If home is truly where the heart is, then few activities possess the same value as sprucing up a house. Whether it be a new DIY painting project or finding the perfect furnishings for a room, the home goods sector is expected to be worth over $460B in North America alone.

And with Spring hitting in Q2 it is of little surprise that the season of renewal drove increased interest in projects. We dove into the Home Goods and Improvement sector to analyze trends and insights from the top players in the space.

Springtime Surge

As might be expected, Q2 presented a strong quarter for the sector with only two of the ten companies analyzed seeing a drop in traffic from Q1. Lowe’s led the way with 37.9% visitor growth in Q2, with The Home Depot close behind at 35.3%, Menards at 29.3%, and Ace Hardware 26.9%. Only IKEA and Bed, Bath & Beyond saw dips from Q1, though the latter did close locations.

Destination IKEA

While IKEA did see a dip in visits, it had the most unique characteristics of any of the brands analyzed. IKEA visitors spend nearly 80 minutes per visit, 94.3% more than the average time spent at the other nine brands analyzed.

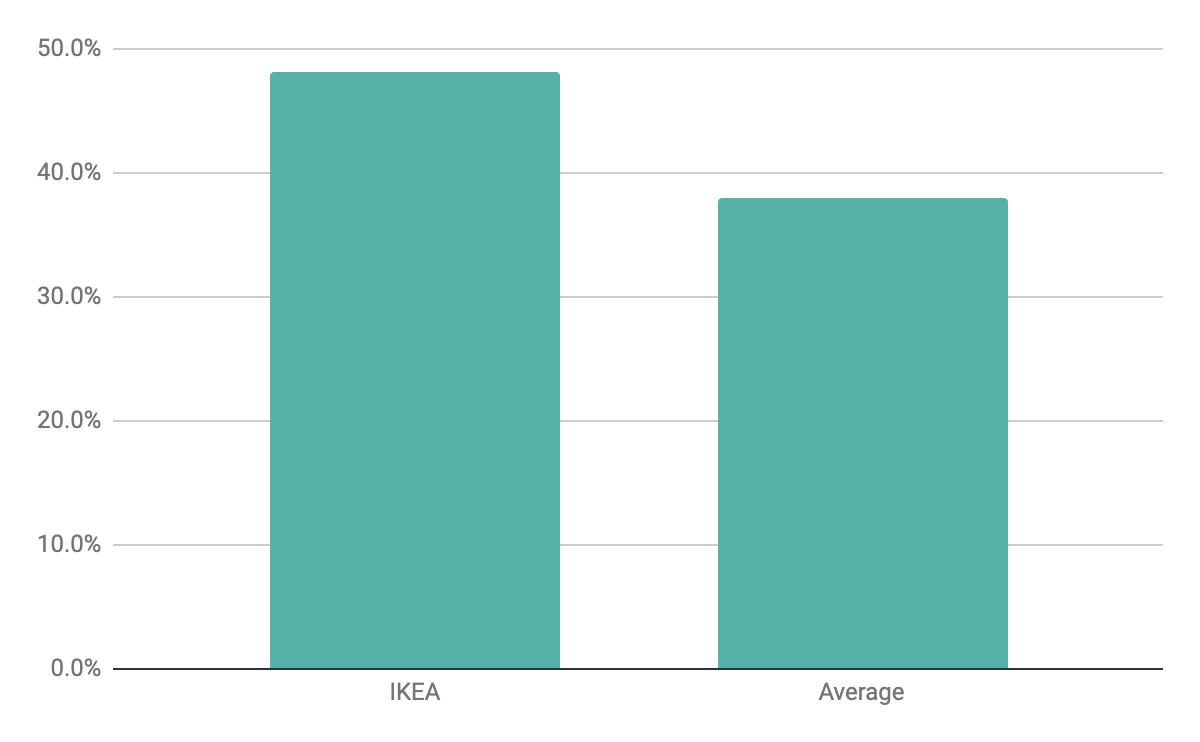

And this duration creates a unique balance of visits that heavily privileges weekends with nearly 48.2% of visitors coming on Saturday or Sunday. This is 26.8% higher than the average of the other companies. These traits present powerful opportunities to IKEA and its neighbors and also hint to ways the brand may look to expand its impact in the coming years.

Kings of the Home Improvement Mountain

But when it comes to Home Improvement supremacy in the US, the greatest battle takes place at the top. Home Depot and Lowe’s together hold 70.3% of the overall visits for Q2 for the ten companies analyzed - showing a dominant position in the space. The two retailers dominate not only in the number of visits but also in the visits per visitor metric where they both saw over 3 visits per visitor in Q2. Only Menards, with 3.5 visits per visitor, beat out Lowe’s, though they still fell short of Home Depot’s 3.8 mark.

Conclusion

The Home Improvement space is marked by the dominance of two key players, though there are interesting actors to monitor. Menards displayed a powerful ability to drive customer loyalty that could bode well for wider expansion.

IKEA, a company that actually saw a decline in traffic from Q1, still possesses a unique mix of traits that position the company with significant flexibility to drive ongoing success. But, as with any DIY project, true success comes with a clear vision. So make sure to check back next quarter to see how the sector progresses.