.svg)

.png)

.png)

.png)

.png)

A cool housing market, still-high interest rates, and other economic headwinds have weighed on the home improvement industry this year. But how did category leaders The Home Depot and Lowe’s fare in Q3 2024 – and what lies ahead for them this holiday season?

We dove into the data to find out.

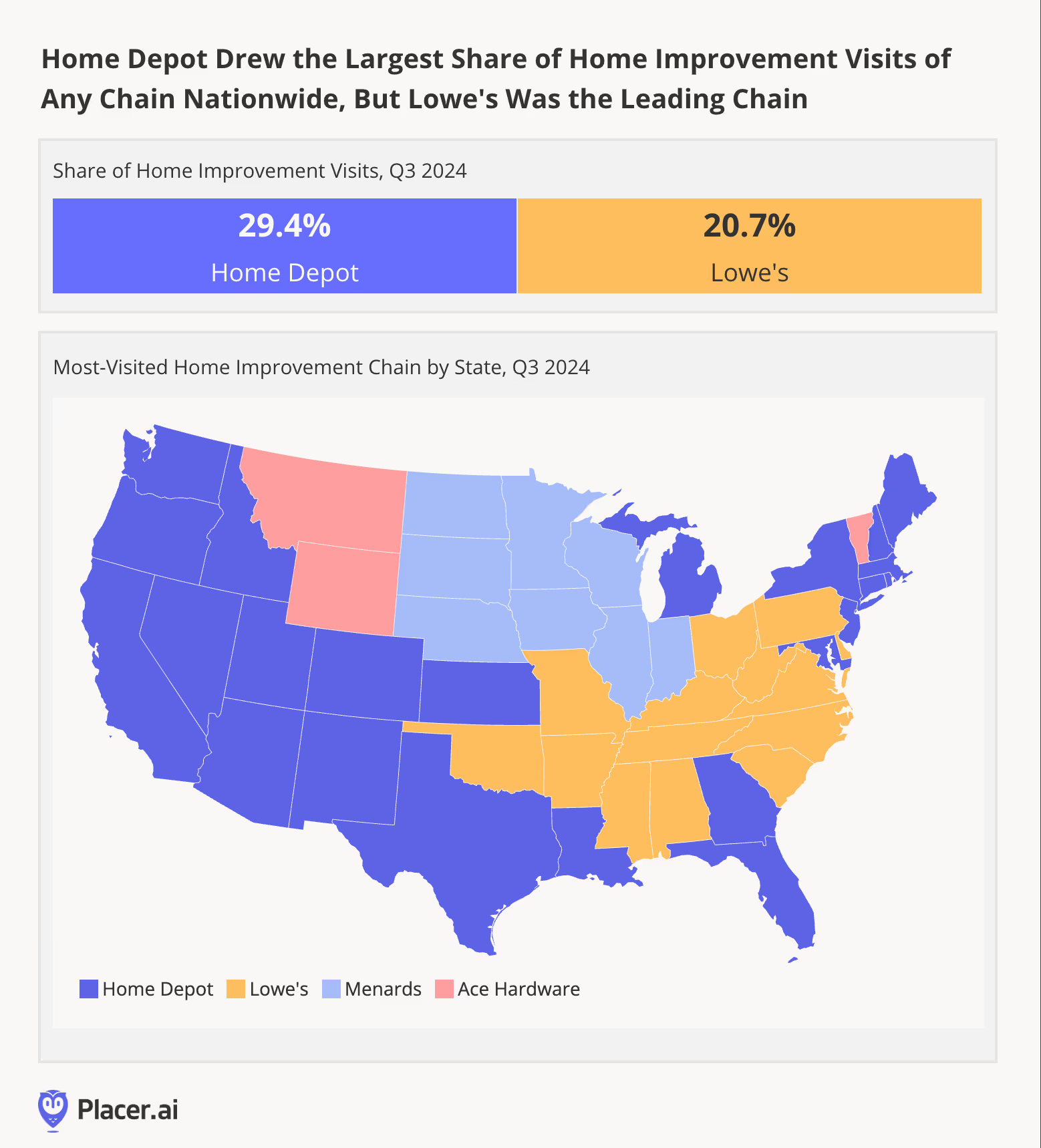

Looking first at the relative positioning of Home Depot and Lowe’s within the wider home improvement sector shows that the two leaders have maintained their dominance, despite the growing popularity of smaller chains like Harbor Freight Tools and Tractor Supply Co.

In Q3 2024, Home Depot accounted for 29.4% of visits to home improvement and furnishing chains nationwide – while Lowe’s accounted for 20.7%. And diving into the data on a statewide level shows that each of the giants holds sway in a different area of the country. Home Depot drew the most visits in much of the Western United States as well as in most of New England. Lowe’s, on the other hand, led parts of the South and Midwest. And in some states, smaller chains like Menards and Ace Hardware dominated the landscape.

Given the challenges faced by the home improvement industry this year, it may come as no surprise that both Home Depot and Lowe’s sustained year-over-year (YoY) visit gaps in Q3 2024 – 3.1% and 4.1%, respectively. But digging deeper into the data suggests that the two chains may still be poised to enjoy a robust holiday season.

Unlike many other categories, visits to home improvement chains tend to peak in spring rather than during the holiday season. Still, Home Depot and Lowe’s do see visit spikes on Q4 retail milestones like Black Friday and Super Saturday. Last year, for example, Home Depot and Lowe’s drew 77.8% and 78.6% more visits, respectively, on Black Friday (Nov. 24th) than on an average day in 2023. Indeed, the big day was Home Depot’s busiest day of 2023 and Lowe’s second-busiest.

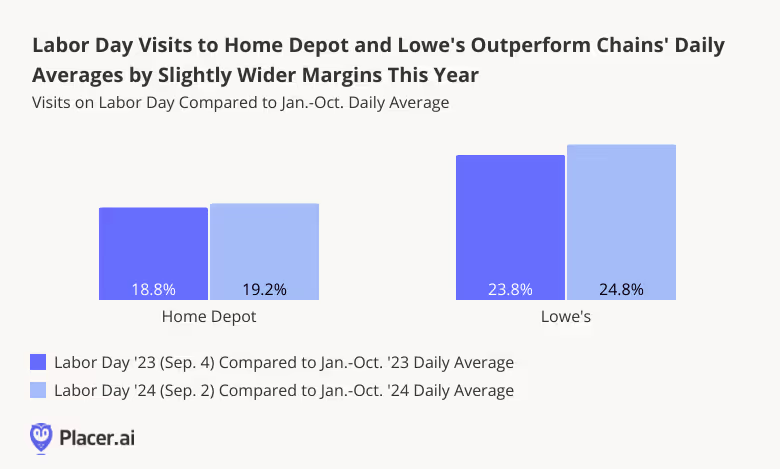

And a look at Home Depot and Lowe’s visit performance during Labor Day – another, more recent retail milestone – shows that the two chains continue to excel at attracting visits on key calendar days. On September 4th, 2023 (Labor Day last year), visits to Lowe’s were 23.8% higher than the January to October 2023 daily visit average. And this year, Lowe’s relative Labor Day spike was even more significant – 24.8%. Home Depot, too, saw a slightly more pronounced Labor Day boost this year than last. So even if overall foot traffic to the home improvement leaders remained somewhat below last year’s levels, they may be in for a busy Q4.

The home improvement industry has yet to regain its pandemic-era glory. But analyzing visit trends to category leaders shows that holiday visit spikes may help fuel a successful holiday season this year. How will Lowe’s and Home Depot perform on Black Friday?

Follow Placer.ai’s data-driven retail analyses to find out.

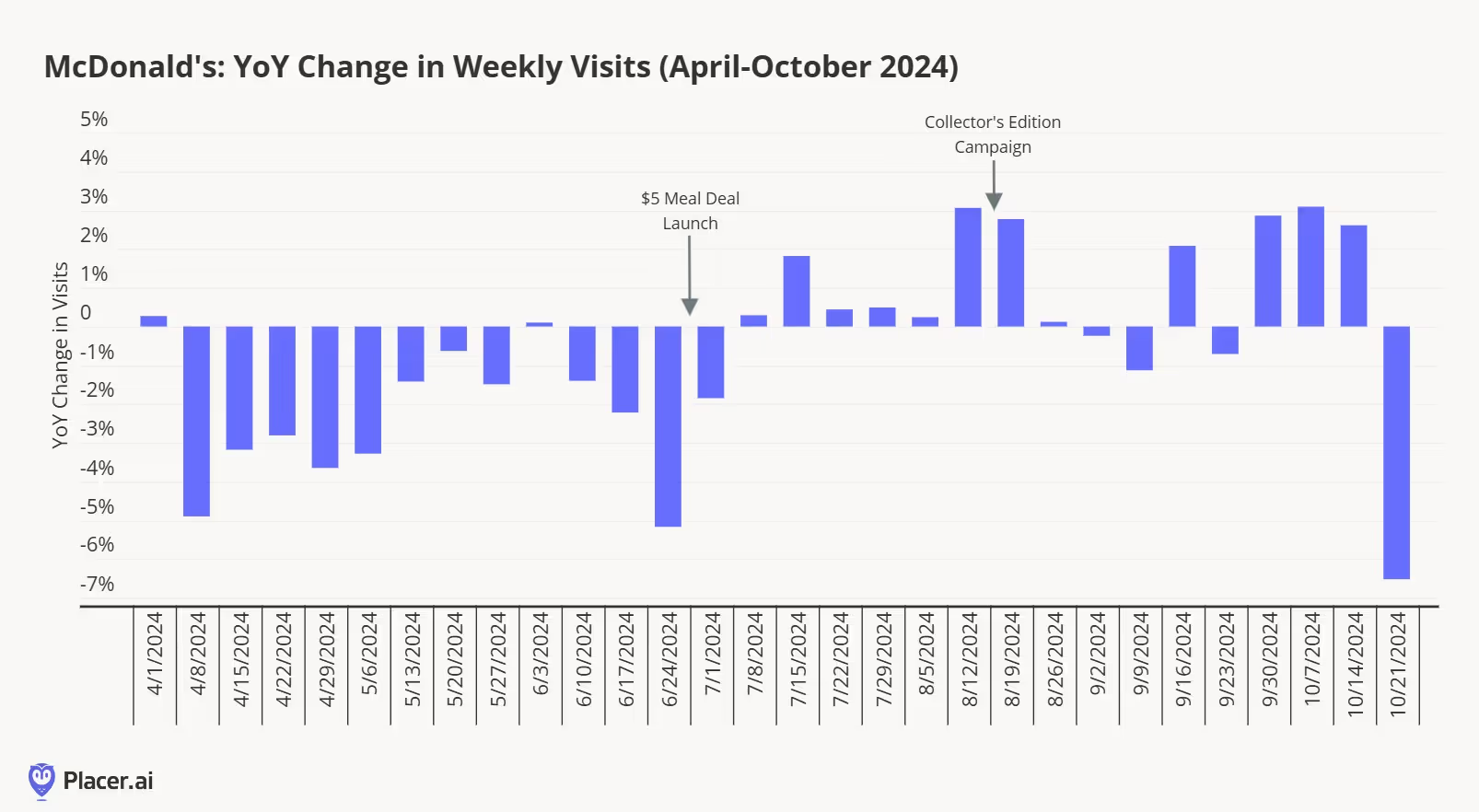

It’s been an eventful week for the QSR Burger category, with much of the focus on this week’s quarterly updates focusing on events that took place after Q3 2024 ended. Let’s start with McDonald’s, where an E.Coli outbreak overshadowed what was largely a positive quarter of visitation gains, where the chain had reversed the visitation declines that it saw during the driven year-over-year visitation increases through its $5 Meal Deal and Collector’s Edition promotion (below).

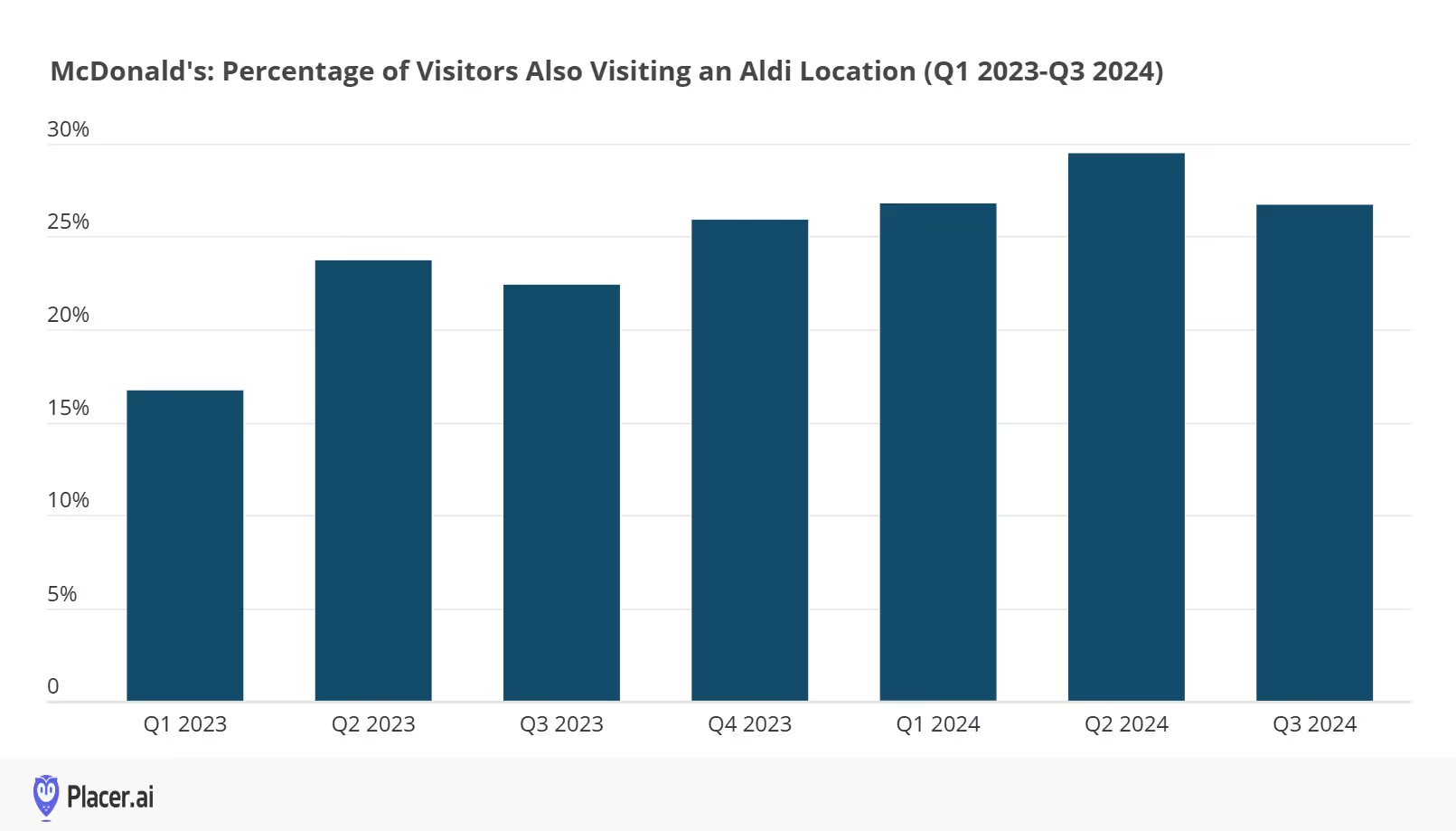

According to the company, the $5 Meal Deal “continued drawing customers back into our restaurants throughout the quarter, maintaining an average check north of $10 and being profitable for our franchisees.” Importantly, McDonald’s management also called out that the $5 Meal Deal is gaining traction among low-income consumers and that it “successfully [grew] traffic share with this group for the first time in over a year.” Our data indicates this as well. Over the past several months, we’ve looked at McDonald’s cross visitation trends with Aldi as a barometer of its traction with lower-income consumers. The percentage of McDonald’s visitors that also visited an Aldi had been steadily increasing through Q2 2024, but we did see a reversal of this trend in Q3 2024, suggesting that more consumers are finding value at the chain. The company remains committed to having the $5 Meal Deal on its menus until December as it works towards “sustainable guest count-led growth.”

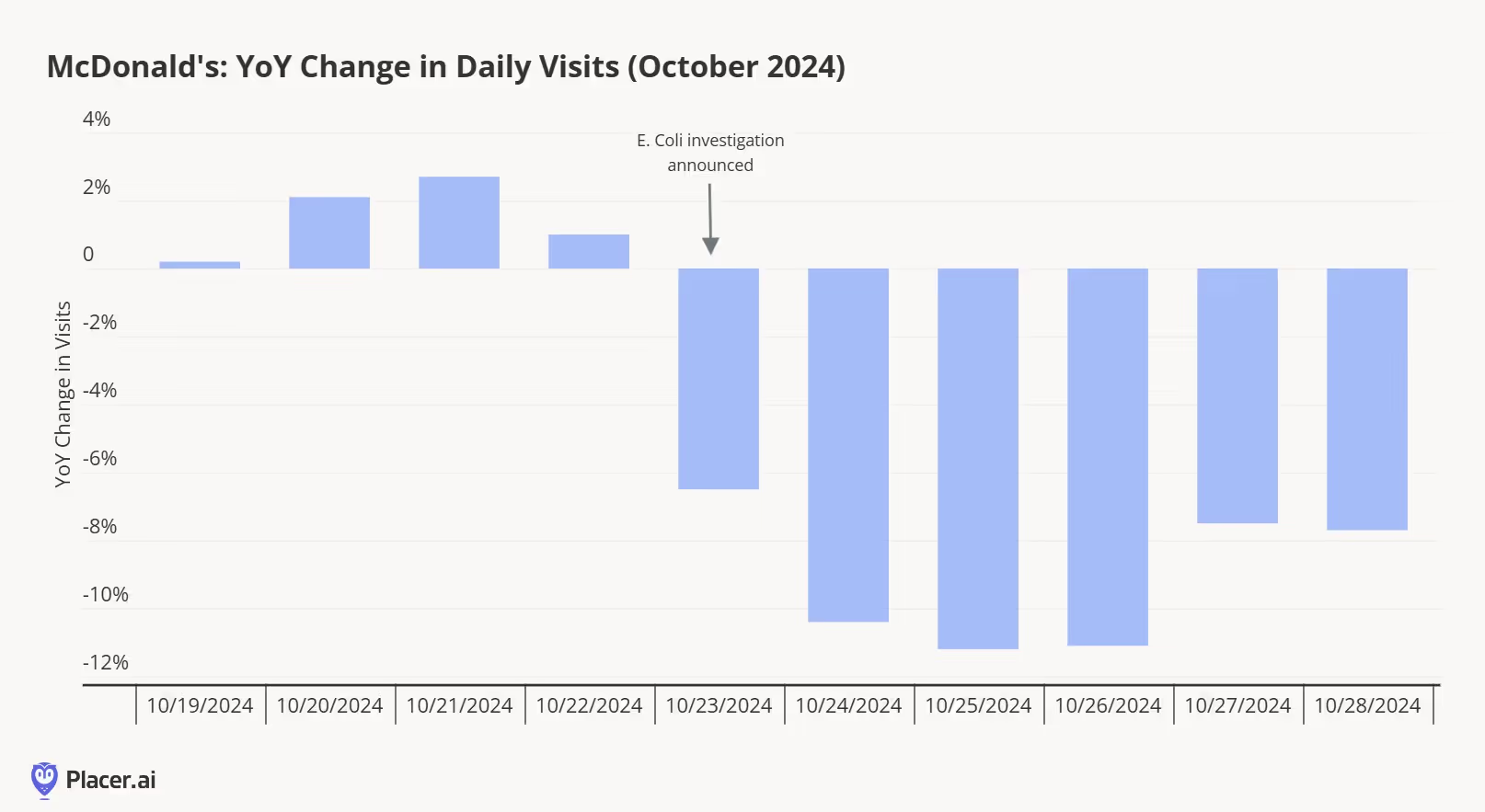

McDonald’s E. Coli outbreak did have a negative impact on visitation trends, but these trends may be short-lived. Our data indicated a 6.5% decline in year-over-year visits nationwide on Wednesday, Oct. 25 (the day after the E. Coli outbreak investigation was announced), 10%-11% declines from Oct. 26-Oct. 28, and 7%-8% declines from Oct 29-30. It’s natural to compare this situation to Chipotle’s E. Coli outbreak in 2015, where visitation trends were severely impacted for many months. However, there are meaningful differences between McDonald’s and Chipotle’s cases. First, McDonald’s was quickly able to identify and communicate the source of the outbreak–slivered onions from a Colorado Springs facility at supplier Taylor Farms, which were immediately removed from the company’s supply chain–while also ruling out its beef patties as a source, which has helped to keep the outbreak relatively contained. Second, in addition to an E. Coli outbreak, Chipotle also faced a norovirus outbreak, calling into question the safety of the chain’s entire supply chain. These differences help to explain why we may already be seeing visitation declines inflect at McDonald’s.

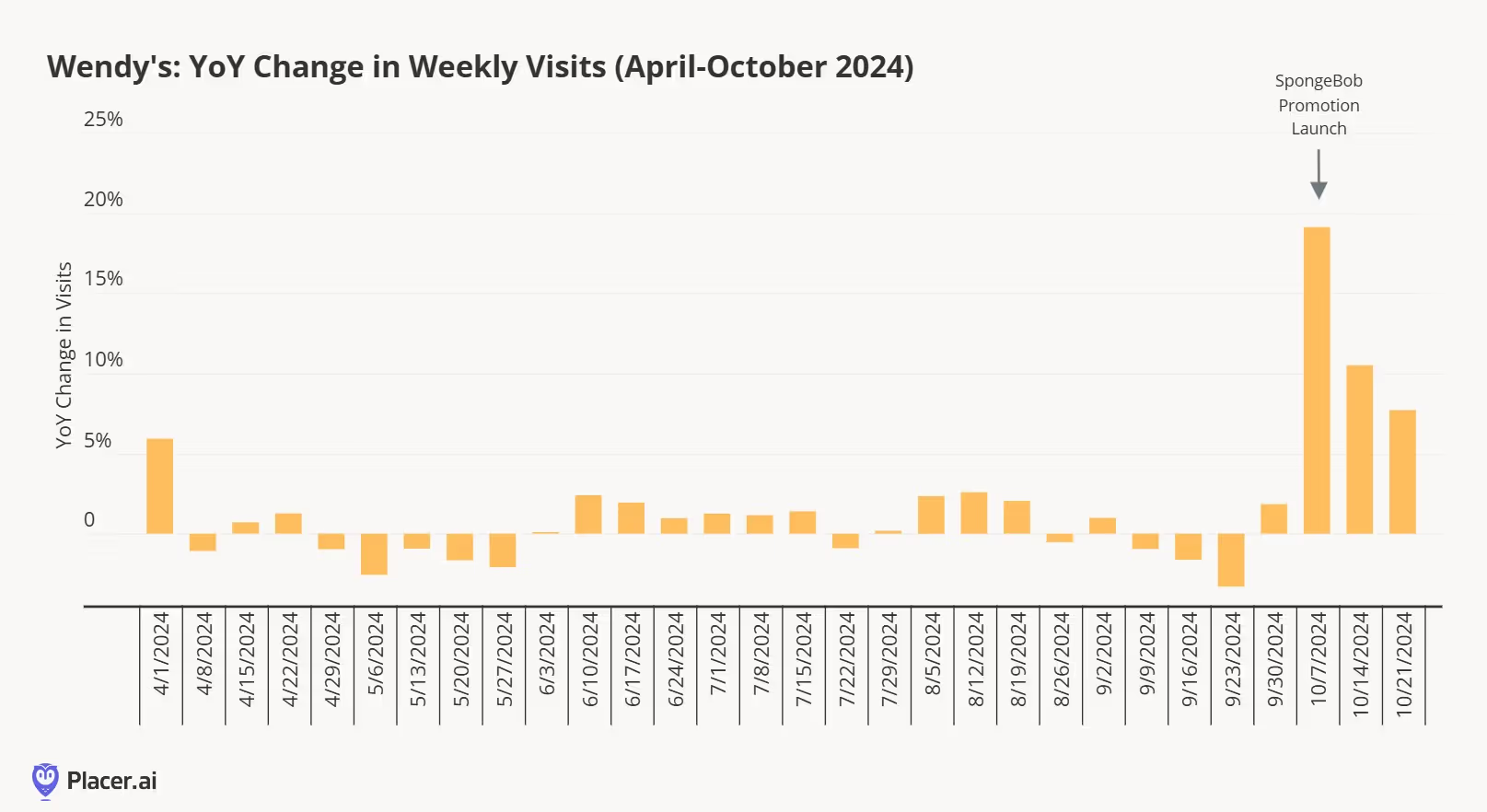

McDonald’s Collector’s Edition was not the only nostalgia-driven promotion driving visits in recent weeks, as Wendy’s Krabby Patty Burger and Pineapple Under the Sea Frosty celebrating SpongeBob's 25th anniversary drove a meaningful lift in visits (below). In fact, this might be the most successful limited-time-offer promotion that we’ve seen across the QSR sector since McDonald’s Adult Happy Meal in October 2022. Importantly, this promotion innovated on existing core menu items without adding complexity. Given the strong visitation lift, we expect more nostalgia-themed promotions in the year ahead.

Affecting everything from merchandise sales to local bars to entire neighborhoods, the economic effect of the Los Angeles Dodgers’ road to the World Series cannot be disputed.

After a comeback from 5-0 to win 7-6 against the New York Yankees, the Dodgers kept everyone on the edge of their seats. With history made by Freddie Freeman’s walk-off grand slam to win Game 1, fans will have moments seared in their memories for decades to come. Dodgers fans are willing to shell out big to celebrate their champions. Fanatics reported that after winning Wednesday night, “the Dodgers set a Fanatics sales record for first-hour sales of a team's merchandise, across any sport, after claiming a championship.” The top five players for merchandise sales were Ohtani, Freeman, Betts, Yamamoto, and Kershaw.

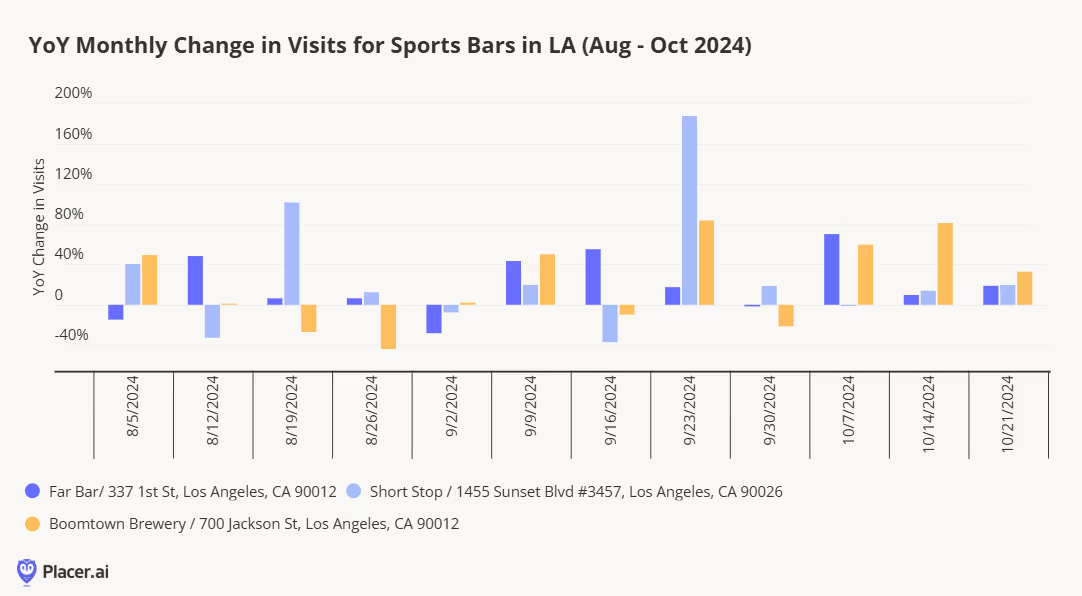

Local bars in various parts of L.A. that featured Dodgers games saw an uptick in year-over-year traffic most weeks, particularly in recent weeks leading up to the National League Championship and the World Series. Spontaneous parades erupted in locations such as Whittier Blvd in East L.A., in Downtown L.A., and near Dodger Stadium in Elysian Park.

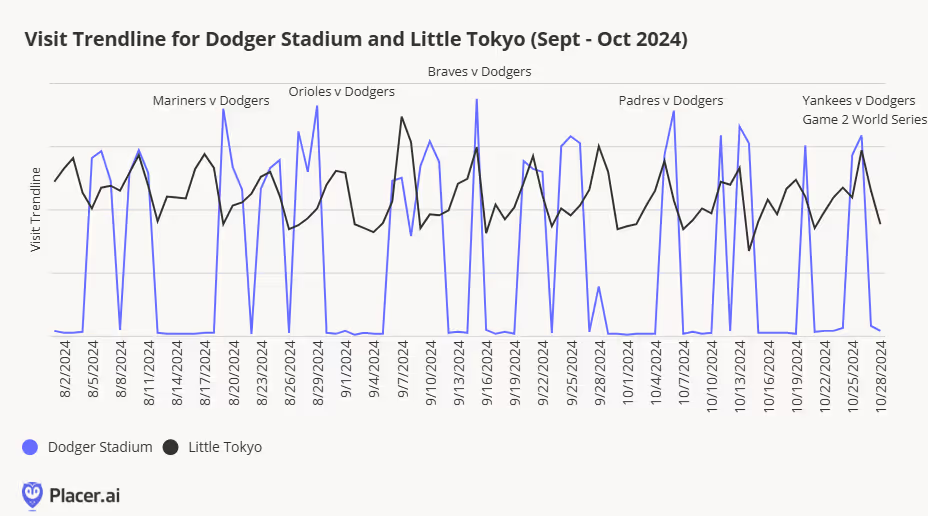

We’ve previously written about the Shohei Effect on hotels like the Miyako that features the mural “LA Rising” by Robert Vargas, but now after a World Series championship, the Boys in Blue are set to go even higher into the stratosphere of fandom. We looked at the foot traffic to Dodger Stadium and to Little Tokyo, and no surprise there’s definitely an uptick to the latter on game days, especially on Saturdays. Vargas is currently working on a mural of the late Fernando Valenzuela in Boyle Heights, and Angelenos will likely be flocking in droves to come see “Fernandomania Forever” when it is unveiled.

One interesting finding is that visitation was actually higher during some of the regular season games than for the World Series Games 1 and 2 that took place in LA. One reason may be the sky high prices. Per reseller Ticket IQ, “the average price for a World Series ticket on the secondary market was $3,887, the second most expensive average since it started tracking data in 2010.” For some fans, it was a dream of a lifetime, one that some were willing to “sell a kidney” to attend.

As we enter November, the holiday season is already in full swing across the country. We’re likely to see the consumer’s embrace of seasonal decorations soon, just as we saw in the fall season. The retail industry has already lived through one major promotional event in October, and it’s time to take the temperature on physical retail foot traffic as we head into the busiest part of the season.

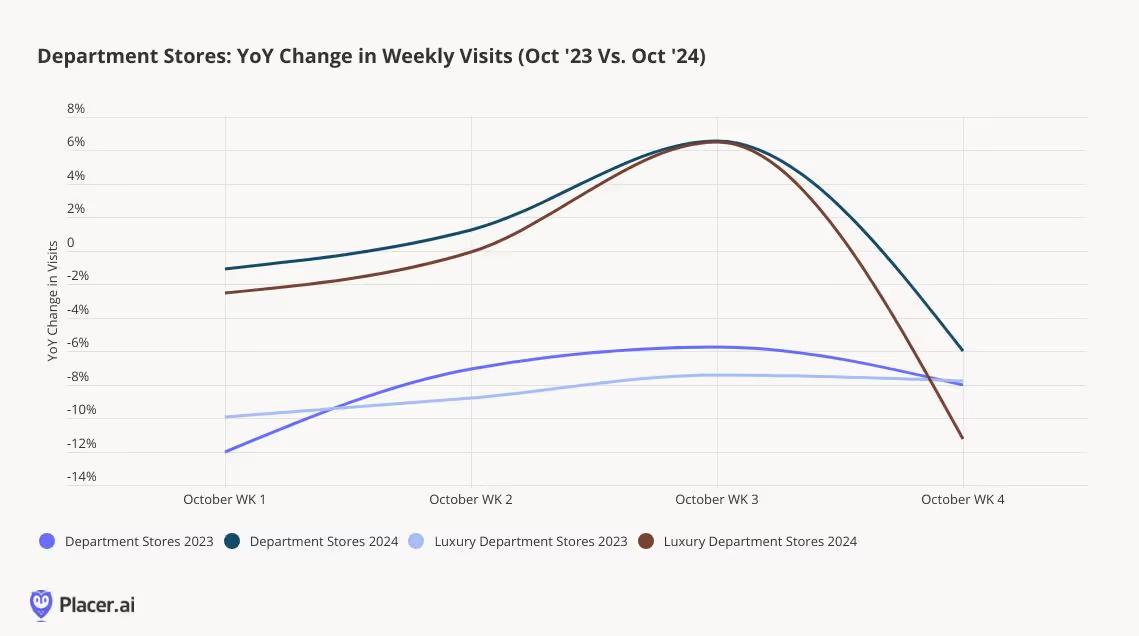

One thing that jumped out upon initial review was the foot traffic from department stores, excluding off-price retail. Looking at the four full weeks of October 2024, traffic to full line department stores was flat to last year, compared to the same period last year when traffic was down 8% to 2022 in October (store counts are about even to last year). Visits to luxury department stores show a similar story; traffic in 2023 was down 9% in October and trended down 2% this year. Coming from a sector of retail that has been challenged for years, this slight improvement is worthy of celebration.

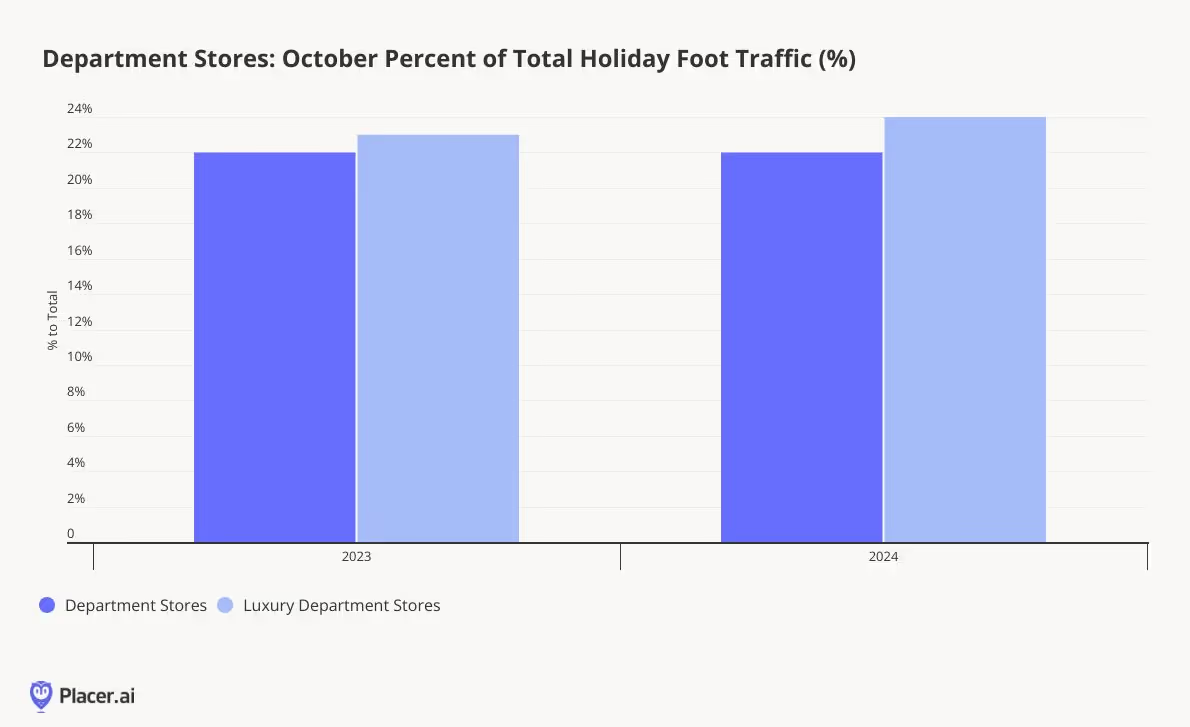

Just how important is October’s contribution to holiday shopping visits? For full line department stores, October accounted for 22% of total holiday season visits in both 2022 and 2023; October traffic for luxury department stores was 24% of total holiday traffic in 2022 and 23% in 2023. That means that there’s still almost ¾ of total visitation still left for retailers to capture over the next two months. However, with traffic trending better in 2024 than in 2023 for department stores overall, this year might actually be a proof point for pull forward holiday demand.

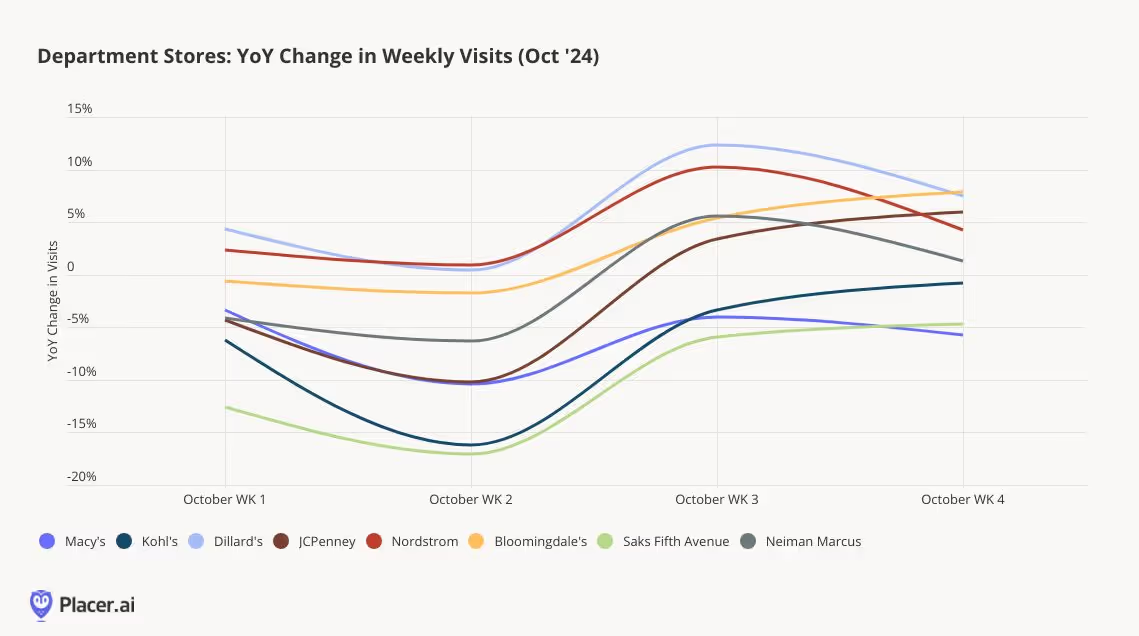

Looking at visitation by retailers within the two sectors, Dillard’s, unsurprisingly led the charge for full line department stores in visitation growth. JCPenney also saw a lot of trend improvement compared to last year, as did Macy’s in the back half of the month. The only major retailer that has underperformed 2023 in October was Kohl’s. Through the lens of luxury department stores, Bloomingdale’s and Nordstrom grew traffic in the low to mid-single digits in October, with Neiman Marcus only down slightly to 2023 levels.

Another interesting insight Placer’s data uncovered; department stores are more of a destination for consumers this year. Looking at Macy’s cross-visitation specifically in October, the percent of visitors to Macy’s that traveled home after visiting was almost 50 basis points higher than in 2023. Our data also showed a lower percentage of cross visitation between Macy’s and other department stores this year compared to last October. Department stores may be doing a better job of capturing consumers' attention and better aligning themselves with the needs of their shoppers. This is in contrast of what we're seeing in essential retail categories such as grocery stores and superstores, where consumers are willing to cross shop multiple retailers; this underscores just how different consumer behavior is by category.

What does this signal about the remainder of the “true” holiday season? It’s hard to tell as we stand today, but the trend improvement across department stores this year gives us some optimism about consumers flocking to physical stores this year. But, it’s important to give consumers a reason to visit as many times as possible, especially as retail fatigue sets in from shopping earlier in the season. Value is still going to be the top driver of visitation this year, but unique products, services and experiences are still important to capturing the joy of the season.

If you’ve ever wished you could root for your alma mater from afar, attend a World Series, or blast into space, Cosm may have the solution. This immersive technology company combines state-of-the art stadium experiences with dining and bar service. Think a smaller version of the Sphere, a larger version of an IMAX theater, with the simulation of being at an actual stadium all while enjoying the comforts of a booth with food brought to you.

For fans of large screen immersive experiences, this venue allows you to be enveloped by the aquatic performers of Cirque du Soleil's “O”, feel like you’re on the 50-yard line for the Ohio State versus Penn State football game, or be a pioneering astronaut seeing the earth from space in “Orbital.”

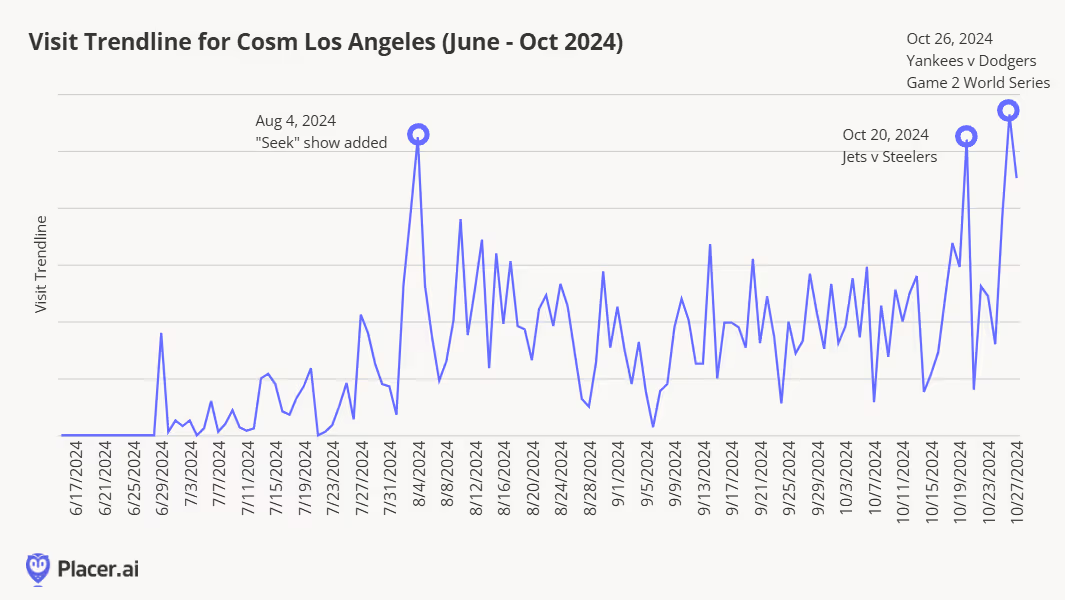

Since it opened at the end of June this year, popular showings have included “Seek,” which takes you on a journey through the cosmos, as well as sports favorites like the New York Jets versus Pittsburgh Steelers game. Game 2 of the World Series had a sell-out crowd as those who chose not to buy tickets for thousands of dollars still had the joy of celebrating in an arena venue with hundreds of other fans, with the feeling of being behind the dugout.

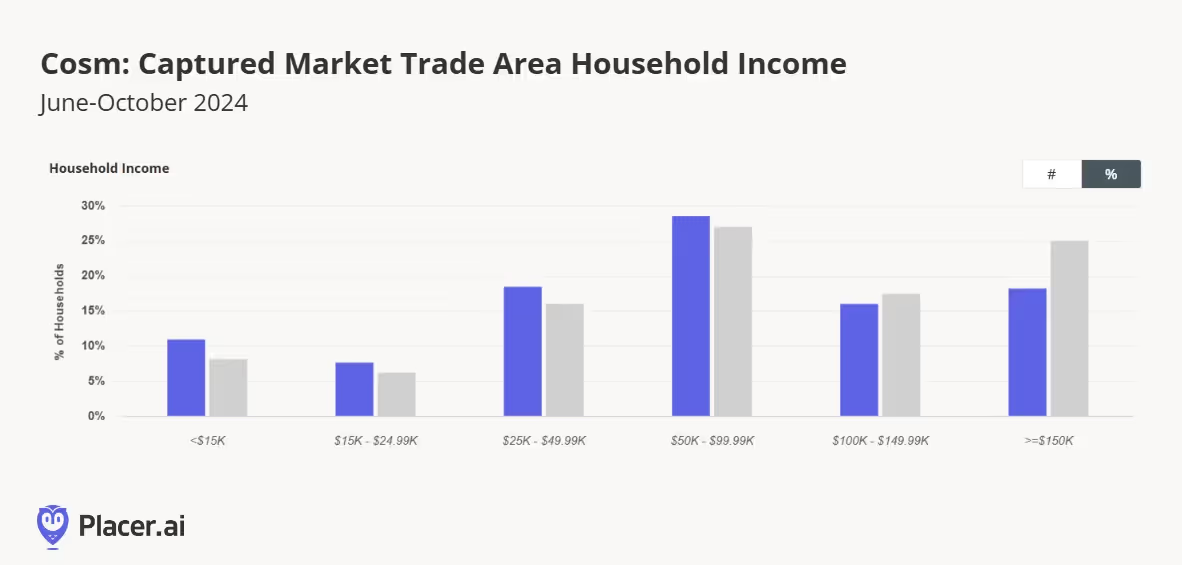

The Los Angeles Times describes Cosm as “part planetarium, part mini-Sphere,” so instead of needing to travel to Griffith Observatory or Las Vegas, one can just jet down the 405 to Inglewood to have a similar experience. So, who’s visiting Cosm? Roughly 3 in 10 (29%) have a hold income (HHI) of $50K-$99.9K. Nearly 1 in 5 (19%) have a HHI of $25K-$49.9K. These two household income segments over index compared to the CA household incomes (shown in gray).

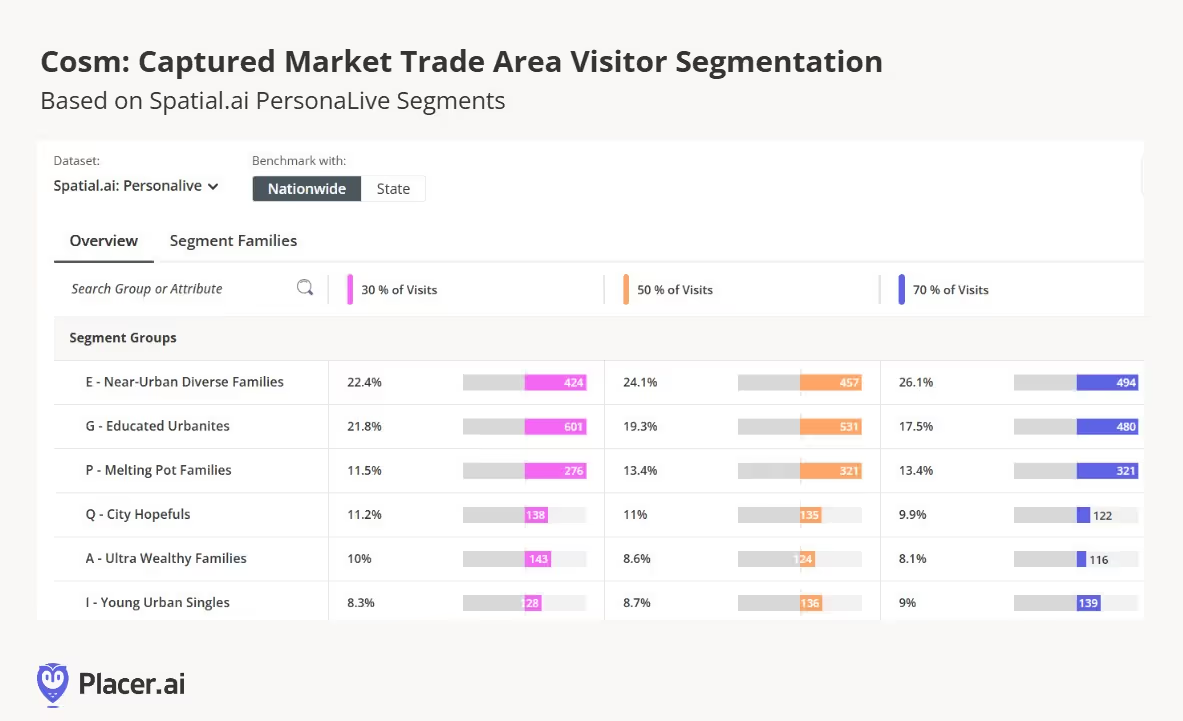

In terms of demographics, per Spatial.ai PersonaLive, Near-Urban Diverse Families, Educated Urbanites, and Melting Pot Families make up the top 3 segments.

Starbucks, the largest coffee chain in the world, and Dutch Bros, one of the fastest growing in the country, are major players in the hot and cold beverage space. With Q3 2024 in the rearview mirror, we took a closer look at the visitation patterns to both chains to see how they are faring – and what might lie ahead for both brands.

Starbucks is one of the most dominant names in coffee across the world, with thousands of stores in the United States alone. Between July 2023 and July 2024, the chain added more than 500 stores to its domestic fleet, bringing its U.S. store count to 16,730. And though Starbucks has faced its share of challenges, these store additions helped keep overall traffic to the coffee leader on par with 2023 levels throughout the summer – though visits dipped somewhat in September as consumers went back to their routines.

But digging deeper into the visit data shows that even as Starbucks saw overall foot traffic growth stall in Q3, the number of short visits to the chain – i.e. those lasting less than 10 minutes – increased. In August and September 2024, the chain drew 8.5% and 4.7% more short visits, respectively, than in the same periods of 2023 – revealing how important these quick stops are for the chain.

In-app ordering, which together with drive-thru orders made up about 70% of sales at the chain as of January 2024, may be contributing to the short visit trend. Still, new CEO Brian Niccol is looking for ways to return the chain to its roots as the third place, and the chain may yet implement shifts to encourage longer visits in the coming months.

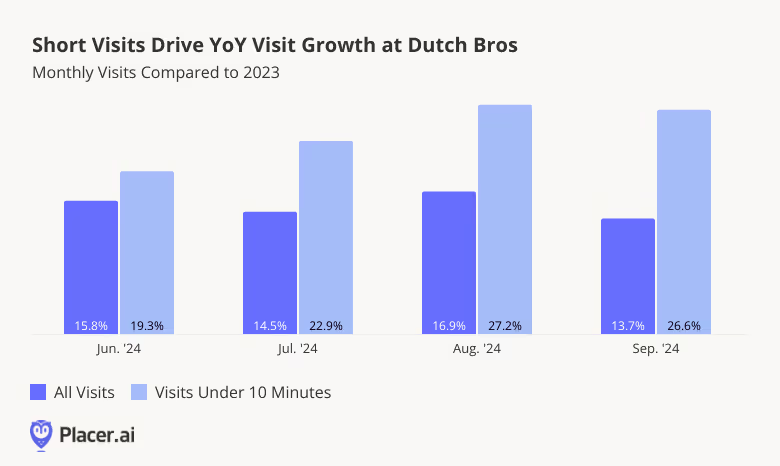

Dutch Bros has been one of the most impressive coffee chains to watch over the past few years. The Oregon-based chain has been on an expansion tear – opening more than 150 stores between Q2 2023 and Q2 2024 – and has seen the elevated monthly visits to match. Between June and September 2024, visits to Dutch Bros increased between 13.7% and 16.9%, highlighting the chain’s success at growing its audience.

But like at Starbucks, short visits outperformed longer ones at Dutch Bros – and by a lot. In September 2024, for example, overall visits to the chain grew by 13.7% – but visits lasting less than 10 minutes shot up by 26.6%.

The strength of these short visits, for both Starbucks and Dutch Bros, suggests a shift towards convenience, with both chains utilizing drive-thru services and in-app ordering to accommodate busy consumers.

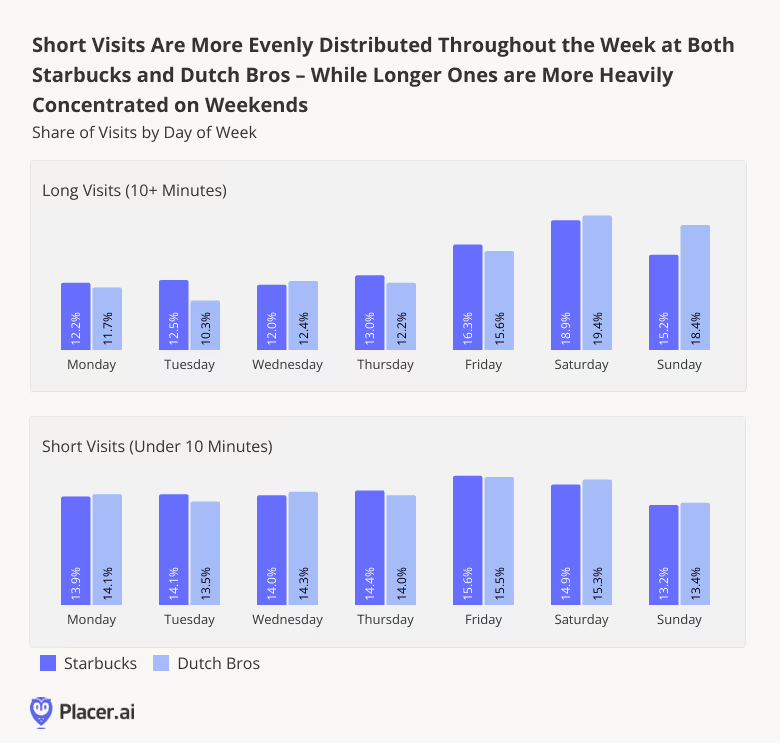

Digging down deeper into the data shows that for both Starbucks and Dutch Bros, these all-important short visits follow a distinct weekly pattern.

While longer visits (≥10 minutes) to both chains peaked in Q3 2024 on Saturdays, shorter visits were more evenly distributed throughout the week, peaking on Fridays. Overall, 34.1% of long visits to Starbucks, and 37.8% of long visits to Dutch Bros, took place on the weekends in Q3 2024 – compared to 28.1% and and 28.7%, respectively, for shorter visits.

Unsurprisingly, customers may be more likely to grab a quick coffee to go during the work week. And with the return to office still underway, quick visits may be enjoying a boost fueled by commuters in need of a quick cubicle pick-me-up.

As Starbucks works to adapt to shifting consumer preferences, understanding when customers spend more time in-store can help the brand reconnect with its roots as a community hub. And Dutch Bros can continue to enhance the quick-service experience that has fueled its growth. How will the two chains continue to perform in what remains a competitive coffee environment?

Follow Placer.ai for the latest data-driven dining insights.

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.