.svg)

.png)

.png)

.png)

.png)

For fashion-focused consumers, there’s never been more choices available to shop. While luxury brands and retailers are still viewed as the trend setters, there are many brands in the mid-tier luxury market gaining traction. At a time when perceived value is paramount to shopper decision-making, brands that provide a great experience and on-trend styles that won’t break a budget are winning visits.

Product knowledge, recommendations and styling tips can all be accessed in the digital and social world, which gives smaller brands a fighting chance at connecting with shoppers who may not have stores located near them. Those brands whose social presence also coincides with a physical shopping experience, they’re able to build a cult-like following.

Accessories is a market that’s even further fragmented when it comes to the number of consumer choices, specifically in areas like handbags. Brands that have found their niche in the mid-tier market, like Clare V. and Stoney Clover Lane, have been able to hedge against the headwinds facing most discretionary brands. Although each brand has a handful of locations in comparison to accessory behemoths, their unique selection, brand storytelling and ability to assimilate to local environments have helped them to garner quite the following.

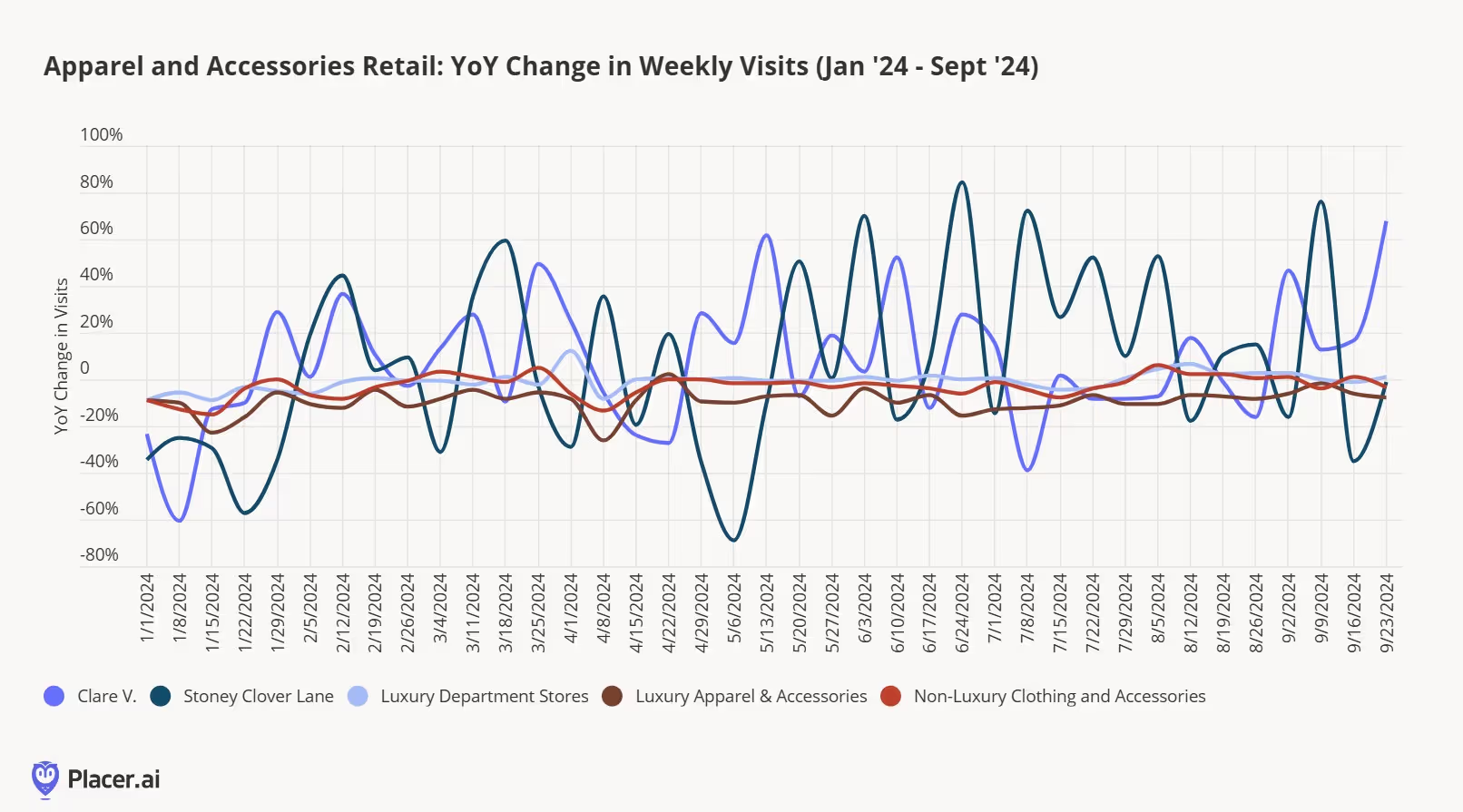

In comparing both brands to other apparel and accessories sectors, they have outperformed the other areas handily throughout 2024. Certainly fashion is very cyclical; one day, a brand is hot, and within a few weeks the craze might be over. However, both of these brands have been around since before the pandemic and continued to climb.

Looking further into Stoney Clover Lane, the brand is known for its colorful nylon pouches, purses and luggage that consumers can customize with a broad assortment of patches. The brand has also had licensing partnerships with brands such as American Girl and Disney.

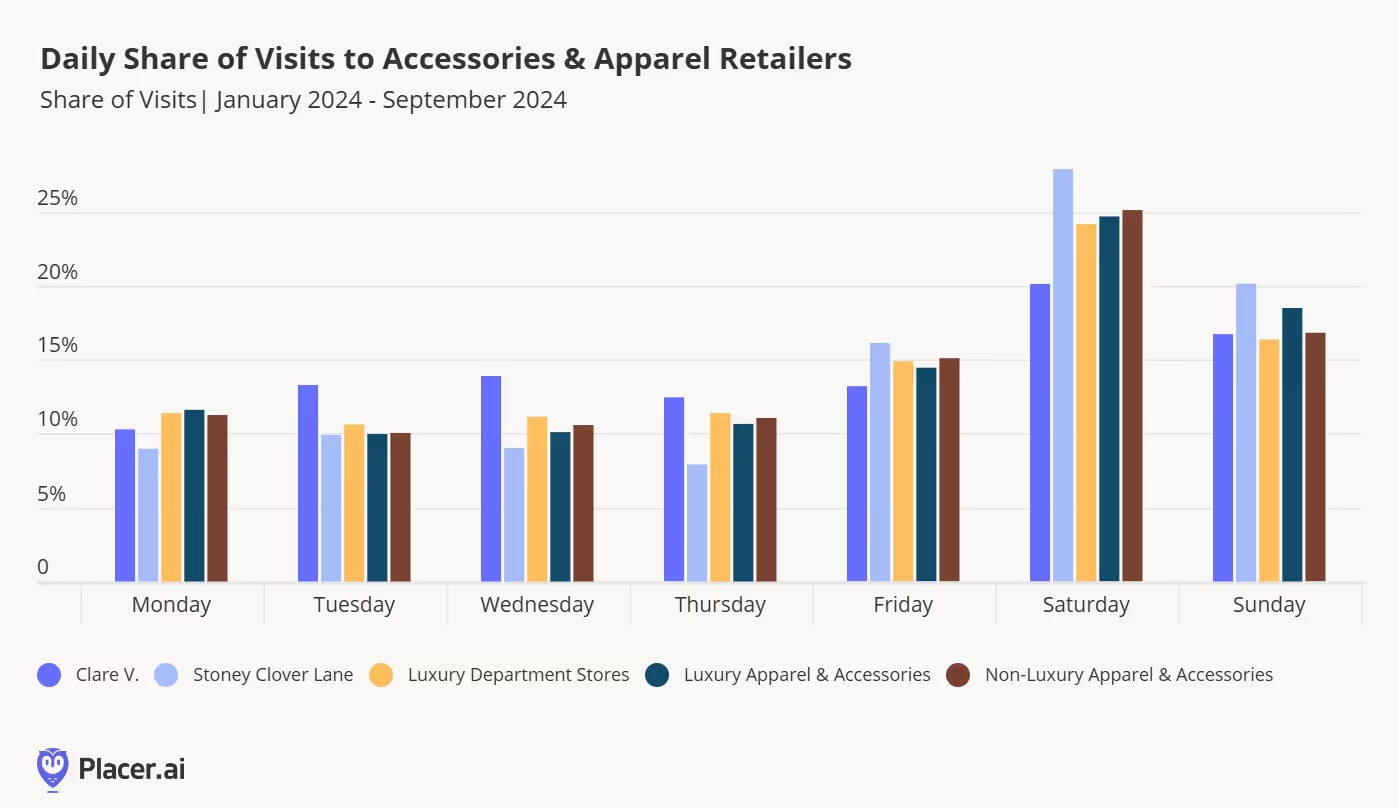

Its physical retail presence combines experiences and an expansive assortment where consumers can customize their bags in store with patches and also attend local events. The brand has the highest percentage of weekend visits compared to the competitive set, and it’s clear that it’s a destination retailer for visitors.

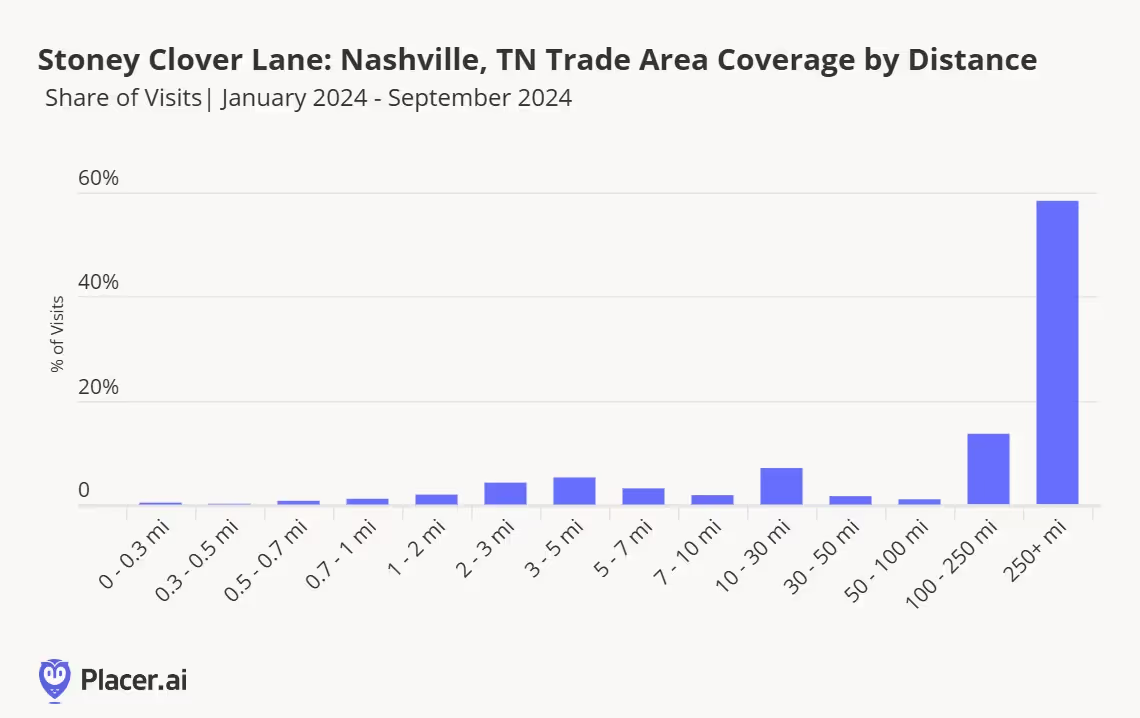

Stoney Clover Lane’s Nashville outpost, located in the popular 12 South neighborhood, offers the product customization as well as a performance stage to infuse some of the local culture into the store. Looking at the visitor journey for this location, there is a high level of cross visitation to hotels and restaurants, indicating that this store may serve as a destination for out-of-town travelers who want to shop the location. Placer’s Trade Area feature corroborates this, as there is a high concentration of visits from other Southern cities including Atlanta, Birmingham, Dallas and Miami.

Clare V. blends the iconic styles of Los Angeles and Paris into an accessories brand that feels inherently cool. Its retail locations feel like an art museum blended with your best friend’s closet and each store location incorporates the local feel of the neighborhood it inhabits, including iconic locations like the Brentwood Country Mart in Los Angeles.

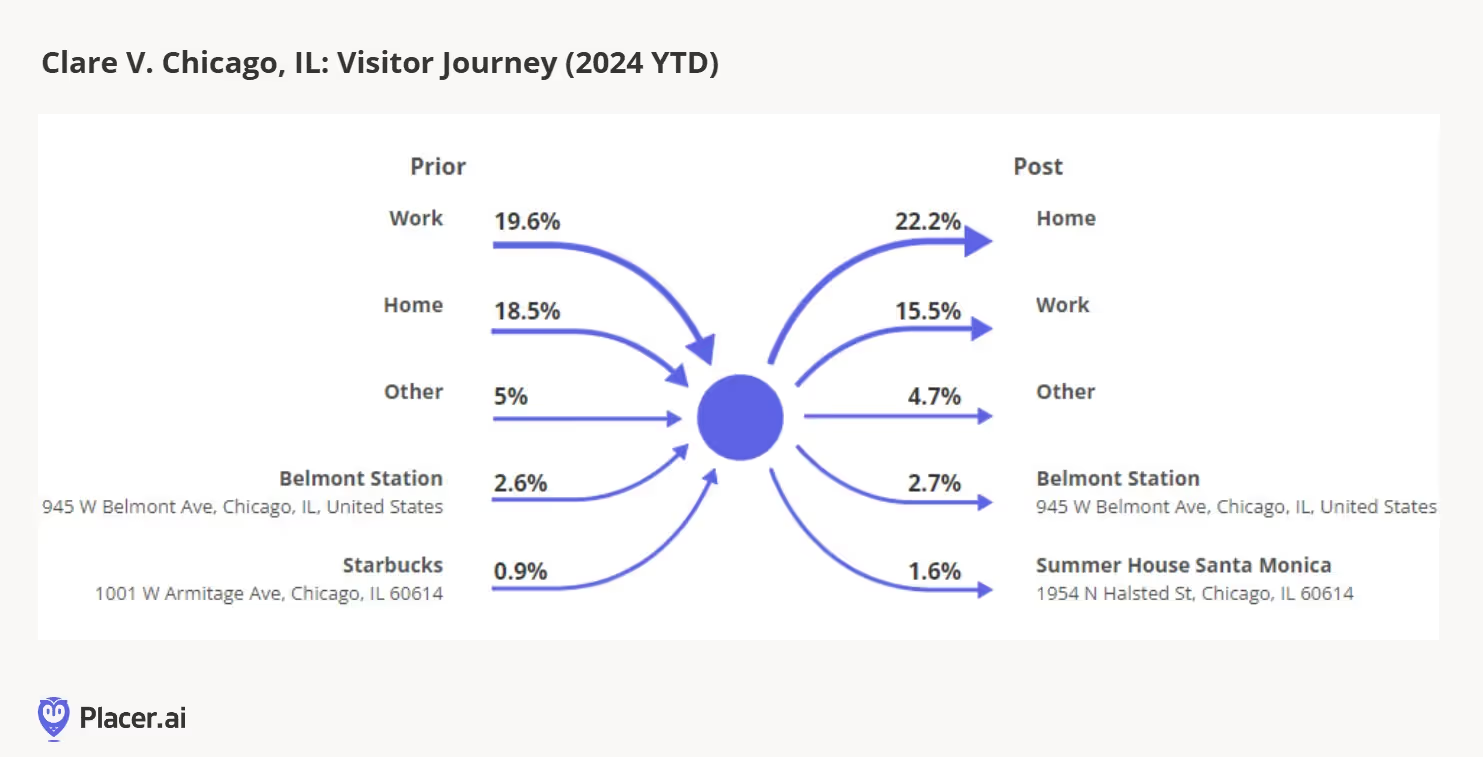

Clare V.’s Chicago shop draws a more local crowd, with a high level of cross-vistation to and from home as well as transportation services. Other neighborhood shops, restaurants and venues like Wrigley Field also have high levels of cross-visitation for visitors to Clare V.. By entrenching itself into the local look and feel of the neighborhoods it occupies, this national brand still feels like a well kept secret for those passing by. In comparing the trade area of the Chicago location in 2024 and 2023, the brand has been able to expand its reach further in Western Chicago Suburbs this year.

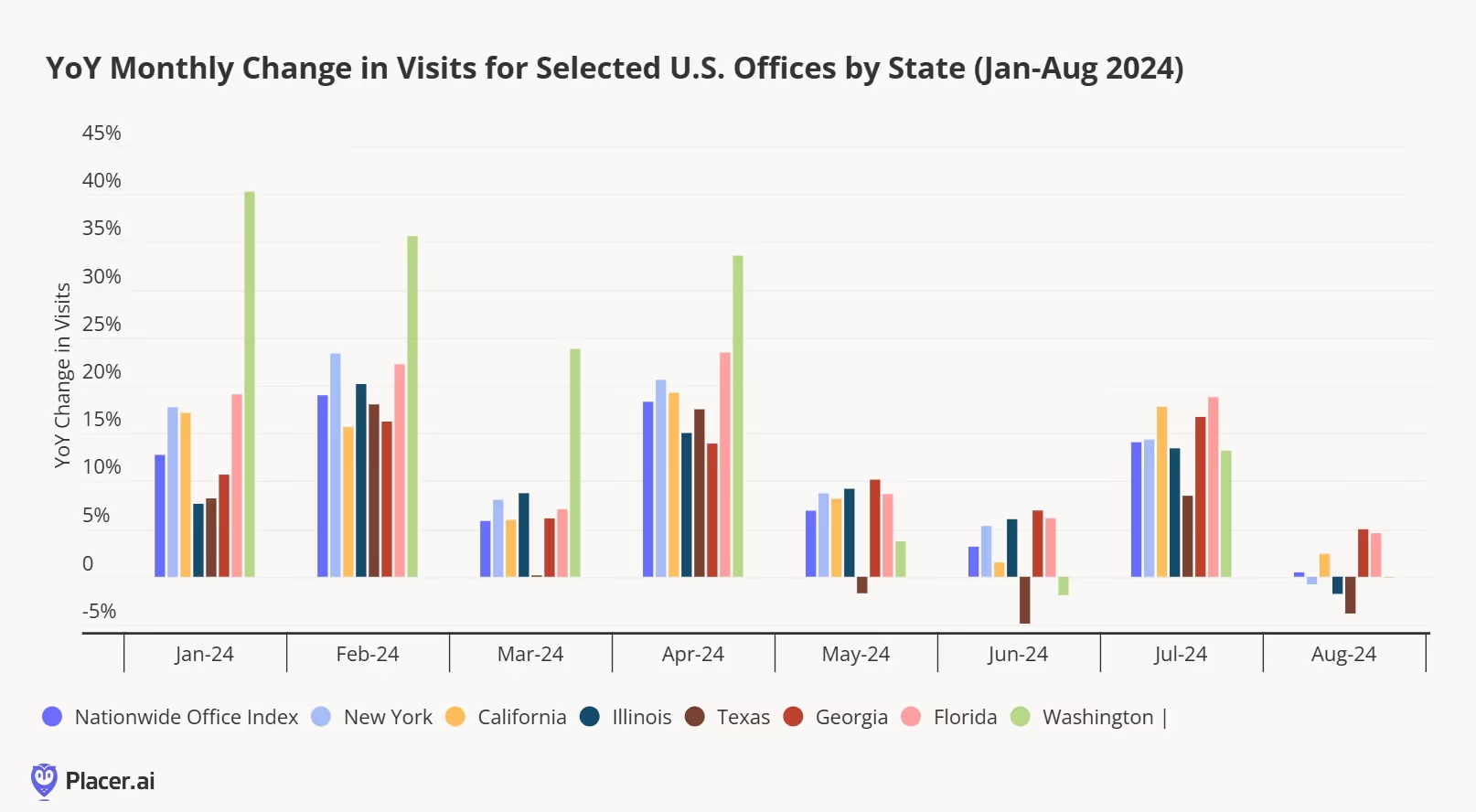

It’s been about a month since Labor Day, so let’s take a look and see how return-to-office (RTO) has been faring year-to-date. A majority of states saw fairly sizable bumps in year-over-year office traffic at the beginning of the year. The return in the state of Washington was particularly pronounced in the first four months of the year, with a 40% increase in January 2024 compared to January 2023.

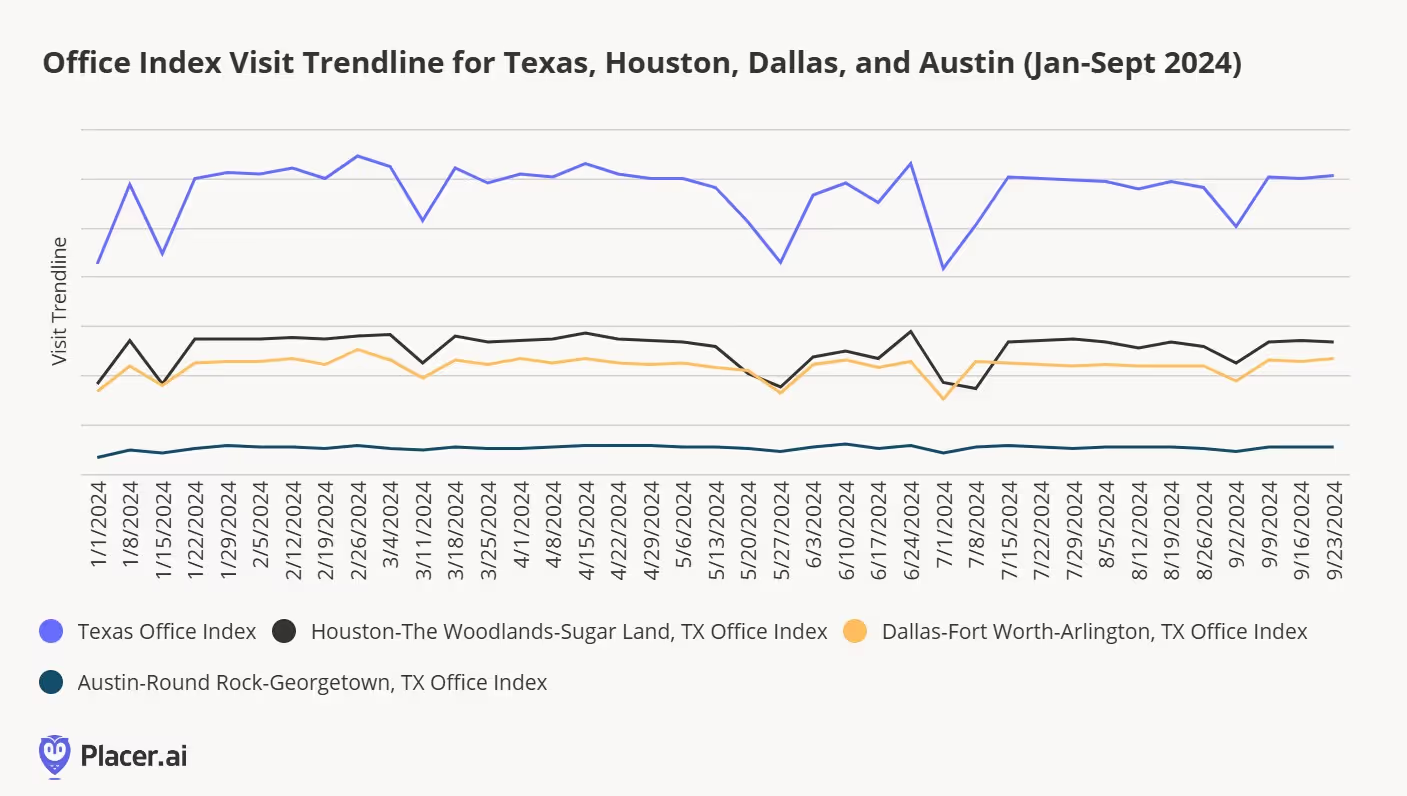

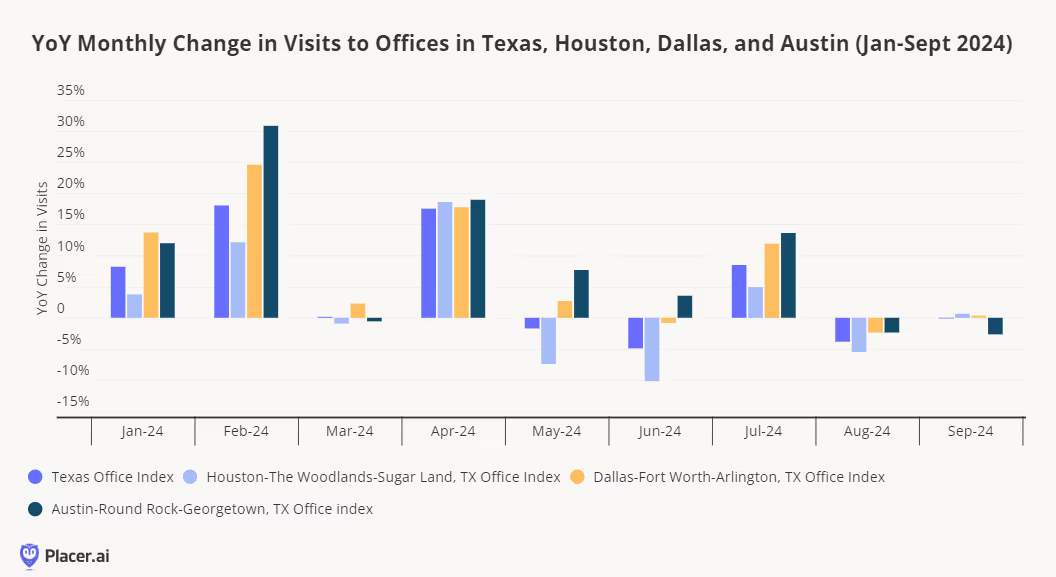

Texas saw a bit of a decrease in May, June, and August. Overall, Houston and Dallas account for more of the office visits, followed by Austin.

Houston drove a decrease in office visits in the months of May, June, and August, while office visits were largely flat in September, with the exception of Austin, which showed a decline compared to the prior year.

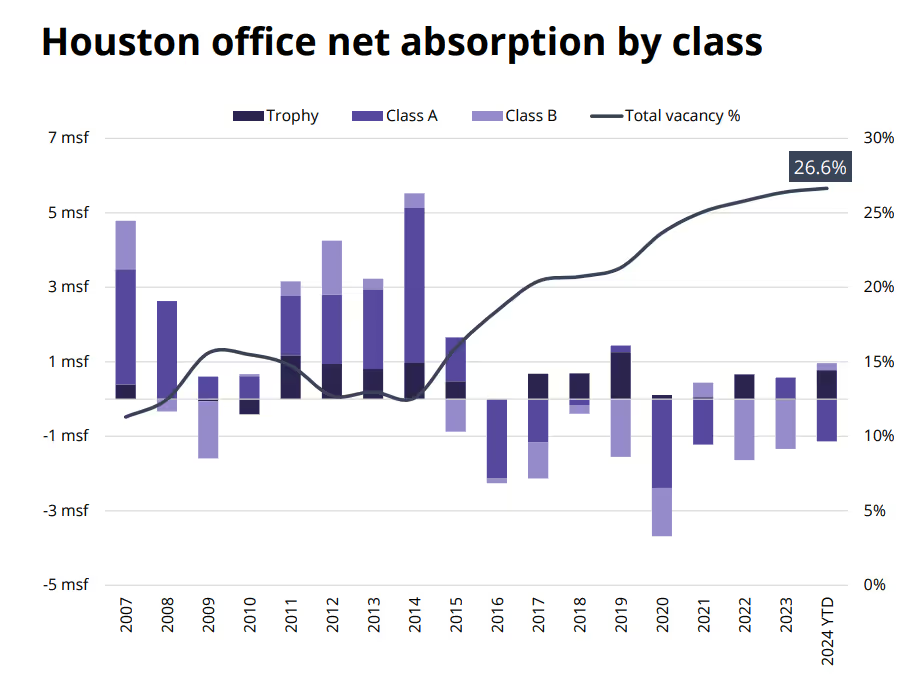

There are multiple reasons potentially driving some of the decreases in Houston. The devastation of Hurricane Harvey in 2017 resulted in a long recovery. Many large companies along the I-10 chose to reduce their office footprint. However, per Avison Young, vacancy rates are lower at trophy assets.

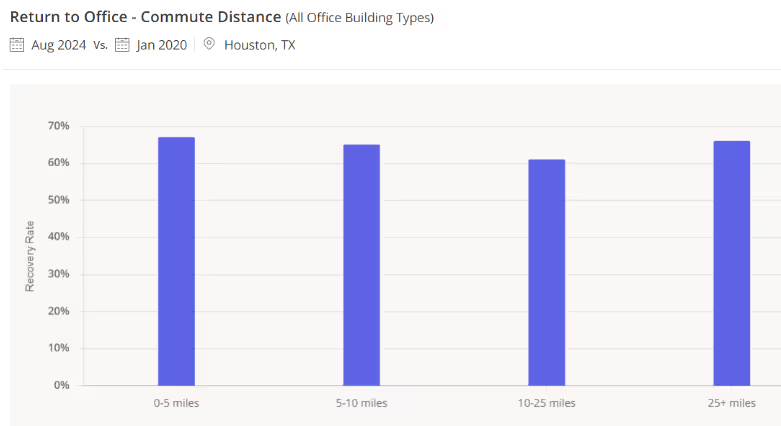

Interestingly, those commuting 10-25 miles away have a lower RTO rate than those living 0-5 miles away, 5-10 miles away, or 25+ miles away. The first two make sense as we generally see higher RTO rates among those living within a closer commuting distance.

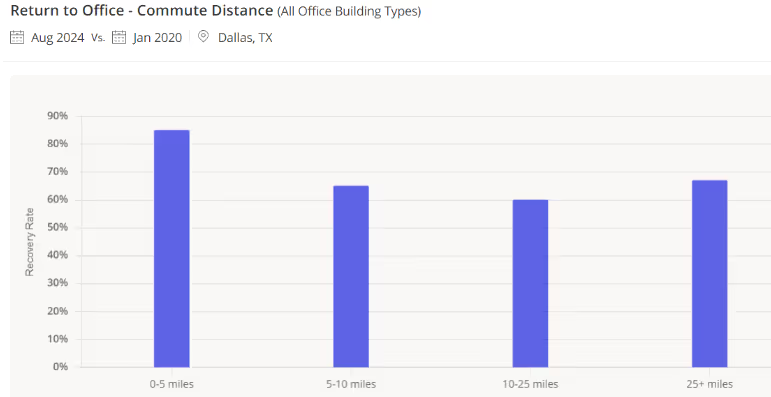

Dallas sees a similar pattern, though those who live within 5 miles have returned to office at a considerably higher rate at 85% than those farther afield.

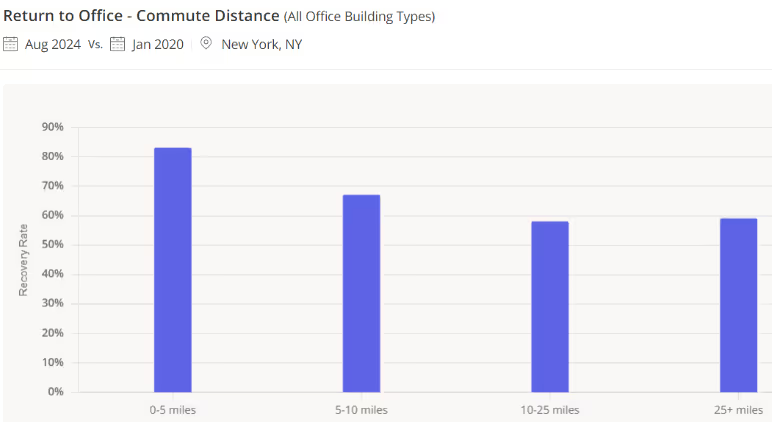

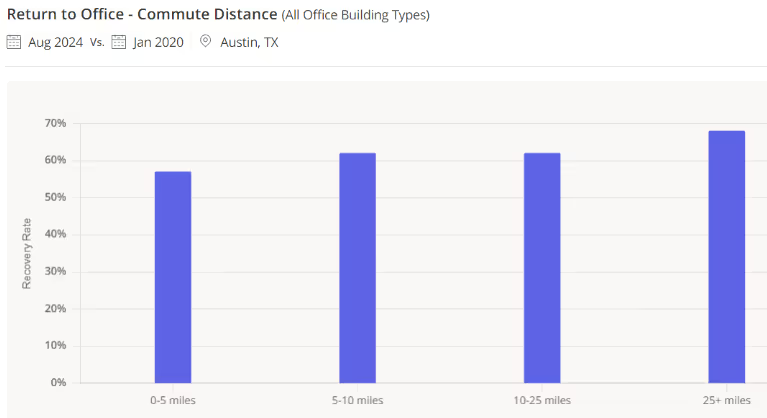

One of the more intriguing patterns we are seeing is in Austin, Texas. Here, the RTO rate is actually higher the longer the commute. This seems rather counterintuitive, as in most locations, highest RTO rates are found the closer one lives to the office. New York is more typical, as we see that people are more likely to come into the office the closer they live.

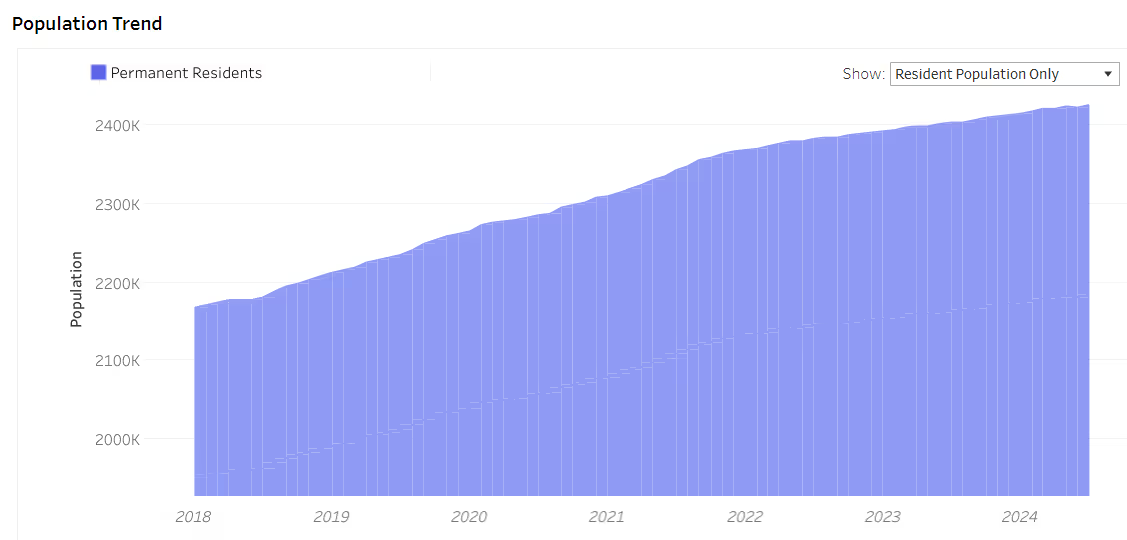

Austin may, in fact, be a victim of its own success. Per Placer’s Migration Dashboard, its population has skyrocketed in the past few years. With more demand comes higher prices, and as a result, people are forced to move farther out in their quest for homes or more land. On the other hand, Austin traffic is not nearly as bad as some major cities like Los Angeles or New York, so living 25+ miles may not be as daunting a prospect when it comes to commuting.

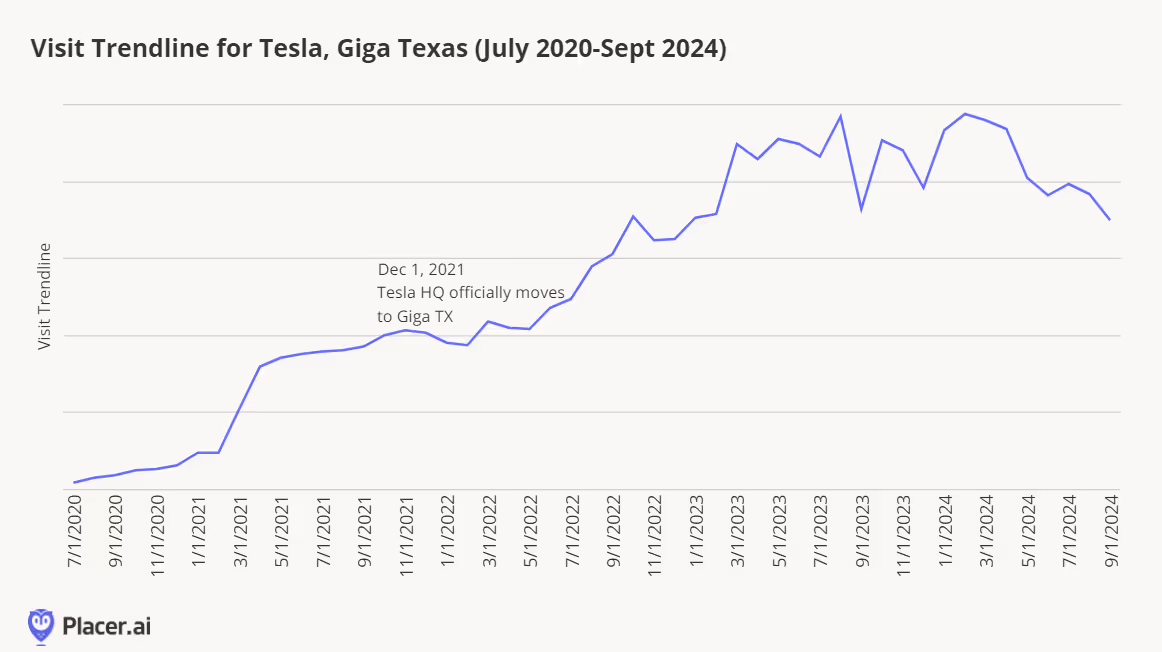

Another huge factor? The move from California to Austin, Texas for Tesla's HQ means that it is now Austin’s largest employer, surpassing H-E-B, and Tesla CEO Elon Musk has made it clear that he expects his employees to fully return to office. Both visits and visitors to Giga, Texas have exploded.

With Q4 2024 just underway, retailers are already gearing up for the all-important holiday season. A condensed shopping window – just 27 days between Thanksgiving and Christmas this year – is prompting many to launch early deals and promotions. And though consumers remain cautious, shoppers are expected to spend more this year than they did in 2023.

But what can recent visitation trends tell us about how this year’s holiday season will really play out? We dove into visit data for various retail categories and chains to try and predict what’s in store for the all-important fourth quarter of 2024.

A look at the overall state of brick-and-mortar retail this year offers a glimpse into what we can expect this holiday season.

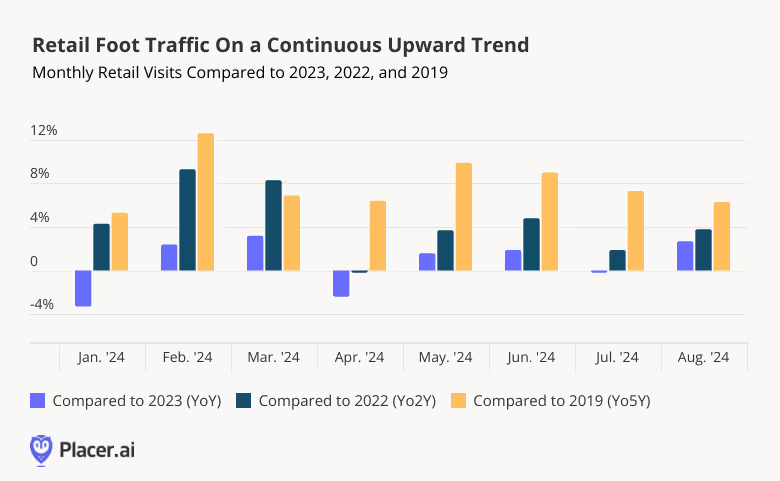

Since January 2024, monthly retail foot traffic has generally been on an upswing, with YoY visits up most months since January 2024 – and foot traffic higher than in 2022 or 2019 (pre-pandemic). This steady rise in retail visits signals strong consumer engagement in 2024, setting the stage for what may turn out to be a robust Q4.

Holiday promotions are kicking off early this year, offering customers more time to take advantage of deals and helping retailers navigate supply chain and logistics challenges. And though early sales are nothing new, 2024’s shorter holiday shopping season may suffuse them with more significance than ever.

In 2023, Thanksgiving fell on November 23rd, leaving consumers with 32 days in which to do their holiday shopping. But this year, the holiday will be on November 28th, shortening the period between Thanksgiving and Christmas by five days. To make up for lost time, retailers and consumers alike may embrace an early shopping frenzy, potentially detracting from the power of milestones like Black Friday, Super Saturday, and Christmas Eve Eve.

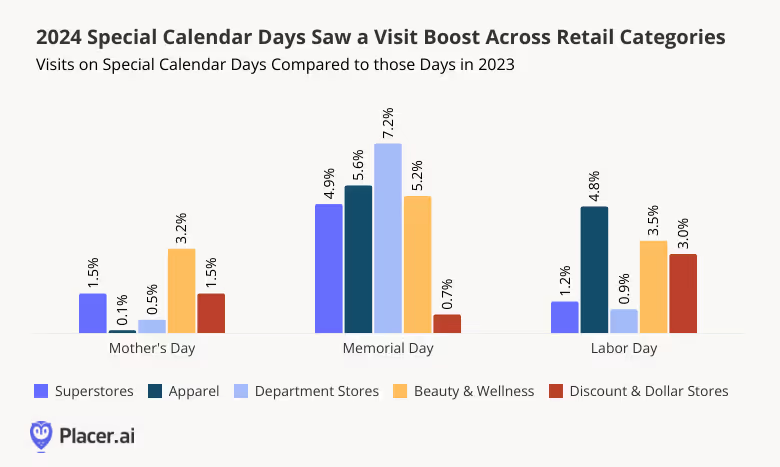

But a look at consumer behavior during special calendar days this year suggests that traditional retail milestones still very much resonate with customers. On Mother’s Day, Memorial Day, and Labor Day, key industries saw YoY visit boosts, though the magnitude of the increases varied across categories.

On Mother’s Day, for example, the beauty and wellness sector saw a 3.2% YoY increase in visits – highlighting the category’s enduring popularity for grateful offspring seeking to give mom a special gift. But on Memorial Day, department stores had their time in the sun, overshadowing other segments with a 7.2% YoY visit boost.

Overall, these occasions proved particularly effective at driving consumer engagement this year. So whether by targeting big days like Black Friday or planning extended holiday campaigns, the 2024 holiday season gives retailers a great chance to benefit from consumer excitement.

While all retail categories participate in the holiday season's flurry of sales, promotions, and limited-time offers, a select few shine especially bright during this period. These segments’ strong performance can often make up for quieter stretches earlier in the year.

Department stores are prime examples of holiday season winners. An analysis of weekly visits throughout 2023 shows that department stores experience one of the most impressive visits spikes of the holiday season. In the week leading up to Christmas, visits to department stores surged 113.4% compared to a 2023 weekly average – highlighting the segment’s success at positioning itself as a go-to destination for holiday shopping.

Another standout during the holiday season is the hobbies, gifts, and crafts category. Unlike department stores, this category sees a more evenly-distributed rise in foot traffic across Q4, with peaks leading up to Halloween, Thanksgiving, and Christmas. This pattern reflects the popularity of holiday-related decorations and gifts, which drive increased visits during these festive periods.

These two powerhouse categories – department stores and hobbies, gifts, and crafts – are poised to dominate the 2024 holiday season, just as they did last year. And with consumer spending expected to rise and foot traffic showing no signs of slowing, both categories have significant potential for even greater success this year.

The upcoming holiday season looks on track to be a big one. Despite the shorter shopping window, retailers are taking steps to maximize shopping opportunities with early promotions. And against the backdrop of this year’s robust consumer engagement – especially around milestones – Q4 is shaping up to be a festive season indeed.

Will retailers rise to the challenge? Follow Placer.ai to see how this holiday season unfolds.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Grocery stores have been on an upward foot traffic trajectory as of late, and Trader Joe’s – with its cult-like following – is often near the top of the pack.

We dove into the location analytics for the chain, exploring its nationwide performance and visitor trends in its home state of California, to uncover what’s behind the grocer’s ongoing success.

Despite positive signs that food-at-home inflation is stabilizing, many consumers are still feeling the pinch of high grocery costs. And with the help of its wide range of premium-quality, private-label products, Trader Joe’s offers an upscale experience at prices that are attractive to value-conscious grocery shoppers.

Perhaps bolstered in part by several new locations, Trader Joe’s year-over-year (YoY) visit growth has outperformed the wider grocery category every month of 2024 so far. And the chain appears to be doubling down on its expansion strategy, with two dozen new stores planned through the end of 2024.

By continuing to meet consumer demand for value and quality, and through the ongoing expansion of its fleet, Trader Joe’s is likely to sustain foot traffic growth in the near future.

In addition to competitive pricing and a growing real estate footprint, examining visitor dynamics in California – Trader Joe’s largest market by far – suggests that the chain may be driving success by becoming more shoppers’ principal grocery destination.

Between January and August 2024, California Trader Joe’s experienced YoY visit growth ranging from 3.2% to 11.1% – while YoY foot traffic to the wider grocery segment ranged from -2.7% to 4.6%. And over the same period, the share of Trader Joe’s visitors that also frequented other leading California grocery chains decreased significantly – indicating that TJ’s is making inroads with some of its toughest competition in the state.

Between January and August 2023, for example, 50.1% of visitors to a California Trader Joe’s also visited Ralphs – a share that dropped to 47.1% during the equivalent period of 2024. Similar patterns could be observed for VONS, Sprouts Farmers Market, and even California’s grocery visit leader, Safeway.

This suggests that a growing percentage of Trader Joe’s shoppers may be relying on the chain for more of their essentials – rather than visiting TJ’s in addition to a traditional grocery store.

Diving deeper into the demographic characteristics of visitors to California Trader Joe’s provides further insight into the consumers driving the chain’s statewide YoY visit gains. Analyzing California TJ’s trade areas with data from STI: PopStats reveals that Trader Joe’s drives an outsized share of visits from singles – living on their own or with roommates.

Between January and August 2024, 26.5% of residents in Trader Joe’s California captured market lived in one-person households – compared to a statewide average of 22.9%. Meanwhile, 10.0% of the trade area residents were from non-family households – well above the state average of 8.0%.

This could be partially due to Trader Joe’s ongoing investment in college town locations, as well as its fail-safe frozen food selection – a winner with novice cooks pressed for time or space for meal-prep. Plus, Trader Joe’s boasts cheerfully-themed, seasonal products that change every few months, which may be particularly likely to resonate with college students that follow seasonal rhythms of their own.

Trader Joe’s continues to shine in the grocery space in part due to ongoing consumer demand for value and the chain’s expansion. And in California, a loyal and disproportionately single audience is a significant driver of foot traffic.

For updates and more grocery foot traffic insights, visit Placer.ai.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Bowlero Corporation operates more than 350 bowling alleys nationwide, under a portfolio of brands that includes Bowlero and AMF – the company’s two largest chains. How have the bowling alleys performed this year?

We dove into the data to find out.

A look at year-over-year (YoY) visitation trends shows that after a January weather-induced slump and a lackluster three months between February and April 2024, YoY visits to both Bowlero and AMF Bowling Centers picked up major steam. Beginning in May, the two chains saw consistent monthly YoY visit growth ranging from 8.4% to 21.9%.

Fleet expansions undoubtedly contributed to the chains’ summer traffic jumps – but the visit increases were likely also driven by the reintroduction of Bowlero’s popular summer season pass – redeemable across the company’s portfolio of brands – which entitles customers to two free games daily at a center of their choosing. (A premium version can be used at any of the company’s locations.) The pass, which was valid from May 24th to September 2nd, proved to be such a runaway success this year that the company decided to launch a similar promotion for fall. This year’s record-breaking heat may have also contributed to the bowling alleys’ visit boosts – as consumers sought to cool down with indoor activities.

Bowlero and AMF are owned by the same company, but customers seem to interact with each brand slightly differently. Between January and August 2024, AMF attracted a higher share of frequent visitors than Bowlero – perhaps indicating the brand’s positioning as a destination for more serious bowlers and league participants.

On average, 21.4% of AMF’s visitors frequented the chain at least twice a month during the analyzed period – and 8.4% visited at least four times a month. Meanwhile, Bowlero, which touts itself as a “bowling/dining/nightlife experience,” drew smaller shares of frequent visitors – though 16.5% of Bowlero visitors turned out 2+ times a month on average during the analyzed period, and 5.7% visited at least four times a month.

Bowlero, which attracts more casual bowlers than AMF, is also a destination for families. Between January and August 2024, Bowlero’s captured market featured a higher-than-average share of households with children – 28.5%, compared to 26.5% for AMF and a nationwide baseline of 26.9%.

AMF, for its part, was more popular among singles: During the analyzed period, 28.6% of its captured market was made up of one-person households – more than both the nationwide baseline and that of Bowlero (26.7%).

Still, though Bowlero and AMF attract somewhat different audiences, drilling down further into the psychographic segmentation of their captured markets shows that bowling really is an all-American favorite pastime.

During the analyzed period, Bowlero’s was more likely to attract “Young Professionals” and “Near-Urban Diverse Families” – middle-class families living in and around cities – while AMF was more likely to attract upper-middle class, suburban families (“Upper-Suburban Diverse Families”) and households from “Blue Collar Suburbs”. But despite these differences, both chains attracted consumers from a variety of communities, highlighting their broad appeal.

Will consumers continue frequenting bowling alleys as the weather cools down – and will Bowlero’s autumn season pass be as successful as its summer one?

Follow Placer.ai’s data-driven analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Recreational retailers – from hobby shops to arts and crafts retailers and bookstores – can play a role in fostering creativity and community.

We took a closer look at several players in the space – including Barnes & Noble, Half Price Books, Hobby Lobby, and Michaes – to see how they are faring as 2024 draws to a close.

One of the biggest challenges traditional brick-and-mortar retailers have faced in recent decades is the rise of online shopping, especially from Amazon – ironically, a company that started as a book retailer. Yet, in 2024, brick-and-mortar bookstores are defying expectations and thriving. Nearly every month this year, chains like Barnes & Noble and Half Price Books have seen more foot traffic at their stores than in 2023.

Despite closing several locations over the past year, Half Price Books experienced significant YoY visit increases between May and August 2024 – with only July seeing a YoY lag likely reflective of the chain’s substantial July 2023 seasonal uptick. Meanwhile, Barnes & Noble – which has been expanding its fleet – saw YoY foot traffic increases ranging from 8.0% to 17.2% throughout the analyzed period. Both chains finished off the summer with impressive 14.3% (Barnes & Noble) and 10.3% (Half Price Books) YoY boosts.

Analyzing monthly fluctuations in visits to the two chains relative to a January 1, 2021 baseline shows just how important both the summer and holiday seasons are for the two bookstores. As brands that cater to both families and college students (see below), Barnes & Noble and Half Price Books see significant annual summer visit upticks in July and August – likely boosted by back-to-school shopping. But particularly for Barnes & Noble, the real magic happens during the holiday season, when people flock to the chain in search of gifts for loved ones.

Bookstores’ strong performance shows that consumers are voting with their feet – embracing the special – and irreplaceable –reading and browsing experience provided by brick-and-mortar stores. And with a strong summer under their belts, Barnes & Noble and Half Price books have every reason to expect a highly successful Q4 2024.

Diving into trade area demographics shows that both Barnes & Noble and Half Price Books appeal to diverse audiences – outperforming nationwide baselines for everything from “Wealthy Suburban Families” to “Young Professionals” (a segment group that includes college students) and “Blue Collar Suburbs”. Still, there are differences between the two chains – offering opportunities for the retailers to tailor their marketing strategies to align with their respective visitors.

Barnes & Noble’s captured market trade area, for example, features a higher share of the middle-class “Near Urban Diverse Families” segment group – while that of Half Price Books features higher shares of the other analyzed segments. The chains’ different audiences can help them strategically curate their book assortments and offer a more tailored experience for their customers – a strategy that Barnes & Noble has placed at the center of its blueprint for growth.

While bookstores have thrived in 2024, craft stores have faced a more mixed performance. Hobby Lobby and Michaels both experienced varying YoY foot traffic trends, with monthly visits tracking closely with 2023’s. Still, August 2024 visits were elevated by 7.9% and 6.0% at Hobby Lobby and Michaels, proving the significance of the back-to-school season.

Weekly visit data further highlights the significant impact of the back-to-school season on craft retailers – which offer both classroom decor and school supplies. As the shopping season kicked in, Hobby Lobby and Michaels both experienced notable increases in foot traffic compared to their year-to-date (YTD) averages.

The week of September 2, 2024 in particular was a strong one across both chains, with visits surging to their highest levels relative to the YTD average. Hobby Lobby experienced an 18.3% surge in visits and Michaels grew by 15.9%. This data emphasizes the critical role seasonality plays in driving traffic to craft retailers, particularly during key periods like back-to-school, when customers are stocking up on supplies. And since the category usually sees its biggest monthly spike during the holiday season (December 2023 visits to Hobby Lobby were 57.7% higher than the 2023 monthly visit average and 52.1% higher at Michaels), the chains seem poised to see more visitors in the coming months. October visits will also likely rise for the two chains, as customers go on the hunt for fall decor.

Hobby and recreational stores have shown resilience and adaptability in 2024, with strong seasonal peaks and diverse customer bases fueling their visits. With the holiday season fast approaching, these companies seem set to continue experiencing foot traffic boosts for the rest of the year.

Visit Placer.ai to keep up with the latest data-driven retail news.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

Grocery chains in the United States are increasingly investing in on-site healthcare clinics, transforming their stores into hubs for both food and wellness. While grocery stores have long featured pharmacies and some basic healthcare services like vaccinations, recent years have seen a shift towards more extensive healthcare offerings.

Today, many grocery stores offer a range of services – from primary and urgent care to dental and mental health care. In addition to providing an important community service, grocery-anchored healthcare clinics can boost foot traffic at chains, help health providers reach more patients, and allow shoppers to manage their health and home needs in one convenient trip.

This white paper examines the impact these in-store clinics have on grocery chain visitation patterns and trade area characteristics. Are shoppers more or less likely to make repeat visits to grocery stores with healthcare services? And how does the addition of a clinic affect the demographic profile of a grocery store’s captured market? The report examines these questions and more, offering insights for stakeholders across the grocery and healthcare industries.

Analyzing foot traffic to grocery stores with and without in-store clinics shows the positive impact of these services: Across chains, locations with on-site healthcare offerings drew more visits in H1 2024 than their chain-wide averages.

The Kroger Co., which operates numerous regional banners as well as its own eponymous chain, has been a leader in in-store healthcare services since the early aughts. The company introduced its in-store medical center, The Little Clinic in 2003 – and today operates over 225 Little Clinic locations across its Kroger banner, as well as regional chains Dillons, Jay C Food Stores, Fry’s, and King Soopers.

And in H1 2024, the eight Dillons locations with clinics saw, on average, 93.0% more visits per location than the chain’s banner-wide average. Jay C, which offers two in-store clinics, also saw visits to these venues outpace the H1 2024 banner-wide average by 92.9%. For both chains, relatively small overall footprints may contribute to their outsize visit differences: Indiana-focused Jay C operates just 22 locations, all in the Hoosier State, while Kansas-based Dillons has some 64 locations.

But similar patterns, if somewhat less pronounced, could be observed at Kroger (43.0%), Fry’s (19.2%), and King Soopers (16.5%) – as well as at H-E-B (14.5%), which boasts its own expanding network of in-store clinics.

Analyzing the trade areas of grocery stores with healthcare clinics shows that these services tend to draw more affluent visitors from within the stores’ trade areas.

For some chains, including King Soopers, H-E-B, and Jay C, the clinics are positioned to begin with in areas serving higher-income communities. The median household income (HHI) of King Soopers’ in-store clinic’s potential markets, for example, came in at $92.3K in H1 2024 – significantly above the chain’s overall potential market median HHI of $88.1K. Similarly, the potential markets of H-E-B and Jay C Food Stores with clinics had higher median HHIs than the chains’ overall averages.

And for all three chains, stores with clinics tended to attract visitors from captured markets with even higher median HHIs – showing that within these affluent communities, it is the more well-to-do customers that tend to frequent these venues. (A chain or store’s potential market is obtained by weighting each CBG in its trade area according to the size of the population – thus reflecting the general composition of the community it serves. A chain or store’s captured market, on the other hand, is obtained by weighting each CBG according to its share of visits to the business in question – and thus represents the population that actually visits it in practice.)

Other brands, including Fry’s, Kroger, and Dillons, have positioned clinics in stores with potential market median HHIs slightly below chain-wide averages. But within these markets, too, it is the more affluent consumers that are visiting these stores, pushing up the median HHI of their captured markets.

These patterns highlight that, for now, grocery store clinics tend to attract consumers on the upper ends of local income spectrums. This information can be utilized by healthcare professionals and grocery store owners to pinpoint neighborhoods that may be open to grocery-anchored clinics, or to take steps to increase penetration in other areas.

Supermarket giant Kroger is a major player in the world of grocery-anchored healthcare, offering visitors access to pharmacies, clinics, and telehealth options via its grocery stores. What impact has the company’s embrace of healthcare had on visits and loyalty?

An analysis of household compositions across the potential and captured markets of Kroger-owned stores with and without Little Clinic offerings suggests that families with children are extremely receptive to these services.

In H1 2024, Kroger, King Soopers, Fry’s, Jay C, and Dillons all featured captured markets with higher shares of STI: PopStats’ “Households With Children” segment than their potential ones – highlighting the chains’ appeal for families. But the share of parental households in those stores with Little Clinics jumped significantly higher for all five banners.

The share of families with children in King Soopers’ overall captured market stood at 28.3% in H1 2024, higher than the 27.2% in its potential one. But the households with children in the captured markets of King Soopers locations with Little Clinics was significantly higher – 30.6% – and similar patterns emerged at Jay C, Dillons, Kroger, and Fry’s.

This special draw is likely linked to the clinics' focus on family health services like physicals, nutrition plans, and vaccines. The convenience of being able to take care of healthcare, grocery shopping, and pharmacy needs all in one go makes these stores particularly attractive to parents. And this jump in foot traffic shows the strategic advantage of incorporating healthcare services into the retail environment.

Providing essential healthcare services at the supermarket can establish a grocery chain as a crucial part of a shopper's daily life, enhancing visitor loyalty, and helping nurture long-term customer relationships. Indeed, in-store clinics offer a unique opportunity for grocery providers to connect with customers on a level that extends beyond the transactional.

An analysis of several Kroger-branded locations in the Cincinnati metro area showcases the profound impact in-store clinics can have on customer loyalty. In H1 2024, stores with Little Clinics had significantly higher shares of repeat visitors – defined as those making six or more stops at the store during the analyzed period – than those without.

For instance, 36.4% of visitors to a Kroger Marketplace store with an in-store clinic in Harrison, Ohio, frequented the location at least six times during the first half of 2024. But over the same period, only 29.0% of visitors stopped by at least six times to a nearby Kroger location in Cleves, Ohio – just ten miles away. Similarly, 30.7% of visitors to the Beechmont Ave. Kroger Food & Drug location with a clinic visited at least six times in H1 2024, compared to 23.0% for the nearby Ohio Pike Kroger store.

This trend was consistent across the analyzed locations, with those offering in-store clinics attracting significantly higher shares of loyal visitors. These metrics support the value of offering additional services as a draw for frequent visitors, while also providing the clinics themselves with the visitor volume needed to operate profitably.

Texan grocery chain H-E-B is beloved across the state – and though the chain isn’t new to the healthcare scene, it has been doubling down on wellness. In 2022, H-E-B launched H-E-B Wellness, a healthcare platform that offers patrons a variety of medical services, including – as of today – some 12 primary care clinics, many of them inside stores.

H-E-B stores with primary care clinics are helping to cement the grocer’s role as a convenient one-stop for local residents – allowing them to drop in to a nearby location for both daily grocery needs and wellness care.

H-E-B has always placed a premium on community, stepping up to help local residents in times of need. And though the chain as a whole draws an overwhelming majority of its visitors from nearby areas, those with clinics do so even more effectively. In H1 2024, some 83.6% of visitors to H-E-B came from less than 10 miles away. But for locations with primary care clinics, this share increased to 88.0%.

This suggests that wellness services are particularly appealing to nearby residents, strengthening H-E-B’s connection with local consumers even further. And for a grocery store centered on community engagement, the integration of health services into its offerings is proving to be a winning strategy.

H-E-B has been steadily expanding its primary care offerings since it launched the Wellness concept, adding two primary clinics at locations in Cypress, TX and Katy, TX in June 2023. Following the opening of these clinics – which operate Mondays through Fridays – both locations saw marked increases in the share of “Urban Cliff Dwellers” in their weekday captured markets. This STI: Landscape segment group encompasses families both with and without children, earning modest incomes and enjoying middle-class pleasantries.

Between June 2022 - May 2023, the share of “Urban Cliff Dwellers” in the weekday captured markets of the Cypress and Katy locations stood at 9.5% and 7.2%, respectively. But once the stores had clinics in place, those numbers jumped to 12.4% and 11.0%, respectively.

This increase in the stores’ reach among “Urban Cliff Dwellers” immediately following the clinics’ openings suggests that in addition to more affluent consumers, middle-class families also harbor considerable interest in these services. As more retailers continue making inroads into the healthcare sector, they may find similar success in attracting diverse groups of convenience-seeking shoppers.

As grocery stores lean into healthcare, they are transforming into multifaceted hubs that offer both essential health services and everyday shopping needs. Retailers like Kroger and H-E-B are reaping the benefits of boosted foot traffic, higher-income visitors, and strengthened community ties – while offering their shoppers convenience that helps streamline their daily routines.

Walmart, Target, and Costco are three of the most popular retailers in the country, drawing millions of shoppers through their doors each day. Each of these retail giants boasts distinct strengths and strategies that cater to their unique customer bases, allowing them to thrive in a highly competitive market.

This white paper takes a closer look at some of the factors that are helping the three chains flourish. How does Walmart’s positioning as a family-friendly retailer help it drive visits in its more competitive markets? How can Target leverage its reach to drive more loyal visits? And what does the increase in young shoppers frequenting membership warehouse clubs mean for Costco?

We dove into the location analytics to explore these questions further.

Examining monthly visitation patterns for the three retail giants shows Costco’s wholesale club model leading the way with consistent year-over-year (YoY) visit growth – ranging from 6.1% in stormy January 2024 to 13.3% in June. Family favorite Walmart followed closely behind, seeing YoY foot traffic growth during all but two months, when visits briefly trailed slightly behind 2023 levels before rebounding.

Target, meanwhile, had a slower start to the year, with visits trending below 2023 levels for most of January to April. Over this same period (the three months ending May 2024), Target reported a 3.7% decline in YoY comparable sales. But since then, things have begun to turn around for the chain, with YoY visits rising in May (2.5%), June (8.9%), and July (4.7%). This renewed visit growth into the second half of the year bodes well for the superstore – and the ongoing back-to-school season may well push visits up further as the summer winds down.

For all three chains, Q2 2024’s visit success has likely been bolstered in part by summer deals and intensifying price wars – as the retailers slash prices to woo inflation-weary consumers back to the store.

Over the past few years, consumer behaviors have been changing rapidly in response to shifting economic conditions. This next section explores some of these changes at Walmart, Target, and Costco, to better understand what may be driving these shifts.

One way that consumers have traditionally responded to inflation and other headwinds has been through the adoption of mission-driven shopping – making fewer, but longer, trips to retailers, so that every visit counts. Superstores and wholesale clubs, which offer one-stop shopping experiences, have long been prime destinations for these extended shopping trips. And even during periods when visits have lagged, these retailers have often benefited from extended dwell times – leading to bigger basket sizes.

A look at changes in average dwell times at Walmart and Target suggests that as YoY visits have picked up, dwell times have come down – perhaps reflecting a normalization of consumers’ shopping patterns. With inflation stabilizing and gas prices lower than they were in 2022 and 2023, customers may feel less pressure to consolidate shopping trips than they have in recent years.

In contrast, Costco’s comparatively long dwell times have remained stable over the past several years. The warehouse club’s bulk offerings, plentiful free samples, and inexpensive food court encourage shoppers to spend more time browsing the aisles than they would at other retailers. And even if mission-driven shopping continues to subside, Costco customers will likely keep on making extra-long shopping trips.

While inflation is cooling faster than expected, prices remain high, and new players are stepping into the retail space occupied by Walmart, Target, and Costco – especially dollar stores. Though higher-income customers increasingly rely on the three retail giants for many of their purchases, customers of more modest means are often drawn to the rock-bottom prices offered at dollar stores.

And analyzing the cross-shopping patterns of visitors to Walmart, Target, and Costco shows that growing shares of visitors to the three behemoths also visit Dollar Tree on a regular basis. In Q2 2019, the share of visitors to Walmart, Target, and Costco who frequented Dollar Tree at least three times ranged between 9.8% and 13.7%. But by Q2 2024, that share rose to 16.7%-21.6%.

Dollar Tree is leaning into this increased interest among superstore shoppers. Over the past year, Dollar Tree added some 350 Dollar Tree locations, even as it shuttered nearly 400 Family Dollar stores. And the chain recently acquired the leases of some 170 99 Cents Only Stores – offering Dollar Tree access to a customer base accustomed to buying everything from groceries to household goods. As Dollar Tree continues to grow its footprint and expand its food offerings, the chain will be better positioned than ever to provide a real challenge to Walmart, Target, and Costco.

Still, the three retail giants each have unique offerings that distinguish them from dollar stores. This next section examines what sets Walmart, Target, and Costco apart – and how they can continue to strengthen their competitive edge.

With competition on the rise, Walmart, Target, and Costco must display agility in navigating an ever-evolving market landscape. This section dives into the data for each chain’s more successful metro areas to see what factors are helping them outperform nationwide averages – and what metrics the retailers can harness to try to replicate these results nationwide.

Target recently expanded its Target Circle Rewards program, rolling out three new tiers for its 100 million members. And this focus on loyalty has proven successful for the chain. Demographic and visitation data reveal a strong correlation between the median household incomes (HHIs) of Target locations’ captured markets across CBSAs (core-based statistical areas), and their share of loyal visitors in Q2 2024: CBSAs where Target locations’ captured markets had higher median HHIs also tended to draw more repeat monthly visitors.

Target’s captured markets in the Los Angeles-Long Beach-Anaheim, LA CBSA, for example, featured a median HHI of $89.8K in Q2 2024 – and 48.0% of the chain’s LA visitors frequented a Target at least twice a month during the quarter. Target stores in the Chicago-Naperville-Elgin, IL-IN-WI CBSA, where the chain’s captured markets had a median HHI of $88.7K in Q2 2024, also had a loyalty rate of 48.0%.

Target generally attracts a more affluent audience than Walmart. And even as the superstore slashes prices to attract more price-conscious consumers, the retailer is also taking steps likely to enhance its popularity among higher-income households. In April 2024, Target debuted a paid membership tier within its loyalty program offering perks like same-day delivery for a fee. Maintaining and expanding these premium offerings will be key for Target as it seeks to attract more affluent customers and replicate its high-performing results in CBSAs nationwide.

The persistent inflation of the past few years, while challenging for some retailers, has also created new opportunities – particularly for wholesalers. Membership warehouse clubs, including Costco, are gaining popularity among younger shoppers, a cohort often looking for new ways to stretch their more limited budgets. An October 2023 survey revealed that nearly 15% of respondents aged 18 to 24 and 17% of those aged 25 to 30 shop at Costco.

A closer look at some of Costco’s best-performing CBSAs for YoY visit-per-location growth highlights the significance of these younger shoppers: In H1 2024, the company’s YoY visit-per-location growth was strongest in areas with higher-than-average shares of young urban singles.

For example, the San Diego-Chula Vista-Carlsbad, CA CBSA experienced visit-per-location growth of 10.4% YoY in H1 2024, while the nationwide average stood at 7.9%. And the CBSA’s share of Young Urban Singles, defined by the Spatial.ai: PersonaLive dataset as “singles starting their careers in trade and service jobs,” was 12.1%, well above Costco’s nationwide average of 7.3%.

Walmart is a one-stop shop for everything from affordable groceries to clothing to home furnishings, making it especially popular among families. The retailer actively courts this segment with baby offerings designed to meet the needs of both kids and parents, virtual offerings in the metaverse, and collectible toys.

And visitation data reveals a connection between the extent of different Walmart locations’ YoY visit growth and the share of households with children in their captured markets.

In H1 2024, nationwide visits to Walmart increased by 4.1% YoY, while the share of households with children in the chain’s overall captured market hovered just under the nationwide baseline. But in some CBSAs where Walmart outpaced this nationwide growth, the retail giant also proved especially adept at attracting parental households – outpacing relevant statewide baselines.

In Boston-Cambridge-Newton, MA, for example, Walmart experienced 5.0% YoY visit growth in H1 2024 – while the share of households with children in the chain’s local captured market stood 7% above the Massachusetts state average. And in Grand Rapids-Kentwood, MI, where Walmart’s share of parental households outpaced the Minnesota state average by an even wider 15% margin, the retailer saw impressive 7.3% YoY visit growth. This pattern repeated itself in other metro areas, suggesting that there may be a correlation between local Walmart locations’ visit growth and their relative ability to draw households with children.

Walmart can continue solidifying its market position by leaning into its family-oriented offerings and expanding its footprint in regions with growing populations of young families.

Walmart, Target, and Costco all experienced YoY visit growth in the final months of H1 2024, with Costco leading the way. And though the three chains still face considerable challenges, each one brings unique strengths to the table. By continuously innovating and responding to changing market conditions, Walmart, Target, and Costco can not only overcome obstacles but also leverage them to reinforce their market positions and drive continued growth.

The first Lollapalooza – a four-day music festival – took place in 1991. Chicago’s Grant Park became the event’s permanent home (at least in the United States) in 2005, drawing thousands of revelers and music fans to the park each year.

This year, the festival once again demonstrated its powerful impact on the city. On August 1st, 2024, visits to Grant Park surged by 1,313.2% relative to the YTD daily average, as crowds converged on the park to see Chappell Roan’s much-anticipated performance. And during the first three days of the event, the event drew significantly more foot traffic than in 2023 – with visits up 18.9% to 35.9% compared to the first three days of last year’s festival (August 3rd to 5th, 2023).

Lollapalooza led to a dramatic spike in visits to Grant Park – and it also attracted a different type of visitor compared to the rest of the year.

Analyzing Grant Park’s captured market with Spatial.ai’s PersonaLive dataset reveals that Lollapalooza attendees are more likely to belong to the “Young Professionals” and “Ultra Wealthy Families” segment groups than the typical Grant Park visitor.

By contrast, the “Near-Urban Diverse Families” segment group, comprising middle-class diverse families living in or near cities, made up only 6.5% of visitors during the festival, compared to 12.0% during the rest of the year.

Additionally, visitors during Lollapalooza came from areas with higher HHIs than both the nationwide baseline of $76.1K and the average for park visitors throughout the year. Understanding the demographic profile of visitors to the park during Lollapalooza can help planners and city officials tailor future events to these segment groups – or look for ways to make the festival accessible to a wider range of music lovers.

Lollapalooza’s impact on Chicago extended beyond the boundaries of Grant Park, with nearby hotels seeing remarkable surges in foot traffic. The Congress Plaza Hotel on South Michigan Avenue witnessed a staggering 249.1% rise in visits during the week of July 29, 2024, compared to the YTD visit average. And Travelodge on East Harrison Street saw an impressive 181.8% increase. These spikes reflect the festival’s draw not just for locals but for out-of-town visitors who fill hotels across the city.

The North Michigan Avenue retail corridor also enjoyed a significant increase in foot traffic during the festival, with visits on Thursday, August 1st 56.0% higher than the YTD Thursday visit average. On Friday, August 2nd, visits to the corridor were 55.7% higher than the Friday visit average. These numbers highlight Lollapalooza’s role in driving economic activity across Chicago, as festival-goers venture beyond the park to explore the city’s vibrant retail and hospitality offerings.

City parks often serve as community hubs, and Flushing Meadows Corona Park in Queens, NY, has been a major gathering point for New Yorkers. The park hosted one of New York’s most beloved summer concerts – Governors Ball – which moved from Governors Island to Flushing Meadows in 2023.

During the festival (June 9th -11th, 2024), musicians like Post Malone and The Killers drew massive crowds to the park, with visits soaring to the highest levels seen all year. On June 9th, the opening day of the festival, foot traffic in the park was up 214.8% compared to the YTD daily average, and at its height, on June 8th, the festival drew 392.7% more visits than the YTD average.

The park also hosted other big events this summer – a July 21st set by DMC helped boost visits to 185.1% above the YTD average. And the Hong Kong Dragon Boat Festival on August 3rd and 4th led to major visit boosts of 221.4% and 51.6%, respectively.

These events not only draw large crowds, but also highlight the park’s role as a space where cultural and civic life can find expression, flourish, and contribute to the health of local communities.

Analyzing changes in Flushing Meadows Corona Park’s trade area size offers insight into how far people are willing to travel for these events. During Governors Ball, for example, the park’s trade area ballooned to 254.5 square miles, showing the festival's wide appeal. On July 20th, by contrast, when the park hosted several local bands and DJs, the trade area was a much more modest 57.0 square miles.

Summer events drive community engagement, economic activity, and civic pride. Cities that invest in their parks and event hubs, fostering lively and inclusive spaces, can create lasting value for both residents and visitors, enriching the cultural and social life of urban areas.

For more data-driven civic stories, visit Placer.ai.