Learn how to perform real estate market analysis quickly and efficiently by using up to date data and the latest technological solutions.

Table of Contents

Real estate market analysis is the process of collecting and analyzing all the relevant information needed to make informed decisions about the acquisition, sale, rental, or development of real property.

Real estate agents often use comparative market analysis (CMA) – a form of real estate market analysis that focuses primarily on comparing a property’s attributes to those of similar units in a given area – to determine the fair market value of private homes. Property owners and buyers can also harness CMA to determine an asking price before putting a house on the market, or to decide how high they are willing to go to snag a property in a particular neighborhood.

In the world of commercial real estate (CRE), a more complex form of market analysis is used by professionals to create and assess investment strategies, evaluate deals, and determine the most profitable uses for land parcels. Commercial real estate market analysis seeks to gather and analyze a broad range of metrics in order answer questions like:

The first step in conducting real estate market analysis is to clearly define the specific goal at hand. Is the main purpose to build equity by investing in property likely to appreciate over time? Or is the primary aim to identify the ideal market to establish a retail presence, or develop a rental property to generate more immediate income? The concrete goal of the analysis will determine the factors to be considered and shape the relative weight given to each of them.

But whatever the main goal, hard data is key. In this guide, we’ll discuss best practices for conducting commercial real estate market analysis and explore how brokers, owners, and buyers can leverage location intelligence to boost the accuracy and quality of real estate market analysis and improve CRE decision-making.

Broadly speaking, the factors that go into real estate market analysis can be divided into two main categories: market-level factors and property-level factors.

As everybody knows, what really matters in real estate is location, location, location. Even before delving into the data on specific properties, real estate market analysis must account for a wealth of information on the broader geographic areas where potential properties are situated. Some of the main data points that go into market-level analysis include:

Most of these factors should be analyzed on both a local (metropolitan area) and hyperlocal (neighborhood) level. Different areas within cities may experience varying growth trajectories and may be positioned to support very different kinds of businesses. And states and even cities that appear to be in decline may boast neighborhoods that are experiencing a localized renaissance.

In addition to market-wide factors, real estate market analysis should account for a variety of factors relating more specifically to the properties under consideration. Some of the elements that should be considered include:

If the main goal in purchasing a property is to achieve long-term value appreciation, analyzing the factors listed above can help assess potential real estate deals and determine whether a given property is expected to appreciate at a good rate.

If the goal, on the other hand, is to generate rental or other more immediate income, a variety of additional metrics will be useful for comparing different opportunities and evaluating profitability. Some of the most important of these include (this is not an exhaustive list):

Many of the data points that go into conducting commercial real estate market analysis rely on foot traffic data and other forms of location intelligence. In this section we’ll explore a couple of examples of industries that utilize real estate market analysis, to illustrate the potential for location intelligence to enhance the quality of potential insights.

Imagine you manage a real estate firm that invests in multifamily rental properties. You are evaluating opportunities in several different cities and need to decide which, if any, are worth pursuing.

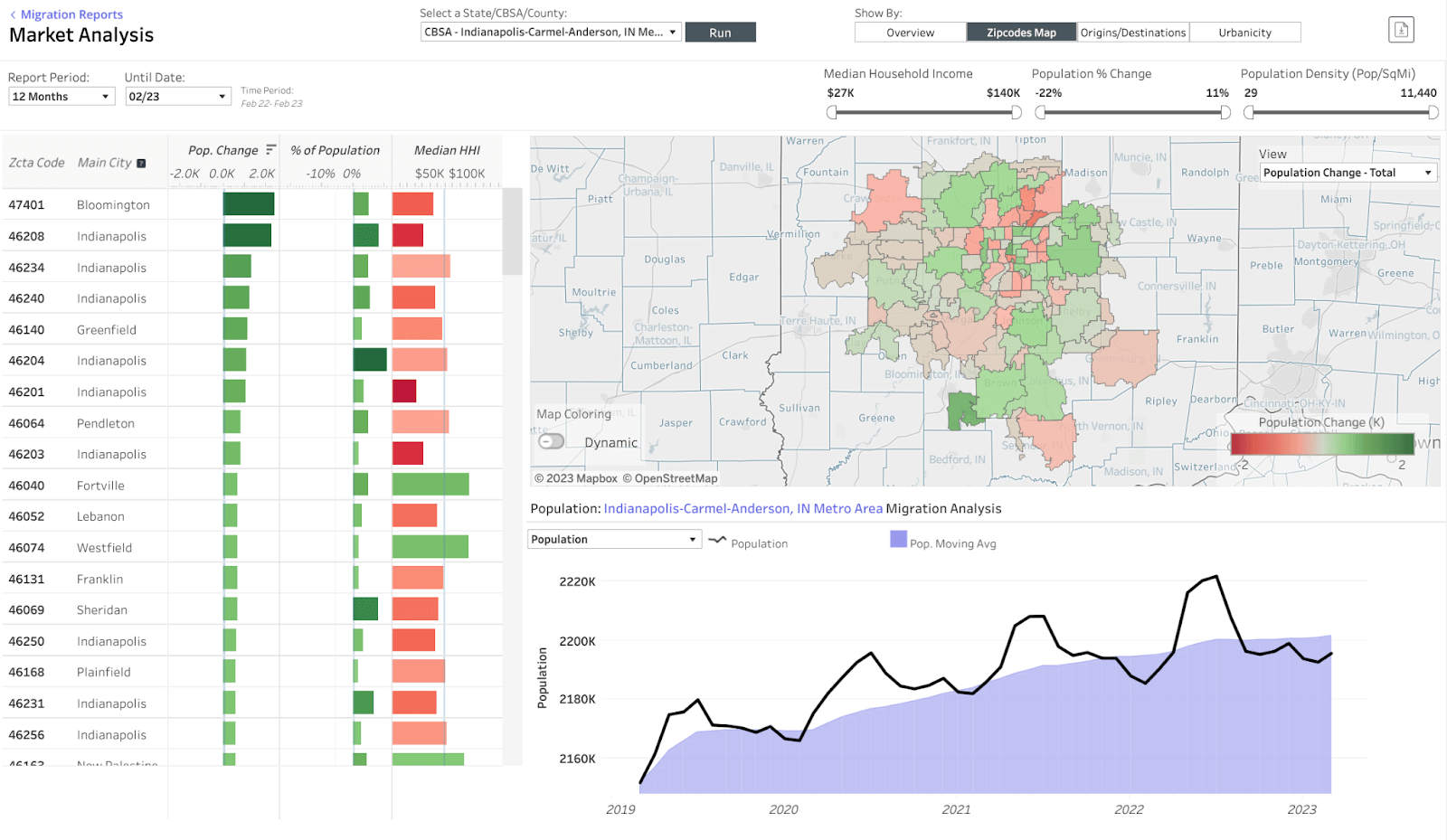

Using up-to-date foot traffic analytics, you can analyze population movements on both a macro (state- or CBSA-wide) and micro (zip code) level, to understand local domestic migration patterns. And by layering demographic and psychographic datasets on top of this analysis, you can gain insight into the specific characteristics of the populations moving to and from each area. By accounting for metrics like the ages, median household incomes (HHIs), and household compositions of inbound relocators relative to the local population, you can assess whether the area attracts young families or whether it is more popular among retirees.

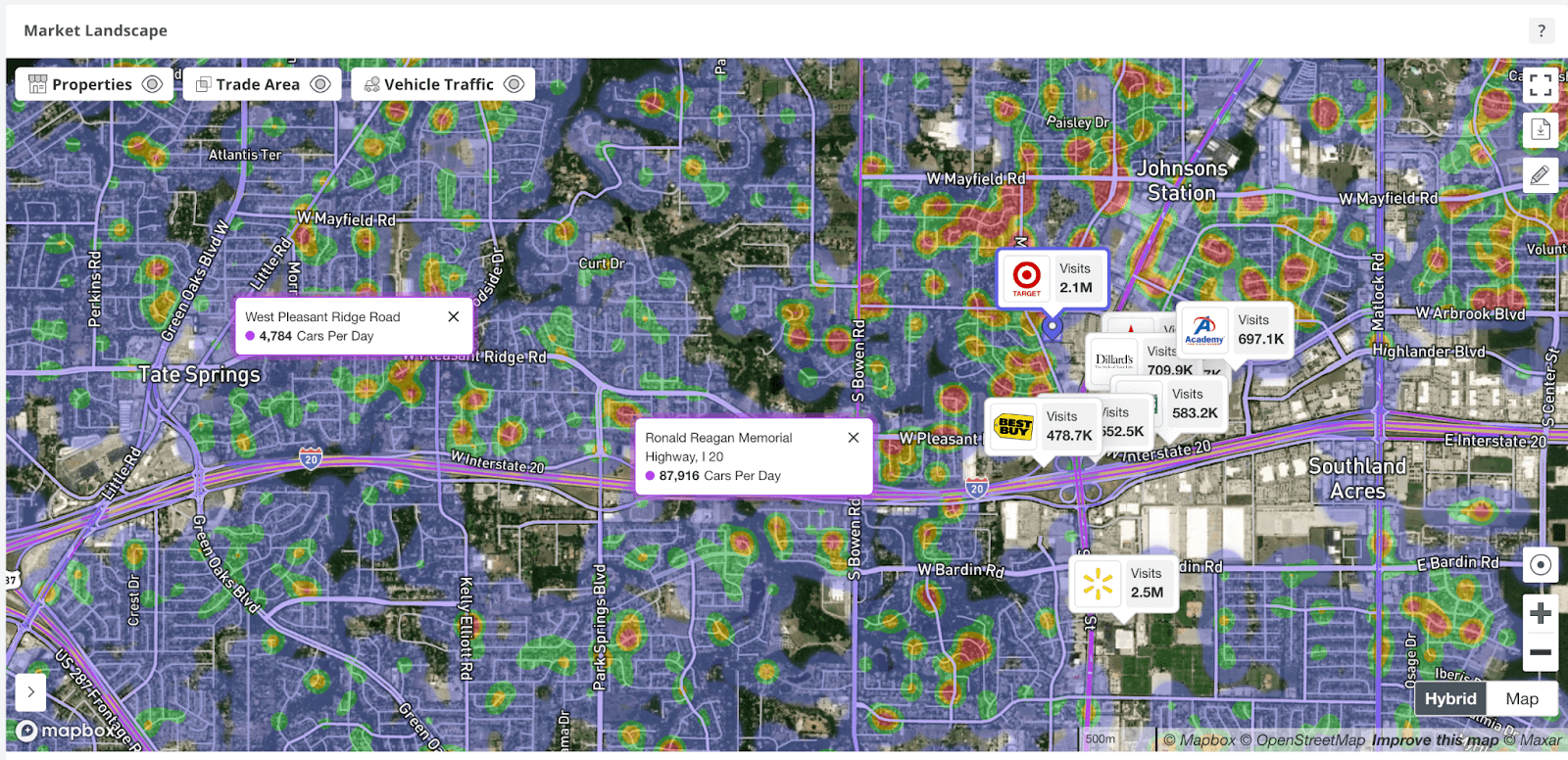

Location analytics can also be harnessed to assess the vitality and quality of the surrounding area. Neighborhood foot traffic trends and visitation to local retailers and business centers can provide a sense of how the area is doing overall. This data can then be integrated with information on local crime rates, development plans, and more granular property-level factors to create a complete picture of the potential risks and benefits of the opportunities under consideration.

Foot traffic analytics can also be key for conducting a robust real estate market analysis in the world of retail CRE.

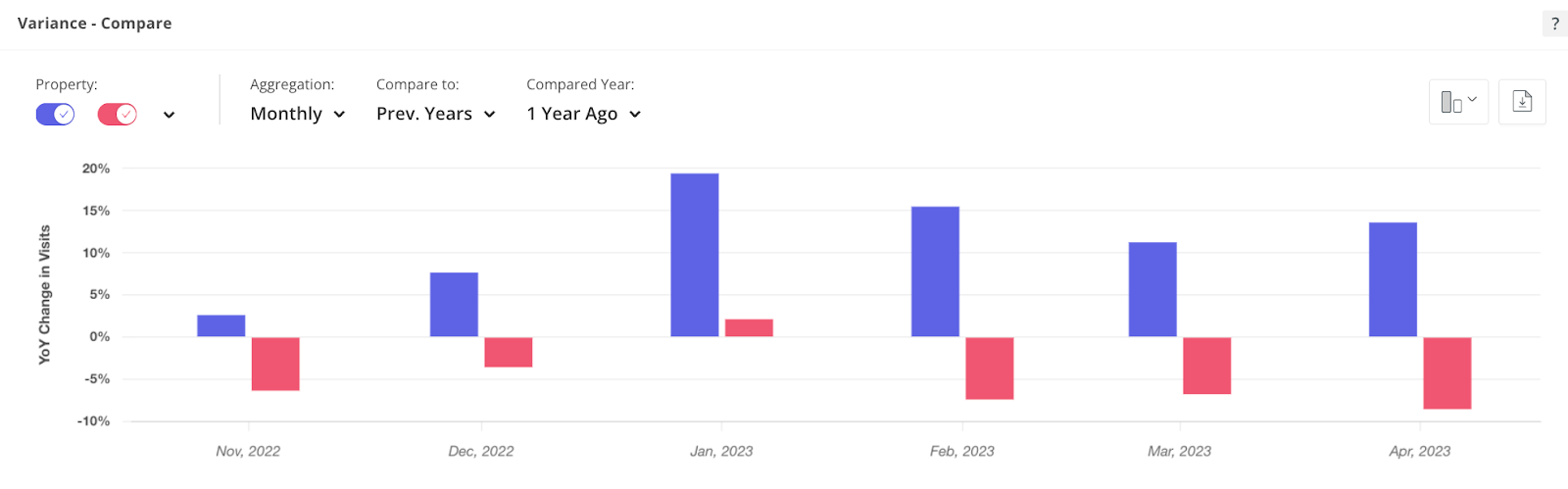

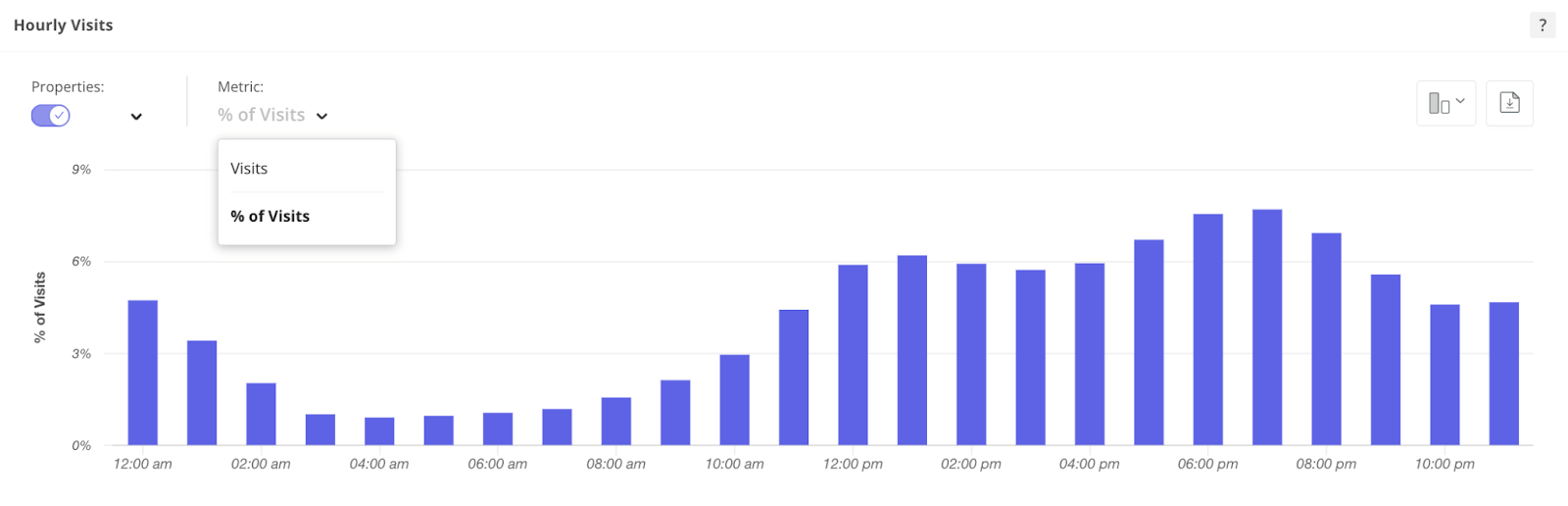

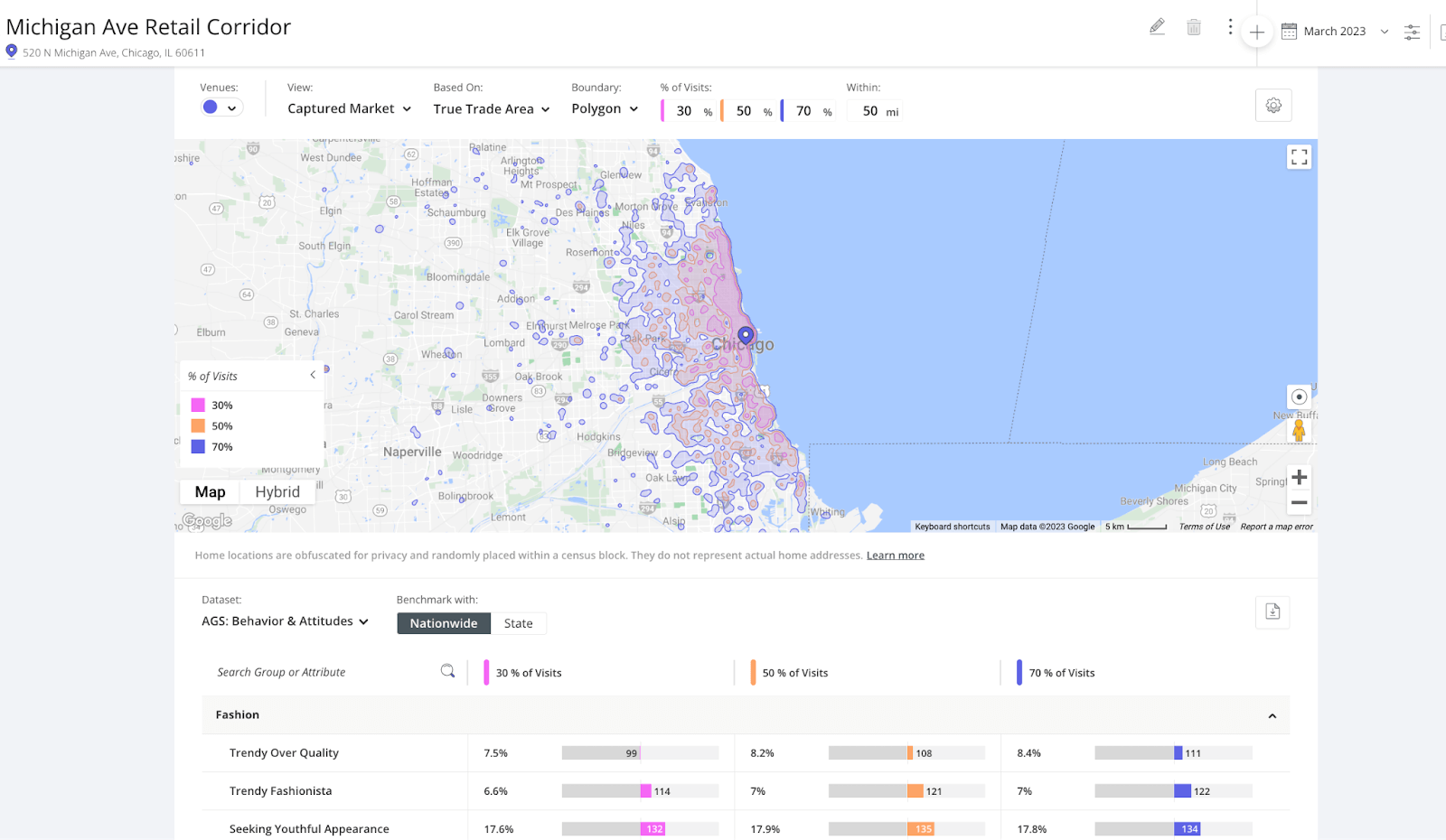

Say you are a CRE broker tasked with selling a shopping center. By leveraging foot traffic data, you can assess the center’s overall health and benchmark it against comparable properties. You can also analyze customer visitation to the center to evaluate relative demand for its different offerings and determine peak visitation times. And by combining visitation data with demographic and psychographic data sets, you can examine the behavior and characteristics of visitors to the center and compare them to those of visitors to other nearby shopping centers. All of these insights can then be harnessed to determine pricing, predict return on investment, and present potential buyers with hard data demonstrating profitability.

Imagine, on the other hand, that you are seeking to lease a vacant store. Foot traffic patterns in the vicinity of the venue can inform your assessment of the property’s desirability and of likely demand – impacting pricing strategies, competitive benchmarking, and more. Determining peak visitation times can also help position the property to prospective tenants. If visitation is highest on the weekends or evenings, for example, this may indicate the property’s particular value for dining or entertainment establishments.

Location intelligence leader Placer.ai provides customers with a variety of tools that make conducting data-driven real estate market analysis easier than ever before. By integrating highly accurate and up-to-date foot traffic data with a broad range of demographic and psychographic datasets, Placer provides users with unmatched visibility into consumer visitation patterns in the physical world. All of Placer’s data is aggregated and stripped of identifiers to ensure the protection of privacy.

Some of Placer’s key features that can be harnessed for real estate market analysis include:

The property dashboard also includes an area analysis feature which provides customers with in-depth information on countless properties’ immediate area, including things like vehicle traffic volume, planned development, area crime data, and local events. Users can also define any geographic area as a POI, or point of interest, and subject it to an in-depth property analysis to get visitation insights and trade area intelligence for unique geofenced locations.

As the real estate market continues to evolve, it’s critical for CRE brokers, investors, and others to keep pace with evolving best practices for conducting real estate market analysis. The rise of accessible location intelligence tools in particular offers professionals an unprecedented capacity to analyze the behavior of markets and sub-markets, and to evaluate the performance and revenue-generating potential of specific properties. By leveraging these tools, CRE professionals and stakeholders can generate more accurate and informed market analysis and stay ahead of the curve.