product proclivities.

Sam's Club and BJ’s also give shoppers an opportunity to save by buying in bulk and cutting down on shopping trips – and related gas expenses – which may also have contributed to their success. The increase in the relative visit share of wholesale clubs indicates that today’s consumer might react positively to more options for bulk purchases in non-warehouse club chains as well.

Retail is not the only sector that has seen slow and steady shifts in recent years – the dining space was also significantly impacted by pandemic restrictions of 2020-2021 and the inflation of 2022-2023. Location intelligence reveals shifts in both the types of establishments favored by consumers and in the in-store behaviors of dining consumers.

Convenience stores’ dining options have evolved in recent years, with today’s consumers heading to Wawa for a freshly made specialty hoagie or to Buc-ee’s to enjoy the chain’s variety of specialty snacks.

Analyzing the visit distribution among C-Stores and other discretionary dining categories (Fast Food and QSR, Restaurants, and Breakfast & Coffee, not including Grocery and Superstores) showcases the growing role of C-Stores in the dining space. Between 2019 and 2023, C-stores' visit share relative to the other discretionary dining categories jumped from 24.2% to 27.1%. The relative visit share of Breakfast, Coffee, Bakeries & Dessert Shops also grew slightly during the period. Meanwhile, Restaurants’ relative visit share dropped from 13.8% to 11.7% and Fast Food & QSR’s dipped from 51.8% to 50.6%.

Several factors are likely driving this evolution. Most Restaurants shuttered temporarily at the height of the pandemic while C-Stores remained open – and consumers likely took the opportunity to get acquainted with C-Stores’ food-away-from-home options. And many C-Stores expanded their footprint in recent years, while some dining chains downsized, which likely also contributed to the changes in relative visit share between the segments.

But the continued growth of C-Stores between 2021 and 2022, and again between 2022 and 2023, indicates that many diners are now embracing C-Store food out of choice and not just due to necessity. The rise of the Breakfast, Coffee, Bakeries & Dessert Shops category alongside C-Stores in the past five years may also highlight the current appetite for affordable grab-and-go food options. And with C-Store operators embracing the shifts brought on by the pandemic and actively expanding their food options, diners are increasingly likely to consider C-Stores for their portable meals and packaged snacks.

C-Store visitors are increasingly receptive to trying new products at their local c-store. So how can C-Store operators and CPG companies determine which products will best appeal to customers? Analyzing the trade areas of seven major chains – 7-Eleven, Wawa, Casey’s, QuikTrip, Cumberland Farms, Plaid Pantry, and Buc-ee’s – using the Spatial.ai: FollowGraph dataset reveals significant variance in food preferences between the chains’ visitor bases.

For instance, Plaid Pantry visitors were 55% more likely than the nationwide average to fall into the “Asian Food Enthusiasts” segment in 2023, in contrast with Casey’s visitors who are 7% less likely to belong to this psychographic. Residents of the trade areas of QuikTrip and Buc-ee’s rank highest for "Fried Chicken Lovers," while Cumberland Farms and Plaid Pantry visitors register the least interest. C-Store operators, QSR franchisees, packaged food manufacturers, and other stakeholders can leverage these insights to optimize food offerings, identify promising partnership opportunities, and find new venues for product testing.

While C-Stores stores may be the exciting story of the day, Full-Service Restaurants continue to play a major role in the wider dining landscape. And despite the ongoing economic headwinds, several dining brands and categories are seeing growth – although location intelligence suggests that in-restaurant behavior may be changing as well.

For example, the hourly visits distribution for leading steakhouse chains has shifted over the past five years: Between 2019 and 2023, Texas Roadhouse, LongHorn Steakhouse, and Outback Steakhouse all saw a jump in the share of visits occurring between 2:00 PM and 6:00 PM – not typical steak eating hours.

Outback and Texas Roadhouse offer early bird dinner specials while LongHorn has a happy hour, so some diners may be choosing to visit these restaurant chains earlier in the evening in order to stretch their eating out budget. Other consumers who are still working from home most of the week may also be eating on a more flexible schedule, and these diners may be having more late lunches in 2023 when compared to 2019. Restaurant operators, drink providers, and menu developers may want to adapt their offerings to this emerging mid-afternoon rush.

The data examined above shows changes within key retail and dining segments over the past five years. So what do these shifts reveal about today’s consumer? What are shoppers and diners looking for in 2024?

The beginning of 2024 was marked by an Arctic blast and plunging temperatures. Consumers, unsurprisingly, hunkered down at home – and foot traffic to many retail categories took a dip. But the declines were short-lived, and by the fourth week of January 2024 foot traffic had rebounded across major categories.

Still, zooming into weekly visit performance for key retail and dining categories for the first eight weeks of the year reveals that the cold did not impact all segments equally – and the subsequent resurgence boosted some sectors more than others.

Discount & Dollar Stores had the strongest start to 2024, with YoY visits up almost every week since the start of the year, and the category showing even more substantial growth once the cold spell subsided. The Grocery category also succeeded in exceeding 2023 weekly visit levels almost every week, although its visit increases were more subdued than those in the Discount & Dollar Store segment.

Superstore and C-Store experienced relatively muted YoY declines in early January and saw significant weekly visit growth as Q1 progressed, with C-Stores outperforming Superstores by late January 2024. And Dining – which suffered a particularly heavy blow in early 2024 – also rebounded with gusto, offering another strong indicator of the resilience of today’s consumer.

Like in the wider Dining industry, weekly YoY visits to the QSR segment quickly rebounded following the unusual cold of the first three weeks of January 2024. And three chains from across the QSR spectrum – legacy chain Wingstop, rapidly expanding Raising Cane’s, and regional cult favorite Whataburger – are seeing particularly strong foot traffic performances.

Diving deeper into the location intelligence reveals that the three chains’ success may be due in part to their visitor base composition: The trade areas of all three brands included a larger share of four-person households compared to the nationwide average of 24.6%.

Wingstop, Raising Cane’s, and Whataburger’s menus all include larger orders to create shareable meals. And larger households seem to be particularly receptive to dining options that allow them to save money, which could explain the significant share of 4+ person households that visit these chains.

The success of these diverse QSR chains also indicates that, although larger households may have more expenses – and might therefore be more impacted by inflation – they can also drive visits to brands that cater to their needs. So dining operators and food manufacturers looking to attract family demographics may consider offering larger meal combos or larger packaging to help larger households splurge on affordable luxuries without breaking the bank.

Perhaps the most significant sign that today’s consumers are still willing to spend money on non-essentials is the recent success of the Starbucks X Stanley “Pink Cup”. The cup has caused such a sensation that re-sellers ask for up to six times the original $50 price – and for those unwilling to shell out the big bucks on the cup, enterprising cup owners offer photo shoots with the product for $5.

The Starbucks X Stanley “Pink Cup” was released on January 3rd, 2024 and could only be bought at Starbucks kiosks located inside a Target. Viral videos of the release circulated on social media, showing eager crowds lining up early in the morning for the chance to be first to grab their cup. Location intelligence reveals that these early morning visits were significant enough to change Target’s typical hourly visit pattern.

Foot traffic between 7:00 AM and 9:00 AM on January 3rd, 2024 accounted for 4.4% of daily visits, compared to 2.6% of daily visits occurring during that time slot on a typical Wednesday in January or February. And demand for the pink Stanley cup drove a spike in daily visits as well – overall daily visits to Target on January 3rd were 18.7% higher than the average Wednesday visits in January and February 2024.

The visit trends to Target on Pink Cup Day are particularly impressive given the freezing weather in some regions of the country and because consumers were coming off the holiday shopping season. And the success of the cup shows that 2024’s shopper is willing to show up – especially for a viral product. Creating buzzy marketing campaigns, then, may be the key to driving retail success.

The retail changes of the past few years have left their mark on how people shop, eat, and spend. And keeping ahead of these changes allows companies and product managers to ensure they can tailor their offerings – whether product selection or marketing campaigns – to the right audience.

The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from some 1,000 office buildings across the country. It only includes commercial office buildings, and commercial office buildings with retail offerings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

This white paper includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

The remote work war is far from over – and as the labor market cools, companies are ramping up efforts to get workers back in the office. But even those employers that are cracking down on WFH aren’t generally insisting that employees come in five days a week – for the most part.

Indeed, a growing consensus seems to posit that though in-person work carries important benefits, plugging in remotely at least part of the time also has its upsides. Nixing the daily commute can put the ever-elusive work/life balance within reach. And there’s evidence to suggest that remote work can enhance productivity – limiting distractions and letting workers lean into their individual biological clocks (so-called “chronoworking”).

But the precise contours of the new hybrid status-quo are still a work in progress. And to keep up, relevant stakeholders – from employers and workers to municipalities and local businesses – need to keep their fingers on the pulse of how this fast-changing reality is evolving on the ground.

This white paper dives into the data to explore some of the key trends shaping the office recovery. The analysis is based on Placer.ai’s Nationwide Office Index, which examines foot traffic data from more than 1,000 office buildings across the country. What was the trajectory of the post-COVID office recovery in 2023? What impact did return-to-office (RTO) mandates have on major cities nationwide, including New York, Dallas, San Francisco, and others? And how has the demographic and psychographic profile of office-goers changed since the pandemic?

Analyzing office building foot traffic over the past several years suggests that the office recovery story is still very much being written. After plummeting during COVID, nationwide office visits began a slow but steady upward climb in 2021, reaching about 70.0% of January 2019 levels in August 2023.

Since then, the recovery appears to have stalled – with some observers even proclaiming the death of RTO. But looking back at the office visit trajectory since 2019 shows that the process has been anything but linear, with plenty of jumps, dips, and plateaus along the way. And though office foot traffic tapered somewhat between November 2023 and January 2024, this may be a reflection of holiday work patterns and of January’s unusually cold and stormy weather, rather than of any true reversal of RTO gains. Indeed, if 2024 is anything like last year, office visits may yet experience an additional boost as the year wears on.

TGIF Vibes

But for now, at least, a full return to pre-COVID work norms doesn’t appear to be in the cards. And like in 2022, last year’s hybrid work week gave off some serious TGIF vibes.

On Tuesdays, Wednesdays, and Thursdays, office foot traffic was just 33.2% to 35.3% lower than it was pre-COVID. But on Mondays and Fridays, visits were down a whopping 46.0% and 48.9%, respectively. From a Year-over-year (YoY) perspective too, the middle of the week experienced the most pronounced visit recovery, with Tuesday, Wednesday, and Thursday visits up about 27.0% compared to 2022.

The slower Monday and Friday office recovery may be driven in part by workers seeking to leverage the flexibility of WFH for extended weekend trips. (Indeed, hybrid work even gave rise to a new form of nuptials – the remote-work wedding.) So-called super commuters, many of whom decamped to more remote locales during COVID, may also prefer to concentrate visits mid-week to limit time on the road. And let’s face it – few people would object to easing in and out of the weekend by working in their pajamas. Whatever the motivating factors – and despite employer pushback – the TGIF work week appears poised to remain a fixture of the post-pandemic working world.

Analyzing nationwide office visitation patterns can shed important light on evolving work and commuting norms. But to really understand the dynamics of office recovery, it is crucial to zoom in on local trends. RTO in tech-heavy San Francisco doesn’t look the same as it does in New York’s financial districts. And commutes in Dallas are very different than in Chicago or Washington, D.C.

Overall, foot traffic to buildings in Placer.ai’s Nationwide Office Index was down 36.8% in 2023 compared to 2019 – and up 23.6% compared to 2022. But drilling down into the data for seven major markets shows that each one experienced a very different recovery trajectory.

In New York and Miami, offices drew just 22.5% and 21.9% less visits, respectively, in 2023 than in 2019 – meaning that they recovered nearly 80.0% of their pre-COVID foot traffic. In New York, remote work policy shifts by major employers like Goldman Sachs and JPMorgan appear to have helped set a new tone for the financial sector. And Miami may have benefited from Florida’s early lifting of COVID restrictions in late 2020, as well as from the steady influx of tech companies over the past several years.

San Francisco, for its part, continued to lag behind the other major cities in 2023, with office building foot traffic still 55.1% below 2019 levels. But on a YoY basis, the northern California hub experienced the greatest visit growth of any analyzed city, indicating that San Francisco’s office recovery is still unfolding.

To better understand the relationship between employees’ occupational backgrounds and local office recovery trends, we examined the share of Financial, Insurance, and Real Estate sector workers in the captured markets of different cities’ office buildings. (A POI’s captured market is derived by weighting the census block groups (CBGs) in its True Trade Area according to the share of actual visits from each CBG – thus providing a snapshot of the people that actually visit the POI in practice). We then compared this metric to each city’s year-over-four-year (Yo4Y) office visit gap.

The analysis suggests that the finance sector has indeed been an important driver of office recovery. Generally speaking, cities with greater shares of employees from this sector tended to experience greater office recovery than other urban centers. And for New York City in particular, the dominance of the finance industry may go some way towards explaining the city’s emergence as an RTO leader.

Regional differences notwithstanding, office foot traffic has yet to rebound to pre-COVID levels in any major U.S. market. But counting visits only tells part of the RTO story. Stakeholders seeking to adapt to the new normal also need to understand the evolving characteristics of the in-office crowd. Are office-goers more or less affluent than they were four years ago? And is there a difference in the employee age breakdown?

To explore the evolution of the demographic and psychographic attributes of office-goers since COVID, we analyzed the captured markets of buildings included in the Placer.ai Office Indexes with data from STI (Popstats) and Spatial.ai (PersonaLive). And strikingly, despite stubborn Yo4Y office visit gaps, the profiles of last year’s office visitors largely resembled what they were before COVID – with some marked shifts. This may serve as a further indication that 2023 brought us closer to an emerging new normal.

The median household income (HHI) of the Office Indexes fell during COVID. But by 2022, the median HHI in the trade areas of the Office Indexes was climbing back nationwide in all cities analyzed, and fell just 0.6% short of 2019 levels in 2023. And in some cities, including San Francisco and Dallas, the median HHI of office-goers is higher now than it was pre-pandemic.

Better-paid, and more experienced employees often have more access to remote and hybrid work opportunities – and at the height of the pandemic, it was these workers that disproportionately stayed home. But as COVID receded, many of them came back to the office. Now, even if high-income workers – like many other employees – are coming in less frequently, their share of office visitors has very nearly bounced back to what it was before COVID.

Who are the affluent employees driving the median HHI back up? Foot traffic data suggests that much of the HHI rebound may be fueled by “Educated Urbanites” – a segment defined by Spatial.ai PersonaLive as affluent, educated singles between the ages of 24 and 35 living in urban areas.

For younger employees in particular, fully remote work can come at a significant cost. A lot of learning takes place at the water cooler – and informal interactions with more experienced colleagues can be critical for professional development. Out of sight can also equal out of mind, making it more difficult for younger workers that don’t develop personal bonds with their co-workers and to potentially take other steps to advance their careers.

Analyzing the trade areas of offices across major markets shows that – while parents were somewhat less likely to visit office buildings in 2023 than in 2019 – affluent young professionals are making in-person attendance a priority. Indeed, in 2023, the share of “Educated Urbanites” in offices’ captured markets exceeded pre-COVID levels in most analyzed cities – although the share of this segment still varied between regions, as did the magnitude of the shift over time.

Miami and Dallas, both of which feature relatively small shares of this demographic, saw more dramatic increases relative to their 2019 baselines – but smaller jumps in absolute terms. On the other end of the spectrum lay San Francisco, where the share of “Educated Urbanites” jumped from 47.8% in 2019 to a remarkable 50.0% in 2023. New York office buildings, for their parts, saw the share of this segment rise from 28.8% in 2019 to 31.0% in 2023.

Other segments’ RTO patterns seem a little more mixed. The share of “Ultra Wealthy Families” – a segment consisting of affluent Gen Xers between the ages of 45 and 54 – is still slightly below pre-COVID levels on a nationwide basis. In 2023, this segment made up 13.0% of the Nationwide Office Index’s captured market – down slightly from 13.3% in 2019. In New York and San Francisco, for example – both of which saw the share of “Educated Urbanites” exceed pre-COVID levels last year – the share of “Ultra Wealthy Families” remained lower in 2023 than in 2019. At the same time, some cities’ Office Indexes, such as Miami, Dallas, and Los Angeles, have seen the share of this segment grow Yo4Y.

Workers belonging to this demographic tend to be more established in their careers, and may be less likely to be caring for small children. Well-to-do Gen Xers may also be more likely to be executives, called back to the office to lead by example. But employees belonging to this segment may consider the return to in-person work to be a choice rather than a necessity, which could explain this cohort’s more varied pace of RTO.

COVID supercharged the WFH revolution, upending traditional commuting patterns and offering employees and companies alike a taste of the advantages of a more flexible approach to work. But as employers and workers seek to negotiate the right balance between at-home and in-person work, the office landscape remains very much in flux. And by keeping abreast of nationwide and regional foot traffic trends – as well as the shifting demographic and psychographic characteristics of today’s office-goers – stakeholders can adapt to this fast-changing reality.