The supermarket industry is one of the few continuously bringing in traffic as the coronavirus pandemic unfolds. Analyzing the second week of March, grocers saw significant peaks, with Friday the 13th marking one of the highest traffic days in years.

Was this a panic-driven spike, or are supermarkets sustaining growth deeper into the month of March? We dove into the latest data to find out.

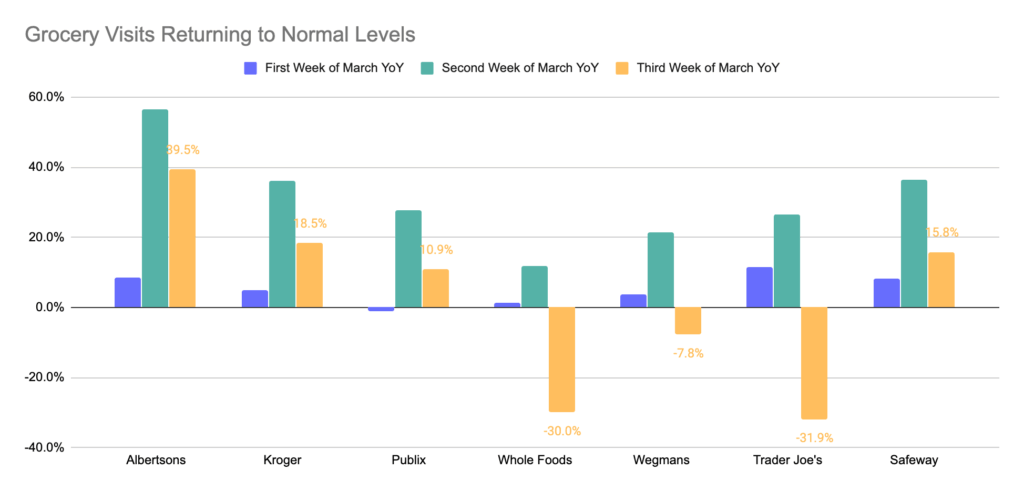

Returning to Normal Levels

Looking at year-over-year growth in weekly visits from the beginning of March reveals some very interesting trends. While we saw traffic rise significantly from late February through the second week of March, none of the seven chains analyzed saw visits in the third week of March match the peak of a week prior. Most still saw significant year-over-year growth, but the levels were far closer to normal, with that pace quickening.

While Albertsons, Kroger, Publix and Safeway all maintained double-digit growth in the same week a year prior, Whole Foods, Wegmans and Trader Joe saw losses. And Whole Foods and Trader Joe’s were hit hard with losses of 30.0% and 31.9% in visits year-over-year respectively.

There are a multitude of factors that could be driving these declines, but chief among them is likely the distribution of locations in major cities. The impact on large cities has been massive. Travel is dropping dramatically, universities, many of whom sit within major cities, are emptying out, and these areas are also among the hardest hit by the coronavirus itself. Additionally, Trader Joe’s is impacted by a wider perception of not being ‘full grocery’ but having a more niche appeal. As mentioned in earlier research, huge numbers of Trader Joe’s visitors will visit another grocery on the same day.

Wegman’s is likely also being affected by its regional setup with nearly all of its locations in the northeast with heavy concentrations in NY. Additionally, though the wide range of products do position this brand with an audience more likely to stock up for longer terms.

The Unsustainable Peak

But even looking at the top-performing brands there are signs of a more normal shopping pattern. Albertsons, one of the brands seeing especially strong performance of late, saw Friday visits drop from a March 13th peak of 135.9% above the daily baseline, to visits the next Friday that were just 13.4% above. Assuredly, this is still impressive, but a far cry from the initial rush.

The same can be said for Publix who watched visits on Saturday the 14th rise 59.6% above the baseline only to see visits fall to 26.7% below the next Saturday.

This likely points to a reality where visits will return to a more expected level. The big remaining questions are whether those levels will remain above or below the normal visit ranges.

True Trade Area Takeaways

But one of the most interesting insights has come from looking at the impact of coronavirus on visitation patterns. Analyzing the True Trade Area, a breakdown of where visitors to a specific location are coming from, can break down critical changes in customer behavior. For example, looking at a Publix in South Florida, there was a massive reduction in the overall True Trade Area size comparing the first two weeks of March to the first two weeks of February. The actual size decreased by 13.9% and the addressable population declined by over 17.0%. Yet, even with these difficult changes, the location saw visit growth of 15.4%.

However, this trend was not applicable across the country. Grocers in some areas saw massive jumps in True Trade Area size while others saw declines. And this could have a huge impact on strategy. Larger than normal trade areas could indicate new markets for these groceries to target upon a return to normalcy, while smaller trade areas could help brands distinguish between local audiences and regulars who stop by on their way to work. The process could even help brands sharpen their delivery strategies by recognizing their core home audiences.

Will Grocery Visits Stabilize?

Only time will tell. But considering the shifts already seen, it is likely that new and impactful changes are on the way.

Check back in next week at the Placer.ai blog for the Supermarkets update.